OFFTAKE AGREEMENT

EXHIBIT 99.2

EXECUTION VERSION

Between

PRETIUM EXPLORATION INC.

- and -

- and -

0890696 B.C. LTD

- and -

EACH OF THE OTHER GUARANTORS FROM TIME TO TIME PARTY HERETO

- and -

ORION CO-INVESTMENTS II (STREAM) LIMITED, BTO MIDAS L.P. AND EACH OF THE

OTHER PURCHASERS FROM TIME TO TIME PARTY HERETO

September 15, 2015

TABLE OF CONTENTS

|

Page

|

|||

|

1.

|

DEFINITIONS AND INTERPRETATION

|

2

|

|

|

|

|||

|

1.1

|

Defined Terms

|

2

|

|

|

1.2

|

Certain Rules of Interpretation

|

9

|

|

|

1.3

|

Measurements

|

10

|

|

|

1.4

|

Currency and Manner of Payment

|

10

|

|

|

1.5

|

Time of Essence

|

10

|

|

|

2.

|

PURCHASE, SALE AND DELIVERY

|

11

|

|

|

2.1

|

Purchase and Sale of Refined Gold

|

11

|

|

|

2.2

|

Product Specifications

|

11

|

|

|

2.3

|

Delivery Obligations

|

11

|

|

|

2.4

|

Passing of Title

|

12

|

|

|

2.5

|

Documentation

|

12

|

|

|

2.6

|

Reduction Election

|

13

|

|

|

3.

|

PRICING AND PAYMENT

|

14

|

|

|

3.1

|

Provisional Payment

|

14

|

|

|

3.2

|

Final Payment

|

14

|

|

|

3.3

|

Replacement Pricing

|

15

|

|

|

4.

|

TAXES, TARIFFS AND DUTIES

|

15

|

|

|

5.

|

TERM AND TERMINATION

|

17

|

|

|

5.1

|

Term

|

17

|

|

|

5.2

|

Purchasers’ Right to Terminate

|

17

|

|

|

5.3

|

Seller’s Right to Terminate

|

17

|

|

|

5.4

|

Effect of Termination

|

18

|

|

|

6.

|

REPORTING; BOOKS AND RECORDS; INSPECTIONS

|

18

|

|

|

6.1

|

Production Start Date and Annual Forecasts

|

18

|

|

|

6.2

|

Operations Reports

|

18

|

|

|

6.3

|

Other Notices

|

18

|

|

|

6.4

|

Books and Records; Audits

|

19

|

|

|

6.5

|

Inspections

|

19

|

|

|

7.

|

MANAGEMENT OF OPERATIONS

|

19

|

|

|

7.1

|

Performance of Mining Operations

|

19

|

|

|

7.2

|

Processing and Sale of Minerals

|

20

|

|

|

7.3

|

Commingling

|

21

|

|

|

7.4

|

Stockpiling off Property

|

21

|

|

-i-

|

7.5

|

Insurance

|

22

|

|

|

7.6

|

Authorizations

|

22

|

|

|

8.

|

REPRESENTATIONS AND WARRANTIES

|

22

|

|

|

8.1

|

Representations and Warranties of the Purchaser

|

22

|

|

|

8.2

|

Representations and Warranties of the Pretium Group Entities

|

23

|

|

|

9.

|

INDEMNIFICATION

|

24

|

|

|

10.

|

GUARANTEED OBLIGATIONS

|

25

|

|

|

10.1

|

Guarantee

|

25

|

|

|

10.2

|

Transfers of Guarantor Obligations

|

27

|

|

|

11.

|

TRANSFER RIGHTS

|

27

|

|

|

11.1

|

Transfer Rights of Purchasers

|

27

|

|

|

11.2

|

Transfer Rights of Seller

|

27

|

|

|

12.

|

THE PURCHASERS AND THE PURCHASERS’ AGENT

|

28

|

|

|

12.1

|

Decision-Making

|

28

|

|

|

12.2

|

Purchasers’ Obligations Several; No Partnership

|

28

|

|

|

12.3

|

Purchasers’ Agent

|

29

|

|

|

12.4

|

Sharing of Information

|

29

|

|

|

12.5

|

Amendments to this Article

|

29

|

|

|

12.6

|

Number of Purchasers

|

30

|

|

|

13.

|

GOVERNING LAW AND ATTORNMENT

|

30

|

|

|

14.

|

DISPUTES AND ARBITRATION

|

30

|

|

|

15.

|

CONFIDENTIALITY AND DISCLOSURES

|

31

|

|

|

15.1

|

Confidentiality

|

31

|

|

|

15.2

|

Press Releases and Public Disclosure

|

32

|

|

|

16.

|

NOTICES

|

33

|

|

|

17.

|

MISCELLANEOUS

|

34

|

|

|

17.1

|

Further Assurances

|

34

|

|

|

17.2

|

No Partnership or Joint Venture

|

34

|

|

|

17.3

|

Severability

|

34

|

|

|

17.4

|

Entire Agreement

|

34

|

|

|

17.5

|

Amendments

|

35

|

|

|

17.6

|

Waivers

|

35

|

|

|

17.7

|

Specific Performance

|

35

|

|

|

17.8

|

Benefit of Agreement

|

35

|

|

-ii-

|

17.9

|

Costs and Expenses

|

35

|

|

|

17.10

|

Execution in Counterparts

|

35

|

|

|

SCHEDULES

|

|||

|

SCHEDULE A – DESCRIPTION OF PROJECT REAL PROPERTY

|

|||

|

SCHEDULE B – PURCHASERS

|

|||

-iii-

THIS AGREEMENT is made as of the 15th day of September, 2015. BETWEEN:

PRETIUM EXPLORATION INC., a corporation existing under the laws of British Columbia (the “Seller”)

- and -

PRETIUM RESOURCES INC., a corporation existing under the laws of British Columbia (“Pretium”)

- and -

0890696 B.C. LTD., a corporation existing under the laws of British Columbia (“0890696” and collectively with Pretium, the “Guarantors”)

- and -

EACH OF THE OTHER GUARANTORS FROM TIME TO TIME PARTY HERETO

- and -

ORION CO-INVESTMENTS II (STREAM) LIMITED, BTO MIDAS L.P. AND EACH OF THE OTHER PURCHASERS FROM TIME TO TIME PARTY HERETO

- and -

ORION CO-INVESTMENTS II (STREAM) LIMITED, An exempted company formed under the laws of Bermuda, in its capacity as the Purchasers’ Agent.

WHEREAS:

|

(A)

|

The Seller, a wholly-owned Subsidiary of Pretium, has the right to develop, operate and mine 100% of the Project.

|

|

(B)

|

The Seller has agreed to sell to the Purchasers, and the Purchasers have agreed to purchase from the Seller, Refined Gold (up to the Aggregate Gold Quantity) processed from the Minerals, on and subject to the terms and conditions of this Agreement.

|

|

(C)

|

The Guarantors have agreed to guarantee the performance of the Seller’s obligations under this Agreement.

|

NOW THEREFORE, in consideration of the premises and the mutual covenants and agreements herein contained and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by the Parties hereto, the Parties mutually agree as follows:

-1-

1. DEFINITIONS AND INTERPRETATION

1.1 Defined Terms

For the purposes of this Agreement (including the recitals hereto and the Schedules), unless the context otherwise requires, the following terms shall have the respective meanings given to them, as set out below, and grammatical variations of such terms shall have corresponding meanings:

“Affiliate” means, with respect to any Person, any other Person which directly or indirectly, through one or more intermediaries, Controls, or is Controlled by, or is under common control with, such Person.

“Aggregate Gold Quantity” means (i) 7,067,000 ounces of Refined Gold less the ounces of Refined Gold Delivered pursuant to the Stream Agreement, or (ii) in the case of an adjustment in accordance with Section 2.6, the Aggregate Gold Quantity determined in accordance with Section 2.6.

“Agreement” means this Offtake Agreement and all attached schedules, in each case as the same may be amended, restated, supplemented, modified or superseded from time to time in accordance with the terms hereof.

“Annual Forecast Report” means a written report in relation to a fiscal year with respect to the Project, to be prepared by or on behalf of the Seller, including with reasonable detail:

|

|

(i)

|

the mineral reserves and mineral resources (by category), determined in accordance with National Instrument 43-101 (with the assumptions used, including cut-off grade, metal prices and metal recoveries), as of the end of such year; and

|

|

|

(ii)

|

a forecast, based on the then current Mine Plan, for such fiscal year on a month-by-month basis and over the remaining life of the mine on a year-by-year basis of:

|

|

|

(A)

|

the tonnes and estimated grade of Minerals to be mined; and

|

|

|

(B)

|

the tonnes and grade of Minerals to be processed, and expected recoveries for gold and other types of marketable Minerals.

|

“Anti-Corruption Policy” means the anti-bribery and anti-corruption policy of the Pretium Group Entities adopted by the Board, as the same may be amended, revised, supplemented or replaced from time to time in accordance with the Credit Agreement, a copy of which has been provided to the Purchasers prior to the date hereof.

“Applicable Law” means any law (including common law and equity), any international or other treaty, any domestic or foreign constitution or any multinational, federal, provincial, territorial, state, municipal, county or local statute, law, ordinance, code, rule, regulation, Order (including any securities laws or requirements of stock exchanges and any consent decree or administrative Order), or Authorization of a Governmental Body in each case to the extent applicable to and legally binding upon or having the force of law over any specified Person, property, transaction or event, or any of such Person’s property or assets.

-2-

“Applicable Percentage” means (i) a percentage equal to 100% minus the Applicable Stream Percentage, if any, from time to time; or (ii) following an adjustment in accordance with Section 2.6, the Applicable Percentage determined in accordance with Section 2.6.

“Applicable Stream Percentage” means, following the Delivery Start Date (as defined in the Stream Agreement) and until the Stream Agreement is terminated in accordance with its terms, the Designated Metal Percentage (as defined in the Stream Agreement) for Refined Gold, and in all other cases, nil.

“Associate” has the meaning ascribed to such term in the Securities Act (Ontario), as in effect on the date of this Agreement.

“Authorization” means any authorization, approval, consent, concession, exemption, license, lease, grant, permit, franchise, right, privilege or no-action letter from any Governmental Body having jurisdiction with respect to any specified Person, property, transaction or event, or with respect to any of such Person’s property or business and affairs (including any zoning approval, mining permit, development permit or building permit) or from any Person in connection with any easements, contractual rights or other matters.

“Business” means the business of the Pretium Group Entities, taken as a whole, as described in the Public Disclosure Documents, including, without limitation, the development, construction, and operation of, and extraction of mineral resources from, the Project.

“Business Day” means any day, other than: (a) a Saturday, Sunday or statutory holiday in all or any of Vancouver, British Columbia, New York City, New York, Xxxxxxxx, Bermuda or London, England or (b) a day on which banks are generally closed in all or any of those cities.

“Capitalized Lease Obligation” means, for any Person, any payment obligation of such Person under an agreement for the lease, license or rental of, or providing such Person with the right to use, property that, in accordance with IFRS, is required to be capitalized.

“Control” means, in respect of a particular Person, the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of such Person, whether through the ability to exercise voting power, by contract or otherwise. “Controlling” and “Controlled” have meanings correlative thereto.

“Credit Agreement” means the credit agreement dated the date hereof between the lenders thereto and Pretium, as borrower.

“Delivery” means delivery of Refined Gold, and transfer of possession and title in respect thereof, from the Seller to the Purchasers, or the Purchaser's Agent pursuant to Section 12.6, as applicable, in the manner provided for in this Agreement, and “Deliver” and “Delivered” have corresponding meanings.

“Delivery Date” has the meaning set out in Section 2.3(a).

“Delivery Time” has the meaning set out in Section 2.3(a).

“Encumbrance” means, with respect to any Person, any mortgage, debenture, pledge, hypothec, lien, charge, contractual right of set-off, assignment by way of security, hypothecation or security interest, including a purchase money security interest, in respect of any such Person’s property, or any consignment by way of security or the interest of the lessor under any lease constituting a Capital Lease Obligation or any other security agreement, trust or arrangement having the effect of creating an interest in any property of such Person as security for the payment of any debt, liability or obligation, and “Encumbrances”, “Encumbrancer” and “Encumbered” shall have corresponding meanings.

-3-

“Gold Market Price” has the meaning set out in Section 3.2(a).

“Gold Purchase Price” has the meaning set out in Section 3.2(a).

“Good Delivery Specifications” means the specifications for good delivery of gold bars under the “Good Delivery Rules” published by the LBMA from time to time, or such other specifications as agreed to by the Seller and the Purchaser pursuant to Section 2.2(b).

“Good Industry Practice” means, in relation to any specified decision or undertaking, the exercise of a degree of diligence, skill, care and prudence and which would reasonably be expected to be observed by experienced professionals in the Canadian mining industry engaged in the same type of undertaking under the same or similar circumstances.

“Governmental Body” means the government of Canada or any other nation, or of any political subdivision thereof, whether state, provincial or local, and any agency, authority, instrumentality, regulatory body, court, arbitrator or arbitrators, tribunal, central bank or other entity exercising executive, legislative, judicial or arbitral, taxing, regulatory or administrative powers or functions (including any applicable stock exchange).

“Guaranteed Obligations” has the meaning set out in Section 10.1(a).

“Guarantors” means, collectively, Pretium, 0890696 B.C. Ltd. and any other Person (now or hereafter formed or acquired) that holds or acquires directly or indirectly any interest in the Seller or the Project Property, provided that if any such Person transfers or otherwise ceases to hold any direct or indirect interest in the Seller or the Project Property, it will cease to be a Guarantor for the purpose of this Agreement, and “Guarantor” means any one of them, as the context may require.

“IFRS” means the International Financial Reporting Standards adopted by the International Accounting Standards Board from time to time.

“Insolvency Event” means any of the following:

|

|

(i)

|

a Party suffers or consents to or applies for the appointment of a receiver, trustee, custodian or liquidator of itself or any of its property, or is generally unable to or fails to pay its debts as they become due, or makes a general assignment for the benefit of creditors;

|

|

|

(ii)

|

a Party files a voluntary petition in bankruptcy, or seeks to effect a plan or other arrangement with creditors or any other relief under any Bankruptcy Code, or under any Applicable Law granting similar relief to debtors, whether now or hereafter in effect;

|

|

|

(iii)

|

any involuntary petition or proceeding pursuant to any Bankruptcy Code or any other Applicable Law relating to bankruptcy, reorganization or other relief for debtors is filed or commenced against a Party and is not dismissed, stayed or vacated within 30 days thereafter, or such Party files an answer admitting the jurisdiction of the court and the material allegations of the involuntary petition;

|

-4-

|

|

(iv)

|

a Party is adjudicated bankrupt, or an order for relief is entered by any court of competent jurisdiction under any Bankruptcy Code or any other Applicable Law relating to bankruptcy, reorganization or other relief for debtors;

|

|

|

(v)

|

a Party suffers the enforcement of security interests over all or substantially all of its assets (which in the case of the Seller or any Pretium Group Entity includes the Project Property);

|

|

|

(vi)

|

a Party liquidates, winds up or dissolves (or suffers any liquidation, wind-up or dissolution); or

|

|

|

(vii)

|

a Party takes any action authorizing or in furtherance of any of the foregoing.

|

For the purposes of this definition, “Bankruptcy Code” means any of the Bankruptcy and Insolvency Act (Canada), the Companies Creditors Arrangement Act (Canada) and the Winding-Up and Restructuring Act (Canada) or any similar legislation, each as amended or recodified from time to time, including any rules or regulations promulgated thereunder.

“LBMA” means the London Bullion Market Association.

“Losses” means any and all damages, claims, losses, diminution of value, liabilities, fines, injuries, costs, penalties and expenses (including reasonable legal fees). Losses shall not include consequential, special, exemplary, indirect, incidental or punitive damages or opportunity.

“Majority Purchaser” means, at any time, one or more Purchasers holding in the aggregate a Purchaser’s Share greater than 662/3% or as otherwise agreed to by each of the Purchasers.

“Material Adverse Effect” means a material adverse change to or effect on:

|

|

(viii)

|

the Business or the capitalization, assets, liabilities, operations or condition (financial or otherwise) of the Pretium Group Entities, taken as a whole; or

|

|

|

(ix)

|

the ability of the Pretium Group Entities, taken as a whole, to develop, construct or operate the Project, or on the economic viability of the Project, substantially as contemplated by the Mine Plan (as in effect at the time of such material adverse change or effect; or

|

|

|

(x)

|

the ability of any Pretium Group Entities to perform its obligations under this Agreement,

|

provided, in each case, that it shall not include any event, change or effect resulting exclusively from (x) the announcement of the execution of this Agreement, the Subscription Agreements, the Stream Agreement or the Credit Agreement; (y) any change in the price of the publicly listed stock of Pretium; or (z) any change in gold prices (it being understood that the underlying effects, events, facts or occurrences giving rise to any of (x), (y) or (z) that are not otherwise excluded by this proviso may be determined to constitute, or give rise to, a Material Adverse Effect), and provided further that it shall not include putting the Project into care and maintenance after the Commercial Production Date (as such term is defined in the Credit Agreement) solely as a result of any change in gold and silver prices.

“Mine Plan” means ●.

-5-

“Minerals” means any and all marketable metal bearing material in whatever form or state that is mined, produced, extracted or otherwise recovered from the Project Real Property, including any such material derived from any processing or reprocessing of any tailings, waste rock or other waste products originally derived from the Project Real Property, and including ore, concentrate and doré and any other products resulting from the further milling, processing or other beneficiation of Minerals.

“Monthly Production Report” means a written report in relation to a calendar month with respect to the Project, to be prepared by or on behalf of the Seller for each month, which contains:

|

|

(xi)

|

the tonnes and estimated grade of Minerals mined during such month;

|

|

|

(xii)

|

the tonnes and estimated grade of Minerals stockpiled during such month (and the total stockpile at the end of such month);

|

|

|

(xiii)

|

the tonnes and estimated grade of Minerals processed during such month and recoveries for gold and other types of marketable minerals;

|

|

|

(xiv)

|

the number of ounces of gold Outturned by the Refinery during such month;

|

|

|

(xv)

|

the estimated number of ounces of gold contained in Minerals processed as of the end of such month that have not yet been delivered to or Outturned by the Refinery; and

|

|

|

(xvi)

|

the aggregate number of ounces of Refined Gold delivered to the Purchasers under this Agreement and delivered pursuant to the Stream Agreement up to the end of such month.

|

“National Instrument 43-101” means National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (or any successor instrument, rule or policy).

“Non-Committed Products” means, collectively, Refined Gold and Refined Silver (as defined in the Stream Agreement) which are sold, transferred or otherwise disposed of in the ordinary course of business, provided such sales or transfers are done in compliance with this Agreement and are in excess of the Refined Gold and Refined Silver (as defined in the Stream Agreement) required to be delivered in compliance with the Stream Agreement or this Agreement from time to time, and in any event provided further that, prior to the applicable Delivery Start Date (as defined in the Stream Agreement), the Seller will not sell, transfer or otherwise dispose of more than 3,533,500 ounces of Refined Gold and 13,148,500 ounces of Refined Silver (as defined in the Stream Agreement).

“Order” means, in respect of any Person, any order, directive, decree, judgment, ruling, award, injunction or direction of any Governmental Body or other decision-making authority of competent jurisdiction which is legally binding on such Person.

“Other Minerals” means minerals that are not Minerals.

“Other Rights” means all material licenses, approvals, authorizations, consents, rights (including surface rights, access rights and rights of way), privileges, concessions or franchises held by the a Pretium Group Entity and issued or obtained from or which are required to be issued by or obtained from any Person not a Related Party to any Pretium Group Entity (other than a Governmental Body) and which are required for the construction, development and operation of the Project, substantially in accordance with the Mine Plan as then in effect.

-6-

“Outturn” means (i) an outturn of Refined Gold from a Refinery, or (ii) in the case of a sale of gold-silver bearing concentrate to a Smelter pursuant to a Sales Contract, the receipt by the Seller or its Affiliates of Refined Gold, whether provisional or otherwise, or the receipt by the Seller or its Affiliates of a final cash payment pursuant to the Sales Contract, in each case, processed from Minerals.

“Parties” means the parties to this Agreement and “Party” means any one of the Parties.

“Payment Adjustment Date” means ●.

“Person” means and includes individuals, corporations, bodies corporate, limited or general partnerships, joint stock companies, limited liability companies, joint ventures, associations, companies, trusts, banks, trust companies, Governmental Bodies or any other type of organization or entity, whether or not a legal entity.

“Pool Accounts” means such metal account as each Purchaser may notify to the Seller from time to time.

“Pretium Group Entities” means, collectively, the Seller and the Guarantors.

“Process Plant” means the process plant to be completed in connection with the Project, substantially as contemplated in the Mine Plan, and used to process Minerals into doré or gold-silver bearing concentrate.

“Production Start Date” has the meaning set out in Section 6.1(a).

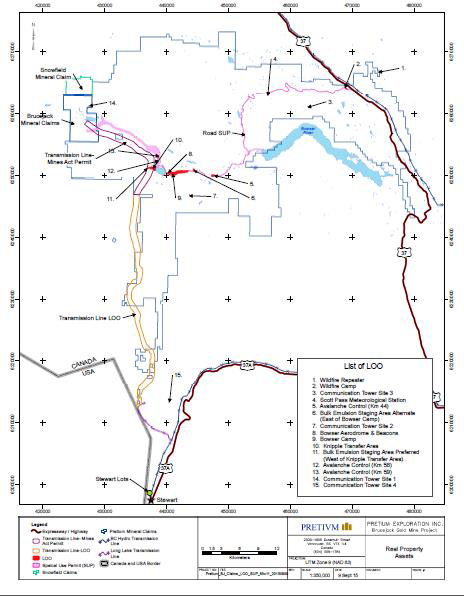

“Project” means the Brucejack Project located approximately 00 xxxxxxxxxx xxxxx-xxxxxxxxx xx Xxxxxxx, Xxxxxxx Xxxxxxxx, as described in the Technical Report, and including the mining, exploration and development operations thereon, and the mines, infrastructure, processing facilities constructed or used therein.

“Project Property” means all of the property, assets, undertaking and rights of the Pretium Group Entities in and relating to the Project, whether now owned or existing or hereafter acquired or arising, including real property, personal property and mineral interests, and specifically including, but not limited to: (i) the Project Real Property; (ii) all accounts, instruments, chattel paper, deposit accounts, documents, intangibles, goods (including inventory, equipment and fixtures), money, letter of credit rights, supporting obligations, claims, causes of action and other legal rights and investment property; (iii) all products, proceeds (including proceeds of proceeds), rents and profits of the foregoing; and (iv) all books and records of the Pretium Group Entities related to any of the foregoing.

“Project Real Property” means all real property interests, all mineral claims, mineral leases and other mineral rights, mineral claims and interests, and all surface access rights held by any of the Pretium Group Entities relating to the Project (which as of the date hereof, are as set forth in Schedule A), and all buildings, structures, improvements, appurtenances and fixtures thereon or attached thereto, whether created privately or by the action of any Governmental Body. “Project Real Property” shall also include any term extension, renewal, replacement, conversion or substitution of any such real property interests, mineral claims, mineral leases, mineral rights, mineral claims or interests, and surface access rights, owned or in respect of which an interest is held, directly or indirectly, by any Pretium Group Entity at any time during the term of this Agreement, whether or not such ownership or interest is held continuously.

“Provisional Payment Amount” has the meaning given to it in Section 3.1.

“Provisional Payment Date” has the meaning given to it in Section 3.1.

-7-

“Public Disclosure Documents” means, collectively, all of the documents which have been filed by or on behalf of Pretium with the relevant Securities Regulators pursuant to the requirements of Securities Laws, including all documents publicly available on Pretium’s SEDAR profile.

“Purchaser’s Share” means, at any time, in respect of each Purchaser, the percentage set forth next to each Purchaser in Schedule B, as may be updated from time to time in accordance with this Agreement.

“Purchasers” means the Purchasers party hereto from time to time as set forth in Schedule B, as may be updated from time to time in accordance with this Agreement and “Purchaser” means any one of them, as the context so requires.

“Purchasers’ Agent” means Orion Co-Investments II (Stream) Limited, in its capacity as agent for the Purchasers under this Agreement, or any successor Purchasers’ Agent appointed by the Majority Purchasers in accordance with Section 12.3.

[omitted a pricing related definition]

“Refined Gold” means marketable metal bearing material in the form of gold bars or coins that is refined to standards meeting or exceeding 995 parts per 1,000 fine gold, and otherwise conforming to the Good Delivery Specifications.

“Related Party” means, with respect to any Person (the “first named Person”), any Person that does not deal at arm’s length (as such term is defined in the Income Tax Act (Canada)) with the first named Person or is an Associate of the first named Person and, in the case of any Pretium Group Entity includes: (i) any director, officer, employee or Associate of Pretium or any of its Affiliates, (ii) any Person that does not deal at arm’s length (as such term is defined in the Income Tax Act (Canada)) with Pretium or any of its Affiliates, and (iii) any Person that does not deal at arm’s length (as such term is defined in the Income Tax Act (Canada)) with, or is an Associate of, a director, officer, employee or Associate of Pretium or any of its Affiliates.

“Remaining Contained Gold” has the meaning given to it in Section 2.6(d).

“Refinery” means any smelter or refinery that is recognized by the LBMA at the relevant time as producing gold bars meeting the Good Delivery Specifications chosen by the Seller from time to time, provided that the Seller has given the Purchasers at least 10 Business Days’ written notice of such choice.

“Sales Contract” means an agreement with a Smelter for the sale of gold-silver bearing concentrate to such Smelter in exchange for payment to the Seller or its Affiliates of cash proceeds or Refined Gold.

“Securities Laws” means all applicable securities laws and the respective regulations made thereunder, together with applicable published fee schedules, prescribed forms, policy statements, notices, orders, blanket rulings and other regulatory instruments of the Securities Regulators, and all rules and policies of the Toronto Stock Exchange and any other stock exchange on which securities of Pretium are traded.

“Securities Regulators” means, collectively, the securities regulators or other securities regulatory authorities in (i) each of the provinces and territories of Canada in which Pretium is a reporting issuer, (ii) the United States and (iii) any other jurisdictions whose Securities Laws are applicable to Pretium.

“SEDAR” means the System for Electronic Document Analysis and Retrieval operated by the Canadian Securities Administrators.

-8-

“Smelter” means any smelter (other than a smelter forming part of the Process Plant or a smelter that is a Refinery) that processes Minerals in the form of gold-silver bearing concentrate into doré or other beneficiated form of gold suitable for delivery to a Refinery.

“Stream Agreement” means the Stream Agreement dated the date hereof between, among others, Pretium, the Seller and the purchasers from time to time party thereto.

“Subscription Agreements” means the subscription agreements dated the date hereof between Pretium and Orion Co-Investments II (ED) Limited and BTO Midas L.P. pursuant to which Pretium agreed to issue, and Orion Co-Investments II (ED) Limited and BTO Midas L.P. agreed to subscribe for, the number of common shares of Pretium set forth therein.

“Subsidiary” means with respect to any Person, any other Person which is controlled directly or indirectly by that Person.

“Taxes” means all present and future taxes (including, for certainty, real property taxes), levies, imposts, stamp taxes, duties, deductions, withholdings, assessments, fees or other charges imposed by any Governmental Body, including any interest, additions to tax or penalties applicable thereto and “Tax” shall have a corresponding meaning.

“Tax Returns” means all returns, declarations, reports, estimates, information returns and statements required to be filed with any Governmental Body in respect of any Taxes, including any schedule or attachment thereto or amendment thereof.

“Technical Report” means the technical report titled “Feasibility Study and Technical Report Update on the Brucejack Project, Xxxxxxx, XX” dated June 19, 2014 and prepared for the Company by Tetra Tech and co-authored by Xxxxxxx Mining Industry Consultants Inc., AMC Mining Consultants (Canada) Ltd., ERM Rescan, BGC Engineering Inc., Alpine Solutions Avalanche Services and Valard Construction.

“Term” means the period of time during which this Agreement is in effect as described in Section 5.1.

“Transfer” means to, directly or indirectly, sell, transfer, assign, convey, dispose or otherwise grant a right, title or interest (including expropriation or other transfer required or imposed by law or any Governmental Body), whether voluntary or involuntary.

1.2 Certain Rules of Interpretation

In this Agreement, unless otherwise specifically provided or unless the context otherwise requires:

|

|

(a)

|

the terms “Agreement”, “this Agreement”, “the Agreement”, “hereto”, “hereof”, “herein”, “hereby”, “hereunder” and similar expressions refer to this Agreement in its entirety and not to any particular provision hereof;

|

|

|

(b)

|

references to a “clause”, “Section” or “Schedule” followed by a number or letter refer to the specified clause or Section of or Schedule to this Agreement;

|

|

|

(c)

|

references to a Party in this Agreement mean the Party or its successors or permitted assigns;

|

-9-

|

|

(d)

|

for the purposes of Sections 14, 15 and 16, the Pretium Group Entities shall treated as a single Party;

|

|

|

(e)

|

the division of this Agreement into articles and sections and the insertion of headings are for convenience of reference only and shall not affect the construction or interpretation of this Agreement;

|

|

|

(f)

|

words importing the singular shall include the plural and vice versa, and words importing gender shall include all genders;

|

|

|

(g)

|

the words “including”, “includes” and “include” shall be deemed to be followed by the words “without limitation”;

|

|

|

(h)

|

unless specified otherwise, in this Agreement a period of days shall be deemed to begin on the first day after the event which began the period and to end at 5:00 pm (Vancouver time) on the last day of the period. If, however, the last day of the period does not fall on a Business Day, the period shall terminate at 5:00 pm (Vancouver time) on the next Business Day;

|

|

|

(i)

|

whenever any payment is required to be made, action is required to be taken or period of time is to expire on a day other than a Business Day, such payment shall be made, action shall be taken or period shall expire on the next following Business Day;

|

|

|

(j)

|

references to agreements (including this Agreement) and other contractual instruments shall be deemed to include all subsequent amendments and other modifications thereto, but only to the extent such amendments and other modifications are not prohibited by the terms of this Agreement; and

|

|

|

(k)

|

references to statutes or regulations are to be construed as including all statutory and regulatory provisions consolidating, amending, supplementing, interpreting or replacing the statute or regulation referred to.

|

1.3 Measurements

References to “ounce” or “oz” mean a xxxx ounce (being equal to 31.1034768 grams).

1.4 Currency and Manner of Payment

All references in this Agreement to currency or to “$”, unless otherwise expressly indicated, shall be to United States dollars. All payments made by the Parties to each other under this Agreement shall be made in such currency in immediately available funds by means of electronic transfer to the account designated by the recipient Party in writing from time to time.

1.5 Time of Essence

Time shall be of the essence of this Agreement.

-10-

2. PURCHASE, SALE AND DELIVERY

2.1 Purchase and Sale of Refined Gold

|

|

(a)

|

Subject to and in accordance with the terms and conditions of this Agreement, the Seller hereby agrees to sell to each Purchaser, and each Purchaser hereby agrees to purchase from the Seller, in respect of each Outturn, the Purchaser’s Share of the Applicable Percentage of Refined Gold, free and clear of all Encumbrances, until the Aggregate Gold Quantity has been Delivered to the Purchasers under this Agreement.

|

|

|

(b)

|

Subject to Section 2.1(c) below, the amount of Refined Gold to be delivered by the Seller to the Purchasers under this Agreement shall be measured by the amount of Refined Gold credited to the Seller in each Outturn.

|

|

|

(c)

|

In the case of the sale of gold-silver bearing concentrate to a Smelter for cash, the number of ounces of Refined Gold to be delivered to the Purchasers will be equal to the number of ounces of payable gold contained in each shipment delivered to a Smelter, determined in accordance with the applicable Sales Contract.

|

|

|

(d)

|

For greater certainty, the Purchasers shall not be responsible for any processing, refining, treatment or other charges, penalties, insurance, deductions, transportation, settlement, financing, price participation charges or other charges, penalties, deductions, set-offs, Taxes or expenses pertaining to and/or in respect of the Refined Gold purchased by them hereunder, all of which shall be for the account of the Seller.

|

2.2 Product Specifications

|

|

(a)

|

The Refined Gold to be purchased by and delivered to the Purchasers hereunder shall conform in all respects with the Good Delivery Specifications and the Purchasers shall not be required to purchase any Refined Gold that does not meet such specifications.

|

|

|

(b)

|

If the LBMA ceases to exist or ceases to publish rules for the good delivery of gold or such rules should no longer be internationally recognized as the basis for good delivery of gold, upon the request of either of them, the Seller and the Purchasers’ Agent shall promptly meet to agree on a new basis for determining good delivery of Refined Gold under this Agreement. Until a replacement set of rules is mutually agreed by the Seller and the Purchasers’ Agent, deliveries of Refined Gold by the Seller to the Purchasers under this Agreement shall conform to the last set of rules for good delivery in effect under this Agreement immediately prior to the time such rules ceased to be published or recognized.

|

2.3 Delivery Obligations

|

(a)

|

The Seller shall sell and deliver the Refined Gold referred to in Section 2.1 to the Purchasers by credit to their respective Pool Accounts (or as otherwise directed by each Purchaser) as provided in Sections 2.3(b) or 2.3(c), as the case may be. Delivery of the Refined Gold by the Seller to the Purchasers shall be deemed to have been made at the time and on the date such Refined Gold is credited to their respective Pool Accounts (the “Delivery Time” on the “Delivery Date”).

|

-11-

|

|

(b)

|

Subject to Section 2.3(c) below, the Seller shall direct the Refinery or Smelter, as the case may be, to deliver the Refined Gold referred to in Section 2.1 directly to the Purchasers by credit to their respective Pool Accounts after each Outturn in accordance with Section 2.3(a).

|

|

|

(c)

|

In the case of a sale of gold-silver bearing concentrate to a Smelter for cash, the Seller shall deliver the Refined Gold referred to in Section 2.1 to the Purchasers by credit to their respective Pool Accounts on the second Business Day following each applicable Outturn.

|

|

|

(d)

|

The Seller shall ensure that all contractual or other arrangements entered into with the Refinery or Smelter, as the case may be, shall contain provisions implementing the terms and conditions of delivery of the Refined Gold to the Purchasers set forth in this Section 2.3 and shall procure the written undertaking of the Refinery or Smelter, as the case may be, contractually binding the Refinery to performance in accordance with this Sections 2.3 in form and substance acceptable to the Purchasers’ Agent. The Seller shall promptly notify the Purchasers in writing of any dispute with the Refinery or Smelter, as the case may be, in respect of a material matter arising out of or in connection with the processing of Minerals into Refined Gold and shall provide the Purchasers with timely updates of the status of any such dispute and the final decision and award of the court or arbitration panel with respect to such dispute, as the case may be. The Seller acknowledges its primary obligation to deliver the Refined Gold to the Purchasers pursuant to this Agreement and that no undertaking by the Refinery or Smelter shall relieve the Seller of that obligation.

|

|

|

(e)

|

All costs and expenses pertaining to each delivery of Refined Gold to the Purchasers shall be borne by the Seller.

|

2.4 Passing of Title

Title to and risk of loss of or damage to Refined Gold shall pass from the Seller to the Purchasers upon Delivery of such Refined Gold. The Seller represents and warrants to and covenants with each Purchaser that, at each Delivery Time:

|

|

(a)

|

it will be the sole legal and beneficial owner of the Refined Gold credited to the Pool Accounts;

|

|

|

(b)

|

it will have good, valid and marketable title to such Refined Gold; and

|

|

(c)

|

such Refined Gold will be free and clear of all Encumbrances.

|

2.5 Documentation

|

(a)

|

Promptly, and in any event no later than 24 hours, after each shipment of Minerals by the Seller to the Refinery or Smelter, the Seller shall send the Purchasers, initially by email (at xxxxxxxxx@xxxxxxxxxxxxxxxxxxxxx.xxx and Xxxxxx@xxxxxxxxxx.xxx or such other email address(es) designated by any Purchaser in writing from time to time) notice of such shipment, including the date of shipment and the weight and fineness (if estimated) of the gold bars as shipped, or in the case of a shipment to a Smelter under a Sales Contract, the provisional weight, moisture content and assays of the gold-silver bearing concentrate as shipped.

|

-12-

|

|

(b)

|

Promptly, and in any event no later than 24 hours, after receipt thereof by the Seller, the Seller shall send the Purchasers, by email (at xxxxxxxxx@xxxxxxxxxxxxxxxxxxxxx.xxx and Xxxxxx@xxxxxxxxxx.xxx or such other email address(es) designated by any Purchaser in writing from time to time), a copy or notice of, as applicable, all documents and information received from the Refinery or Smelter related to the processing of Minerals shipped to the Refinery or Smelter, including any rejection of Minerals, the expected date of the Outturn, final sampling/assay information, umpire reports (if any), invoices and other settlement documents, unless the sharing of such information or documentation is restricted by applicable confidentiality restrictions or Applicable Laws, and then only to the extent of such restriction.

|

|

|

(c)

|

The Seller shall notify the Purchasers in writing by email (at xxxxxxxxx@xxxxxxxxxxxxxxxxxxxxx.xxx and Xxxxxx@xxxxxxxxxx.xxx or such other email address(es) designated by any Purchaser in writing from time to time), at least two Business Days prior to each Outturn, of the Delivery Date, the number of ounces of Refined Gold to be sold to each Purchaser and, in accordance with Section 2.1, the estimated net number of ounces of Refined Gold to be credited to each Purchaser on the Delivery Date.

|

|

|

(d)

|

On the date of each Outturn, the Seller shall deliver an invoice to each of the Purchasers that shall include:

|

|

|

(i)

|

a calculation of the number of ounces of Refined Gold sold and delivered to such Purchaser;

|

|

|

(ii)

|

the Delivery Date and Delivery Time; and

|

|

|

(iii)

|

such other information as may be reasonably requested by such Purchaser to allow it to verify all aspects of the delivery of Refined Gold reflected in such invoice.

|

2.6 Reduction Election

|

|

(a)

|

Effective on December 31, 2018 (or if such day is not a Business Day, the previous day that is a Business Day), the Seller may elect to reduce the Applicable Percentage to either (i) 50%, in exchange for a payment equal to $11 per ounce of Remaining Contained Gold multiplied by .50; or (ii) 25%, in exchange for a payment equal to $11 per ounce of Remaining Contained Gold multiplied by .75.

|

|

|

(b)

|

Provided the Seller did not elect the reduction in paragraph (a) above, effective on December 31, 2019 (or if such day is not a Business Day, the previous day that is a Business Day), the Seller may elect to reduce the Applicable Percentage to either (i) 50%, in exchange for a payment equal to $13 per ounce of Remaining Contained Gold multiplied by .50; or (ii) 25%, in exchange for a payment equal to $13 per ounce of Remaining Contained Gold multiplied by .75.

|

|

|

(c)

|

The Seller shall exercise such election by providing written notice thereof to each of the Purchasers at least 90 days in advance of the applicable effective date, and delivering the applicable payment amount on or before the applicable effective date.

|

-13-

|

|

(d)

|

For the purposes of this Section 2.6, “Remaining Contained Gold” shall mean the number calculated by subtracting the number of oz of Refined Gold delivered to the Purchasers in accordance with this Agreement from 7,067,000.

|

|

|

(e)

|

In the event of a reduction under either paragraph (a) or (b) above, following such reduction becoming effective, the Aggregate Gold Quantity will be equal to A+B (C-A),

|

where:

|

A =

|

the number of oz of Refined Gold delivered to the Purchaser in accordance with this Agreement immediately prior to the applicable effective date.

|

|

B =

|

the Applicable Percentage resulting from the adjustment elected in paragraph (a) or (b) above.

|

|

C =

|

7,067,000.

|

3. PRICING AND PAYMENT

3.1 Provisional Payment

After each Delivery of Refined Gold to a Purchaser hereunder, such Purchaser shall make a provisional payment of the applicable purchase price payable to the Seller for the Refined Gold Delivered to such Purchaser in an amount (the “Provisional Payment Amount”) equal to ●% of the product of: (i) the number of ounces of Refined Gold credited to such Purchaser’s Pool Account; and (ii) the a.m. LBMA Gold Price in U.S. dollars per ounce quoted by the LBMA on the Delivery Date. The electronic transfer of funds representing the Provisional Payment Amount to the account designated by the Seller shall be initiated by such Purchaser no later than noon (in New York City, New York) on the second Business Day (the “Provisional Payment Date”) after the Delivery Date.

3.2 Final Payment

|

|

(a)

|

The final purchase price (the “Gold Purchase Price”) payable by a Purchaser to the Seller for each ounce of Refined Gold Delivered to such Purchaser hereunder shall be equal to such Purchaser’s choice of any one of the following prices (the Purchaser’s choice referred to herein as the “Gold Market Price”):

|

[●].

|

|

(b)

|

At or before 4:00 p.m. (in New York City, New York) on the Payment Adjustment Date in respect of each Delivery of Refined Gold to a Purchaser hereunder, such Purchaser shall provide the following to the Seller by email (at such email address(es) designated by the Seller in writing from time to time):

|

|

(i)

|

notice of the Gold Market Price chosen by such Purchaser in accordance with Section 3.2(a) for such Refined Gold;

|

-14-

|

|

(ii)

|

a statement detailing the calculation of the aggregate Gold Purchase Price for such Refined Gold; and

|

|

|

(iii)

|

a statement of the amount owing to either such Purchaser or the Seller in respect of such Refined Gold after netting the Provisional Payment Amount from such aggregate Gold Purchase Price.

|

|

|

(c)

|

On the next Business Day after each Payment Adjustment Date, such Purchaser or the Seller, as applicable, shall pay the amount owing to the other of them as notified by such Purchaser to the Seller pursuant to Section 3.2(b)(iii) by electronic transfer of funds to the account designated by the recipient of such funds. Notwithstanding the foregoing, such Purchaser shall, by written notice to the Seller delivered no later than the Payment Adjustment Date, be entitled to set-off any such adjustment amount owing to such Purchaser against the next Provisional Payment Amount payable by such Purchaser to the Seller.

|

3.3 Replacement Pricing

If any of the price quotations used in the determination of the Provisional Payment Amount or the Gold Market Price cease to exist, cease to be published or should no longer be internationally recognized as the basis for the settlement of bullion contracts, then, upon the request of either of them, the Purchasers’ Agent and the Seller shall promptly meet to select a comparable commodity quotation for purposes of this Agreement (which selection shall become effective upon the agreement of the Seller and Purchasers’ Agent). The basic objective of such selection shall be to secure the continuity of fair market pricing of Refined Gold Delivered to the Purchasers under this Agreement. [omitted certain pricing related information].

4. TAXES, TARIFFS AND DUTIES

|

|

(a)

|

All Deliveries of Refined Gold and any other payment or transfer of property of any kind made under this Agreement to the Purchasers shall be made free and clear and without any present or future deduction, withholding, charge, levy or imposition for or on account of any Taxes, except as required by Applicable Laws. Subject to 4(d) below, all Taxes, if any, as are required by Applicable Laws to be so deducted, withheld, charged, levied, collected or imposed by the Seller on any such delivery (or payment, as applicable), shall be paid by the Seller delivering (or paying, as applicable) to the applicable Purchaser or on its behalf, in addition to such delivery (or payment, as applicable), such additional deliveries (or payments, as applicable) as are necessary to ensure that the net delivery (or payment, as applicable) received by such Purchaser (net of any such Taxes, including any Taxes required to be deducted, withheld, charged, levied, collected or imposed on any such additional amount) equals the full delivery (or payment, as applicable) that such Purchaser would have received had no such deduction, withholding, charge, levy, collection or imposition been required.

|

|

|

(b)

|

If any Purchaser becomes liable for any Tax, other than Excluded Taxes, imposed on any delivery (or payment, as applicable) under this Agreement the Seller shall indemnify such Purchaser for such Tax, and the indemnity payment shall be increased as necessary so that after the imposition of any Tax on the indemnity payment (including Tax in respect of any such increase in the indemnity payment), such Purchaser shall receive the full amount of Taxes for which it is liable and, if requested by the Seller, such Purchaser shall use reasonable efforts to dispute that such Taxes were correctly or legally imposed or asserted by the relevant Governmental Body, at the Seller’s expense. A certificate as to the amount of such payment or liability delivered to the Seller by such Purchaser shall be conclusive absent manifest error.

|

-15-

|

(c)

|

If any Purchaser determines, in its sole discretion, that it has received a refund of any Taxes as to which it has been indemnified by the Seller or with respect to which the Seller has paid additional amounts pursuant to this Section 4 or that, because of the payment of such Taxes, it has benefited from a reduction in Excluded Taxes otherwise payable by it, it shall pay to the Seller an amount equal to such refund or reduction (but only to the extent of indemnity payments made, or additional amounts paid, by the Seller under this Section 4 with respect to the Taxes giving rise to such refund or reduction), net of all out-of-pocket expenses of such Purchaser and without interest (other than any net after-Tax interest paid by the relevant Governmental Body with respect to such refund). The Seller, upon the request of any Purchaser, agrees to repay the amount paid over to the Seller (plus any penalties, interest or other charges imposed by the relevant Governmental Body) to such Purchaser if such Purchaser is required to repay such refund or reduction to such Governmental Body. If the Seller determines in good faith that a reasonable basis exists for contesting any Taxes for which a payment has been made hereunder, such Purchaser shall use its commercially reasonable efforts to co-operate with the Seller in challenging such Taxes at the Seller’s cost and expense if so requested by the Seller, provided that such Purchaser does not reasonably determine that such challenge could be prejudicial to it. This Section 4(c) shall not be construed to require the Purchasers to make available their Tax Returns (or any other information relating to its Taxes that the Purchasers deems confidential) to the Seller or any other Person, to arrange their affairs in any particular manner or to claim any available refund or reduction.

|

|

(d)

|

Notwithstanding Sections 4(a) and 4(b), the Seller shall not be responsible for any Excluded Taxes (as defined below) imposed or collected by any jurisdiction in respect of deliveries of Refined Gold or payments and transfers of property of any kind made by a Pretium Group Entity pursuant to this Agreement. For these purposes “Excluded Taxes” means any Taxes that are recoverable by a Purchaser or its assignees by way of input tax credit, refund or rebate and any additional Taxes imposed or collected by a jurisdiction by reason of a Purchaser (or any assignee of a Purchaser pursuant to Section 11.1, but with respect only to the interest of such assignee) being incorporated or resident in that jurisdiction, carrying on business in, or having a permanent establishment or a connection in that jurisdiction or participating in a transaction separate from this Agreement in that jurisdiction, in each case determined by application of the laws of that jurisdiction, other than by reason of purchasing Refined Gold under this Agreement, receiving payments or deliveries under this Agreement in that jurisdiction, making payments under this Agreement, or enforcing rights under this Agreement.

|

|

(e)

|

Notwithstanding anything herein to the contrary, the Seller shall not be required pursuant to this Article 4 to pay any increased or additional amount to, or to indemnify, any Purchaser that is an assignee of all or any interest in this Agreement except to the extent that the assignor to such Purchaser would have been, as an original Purchaser, entitled to receive additional amount or indemnity payment from the Seller pursuant to this Article 4 (and provided that nothing in this Section 4(e) shall be construed as relieving the Seller from any obligation to make such payments or indemnification to any assignor). For greater certainty, if an assignment would result in an increase in an amount of Taxes to be withheld pursuant to this Section 4, the Seller will not be responsible for indemnifying or making additional payments to any Purchaser that is an assignee with respect to such increase.

|

-16-

5. TERM AND TERMINATION

5.1 Term

Unless otherwise terminated in accordance with this Section 5, the rights and obligations of the Parties under this Agreement shall begin on the date of this Agreement and end upon Delivery by the Seller to Purchasers of, and final payment by Purchasers for, the Aggregate Gold Quantity in accordance with this Agreement.

5.2 Purchasers’ Right to Terminate

The Purchasers shall have the right, by written notice from the Purchasers’ Agent (at the direction of the Majority Purchasers) to the Seller, to terminate this Agreement prior to the end of the Term if:

|

|

(a)

|

any Pretium Group Entity is affected by an Insolvency Event; or

|

|

|

(b)

|

the financial position of any Pretium Group Entity deteriorates to such extent that in the reasonable opinion of the Purchasers’ Agent the ability of such Pretium Group Entity to perform its obligations under this Agreement have been placed in jeopardy; or

|

|

|

(c)

|

any Pretium Group Entity is, in any material respect, in default of its obligations under this Agreement, which default, if capable of cure, has not been cured to the satisfaction of the Purchasers’ Agent, acting reasonably, within a period of 30 days of a written demand made in respect thereof by the Purchasers’ Agent; or

|

|

|

(d)

|

any representation or warranty made by a Pretium Group Entity under or in connection with this Agreement is, in any material respect, incorrect or incomplete, which incorrectness or incompleteness, if capable of cure, has not been cured to the satisfaction of the Purchasers’ Agent, acting reasonably, within a period of 30 days of a written demand made in respect thereof by the Purchasers’ Agent; or

|

|

|

(e)

|

an Event of Default under the Stream Agreement or the Credit Agreement has occurred and is continuing.

|

5.3 Seller’s Right to Terminate

The Seller shall have the right, by written notice to a Purchaser, to terminate this Agreement in respect of such Purchaser prior to the end of the Term if:

|

|

(a)

|

such Purchaser is affected by an Insolvency Event; or

|

|

|

(b)

|

such Purchaser fails to make payments of amounts due in accordance with Section 3, which default has not been cured to the satisfaction of the Seller, acting reasonably, within a period of 30 days of a written demand made in respect thereof by the Seller; provided that any day during which such Purchaser is in good faith disputing a payment hereunder shall not count toward such 30-day period; or

|

-17-

|

|

(c)

|

such Purchaser is, in any material respect, in default of its obligations under this Agreement (other than Section 3), which default, if capable of cure, has not been cured to the satisfaction of the Seller, acting reasonably, within a period of 30 days of a written demand made in respect thereof by Seller.

|

5.4 Effect of Termination

If this Agreement is terminated under this Section 5, then all rights and obligations under this Agreement shall terminate other than in connection with any antecedent breach. Notwithstanding the foregoing, Sections 1 (to the extent applicable to surviving provisions), 3 (in respect of Refined Gold already Delivered), 4, 6.2 (in respect of the period prior to termination of this Agreement), 9, 10, 12, 14, 15, 16 and 17 shall survive termination of this Agreement.

6. REPORTING; BOOKS AND RECORDS; INSPECTIONS

6.1 Production Start Date and Annual Forecasts

|

|

(a)

|

At least 45 days prior to the anticipated date of the first production of Minerals containing gold suitable for shipment to a Refinery or Smelter (the “Production Start Date”), the Seller shall send the Purchasers by email (at xxxxxxxxx@xxxxxxxxxxxxxxxxxxxxx.xxx and Xxxxxx@xxxxxxxxxx.xxx or such other email address(es) designated by any Purchaser in writing from time to time) a notice of the Production Start Date, and a production forecast of the quantity of Minerals containing gold to be produced from the Project for the remainder of the then current calendar year.

|

|

|

(b)

|

Commencing after the Production Start Date, the Seller shall deliver to the Purchasers on or before December 15 of each calendar year: (i) during the term of the Credit Agreement, an Annual Forecast Report in respect of the upcoming calendar year; and (ii) following the termination of the Credit Agreement, a production forecast of the quantity of Minerals containing gold to be produced from the Project during such calendar year.

|

6.2 Operations Reports

Commencing after the Production Start Date, the Seller shall deliver to the Purchasers on or before the 15th Business Day after the end of each calendar month, a Monthly Production Report in respect of such month.

6.3 Other Notices

The Seller shall deliver to the Purchasers:

|

|

(a)

|

promptly after the Seller has knowledge or becomes aware thereof, written notice of all actions, suits and proceedings before any Governmental Body or arbitrator, pending or threatened, against or directly affecting the Project, including any actions, suits, claims, notices of violation, hearings, investigations or proceedings with respect to the ownership, use, maintenance and operation of the Project, including those relating to environmental laws; and

|

|

|

(b)

|

promptly after the Seller has knowledge or becomes aware thereof, written notice of any other condition or event which has resulted, or that could reasonably be expected to result, in a Material Adverse Effect.

|

-18-

6.4 Books and Records; Audits

|

|

(a)

|

The Seller and the other Pretium Group Entities shall keep true, complete and accurate books and records of all of their respective operations and activities with respect to the Project and the Project Property, including the mining, treatment, processing, refining, transportation and sale of Minerals.

|

|

|

(b)

|

The Seller and the other Pretium Group Entities shall permit the Purchasers and their authorized representatives and agents to perform audits or other reviews and examinations of their books and records and other information relevant to the production, delivery and determination of Refined Gold under this Agreement and compliance with this Agreement from time to time at reasonable times at such Purchasers’ sole risk and expense and not less than three Business Days’ notice, provided that such Purchasers and their authorized representatives and agents will not exercise such rights more often than once during any calendar year absent a material deficiency identified during a previous audit or review, in which case such rights may be exercised at such periods as may be reasonably determined by the Purchasers (and in any event at least once during any calendar quarter) until no material deficiencies are identified during four consecutive audits or reviews, at which point the Purchasers will once again be limited to exercising such rights once per calendar year. The Purchasers shall use their commercially reasonable efforts to diligently complete any audit or other examination permitted hereunder.

|

6.5 Inspections

Upon no less than ten Business Days’ notice to the Seller and subject at all times to the workplace rules and supervision of the Seller, the Seller shall grant, or cause to be granted, to the Purchasers and their representatives and agents, at reasonable times and at the Purchasers’ sole risk and expense, the right to access the Project Real Property, the Process Plant and other facilities of the Project, in each case to monitor the mining, processing and infrastructure operations relating to the Project and compliance with this Agreement. The Purchasers shall use their commercially reasonable efforts to not interfere with exploration, development, mining or processing work conducted on the Project Real Property. The Purchasers agree to indemnify and save the Pretium Group Entities and their respective directors, officers, employees and agents harmless from and against any and all losses suffered or incurred by any of them as a result of the actions of the Purchasers or their representations or agents during any such visit except to the extent that such losses arise from the gross negligence or willful misconduct of such indemnified persons.

7. MANAGEMENT OF OPERATIONS

7.1 Performance of Mining Operations

|

|

(a)

|

Subject to the provisions of this Section 7, all decisions regarding the Project, including concerning (i) the methods, the extent, times, procedures and techniques of any exploration, construction, development and mining related to the Project or any portion thereof, and (ii) any decisions to operate or continue to operate the Project or any portion thereof, including with respect to closure and care and maintenance, shall be made by the Seller in its sole discretion.

|

|

|

(b)

|

The Seller shall ensure that all exploration, construction, development and mining operations and other activities in respect of the Property will be performed in a commercially reasonable manner in compliance with Applicable Laws, Authorizations and Other Rights, and in accordance with Good Industry Practice.

|

-19-

|

|

(c)

|

The Pretium Group Entities shall at all times comply with the Anti-Corruption Policy, and shall immediately notify the Purchasers’ Agent upon becoming aware of any breach or suspected breach of the Anti-Corruption Policy.

|

|

|

(d)

|

Notwithstanding any other provision in this Agreement, the Seller will have the right at any time to curtail, suspend or terminate the mining, production, extraction or recovery of Minerals and/or the shipment of processed Minerals containing gold to a Refinery and/or gold-silver bearing concentrate to a Smelter, as applicable, if in its sole discretion it deems advisable to do so.

|

7.2 Processing and Sale of Minerals

|

(a)

|

The Seller shall use all commercially reasonable efforts to ensure that:

|

|

|

(i)

|

all Minerals from the Project are processed in a prompt and timely manner;

|

|

|

(ii)

|

all processed Minerals containing gold in a quantity and form suitable for shipment to a Refinery are shipped in a prompt and timely manner, from the Process Plant to a Refinery for processing into Refined Gold and other materials; and

|

|

|

(iii)

|

processed Minerals not containing gold in a quantity and form suitable for shipment to a Refinery are either shipped in a prompt and timely manner to a Smelter for toll processing into Refined Gold and other materials or sold to a Smelter pursuant to a Sales Contract.

|

|

(b)

|

The Seller shall not, without the prior written consent of the Purchasers’ Agent (at the direction of the Majority Purchasers), acting reasonably:

|

|

|

(i)

|

sell unprocessed Minerals mined from the Project Real Property;

|

|

|

(ii)

|

process Minerals mined from the Project Real Property other than through the Process Plant in order to produce doré or gold-silver bearing concentrate.

|

|

|

(iii)

|

sell, ship or deliver processed Minerals processed through the Process Plant and containing gold to any Person other than the shipment of such Minerals:

|

|

|

(A)

|

in the case of doré, to a Refinery for processing into Refined Gold; or

|

|

|

(B)

|

in the case of gold-silver bearing concentrate, either (i) to a Refinery for processing into Refined Gold, (ii) to a Smelter for toll processing into doré or other beneficiated form of gold suitable for delivery to a Refinery for processing into Refined Gold, or (iii) to a Smelter for sale pursuant to a Sales Contract;

|

-20-

|

|

(C)

|

in the case of gold-silver bearing concentrate toll processed by a Smelter, to a Refinery for processing into Refined Gold and/or refined silver; or

|

|

|

(D)

|

which are Non-Committed Products produced in accordance with clauses (A) to (C) above.

|

provided that, in any event, as a condition to any such activities, the Seller shall ensure that such activities do not in any way adversely impact on the quantity or rate of delivery of Refined Gold that would otherwise have been Delivered to the Purchasers under this Agreement.

|

(c)

|

The Seller may sell, ship or deliver any Other Minerals to any Person provided that such sale, shipment or delivery does not and could not reasonably be expected to have a material adverse impact on the quantity or rate of delivery of Refined Gold that would otherwise have been Delivered to the Purchasers under this Agreement.

|

7.3 Commingling

The Seller shall not process Other Minerals through the Process Plant in priority to or in place of, or commingle Other Minerals with, Minerals which are or can be mined, produced, extracted or otherwise recovered from the Project Real Property, unless: (i) the Seller has adopted and employs reasonable practices and procedures for weighing, determining moisture content, sampling and assaying and determining recovery factors (a “Commingling Plan”), such Commingling Plan to ensure the division of Other Minerals and Minerals for the purposes of determining the quantum of the Refined Gold to be delivered hereunder; (ii) the Purchasers shall not be disadvantaged as a result of the processing of Other Minerals in place of, in priority to, or concurrently with, Minerals; (iii) the Purchasers’ Agent has approved the Commingling Plan and any changes to such plan which may be proposed from time to time, such approval not to be unreasonably withheld; (iv) the Seller keeps all books, records, data and samples required by the Commingling Plan and makes such books, records, data and samples available to the Purchasers in accordance with Section 6.2; and (v) the Seller shall have provided notice to the Purchasers’ Agent of the commencement of commingling at least two (2) Business Days prior to such commencement.

7.4 Stockpiling off Property

The Seller may temporarily stockpile, store or place Minerals off the Project Real Property provided that the Seller shall at all times do or cause to be done all things necessary to ensure that:

|

|

(a)

|

such Minerals are appropriately identified as to ownership and origin;

|

|

|

(b)

|

such Minerals are secured from loss, theft, tampering and contamination; and

|

|

|

(c)

|

the Purchasers’ rights in and to the Minerals pursuant to this Agreement shall otherwise be preserved.

|

-21-

7.5 Insurance

|

|

(a)

|

The Seller shall ensure that insurance is maintained with reputable insurance companies with respect to the Project Property and the operations conducted at, on and in respect thereof against such casualties and contingencies and of such types and in such amounts as is customary in the case of similar operations in Canada. Without limiting the foregoing, such insurance shall include commercial general liability insurance in such amounts as will, in the Purchasers’ Agent’s reasonable judgment, adequately protect the Seller, the Purchasers and the Property from any Losses which may reasonably be expected to arise with respect to this Agreement or the Property and that can be covered by commercial general liability insurance.

|

|

|

(b)

|

The Seller shall ensure that each shipment of Minerals is adequately insured in such amounts and with such coverage as is customary in the mining industry, until the time that the Refined Gold processed from such Minerals is Delivered to the Purchasers.

|

|

|

(c)

|

The Seller shall promptly provide the Purchasers with written notice of any material loss or damage suffered to the Property, the Project or any Minerals and whether the Seller or any of its Affiliates plans to make any insurance claim.

|

7.6 Authorizations

The Seller shall be responsible, at its own expense, for obtaining and maintaining any Authorizations and Other Rights required in order to perform its obligations under this Agreement, including the sale and delivery of Refined Gold to the Purchasers.

8. REPRESENTATIONS AND WARRANTIES

8.1 Representations and Warranties of the Purchaser

Each of the Purchasers represents and warrants to the Seller as follows and acknowledges that the Seller is relying upon such representations and warranties in connection with the entering into of this Agreement.

|

|

(a)

|

Such Purchaser is duly organized, validly existing and in good standing under the laws of the jurisdiction of its formation, and has all requisite power and authority to execute and deliver, and perform its obligations under this Agreement.

|

|

|

(b)

|

The execution and delivery by such Purchaser of, the performance of its obligations under, and the consummation of the transactions contemplated by this Agreement have been duly authorized by all necessary corporate or other action of such Purchaser, as applicable, and do not and will not:

|

|

|

(i)

|

contravene the terms of its constating documents;

|

|

|

(ii)

|

conflict with, result in a breach of, or constitute a default or an event creating rights of acceleration, termination, modification or cancellation or a loss of rights under (with or without the giving notice or lapse of time or both), any written or oral contract, agreement, license, concession, indenture, mortgage, debenture, note or other instrument to which it is a party, subject or otherwise bound (including with respect to its assets) except in each case as would not have a material adverse effect on its ability to perform its obligations under this Agreement; or

|

-22-

|

|

(iii)

|

violate in any material respect any Applicable Law to which it is subject or otherwise bound (including with respect to its assets).

|

|

|

(c)

|

This Agreement has been duly and validly executed and delivered by such Purchaser, and constitutes a legal, valid and binding obligation of such Purchaser, enforceable against it in accordance with its terms, except to the extent enforcement may be affected by Applicable Laws and regulations relating to bankruptcy, reorganization, insolvency and creditors’ rights and by the availability of injunctive relief, specific performance and other equitable remedies.

|

|

|

(d)

|

Such Purchaser is not required to give any notice to, make any filing with or obtain any authorization, consent, Order or approval of any Person in connection with the execution and delivery of this Agreement or the consummation of the transactions contemplated herein, in each case, other than as have been obtained or, if not obtained, would not have a material adverse effect on its ability to perform its obligations under this Agreement.

|

8.2 Representations and Warranties of the Pretium Group Entities

Each of the Pretium Group Entities, jointly and severally, represents and warrants to the Purchaser as follows and acknowledges that the Purchasers are relying upon such representations and warranties in connection with the entering into of this Agreement.

|

(a)

|

Each Pretium Group Entity is:

|

|

|

(i)

|

duly organized, validly existing and in good standing under the laws of the jurisdiction of its formation, and has all requisite power and authority to execute and deliver, and perform its obligations under this Agreement;

|

|

|