Employment Agreement with Paul R. Miller

Exhibit 10.12

Employment Agreement with Xxxx X. Xxxxxx

EMPLOYMENT AGREEMENT – Xxxx X. Xxxxxx

THIS EMPLOYMENT AGREEMENT (the “Agreement”) is made by and between MPM Medical, Inc. (“Employer”), wholly-owned subsidiary of Royal BodyCare, Inc. (“Parent”), located at 0000 Xxxxx Xxxxx, Xxxxxx, Xxxxx 00000 and Xxxx X. Xxxxxx (“Employee”), 0000 Xxxxxxx Xxxx Xx., Xxxxxxxxx, Xxxxx 00000.

The parties to this Agreement declare that:

The Employer is engaged in, among other businesses, the distribution of wound care and oncology care products.

The Employee is willing to be employed by the Employer, and the Employer is willing to employ the Employee, on the terms, covenants, and conditions set forth in this Agreement.

In consideration of the mutual promises set forth in this Agreement, the Employer and the Employee agree as follows:

Section 1. Effective Date. The Effective Date of this Agreement shall be January 1, 2004.

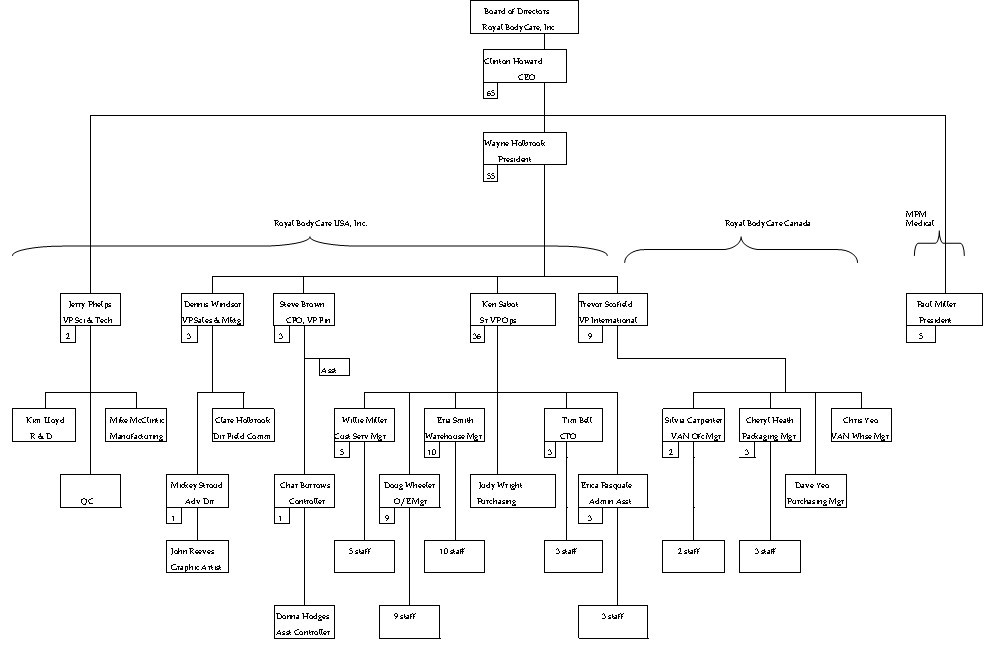

Section 2. Employment Title and Duties. The Employer shall employ the Employee in the capacity of President. In this capacity, Employee shall have the responsibility to perform all duties that are customarily performed by one holding that position in other, same, or similar businesses or enterprises as that engaged by Employer. The Employee shall be responsible for all sales and marketing operations related to Employer’s business. A diagram of the Employee’s functional responsibility is attached as Exhibit A. The Employee accepts this employment, subject to the general supervision and pursuant to the orders and direction of the Employer. The Employee shall also render such other and unrelated services and duties as may be assigned from time to time by the Employer.

Section 3. Compensation of the Employee. The Employer shall pay the Employee in full payment for the Employee’s services under this Agreement, the following compensation:

| a. | Annual Base Salary. Employee’s annual base salary shall be One Hundred One Thousand Two Hundred Dollars ($101,200) per year payable bi-weekly in twenty-six (26) equal payments. Employee’s annual base salary will be increased by 10% in the first pay period of the month following the first three-month period in which Employer’s Pre-tax Income, as hereinafter defined, exceeds Twenty-Five Thousand Dollars ($25,000). “Pre-tax Income” shall mean Employer’s earnings (loss) from continuing operations before income taxes, as reported in Parent’s consolidating financial statements, where Parent’s financial statements are prepared in accordance with generally accepted accounting principles. Employee’s annual base salary will be increased by an additional 10% in the first pay period of the month following the first three-month period in which Employer’s Pre-tax Income exceeds Fifty Thousand Dollars ($50,000). If Employer achieves this Fifty Thousand Dollar ($50,000) threshold in the same three-month period as the aforementioned Twenty-Five Thousand Dollar ($(25,000) threshold, the 10% increases related to achievement of each of these threshold Pre-tax Income amounts shall be combined such that Employee’s annual base salary will be increased by 20% in the first pay period of the |

Employment Agreement – Xxxx X. Xxxxxx

Page 2

| month following this three-month period. Employee’s annual base salary will be increased by an additional 10% of the then current annual base salary in the first pay period of the month following the following the first twelve-month period in which Employer earns Pre-tax Income of One Hundred Thousand Dollars ($100,000). |

| b. | Incentive Bonus. Employee shall be paid a cash incentive bonus as described in Exhibit B. |

| c. | Uniform Benefits. Employee shall receive uniform benefits as set forth in Employer’s manual for executive employees, such benefits to include but not be limited to personal time off, holidays, retirement benefits and health insurance benefits. EMPLOYER RESERVES THE RIGHT UNILATERALLY TO AMEND ANY AND ALL PARTS OF THE EMPLOYER’S MANUAL FOR EXECUTIVE EMPLOYEES AT ITS SOLE DISCRETION. |

Section 4. Best Efforts of the Employee. The Employee agrees to perform all of the duties pursuant to the express and implicit terms of this Agreement to the reasonable satisfaction of the Employer. The Employee further agrees to perform such duties faithfully and to the best of his ability, talent, and experience.

Section 5. Place of Employment. The Employee shall render such duties at 0000 Xxxxx Xxxxx, Xxxxxx, Xxxxx 00000 and at such other places as the Employer shall in good faith require or as the interest, needs, business, or opportunity of the Employer shall require.

Section 6. Non-Competition with the Employer during the Term of Employment. The Employee shall devote all his time, attention, knowledge, and skills solely to the business and interest of the Employer, and the Employer shall be entitled to all of the benefits and profits arising from the work of the Employee. The Employee shall not, during the term of this Agreement, be interested directly or indirectly, in any manner, as partner, officer, director, shareholder, advisor, employee, or in any other capacity in any other business similar to the Employer’s business or any allied trade. However, nothing contained in this section shall prevent or limit the right of the Employee from investing in the capital stock or other securities of any corporation whose stock or securities are publicly owned and traded on any public exchange, nor shall anything contained in this section prevent or limit the Employee from investing in real estate.

Section 7. Restrictions on the Use of Trade Secrets and Records. During the term of employment under this Agreement, the Employee may have access to various trade secrets, consisting of formulas, patterns, devices, inventions, processes, and compilations of information, records and specifications, all of which are owned by the Employer and regularly used in the operation of the Employer’s business. All files, records, customer lists, documents, drawings, specifications, equipment, and similar items relating to the business of the Employer, whether they are prepared by the Employee or come into the Employee’s possession in any other way and whether or not they contain or constitute trade secrets owned by the Employer, are and shall remain the exclusive property of the Employer and shall not be removed from the premises of the Employer under any circumstances whatsoever without the prior written consent of the Employer. The Employee agrees not to divulge, misappropriate, or disclose any of these trade secrets and records directly or indirectly, to any person, firm, corporation, or other entity in any manner whatsoever, either during the term of this Agreement or at any time thereafter except as required in the course of employment.

Employment Agreement – Xxxx X. Xxxxxx

Page 3

Section 8. Term. This Agreement shall be effective for period of three (3) years beginning on January 1, 2004 and ending on December 31, 2006. This Agreement shall be automatically renewed for an additional one-year period upon expiration of its initial term and each anniversary thereafter, unless terminated by either Employer or Employee upon thirty (30) days prior written notice to the other.

Section 9. Termination.

| a. | Non-renewal by Employer. If the Employer elects to terminate this Agreement pursuant to the terms of Section 8, the Employee, if requested by the Employer, shall continue to render services, and shall be paid compensation as provided in this Agreement up to the date of termination, and shall be entitled to receive payment for accrued, unused personal time off as provided in the Employer’s manual for executive employees. In addition, the Employee shall continue to be paid his base salary for a period of six (6) months following the date of termination, less all amounts required to be held and deducted. |

| b. | Non-renewal by Employee. If the Employee elects to terminate this Agreement pursuant to the terms of Section 8, the Employee shall continue to render services and shall be paid compensation as provided in this Agreement up to the date of termination. In addition, Employee shall be entitled to receive payment for accrued, unused personal time off as provided in the Employer’s manual for executive employees. |

| c. | Cause. If the Employee willfully breaches or habitually neglects the performance of duties required under the terms of this Agreement (“Cause”), the Employer may terminate this Agreement by giving written notice of termination to the Employee without prejudice to any other remedy to which the Employer may be entitled either at law, in equity, or under this Agreement. In this case, Employee shall be paid compensation as provided in this Agreement up to the date of termination, and shall be entitled to receive payment for accrued, unused personal time off as provided in the Employer’s manual for executive employees. |

| d. | Good Reason. If the Employer willfully breaches any material term of this Agreement, Employee may terminate this Agreement by giving written notice of termination to the Employer without prejudice to any other remedy to which the Employee may be entitled either at law, in equity, or under this Agreement. In this case, Employee shall be paid compensation as provided in this Agreement up to the end of the initial term or renewal term in effect, and shall be entitled to receive payment for accrued, unused personal time off as provided in the Employer’s manual for executive employees. In addition, the Employee shall continue to be paid his base salary for a period of six (6) months following the date of termination, less all amounts required to be held and deducted. |

| e. | Death. This Agreement shall be deemed terminated as of the date of Employee’s death. In this case, the Employer shall pay compensation as provided in this Agreement up to the date of termination. In addition, the Employer shall be obligated to pay Employee’s accrued, unused personal time off as provided for terminating employee’s in the Employer’s manual for executive employees. |

Employment Agreement – Xxxx X. Xxxxxx

Page 4

| f. | Disability. Should the Employee be unable to perform his duties under this Agreement by reason of disability for a period of sixty (60) days, Employer shall have the right to terminate this Agreement upon written notice to Employee. During the period that Employee fails to perform his duties as a result of disability, the Employee shall continue to receive compensation as provided by this Agreement to the extent Employee has accrued, unused personal time off available. Should Employee exhaust accrued, unused personal time off prior to a date six (6) months following the date on which Employee was determined to be disabled, Employer will continue to pay the Employee 50% of the Employee’s base compensation until the sooner of (i) the date on which Employee begins to receive disability benefits under a long-term disability insurance policy provided to Employee by or through Employer, or (ii) the date that is six (6) months after the date on which Employee was determined to be disabled. It is the intent of the parties hereto that, in the event Employee is disabled, Employer’s maximum obligation for payment of accrued, unused personal time off is a period of six (6) months. |

| g. | Early Termination by Employer. Should Employer terminate this Agreement prior to the end of the initial term or any renewal term in effect, other than by reason of Cause, death or disability, whether or not such termination is in connection with or as a result of a Change of Control, Employee shall be paid compensation as provided in this Agreement up to the end of the initial term or renewal term in effect, and shall be entitled to receive payment for accrued, unused personal time off as provided in the Employer’s manual for executive employees. In addition, the Employee shall continue to be paid his base salary for a period of six (6) months following the date of termination, less all amounts required to be held and deducted. |

| h. | Early Termination by Employee. Should Employee terminate this Agreement prior to the end of the initial term or any renewal term in effect, other than for Good Reason, death or disability, Employee shall be paid compensation as provided in this Agreement up to the date of termination, but shall not be entitled to receive payment for any accrued, unused personal time off, notwithstanding the provisions of the Employer’s manual for executive employees. |

Section 10. Effect of Partial Invalidity. The invalidity of any portion of this Agreement shall not affect the validity of any other provision. In the event that any provision of this Agreement is held to be invalid, the parties agree that the remaining provisions shall remain in full force and effect.

Section 11. Entire Agreement. This Agreement contains the complete Agreement between the parties and shall supersede all other agreements, either oral or written, between the parties. The parties stipulate that neither of them has made any representations except as are specifically set forth in this Agreement and each of the parties acknowledges that they have relied on their own judgment in entering into this Agreement.

Section 12. Assignment. Neither party to this Agreement may assign their rights under this Agreement unless the other party so consents to the assignment in writing.

Section 13. Notices. All notices, requests, demands, and other communications shall be in writing and shall be given by registered or certified mail, postage prepaid, to the addresses shown on the first page of this Agreement, or to such subsequent addresses as the parties shall so designate in writing.

Employment Agreement – Xxxx X. Xxxxxx

Page 5

Section 14. Arbitration. Any controversy or claim arising out of this Agreement, or the breach of this Agreement shall be settled by arbitration in accordance with the Commercial Arbitration Rules of the American Arbitration Association, and judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction.

Section 15. Attorney’s Fees. If any action at law or in equity, including an action for declaratory relief is brought to enforce or interpret the provisions of this Agreement, the prevailing party will be entitled to reasonable attorney’s fees as determined by the court in the same action.

Section 16. Amendment. Any modification, amendment or change of this Agreement will be effective only if it is in a writing signed by both parties.

Section 17. Governing Law. This Agreement, and all transactions contemplated by this Agreement, shall be governed by, construed, and enforced in accordance with the laws of the State of Texas.

Section 18. Headings. The titles to the paragraphs of this Agreement are solely for the convenience of the parties and shall not affect in any way the meaning or interpretation of this Agreement.

Section 19. MANAGEMENT ORGANIZATION. EMPLOYER, ACTING THROUGH ITS CHIEF EXECUTIVE OFFICER WITH THE CONCURRENCE OF THE INDEPENDENT MEMBERS OF EMPLOYER’S BOARD OF DIRECTORS, RESERVES THE RIGHT UNILATERALLY TO REVISE THE ORGANIZATION OF ANY AND ALL OF THE MANAGEMENT FUNCTIONS AND RELATED REPORTING RELATIONSHIPS AT ITS SOLE DISCRETION. THE CONTENTS OF THE DIAGRAM ATTACHED AS EXHIBIT A SHALL BE SUBORDINATE TO THE AUTHORITY OF THE EMPLOYER TO REVISE MANAGEMENT ORGANIZATION AND RELATED REPORTING RELATIONSHIPS AS PROVIDED IN THIS SECTION.

IN WITNESS WHEREOF, the parties have executed this Agreement on this 20th day of February, 2004.

| EMPLOYEE: |

EMPLOYER: | |||

| MPM Medical, Inc. | ||||

| /s/ Xxxx X. Xxxxxx |

By: |

/s/ Xxxxxxx X. Xxxxxx | ||

| (Signature) |

(Signature) | |||

| Xxxx X. Xxxxxx |

Xxxxxxx X. Xxxxxx | |||

| Chairman of the Board | ||||

EXHIBIT A

|

EXHIBIT B

CASH INCENTIVE BONUS

Employee shall be eligible for additional bonuses at the discretion of the Parent’s Board, and will participate in an annual bonus plan that will be adopted in advance each year. The maximum cash incentive bonus that may be earned by Employee in any calendar year is two (2) times Employee’s annual base salary.

Annual Bonus Plan for 2004

In 2004, if MPM’s Pre-tax Income exceeds twenty five thousand dollars ($25,000), Employee shall be awarded a cash incentive bonus in an amount equal to 10 % of Employer’s Pre-tax Income in excess of twenty five thousand dollars ($25,000).