SERIES D-1 PREFERRED SHARE PURCHASE AGREEMENT

SERIES D-1 PREFERRED SHARE PURCHASE AGREEMENT

THIS SHARE PURCHASE AGREEMENT (this “Agreement”) is entered into as of January 10, 2017, by and among:

(1) CooTek (Cayman) Inc., a company duly incorporated and validly existing under the Laws of the Cayman Islands (the “Company”),

(2) CooTek HongKong Limited, a company duly incorporated and validly existing under the Laws of the Hong Kong Special Administrative Region (the “HK Subsidiary”),

(3) TouchPal HK Co., Limited, a company duly incorporated and validly existing under the Law of the Hong Kong Special Administrative Region (“TouchPal HK”),

(4) TouchPal, Inc., a corporation duly incorporated and validly existing under the Law of Delaware State, USA (“TouchPal US”, together with TouchPal HK collectively, the “Offshore Subsidiaries”),

(5) Shanghai Chu Le (CooTek) Information Technology Co., Ltd. (上海触乐信息科技有限公司), a wholly foreign-owned enterprise duly organized and validly existing under the Laws of the PRC (the “WFOE”),

(6) Shanghai Han Xiang (CooTek) Information Technology Co., Ltd. (上海汉翔信息技术有限公司), a Sino-foreign joint venture company duly incorporated and validly existing under the Laws of the PRC (“Han Xiang”),

(7) Shanghai Xxx Xxx (CooTek) Information Technology Co., Ltd. (上海触宝信息技术有限公司), a limited liability company duly incorporated and validly existing under the Laws of the PRC (“Xxx Xxx,” together with Han Xiang, the “Domestic Companies” and each a “Domestic Company”; and the Domestic Companies together with the WFOE, collectively, the “PRC Subsidiaries” and each, a “PRC Subsidiary”),

(8) Haiyan’s Global Creativity Investment Inc., a company duly incorporated and validly existing under the Laws of the British Virgin Islands (the “Haiyan’s Holdco”),

(9) Xxx Xxxxxx (朱海燕, referred herein as “Zhu”), a citizen of the PRC with her ID card number of ***,

(10) The individuals listed in Schedule I attached hereto (the “Founders”, and each, a “Founder”),

(11) The entities listed in Schedule II attached hereto (the “Founder Holdcos”, and each, a “Founder Holdco”),

(12) Qualcomm International, Inc., a company duly incorporated and validly existing under the Laws of the State of California of the United States of America (“Qualcomm”, together with the Founder Holdcos, the “Selling Shareholders”, and each, a “Selling Shareholder”), and

(13) HG Qiandao Limited, a company duly incorporated and validly existing under the Laws of British Virgin Islands (the “Investor”).

Each of the Company, HK Subsidiary, the Offshore Subsidiaries, the PRC Subsidiaries, the Founders, the Founder Holdcos, Haiyan’s Holdco, Zhu, Qualcomm and the Investor is referred to herein individually as a “Party” and collectively as the “Parties.”

RECITALS

WHEREAS, the Investor wishes to invest in the Company by subscribing for Series D-1 Preferred Shares (as defined below), to be issued by the Company pursuant to the terms and subject to the conditions of this Agreement;

WHEREAS, upon the Initial Closing, the Investor wishes to designate one of its Affiliates to provide a loan to WFOE, and WFOE wishes to accept and borrow such loan from such Affiliate designated by the Investor, in a principal equal to an amount of US$20,000,000 or its equivalent RMB pursuant to the terms and subject to the conditions of the Loan Agreement (the “Domestic Loan Agreement”) entered into by and among the Investor’s Affiliate, the WFOE and other parties thereto (the “Domestic Loan”);

WHEREAS, the Company wishes to issue and sell Series D-1 Preferred Shares to the Investor pursuant to the terms and subject to the conditions of this Agreement;

WHEREAS, each of the Selling Shareholders agrees to sell to the Company, and the Company agrees to repurchase from each of the Selling Shareholders and cancel certain shares of the Company pursuant to the terms and subject to the conditions of this Agreement;

WHEREAS, the Parties desire to enter into this Agreement and make the respective representations, warranties, covenants and agreements set forth herein on the terms and conditions set forth herein;

WHEREAS, on or prior to the execution of this Agreement, the shareholders of the Company have approved, (a) by special resolution, the adoption of the Memorandum and Articles (subject to the consummation of the Initial Closing under this Agreement), and (b) by ordinary resolution, this Agreement;

WITNESSETH

NOW, THEREFORE, in consideration of the foregoing recitals, the mutual promises hereinafter set forth, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties intending to be legally bound hereto hereby agree as follows:

1. Definitions. The following terms shall have the meanings ascribed to them below:

“2012 Stock Incentive Plan” means the Company’s 2012 Stock Incentive Plan.

“Action” means any notice, charge, claim, action, complaint, petition, investigation, suit or other proceeding, whether administrative, civil or criminal, whether at Law or in equity, and whether or not before any mediator, arbitrator or Governmental Authority.

“Affiliate” means, with respect to a Person, any other Person that, directly or indirectly, Controls, is Controlled by or is under common Control with such Person.

“Agreement” means this Share Purchase Agreement.

“Ancillary Agreements” means the Shareholders’ Agreement defined herein, as amended from time to time.

“Applicable Accounting Principles” means, in the case of the WFOE and the PRC Subsidiaries, PRC GAAP, and in the case of all other Group Companies, the local accounting principles of the country where the Group Company is incorporated.

“Approval” means any approval, authorization, license, permit, release, order, or consent required to be obtained from, or any registration, qualification, designation, declaration, filing, notice, statement or other communication required to be filed with or delivered to, any Governmental Authority or any other Person, or any waiver of any of the foregoing.

“Domestic Companies” has the meaning set forth in the Preamble of this Agreement.

“Domestic Loan” has the meaning set forth in the Recitals of this Agreement.

“Domestic Loan Agreement” has the meaning set forth in the Recitals of this Agreement.

“Board” or “Board of Directors” means the board of directors of the Company.

“Business Plan” has the meaning set forth in Section 3.29 hereof.

“Charter Documents” means, as to a Person, such Person’s certificate of incorporation, formation or registration (including, if relevant, certificates of change of name), memorandum of association, articles of association or incorporation, charter, by-laws, trust deed, trust instrument, partnership, operating agreement, limited liability company, joint venture or shareholders’ agreement or equivalent documents, and business license, in each case as amended.

“Circular 37” has the meaning set forth in Section 3.10(ii) hereof.

“Circular 698” means the Circular issued by the PRC State Administration of Taxation titled ‘strengthening of Administration of Corporate Income Tax Liability on Income of Non-Resident Enterprises from Transfer of Equity Interests’(Guoshuihan 2009 No. 698) (in Chinese: ![]() and the further explanatory document, the Announcement No. 7 issued by the PRC State Administration of Taxation titled ‘Announcement of the State Administration of Taxation on Several Issues Relating to Corporate Income Tax on Gains from Indirect Transfer of Assets by Non-resident Enterprises’ (Gong Gao [2015] No. 7 ) (in Chinese:

and the further explanatory document, the Announcement No. 7 issued by the PRC State Administration of Taxation titled ‘Announcement of the State Administration of Taxation on Several Issues Relating to Corporate Income Tax on Gains from Indirect Transfer of Assets by Non-resident Enterprises’ (Gong Gao [2015] No. 7 ) (in Chinese:![]()

![]()

“Closing” has the meaning set forth in Section 2.3(iii) hereof.

“Company” has the meaning set forth in the Preamble of this Agreement.

“Company Intellectual Property” has the meaning set forth in Section 3.19(i) hereof.

“Company Owned IP” has the meaning set forth in Section 3.19(i) hereof.

“Company Registered IP” has the meaning set forth in Section 3.19(i) hereof.

“Company Security Holder” has the meaning set forth in Section 3.10(ii) hereof.

“Compliance Laws” has the meaning set forth in Section 3.9(ii).

“Contract” means, as to any Person, any contract, agreement, undertaking, understanding, indenture, note, bond, loan, instrument, lease, mortgage, deed of trust, franchise, or license to which such Person is a party or by which such Person or any of its property is bound, whether oral or written.

“Control” of a given Person means the power or authority, whether exercised or not, to direct the business, management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise, which power or authority shall conclusively be presumed to exist upon possession of beneficial ownership or power to direct the vote of more than fifty percent (50%) of the votes entitled to be cast at a meeting of the members or shareholders of such Person or power to control the composition of a majority of the board of directors of such Person; the term “Controlled” has the meaning correlative to the foregoing.

“Control Documents” means the following Contracts collectively: (a) the Amended and Restated Exclusive Option Agreement by and among the WFOE, Han Xiang, and each of the Founders and ZHU, each dated October 30, 2012; the Exclusive Option Agreement by and among the WFOE, Han Xiang, and each of Orange Capital Management, Qi Ming century (HK) Limited, Qualcomm International, Inc., each dated October 30, 2012; (b) the Amended and Restated Exclusive Option Agreement by and among the WFOE, Xxx Xxx, and each shareholder of Xxx Xxx, each dated October 30, 2012; (c) the Equity Interest Pledge Agreement and the Amended and Restated Equity Interest Pledge Agreement by and among the WFOE, Han Xiang, and each of the Founders and ZHU, each dated October 30, 2012; the Equity Interest Pledge Agreements (version for SAIC filing purpose) by and among the WFOE, Han Xiang, and each of Orange Capital Management, Qi Ming century (HK) Limited, Qualcomm International, Inc., each dated October 30, 2012; (d) the Equity Interest Pledge Agreement (version for SAIC filing purpose ) and Amended and Restated Equity Interest Pledge Agreement by and among the WFOE, Xxx Xxx, and each shareholder of Xxx Xxx, each dated October 30, 2012; (e) the Amended and Restated Exclusive Business Cooperation Agreement by and between the WFOE and Han Xiang dated October 30, 2012; (f) the Exclusive Business Cooperation Agreement by and between the WFOE and Xxx Xxx dated August 6, 2012; (g) the Powers of Attorney by and between the WFOE and each shareholder of Xxx Xxx, each dated October 30, 2012; (h) the Powers of Attorney by and between the WFOE and each shareholder of Han Xiang, each dated October 30, 2012; and (i) the Loan Agreement by and between the WFOE, and each shareholder of Xxx Xxx, each dated August 6, 2012.

“Conversion Shares” means Ordinary Shares issuable upon conversion of any Series D-1 Preferred Shares.

“Director” means the member of the Board of the Company.

“Disclosing Party” has the meaning set forth in Section 10.3 hereof.

“Disclosure Schedule” has the meaning set forth in Section 3 hereof.

“Domestic Company” has the meaning set forth in the Preamble of this Agreement.

“Employee Benefit Plans” has the meaning set forth in Section 3.20 hereof

“Equity Securities” means, with respect to a Person, any shares, share capital, registered capital, ownership interest, equity interest, or other securities of such Person, and any option, warrant, or right to subscribe for, acquire or purchase any of the foregoing, or any other security or instrument convertible into or exercisable or exchangeable for any of the foregoing, or any equity appreciation, phantom equity, equity plans or similar rights with respect to such Person, or any Contract of any kind for the purchase or acquisition from such Person of any of the foregoing, either directly or indirectly.

“FCPA” has the meaning set forth in Section 3.9(ii) hereof.

“Financial Statements” has the meaning set forth in Section 3.14 hereof.

“Financing Terms” has the meaning set forth in Section 10.1 hereof.

“Foreign Exchange Authorization” has the meaning set forth in Section 3.10(ii) hereof.

“Founders” has the meaning set forth in the Preamble of this Agreement.

“Founder Holdcos” has the meaning set forth in the Preamble of this Agreement.

“Governmental Authority” means any nation or government or any federation, province or state or any other political subdivision thereof; any entity, authority or body exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government, including any government authority, agency, department, board, commission or instrumentality of the PRC, the Cayman Islands, the British Virgin Islands, or any other country, or any political subdivision thereof, any court, tribunal or arbitrator, and any self-regulatory organization.

“Governmental Order” means any applicable order, ruling, decision, verdict, decree, writ, subpoena, mandate, precept, command, directive, consent, approval, award, judgment, injunction or other similar determination or finding by, before or under the supervision of any Governmental Authority.

“Group Company” means each of the Company, HK Subsidiary, the Offshore Subsidiaries and the PRC Subsidiaries, together with each Subsidiary of any of the foregoing, and each Person (other than a natural person) that is, directly or indirectly, Controlled by any of the foregoing, including but not limited to each joint venture in which any of the foregoing holds more than fifty percent (50%) of the voting power, and “Group” refers to all of Group Companies collectively.

“Haiyan’s Holdco” has the meaning set forth in the Preamble of this Agreement.

“Hong Kong” means the Hong Kong Special Administrative Region of the PRC.

“IFRS” means the International Financial Reporting Standards.

“Indemnifiable Loss” has the meaning set forth in Section 11.1 hereof.

“Initial Closing” has the meaning set forth in Section 2.3(i) hereof.

“Intellectual Property” means any and all (i) patents, all patent rights and all applications therefor and all reissues, reexaminations, continuations, continuations-in-part, divisions, and patent term extensions thereof, (ii) inventions (whether patentable or not), discoveries, improvements, concepts, innovations and industrial models, (iii) registered and unregistered copyrights, copyright registrations and applications, author’s rights and works of authorship (including artwork of any kind and software of all types in whatever medium, inclusive of computer programs, source code, object code and executable code, and related documentation), (iv) URLs, domain names, web sites, web pages and any part thereof, (v) technical information, know-how, trade secrets, drawings, designs, design protocols, specifications for parts and devices, quality assurance and control procedures, design tools, manuals, research data concerning historical and current research and development efforts, including the results of successful and unsuccessful designs, databases and proprietary data, (vi) proprietary processes, technology, engineering, formulae, algorithms and operational procedures, (vii) trade names, trade dress, trademarks, and service marks, and registrations and applications therefor, and (viii) the goodwill of the business symbolized or represented by the foregoing, customer lists and other proprietary information and common-law rights.

“Investor” has the meaning set forth in the Preamble of this Agreement.

“IPO” means the first firmly underwritten registered public offering (a) by the Company of its Ordinary Shares or any member of Group Companies pursuant to a Registration Statement (as defined in the Shareholders’ Agreement) that is filed with and declared effective by either the Commission (as defined in the Shareholders’ Agreement) under the Securities Act in the United States, or (b) listing of all the equity interest or shares of any member of Group Companies on the Hong Kong Stock Exchange or United States stock exchange or PRC stock exchange approved by the Board of the Company.

“Key Employee” means each of the Persons listed on Schedule IV and Key Employees mean such Persons collectively.

“Knowledge” means, with respect to any of the Warrantors, the actual knowledge of any of the Founders and the Key Employees, and that knowledge which should have been acquired by each such individual after making such due inquiry and exercising such due diligence as a prudent business person would have made or exercised in the management of his or her business affairs, including but not limited to due inquiry of all officers, directors, employees, consultants and professional advisers (including attorneys, accountants and auditors) of the Group and of its Affiliates who could reasonably be expected to have knowledge of the matters in question, and where any statement in the representations and warranties hereunder is expressed to be given or made to a Person’s Knowledge, or so far as a Party is aware, or is qualified in some other manner having a similar effect, the statement shall be deemed to be supplemented by the additional statement that such Party has made such due inquiry and due diligence.

“Law” or “Laws” means any constitutional provision, statute or other law, rule, regulation, official policy or interpretation of any Governmental Authority and any Governmental Order.

“Liability” or “Liabilities” means, with respect to any Person, all debts, obligations, liabilities owed by such Person of any nature, whether accrued, absolute, contingent or otherwise, and whether due or to become due.

“Licensed IP” has the meaning set forth in Section 3.19(i) hereof.

“Lien” means any mortgage, pledge, claim, security interest, encumbrance, title defect, lien, charge, easement, adverse claim, restrictive covenant, or other restriction or limitation of any kind whatsoever, including any restriction on the use, voting, transfer, receipt of income, or exercise of any attributes of ownership.

“Long-Stop Date” has the meaning set forth in Section 2.3 hereof.

“Material Adverse Effect” means any (i) event, occurrence, fact, condition, change or development that has had, has, or could reasonably be expected to have, either alone or together with other events, occurrences, facts, conditions, changes or developments, a material adverse effect on the business, properties, assets, employees, operations, results of operations, condition (financial or otherwise), prospects, assets or liabilities of the Group, (ii) material impairment of the ability of any Group Company, any Founder, or any Founder Holdco to perform the material obligations of such Person hereunder or under any other Transaction Documents, as applicable, or (iii) material impairment of the validity or enforceability of this Agreement or any Transaction Document against any Group Company, any Founder, or any Founder Holdco.

“Material Contracts” has the meaning set forth in Section 3.17 hereof.

“Memorandum and Articles” means the Fifth Amended and Restated Memorandum of Association of the Company and the Fifth Amended and Restated Articles of Association of the Company attached hereto as Exhibit B, to be adopted in accordance with applicable Law on or before the Initial Closing and which shall be in full force and effect as of the Initial Closing.

“Offshore Subsidiaries” has the meaning set forth in the Preamble of this Agreement.

“Ordinary Shares” means the Company’s ordinary shares, par value US$0.00001 per share.

“Party” or “Parties” has the meaning set forth in the Preamble of this Agreement.

“Permitted Liens” means (i) Liens for Taxes not yet delinquent or the validity of which are being contested in good faith and (ii) Liens incurred in the ordinary course of business, which (x) do not individually or in the aggregate materially detract from the value, use, or transferability of the assets that are subject to such Liens and (y) were not incurred in connection with the borrowing of money.

“Permits” has the meaning set forth in Section 3.8 hereof.

“Person” means any individual, corporation, partnership, limited partnership, proprietorship, association, limited liability company, firm, trust, estate or other enterprise or entity.

“PRC” means the People’s Republic of China, but solely for the purposes of this Agreement and the other Transaction Documents, excluding Hong Kong, the Macau Special Administrative Region and the islands of Taiwan.

“PRC GAAP” means the Corporate Accounting Standards (2006) ![]() as promulgated by the Ministry of Finance of the PRC and as amended and in effect from time to time.

as promulgated by the Ministry of Finance of the PRC and as amended and in effect from time to time.

“PRC Subsidiaries” has the meaning set forth in the Preamble of this Agreement.

“PRC Tax Authority” means the PRC tax authority competent to impose, assess or enforce the tax liabilities in connection with the repurchase contemplated hereunder.

“Preferred Shares” has the meaning set forth in Section 3.2(i) hereof.

“Public Official” means any employee of a Governmental Authority, an active member of a political party engaged in political or governmental activities, a political candidate, officer of a public international organization, or officer or employee of a state-owned enterprise, including a PRC state-owned enterprise.

“Purchase Price” has the meaning set forth in Section 2.1 hereof.

“Qualcomm” has the meaning set forth in the Preamble of this Agreement.

“Real Property” has the meaning set forth in Section 3.18(ii) hereof.

“Related Party” means an officer, director or employee of any Group Company or any “affiliate” or “associate” (as those terms are defined in Rule 405 promulgated under the Securities Act) of any of them (each of the foregoing, a “Related Party”).

“Related Party Contract” means a contract between any Group Company and any Related Party.

“Representatives” has the meaning set forth in Section 3.9(ii) hereof.

“SAIC” means the State Administration for Industry and Commerce of the PRC and any of its local branches.

“SAFE” means the State Administration of Foreign Exchange of the PRC and any of its local branches.

“SAFE Rules and Regulations” has the meaning set forth in Section 3.10(ii) hereof.

“Securities Act” means the U.S. Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Selling Shareholders” has the meaning set forth in the Preamble of this Agreement.

“Series A Preferred Shares” has the meaning set forth in Section 3.2(i) hereof.

“Series B Preferred Shares” has the meaning set forth in Section 3.2(i) hereof.

“Series B-1 Preferred Shares” has the meaning set forth in Section 3.2(i) hereof.

“Series C Preferred Shares” has the meaning set forth in Section 3.2(i) hereof.

“Series D Preferred Shares” has the meaning set forth in Section 3.2(i) hereof.

“Series D-1 Preferred Shares” has the meaning set forth in Section 3.2(i) hereof.

“Settlement Agreement” has the meaning set forth in Section 3.19(iii) hereof.

“Shareholders’ Agreement” means the Fifth Amended and Restated Shareholders’ Agreement to be entered into by and among the parties thereto on or prior to the Initial Closing, in the form attached hereto as Exhibit C.

“Social Insurance” has the meaning set forth in Section 3.20(vii) hereof.

“Statement Date” has the meaning set forth in Section 3.14 hereof.

“Subsequent Closing” has the meaning set forth in Section 2.3(iii) hereof.

“Subsidiary” means, with respect to any specified Person, any Person of which the specified Person, directly or indirectly, owns or Controls more than fifty percent (50%) of the issued and outstanding share capital, voting interests or registered capital.

“Tax” means (i) in the PRC: (a) any national, provincial, municipal, or local taxes, charges, fees, levies, or other assessments, including, without limitation, all net income (including enterprise income tax and individual income withholding tax), turnover (including value-added tax, business tax, and consumption tax), resource (including urban and township land use tax), special purpose (including land value-added tax, urban maintenance and construction tax, and additional education fees), property (including urban real estate tax and land use fees), documentation (including stamp duty and deed tax), filing, recording, social insurance (including pension, medical, unemployment, housing, and other social insurance withholding), tariffs (including import duty and import value-added tax), and estimated and provisional taxes, charges, fees, levies, or other assessments of any kind whatsoever, (b) all interest, penalties (administrative, civil or criminal), or additional amounts imposed by any Governmental Authority in connection with any item described in clause (a) above, and (c) any form of transferee liability imposed by any Governmental Authority in connection with any item described in clauses (a) and (b) above, and (ii) in any jurisdiction other than the PRC, all similar liabilities as described in clause (i) above.

“TouchPal HK” has the meaning set forth in the Preamble of this Agreement.

“TouchPal US” has the meaning set forth in the Preamble of this Agreement.

“Tax Return” means any return, report or statement showing Taxes, used to pay Taxes, or required to be filed with respect to any Tax (including any elections, declarations, schedules or attachments thereto, and any amendment thereof), including any information return, claim for refund, amended return or declaration of estimated or provisional Tax.

“Transaction Documents” means this Agreement, the Ancillary Agreements, the exhibits attached to any of the foregoing and each of the agreements and other documents otherwise required in connection with implementing the transactions contemplated by any of the foregoing.

“U.S.” means the United States of America.

“Warrantors” has the meaning set forth in Section 3 hereof.

“WFOE” has the meaning set forth in the Preamble of this Agreement.

“Zhu” has the meaning set forth in the Preamble of this Agreement.

2. Purchase and Sale of Series D-1 Preferred Shares

2.1 Sale and Issuance of the Series D-1 Preferred Shares. Subject to the terms and conditions of this Agreement, at the Initial Closing, the Investor agrees to subscribe for and purchase, and the Company agrees to issue and sell to the Investor, that number of Series D-1 Preferred Shares set forth opposite the Investor’s name on Schedule III-A attached hereto, with the Investor to pay after the Initial Closing as consideration for such Series D-1 Preferred Shares the aggregate purchase price (the “Purchase Price”) set forth opposite the Investor’s name on Schedule III-A attached hereto.

2.2 Repurchase of Shares. Subject to the terms and conditions of this Agreement, (i) at the Initial Closing, Qualcomm agrees to sell to the Company, and the Company agrees to repurchase from Qualcomm and cancel that number of shares of the Company (the “Qualcomm Repurchased Shares”) as set forth opposite Qualcomm on Schedule III-B for the repurchase price (the “Qualcomm Repurchase Price”) as set forth opposite Qualcomm on Schedule III-B; (ii) at the Subsequent Closing, each of Founder Holdcos, severally but not jointly, agrees to sell to the Company, and the Company agrees to repurchase from each of the Founder Holdcos and cancel that number of shares of the Company (the “Founder Holdcos Repurchased Shares”, together with Qualcomm Repurchased Shares the “ Repurchased Shares”) as set forth opposite such Founder Holdco on Schedule III-B for the repurchase price (the “Founder Holdcos Repurchase Price”, together with Qualcomm Repurchase Price the “Repurchase Price” ) as set forth opposite such Founder Holdco on Schedule III-B.

2.3 Closing

(i) Initial Closing. The consummation of the sale and issuance of the Series D-1 Preferred Shares pursuant to Section 2.1 and the repurchase and cancellation of the Qualcomm Repurchased Shares pursuant to Section 2.2(i) (the “Initial Closing”) shall, take place remotely via the exchange of documents and signatures as soon as practicable, but in no event later than five (5) business days following the satisfaction or waiver of all of the conditions set forth in Section 6, as confirmed in writing by the Investor and the Company, or at such other place or at such other time or on such other date as the Company and the Investor may mutually agree in writing.

(ii) Initial Closing Deliveries. At the Initial Closing, the Company shall deliver to the Investor (a) a scanned copy of the updated register of members of the Company, certified by the registered office provider of the Company, reflecting the issuance to the

Investor of the Series D-1 Preferred Shares being purchased but unpaid and the repurchase and cancellation of the Qualcomm Repurchased Shares at the Initial Closing, (b) the share certificate or certificates representing the relevant Series D-1 Preferred Shares being purchased but unpaid by the Investor at the Initial Closing, and (c) all Transaction Documents duly executed by relevant Parties.

At the Initial Closing, the Company shall deliver to Qualcomm (a) a scanned copy of the updated register of members of the Company, certified by the registered office provider of the Company, reflecting the issuance to the Investor of the Series D-1 Preferred Shares being purchased but unpaid and the repurchase and cancellation of the Qualcomm Repurchased Shares at the Initial Closing, (b) the share certificate or certificates representing the Series A Preferred Shares held by Qualcomm after the repurchase of Qualcomm Repurchased Shares at the Initial Closing subject to any tax payment or tax withholding obligation under Circular 698 filing and tax filing arrangement under Section 9.9, and (c) all Transaction Documents duly executed by relevant Parties.

At the Initial Closing, Qualcomm shall deliver to the Company the original share certificate(s) representing the Qualcomm Repurchased Shares for cancellation against payment of the Qualcomm Repurchase Price by wire transfer of U.S. funds by the Company to the account otherwise designated by Qualcomm.

At the Initial Closing, the Investor and Qualcomm shall deliver to the Company all Transaction Documents duly executed by the Investor and Qualcomm.

(iii) Subsequent Closing. The consummation of the repurchase and cancellation of the Founder Holdcos Repurchased Shares pursuant to Section 2.2(ii) (the “Subsequent Closing”, together with the Initial Closing, the “Closing”) shall take place on or within ten (10) business days after January 20, 2017, or at such other time or on such other date as the Company, the Founder Holdcos and the Investor may mutually agree in writing.

(iv) Subsequent Closing Deliveries. At the Subsequent Closing, the Company shall deliver to each of the Founder Holdcos (a) a scanned copy of the updated register of members of the Company, certified by the registered office provider of the Company, reflecting the repurchase and cancellation of the Founder Holdcos Repurchased Shares at the Subsequent Closing, (b) the share certificate or certificates representing the Ordinary Shares held by such Founder Holdcos after the repurchase and cancellation of Founder Holdcos Repurchased Shares at the Subsequent Closing subject to any tax payment or tax withholding obligation under Circular 698 filing and tax filing arrangement under Section 9.9, and (c) all Transaction Documents duly executed by relevant Parties.

At the Subsequent Closing, the Founder Holdcos shall deliver to the Company the original share certificate(s) representing the Founder Holdcos Repurchased Shares for cancellation against payment of the Founder Holdcos Repurchase Price by wire transfer of U.S. funds by the Company to the bank account otherwise designated by such Founder Holdcos.

(v) Payment of Domestic Loan. The Investor shall procure and guarantee that its Affiliate make the payment of the Domestic Loan to the bank account designated by WFOE at or after the Initial Closing pursuant to the terms and subject to the conditions of the Domestic Loan Agreement.

(vi) Deferred Arrangement of the Initial Closing Payment. After the Initial Closing but in no event after the later date of (i) the commencement of IPO application as determined by the Board of the Company or (ii) one year after the execution of the Domestic Loan Agreement, the Investor shall make the payment of the Purchase Price in an amount set forth opposite the Investor’s name on Schedule III-A (on the basis that the pre-money valuation of the Company is US$700,000,000) to the Company by remittance of immediately available funds to the following bank account of the Company. All bank charges and related expenses for remittance and receipt of funds shall be borne by the Company.

Account Bank: SILICON VALLEY BANK

Bank Address: 0000 XXXXXX XXXXX, XXXXX XXXXX, XX 00000, XXX

Account Name: COOTEK (CAYMAN) INC.

Account No.: 3300886130

Swift Code: XXXXXX0X

If the Investor fails to make the payment of the Purchase Price in accordance with this Section 2.3(vi) or the circumstance under Article 11.2(3) of Domestic Loan Agreement occurs, the Series D-1 Preferred Shares being purchased but unpaid by the Investor shall be forfeited by the Company in accordance with the Memorandum and Articles And subject to the terms and conditions of the Domestic Loan Agreement, the Investor shall provide reasonable efforts and cooperation to complete such forfeiture of the Series D-1 Preferred Shares as requested by the Company.

Further all Parties agree that, the aforesaid deferred arrangement of the payment of the Purchase Price will be subject to the rules and requirements of the relevant stock exchange applicable to the Company, provided that the time of IPO application and listing of the Company will not be delayed due to aforesaid deferred arrangement of the payment of the Purchase Price.

2.4 Long-Stop Date. If the Initial Closing fails to occur within sixty (60) days from the date hereof or another date as the Company and the Investor may mutually agree in writing (the “Long-Stop Date”), either the Investor (with respect to itself only) or the Company shall have the right (but not the obligation) to terminate this Agreement and the transaction contemplated hereunder. If the Investor or the Company terminates this Agreement pursuant to this Section 2.4, and the purchase of the Series D-1 Preferred Shares and the repurchase and the cancellation of the Repurchased Shares hereunder shall be abandoned, each of the Parties shall be relieved of any and all of its obligations under this Agreement without prejudice to any accrued rights it may have.

3. Representations and Warranties of the Warrantors to the Investor. Subject to such exceptions as may be specifically set forth in the Disclosure Schedule attached to this Agreement as Exhibit D (the “Disclosure Schedule”), each of the Company, HK Subsidiary, the Offshore Subsidiaries, the PRC Subsidiaries, the Founders, the Founder Holdcos, Haiyan’s Holdco and Zhu (collectively, the “Warrantors”, however, Haiyan’s Holdco and Zhu only jointly and severally give the representations and warranties regarding Haiyan’s Holdco or Zhu in Section 3.3, 3.4, 3.6, 3.9, 3.10, 3.11, 3.12, 3.24, 3.25), jointly and severally, represents and warrants to the Investor that each of the statements contained in this Section 3 is true and complete as of the date of this Agreement and the date of the Initial Closing as follows:

3.1 Organization, Good Standing and Qualification. The Company is duly incorporated, validly existing and in good standing under the Laws of the Cayman Islands. Each of the PRC Subsidiaries is validly existing and in good standing with its business license and articles of association in full force and effect under, and in compliance with, the Laws of the PRC. Each other Group Company, if any, is duly organized, validly existing and in good standing under the Laws of the jurisdiction of its incorporation. Each Group Company has all requisite legal and corporate power and authority to own, lease and operate its properties and assets and to carry on its business as now conducted, and is duly qualified to transact business in each jurisdiction it conducts its business. As of the date hereof, the Company was formed solely to acquire and hold the equity interests in the WFOE, and since its formation, has not engaged in any other business and has not incurred any Liability (except for transactions between the Company and other Group Companies).

3.2 Capitalization and Voting Rights.

(i) Company. (A) As set forth in Schedule VII, immediately after the Initial Closing, the authorized share capital of the Company shall be US$50,000 divided into 5,000,000,000 shares of par value US$0.00001 each comprising of (i) 2,920,061,989 Ordinary Shares of par value US$0.00001 each, of which 1,138,705,583 are issued and outstanding, (ii) 442,174,065 Series A Preferred Shares of par value US$0.00001 each (the “Series A Preferred Shares”), all of which are issued and outstanding, (iii) 553,299,062 Series B Preferred Shares of par value US$0.00001 each (the “Series B Preferred Shares”), all of which are issued and outstanding, (iv) 119,688,525 Series B-1 Preferred Shares (the “Series B-1 Preferred Shares”), all of which are issued and outstanding, and (v) 651,629,045 Series C Preferred Shares of par value US$0.00001 each (the “Series C Preferred Shares”), all of which are issued and outstanding, (vi) 223,478,358 Series D Preferred Shares of par value US$0.00001 each (the “Series D Preferred Shares), all of which are issued and outstanding, (vii) 89,668,956 Series D-1 Preferred Shares of par value US$0.00001 each (the “Series D-1 Preferred Shares”, and together with the Series A Preferred Shares, Series B Preferred Shares, Series B-1 Preferred Shares, Series C Preferred Shares, and Series D Preferred Shares, the “Preferred Shares”), all of which are issued and outstanding. As of the Initial Closing, the Company shall have reserved (a) 226,153,637 Ordinary Shares for issuance to officers, directors, employees, consultants or service providers of the Company pursuant to the 2012 Stock Incentive Plan, which was adopted by the Board of Directors in 2013, or such other equity incentive plans that are approved by the Board, 44,536,997 of which remain available for grant, (b) 442,174,065 Ordinary Shares for issuance upon conversion of the Series A Preferred Shares, (c) 533,299,062 Ordinary Shares for issuance upon conversion of the Series B Preferred Shares, (d) 119,688,525 Ordinary Shares for issuance upon conversion of the Series B-1 Preferred Shares, (e) 651,629,045 Ordinary Shares for issuance upon conversion of the Series C Preferred Shares, (f)223,478,358 Ordinary Shares for issuance upon conversion of the Series D Preferred Shares, and (g) 89,668,956 Ordinary Shares for issuance upon conversion of the Series D-1 Preferred Shares. The rights, privileges and preferences of the Ordinary Shares and Preferred Shares are as set forth in the Memorandum and Articles. Section 3.2(i) of the Disclosure Schedule set forth as of (1) the date hereof, (2) immediately prior to the Initial Closing, and (3) immediately after the Initial Closing, the outstanding and authorized Equity Securities of each Group Company, the record and beneficial holders thereof, the issuance date, and the terms of any vesting applicable thereto.

(B) As set forth in Schedule VII, immediately after the Subsequent Closing, the authorized share capital of the Company shall be US$50,000 divided into 5,000,000,000 shares of par value US$0.00001 each comprising of (i) 2,920,061,989 Ordinary Shares of par value US$0.00001 each, of which 1,124,547,327 are issued and outstanding, (ii) 442,174,065 Series A Preferred Shares of par value US$0.00001 each, all of which are issued and outstanding, (iii) 553,299,062 Series B Preferred Shares of par value US$0.00001 each, all of which are issued and outstanding, (iv) 119,688,525 Series B-1 Preferred Shares, all of which are issued and outstanding, and (v) 651,629,045 Series C Preferred Shares of par value US$0.00001 each , all of which are issued and outstanding, (vi) 223,478,358 Series D Preferred Shares of par value US$0.00001 each, all of which are issued and outstanding, (vii) 89,668,956 Series D-1 Preferred Shares of par value US$0.00001 each, all of which are issued and outstanding.

(ii) No Other Securities. Except as (a) set forth in Section 3.2(i), (b) the conversion privileges of the Preferred Shares and (c) certain rights provided in the Shareholders’ Agreement, there are no and at the Initial Closing there will not be any authorized or outstanding Equity Securities of any Group Company. No Group Company is a party or subject to any agreement that affects or relates to the voting or giving of written consents with respect to, or the right to cause the registration, redemption, or repurchase of, any Equity Security of such Group Company.

(iii) Issuance and Status. All presently outstanding Equity Securities of each Group Company were duly and validly issued (or subscribed for) in compliance with all applicable Laws, preemptive rights of any Person, and applicable Contracts and are fully paid and non-assessable. All share capital of each Group Company is and as of the Initial Closing shall be free of any and all Liens (except for any restrictions on transfer under the Ancillary Agreements or applicable securities Laws). There are no (a) resolutions pending to change the share capital of any Group Company or cause the liquidation, winding up, or dissolution of any Group Company or (b) dividends which have accrued or been declared but are unpaid by any Group Company. The registered capital of each Group Company (if applicable) has been fully paid, and such capital contribution has been duly verified by a certified accountant registered in the PRC or relevant written payment evidence provided by the Group Company (if applicable) or the financial statement provided by the Group Company (if applicable).

(iv) Vesting. No Contracts of any Group Company relating to its Equity Securities provides for acceleration of vesting (or lapse of a repurchase right) or other changes in the vesting provisions or other terms of such agreement or understanding upon the occurrence of any event or combination of events. No Group Company has ever adjusted or amended the exercise price of any share options previously awarded, whether through amendment, cancellation, replacement grant, repricing, or any other means.

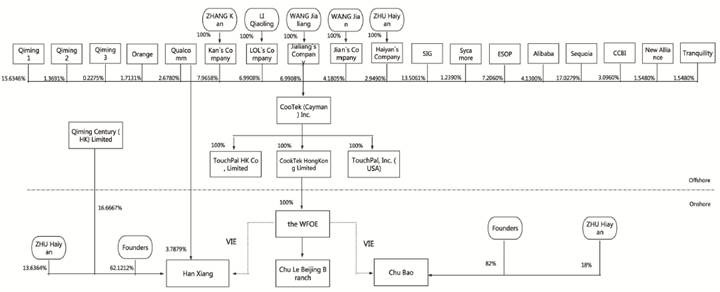

3.3 Corporate Structure; Subsidiaries. Exhibit A sets forth a complete structure chart as of the date hereof showing Group Companies, indicating the ownership and Control relationships among all Group Companies, and the Founders, the Founder Holdcos, Zhu, and Haiyan’s Holdco. No Group Company owns or Controls, or has ever owned or Controlled, directly or indirectly, any interest or share in any other Person or is or was a participant in any joint venture, partnership or similar arrangement. No Group Company is obligated to make any investment in or capital contribution in or on behalf of any other Person.

3.4 Authorization. Each Warrantor has all requisite power and authority to execute and deliver the Transaction Documents to which it is a party and to carry out and

perform its obligations thereunder. All actions on the part of each Warrantor (and, as applicable, its officers, directors, employees and shareholders) necessary for the authorization, execution and delivery of the Transaction Documents to which it is a party, the performance of all obligations of each Warrantor thereunder, and, in the case of the Company, the authorization, issuance (or reservation for issuance), sale and allotment of the Series D-1 Preferred Shares, have been taken or will be taken prior to the Initial Closing. This Agreement has been duly executed and delivered by each Warrantor. This Agreement and each of the Transaction Documents are, or when executed and delivered by such Warrantor will be, valid and legally binding obligations of such Warrantor, enforceable against such Warrantor in accordance with its terms, except (i) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, and other Laws of general application affecting enforcement of creditors’ rights generally, and (ii) as limited by Laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

3.5 Valid Issuance of Securities. The Series D-1 Preferred Shares, when issued, allotted and paid for in accordance with the terms of this Agreement for the consideration expressed herein, will be duly and validly issued, fully paid and non-assessable, free from any Liens (except for any restrictions on transfer under applicable securities Laws and under the Ancillary Agreements). The Conversion Shares have been reserved for issuance and, upon issuance in accordance with the terms of the Memorandum and Articles, will be duly and validly issued, fully paid and non-assessable, free from any Liens (except for any restrictions on transfer under applicable securities Laws and under the Ancillary Agreements). The issuance of the Series D-1 Preferred Shares is not subject to any preemptive rights, rights of first refusal or similar rights.

3.6 Approvals. Except for Circular 698 filings, no other Approval with respect to or on the part of any Group Company, any Founder, any Founder Holdco, Haiyan’s Holdco or Zhu is required in connection with its valid execution, delivery, or performance of the transactions contemplated by this Agreement or the Transaction Documents or the offer, sale, issuance or reservation for issuance of the Series D-1 Preferred Shares or the Conversion Shares.

3.7 Offering. The offer, sale and issuance of the Series D-1 Preferred Shares and the Conversion Shares, as contemplated by the Transaction Documents, are exempt from the qualification, registration and prospectus delivery requirements of the Securities Act and any other applicable securities Laws.

3.8 Permits. Each Group Company has all material franchises, authorizations, approvals, permits, certificates and licenses, including without limitation any special approvals or permits required under applicable Laws (“Permits”) necessary for its respective business and operations as now conducted or planned to be conducted. Each Permit is valid and in full force and effect. No Group Company is in default or violation of any Permit. No Group Company has received any written notice from any Governmental Authority regarding any actual or possible default or violation of any Permit. Each Permit will remain in full force and effect upon the consummation of the transactions contemplated hereby for not less than one (1) year after the Initial Closing. To the Knowledge of the Warrantors, no suspension, cancellation or termination of any such Permits is pending, threatened or imminent.

3.9 Compliance with Laws and Governmental Orders.

(i) Each Group Company (including the ownership thereof, the operation of its business, and the ownership and use of its assets) has been and is in compliance with all applicable Laws.

(ii) Each Warrantor and each of its respective directors, officers, and employees, and to the Knowledge of each Warrantor, each of its agents and other persons authorized to act on his or its behalf (collectively, “Representatives”), are in compliance with and have complied with all applicable anti-bribery, anti-corruption, anti-money laundering, recordkeeping and internal controls Laws, Office of Foreign Assets Control Guide and Foreign Account Tax Compliance Act and any treaty, convention, understanding or other agreement between or among Governmental Authorities to comply with, facilitate, supplement, implement or otherwise related to the foregoing (collectively, the “Compliance Laws”). Without limiting the foregoing, no Warrantor nor any Representative (to the Knowledge of each Warrantor with respect to its agents and other persons authorized to act on its behalf) has, directly or indirectly, offered, authorized, promised, condoned, participated in, or received notice of any allegation of:

(a) the making of any gift or payment of anything of value to any Public Official by any Person to obtain any improper advantage, affect or influence any act or decision of any such Public Official, or assist any Group Company in obtaining or retaining business for, or with, or directing business to, any Person;

(b) the taking of any action by any Person which (i) would violate the Foreign Corrupt Practices Act of the United States of America (the “FCPA”), as amended, if taken by an entity subject to the FCPA or (ii) could reasonably be expected to constitute a violation of any applicable Compliance Laws; or

(c) the making of any false or fictitious entries in the books or records of any Group Company by any Person.

(iii) None of the Founders or Key Employees are or were Public Officials. No Founder or Key Employee has been involved on behalf of a Governmental Authority in decisions as to whether any Group Company or the Investor would be awarded business or that otherwise could benefit any Group Company or the Investor, or in the appointment, promotion, or compensation of persons who will make such decisions. If applicable, no Founder or Key Employee will use their government positions to influence acts or decisions of a Governmental Authority for the benefit of any Group Company or the Investor. No Founder or Key Employee will meet or communicate with Public Officials on behalf of any Group Company or the Investor prior to the completion of the transactions contemplated hereby without advising the Investor in writing in advance of such meeting or communication.

(iv) The business of each Group Company as now conducted and proposed to be conducted (including any business proposed to be conducted by entities that are not currently existing as of the Initial Closing) are in compliance with all Laws and regulations that may be applicable, including without limitation all Laws of the PRC with respect to mergers, acquisitions, foreign investment and foreign exchange transactions.

(v) No event has occurred and no circumstance exists that (with or without notice or lapse of time) (a) may constitute or result in a material violation by any Group

Company of, or a failure on the part of such Group Company to comply with, any applicable Law or (b) may give rise to any obligation on the part of a Group Company to undertake, or to bear all or any portion of the cost of, any remedial action of any nature.

(vi) No Group Company has received any notice from any Governmental Authority regarding (a) any actual, alleged, possible or potential material violation of, or material failure to comply with, any applicable Law or (b) any actual, alleged, possible or potential material obligation on the part of such Group Company to undertake, or to bear all or any portion of the cost of, any remedial action of any nature. To the Knowledge of the Warrantors, the Company is not under investigation with respect to a violation of any applicable Law.

(vii) None of the Warrantors and other Group Companies has been subject to any indictment, convicted in any criminal case, subject to government investigation for bribery or found by a court of providing misleading information in any matter.

3.10 Certain Regulatory Matters.

(i) The Founders, the Founder Holdcos, Haiyan’s Holdco, Zhu, and the Group Companies have obtained any and all Approvals from applicable Governmental Authorities and have fulfilled any and all filings and registration requirements with applicable Governmental Authorities necessary in respect of the Founders, the Founder Holdcos, Haiyan’s Holdco, Zhu and their investment in the Group Companies, and in respect of the Group Companies and their operations, respectively. All filings and registrations with applicable Governmental Authorities required in respect of the Group Companies, the Founder Holdcos, the Founders, Haiyan’s Holdco, and Zhu, including but not limited to the registrations with the Ministry of Commerce (or any predecessors), the Ministry of Information Industry, the SAIC, SAFE, the tax bureau, customs authorities, product registration authorities, health regulatory authorities and the local counterpart of each of such Governmental Authorities, as applicable, have been duly completed in accordance with applicable Law. No Founder, Founder Holdco, or Group Company, and to the Knowledge of each Warrantor, neither Haiyan’s Holdco nor Zhu, has received any letter or notice from any applicable Governmental Authorities notifying it of the revocation of any Approval issued to it or the need for compliance or remedial actions in respect of the activities carried out directly or indirectly by any Founder, any Founder Holdco, Haiyan’s Holdco, Zhu, or Group Company. Each Group Company has been conducting its business activities within the permitted scope of business or is otherwise operating its businesses in full compliance with all relevant Laws and Governmental Orders. No Founder or Group Company has reason to believe that any Approval requisite for the conduct of any part of its business, which is subject to periodic renewal will not be granted or renewed by the relevant Governmental Authorities.

(ii) Each holder or beneficiary owner of Equity Securities of the Company (each, a “Company Security Holder”), who is a “Domestic Resident” as defined in Circular 37 issued by the SAFE on July 4, 2014 (as supplemented by implementing rules and regulations and by any successor rule or regulation under PRC law, including but not limited to any rule or regulation interpreting or setting forth provisions for implementation of any of the foregoing, “Circular 37”) has complied with any applicable reporting and/or registration requirements under Circular 37 and any other applicable SAFE rules and regulations, (collectively, the “SAFE Rules and Regulations”). Neither the Warrantors nor, to the Knowledge of the Warrantors, any of the Company Security Holders has received any oral or

written inquiries, notifications, orders or any other forms of official correspondence from SAFE or any of its local branches with respect to any actual or alleged non-compliance with the SAFE Rules and Regulations and the Company and the Company Security Holders have made all oral or written filings, registrations, reporting or any other communications required by SAFE or any of its local branches. The WFOE has obtained all certificates, approvals, permits, licenses, registration receipts and any similar authorization necessary under PRC Laws to conduct foreign exchange transactions (collectively, the “Foreign Exchange Authorization”) as now being conducted by it, and believes it can obtain, without undue burden or expense, any such Foreign Exchange Authorization for the conduct of foreign exchange transactions as planned to be conducted. All existing Foreign Exchange Authorization held by the WFOE is valid and the WFOE is not in default under any of such Foreign Exchange Authorization.

3.11 Compliance with Other Instruments. No Group Company is in violation, breach or default of its Charter Documents. The execution, delivery and performance by each Group Company, each Founder, each Founder Holdco, Haiyan’s Holdco and Zhu of and compliance with each of the Transaction Documents, and the consummation of the transactions contemplated hereby and thereby, will not result in (i) any such violation, breach or default, or be in conflict with or constitute, with or without the passage of time or the giving of notice or both, a default under (a) the Charter Documents of any Group Company, (b) any Material Contract, or (c) any applicable Law, (ii) the creation or imposition of any material Lien upon, or with respect to, any of the properties, assets or rights of any Group Company, or (iii) any termination, modification, cancellation, or suspension of any material right of, or any augmentation or acceleration of any material obligation of, any Group Company.

3.12 Actions and Governmental Orders. There is no Action pending or, to the Knowledge of any Warrantor, threatened against any Group Company or any of the officers, directors or employees of any Group Company with respect to their businesses or proposed business activities, nor is any Warrantor aware of any basis for any of the foregoing, including with respect to any Action involving the prior employment of any of the employees of any Group Company, their use in connection with such Group Company’s business of any information or techniques allegedly proprietary to any of their former employers or their obligations under any agreements with prior employers. There is no Governmental Order in effect and binding on any Group Company or their respective assets or properties. There is no Action by any Group Company pending or which such Person intends to initiate against any third party. No Government Authority has at any time challenged or questioned in writing the legal right of any Group Company to conduct its business as presently being conducted or proposed to be conducted. No Group Company has received any opinion or memorandum or advice from legal counsel to the effect that it is exposed, from a legal standpoint, to any liability or disadvantage which may be material to its business.

3.13 Charter Documents; Books and Records. The Charter Documents of each Group Company are in the form provided to the Investor. Each Group Company has made available to the Investor or its counsel a copy of its minute books. Such copy is true, correct and complete, and contains all amendments and all minutes of meetings and actions taken by its shareholders and directors since the time of formation through the date hereof and reflects all transactions referred to in such minutes accurately in all material respects. Each Group Company maintains its books of accounts and records in the usual, regular and ordinary manner, on a basis consistent with prior practice and in compliance with applicable Laws,

and which permits its Financial Statements (as defined below) to be prepared in accordance with Applicable Accounting Principles.

3.14 Financial Statements. The Company has delivered to the Investor true, correct and complete copies of (A) the audited balance sheets, income statements and cash flow statements for each PRC Subsidiary as of and for the twelve-months ended December 31, 2015 (the “Statement Date”), and (B) the unaudited balance sheets, income statements and cash flow statements for each PRC Subsidiaries as of and for the three-month period ending September 30, 2016. The financial statements referred to above are collectively referred herein as the “Financial Statements”. The Financial Statements (i) have been prepared in accordance with the books and records of the Group, (ii) fairly present in all material respects the financial condition and position of the Group as of the dates indicated therein and the results of operations and cash flows of the Group for the periods indicated therein, except in the case of unaudited financial statements for the absence of notes, and (iii) were prepared in accordance with the Applicable Accounting Principles applied on a consistent basis throughout the periods involved. All of the accounts receivable owing to any of the Group Companies, including without limitation all accounts receivable set forth on the Financial Statements, constitute valid and enforceable claims and are good and collectible in the ordinary course of business, net of any reserves shown on the Financial Statements (which reserves are adequate and were calculated on a basis consistent with the Applicable Accounting Principles), and no further goods or services are required to be provided in order to complete the sales and to entitle the applicable Group Company to collect in full. There are no material contingent or asserted claims, refusals to pay, or other rights of set-off with respect to any accounts receivable of the Group Companies to the Knowledge of the Warrantors.

3.15 Changes. Since the Statement Date, the Group has operated its business in the ordinary course consistent with its past practice, there has not been any Material Adverse Effect or any material change in the way the Group conducts its business, no Group Company has entered into any transaction outside of the ordinary course of business consistent with its past practice, and there has not been by or with respect to any Group Company:

(i) any purchase, acquisition, sale, lease, disposal of or other transfer of any assets that are individually or in the aggregate material to its business, whether tangible or intangible, other than the purchase or sale of inventory in the ordinary course of business consistent with its past practice, or any acquisition (by merger, consolidation or other combination, or acquisition of stock or assets, or otherwise) of any business or other Person or division thereof;

(ii) any waiver, termination, settlement or compromise of a valuable right or of a debt;

(iii) any incurrence, creation, assumption, repayment, satisfaction, or discharge of (1) any material Lien (other than Permitted Liens) or (2) any indebtedness or guarantee, or the making of any loan or advance (other than reasonable and normal advances to employees for bona fide expenses that are incurred in the ordinary course of business consistent with its past practice), or the making of any investment or capital contribution;

(iv) any amendment to any Material Contract, any entering into of any new Material Contract, or any termination of any Contract that would have been a Material

Contract if in effect on the date hereof, or any amendment to any Charter Document, or any amendment to or waiver under any Charter Document;

(v) any declaration, setting aside or payment or other distribution in respect of any Equity Securities, or any direct or indirect redemption, purchase or other acquisition of any Equity Securities;

(vi) any damage, destruction or loss, whether or not covered by insurance, adversely affecting the assets, properties, financial condition, operations or business of any Group Company;

(vii) any material change in accounting methods or practices or any revaluation of any of its assets;

(viii) except in the ordinary course of business consistent with its past practice, settlement of any claim or assessment in respect of any material Taxes, or consent to any extension or waiver of the limitation period applicable to any claim or assessment in respect of any material Taxes, entry or change of any material Tax election, change of any method of accounting resulting in a material amount of additional Tax or filing of any material amended Tax Return;

(ix) any material change in any compensation arrangement or agreement with any employee, officer, director, or shareholder;

(x) any resignation or termination of employment of any senior manager (i.e., the chief executive officer, the chief financial officer, the chief technology officer, the president, the general manager or any other manager with the title of “vice-president” or higher, similarly hereafter) or Key Employee of any Group Company;

(xi) any sale, assignment or transfer of any Company Intellectual Property that could reasonably be expected to result in a Material Adverse Effect;

(xii) receipt of notice that there has been a loss of, or material order cancellation by, any major customer of any Group Company;

(xiii) to the Warrantors’ Knowledge, any other event or condition of any character, other than events affecting the economy or the Company’s industry generally, that could be reasonably be expected to result in a Material Adverse Effect;

(xiv) any commencement or settlement of any Action; or

(xv) any agreement or commitment to do any of the things described in this Section 3.15 except pursuant to this Agreement or the Ancillary Agreements.

3.16 Liabilities. No Group Company has any Liabilities except for (i) liabilities set forth in the Financial Statements that have not been satisfied since the Statement Date, and (ii) current liabilities incurred since the Statement Date in the ordinary course of the Group’s business consistent with its past practices.

3.17 Material Contracts. A true, fully-executed copy of each Material Contract has been delivered to the Investor. Each Material Contract is a valid and binding agreement of the Group Company that is a party thereto, the performance of which does not and will not

violate any applicable Law or Governmental Order, and is in full force and effect, and such Group Company has duly performed all of its obligations under each Material Contract to the extent that such obligations to perform have accrued, and no breach or default, alleged breach or alleged default, or event which would (with the passage of time, notice or both) constitute a breach or default thereunder by such Group Company or, to the Knowledge of the Warrantors, any other party or obligor with respect thereto, has occurred, or as a result of the execution, delivery, and performance of the Transaction Documents will occur. No Group Company has given notice (whether or not written) that it intends to terminate a Material Contract or that any other party thereto has breached, violated or defaulted under any Material Contract. No Group Company has received any notice (whether written or not) that it has breached, violated or defaulted under any Material Contract or that any other party thereto intends to terminate such Material Contract. For the purpose of this Agreement, the term “Material Contract” means any Contract to which a Group Company is bound that (a) involves obligations (contingent or otherwise) or payments in excess of US$200,000 individually or in the aggregate, (b) involves Intellectual Property that is material to a Group Company (other than generally-available “off-the-shelf” shrink-wrap software licenses obtained by the Group on non-exclusive and non-negotiated terms) other than the business contracts of any Group Company in the ordinary course of business which involves any kind of Intellectual Property, (c) restricts the ability of a Group Company to compete or to conduct or engage in any business or activity or in any territory, (d) relates to the sale, issuance, grant, exercise, award, purchase, repurchase or redemption of any Equity Securities, (e) involves any provisions providing exclusivity, “change in control”, “most favored nations”, rights of first refusal or first negotiation or similar rights, or grants a power of attorney, agency or similar authority, (f) is with an officer, director, shareholder or Affiliate, (g) involves indebtedness, an extension of credit, a guaranty or assumption of any obligation, or the grant of a Lien, (h) involves the lease, license, sale, use, disposition or acquisition of a material amount of assets or of a business, (i) involves the waiver, compromise, or settlement of any material dispute, claim, litigation or arbitration, (j) involves the ownership or lease of, title to, use of, or any leasehold or other interest in, any real or personal property (except for personal property leases involving payments of less than US$25,000 per annum), (k) involves the establishment, contribution to, or operation of a partnership, joint venture or involving a sharing of profits or losses, or any investment in, loan to or acquisition or sale of the securities, equity interests or assets of any Person, (l) is with any Key Employee, (m) is between a Group Company and another Group Company, (n) is with a Governmental Authority or state-owned enterprise, (o) is a Control Document or (p) is otherwise material to a Group Company. A true and correct list of the Material Contracts is set forth in Schedule 3.17 of the Disclosure Schedule.

3.18 Title; Properties.

(i) Title. The Group Companies have good and valid title to, or a valid leasehold interest in, all of their assets, whether real, personal or mixed, purported to be owned by them (including but not limited to all such assets reflected in the Financial Statements), free and clear of any Liens, other than Permitted Liens. The foregoing assets collectively represent in all material respects all assets, rights and properties necessary for the conduct of the business of the Group in the manner conducted during the periods covered by the Financial Statements. Except for leased items, no Person other than a Group Company owns any interest in any such assets. All leases of real or personal property to which a Group Company is a party are fully effective and afford the Group Company valid leasehold possession of the real or personal property that is the subject of the lease.

(ii) Real Property. No Group Company owns any real property or has any easements, licenses, rights of way, or other interests in or to real property (“Real Property”). All leasehold properties of the Group are held under valid, binding and enforceable leases of a Group Company. To the Knowledge of the Warrantors, all structures, improvements and appurtenances on the Real Property lie wholly within the boundaries of such Real Property and do not encroach upon the property of, or otherwise conflict with the property rights of, any adjoining property owner. To the Knowledge of the Warrantors, all structures and improvements on the Real Properties, and appurtenances thereto, and the roof, walls and other structural components which are part thereof, and the heating, air conditioning, plumbing and other mechanical facilities thereof, are in good condition and repair in all material respects (reasonable wear and tear excepted) and without structural defects. There are no facilities, services, assets or properties shared with any other Person, which is not a Group Company, which are used in connection with the business of the Group.

(iii) Personal Property. All machinery, vehicles, equipment and other tangible personal property owned or leased by a Group Company are (a) in good condition and repair in all material respects (reasonable wear and tear excepted) and (b) not obsolete or in need in any material respect of renewal or replacement, except for renewal or replacement in the ordinary course of business.

3.19 Intellectual Property Rights.

(i) Company Intellectual Property. The Group owns, has the sufficient rights (including but not limited to the rights of development, maintenance, licensing and sale) to, or otherwise has the licenses to use all Intellectual Property (“Company Intellectual Property”) (including Company Owned IP and Licensed IP, each as defined below) necessary and sufficient to conduct its business and any business as proposed to be conducted by the Group without any conflict with or infringement of the rights of any other Person. Section 3.19(i)(A) of the Disclosure Schedule sets forth a complete list of all patents, trademarks, service marks, trade names, domain names, copyrights and other forms of Intellectual Property (“Company Registered IP”) for which registrations have been obtained throughout the world (and all extensions or reissues of, any of the foregoing throughout the world) that are owned by, or registered or applied for in the name of, any Group Company. In addition to the Company Registered IP, all Intellectual Property owned by any Group Company but not covered under Company Registered IP together with the Company Registered IP are hereby referred to as the “Company Owned IP”. Section 3.19(i)(B) of the Disclosure Schedule sets forth a complete list of all Intellectual Property used by any Group Company through license from third parties (other than generally available “off-the-shelf” shrink-wrap software licenses obtained by the Group on non-exclusive and non-negotiated terms) (“Licensed IP”).

(ii) IP Ownership. All of Company Registered IP are owned by, registered or applied for solely in the name of a Group Company, are valid and subsisting and have not been abandoned, and all necessary registration, maintenance and renewal fees with respect thereto and currently due have been satisfied. No Group Company or any of its employees, officers or directors has taken any actions or failed to take any actions that would cause any of Company Intellectual Property to be invalid, unenforceable or not subsisting. No funding or facilities of a Governmental Authority or a university, college, other educational institution or research center was used in the development of any Company Intellectual Property. No Company Owned IP is the subject of any security interest, Lien, license or other Contract granting rights therein to any other Person. No Group Company has (a) transferred

or assigned, (b) granted a license to, or (c) provided to any Person any Company Owned IP material to its business as now conducted and as proposed to be conducted, to any Person. No Group Company is or has been a member or promoter of, or contributor to, any industry standards bodies, patent pooling organizations or similar organizations that could require or obligate a Group Company to grant or offer to any Person any license or right to any Company Owned IP. No Company Owned IP is subject to any proceeding or outstanding Government Order or settlement agreement or stipulation that restricts in any manner the use, transfer or licensing thereof, or any Group Company’s products or services, by the Company or may affect the validity, use or enforceability of such Company Owned IP. Each of the Founders and Key Employees has assigned and transferred to the Company or the WFOE any and all of his Intellectual Property related to the business currently conducted or proposed to be conducted by any Group Company.

(iii) Infringement, Misappropriation and Claims. No Group Company has violated, infringed or misappropriated in any material respect any Intellectual Property of any other Person, nor has any Group Company received any written notice alleging any of the foregoing. To the Knowledge of the Warrantors, no Person has violated, infringed or misappropriated any Company Intellectual Property, and no Group Company has given any written notice to any other Person alleging any of the foregoing. No Group Company has agreed to indemnify any Person for any infringement, violation or misappropriation of any Intellectual Property. Each of (A) the legal proceeding commenced by Nuance Communications, Inc. and certain of its subsidiaries (collectively, “Nuance”) against the Company and certain of its subsidiaries in the United States District Court for the District of Delaware entitled Nuance Communications, Inc., et al. v. Shanghai Han Xiang (CooTek) Information Technology Co., Ltd., Civil Action No. 13-095, (B) the complaint filed by Nuance in the United States International Trade Commission entitled In the Matter of Certain Mobile Handset Devices and Related Touch Keyboard Software, Inv. No. 337-TA-864, and (C) the legal proceeding commenced by Han Xiang in the Shanghai First Intermediate People’s Court entitled Shanghai Han Xiang (CooTek) Information Technology Co., Ltd. v. Nuance Communications, Inc. et al., No.(2013) Hu Xx Xxxxx Xxx Xx (Zhi) Chuzi 98 has been (i) completely and irrevocably terminated by the relevant parties with the approval by the relevant tribunals and (ii) fully settled among the relevant parties in accordance with the Settlement Agreement entered thereby on October 21, 2013 (the “Settlement Agreement”). The Settlement Agreement is effective and binding upon all the parties thereto. The Company has duly performed all its obligations under the Settlement Agreement, including having made all payments due from the Company under the Settlement Agreement. The Company has not breached any undertaking or commitment it made under the Settlement Agreement. Other than restrictions on the Company’s TouchPal products that are older than the V5.5 and V5.6 series, there is no restriction of any sort on the sale or delivery of any of the Company’s products in the United States or any other jurisdiction under the Settlement Agreement.

(iv) Assignments and Prior IP. All employees, contractors, agents and consultants of a Group Company who are or were involved in the creation of any Intellectual Property for such Group Company have executed an assignment of inventions agreement that vests in the Group Company exclusive ownership of all right, title and interest in and to such Intellectual Property, to the extent not already provided by Law. To the Knowledge of the Warrantors, it will not be necessary to utilize any inventions, trade secrets or proprietary information or other Intellectual Property of any of its employees or of any other Person (whether a former employee of a Group Company or otherwise), except for inventions, trade

secrets or proprietary information that have been properly assigned to and are exclusively owned by a Group Company. To the Knowledge of the Warrantors, none of the officers, employees and consultants currently or previously employed or otherwise engaged by any Group Company is in violation of any current or prior confidentiality, non-competition or non-solicitation obligations to any Group Company or to any other Persons, including former employers. None of the Key Employees of any Group Company is obligated under any Contract, or subject to any Governmental Order, that would interfere with the use of his or her best efforts to promote the interests of the Group or that would conflict with the business of the Group as presently conducted.