pILOT Agreement

Exhibit 10.3

THIS PILOT AGREEMENT (this “Agreement” or “PILOT Agreement”) is dated February 17, 2022, and is entered into by and between the Development Authority of Xxxxxxx County, a public body corporate and politic created and existing under the Constitution and laws of the State of Georgia (the “Authority”) and Aspen Aerogels GEORGIA, LLc, a Georgia limited liability company (the “Company”), in order to evidence their agreements as the respective parties hereto. Xxxxxxx County, GEORGIA (the “County”), the Board of Tax Assessors of Xxxxxxx County (the “Board of Assessors”), and CITY OF STATESBORO, GEORGIA, a municipal corporation created and existing under the laws of the State of Georgia (the “City”), are each executing an Acknowledgment hereof attached to this Agreement in order to acknowledge its agreement to the provisions hereof which are applicable to it.

The Authority has been duly created and is validly existing as an instrumentality of the County, and is a public body corporate and politic, all as more particularly set forth in O.C.G.A. § 36-62-1 et seq. (the “Development Authorities Law”). Pursuant to the Development Authorities Law, the Authority is created for the purpose of developing and promoting trade, commerce, industry, and employment opportunities for the public good and the general welfare and to promote the general welfare of the State of Georgia (the “State”). Pursuant to the public purposes for which it has been created, the Authority agrees to the provision to the Company of the incentives described below in consideration of the Company’s agreement, as set forth below, to locate the Project (as hereinafter defined) within the borders of the County, with attendant job creation and investment on the part of the Company, all of which constitutes valuable, non-cash consideration to the Authority, the County, and their citizens. All capitalized terms defined herein shall have the meanings so provided throughout this Agreement.

|

1. |

THE PROJECT. |

1.1The Project. The Company currently is acquiring, constructing and equipping a new project for the production of aerogel based products on site located in the Southern Gateway Commerce Park (the “Commerce Park”) in Xxxxxxx County, Georgia (the “Project”). The Company estimates that the total capital investment to be made in connection with the Project will be approximately $325,000,000 and that the Project will create a total of up to 250 jobs.

|

2. |

BOND FINANCING. |

2.1The Bonds. The Authority shall initially issue its economic development revenue bonds (the “Bonds”) in a principal amount not to exceed $650,000,000, to pay or to reimburse the Company or the Authority, or both, for costs of the Project as permitted by the Development Authorities Law. It is acknowledged by the parties hereto that the anticipated amount of the capital investment with respect to the Project exceeds the limits in the Internal Revenue Code of 1986, as amended (the “Code”) applicable to the issuance of tax-exempt bonds and therefore the Bonds will not qualify for tax-exempt status under the applicable provisions of the Code. The Company shall be responsible for the arrangements pertaining to the sale of the Bonds.

2.2Project Site; Lease. The Authority represents and warrants that it holds marketable, fee simple title to (i) Exhibit A attached hereto containing approximately 84 acres (the “Main Site”), and (ii) Exhibit B attached hereto containing approximately six acres (the “Ancillary Site” and together with the Main Site, the “Project Site”), all such property being located in the Commerce Park. As provided in that certain Inducement Agreement, dated as of the date hereof (the “Inducement Agreement”), between the Company and the Authority, in the event that the Ancillary Site is removed from the Project (and only at and from such point), the Main Site alone shall constitute the “Project Site” for all purposes under this Agreement and the transactions contemplated hereby.

|

3. |

AD VALOREM TAX SAVINGS; ORDINARY PILOT PAYMENTS. |

3.1Project Exempt from Property Taxation. Pursuant to the act under which the Authority was created, the Authority will pay no Ad Valorem tax on all real and personal property which is included in the Project while under Lease. The parties to this Agreement understand and agree that the Authority is not subject to Ad Valorem taxation on its interest in either the real property or the personal property of the Project. The parties further acknowledge and agree that (i) the interest of the Company in the real property portions of the Project is intended and shall be treated as a usufruct, (ii) the interest of the Company in the personal property portions of the Project is intended and shall be treated as a bailment for hire. As a result, the Project shall not be subject to ad valorem property taxation on the property titled in the name of the Authority and leased to the Company pursuant to the Lease. The Board of Assessors acknowledges and attests to its familiarity with the form of the Lease, and expressly confirms that neither the interest of the Authority nor the interest of the Company in the real and personal property portions of the Project will be subject to ad valorem taxation. This Agreement shall be among the documents that are judicially validated in connection with the validation of the Bonds.

3.2Tax Filings; Determination of Tax Values. During the first calendar year following the completion of the Project and issuance of the certificate of occupancy with respect thereto (the “Tax Commencement Year”) and for each calendar year thereafter, (i) the Company agrees to file with the Board of Tax Assessors a personal property tax return identifying all of the personal property located in the County as of January 1 of that year which is titled in the name of the Authority, and (ii) the Board of Tax Assessors shall determine the fair market value of the real property portions of the Project using its standard assessment policies and procedures applicable to industrial property. Based on the foregoing and the millage rate applicable to the Xxxxxxx County School System (the “School System”) and the County Rural Fire District (the “Fire District”), the County shall prepare or cause to be prepared and submitted to the Company a xxxx indicating the portion of the property taxes that would have been due and payable with respect to the School System and the Fire District if the Company held full legal title to the Project as of January 1 of that year (the “PILOT Payment Xxxx”).

3.3Tax Value Contest Rights. Notwithstanding the foregoing, the parties hereto acknowledge and agree that the Company shall have the right, at its own expense and in its own name or in the name and on the behalf of the Authority, to contest the determination of the fair market value of the real and/or personal property portions of the Project or the calculation of such PILOT payments. The Company shall have all of the same rights and remedies as it would have in the case of a dispute over ad valorem property taxes, including, without limitation, the right to dispute the valuation used by the Board of Assessors. Without limitation, the Authority, the Board of Assessors and the Company agree that the Company shall have the right of arbitration provided in O.C.G.A. Sec. 48-5-311(f) and the right of appeal to the Superior Court provided in O.C.G.A. Sec. 48-5-311(g).

3.4PILOT Payments. The Company expressly acknowledges and agrees that commencing with the Tax Commencement Year and for each calendar year thereafter during the term of the Lease it shall be obligated to make annual payments in lieu of taxes in the amount set forth in the PILOT Payment Xxxx prepared by the County in accordance with Section 3.2 hereof, subject to the right of the Company to contest the same as described in Section 3.3 hereof (the “PILOT Payments”). Such PILOT Payments will be due and payable at the same time as property taxes would ordinarily be payable in each year and late payments will be subject to the same penalties and interest as late property tax payments . Failure to make such PILOT Payments in accordance with this Agreement after the notice and cure rights provided therein) will constitute an event of default under the Lease and will permit the Authority to terminate the Lease.

3.5Reversion to Normal Taxability. If the option to purchase the Project set forth in the Purchase Option Agreement between the Authority and the Company is exercised by the Company or if the Lease is otherwise terminated or expires, the Project will be taxable according to normal ad valorem property taxation rules that are applicable to privately-owned property.

3.6Board of Tax Assessors. The provisions of this Agreement relative to the assessment and taxability of the Project for ad valorem property tax purposes are the obligation and responsibility of the Board of Assessors. By its Acknowledgement, the Board of Tax Assessors is joining in this Agreement to acknowledge that this Agreement is consistent with applicable requirements and that the Board of Tax

Assessors intends and agrees to classify, for taxation purposes, the respective interests of the Authority and the Company in the Project as contemplated in this Agreement. The County also acknowledges and agree to such provisions and agree that the Board of Tax Assessors shall comply with the foregoing.

|

4. |

RECOUPMENT OF INCENTIVES: |

4.1Inducement. The Company’s agreement to consider locating the Project at the Project Site is based, in part, on the incentives being provided by the Authority, the State of Georgia and by the other public bodies signing Acknowledgements hereof. Such incentives are being provided to induce the Company to make capital investments of $325,000,000 in connection with the Project (the “Community Investment Goal”) and to create 250 full-time jobs in connection with the Project (the “Community Jobs Goal”). The making of such capital investments in the County and the creation of such local jobs by the Company constitutes valuable, non-cash consideration to the Authority and the citizens of the County and of the State. The parties acknowledge that the incentives provided for in this Agreement serve a public purpose through the estimated job creation and investment generation in connection with the Project. The parties further acknowledge that the cost/benefit requirements applicable to the Authority in the course of providing such incentives dictate that some measure of recovery must be applied in the event that a significant portion of the anticipated jobs and investment do not for any reason fully materialize. It is the intention of the parties hereto that the Company will within 36 months following the earlier to occur of (i) the completion and issuance of the final certificate of occupancy with respect to the Project or (ii) December 31, 2024, achieve 80% of the average of the Community Investment and Jobs Goals actually achieved (such achievement date, the “Commencement Date”). Further, the Company will maintain at least such level for the next 60 months (said 60 month period herein described as the “Performance Period” and said period commencing on the Commencement Date and continuing to the end of the Performance Period is herein called the “Goal Period”). If the Company does not achieve 80% of the average of the Community Investment and Jobs Goals in any Goal Year (as hereinafter described), then the Company may be required to repay all or a portion of the property tax savings and other incentives otherwise offered to the Company in this Agreement for such Goal Year in accordance with the provisions of this Article 4. The following provisions of this Agreement, together with the Schedules attached hereto, are intended to further prescribe and define the foregoing intentions of the parties.

4.2Community Jobs Goal. For purposes of this Agreement, the types of jobs that would qualify to be counted against the Community Jobs Goal shall be defined and determined, from time to time, as provided on Schedule B-1 attached hereto (and by reference made a part hereof). Schedule B-1 also determines how the number of full-time jobs shall be calculated.

4.3Community Jobs Percentage. At the end of each 12-month period during the Goal Period (each a “Goal Year”), the number of full-time jobs at the Project shall be calculated and shall be divided by the applicable Community Jobs Goal and converted to a percentage to determine the “Community Jobs Percentage.”

4.4Community Investment Goal. For purposes of the Community Investment Goal the investment at the Project shall be calculated on a cumulative basis from October 8, 2021 to the end of the Reporting Period. Schedule B-2 attached hereto (and by reference made a part hereof) provides rules that shall apply to satisfying the Community Investment Goal.

4.5Community Investment Shortfall Percentage. At the end of each Goal Year during the Goal Period, the Company shall calculate the cumulative amount of capital investment by the Company with respect to the Project and shall divide such amount by the applicable Community Investment Goal and convert the result to a percentage to determine the “Community Investment Percentage.”

4.6Annual Report. The Company agrees to file with the County and Authority an annual report (the “Annual Report”) within 60 days of the end of each Goal Year during the Performance Period (each such year, an “Annual Report Year”) containing the calculation of the Community Investment Percentage and the Community Jobs Percentage. The average of the Community Jobs Percentage and the Community Investment Percentage shall be the “Project Goals Percentage,” which shall also be calculated

and stated in the Annual Report; provided, however, for purposes of calculating the Project Goals Percentage the Community Jobs Percentage may not exceed 110% and the Community Investment Percentage may not exceed 120% for the first two years of the Performance Period, nor 110% for the last three years of the Performance Period. Each Annual Report shall be in substantially the form of Schedule B-3 attached hereto (and by reference made a part hereof), as revised for the matters being reported.

4.7Community Recovery Payments. If the Annual Report for any Goal Year during the Performance Period shows that, for such Goal Year, the Project Goals Percentage is less than 80% (a “Shortfall Year”), then the Company, in such Annual Report, shall calculate the amount of the “Community Recovery Payments.” If the Project Goals Percentage as shown in the Annual Report for the Goal Year immediately succeeding a Shortfall Year is less than 80%, then the Company shall pay the Community Recovery Payments for the prior Shortfall Year.

4.8Failure to Make Required Payments; Failure to File Report. If the Company fails to pay any Community Recovery Payment when due, interest shall be paid by the Company thereon at the rate of 6% per annum from the thirtieth (30th) day following the date of the Authority notice to the Company of a failure to make such payment until paid. If there has been a failure to pay any Community Recovery Payment which is not cured within thirty (30) days following a written notice from the Authority, the Authority shall be entitled to enforce its rights under this Article 4, and the Company shall indemnify the Authority for all costs of enforcement, including reasonable and actual attorneys’ fees and court costs.

If the Company fails to provide to the Authority an Annual Report for any year as required pursuant to Section 4.6 and such failure continues for thirty (30) days following a written notice from the Authority, the Authority shall have the right to inspect the books and records of the Company regarding employment and capital investment in connection with the Project (subject to the confidentiality policies of the Company) in order to calculate the Project Goals Percentage and to determine the amount of Community Recovery Payments, if any, due from the Company hereunder.

4.9Extension of Deadlines Not Unreasonably Withheld. Notwithstanding anything herein to the contrary, in the event that an extension of the Performance Period or the due date of any Annual Report is needed in order to permit the Company to satisfy its obligations hereunder, and the Company has shown diligence in attempting to timely meet such obligations, the Authority agrees to not unreasonably withhold its consent to the extension of the period to time required to satisfy such obligations.

|

5. |

DELAY; TERMINATION OF AGREEMENT. |

5.1Delay. No party hereto shall be liable for any failure or delay in performance if caused, in whole or in part, by any circumstance or events beyond the reasonable control of such party, whether foreseeable or unforeseeable, including, without limitation, fire; flood; earthquake; acts of God; strikes, boycotts, riots or civil disorders; declared or undeclared wars; casualty; epidemic or pandemic, delays in obtaining governmental permits; compliance with government orders; acts of civil or military authority; accidents; industrial disturbances; interruptions of transportation facilities or delays in transit; delays, curtailment or shortages of construction, production, manufacturing or other materials, equipment, raw materials or supplies; failure of any party hereunder to perform, or any delays in the performance of, any commitment to such other party relating to the performance of its obligations; or any other cause, whether similar or dissimilar to the foregoing causes (including, without limitation, general, macro or special economic circumstances that adversely affects net revenues or sales volumes). In the event of any such contingency, the affected party shall notify the other parties of the contingency within a reasonable period of time and shall make commercially reasonable efforts promptly to remove the contingency such that performance may be resumed; provided, however, no party shall be obligated to settle any labor dispute. If as a result of the occurrence of any such contingency, such party’s performance hereunder cannot be completed within the original period for performance, the period for performance shall be extended for a period of time equal to the duration of such contingency and a reasonable period thereafter to allow for completion of performance without prejudice to any of the other rights of such party under this Agreement.

(a)So long as none of the Local Governmental Entities is in default of its obligations hereunder, the Authority may terminate this Agreement by written notice to the Company if the acquisition, construction and equipping of the Project (the “Construction”) has not been commenced prior to the first anniversary of the date of this Agreement, or the Construction has not been completed prior to the fourth anniversary of the commencement of Construction. Construction will be deemed to have commenced with the pouring of the building pad for the project. Construction will be deemed to be completed with the issuance of a Certificate of Occupancy or Temporary Certificate of Occupancy for the building. Any such termination shall be evidenced by a written notice from the terminating party to the other parties hereto.

(b)So long as the Company is not in default under this Agreement, the Company may terminate this Agreement at any time by written notice to the Authority; provided, that upon such termination the Company shall reimburse the Local Governmental Entities for their actual costs in providing the incentives described in the Incentives Table appearing on Schedule B hereto. If the Company has exercised its right to purchase the Project site, it shall also pay to the Authority the cost of such property as described on Schedule B.

5.3Effect of Termination. If any party terminates this Agreement pursuant to a right provided herein or if this Agreement expires, this Agreement shall terminate or expire as to all parties without any further liability on the part of any party, except as may theretofore have accrued, or except as otherwise expressly provided in this Agreement, or shall exist as a result of any prior breach hereof.

6.1Intergovernmental Agreement. By their respective Acknowledgements at the end hereof, the County and the Board of Tax Assessors agree to the provisions applicable to them. The Agreement shall also constitute an intergovernmental agreement under Georgia Constitution Art. IX, Sec. III, Para. I between and among the Authority, the County and the Board of Tax Assessors. Such intergovernmental agreement is subject to the 50-year term limit contained in such provision of the Georgia Constitution, but shall expire earlier upon its complete performance.

6.2.1By the Authority. The Authority may not assign its rights and obligations hereunder except to another public body of the State which has the power to perform the Authority’s obligations hereunder and which assumes all the Authority’s obligations hereunder either in writing or by operation of law.

6.2.2By the Company. All rights and benefits of the Company under this Agreement may be transferred and assigned by the Company, in whole or in part, to any one or more individuals, corporations, partnerships, joint ventures, limited liability companies, or other business entities (the “Assignees”) which propose to acquire all or part of the Project with the same effect as if such Assignees were named as the Company in this Agreement; provided, however, each such Assignee shall execute and deliver to the Authority and County an assignment agreement pursuant to which such Assignee shall assume the obligations of the Company hereunder.

6.3Notices. Any notice required to be given by any party pursuant to this Agreement, shall be in writing and shall be deemed to have been properly given, rendered or made only if personally delivered, or if sent by Federal Express or other comparable commercial overnight delivery service, addressed to each other party at the addresses set forth below (or to such other address as the Authority or the Company may designate to each other from time to time by written notice), and shall be deemed to have been given, rendered or made on the day so delivered or on the first business day after having been deposited with the courier service:

|

If to the Authority: |

Development Authority of Xxxxxxx Xxxxxx Xxxx Xxxxxx Xxx 000 Xxxxxxxxxx, Xxxxxxx 00000 Attention: Chairman |

|

with a copy to: |

Xxxxxxx X. Xxxxxxx, Esq. Xxxx Xxxxxx Xxx 000 Xxxxxxxxxx, Xxxxxxx 00000

|

|

If to the Board of Assessors: |

Xxxxxxx County Board of Assessors Statesboro, Georgia |

|

If to the Board of Commissioners: |

Xxxxxxx County Board of Commissioners 000 Xxxxx Xxxx Xxxxxx Xxxxxxxxxx, Xxxxxxx 00000

|

|

If to the City: |

City of Statesboro Attn: City Manager 00 X Xxxx Xxxxxx Xxxxxxxxxx, XX 00000 |

|

|

|

|

If to the Company: |

Aspen Aerogels Georgia, LLC 00 Xxxxxx Xxxx, Xxxxxxxx X Xxxxxxxxxxxx, XX 00000 Attention: President

|

|

with a copy to: |

Xxxxxx X. Xxxxxxx, Esq. Xxxxxx & Bird LLP 0000 Xxxx Xxxxxxxxx Xxxxxx Xxxxxxx, Xxxxxxx 00000-0000

|

6.4Confidential Information. All confidential information acquired by the Authority, the County or the Board of Assessors relating to the Company, shall be held in confidence by them, subject to their legal obligations as public bodies, including, without limitation X.X.XX. § 15-18-70, et seq. and § 50-14-1, et seq. The Company and its advisors shall, prior to the execution and delivery hereof, treat the contents of this Agreement as confidential, and, without limitation, shall not disclose such contents to competing communities or States.

6.5No Partnership or Agency. No partnership or agency relationship between or among the parties shall be created as a result of this Agreement.

6.6Survival of Agreement. This Agreement shall survive the issuance of the Bonds and the expiration or termination of the Lease but may be modified or superseded in whole or in part by the Lease or any of the other documents and agreements executed in connection with the issuance of the Bonds (collectively, the “Definitive Documents”) to the extent that the Definitive Documents expressly so provide.

6.7Governing Law; Jurisdiction and Venue. The transactions contemplated hereunder and the validity and effect of this Agreement are exclusively governed by, and shall be exclusively construed and enforced in accordance with, the laws of the State of Georgia, except for the state’s conflict of law rules.

6.8Amendments. Any amendments, deletions, additions, changes or corrections hereto must be in writing executed by the parties hereto.

6.9Entire Agreement. This Agreement, together with the Definitive Documents, constitutes the entire agreement between the parties with respect to the subject matter hereof.

6.10Counterparts. This Agreement may be signed in counterparts, each of which shall be an original and all of which together shall constitute one and the same instrument.

6.11No Personal Liability of Representatives of Public Bodies. No official, member, director, officer, agent, or employee of the Authority, the County or the Board of Tax Assessors shall have any personal liability under or relating to this Agreement. Rather, the agreements, undertakings, representations, and warranties contained herein are and shall be construed only as corporate agreements, undertakings, representations, and warranties, as appropriate, of such public bodies. Without limitation, and without implication to the contrary, all parties hereto waive and release any and all claims against each such official, member, director, officer, agent, or employee, personally, under or relating to this Agreement, in consideration of the entry of such public bodies into this Agreement.

6.12No Personal Liability of Representatives of Company. No official, member, manager, director, officer, agent, or employee of the Company shall have any personal liability under or relating to this Agreement. Rather, the agreements, undertakings, representations, and warranties contained herein are and shall be construed only as corporate agreements, undertakings, representations, and warranties, as appropriate, of such entity. Without limitation, and without implication to the contrary, all parties hereto waive and release any and all claims against each such official, member, manager, director, officer, agent, or employee, personally, under or relating to this Agreement, in consideration of the entry of such entity into this Agreement.

6.13Captions. The captions and title heading included in this Agreement are for convenience only and in no way define, limit or describe the scope or intent of any provisions of this Agreement.

6.14Time is of the Essence. Time is of the essence for this Agreement.

IN WITNESS WHEREOF, the parties have executed this PILOT Agreement and caused it to be delivered as of the date first above written.

|

AUTHORITY: |

||

|

DEVELOPMENT AUTHORITY OF XXXXXXX COUNTY |

||

|

|

||

|

By: |

/s/ Xxxxx Xxxxx |

|

|

|

Xxxxx Xxxxx |

|

|

|

Vice Chair, Development Authority of Xxxxxxx County |

|

|

|

||

|

(SEAL) |

||

|

COMPANY: |

||

|

ASPEN AEROGELS GEORGIA, LLC |

||

|

a Georgia limited liability company |

||

|

|

||

|

By: |

/s/ Xxxxxx X. Xxxxx |

|

|

|

Xxxxxx X. Xxxxx |

|

|

|

President and CEO |

|

|

|

||

|

(SEAL) |

||

ACKNOWLEDGED

The undersigned acknowledges this Agreement and agrees to the provisions hereof that are applicable to it.

|

XXXXXXX COUNTY, GEORGIA |

||||

|

|

||||

|

|

||||

|

|

||||

|

By: |

/s/ Xxx Xxxxxxxx |

|

||

|

|

Xxx Xxxxxxxx |

|||

|

|

Chairman, Board of Commissioners |

|||

|

|

||||

|

Attest: |

/s/ Olympia Games |

|

||

|

|

Olympia Games |

|||

|

|

Clerk, Board of Commissioners |

|||

|

|

|

|||

|

(SEAL) |

||||

ACKNOWLEDGED

The undersigned acknowledges this Agreement and agrees to the provisions hereof that are applicable to it.

|

BOARD OF TAX ASSESSORS OF XXXXXXX COUNTY |

|||

|

|

|||

|

By: |

/s/ Xxxxxx Xxxxxx |

|

|

|

|

Xxxxxx Xxxxxx |

||

|

|

Chair, Board of Assessors |

||

|

|

|

||

|

(SEAL) |

|||

ACKNOWLEDGED

The undersigned acknowledges this Agreement and agrees to the provisions hereof that are applicable to it.

|

CITY OF STATESBORO, GEORGIA |

||||

|

|

||||

|

By: |

/s/ Xxxxxxxx XxXxxxxx |

|

||

|

|

Xxxxxxxx XxXxxxxx |

|||

|

|

Mayor, City of Statesboro |

|||

|

|

||||

|

Attest: |

/s/ Xxxx Xxxxxx |

|

||

|

|

Xxxx Xxxxxx |

|||

|

|

Clerk, City of Statesboro, Georgia |

|||

|

|

||||

|

(SEAL) |

||||

SCHEDULE A

[Intentionally Deleted]

SCHEDULE B

COMMUNITY INCENTIVES SCHEDULE

|

1. |

The recovery value (“Recovery Value”) of the Community Incentive identified below shall be as specified below (the “Incentives Table”), with any payments to be made as provided in this Community Incentives Schedule to the public bodies indicated as follows: |

Incentives Table

|

Community Incentive |

Recovery Value |

Recovery Factor |

Recovery Paid To |

|

Property Tax Savings on Project |

Actual amount of ad valorem property taxes on Project saved, less any payments in lieu of taxes paid pursuant to Section 4.7 of this Agreement |

100% for each Goal Year |

Appropriate Taxing Authorities, Pro Rata in Proportion to Applicable Millage Rates |

|

Project Site (Approx. 90 acres |

The lesser of $30,000 per acre (pro-rated for fractions of an acre) or the fair market value of the property as of the date of this Agreement |

12.5% for each Goal Year. |

Authority |

|

Workforce Training at Ogeechee Technical College |

Actual cost of such training up to $20,000 |

12.5% for each Goal Year. |

Authority |

|

Provision of Temporary Office Space |

Actual cost of such office space up to $24,000 |

12.5% for each Goal Year. |

Authority |

|

Infrastructure and Utility extensions |

Actual cost of such work presently estimated at no more than $500,000. |

12.5% for each Goal Year. |

City |

|

2. |

If the Annual Report for any Goal Year during the Performance Period shows that, for such Goal Year, the Project Goals Percentage is less than 80% (a “Shortfall Year”), then the Company, in such Annual Report, shall calculate the amount of the “Community Recovery Payments” with respect to the incentive listed in the Incentives Table above. If the Project Goals Percentage as shown in the Annual Report for the Goal Year immediately succeeding a Shortfall Year is less than 80%, then the Company shall pay the Community Recovery Payments for the prior Shortfall Year. The Community Recovery Payment for any Goal Year shall be calculated as follows: the Recovery Values as so determined for such year shall be multiplied by the Recovery Factors which shall produce the Recovery Amounts. The Recovery Amounts shall be multiplied by the difference between eighty percent (80%) minus the Project Goals Percentage actually achieved which shall produce the Community Recovery Payment. The Company shall pay the amount of the Community Recovery Payment to the appropriate public body specified above simultaneously with its delivery of the applicable Annual Report as required by this Agreement. If the Project Goals Percentage for any Goal Year is 80% or more, there shall be no Community Recovery Payment due for that Goal Year or the immediately preceding Goal Year. In not event shall there be a Community Recovery Payment with respect to any Goal Year prior to the Performance Period. However, notwithstanding the foregoing, in calculating the potential Community Recovery Payment for the first Goal Year during the Performance Period, the Recovery Amount with respect to property tax savings shall equal the total actual amount of ad valorem property taxes saved with respect to the Project (less the amount of any payments in lieu of taxes paid pursuant to Section 4.7 of this Agreement) during the first three Goal Years. |

SCHEDULE B-1

RULES FOR SATISFYING THE COMMUNITY JOBS GOAL

|

1. |

For purposes of this Agreement and satisfaction of the Community Jobs Goal, the number of new “full-time jobs” shall be defined and determined, from time to time, as follows: |

Full-time job – means a new job that did not previously exist in the County with no predetermined end date, with a regular work week of 35 hours or more for the period in question, and an average hourly wage of $18.33 per hour; leased, contract, or third party jobs will be considered full-time employees of the Company if such jobs are created in connection with the Project.

|

2. |

The number of full-time jobs shall be calculated as provided below. |

|

|

a) |

A full-time job shall consist of a full-time employee subject to Georgia income tax withholding employed for more than 180 days during such calendar year with the opportunity for access to, but not necessarily paid or subsidized, medical benefits. |

|

|

b) |

The average number of full-time employees in the Annual Report Year shall be determined by the following method: |

|

|

(i) |

for each month of the Annual Report Year, count the total number of full-time employees of the business enterprise that are subject to Georgia income tax withholding as of the last payroll period of the month or as of the payroll period during each month used for the purpose of reports to the Georgia Department of Labor; |

|

|

(ii) |

add the monthly totals of full-time employees; and |

|

|

(iii) |

divide the result by the number of months the business enterprise was in operation during the Annual Report Year. Transferred jobs and replacement jobs may not be included in the monthly totals. |

SCHEDULE B-2

RULES FOR SATISFYING THE COMMUNITY INVESTMENT GOAL

|

1. |

Capital investments in the Project by the Company shall be counted regardless of whether or not the property financed by such capital investment is leased to the Company under the Lease. |

|

2. |

Original cost, without regard to depreciation, shall be used in calculating whether the Community Investment Goal is met, except as provided in 3, below. |

|

3. |

Transferred equipment relocated by the Company to the Project may be counted at the greater of net book value, or fair market value. |

|

4. |

Machinery and equipment leased to the Company under an operating lease (even though such property is not titled to the Authority and is not leased to the Company under the Lease) and other machinery and equipment owned or beneficially owned by the Company but not leased to it under the Lease, shall be counted. |

|

5. |

All expenditures in connection with the Project that under any generally accepted accounting principles or applicable federal tax laws and regulations may be capitalized by the Company shall count as capital expenditures. |

SCHEDULE B-3

FORM OF ANNUAL REPORT

[DATE]

Development Authority of Xxxxxxx County

Statesboro, Georgia

|

|

Re: |

PILOT Agreement (the “Agreement”) between the Development Authority of Xxxxxxx County and Aspen Aerogels Georgia, LLC (“Company”) regarding the capital project located in Xxxxxxx County, Georgia (the “Project”) – 20__ Annual Report |

Dear ________:

This letter shall serve as the ___ Goal Year Annual Report, as required under the Agreement.

1.Community Jobs Report

As of the end of the Goal Year, the total number of full-time jobs located at the Project was ___.

The Community Jobs Goal is 250 jobs. The Community Jobs as of the end of such Goal Year was ___ jobs. The Community Jobs Percentage is ___%1 (__ ÷ 250).

2.Community Investment Report

During the period from October 8, 2021 through the end of the Goal Year, the Company has cumulatively invested a total of $________ with respect to the Project.

The Community Investment Goal is $325,000,000. Therefore, the Community Investment Percentage is __%* ($________ ÷ $325,000,000).

3.Community Recovery Payments

The Project Goals Percentage for the Global Year is ___% ((___% + __%) ÷ 2). IF such Project Goals Percentage is less than 80% A COMMUNITY RECOVERY PAYMENT IS DUE, THAT PAYMENT SHOULD BE CALCULATED HERE BASED ON THE RECOVERY SCHEDULE B IN THE AGREEMENT.

1The Community Jobs Percentage may not exceed 110% and the Community Investment Percentage may not exceed 120% for the first two years of the Performance Period, nor 110% for the last three years of the Performance Period, for purposes of these calculations.

Please do not hesitate to let us know if you require any additional information.

Sincerely,

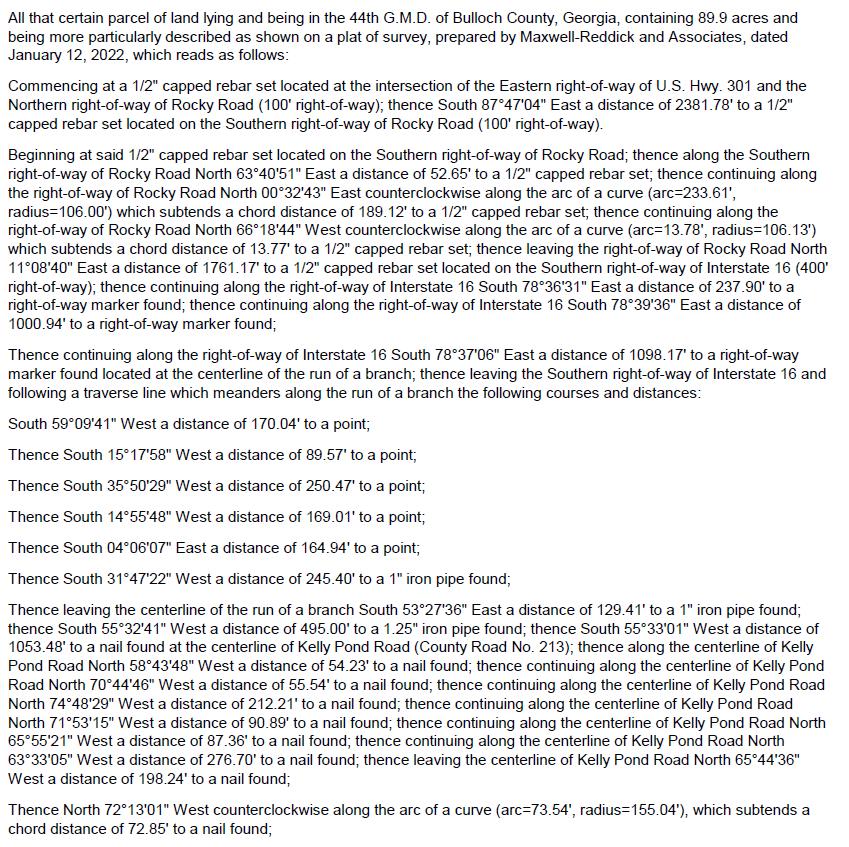

EXHIBIT A

DESCRIPTION OF MAIN SITE

The Main Site shall consist of the below description, excluding Ancillary Site described in Exhibit B.

EXHIBIT B

DESCRIPTION OF ANCILLARY SITE

The Ancillary Site shall consist of the space within the dotted lines in the map below marked as “Ancillary Site”.