UNDERWRITING AGREEMENT

Exhibit 99.3

Execution Version

January 19, 2021

Americas Gold and Silver Corporation

000 Xxxx Xxxxxx Xxxx, Xxxxx 0000

Xxxxxxx, Xxxxxxx, Xxxxxx X0X 0X0

Attention: Xxxxxx Xxxxxxxx, President and Chief Executive Officer

Dear Sirs:

Based upon and subject to the terms and conditions set out in this agreement (the “Underwriting Agreement”), Desjardins Securities Inc. (“Desjardins”), as lead underwriter and sole bookrunner, and Cormark Securities Inc., Xxxxxx Xxxxxxxx Canada Inc., X.X. Xxxxxxxxxx & Co., LLC, A.G.P./Alliance Global Partners, Clarus Securities Inc., Laurentian Bank Securities Inc., and Xxxx Capital Partners, LLC (collectively and together with Desjardins, the “Underwriters”) hereby severally, and not jointly or jointly and severally, in the respective percentages set out in Section 17, offer to purchase from Americas Gold and Silver Corporation (the “Company”), and the Company hereby agrees to issue and sell to the Underwriters, on the Closing Date, 9,063,500 Common Shares (as hereinafter defined) (the “Initial Shares”), at a price of $3.31 per Initial Share (the “Issue Price”), for aggregate gross proceeds to the Company of $30,000,185.

The Underwriters shall have an option (the “Option”), which Option may be exercised in the Underwriters’ sole discretion and without obligation, to acquire from the Company, on and subject to the terms and conditions contained herein (including Section 7), up to an additional 1,359,525 Common Shares (the “Option Shares” and, together with the Initial Shares, the “Offered Shares”) at the Issue Price, for additional aggregate gross proceeds of up to $4,500,027.75. The Option shall be exercisable by the Underwriters in whole or in part at any time after the Closing Date (as hereinafter defined) until 11:59 p.m. (Toronto time) on the 30th day following the Closing Date, after which time the Option shall be void and of no further force and effect. Option Shares may be purchased solely for the purpose of covering over-allotments made in connection with the Offering (as defined herein) and for market stabilization purposes.

The Offered Shares may be distributed in each of the Provinces of Canada, other than Québec (the “Qualifying Jurisdictions”), by the Canadian Underwriters (as defined herein) pursuant to the Final Prospectus (as defined herein). The Offered Shares may also be offered and sold in the “United States” or to “U.S. persons” (as such terms are defined in Regulation S under the U.S. Securities Act (as hereinafter defined)) on a private placement basis and on a “substituted purchaser” basis pursuant to the exemption from the registration requirements of the U.S. Securities Act provided by Rule 506(b) of Regulation D thereunder and similar exemptions under applicable U.S. state securities laws, and outside the United States to non-U.S. persons pursuant to Rule 903 of Regulation S under the U.S. Securities Act. All offers and sales of the Offered Shares: (i) will be made in accordance with Schedule “B” attached hereto (which schedule is incorporated into and forms part of this Underwriting Agreement); (ii) will be conducted in such a manner so as not to require registration thereof or the filing of a prospectus or an offering memorandum with respect thereto under the U.S. Securities Act; and (iii) will be conducted through an affiliate of one or more of the Underwriters duly registered with the SEC (as hereinafter defined) and the Financial Industry Regulatory Authority, Inc. and in compliance with U.S. Securities Laws (as hereinafter defined). Subject to applicable law, including the Applicable Securities Laws, and the terms of this Underwriting Agreement, the Offered Shares may also be distributed in other jurisdictions outside Canada and the United States, provided that they are lawfully offered and sold on a basis exempt from the prospectus, registration or similar requirements of any such jurisdictions and that the Company will not be or become subject to any continuous disclosure or similar obligations of any such jurisdictions.

The Underwriters shall have the right, at the sole cost and expense of the Underwriters, to invite one or more investment dealers (each, a “Selling Firm”) to form a selling group to participate in the soliciting of offers to purchase the Offered Shares and the Underwriters have the exclusive right to control all compensation arrangements between the members of the selling group. The Underwriters shall ensure that any Selling Firm shall agree with the Underwriters to comply with all applicable laws and with the covenants and obligations given by the Underwriters herein.

- 2 -

Subject to Section 12, in consideration of the Underwriters’ services to be rendered in connection with the Offering, the Company shall pay to the Underwriters the Underwriting Fee.

The Underwriters may offer the Offered Shares at a price less than the Issue Price as described in further detail in Section 17 below, in compliance with Canadian Securities Laws, including the requirements of NI 44-101 (as hereinafter defined), and the disclosure concerning the same contained in the Prospectus (as hereinafter defined) and the U.S. Placement Memorandum (as hereinafter defined).

The following are the terms and conditions of the agreement between the Company and the Underwriters:

TERMS AND CONDITIONS

| Section 1 | Definitions and Interpretation |

| (1) | In this Underwriting Agreement: |

“Act” means the Canada Business Corporations Act;

“affiliate”, “associate”, “material fact”, “material change”, and “misrepresentation” shall have the respective meanings ascribed thereto in the Securities Act (Ontario);

“AIF” means the annual information form of the Company for the year ended December 31, 2019, dated March 9, 2020;

“Applicable Securities Laws” means Canadian Securities Laws and U.S. Securities Laws;

“Business Day” means any day other than a Saturday, Sunday or statutory or civic holiday in Toronto, Ontario;

“Canadian Securities Laws” means, collectively, all applicable securities laws of each of the Qualifying Jurisdictions and the respective rules and regulations under such laws, together with applicable published instruments, notices and orders of the securities regulatory authorities in the Qualifying Jurisdictions;

“Canadian Underwriters” means, collectively, Desjardins, Cormark Securities Inc., Xxxxxx Xxxxxxxx Canada Inc., Clarus Securities Inc., and Laurentian Bank Securities Inc.;

“Closing” means the completion of the issue and sale by the Company and the purchase by the Underwriters on the Closing Date of the Initial Shares as contemplated by this Underwriting Agreement;

“Closing Date” means January 29, 2021, or any earlier or later date as may be agreed to by the Company and Desjardins, on its own behalf and on behalf of the other Underwriters, each acting reasonably;

“Common Shares” means common shares in the capital of the Company;

“Company’s Auditors” means PricewaterhouseCoopers LLP, or such firm of chartered accountants as the Company may from time to time appoint as auditors of the Company;

“Continuing Underwriters” has the meaning ascribed thereto in Section 17(2);

“COVID-19 Outbreak” has the meaning ascribed thereto in Section 8(1)(ddd).

“Debt Instrument” means any note, loan, bond, debenture, indenture, promissory note, credit facility, or other instrument evidencing material indebtedness (demand or otherwise) for borrowed money or other liability, and any amendments thereto, to which the Company or its Material Subsidiaries are a party or to which their property or assets are otherwise bound, including, but not limited to, the Glencore Pre-Payment Facility and the Sandstorm Convertible Debenture;

- 3 -

“Defaulted Securities” has the meaning ascribed thereto in Section 17(2);

“Desjardins” has the meaning ascribed thereto in the first paragraph of this Underwriting Agreement;

“distribution” means distribution or distribution to the public, as the case may be, for the purposes of the Canadian Securities Laws;

“Documents Incorporated by Reference” means, in respect of any of the Offering Documents, the documents specified as being incorporated therein by reference or which are deemed to be incorporated therein by reference pursuant to Canadian Securities Laws;

“Environmental Laws” has the meaning ascribed thereto in Section 8(1)(xx)(i);

“Environmental Permits” has the meaning ascribed thereto in Section 8(1)(xx)(ii);

“Exchanges” means, collectively, the TSX and the NYSE American;

“Exercise Notice” has the meaning ascribed thereto in Section 7(1);

“Final Prospectus” means the (final) short form prospectus of the Company, including all of the Documents Incorporated by Reference to be prepared and filed by the Company in accordance with the Passport System and NI 44-101 in the Qualifying Jurisdictions in respect of the Offering;

“Final Receipt” means the receipt to be issued by the OSC, evidencing that a receipt has been, or has been deemed to be, issued for the Final Prospectus in each of the Qualifying Jurisdictions;

“Financial Statements” means, collectively: (i) the Company’s audited financial statements for the years ended December 31, 2019 and December 31, 2018; and (ii) the unaudited condensed consolidated interim financial statements for the three and nine months ended September 30, 2020;

“Galena JV” shall have the meaning ascribed thereto in the AIF;

“Glencore Pre-Payment Facility” shall have the meaning ascribed thereto in the AIF;

“Governmental Authority” means and includes, without limitation, any national, federal government, province, state, municipality or other political subdivision of any of the foregoing, any entity exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government and any corporation or other entity owned or controlled (through stock or capital ownership or otherwise) by any of the foregoing, and any governmental department, commission, board, bureau, agency or instrumentality, including the Securities Commissions and the Exchanges;

“IFRS” means International Financial Reporting Standards which are issued by the International Accounting Standards Board, as adopted in Canada;

“including” means including without limitation;

“Indemnified Parties” has the meaning ascribed thereto in Section 15(1);

“Indemnifying Party Indemnification” has the meaning ascribed thereto in Section 31(4);

“Indemnitor” has the meaning ascribed thereto in Section 15(1);

- 4 -

“Initial Shares” has the meaning ascribed thereto in the first paragraph of this Underwriting Agreement;

“Inter-Underwriter Indemnified Claims” has the meaning ascribed thereto in Section 31(2);

“Locked-Up Parties” has the meaning ascribed thereto in Section 9(1)(f);

“marketing materials”, “standard term sheet” and “template version” shall have their respective meanings ascribed thereto in NI 41-101;

“Material Adverse Effect” means any event, change, fact, or state of being that would reasonably be expected to have a significant and adverse effect on the business, affairs, capital, operation, properties, permits, assets, liabilities (absolute, accrued, contingent or otherwise) or condition (financial or otherwise) of the Company and the Material Subsidiaries considered on a consolidated basis;

“Material Agreement” means any Debt Instrument, contract, commitment, agreement (written or oral), instrument, lease, license, or other document (written or oral), to which the Company or the Material Subsidiaries are a party and which is material to the Company and the Material Subsidiaries on a consolidated basis, including, but not limited to, the Precious Metals Purchase Agreement and the Galena JV;

“Material Permits” means all material permits, certificates, licences, approvals, consents, registrations and other authorizations of the Company and the Material Subsidiaries;

“Material Properties” means, collectively: (i) the Relief Canyon Mine, located in Nevada, United States; (ii) the Cosalá Operations, located in Mexico; and (iii) the Galena Complex, located in Idaho, United States, each as described in the AIF;

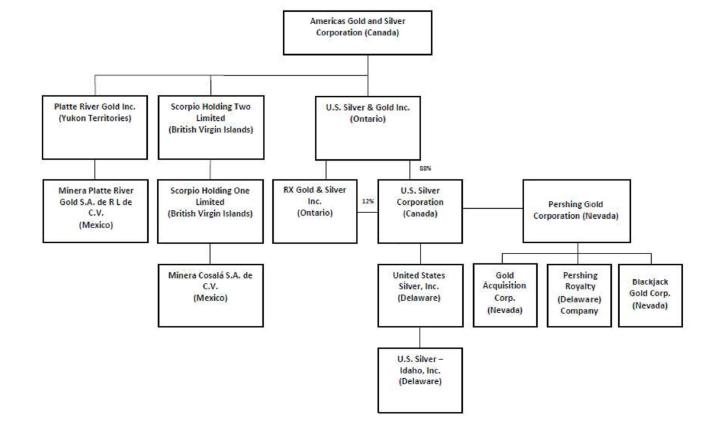

“Material Subsidiaries” means the subsidiaries of the Company set out in Schedule “A” (which schedule includes the Company’s direct or indirect percentage ownership interest therein) other than RX Silver & Gold Inc. and Pershing Royalty Company;

“NI 41-101” means National Instrument 41-101 – General Prospectus Requirements;

“NI 43-101” means National Instrument 43-101 – Standards of Disclosure for Mineral Projects;

“NI 44-101” means National Instrument 44-101 – Short Form Prospectus Distributions;

“NP 11-202” means National Policy 11-202 – Process for Prospectus Reviews in Multiple Jurisdictions;

“NYSE American” means the NYSE American LLC;

“OFAC” has the meaning ascribed thereto in Section 8(1)(ooo);

“Offered Shares” has the meaning ascribed thereto in the second paragraph of this Underwriting Agreement;

“Offering” means the distribution of the Offered Shares pursuant to the Prospectus;

“Offering Documents” means, collectively, the Preliminary Prospectus, the Final Prospectus, any Prospectus Amendment, any Supplementary Material, the U.S. Placement Memorandum and any U.S. Supplementary Material;

“Option” has the meaning ascribed thereto in the second paragraph of this Underwriting Agreement;

“Option Closing Date” has the meaning ascribed to such term in Section 7(1);

“Option Shares” has the meaning ascribed thereto in the second paragraph of this Underwriting Agreement;

- 5 -

“OSC” means the Ontario Securities Commission, as principal regulator of the Company under the Passport System;

“Passport System” means the system and procedures for prospectus filing and review under Multilateral Instrument 11-102 – Passport System adopted by the Securities Commissions (other than the OSC) and NP 11-202;

“person” means any individual, sole proprietorship, partnership, firm, entity, unincorporated association, unincorporated syndicate, unincorporated organization, joint venture association, trust, body corporate, Governmental Authority or other legal entity;

“Personnel” has the meaning ascribed thereto in Section 15(1);

“Precious Metals Purchase Agreement” has the meaning ascribed thereto in the AIF;

“Preliminary Prospectus” means the preliminary short form prospectus dated as of the date hereof, including all of the Documents Incorporated by Reference, prepared and filed by the Company in accordance with the Passport System and NI 44-101 in the Qualifying Jurisdictions in respect of the Offering;

“Preliminary Receipt” means the receipt issued by the OSC evidencing that a receipt has been, or has been deemed to be, issued for the Preliminary Prospectus (or Prospectus Amendment thereto), in each of the Qualifying Jurisdictions;

“Prospectus” means, collectively, the Preliminary Prospectus, the Final Prospectus and any Prospectus Amendment, in each case including all of the Documents Incorporated by Reference;

“Prospectus Amendment” means any amendment to the Preliminary Prospectus or the Final Prospectus required to be prepared and filed by the Company pursuant to Canadian Securities Laws;

“Public Disclosure Documents” means, collectively, all of the documents which have been filed on SEDAR by or on behalf of the Company during the three-year period prior to the Closing Date with the relevant Securities Commissions pursuant to the requirements of Canadian Securities Laws;

“Purchasers” means, collectively, each of the purchasers of Offered Shares pursuant to the Offering, including, if applicable, the Underwriters;

“Qualifying Jurisdictions” has the meaning ascribed thereto in the third paragraph of this Underwriting Agreement;

“Regulation D” has the meaning ascribed thereto in Schedule “B”;

“Reporting Jurisdictions” means the provinces of Ontario, British Columbia, Alberta, Saskatchewan, Manitoba, Québec, New Brunswick, Nova Scotia, Xxxxxx Xxxxxx Island and Newfoundland and Labrador;

“Restricted Dealers” has the meaning ascribed thereto in Section 31(1);

“Sandstorm Convertible Debenture” shall have the meaning ascribed thereto in the AIF;

“SEC” means the United States Securities and Exchange Commission;

“Securities Commissions” means the applicable securities commission or similar regulatory authority in each of the Qualifying Jurisdictions;

“SEDAR” means the System for Electronic Document Analysis and Retrieval of the Canadian Securities Administrators;

- 6 -

“Selling Firm” has the meaning ascribed thereto in the fifth paragraph of this Underwriting Agreement;

“Standard Listing Conditions” has the meaning ascribed thereto in Section 3(3)(d);

“subsidiary” means a subsidiary for purposes of the Securities Act (Ontario);

“Supplementary Material” means, collectively, any Prospectus Amendment, any amendment to any of the other Offering Documents or any amendment or supplemental prospectus or ancillary materials that may be filed by or on behalf of the Company under Applicable Securities Laws relating to the distribution of the Offered Shares and the Option;

“Time of Closing” means 8:00 a.m. (Toronto time) on the Closing Date or Option Closing Date, as applicable, or any other time on the Closing Date or Option Closing Date, as applicable, as may be mutually agreed to by Company and Desjardins;

“Transfer Agent” means Computershare Trust Company of Canada, acting in such capacity;

“TSX” means the Toronto Stock Exchange;

“Underwriters” has the meaning ascribed thereto in the first paragraph of this Underwriting Agreement;

“Underwriting Fee” has the meaning ascribed thereto in Section 12;

“United States” means the United States of America, its territories and possessions, any state of the United States and the District of Columbia;

“U.S. Exchange Act” means the United States Securities Exchange Act of 1934, as amended;

“U.S. person” has the meaning ascribed thereto in Schedule “B”;

“U.S. Placement Memorandum” means the U.S. private placement memorandum, in a form satisfactory to the Underwriters and the Company, each acting reasonably, the preliminary version of which will be attached to a copy of the Preliminary Prospectus and the final version of which will be attached to the Final Prospectus, to be delivered to each offeree and purchaser of the Offered Shares that is in the United States or a U.S. person, in accordance with Schedule “B”;

“U.S. Purchasers” has the meaning ascribed thereto in Section 6(3);

“U.S. Securities Act” means the United States Securities Act of 1933, as amended;

“U.S. Securities Laws” means all applicable securities legislation in the United States, including the U.S. Securities Act, the U.S. Exchange Act and the rules and regulations promulgated thereunder, and any applicable state securities laws; and

“U.S. Supplementary Material” means any Supplementary Material required, in the opinion of the Underwriters, acting reasonably, to be delivered to Purchasers or prospective purchasers that are in the United States or U.S. persons with any supplemental, or supplement to the, U.S. Placement Memorandum as may be so required.

| (2) | Headings, etc. The division of this Underwriting Agreement into sections, subsections, paragraphs and other subdivisions and the insertion of headings are for convenience of reference only and shall not affect the construction or interpretation of this Underwriting Agreement. Unless something in the subject matter or context is inconsistent therewith, references herein to sections, subsections, paragraphs and other subdivisions are to sections, subsections, paragraphs and other subdivisions of this Underwriting Agreement. |

- 7 -

| (3) | Currency. Except as otherwise indicated, all amounts expressed herein in terms of money refer to lawful currency of Canada and all payments to be made hereunder shall be made in such currency. |

| (4) | Capitalized Terms. Capitalized terms used but not defined herein have the meanings ascribed to them in the Prospectus. |

| (5) | Schedules. The following Schedules are attached to this Underwriting Agreement and are deemed to be part of and incorporated in this Underwriting Agreement: |

| Schedule | Title | |

| “A” | Material Subsidiaries | |

| “B” | Compliance with United States Securities Laws | |

| “C” |

Form of Lock-Up Agreement

|

| Section 2 | Prospectus Covenants |

| (1) | Prior to the applicable Time of Closing, the Company will allow the Underwriters to participate fully in the preparation of the Offering Documents (other than material filed prior to the date hereof and incorporated by reference therein). |

| (2) | The Company will prepare and file the Preliminary Prospectus pursuant to the Passport System on or prior to 5:00 p.m. (Toronto time) on the date hereof, and shall obtain the Preliminary Receipt from the OSC under the Passport System as soon as practicable thereafter. |

| (3) | The Company will use its reasonable best efforts to satisfy all comments of the Securities Commissions with respect to the Preliminary Prospectus as soon as possible after receipt of such comments and prepare and file the Final Prospectus pursuant to the Passport System and obtain the Final Receipt therefor on or prior to 5:00 p.m. (Toronto time) on January 26, 2021, or such later date as may be agreed to in writing by Desjardins (on behalf of itself and the other Underwriters) and the Company, each acting reasonably, and shall have taken all other steps and proceedings that may be necessary in order to qualify the Offered Shares and Option for distribution pursuant to the Final Prospectus in each of the Qualifying Jurisdictions by the Canadian Underwriters, and other persons who are registered in a category permitting them to distribute the Offered Shares under the Canadian Securities Laws and who comply with the Canadian Securities Laws, prior to 5:00 p.m. (Toronto time) on January 26, 2021, or such later date as may be agreed to in writing by Desjardins (on behalf of itself and the other Underwriters) and the Company, each acting reasonably. |

| (4) | Until the earlier of the date on which (i) the distribution of the Offered Shares is completed; or (ii) the Underwriters have exercised their termination rights pursuant to Section 13, the Company will promptly take, or cause to be taken, all additional steps and proceedings that may from time to time be required under Canadian Securities Laws to continue to qualify the distribution of the Offered Shares and the Option, or, in the event that the Offered Shares or the Option have, for any reason, ceased so to qualify, to so qualify again the distribution of the Offered Shares and the Option in the Qualifying Jurisdictions. |

| (5) | The Company, and the Underwriters, severally, and not jointly, or jointly and severally, covenant and agree: |

| (a) | that during the distribution of the Offered Shares, the Company and Desjardins shall, prior

to the provision of such marketing materials to potential investors, approve in writing, any marketing materials reasonably

requested to be provided by the Underwriters to any potential investor of Offered Shares, such marketing materials to comply

with Canadian Securities Laws. The Company shall file a template version of such marketing materials with the Securities

Commissions as soon as reasonably practicable after such marketing materials are so approved in writing by the Company and

Desjardins, on behalf of the Underwriters, and in any event on or before the day the marketing materials are first provided

to any potential investor of Offered Shares, and such filing shall constitute the Underwriters’ authority to use such

marketing materials in connection with the Offering. The Company and Desjardins may agree that any comparables shall be

redacted from the template version in accordance with NI 44-101 prior to filing such template version with the Securities

Commissions and a complete template version containing such comparables and any disclosure relating to the comparables, if

any, shall be delivered to the Securities Commissions by the Company.

|

- 8 -

| (b) | not to provide any potential investor of Offered Shares with any marketing materials unless a template version of such marketing materials has been filed by the Company with the Securities Commissions on or before the day such marketing materials are first provided to any potential investor of Offered Shares; |

| (c) | not to provide any potential investor with any materials or information in relation to the distribution of the Offered Shares or the Company other than: (i) such marketing materials as have been approved and filed in accordance with Section 2(5)(a); (ii) the Offering Documents; and (iii) any standard term sheet(s) approved in writing by the Company and Desjardins; and |

| (d) | that any marketing materials approved and filed in accordance with Section 2(5)(a), and any standard term sheets approved in writing by the Company and Desjardins, shall only be provided to potential investors in the Qualifying Jurisdictions. |

| Section 3 | Delivery of Offering Documents |

| (1) | The Company will deliver without charge to the Underwriters, as soon as practicable, but in any event for deliveries to be made within Toronto, Ontario on the next Business Day after, and for deliveries to be made outside of Xxxxxxx, Xxxxxxx, on the second Business Day following, the date that the Preliminary Receipt or Final Receipt, as applicable, is obtained, and thereafter from time to time as requested by the Underwriters, as many commercial copies of the applicable Offering Documents as the Underwriters may reasonably request for the purposes contemplated hereunder and permitted by Applicable Securities Laws, and each such delivery of the Offering Documents will have constituted and shall constitute the consent of the Company to the use of such documents by the Underwriters in connection with the distribution of the Offered Shares, subject to the Underwriters complying with the provisions of Applicable Securities Laws and the provisions of this Underwriting Agreement. |

| (2) | Each delivery of the Offering Documents to the Underwriters by the Company in accordance with this Underwriting Agreement will constitute the representation and warranty of the Company to the Underwriters that (except for information and statements relating solely to the Underwriters and furnished by them specifically for use in the Offering Documents), at the respective date of such document: |

| (a) | the information and statements contained in each of the Offering Documents (including, for greater certainty, the Documents Incorporated by Reference, except to the extent such Documents Incorporated by Reference have been updated or superseded by information and statements contained in the Offering Documents or a subsequent Document Incorporated by Reference): (i) are true and correct in all material respects and contain no misrepresentation; and (ii) constitute full, true and plain disclosure of all material facts relating to the Offered Shares and the Company; |

| (b) | the Prospectus complies as to form in all material respects with Canadian Securities Laws; and |

| (c) | each of the U.S. Placement Memorandum and any U.S. Supplementary Material complies in all material respects with U.S. Securities Laws. |

| (3) | The Company will also deliver to the Underwriters, prior to the filing of the Final Prospectus, as applicable, unless otherwise indicated: |

| (a) | a copy of the Final Prospectus in the form required by Canadian Securities Laws; |

- 9 -

| (b) | a copy of any other document filed with, or delivered to, the Securities Commissions by the Company under Canadian Securities Laws in connection with the Offering, including any Supplementary Material and any Document Incorporated by Reference in the Prospectus not previously filed on SEDAR; |

| (c) | a copy of the U.S. Placement Memorandum and any U.S. Supplementary Material; |

| (d) | evidence satisfactory to the Underwriters of the conditional approval of the listing and posting for trading on the TSX of the Offered Shares, subject only to the satisfaction by the Company of customary post-closing conditions imposed by the TSX in similar circumstances (the “Standard Listing Conditions”); and |

| (e) | a “long-form” comfort letter dated the date of the Final Prospectus, in form and substance satisfactory to the Underwriters, acting reasonably, addressed to the Underwriters and the directors of the Company, from the Company’s Auditors, and based on a review completed not more than two Business Days prior to the date of the letter, with respect to financial and accounting information relating to the Company included and incorporated by reference in the Final Prospectus, which letter shall be in addition to the auditors’ report contained in the Prospectus and any auditors’ consent letter addressed to the Securities Commissions and filed with or delivered to the Securities Commissions under Canadian Securities Laws. |

| (4) | The Company shall deliver to the Underwriters, contemporaneously with, or prior to, any filing of any Supplementary Material, comfort letters and other documents substantially similar to those referred to in Section 3(3), with respect to such Supplementary Material. |

| Section 4 | Notifications of Material Changes During the Distribution of the Offered Shares |

| (1) | The Company will promptly notify the Underwriters during the period prior to the completion of the distribution of the Offered Shares of the full particulars of: |

| (a) | any material change (actual, threatened or contemplated) in the business, affairs, operations, assets, liabilities (contingent or otherwise), financial condition or capital of the Company and its subsidiaries, taken as a whole; |

| (b) | any material fact that has arisen or has been discovered and would have been required to have been stated in any of the Offering Documents had that fact arisen or been discovered on, or prior to, the date of the Offering Documents, as the case may be; |

| (c) | any change in any material fact or any misstatement of any material fact contained in any of the Offering Documents, or the existence of any new material fact, in each case which is of a nature as to render any of the Offering Documents misleading or untrue in any material respect or would result in a misrepresentation therein; |

| (d) | any breach of any material covenant of this Underwriting Agreement by the Company, or upon it becoming aware that any representation or warranty of the Company contained in this Underwriting Agreement is or has become untrue or inaccurate in any material respect; or |

| (e) | any notice or other material correspondence received by the Company from any regulatory or governmental body and any requests from such bodies for information or a hearing relating to the Company, the Offering, the issue and sale of the Offered Shares or grant of the Option; |

and the Company shall promptly, and in any event within any applicable time limitation, comply with all applicable filings and other requirements under the Applicable Securities Laws as a result of such fact or change, including, for greater certainty, filing any Supplementary Material which may be necessary under Canadian Securities Laws to qualify the distribution of Offered Shares and the Option in the Qualifying Jurisdictions; provided that the Company shall not file any Supplementary Material or other document without first providing the Underwriters with a copy of such Supplementary Material or other document and consulting with the Underwriters and their counsel with respect to the form and content thereof.

- 10 -

| (2) | In addition to the provisions of Section 4(1), the Company will, in good faith, discuss with the Underwriters any change, event, development or fact, contemplated, anticipated, threatened, or proposed in Section 4(1) that is of such a nature that there may be reasonable doubt as to whether notice should be given to the Underwriters under Section 4(1) and will consult with the Underwriters with respect to the form and content of any Supplementary Material proposed to be filed by the Company, it being understood and agreed that no such Supplementary Material will be filed with any Securities Commission until the Underwriters and their legal counsel have been given a reasonable opportunity to review and comment on, and, if required under Canadian Securities Laws, approve such material. |

| Section 5 | Due Diligence |

Prior to the Time of Closing and, if applicable, prior to the filing of any Supplementary Material, the Underwriters and their legal counsel will be provided with timely access to all information required to permit them to conduct a full due diligence investigation of the Company and the Material Subsidiaries and their business operations, properties, assets, affairs and financial condition. In particular, the Underwriters shall be permitted to conduct all due diligence that they may require in order to fulfil their obligations under Applicable Securities Laws and, in that regard, the Company will make available to the Underwriters and their legal counsel, on a timely basis, all corporate and operating records, material contracts, financial information, budgets, key officers, and other relevant information necessary in order to complete the due diligence investigation of the Company and the Material Subsidiaries and their business, properties, assets, affairs and financial condition for this purpose, and without limiting the scope of the due diligence inquiries the Underwriters may conduct, to participate and cause their counsel, the Company’s Auditors and the Company’s technical consultants to participate in one or more due diligence sessions to be held prior to the filing of the Preliminary Prospectus, the Final Prospectus and the Time of Closing. It shall be a condition precedent to the Canadian Underwriters’ execution of any certificate in any Offering Document that the Underwriters be satisfied, acting reasonably, as to the form and content of the document based on their due diligence review. The Underwriters shall not unreasonably withhold or delay the execution of such Offering Document required to be executed by the Underwriters and filed in compliance with Canadian Securities Laws for the purposes of the Offering.

| Section 6 | Conditions of Closing |

The Underwriters’ obligations under this Underwriting Agreement (including the obligation to complete the purchase of the Offered Shares or any of them) are conditional upon and subject to:

| (1) | Legal Opinions. The Underwriters receiving at the Time of Closing favourable legal opinions addressed to the Underwriters from Blake, Xxxxxxx & Xxxxxxx LLP, counsel to the Company, or local counsel with respect to those matters governed by the laws of jurisdictions other than the jurisdictions in which it is qualified to practice, which counsel may rely as to matters of fact, on certificates of the officers of the Company, public and stock exchange officials and other documentation standard for legal opinions in transactions of a similar nature, in form and substance acceptable to the Underwriters, acting reasonably, with respect to the following matters: |

| (a) | the Company being a “reporting issuer”, or its equivalent, in each of the Qualifying Jurisdictions and not in default under Canadian Securities Laws in such Qualifying Jurisdictions; |

| (b) | the Company being a corporation existing under the Canada Business Corporations Act and having all requisite corporate power and capacity to carry on business, to own, lease and operate properties and assets and to enter into this Underwriting Agreement and to perform its obligations hereunder; |

| (c) | the authorized share capital of the Company; |

- 11 -

| (d) | all necessary corporate action having been taken by the Company to authorize the execution and delivery of this Underwriting Agreement and the performance of its obligations hereunder and as to this Underwriting Agreement having been duly authorized, executed and delivered on behalf of the Company, and constituting a legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except as the enforcement thereof may be limited by the application of equitable principles when equitable remedies are sought, and by the fact that rights to indemnity, contribution and waiver, and the ability to sever unenforceable terms, may be limited by applicable law; |

| (e) | all necessary corporate action having been taken by the Company to authorize the execution and delivery of the Prospectus and any Supplementary Material and the filing thereof with the Securities Commissions; |

| (f) | the execution and delivery of this Underwriting Agreement by the Company and the performance by the Company of its obligations hereunder (including the issuance, sale and delivery of the Offered Shares and the grant of the Option, as applicable) do not and will not (as the case may be) conflict with or result in a breach or violation of any of the terms or provisions of, or constitute a default under, whether after notice or lapse of time or both: (i) the provisions of any law, statute, rule or regulation to which the Company is subject; or (ii) the constating documents and by-laws of the Company; |

| (g) | the Offered Shares having been duly authorized for issuance and, at the Time of Closing and upon receipt by the Company of the purchase price therefor, the Offered Shares will be validly issued as fully paid and non-assessable Common Shares; |

| (h) | the Offered Shares issuable on exercise of the Option having been duly authorized for issuance and, upon due exercise of the Option and receipt by the Company of the purchase price therefor, such Offered Shares will be validly issued as fully paid and non-assessable Common Shares; |

| (i) | all necessary documents having been filed, all requisite proceedings having been taken and all approvals, permits, authorizations and consents of the appropriate regulatory authority in each of the Qualifying Jurisdictions having been obtained by the Company to qualify the distribution of the Offered Shares and the Option in each of the Qualifying Jurisdictions in compliance with the relevant provisions of applicable Canadian Securities Laws; |

| (j) | subject to the qualifications and assumptions set out therein, the statements set forth in the Final Prospectus under the heading “Eligibility for Investment” insofar as they purport to describe the provisions of the laws referred to therein are fair and accurate summaries of the matters discussed therein; |

| (k) | the Offered Shares being conditionally approved for listing on the TSX (subject to the Standard Listing Conditions); and |

| (l) | the Transfer Agent having been duly appointed as the transfer agent and registrar for the Common Shares; |

| (2) | Material Subsidiaries Opinions. The Company shall use commercially reasonable efforts to deliver to the Underwriters at the Time of Closing a favourable legal opinion addressed to the Underwriters dated as of the Closing Date, as to the incorporation, capacity, ownership, subsistence and authorized and issued capital of each of the Material Subsidiaries relating to the chain of title of each of the Material Properties, being: Platte River Gold Inc. (Yukon), Minera Platte River Gold S.A. de X X de C.V. (Mexico), Scorpio Holding Two Limited (BVI), Scorpio Holding One Limited (BVI), and Minera Cosalá S.A. de C.V. (Mexico), U.S. Silver & Gold Inc. (Ontario), RX Gold & Silver Inc. (Ontario), U.S. Silver Corporation (Canada), United States Silver, Inc. (Delaware), U.S. Silver – Idaho, Inc. (Delaware), Pershing Gold Corporation (Nevada) and Gold Acquisition Corp. (Nevada), and such other legal matters reasonably requested by the Underwriters; |

- 12 -

| (3) | United States Legal Opinion. If any Offered Shares are sold to Purchasers in the United States or who are U.S. persons (the “U.S. Purchasers”), the Underwriters receiving at the Time of Closing a favourable legal opinion addressed to the Underwriters dated as of the Closing Date, from United States counsel to the Company, Xxxxxx & Xxxxxxx LLP, to the effect that it is not necessary in connection with the offer and sale of the Offered Shares to the U.S. Purchasers to register the Offered Shares under the U.S. Securities Act, it being understood the no opinion is expressed as to any subsequent resale of any Offered Shares; |

| (4) | Title Opinions. The Company shall use commercially reasonable efforts to deliver to the Underwriters at the Time of Closing favourable legal opinions addressed to the Underwriters dated as of the Closing Date, in form and substance acceptable to the Underwriters, acting reasonably, as to the title matters relating to mining activities as currently conducted at each of the Material Properties; |

| (5) | Corporate Certificate. The Underwriters shall have received at the Time of Closing a certificate, dated as of the Closing Date, signed by the Chief Executive Officer and Chief Financial Officer of the Company, or such other officer(s) of the Company as the Underwriters may agree, certifying for and on behalf of the Company and not in their personal capacity, to the best of the knowledge, information and belief of the person(s) so signing, with respect to: (a) the articles and by-laws of the Company; (b) the resolutions of the Company’s board of directors relevant to the issue and sale of the Offered Shares by the Company and the authorization of this Underwriting Agreement and the transactions contemplated herein; and (c) the incumbency and signatures of the signing officers of the Company who have signed the Offering Documents or other documents relating to Closing; |

| (6) | Bring-Down Certificate. The Company shall have delivered to the Underwriters, at the Time of Closing, a certificate dated the Closing Date addressed to the Underwriters and signed by the Chief Executive Officer and Chief Financial Officer of the Company, or such other officer(s) of the Company as the Underwriters may agree, certifying for and on behalf of the Company, and not in their personal capacities, after having made due inquiries, with respect to the following matters: |

| (a) | the Company having complied with all of the covenants, in all material respects, and satisfied all the terms and conditions of this Underwriting Agreement on its part to be complied with and satisfied at or prior to the Time of Closing (other than to the extent any such covenants or terms or conditions have been waived by Desjardins, on behalf of the Underwriters, as the case may be); |

| (b) | that no order, ruling or determination having the effect of ceasing or suspending the trading in the Common Shares or prohibiting the sale of the Offered Shares or grant of the Option or any other securities of the Company has been issued by any regulatory authority and is continuing in effect and no proceedings for such purpose have been instituted or are pending or, to the knowledge of such officers, contemplated or threatened under any relevant securities laws (including Applicable Securities Laws) or by any regulatory authority; |

| (c) | subsequent to the respective dates as at which information is given in the Prospectus, there having not occurred a Material Adverse Effect or any change or development involving a prospective Material Adverse Effect, other than as disclosed in the Prospectus or any Supplementary Material, as the case may be; |

| (d) | other than the Offering, no material change relating to the Company and its subsidiaries on a consolidated basis having occurred since the date hereof with respect to which the requisite material change report has not been filed, and no such disclosure having been made on a confidential basis that remains confidential; and |

| (e) | the representations and warranties of the Company contained in this Underwriting Agreement and in any certificates of the Company delivered pursuant to or in connection with this Underwriting Agreement, being true and correct in all material respects (or (i) if qualified by materiality, in all respects, and (ii) if given at a specified date, in all material respects as at such date) as at the Time of Closing, with the same force and effect as if made on and as at the Time of Closing, after giving effect to the transactions contemplated by this Underwriting Agreement; |

- 13 -

| (7) | Certificate of Transfer Agent. The Company having delivered to the Underwriters at the Time of Closing a certificate or letter of the Transfer Agent, certifying as to: (i) its appointment as transfer agent and registrar of the Common Shares; and (ii) the number of Common Shares issued and outstanding on the Business Day prior to the Closing Date, or such other earlier date prior to the Closing Date as is acceptable to the Underwriters, acting reasonably; |

| (8) | Bring-Down Auditors Comfort Letter. The Company having caused the Company’s Auditors to deliver to the Underwriters a comfort letter, dated the Closing Date, in form and substance satisfactory to the Underwriters, acting reasonably, bringing forward to the date which is two Business Days prior to the Closing Date, the information contained in the comfort letter referred to in Section 3(3)(e); |

| (9) | Certificate of Status. The Underwriters shall have received a certificate of compliance (or the equivalent) in respect of the Company and each of the Material Subsidiaries relating to the chain of title of each of the Material Properties, being Platte River Gold Inc. (Yukon), Minera Platte River Gold S.A. de X X de C.V. (Mexico), Scorpio Holding Two Limited (BVI), Scorpio Holding One Limited (BVI), Minera Cosalá S.A. de C.V. (Mexico), U.S. Silver & Gold Inc. (Ontario), RX Gold & Silver Inc. (Ontario), U.S. Silver Corporation (Canada), United States Silver, Inc. (Delaware), U.S. Silver – Idaho, Inc. (Delaware), Pershing Gold Corporation (Nevada) and Gold Acquisition Corp. (Nevada), issued by the appropriate regulatory authority, as applicable, in each jurisdiction under which the Company and such Material Subsidiaries exist, to the extent that such certificates of compliance (or their equivalent) are available in such jurisdictions; |

| (10) | Lock-Up Agreements. The Underwriters shall have received lock-up agreements dated as of the Closing Date pursuant to Section 9(1)(f) in favour of the Underwriters, in the form set forth as Schedule “C” hereof; |

| (11) | No Termination. The Underwriters not having exercised any rights of termination set forth in Section 13; and |

| (12) | Other Documentation. The Underwriters having received at the Time of Closing such further opinions, certificates and other documentation from the Company as may be contemplated herein, provided, however, that the Underwriters shall request any such opinion, certificate or document within a reasonable period prior to the Time of Closing that is sufficient for the Company to obtain and deliver such certificate or document and provided further that any such requested opinion, certificate or document is customary for financings of the nature contemplated hereby. |

| Section 7 | Option Closing |

| (1) | If the Underwriters elect to exercise the Option, Desjardins, on behalf of the Underwriters, shall provide written notice (the “Exercise Notice”) to the Company not later than the 30th day after the Closing Date, which Exercise Notice shall specify the number of Option Shares to be purchased by the Underwriters and the date on which such Offered Shares are to be purchased, which may not be earlier than the Closing Date (the “Option Closing Date”). Pursuant to the Exercise Notice, the Underwriters shall severally, and not jointly, nor jointly and severally, purchase in their respective percentages set out in Section 17 below, and the Company shall deliver and sell, the number of Option Shares indicated in such notice, in accordance with the provisions of this Underwriting Agreement. |

| (2) | Desjardins, on behalf of the Underwriters, shall deliver the Exercise Notice to the Company at least two Business Days, but not more than five Business Days, prior to the Option Closing Date, provided that if the Closing of the Option is to occur concurrently with the Closing of the issue and sale of the Initial Shares, Desjardins may deliver the Exercise Notice to the Company not later than 12 noon (Toronto time) on the Business Day preceding the Closing Date. The purchase and sale of the Option Shares issuable on exercise of the Option, if required, shall be completed at 8:00 a.m. (Toronto time) on the Option Closing Date at such place as the Underwriters and the Company may agree. |

| (3) | The applicable terms, conditions and provisions of this Underwriting Agreement (including the provisions of Section 6 relating to Closing deliveries) shall apply mutatis mutandis to the Closing of the issuance of any Offered Shares pursuant to the exercise of the Option. |

- 14 -

| Section 8 | Representations and Warranties of the Company |

| (1) | The Company represents and warrants to the Underwriters as of the date hereof, and acknowledges that the Underwriters are relying upon each of such representations and warranties in completing the Closing, that: |

| (a) | Good Standing of the Company. The Company (i) is duly incorporated under the Act and is up-to-date in respect of all material corporate filings and is in good standing under such Act, (ii) has all requisite corporate power, authority and capacity to carry on its business as now conducted and to own, lease and operate its properties and assets as described in the Prospectus; and (iii) has all requisite corporate power and authority to enter into this Underwriting Agreement and to perform its obligations hereunder; |

| (b) | Good Standing of the Material Subsidiaries. The Material Subsidiaries are the only subsidiaries of the Company which are material to the Company and Schedule “A” is true and accurate in all respects. Each of the Material Subsidiaries (i) has been duly incorporated or otherwise organized in its respective jurisdiction of incorporation or organization (as applicable) and is up-to-date in respect of all material corporate or other filings and is in good standing under the laws of such jurisdiction, and (ii) has all requisite corporate or other power and capacity to carry on its business as now conducted and to own, lease and operate its properties and assets as described in the Prospectus; |

| (c) | Ownership of the Material Subsidiaries. The Company is the direct or indirect legal, registered and beneficial owner of the issued and outstanding shares or other equity interests of each of the Material Subsidiaries as set out in Schedule “A”, free and clear of all mortgages, liens, charges, pledges, security interests, encumbrances, claims and demands whatsoever, except as disclosed in the Offering Documents. All of such shares or equity interests in the capital of the Material Subsidiaries have been duly authorized and validly issued and are outstanding as fully paid and non-assessable shares or equity interests and, except as disclosed in the Offering Documents or in the Public Disclosure Documents, no person has any right, agreement or option, present or future, contingent or absolute, or any right capable of becoming a right, agreement or option, for the purchase from the Company or any subsidiary of the Company of any interest in any of such shares or equity interests for the issue or allotment of any unissued shares or other equity interests in the capital of the Material Subsidiaries or any other security convertible into or exchangeable for any such shares or equity interests; |

| (d) | No Proceedings for Dissolution. No proceedings have been taken or instituted or, to the knowledge of the Company, are pending for the dissolution or liquidation of the Company or any of the Material Subsidiaries; |

| (e) | Compliance with Laws. The Company and each of the Material Subsidiaries is conducting its business in compliance with all applicable laws, rules and regulations of each jurisdiction in which its respective business is carried on, and the Company has not received a notice of non-compliance, or knows of, or has reasonable grounds to know of, any facts that could give rise to a notice of non-compliance with any such laws, regulations or permits, except where any failure to so comply or any non-compliance would not reasonably be expected to have a Material Adverse Effect, and the Company and each of the Material Subsidiaries is licensed, registered or qualified in all jurisdictions in which it owns, leases or operates its property or carries on business to enable it to carry on its business as now conducted and its property and assets to be owned, leased and operated and all such licences, registrations and qualifications are valid, subsisting and in good standing, except where the failure of such licences, registrations or qualifications to be valid, subsisting or in good standing would not reasonably be expected to have a Material Adverse Effect; |

| (f) | Valid and Binding Documents. The execution and delivery of this Underwriting Agreement and the performance of the transactions contemplated hereunder have been duly authorized by all necessary corporate action of the Company and this Underwriting Agreement has been duly executed and delivered by the Company and constitutes a valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except as enforcement thereof may be limited by bankruptcy, insolvency, reorganization, moratorium and other laws relating to or affecting the rights of creditors generally and except as limited by the application of equitable principles when equitable remedies are sought, and by the fact that rights to indemnity, contribution and waiver, and the ability to sever unenforceable terms, may be limited by applicable law; |

- 15 -

| (g) | Validly Issued Securities. (i) The Offered Shares have been duly authorized for issuance and, upon issuance thereof in accordance with this Underwriting Agreement, the Offered Shares will be validly issued as fully paid and non-assessable Common Shares, and all statements made in the Offering Documents describing the Offered Shares (including their attributes) are accurate in all material respects; (ii) the Option has been duly authorized for grant; and (iii) the Offered Shares and the Option have not and will not have been issued or granted in violation of any pre-emptive rights or contractual rights to purchase securities issued by the Company; |

| (h) | Offered Shares Qualified Investments. The Offered Shares will be, once listed on the TSX, qualified investments under the Income Tax Act (Canada) for trusts governed by registered retirement savings plans, registered education savings plans, registered retirement income funds, deferred profit sharing plans, registered disability savings plans and tax-free savings accounts, in each case, subject to the qualifications, limitations and assumptions set forth in the Final Prospectus under the heading “Eligibility for Investment”; |

| (i) | Prospectus Eligibility. The Company is eligible to file a short form prospectus in each of the Qualifying Jurisdictions pursuant to Canadian Securities Laws and on the date of and upon filing of the Final Prospectus there will be no documents required to be filed under applicable Canadian Securities Laws in connection with the Offering that will not have been filed as required; |

| (j) | No Order Restricting Use of Prospectus. To the knowledge of the Company, no securities commission, stock exchange or comparable authority has issued any order restricting, preventing or suspending the use or effectiveness of the Prospectus or any Prospectus Amendment or preventing the distribution of the Offered Shares or the Option in any Qualifying Jurisdiction or instituted proceedings for that purpose and, to the knowledge of the Company, no such proceedings are pending or contemplated; |

| (k) | Filing of Offering Documents. Each of the Preliminary Prospectus, the Final Prospectus and the U.S. Placement Memorandum, and the execution and filing of the Preliminary Prospectus and the Final Prospectus with the Securities Commissions, have been or will be duly approved and authorized by all necessary action by the Company, and the Preliminary Prospectus has been duly executed and filed, and will be, in the case of the Final Prospectus, duly executed and filed, in each case by and on behalf of the Company; |

| (l) | Prospectus Compliance. Each of the Preliminary Prospectus, the Final Prospectus and any Prospectus Amendment complies or will comply, as the case may be, in all material respects with the Canadian Securities Laws and, at the time of delivery of the Offered Shares and grant of the Option to the Underwriters and the Purchasers, as applicable, the Prospectus will comply in all material respects with the Canadian Securities Laws; |

| (m) | Forward-Looking Information. With respect to forward-looking information contained in the Offering Documents: |

| (i) | the Company had a reasonable basis for the forward-looking information at the time the disclosure was made; |

| (ii) | all forward-looking information is identified as such, and all such documents caution users of forward-looking information that actual results may vary from the forward-looking information, identify material risk factors that could cause actual results to differ materially from the forward-looking information, and state the material factors or assumptions used to develop the forward-looking information; and |

| (iii) | the future-oriented financial information or financial outlook contained therein is limited to a period for which the information can be reasonably estimated; |

- 16 -

| (n) | Necessary Consents and Approvals. No approval, authorization, consent or other order of, and no filing, registration or recording with, the shareholders of the Company, any Governmental Authority or other person is required of the Company in connection with its execution and delivery of this Underwriting Agreement and the performance of its obligations hereunder except: (i) as disclosed in the Offering Documents, (ii) in compliance with the Applicable Securities Laws with regard to the distribution of the Offered Shares and the Option, and (iii) those which have been obtained or will be obtained by the Closing Date and provided to the Underwriters; |

| (o) | Stock Exchange Listing, Filings and Fees. The currently issued and outstanding Common Shares are listed and posted for trading on the Exchanges and the Company is currently in compliance with the rules and regulations of the Exchanges and all material filings and fees required to be made and paid by the Company pursuant to Applicable Securities Laws and general corporate law have been made and paid; |

| (p) | No Cease Trade Orders or Action to Delist. No order ceasing or suspending trading in any securities of the Company or prohibiting the sale of the Offered Shares or the trading of any of the Company’s issued securities has been issued and no proceedings for such purpose are threatened or, to the best of the Company’s knowledge, pending, and the Company has not taken any action which would be reasonably expected to result in the delisting or suspension of the Common Shares on or from the Exchanges; |

| (q) | Dividends. The Company has not, directly or indirectly, declared or paid any dividend or declared or made any other distribution on any of its shares or securities of any class, or, directly or indirectly, redeemed, purchased or otherwise acquired any of the Common Shares or securities or agreed to do any of the foregoing, and there are no restrictions upon or impediment to, the declaration or payment of dividends by the Company in the constating documents of the Company or in any Material Agreements or Debt Instruments; |

| (r) | No Default or Breach. The execution and delivery of this Underwriting Agreement and the performance by the Company of its obligations hereunder, and the issuance of the Offered Shares and the grant of the Option does not and will not (as the case may be) conflict with or result in a breach or violation of any of the terms or provisions of, or constitute a default under, whether after notice or lapse of time or both, (i) any statute, rule or regulation applicable to the Company or any of the Material Subsidiaries, including Applicable Securities Laws; (ii) the constating documents, by-laws or resolutions of the Company or any of the Material Subsidiaries, that are in effect at the date hereof; (iii) the terms of any Debt Instrument or Material Agreement to which the Company or any of the Material Subsidiaries are a party or by which they are bound; or (iv) any judgment, decree or order binding the Company, any of the Material Subsidiaries or the respective property or assets of the Company or the Material Subsidiaries; |

| (s) | Absence of Rights to Acquire Securities. Except as disclosed in the Offering Documents, no person now has any agreement or option or right or privilege (whether at law, pre-emptive or contractual) capable of becoming an agreement for the purchase, subscription or issuance of, or conversion into, any unissued shares, securities, warrants or convertible obligations of any nature of the Company or any of the Material Subsidiaries; |

| (t) | Share Capital. The authorized capital of the Company consists of an unlimited number of Common Shares without par value and 8,000,000 Preferred Shares, of which, as of January 18, 2021, an aggregate of 118,095,427 Common Shares and nil Preferred Shares were outstanding as fully paid and non-assessable shares of the Company. Except as disclosed in the Offering Documents, there are no options, warrants or other securities convertible into, or exchangeable or exercisable for, Common Shares; |

- 17 -

| (u) | No Adverse Legislation. The Company is not aware of any legislation, or proposed legislation published by a legislative body, which it anticipates will materially and adversely affect the condition (financial or otherwise), assets, liabilities (contingent or otherwise), business, affairs, operations, properties, capital or prospects of the Company and its subsidiaries on a consolidated basis; |

| (v) | No Material Changes. Since December 31, 2019, other than as disclosed in the Public Disclosure Documents: (i) there has been no material change in the assets, liabilities, obligations (absolute, accrued, contingent or otherwise), business, condition (financial or otherwise) or results of operations of the Company and its subsidiaries on a consolidated basis, (ii) there has been no material change in the capital stock or long-term debt of the Company and its subsidiaries on a consolidated basis, and (iii) the Company and the Material Subsidiaries have carried on their respective businesses in the ordinary course; |

| (w) | Reporting Issuer. The Company is currently a “reporting issuer” (within the meaning of Canadian Securities Laws) in each of the Reporting Jurisdictions and the Company will, as of the Closing Date, be a reporting issuer in each of the Reporting Jurisdictions and not included in a list of defaulting reporting issuers maintained by the Securities Commissions in such jurisdictions, and in particular, without limiting the foregoing, the Company has at all relevant times complied with its obligations to make timely disclosure of all material changes relating to it, no such disclosure has been made on a confidential basis (including, but not limited to, the filing of any confidential material change report) that is still maintained on a confidential basis, and there is no material change relating to the Company which has occurred and with respect to which the requisite material change report has not been filed with the Securities Commissions; |

| (x) | Continuous Disclosure Compliance. The Company is in compliance in all material respects with its timely and continuous disclosure obligations under Applicable Securities Laws and the rules and regulations of the Exchanges, including insider reporting obligations, and, without limiting the generality of the foregoing, there has been no material change that has occurred since December 31, 2019, which has not been publicly disclosed. The information and statements in the Public Disclosure Documents were true and correct in all material respects as of the respective dates of such information and statements and at the time any such documents were filed on SEDAR and, except as may have been corrected or superseded by subsequent disclosure, do not contain any misrepresentations and no material facts have been omitted therefrom which would make such information materially misleading; |

| (y) | Financial Statements. The Financial Statements incorporated by reference in the Prospectus: (i) have been prepared in accordance with IFRS consistently applied throughout the periods involved, and comply as to form in all material respects with applicable accounting requirements of Canadian Securities Laws, (ii) are, in all material respects, consistent with the books and records of the Company, (iii) contain and reflect all material adjustments for the fair presentation of the results of operations and the financial condition of the business of the Company for the periods covered thereby, (iv) present fairly, in all material respects, the financial position of the Company as at the date thereof and the results of its operations and the changes in its financial position for the periods then ended, (v) contain and reflect adequate provision or allowance for all reasonably anticipated liabilities, expenses and losses of the Company, and (vi) do not omit to state any material fact that is required by generally accepted accounting principles or by applicable law to be stated or reflected therein or which is necessary to make the statements contained therein not misleading, respectively; |

| (z) | Independent Auditors. The Company’s Auditors who audited the consolidated financial statements as at and for the financial years ended December 31, 2019 and 2018 incorporated by reference in the Prospectus and delivered their auditors’ report thereon are independent public accountants as required by the Canadian Securities Laws; |

- 18 -

| (aa) | No Reportable Events. Since December 31, 2018, there has not been any “reportable event” (within the meaning of National Instrument 51-102 – Continuous Disclosure Obligations) with the Company’s Auditors; |

| (bb) | Accounting Controls. The Company and each of the Material Subsidiaries maintains a system of internal accounting controls sufficient to provide reasonable assurance that: (i) transactions are executed in accordance with management’s general or specific authorizations, (ii) transactions are recorded as necessary to permit preparation of financial statements in conformity with generally accepted accounting principles in Canada and to maintain asset accountability, (iii) access to assets is permitted only in accordance with management’s general or specific authorization, and (iv) the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with respect to any differences. Since December 31, 2019, the Company has not become aware of any material weakness in the Company’s internal control over financial reporting (whether or not remediated) or change in the Company’s internal control over financial reporting that has materially affected or is reasonably likely to materially affect the Company’s internal control over financial reporting; |

| (cc) | Accounting Policies. There has been no change in accounting policies or practices of the Company since December 31, 2019, other than as required by IFRS. |

| (dd) | Off-Balance Sheet Arrangements and Liabilities. There are no off-balance sheet transactions, arrangements or obligations of the Company or its subsidiaries, whether direct, indirect, absolute, contingent or otherwise which are required to be disclosed and are not disclosed or reflected in the Public Disclosure Documents. |

| (ee) | No Actions or Proceedings. There is no action, suit, proceeding, inquiry or investigation before or brought by any court or governmental agency, governmental instrumentality or body, domestic or foreign, now pending or, to the knowledge of the Company, threatened against or affecting the Company or any Material Subsidiary, which is required to be disclosed in the Prospectus and which is not so disclosed, or which if determined adversely, would reasonably be expected to result in a Material Adverse Effect or to materially and adversely affect the consummation of the transactions contemplated in this Underwriting Agreement or the performance by the Company of its obligations hereunder; |

| (ff) | No Voting Agreements. Other than as disclosed in the Offering Documents, to the knowledge of the Company, no agreement is in force or effect which in any manner affects the voting or control of any of the securities of the Company or the Material Subsidiaries; |

| (gg) | Purchases and Sales. The Company has not approved or entered into any binding agreement in respect of: (i) the purchase of any material property or assets or any interest therein or the sale, transfer or other disposition of any material property or assets or any interest therein currently owned, directly or indirectly, by the Company or any Material Subsidiary whether by asset sale, transfer of shares or otherwise, other than pursuant to the terms of the Galena JV, or (ii) the change of control (by sale or transfer of shares or sale of all or substantially all of the property and assets of the Company or otherwise) of the Company; |

| (hh) | Taxes. All taxes (including income tax, capital tax, payroll taxes, employer health tax, workers’ compensation payments, property taxes, custom and land transfer taxes), duties, royalties, levies, imposts, assessments, deductions, charges or withholdings and all liabilities with respect thereto including any penalty and interest payable with respect thereto (collectively, “Taxes”) due and payable by the Company or the Material Subsidiaries have been paid except where the failure to pay such taxes would not reasonably be expected to constitute a Material Adverse Effect. All tax returns, declarations, remittances and filings required to be filed by the Company and the Material Subsidiaries have been filed with all appropriate Governmental Authorities and all such returns, declarations, remittances and filings are complete and materially accurate and no material fact or facts have been omitted therefrom which would make any of them misleading except where the failure to file or any incompleteness of or inaccuracy in such documents would not reasonably be expected to constitute a Material Adverse Effect. To the best of the knowledge of the Company and the Material Subsidiaries, no examination of any tax return of the Company or the Material Subsidiaries is currently in progress and there are no issues or disputes outstanding with any Governmental Authority respecting any taxes that have been paid, or may be payable, by the Company, in any case, except where such examinations, issues or disputes would not reasonably be expected to constitute a Material Adverse Effect; |

- 19 -

| (ii) | Material Agreements. With respect to the Material Agreements: |

| (i) | all of the Material Agreements are valid, subsisting, in good standing and in full force and effect, enforceable in accordance with the terms thereof; |

| (ii) | the Company and the Material Subsidiaries have performed all material obligations (including payment obligations) in a timely manner under, and are in compliance with all terms, conditions and covenants contained in each Material Agreement that could have a material impact on the Company or the Material Subsidiaries; and |

| (iii) | to the knowledge of the Company, no other party is in breach, violation or default of any term under any Material Agreement; |

(jj) Debt Instruments. With respect to the Debt Instruments:

| (i) | the Company and the Material Subsidiaries, as applicable, have performed all material obligations (including payment obligations) in a timely manner under, and are in compliance with all material terms, conditions and covenants contained in any Debt Instruments; |

| (ii) | each of the Company and the Material Subsidiaries does not reasonably expect to fail to perform any material obligations (including payment obligations) under any Debt Instruments, and expects to remain in compliance with all material terms, conditions and covenants contained in each of the Debt Instruments; and |

| (iii) | the entering into of this Underwriting Agreement will not trigger any event of default or similar provisions in respect of any Debt Instruments; |

| (kk) | No Non-Arm’s Length Indebtedness. Neither the Company nor any of the Material Subsidiaries is party to any material Debt Instrument or has any material loans or other indebtedness outstanding which has been made to any of its shareholders, officers, directors, employees or independent contractors, past or present, or any person not dealing at arm’s length with them; |

| (ll) | Related Parties. Except as disclosed in the Prospectus, none of the directors or officers of the Company, any known holder of more than 10% of any class of shares of the Company, or any known associate or affiliate of any of the foregoing persons, has had any material interest, direct or indirect, in any material transaction within the previous two years or any proposed material transaction which, as the case may be, materially affected, is material to or will materially affect the Company and the Material Subsidiaries on a consolidated basis; |

| (mm) | Compliance with Mining Laws. The Company and each Material Subsidiary has conducted and is conducting its business in compliance in all material respects with all applicable laws, rules and regulations of each jurisdiction in which it carries on business and with all laws, regulations, tariffs, rules, orders and directives material to its operation, including all applicable laws, regulations and statutes relating to mining and/or mining claims, concessions, licenses or leases, and neither the Company nor any Material Subsidiary has received any notice of the revocation or cancellation of, or any intention to revoke or cancel, any of the mining claims, concessions, licenses, leases or other instruments conferring mineral rights, including in respect of the Material Properties, where such revocation or cancellation would have a Material Adverse Effect; |

- 20 -

| (nn) | Material Properties. The Material Properties are the only mineral properties or mineral assets which the Company considers material to the business of the Company and the Material Subsidiaries, as applicable; |

| (oo) | Title to Material Properties. Except as disclosed in the Prospectus: (i) each of the Company or the Material Subsidiaries, as applicable, is the absolute legal and beneficial owner of, and has good and marketable title to or a valid leasehold interest in the Material Properties and all of its other material properties or assets as described in the Prospectus, free of all liens or encumbrances; (ii) no other material property rights are necessary for the conduct of the Company’s or any Material Subsidiary’s business in respect of the Material Properties or any Material Subsidiary, as currently conducted; neither the Company nor any Material Subsidiary knows of any material claim or the basis for any material claim that could reasonably be expected to adversely affect the right thereof to use, transfer or otherwise exploit such property rights; and (iii) neither the Company nor any Material Subsidiary has any current responsibility or obligation to pay any outstanding material commission, royalty, licence fee or similar payment to any person with respect to the property rights thereof except pursuant to applicable legislation. |

| (pp) | Mineral Rights. The Company and any applicable Material Subsidiaries hold freehold title, leases, licences, mining claims or other conventional property, proprietary or contractual interests or rights, recognized in the jurisdiction in which the Material Properties are located, under valid, subsisting and enforceable title documents or other recognized and enforceable agreements or instruments, sufficient to permit the Company or any Material Subsidiary to explore or exploit (as the case may be) the minerals relating thereto. All property, leases or claims relating to the Material Properties in which the Company or any Material Subsidiary has any interest or right have been validly applied for and, if issued, to the knowledge of the Company, issued in accordance with all applicable laws and are valid and subsisting. The Company and any applicable Material Subsidiaries have all necessary surface rights, access rights and other necessary rights and interests relating to the Material Properties, granting the Company and any applicable Material Subsidiaries the right and ability to explore, exploit and mine the mineral resources as are appropriate in view of the rights and interest therein of the Company or any Material Subsidiary and the current state of exploration, with only such exceptions as do not materially interfere with the use made by the Company or any Material Subsidiary of the rights or interests so held and each of the proprietary interests or rights and each of the documents, agreements, leases, instruments and obligations relating thereto referred to above is currently in good standing in the name of the Company or any Material Subsidiary. |