TOGA LIMITED SUBSCRIPTION AGREEMENT Dated: May 7, 2018

EXHIBIT 10.17

TOGA LIMITED

Dated: May 7, 2018

The Securities have not been registered under U.S. Securities Act of 1933 (the "U.S. Securities Act") or any state securities laws and may not be offered or sold in the United States or to U.S. persons unless the securities are registered under U.S. Securities Act, or an exemption from the registration requirements of U.S. Securities Act is available. Hedging transactions involving the Securities may not be conducted unless in compliance with the U.S. Securities Act.

| TO: | TOGA LIMITED |

The undersigned (the "Purchaser") hereby agrees to subscribe for and purchase from Toga Limited, a corporation incorporated under the laws of the State of Delaware (the "Company") on the terms and conditions set forth in this Subscription Agreement (this "Subscription Agreement") up to 1,076,752,423 shares of the Company’s common stock, par value $0.0001 per share (the “Offered Shares”) (hereinafter referred to as the “Shares” or the “Securities”), at a subscription price of US$0.02 per Share, for an aggregate purchase price of up to TWENTY-ONE MILLION FIVE HUNDRED THIRTY FIVE THOUSAND FORTY-EIGHT AND 46/100 US Dollars (USD$21,535,048.46) (the “Purchase Price”). The actual number of Offered Shares to be purchased hereunder shall be at the Purchaser’s sole discretion, subject to the terms hereof. The Offered Shares may be purchased only up to and through May 7 , 2018. The Purchaser may purchase any portion of the Offered Shares in such amounts and at such time as determined by the Purchaser, subject to the terms hereof.

The Purchaser understands that the Shares are being offered and issued only pursuant to a certain exemption from registration requirements under U.S. securities laws and pursuant to certain representations and warranties provided herein by the Purchaser to US Persons (as such term is defined in Schedule A attached hereto).

1. CONDITIONS OF PURCHASE

The Purchaser acknowledges and agrees that the Company's obligation to sell the Securities to the Purchaser is subject to, among other things, the following conditions:

|

| (a) | that the Purchaser executes and returns to the Company this Subscription Agreement (including Schedule "A" which is incorporated herein by reference) and all documents required by applicable securities legislation for delivery on behalf of the Purchaser and the aggregate Purchase Price; |

|

|

|

|

|

| (b) | that the issue, sale and delivery of the Securities is exempt from all registration requirements and the requirements to file a prospectus or registration statement, or deliver an offering memorandum under applicable securities legislation relating to the sale of the Securities in each of the applicable jurisdictions, or that the Company has received such orders, consents, or approvals as may be required to permit such sale without the requirement of filing a prospectus or registration statement, or delivering an offering memorandum or complying with the registration requirements; |

| 1 |

|

| (c) | for each traunche of Shares to be purchased hereunder, the Purchaser shall provide the Company written notice of its election to purchase a certain number of Shares (the "Election to Purchase Notice") and complete, execute and deliver the documents referred to in Section 2 of this Subscription Agreement; |

|

|

|

|

|

| (d) | all documentation relating to the offer, sale and issuance of the Securities being in form and substance satisfactory to the Company; and |

|

|

|

|

|

| (e) | that the representations and warranties of the Purchaser contained in this Subscription Agreement (including Schedule "A" attached hereto) remain true and correct as of the Closing Date. |

The Purchaser acknowledges that its subscription for Securities is subject to acceptance or rejection, in whole or in part, by the Company at any time before the Closing, and the availability of Offered Shares.

2. DELIVERY, PAYMENT AND ESCROW

The Purchaser agrees that the following will be delivered to the Company contemporaneously with the Elections to Purchase Notice provided by the Purchaser, to the Company:

|

| (a) | payment of the Purchase Price for such number of Offered Shares set forth in the Election Notice to be purchased by wire transfer to the Company utilizing the instructions set forth on Schedule "B" attached hereto; and |

|

|

|

|

|

| (b) | all other documentation as may be required by applicable securities legislation. |

The closing of each sale of Securities pursuant to each Election to Purchase Notice (the "Closing") shall be effected, subject to the satisfaction of all of the conditions of purchase set forth in Section 1 of this Subscription Agreement upon receipt of all of the items described in subparagraphs (a) through (b) above.

At Closing, the Company shall deliver certificates representing the Securities and payment for the Securities will be completed at the Closing.

3. PURCHASER'S ACKNOWLEDGEMENTS

The Purchaser acknowledges (on its own behalf and, if applicable, on behalf of those for whom the Purchaser is contracting hereunder, and for greater certainty, any reference to the Purchaser in this Subscription Agreement includes any such beneficial purchaser for whom the Purchaser is purchasing hereunder) that:

|

| (a) | AN INVESTMENT IN THE SECURITIES IS NOT WITHOUT RISK AND THE PURCHASER MAY LOSE HIS, HER OR ITS ENTIRE INVESTMENT; |

|

|

|

|

|

| (b) | the Company may complete additional, and existing, financings in the future in order to develop the business of the Company and fund its ongoing development, and such future financings may have a dilutive effect on current shareholders of the Company, including the Purchaser; |

| 2 |

|

| (c) | the Company has the right to accept the Purchaser's subscription and purchase in whole or in part or not at all; |

|

|

|

|

|

| (d) | the Purchaser has not been provided with, nor has it requested, nor does it have any need to receive, an offering memorandum or any similar document in connection with its subscription for the Securities, and its decision to execute this Subscription Agreement and to purchase the Securities has been based entirely upon publicly available information concerning the Company and not upon any verbal or other written representation as to fact or otherwise made by or on behalf of the Company or any employees, agents or affiliates thereof; |

|

|

|

|

|

| (e) | the Securities have not been registered under the U.S. Securities Act of 1933 (the "U.S. Securities Act") or the securities laws of any state, and that the Securities upon issuance will be, "restricted securities" in the United States within the meaning of Rule 144(a)(3) of the U.S. Securities Act; |

|

|

|

|

|

| (f) | no agency, governmental authority, regulatory body, stock exchange or other entity has made any finding or determination as to the merit for investment of, nor have any such agencies or governmental authorities made any recommendation or endorsement with respect to the Securities or the offering of the Securities (the "Offering"); |

|

|

|

|

|

| (g) | the purchase of the Securities has not been made through, or as a result of, and the distribution of the Securities is not being accompanied by, and the Purchaser is not aware of, any form of general solicitation or general advertising including advertisements, articles, notices or other communications published in any newspaper, magazine or similar media, or broadcast over radio, internet or television, or any seminar or meeting whose attendees have been invited by general solicitation or general advertising; |

|

|

|

|

|

| (h) | the Securities are being offered for sale on a "private placement" basis only; |

|

|

|

|

|

| (i) | the issuance, sale and delivery of the Securities to the Purchaser or (if applicable) to any purchaser on whose behalf it is contracting hereunder, is conditional upon such issuances and sales being exempt from the registration requirements and the prospectus requirements, or the requirement to file a registration statement, of all applicable securities legislation relating to the issuance and sale of Securities, or upon the issuance of such orders, consents or approvals as may be required to permit such sales without the requirement of filing a prospectus or complying with the registration requirements; |

|

|

|

|

|

| (j) | the Company may be required to disclose to applicable securities regulatory authorities the identity of the beneficial purchasers of the Securities; |

|

|

|

|

|

| (k) | upon the issuance of the Securities, the certificates representing the Securities shall bear a legend to the effect that transfer is prohibited for a minimum period of one (1) year after the purchase of the Securities, and thereafter that transfer is prohibited except (i) in accordance with the provisions of Regulation S under the U.S. Securities Act, (ii) pursuant to registration under U.S. Securities Act, or (iii) pursuant to an available exemption from registration; and that hedging transactions involving those securities may not be conducted unless in compliance with U.S. Securities Act; |

| 3 |

|

| (I) | the Securities will be subject to resale restrictions under applicable securities legislation, rules, regulations and policies, and the Purchaser or (if applicable) others for whom it is contracting hereunder will comply with all relevant securities legislation, rules, regulations and policies concerning any Securities and will consult with its own legal advisers with respect to complying with all restrictions applying to any such resale and further agrees that it, or (if applicable) others for whom it is contracting, is solely responsible for compliance with all applicable resale restrictions and will only resell the Securities in compliance with all applicable securities laws; |

|

|

|

|

|

| (m) | the Offering is only being made to persons to whom it may be lawfully made and the Securities issued and sold without breach of any applicable securities legislation; |

|

|

|

|

|

| (n) | it has been given the opportunity by the Company to ask questions of, and receive answers from, the management of the Company and has had access to such financial and other information concerning the Company as it has considered necessary to make a decision to invest in the Securities and has availed itself of such opportunity to the full extend desired; and |

|

|

|

|

|

| (o) | that even though Purchaser has subscribed for the Shares, Purchaser may not be able to purchase the Shares if another purchaser (or purchasers) have previously paid for all of the Offered Shares (whether or not such purchasers delivered their subscription for Offered Shares to the Company before or after Purchaser). |

4. PURCHASER'S REPRESENTATIONS, WARRANTIES AND COVENANTS

The Purchaser hereby acknowledges and agrees with, represents and warrants to, and covenants with, the Company (which representations, warranties and covenants will survive Closing) on its own behalf and on behalf of others for whom it is contracting hereunder, that:

|

| (a) | the Purchaser (and each beneficial purchaser for whom it is acting) is purchasing the Securities as principal for its own account, not for the benefit of any other person (other than any disclosed principal disclosed to the Company) and not with a view to the resale, distribution or other disposition of all or any of the Securities, and it is not a resident of the United States and by virtue thereof is a "non-U.S. person" as defined in Regulation S under the U. S. Securities Act (and as set forth in Schedule "A" attached hereto, which is incorporated herein in its entirety), and confirms that the purchase of the Securities by the Purchaser is not in violation of any applicable laws of its jurisdiction of residence, and Purchaser hereby makes the statements set forth in Schedule "A" attached to this Agreement indicating the means by which Purchaser is a "non-U.S. Person" and confirms the truth and accuracy of all statements made by Purchaser in Schedule "A"; |

|

|

|

|

|

| (b) | it consents to the Company making a notation on its records or g1vmg instructions to any transfer agent of the Securities in order to implement the restriction on transfer set forth and described herein; |

| 4 |

|

| (c) | it (and any beneficial purchaser for whom it is acting) understands that an investment in the Company includes a high degree of risk, has such knowledge and experience in financial and business matters, investments, securities and private placements as to be capable of evaluating the merits and risks of its investment in the Securities, is in a financial position to hold the Securities for an indefinite period of time, and is able to bear the economic risk of, and withstand a complete loss of such investment in the Securities; |

|

|

|

|

|

| (d) | it (and if the Purchaser is acting as agent for a disclosed principal, such disclosed principal) was offered the Securities in, and is resident in, the jurisdiction outside of the United States disclosed to the Company, and intends that the securities law of that jurisdiction govern the Purchaser's subscription; |

|

|

|

|

|

| (e) | it (and any beneficial purchaser for whom it is acting) has been independently advised as to, and is aware of, the restrictions with respect to trading in the Securities pursuant to the applicable securities laws and the rules of any applicable stock exchanges and further agrees that it (and any beneficial purchaser for whom it is acting) is solely responsible for compliance with all such restrictions; |

|

|

|

|

|

| (f) | if required by applicable securities laws or order of a securities regulatory authority, stock exchange or other regulatory authority, it will execute, deliver, file and otherwise assist the Company in filing such reports, undertakings and other documents with respect to the issuance of the Securities; |

|

|

|

|

|

| (g) | if it is an individual, the Purchaser has attained the age of majority and in every case the Purchaser is legally competent and has the legal capacity to purchase the Securities and to execute the Subscription Agreement and take all actions required pursuant to this Subscription Agreement; |

|

|

|

|

|

| (h) | if the Purchaser is a corporation, the Purchaser is a valid and subsisting corporation, has the necessary corporate power, capacity and authority to execute and deliver this Subscription Agreement and to observe and perform its covenants and obligations hereunder and has taken all necessary corporate action in respect thereof and has obtained all necessary approvals in respect thereof or, if the Purchaser is a partnership, syndicate or other form of unincorporated organization, the Purchaser has the necessary legal power, capacity and authority to execute and deliver this Subscription Agreement and to observe and perform its covenants and obligations hereunder and has taken all necessary action in respect thereof and has obtained all necessary approvals in respect thereof; |

|

|

|

|

|

| (i) | upon acceptance of this Subscription Agreement by the Company, this Subscription Agreement will constitute a legal, valid and binding obligation of the Purchaser (and any beneficial purchaser for whom it is acting), enforceable against the Purchaser (and any beneficial purchaser for whom it is acting) in accordance with its terms; |

| 5 |

|

| (j) | it has had the opportunity to review this Subscription Agreement and the Schedule attached hereto and the transactions contemplated by this Subscription Agreement and fully understands the same; |

|

|

|

|

|

| (k) | it (and if the Purchaser is acting as agent for a disclosed principal, such disclosed principal) is responsible for obtaining such legal, including tax, advice as it considers necessary or appropriate in connection with the execution, delivery and performance by it of this Subscription Agreement and the transactions contemplated herein; |

|

|

|

|

|

| (I) | the entering into of this Subscription Agreement and the transactions contemplated hereby will not result in a violation of any of the terms and provisions of any law applicable to the Purchaser or any beneficial purchaser for whom the Purchaser is acting as trustee or agent, or any of its corporate documents, or of any agreement, deed, order or judgment to which it is a party or by which it is bound; |

|

|

|

|

|

| (m) | it is solely responsible for its own due diligence investigation of the Company and its business, for its own analysis of the merits and risks of its investment in the Securities made pursuant to this Subscription Agreement and for its own analysis of the terms of its investment; |

|

|

|

|

|

| (n) | it is solely responsible for obtaining such advice concerning the tax consequences of its investment in the Securities and it is not relying on the Company or its counsel for advice concerning such tax consequences; |

|

|

|

|

|

| (o) | if the Purchaser is not an individual but is a corporation, syndicate, partnership, trust, association or any other form of unincorporated organization or organized group of persons, it has not been formed for the specific purpose of acquiring the Securities, nor created solely or used primarily to permit a group of persons to purchase the Securities, without a prospectus in reliance on a prospectus exemption or registration exemption; |

|

|

|

|

|

| (p) | the purchase of the Securities by the Purchaser hereunder is not a transaction in which any director or officer of the Company, or any beneficial owner of securities carrying more than 10% of the voting rights attaching to all outstanding voting securities of the Company, has a direct or indirect beneficial interest, unless the Purchaser has otherwise notified the Company; |

|

|

|

|

|

| (q) | the Purchaser (and each beneficial purchaser for whom it is acting) is acquiring the Securities to be held for investment only and not for the benefit of any other person (other than any disclosed principal disclosed to Company) and not with a view to resale, distribution or any other disposition of any or all of such Securities; |

|

|

|

|

|

| (r) | the Purchaser (and each beneficial purchaser for whom it is acting) shall hold the Securities and not offer, sell, or otherwise transfer any of the Securities for a minimum of one year after the purchase of the securities hereunder (the "Restrictive Period") regardless of any sorter period under applicable laws, rules or regulations; |

| 6 |

|

| (s) | after the expiration of the Restrictive Period, if it decides to offer, sell or otherwise transfer any of the Securities, the Purchaser will not offer, sell or otherwise transfer any of such Securities directly or indirectly, unless: |

|

| (i) | the sale is to the Company; |

|

|

|

|

|

| (ii) | the sale is made outside the United States in a transaction meeting the requirements of Regulation S under the U.S. Securities Act and in compliance with applicable local laws and regulations; |

|

|

|

|

|

| (iii) | the sale is made in the United States pursuant to the exemption from tile registration requirements under the U.S. Securities Act provided by Rule 144 (if it as available) thereunder and in accordance with any applicable state securities or "blue sky" laws, and the Purchaser has prior to such sale furnished to the Company an opinion of counsel reasonably satisfactory to the Company to the effect that such transaction does not require registration pursuant to Rule 144 under the U.S. Securities Act; |

|

|

|

|

|

| (iv) | the Securities are sold in the United States in a transaction that does not require registration under the U.S. Securities Act or any applicable state laws and regulations governing the offer and sale of securities, and the Purchaser has prior to such sale furnished to the Company an opinion of counsel reasonably satisfactory to the Company to the effect that such transaction does not require registration; or |

|

|

|

|

|

| (v) | the sale is made in the United States pursuant to an effective registration statement filed under the U.S. Securities Act. |

The Purchaser acknowledges and agrees that the Company will refuse to register any sale of Securities made in breach of the provisions hereof.

|

| (t) | all of the acknowledgements, representations, warranties and covenants set out in Schedule "A" hereto are true and correct as of the day hereof and as of the Closing and are incorporated by reference herein; |

|

|

|

|

|

| (u) | none of the funds being used to purchase the Securities are, to the knowledge of tt1e Purchaser, obtained or derived directly or indirectly as a result of illegal activities of Purchaser or of any beneficial purchaser for whom the Purchaser is acting; and |

|

|

|

|

|

| (v) | Purchaser shall provide to the Company (i) the Purchaser's street address, city, state or province, country, postal code, and phone number for the Purchaser, and, if the Purchaser is acting for a beneficial purchaser or disclosed principal, Purchaser shall provide such beneficial purchaser's or disclosed principal's full name, street address, city, state or province, country, postal code, and phone number; (ii) information requested by the Company regarding the registration of the certificates representing the Securities purchased hereunder; and (iii) any other information required by the Company, from time to time, regarding the Purchaser or such beneficial purchaser or disclosed principal. |

| 7 |

5. POWER OF ATTORNEY

The Company is hereby irrevocably appointed as the Purchaser's agent and attorney to represent the Purchaser at the Closing for the purposes of all closing matters and deliveries of documents, including without limitation (i) the delivery of certificates representing the Securities; (ii) executing in the Purchaser's name and on its behalf all closing receipts and documents; and (iii) negotiating and settling documents related to the Offering including any opinions, certificates or other documents addressed to the Purchaser.

6. WAIVER

The Purchaser, and each beneficial purchaser, if any, for whom the Purchaser is acting, hereby waives and releases the Company from, to the fullest extent permitted by law, any and all rights of withdrawal, rescission or compensation for damages to which the Purchaser or such beneficial purchaser might otherwise be entitled under applicable securities legislation, rules, regulations and policies.

7. GOVERNING LAW

This Subscription Agreement will be governed by and construed in accordance with the laws of the State of Arizona and the federal laws of the U.S. applicable therein. The Purchaser, on its own behalf and (if applicable) on behalf of others for whom it is contracting hereunder, hereby irrevocably attorns to the exclusive jurisdiction of the courts of the State of Arizona with respect to any matters arising out of this Subscription Agreement.

8. ASSIGNMENT

This Subscription Agreement is not transferable or assignable by the parties hereto.

9. ENTIRE AGREEMENT

This Subscription Agreement (including the Schedule hereto) contains the entire agreement of the parties hereto relating to the subject matter hereof and there are no representations, covenants or other agreements relating to the subject matter hereof except as stated or referred to herein.

10. SURVIVAL AND ENUREMENT

The representations, warranties, acknowledgments and covenants contained in this Subscription Agreement and in the Schedule hereto are made by the Purchaser with the intent that they may be relied upon by the Company in determining the Purchaser's eligibility or the eligibility of any others on whose behalf the Purchaser is contracting hereunder to purchase the Securities, and the Purchaser hereby agrees to indemnify the Company (and its officers, directors, employees, advisors, legal counsel and agents of the Company) against all losses, claims, costs, expenses and damages or liabilities which they may suffer or incur that are caused by or arise from the Purchaser's breach thereof. The Purchaser further agrees that by accepting the Securities the Purchaser shall be representing and warranting that the representations, warranties and acknowledgements contained herein are true as at the Closing with the same force and effect as if they had been made by the Purchaser at the Closing and that they and the covenants set forth in this Subscription Agreement shall survive the purchase by the Purchaser of the Securities and shall continue in full force and effect notwithstanding any subsequent disposition by it of any or all of the Securities. With respect to any indemnified person who is not a party to this Subscription Agreement, it is the intention of the Purchaser to constitute the Company as trustee for such indemnified persons of the rights and benefits of this Section 10 and the Company agrees to accept such trust and to hold the rights and benefits of this Section 10 in trust for and on behalf of each such indemnified person.

This Subscription Agreement will be binding upon and enure to the benefit of the parties hereto and their respective successors and assigns.

| 8 |

11. CURRENCY

Except where otherwise expressly provided, all amounts in this Subscription Agreement are stated and will be paid in United States currency.

12. COSTS

All costs and expenses incurred by the Purchaser and any beneficial purchaser for whom it is acting as trustee or agent relating to its purchase of Shares shall be borne by the Purchaser.

13. TIME OF ESSENCE

Time will be of the essence of this Subscription Agreement.

14. HEADINGS

The headings contained herein are for convenience only and will not affect the meaning or interpretation of this Subscription Agreement.

15. SCHEDULE

The following Schedule is incorporated into and forms an integral part of this Subscription Agreement, and any reference to this Subscription Agreement includes the Schedule "A"- CERTIFICATE OF NON-U.S. PERSON.

16. EXECUTION BY FACSIMILE, COUNTERPARTS

The Company will be entitled to rely on delivery by facsimile or electronic mail of an executed copy of this Subscription Agreement, including any attachments hereto, and acceptance by the Company of such facsimile or electronic copy will be legally effective to create a valid and binding agreement between the Company and tt1e Purchaser in accordance with the terms hereof. This Subscription Agreement may be executed in counterparts, each of which shall be deemed to be an original and all of which shall constitute one and the same document.

(Intentionally left blank)

| 9 |

17. SUBSCRIPTION PARTICULARS

BOX A:

| Particulars of Purchase of Shares | |||

|

|

| ||

| Number of Shares Subscribed For: |

| 1,076,752,423 ) |

|

|

|

|

|

|

| Total subscription price payable: |

| USD$21,535,048.46 |

|

| (US$0.02 x number of Shares subscribed for) |

|

|

|

BOX B:

| Purchaser Information | |||

|

|

|

|

|

| Name of Purchaser: |

| Agel Enterprises International Sdn. Bhd. |

|

|

|

|

|

|

| Street Address: |

| X-0-00, Xxxxx X, 0xx Xxxxxx, Xxxxx Xx Jernih 811, Section 8 |

|

|

|

|

|

|

| City and Province: |

| Petaling Jaya, Selangor |

|

|

|

|

|

|

| Country/Postal Code: |

| 00000, Xxxxxxxx |

|

|

|

|

|

|

| Contact Name: |

| Xxxxxxxx Xxx |

|

|

|

|

|

|

| Alternate Contact: |

| Xxxxxxx |

|

|

|

|

|

|

| Phone No.: |

| 000-0000-0000 |

|

|

|

|

|

|

| Fax No.: |

| 000-0000-0000 |

|

|

|

|

|

|

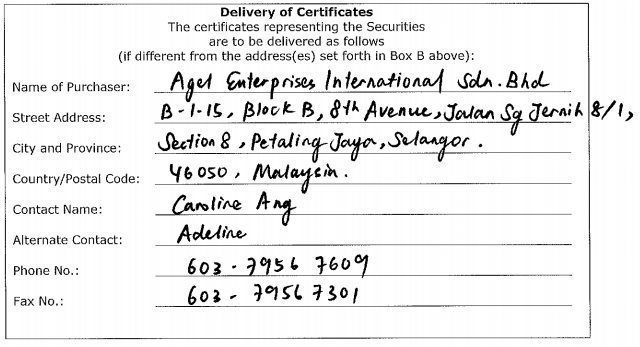

BOX C:

| Registration Information Registration of the certificates representing the Securities should be made exactly as follows: | |||

|

|

|

|

|

| Name of Purchaser: |

| Agel Enterprises International Sdn. Bhd. |

|

|

|

|

|

|

| Street Address: |

| X-0-00, Xxxxx X, 0xx Xxxxxx, Xxxxx Xx Jernih 811, Section 8 |

|

|

|

|

|

|

| City and Province: |

| Petaling Jaya, Selangor |

|

|

|

|

|

|

| Country/Postal Code: |

| 00000, Xxxxxxxx |

|

|

|

|

|

|

| Contact Name: |

| Xxxxxxxx Xxx |

|

|

|

|

|

|

| Alternate Contact: |

| Xxxxxxx |

|

|

|

|

|

|

| Phone No.: |

| 000-0000-0000 |

|

|

|

|

|

|

| Fax No.: |

| 000-0000-0000 |

|

|

|

|

|

|

| 10 |

BOX D:

BOX E:

| 11 |

18. SIGNATURE OF PURCHASER

Signature of Purchaser (on its own behalf and, if applicable, on behalf of each principal for whom it is contracting hereunder).

AGEL ENTERPRISES INTERNATIONAL SON. BHD.

a Malaysian corporation

| By: /s/ Khairul Razikin Bin Jamalludin Name: Khairul Razikin Bin Jamalludin Title: Director |

|

19. CONFIRMATION AND ACCEPTANCE

This Subscription Agreement is confirmed and accepted by the Company.

DATED as of the 7th day of May, 2018.

TOGA LIMITED,

a Delaware corporation

| By: | /s/ Toh Kok Soon |

|

| Name: | Toh Kok Soon |

|

| Title: | CEO |

|

| 12 |

SCHEDULE "A"

CERTIFICATE OF NON-U.S. PERSON

The Purchaser covenants, represents and warrants to Toga Limited (the "Company") that:

1. The representation and warranties contained herein are made by the Purchaser with the intent that they may be relied upon by the Company in determining the Purchaser's suitability as a purchaser of shares of its capital stock (the "Shares").

2. The Purchaser confirms that the purchase of the Shares occurred in an "offshore transaction" in that:

(a) The Purchaser is not an "entity" in the United States;

(b) At the time the Subscription Agreement between Purchaser and Company (the "Subscription Agreement") was entered into (which this Schedule "A" is a part), and as of the effective date of the Subscription Agreement, the Purchaser was outside of the United States;

(c) The Purchaser is not a U.S. Person. For purposes hereof, "U.S. Person" means:

|

| (i) | any natural person resident in the United States; |

|

| (ii) | any partnership or corporation organized or incorporated under the laws of the United States; |

|

| (iii) | any estate of which any trustee is a U.S. Person; |

|

| (iv) | any trust of which any trustee is a U.S. Person; |

|

| (v) | any agency or branch of a foreign entity located in the United States; |

|

| (vi) | any non-discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary organized, incorporated, or (if any individual) resident in the United States; and |

|

| (vii) | any partnership or corporation if: |

|

| (a) | organized or incorporated under the laws of any foreign jurisdiction; and |

|

| (b) | formed by a U.S. Person principally for the purpose of investing in securities not registered under the U.S. Securities Act, unless it is organized or incorporated, and owned by accredited investors (as defined in Rule 501(1) under the U.S. Securities Act) who are not natural persons, estates or trusts. |

| A-1 |

3. The Purchaser has previously been advised that the Purchaser would have an opportunity to review all the pertinent facts concerning the Company, and to obtain any additional information which it might request, to the extent possible or obtainable, without unreasonable effort and expense.

4. The Purchaser has personally communicated or been offered the opportunity to communicate with an executive officer of the Company to discuss the business and financial affairs of the Company, its products and activities, and its plans for the future. The Purchaser acknowledges that if the Purchaser would like to further avail itself of the opportunity to ask additional questions of the Company, the Company will make arrangements for such an opportunity on request.

5. The Purchaser has been advised that no accountant or attorney engaged by the Company is acting as its representative, accountant, or attorney.

|

| 8th May 2018 |

|

|

| Date |

|

|

|

|

|

|

| /s/ Khairul Razikin Bin Jamalludin |

|

|

| Duly Authorized Signatory for Purchaser |

|

|

|

|

|

|

| Khairul Razikin Bin Jamalludin |

|

|

| (Print Name of Purchaser) |

|

| A-2 |