ASSET PURCHASE AND SALE AGREEMENT by and among REED KRAKOFF INVESTMENTS LLC, REED KRAKOFF and COACH, INC. Dated: July 29, 2013

EXECUTION VERSION

ASSET PURCHASE AND SALE AGREEMENT

by and among

▇▇▇▇ ▇▇▇▇▇▇▇ INVESTMENTS LLC,

▇▇▇▇ ▇▇▇▇▇▇▇

and

COACH, INC.

Dated: July 29, 2013

TABLE OF CONTENTS

| ARTICLE I Definitions and Rules of Construction | 1 | |

| 1.1. | Definitions | 1 |

| 1.2. | Rules of Construction | 9 |

| ARTICLE II Purchase and Sale | 10 | |

| 2.1. | Closing | 10 |

| 2.2. | Sale and Purchase of the Assets | 10 |

| 2.3. | Nonassignable Assets and Liabilities | 12 |

| 2.4. | Excluded Assets | 12 |

| 2.5. | Assumption of Liabilities | 13 |

| 2.6. | Excluded Liabilities | 14 |

| 2.7. | Payments at the Closing | 14 |

| 2.8. | Working Capital Adjustment | 15 |

| ARTICLE III Representations and Warranties of Seller | 17 | |

| 3.1. | Organization and Power | 17 |

| 3.2. | Authorization and Enforceability | 17 |

| 3.3. | No Violation | 18 |

| 3.4. | Governmental Authorizations and Consents | 18 |

| 3.5. | Title | 18 |

| 3.6. | No Brokers | 18 |

| 3.7. | Intellectual Property | 18 |

| 3.8. | Real Property Leases | 20 |

| 3.9. | Assumed Contracts | 20 |

| 3.10. | No Undisclosed Liabilities of RK LLC | 20 |

| ARTICLE IV Representations and Warranties of Buyer | 20 | |

| 4.1. | Organization and Power | 20 |

| 4.2. | Authorization and Enforceability | 20 |

| 4.3. | No Violation | 21 |

| 4.4. | Governmental Authorizations and Consents | 21 |

| 4.5. | Litigation | 21 |

| 4.6. | Capitalization | 21 |

| 4.7. | No Brokers | 21 |

| 4.8. | Investigation | 22 |

| 4.9. | Business Prospects | 22 |

| 4.10. | Sketches, Drawings and Designs | 22 |

| ARTICLE V Covenants | 22 | |

| 5.1. | Conduct of Seller | 22 |

| 5.2. | Approvals and Consents | 23 |

| 5.3. | Tax Matters | 24 |

| 5.4. | Employee Matters | 24 |

| 5.5. | Preservation of Books and Records | 26 |

| 5.6. | Proprietary Information | 26 |

| 5.7. | Non-Solicitation | 27 |

| 5.8. | Public Announcements | 27 |

| 5.9. | Funding of Buyer | 28 |

| 5.10. | Intellectual Property | 28 |

| 5.11. | Post-Closing Deliveries | 29 |

| 5.12. | Efforts | 30 |

| ARTICLE VI Conditions to Closing | 30 | |

| 6.1. | Conditions to All Parties’ Obligations | 30 |

| 6.2. | Conditions to Seller’s Obligations | 30 |

| 6.3. | Conditions to Buyer’s Obligations | 31 |

| ARTICLE VII Deliveries by Seller at Closing | 32 | |

| 7.1. | Officer’s Certificate | 32 |

| 7.2. | Lease Assignment and Assumption Agreements | 32 |

| 7.3. | ▇▇▇▇ of Sale | 32 |

| 7.4. | Intellectual Property Assignments | 32 |

| 7.5. | LLC Agreement | 32 |

| 7.6. | Credit Agreement | 32 |

| 7.7. | Modified Branding Agreement | 32 |

| 7.8. | Branding Agreement Side Letter | 33 |

| 7.9. | Branding Agreement Termination Agreement | 33 |

| 7.10. | Transition Services Agreement | 33 |

| 7.11. | RK Interest Assignment | 33 |

| 7.12. | FIRPTA Certificate | 33 |

| 7.13. | Concession Agreement Assignment | 33 |

| 7.14. | Further Instruments | 33 |

| ARTICLE VIII Deliveries by Buyer at Closing | 33 | |

| 8.1. | Officer’s Certificate | 33 |

| 8.2. | Closing Consideration Amount | 33 |

| 8.3. | Confirmation of Funding | 34 |

| 8.4. | Assumption Agreement | 34 |

| 8.5. | LLC Agreement | 34 |

| 8.6. | Credit Agreement | 34 |

| 8.7. | Modified Branding Agreement | 34 |

| 8.8. | Branding Agreement Side Letter | 34 |

| 8.9. | Branding Agreement Termination Agreement | 34 |

| 8.10. | Transition Services Agreement | 34 |

| 8.11. | Lease Assignment and Assumption Agreements | 34 |

| 8.12. | Further Instruments | 34 |

| ARTICLE IX Indemnification; Survival | 35 | |

| 9.1. | Expiration/Survival of Representations and Warranties | 35 |

| 9.2. | Indemnification | 35 |

| ARTICLE X Termination | 38 | |

| 10.1. | Termination | 38 |

| 10.2. | Procedure and Effect of Termination | 38 |

| ARTICLE XI Miscellaneous | 39 | |

| 11.1. | Expenses | 39 |

| 11.2. | Notices | 39 |

| 11.3. | Governing Law | 40 |

| 11.4. | Entire Agreement | 40 |

| 11.5. | Severability | 40 |

| - ii - |

| 11.6. | Amendment | 40 |

| 11.7. | Effect of Waiver or Consent | 41 |

| 11.8. | Bulk Transfer Laws | 41 |

| 11.9. | Parties in Interest; Limitation on Rights of Others | 41 |

| 11.10. | Assignability | 41 |

| 11.11. | Jurisdiction; Court Proceedings; Waiver of Jury Trial | 42 |

| 11.12. | No Other Duties | 42 |

| 11.13. | Reliance on Counsel and Other Advisors | 42 |

| 11.14. | Remedies | 42 |

| 11.15. | Specific Performance | 42 |

| 11.16. | Counterparts | 43 |

| 11.17. | Further Assurance | 43 |

| Exhibits | ||

| Exhibit A – Form of LLC Agreement | ||

| Exhibit B – Amended LLC Agreement Term Sheet | ||

| Exhibit C – Form of Modified Branding Agreement | ||

| Exhibit D – Form of Transition Services Agreement | ||

| Exhibit E – Form of Credit Agreement | ||

| Exhibit F – Form of U.S. Patent Assignment | ||

| Exhibit G – Form of U.S. Trademark Assignment | ||

| Exhibit H – Form of U.S. Copyright Assignment | ||

| Exhibit I – Form of Domain Name Assignment | ||

| Exhbiit J – Form of Branding Agreement Side Letter | ||

| Exhibit K – Form of Branding Agreement Termination Agreement | ||

| - iii - |

ASSET PURCHASE AND SALE AGREEMENT

ASSET PURCHASE AND SALE AGREEMENT, dated as of July 29, 2013, by and among ▇▇▇▇ ▇▇▇▇▇▇▇ Investments LLC, a Delaware limited liability company (“Buyer”), ▇▇▇▇ ▇▇▇▇▇▇▇ (“Krakoff”) and Coach, Inc., a Maryland corporation (“Seller”).

RECITALS

WHEREAS, Seller and its Affiliates are individually, jointly or in collaboration with or through third parties, engaged in the business of designing, marketing, distributing, producing, manufacturing, selling, importing and exporting luxury ready-to-wear clothing, handbags, shoes, fragrances, accessories and other products or services under, or otherwise exploiting, the ▇▇▇▇ ▇▇▇▇▇▇▇ Brand (the “Business”); and

WHEREAS, Buyer desires to purchase and acquire from Seller, and Seller desires to sell, transfer, convey, assign and deliver to Buyer, the RK Interests and the Assets, upon the terms and subject to the conditions hereinafter set forth.

NOW THEREFORE, in consideration of the premises and the representations, warranties, covenants and agreements contained in this Agreement, and intending to be legally bound hereby, the parties hereto agree as follows:

ARTICLE I

Definitions and Rules of Construction

1.1. Definitions.

As used in this Agreement, the following terms shall have the meanings set forth below:

“Accounting Arbiter” has the meaning set forth in Section 2.8(d).

“Arbiter Statement” has the meaning set forth in Section 2.8(d).

“Affiliate” means, as to any Person, any other Person that, directly or indirectly, is in control of, is controlled by, or is under common control with, such Person. For purposes of this definition, “control” of a Person means the power, directly or indirectly, either to (a) vote 10% or more of the securities having ordinary voting power for the election of directors of such Person or (b) direct or cause the direction of the management and policies of such Person, whether by contract or otherwise. Seller shall not be deemed an Affiliate of Buyer for the purposes of this Agreement.

“Agreement” means this Asset Purchase and Sale Agreement, as it may be amended from time to time.

“Ancillary Documents” means the following documents being executed and delivered in connection with this Agreement and the transactions contemplated hereby: the LLC Agreement, the Credit Agreement (if Buyer exercises its option to enter into the Credit Agreement in accordance with Section 5.9), the Transition Services Agreement, the IP Assignments, the Modified Branding Agreement, the Branding Agreement Side Letter, the Branding Agreement Termination Agreement, the Krakoff Resignation Letter, the Lease Assignment and Assumption Agreements or the Sublease Agreements, as applicable, and the ▇▇▇▇ of Sale.

“Assets” has the meaning set forth in Section 2.2.

“Assumption Agreement” has the meaning set forth in Section 8.4.

“Assumed Contracts” has the meaning set forth in Section 2.2(l).

“Assumed Liabilities” has the meaning set forth in Section 2.5.

“Balance Sheet” means the balance sheet of the Business as of June 29, 2013 set forth in Section 1.1(a) of the Schedules.

“▇▇▇▇ of Sale” has the meaning set forth in Section 7.3.

“Books and Records” has the meaning set forth in Section 5.5(a).

“Branding Agreement” means that certain Branding Agreement, dated as of August 5, 2010, by and between Seller and Krakoff.

“Branding Agreement Side Letter” has the meaning set forth in Section 7.9.

“Branding Agreement Termination Agreement” has the meaning set forth in Section 7.9.

“Bulk Transfer Laws” has the meaning set forth in Section 11.8.

“Business” has the meaning set forth in the Recitals.

“Business Benefit Plan” has the meaning set forth in Section 5.4(c).

“Business Day” means any day other than a Saturday, Sunday or day on which banks are closed in New York, New York. If any period expires on a day which is not a Business Day or any event or condition is required by the terms of this Agreement to occur or be fulfilled on a day which is not a Business Day, such period shall expire or such event or condition shall occur or be fulfilled, as the case may be, on the next succeeding Business Day.

“Business Employee” has the meaning set forth in Section 5.4(a).

“Business Intellectual Property” has the meaning set forth in Section 2.2(h).

“Business IP Agreements” means all Contracts to which Seller or one or more of its Affiliates is a party relating solely to the license, sublicense, creation, development, use, exploitation, disclosure, or transfer of Business Intellectual Property (including any release, covenant not to ▇▇▇ or immunity from suit) other than (a) licenses of Commercial Software and (b) non-exclusive licenses of Intellectual Property incidental to the sale of products in the ordinary course of business.

| - 2 - |

“Business Material Adverse Effect” means any material adverse effect on the business, operations or financial condition of the Business taken as a whole; provided, that none of the following Events shall be taken into account in determining whether there has been or may be a Business Material Adverse Effect: (i) any Event with respect to United States financial or securities markets, general economic or business conditions, or political or regulatory conditions, (ii) any act of war, armed hostilities or terrorism, (iii) any Event with respect to the luxury apparel and accessories industry, (iv) any change in Law or GAAP or the interpretation or enforcement of either, (v) any termination or failure to renew by any Governmental Authority of any permit or license of the Business, (vi) the negotiation, execution, delivery, performance or public announcement of this Agreement (including, without limitation, any litigation related thereto and/or any adverse change in customer, employee, supplier, financing source, licensor, licensee, stockholder, joint venture partner or any other similar relationships), (vii) any change resulting from the failure of Buyer to consent to any acts or actions requiring Buyer’s consent under this Agreement and for which Seller has sought such consent, (viii) any failure of the Business to meet, with respect to any period or periods, any internal or industry analyst projections, forecasts, estimates of earnings or revenues, or business plans or (ix) any change, in or of itself, in the market price or trading volume of Seller common stock, except, in the case of clauses (i), (ii) or (iii), to the extent such Events have a materially disproportionate effect on the Business, taken as a whole, relative to other Persons engaged in the luxury apparel and accessories industry.

“Business Trademarks” has the meaning set forth in Section 3.7(a).

“Buyer” has the meaning set forth in the Preamble.

“Buyer Benefit Plan” has the meaning set forth in Section 5.4(c).

“Buyer Indemnitees” has the meaning set forth in Section 9.2(b).

“Buyer Material Adverse Effect” means (i) a material adverse effect on the ability of Buyer to consummate the transactions contemplated hereby and fulfill its obligations hereunder or (ii) any fact, event or circumstance that would be reasonably likely to delay in any material respect the consummation of the transactions contemplated hereby.

“Closing” has the meaning set forth in Section 2.1.

“Closing Consideration Amount” has the meaning set forth in Section 2.7(a)(i).

“Closing Date” has the meaning set forth in Section 2.1.

“Code” means the Internal Revenue Code of 1986, as amended.

“Co-Invest Funding” has the meaning set forth in Section 5.9.

| - 3 - |

“Commercial Software” means commercially available Software widely licensed by the owner of such Software pursuant to a standard license agreement and used internally (and not licensed or sublicensed to third parties).

“Common Units” means the member interests in Buyer that are designated as Common Units in the LLC Agreement.

“Concession Agreement” means the Licensed Department and Concession Agreement between Saks & Company and Seller dated January 28, 2013.

“Consent” has the meaning set forth in Section 5.2(a).

“Contemplated Transactions” means the purchase and sale of the RK Interests and the Assets as contemplated by this Agreement and the Ancillary Documents.

“Contract” means any oral or written agreement, license, contract, arrangement, understanding, obligation or commitment to which a party is bound.

“Credit Agreement” has the meaning set forth in Section 5.9.

“Determination Date” has the meaning set forth in Section 2.8(d).

“End Date” means August 30, 2013.

“Event” means events, changes, developments, effects, conditions, circumstances, matters, occurrences or state of facts.

“Excluded Assets” has the meaning set forth in Section 2.4(b).

“Excluded Liabilities” has the meaning set forth in Section 2.6.

“Final CFO Certificate” has the meaning set forth in Section 2.8(b).

“Final Working Capital” has the meaning set forth in Section 2.8(d).

“Fundamental Representations” means (i) with respect to Seller, the representations and warranties in Section 3.1 (Organization and Power), Section 3.2 (Authorization and Enforceability), Section 3.3 (No Violation), Section 3.4 (Government Authorizations and Consents), Section 3.5 (Title) and Section 3.6 (No Brokers) and (ii) with respect to Buyer, the representations and warranties in Section 4.1 (Organization and Power), Section 4.2 (Authorization and Enforceability), Section 4.3 (No Violation), Section 4.4 (Government Authorizations and Consents), and Section 4.7 (No Brokers).

“GAAP” means generally accepted accounting principles as set forth in the opinions and pronouncements of the Accounting Principles Board of the American Institute of Certified Public Accountants and statements and pronouncements of the Financial Accounting Standards Board or in such other statements by such other Person as may be approved by a significant segment of the accounting profession in the United States.

| - 4 - |

“Governmental Authority” means any nation or government, any foreign or domestic federal, state, county, municipal or other political instrumentality or subdivision thereof and any foreign or domestic entity or body exercising executive, legislative, judicial, regulatory, administrative or taxing functions of or pertaining to government, including any court.

“Governmental Consents” has the meaning set forth in Section 3.4.

“Indemnitee” has the meaning set forth in Section 9.2(d)(i).

“Indemnitor” has the meaning set forth in Section 9.2(d)(i).

“Intellectual Property” means, collectively, all intellectual property and other similar proprietary rights in any jurisdiction, whether owned or held for use under license, whether registered or unregistered, including without limitation such rights in and to: (a) utility and design patents and patent applications, and any and all divisions, continuations-in-part, reissues, reexaminations and extensions thereof, any counterparts claiming priority therefrom, and utility models, (collectively, “Patents”), any intellectual property and similar proprietary rights in inventions and invention disclosures, whether or not patentable, (b) copyrights, including copyrights in any works of authorship, such as in drawings, Software, records, website content, marketing materials and databases, (c) trademarks, service marks, certification marks, trade dress, logos, slogans, trade names, corporate names, brand names and other similar identifiers of source or origin, together with all goodwill associated with any of the foregoing, (“Trademarks”) (d) domain names, (e) any intellectual property and similar proprietary rights in designs (f) trade secrets (including those trade secrets defined in the Uniform Trade Secrets Act and under corresponding foreign statutory Laws and common law), any intellectual property and similar proprietary rights in business, marketing and technical information, product specifications, product designs, plans, proprietary processes, customer or supplier lists, know-how, other non-public, confidential or proprietary information and rights to limit the use or disclosure thereof by any person (“Trade Secrets”), (g) all intellectual property and similar proprietary rights in Software, (h) rights of publicity and other rights to use the names and likeness of individuals, (i) moral rights and (j) claims, causes of action and defenses relating to the enforcement of any of the foregoing, and in each case of (a) to (d), above, including any registrations of, applications to register and renewals and extensions of any of the foregoing with or by any Governmental Authority in any jurisdiction.

“IP Assignments” has the meaning set forth in Section 7.4.

“IP Representations” means the representations and warranties in Section 3.7.

“Krakoff” has the meaning set forth in the Preamble.

“Krakoff Employment Agreement” means that certain Employment Agreement, dated as of June 1, 2003, by and between Seller and Krakoff, as amended.

“Krakoff Funding” has the meaning set forth in Section 5.9.

“Krakoff Investor” has the meaning set forth in Section 5.9.

| - 5 - |

“Krakoff Resignation Letter” means that certain resignation letter, dated July 29, 2013, from Krakoff to Seller.

“Las Vegas Store” means the ▇▇▇▇ ▇▇▇▇▇▇▇ boutique located at ▇▇▇▇ ▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇.

“Laws” means all laws, Orders, statutes, codes, regulations, ordinances, decrees, rules, or other requirements with similar effect of any Governmental Authority.

“Lease Assignment and Assumption Agreement” has the meaning set forth in Section 5.2(a).

“Lease Retention Period” has the meaning set forth in Section 5.2(b).

“Lien” means any lien, security interest, easement, sublease, pledge or other similar encumbrance.

“Litigation” has the meaning set forth in Section 4.5.

“LLC Agreement” means that certain Amended and Restated Limited Liability Company Agreement of Buyer, substantially in the form attached as Exhibit A hereto, to be entered into by Buyer and Seller at the Closing; provided that if Buyer receives the Co-Invest Funding in accordance with Section 5.9, such form attached as Exhibit A may be amended in a manner generally consistent with the term sheet attached as Exhibit B hereto.

“Loss” or “Losses” means all claims, losses, liabilities, damages, costs and expenses, including, without limitation, reasonable attorneys’ fees, provided, that (i) Losses shall not include consequential damages, special damages, or punitive damages, and (ii) for purposes of computing Losses incurred by an Indemnitee, there shall be deducted an amount equal to the amount of any insurance proceeds, indemnification payments, contribution payments or reimbursements, and any Tax benefits, received or (in the reasonable determination of the Indemnitee and the Indemnitor) receivable by such Indemnitee or any of such Indemnitee’s Affiliates in connection with such Losses or the circumstances giving rise thereto.

“Modified Branding Agreement” means that certain Branding Agreement, substantially in the form attached as Exhibit C hereto, to be entered into by Seller, Buyer and Krakoff at the Closing.

“Negotiation Period” has the meaning set forth in Section 2.8(c).

“Net Working Capital” means an amount equal to (i) those current assets of the Business consisting of the sum of the following line items, as set forth on the Balance Sheet: “Accounts Receivable” and “Prepaid Assets”, as of the Closing Date minus (ii) those current liabilities of the Business consisting of the sum of the following line items, as set forth on the Balance Sheet: “Accounts Payable”, “Accrued Payroll”, “Accrued Payroll Taxes”, Accrued Sales/VAT Taxes” and “Accrued Other”, as of the Closing Date, calculated in accordance with the Working Capital Principles.

| - 6 - |

“Neutral Arbiter” means such independent accounting firm as Seller and Buyer mutually agree in writing; provided, if Buyer and Seller are unable to mutually agree upon such an accountant within a ten (10) day period, then Buyer and Seller shall each select a nationally recognized accountant and within five (5) days after their selection, those two accountants shall select a third nationally recognized accountant, which third accountant shall act as the Neutral Arbiter.

“Orders” means all judgments, orders, writs, injunctions, decisions, rulings, decrees and awards of any Governmental Authority.

“Patents” has the meaning set forth in the definition of “Intellectual Property.”

“Permitted Liens” means any (i) Lien in respect of Taxes, if due, the validity of which is being contested in good faith by appropriate proceedings, or Liens in respect of Taxes not yet due and payable, (ii) mechanics’, carriers’, workmen’s, repairmen’s or other like Liens arising or incurred in the ordinary course of business, (iii) with respect to leasehold interests, mortgages and other Liens incurred, created, assumed or permitted to exist and arising by, through or under a landlord or owner of the leased real property and (iv) any non-exclusive licenses or grants to use any Business Intellectual Property that are incidental to the sale of products in the ordinary course of business.

“Person” means any individual, person, entity, general partnership, limited partnership, limited liability partnership, limited liability company, corporation, joint venture, trust, business trust, cooperative, association, foreign trust or foreign business organization.

“Real Property Leases” means the real property leases, subleases or other occupancies used by the Seller or to which it is a party as lessee or lessor, with respect to the Business, each as set forth in Section 1.1(b) of the Schedules.

“▇▇▇▇ ▇▇▇▇▇▇▇ Brand” means the brand of products and services developed and marketed by Seller or its Affiliates under the ▇▇▇▇ ▇▇▇▇▇▇▇ Name pursuant to the Branding Agreement.

“▇▇▇▇ ▇▇▇▇▇▇▇ Name” means the name “▇▇▇▇ ▇▇▇▇▇▇▇”, and all derivations and combinations thereof (including the names “▇▇▇▇” and “Krakoff” and the initials “RK”).

“Retained Lease” has the meaning set forth in Section 5.2(b).

“RK Employee” shall mean each Business Employee who commences employment with Buyer as of 11:59 p.m. on the Closing Date.

“RK Interests” means the equity interests owned by Seller in RK LLC.

“RK LLC” means ▇▇▇▇ ▇▇▇▇▇▇▇ LLC, a Delaware limited liability company.

“Resolution Period” has the meaning set forth in Section 2.8(c).

“Restraints” has the meaning set forth in Section 6.1(a).

| - 7 - |

“Schedules” means the schedules of even date herewith delivered by Seller to Buyer in connection with the execution and delivery of this Agreement.

“Seller” has the meaning set forth in the Preamble.

“Seller Bridge Line” has the meaning set forth in Section 5.9.

“Seller Indemnitees” has the meaning set forth in Section 9.2(a).

“Short Hills Store” means the ▇▇▇▇ ▇▇▇▇▇▇▇ boutique located at ▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇ ▇▇▇▇▇.

“Software” means object code, source code, data files, application programming interfaces and databases, and documentation related thereto.

“Special Convertible Preferred Units” means the membership interests in Buyer that are designated as Special Convertible Preferred Units in the LLC Agreement.

“Sublease Agreement” has the meaning set forth in Section 5.2(a).

“Subsidiary” means, with respect to any Person, any corporation or other organization, whether incorporated or unincorporated, (a) of which such Person or any other Subsidiary of such Person is a general partner (excluding partnerships, the general partnership interests of which held by such Person or any Subsidiary of such Person do not have a majority of the voting interests in such partnership), or (b) at least a majority of the securities or other interests of which having by their terms ordinary voting power to elect a majority of the board of directors or others performing similar functions with respect to such corporation or other organization is directly or indirectly owned or controlled by such Person or by any one or more of its Subsidiaries, or by such Person and one or more of its Subsidiaries.

“Target Working Capital” means negative $1,000,000.

“Tax” or “Taxes” means all federal, state, local and foreign income, profits, franchise, gross receipts, environmental, customs duty, capital stock, severances, stamp, payroll, sales, employment, unemployment, disability, use, property, withholding, excise production, value added, occupancy, Transfer Taxes, and other taxes of any kind whatsoever, together with all interest, penalties or additions to tax.

“Tax Contest” shall mean any audit, hearing, proposed adjustment, arbitration, deficiency, assessment, suit, dispute, claim, proceeding or other Litigation commenced, filed or otherwise initiated or convened to investigate or resolve the existence and extent of a liability for Taxes.

“Tax Return” means any report, return, statement or other written information required to be supplied by Seller to a Taxing Authority in connection with any Taxes.

| - 8 - |

“Taxing Authority” shall mean any government or any subdivision, agency, commission or authority thereof, or any quasi-governmental or private body, having jurisdiction over the assessment, determination, collection or other imposition of Taxes.

“Third Party Claim” has the meaning set forth in Section 9.2(d)(ii)(A).

“Trade Secrets” has the meaning set forth in the definition of “Intellectual Property.”

“Trademarks” has the meaning set forth in the definition of “Intellectual Property.”

“Transfer Taxes” has the meaning set forth in Section 5.3(a).

“Transition Services Agreement” means that certain Transition Services Agreement, substantially in the form attached as Exhibit D hereto, to be entered into by Seller and Buyer at the Closing.

“Working Capital Estimate” has the meaning set forth in Section 2.8(a).

“Working Capital Overage” has the meaning set forth in Section 2.7(c).

“Working Capital Principles” means the principles, practices and methodologies for the determination and valuation of Net Working Capital as set forth in Section 1.1(c) of the Schedules.

“Working Capital Underage” has the meaning set forth in Section 2.7(c).

1.2. Rules of Construction.

Unless the context otherwise requires:

(a) A capitalized term has the meaning assigned to it;

(b) An accounting term not otherwise defined has the meaning assigned to it in accordance with GAAP;

(c) References in the singular or to “him,” “her,” “it,” “itself,” or other like references, and references in the plural or the feminine or masculine reference, as the case may be, shall also, when the context so requires, be deemed to include the plural or singular, or the masculine or feminine reference, as the case may be;

(d) References to Articles, Sections and Exhibits shall refer to articles, sections and exhibits of this Agreement, unless otherwise specified;

(e) The headings in this Agreement are for convenience and identification only and are not intended to describe, interpret, define or limit the scope, extent or intent of this Agreement or any provision thereof;

| - 9 - |

(f) This Agreement shall be construed without regard to any presumption or other rule requiring construction against the party that drafted and caused this Agreement to be drafted;

(g) All monetary figures shall be in United States dollars unless otherwise specified; and

(h) References to “including” in this Agreement shall mean “including, without limitation,” whether or not so specified.

ARTICLE II

Purchase and Sale

2.1. Closing.

The closing of the Contemplated Transactions (the “Closing”) will take place at the offices of Fried, Frank, Harris, ▇▇▇▇▇▇▇ & ▇▇▇▇▇▇▇▇ LLP, ▇▇▇ ▇▇▇ ▇▇▇▇ ▇▇▇▇▇, ▇▇▇ ▇▇▇▇, ▇▇ ▇▇▇▇▇, at 10:00 A.M. local time on the second Business Day immediately following the day on which the last of the conditions set forth in Article VI (other than those conditions that by their nature are to be satisfied at the Closing, but subject to the satisfaction or waiver of those conditions) are satisfied or waived in accordance with this Agreement, or on such other date as Buyer and Seller may otherwise agree. The day on which the Closing actually occurs is referred to herein as the “Closing Date.”

2.2. Sale and Purchase of the Assets.

Subject to the terms and conditions set forth in this Agreement, at the Closing, Seller shall sell, transfer, assign and deliver (or cause to be sold, transferred, assigned and delivered) to Buyer, and Buyer shall purchase and acquire, all of Seller’s right, title and interest in and to the RK Interests and the Assets, in each case free and clear of all Liens other than Permitted Liens. For purposes of this Agreement, “Assets” shall mean the following assets to the extent related solely to the Business (which shall not in any event include any of the Excluded Assets):

(a) the Real Property Leases;

(b) all fixtures and furniture located in the Las Vegas Store, the Short Hills Store, the premises related to the Real Property Leases and the workshops, design studios, show rooms and storage facilities set forth in Section 2.2(b) of the Schedules;

(c) all accounts receivable of the Business;

(d) all inventories of work-in-process, merchandise, raw materials (and permits related thereto, if any) and finished goods related solely to the Business, including inventories (i) located in the Las Vegas Store or the Short Hills Store, (ii) located in the show rooms and the storage space set forth in Section 2.2(d) of the Schedules, (iii) with manufacturers and (iv) under consignment;

| - 10 - |

(e) all minute books, stock records and charter documents, corporate seals related to the RK Interests and all other books, records or documents relating solely to the Business, including all design studio and workshop records and strategic or marketing materials;

(f) all purchase orders with manufacturers for merchandise and finished goods set forth in Section 2.2(f) of the Schedules;

(g) all Business IP Agreements, including those set forth in Section 2.2(g) of the Schedules, and all rights therein or thereunder;

(h) all of Seller and its Affiliates’ (other than RK LLC) right, title and interest in and to (i) all Trademarks consisting of or containing the ▇▇▇▇ ▇▇▇▇▇▇▇ Name, including all registration and applications therefore and those Trademarks listed on Schedule 2.2(h)(i), (ii) all Internet domain names, Patents and copyright registrations listed on Schedule 2.2(h)(ii), (iii) the ▇▇▇▇ ▇▇▇▇▇▇▇ Brand, (iv) all Intellectual Property in and to sketches, drawings and designs created by Krakoff in connection with the ▇▇▇▇ ▇▇▇▇▇▇▇ Brand and identified as such in the Seller’s archives prior to the date hereof or created after the date hereof and labeled as such at the time of creation, all sketches and designs derived therefrom, and all specification sheets related to the foregoing (in each case, including all initial sketches, designer sketch options, design cards, prototypes, samples and technical specifications for production) (v) all images and personal likenesses of Krakoff captured or used by Seller or its Affiliates exclusively in connection with the ▇▇▇▇ ▇▇▇▇▇▇▇ Brand and all Intellectual Property rights therein and (vi) publicity materials, websites or advertisements used solely in connection with the Business ((i) through (vi) above together with the Intellectual Property owned by RK LLC, the “Business Intellectual Property”), together with the right to ▇▇▇ for future or past infringements thereof and entirely stand in the place of Seller and its Affiliates in all matters related thereto, and all income, royalties, damages and payments due or payable at the Closing or thereafter therefrom and all claims, causes of action and defenses relating to the enforcement of any of the foregoing;

(i) all past and present goodwill related solely to the Business or Business Intellectual Property or otherwise associated with or symbolized by any of the Assets;

(j) all machinery, equipment, molds, tools, furniture and furnishings, leasehold improvements, goods, vehicles, office equipment and supplies, computers and related equipment, telephones, telecopiers, and other fixed assets, including such Assets set forth on Section 2.2(j) of the Schedules;

(k) all rights of Seller relating to deposits and prepaid expenses, claims for refunds and rights to offset in respect thereof set forth on Section 2.2(k) of the Schedules, but not including such rights related to real property leases, subleases and occupancies used by the Seller or to which it is a party as lessee or lessor, other than the Real Property Leases;

(l) all other Contracts related solely to the Business, including those Contracts set forth on Section 2.2(l) of the Schedules (the “Assumed Contracts”); and

(m) all rights to receive mail (including e-mail) and other communications related solely to the Business.

| - 11 - |

2.3. Nonassignable Assets and Liabilities.

(a) Notwithstanding anything in this Agreement to the contrary, this Agreement shall not constitute an agreement to assign any Asset if the attempted assignment thereof, without the consent of a third party thereto, would constitute a breach of any obligation of Seller or would in any way adversely affect the rights of Buyer or Seller thereunder. If such consent is not obtained, or if an attempted assignment thereof would be ineffective or would affect the rights of Seller thereunder so that Buyer would not in fact receive all such rights, Seller will, to the extent not prohibited by or not in violation of any such agreement, (a) cooperate with Buyer in any commercially reasonable arrangement designed to provide for Buyer the benefits (including the exercise of the Seller’s rights) under any such Asset, including enforcement for the benefit of Buyer of any and all rights of the Seller against a third party thereto arising out of the breach or cancellation by such third party or otherwise, (b) hold all monies paid to Seller thereunder on and after the Closing Date in trust for the account of Buyer, and (c) remit such money to Buyer as promptly as possible. Any transfer or assignment to Buyer by Seller of any property or property rights or any agreement which shall require the consent or approval of any third party shall be made subject to such consent or approval being obtained.

(b) Notwithstanding anything in this Agreement to the contrary, if an attempted assumption of an Assumed Liability would be ineffective or would not result in the full release of Seller from its obligations under such Assumed Liability without consent of a third party thereto and such consent is not obtained prior to Closing, Buyer will indemnify Seller for any and all amounts payable by Seller pursuant to such Assumed Liability from and after the Closing Date.

2.4. Excluded Assets.

(a) Other than the Assets, Seller shall not sell, transfer, assign or deliver to Buyer any of its rights, titles to or interests in any assets, including any of the Excluded Assets.

(b) For purposes of this Agreement, “Excluded Assets” mean the following:

(i) all assets and properties related to Seller’s and its Affiliates’ (other than RK LLC) businesses but not solely to the Business;

(ii) Seller’s trade names and common law names (other than the ▇▇▇▇ ▇▇▇▇▇▇▇ Name), including, without limitation, the “Coach” name and all Trademarks consisting of or containing such trade and common law names (other than the ▇▇▇▇ ▇▇▇▇▇▇▇ Name); provided, however, that Buyer and its Affiliates shall have the right to make non-trademark use of the word “Coach” (but not, for the avoidance of doubt, any other Trademark of Seller, including any logo or stylized representation of the word “Coach”) in connection with accurate historical descriptions of the Assets and/or the Business;

(iii) all rights to refunds of Taxes paid by Seller, except to the extent included as an asset on the Balance Sheet;

(iv) all data and records to the extent relating to Tax liabilities, potential Tax liabilities, or refunds of Taxes of Seller or Taxes of the Business, in each case, with respect to taxable periods or portions thereof, ending on or prior to the Closing Date, excluding however, books and records related to Taxes that are Assumed Liabilities;

| - 12 - |

(v) all minute books, stock records and charter documents, corporate seals and other books, records or documents relating to the corporate organization of Seller, existence or capitalization of Seller, as well as any other records or materials relating to Seller generally and not relating solely to the Assets or Business;

(vi) all consideration received by, and all rights of, Seller pursuant to this Agreement;

(vii) all cash and cash equivalents (including marketable securities and short term investments) and deposits held by Seller or related to the Business;

(viii) any amounts due from Seller’s Affiliates;

(ix) all insurance benefits, including rights and proceeds, arising from or primarily relating to the Assets;

(x) the closed-circuit television systems located in the Las Vegas Store and the Short Hills Store, including all related equipment;

(xi) all machinery, equipment, molds, tools, furniture and furnishings, leasehold improvements, goods, vehicles, office equipment and supplies, computers and related equipment, telephones, telecopiers, and other fixed assets not solely used by the Business; and

(xii) any assets or properties set forth in Section 2.4(b)(xii) of the Schedules.

2.5. Assumption of Liabilities.

Effective as of the Closing, Seller shall not have any liability or obligation with respect to, and Buyer shall assume and thereafter pay, perform and discharge when due, only the following liabilities and obligations of Seller (which shall not in any event include the Excluded Liabilities) to the extent related to or arising from the RK Interests, the Assets and/or the Business (collectively, the “Assumed Liabilities”):

(a) all obligations and liabilities arising under the Real Property Leases and the Assumed Contracts arising from and after the Closing;

(b) (i) all current liabilities of the Business set forth on the Balance Sheet, including accounts payable, accrued payroll, accrued payroll taxes, accrued sales/VAT taxes and other accruals to the extent included in the calculation of the Net Working Capital pursuant to the Working Capital Principles plus (ii) accounts payable in the ordinary course of business representing inventory purchased;

(c) all liabilities for Taxes relating to the Assets and/or the Business for taxable periods or portions thereof beginning after the Closing; and

| - 13 - |

(d) the liabilities set forth in Section 2.5(d) of the Schedules.

2.6. Excluded Liabilities.

Seller shall, without any further responsibility or liability of, or recourse to, Buyer or RK LLC, or any of Buyer’s directors, managers, equityholders, officers, employees, agents, consultants, representatives, affiliates, successors or assigns, absolutely and irrevocably assume and be solely liable and responsible for, and indemnify Buyer in respect of, any liabilities or obligations other than the Assumed Liabilities (the “Excluded Liabilities”), including:

(a) all liabilities relating to or arising out of the Excluded Assets;

(b) all liabilities for Taxes relating to the Assets and/or the Business for taxable periods or portions thereof ending on or prior to the Closing;

(c) any liabilities relating to the Business or RK LLC in connection with any litigation arising out of events occurring prior to the Closing Date, including the litigation set forth on Section 2.6(c) of the Schedules;

(d) any liabilities for personal injury or property damage, whether in contract, tort, strict liability or under any other theory, arising from products sold or services rendered by the Business prior to the Closing Date;

(e) any liabilities of the Business for indebtedness incurred prior to the Closing Date;

(f) all liabilities relating to the Las Vegas Store or the Short Hills Store;

(g) all obligations and liabilities of Seller with respect to employment, or termination of employment, in each case, on or prior to the Closing Date, other than accrued compensation obligations to the extent included in the calculation of the Net Working Capital pursuant to the Working Capital Principles.

(h) all obligations and liabilities of Seller following the Closing Date with respect to the employment of, termination of employment of or failure to offer employment to any employee of Seller other than an RK Employee;

(i) the liabilities set forth on Section 2.6(i) of the Schedules; and

(j) any liabilities of RK LLC that are not Assumed Liabilities.

2.7. Payments at the Closing.

(a) The purchase price to be paid by Buyer for the RK Interests and the Assets, and the assumption of the Assumed Liabilities, shall be as follows:

(i) Ten Dollars ($10.00) in cash (the “Closing Consideration Amount”); plus

| - 14 - |

(ii) that number of Common Units equal to fifteen percent (15%) of the issued and outstanding Common Units immediately following the Closing (provided, that if Buyer receives the Co-Invest Funding in accordance with Section 5.9, the number of Common Units to be received by Seller in accordance with this Section 2.7(a)(ii) shall equal 7.5% of the issued and outstanding Common Units immediately following the Closing); plus

(iii) the Special Convertible Preferred Units as set forth in the LLC Agreement; plus

(iv) the Working Capital Overage (as defined below), if any, in accordance with Section 2.7(c).

(b) At the Closing, Buyer shall pay to Seller in consideration for the RK Interests and all of the Assets an amount equal to the Closing Consideration Amount, by wire transfer of immediately available funds to an account designated by Seller no fewer than three (3) Business Days prior to the Closing Date.

(c) At Closing, (i) If the Working Capital Estimate is has a higher value than the Target Working Capital, then Buyer shall make a payment equal to such difference (the “Working Capital Overage”) in immediately available funds to such account as is designated by Seller at Closing, or (ii) if the Working Capital Estimate has a lower value than the Target Working Capital, then Seller shall make a payment equal to such difference (the “Working Capital Underage”) in immediately available funds to such account as is designated by Buyer at Closing.

2.8. Working Capital Adjustment.

(a) No later than three (3) Business Days prior to the Closing Date, Seller shall deliver to Buyer a certificate of the Chief Financial Officer of Seller setting forth in reasonable detail the estimated computation based on the Working Capital Principles of the amount of (i) the Net Working Capital (the “Working Capital Estimate”), and (ii) the Working Capital Overage or the Working Capital Underage, as applicable. Seller will consult in good faith with Buyer regarding the calculation of the Working Capital Estimate and the resulting Working Capital Overage or Working Capital Underage, as applicable.

(b) Promptly, but in any event within sixty (60) days after the Closing, Buyer shall prepare and deliver to Seller a certificate of the Chief Financial Officer of Buyer (the “Final CFO Certificate”) setting forth the proposed calculation of the Net Working Capital pursuant to the Working Capital Principles. Thereafter, at the request of either Seller or Buyer, the other party shall give Seller or Buyer (as the case may be) access during normal business hours to the books and records relating to the Business that are relevant to the calculation of the Net Working Capital. In addition, Buyer shall make its representatives reasonably available to answer questions with respect to the calculation of the Net Working Capital.

| - 15 - |

(c) If Seller disagrees with Buyer’s calculation of the Net Working Capital, it shall notify Buyer of such disagreement in writing, setting forth in reasonable detail the particulars of such disagreement, within thirty (30) days after its receipt of the Final CFO Certificate. Following the Closing, Buyer shall provide Seller access to the records and employees of Buyer to the extent necessary for the review of Buyer’s calculation of the Net Working Capital and shall cause the employees of Buyer to cooperate with Seller in connection with its review of Buyer’s calculation of the Net Working Capital; provided that such access shall be reasonably necessary and does not unreasonably disrupt the personnel and operations of Buyer. In the event that Seller does not provide such a notice of disagreement to Buyer within such 30-day period, Seller shall be deemed to have accepted Buyer’s calculation of the Net Working Capital, which shall be final, binding and conclusive for all purposes hereunder. In the event any such notice of disagreement is timely provided, Buyer and Seller shall use commercially reasonable efforts for a period of thirty (30) days (or such longer period as they may mutually agree) (the “Resolution Period”), to resolve any disagreements with respect to Buyer’s calculation of the Net Working Capital. If, at the end of the Resolution Period, they are unable to resolve such disagreements, then Buyer’s calculation of the Net Working Capital along with Seller’s notice of disagreement (both modified to reflect only unresolved disagreements) and a written response from Buyer to Seller’s notice of disagreement (setting forth in reasonable detail the particulars of Buyer’s disagreement) shall be submitted within ten (10) days after the last day of the Resolution Period to the Neutral Arbiter to resolve any remaining disagreements. Buyer and Seller agree to execute, if requested by the Neutral Arbiter, a customary engagement letter. The Neutral Arbiter shall determine as promptly as practicable, but in any event within thirty (30) days of the date on which such dispute is referred to the Neutral Arbiter, whether (and only with respect to the remaining disagreements submitted to the Neutral Arbiter) and to what extent (if any) the amount of the Net Working Capital as determined in accordance with the terms of this Agreement requires correction; provided that the scope of the dispute to be resolved by the Neutral Arbiter shall be limited to whether the Buyer’s calculation of the Net Working Capital was calculated in accordance with the Working Capital Principles, and whether there were mathematical errors in such calculation, and the Neutral Arbiter shall not make any other determination. In reaching its determination, the only alternatives available to the Neutral Arbiter will be to (i) accept the position of Buyer, (ii) accept the position of Seller or (iii) determine a position between those two positions. The Neutral Arbiter will determine the allocation of its costs and expenses based on the inverse of the percentage which its award (before such allocation) bears to the total amount of the total items in arbitration as originally submitted to it. Accordingly, by way of example, should the items in arbitration total in amount to $1,000 and the Neutral Arbiter awards $600 in favor of Seller’s position, 60% of the costs and expenses would be assessed against Buyer and 40% of the costs and expenses would be assessed against Seller. The determination of the Neutral Arbiter shall be final, binding and conclusive. The date on which the amount of the Closing Working Capital is finally determined in accordance with this Section 2.8(c) (whether due to agreement by Buyer and Seller or a determination by the Neutral Arbiter in accordance with this Section 2.8(c)), is hereinafter referred as to the “Determination Date.”

(d) For the purposes of this Agreement, “Final Working Capital” means the Net Working Capital, as finally agreed or determined in accordance with Section 2.8(c). Upon the determination of the Final Working Capital pursuant to Section 2.8(c), (i) if (and only if) the Final Working Capital has a higher value than the Working Capital Estimate, Buyer shall promptly (but in any event within five (5) Business Days following the Determination Date) deliver to Seller the amount by which the Final Working Capital exceeds the Working Capital Estimate by wire transfer of immediately available funds to an account or accounts designated by Seller in writing and (ii) if (and only if) the Working Capital Estimate has a higher value than the Final Working Capital, then Seller shall promptly (but in any event within five Business Days following the Determination Date) deliver to Buyer a cash payment in the amount by which the Working Capital Estimate exceeds the Final Working Capital by wire transfer of immediately available funds to one or more accounts designated by Buyer in writing. Upon payment of the amounts provided in this Section 2.8(d), none of the parties hereto may make or assert any claim under this Section 2.8.

| - 16 - |

ARTICLE III

Representations and Warranties of Seller

Seller hereby represents and warrants to Buyer that the statements contained in this Article III are true and correct on the date of this Agreement and shall be true and correct on the Closing Date:

3.1. Organization and Power.

Seller is a corporation duly incorporated, validly existing and in good standing under the Laws of the State of Maryland. Seller has full power and authority to execute, deliver and perform this Agreement and the Ancillary Documents to which it is a party and to consummate the Contemplated Transactions. Seller has all power and authority, and possesses all governmental licenses and permits necessary to enable it to own or lease and to operate the properties and assets with respect to the Business and carry on the Business as currently conducted, except such power, authority, licenses and permits the absence of which do not have a Business Material Adverse Effect.

3.2. Authorization and Enforceability.

The execution and delivery of this Agreement and the Ancillary Documents to which Seller is a party and the performance by Seller of the Contemplated Transactions that are required to be performed by Seller have been duly authorized by Seller and no other corporate proceedings on the part of Seller (including, without limitation, any shareholder vote or approval) are necessary to authorize the execution, delivery and performance of this Agreement and the Ancillary Documents to which Seller is a party or the consummation of the Contemplated Transactions that are required to be performed by Seller. This Agreement is and each of the Ancillary Documents to be executed and delivered at the Closing by Seller will be, at the Closing, duly authorized, executed and delivered by Seller and constitute, or as of the Closing Date will constitute, valid and legally binding agreements of Seller enforceable against Seller in accordance with their terms, subject to bankruptcy, insolvency, reorganization and other Laws of general applicability relating to or affecting creditors’ rights and to general equity principles.

| - 17 - |

3.3. No Violation.

Except as set forth in Section 3.3 of the Schedules, the execution and delivery by Seller of this Agreement and the Ancillary Documents to which Seller is a party, consummation of the Contemplated Transactions that are required to be performed by Seller and compliance with the terms of this Agreement and the Ancillary Documents to which Seller is a party will not (a) conflict with or result in any breach of any of the terms, conditions or provisions of, (b) constitute a default under, (c) result in a violation of, (d) give any third party the right to modify, terminate or accelerate or cause the modification, termination or acceleration of, any obligation under, or (e) result in the creation of any Lien upon RK Interests or the Assets, under (i) the provisions of the certificate of incorporation, bylaws, or other similar organization documents of Seller, (ii) any Contract to which Seller is bound or affected that relates to the Business, (iii) any judgment, order or decree to which the Seller is subject, or (iv) any Law applicable to Seller or by which its properties are bound or affected, with respect to the Business except in the case of clause (ii) for conflicts, breaches, defaults, violations, rights, Liens, or requirements that would not have a Business Material Adverse Effect. Neither Seller nor its Affiliates are subject to any Contract that would impair or delay Seller’s ability to consummate the Contemplated Transactions.

3.4. Governmental Authorizations and Consents.

No consents, licenses, approvals or authorizations of, or registrations, declarations or filings with, any Governmental Authority (“Governmental Consents”) are required to be obtained or made by Seller in connection with the execution, delivery, performance, validity and enforceability of this Agreement or any Ancillary Documents to which Seller is, or is to be, a party or the consummation by Seller of the Contemplated Transactions.

3.5. Title.

Seller has good title to, or valid leasehold or license interests in, as the case may be, all of the Assets, free and clear of all Liens other than Permitted Liens. Seller is the beneficial owner of the RK Interests free and clear of all Liens other than Permitted Liens.

3.6. No Brokers.

Seller has not employed or incurred any liability to any broker, finder or agent for any brokerage fees, finder’s fees, commissions or other amounts with respect to this Agreement, the Ancillary Documents or the Contemplated Transactions, other than those fees, commissions or other amounts that will be charged to and paid by Seller.

3.7. Intellectual Property.

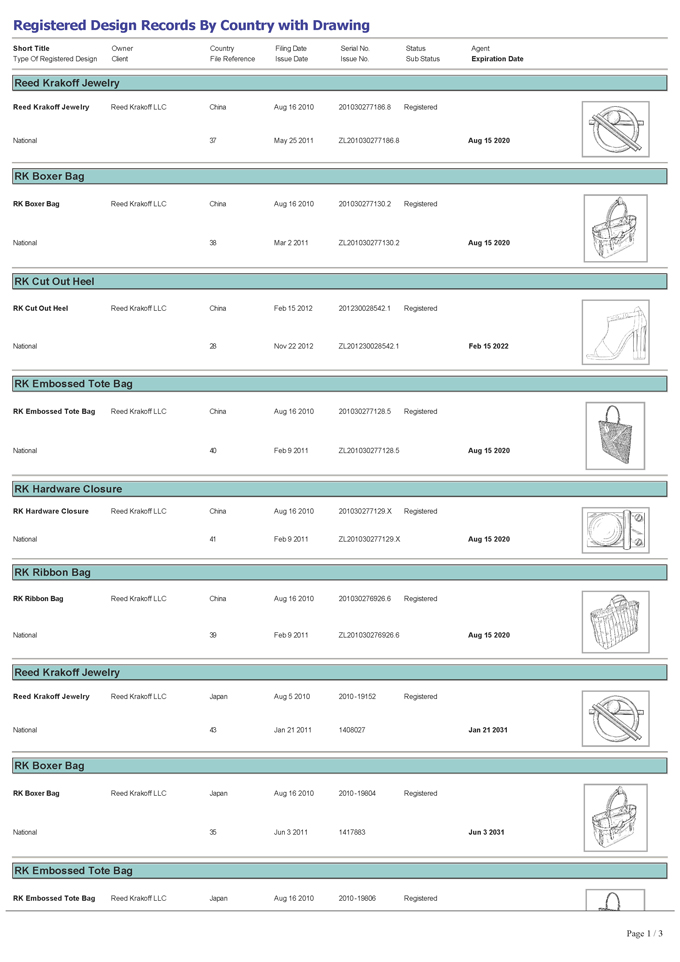

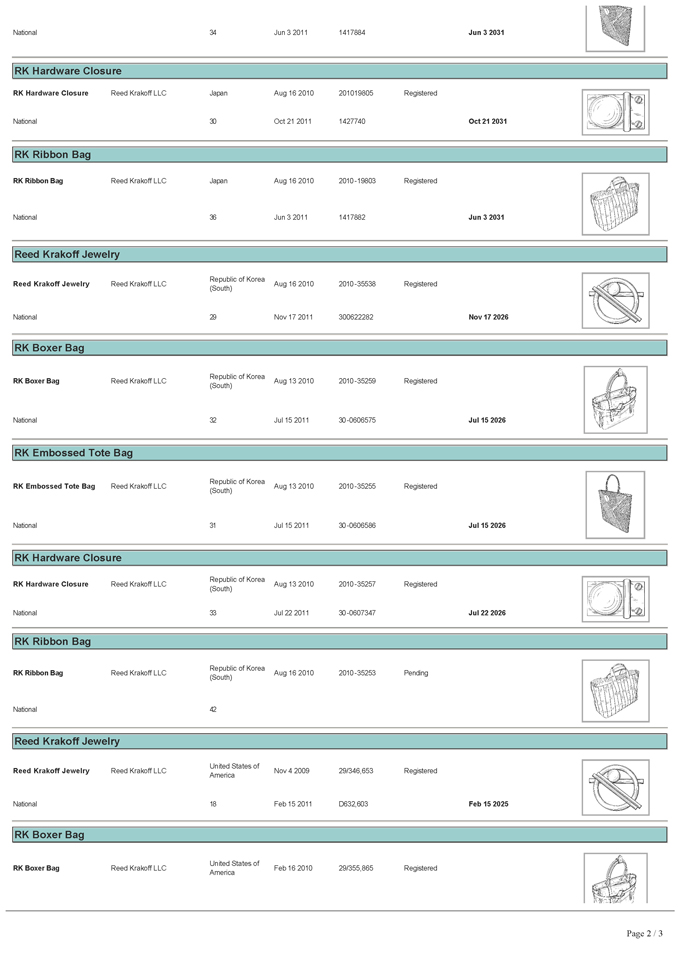

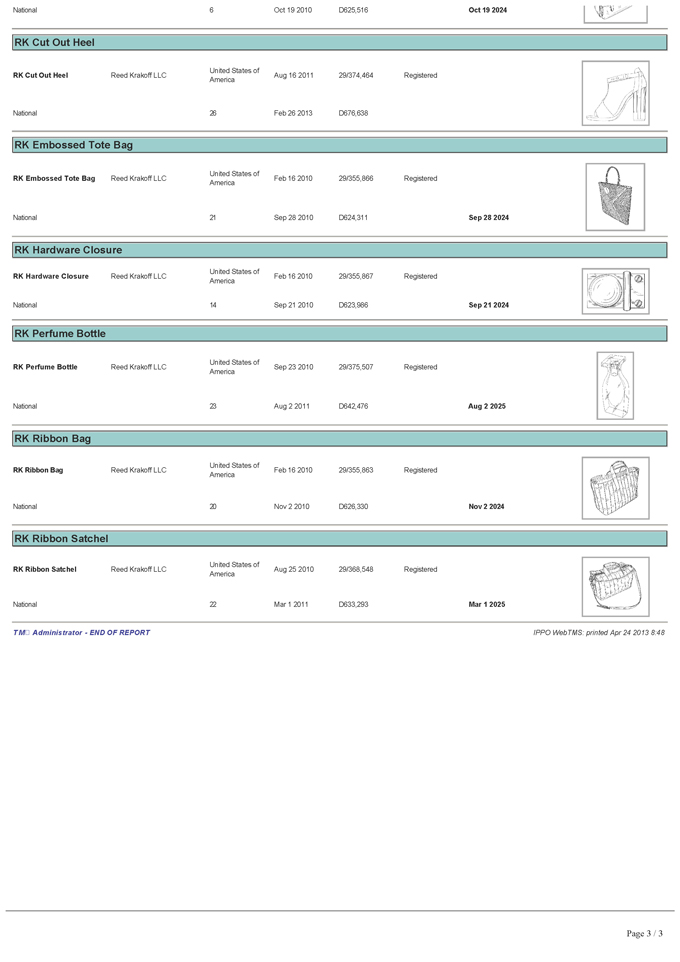

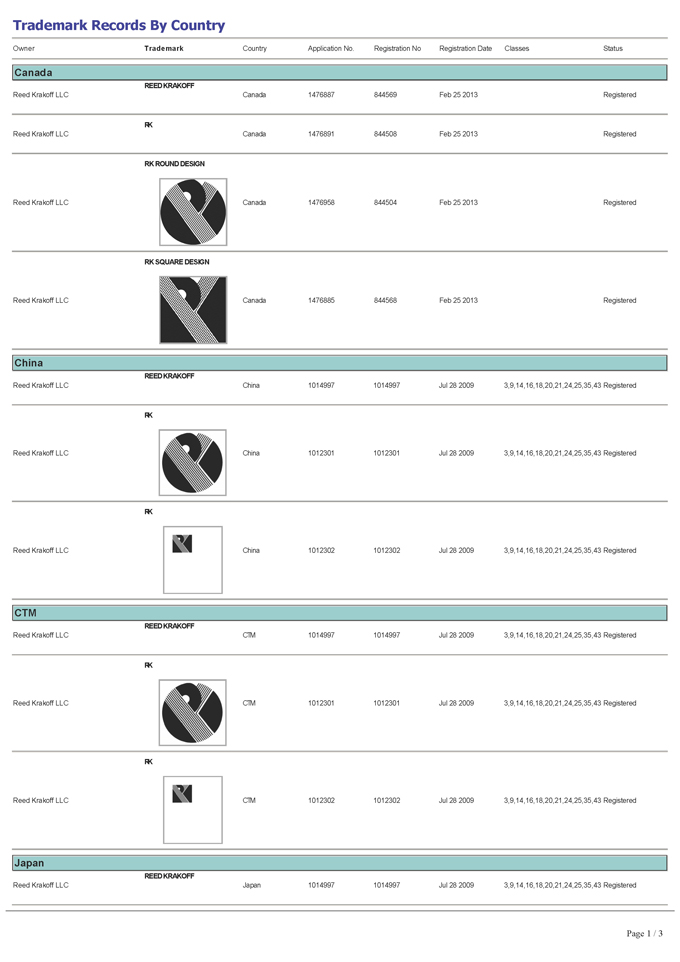

(a) Section 3.7(a) of the Schedules sets forth a complete and correct list of the following categories of Business Intellectual Property: (i) all registered Trademarks and applications therefor (the “Business Trademarks”); (ii) all Patents (iii) all registered Copyrights and applications therefor; (iv) all registered design rights and applications therefor; and (v) all domain names; in each case listing, as applicable, (A) the name of the current owner of record, (B) the jurisdiction where the application or registration is located and (C) the application or registration number.

(b) Section 3.7(b) of the Schedules sets forth a complete and correct list of all Business IP Agreements. Neither Seller nor RK LLC have assigned or granted any rights in, to or under the Branding Agreement to any third Person.

| - 18 - |

(c) Except as otherwise set forth in Section 3.7(c) of the Schedules, Seller or RK LLC is the sole and exclusive owner of the Business Intellectual Property; in each case, free and clear of any Liens other than Permitted Liens.

(d) To the knowledge of Seller, the Intellectual Property set forth in Section 3.7(a) of the Schedules is valid, subsisting and enforceable and has not been cancelled, expired or abandoned. None of the Business Trademarks have been assigned from any Person without the associated goodwill. To the knowledge of Seller, Seller and RK LLC have complied with and are in compliance with all Laws with respect to registered and applied for Business Intellectual Property. All such Business Intellectual Property is duly registered, issued and/or filed in the name of Seller or RK LLC, as applicable. To the knowledge of Seller, there are no facts or circumstances that would render any registered or applied for Business Intellectual Property invalid or unenforceable. To the knowledge of Seller, no false allegations of use or other false statements have been made in connection with the filing, prosecution or maintenance of any registered or applied for Business Intellectual Property.

(e) Except as set forth on Section 3.7(e) of the Schedules there is no pending or, to the knowledge of Seller, threatened, Litigation or any other proceeding: (i) challenging the validity or enforceability of, or contesting Seller’s or RK LLC’s ownership rights with respect to, any of the Business Intellectual Property, (ii) challenging the validity or enforceability of, or Seller’s or RK LLC’s rights under, any Business IP Agreement or (iii) asserting that RK LLC, the conduct of the Business or any product thereof infringes upon, misappropriates, dilutes or violates the Intellectual Property of any Person. To the knowledge of Seller, no Person has infringed, misappropriated, violated or diluted any Business Intellectual Property. There has been no refusal by any Governmental Authority to register any Trademarks used in the Business on the grounds of conflicting prior rights by any other Person.

(f) Neither the execution, delivery and performance by Seller of this Agreement nor the consummation of the Contemplated Transactions will result in, the creation of any Lien on any Business Intellectual Property or a violation or breach of, or cause acceleration, termination or cancellation, or constitute (with or without notice of lapse of time or both) a default or result in the loss of a material benefit under any of the terms, conditions or provisions of any Business IP Agreement. Neither Seller, nor, to the knowledge of Seller, any other Person, is in default under any Business IP Agreement; and Seller has not given or received any notice of default, or of any event which with the lapse of time would constitute a default, under any such agreements.

(g) To the knowledge of Seller, Seller and RK LLC’s collection, storage, use and dissemination of any personally identifiable information with relation to the Business are and have been in material compliance with all applicable Laws relating to privacy, data security and data protection, and all applicable privacy policies and terms of use or other contractual obligations.

(h) No representations or warranties are made by Seller in respect of any Intellectual Property identified as abandoned or rejected in the Schedules.

| - 19 - |

3.8. Real Property Leases.

True and correct copies of the Real Property Leases, as amended, have been provided to Buyer. Seller is not in material default and, to the knowledge of Seller, no event has occurred which, with notice or the passage of time, would result in a material default by Seller. To the knowledge of the employees or agents of Seller with responsibility for the day-to-day management of the leased properties, the landlords are not in material default thereunder.

3.9. Assumed Contracts.

Except as set forth in Section 3.9 of the Schedules, to the knowledge of Seller (a) each Assumed Contract in effect at the Closing is a valid and binding agreement of Seller and/or its Subsidiary party thereto and is in full force and effect, (b) none of Seller or any of its Subsidiaries or any other party thereto, is in default or breach in any material respect under the terms of any such Assumed Contract and (c) no event or circumstance has occurred that, with notice or lapse of time or both, would constitute an event of default under any Assumed Contract. Complete and accurate copies of each Assumed Contract have been made available to Buyer.

3.10. No Undisclosed Liabilities of RK LLC.

RK LLC does not have any material debts, liabilities or obligations other than those debts, liabilities and obligations that (i) are or would be required to be reflected on a balance sheet in accordance with U.S. GAAP or (ii) were incurred in the ordinary course of business consistent with past practice.

ARTICLE IV

Representations and Warranties of Buyer

Buyer hereby represents and warrants to Seller that the statements contained in this Article IV are true and correct on the date of this Agreement and shall be true and correct on the Closing Date:

4.1. Organization and Power.

Buyer is a limited liability company duly formed, validly existing and in good standing under the Laws of the state of Delaware and has full power and authority to execute and deliver this Agreement and the Ancillary Documents to which it is a party, to perform its obligations hereunder and thereunder and to consummate the Contemplated Transactions.

4.2. Authorization and Enforceability.

The execution and delivery of this Agreement and the Ancillary Documents to which Buyer is a party and the performance by Buyer of the Contemplated Transactions have been duly authorized by Buyer and no other proceedings on the part of Buyer (including, without limitation, any equityholder vote or approval) are necessary to authorize the execution, delivery and performance of this Agreement and the Ancillary Documents to which Buyer is a party or the consummation of the Contemplated Transactions. This Agreement is, and each of the Ancillary Documents to be executed and delivered at the Closing by Buyer will be at the Closing, duly authorized, executed and delivered by Buyer and constitute, or as of the Closing Date will constitute, valid and legally binding agreements of Buyer enforceable against Buyer, in accordance with their terms, subject to bankruptcy, insolvency, reorganization and other Laws of general applicability relating to or affecting creditors’ rights and to general equity principles.

| - 20 - |

4.3. No Violation.

The execution and delivery by Buyer of this Agreement and the Ancillary Documents to which Buyer is a party, consummation of the Contemplated Transactions and compliance with the terms of this Agreement and the Ancillary Documents to which Buyer is a party will not (a) conflict with or violate any provision of the certificate of formation, limited liability company agreement or similar organizational documents of Buyer, or (b) conflict with or violate in any material respect any Law applicable to Buyer or by which its respective properties are bound or affected. Neither Buyer nor its Affiliates are subject to any Contract that would impair or delay Buyer’s ability to consummate the Contemplated Transactions.

4.4. Governmental Authorizations and Consents.

No Governmental Consents are required to be obtained or made by Buyer in connection with the execution, delivery, performance, validity and enforceability of this Agreement or any Ancillary Documents to which Buyer is, or is to be, a party or the consummation by Buyer of the Contemplated Transactions. All representations, warranties, statements or other communications, whether express or implied, made by Buyer to any Governmental Authority in connection with any Governmental Consents shall be true and correct.

4.5. Litigation.

There are no claims, actions, suits or proceedings (“Litigation”) pending or, to the knowledge of Buyer, threatened against or involving Buyer which questions the validity of this Agreement or any of the Ancillary Documents to which it is a party or seeks to prohibit, enjoin or otherwise challenge Buyer’s ability to consummate the Contemplated Transactions.

4.6. Capitalization.

The Common Units and the Special Convertible Preferred Units to be issued pursuant to the terms of this Agreement, when issued pursuant to the terms of this Agreement, will be duly authorized and validly issued, fully paid and non-assessable and free of all Liens, claims and restrictions other than those imposed by applicable securities laws or the organizational documents of Buyer. After giving effect to the Contemplated Transactions, the capitalization of Buyer will be as set forth in the LLC Agreement.

4.7. No Brokers.

Neither Buyer nor any of its Affiliates has employed or incurred any liability to any broker, finder or agent for any brokerage fees, finder’s fees, commissions or other amounts with respect to this Agreement, the Ancillary Documents or the Contemplated Transactions, other than those fees, commissions or other amounts that will be charged to and paid by Buyer.

| - 21 - |

4.8. Investigation.

Buyer is knowledgeable about the industry in which the Business operates and the Laws and regulations applicable to the Business, and is experienced in the acquisition and management of businesses.

4.9. Business Prospects.

Buyer acknowledges that Seller (or its Affiliates, officers, directors, employees, agents or representatives) does not make, will not make and has not made any representation or warranty, express or implied, as to the prospects of the Business or its profitability for Buyer, or with respect to any forecasts, projections or business plans made available to Buyer (or its Affiliates, officers, directors, employees, agents or representatives) in connection with Buyer’s review of the Business.

4.10. Sketches, Drawings and Designs.

The sketches, drawings and designs created by Krakoff which are stamped or otherwise marked with the ▇▇▇▇ ▇▇▇▇▇▇▇ Name were created solely in connection with the ▇▇▇▇ ▇▇▇▇▇▇▇ Brand and relate solely to the Business.

ARTICLE V

Covenants

5.1. Conduct of Seller.

(a) Except (i) to the extent compelled or required by applicable Law, (ii) as otherwise permitted or contemplated by this Agreement, (iii) as set forth in Section 5.1(a) of the Schedules, (iv) as consented to in writing by Buyer (which consent shall not be unreasonably withheld or delayed) or (v) as set forth in Section 5.1(b), during the period from the date hereof to the Closing Date, Seller shall conduct the Business in the ordinary course, consistent with past practice (including the purchasing and manufacturing processes of the Business).

(b) During the period from the date hereof to the Closing Date, Seller shall continue to fund the operation of the Business in the ordinary course consistent with past practice; provided, that, at the Closing, Buyer shall reimburse Seller for such funding in an aggregate amount equal to the product of (x) three million dollars ($3,000,000) multiplied by (y) a fraction (i) the numerator of which is the number of days during the period from August 1, 2013 to the Closing Date (including both August 1, 2013 and the Closing Date) and (ii) the denominator of which is thirty one (31); provided further, that such reimbursement will be in the form of a draw down on the Seller Bridge Line if Buyer and Seller enter into the Credit Agreement in accordance with Section 5.9.

| - 22 - |

5.2. Approvals and Consents.

(a) Upon the terms and conditions set forth herein, each of the parties shall use commercially reasonable efforts to take, or cause to be taken, all actions and to do, or cause to be done, and to assist and cooperate with the other parties in doing, all things, necessary, proper or advisable to make effective as promptly as practicable, but in no event later than the End Date, the Contemplated Transactions, including obtaining those consents, approvals, clearances, ratifications, permissions, authorizations and waivers from third Persons listed in Section 5.2(a) of the Schedules (collectively, the “Consents”). If the parties cannot obtain a Consent that is necessary to assign a Real Property Lease to Buyer pursuant to an assignment and assumption agreement between Buyer and Seller (a “Lease Assignment and Assumption Agreement”), Seller shall use commercially reasonable efforts to obtain consent to sublease the entire premises related to such Real Property Lease to Buyer pursuant to a sublease agreement between Buyer and Seller (a “Sublease Agreement”) and, if such consent is obtained, Buyer and Seller will enter into a Sublease Agreement in customary form. During the period prior to Closing, Seller shall exclusively negotiate with the landlords regarding the Consents and neither Buyer nor Krakoff will have any discussions with any landlord for the Real Property Leases unless Seller consents to such discussions and is granted an opportunity to participate in such discussions. Following the Closing, each of the parties shall continue to use commercially reasonable efforts to obtain any of the Consents that were not obtained prior to the Closing. Notwithstanding the foregoing, neither Seller nor its Affiliates shall have any obligation to make payments or any concessions to any third party in connection with obtaining any of the Consents. In connection with obtaining a Consent necessary to assign or sublease, as applicable, the Real Property Leases pursuant to this Section 5.2(a), except as otherwise provided in this Agreement, neither Buyer nor Seller shall be required to pay any increase in the rent or other amounts payable under the related Real Property Lease, to agree to any other modifications of the terms of such Real Property Lease (including a shortening of the lease term) or otherwise be required to pay any premium or fee, except that Buyer and Seller shall each pay half of any processing fee or reimbursement of landlord legal expenses required by the terms of the assignment clause of such Real Property Lease.

(b) Subject to Section 6.3(d), without limiting the foregoing in Section 5.2(a), in the event that the parties are unable to obtain the Consent(s) necessary to assign or sublease a Real Property Lease to Buyer (such Real Property Lease, a “Retained Lease”), Seller shall use commercially reasonable efforts to provide Buyer with such rights as it would have as a lessee under such Retained Lease for a period beginning on the Closing Date and continuing until the earlier to occur of (i) the expiration of the current term of such Retained Lease (not including any amendments to, or extensions or renewals of, such term) and (ii) the date upon which all Consents necessary to assign or sublease such Retained Lease to Buyer have been obtained (such period, the “Lease Retention Period”); provided, that neither Buyer nor Seller shall be required to agree to any modifications to any such Retained Lease. Buyer shall indemnify and hold harmless Seller with respect to all liabilities arising from any Retained Lease during the Lease Retention Period, including all payments required to be made under the terms of the Retained Lease. Buyer shall immediately, and in any event within ten (10) Business Days after receipt by Buyer of notice from Seller of a claim for indemnification hereunder, fully indemnify Seller for any liability with respect to a Retained Lease. Notwithstanding any other provision hereof, if despite Seller’s use of commercially reasonable efforts as required by this Section 5.2(b), Seller has not satisfied the condition identified in Section 6.3(d) of this Agreement, Buyer shall not be obligated to consummate the Contemplated Transactions.

| - 23 - |

(c) Seller shall use commercially reasonable efforts to procure from the mortgagee of the landlord under each Real Property Lease customary non-disturbance protections for the benefit of Buyer as the tenant under such Real Property Lease following the assignment of such Real Property Lease contemplated by Section 2.2(a), to the extent that such non-disturbance protections benefitting Buyer are not already in place.

5.3. Tax Matters.

(a) All sales, use, excise, value-added, goods and services, transfer, recording, documentary, registration, conveyance and similar Taxes imposed in connection with the Contemplated Transactions, together with any and all penalties, interest and additions to Tax with respect thereto (together, “Transfer Taxes”), shall be timely paid 50% by Buyer and 50% by Seller.

(b) Seller, on the one hand, and Buyer, on the other hand, shall (and shall cause their respective Affiliates to) cooperate fully with each other and make available or cause to be made available to each other for consultation, inspection and copying (at such other party’s expense) in a timely fashion such personnel, Tax data, relevant Tax Returns or portions thereof and filings, files, books, records, documents, financial, technical and operating data, computer records and other information as may be reasonably requested, including, without limitation, (i) for the preparation by such other party of any Tax Returns or (ii) in connection with any Tax Contest including one party (or an Affiliate thereof) to the extent such Tax Contest relates to or arises from the Contemplated Transactions.

(c) Seller and Buyer shall reasonably cooperate in obtaining resale certificates or other relevant exemptions from sales or use tax.

(d) The transfer of the Assets by Seller to Buyer pursuant to this Agreement shall be treated as a transaction under section 721 of the Code. Seller shall cooperate with Buyer in determining the tax basis and book value (within the meaning of section 704(b) of the Code) of the contributed Assets.

5.4. Employee Matters.

(a) Prior to the Closing Date, but effective as of the Closing, Buyer shall make offers of employment to the employees of Seller which are mutually agreed upon by Seller and Buyer and listed in Section 5.4 of the Schedules (each such employee, upon accepting an offer of employment from Buyer, a “Business Employee”). Each such offer shall be communicated in writing and the terms and conditions of such offers of employment shall be in compliance with this Section 5.4. Buyer and Seller acknowledge that (i) Seller shall not be obligated to pay severance to any Business Employee or any employee of Seller listed in Section 5.4 of the Schedules who receives an offer of employment from Buyer but does not accept such offer and (ii) Buyer shall not have any liability or obligations in respect of any benefits, payments or amounts that may be claimed to be due by any Business Employee or any employee of Seller listed in Section 5.4 of the Schedules who receives an offer of employment from Buyer but does not accept such offer.

| - 24 - |

(b) For a period of at least one (1) year following the Closing Date, each Business Employee shall be entitled to a position and salary that is at least substantially comparable to the position held and salary received by such Business Employee immediately prior to the Closing. Nothing in this Section 5.4 shall limit the right of Buyer or any of its affiliates to terminate the employment of any Business Employee at any time following the Closing Date.

(c) For purposes of participation of a Business Employee in a benefit plan of Buyer or its Affiliates (a “Buyer Benefit Plan”), each Business Employee shall be credited with all years of service for which such Business Employee was credited before the Closing Date under any comparable benefit plan of Seller or its Affiliates (a “Business Benefit Plan”), except to the extent such credit would result in a duplication of benefits for the same period of service. In addition, and without limiting the generality of the foregoing: (i) each Business Employee shall be immediately eligible to participate, without any waiting time, in any and all Buyer Benefit Plans to the extent that coverage under such Buyer Benefit Plans replaces coverage under comparable Business Benefit Plans in which such Business Employee participated; and (ii) for purposes of each Buyer Benefit Plan providing medical, dental, pharmaceutical and/or vision benefits to any Business Employee, Buyer shall cause all pre-existing condition exclusions and actively-at-work requirements of such Buyer Benefit Plan to be waived for such Buyer Employee and his or her covered dependents, and Buyer shall cause any eligible expenses incurred by such Business Employee and his or her covered dependents during the portion of the plan year of the Business Benefit Plan ending on the date such Business Employee’s participation in the corresponding Buyer Benefit Plan begins to be taken into account under such Buyer Benefit Plan for purposes of satisfying all deductible, coinsurance and maximum out-of-pocket requirements applicable to such Business Employee and his or her covered dependents for the applicable plan year as if such amounts had been paid in accordance with such Buyer Benefit Plan.

(d) Buyer shall (i) credit each of the Business Employees with an amount of paid vacation and sick leave days following the Closing Date equal to the amount of vacation time and sick leave days each such Business Employee has accrued but not yet used or cashed out as of the Closing Date under the Business’ vacation and sick leave policies as in effect immediately prior to the Closing Date, to the extent such accrued but not yet used or cashed out paid vacation and sick leave days are reflected on the Balance Sheet, and (ii) allow each of the Business Employees to use such accrued vacation and sick leave days at such times as each would have been allowed under the Business’ vacation and sick leave policies as in effect immediately prior to the Closing Date.