EIGHTH AMENDMENT TO SECOND AMENDED AND RESTATED CREDIT AGREEMENT

Exhibit 10.1

EXECUTION

EIGHTH AMENDMENT TO SECOND AMENDED

AND RESTATED CREDIT AGREEMENT

THIS EIGHTH AMENDMENT TO SECOND AMENDED AND RESTATED CREDIT AGREEMENT (this “Eighth Amendment”), dated as of April 18, 2017, is entered into by and among XXXXXXX ENERGY CORPORATION, a Delaware corporation (“Borrower”), each of SN PALMETTO, LLC, a Delaware limited liability company f/k/a SEP Holdings III, LLC (“SN Palmetto”), XX XXXXXXX LLC, a Delaware limited liability company (“XX Xxxxxxx”), SN COTULLA ASSETS, LLC, a Texas limited liability company (“SN Cotulla”), SN OPERATING, LLC, a Texas limited liability company (“SN Operating”), SN TMS, LLC, a Delaware limited liability company (“SN TMS”), SN CATARINA, LLC, a Delaware limited liability company (“SN Catarina”), SN EF MAVERICK, LLC, a Delaware limited liability company (“SN Maverick”) and ROCKIN L RANCH COMPANY, LLC, a Delaware limited liability company (“RLRC”; together with SN Palemetto, XX Xxxxxxx, SN Cotulla, SN Operating, SN TMS, SN Catarina and SN Maverick collectively, the “Guarantors” and each, a “Guarantor”), the Required Lenders party hereto, and ROYAL BANK OF CANADA, as Administrative Agent for the Lenders (in such capacity, together with its successors in such capacity, the “Administrative Agent”).

RECITALS

A. The Borrower, the Guarantors, the Lenders, RBC, as Issuing Bank, and the Administrative Agent previously entered into that certain Second Amended and Restated Credit Agreement dated as of June 30, 2014 (as amended by that certain First Amendment to Second Amended and Restated Credit Agreement dated as of September 9, 2014, that certain Second Amendment to Second Amended and Restated Credit Agreement dated as of March 31, 2015, that certain Third Amendment to Second Amended and Restated Credit Agreement dated as of July 20, 2015, that certain Fourth Amendment to Second Amended and Restated Credit Agreement dated as of September 29, 2015, that certain Fifth Amendment to Second Amended and Restated Credit Agreement dated as of October 30, 2015, that certain Sixth Amendment to Second Amended and Restated Credit Agreement dated as of January 22, 2016, that certain Seventh Amendment to Second Amended and Restated Credit Agreement dated as of March 18, 2016, the “Credit Agreement”) and certain other Loan Documents (as defined in the Credit Agreement) in connection therewith.

B. The Borrower has requested that the Administrative Agent and the Lenders amend the Credit Agreement as set forth herein to (i) increase certain Investment amounts and (ii) make certain other amendments as set forth herein. The Administrative Agent and the Required Lenders are willing to amend the Credit Agreement on the terms and conditions contained in this Eighth Amendment.

AGREEMENT

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants set forth in this Eighth Amendment and other good and valuable consideration, the receipt and sufficiency of which are acknowledged by the parties hereto, the Borrower, the Guarantors, the Required Lenders, the Issuing Bank and the Administrative Agent agree as follows:

1. Defined Terms. Unless otherwise defined herein, capitalized terms used herein have the meanings assigned to them in the Credit Agreement.

2. Specific Amendments to Credit Agreement. The Credit Agreement is hereby amended as follows:

(i) The following defined terms are hereby added to Section 1.02 of the Credit Agreement in the proper alphabetical order:

“Anadarko” means Anadarko E&P Onshore LLC and/or Xxxx-XxXxx Oil and Gas Onshore LP, individually or collectively, as the context may require.

“CEF” means Carrizo (Eagle Ford), LLC, a Delaware limited liability company.

“CEF Properties” means the Properties to be conveyed by SN Cotulla to CEF pursuant to the CEF PSA.

“CEF Property Disposition” means the disposition by SN Cotulla to CEF of the CEF Properties in accordance with the CEF PSA.

“CEF PSA” means that certain Purchase and Sale Agreement dated October 24, 2016, together with all schedules and exhibits thereto, between SN Cotulla, as “seller”, and CEF, as “buyer”, providing for (i) the transfer by SN Cotulla to CEF of the CEF Properties, and (ii) the payment by CEF to SN Cotulla of approximately $181,000,000 in cash (subject to adjustment in accordance with the CEF PSA).

“CEF PSA Transaction” means the collective reference to the transactions contemplated by the CEF PSA including, without limitation, the CEF Property Disposition.

“Comanche Marketing Agreements” means (a) the Hydrocarbons Purchase and Marketing Agreement dated as of January 12, 2017, between SN Maverick and UnSub LP, (b) the Natural Gas Liquids Marketing Agreement dated as of March 1, 2017, between SN Maverick and Gavilan, (c) the Residue Gas Marketing Agreement dated as of March 1, 2017, between SN Maverick and Gavilan, and (d) the Crude Oil Production Marketing Agreement dated as of March 1, 2017, between SN Maverick and Gavilan, in each case, as the same may be amended or otherwise modified from time to time.

“Comanche Property Acquisition” means the acquisition by SN Maverick, together with UnSub LP and Gavilan, collectively as buyers, of Oil and Gas Properties from Anadarko, as sellers, pursuant to the Comanche Property PSA.

“Comanche Property PSA” means that certain Purchase and Sale Agreement dated January 12, 2017, together with all schedules and exhibits thereto, between Anadarko, as sellers, and SN Maverick, together with UnSub LP and Gavilan, collectively as buyers, providing for the sale to SN Maverick, UnSub LP and Gavilan of Oil and Gas Properties consisting of approximately 155,000 net acres mainly in Dimmit and Xxxx Counties, Texas in the Eagle Ford Shale for a purchase price (before adjustments) of approximately $2,300,000,000.

“Comanche Property PSA Transaction” means the acquisition by SN Maverick of Oil and Gas Properties from Anadarko pursuant to the Comanche Property PSA.

“Comanche Transaction” collectively means the Comanche Property PSA Transaction and the other transactions provided for in the Comanche Transaction Agreements.

“Comanche Transaction Agreements” collectively means the agreements and other writings listed on Schedule 1.02 (Comanche Transaction Agreements).

“Eighth Amendment” means that certain Eighth Amendment to Second Amended and Restated Credit Agreement dated as of the Eighth Amendment Effective Date by and among the Borrower, the Guarantors, the Lenders party thereto, and the Administrative Agent.

“Eighth Amendment Effective Date” means April 18, 2017.

“Gavilan” means Gavilan Resources, LLC, a Delaware limited liability company formerly known as Xxxxxx Production, LLC.

“GSO Associates” means GSO ST Holdings Associates LLC, a Delaware limited liability company.

“GSO Capital Partners” means GSO Capital Partners LP, a Delaware limited partnership.

“GSO Holdings” means GSO ST Holdings LP, a Delaware limited partnership.

“Intrepid” means Intrepid Private Equity V-A, LLC, a Delaware limited liability company.

“Rockin L” means Rockin L Ranch Company, LLC, a Delaware limited liability company, and wholly-owned Subsidiary of Borrower.

“SN Capital” means SN Capital, LLC, a Delaware limited liability company, and wholly-owned Subsidiary of Borrower.

“SN Comanche” means SN Comanche Manager, LLC, a Delaware limited liability company, and wholly-owned Subsidiary of Borrower.

“SN Maverick” means SN EF Maverick, LLC, a Delaware limited liability company, and wholly-owned Subsidiary of Borrower.

“2016 SPP Properties” means the Properties conveyed by SEP or SN Cotulla to SEP Holdings IV pursuant to the 2016 SPP PSA.

“2016 SPP Property Disposition” means the disposition by SEP or SN Cotulla to SEP Holdings IV of the 2016 SPP Properties in accordance with the 2016 SPP PSA.

“2016 SPP PSA” means that certain Purchase and Sale Agreement dated October 6, 2016, together with all schedules and exhibits thereto, between SEP and SN Cotulla, as “seller”, SEP Holdings IV, as “buyer”, and SPP, providing for (i) the transfer by SEP and SN Cotulla to SEP Holdings IV of the 2016 SPP Properties, and (ii) the payment by SEP Holdings IV to SEP and SN Cotulla of approximately $27,000,000 in cash (subject to adjustment in accordance with the 2016 SPP PSA).

“2016 SPP PSA Transaction” means the collective reference to the transactions contemplated by the 2016 SPP PSA.

“UnSub GP” means SN EF UnSub GP, LLC, a Delaware limited liability company, and wholly-owned Subsidiary of Borrower.

“UnSub Holdings” means SN EF UnSub Holdings, LLC, a Delaware limited liability company, and wholly-owned Subsidiary of Borrower.

“UnSub LP” means SN EF UnSub, LP, a Delaware limited partnership, 100% of whose common limited partnership interests are indirectly owned by Borrower and whose sole general partner is UnSub GP.

(ii) The defined term “Aggregate Elected Commitment Amount” in Section 1.02 of the Credit Agreement is hereby amended by deleting the word “Seventh” and replacing it with the word “Eighth”.

(iii) The defined term “Agreement” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Agreement” means this Second Amended and Restated Credit Agreement, as amended by the First Amendment, Second Amendment, Third Amendment, Fourth Amendment, Fifth Amendment, Sixth Amendment, Seventh Amendment, Eighth Amendment and as the same may from time to time be amended, modified, supplemented or restated.

(iv) Clause (c) of the defined term “Consolidated EBITDA” in Section 1.02 of the Credit Agreement is hereby amended by adding after the semicolon following the words “Restricted Subsidiaries” the following: “provided consolidated exploration cost, depletion, depreciation and amortization expense of Unrestricted Subsidiaries shall be excluded;”

(v) Clause (d) of the defined term “Consolidated EBITDA” in Section 1.02 of the Credit Agreement is hereby amended by adding after the word “charges” and before the word “to” the words “of the Borrower and its Restricted Subsidiaries”.

(vi) Clause (e) of the defined term “Consolidated EBITDA” in Section 1.02 of the Credit Agreement is hereby amended by replacing the word “and” before clause (6) with a comma, and inserting the words “, (7) the February 2017 offering of Borrower’s Equity Interests and (8) the Comanche Transaction” immediately before the semicolon.

(vii) The defined term “Consolidated Income Tax Expense” in Section 1.02 of the Credit Agreement is hereby amended by adding a new sentence at the end of such definition to read as follows:

“For the avoidance of doubt, Consolidated Income Tax Expense shall be calculated excluding the provision for federal, state, local and foreign taxes (including state franchise taxes) based on income of the Unrestricted Subsidiaries.”

(viii) The defined term “Consolidated Net Interest Expense” in Section 1.02 of the Credit Agreement is hereby amended by (i) deleting the words “total consolidated” in the introductory clause thereof and (ii) adding at the end thereof a new sentence as follows:

“For the avoidance of doubt, Consolidated Net Interest Expense and each of the components thereof and exclusions therefrom shall be calculated excluding amounts attributable to Unrestricted Subsidiaries.”

(ix) The defined term “First Two Years Proved Percentage” in Section 1.02 of the Credit Agreement is hereby deleted.

(x) The defined term “SEP” appearing after the defined term “SEC” in Section 1.02 of the Credit Agreement is hereby deleted.

(xi) The defined term “Senior Unsecured Notes Maximum Issuance Amount” in Section 1.02 of the Credit Agreement is hereby deleted and the following substituted therefor:

“Senior Unsecured Notes Maximum Issuance Amount” means the maximum amount of Senior Unsecured Notes that at the time of issuance could be issued such that, after giving effect to such issuance and any repayment, redemption, defeasance or satisfaction and discharge of Senior Unsecured Notes out of the proceeds thereof and the proceeds of any Permitted Second Lien Debt issued substantially contemporaneously therewith, the aggregate principal amount of Senior Unsecured Notes outstanding is not greater than the remainder of (a) the sum of (i) $2,150,000,000 and (ii) all redemption premiums payable in respect of any Senior Unsecured Notes being repaid, redeemed, defeased, or satisfied and discharged, and all accrued but unpaid interest in respect of such Senior Unsecured Notes, minus (b) the Permitted Second Lien Debt Original Principal Amount.

(xii) The defined term “Sixth Amendment Effective Date Replenishment Amount” in Section 1.02 of the Credit Agreement is hereby deleted.

(xiii) The defined term “SN Services Transaction” in Section 1.02 of the Credit Agreement is hereby deleted and the following substituted therefor:

“SN Services Transaction” means Investments in, or contributions of cash or Property by any Loan Party to, SN Services and Letters of Credit issued hereunder to support Debt or other obligations of SN Services in an aggregate amount at any one time outstanding from and after the Eighth Amendment Effective Date not to exceed the sum of (A) $10,000,000 plus (B) the aggregate amount of cash dividends and other cash distributions received by Borrower or any Restricted Subsidiary from SN Services, whether directly or indirectly, from and after the Eighth Amendment Effective Date.

(xiv) The defined term “Specified Acquisition” in Section 1.02 of the Credit Agreement is hereby deleted and the following substituted therefor:

“Specified Acquisition” means any Acquisition for which: (i) a binding and enforceable purchase and sale agreement has been signed by the Borrower or one or more of its Restricted Subsidiaries; (ii) at the time of the signing of the applicable purchase and sale agreement, the ratio of Availability to the then effective total Commitments is at least 0.10 to 1.0, and (iii) the aggregate volumes hedged with respect to the reasonably anticipated projected production to be acquired by the Borrower and its Restricted Subsidiaries in all pending Specified Acquisitions that have not yet been consummated shall not exceed the amount permitted by Section 9.17(c).

(xv) The defined term “Swap Agreement” in Section 1.02 of the Credit Agreement is hereby amended by (i) deleting the word “and” at the end of clause (c) in the second sentence thereof and replacing such word with a comma, and (ii) inserting the following before the period at the end of such definition:

“and (e) the Comanche Marketing Agreements shall not constitute Swap Agreements for purposes of Section 9.17”.

(xvi) The introductory clause of the defined term “Unrestricted Subsidiary” in Section 1.02 of the Credit Agreement is hereby deleted and the following substituted therefor:

“Unrestricted Subsidiary” means SN Midstream, SN Services, SN UR Holdings, SN Terminal, the Special Purpose Unrestricted Subsidiary, SN Capital, UnSub Holdings, UnSub GP, UnSub LP, SN Comanche and each other Subsidiary of the Borrower that is designated by the Board of Directors of the Borrower as an Unrestricted Subsidiary pursuant to a resolution of the Board of Directors of Borrower (in each case for so long as such Person remains a Subsidiary), but only to the extent that such Subsidiary:

(xvii) The defined term “Unrestricted Subsidiary Maximum Cash Investment Amount” in Section 1.02 of the Credit Agreement is hereby deleted and the following substituted therefor:

“Unrestricted Subsidiary Maximum Cash Investment Amount” at any time from and after the Eighth Amendment Effective Date means the amount equal to (A) $150,000,000, plus (B) the aggregate amount of dividends and other distributions received by the Borrower and the Restricted Subsidiaries in cash from Unrestricted Subsidiaries after the Eighth Amendment Effective Date to and including such time, plus (C) the amount of any capital contributions made in cash to, or any proceeds of an equity issuance received by, the Borrower after the Eighth Amendment Effective Date, minus (D) the aggregate amount drawn at such time under Letters of Credit issued pursuant to Section 9.05(l) after the Eighth Amendment Effective Date that have been drawn and for which the Borrower has not then been reimbursed by the Persons whose Debt or obligations were supported by such Letters of Credit.

(xviii) The second sentence of Section 7.01 of the Credit Agreement is hereby amended by deleting the words and the comma following such words “As of the Sixth Amendment Effective Date,”.

(xix) Section 7.14 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Section 7.14 Subsidiaries. Schedule 7.14 sets forth the name of, and the ownership interest of Borrower in, each Subsidiary of Borrower as of the Eighth Amendment Effective Date. As of the Eighth Amendment Effective Date there are no Unrestricted Subsidiaries other than SN Midstream, SN Services, SN UR Holdings, SN Terminal, SN Capital, UnSub Holdings, UnSub GP, UnSub LP and SN Comanche.”

(xx) Section 7.19 of the Credit Agreement is hereby amended by deleting the word “Fifth” and replacing it with the word “Eighth”.

(xxi) Section 7.20 of the Credit Agreement is hereby amended by deleting the word “Fifth” wherever it appears in such Section and replacing it with the word “Eighth”.

(xxii) The second sentence of Section 8.11(c) of the Credit Agreement is hereby amended by deleting the word “Second” and replacing it with the word “Eighth”.

(xxiii) The fourth sentence of Section 8.11(d) of the Credit Agreement is hereby amended by deleting the word “Fifth” and replacing it with the word “Eighth”.

(xxiv) Section 8.13(b) of the Credit Agreement, the first sentence of Section 8.13(c) of the Credit Agreement and the second sentence of Section 8.13(c) of the Credit Agreement are each hereby amended by deleting the phrase “ninety percent (90%) of the value” and replacing it with the phrase “ninety percent (90%) of the Engineered Value”.

(xxv) Section 8.18 of the Credit Agreement is hereby deleted.

(xxvi) Section 9.01(a) of the Credit Agreement is hereby amended by adding at the end thereof the following sentence:

“For the avoidance of doubt, the consolidated current assets and consolidated current liabilities of the Borrower shall be calculated excluding the consolidated current assets and consolidated current liabilities of Unrestricted Subsidiaries.”

(xxvii) Section 9.02(d) of the Credit Agreement is hereby amended by deleting the word “and” at the end of clause (iv) and inserting the following before the semicolon at the end of clause (v):

“, and (vi) Debt, if any, arising under the Comanche Transaction Agreements, including any joint and several obligations of SN Maverick and guarantees thereof of the Borrower”

(xxviii) Section 9.04 of the Credit Agreement is hereby amended by:

(a) deleting clause (c) thereof and substituting therefor the following:

“(c) Restricted Payments occurring or deemed to occur upon or in connection with (1) the acquisition or exercise of stock options, warrants or other equity-based awards to the extent such Restricted Payment or the proceeds thereof are used to satisfy a portion of the acquisition or exercise price of such options, warrants or other equity-based awards, (2) the exercise of stock options, warrants or other equity-based awards or the vesting or issuance of Equity Interests to the extent such Restricted Payment or the proceeds thereof are used to satisfy a portion of the tax liability of the holder thereof with respect to such exercise, vesting or issuance, or (3) the purchase, redemption, retirement, acquisition, cancellation or termination of any Equity Interests of the Borrower held by any current or former employee, director or consultant of the Borrower or any Restricted Subsidiary (or their respective estates, heirs, family members, spouses,

former spouses or beneficiaries under their estates or other permitted transferees) pursuant to any equity subscription agreement, stock option agreement, employee benefit plan or similar arrangement or agreement;” and

(b) deleting clause (f) thereof and all the words following such clause and substituting therefor the following:

“(f) (i) repurchases made prior to the Eighth Amendment Effective Date pursuant to and in compliance with this Section 9.04(f) as in effect immediately prior to the Eighth Amendment Effective Date and (ii) so long as at the time of and after giving effect to any such repurchase, there is Buyback Availability, repurchases made after the Eighth Amendment Effective Date for aggregate cash consideration not to exceed $50,000,000 of Preferred Stock issued by Borrower; provided, that Restricted Payments made under this Section 9.04, other than (x) pursuant to clauses (c) and (e) above and (y) Permitted Preferred Stock Distributions comprised of common stock of Borrower and cash payments in lieu of the issuance of fractional shares in connection therewith, may be made only so long as no Default or Event of Default exists or will exist after giving effect to such Restricted Payment”.

(xxix) Section 9.05(j) of the Credit Agreement is hereby amended by adding after the words “boundaries of the U.S.” and before the semicolon immediately following such words, the words “or the offshore area in the Gulf of Mexico over which the U.S. asserts jurisdiction, including SN Maverick’s acquisition of Oil and Gas Properties pursuant to the Comanche Transaction”

(xxx) Section 9.05(m) of the Credit Agreement is hereby amended by deleting the first parenthetical thereof and substituting therefor the following:

“(including for the avoidance of doubt Investments in SN Capital, SN Comanche, UnSub Holdings, UnSub GP and UnSub LP and Investments in the Eagle Ford Midstream XX Xxxxxxx Party, the Point Comfort Port XX Xxxxxxx Party, SN Midstream and SN Services in excess of amounts otherwise provided in this Agreement)”

(xxxi) Section 9.05(n) of the Credit Agreement is hereby deleted and the following substituted therefor:

“(n) Investments contemplated by the DW Midstream Transaction, Investments contemplated by the Eagle Ford Midstream JV Transaction (including Letters of Credit to support obligations of the Eagle Ford Midstream XX Xxxxxxx Party), Investments contemplated by the Point Comfort Port JV Transaction and Investments contemplated by the Comanche Transaction, including the Comanche Property PSA Transaction; provided, for the sake of clarity, that to the extent such Investments are permitted pursuant to Section 9.05(m), Investments in connection with the DW Midstream Transaction, the Eagle Ford Midstream JV Transaction,

the Point Comfort Port JV Transaction and the Comanche Transaction in excess of the amounts provided for in the definitions thereof shall be permitted;”

(xxxii) Section 9.05(p) of the Credit Agreement is hereby amended by deleting the reference to “Section 9.02” therein and substituting therefor “Section 9.05”.

(xxxiii) Section 9.05(r) of the Credit Agreement is hereby deleted and the following substituted therefor:

“(r) Investments consisting of the purchase or other acquisition of Senior Unsecured Notes and Preferred Stock issued by the Borrower; provided, that at the time of such Investment, Buyback Availability exists; and provided further, that the aggregate cash consideration paid by the Borrower and the Restricted Subsidiaries after the Eighth Amendment Effective Date to purchase Senior Unsecured Notes and Preferred Stock issued by the Borrower is not greater than $250,000,000; and provided further, purchases or other acquisitions of Preferred Stock issued by the Borrower are subject to the limitation set forth in the proviso in Section 9.04; and provided, further, for the sake of clarity that the limitation in the foregoing proviso shall not apply to the issuance of Permitted Second Lien Debt in exchange for Senior Unsecured Notes and/or Preferred Stock issued by the Borrower; and”.

(xxxiv) Section 9.05(s) of the Credit Agreement is hereby deleted.

(xxxv) The introductory clause of Section 9.11(e) of the Credit Agreement is hereby amended by adding after the words “owning Oil and Gas Properties” and before the semicolon immediately following such words, the words “including without limitation, Oil and Gas Properties sold or otherwise disposed of in connection with the CEF Property Disposition and 2016 SPP Property Disposition”.

(xxxvi) Section 9.11(e)(2) of the Credit Agreement is hereby amended by deleting the percentage “100%” therein and substituting therefor the words “at least 75%”.

(xxxvii) Section 9.13 of the Credit Agreement is hereby amended by deleting the words at the beginning of such section “Except for the SPP PSA Transaction and,” and substituting therefor the words “Except for the 2016 SPP PSA Transaction, the Comanche Transaction, SPP PSA Transaction and,”.

(xxxviii) Section 9.13 of the Credit Agreement is hereby amended by:

(a) deleting the word “Company” in clause (iv) of the third sentence thereof and substituting therefor the word “Borrower”;

(b) deleting the word “or” at the end of clause (iv) of the third sentence thereof;

(c) adding the word “and” immediately after the words “majority of the Board of Directors,” at the end of clause (v)(A) of the third sentence thereof; and

(d) adding after clause (v) of the third sentence thereof and immediately before the period following clause (v) the following:

“, or (vi) transactions permitted by the exceptions set forth in Sections 9.02, 9.03, 9.04, 9.05, 9.07, 9.11 and 9.15. “

(xxxix) Section 9.17(b) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“(b) From and after the Eighth Amendment Effective Date, the Borrower will not, and will not permit any Restricted Subsidiary to, enter into any Swap Agreements with respect to commodities with any Person other than (i) Swap Agreements in effect as of the Eighth Amendment Effective Date described on Schedule 9.17 to the Eighth Amendment, (ii) Swap Agreements constituting floor or put options with an Approved Counterparty, (iii) Swap Agreements (other than floor or put options) with an Approved Counterparty that are limited to notional volumes which (when aggregated with other commodity Swap Agreements then in effect other than floor or put options and basis differential swaps on volumes already hedged pursuant to other Swap Agreements) do not exceed, as of the date such Swap Agreement is executed, (A) for the period remaining in the then current calendar year plus the next three calendar years following the date such Swap Agreement is executed, eighty-five percent (85%) of the Borrower’s and its Restricted Subsidiaries’ reasonably anticipated projected production based on Borrower’s reasonable and justifiable internal projections (assuming no curtailment or interruption of transportation for such projected production) for each month during the period during which such Swap Agreement is in effect, calculated separately for each of crude oil, natural gas and natural gas liquids (which may be hedged with Swap Agreements for crude oil, natural gas, and/or direct and/or basket product components of natural gas), (B) for the period commencing with the end of the period specified in clause (A) above to the end of the 66th month after the date of execution of such Swap Agreement, sixty-five percent (65%) of the Borrower’s and its Restricted Subsidiaries’ reasonably anticipated projected production based on Borrower’s reasonable and justifiable internal projections (assuming no curtailment or interruption of transportation for such projected production) for each month during the period during which such Swap Agreement is in effect, calculated separately for each of crude oil, natural gas and natural gas liquids (which may be hedged with Swap Agreements for crude oil, natural gas, and/or direct and/or basket product components of natural gas), and (C) for the period after the end of the 66th month after the date of execution of such Swap Agreement, zero percent (0%) (no commodity Swap Agreements other than floor or put options).”

(xl) Section 9.17(c) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“(c) From and after the Eighth Amendment Effective Date, reserves pertaining to Oil and Gas Properties to be acquired pursuant to a Specified Acquisition may be hedged as if such Specified Acquisition had closed and Borrower or one or more Restricted Subsidiaries owned the reserves to be acquired in such Specified Acquisition and the Borrower or any one or more Restricted Subsidiaries may enter into Swap Agreements that would be permitted by Section 9.17(b) based on Borrower’s reasonable and justifiable internal projections submitted to the Lenders in connection with such Specified Acquisition; provided that Swap Agreements entered into pursuant to this Section 9.17(c) must be Liquidated upon the date which is the earlier to occur of: (i) the date that is 120 days after the execution of the purchase and sale agreement relating to the Specified Acquisition to the extent that such Specified Acquisition has not been consummated by such date and (ii) the date that is 60 days after the date on which Borrower or any Restricted Subsidiary knows with reasonable certainty that the Specified Acquisition will not be consummated.”

(xli) A new Annex 1 to the Credit Agreement, “List of Maximum Credit Amounts” in the form attached as Annex 1 to this Eighth Amendment is hereby added to the Credit Agreement to reflect the assignment of 100% of the Commitment of MUFG Union Bank, N.A. to ABN AMRO Capital USA LLC effective as of March 17, 2017.

(xlii) A new Schedule 1.02 to the Credit Agreement, “Comanche Transaction Agreements” in the form attached as Schedule 1.02 to this Eighth Amendment is hereby added to the Credit Agreement.

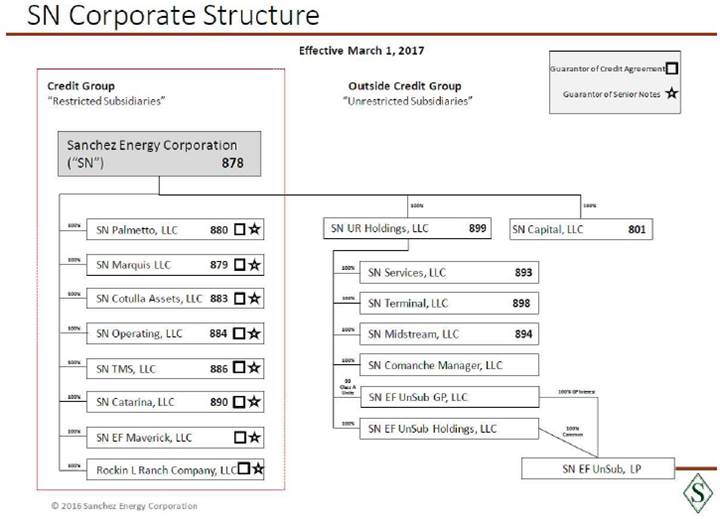

(xliii) A new Schedule 7.01 to the Credit Agreement, “Corporate Organizational Chart” in the form attached as Schedule 7.01 to this Eighth Amendment is hereby added to the Credit Agreement in substitution for the prior Schedule 7.01.

(xliv) A new Schedule 7.14 to the Credit Agreement, “Subsidiaries” in the form attached as Schedule 7.14 to this Eighth Amendment is hereby added to the Credit Agreement in substitution for the prior Schedule 7.14.

(xlv) A new Schedule 7.19 to the Credit Agreement, “Marketing Contracts” in the form attached as Schedule 7.19 to this Eighth Amendment is hereby added to the Credit Agreement in substitution for the prior Schedule 7.19.

(xlvi) A new Schedule 7.20 to the Credit Agreement, “Swap Agreements” in the form attached as Schedule 7.20 to this Eighth Amendment is hereby added to the Credit Agreement in substitution for the prior Schedule 7.20.

(xlvii) A new Schedule 9.05 to the Credit Agreement, “Investments” in the form attached as Schedule 9.05 to this Eighth Amendment is hereby added to the Credit Agreement in substitution for the prior Schedule 9.05.

(xlviii) A new Schedule 9.17 to the Credit Agreement, “Existing Swap Agreements as of the Eighth Amendment Effective Date” in the form attached as Schedule 9.17 to the Eighth Amendment is hereby added to the Credit Agreement in substitution for the prior Schedule 9.17 “Existing Swap Agreements as of the Third Amendment Effective Date”.

(xlix) The Financial Covenant Calculation Worksheet attached to Exhibit D “Form of Compliance Certificate” is hereby deleted and the Financial Covenant Calculation Worksheet attached as Exhibit D to this Eighth Amendment is substituted therefor.

3. Representations. The Borrower represents and warrants that the representations and warranties contained in the Credit Agreement and the representations and warranties contained in the other Loan Documents are true and correct in all material respects on and as of the date this Eighth Amendment becomes effective pursuant to Section 6 as if made on and as of such date, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they shall be true and correct in all material respects as of such earlier date.

4. Loan Parties’ Ratification. Subject to the conditions set out in Section 6, Borrower (and each Loan Party by its execution in the space provided below under “ACKNOWLEDGED for the purposes stated in Sections 4, 5 and 8”) hereby ratifies all of its Obligations under the Credit Agreement and each of the other Loan Documents to which it is a party (other than the Guaranty, which is specifically addressed in Section 5), and agrees and acknowledges that the Credit Agreement and each of the other Loan Documents to which it is a party (other than the Guaranty, which is specifically addressed in Section 5) are and shall continue to be in full force and effect. Nothing in this Eighth Amendment extinguishes, novates or releases any right, claim, Lien, security interest or entitlement of any of the Lenders, any Issuing Bank or the Administrative Agent created by or contained in any of such documents nor is any Loan Party released from any covenant, warranty or obligation created by or contained herein or therein. Each Loan Party (other than the Borrower) agrees that its execution and delivery of this Eighth Amendment does not indicate or establish an approval or consent requirement by any such Loan Party under the Credit Agreement in connection with the execution and delivery of amendments to the Credit Agreement, the Notes or any of the other Loan Documents (other than any Loan Document to which such a Loan Party is a party).

5. Guarantors’ Ratification. Each Guarantor by its execution in the space provided below under “ACKNOWLEDGED for the purposes stated in Sections 4, 5 and 8” hereby ratifies, confirms, acknowledges and agrees that its obligations under the Guaranty are in full force and effect and that such Guarantor continues to unconditionally and irrevocably guarantee the full and punctual payment, when due, whether at stated maturity or earlier by acceleration or otherwise, of the Obligations, and its execution and delivery of this Eighth Amendment does not indicate or establish an approval or consent requirement by any Guarantor under the Guaranty in connection with the execution and delivery of amendments to the Credit Agreement, the Notes or

any of the other Loan Documents (other than the Guaranty or any other Loan Document to which a Guarantor is a party).

6. Conditions to Effectiveness of Eighth Amendment. This Eighth Amendment shall be effective upon the satisfaction, in the Administrative Agent’s sole discretion, of the following conditions precedent:

(i) The Administrative Agent shall have executed, and shall have received from the Borrower and the Required Lenders duly executed signature pages to, this Eighth Amendment, and shall have received a duly executed acknowledgement of Sections 4, 5 and 8 of this Eighth Amendment from each Guarantor; and

(ii) the Administrative Agent shall have received such other documents as the Administrative Agent or its counsel may reasonably request.

7. No Implied Amendment, Waiver or Consent. This Eighth Amendment shall not constitute an amendment or waiver of any provision not expressly referred to herein and shall not be construed as a consent to any action on the part of the Borrower that would require a waiver or consent of the Lenders or Required Lenders, as applicable, or an amendment or modification to any term of the Loan Documents except as expressly stated herein.

8. Miscellaneous. This Eighth Amendment is a Loan Document. Except as affected by this Eighth Amendment, the Loan Documents are unchanged and continue in full force and effect. However, in the event of any inconsistency between the terms of the Credit Agreement, as amended by this Eighth Amendment, and any other Loan Document, the terms of the Credit Agreement as amended by this Eighth Amendment will control and the other document will be deemed to be amended to conform to the terms of the Credit Agreement as amended by this Eighth Amendment. All references to the Credit Agreement will refer to the Credit Agreement as amended by this Eighth Amendment and any other amendments properly executed among the parties. Borrower and each Guarantor agrees that all Loan Documents to which it is a party (whether as an original signatory or by assumption of the Obligations) remain in full force and effect and continue to evidence its legal, valid and binding obligations enforceable in accordance with their terms (as the same are affected by this Eighth Amendment or are amended in connection with this Eighth Amendment). AS A MATERIAL INDUCEMENT TO THE ADMINISTRATIVE AGENT, THE ISSUING BANKS AND LENDERS PARTY HERETO TO ENTER INTO THIS EIGHTH AMENDMENT, BORROWER AND EACH GUARANTOR RELEASES THE ADMINISTRATIVE AGENT, THE ISSUING BANKS, THE LENDERS AND THEIR RESPECTIVE PREDECESSORS, SUCCESSORS, ASSIGNS, DIRECTORS, OFFICERS, EMPLOYEES, TRUSTEES, AGENTS AND ATTORNEYS FROM ANY LIABILITY FOR ACTIONS OR FAILURES TO ACT IN CONNECTION WITH THE LOAN DOCUMENTS PRIOR TO THE EIGHTH AMENDMENT EFFECTIVE DATE. NO COURSE OF DEALING BETWEEN BORROWER, ANY GUARANTOR OR ANY OTHER PERSON, ON THE ONE HAND, AND THE ADMINISTRATIVE AGENT, ISSUING BANKS AND THE LENDERS, ON THE OTHER, WILL BE DEEMED TO HAVE ALTERED OR AMENDED THE CREDIT AGREEMENT OR AFFECTED BORROWER’S, ANY GUARANTOR’S, THE ADMINISTRATIVE AGENT’S, THE ISSUING BANKS’ OR THE

LENDERS’ RIGHT TO ENFORCE THE CREDIT AGREEMENT AS AMENDED BY THIS EIGHTH AMENDMENT AS WRITTEN. This Eighth Amendment will be binding upon and inure to the benefit of each of the undersigned and their respective successors and permitted assigns.

9. Form. Each agreement, document, instrument or other writing to be furnished to the Administrative Agent and/or the Lenders under any provision of this instrument must be in form and substance reasonably satisfactory to the Administrative Agent and its counsel.

10. Headings. The headings and captions used in this Eighth Amendment are for convenience only and will not be deemed to limit, amplify or modify the terms of this Eighth Amendment, the Credit Agreement, or the other Loan Documents.

11. Interpretation. Wherever possible each provision of this Eighth Amendment shall be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Eighth Amendment shall be prohibited by or invalid under such law, such provision shall be ineffective to the extent of such prohibition or invalidity, without invalidating the remainder of such provision or the remaining provisions of this Eighth Amendment.

12. Multiple Counterparts. This Eighth Amendment may be separately executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed shall be deemed to constitute one and the same agreement. This Eighth Amendment may be transmitted and/or signed by facsimile, telecopy or electronic mail. The effectiveness of any such documents and signatures shall, subject to applicable law, have the same force and effect as manually-signed originals and shall be binding on all Loan Parties, all Lenders, the Administrative Agent and the Issuing Banks. The Administrative Agent may also require that any such documents and signatures be confirmed by a manually-signed original thereof; provided, however, that the failure to request or deliver the same shall not limit the effectiveness of any facsimile document or signature.

13. Governing Law. THIS EIGHTH AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK WITHOUT REGARD TO ANY CHOICE-OF-LAW PROVISIONS THAT WOULD REQUIRE THE APPLICATION OF THE LAW OF ANOTHER JURISDICTION.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Eighth Amendment to be executed by their respective officers thereunto duly authorized as of the date first above written.

|

|

BORROWER: | ||

|

|

|

| |

|

|

XXXXXXX ENERGY CORPORATION, | ||

|

|

a Delaware corporation | ||

|

|

|

| |

|

|

By: |

/s/ Xxxxxx X. Xxxxx | |

|

|

Name: Xxxxxx X. Xxxxx | ||

|

|

Title: EVP/CFO | ||

|

|

ACKNOWLEDGED for the purposes stated in Sections 4, 5 and 8: | |

|

|

| |

|

|

| |

|

|

GUARANTORS: | |

|

|

| |

|

|

| |

|

|

SN PALMETTO, LLC, | |

|

|

a Delaware limited liability company, f/k/a | |

|

|

SEP Holdings III, LLC | |

|

|

| |

|

|

XX XXXXXXX LLC, | |

|

|

a Delaware limited liability company | |

|

|

| |

|

|

SN COTULLA ASSETS, LLC, | |

|

|

a Texas limited liability company | |

|

|

| |

|

|

SN OPERATING, LLC, | |

|

|

a Texas limited liability company | |

|

|

| |

|

|

SN TMS, LLC, | |

|

|

a Delaware limited liability company | |

|

|

| |

|

|

SN CATARINA, LLC, | |

|

|

a Delaware limited liability company | |

|

|

| |

|

|

SN EF MAVERICK, LLC, | |

|

|

a Delaware limited liability company | |

|

|

| |

|

|

| |

|

|

ROCKIN L RANCH COMPANY, LLC, | |

|

|

a Delaware limited liability company | |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Xxxxxx X. Xxxxx |

|

|

Name: Xxxxxx X. Xxxxx | |

|

|

Title: EVP/CFO | |

|

|

ADMINISTRATIVE AGENT: | |

|

|

|

|

|

|

|

|

|

|

ROYAL BANK OF CANADA, as Administrative Agent | |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Xxx Xxxxxx |

|

|

|

Xxx Xxxxxx |

|

|

|

Manager, Agency |

|

|

LENDERS: | |

|

|

|

|

|

|

ISSUING BANK AND LENDER: | |

|

|

|

|

|

|

ROYAL BANK OF CANADA | |

|

|

|

|

|

|

By: |

/s/ Xxxx Xxxxxxx, Xx. |

|

|

|

Xxxx Xxxxxxx, Xx. |

|

|

|

Authorized Signatory |

|

|

CAPITAL ONE, NATIONAL ASSOCIATION | |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Xxxxxxx Xxxxxxx |

|

|

|

Xxxxxxx Xxxxxxx |

|

|

|

Senior Director |

|

|

ING CAPITAL LLC | |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Xxxxxxx Xxxx |

|

|

|

Xxxxxxx Xxxx |

|

|

|

Managing Director |

|

|

|

|

|

|

By: |

/s/ Xxxxxxx Xxxxx |

|

|

|

Xxxxxxx Xxxxx |

|

|

|

Managing Director |

|

|

BRANCH BANKING AND TRUST COMPANY | |

|

|

|

|

|

|

By: |

/s/ Xxxxxx Xxxx |

|

|

|

Xxxxxx Xxxx |

|

|

|

Assistant Vice President |

|

|

ABN AMRO Capital USA LLC | |

|

|

|

|

|

|

By: |

/s/ Xxxxxxx Xxxxxx |

|

|

|

Xxxxxxx Xxxxxx |

|

|

|

Managing Director |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Xxxxx Xxxxxxxxxx |

|

|

|

Xxxxx Xxxxxxxxxx |

|

|

|

Executive Director |

|

|

CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK | |

|

|

| |

|

|

|

|

|

|

By: |

/s/ Xxxxxxx Xxxxx |

|

|

|

Xxxxxxx Xxxxx |

|

|

|

Managing Director |

|

|

| |

|

|

|

|

|

|

By: |

/s/ Xxxxxxx Xxxxxx |

|

|

|

Xxxxxxx Xxxxxx |

|

|

|

Managing Director |

|

|

SUMITOMO MITSUI BANKING CORPORATION | |

|

|

| |

|

|

|

|

|

|

By: |

/s/ Xxxxxxxxx Xxxxxx |

|

|

|

Xxxxxxxxx Xxxxxx |

|

|

|

General Manager |

ANNEX I

LIST OF MAXIMUM CREDIT AMOUNTS

|

Name of Lender |

|

Applicable |

|

Elected Commitment |

|

Maximum Credit |

| ||

|

Royal Bank of Canada |

|

10.000000 |

% |

$ |

30,588,235.30 |

|

$ |

152,941,176.45 |

|

|

Capital One, National Association |

|

10.196078 |

% |

$ |

30,588,235.30 |

|

$ |

152,941,176.45 |

|

|

Compass Bank |

|

8.921569 |

% |

$ |

26,764,705.88 |

|

$ |

133,823,529.42 |

|

|

SunTrust Bank |

|

8.921569 |

% |

$ |

26,764,705.88 |

|

$ |

133,823,529.42 |

|

|

Credit Suisse AG, Cayman Islands Branch |

|

6.372549 |

% |

$ |

19,117,647.06 |

|

$ |

95,588,235.29 |

|

|

Branch Banking and Trust Company |

|

6.372549 |

% |

$ |

19,117,647.06 |

|

$ |

95,588,235.29 |

|

|

ING Capital LLC |

|

6.372549 |

% |

$ |

19,117,647.06 |

|

$ |

95,588,235.29 |

|

|

ABN AMRO Capital USA LLC |

|

6.372549 |

% |

$ |

19,117,647.06 |

|

$ |

95,588,235.29 |

|

|

Sociètè Genèralè |

|

6.372549 |

% |

$ |

19,117,647.06 |

|

$ |

95,588,235.29 |

|

|

IBERIABANK |

|

6.372549 |

% |

$ |

19,117,647.06 |

|

$ |

95,588,235.29 |

|

|

BMO Xxxxxx Bank, N.A. |

|

4.705882 |

% |

$ |

14,117,647.06 |

|

$ |

70,588,235.30 |

|

|

Credit Agricole Corporate and Investment Bank |

|

4.705882 |

% |

$ |

14,117,647.06 |

|

$ |

70,588,235.30 |

|

|

Sumitomo Mitsui Banking Corporation |

|

3.529412 |

% |

$ |

10,588,235.29 |

|

$ |

52,941,176.48 |

|

|

U.S. Bank National Association, |

|

3.529412 |

% |

$ |

10,588,235.29 |

|

$ |

52,941,176.48 |

|

|

Comerica Bank |

|

3.529412 |

% |

$ |

10,588,235.29 |

|

$ |

52,941,176.48 |

|

|

Fifth Third Bank |

|

3.529412 |

% |

$ |

10,588,235.29 |

|

$ |

52,941,176.48 |

|

|

TOTAL |

|

100 |

% |

$ |

300,000,000.00 |

|

$ |

1,500,000,000.00 |

|

SCHEDULE 1.02

COMANCHE TRANSACTION AGREEMENTS

“Comanche Transaction Agreements” collectively means (a) the Purchase and Sale Agreement among Anadarko, SN Maverick, UnSub LP and Gavilan, dated January 12, 2017, (b) the Securities Purchase Agreement among the Borrower, SN UR Holdings, UnSub Holdings, UnSub LP, UnSub GP, GSO Associates and GSO Holdings dated January 12, 2017, (c) the Amended and Restated Securities Purchase Agreement among the Borrower, SN UR Holdings, UnSub Holdings, UnSub LP, UnSub GP, Intrepid, GSO Associates, GSO Holdings dated February 28, 2017, (d) the Warrant Agreement among the Borrower and the GSO Funds, as defined therein, dated March 1, 2017, (e) the Warrant Agreement between the Borrower and Intrepid dated Xxxxx 0, 0000, (x) the Development Agreement among Anadarko, SN Maverick, UnSub LP and Gavilan dated March 1, 2017, (g) the Comanche Marketing Agreements, (h) the Registration Rights Agreement between the Borrower and the GSO Funds, as defined therein, dated Xxxxx 0, 0000, (x) the Registration Rights Agreement between the Borrower and Intrepid dated March 1, 2017, (j) the Non-Solicitation Agreement among GSO Capital Partners, the Borrower and SOG, (k) the Non-Solicitation Agreement among Intrepid, the Borrower and SOG, (1) the Standstill and Voting Agreement between the Borrower and the GSO Funds, as defined therein, dated February 6, 2017, as amended by Amendment No. 1 dated as of Xxxxx 0, 0000, (x) the letter agreement from the Borrower to and accepted and agreed to by UnSub LP and SN Maverick dated January 12, 2017, (n) the Amended and Restated Agreement of Limited Partnership of UnSub LP dated as of March 1, 2017, (o) the Amended and Restated Limited Liability Company Agreement of UnSub GP dated as of Xxxxx 0, 0000, (x) the Joint Development Agreement among Gavilan, SN Maverick, UnSub LP and, solely for the limited purposes stated therein, the Borrower dated as of March 1, 2017, (q) the Equity Commitment Letters of the GSO Funds, each as defined in the Amended and Restated Securities Purchase Agreement described in clause (c) above, in respect of certain obligations of GSO Holdings under such Amended and Restated Securities Purchase Agreement, (r) the Management Services Agreement, dated as of March 1, 2017, between SOG and UnSub LP, (s) the Assignment and Xxxx of Sale among Anadarko and SN Maverick (Dimmit County, Texas), dated February 28th, 2017 and effective July 1, 2016, (t) the Assignment and Xxxx of Sale among Anadarko and SN Maverick (La Salle County, Texas), dated February 28th, 2017 and effective July 1, 2016, (u) the Assignment and Xxxx of Sale among Anadarko and SN Maverick (Maverick County, Texas), dated February 28th, 2017 and effective July 1, 2016, (v) the Assignment and Xxxx of Sale among Anadarko and SN Maverick (Xxxx County, Texas), dated February 28th, 2017 and effective July 1, 2016, (w) the Assignment and Xxxx of Sale among Anadarko and SN Maverick (Xxxxxx County Texas), dated February 28th, 2017 and effective July 1, 2016, (x) the Assignment and Xxxx of Sale among Anadarko and UnSub LP (Dimmit County, Texas), dated February 28th, 2017 and effective July 1, 2016, (y) the Assignment

and Xxxx of Sale among Anadarko and UnSub LP (La Salle County, Texas), dated February 28th, 2017 and effective July 1, 2016, (z) the Assignment and Xxxx of Sale among Anadarko and UnSub LP (Maverick County, Texas), dated February 28th, 2017 and effective July 1, 2016, (aa) the Assignment and Xxxx of Sale among Anadarko and UnSub LP (Xxxx County, Texas), dated February 28th, 2017 and effective July 1, 2016, (bb) the Assignment and Xxxx of Sale among Anadarko and UnSub LP (Xxxxxx County, Texas), dated February 28th, 2017 and effective July 1, 2016, (cc) the Non-Exclusive Data Use License and Access Agreement among Anadarko, SN Maverick, UnSub LP and Gavilan, dated Xxxxx 0, 0000, (xx) the Transition Services Agreement between Anadarko and SN Maverick, dated March 1, 2017, (ee) the Marketing Transition Services Agreement among SN Maverick, Anadarko Energy Services Company, Anadarko, and solely for the limited purposes stated therein, the Borrower, dated as of March 1, 2017, (ff) the Non-Exclusive Seismic Data Use License among Anadarko Petroleum Corporation, SN Maverick, UnSub LP and Gavilan, dated March 1, 2017, (gg the Project Lightning Commitment Letter from JPMorgan Chase Bank, N.A. and Citigroup Global Markets Inc. to and accepted and agreed to by UnSub GP, dated January 12, 2017, (hh) the Interim Investors Agreement among the Borrower, SN Maverick, UnSub LP, Gavilan, Gavilan Resources HoldCo, LLC and the Blackstone Funds, as defined therein, dated January 12, 2017, (ii) the Management Services Agreement among Gavilan Resources HoldCo, LLC, SN Comanche Manager, LLC, and solely for the limited purposes stated therein, SN Maverick, dated Xxxxx 0, 0000, (xx) the Amended and Restated Limited Liability Company Agreement of Gavilan Resources HoldCo, dated Xxxxx 0, 0000, (xx) the Warrant Agreement between the Borrower and Gavilan Resources Holdings – A, LLC, dated March 1, 2017, (ll) the Warrant Agreement between the Borrower and Gavilan Resources Holdings – B, LLC, dated Xxxxx 0, 0000, (xx) the Warrant Agreement between the Borrower and Gavilan Resources Holdings – C, LLC, dated Xxxxx 0, 0000, (xx) the Standstill and Voting Agreement among the Borrower, Blackstone Capital Partners VII L.P. and Blackstone Energy Partners II L.P., dated March 1, 2017, (oo) the Registration Rights Agreement among the Borrower, Gavilan Resources Holdings – A, LLC, Gavilan Resources Holdings – B, LLC and Gavilan Resources Holdings – C, LLC, dated March 1, 2017, (pp) the Shareholders Agreement between Gavilan Resources HoldCo, LLC and the Borrower, dated March 1, 2017, (qq) the First Lien Credit Agreement among UnSub LP, JPMorgan Chase Bank, N.A., Citigroup Global Markets Inc., Capital One, National Association, RBC Capital Markets, BMO Xxxxxx Bank, NA, ING Capital LLC and Suntrust Xxxxxxxx Xxxxxxxx, Inc., dated March 1, 2017, (rr) the Note between UnSub LP and BOKF dba Bank of Texas, dated March 1, 2017, (ss) the Note between UnSub LP and Citizens Bank, N.A., dated March 1, 2017, (tt) the Note between UnSub LP and Capital One, National Association, dated March 1, 2017, (uu) the Note between UnSub LP and Comerica Bank, dated March 1, 2017, (vv) the Collateral Agreement among UnSub LP and each of its subsidiaries identified therein, UnSub Holdings, UnSub GP and JPMorgan Chase Bank, N.A., dated March 1, 2017, and (zz) the Operating Agreement among SN Maverick,

Anadarko, UnSub LP, and Gavilan, dated as of March 1, 2017, in each case, as the same may be amended or otherwise modified from time to time.

SCHEDULE 7.01

CORPORATE ORGANIZATIONAL CHART

SCHEDULE 7.14

SUBSIDIARIES

|

Name of Subsidiary |

|

Jurisdiction of |

|

Federal Taxpayer ID |

|

Ownership Interest |

|

SN Palmetto, LLC (f/k/a SEP Holdings III, LLC) |

|

Delaware |

|

00-0000000 |

|

100% Membership Interest held by Borrower |

|

SN Catarina, LLC |

|

Delaware |

|

00-0000000 |

|

100% Membership Interest held by Borrower |

|

SN Cotulla Assets, LLC |

|

Texas |

|

00-0000000 |

|

100% Membership Interest held by Borrower |

|

XX Xxxxxxx LLC |

|

Delaware |

|

00-0000000 |

|

100% Membership Interest held by Borrower |

|

SN Operating, LLC |

|

Texas |

|

00-0000000 |

|

100% Membership Interest held by Borrower |

|

SN Midstream, LLC |

|

Delaware |

|

00-0000000 |

|

100% Membership Interest held by SN UR Holdings, LLC |

|

SN Services, LLC |

|

Delaware |

|

00-0000000 |

|

100% Membership Interest held by SN UR Holdings, LLC |

|

SN Terminal, LLC |

|

Delaware |

|

00-0000000 |

|

100% Membership Interest held by SN UR Holdings, LLC |

|

SN TMS, LLC |

|

Delaware |

|

00-0000000 |

|

100% Membership Interest held by Borrower |

|

SN UR Holdings, LLC |

|

Delaware |

|

00-0000000 |

|

100% Membership Interest held by Borrower |

|

SN Capital, LLC |

|

Delaware |

|

00-0000000 |

|

100% Membership Interest held by Borrower |

|

SN EF Maverick, LLC |

|

Delaware |

|

00-0000000 |

|

100% Membership Interest held by Borrower |

|

SN EF UnSub Holdings, LLC |

|

Delaware |

|

00-0000000 |

|

100% Membership Interest held by SN UR Holdings, LLC |

|

SN EF UnSub GP, LLC |

|

Delaware |

|

00-0000000 |

|

99 Class A Units held by SN UR Holdings, LLC |

|

SN EF UnSub LP |

|

Delaware |

|

00-0000000 |

|

100% of the GP Interest held by SN EF UnSub GP, LLC; 100% of the common LP Interest held by SN EF UnSub Holdings, LLC |

|

SN Comanche Manager, LLC |

|

Delaware |

|

00-0000000 |

|

100% Membership Interest held by SN UR Holdings, LLC |

|

Rockin L Ranch Company, LLC |

|

Delaware |

|

00-0000000 |

|

100% Membership Interest held by Borrower |

SCHEDULE 7.19

MARKETING CONTRACTS

Gas Services Agreement between SWEPI LP and Xxxxxx Xxxxxx (Eagle Ford Gathering LLC) effective November 1 2011.

Oil Gathering Agreement between SWEPI LP and Plains All American Pipeline, L.P. (Velocity Midstream Partners, LLC) effective April 18, 2011.

Camino Real Gas Gathering Agreement Dated April 7, 2011 (Xxxxxx Ranch)

Eagle Ford Gathering LLC (“EFG”) Gas Services Agreement Dated January, 1, 2017 (Xxxxxx Ranch)

Upstream Energy Services, L.P. Natural Gas Marketing, Transportation, and Processing Agency Agreement dated May 1, 2016

Mockingbird Midstream Gas Services, LLC (Xxxxxxxx) Gas Gathering Contract dated February 1, 2014 (Xxxxx Dim E)

Mockingbird Midstream Gas Services, LLC (Xxxxxxxx) Gas Gathering Contract dated April 1, 2014 (Xxxxx)

Mockingbird Midstream Gas Services, L.L.C. Gas Gathering Contract dated May 1, 2015 (Holdsworth)

Mockingbird Midstream Gas Services, L.L.C. Gas Gathering Contract dated January 1, 2017 (Xxxxxx)

Enterprise Hydrocarbons, L.P. Gas Processing Agreement dated May 1, 2015

Enterprise Hydrocarbons, L.P. Natural Gas Purchase Confirmation dated May 1, 2015

American Midstream L.P. Gas Gathering Agreement Dated August 25, 2014

TPL SouthTex Processing L.P. Firm Gas Gathering Agreement Dated October 2, 2015

TPL SouthTex Processing L.P. Firm Gas Processing Agreement (SOII) Dated October 2, 2015

TPL SouthTex Processing L.P. Firm Gas Processing Agreement (Raptor) Dated October 2, 2015

Catarina Midstream LLC (SPP) Firm Gathering and Processing Agreement Dated October 14, 2015

Gas Purchase Agreement by and between DCP Midstream, LP and Zaza Energy Corporation dated December 1, 2011

Gas Gathering and Processing Agreement by and between ETC Texas Pipeline LTD and Xxxxxxx Oil & Gas Corporation dated October 1, 2012

Facilities and Sites for Interconnection Agreement by and between ETC Texas Pipeline LTD and Xxxxxxx Oil & Gas Corporation dated September 19, 2012

Facilities and Sites for Interconnection Agreement by and between ETC Texas Pipeline LTD and Xxxxxxx Oil & Gas Corporation dated November 25, 2013 (Prost H Common Point)

Firm Gas Gathering Agreement by and between American Midstream (Lavaca) LP and XX Xxxxxxx LLC dated August 25, 2014

Amended and Restated Lease Dedication and Gas Gathering Agreement between Springfield Pipeline LLC and Anadarko E&P Onshore LLC effective January 1, 2016

Amended and Restated Lease Dedication and Oil Gathering Agreement between Springfield Pipeline LLC and Anadarko E&P Onshore LLC effective January 1, 2016

Gas Processing Agreement between WGR Operating, LP and Anadarko E&P Company LP dated February 27, 2012

Crude Oil Supply Agreement between Anadarko E&P Company LP and Flint Hills Resources, LP effective as of March 18, 2011

Crude Oil Throughput and Deficiency Agreement dated as of March 18, 2011 between Arrowhead Gathering Company, LP and Anadarko E&P Company LP

Master Terminal Services Agreement executed July 2, 2012 among TexStar Crude Oil Services, LP and Anadarko E&P Company LP

Crude Oil Pipeline Throughput and Deficiency Agreement between TexStar Crude Oil Pipeline, LP and Anadarko E&P Company LP dated as of July 2, 2012

Crude Oil Purchase and Sale Agreement made effective as of December 13, 2013 by and between BP Products North America Inc and Anadarko E&P Onshore LLC

Crude Oil Purchase and Sale Agreement made effective as of June 28, 2012 by and between BP Products North America Inc and Anadarko E&P Company LP

Interconnect Agreement dated March 9, 2017 by and between Arrowhead Gathering Company, LLC and SN Cotulla Assets, LLC

Petroleum Transportation Agreement dated as of March 9, 2017 between Arrowhead Gathering Company, LLC and SN Cotulla Assets, LLC

SCHEDULE 7.20

SWAP AGREEMENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Floor |

|

Cap |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Trd Date |

|

ENTITY |

|

COMM |

|

PUT |

|

PUT |

|

SWAP |

|

CALL |

|

CALL |

|

Price |

|

Price |

|

Term |

|

Counterparty |

|

Cal 17 |

|

Cal 18 |

|

Cal 19 |

|

Cal 20 |

|

Cal 21 |

| |||||

|

4/12/16 |

|

XXXXXXX ENERGY |

|

WTI |

|

|

|

|

|

$ |

50.00 |

|

|

|

|

|

$ |

50.00 |

|

$ |

50.00 |

|

Cal 17 |

|

Capital One |

|

365,000 |

|

|

|

|

|

|

|

|

| ||

|

5/26/16 |

|

XXXXXXX ENERGY |

|

WTI |

|

|

|

|

|

$ |

51.50 |

|

|

|

|

|

$ |

51.50 |

|

$ |

51.50 |

|

Cal 17 |

|

Capital One |

|

365,000 |

|

|

|

|

|

|

|

|

| ||

|

6/8/16 |

|

XXXXXXX ENERGY |

|

WTI |

|

|

|

|

|

$ |

53.50 |

|

|

|

|

|

$ |

53.50 |

|

$ |

53.50 |

|

Cal 17 |

|

ING |

|

365,000 |

|

|

|

|

|

|

|

|

| ||

|

6/8/16 |

|

XXXXXXX ENERGY |

|

WTI |

|

|

|

|

|

$ |

53.50 |

|

|

|

|

|

$ |

53.50 |

|

$ |

53.50 |

|

Cal 17 |

|

Capital One |

|

365,000 |

|

|

|

|

|

|

|

|

| ||

|

6/8/16 |

|

XXXXXXX ENERGY |

|

WTI |

|

|

|

$ |

45.00 |

|

|

|

|

|

$ |

62.00 |

|

$ |

45.00 |

|

$ |

62.00 |

|

Cal 17 |

|

Capital One |

|

365,000 |

|

|

|

|

|

|

|

|

| |

|

6/8/16 |

|

XXXXXXX ENERGY |

|

WTI |

|

|

|

$ |

45.00 |

|

|

|

|

|

$ |

62.00 |

|

$ |

45.00 |

|

$ |

62.00 |

|

Cal 17 |

|

Comerica |

|

365,000 |

|

|

|

|

|

|

|

|

| |

|

12/30/16 |

|

XXXXXXX ENERGY |

|

WTI (Exercised swaption) |

|

|

|

|

|

$ |

50.00 |

|

|

|

|

|

$ |

50.00 |

|

$ |

50.00 |

|

Cal 17 |

|

Capital One |

|

365,000 |

|

|

|

|

|

|

|

|

| ||

|

3/29/17 |

|

XXXXXXX ENERGY |

|

WTI |

|

|

|

|

|

$ |

50.00 |

|

|

|

|

|

$ |

50.00 |

|

$ |

50.00 |

|

Cal 19 |

|

Comerica |

|

|

|

|

|

365,000 |

|

|

|

|

| ||

|

3/29/17 |

|

XXXXXXX ENERGY |

|

WTI |

|

|

|

|

|

$ |

50.40 |

|

|

|

|

|

$ |

50.40 |

|

$ |

50.40 |

|

Cal 18 |

|

Capital One |

|

|

|

365,000 |

|

|

|

|

|

|

| ||

|

3/29/17 |

|

XXXXXXX ENERGY |

|

WTI |

|

|

|

|

|

$ |

50.14 |

|

|

|

|

|

$ |

50.14 |

|

$ |

50.14 |

|

J17-Z17 |

|

Capital One |

|

275,000 |

|

|

|

|

|

|

|

|

| ||

|

3/29/17 |

|

XXXXXXX ENERGY |

|

WTI |

|

|

|

|

|

$ |

50.07 |

|

|

|

|

|

$ |

50.07 |

|

$ |

50.07 |

|

J17-Z19 |

|

Capital One |

|

275,000 |

|

365,000 |

|

365,000 |

|

|

|

|

| ||

|

3/29/17 |

|

XXXXXXX ENERGY |

|

WTI |

|

|

|

|

|

$ |

50.10 |

|

|

|

|

|

$ |

50.10 |

|

$ |

50.10 |

|

J17-Z19 |

|

Capital One |

|

275,000 |

|

365,000 |

|

365,000 |

|

|

|

|

| ||

|

3/29/17 |

|

XXXXXXX ENERGY |

|

WTI |

|

|

|

|

|

$ |

50.06 |

|

|

|

|

|

$ |

50.06 |

|

$ |

50.06 |

|

J17-Z19 |

|

BMO |

|

275,000 |

|

365,000 |

|

365,000 |

|

|

|

|

| ||

|

1/7/15 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

3.65 |

|

|

|

|

|

$ |

3.65 |

|

$ |

3.65 |

|

Cal 17 |

|

BMO |

|

3,650,000 |

|

|

|

|

|

|

|

|

| ||

|

11/17/15 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

2.91 |

|

|

|

|

|

$ |

2.91 |

|

$ |

2.91 |

|

Cal 17 |

|

ING |

|

3,650,000 |

|

|

|

|

|

|

|

|

| ||

|

11/17/15 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

2.91 |

|

|

|

|

|

$ |

2.91 |

|

$ |

2.91 |

|

Cal 17 |

|

ING |

|

3,650,000 |

|

|

|

|

|

|

|

|

| ||

|

11/17/15 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

2.91 |

|

|

|

|

|

$ |

2.91 |

|

$ |

2.91 |

|

Cal 17 |

|

BMO |

|

7,300,000 |

|

|

|

|

|

|

|

|

| ||

|

11/17/15 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

2.91 |

|

|

|

|

|

$ |

2.910 |

|

$ |

2.910 |

|

Cal 17 |

|

SocGen |

|

3,650,000 |

|

|

|

|

|

|

|

|

| ||

|

11/17/15 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

2.89 |

|

|

|

|

|

$ |

2.885 |

|

$ |

2.885 |

|

Cal 17 |

|

BMO |

|

5,890,000 |

|

|

|

|

|

|

|

|

| ||

|

11/17/15 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

3.01 |

|

|

|

|

|

$ |

3.010 |

|

$ |

3.010 |

|

F17 |

|

Shell |

|

155,000 |

|

|

|

|

|

|

|

|

| ||

|

4/21/16 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

3.00 |

|

|

|

|

|

$ |

3.000 |

|

$ |

3.000 |

|

Cal 18 |

|

Capital One |

|

|

|

3,650,000 |

|

|

|

|

|

|

| ||

|

5/4/16 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

3.00 |

|

|

|

|

|

$ |

3.000 |

|

$ |

3.000 |

|

Cal 18 |

|

RBC |

|

|

|

3,650,000 |

|

|

|

|

|

|

| ||

|

6/9/16 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

3.02 |

|

|

|

|

|

$ |

3.020 |

|

$ |

3.020 |

|

Cal 18-19 |

|

Capital One |

|

|

|

3,650,000 |

|

3,650,000 |

|

|

|

|

| ||

|

6/9/16 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

3.02 |

|

|

|

|

|

$ |

3.020 |

|

$ |

3.020 |

|

Cal 18-19 |

|

BMO |

|

|

|

3,650,000 |

|

3,650,000 |

|

|

|

|

| ||

|

7/15/16 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

3.10 |

|

|

|

|

|

$ |

3.100 |

|

$ |

3.100 |

|

Cal 17 |

|

Capital One |

|

6,190,000 |

|

|

|

|

|

|

|

|

| ||

|

10/7/16 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

3.00 |

|

|

|

|

|

$ |

3.000 |

|

$ |

3.000 |

|

Cal 18 |

|

ING |

|

|

|

912,500 |

|

|

|

|

|

|

| ||

|

10/11/16 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

3.00 |

|

|

|

|

|

$ |

3.000 |

|

$ |

3.000 |

|

Cal 18 |

|

ING |

|

|

|

3,650,000 |

|

|

|

|

|

|

| ||

|

11/30/16 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

3.30 |

|

|

|

|

|

$ |

3.300 |

|

$ |

3.300 |

|

Cal 17 |

|

BMO |

|

6,670,000 |

|

|

|

|

|

|

|

|

| ||

|

11/30/16 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

3.07 |

|

|

|

|

|

$ |

3.068 |

|

$ |

3.068 |

|

Cal 18 |

|

BMO |

|

|

|

6,720,000 |

|

|

|

|

|

|

| ||

|

12/29/16 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

3.00 |

|

|

|

|

|

$ |

3.000 |

|

$ |

3.000 |

|

Cal 18 |

|

Capital One |

|

|

|

3,650,000 |

|

|

|

|

|

|

| ||

|

3/28/17 |

|

XXXXXXX ENERGY |

|

NYMEX HH |

|

|

|

|

|

$ |

3.04 |

|

|

|

|

|

$ |

3.040 |

|

$ |

3.040 |

|

Cal 18 |

|

ING |

|

|

|

18,250,000 |

|

|

|

|

|

|

| ||

|

1/13/17 |

|

SN UNSUB |

|

WTI |

|

|

|

|

|

$ |

55.85 |

|

|

|

|

|

$ |

55.85 |

|

$ |

55.85 |

|

J17-U18 |

|

JPM |

|

1,873,000 |

|

1,544,000 |

|

|

|

|

|

|

| ||

|

2/21/17 |

|

SN UNSUB |

|

WTI |

|

|

|

|

|

$ |

53.52 |

|

|

|

|

|

$ |

53.52 |

|

$ |

53.52 |

|

V18-H20 |

|

Citi |

|

|

|

471,000 |

|

1,689,000 |

|

381,000 |

|

|

| ||

|

1/13/17 |

|

SN UNSUB |

|

NYMEX HH |

|

|

|

|

|

$ |

3.260 |

|

|

|

|

|

$ |

3.26 |

|

$ |

3.260 |

|

J17-U18 |

|

JPM |

|

10,967,000 |

|

9,274,000 |

|

|

|

|

|

|

| ||

|

2/21/17 |

|

SN UNSUB |

|

NYMEX HH |

|

|

|

|

|

$ |

2.820 |

|

|

|

|

|

$ |

2.82 |

|

$ |

2.820 |

|

V18-H20 |

|

Citi |

|

|

|

2,856,000 |

|

10,344,000 |

|

2,361,000 |

|

|

| ||

|

Jan-17 |

|

Feb-17 |

|

Mar-17 |

|

Apr-17 |

|

May-17 |

|

Jun-17 |

|

Jul-17 |

|

Aug-17 |

|

Sep-17 |

|

Oct-17 |

|

Nov-17 |

|

Dec-17 |

|

Jan-18 |

|

Feb-18 |

|

Mar-18 |

|

Apr-18 |

|

May-18 |

|

Jun-18 |

|

Jul-18 |

|

Aug-18 |

|

Sep-18 |

|

Oct-18 |

|

Nov-18 |

|

Dec-18 |

|

Jan-19 |

|

|

31,000 |

|

28,000 |

|

31,000 |

|

30,000 |

|

31,000 |

|

30,000 |

|

31,000 |

|

31,000 |

|

30,000 |

|

31,000 |

|

30,000 |

|

31,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31,000 |

|

28,000 |

|

31,000 |

|

30,000 |

|

31,000 |

|

30,000 |

|

31,000 |

|

31,000 |

|

30,000 |

|

31,000 |

|

30,000 |

|

31,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31,000 |

|

28,000 |

|

31,000 |

|

30,000 |

|

31,000 |

|

30,000 |

|

31,000 |

|

31,000 |

|

30,000 |

|

31,000 |

|

30,000 |

|

31,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31,000 |

|

28,000 |

|

31,000 |

|

30,000 |

|

31,000 |

|

30,000 |

|