Contract

Exhibit 10.27

EXECUTION VERSION

This SECOND AMENDMENT TO THE REVOLVING CREDIT AND SECURITY AGREEMENT (this “Amendment”), dated as of February 2, 2023 (the “Amendment Date”), is entered into by and among OFSCC-FS, LLC, a Delaware limited liability company, as the borrower (the “Borrower”), the LENDERS party to the Revolving Credit Agreement, BNP PARIBAS, as the administrative agent for the Secured Parties (the “Administrative Agent”), OFSCC-FS HOLDINGS, LLC, a Delaware limited liability company, as equityholder (the “Equityholder”), OFS CAPITAL CORPORATION, a Delaware corporation, as servicer (the “Servicer”), and VIRTUS GROUP, LP, as collateral administrator (the “Collateral Administrator”).

WHEREAS, the Borrower, the lenders from time to time party thereto, the Administrative Agent, the Equityholder, the Servicer, CITIBANK, N.A., as collateral agent, and the Collateral Administrator are party to the Revolving Credit and Security Agreement, dated as of June 20, 2019 (as amended from time to time prior to the date hereof, the “Revolving Credit Agreement”); and

WHEREAS, the parties hereto desire to amend the Revolving Credit Agreement, in accordance with Section 13.01(b) of the Revolving Credit Agreement subject to the terms and conditions set forth herein.

NOW THEREFORE, in consideration of the foregoing premises and the mutual agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound, hereby agree as follows:

ARTICLE I

Definitions

SECTION 1.1Defined Terms. Terms used but not defined herein have the respective meanings given to such terms in the Revolving Credit Agreement.

ARTICLE II

Amendments to Revolving Credit Agreement

Amendments to Revolving Credit Agreement

SECTION 2.1As of the Amendment Date the Revolving Credit Agreement (including the exhibits thereto) is hereby amended to delete the stricken text (indicated textually in the same manner as the following example: stricken text) and to add the bold and double-underlined text (indicated textually in the same manner as the following example: bold and double-underlined text) as set forth on the pages attached as Appendix A hereto.

1

ARTICLE III

Representations and Warranties

SECTION 3.1The Borrower, the Servicer and the Equityholder hereby represent and warrant to the Administrative Agent and the Lender that, as of the Amendment Date, (i) no Default, Event of Default, Potential Servicer Removal Event or Servicer Removal Event has occurred and is continuing or shall occur on the Amendment Date after giving effect to this Amendment and the transaction contemplated hereby and (ii) the representations and warranties of the Borrower, the Servicer and the Equityholder contained in Sections 4.01, 4.02 and 4.03 of the Revolving Credit Agreement are true and correct in all material respects on and as of the Amendment Date (other than any representation and warranty that is made as of a specific date).

ARTICLE IV

Conditions Precedent

Conditions Precedent

SECTION 4.1This Amendment will be effective upon the satisfaction of each of the following conditions:

a.the execution and delivery of this Amendment by the parties hereto; and

b.all fees due and owing to the Administrative Agent and each Lender on or prior to the Amendment Date have been paid.

ARTICLE V

Miscellaneous

Miscellaneous

SECTION 5.1Governing Law. THIS AMENDMENT AND THE RIGHTS AND OBLIGATIONS OF THE PARTIES UNDER THIS AMENDMENT AND ANY CLAIM, CONTROVERSY, DISPUTE OR CAUSE OF ACTION (WHETHER IN CONTRACT OR TORT OR OTHERWISE) BASED UPON, ARISING OUT OF OR RELATING TO THIS AMENDMENT AND THE TRANSACTIONS CONTEMPLATED HEREBY SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAW OF THE STATE OF NEW YORK.

SECTION 5.2Severability Clause. In case any provision in this Amendment deemed to be invalid, illegal or unenforceable, the remaining provisions of this Amendment remain in full force and effect.

SECTION 5.3Ratification. Except as expressly amended hereby, the Revolving Credit Agreement is in all respects ratified and confirmed and all the terms, conditions and provisions thereof will remain in full force and effect. When effective, this Amendment will form a part of the Revolving Credit Agreement for all purposes and reference to this specific Amendment need not be made in the Revolving Credit Agreement or any other instrument or document executed in connection therewith, or in any certificate, letter or communication issued or made pursuant to or with respect to the Revolving Credit Agreement, any reference in any of

2

such items to the Revolving Credit Agreement being sufficient to refer to the Revolving Credit Agreement as amended hereby. On and after the effectiveness of this Amendment, this Amendment shall for all purposes constitute a “Facility Document” and each reference in the Revolving Credit Agreement to “herein”, “hereunder” or words of like import referring to the Revolving Credit Agreement and each reference in any other Facility Document to “Revolving Credit Agreement”, “thereunder”, “thereof” or words of like import referring to the “Revolving Credit Agreement” shall mean and be a reference to the Revolving Credit Agreement as amended hereby. The execution, delivery and performance of this Amendment shall not constitute a waiver of any provision of or operate as a waiver of any right, power or remedy under the Revolving Credit Agreement or any of the other Facility Documents. This Amendment shall not constitute a novation of the obligations and liabilities of the parties under the Revolving Credit Agreement or the other Facility Documents as in effect on or prior to the Amendment Date.

SECTION 5.4Counterparts. The parties hereto may sign one or more copies of this Amendment in counterparts, all of which together constitute one and the same agreement. Delivery of an executed signature page of this Amendment by facsimile or email transmission is effective as delivery of a manually executed counterpart hereof. This Amendment shall be valid, binding and enforceable against a party when executed and delivered by an authorized individual on behalf of the party by means of (i) an original manual signature; (ii) a faxed, scanned or photocopied manual signature; or (iii) any other electronic signature permitted by the federal Electronic Signatures in Global and National Commerce Act, state enactments of the Uniform Electronic Transactions Act, and/or any other relevant electronic signatures law, including any relevant provisions of the Uniform Commercial Code (collectively, “Signature Law”), in each case, to the extent applicable; provided that no electronic signatures may be affixed through the use of a third-party service provider. Each faxed, scanned, or photocopied manual signature, or other electronic signature, shall for all purposes have the same validity, legal effect, and admissibility in evidence as an original manual signature. Each party hereto shall be entitled to conclusively rely upon, and shall have no liability with respect to, any faxed, scanned, or photocopied manual signature, or other electronic signature, of any other party and shall have no duty to investigate, confirm or otherwise verify the validity or authenticity thereof. For the avoidance of doubt, original manual signatures shall be used for execution or indorsement of writings when required under the Uniform Commercial Code or other Signature Law due to the character or intended character of the writings.

SECTION 5.5Headings. The headings of the Articles and Sections in this Amendment are for convenience of reference only and are not deemed to alter or affect the meaning or interpretation of any provisions hereof.

SECTION 5.6Direction to Execute. The Administrative Agent hereby authorizes and directs the Collateral Agent to execute this Amendment.

[Signature Pages Follow]

3

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the Amendment Date.

BORROWER:

OFSCC-FS, LLC

By: /s/ Xxx X. Xxxxxxxx

Name: Xxx X. Xxxxxxxx

Title: Managing Director

Name: Xxx X. Xxxxxxxx

Title: Managing Director

Second Amendment to Revolving Credit and Security Agreement

SERVICER:

OFS CAPITAL CORPORATION

By: /s/ Xxx X. Xxxxxxxx

Name: Xxx X. Xxxxxxxx

Title: Corporate Secretary

Name: Xxx X. Xxxxxxxx

Title: Corporate Secretary

Second Amendment to Revolving Credit and Security Agreement

EQUITYHOLDER:

OFSCC-FS HOLDINGS, LLC

By: /s/ Xxx X. Xxxxxxxx

Name: Xxx X. Xxxxxxxx

Title: Managing Director

Name: Xxx X. Xxxxxxxx

Title: Managing Director

Second Amendment to Revolving Credit and Security Agreement

ADMINISTRATIVE AGENT:

BNP PARIBAS,

as Administrative Agent

as Administrative Agent

By: /s/ Xxxxxxxx Xxxxxxxxx

Name: Xxxxxxxx Xxxxxxxxx

Title: Director

Name: Xxxxxxxx Xxxxxxxxx

Title: Director

By: /s/ Xxxxxxxxxx Xxxxxx

Name: Xxxxxxxxxx Xxxxxx

Title: Director

Name: Xxxxxxxxxx Xxxxxx

Title: Director

Second Amendment to Revolving Credit and Security Agreement

LENDER:

BNP PARIBAS,

as Lender

as Lender

By: /s/ Xxxxxxxx Xxxxxxxxx

Name: Xxxxxxxx Xxxxxxxxx

Title: Director

Name: Xxxxxxxx Xxxxxxxxx

Title: Director

By: /s/ Xxxxxxxxxx Xxxxxx

Name: Xxxxxxxxxx Xxxxxx

Title: Director

Name: Xxxxxxxxxx Xxxxxx

Title: Director

Second Amendment to Revolving Credit and Security Agreement

LENDER:

MITSUBISHI HC CAPITAL AMERICA, INC.,

as Lender

as Lender

By: /s/ Xxxxx X. Xxxxxx

Name: Xxxxx X. Xxxxxx

Title: Chief Credit Officer

Name: Xxxxx X. Xxxxxx

Title: Chief Credit Officer

Second Amendment to Revolving Credit and Security Agreement

COLLATERAL ADMINISTRATOR:

VIRTUS GROUP, LP

By: Rocket Partners Holdings, LLC, its General Partner

By: /s/ Xxxx Xxxxxxx

Name: Xxxx Xxxxxxx

Title: Authorized Signatory

Name: Xxxx Xxxxxxx

Title: Authorized Signatory

Second Amendment to Revolving Credit and Security Agreement

APPENDIX A

ARTICLE VI EXECUTION VERSION

EXECUTION VERSION

EXECUTION VERSION

EXECUTION VERSION Conformed through FirstSecond Amendment, dated as of June 24February 2, 20222023

among OFSCC-FS, LLC,

as Borrower,

THE LENDERS FROM TIME TO TIME PARTIES HERETO, BNP PARIBAS,

as Administrative Agent,

OFSCC-FS HOLDINGS, LLC,

as Equityholder,

OFS CAPITAL CORPORATION,

as Servicer,

VIRTUS GROUP, LP,

as Collateral Administrator, and

CITIBANK, N.A.,

as Collateral Agent

Dated as of June 20, 2019

USActive 58387584.158387591.4 | ||

continuation of his or her service as Independent Manager is not: (i) an employee, director, stockholder, member, manager, partner or officer of the Borrower or any of its Affiliates (other than his or her service as an Independent Manager of the Borrower or other Affiliates that are structured to be “bankruptcy remote”); (ii) a customer or supplier of the Borrower or any of its Affiliates (other than his or her service as an Independent Manager of the Borrower or any such Affiliate); (iii) a Person controlling or under common control with any partner, shareholder, member, manager, Affiliate or supplier of the Borrower or any Affiliate of the Borrower or (iv) any member of the immediate family of a person described in clauses (i), (ii) or (iii); provided that an independent manager may serve in similar capacities for other special purpose entities established from time to time by Affiliates of the Borrower and (B) has (i) prior experience as an Independent Manager for a corporation or limited liability company whose charter documents required the unanimous consent of all Independent Managers thereof before such corporation or limited liability company could consent to the institution of bankruptcy or insolvency proceedings against it or could file a petition seeking relief under any applicable federal or state law relating to bankruptcy and (ii) at least three years of employment experience with one or more entities that provide, in the ordinary course of their respective businesses, advisory, management or placement services to issuers of securitization or structured finance instruments, agreements or securities.

“Individual Lender Maximum Funding Amount” means, as to each Lender, the maximum amount of Advances to the Borrower pursuant to Section 2.01 in an aggregate principal amount at any one time outstanding for such Lender up to but not exceeding the amount set forth opposite the name of such Lender on Schedule 1 or in the Assignment and Acceptance pursuant to which such Lender shall have assumed its Individual Lender Maximum Funding Amount, as applicable, as such amount may be reduced from time to time pursuant to Section 2.07, increased from time to time pursuant to Section 2.19(d) in connection with a Facility Increase or increased or reduced from time to time pursuant to assignments effected in accordance with Section 13.06(a).

“Ineligible Collateral Loan” means, at any time, a Collateral Loan or any portion thereof, that fails to satisfy any criteria of the definition of Eligible Collateral Loan as of the date when such criteria are applicable; it being understood that such criteria in the definition of Eligible Collateral Loan that is specified to be applicable only as of the date of acquisition of such Collateral Loan shall not be applicable after the date of acquisition of such Collateral Loan.

“Initial Approved List” has the meaning specified in Section 2.02 hereof.

“Initial AUP Report Date” has the meaning assigned to such term in Section

8.09(a).

“Insolvency Event” means, with respect to a specified Person, (a) the filing of a decree or order for relief by a court having jurisdiction in the premises in respect of such Person or any substantial part of its property in an involuntary case under the Bankruptcy Code or any other applicable insolvency law now or hereafter in effect, or appointing a receiver, liquidator, assignee, custodian, trustee, sequestrator or similar official for such Person or for any substantial part of its property, or ordering the winding-up or liquidation of such Person’s affairs, and such decree or order shall remain unstayed and in effect for a period of sixty (60) consecutive days; or

USActive 58387584.158387591.4 -31-

(b) the commencement by such Person of a voluntary case under the Bankruptcy Code or any other applicable insolvency law now or hereafter in effect, or the consent by such Person to the entry of an order for relief in an involuntary case under any such law, or the consent by such Person to the appointment of or taking possession by a receiver, liquidator, assignee, custodian, trustee, sequestrator or similar official for such Person or for any substantial part of its property, or the making by such Person of any general assignment for the benefit of creditors, or the failure by such Person generally to pay its debts as such debts become due, or the taking of action by such Person in furtherance of any of the foregoing.

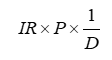

“Instrument” has the meaning specified in Section 9-102(a)(47) of the UCC. “Interest” means, for any day during an Interest Accrual Period with respect to

the Advances made with respect to each Class, the sum of the products (for each day elapsed during such Interest Accrual Period) of:

where:

IR = the Interest Rate for such Class for such Interest Accrual Period;

P = the principal amount of the Advances made in respect of such Class outstanding on such day; and

D = 360 days.

“Interest Accrual Period” means (a) with respect to the first Payment Date, the period from and including the Closing Date to but excluding the first day of the calendar month in which the first Payment Date occurs and (b) with respect to any subsequent Payment Date, the period from and including the first day of the calendar month in which the preceding Payment Date occurred to but excluding the first day of the calendar month in which such Payment Date occurs; provided that the final Interest Accrual Period hereunder ends on and includes the day prior to the payment in full of the Advances hereunder.

“Interest Collection Subaccount” has the meaning assigned to such term in Section 8.02(a).

“Interest Coverage Ratio” means, on any Determination Date, the percentage

equal to:

a.(i) an amount equal to the Collateral Interest Amount at such time minus

(ii) the amount payable on the Payment Date immediately following such date of determination pursuant to Sections 9.01(a)(i)(A) and (CB); divided by

b.the amount payable on the Payment Date immediately following such date of determination pursuant to Section 9.01(a)(i)(BC).

USActive 58387584.158387591.4 -32-

if the same can be obtained without undue expense or effort, all other documents evidencing, securing, guarantying, governing or giving rise to such Collateral Loan.

“Relevant Governmental Body” means the Federal Reserve Board or the Federal Reserve Bank of New York, or a committee officially endorsed or convened by the Federal Reserve Board or the Federal Reserve Bank of New York, or any successor thereto.

“Relevant Test Period” means, with respect to any Collateral Loan, the relevant test period for the calculation of EBITDA, Debt Service Coverage Ratio or Senior Net Leverage Ratio, as applicable, for such Collateral Loan in the applicable Related Documents or, if no such period is provided for therein, for Obligors delivering monthly financial statements, each period of the last twelve consecutive reported calendar months (provided that any such monthly financial statements will not be deemed reported hereunder until the date that is (10) Business Days after the date of receipt by the Borrower thereof), and for Obligors delivering quarterly financial statements, each period of the last four consecutive reported fiscal quarters of the principal Obligor on such Collateral Loan; provided that, with respect to any Collateral Loan for which the relevant test period is not provided for in the applicable Related Documents, if an Obligor is a newly-formed entity as to which twelve consecutive calendar months have not yet elapsed, “Relevant Test Period” shall initially include the period from the date of formation of such Obligor or closing date of the applicable Collateral Loan to the end of the twelfth calendar month or fourth fiscal quarter (as the case may be) from the date of formation or closing, as applicable, and shall subsequently include each period of the last twelve consecutive reported calendar months or four consecutive reported fiscal quarters (as the case may be) of such Obligor.

“Replacement Servicer” has the meaning assigned to such term in Section

11.01 (c).

“Requested Amount” has the meaning assigned to such term in Section 2.03.

“Required Lenders” means, as of any date of determination, the Administrative

Agent and Lenders having aggregate Percentages greater than or equal to 66 2/3%; provided, howeverthat in addition to the foregoing, if there are (x) exactly two (2) Lenders that are not Affiliates at such time, both Lenders shall be required to constitute “Required Lenders” and (y) more than two (2) Lenders that are not Affiliates at such time, at least two (2) Lenders that are not Affiliates shall be required to constitute “Required Lenders”; provided, further, that if any Lender shall be a Defaulting Lender at such time, then Advances owing to such Defaulting Lender and such Defaulting Lender’s unfunded Individual Lender Maximum Funding Amounts shall be excluded from the determination of Required Lenders.

“Responsible Officer” means (a) in the case of (i) a corporation or (ii) a partnership or limited liability company that, in each case, pursuant to its Constituent Documents, has officers, any chief executive officer, chief financial officer, chief administrative officer, managing director, president, senior vice president, vice president, assistant vice president, treasurer, director or manager, and, in any case where two Responsible Officers are acting on behalf of such entity, the second such Responsible Officer may be a secretary or assistant secretary (provided that a director or manager of the Borrower shall be a Responsible

USActive 58387584.158387591.4 -45-

the Collateral hereunder, the consummation of the transactions herein or therein contemplated, or compliance by it with the terms, conditions and provisions hereof or thereof, will (i) conflict with, or result in a material breach or violation of, or constitute a default under its Constituent Documents in any material respect or (ii) conflict with or contravene in any material respect, and with respect to clause (B), result in the creation of a Lien (other than Permitted Liens) under, (A) any Applicable Law, (B) any indenture, agreement or other contractual restriction binding on or affecting it or any of its assets, including any Related Document, or (C) any order, writ, judgment, award, injunction or decree binding on or affecting it or any of its assets or properties.

(f)Governmental Authorizations; Private Authorizations; Governmental Filings. It has obtained, maintained and kept in full force and effect all Governmental Authorizations and Private Authorizations which are necessary for it to properly carry out its business, except where the failure to do so does not and would not have a Material Adverse Effect, and made all material Governmental Filings necessary for the execution and delivery by it of the Facility Documents to which it is a party, the Advances under this Agreement, the pledge of the Collateral under this Agreement and the performance by it of its obligations under this Agreement and the other Facility Documents to which it is a party.

(g)Compliance with Agreements, Laws, Etc. It has duly observed and complied with all Applicable Laws relating to the conduct of its business and its assets, except where the failure to do so does not and would not have a Material Adverse Effect. It has preserved and kept in full force and effect its legal existence. It has preserved and kept in full force and effect its rights, privileges, qualifications and franchises, except where the failure to do so could not reasonably be expected to result in a Material Adverse Effect.

(h)Location. Its office in which it maintains its limited liability company books and records is located at the addresses set forth on Schedule 5. Its registered office and jurisdiction of organization is the jurisdiction referred to in Section 4.01(a).

(i)Investment Company Act. Assuming compliance by each of the Lenders and any Participant with Section 13.06, neither it nor the pool of Collateral is required to register as an “investment company” under the Investment Company Act.

(j)ERISA. Neither it nor any member of the ERISA Group has, or during the past six years had, any liability or obligation with respect to any Plan or Multiemployer Plan that would reasonably be expected to result in a Material Adverse Effect.

(k)Xxxxxxx Rule. To the knowledge of the Borrower, the transactions contemplated by this Agreement and the other TransactionFacility Documents do not result in any Lender or the Administrative Agent holding an “ownership interest” in a “covered fund” for purposes of the Xxxxxxx Rule.

(l)Taxes. It is a disregarded entity for U.S. federal income tax purposes. It has filed all income tax returns and all other material tax returns which are required to be filed by it, if any, and has paid all income taxes and all other material taxes shown to be due and payable on such returns, if any, or pursuant to any assessment received by any such Person other than any such taxes, assessments or charges that are being contested in good faith by appropriate

USActive 58387584.158387591.4 -77-

indemnities afforded to Citibank, N.A. or the Collateral Agent pursuant to this Article XII shall also be afforded to Citibank, N.A. or the Collateral Agent acting in such capacities; provided that such rights, protections, benefits, immunities and indemnities shall be in addition to, and not in limitation of, any rights, protections, benefits, immunities and indemnities provided in the Custodian Agreement, Account Control Agreement or any other Facility Documents to which Citibank, N.A. or the Collateral Agent in such capacity is a party.

(l)The Collateral Agent shall not have any obligation to determine if a Collateral Loan meets the criteria specified in the definition of Eligible Collateral Loan.

(m)The Collateral Administrator shall be entitled to the same rights, protections and indemnities as set forth with respect to the Collateral Agent in this Article XII.

ARTICLE XIII

MISCELLANEOUS

Section 13.01 No Waiver; Modifications in Writing.

(a) No failure or delay on the part of any Secured Party exercising any right, power or remedy hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of any such right, power or remedy preclude any other or further exercise thereof or the exercise of any other right, power or remedy. Any waiver of any provision of this Agreement or any other Facility Document, and any consent to any departure by any party to this Agreement or any other Facility Document from the terms of any provision of this Agreement or such other Facility Document, shall be effective only in the specific instance and for the specific purpose for which given. No notice to or demand on the Borrower or the Servicer in any case shall entitle the Borrower or the Servicer to any other or further notice or demand in similar or other circumstances.

(b)No amendment, modification, supplement or waiver of this Agreement shall be effective unless signed by the Borrower, the Servicer, the Administrative Agent, the Collateral Administrator and the Required Lenders; provided that:

(i)any Fundamental Amendment shall require the written consent of all Lenders affected thereby; and

(ii)no such amendment, modification, supplement or waiver shall amend, modify or otherwise affect the rights or duties of any Agent or the Collateral Administrator hereunder without the prior written consent of such Agent or Collateral Administrator.

(c)Notwithstanding anything to the contrary herein, in connection with the increase of the Individual Lender Maximum Funding Amounts hereunder, only the consent of the Lender increasing its Individual Lender Maximum Funding Amount (or providing a new Individual Lender Maximum Funding Amount) shall be required for any amendment that effects such increase in Individual Lender Maximum Funding Amounts.

USActive 58387584.158387591.4 -137-

ARTICLE VII SCHEDULE 1

INITIAL INDIVIDUAL LENDER MAXIMUM FUNDING AMOUNTS AND PERCENTAGES

Lender | Individual Lender Maximum Funding Amount | Percentage of Individual Lender Maximum Funding Amounts | ||||||

BNP Paribas | An amount equal to the Facility Amount $130,000,000 | 100%86.66666% | ||||||

Mitsubishi HC Capital America, Inc. | $20,000,000 | 13.33333% | ||||||

USActive 58399186.158399186.2 Sch. 1-1

Servicer

OFS Capital Corporation 00 X Xxxxxx Xx #0000

Xxxxxxx, XX 00000 Attention: Xxx Xxxxxxxx Fax No.: (000) 000-0000

Email: xxxxxxxxx@xxxxxxxxxxxxx.xxx

With a copy to:

Dechert LLP Three Bryant Park

1095 Avenue of the Americas Xxx Xxxx, XX 00000-0000

Attention: Xxx X. Xxxxxxxxx Telephone: (000) 000-0000

Administrative Agent

BNP Paribas

Solutions Portfolio Management 000 0xx Xxxxxx

Xxx Xxxx, Xxx Xxxx 00000 Telephone No.: 000-000-0000

Facsimile No.: 000-000-0000

E-mail: xx.xxxx.xxx.xxxxxxxxxxx@xx.xxxxxxxxxx.xxx Attention: Xxxxx Xxxx

Lender

BNP Paribas

Loan Servicing

000 Xxxxxxxxxx Xxxx, 0xx Xxxxx Xxxxxx Xxxx, Xxx Xxxxxx 00000 Attention: NYLS FIG Support Facsimile no.: 000-000-0000

E-mail: xxxx.xxx.xxxxxxx@xx.xxxxxxxxxx.xxx

Mitsubishi HC Capital America, Inc. 000 Xxxxxxxxxxx Xxx.

Xxxxxxx, XX 00000

Collateral Agent

USActive 58399186.158399186.2 Sch. 5-2

EXHIBIT F

AGREED-UPON PROCEDURES FOR INDEPENDENT PUBLIC ACCOUNTANTS

In accordance with Section 8.09 of the Revolving Credit and Security Agreement dated as of June 20, 2019 among OFSCC-FS, LLC, as borrower (the “Borrower”), the lenders from time to time parties thereto, BNP Paribas, as administrative agent (the “Administrative Agent”), OFSCC-FS Holdings, LLC, as equityholder, OFS Capital Corporation, as servicer (the “Servicer”), Citibank, N.A., as collateral agent, and Virtus Group, LP, as collateral administrator (as the same may from time to time be amended, supplemented, waived or otherwise modified, the “Revolving Credit Agreement”), the Servicer will cause a firm of nationally recognized independent public accountants to furnish in accordance with attestation standards established by the American Institute of Certified Public Accountants a report to the effect that such accountants have verified, compared to the systems, underwriting files, compliance certificates, underlying loan documents, or other relevant materials, or recalculated each of the following items in the Monthly Report or the Payment Date Report, as applicable, to the applicable system or records of the Servicer:

•ꞏ Collateral Loan List:

◦Loan Type (First Lien Loan, First Lien Last Out Loan, Second Lien Loan)

◦Loan Class (Class 1 Loan, Class 1A Loan, Class 2 Loan, Class 3 Loan)

◦Principal Balance

◦Adjusted Principal Balance

◦Collateral Loan Purchase Date (date Collateral Loan was added to facility)

◦Purchase Price

◦Collateral Loan Maturity Date

◦Interest Rate (Floating/Fixed), Index, LIBOR Floor, spread, PIK

◦Moody’s Industry Classification

◦Moody’s and S&P ratings (if applicable)

◦Unfunded Amount

◦Net Senior Debt Leverage Ratio and Net Total Debt Leverage Ratio

◦Debt Service Coverage Ratio

◦Interest Coverage Ratio

◦Borrowing Base

◦Advances Outstanding

◦Discretionary Sales Calculations in accordance with Section 10.01(a)

◦Defaulted Collateral Loan Sales Calculations in accordance with Section 10.03(a)(iv) (includes substitutions)

◦Excess Concentration Amounts

◦Minimum OC Coverage Test by Class

◦Priority of Payments in accordance with Section 9.01 of the Revolving Credit Agreement

At the discretion of the Administrative Agent and a firm of nationally recognized independent public accountants, one Monthly Report and one Payment Date Report beginning

EXHIBIT F

with the 2019 fiscal year will be chosen and reviewed in accordance with Section 8.09 of the Revolving Credit Agreement.

The report provided by such firm may be in a format typically utilized for a report of this nature; provided that it will consist of at a minimum (i) a list of material deviations from the Monthly Report and Payment Date Report and (ii) the reason for such material deviations, and set forth the findings in such report. Subject to Section 8.09 of the Revolving Credit Agreement, the format and content of the agreed upon procedures described above may be revised by the Administrative Agent and the Servicer without the necessity of an amendment to the Revolving Credit Agreement.