WARRANT CONSENT AND CONVERSION AGREEMENT by and among GP INVESTMENTS ACQUISITION CORP., RIMINI STREET, INC. and CB AGENT SERVICES LLC Dated as of May 16, 2017

Exhibit 4.8

by and among

RIMINI STREET, INC.

and

CB AGENT SERVICES LLC

Dated as of May 16, 2017

This Warrant Consent and Conversion Agreement (this “Agreement”) is made and entered into as of May 16, 2017, by and among GP Investments Acquisition Corp., a Cayman Islands exempted company limited by shares (which shall domesticate as a Delaware corporation prior to the Closing of the Mergers (each as defined in the Merger Agreement)) (the “Company”), Rimini Street, Inc., a Nevada corporation (“Rimini”), and CB Agent Services LLC, a Delaware limited liability company (“CBAS” and, together with its successors or permitted direct or indirect transferees (including those set forth in Schedule 2.1(b) hereto), each, an “Investor” and collectively, the “Investors”).

ARTICLE I

Section 1.1 Incorporation of Definitions. Each capitalized term used herein without definition has the meaning assigned thereto (or incorporated by reference) in either (a) that certain Financing Agreement, dated as of June 24, 2016 (as amended and in effect from time to time, the “Financing Agreement”) among Rimini, each Subsidiary of Rimini listed as a “Guarantor” on the signature pages thereto, the lenders from time to time party thereto (the “Lenders”), Cortland Capital Market Services LLC, as collateral agent and administrative agent for the Lenders and CB Agent Services LLC, as origination agent or (b) the Merger Agreement, as applicable.

Section 1.2 Definitions. For all purposes of this Agreement the following terms shall have the meanings set forth herein or elsewhere in the provisions hereof:

“Affiliate” means with respect to any Person, any other Person that directly or indirectly through one or more intermediaries controls or is controlled by or is under direct or indirect common control with the specified Person; provided, however, that for purposes of this Agreement neither any Investor nor any Holder (or any of their respective Affiliates) shall be an Affiliate of the Company, Rimini or any of their respective Subsidiaries.

“Change of Control” means a “Change of Control” as defined in the Warrants.

“Closing” has the meaning set forth in Section 2.2.

“Closing Date” has the meaning set forth in Section 2.2.

“Company” has the meaning set forth in the preamble.

“Convertible Securities” means evidences of indebtedness, shares of stock or other Equity Interest or rights that by their terms are exchangeable for or exercisable or convertible, directly or indirectly, into a specified Equity Interest of the Company either immediately or upon the arrival of a specified date or the occurrence of a specified event (other than substitutions for or replacements of a Warrant).

“Equity Interests” means (a) all shares of capital stock (whether denominated as common stock or preferred stock), equity interests, beneficial, partnership or membership interests, joint venture interests, participations or other ownership or profit interests in or equivalents (regardless of how designated) of or in a Person (other than an individual), whether voting or non-voting and (b) all securities convertible into or exchangeable for any of the foregoing and all warrants, options or other rights to purchase, subscribe for or otherwise acquire any of the foregoing, whether or not presently convertible, exchangeable or exercisable; provided that any instrument evidencing Indebtedness convertible or exchangeable for Equity Interests shall not be deemed to be Equity Interests, unless and until any such instruments are so converted or exchanged.

2

“Exchange Act” means the Securities Exchange Act of 1934, as in effect from time to time.

“Financing Agreement” has the meaning set forth in Section 1.1.

“Governmental Authority” means any federal, national, supranational, transnational, domestic, foreign, state, provincial, local, county, municipal or other government, any governmental, regulatory or administrative authority, agency, department, bureau, board, commission or official or any quasi-governmental or private body, including any political subdivision thereof or any self-regulatory organization, exercising any regulatory, taxing, importing or other governmental or quasi-governmental authority or powers, or any court tribunal, judicial or arbitral body.

“Holder” means, as to any Warrant or Warrant Share, the holder thereof, unless such holder shall have presented such Warrant or Warrant Share to the Company for transfer as permitted herein and the transferee shall have been entered in the Company’s register as a subsequent holder, in which case “Holder” means such subsequent holder.

“Investor” or “Investors” has the meaning set forth in the preamble.

“Law” means any law, statute, ordinance, regulation, code or order enacted, issued, promulgated, enforced or entered by a Governmental Authority.

“Lenders” has the meaning set forth in Section 1.1.

“Merger Agreement” has the meaning set forth in the recitals.

“Merger Sub” has the meaning set forth in the recitals.

“Person” means natural persons, corporations, limited liability companies, limited partnerships, general partnerships, limited liability partnerships, joint ventures, trusts, land trusts, business trusts, or other organizations, irrespective of whether they are legal entities, and governments and agencies and political subdivisions thereof.

“Registration Period” has the meaning set forth in Section 7.5.

“Requisite Holders” means with respect to the Company, the Holder or Holders at the relevant time (excluding the Company) of more than 50% of the number of (a) Shares then issuable upon exercise of the Warrants plus (b) the Warrant Shares then outstanding.

“Rimini” has the meaning set forth in the preamble.

“Rimini Exercise Price” has the meaning set forth in the recitals.

“Rimini Ratchet Shares” has the meaning set forth in the recitals.

“Rimini Share Amount” has the meaning set forth in the recitals.

3

“Rimini Shares” means shares of Class A Common Stock, par value $0.001 per share, of Rimini.

“Rimini Warrant Agreement” has the meaning set forth in the recitals.

“Rimini Warrants” has the meaning set forth in the recitals.

“SEC” means the United States Securities and Exchange Commission and any successor thereto.

“Securities Act” means the Securities Act of 1933, as amended, or any successor federal statute, and the rules and regulations of the SEC thereunder, all as the same shall be in effect at the time.

“Shares” means shares of common stock, par value $0.0001 per share, of the Company.

“Spreadsheet” means the Excel spreadsheet titled “RIVER Cap Table Model 2017 05 15 Final” provided to CBAS at 1:53 p.m., Eastern time, on May 15, 2017.

“Subsidiary” or “Subsidiaries” (whether or not capitalized) means, with respect to any Person, any corporation, partnership, limited liability company, association, joint venture or other business entity of which more than 50% of the total voting power of shares of stock or other ownership interests entitled (without regard to the occurrence of any contingency) to vote in the election of the Person or Persons (whether directors, managers, trustees or other Persons performing similar functions) having the power to direct or cause the direction of the management and policies thereof is at the time owned or controlled, directly or indirectly, by that Person or one or more of the other Subsidiaries of that Person or a combination thereof; provided, in determining the percentage of ownership interests of any Person controlled by another Person, no ownership interest in the nature of a “qualifying share” of the former Person shall be deemed to be outstanding.

“Transaction Agreements” shall include this Agreement and the Warrants, and any and every other present or future instrument or agreement from time to time entered into between the Company and an Investor or any other Holder of the Warrants or Warrant Shares and which relates to this Agreement or is stated to be a Transaction Agreement, as from time to time amended or modified.

“Warrants” has the meaning set forth in Section 2.1(b).

“Warrant Shares” means (a) Shares issuable upon exercise of the Warrants in accordance with their terms, (b) any securities into which or for which such Shares issuable upon exercise of the Warrants shall have been converted or exchanged pursuant to any recapitalization, reorganization or merger of the Company, and (c) any securities issued with respect to the foregoing pursuant to a dividend, distribution, combination or split.

4

Section 1.3 Other Definitional Terms. Unless the express context otherwise requires:

(a) the words “hereof,” “herein,” and “hereunder” and words of similar import, when used in this Agreement, shall refer to this Agreement as a whole and not to any particular provision of this Agreement;

(b) the terms defined in the singular have a comparable meaning when used in the plural, and vice versa;

(c) the terms “Dollars” and “$” mean United States Dollars;

(d) references herein to a specific Section, Article, Clause, Exhibit or Schedule shall refer, respectively, to Sections, Articles, Clauses, Exhibits or Schedules of this Agreement;

(e) wherever the word “include,” “includes,” or “including” is used in this Agreement, it shall be deemed to be followed by the words “without limitation”;

(f) the phrase “to the extent” means the extent to which something extends or exists, and not simply “if”; and

(g) references herein to any gender include each other gender.

ARTICLE II

Section 2.1 Conversion of Warrants.

(a) Notwithstanding the provisions contained in the Rimini Warrant Agreement and the Rimini Warrants, each Investor hereby agrees, immediately prior to, and contingent upon the occurrence of, the First Effective Time, to: (i) terminate the Rimini Warrant Agreement, (ii) surrender to Rimini any and all of its Rimini Warrants and (iii) receive Warrants issued pursuant to, and subject to the terms of, this Agreement. Rimini further agrees to terminate the Rimini Warrant Agreement.

(b) At the Closing and subject to the terms and conditions hereof, the Company hereby agrees to issue to each Investor and each Investor hereby agrees to convert its allocated portion, as set forth on Schedule 2.1(b) hereto, of Rimini Warrants into warrants to purchase Shares (the “Warrants”) in the form attached hereto as Exhibit A. As of the Closing, each of the Rimini Warrants shall, upon conversion into Warrants, be cancelled and shall cease to represent a right to acquire Rimini Shares.

(c) The issuance of the Warrants to the Investors at the Closing is being made pursuant to the terms of this Agreement and the Merger Agreement, and no additional consideration shall be payable by any of the Investors to the Company with respect to the issuance of the Warrants.

5

(d) The Company, Rimini and CPAS agree that this Agreement, the Rimini Warrant Agreement, the Rimini Warrants, and the Warrants shall not be Loan Documents pursuant to the Financing Agreement.

Section 2.3 Tax Reporting. The Company, Rimini and the Investors agree that the Rimini Warrants and the Warrants do not have a “readily ascertainable fair market value” within the meaning of Section 83(e) of the Internal Revenue Code of 1986, as amended, and neither the Company, Rimini nor the Investors will take any position on any return, report or other document relating to taxes that is inconsistent with that agreement unless otherwise required by a taxing authority. The Company, Rimini and the Investors further agree that the Rimini Warrants and the Warrants are intended to constitute compensation for the performance of services by an independent contractor under the Consulting Agreement, in which case, provided that (i) the Investors are U.S. Persons (as defined in the Financing Agreement), (ii) such services are performed outside of the United States, or (iii) such services are provided within the United States by a foreign corporation or foreign partnership and the Warrants are effectively connected with the conduct by such entity of a trade or business in the United States, no withholding in respect of any U.S. federal, state or local tax is or will be required.

Section 2.4 Transfer Taxes. The Company shall pay any recording, filing, stamp or similar tax which may be payable in respect of any transfer involved in the issuance of, and the preparation and delivery of any certificate representing, the Warrants.

Section 2.5 Deliverables of the Company. Prior to, or simultaneously with, the Closing, the Company shall have delivered:

(a) a duly executed certificate of the Secretary of the Company, certifying as to the resolutions of the Board of Directors of the Company approving this Agreement, the issuance of the Warrants and the issuance of the Shares upon exercise of the Warrants; and

(b) an original Warrant issued to each Investor, registered in such Investor’s name in the records of the Company.

Section 2.6 Deliverables of the Investors. Prior to, or simultaneously with, the Closing, each Investor shall have delivered the Rimini Warrants held by such Investor.

Section 2.7 Deliverables of Rimini. Prior to, or simultaneously with, the Closing, Rimini shall have delivered a duly executed certificate of the Secretary of Rimini, certifying as to the resolutions of the Board of Directors of Rimini approving this Agreement.

6

ARTICLE III

Each Investor, severally and not jointly and only with respect to itself, represents and warrants to the Company and Rimini that, as of the Closing:

Section 3.1 Organization; Requisite Power and Authority; Qualification. Such Investor (a) is duly organized, validly existing and in good standing under the laws of its jurisdiction of organization, (b) has all requisite power and authority to own and operate its properties, to carry on its business as now conducted and as proposed to be conducted, to enter into the Transaction Agreements to which it is a party and to carry out the transactions contemplated thereby, and (c) is qualified to do business and in good standing in every jurisdiction where its assets are located and wherever necessary to carry out its business and operations, except in jurisdictions where the failure to be so qualified or in good standing has not had, and could not be reasonably expected to have, a material adverse effect on such Investor.

Section 3.2 Due Authorization. The execution, delivery and performance of this Agreement and each Transaction Agreement to which such Investor is a party have been duly authorized by all necessary action on the part of such Investor.

Section 3.3 No Conflict. The execution, delivery and performance by such Investor of this Agreement and each of the Transaction Agreements to which such Investor is a party and the consummation of the transactions contemplated by this Agreement and each of the Transaction Agreements do not and will not violate any provision of any law or any governmental rule or regulation applicable to such Investor, any of the Governing Documents of such Investor, or any order, judgment or decree of any court or other agency of government binding on such Investor.

Section 3.4 Governmental Consents. The execution, delivery and performance by such Investor of this Agreement and each of the Transaction Agreements to which such Investor is a party and the consummation of the transactions contemplated by this Agreement and each of the Transaction Agreements do not and will not require any registration with, consent or approval of, or notice to, or other action to, with or by, any Governmental Authority.

Section 3.5 Binding Obligation. This Agreement and each of the Transaction Agreements to which such Investor is a party has been duly executed and delivered by such Investor and is the legally valid and binding obligation of such Investor, enforceable against such Investor in accordance with its respective terms, except as may be limited by bankruptcy, insolvency, reorganization, moratorium or similar laws relating to or limiting creditors’ rights generally or by equitable principles relating to enforceability.

Section 3.6 Investment Representation.

(a) Such Investor (i) is an “accredited investor” as defined in Regulation D under the Securities Act, and (ii) is acquiring the Warrants for its own account, not as nominee or agent, for investment and, subject to the provisions of Section 7.5 hereof, not with a view to selling or otherwise distributing the Warrants or the Warrant Shares; provided, however, that the disposition of such Investor’s property shall at all times be and remain in its control. Investor further represents that it does not have any contract, undertaking, agreement or arrangement with any person to sell, transfer or grant participation to such Person with respect to the Warrant or Warrant Shares.

7

(b) Such Investor understands that it may be required to bear the economic risk of its investment in the Warrants for a substantial period of time because neither the Warrants nor the Warrant Shares have been registered under the Securities Act or the securities Laws of any state by reason of specific exemptions under the provisions thereof which depend in part on the investment intent of such Investor and upon the other representations made by such Investor in this Agreement and, therefore, cannot be sold unless they are subsequently registered under the Securities Act (including pursuant to Section 7.5 hereof) or an exemption from such registration is available.

(c) Such Investor understands that no federal or state agency, including the SEC or the securities regulatory agency of any state, has approved or disapproved the Warrants or the Warrant Shares, passed upon or endorsed the merits of the Warrants or the Warrant Shares, or made any finding or determination as to the fairness of the Warrants or Warrant Shares for private investment.

(d) Such Investor further understands that the Warrants and the Warrant Shares are currently “restricted securities” under the Securities Act. The Warrants and the Warrant Shares may not be sold, transferred or otherwise disposed of without registration under the Securities Act (including pursuant to Section 7.5 hereof) and applicable state securities laws or exemptions therefrom and, in the absence of an effective registration statement covering the Warrants or the Warrant Shares or available exemptions from registration under the Securities Act and applicable state securities laws, the Warrants and the Warrant Shares must be held indefinitely.

(e) The Investor has substantial experience in evaluating and investing in private placement transactions of securities in companies similar to the Company and acknowledges that the Investor can protect its own interests. The Investor has such knowledge and experience in financial and business matters so that the Investor is capable of evaluating the merits and risks of its investment in the Company.

Section 3.7 Legends. Subject to the provisions of Section 7.4 hereof, it is understood that the Warrants and Warrant Shares will bear one or all of the following conspicuous legends prior to such time as the Warrants or Warrant Shares are sold in accordance with either (x) an effective registration statement under the Securities Act covering the Warrants or Warrant Shares (including pursuant to Section 7.5 hereof) or a public sale or (y) Rule 144 promulgated under the Securities Act:

(a) THIS WARRANT AND THE UNDERLYING SECURITIES OF THE ISSUER ISSUED UPON EXERCISE OF SUCH WARRANT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR UNDER THE SECURITIES LAWS OF ANY STATE. THESE SECURITIES MAY NOT BE OFFERED, SOLD OR OTHERWISE TRANSFERRED, PLEDGED OR HYPOTHECATED EXCEPT AS PERMITTED UNDER THE ACT AND APPLICABLE STATE SECURITIES LAWS IN ACCORDANCE WITH APPLICABLE REGISTRATION REQUIREMENTS OR AN EXEMPTION THEREFROM. THE ISSUER OF THESE SECURITIES MAY REQUIRE AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE ISSUER THAT SUCH OFFER, SALE, TRANSFER, PLEDGE OR HYPOTHECATION OTHERWISE COMPLIES WITH THE SECURITIES ACT AND ANY APPLICABLE STATE SECURITIES LAWS.

8

(b) THE UNDERLYING SECURITIES OF THE ISSUER ISSUED UPON EXERCISE OF THIS WARRANT SHALL BE ENTITLED TO REGISTRATION RIGHTS UNDER THE WARRANT CONSENT AND CONVERSION AGREEMENT EXECUTED BY THE COMPANY AND THE HOLDER HEREOF. SUBJECT TO SUCH REGISTRATION RIGHTS, THIS WARRANT MUST BE SURRENDERED TO THE COMPANY OR ITS TRANSFER AGENT AS A CONDITION PRECEDENT TO THE SALE, TRANSFER, PLEDGE OR HYPOTHECATION OF ANY INTEREST IN ANY OF THE SECURITIES REPRESENTED HEREBY.

(c) Any legend required by any applicable state securities Laws.

Section 3.8 Tax Advisors. The Investor has reviewed with its own tax advisors the U.S. federal, state and local and non-U.S. tax consequences of this Agreement and the transactions contemplated hereby. With respect to such matters, the Investor relies solely on any such advisors and not on any statements or representations of the Company or Rimini or any of their agents, written or oral. The Investor understands that it (and not the Company or Rimini) shall be responsible for its own tax liability that may arise as a result of this Agreement and the transactions contemplated hereby.

ARTICLE IV

The Company hereby represents and warrants to each Investor on behalf of itself and Merger Sub that, as of the Closing:

Section 4.1 Organization; Requisite Power and Authority; Qualification. Each of the Company and Merger Sub (a) is duly organized, validly existing and in good standing under the laws of its jurisdiction of organization, (b) has all requisite power and authority to own and operate its properties, to carry on its business as now conducted and as proposed to be conducted, to enter into the Transaction Agreements to which it is a party and to carry out the transactions contemplated thereby, and (c) is qualified to do business and in good standing in every jurisdiction where its assets are located and wherever necessary to carry out its business and operations, except in jurisdictions where the failure to be so qualified or in good standing has not had, and could not be reasonably expected to have, an Acquiror Material Adverse Effect (as defined in the Merger Agreement).

Section 4.2 Due Authorization. The execution, delivery and performance of this Agreement and each Transaction Agreement to which the Company is a party have been duly authorized by all necessary action on the part of the Company.

9

Section 4.3 No Conflict. The execution, delivery and performance by the Company of this Agreement and each of the Transaction Agreements to which the Company is a party and the consummation of the transactions contemplated by this Agreement and each of the Transaction Agreements do not and will not (a) violate any provision of any law or any governmental rule or regulation applicable to the Company or any of its Subsidiaries, any of the Acquiror Governing Documents (as defined in the Merger Agreement) or the Governing Documents of Merger Sub, or any order, judgment or decree of any court or other agency of government binding on the Company or Merger Sub; (b) conflict with, result in a breach of or constitute (with due notice or lapse of time or both) a default under any material agreement of the Company or Merger Sub; (c) result in or require the creation or imposition of any Lien upon any of the properties or assets of the Company or Merger Sub; or (d) require any approval of stockholders, members or partners or any approval or consent of any Person under any material agreement of the Company or Merger Sub, except for such approvals or consents which will be obtained on or before the Closing Date.

Section 4.4 Governmental Consents. The execution, delivery and performance by the Company of this Agreement and each of the Transaction Agreements to which the Company is a party and the consummation of the transactions contemplated by this Agreement and each of the Transaction Agreements do not and will not require any registration with, consent or approval of, or notice to, or other action to, with or by, any Governmental Authority except the filing of such notices as may be required under the Securities Act and such filings as may be required under applicable state securities laws, which will be timely made by the Company as and when required by such laws.

Section 4.5 Binding Obligation. This Agreement and each of the Transaction Agreements to which the Company is a party has been duly executed and delivered by the Company and is the legally valid and binding obligation of the Company, enforceable against the Company in accordance with its respective terms, except as may be limited by bankruptcy, insolvency, reorganization, moratorium or similar laws relating to or limiting creditors’ rights generally or by equitable principles relating to enforceability.

Section 4.6 Capitalization.

(a) Capitalization. The authorized Equity Interests of the Company and the issued and outstanding Equity Interests of the Company are as set forth in Section 5.13 of the Merger Agreement. All of the issued and outstanding shares of Equity Interests of the Company and each of its Subsidiaries have been validly issued and are fully paid and non-assessable. All Equity Interests of such Subsidiaries that are owned, directly or indirectly, by the Company are free and clear of all Liens (other than Permitted Liens). Except as described in Section 5.13 of the Merger Agreement, there are no outstanding debt or equity securities of the Company or Merger Sub and no outstanding obligations of the Company or Merger Sub convertible into or exchangeable for, or warrants, options or other rights for the purchase or acquisition from the Company or Merger Sub, or other obligations of the Company or Merger Sub to issue, directly or indirectly, any shares of Equity Interests of the Company or Merger Sub.

(b) Redemptions. Except as provided in this Agreement or the Acquiror Governing Documents, the Company has no obligation (contingent or otherwise) to purchase or redeem any of its Equity Interests or any outstanding warrants, options or other rights to purchase Equity Interests.

10

(c) Anti-Dilution; Preemptive Rights. The issuance of the Warrants and the issuance of the Warrant Shares, as applicable, does not and will not result in or give rise to any anti-dilution rights (or adjustment to an exercise price or a conversion price with respect to any Equity Interests of the Company), preemptive rights, rights of first refusal, rights of first offer or similar rights of any other Person with respect to Equity Interests of the Company and Merger Sub.

(d) Reserved Shares. A sufficient number of authorized but unissued Shares have been reserved by appropriate company action of the Company in connection with the prospective exercise of the Warrants.

(e) No Further Action; No Conflict. The issuance of the Warrant Shares (i) does not require any further company action by the equity holders of the Company or the Board of Directors, (ii) is not subject to the pre-emptive rights or rights of first refusal of any present or future equity holders of the Company and (iii) does not conflict with any provision of any agreement to which the Company is a party or by which it is bound. All Warrant Shares when issued upon exercise of the Warrants in accordance with their terms, against payment of the exercise price therefor, will be duly authorized, validly issued, fully paid and non-assessable.

Section 4.7 Valid Issuance. The Warrants when issued, sold and delivered in accordance with the terms and for the consideration set forth in this Agreement, will be validly issued and will be free of preemptive rights, rights of first refusal, rights of first offer and similar rights and restrictions on transfer other than restrictions on transfer under this Agreement, the terms of the Warrant, applicable state and federal securities Laws and Liens subsequently created by or imposed by an Investor with respect to the applicable Warrants. Subject to any filings pursuant to Regulation D of the Securities Act and applicable state securities Laws, the Warrants will be issued in compliance with all applicable federal and state securities Laws and all agreements applicable thereto to which the Company is a party or by which it is bound. The Equity Interests issuable upon exercise of the Warrants, have been or will be duly reserved for issuance, and upon issuance in accordance with the applicable terms of the Warrants will be validly issued, fully paid and non-assessable and will be free of preemptive rights, rights of first offer, rights of first refusal and restrictions on transfer other than the restrictions on transfer under the Acquiror Governing Documents, applicable federal and state securities Laws and Liens subsequently created by or imposed by an Investor with respect to the Warrants or the Warrant Shares, as applicable. Subject to any filings pursuant to Regulation D and applicable state securities Laws, the Equity Interests issuable upon exercise of the Warrants will be issued in compliance with all agreements applicable thereto to which the Company is a party or by which it is bound and with all applicable federal and state securities Laws.

Section 4.8 Voting Rights. To the knowledge of the Company, no stockholder of the Company has entered into any agreement (whether written or oral) with respect to the voting of any securities of the Company, other than the entry into a Transaction Support and Voting Agreement by GPIAC, LLC in connection with the transactions contemplated by the Merger Agreement.

11

Section 4.9 Material Agreements. This Agreement, the Merger Agreement, the Loan Documents, the other Transaction Agreements and the Acquiror Governing Documents existing as of the date hereof are the only material agreements relating to the transactions contemplated hereby to which the Company or Merger Sub is a party. Prior to the date hereof, the Company has delivered (a) to each Investor and CBAS true and complete copies of all Acquiror Governing Documents and (b) to CBAS a true and complete copy of the Merger Agreement and, to the extent requested by CBAS, all documents and agreements related thereto or entered into in connection therewith.

Section 4.10 Defaults: Violations. Neither the Company nor Merger Sub are in default under any provisions of their respective governing documents or in violation of any Law, except for violations or defaults which could not reasonably be expected to materially adversely affect the Company’s and Merger Sub’s business, assets or financial condition, taken as a whole.

ARTICLE V

Rimini hereby represents and warrants to each Investor on behalf of itself and each of the Loan Parties that, as of the Closing and except as disclosed in and pursuant to the Financing Agreement and the Merger Agreement and schedules thereto:

Section 5.1 Organization; Requisite Power and Authority; Qualification. Each of Rimini and the Loan Parties (a) is duly organized, validly existing and in good standing under the laws of its jurisdiction of organization, (b) has all requisite power and authority to own and operate its properties, to carry on its business as now conducted and as proposed to be conducted, to enter into the Transaction Agreements to which it is a party and to carry out the transactions contemplated thereby, and (c) is qualified to do business and in good standing in every jurisdiction where its assets are located and wherever necessary to carry out its business and operations, except in jurisdictions where the failure to be so qualified or in good standing has not had, and could not be reasonably expected to have, a Company Material Adverse Effect (as defined in the Merger Agreement).

Section 5.2 Due Authorization. The execution, delivery and performance of this Agreement and each Transaction Agreement to which Rimini is a party have been duly authorized by all necessary action on the part of Rimini.

Section 5.3 No Conflict. The execution, delivery and performance by Rimini of this Agreement and each of the Transaction Agreements to which Rimini is a party and the consummation of the transactions contemplated by this Agreement and each of the Transaction Agreements do not and will not (a) violate any provision of any law or any governmental rule or regulation applicable to Rimini or any of its Subsidiaries, any of the Governing Documents of Rimini or any of its Subsidiaries, or any order, judgment or decree of any court or other agency of government binding on Rimini or any of its Subsidiaries; (b) conflict with, result in a breach of or constitute (with due notice or lapse of time or both) a default under any material agreement of Rimini or any of its Subsidiaries; (c) result in or require the creation or imposition of any Lien upon any of the properties or assets of Rimini or any of its Subsidiaries (other than any Liens created under any of the Loan Documents in favor of Collateral Agent, on behalf of Secured Parties); or (d) require any approval of stockholders, members or partners or any approval or consent of any Person under any material agreement of Rimini or any of its Subsidiaries, except for such approvals or consents which will be obtained on or before the Closing Date.

12

Section 5.4 Governmental Consents. The execution, delivery and performance by Rimini of this Agreement and each of the Transaction Agreements to which Rimini is a party and the consummation of the transactions contemplated by this Agreement and each of the Transaction Agreements do not and will not require any registration with, consent or approval of, or notice to, or other action to, with or by, any Governmental Authority except the filing of such notices as may be required under the Securities Act and such filings as may be required under applicable state securities laws, which will be timely made by the Company as and when required by such laws.

Section 5.5 Binding Obligation. This Agreement and each of the Transaction Agreements to which Rimini is a party has been duly executed and delivered by Rimini and is the legally valid and binding obligation of Rimini, enforceable against Rimini in accordance with its respective terms, except as may be limited by bankruptcy, insolvency, reorganization, moratorium or similar laws relating to or limiting creditors’ rights generally or by equitable principles relating to enforceability.

Section 5.6 Capitalization.

(a) Capitalization. The authorized Equity Interests of Rimini and the issued and outstanding Equity Interests of Rimini are as set forth in Section 4.6 of the Merger Agreement. All of the issued and outstanding shares of Equity Interests of Rimini and each of its Subsidiaries have been validly issued and are fully paid and non-assessable. All Equity Interests of such Subsidiaries that are owned, directly or indirectly, by Rimini are free and clear of all Liens (other than Permitted Specified Liens). Except as described in Section 4.6 of the Merger Agreement, there are no outstanding debt or equity securities of Rimini or any of its Subsidiaries and no outstanding obligations of Rimini or any of its Subsidiaries convertible into or exchangeable for, or warrants, options or other rights for the purchase or acquisition from Rimini or any of its Subsidiaries, or other obligations of Rimini or any of its Subsidiaries to issue, directly or indirectly, any shares of Equity Interests of Rimini or any of its Subsidiaries.

(b) Redemptions. Except as provided in this Agreement, Rimini has no obligation (contingent or otherwise) to purchase or redeem any of its Equity Interests or any outstanding warrants, options or other rights to purchase Equity Interests.

(c) Anti-Dilution; Preemptive Rights. The issuance of the Warrants and the issuance of the Warrant Shares, as applicable, by the Company does not and will not result in or give rise to any anti-dilution rights (or adjustment to an exercise price or a conversion price with respect to any Equity Interests of Rimini), preemptive rights, rights of first refusal, rights of first offer or similar rights of any other Person with respect to Equity Interests of Rimini or any of its Subsidiaries.

(d) No Further Action; No Conflict. The issuance of the Warrant Shares by the Company (i) is not subject to the pre-emptive rights or rights of first refusal of any present or future equity holders of Rimini and (ii) does not conflict with any provision of any agreement to which Rimini is a party or by which it is bound.

13

ARTICLE VI

Section 6.1 Reservation. For as long as the Warrants are outstanding, the Company shall reserve, and at all times from and after the date hereof keep reserved out of its authorized but unissued Shares, such number of Shares as may be necessary from time to time for the purposes of effecting the issuance of Shares upon exercise of the Warrants.

Section 6.2 Compliance with Laws. For as long as the Warrants or the Warrant Shares are outstanding, the Company and its Subsidiaries shall use commercially reasonable efforts to comply with all applicable statutes and regulations except (a) where the necessity of compliance therewith is contested in good faith by appropriate proceedings, or (b) the failure to comply has not had, and could not be reasonably expected to have, an Acquiror Material Adverse Effect that cannot be cured within a reasonable period of time given the circumstances.

Section 6.3 Adjustments to Shares and Exercise Price. The Company, Rimini and CBAS agree that, on the Closing Date, the aggregate number of Shares under the Warrants issued pursuant to, and subject to the terms of, this Agreement and the Exercise Price of such Shares (each as set forth in the form of Warrants attached hereto as Exhibit A) shall be adjusted to reflect any changes in the underlying facts or assumptions set forth in the Spreadsheet. For avoidance of doubt, the number of Shares and the Exercise Price of such Shares was calculated based upon the conversion of the Rimini Share Amount and the Rimini Ratchet Shares pursuant to the Spreadsheet using the representations and warranties of Company and Rimini in this Agreement and the Merger Agreement regarding their respective Equity Interests as of the date hereof and as of the Closing and the other assumptions in the Spreadsheet, including, among other items, the amount of actual redemptions of the Company’s Equity Interests, any other equity investments consummated contingent upon the Closing of the Mergers, and the actual Merger Consideration and the Merger Consideration Per Fully Diluted Share. For further avoidance of doubt, for the purpose of adjusting the calculation of the aggregate number of Shares and the Exercise Price for such Shares, the Company, Rimini and CBAS agree that the aggregate amount of Rimini Shares subject to the Rimini Warrants shall be deemed to be equal to 14,370,259 Rimini Shares (14,110,259 Rimini Share Amount plus the 260,000 Rimini Ratchet Shares) with an exercise price per share of $1.35.

Section 6.4 Amendments to the Merger Agreement. The Company and Rimini agree that unless CBAS provides its prior written consent (which consent may be withheld in its sole discretion), (a) no waiver, modification or amendment shall be made to the Warrants and (b) the Mergers shall be consummated in accordance with the Merger Agreement, without any waiver, modification or amendment thereto that could reasonably be expected to be materially adverse to CBAS or the Investors.

14

ARTICLE VII

Section 7.1 Subsequent Holders. The provisions of this Agreement shall inure to the benefit of, and be binding upon, the successors, assigns, heirs, executors and administrators of the parties hereto.

Section 7.2 Registration, Transfer and Exchange of Warrants.

(a) The Company shall keep at its principal office a register in which shall be entered the name and address of the Holder of the applicable Warrants and of all permitted transfers of such Warrants. The ownership of any of the Warrants shall be proven by such register and the Company may conclusively rely upon such register.

(b) Subject to applicable transfer restrictions and the terms and conditions of this Agreement and the Warrant, the Holder of a Warrant may, at any time and from time to time prior to the exercise thereof, surrender any one or more of the Warrants held by it for exchange or transfer at the principal office of the Company. On surrender for exchange of the Warrants, properly endorsed, to the Company, the Company, at its expense, will issue and deliver to or on the order of the Holder thereof a new Warrant or Warrants of like tenor, in the name of such Holder or, upon payment by such Holder of any applicable transfer taxes, as such Holder may direct, calling in the aggregate on the face or faces thereof for the number of Warrant Shares called for on the face or faces of the Warrants so surrendered.

(c) Each Warrant issued hereunder, whether originally or in substitution for, or upon transfer or exchange of, any Warrant shall be registered on the date of execution thereof by the Company. The registered Holder of a Warrant shall be deemed to be the owner of such Warrant for all purposes of this Agreement. All notices given hereunder to such Holder shall be deemed validly given if given in the manner specified in Section 8.2.

Section 7.3 Replacement. Upon receipt of evidence reasonably satisfactory to the Company of the loss, theft, destruction or mutilation of any Warrant or Warrant Share and, in the case of any such loss, theft or destruction, upon delivery of an indemnity agreement from such Holder reasonably satisfactory to the Company or, in the case of any such mutilation, upon the surrender of such Warrant or Warrant Share for cancellation to the Company at its principal office, the Company, at its own expense, will execute and deliver, in lieu thereof, a new Warrant or Warrant Share of like tenor, dated so that there will be no loss of dividends thereon. Any Warrant or Warrant Share in lieu of which any such new Warrant or Warrant Share has been so executed and delivered by the Company shall not be deemed to be outstanding for any purpose of this Agreement.

Section 7.4 Restrictions on Transfer; Restrictive Legend. In connection with any proposed transfer of the Warrants, prior to the registration of the offer and sale of the Warrants and Warrant Shares under the Securities Act (including pursuant to Section 7.5 hereof), it shall be a condition of such transfer that the transferee agree to be bound by the terms of this Section 7.4 and the other terms of this Agreement and the Warrant. Subject to the provisions of Section 7.5, each Warrant shall bear a legend referring to the foregoing restriction on transfer. The transfer restrictions set forth in the foregoing provisions of this Section 7.4 shall terminate as to any particular Warrants and/or Warrant Shares when such Warrants and/or Warrant Shares shall have been effectively registered under the Securities Act (including pursuant to Section 7.5 hereof), sold pursuant to a public sale or sold pursuant to Rule 144 promulgated under the Securities Act. Whenever such transfer restrictions shall terminate as to any Warrants and/or Warrant Shares, the Company shall promptly instruct its warrant or transfer agent to immediately remove any restrictive legends on the Warrants and/or Warrant Shares and to prepare and deliver (at the Company’s expense) new Warrants and/or Warrant Shares, as applicable, without any such legends.

15

Section 7.5 Registration Rights. The Company agrees that, as soon as practicable, but in no event more than fifteen (15) business days, after the First Effective Time, it shall use its best efforts to prepare and file with the SEC a registration statement (which shall be in form and substance acceptable to the Investors) for the registration, under the Securities Act, of the offer and sale of all Warrant Shares issued or issuable under the Warrants (the “Registration Statement”). The Company shall use its best efforts to cause such Registration Statement to become effective as soon as practicable thereafter, but in any event shall cause such Registration Statement to have become effective no later than one hundred and five (105) days after the First Effective Time (the “Registration Period”), and to do all things and undertake all such acts as may be necessary or desirable to (a) file any necessary amendments or supplements and maintain the effectiveness of such Registration Statement, and a current prospectus relating thereto, until the expiration of the Warrants (including any additional Warrants issued in connection with Section 6.3) in accordance with the provisions of this Agreement and the Warrants and (b) cooperate with and otherwise permit any Holder, at any time and from time to time after effectiveness of such Registration Statement, to undertake sales of the securities covered thereby. The Company shall, from time to time at the request and without any additional consideration, furnish Holders such further information or assurances, execute and deliver such additional documents, instruments and conveyances, and take such other actions and do such other things, as may be necessary or desirable in the opinion of counsel to the requesting party to carry out the provisions of this Agreement and the registration rights contemplated hereby and to give effect to the transactions contemplated hereby. If Holders notify the Company that they desire to effect sales of Warrant Shares pursuant to such Registration Statement by means of an underwritten offering, the Company will cooperate to the extent reasonably requested by such Holders in such underwritten offering in customary fashion, including by entering into a customary underwriting agreement, providing for the delivery of customary legal opinions, auditor “comfort” letters and certificates, cooperating with such Holder’s and any underwriter’s due diligence investigation and making customary submissions and filings with stock exchanges, governmental and self-regulatory bodies. Filing fees, printer fees, fees and expenses of attorneys and independent auditors of the Company and the Holders, and all other expenses of any such offering shall be the sole responsibility of the Company. For the avoidance of any doubt, unless and until all of the Warrants (including any additional Warrants issued in connection with Section 6.3) have been exercised and Warrant Shares sold by the Holders, the Company shall continue to be obligated to comply with its registration obligations under this Section 7.5. Notwithstanding the foregoing, if, during the Registration Period, the Company furnishes to Holders a certificate signed by the Company’s chief executive officer certifying that, in the good faith judgment of the Board of Directors of the Company and based on a recommendation from an independent investment bank of recognized national standing, it would be materially detrimental to the Company and its stockholders for the Holders to sell Warrant Shares pursuant to such Registration Statement, the Company shall have the right to require Holders to reduce the number of Warrant Shares to be sold during the Registration Period pursuant to such Registration Statement (but only in the amount deemed necessary by the Board of Directors of the Company, acting in good faith and upon the recommendation of such independent investment bank); provided that the Company may not invoke this right more than once during the term of this Agreement. In the event of a breach of this Section 7.5, the Investors shall be entitled to seek specific enforcement of the terms and provisions of this Section 7.5, in addition to any other remedy to which the Investors are entitled at law or equity.

16

Section 7.6 Transferability. The Warrants shall be transferable only upon compliance with the Securities Act and applicable state securities Laws and regulations and, prior to registration of the Warrant Shares (including pursuant to Section 7.5 hereof), (a) Section 7.4 hereof and (b) Sections 4 and 5 of the Warrant.

ARTICLE VIII

Section 8.1 Expenses. The Company, on behalf of itself and its Subsidiaries, hereby agrees to pay on demand all reasonable out-of-pocket expenses (including fees and expenses of counsel) incurred by any Investor in connection with the transactions contemplated by this Agreement and the other Transaction Agreements (but for the avoidance of doubt, not with respect to (x) the issuance or delivery of the Warrant Shares upon exercise of the Warrants or (y) any transfer of the Warrants or the Warrant Shares) and in connection with any amendments or waivers (whether or not the same become effective) hereof or thereof, and all reasonable out-of-pocket expenses incurred by such Investor or any Holder of any Warrant or Warrant Share issued hereunder in connection with the successful enforcement of any rights hereunder, under any other Transaction Agreement, or with respect to any Warrant or Warrant Shares (including any fees or expenses incurred in connection with exercise of the registration rights contained in Section 7.5 hereof).

Section 8.2 Notices. All notices and other communications provided for hereunder shall be in writing and shall be delivered by hand, sent by registered or certified mail (postage prepaid, return receipt requested), overnight courier, fax or email. In the case of notices or other communications to any party, as the case may be, they shall be sent to the respective address set forth below (or, as to each party, at such other address as shall be designated by such party in a written notice to the other parties complying as to delivery with the terms of this Section 8.2):

If to the Company, then to:

|

150 E. 52nd Street, Suite 5003

|

|||

|

New York, NY 10022

|

|||

|

Attention:

|

Antonio Bonchristiano

|

||

|

Telecopy No.:

|

|||

17

with a copy (which shall not constitute notice) to:

|

Skadden, Arps, Slate, Xxxxxxx & Xxxx LLP

|

|||

|

Four Times Square

|

|||

|

Attention:

|

Xxxx X. Xxxxxxx

|

|

|

|

Xxxxxxx X. Xxxxxxxxx

|

|||

|

Telecopy No.:

|

|||

|

Email:

|

|||

If to Rimini, then to:

|

Rimini Street, Inc.

|

|||

|

3993 Xxxxxx Xxxxxx Parkway, Suite 500

|

|||

|

Las Vegas, NV 89169

|

|||

|

Attention:

|

Xxx Xxxxxxx, General Counsel

|

||

|

Xxx Xxxxx, Chief Financial Officer

|

|||

|

Telephone:

|

|||

|

Email :

|

|||

with copies (which shall not constitute notice) to:

|

Xxxxxx Xxxxxxx Xxxxxxxx & Xxxxxx

|

|||

|

Professional Corporation

|

|||

|

650 Page Mill Road

|

|||

|

Palo Alto, California 94304

|

|||

|

Attention:

|

Xxx X. Xxxxx

|

||

|

Xxxxxxx X. Xxxxxxx

|

|||

|

Telecopy No.:

|

|||

|

Email:

|

|||

If to an Investor, then to:

|

c/o Colbeck Capital Management, LLC

|

|||

|

888 Seventh Avenue -29th Floor

|

|||

|

New York, NY 10106

|

|||

|

Attention:

|

Xxxxxx Xxxxx

|

||

|

Email:

|

|||

with copies (which shall not constitute notice) to:

|

Aequum Law, LLC

|

|||

|

555 Madison Avenue, 5th Floor

|

|||

|

New York, NY 10022

|

|||

|

Attention: Xxxx X. Xxxxxxxxx

|

|||

|

Telephone:

|

|||

|

Email:

|

|||

|

and:

|

|||

|

Xxxxxxxxx & Xxxxxxx LLP

|

|||

|

620 Eighth Avenue

|

|||

|

Attention:

|

Xxxxxx X. Xxxxxx

|

||

|

Telephone:

|

|||

|

Telecopier:

|

|||

|

Email:

|

|||

18

If to any other Holder of any Warrant or Warrant Share, to it at its address set forth in the applicable Company’s records.

All notices or other communications sent in accordance with this Section 8.2, shall be deemed received on the earlier of the date of actual receipt or three business days after the deposit thereof in the mail; provided, that (i) notices sent by overnight courier service shall be deemed to have been given when received and (ii) notices by facsimile shall be deemed to have been given when sent (except that, if not given during normal business hours for the recipient, shall be deemed to have been given at the opening of business on the next business day for the recipient).

Section 8.3 Survival. All representations and warranties made herein or in any other document referred to herein or delivered to the Investors pursuant hereto shall be deemed to have been relied on by the Investors, notwithstanding any investigation made by an Investor or on its behalf, and shall survive the execution and delivery to the Investors hereof and of the Warrants for a period of one year from the date hereof.

Section 8.4 Right to Publicize. Each Investor will have the right to publicize its investment in the Company as contemplated hereby by means of a tombstone advertisement or other customary advertisement in newspapers and other periodicals and in electronic mail transmissions and on its website, subject to each Company’s prior written consent and applicable law.

Section 8.5 Amendments and Waivers. Any term of this Agreement may be amended and the observance of any term of this Agreement may be waived (either generally or in a particular instance and either retroactively or prospectively) only with the written consent of the Company and the Requisite Holders. Any amendment or waiver effected in accordance with this Section 8.5 shall be binding upon the Company, its Subsidiaries and each Holder of the Warrants or Warrant Shares.

Section 8.6 Governing Law. This Agreement and the other Transaction Agreements (unless expressly provided to the contrary in another Transaction Agreement in respect of such other Transaction Agreement) shall be governed by, and construed in accordance with, the laws of the State of New York applicable to contracts made and to be performed in the state of New York, without giving effect to any choice or conflict of law provisions (other than Section 5-1401 of the New York General Obligations Law).

19

Section 8.7 Consent to Jurisdiction; Service of Process and Venue. Any legal action or proceeding with respect to this Agreement or any other Transaction Agreement may be brought in the courts of the state of New York in the county of New York or of the United States district court for the Southern District of New York, and, by execution and delivery of this Agreement, each party hereby irrevocably accepts in respect of its property, generally and unconditionally, the jurisdiction of the aforesaid courts. Each party hereby irrevocably consents to the service of process out of any of the aforementioned courts and in any such action or proceeding by any means permitted by applicable Law, including by the mailing of copies thereof by registered or certified mail, postage prepaid, to the party at its address for notices as set forth in Section 8.2, such service to become effective 10 days after such mailing. The parties agree that a final judgment in any such action or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by Law. Each party hereby expressly and irrevocably waives, to the fullest extent permitted by Law, any objection which it may now or hereafter have to the jurisdiction or laying of venue of any such litigation brought in any such court referred to above and any claim that any such litigation has been brought in an inconvenient forum. To the extent that any party has or hereafter may acquire any immunity from jurisdiction of any court or from any legal process (whether through service or notice, attachment prior to judgment, attachment in aid of execution or otherwise) with respect to itself or its property, each party hereby irrevocably waives such immunity in respect of its obligations under this Agreement and the other Transaction Agreements.

Section 8.8 WAIVER OF JURY TRIAL. EACH PARTY, EACH AGENT AND EACH LENDER HEREBY WAIVES ANY RIGHT TO A TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM CONCERNING ANY RIGHTS UNDER THIS AGREEMENT OR THE OTHER TRANSACTION AGREEMENTS, OR UNDER ANY AMENDMENT, WAIVER, CONSENT, INSTRUMENT, DOCUMENT OR OTHER AGREEMENT DELIVERED OR WHICH IN THE FUTURE MAY BE DELIVERED IN CONNECTION THEREWITH, OR ARISING FROM ANY FINANCING RELATIONSHIP EXISTING IN CONNECTION WITH THIS AGREEMENT, AND AGREES THAT ANY SUCH ACTION, PROCEEDINGS OR COUNTERCLAIM SHALL BE TRIED BEFORE A COURT AND NOT BEFORE A JURY. EACH PARTY CERTIFIES THAT NO OFFICER, REPRESENTATIVE, AGENT OR ATTORNEY OF ANY AGENT OR ANY LENDER HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT ANY AGENT OR ANY LENDER WOULD NOT, IN THE EVENT OF ANY ACTION, PROCEEDING OR COUNTERCLAIM, SEEK TO ENFORCE THE FOREGOING WAIVERS. EACH PARTY HEREBY ACKNOWLEDGES THAT THIS PROVISION IS A MATERIAL INDUCEMENT FOR THE AGENTS AND THE LENDERS ENTERING INTO THIS AGREEMENT.

Section 8.9 No Waiver. Notwithstanding any provision herein to the contrary, nothing herein or in any Transaction Agreement shall be construed to limit, waive, amend or alter the terms and provisions of the Financing Agreement and Loan Documents or any rights or remedies available to the Investors (or Affiliate(s) thereof) (as administrative agent, collateral agent or lender thereunder) as creditor of Rimini or its Subsidiaries or Affiliates thereunder.

(Signature Page Follows)

20

IN WITNESS WHEREOF, each of the parties hereto has executed this Warrant Consent and Conversion Agreement as of the date and year first written above.

|

By:

|

||

|

Name:

|

||

|

Title:

|

||

[Signature Page to Warrant Agreement]

IN WITNESS WHEREOF, each of the parties hereto has executed this Warrant Consent and Conversion Agreement as of the date and year first written above.

|

By:

|

/s/ ANTONIO BONCHRISTIANO

|

|

|

Name:

|

ANTONIO BONCHRISTIANO

|

|

|

Title:

|

Chief Executive Officer

|

|

|

RIMINI STREET, INC.

|

||

|

By:

|

||

|

Name:

|

||

|

Title:

|

||

|

CB AGENT SERVICES LLC

|

||

|

By:

|

||

|

Name:

|

||

|

Title:

|

||

[Signature Page to Warrant Agreement]

IN WITNESS WHEREOF, each of the parties hereto has executed this Warrant Consent and Conversion Agreement as of the date and year first written above.

|

RIMINI STREET, INC.

|

||

|

By:

|

/s/ Xxxx Xxxxx

|

|

|

Name: Xxxx Xxxxx

|

||

|

Title: Chief Executive Officer

|

||

[Signature Page to Warrant Agreement]

|

ORIGINATION AGENT:

|

||

|

CB AGENT SERVICES LLC

|

||

|

By:

|

/s/ Xxxxxx Xxxxx

|

|

|

Name: Xxxxxx Xxxxx

|

||

|

Title: Partner & COO

|

||

[Signature Page to Warrant Agreement]

Schedule 2.1(b)

Investor Allocations

CB AGENT SERVICES, LLC – 9,760,279 Rimini Shares

XXXXXXX STRATEGIC LENDING MASTER, L.P. – 4,609,980 Rimini Shares

Exhibit A

Form of Equity Warrant

[See attached.]

THIS WARRANT AND THE UNDERLYING SECURITIES OF THE ISSUER ISSUED UPON EXERCISE OF SUCH WARRANT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR UNDER THE SECURITIES LAWS OF ANY STATE. THESE SECURITIES MAY NOT BE OFFERED, SOLD OR OTHERWISE TRANSFERRED, PLEDGED OR HYPOTHECATED EXCEPT AS PERMITTED UNDER THE ACT AND APPLICABLE STATE SECURITIES LAWS IN ACCORDANCE WITH APPLICABLE REGISTRATION REQUIREMENTS OR AN EXEMPTION THEREFROM. THE ISSUER OF THESE SECURITIES MAY REQUIRE AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE ISSUER THAT SUCH OFFER, SALE, TRANSFER, PLEDGE OR HYPOTHECATION OTHERWISE COMPLIES WITH THE SECURITIES ACT AND ANY APPLICABLE STATE SECURITIES LAWS.

THE UNDERLYING SECURITIES OF THE ISSUER ISSUED UPON EXERCISE OF THIS WARRANT SHALL BE ENTITLED TO REGISTRATION RIGHTS UNDER THE WARRANT CONSENT AND CONVERSION AGREEMENT EXECUTED BY THE COMPANY AND THE HOLDER HEREOF. SUBJECT TO SUCH REGISTRATION RIGHTS, THIS WARRANT MUST BE SURRENDERED TO THE COMPANY OR ITS TRANSFER AGENT AS A CONDITION PRECEDENT TO THE SALE, TRANSFER, PLEDGE OR HYPOTHECATION OF ANY INTEREST IN ANY OF THE SECURITIES REPRESENTED HEREBY.

WARRANT TO PURCHASE SHARES OF COMMON STOCK

of

Dated as of [__________], 2017

Void after the date specified in Section 8

|

Warrant to Purchase

3,630,2221 Shares of

Common Stock

(subject to adjustment)

|

THIS CERTIFIES THAT, for value received, CB Agent Services LLC, or its registered assigns (collectively, the “Holder”), is entitled, subject to the provisions and upon the terms and conditions set forth herein, to purchase from GP Investments Acquisition Corp., a Cayman Islands exempted company limited by shares (which shall domesticate as a Delaware corporation prior to the Closing of the Mergers (each as defined in the Merger Agreement)) (the “Company”), shares of the Company’s common stock, par value $0.0001 per share (the “Shares”), in the amounts, at such times and at the price per share set forth in Section 1. The term “Warrant” as used herein shall include this Warrant and any warrants delivered in substitution or exchange therefor as provided herein. This Warrant is issued pursuant to that certain Warrant Consent and Conversion Agreement (the “Warrant Agreement”), dated as of [•], 2017, by and among the Holder, the Company and Rimini Street, Inc., a Nevada corporation. Capitalized terms used but not defined herein shall have the meanings ascribed thereto in the Warrant Agreement.

1 The number of Shares is based on the “Base Case” calculation in the Spreadsheet and is subject to adjustment pursuant to Section 6.3 of the Warrant Agreement.

1

The following is a statement of the rights of the Holder and the conditions to which this Warrant is subject, and to which Holder, by acceptance of this Warrant, agrees:

1. Number and Price of Shares; Exercise Period.

(a) Number of Shares. Upon or after the date of the issuance of this Warrant, the Holder shall have the right to purchase up to 3,630,222 Shares, as may be adjusted pursuant hereto, minus any Shares issued previously pursuant to the exercise of this Warrant, prior to (or in connection with) the expiration of this Warrant as provided in Section 8.

(b) Exercise Price. The exercise price per Share shall be equal to $5.342 (the “Exercise Price”), subject to adjustment as set forth herein.

(c) Exercise Period. This Warrant shall be exercisable, in whole or in part, prior to (or in connection with) the expiration of this Warrant as set forth in Section 8.

2. Exercise of the Warrant.

(a) Exercise. The purchase rights represented by this Warrant may be exercised at the election of the Holder, in whole or in part, in accordance with Section 1, by:

(i) the tender to the Company at its principal office (or such other office or agency as the Company may designate) of a notice of exercise in the form of Exhibit A (the “Notice of Exercise”), duly completed and executed by or on behalf of the Holder, together with the surrender of this Warrant; and

(ii) the payment to the Company of an amount equal to (x) the Exercise Price multiplied by (y) the number of Shares being purchased, by (a) wire transfer or certified, cashier’s or other check acceptable to the Company and payable to the order of the Company; (b) surrender and cancellation of promissory notes or other instruments representing indebtedness of the Company to the Holder; or (c) a combination of (a) and (b).

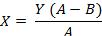

(b) Net Issue Exercise. In lieu of exercising this Warrant pursuant to Section 2(a)(ii), if the fair market value of one Share is greater than the Exercise Price (at the date of calculation as set forth below), the Holder may elect to receive a number of Shares equal to the value of this Warrant (or of any portion of this Warrant being canceled) by surrender of this Warrant at the principal office of the Company (or such other office or agency as the Company may designate) together with a properly completed and executed Notice of Exercise reflecting such election, in which event the Company shall issue to the Holder that number of Shares computed using the following formula:

2 The Exercise Price is based on the “Base Case” calculation in the Spreadsheet and is subject to adjustment pursuant to Section 6.3 of the Warrant Agreement.

2

|

|||

|

X

|

=

|

The number of Shares to be issued to the Holder

|

|

|

Y

|

=

|

The number of Shares purchasable under this Warrant, or, if only a portion of the Warrant is being exercised, the portion of the Warrant being canceled (at the date of such calculation)

|

|

|

A

|

=

|

The fair market value of one Share (at the date of such calculation)

|

|

|

B

|

=

|

The Exercise Price (as adjusted to the date of such calculation)

|

|

For purposes of the calculation above, the “fair market value” of one Share shall be, so long as a public market exists for the Company’s Shares at the time of such exercise, the volume weighted average of the closing bid and asked prices of the Shares or the closing price reported on the national securities exchange on which the Shares are listed as published in the Wall Street Journal, as applicable, for the ten (10) trading day period ending five (5) trading days prior to the date of determination of fair market value.

(c) Stock Certificates. The rights under this Warrant shall be deemed to have been exercised and the Shares or other securities issuable upon such exercise shall be deemed to have been issued immediately prior to the close of business on the date this Warrant is exercised in accordance with its terms, and the person entitled to receive the Shares or other securities issuable upon such exercise shall be treated for all purposes as the holder of record of such Shares as of the close of business on such date. As promptly as reasonably practicable on or after such date, and in any event within thirty (30) days thereafter, the Company shall issue and deliver to the person or persons entitled to receive the same a certificate or certificates for that number of Shares or other securities issuable upon such exercise. In the event that the rights under this Warrant are exercised in part and have not expired, the Company shall execute and deliver a new Warrant reflecting the number of Shares that remain subject to this Warrant.

(d) No Fractional Shares or Scrip. No fractional shares or scrip representing fractional shares shall be issued upon the exercise of the rights under this Warrant. In lieu of such fractional share to which the Holder would otherwise be entitled, the Company shall make a cash payment equal to the Exercise Price multiplied by such fraction.

(e) Conditional Exercise. The Holder may exercise this Warrant conditioned upon (and effective immediately prior to) consummation of any transaction that would cause the expiration of this Warrant pursuant to Section 8 by so indicating in the notice of exercise.

(f) Automatic Exercise. If the Holder of this Warrant has not elected to exercise this Warrant prior to the Expiration Time, then this Warrant shall automatically (without any act on the part of the Holder) be exercised pursuant to Section 2(b) effective immediately prior to the expiration of the Warrant to the extent such net issue exercise would result in the issuance of Shares, unless Holder shall earlier provide written notice to the Company that the Holder desires that this Warrant expire unexercised. If this Warrant is automatically exercised, the Company shall notify the Holder of the automatic exercise as soon as reasonably practicable, and the Holder shall surrender the Warrant to the Company in accordance with the terms hereof.

3

(g) Reservation of Stock. The Company agrees during the term the rights under this Warrant are exercisable to reserve and keep available from its authorized and unissued shares of common stock solely for the purpose of effecting the exercise of this Warrant such number of shares as shall from time to time be sufficient to effect the exercise of the rights under this Warrant; and if at any time the number of authorized but unissued shares of common stock shall not be sufficient for purposes of the exercise of this Warrant in accordance with its terms, without limitation of such other remedies as may be available to the Holder, the Company shall take such corporate action as may be necessary to increase its authorized and unissued shares of its common stock to a number of shares as shall be sufficient for such purposes. The Company represents and warrants that all shares that may be issued upon the exercise of this Warrant will, when issued in accordance with the terms hereof, be validly issued, fully paid and non-assessable.

3. Replacement of the Warrant. Subject to the receipt of evidence reasonably satisfactory to the Company of the loss, theft, destruction or mutilation of this Warrant and, in the case of loss, theft or destruction, on delivery of an indemnity agreement reasonably satisfactory in form and substance to the Company or, in the case of mutilation, on surrender and cancellation of this Warrant, the Company at the expense of the Holder shall execute and deliver, in lieu of this Warrant, a new warrant of like tenor and amount.

(a) Warrant Register. The Company shall maintain a register (the “Warrant Register”) containing the name and address of the Holder or Holders. Until this Warrant is transferred on the Warrant Register in accordance herewith, the Company may treat the Holder as shown on the Warrant Register as the absolute owner of this Warrant for all purposes, notwithstanding any notice to the contrary. Any Holder of this Warrant (or of any portion of this Warrant) may change its address as shown on the Warrant Register by written notice to the Company requesting a change.

(b) Warrant Agent. The Company may appoint an agent for the purpose of maintaining the Warrant Register referred to in Section 4(a), issuing the Shares or other securities then issuable upon the exercise of the rights under this Warrant, exchanging this Warrant, replacing this Warrant or conducting related activities.

(c) Transferability of the Warrant. Subject to the (i) provisions of this Warrant with respect to compliance with the Securities Act, including in connection with a registered offering pursuant to an effective registration statement (including pursuant to Section 7.5 of the Warrant Agreement) and (ii) limitations on assignments and transfers, including compliance with the restrictions on transfer set forth in Section 5, title to this Warrant may be transferred by endorsement (by the transferor and the transferee executing the assignment form attached as Exhibit A-2 (the “Assignment Form”)) and delivery in the same manner as a negotiable instrument transferable by endorsement and delivery.

4

(d) Exchange of the Warrant upon a Transfer. On surrender of this Warrant (and a properly endorsed Assignment Form) for exchange, subject to the provisions of this Warrant with respect to compliance with the Securities Act and limitations on assignments and transfers contained herein, the Company shall issue to or on the order of the Holder a new warrant or warrants of like tenor, in the name of the Holder or as the Holder (on payment by the Holder of any applicable transfer taxes) may direct, for the number of Shares or other securities issuable upon exercise hereof, and the Company shall register any such transfer upon the Warrant Register. Subject to the registration rights contained in Section 7.5 of the Warrant Agreement, this Warrant (and the Shares or other securities issuable upon exercise of the rights under this Warrant) must be surrendered to the Company or its warrant or transfer agent, as applicable, as a condition precedent to the sale, pledge, hypothecation or other transfer of any interest in any of the securities represented hereby.

(e) Taxes. In no event shall the Company be required to pay any tax which may be payable in respect of any transfer involved in the issue and delivery of any certificate in a name other than that of the Holder, and the Company shall not be required to issue or deliver any such certificate unless and until the person or persons requesting the issue thereof shall have paid to the Company the amount of such tax or shall have established to the satisfaction of the Company that such tax has been paid or is not payable.

5. Restrictions on Transfer of the Warrant and Shares; Compliance with Securities Laws. By acceptance of this Warrant, the Holder agrees to comply with the following:

(a) Restrictions on Transfers. Any transfer of this Warrant or the Shares (the “Securities”) must be in compliance with all applicable federal and state securities laws. The Holder agrees not to make any sale, assignment, transfer, pledge or other disposition (a “Transfer”) of all or any portion of the Securities, or any beneficial interest therein, unless and until the transferee thereof has agreed in writing for the benefit of the Company to take and hold such Securities subject to, and to be bound by, the terms and conditions set forth in this Warrant to the same extent as if the transferee were the original Holder hereunder, unless

(i) there is then in effect a registration statement under the Securities Act (including pursuant to Section 7.5 of the Warrant Agreement) covering such proposed disposition and such disposition is made in accordance with such registration statement; or

(ii) (A) such Holder shall have furnished the Company with a description of the manner and circumstances of the proposed disposition, (B) the transferee shall have confirmed to the Company in writing that the Securities are being acquired (i) solely for the transferee’s own account and not as a nominee for any other party, (ii) for investment and (iii) subject to the provisions of Section 7.5 of the Warrant Agreement, not with a view toward distribution or resale and (C) if reasonably requested by the Company, such Holder shall have furnished the Company, at the Company’s expense, with an opinion of counsel, reasonably satisfactory to the Company, to the effect that such disposition will not require registration of such Securities under the Securities Act prior to the registration contemplated by the Section 7.5 of the Warrant Agreement. It is agreed that the Company will not require opinions of counsel for transactions made pursuant to Rule 144.

5

(b) Permitted Transfers. Except in the case of an offering pursuant to an effective registration statement under the Securities Act (including pursuant to Section 7.5 of the Warrant Agreement), subject to Section 5(a), the Holder may not Transfer the Warrant (or any part thereof) to any party which is a Competitor of the Company. For purposes of this Section 5(b), “Competitor” shall mean any entity which is an “Ineligible Assignee” under the terms of the Financing Agreement.

(c) Investment Representation Statement. Unless the rights under this Warrant are exercised in accordance with either (i) an effective registration statement under the Securities Act that includes the Shares with respect to which the Warrant was exercised (including pursuant to Section 7.5 of the Warrant Agreement) or (ii) Rule 144 promulgated under the Securities Act, it shall be a condition to any exercise of the rights under this Warrant that the Holder shall have confirmed to the satisfaction of the Company, in writing substantially in the form of Exhibit A-1, the matters set forth such Exhibit A-1.

(d) Securities Law Legend. Subject to the provisions of Section 7.4 of the Warrant Agreement, the Securities shall (unless otherwise permitted by the provisions of this Warrant or the Warrant Agreement) be stamped or imprinted with a legend substantially similar to the following (in addition to any legend required by state securities laws):

THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR UNDER THE SECURITIES LAWS OF CERTAIN STATES. THESE SECURITIES MAY NOT BE OFFERED, SOLD OR OTHERWISE TRANSFERRED, PLEDGED OR HYPOTHECATED EXCEPT AS PERMITTED UNDER THE ACT AND APPLICABLE STATE SECURITIES LAWS IN ACCORDANCE WITH APPLICABLE REGISTRATION REQUIREMENTS OR AN EXEMPTION THEREFROM. THE ISSUER OF THESE SECURITIES MAY REQUIRE AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE ISSUER THAT SUCH OFFER, SALE OR TRANSFER, PLEDGE OR HYPOTHECATION OTHERWISE COMPLIES WITH THE SECURITIES ACT AND ANY APPLICABLE STATE SECURITIES LAWS.

THE SECURITIES REPRESENTED HEREBY SHALL BE ENTITLED TO REGISTRATION RIGHTS UNDER THE WARRANT CONSENT AND CONVERSION AGREEMENT EXECUTED BY THE COMPANY AND THE HOLDER HEREOF. SUBJECT TO SUCH REGISTRATION RIGHTS, THIS CERTIFICATE MUST BE SURRENDERED TO THE COMPANY OR ITS TRANSFER AGENT AS A CONDITION PRECEDENT TO THE SALE, TRANSFER, PLEDGE OR HYPOTHECATION OF ANY INTEREST IN ANY OF THE SECURITIES REPRESENTED HEREBY.

6