900 NORTH POINT PARKWAY ALPHARETTA, GEORGIA 30005 OFFICE LEASE AGREEMENT BETWEEN BRE/COH GA LLC, a Delaware limited liability company (“LANDLORD”) AND CLEARSIDE BIOMEDICAL, INC., a Delaware corporation (“TENANT”)

EXHIBIT 10.1

000 XXXXX XXXXX XXXXXXX

XXXXXXXXXX, XXXXXXX 00000

BETWEEN

BRE/COH GA LLC, a Delaware limited liability company

(“LANDLORD”)

AND

CLEARSIDE BIOMEDICAL, INC., a Delaware corporation

(“TENANT”)

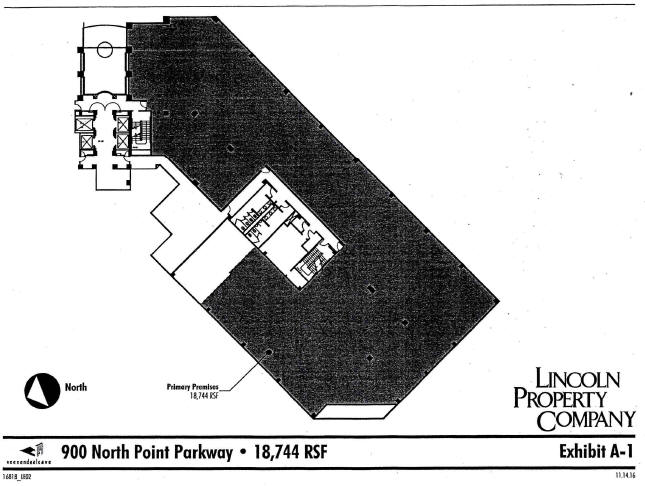

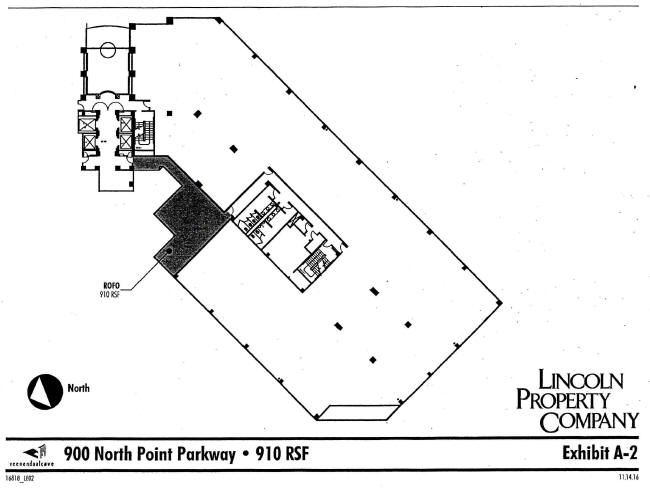

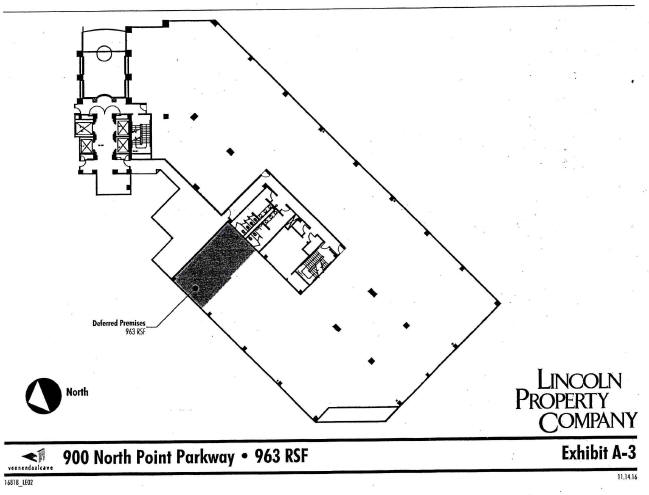

THIS OFFICE LEASE AGREEMENT (this “Lease”) is made and entered into as of November 21, 2016, by and between BRE/COH GA LLC, a Delaware limited liability company (“Landlord”) and CLEARSIDE BIOMEDICAL, INC., a Delaware corporation (“Tenant”). The following exhibits and attachments are incorporated into and made a part of this Lease: Exhibit A-1 (Outline and Location of Premises), Exhibit A-2 (Outline and Location of Refusal Space), Exhibit A-3 (Outline and Location of Deferred Space), Exhibit B (Expenses and Taxes), Exhibit C (Work Letter), Exhibit D (Commencement Letter), Exhibit E (Building Rules and Regulations), Exhibit F (Additional Provisions) and Exhibit G (Form of Letter of Credit).

| 1.01 | “Building” shall mean the building located at 000 Xxxxx Xxxxx Xxxxxxx, Xxxxxxxxxx, Xxxxxxx 00000, and commonly known as 000 Xxxxx Xxxxx. “Rentable Square Footage of the Building” is deemed to be 130,381 square feet. |

| 1.02 | “Premises” shall mean the area shown on Exhibit A-1 to this Lease. The Premises is located on the 2nd floor and known as suite 250. If the Premises include one or more floors in their entirety, all corridors and restroom facilities located on such full floor(s) shall be considered part of the Premises. The “Rentable Square Footage of the Premises” is deemed to be 18,744 square feet. Landlord and Tenant stipulate and agree that the Rentable Square Footage of the Building and the Rentable Square Footage of the Premises are correct. |

| 1.03 | “Base Rent”: |

| Months of Term |

Annual Rate Per Square Foot |

Monthly Base Rent |

||||||

| Commencement Date – Last day of 12th full calendar month of the Term |

$ | 22.50 | $ | 35,145.00 | ||||

| First day of 13th full calendar month of the Term - Last day of 24th full calendar month of the Term |

$ | 23.18 | $ | 36,207.16 | ||||

| First day of 25th full calendar month of the Term - Last day of 36th full calendar month of the Term |

$ | 23.88 | $ | 37,300.56 | ||||

| First day of 37th full calendar month of the Term - Last day of 48th full calendar month of the Term |

$ | 24.60 | $ | 38,425.20 | ||||

| First day of 49th full calendar month of the Term - Last day of 60th full calendar month of the Term |

$ | 25.34 | $ | 39,581.08 | ||||

| First day of 61st full calendar month of the Term - Last day of 72nd full calendar month of the Term |

$ | 26.10 | $ | 40,768.20 | ||||

| First day of 73rd full calendar month of the Term - Termination Date |

$ | 26.88 | $ | 41,986.56 | ||||

Notwithstanding anything in this Section of the Lease to the contrary, so long as Tenant is not in Default (as defined in Section 18) under this Lease, Tenant shall be entitled to an abatement of Base Rent in the amount of $35,145.00 per month for 6 consecutive full calendar months of the Term (as defined in Section 1.06),

beginning with the 1st full calendar month of the Term (the “Base Rent Abatement Period”). The total amount of Base Rent abated during the Base Rent Abatement Period shall equal $210,870.00 (the “Abated Base Rent”). If Tenant Defaults at any time during the Term and fails to cure such Default within any applicable cure period under the Lease, all Abated Base Rent shall immediately become due and payable. The payment by Tenant of the Abated Base Rent in the event of a Default shall not limit or affect any of Landlord’s other rights, pursuant to this Lease or at law or in equity. During the Base Rent Abatement Period, only Base Rent shall be abated, and all Additional Rent and other costs and charges specified in this Lease shall remain as due and payable pursuant to the provisions of this Lease. Notwithstanding the foregoing, at any time prior to or during the Base Rent Abatement Period, Landlord shall have the option to purchase, by check or wire transfer of available funds, all or any part (in whole-month increments only) of the remaining Abated Base Rent (“Remaining Abated Base Rent Amount”), by providing Tenant with written notice (“Abated Base Rent Payment Notice”). The Abated Base Rent Payment Notice shall set forth the month(s) of abatement that Landlord elects to purchase and the total portion of the Remaining Abated Base Rent Amount that Landlord elects to purchase (the “Purchase Amount”). The Purchase Amount to be paid by Landlord to Tenant shall be paid simultaneously with the giving of the Abated Base Rent Payment Notice. Upon Landlord’s tender of the Purchase Amount, the Abated Base Rent shall be reduced by the number of months of Abated Base Rent so purchased by Landlord. Upon request by Landlord, Landlord and Tenant shall enter into an amendment to the Lease to reflect the Purchase Amount paid by Landlord and the corresponding reduction of the Abated Base Rent.

| 1.04 | “Tenant’s Pro Rata Share”: 14.3763%. |

| 1.05 | “Base Year”: 2017. |

| 1.06 | “Term”: The period commencing on the Commencement Date (defined below) and, unless terminated earlier in accordance with this Lease, ending on the last day of the 78th full calendar month following the Commencement Date (the “Termination Date”). The “Commencement Date” shall mean the date on which the Landlord Work (defined in Section 1.14) is Substantially Complete (defined in Section 3). The parties anticipate that the Landlord Work will be Substantially Complete on or about March 1, 2017 (the “Target Commencement Date”). |

| 1.07 | Allowance(s): an amount not to exceed $679,296.45, as further described in the attached Exhibit C. |

| 1.08 | “Security Deposit”: As of the date of this Lease, there is no Security Deposit. |

| 1.09 | “Guarantor”: As of the date of this Lease, there is no Guarantor. |

| 1.10 | “Broker(s)”: Lavista Associates, Inc. (“Tenant’s Broker”), which represented Tenant in connection with this transaction, and Lincoln Property Company (“Landlord’s Broker”), which represented Landlord in connection with this transaction. |

2

| 1.11 | “Permitted Use”: General office use, plus use of lab space for the sole purpose of conducting testing/engineering related to Tenant’s business, provided that such lab space use shall not exceed 10% of the total square footage of the Premises (the “Lab Space”),and the use of such Lab Space shall be subject to the terms of this Lease. |

| 1.12 | “Notice Address(es)”: |

| Landlord: | Tenant: | |

| BRE/COH GA LLC c/o Equity Xxxxxx 0000 Xxxxx Xxxxxxx Xxxx, Xxxxx 000 Xxxxxx, Xxxxx 00000 Attention: Asset Manager

With copies of any notices to Landlord shall be sent to:

BRE/COH GA LLC c/o Lincoln Property Company 000 Xxxxx Xxxxx Xxxxxxx, Xxxxx 000 Xxxxxxxxxx, Xxxxxxx 00000 Attention: Property Manager

and

BRE/COH GA LLC c/o Equity Xxxxxx 000 Xxxxx Xxxxxxxxx Xxxxx Xxxxx 0000 Xxxxxxx, Xxxxxxxx 00000 Attention: Managing Counsel |

Prior to the Commencement Date:

0000 Xxx Xxxxxxxxxx Xxxx Xxxxx 000 Xxxxxxxxxx, Xxxxxxx 00000

From and after the Commencement Date:

000 Xxxxx Xxxxx Xxxxxxx Xxxxx 000 Xxxxxxxxxx, Xxxxxxx 00000 | |

| 1.13 | “Business Day(s)” are Monday through Friday of each week, exclusive of New Year’s Day, Presidents Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day (“Holidays”). Landlord may designate additional Holidays that are commonly recognized by other office buildings in the area where the Building is located. “Building Service Hours” are 8:00 A.M. to 6:00 P.M. on Business Days and 8:00 A.M. to 1:00 P.M. on Saturdays. |

| 1.14 | “Landlord Work” means the work that Landlord is obligated to perform in the Premises pursuant to a separate agreement (the “Work Letter”) attached to this Lease as Exhibit C. |

| 1.15 | “Property” means the Building and the parcel(s) of land on which it is located and, at Landlord’s discretion, the parking facilities and other improvements, if any, serving the Building and the parcel(s) of land on which they are located. |

| 1.16 | “Letter of Credit” is as described in Section 5 of Exhibit F attached hereto. |

3

2. Lease Grant.

Landlord hereby leases the Premises to Tenant and Tenant hereby leases the Premises from Landlord. Landlord further grants to Tenant the non-exclusive right to use any portions of the Property that are designated by Landlord for the common use of tenants and others (the “Common Areas”).

3. Adjustment of Commencement Date; Possession.

3.01 The Landlord Work shall be deemed to be “Substantially Complete” on the later of (i) the date that all Landlord Work has been performed, other than any details of construction, mechanical adjustment or any other similar matter, the noncompletion of which does not materially interfere with Tenant’s use of the Premises; and (ii) the date Landlord receives from the appropriate governmental authorities, with respect to the Landlord Work performed by Landlord or its contractors in the Premises, all approvals necessary for the occupancy of the Premises (or would have received such approvals absent any Tenant Delays). If Landlord is delayed in the performance of the Landlord Work as a result of the acts or omissions of Tenant, the Tenant Related Parties (defined in Section 13) or their respective contractors or vendors, including, without limitation, changes requested by Tenant to approved plans, Tenant’s failure to comply with any of its obligations under this Lease, or Tenant’s specification of any materials or equipment with long lead times (each a “Tenant Delay”), the Landlord Work shall be deemed to be Substantially Complete on the date that Landlord could reasonably have been expected to Substantially Complete the Landlord Work absent any Tenant Delay. Notwithstanding anything to the contrary in Section 1.06 above, Landlord’s failure to Substantially Complete the Landlord Work by the Target Commencement Date (described in Section 1.06) shall not be a default by Landlord or otherwise render Landlord liable for damages. Promptly after the determination of the Commencement Date, Landlord and Tenant shall execute and deliver a commencement letter in the form attached as Exhibit D (the “Commencement Letter”). Tenant’s failure to execute and return the Commencement Letter, or to provide written objection to the statements contained in the Commencement Letter, within 30 days after the date of the Commencement Letter shall be deemed an approval by Tenant of the statements contained therein. Landlord shall use reasonable efforts to notify Tenant, orally or in writing, of any circumstances of which Landlord is aware that have caused or may cause a Tenant Delay (including informing Tenant of long lead times related to availability of materials), so that Tenant may take whatever action is appropriate to minimize or prevent such Tenant Delay.

3.02 Subject to Landlord’s obligation to perform Landlord Work, the Premises are accepted by Tenant in “as is” condition and configuration without any representations or warranties by Landlord. By taking possession of the Premises, Tenant agrees that the Premises are in good order and satisfactory condition. Notwithstanding the foregoing, Landlord represents that to Landlord’s knowledge, the mechanical (including HVAC), electrical, plumbing and fire/life safety systems serving the Premises are in good working order as of the date of this Lease. Notwithstanding the foregoing, Landlord shall be responsible for latent defects in the Landlord Work of which Tenant notifies Landlord to the extent that the correction of such defects is covered under valid and enforceable warranties given Landlord by contractors or subcontractors performing the Landlord Work. Landlord, at its option, may pursue such claims directly or assign any such warranties to Tenant for enforcement. Tenant’s acceptance of the Premises shall be subject to Landlord’s obligation to correct portions of the Landlord Work as set forth on a construction punch list prepared by Landlord and Tenant in accordance with the terms hereof. Within 15 days after Substantial Completion of the Landlord Work, Landlord and Tenant shall together conduct an inspection of the Premises and prepare a “punch list” setting

4

forth any portions of the Landlord Work that are not in conformity with the Landlord Work as required by the terms of this Lease. Notwithstanding the foregoing, at the request of Landlord, such construction punch list shall be mutually prepared by Landlord and Tenant prior to the date on which Tenant first begins to move its furniture, equipment or other personal property into the Premises. Landlord, as part of the Landlord Work, shall use good faith efforts to correct all such items within a reasonable time following the completion of the punch list. Landlord shall not be liable for a failure to deliver possession of the Premises or any other space due to the holdover or unlawful possession of such space by another party, provided, however, Landlord shall use reasonable efforts to obtain possession of any such space. In such event, the Commencement Date for the Premises, or the commencement date for such other space, as applicable, shall be postponed until the date Landlord delivers possession of such space to Tenant free from occupancy by any party. Except as otherwise provided in this Lease, Tenant shall not be permitted to take possession of or enter the Premises prior to the Commencement Date without Landlord’s permission. If Tenant takes possession of or enters the Premises before the Commencement Date, Tenant shall be subject to the terms and conditions of this Lease; provided, however, except for the cost of services requested by Tenant (e.g. after hours HVAC service), Tenant shall not be required to pay Rent for any entry or possession before the Commencement Date during which Tenant, with Landlord’s approval, has entered, or is in possession of, the Premises for the sole purpose of performing improvements or installing furniture, equipment or other personal property. However, notwithstanding the foregoing but subject to the terms of this Section 3.02, Landlord shall use its reasonable efforts to permit Tenant to enter the Premises after notice from Landlord, at Tenant’s sole risk, at least 14 days prior to the Commencement Date, solely for the purpose of installing equipment, furnishings and other personalty provided that such installations do not interfere with the Landlord Work. The parties agree to cooperate reasonably to coordinate their respective access to and work within the Premises so as to minimize any delay to the performance of the Landlord Work. Landlord may withdraw such permission to enter the Premises prior to the Commencement Date at any time that Landlord reasonably determines that such entry by Tenant is causing a dangerous situation for Landlord, Tenant or their respective contractors or employees, or if Landlord reasonably determines that such entry by Tenant is hampering or otherwise preventing Landlord from proceeding with the completion of the Landlord Work at the earliest possible date, provided that Landlord agrees to act reasonably in making any such determination in light of the mutual obligation of Landlord and Tenant to cooperate reasonably to coordinate their respective work as set forth above.

3.03 If (i) Landlord has received all required permits for the performance of the Landlord Work within 30 days after the date of this Lease, and (ii) the Commencement Date has not occurred on or before April 15, 2017 (the “Outside Completion Date”), Tenant shall be entitled to a rent abatement following the Base Rent Abatement Period of $1,155.45 for every day in the period beginning on the Outside Completion Date and ending on the Commencement Date. Landlord and Tenant acknowledge and agree that: (a) the determination of the Commencement Date shall take into consideration the effect of any Tenant Delays; and (b) the Outside Completion Date shall be postponed by the number of days the Commencement Date is delayed due to events of Force Majeure and the number of days Landlord is delayed in obtaining all required permits for the performance of the Landlord Work beyond the initial 30 day period after the date of this Lease.

4. Rent.

4.01 Tenant shall pay Landlord, without any setoff or deduction, unless expressly set forth in this Lease, all Base Rent and Additional Rent due for the Term (collectively referred to

5

as “Rent”). “Additional Rent” means all sums (exclusive of Base Rent) that Tenant is required to pay Landlord under this Lease. Tenant shall pay and be liable for all rental, sales and use taxes (but excluding income taxes), if any, imposed upon or measured by Rent. Base Rent and recurring monthly charges of Additional Rent shall be due and payable in advance on the first day of each calendar month without notice or demand, provided that the installment of Base Rent for the seventh full calendar month of the Term shall be payable upon the execution of this Lease by Tenant. All other items of Rent shall be due and payable by Tenant on or before 30 days after billing by Landlord. Rent shall be made payable to the entity, and sent to the address, Landlord designates and shall be made by good and sufficient check payable in United States of America currency or by other means acceptable to Landlord. If Tenant does not pay any Rent when due hereunder, Tenant shall pay Landlord an administration fee in the amount of $250.00, provided that Tenant shall be entitled to a grace period of up to 5 Business Days for the first 2 late payments of Rent in a calendar year. In addition, past due Rent shall accrue interest at 10% per annum, and Tenant shall pay Landlord a reasonable fee for any checks returned by Tenant’s bank for any reason. Landlord’s acceptance of less than the correct amount of Rent shall be considered a payment on account of the oldest obligation due from Tenant hereunder, then to any current Rent then due hereunder, notwithstanding any statement to the contrary contained on or accompanying any such payment from Tenant. Rent for any partial month during the Term shall be prorated. No endorsement or statement on a check or letter accompanying payment shall be considered an accord and satisfaction. Tenant’s covenant to pay Rent is independent of every other covenant in this Lease.

4.02 Tenant shall pay Tenant’s Pro Rata Share of Taxes and Expenses in accordance with Exhibit B of this Lease.

The Premises shall be used for the Permitted Use and for no other use whatsoever. Tenant shall comply with all statutes, codes, ordinances, orders, rules and regulations of any municipal or governmental entity whether in effect now or later, including the Americans with Disabilities Act (“Law(s)”), regarding the operation of Tenant’s business, the use, condition, configuration and occupancy of the Premises and the Building systems located in or exclusively serving the Premises. During the Term, Landlord shall be responsible, at its cost (except to the extent properly included in Expenses), for correcting any violations of Laws relating to or affecting the condition, use or occupancy of the Common Areas except for any obligations specifically imposed upon Tenant pursuant to this Lease. Notwithstanding the foregoing, Landlord shall have the right to contest any alleged violation of any of the foregoing in good faith, or bring suit against any third party causing such violation of Laws, including, without limitation, the right to apply for and obtain a waiver or deferment of compliance, the right to assert any and all defenses allowed by law and the right to appeal any decisions, judgments or rulings to the fullest extent permitted by Law. Landlord, after the exhaustion of any and all rights to appeal, contest or litigate, will make all repairs, additions, alterations, improvements or adjustments necessary to comply with the terms of any final order or judgment. In addition, Tenant shall, at its sole cost and expense, promptly comply with any Laws that relate to the “Base Building” (defined below), but only to the extent such obligations are triggered by Tenant’s use of the Premises, other than for general office use, or Alterations or improvements in the Premises performed or requested by Tenant. “Base Building” shall include the structural portions of the Building, the public restrooms and the Building mechanical, electrical and plumbing systems and equipment located in the internal core of the Building on the floor or floors on which the Premises are located. Tenant shall promptly provide Landlord with copies of any notices it receives regarding an alleged violation of Law. Tenant shall not exceed the standard density

6

limit for the Building. Tenant shall comply with the rules and regulations of the Building attached as Exhibit E and such other reasonable rules and regulations adopted by Landlord from time to time, including rules and regulations for the performance of Alterations (defined in Section 9.03). The rules and regulations shall be generally applicable, and generally applied in the same manner, to all tenants of the Building.

The Security Deposit, if any, shall be delivered to Landlord upon the execution of this Lease by Tenant and held by Landlord without liability for interest (unless required by Law) as security for the performance of Tenant’s obligations. The Security Deposit is not an advance payment of Rent or a measure of damages. Landlord may from time to time and without prejudice to any other remedy provided in this Lease or by Law, use all or a portion of the Security Deposit to the extent necessary to satisfy past due Rent or to satisfy any other loss or damage resulting from Tenant’s breach under this Lease. If Landlord uses any portion of the Security Deposit, Tenant, within 5 days after demand, shall restore the Security Deposit to its original amount. Landlord shall return any unapplied portion of the Security Deposit to Tenant within 45 days after the later to occur of: (a) determination of the final Rent due from Tenant; or (b) the later to occur of the Termination Date or the date Tenant surrenders the Premises to Landlord in compliance with Section 25. Landlord may assign the Security Deposit to a successor or transferee and, following the assignment, Landlord shall have no further liability for the return of the Security Deposit. Landlord shall not be required to keep the Security Deposit separate from its other accounts.

7.01 Landlord shall furnish Tenant with the following services: (a) water for use in the Base Building lavatories; (b) customary heat and air conditioning in season during all Building Service Hours plus air conditioning such that the temperature does not exceed 76 degrees Fahrenheit until 6:30 p.m. Monday through Thursday from June through August on Business Days, although (i) Tenant shall have the right to receive HVAC service during hours other than set forth herein by paying Landlord’s then standard charge for additional HVAC service and providing such prior notice as is reasonably specified by Landlord, and (ii) if Tenant is permitted to connect any supplemental HVAC units to the Building’s condenser water loop or chilled water line, such permission shall be conditioned upon Landlord having adequate excess capacity from time to time and such connection and use shall be subject to Landlord’s reasonable approval and reasonable restrictions imposed by Landlord, and Landlord shall have the right to charge Tenant a connection fee and/or a monthly usage fee, as reasonably determined by Landlord; (c) standard janitorial service on Business Days; (d) elevator service; (e) electricity in accordance with the terms and conditions in Section 7.02; (f) access to the Building for Tenant and its employees 24 hours per day/7 days per week, subject to the terms of this Lease and such protective services or monitoring systems, if any, as Landlord may reasonably impose, including, without limitation, sign-in procedures and/or presentation of identification cards; (g) snow and ice removal; (h) landscaping services; and (i) such other services as Landlord reasonably determines are necessary or appropriate for the Property. If Landlord, at Tenant’s request, provides any services which are not Landlord’s express obligation under this Lease, including, without limitation, any repairs which are Tenant’s responsibility pursuant to Section 9 below, Tenant shall pay Landlord, or such other party designated by Landlord, the cost of providing such service plus a reasonable administrative charge.

7

7.02 Electricity used by Tenant in the Premises shall, at Landlord’s option, be paid for by Tenant either: (a) through inclusion in Expenses (except as provided for excess usage); (b) by a separate charge payable by Tenant to Landlord; or (c) by separate charge billed by the applicable utility company and payable directly by Tenant. Without the consent of Landlord, Tenant’s use of electrical service shall not exceed the Building standard usage, per square foot, as reasonably determined by Landlord, based upon the Building standard electrical design load. Landlord shall have the right to measure electrical usage by commonly accepted methods, including the installation of measuring devices such as submeters and check meters. If it is determined that Tenant is using electricity in such quantities or during such periods as to cause the total cost of Tenant’s electrical usage, on a monthly, per-rentable-square-foot basis, to materially exceed that which Landlord reasonably deems to be standard for the Building, Tenant shall pay Landlord Additional Rent for the cost of such excess electrical usage and, if applicable, for the cost of purchasing and installing the measuring device(s). For purposes hereof, the Building “electrical standard” is 5 xxxxx per usable square foot of connected load to the Premises, exclusive of base Building HVAC.

7.03 Landlord’s failure to furnish, or any interruption, diminishment or termination of services due to the application of Laws, the failure of any equipment, the performance of maintenance, repairs, improvements or alterations, utility interruptions or the occurrence of an event of Force Majeure (defined in Section 26.03) (collectively a “Service Failure”) shall not render Landlord liable to Tenant, constitute a constructive eviction of Tenant, give rise to an abatement of Rent, nor relieve Tenant from the obligation to fulfill any covenant or agreement. However, if the Premises, or a material or critical business portion of the Premises, are made untenantable for a period in excess of 3 consecutive Business Days as a result of a Service Failure that is reasonably within the control of Landlord to correct, then Tenant, as its sole remedy, shall be entitled to receive an abatement of Rent payable hereunder during the period beginning on the 4th consecutive Business Day of the Service Failure and ending on the day the service has been restored. If the entire Premises have not been rendered untenantable by the Service Failure, the amount of abatement shall be equitably prorated.

All improvements in and to the Premises, including any Alterations (defined in Section 9.03) (collectively, “Leasehold Improvements”) shall remain upon the Premises at the end of the Term without compensation to Tenant, provided that Tenant, at its expense, shall remove any Cable (defined in Section 9.01 below). In addition, Landlord, by written notice to Tenant at least 30 days prior to the Termination Date, may require Tenant, at Tenant’s expense, to remove any Landlord Work or Alterations that, in Landlord’s reasonable judgment, are of a nature that would require removal and repair costs that are materially in excess of the removal and repair costs associated with standard office improvements (the Cable and such other items collectively are referred to as “Required Removables”). Required Removables shall include, without limitation, internal stairways, raised floors, personal baths and showers, vaults, rolling file systems and structural alterations and modifications. The Required Removables shall be removed by Tenant before the Termination Date. Tenant shall repair damage caused by the installation or removal of Required Removables. If Tenant fails to perform its obligations in a timely manner, Landlord may perform such work at Tenant’s expense. Notwithstanding the foregoing to the contrary, Tenant, at the time it requests approval for a proposed Alteration, including any Landlord Work, as such term may be defined in the Work Letter attached as Exhibit C, may request in writing that Landlord advise Tenant whether the Alteration, including any Landlord Work, or any portion thereof, is a Required Removable. Within 10 days after receipt of Tenant’s request, Landlord shall advise Tenant in writing as to which portions of the alteration or other improvements are

8

9.01 Tenant shall periodically inspect the Premises to identify any conditions that are dangerous or in need of maintenance or repair. Tenant shall promptly provide Landlord with notice of any such conditions. Tenant, at its sole cost and expense, shall perform all maintenance and repairs to the Premises that are not Landlord’s express responsibility under this Lease, and keep the Premises in good condition and repair, reasonable wear and tear and damage by Casualty (subject to the terms of Section 16) and condemnation (subject to the terms of Section 17) excepted. Tenant’s repair and maintenance obligations include, without limitation, repairs to: (a) floor covering; (b) interior partitions; (c) doors; (d) the interior side of demising walls; (e) Alterations (described in Section 9.03); (f) supplemental air conditioning units, kitchens, including hot water heaters, plumbing, and similar facilities exclusively serving Tenant, whether such items are installed by Tenant or are currently existing in the Premises but not including any components that are Landlord’s express responsibility; and (g) electronic, fiber, phone and data cabling and related equipment that is installed by or for the exclusive benefit of Tenant (collectively, “Cable”). All repairs and other work performed by Tenant or its contractors, including that involving Cable, shall be subject to the terms of Section 9.03 below. If Tenant fails to make any repairs to the Premises for more than 15 days after notice from Landlord (although notice shall not be required in an emergency), Landlord may make the repairs, and, within 30 days after demand, Tenant shall pay the reasonable cost of the repairs, together with an administrative charge in an amount equal to 10% of the cost of the repairs.

9.02 Landlord shall keep and maintain in good repair and working order and perform maintenance upon the: (a) structural elements of the Building; (b) mechanical (including HVAC), electrical, plumbing and fire/life safety systems serving the Building and the Common Areas in general; (c) Common Areas; (d) roof of the Building and roof membrane; (e) exterior windows of the Building and exterior demising walls; and (f) elevators serving the Building. Landlord shall promptly make repairs for which Landlord is responsible.

9.03 Tenant shall not make alterations, repairs, additions or improvements or install any Cable (collectively referred to as “Alterations”) without first obtaining the written consent of Landlord in each instance, which consent shall not be unreasonably withheld, conditioned or delayed. However, Landlord’s consent shall not be required for any Alteration that satisfies all of the following criteria (a “Cosmetic Alteration”): (a) is of a cosmetic nature such as painting, wallpapering, hanging pictures and installing carpeting; (b) is not visible from the exterior of the Premises or Building; (c) will not affect the Base Building (defined in Section 5); and (d) does not require work to be performed inside the walls or above the ceiling of the Premises. Cosmetic Alterations shall be subject to all the other provisions of this Section 9.03. Prior to starting work, Tenant shall furnish Landlord with plans and specifications (which shall be in CAD

9

format if requested by Landlord), although such plans and specifications need be supplied to Landlord only if they are necessary for the issuance of required permits or if reasonably deemed necessary by Landlord due to the nature of the work to be performed; names of contractors reasonably acceptable to Landlord (provided that Landlord may designate specific contractors with respect to Base Building and vertical Cable, as may be described more fully below); required permits and approvals; evidence of contractor’s and subcontractor’s insurance in amounts reasonably required by Landlord and naming Landlord and the managing agent for the Building (or any successor(s)) as additional insureds; and any security for performance in amounts reasonably required by Landlord. Landlord may designate specific contractors with respect to oversight, installation, repair, connection to, and removal of vertical Cable. All Cable shall be clearly marked with adhesive plastic labels (or plastic tags attached to such Cable with wire) to show Tenant’s name, suite number, and the purpose of such Cable (i) every 6 feet outside the Premises (specifically including, but not limited to, the electrical room risers and any Common Areas), and (ii) at the termination point(s) of such Cable. Changes to the plans and specifications must also be submitted to Landlord for its approval. Alterations shall be constructed in a good and workmanlike manner using materials of a quality reasonably approved by Landlord, and Tenant shall ensure that no Alteration impairs any Building system or Landlord’s ability to perform its obligations hereunder. Tenant shall reimburse Landlord for any reasonable sums paid by Landlord for third party examination of Tenant’s plans for non-Cosmetic Alterations. In addition, Tenant shall pay Landlord a fee for Landlord’s oversight and coordination of any non-Cosmetic Alterations equal to 7% of the cost of the non-Cosmetic Alterations. Upon completion, Tenant shall furnish “as-built” plans (in CAD format, if requested by Landlord) for non-Cosmetic Alterations, completion affidavits and full and final waivers of lien. Landlord’s approval of an Alteration shall not be deemed a representation by Landlord that the Alteration complies with Law.

Landlord may enter the Premises to inspect, show or clean the Premises or to perform or facilitate the performance of repairs, alterations or additions to the Premises or any portion of the Building. Except in emergencies or to provide Building services, Landlord shall provide Tenant with reasonable prior verbal notice of entry and shall use reasonable efforts to minimize any interference with Tenant’s use of the Premises. Notwithstanding the foregoing, except in emergencies or to provide Building services, Landlord shall provide Tenant with at least 12 hours’ prior notice of entry into the Premises, which may be given orally to the entity occupying the Premises. If reasonably necessary, Landlord may temporarily close all or a portion of the Premises to perform repairs, alterations and additions. However, except in emergencies, Landlord will not close the Premises if the work can reasonably be completed on weekends and after Building Service Hours. Entry by Landlord shall not constitute a constructive eviction or entitle Tenant to an abatement or reduction of Rent.

11. Assignment and Subletting.

11.01 Except in connection with a Business Transfer (defined in Section 11.04), Tenant shall not assign, sublease, transfer or encumber any interest in this Lease or allow any third party to use any portion of the Premises (collectively or individually, a “Transfer”) without the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed if Landlord does not exercise its recapture rights under Section 11.02. Without limitation, it is agreed that Landlord’s consent shall not be considered unreasonably withheld if the proposed transferee intends to use the Lab Space in the Premises in a different way, for different purposes or with different substances or materials than the originally named Tenant

10

under this Lease. In addition it is agreed that Landlord’s consent shall not be considered unreasonably withheld if the proposed transferee is a governmental entity or an occupant of the Building or an occupant of the building located at 000 Xxxxx Xxxxx Xxxxxxx, Xxxxxxxxxx, Xxxxxxx (the “800 North Point Building”) or if the proposed transferee, whether or not an occupant of the Building or an occupant of the 000 Xxxxx Xxxxx Xxxxxxxx, is in discussions with Landlord regarding the leasing of space within the Building or within the 000 Xxxxx Xxxxx Xxxxxxxx. Notwithstanding the above, Landlord will not withhold its consent solely because the proposed subtenant or assignee is an occupant of the Building or an occupant of the 000 Xxxxx Xxxxx Xxxxxxxx if Landlord does not have space available for lease in the Building or the 000 Xxxxx Xxxxx Xxxxxxxx that is comparable to the space Tenant desires to sublet or assign. Landlord shall be deemed to have comparable space if it has, or will have, space available on any floor of the Building or on any floor of the 000 Xxxxx Xxxxx Xxxxxxxx that is approximately the same size as the space Tenant desires to sublet or assign within 6 months of the proposed commencement of the proposed sublease or assignment. If the entity(ies) which directly or indirectly controls 50% or more of the voting shares/rights of Tenant (other than through the ownership of voting securities listed on a recognized securities exchange) changes at any time, such change of ownership or control shall constitute a Transfer. Any Transfer in violation of this Section shall, at Landlord’s option, be deemed a Default by Tenant as described in Section 18, and shall be voidable by Landlord. In no event shall any Transfer, including a Business Transfer, release or relieve Tenant from any obligation under this Lease, and Tenant shall remain primarily liable for the performance of the tenant’s obligations under this Lease, as amended from time to time.

11.02 Tenant shall provide Landlord with financial statements for the proposed transferee (or, in the case of a change of ownership or control, for the proposed new controlling entity(ies)), which may be subject to reasonable confidentiality restrictions, a fully executed copy of the proposed assignment, sublease or other Transfer documentation and such other information as Landlord may reasonably request. Within 15 Business Days after receipt of the required information and documentation, Landlord shall either: (a) consent to the Transfer by execution of a consent agreement in a form reasonably designated by Landlord; (b) reasonably refuse to consent to the Transfer in writing; or (c) in the event of an assignment of this Lease or subletting of more than 20% of the Rentable Square Footage of the Premises for more than 50% of the remaining Term (excluding unexercised options), recapture the portion of the Premises that Tenant is proposing to Transfer. If Landlord exercises its right to recapture, this Lease shall automatically be amended (or terminated if the entire Premises is being assigned or sublet) to delete the applicable portion of the Premises effective on the proposed effective date of the Transfer, although Landlord may require Tenant to execute a reasonable amendment or other document reflecting such reduction or termination. Tenant shall pay Landlord a review fee of $1,500.00 for Landlord’s review of any requested Transfer.

11.03 Tenant shall pay Landlord 50% of all rent and other consideration which Tenant receives as a result of a Transfer that is in excess of the Rent payable to Landlord for the portion of the Premises and Term covered by the Transfer. Tenant shall pay Landlord for Landlord’s share of the excess within 30 days after Tenant’s receipt of the excess. In determining excess rent due Landlord, Tenant may deduct from the excess, on a straight line basis, all reasonable and customary expenses directly incurred by Tenant attributable to the Transfer, including brokerage fees, legal fees, construction costs, and Landlord’s review fee. If Tenant is in Default, Landlord may require that all sublease payments be made directly to Landlord, in which case Tenant shall receive a credit against Rent in the amount of Tenant’s share of payments received by Landlord. However, by accepting any such payments directly from the subtenant, whether as a result of the foregoing or otherwise, Landlord does not waive any claims against the Tenant hereunder or release Tenant from any obligations under this Lease, nor recognize the subtenant as the tenant under the Lease.

11

11.04 Tenant may (i) assign this Lease to a successor to Tenant by merger, consolidation, reorganization or the purchase of all or substantially all of Tenant’s assets, or (ii) assign this Lease or sublet all or a portion of the Premises to an Affiliate (defined below), or (iii) sell a controlling interest in Tenant’s stock, partnership or membership interests, without the consent of Landlord, provided that all of the following conditions are satisfied (a “Business Transfer”): (a) Tenant must not be in Default; (b) Tenant must give Landlord written notice at least 15 Business Days before such Transfer; (c) if such Transfer will result from a merger, consolidation or reorganization of Tenant with another entity, or the purchase of all or substantially all of Tenant’s assets by another entity, then the Credit Requirement (defined below) must be satisfied, and (d) if such Transfer involves the sale of a controlling interest in Tenant’s stock, partnership or membership interests, the Credit Requirement must be satisfied. Tenant’s notice to Landlord shall include information and documentation evidencing the Business Transfer and showing that each of the above conditions has been satisfied. If requested by Landlord, Tenant’s successor shall sign and deliver to Landlord a commercially reasonable form of assumption agreement. “Affiliate” shall mean an entity controlled by, controlling or under common control with Tenant. The “Credit Requirement” shall be deemed satisfied if, as of the date immediately succeeding the date of the Business Transfer, the financial strength of either (a) Tenant, in the event of a sale of a controlling interest in Tenant’s stock, partnership or membership interests, or (b) the entity with which Tenant is to merge, consolidate or reorganize in the event of a merger, consolidation or reorganization, or (c) the entity which is purchasing all or substantially all of Tenant’s assets in the event of a sale of all or substantially all of Tenant’s assets, is not less than that of Tenant as of the date immediately preceding the Transfer as determined (x) based on credit ratings of such entity and Tenant by both Moody’s and Standard & Poor’s (or by either such agency alone, if applicable ratings by the other agency do not exist), or (y) if such credit ratings do not exist, then in accordance with Moody’s KMV RiskCalc (i.e., the on-line software tool offered by Moody’s for analyzing credit risk) based on CFO-certified financial statements for such entity and Tenant covering their last two fiscal years ending before the Transfer.

11.05 Notwithstanding anything to the contrary contained in this Section 11, neither Tenant nor any other person having a right to possess, use, or occupy (for convenience, collectively referred to in this subsection as “Use”) the Premises shall enter into any lease, sublease, license, concession or other agreement for Use of all or any portion of the Premises which provides for rental or other payment for such Use based, in whole or in part, on the net income or profits derived by any person that leases, possesses, uses, or occupies all or any portion of the Premises (other than an amount based on a fixed percentage or percentages of receipts or sales), and any such purported lease, sublease, license, concession or other agreement shall be absolutely void and ineffective as a transfer of any right or interest in the Use of all or any part of the Premises.

12. Liens.

Tenant shall not permit mechanics’ or other liens to be placed upon the Property, Premises or Tenant’s leasehold interest in connection with any work or service done or purportedly done by or for the benefit of Tenant or its subtenants or transferees. Tenant shall give Landlord notice at least 10 days prior to the commencement of any Alterations in the Premises to afford Landlord the opportunity, where applicable, to post and record notices of non-responsibility. Tenant, within 20 days of notice from Landlord, shall fully discharge any lien by settlement, by bonding

12

or by insuring over the lien in the manner prescribed by the applicable lien Law and, if Tenant fails to do so, Tenant shall be deemed in Default under this Lease and, in addition to any other remedies available to Landlord as a result of such Default by Tenant, Landlord, at its option, may bond, insure over or otherwise discharge the lien. Tenant shall reimburse Landlord for any amount paid by Landlord, including, without limitation, reasonable attorneys’ fees. Landlord shall have the right to require Tenant to post a performance or payment bond in connection with any work or service done or purportedly done by or for the benefit of Tenant. Tenant acknowledges and agrees that all such work or service is being performed for the sole benefit of Tenant and not for the benefit of Landlord.

13. Indemnity and Waiver of Claims.

Except to the extent caused by the negligence or willful misconduct of Landlord or any Landlord Related Parties (defined below), Tenant shall indemnify, defend and hold Landlord and Landlord Related Parties harmless against and from all liabilities, obligations, damages, penalties, claims, actions, costs, charges and expenses, including, without limitation, reasonable attorneys’ fees and other professional fees (if and to the extent permitted by Law) (collectively referred to as “Losses”), which may be imposed upon, incurred by or asserted against Landlord or any of the Landlord Related Parties by any third party and arising out of or in connection with any damage or injury occurring in the Premises or any acts or omissions (including violations of Law) of Tenant, its trustees, managers, members, principals, beneficiaries, partners, officers, directors, employees and agents (the “Tenant Related Parties”) or any of Tenant’s transferees, contractors or licensees. Tenant hereby waives all claims against and releases Landlord and its trustees, managers, members, principals, beneficiaries, partners, officers, directors, employees, Mortgagees (defined in Section 23) and agents (the “Landlord Related Parties”) from all claims for any injury to or death of persons, damage to property or business loss in any manner related to (a) Force Majeure, (b) acts of third parties, (c) the bursting or leaking of any tank, water closet, drain or other pipe, (d) the inadequacy or failure of any security or protective services, personnel or equipment, or (e) any matter not within the reasonable control of Landlord. Notwithstanding the foregoing, except as provided in Section 15 to the contrary, Tenant shall not be required to waive any claims against Landlord (except, to the extent permitted by Law, for loss or damage to Tenant’s business) where such loss or damage is due to the negligence or willful misconduct of Landlord or any Landlord Related Parties.

14. Tenant’s Insurance. Tenant shall maintain the following coverages in the following amounts:

14.02 Property insurance covering (i) all office furniture, business and trade fixtures, office equipment, free-standing cabinet work, movable partitions, merchandise and all other items of Tenant’s property in the Premises installed by, for, or at the expense of Tenant (“Tenant’s Property”), and (ii) any Leasehold Improvements installed by or for the benefit of Tenant, whether pursuant to this Lease or pursuant to any prior lease or other agreement to which Tenant was a party (“Tenant-Insured Improvements”). Such insurance shall be written on a special cause of loss form for physical loss or damage, for the full replacement cost value (subject to reasonable deductible amounts) without deduction for depreciation of the covered

13

items and in amounts that meet any co-insurance clauses of the policies of insurance, and shall include coverage for damage or other loss caused by fire or other peril, including vandalism and malicious mischief, theft, water damage of any type, including sprinkler leakage, bursting or stoppage of pipes, and explosion.

14.03 Worker’s Compensation and Employer’s Liability or other similar insurance to the extent required by Law.

14.04 Form of Policies. The minimum limits of insurance required to be carried by Tenant shall not limit Tenant’s liability. Such insurance shall (i) be issued by an insurance company that has an A.M. Best rating of not less than A-VIII; (ii) be in form and content reasonably acceptable to Landlord; and (iii) provide that it shall not be canceled without 30 days’ prior notice to Landlord, except that 10 days’ prior notice may be given in the case of nonpayment of premiums. Tenant’s Commercial General Liability Insurance shall (a) name Landlord, Landlord’s managing agent, and any other party designated by Landlord (“Additional Insured Parties”) as additional insureds; and (b) be primary insurance as to all claims thereunder and provide that any insurance carried by Landlord is excess and non-contributing with Tenant’s insurance. Landlord shall be designated as a loss payee with respect to Tenant’s Property insurance on any Tenant-Insured Improvements. Tenant shall deliver to Landlord, on or before the Commencement Date and at least 15 days before the expiration dates thereof, certificates from Tenant’s insurance company on the forms currently designated “XXXXX 28” (Evidence of Commercial Property Insurance) and “XXXXX 25-S” (Certificate of Liability Insurance) or the equivalent. Attached to the XXXXX 25-S (or equivalent) there shall be an endorsement naming the Additional Insured Parties as additional insureds which shall be binding on Tenant’s insurance company. Upon Landlord’s request, Tenant shall deliver to Landlord, in lieu of such certificates, copies of the policies of insurance required to be carried under Section 14.01 showing that the Additional Insured Parties are named as additional insureds.

14.05 Tenant shall maintain such increased amounts of the insurance required to be carried by Tenant under this Section 14, and such other types and amounts of insurance covering the Premises and Tenant’s operations therein, as may be reasonably requested by Landlord, but not in excess of the amounts and types of insurance then being required by landlords of buildings comparable to and in the vicinity of the Building.

15. Subrogation.

Subject to Section 16, each party waives, and shall cause its insurance carrier to waive, any right of recovery against the other for any loss of or damage to property which loss or damage is (or, if the insurance required hereunder had been carried, would have been) covered by insurance. For purposes of this Section 15, any deductible with respect to a party’s insurance shall be deemed covered by, and recoverable by such party under, valid and collectable policies of insurance.

16. Casualty Damage.

16.01 If all or any portion of the Premises becomes untenantable or inaccessible by fire or other casualty to the Premises or the Common Areas (collectively a “Casualty”), Landlord, with reasonable promptness, shall cause a general contractor selected by Landlord to provide Landlord with a written estimate of the amount of time required, using standard working methods, to substantially complete the repair and restoration of the Premises and any Common

14

Areas necessary to provide access to the Premises (“Completion Estimate”). Landlord shall promptly forward a copy of the Completion Estimate to Tenant. If the Completion Estimate indicates that the Premises or any Common Areas necessary to provide access to the Premises cannot be made tenantable within 210 days from the date the repair is started, then either party shall have the right to terminate this Lease upon written notice to the other within 10 days after Tenant’s receipt of the Completion Estimate. Tenant, however, shall not have the right to terminate this Lease if the Casualty was caused by the negligence or intentional misconduct of Tenant or any Tenant Related Parties. In addition, Landlord, by notice to Tenant within 90 days after the date of the Casualty, shall have the right to terminate this Lease if: (1) the Premises have been materially damaged and there is less than 1 year of the Term remaining on the date of the Casualty; (2) any Mortgagee requires that the insurance proceeds be applied to the payment of the mortgage debt; or (3) a material uninsured loss to the Building or Premises occurs. Tenant shall have the right to terminate this Lease if: (a) a substantial portion of the Premises has been damaged by Casualty and such damage cannot reasonably be repaired within 60 days after Tenant’s receipt of the Completion Estimate; (b) there is less than 1 year of the Term remaining on the date of the Casualty; (c) the Casualty was not caused by the negligence or willful misconduct of Tenant or its agents, employees or contractors; and (d) Tenant provides Landlord with written notice of its intent to terminate within 30 days after the date of Tenant’s receipt of the Completion Estimate.

16.02 If this Lease is not terminated, Landlord shall promptly and diligently, subject to reasonable delays for insurance adjustment or other matters beyond Landlord’s reasonable control, restore the Premises and Common Areas. Such restoration shall be to substantially the same condition that existed prior to the Casualty, except for modifications required by Law or any other modifications to the Common Areas deemed desirable by Landlord. Notwithstanding Section 15 above, upon notice from Landlord, Tenant shall assign or endorse over to Landlord (or to any party designated by Landlord) all property insurance proceeds payable to Tenant under Tenant’s insurance with respect to any Leasehold Improvements performed by or for the benefit of Tenant; provided if the estimated cost to repair such Leasehold Improvements exceeds the amount of insurance proceeds received by Landlord from Tenant’s insurance carrier, the excess cost of such repairs shall be paid by Tenant to Landlord prior to Landlord’s commencement of repairs. Within 15 days of demand, Tenant shall also pay Landlord for any additional excess costs that are determined during the performance of the repairs to such Leasehold Improvements. However, notwithstanding the foregoing, if Tenant has maintained the insurance required to be maintained by Tenant pursuant to the terms of Section 14 of this Lease throughout the Term, and if the proceeds from the insurance required to be maintained by Tenant with respect to the Leasehold Improvements have been paid to Landlord prior to Landlord commencing repair of the Leasehold Improvements, then Landlord agrees Tenant shall not be required to pay any deficiency between the estimated or actual Leasehold Improvement repair costs and the insurance proceeds received by Landlord from Tenant’s insurance until after substantial completion of the repairs to the Leasehold Improvements, and such sums shall be payable by Tenant within 15 days after demand of Landlord. In no event shall Landlord be required to spend more for the restoration of the Premises and Common Areas than the proceeds received by Landlord, whether insurance proceeds or proceeds from Tenant. Landlord shall not be liable for any inconvenience to Tenant, or injury to Tenant’s business resulting in any way from the Casualty or the repair thereof. Provided that Tenant is not in Default, during any period of time that all or a material portion of the Premises is rendered untenantable as a result of a Casualty, the Rent shall xxxxx for the portion of the Premises that is untenantable and not used by Tenant.

15

17. Condemnation.

Either party may terminate this Lease if any material part of the Premises is taken or condemned for any public or quasi-public use under Law, by eminent domain or private purchase in lieu thereof (a “Taking”). Landlord shall also have the right to terminate this Lease if there is a Taking of any portion of the Building or Property which would have a material adverse effect on Landlord’s ability to profitably operate the remainder of the Building. Tenant may also terminate this Lease if there is a Taking of a material part of the Building such that Tenant is prevented from accessing the Premises or otherwise utilizing the Premises for the purposes described herein. The terminating party shall provide written notice of termination to the other party within 45 days after it first receives notice of the Taking. The termination shall be effective as of the effective date of any order granting possession to, or vesting legal title in, the condemning authority. If this Lease is not terminated, Base Rent and Tenant’s Pro Rata Share shall be appropriately adjusted to account for any reduction in the square footage of the Building or Premises. All compensation awarded for a Taking shall be the property of Landlord. The right to receive compensation or proceeds are expressly waived by Tenant, provided, however, Tenant may file a separate claim for Tenant’s Property and Tenant’s reasonable relocation expenses, provided the filing of the claim does not diminish the amount of Landlord’s award. If only a part of the Premises is subject to a Taking and this Lease is not terminated, Landlord, with reasonable diligence, will restore the remaining portion of the Premises as nearly as practicable to the condition immediately prior to the Taking.

In addition to any other default specifically described in this Lease, each of the following occurrences shall be a “Default”: (a) Tenant’s failure to pay any portion of Rent when due, if the failure continues for 3 Business Days after written notice to Tenant (“Monetary Default”); (b) Tenant’s failure (other than a Monetary Default) to comply with any term, provision, condition or covenant of this Lease, if the failure is not cured within 10 days after written notice to Tenant provided, however, if Tenant’s failure to comply cannot reasonably be cured within 10 days, Tenant shall be allowed additional time (not to exceed 90 days) as is reasonably necessary to cure the failure so long as Tenant begins the cure within 10 days and diligently pursues the cure to completion; (c) Tenant permits a Transfer without Landlord’s required approval or otherwise in violation of Section 11 of this Lease; (d) Tenant or any Guarantor becomes insolvent, makes a transfer in fraud of creditors, makes an assignment for the benefit of creditors, admits in writing its inability to pay its debts when due or forfeits or loses its right to conduct business; (e) the leasehold estate is taken by process or operation of Law; (f) in the case of any ground floor or retail Tenant, Tenant does not take possession of or abandons or vacates all or any portion of the Premises for a period of 30 days or longer; or (g) Tenant is in default beyond any notice and cure period under any other lease or agreement with Landlord at the Building or Property. If Landlord provides Tenant with notice of Tenant’s failure to comply with any specific provision of this Lease on 3 separate occasions during any 12 month period, Tenant’s subsequent violation of such provision shall, at Landlord’s option, be an incurable Default by Tenant. All notices sent under this Section shall be in satisfaction of, and not in addition to, notice required by Law.

19. Remedies.

(a) Terminate this Lease, in which case Tenant shall immediately surrender the Premises to Landlord. If Tenant fails to surrender the Premises, Landlord, in compliance

16

with Law, may enter upon and take possession of the Premises and remove Tenant, Tenant’s Property and any party occupying the Premises. Tenant shall pay Landlord, on demand, all past due Rent and other losses and damages Landlord suffers as a result of Tenant’s Default, including, without limitation, all Costs of Reletting (defined below) and any deficiency that may arise from reletting or the failure to relet the Premises. “Costs of Reletting” shall include all reasonable costs and expenses incurred by Landlord in reletting or attempting to relet the Premises, including, without limitation, legal fees, brokerage commissions, the cost of alterations and the value of other concessions or allowances granted to a new tenant. Landlord agrees to use reasonable efforts to mitigate damages, provided that those efforts shall not require Landlord to relet the Premises in preference to any other space in the Building or to relet the Premises to any party that Landlord could reasonably reject as a transferee pursuant to Section 11.

(b) Terminate Tenant’s right to possession of the Premises and, in compliance with Law, remove Tenant, Tenant’s Property and any parties occupying the Premises. Landlord may (but shall not be obligated to) relet all or any part of the Premises, without notice to Tenant, for such period of time and on such terms and conditions (which may include concessions, free rent and work allowances) as Landlord in its absolute discretion shall determine. Landlord may collect and receive all rents and other income from the reletting. Tenant shall pay Landlord on demand all past due Rent, all Costs of Reletting and any deficiency arising from the reletting or failure to relet the Premises. The re-entry or taking of possession of the Premises shall not be construed as an election by Landlord to terminate this Lease. Landlord agrees to use reasonable efforts to mitigate damages, provided that those efforts shall not require Landlord to relet the Premises in preference to any other space in the Building or to relet the Premises to any party that Landlord could reasonably reject as a transferee pursuant to Section 11.

19.02 In lieu of calculating damages under Section 19.01, Landlord may elect to receive as damages the sum of (a) all Rent accrued through the date of termination of this Lease or Tenant’s right to possession, and (b) an amount equal to the total Rent that Tenant would have been required to pay for the remainder of the Term discounted to present value at the Prime Rate (defined below) then in effect, minus the then present fair rental value of the Premises for the remainder of the Term, similarly discounted, after deducting all anticipated Costs of Reletting. “Prime Rate” shall be the per annum interest rate publicly announced as its prime or base rate by a federally insured bank selected by Landlord in the state in which the Building is located. Such payment shall not constitute a penalty or forfeiture but shall constitute liquidated damages for Tenant’s failure to comply with the terms of this Lease (Landlord’s actual damages in such event are impossible to ascertain and the amount set forth above is a reasonable estimate thereof).

19.03 If Tenant is in Default of any of its non-monetary obligations under this Lease, Landlord shall have the right to perform such obligations. Tenant shall reimburse Landlord for the cost of such performance upon demand together with an administrative charge equal to 10% of the cost of the work performed by Landlord. The repossession or re-entering of all or any part of the Premises shall not relieve Tenant of its liabilities and obligations under this Lease. No right or remedy of Landlord shall be exclusive of any other right or remedy. Each right and remedy shall be cumulative and in addition to any other right and remedy now or subsequently available to Landlord at Law or in equity.

17

NOTWITHSTANDING ANYTHING TO THE CONTRARY CONTAINED IN THIS LEASE, THE LIABILITY OF LANDLORD (AND OF ANY SUCCESSOR LANDLORD) SHALL BE LIMITED TO THE INTEREST OF LANDLORD IN THE PROPERTY. TENANT SHALL LOOK SOLELY TO LANDLORD’S INTEREST IN THE PROPERTY FOR THE RECOVERY OF ANY JUDGMENT OR AWARD AGAINST LANDLORD OR ANY LANDLORD RELATED PARTY. NEITHER LANDLORD NOR ANY LANDLORD RELATED PARTY SHALL BE PERSONALLY LIABLE FOR ANY JUDGMENT OR DEFICIENCY, AND IN NO EVENT SHALL LANDLORD OR ANY LANDLORD RELATED PARTY BE LIABLE TO TENANT FOR ANY LOST PROFIT, DAMAGE TO OR LOSS OF BUSINESS OR ANY FORM OF SPECIAL, INDIRECT OR CONSEQUENTIAL DAMAGE. BEFORE FILING SUIT FOR AN ALLEGED DEFAULT BY LANDLORD, TENANT SHALL GIVE LANDLORD AND THE MORTGAGEE(S) WHOM TENANT HAS BEEN NOTIFIED HOLD MORTGAGES (DEFINED IN SECTION 23 BELOW), NOTICE AND REASONABLE TIME TO CURE THE ALLEGED DEFAULT. WITHOUT LIMITING THE FOREGOING, IN NO EVENT SHALL LANDLORD OR ANY MORTGAGEES OR LANDLORD RELATED PARTIES EVER BE LIABLE FOR ANY CONSEQUENTIAL OR INCIDENTAL DAMAGES OR ANY LOST PROFITS OF TENANT.

21. Relocation.

22. Holding Over.

If Tenant fails to surrender all or any part of the Premises at the termination of this Lease, occupancy of the Premises after termination shall be that of a tenancy at sufferance, and in no event shall Landlord be prevented from immediate recovery of possession of the Premises by summary proceedings or otherwise. Tenant’s occupancy shall be subject to all the terms and provisions of this Lease, and Tenant shall pay an amount (on a per month basis without reduction for partial months during the holdover) equal to 150% of the sum of the Base Rent and Additional Rent due for the period immediately preceding the holdover. No holdover by Tenant or payment by Tenant after the termination of this Lease shall be construed to extend the Term or prevent Landlord from immediate recovery of possession of the Premises by summary proceedings or otherwise. If Landlord is unable to deliver possession of the Premises to a new tenant or to perform improvements for a new tenant as a result of Tenant’s holdover and Tenant fails to vacate the Premises within 30 days after notice from Landlord, Tenant shall be liable for all damages that Landlord suffers from the holdover.

23. Subordination to Mortgages; Estoppel Certificate.

23.01 Tenant accepts this Lease subject and subordinate to any mortgage(s), deed(s) of trust, deeds to secure debt, ground lease(s) or other lien(s) now or subsequently arising upon the Premises, the Building or the Property, and to renewals, modifications, refinancings and extensions thereof (collectively referred to as a “Mortgage”). The party having the benefit of a Mortgage shall be referred to as a “Mortgagee”. This clause shall be self-operative, but upon request from a Mortgagee, Tenant shall execute a commercially reasonable subordination agreement in favor of the Mortgagee. As an alternative, a Mortgagee shall have the right at any time to subordinate its Mortgage to this Lease. Upon request, Tenant, without charge, shall attorn to any successor to Landlord’s interest in this Lease. Landlord and Tenant shall each, within 10 days after receipt of a written request from the other, execute and deliver a commercially reasonable estoppel certificate to those parties as are reasonably requested by the other (including a Mortgagee or prospective purchaser). Without limitation, such estoppel certificate may include a certification as to the status of this Lease, the existence of any defaults and the amount of Rent that is due and payable.

18

23.02 In the event Mortgagee enforces it rights under the Mortgage, Tenant, at Mortgagee’s option, will attorn to Mortgagee or its successor; provided, however, that Mortgagee or its successor shall not be liable for or bound by (i) any payment of any Rent installment which may have been made more than 30 days before the due date of such installment, (ii) any act or omission of or default by Landlord under this Lease (but Mortgagee, or such successor, shall be subject to the continuing obligations of landlord under the Lease to the extent arising from and after such succession to the extent of Mortgagee’s, or such successor’s, interest in the Property), (iii) any credits, claims, setoffs or defenses which Tenant may have against Landlord prior to the date Mortgagee enforces its rights under the Mortgage, (iv) any modification or amendment to this Lease for which Mortgagee’s consent is required, but has not been obtained, under a Mortgage or (v) any obligation under this Lease to maintain a fitness facility at the Building, if any. Tenant, upon the reasonable request by Mortgagee or such successor in interest, shall execute and deliver an instrument or instruments confirming such attornment.

24. Notice.

All demands, approvals, consents or notices (collectively referred to as a “notice”) shall be in writing and delivered by hand or sent by registered, express, or certified mail, with return receipt requested or with delivery confirmation requested from the U.S. postal service, or sent by overnight or same day courier service at the party’s respective Notice Address(es) set forth in Section 1; provided, however, notices sent by Landlord regarding general Building operational matters may be posted in the Building mailroom or the general Building newsletter or sent via e-mail to the e-mail address provided by Tenant to Landlord for such purpose. In addition, if the Building is closed (whether due to emergency, governmental order or any other reason), then any notice address at the Building shall not be deemed a required notice address during such closure, and, unless Tenant has provided an alternative valid notice address to Landlord for use during such closure, any notices sent during such closure may be sent via e-mail or in any other practical manner reasonably designed to ensure receipt by the intended recipient. Each notice shall be deemed to have been received on the earlier to occur of actual delivery (which, in the case of hand delivery, may be deemed “actually delivered” by posting same on the exterior door of the Premises, if the notice is for Tenant, or Landlord’s management office, if the notice is for Landlord) or the date on which delivery is refused, or, if Tenant has vacated the Premises or any other Notice Address of Tenant without providing a new Notice Address, 3 days after notice is deposited in the U.S. mail or with a courier service in the manner described above. Either party may, at any time, change its Notice Address (other than to a post office box address) by giving the other party written notice of the new address.

At the termination of this Lease or Tenant’s right of possession, Tenant shall remove Tenant’s Property from the Premises, and quit and surrender the Premises to Landlord, broom clean, and in good order, condition and repair, ordinary wear and tear and damage by Casualty (subject to the terms of Section 16) and condemnation (subject to the terms of Section 17) excepted which Landlord is obligated to repair hereunder excepted. If Tenant fails to remove any of Tenant’s Property, or to restore the Premises to the required condition, within 2 days after termination of this Lease or Tenant’s right to possession, Landlord, at Tenant’s sole cost and expense, shall be entitled (but not obligated) to remove and store Tenant’s Property and/or perform such

19

restoration of the Premises. Landlord shall not be responsible for the value, preservation or safekeeping of Tenant’s Property. Tenant shall pay Landlord, upon demand, the expenses and storage charges incurred. If Tenant fails to remove Tenant’s Property from the Premises or storage, within 30 days after notice, Landlord may deem all or any part of Tenant’s Property to be abandoned and, at Landlord’s option, title to Tenant’s Property shall vest in Landlord or Landlord may dispose of Tenant’s Property in any manner Landlord deems appropriate.

| 26. | Miscellaneous. |

26.01 This Lease shall be interpreted and enforced in accordance with the Laws of the state or commonwealth in which the Building is located and Landlord and Tenant hereby irrevocably consent to the jurisdiction and proper venue of such state or commonwealth. If any term or provision of this Lease shall to any extent be void or unenforceable, the remainder of this Lease shall not be affected. If there is more than one Tenant or if Tenant is comprised of more than one party or entity, the obligations imposed upon Tenant shall be joint and several obligations of all the parties and entities, and requests or demands from any one person or entity comprising Tenant shall be deemed to have been made by all such persons or entities. Notices to any one person or entity shall be deemed to have been given to all persons and entities. Tenant represents and warrants to Landlord, and agrees, that each individual executing this Lease on behalf of Tenant is authorized to do so on behalf of Tenant and that the entity(ies) or individual(s) constituting Tenant or Guarantor or which may own or control Tenant or Guarantor or which may be owned or controlled by Tenant or Guarantor are not and at no time will be (i) in violation of any Laws relating to terrorism or money laundering, or (ii) among the individuals or entities identified on any list compiled pursuant to Executive Order 13224 for the purpose of identifying suspected terrorists or on the most current list published by the U.S. Treasury Department Office of Foreign Assets Control at its official website, xxxx://xxx.xxxxxxxx.xxx/xxxxxxxx-xxxxxx/xxxxxxxxx/XXX-Xxxx/Xxxxx/xxxxxxx.xxxx or any replacement website or other replacement official publication of such list.

26.02 If Tenant fails to pay any Rent or other sum due and owing under this Lease, and such sum is thereafter collected by or through an attorney at law, then, in addition to such sums, Tenant shall also pay Landlord’s reasonable attorneys’ fees for such collection. In any action or proceeding between Landlord and Tenant, the prevailing party shall be entitled to recover all of its costs and expenses in connection therewith, including, but not limited to, reasonable attorneys’ fees actually incurred from the non-prevailing party; provided, however, that a recovery of attorneys’ fees by Landlord against Tenant under this sentence shall include, but shall not duplicate, the recovery by Landlord against Tenant of its reasonable attorneys’ fees and other reasonable costs of collection permitted under the immediately preceding sentence. The phrase “reasonable attorneys’ fees actually incurred” or phrases of similar meanings regarding attorneys fees used in this Section and other Sections of this Lease relating to the attorneys’ fees the prevailing party in any action or proceeding is permitted to recover under the terms of this Lease shall be deemed to mean reasonable attorney’s fees, without consideration of the terms of O.C.G.A.13-1-11(a)(1) or O.C.G.A.13-1-11(a)(2), and shall be deemed to include the cost of enforcing any term or condition of this Lease, the cost of proving all damages and the cost of proving the amount of and the reasonableness of all attorneys’ fees, including, but not limited to, the cost of any experts to prove same. In addition, “attorneys’ fees” as used throughout this Lease shall include the fees of third party attorneys and the fees of “in house” legal counsel of Landlord and Tenant, as appropriate. Landlord and Tenant hereby waive any right to trial by jury in any proceeding based upon a breach of this Lease. No failure by either party to declare a default immediately upon its occurrence, nor any delay by either party in taking action for a default, nor Landlord’s acceptance of Rent with knowledge of a default by Tenant, shall constitute a waiver of the default, nor shall it constitute an estoppel.

20

26.03 Whenever a period of time is prescribed for the taking of an action by Landlord or Tenant (other than the payment of the Security Deposit or Rent), the period of time for the performance of such action shall be extended by the number of days that the performance is actually delayed due to strikes, acts of God, shortages of labor or materials, war, terrorist acts, pandemics, civil disturbances and other causes beyond the reasonable control of the performing party (“Force Majeure”).

26.04 Landlord shall have the right to transfer and assign, in whole or in part, all of its rights and obligations under this Lease and in the Building and Property. Upon transfer, Landlord shall be released from any further obligations hereunder and Tenant agrees to look solely to the successor in interest of Landlord for the performance of such obligations, provided that any successor pursuant to a voluntary, third party transfer (but not as part of an involuntary transfer resulting from a foreclosure or deed in lieu thereof) shall have assumed Landlord’s obligations under this Lease from and after the date of the transfer, and further provided that Landlord and its successors, as the case may be, shall remain liable after their respective periods of ownership with respect to any sums due in connection with a breach or default by such party that arose during such period of ownership by such party.