Contract

Exhibit 99.4

THIS INSTRUMENT AND THE OBLIGATIONS EVIDENCED HEREBY ARE EXPRESSLY SUBORDINATED PURSUANT TO THAT CERTAIN SUBORDINATION AGREEMENT, DATED AS OF JANUARY 13, 2017 (THE "SUBORDINATION AGREEMENT"), AMONG THE HOLDER OF THIS INSTRUMENT, THE MAKER OF THIS INSTRUMENT, AND AVIDBANK, A CALIFORNIA BANKING CORPORATION. EACH SUCCESSIVE HOLDER OF THIS INSTRUMENT OR ANY PORTION HEREOF, OR OF ANY RIGHTS OBTAINED HEREUNDER, BY ITS ACCEPTANCE HEREOF OR THEREOF, AGREES (1) TO BE BOUND BY THE TERMS OF THE SUBORDINATION AGREEMENT, AND (2) THAT IF ANY CONFLICT EXISTS BETWEEN THE TERMS OF THIS INSTRUMENT OR ANY DOCUMENT EXECUTED IN CONNECTION WITH THE DELIVERY OF THIS INSTRUMENT AND THE TERMS OF THE SUBORDINATION AGREEMENT, THE TERMS OF THE SUBORDINATION AGREEMENT SHALL GOVERN AND BE CONTROLLING.

|

$4,500,000.00

|

|

January 13, 2017

|

FOR VALUE RECEIVED, Auxilio, Inc., a Nevada corporation ("Maker"), promises to pay to the order of Xxxxxxx X. XxXxxxxx, an individual ("Payee"), in lawful money of the United States of America, the principal sum of Four Million Five Hundred Thousand and No/00 Dollars ($4,500,000.00), together with simple interest payable on the unpaid principal balance at a rate equal to eight percent (8.00%) per annum. Interest shall be calculated on the basis of a year of 365 days, and charged for the actual number of days elapsed.

This Note has been executed and delivered pursuant to and in accordance with the terms and conditions of the Stock Purchase Agreement, dated effective January 13, 2017, by and among Maker, Payee, CynergisTek, Inc. and Xx. Xxxxxxx X. Xxxxxxx (the "Purchase Agreement"). Capitalized terms used in this Note without definition shall have the respective meanings set forth in the Purchase Agreement.

1. PAYMENTS

1.1 Principal and Interest.

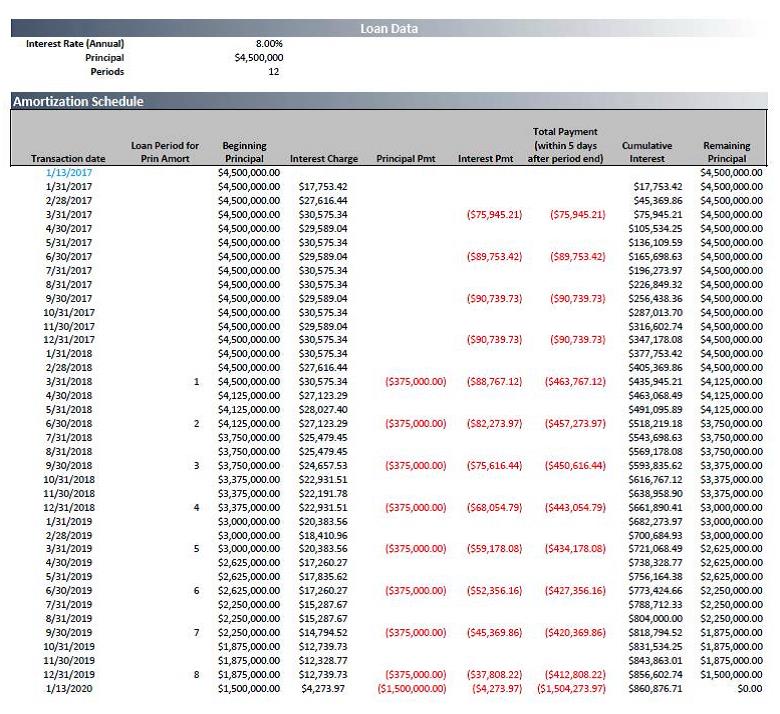

Maker shall make quarterly interest-only payments in arrears during the first twelve (12) months, payable on the fifth (5th) day of each calendar quarter following the date hereof, beginning on April 5, 2017. Maker shall make (i) quarterly payments of principal and accrued interest in arrears during the remaining twenty-four (24) months, based on a thirty-six (36) month amortization, payable on the fifth day of each calendar quarter, beginning April 5, 2018, and (ii) a balloon payment for the remaining principal and accrued interest on or before January 13, 2020, pursuant to the amortization schedule attached hereto as Exhibit A (the "Amortization Schedule").

Maker does hereby agree that upon the occurrence of an Event of Default, including Maker's failure to pay principal when due in full on the Maturity Date, Payee shall be entitled to receive, and Maker shall pay, interest on the entire outstanding principal balance and any other amounts due at the rate equal to the lesser of (a) the Maximum Rate, and (b) the interest rate then applicable under this Note plus four percent (4%) (the "Default Rate"), such rate of interest shall apply from and after the date on which any such payment is due, without any period of grace or cure. Interest shall accrue and be payable at the Default Rate from the occurrence of the Event of Default until all Events of Default have been fully cured. Interest at the Default Rate shall be added to the principal on this Note. This provision, however, shall not be construed as an agreement or privilege to extend the date of the payment of the indebtedness evidenced by this Note, nor as a waiver of any other right or remedy accruing to Payee by reason of the occurrence of any Event of Default.

1.2 Manner of Payment.

All payments of principal and interest on this Note shall be made by certified or bank cashier's check at 000 Xxxxxxxx Xxxxxxx Xx., Xxxxxxxxxx, Xxxxx 00000 or at such other place in the United States of America as Payee shall designate to Maker in writing, or by wire transfer of immediately available funds to an account designated by Payee in writing. If any payment of principal or interest on this Note is due on a day which is not a Business Day, such payment shall be due on the next succeeding Business Day. Such extension of time shall be taken into account in calculating the amount of interest payable under this Note.

1.3 Prepayment.

Maker may, without premium or penalty, at any time and from time to time, prepay all or any portion of the outstanding principal balance due under this Note, provided that each such prepayment is accompanied by accrued interest on the amount of principal prepaid calculated to the date of such prepayment. In the event of any partial payment of principal outstanding on this Note, the prepayment shall be deemed to reduce the principal payments required to be made on the immediately following payment dates in consecutive succession.

1.4 Right of Set-Off.

Maker shall have the right to withhold and set-off against any amount due hereunder the amount of any claim for indemnification to which Maker is determined by the written agreement of Maker and Payee or by a final arbitration award in accordance with Section 9.12 of the Purchase Agreement to be entitled under Section 7.01 of the Purchase Agreement, as provided in and subject to the limitations of Section 7.02 thereof, subject to Payee's rights to contest any such set-off pursuant to the provisions for resolving disputes as provided in the Purchase Agreement. Prior to any such set-off, Maker shall notify Payee in writing of the amount of the set-off and the specific reason for claiming the same.

1.5 Subordination.

All amounts due and owing under this Note are subject to the Subordination Agreement. For sake of clarity, as between Maker and Payee and for purposes of this Note, an act or circumstance that would constitute an Event of Default hereunder (including, without limitation, any failure to make payment when due) but for the application of any terms or provisions of the Subordination Agreement shall be deemed an Event of Default under this Note (including for purposes of triggering default interest). In the event that the Subordination Agreement prohibits or restricts Maker from making, or Payee from receiving, any amounts due hereunder, such amounts shall become automatically due and payable on the date that any of such prohibition or restriction no longer applies (and in the case of unpaid interest, Payee may elect to add such unpaid interest to the principal under this Note).

1.6 Acceleration on Change of Control.

The entire unpaid principal balance of this Note, together with all accrued interest thereon, shall accelerate and become immediately due and payable in the event of a Change of Control of Maker or in the event that Maker ceases to own 100% of the Company Business.

2. DEFAULT

2.1 Events of Default.

The occurrence of any one or more of the following events with respect to Maker shall constitute an event of default hereunder ("Event of Default"):

(a) If Maker shall fail to pay when due any payment of principal or interest on this Note and such failure continues for ten (10) Business Days after Payee notifies Maker in writing of such failure; provided, however, that the exercise by Maker in good faith of its right of set-off pursuant to Section 1.4 above, whether or not ultimately determined to be justified, shall not constitute an Event of Default.

(b) The failure or refusal of Maker to punctually and properly perform, observe, and comply with any covenant or agreement contained herein or the Purchase Agreement (other than a covenant to pay money addressed in Section 2.1(a)) and such failure or refusal continues for a period of thirty (30) days after the earlier of the date that Payee notifies Maker in writing.

(c) Any representation or warranty of Maker made herein or in the Purchase Agreement shall have been false or misleading in any material respect on or as of the date made or deemed made.

(d) If, pursuant to or within the meaning of the United States Bankruptcy Code or any other federal or state law relating to insolvency or relief of debtors (a "Bankruptcy Law"), Maker shall (i) commence a voluntary case or proceeding; (ii) consent to the entry of an order for relief against it in an involuntary case; (iii) consent to the appointment of a trustee, receiver, assignee, liquidator or similar official; (iv) make an assignment for the benefit of its creditors; or (v) admit in writing its inability to pay its debts as they become due.

(e) If a court of competent jurisdiction enters an order or decree under any Bankruptcy Law that (i) is for relief against Maker in an involuntary case, (ii) appoints a trustee, receiver, assignee, liquidator or similar official for Maker or substantially all of Maker's properties, or (iii) orders the liquidation of Maker, and in each case the order or decree is not dismissed within 90 days.

2.2 Notice by Maker.

Maker shall notify Payee in writing within five days after the occurrence of any Event of Default of which Maker acquires knowledge.

2.3 Remedies.

Upon the occurrence of an Event of Default hereunder (unless all Events of Default have been cured or waived by Payee), Payee may, at its option, (i) by written notice to Maker, declare the entire unpaid principal balance of this Note, together with all accrued interest thereon, immediately due and payable regardless of any prior forbearance (except in the case of an Event of Default under Sections 2.1(d) or (e), in which case the entire unpaid principal balance of this Note, together with all accrued interest thereon, shall automatically and immediately become due and payable without further action), and (ii) exercise any and all rights and remedies available to it under applicable law, including, without limitation, the right to collect from Maker all sums due under this Note. Maker shall pay all reasonable costs and expenses incurred by or on behalf of Payee in connection with Payee's exercise of any or all of its rights and remedies under this Note, including, without limitation, reasonable attorneys' fees.

3. MISCELLANEOUS

3.1 Waiver.

The rights and remedies of Payee under this Note shall be cumulative and not alternative. No waiver by Payee of any right or remedy under this Note shall be effective unless in writing signed by Payee. Neither the failure nor any delay in exercising any right, power or privilege under this Note will operate as a waiver of such right, power or privilege and no single or partial exercise of any such right, power or privilege by Payee will preclude any other or further exercise of such right, power or privilege or the exercise of any other right, power or privilege. To the maximum extent permitted by applicable law, (a) no claim or right of Payee arising out of this Note can be discharged by Payee, in whole or in part, by a waiver or renunciation of the claim or right unless in a writing, signed by Payee; (b) no waiver that may be given by Payee will be applicable except in the specific instance for which it is given; and (c) no notice to or demand on Maker will be deemed to be a waiver of any obligation of Maker or of the right of Payee to take further action without notice or demand as provided in this Note. Maker hereby waives presentment, demand, protest and notice of dishonor and protest.

3.2 Notices.

Any notice required or permitted to be given hereunder shall be given in accordance with Section 9.03 of the Purchase Agreement.

3.3 Severability.

If any provision in this Note is held invalid or unenforceable by any court of competent jurisdiction, the other provisions of this Note will remain in full force and effect. Any provision of this Note held invalid or unenforceable only in part or degree will remain in full force and effect to the extent not held invalid or unenforceable.

3.4 Governing Law.

This Note will be governed by the laws of the State of Delaware without regard to conflicts of laws principles.

3.5 Parties in Interest.

This Note shall bind Maker and its successors and assigns. This Note shall not be assigned or transferred by either Maker or Payee without the express prior written consent of the other party, which shall not be unreasonably withheld, conditioned or delayed, except by will or, in default thereof, by operation of law; provided that no such assignment by Maker will relieve Maker of its obligations hereunder without Payee's prior written consent in Payee's sole discretion.

3.6 No Usury.

It is the intention of the parties to comply strictly with applicable usury laws. Accordingly, notwithstanding any provision to the contrary in this Note or the Purchase Agreement, or in any contract, instrument or document evidencing or securing or guaranteeing the payment hereof or otherwise relating hereto (each, a "Related Document"), in no event shall this Note or any Related Document require the payment or permit the payment, taking, reserving, receiving, collection or charging of any sums constituting interest under applicable laws that exceed the maximum amount permitted by such laws, as the same may be amended or modified from time to time (the "Maximum Rate"). If any such excess interest is called for, contracted for, charged, taken, reserved or received in connection with this Note or any Related Document, or in any communication to Maker, or in the event that all or part of the principal or interest hereof or thereof shall be prepaid or accelerated, so that under any of such circumstances or under any other circumstance whatsoever the amount of interest contracted for, charged, taken, reserved or received on the amount of principal actually outstanding from time to time under this Note shall exceed the Maximum Rate, then in such event it is agreed that: (a) the provisions of this Section shall govern and control; (b) neither Maker nor any other person or entity now or hereafter liable for the payment of this Note or any Related Document shall be obligated to pay the amount of such interest to the extent it is in excess of the Maximum Rate; (c) any such excess interest which is or has been received by Payee, notwithstanding this paragraph, shall be credited against the then unpaid principal balance hereof or thereof, or if this Note or any Related Document has been or would be paid in full by such credit, refunded to Borrower; and (d) the provisions of this Note and each Related Document, and any other communication to Maker, shall immediately be deemed reformed and such excess interest reduced, without the necessity of executing any other document, to the Maximum Rate. Without limiting the foregoing, all calculations of the rate of interest contracted for, charged, taken, reserved or received in connection with this Note and any Related Document which are made for the purpose of determining whether such rate exceeds the Maximum Rate shall be made to the extent permitted by applicable laws by amortizing, prorating, allocating and spreading during the period of the full term of this Note or such Related Document, including all prior and subsequent renewals and extensions hereof or thereof, all interest at any time contracted for, charged, taken, reserved or received by Lender.

3.7 Section Headings, Construction.

The headings of Sections in this Note are provided for convenience only and will not affect its construction or interpretation. All references to "Section" or "Sections" refer to the corresponding Section or Sections of this Note unless otherwise specified.

All words used in this Note will be construed to be of such gender or number as the circumstances require. Unless otherwise expressly provided, the words "hereof" and "hereunder" and similar references refer to this Note in its entirety and not to any specific section or subsection hereof.

[signature page follows]

IN WITNESS WHEREOF, Maker has executed and delivered this Note as of the date first stated above.

AUXILIO, INC.

By: /s/ Xxxxxx X. Xxxxx

Title: President and CEO

PAYEE

By: /s/ Xxxxxxx X. XxXxxxxx

EXHIBIT A

AMORTIZATION SCHEDULE