INTUITY MEDICAL, INC. COMMON STOCK PURCHASE WARRANT NO. WC-«Number»

Exhibit 4.9

THIS WARRANT AND THE UNDERLYING SECURITIES HAVE BEEN ACQUIRED FOR INVESTMENT AND HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED. THIS WARRANT AND THE UNDERLYING SECURITIES MAY NOT BE SOLD OR TRANSFERRED WITHOUT (I) AN EFFECTIVE REGISTRATION STATEMENT RELATED THERETO, (II) AN OPINION OF COUNSEL FOR THE HOLDER, SATISFACTORY TO THE COMPANY, THAT SUCH REGISTRATION IS NOT REQUIRED UNDER THE ACT OR (III) RECEIPT OF A NO ACTION LETTER FROM THE SECURITIES AND EXCHANGE COMMISSION. COPIES OF THE AGREEMENT COVERING THE ACQUISITION OF THIS WARRANT AND RESTRICTING ITS TRANSFER MAY BE OBTAINED AT NO COST BY WRITTEN REQUEST MADE BY THE HOLDER OF RECORD OF THIS WARRANT TO THE SECRETARY OF THE COMPANY AT THE PRINCIPAL EXECUTIVE OFFICES OF THE COMPANY.

Void after [ 🌑 ], 2026

COMMON STOCK PURCHASE WARRANT

NO. WC-«Number»

THIS CERTIFIES THAT, for value received, «Name» or its registered assigns (hereinafter called the “Holder”) is entitled to purchase from INTUITY MEDICAL, INC., a Delaware corporation, with its principal place of business at 0000 Xxxx Xxxxxx Xxxxxx, Xxxxxxx, XX 00000 (the “Company”), at any time after the date specified in Section 1 hereof and ending at 5:00 p.m. Pacific Time on the Expiration Date, as such term is defined in Section 1 hereof, up to «Shares» shares of the Company’s Common Stock, par value $0.001 per share (the “Common Stock”), subject to adjustment as set forth herein.

This Warrant (the “Warrant”) is being issued pursuant to the terms of that certain Series 5 Preferred Stock, Warrant and Convertible Note Purchase Agreement, dated as of May 2, 2019, by and among the original Holder, the Company and certain other investors set forth therein (the “Purchase Agreement”). This Warrant may be exercised in whole or in part, at the option of the Holder.

1. Definitions. As used herein, the following terms shall have the following respective meanings. Any capitalized terms not defined herein shall have the meaning given to them in the Purchase Agreement.

(a) “Exercise Price” shall mean $0.001, subject to adjustments pursuant to Section 5 below.

(b) Subject to Section 5.1, “Expiration Date” shall mean the period ending on the earlier of (i) [ 🌑 ], 2026 or (ii) the closing of the initial public offering of the Common Stock, unless terminated earlier as provided below.

(c) “Liquidation Transaction” shall mean any liquidation, dissolution or winding up of the Company, whether voluntary or involuntary, or the consolidation or merger of the Company into or with any other entity or entities which results in the exchange of outstanding shares of the Company for securities or other consideration issued or paid or caused to be issued or paid by any such entity or affiliate thereof (other than a merger to reincorporate the Company in a different jurisdiction) in which the stockholders of the Company immediately prior to such consolidation or merger do not own a majority of the voting power of the Company or the surviving corporation immediately after such consolidation or merger, or any transaction or series of related transactions to which the Company is a party in which a majority of the Company’s voting power is transferred (other than a capital raising transaction or transfers to affiliated parties), or the sale, exclusive license, lease, abandonment, transfer or other disposition by the Company of all or substantially all its assets.

(d) “Warrant Shares” shall mean the shares of Common Stock issuable upon exercise of this Warrant, subject to adjustments pursuant to the terms herein, including but not limited to adjustment pursuant to Section 5 below.

2. Term and Exercise Schedule. This Warrant shall be exercisable through the Expiration Date.

3. Method of Exercise; Payment; Issuance of New Warrant. The purchase right represented by this Warrant may be exercised by the Holder, in whole or in part, by:

3.1. the surrender of this Warrant (with an executed notice of exercise in the form attached hereto as Attachment A and an duly executed Investment Representation Statement in the form attached hereto as Attachment B) by delivery to the Company at its address set forth above (or such other address as it may designate by notice in writing to the Holder); and

3.2. the payment to the Company, by check, wire transfer, forgiveness of indebtedness, or any combination of the foregoing, of an amount equal to the then applicable Exercise Price per share multiplied by the number of Warrant Shares then being purchased.

If this Warrant should be exercised in part only, the Company shall, upon surrender of this Warrant, execute and deliver a new Warrant evidencing the rights of the Holder thereof to purchase the balance of the Warrant Shares purchasable hereunder. Upon receipt by the Company of this Warrant and such notice of exercise, together with, if applicable, the aggregate Exercise Price, at such office, or by the stock transfer agent or warrant agent of the Company at its office, the Holder shall be deemed to be the holder of record of the applicable Warrant Shares, notwithstanding that the stock transfer books of the Company shall then be closed or that certificates representing such Warrant Shares shall not then be actually delivered to the Holder. The Company shall pay any and all documentary stamp or similar issue or transfer taxes payable in respect of the issue or delivery of the Warrant Shares.

2

3.3. Net Exercise.

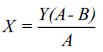

(a) In addition to and without limiting the rights of the Holder under the terms of this Warrant, the Holder may elect to convert this Warrant or any portion thereof (the “Conversion Right”) into Warrant Shares, the aggregate value of which Warrant Shares shall be equal to the value of this Warrant or the portion thereof being converted. The Conversion Right may be exercised by the Holder by surrender of this Warrant at the principal office of the Company together with notice of the Holder’s intention to exercise the Conversion Right, in which event the Company shall issue to the Holder a number of Warrant Shares computed using the following formula:

X - The number of Warrant Shares to be issued to the Holder upon exercise of the Conversion Right.

Y - The number of Warrant Shares issuable upon exercise of this Warrant (or such lesser number as are being exercised).

A - The fair market value of one Warrant Share, as determined pursuant to Section 3.3(b) hereof, as of the time the Conversion Right is exercised pursuant to this Section 3.

B - Exercise Price for one Warrant Share under this Warrant (as adjusted to the date of such calculations).

Notwithstanding the foregoing, this Warrant shall be deemed to have converted into Warrant Shares pursuant to this Section 3.3(a) upon the Expiration Date if not previously exercised or converted before such date.

(i) where a public market exists for the Common Stock at the time of such exercise, then:

(A) the fair market value of one Warrant Share shall be the last closing price per share of the Common Stock on the principal national securities exchange on which the Common Stock is listed or admitted to trading; or

(B) the average of the bid and asked price per share as reported in the “pink sheets” published by the National Quotation Bureau, Inc. (the “pink sheets”) if the Common Stock is not listed or traded on any exchange; or

3

(C) if such quotations are not available, the fair market value of one Warrant Share on the date such notice was received by the Company, as determined in good faith by the Board of Directors of the Company.

(ii) if the Warrant is exercised in connection with the Company’s initial public offering of Common Stock, the fair market value of one Warrant Share shall be the per share offering price to the public of the Company’s initial public offering; and

(iii) all such determinations to be appropriately adjusted for stock dividend, stock split, stock combination or other similar transactions during the applicable calculation period.

4. Stock Fully Paid; Reservation of Warrant Shares. All shares of stock which may be issued upon the exercise of the rights represented by this Warrant will, upon issuance, be fully paid and nonassessable, and free from all taxes, liens and charges with respect to the issue thereof. During the period within which the rights represented by this Warrant may be exercised, the Company will at all times have authorized and reserved for the purpose of issue upon exercise of the purchase rights evidenced by this Warrant, a sufficient number of shares of its stock to provide for the exercise of the rights represented by this Warrant. In the event that there is an insufficient number of Warrant Shares reserved for issuance pursuant to the exercise of this Warrant, the Company will take appropriate action to authorize an increase in its capital stock to allow for such issuance or similar issuance acceptable to the Holder.

5. Adjustment of Exercise Price and Number of Warrant Shares. The number and kind of Warrant Shares purchasable upon the exercise of this Warrant and the Exercise Price shall be subject to adjustment from time to time upon the occurrence of certain events, as follows:

5.1. Reclassification; Merger. In case of any reclassification or change of outstanding securities of the class issuable upon exercise of this Warrant (other than a change in par value, or from par value to no par value, or from no par value to par value, or as a result of a subdivision or combination), or in case of any Liquidation Transaction, the Company shall provide to Holder ten (10) days advance written notice of such reorganization, reclassification or Liquidation Transaction.

5.2. Subdivision or Combination of Warrant Shares. If the Company at any time while this Warrant remains outstanding and unexpired shall subdivide or combine its stock, the Exercise Price shall be proportionately decreased in the case of a subdivision or increased in the case of a combination.

5.3. Stock Dividends. If the Company at any time while this Warrant is outstanding and unexpired shall pay a dividend with respect to stock payable in, or make any other distribution with respect to stock (except any distribution specifically provided for in the foregoing Sections 5.1 and 5.2) of, stock, then the Exercise Price shall be adjusted, from and after the date of determination of stockholders entitled to receive such dividend or distribution, to that price determined by multiplying the Exercise Price in effect immediately prior to such date of determination by a fraction (i) the numerator of which shall be the total number of shares of stock outstanding immediately prior to such dividend or distribution, and (ii) the denominator of which shall be the total number of shares of stock outstanding immediately after such dividend or distribution.

4

5.4. Adjustment of Number of Warrant Shares. Upon each adjustment in the Exercise Price, the number of shares of stock purchasable hereunder shall be adjusted, to the nearest whole share, to the product obtained by multiplying the number of Warrant Shares purchasable immediately prior to such adjustment in the Exercise Price by a fraction, the numerator of which shall be the Exercise Price immediately prior to such adjustment and the denominator of which shall be the Exercise Price immediately thereafter.

6. Fractional Warrant Shares. No fractional Warrant Shares will be issued in connection with any exercise hereunder, but in lieu of such fractional shares the Company shall make a cash payment therefor upon the basis of the Exercise Price then in effect.

7. Compliance with Securities Act; Non-transferability of Warrant; Disposition of Shares of Stock.

7.1. Compliance with Securities Act. The Holder, by acceptance hereof, agrees that this Warrant and the Warrant Shares are being acquired for investment and that he, she or it will not offer, sell or otherwise dispose of this Warrant or any Warrant Shares except under circumstances which will not result in a violation of the Securities Act of 1933, as amended (the “Act”). Upon exercise of this Warrant, the Holder hereof shall confirm in writing, in a form attached hereto as Attachment B, that the Warrant Shares so purchased are being acquired for investment and not with a view toward distribution or resale. In addition, the Holder shall provide such additional information regarding such Holder’s financial and investment background, as the Company may reasonably request, as is relevant for purposes of determining the Holder’s suitability with respect to a purchase of the Warrant Shares. All Warrant Shares (unless registered under the Act) shall be stamped or imprinted with a legend in substantially the following form (in addition to any legend required under applicable state securities laws):

THIS SECURITY HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED. THIS SECURITY MAY NOT BE SOLD OR TRANSFERRED WITHOUT (I) AN EFFECTIVE REGISTRATION STATEMENT RELATED THERETO, (II) AN OPINION OF COUNSEL FOR THE HOLDER, SATISFACTORY TO THE COMPANY, THAT SUCH REGISTRATION IS NOT REQUIRED UNDER THE ACT OR (III) RECEIPT OF A NO ACTION LETTER FROM THE SECURITIES AND EXCHANGE COMMISSION. COPIES OF THE WARRANT AGREEMENT COVERING THE ACQUISITION OF THIS SECURITY AND RESTRICTING ITS TRANSFER MAY BE OBTAINED AT NO COST BY WRITTEN REQUEST MADE BY THE HOLDER OF RECORD OF THIS SECURITY TO THE SECRETARY OF THE COMPANY AT THE PRINCIPAL EXECUTIVE OFFICES OF THE COMPANY.

5

7.2. Transferability of Warrant. This Warrant may not be transferred or assigned in whole or in part without (i) an effective registration statement related thereto, (ii) an opinion of counsel for the Holder, satisfactory to the Company, that such registration is not required under the Act or (iii) receipt of a no action letter from the Securities and Exchange Commission (together, “Securities Law Compliance Guarantees”); provided, however, that the Warrant may be transferred in whole or in part without Securities Law Compliance Guarantees upon any of the following provided that the transferee agrees in writing to be subject to the terms hereof to the same extent as if he/she were an original Holder hereunder:

(a) A transfer of the Warrant by a Holder who is a natural person during such Holder’s lifetime or on death by will or intestacy to such Holder’s immediate family or to any custodian or trustee for the account of such Holder or such Holder’s immediate family. “Immediate family” as used herein shall mean spouse, lineal descendant, father, mother, brother, or sister of the Holder;

(b) A transfer of the Warrant to the Company;

(c) A transfer of the Warrant to a parent, subsidiary or affiliate of a Holder; or

(d) A transfer of the Warrant by a Holder which is a limited or general partnership to any of its partners or former partners (with, a, b and c, a “Permitted Transfer”).

7.3. Disposition of Warrant Shares. Upon exercise of the Warrant, the Holder will be entitled to any registration rights granted to holders of Common Warrants under that certain Ninth Amended and Restated Investors’ Rights Agreement dated as of May 2, 2019, as the same may be amended and/or restated from time to time. With respect to any offer, sale or other disposition of any Warrant Shares prior to registration of such shares, the Holder and each subsequent Holder of this Warrant agrees to give written notice to the Company prior thereto, describing briefly the manner thereof, together with a written opinion of such Holder’s counsel, if requested by the Company, to the effect that such offer, sale or other disposition may be effected without registration or qualification (under the Act as then in effect or any federal or state law then in effect) of such Warrant Shares and indicating whether or not under the Act certificates for such shares to be sold or otherwise disposed of require any restrictive legend as to applicable restrictions on transferability in order to ensure compliance with the Act; provided, however, that no such opinion of counsel or no-action letter shall be necessary for a Permitted Transfer if the transferee agrees in writing to be subject to the terms hereof to the same extent as if he/she/it were an original Holder hereunder.

8. Rights of Stockholders. No Holder of this Warrant shall be entitled to vote or receive dividends or be deemed the holder of stock or any other securities of the Company which may at any time be issuable on the exercise hereof for any purpose, nor shall anything contained herein be construed to confer upon the Holder of this Warrant, as such, any of the rights of a stockholder of the Company or any right to vote for the election of directors or upon any matter submitted to stockholders at any meeting thereof, or to give or withhold consent to any corporate action (whether upon any recapitalization, issuance of stock, reclassification of stock, change of par value or change of stock to no par value, consolidation, merger, conveyance, or otherwise) or to receive notice of meetings, or to receive dividends or subscription rights or otherwise until this Warrant has been exercised and the Warrant Shares shall have become deliverable, as provided herein.

6

9. Governing Law. The terms and conditions of this Warrant shall be governed by and construed in accordance with California law, without giving effect to conflict of law principles.

10. Miscellaneous. The headings in this Warrant are for purposes of convenience and reference only, and shall not be deemed to constitute a part hereof. All notices and other communications shall be delivered by hand or mailed by first-class registered or certified mail, postage prepaid, to the respective addresses provided in the Purchase Agreement, or to such other address as the Company or Holder may designate to the other parties hereto.

11. Purchase Agreement. This Warrant is a Warrant referred to in the Purchase Agreement and is entitled to all the benefits provided therein.

12. Loss, Theft or Destruction of Warrant. Upon receipt by the Company of evidence reasonably satisfactory to it of the loss, theft or destruction of this Warrant and of indemnity or security reasonably satisfactory to it, the Company will make and deliver an affidavit of lost warrant which shall carry the same rights carried by this Warrant, stating that such affidavit of lost warrant is issued in replacement of this Warrant, making reference to the original date of issuance of this Warrant (and any successors hereto) and dated as of such cancellation, in lieu of this Warrant.

13. Amendment and Waiver. Any provision of this Warrant may be waived or amended (either generally or in a particular instance, either retroactively or prospectively, and either for a specified period of time or indefinitely), with the written consent of the Company and the holders of a majority of the Warrant Shares then issuable upon exercise of the Warrants issued pursuant to the Purchase Agreement then outstanding.

(Remainder of Page Intentionally Left Blank)

7

| INTUITY MEDICAL, INC. | ||

| By: |

| |

| Name: | Xxxxx X. Xxxxxxxx | |

| Title: | President and Chief Executive Officer | |

[Signature Page to Warrant]

ATTACHMENT A TO FORM OF WARRANT

NOTICE OF EXERCISE

1. The undersigned hereby elects to purchase ____________ shares of Common Stock of INTUITY MEDICAL, INC. as defined in that certain Series 5 Preferred Stock, Warrant and Convertible Note Purchase Agreement, dated as of May 2, 2019, and pursuant to the terms of the attached Warrant, and tenders herewith payment of the purchase price of such shares in full, together with all applicable transfer taxes, if any.

2. The undersigned hereby elects to convert the attached Warrant into Warrant Shares in the manner specified in Section 3.3 of the Warrant. This conversion is exercised with respect to _______________________ of the Shares covered by the Warrant.

[Strike paragraph above that does not apply.]

3. Please issue a certificate or certificates representing said shares of stock in the name of the undersigned or in such other name as is specified below:

| Name: |

|

|||||

| Address: |

|

|||||

|

|

||||||

|

|

||||||

4. The undersigned represents that the aforesaid shares of stock are being acquired for the account of the undersigned for investment and not with a view to, or for resale in connection with, the distribution thereof and that the undersigned has no present intention of distributing or reselling such shares. In support thereof, the undersigned has executed an Investment Representation Statement attached hereto as Attachment B.

| «NAME» | ||

| By: |

| |

| Title: |

| |

| Date: |

| |

ATTACHMENT B TO FORM OF WARRANT

INVESTMENT REPRESENTATION STATEMENT

| PURCHASER: |

| |

| COMPANY : | Intuity Medical, Inc. | |

| SECURITY : |

| |

| AMOUNT : |

| |

| DATE : |

|

In connection with the purchase of the above-listed securities and underlying stock (the “Securities”), the undersigned represents to the Company the following:

(a) We are purchasing these Securities for our own account for investment purposes only and not with a view to, or for the resale in connection with, any “distribution” thereof for purposes of the Securities Act of 1933, as amended (the “Act”).

(b) We understand that the Securities have not been registered under the Act in reliance upon a specific exemption therefrom, which exemption depends upon, among other things, the bona fide nature of our investment intent as expressed herein. In this connection, we understand that, in the view of the Securities and Exchange Commission (the “SEC”), the statutory basis for such exemption may be unavailable if our representation was predicated solely upon a present intention to hold these Securities for the minimum capital gains period specified under tax statutes, for a deferred sale, for or until an increase or decrease in the market price of the Securities, or for a period of one year or any other fixed period in the future.

(c) We further understand that the Securities must be held indefinitely unless subsequently registered under the Act or unless an exemption from registration is otherwise available. Moreover, we understand that the Company is under no obligation to register the Securities. In addition, we understand that the certificate evidencing the Securities will be imprinted with a legend which prohibits the transfer of the Securities unless they are registered or such registration is not required in the opinion of counsel for the Company.

(d) We are aware of the provisions of Rule 144, promulgated under the Act, which, in substance, permits limited public resale of “restricted securities” acquired, directly or indirectly, from the issuer thereof (or from an affiliate of such issuer), in a non-public offering subject to the satisfaction of certain conditions.

(e) We further understand that at the time we wish to sell the Securities there may be no public market upon which to make such a sale.

| «NAME» | ||

|

| ||

| (signature) | ||

|

| ||

| (title) | ||