Credit Agreement

Exhibit 10.2

\

\ | Credit Agreement |

|

| PROTECTED | |

| March 28, 2013 |

|

| Customer number(s): 200621699 |

VILLAGE FARMS CANADA LIMITED PARTNERSHIP

Dear Sir/Madam:

Farm Credit Canada (“FCC” or “us” or "we" or "our") agrees to extend a credit facility to Village Farms Canada Limited Partnership (“you” or “your” or “Borrower”) in the principal amount of $58,000,000USD (the “Loan”).

The Loan is subject to the terms and conditions set out in this credit agreement and the attached Schedules (collectively the “Credit Agreement” or the “Agreement”). If a conflict arises between any clause, term or condition of this Credit Agreement and a clause, term or condition of the attached Schedules, the clause, term or condition in the body of this Credit Agreement will prevail over the clause, term or condition in the attached Schedules. Standard Terms and Conditions are contained in the attached Schedule B and capitalized terms used in this Agreement shall have the meanings given to them in Schedule C or otherwise as set out herein. Upon the making of the advance contemplated under this Agreement, this Agreement shall replace and supersede all previous credit or loan agreements between you and FCC, which includes any facility letters as amended from time to time issued by HSBC Bank Canada (“HSBC”) to the Borrower as agent for HSBC and FCC.

1. Credit Facility Information

| Credit Facility number: |

XXX |

| Xxxxxxxx(x): |

Xxxxxxx Xxxxx Xxxxxx Limited Partnership |

| Chief Place of Business/Chief Executive Office: |

0000-00xx Xxxxxx, Xxxxx, XX X0X 0X0 |

| Head/Registered office: |

0000-00xx Xxxxxx, Xxxxx, XX X0X 0X0 |

| Guarantor(s): |

|

| Chief Place of Business/Chief Executive Office: |

0000-00xx Xxxxxx, Xxxxx, XX X0X 0X0 |

| Head/Registered office: |

0000-00xx Xxxxxx, Xxxxx, XX X0X 0X0 |

| Guarantor(s): |

VF Operations Canada Inc. |

| Chief Place of Business/Chief Executive Office: |

0000-00xx Xxxxxx, Xxxxx, XX X0X 0X0 |

| Head/Registered office: |

0000-00xx Xxxxxx, Xxxxx, XX X0X 0X0 |

| Guarantor(s): |

Village Farms Canada GP Inc. |

| Chief Place of Business/Chief Executive Office: |

0000-00xx Xxxxxx, Xxxxx, XX X0X 0X0 |

| Head/Registered office: |

0000-00xx Xxxxxx, Xxxxx, XX X0X 0X0 |

| Guarantor(s): |

Agro Power Development, Inc. |

| Chief Place of Business/Chief Executive Office: |

000 Xxxxxxxxxxxxx Xxxxxxx, Xxxxx 000 |

|

|

Xxxxxxxx, Xxxxxxx, X.X.X. 00000 |

| Head/Registered office: |

000 Xxxxxxxxxxxxx Xxxxxxx, Xxxxx 000 |

|

|

Xxxxxxxx, Xxxxxxx, X.X.X. 00000 |

| Guarantor(s): |

VF U.S. Holdings Inc. |

| Chief Place of Business/Chief Executive Office: |

000 Xxxxxxxxxxxxx Xxxxxxx, Xxxxx 000 |

|

|

Xxxxxxxx, Xxxxxxx, X.X.X. 00000 |

| Head/Registered office: |

000 Xxxxxxxxxxxxx Xxxxxxx, Xxxxx 000 |

|

|

Xxxxxxxx, Xxxxxxx, X.X.X. 00000 |

| Guarantor(s): |

Village Farms of Delaware, L.L.C. |

| Chief Place of Business/Chief Executive Office: |

000 Xxxxxxxxxxxxx Xxxxxxx, Xxxxx 000 |

|

|

Xxxxxxxx, Xxxxxxx, X.X.X. 00000 |

| Head/Registered office: |

000 Xxxxxxxxxxxxx Xxxxxxx, Xxxxx 000 |

|

|

Xxxxxxxx, Xxxxxxx, X.X.X. 00000 |

| Guarantor(s): |

Village Farms, L.P. |

| Chief Place of Business/Chief Executive Office: |

000 Xxxxxxxxxxxxx Xxxxxxx, Xxxxx 000 |

|

|

Xxxxxxxx, Xxxxxxx, X.X.X. 00000 |

| Head/Registered office: |

000 Xxxxxxxxxxxxx Xxxxxxx, Xxxxx 000 |

|

|

Xxxxxxxx, Xxxxxxx, X.X.X. 00000 |

Sources and uses:

| Sources |

|

Uses |

|

| FCC |

$58,000,000 (USD) |

Retire HSBC term debt |

*$22,964,097.74 (USD) |

|

|

|

Retire FCC Credit Facility |

*$34,492,416.54 (USD) |

|

|

|

000513865000 |

|

|

|

|

|

|

| Total |

$58,000,000 (USD) |

|

$58,000,000 (USD) |

* Represents amounts owing by March 26, 2013, figures to be updated and settled for purposes of the advance of the Loan, and for greater certainty, FCC acknowledges and agrees that if the HSBC and FCC term debt to be retired together with all applicable fees, disbursements and taxes is less than $58,000,000 (USD), any surplus funds shall be remitted to the Borrower for its working capital.

New Credit Facility information

| 1.1 New Credit Facility details |

| (a) New Credit Facility number: |

XXX |

| Xxxxxxxx(x): |

Xxxxxxx Xxxxx Xxxxxx Limited Partnership |

| Guarantor(s): |

|

|

|

VF Operations Canada Inc. |

|

|

Agro Power Development, Inc. |

|

|

VF U.S. Holdings Inc. |

|

|

Village Farms of Delaware, L.L.C. |

|

|

Xxxxxxx Xxxxx, X.X. |

|

|

Xxxxxxx Xxxxx Xxxxxx GP Inc. |

| Credit facility details | |

| Loan number | 01 |

| Principal amount | $58,000,000 (USD) |

| Credit facility type | Real Property |

| Interest type |

Open Variable |

| Product type |

American Currency |

| Term |

5 years |

| Amortization period |

14 years |

| Interest rate |

Based on Grid pricing "see below" |

| Loan Approval Expiry Date |

August 27, 2013 |

| Balance Due Date |

2018-04-01 |

| Subsequent payment schedule details |

|

| First payment type details |

|

| First payment type |

Interest only (USD) |

| Start date |

*2013-04-01 |

| Payment frequency |

Monthly |

| Payment month(s) |

*April |

| Payment amount |

Interest only |

| End date |

*2013-04-30 |

| Second payment type details |

|

| Second payment type |

**Fixed Principal + Interest (USD) |

| Start date |

***2013-05-01 |

| Payment frequency |

Monthly |

| Payment month(s) |

***April to March |

| Payment amount |

$345,238.10 + Interest (USD) |

| End date |

2018-04-01 |

* Assumes funding by March 31, 2013; if in April, 2013 or beyond, then Start date, Payment months and End date deemed to be adjusted by adding such additional months as are necessary.

** Fixed principal to be determined by FCC based on date of advance and amortization period set forth above.

*** Assumes funding by March 31, 2013, if in April 2013 or beyond, then Start date and Payment months deemed to be adjusted by adding such additional months as are necessary.

1.2 Interest Rate Determination

The interest rate applicable under the Loan shall be determined on the basis of the following grid based on the Borrower’s Debt to EBITDA ratio as provided below.

| Level |

Debt to EBITDA Ratio |

Interest Rate Spread - Libor Plus |

| 1 |

4.01x-4.50x |

500 bps |

| 2 |

4.00x – 3.76x |

450 bps |

| 3 |

3.75x – 3.51x |

400 bps |

| 4 |

3.50x-3.01x |

350 bps |

| 5 |

< 3.01x |

300 bps |

(a) The Borrower shall pay interest, compounded semi-annually, in arrears, on the first day of each month, on the daily amount outstanding under the FCC Loan at the variable rate which is equal to Libor (adjusted as provided in Section 1 of Schedule A) plus the applicable Interest Rate Spread (adjusted from time to time as described in this section 1 and in section 1 of Schedule A), both before and after maturity, default and judgment, with interest on overdue interest at the same rate;

(b) For purposes of determining the applicable Level in the Grid above, upon the advance being made under the Loan, the applicable level in the Grid shall be set at Level 1 until such time thereafter as such rate can be determined by FCC in accordance with Clause (d) below, with reference to annual audited financial statements received by FCC in accordance with Section 6.2 below;

(c) Upon receipt of the annual audited financial statements for the Borrower, FCC shall, based thereon, determine the Debt to EBITDA ratio for the Borrower as at the last day of the fiscal year just ended and, based on such determination:

FCC shall then determine the Level in the Grid above that corresponds to such Debt to EBITDA ratio and the applicable Interest Rate Spread above Libor applicable under such Level, which aggregate rate (i.e. the Libor, plus the applicable Interest Rate Spread so determined) shall apply effective as and from May 1 in accordance with this clause; FCC may from time to time adjust the monthly blended payments payable by the Borrower in respect of amounts outstanding under the FCC Loan to reflect changes in the interest rate payable by the Borrower hereunder, which interest rate changes are reflected in Schedule A; and

(d) If at the time of determination by FCC of any applicable Interest Rate Spread, the Borrower has, for any reason, failed to deliver the annual audited financial statements for the Borrower as required under this Agreement, then the applicable Interest Rate Spread shall be determined based upon Level 1 in the Grid for the applicable fiscal year, unless otherwise agreed by FCC.

See Schedule A for Special Terms and Conditions applicable to the Credit Facility.

2. Security for the Credit Facility

The Loans(s) and the obligations and liabilities of the Borrower under this Credit Agreement will be secured by:

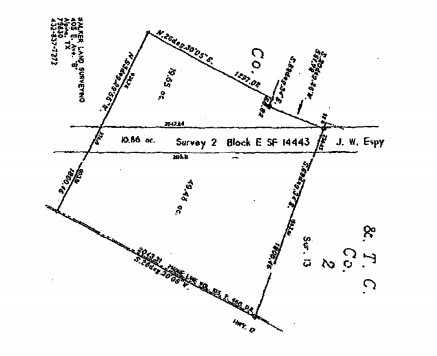

2.1 Mortgage and Deeds of Trust

(1) Collateral mortgage and assignment of rents in the minimum principal amount of $70,000,000 USD, from Village Farms International, Inc. creating a first fixed mortgage and assignment of rents over the Canadian Real Property (the “Canadian Real Property Mortgage”):

(2) First Leasehold Deed of Trust, Assignment of Rents and Security Agreement from Village Farms, L.P. (Presidio County) over the Presidio Leasehold Lands;

(3) First Deed of Trust, Assignment of Rents and Security Agreement (Presidio County) from Village Farms, L.P. over the Presidio Fee Lands;

(4) First Deed of Trust, Assignment of Rents and Security Agreement from Village Farms, L.P. (Xxxx Xxxxx County) over the Xxxx Xxxxx Lands;

(5) First Leasehold Deed of Trust, Assignment of Rents, and Security Agreement (Xxxx County) from Village Farms, L.P. over the Xxxx County Lands.

Village Farms International, Inc.

(1) The Canadian Real Property Mortgage as previously referenced above;

(2) An unlimited guarantee of the obligations and liabilities under the Loan and an assignment and postponement of all present and future claims due and owing to it by the Borrower;

(3) A general security agreement granting FCC a first security interest in all Village Farms International, Inc. presently owned and after-acquired personal property and a first floating charge over all of its other presently owned and after-acquired property, assets and undertaking not subject to that security interest, subject to Permitted Liens and the Operating Lender Security Interest if applicable;

(4) A debt service agreement;

(5) Beneficial Mortgage and Direction to Charge granted by Village Farms International, Inc. as trustee of the Canadian Real Property and the Borrower as beneficial owner of the Canadian Real Property.

Village Farms Canada Limited Partnership (our Borrower)

(1) A general security agreement granting FCC a first security interest in all the Borrower’s presently owned and after-acquired personal property and a first floating charge over all of the Borrower’s other property, assets and undertaking not subject to that security interest, subject to Permitted Liens and the Operating Lender Security Interest, if applicable;

(2) An attornment and non-disturbance agreement, to be executed by Village Farms International, Inc., FCC and Maxim Power (B.C.) Inc. with respect to lease agreements held by Maxim Power (B.C.) Inc. over a portion of the Canadian Real Property; provided that in the event this attornment and non-disturbance agreement is not delivered to FCC or its solicitors by the date of Advance, then it shall be delivered, in the form requested by FCC, by not later than June 1, 2013, failing which the Borrower shall pay FCC a fee of $5,000 USD per month on the first day of each month (commencing June 1, 2013) for each month in which the attornment and non-disburbance agreement has not been delivered by the first of such month.

VF Operations Canada Inc.

(1) An unlimited guarantee of the obligations and liabilities under the Loan and an assignment and postponement of all present and future claims due and owing to it by the Borrower;

(2) A general security agreement granting FCC a first security interest in all VF Operations Canada Inc. presently owned and after-acquired personal property and a first floating charge over all of its other presently owned and after-acquired property, assets and undertaking not subject to that security interest, subject, in each case, to Permitted Liens and the Operating Lender Security Interest, if applicable;

(3) A debt service agreement.

VF U.S. Holdings, Inc.

(1) An unlimited guarantee of the obligations and liabilities under the Loan and an assignment and postponement of all present and future claims due and owing to it by the Borrower;

(2) A general security agreement granting FCC a first security interest in all VF US Holdings Inc., presently owned and after-acquired personal property, subject to Permitted Liens and the Operating Lender Security Interest, if applicable.

Agro Power Development, Inc.

(1) An unlimited guarantee of the obligations and liabilities under the Loan and an assignment and postponement of all present and future claims due and owing to it by the Borrower;

(2) A general security agreement granting FCC a first security interest in all Agro Power Development, Inc. presently owned and after-acquired personal property, subject only to Permitted Liens and the Operating Lender Security Interest, if applicable.

Village Farms Delaware, L.L.C.

(1) An unlimited guarantee of the obligations and liabilities under the Loan and an assignment and postponement of all present and future claims due and owing to it by the Borrower;

(2) A general security agreement granting FCC a first security interest in all Village Farms, L.P.’s presently owned and after acquired-personal property, subject only to Permitted Liens and the Operating Lender Security Interest, if applicable.

Village Farms, L.P.

(1) US Real Property Deeds of Trust as previously referenced above;

(2) An unlimited guarantee of the obligations and liabilities under the Loan and an assignment and postponement of all present and future claims due and owing to it by the Borrower.

Village Farms Canada GP Inc.

(1) An unlimited guarantee of the obligations and liabilities under the Loan and an assignment and postponement of all present and future claims due and owing to it by the Borrower;

(2) A general security agreement granting FCC a first security interest in all Village Farms Canada GP Inc. presently owned and after acquired-personal property, subject only to Permitted Liens and the Operating Lender Security Interest, if applicable.

2.2 Inter-lender Priority Agreement

(1) Inter-Lender Priority Agreement between you, FCC and the Operating Lender (the

“FCC/Operating Lender Priority Agreement”). FCC will postpone its interest in inventory and accounts receivable in the amount required to secure the operating loan, and the Operating Lender will have a second priority interest over all other personal property of the Borrower and the Guarantors. FCC will have a first priority interest in all your present and after acquired personal property other than a second priority interest in your inventory and accounts receivable and a first priority interest in the Real Property.

2.3 Intellectual Property Agreement

(1) Intellectual Property Security Agreement granted by Village Farms, L.P.

2.4 Hazardous Material Agreement

(1) Hazardous Material Indemnity Agreement granted by Agro Power Development, Inc.,VF U.S. Holdings, Inc., Village Farms of Delaware, L.L.C, and Village Farms, L.P.

2.5 Environmental Indemnity Agreement

(1) Environmental Indemnity Agreement granted by Village Farms Canada Limited Partnership, Village Farms International Inc. and VF Operations Canada Inc.

2.6 Representation, Warranty and Covenant Agreement

(1) Limited Partnership Representation, Warranty and Covenant Agreement granted by Village Farms Canada Limited Partnership.

2.7 Landlord Waiver

(1) Landlord Waiver and Consent Agreement from Sealy & Xxxxx Foundation with respect to lease agreements held by Village Farms, L.P. over the Xxxx County Lands.

(2) Landlord Waiver and Consent Agreement from The County of Presidio, Texas,

by and through Presidio County Commissioners Court with respect to lease agreements held by Village Farms, L.P. over the Presidio Leasehold Lands; provided that in the event this waiver and consent is not delivered to FCC or its solicitors by the date of Advance, then it shall be delivered, in the form requested by FCC, by not later than June 1, 2013, failing which the Borrower shall pay FCC a fee of $10,000 USD per month on the first day of each month (commencing June 1, 2013) for each month in which the waiver and consent has not been delivered by the first of such month.

2.8 Insurance

In addition to Section 6 (k) of the attached Schedule B, you will:

(1) maintain the following policies of insurance, each satisfactory to FCC, which will contain a mortgage clause and /or a loss payable clause directing first payment to FCC:

(a) Business interruption insurance to provide insurance for a minimum amount of $10,000,000;

(b) Comprehensive commercial general liability insurance against claims for personal injury, bodily injury and property damage occurring on, in or about the lands and buildings upon the Real Property and covering all operations of the Borrower; such insurance shall be in an amount not less than $2,000,000 per occurrence.

(2) have purchased lender’s title insurance in respect of the US Real Property, with an insurer, in a form and an amount satisfactory to FCC and its solicitors.

3 Repayment, Prepayment and Maturity

3.1 Mandatory Repayments

The Loan and all Indebtedness shall be repaid in full and the Loan will be cancelled on the Balance Due Date set out in section 1 above, unless it is extended in writing by FCC on or before that date, in which case that extended date shall become the new Balance Due Date. Extensions may be requested by the Borrower. Extensions will be granted at the discretion of FCC.

3.2 Time and Place of Payment by Borrower

Each payment or prepayment required or permitted to be made by the Borrower hereunder (whether on account of principal, interest, costs, or any other amount) shall be made to FCC at its corporate office in Regina, Saskatchewan not later than 11:00 a.m. (Regina time) on the date for payment of the same in immediately available funds, and if any payment made by the Borrower hereunder is made after 11:00 a.m., such payment will be deemed to have been made on the immediately following Banking Day and interest will continue to accrue on the amount of such payment until such following Banking Day.

3.3 Payments to be Made on Banking Days

Whenever any payment to be made hereunder is due on a day that is not a Banking Day, such payment shall be made on the immediately following Banking Day unless the following Banking Day falls in another calendar month, in which case payment shall be made on the immediately preceding Banking Day.

3.4. Pre-Authorized payment authority (the “Authority”)

(a) Bank account information

| Branch transit #: |

1 |

0 |

2 |

7 |

0 |

FI #: |

0 |

1 |

6 |

Account #: |

0 |

8 |

9 |

6 |

8 |

3 |

0 |

7 |

0 |

Financial institution name:

Address:

(b) Pre-authorized payment details - Credit Facility

| Payment type |

Payment amount |

Payment start date |

Frequency |

| Variable |

Interest only |

2013-04-01 |

2013-04-01 |

| Fixed principal + Interest |

2013-05-01 |

Monthly |

You hereby instruct and authorize FCC to debit your above bank account (the “Account”) with the above payments for the purpose of repaying your New Credit Facility(s) and related indebtedness to FCC. A specimen cheque for the Account has been marked “void” and attached to this Authority. You undertake to inform FCC, in writing, of any change in the Account information provided in this Agreement prior to the next due date of the pre-authorized payment.

(read and initial box) ☐ You waive the pre-notification requirements of the Canadian Payments Association. You acknowledge that FCC may send you payment notices but that these payment notices do not constitute the pre-notification requirements of the Canadian Payments Association.

The above payment(s) are made for (check one) ☐ personal ☐ business purposes.

FCC reserves the right to cancel this Authority at its discretion and without notice. This Authority may be cancelled at any time upon notice being provided by you, either in writing or orally with proper authorization to verify your identity, to FCC within 30 days before the next payment is to be made. You may obtain a sample cancellation form, or more information on your rights to cancel this Authority, by contacting your financial institution or by visiting xxx.xxxxxx.xx.

You have certain recourse rights if any debit does not comply with this Authority. For example, you have the right to receive reimbursement for any debit that is not authorized or is not consistent with this Authority. To obtain more information on your recourse rights, you may contact your financial institution or visit xxx.xxxxxx.xx.

You may contact FCC to make inquiries or obtain information about this Authority at:

Farm Credit Canada

Customer Service Centre

0000 Xxxxxxxx Xxxxxx, X.X. Xxx 0000

Xxxxxx, XX X0X 0X0

| Telephone: 0-000-000-0000 |

Fax: 0-000-000-0000 |

email: xxx@xxx-xxx.xx |

You warrant and guarantee that you are duly authorized, in accordance with your account agreement at the financial institution identified above, to debit the Account.

You agree that if the Borrower’s operating loan with HSBC Bank Canada is refinanced at any time, then the Borrower shall promptly provide to FCC new pre-authorized payment details from which to debit its new operating account.

3.5 Manner of Payment; No Set-Off / Right of compensation

All payments to be made pursuant to this Credit Agreement including principal. interest and costs will, except as otherwise expressly provided herein, be payable in US Dollars and all payments to be made pursuant to this Credit Agreement are to be made in immediately available funds and without set-off, right of compensation, withholding or deduction of any kind whatsoever.

4 Interest Rates, Fees and Charges

4.1 Interest Rates

Subject to the provisions of this Credit Agreement (including without limitation Section 1.2 hereof and Section 1 of Schedule A hereto), interest shall accrue on the aggregate principal amount of the Loan outstanding from time to time, both before and after maturity, default and judgment, with interest on overdue interest at the same rate, commencing on and including the day on which the Loan is advanced and ending on, but excluding, the day on which it is repaid, such interest to be calculated on the daily outstanding principal balance and payable monthly, in arrears, on the first Banking Day of each and every month during which the Loan remains unpaid, based upon a year of 360 days, for the actual days that the amounts are outstanding under the Loan on this basis, at the variable rate of interest per annum, compounded semi-annually, specified and calculated in the manner set forth in section 1 above and in Schedule A attached hereto.

4.2 For the purpose of the Interest Act (Canada), the annual rate of interest to which interest computed on the basis of a year of 360 days is equivalent is the rate of interest as provided in this Agreement multiplied by the number of days in such year and divided by 360.

4.3 Expenses and Legal Fees

Regardless of whether any or all of the transactions contemplated herein shall be consummated, the Borrower shall pay to FCC all reasonable legal fees and disbursements and all reasonable fees, costs and out-of-pocket expenses incurred by FCC with respect to the negotiation, preparation and registration of this Agreement and the other Documents including, without limitation, amendments of the Documents and their registration. The Borrower shall, in addition, reimburse FCC on demand for all fees, cost and out-of-pocket expenses including, without limitation, legal fees and disbursements (on a solicitor and own client basis) incurred by FCC following the Closing Date in connection with the exercising or defending of any or all of the rights, recourses, remedies and powers of FCC hereunder or under any other Documents or the realization on any assets or property of the Security Parties, or the taking of any proceedings for the purpose of enforcing the remedies provided herein or permitted in connection herewith.

4.4 Other Charges

In addition to the obligations of the Borrower to pay interests, costs, and expenses as provided in this Agreement, the Borrower shall pay the following non-refundable fees:

(a) annual fees related to the Loan that are set out in this Agreement;

(b) if applicable, the fees set out in Schedule D;

(c) if applicable, the non-compliance fees set out in Schedule D;

(d) if applicable, the Conversion Fee set out in Schedule A;

(e) if applicable, the Pre-payment Fee set out in Schedule A; and

(f) all reasonable fees from time to time imposed by FCC for the administration of this Credit Agreement.

All such fees are due and payable by within 30 days of demand or invoice by FCC.

5 Conditions Precedent

5.1 Conditions to the Advance

The obligation of FCC to make available the Advance under this Agreement is subject to and conditional upon the representations and warranties contained in this Agreement being true and correct on and as of the Closing Date with reference to the facts subsisting at such time with the same effect as if made on such date, and upon each of the following terms and conditions being satisfied:

(a) Confirmation that the Borrower has available to it an operating loan in an amount not less than CAD $8,000,000 on terms and conditions acceptable to FCC, which shall include the review by FCC and its solicitors of the governing credit agreement and /or facility letter, as applicable for such operating loan;

(b) Discharge and cancellation of any encumbrances that secures indebtedness on the Borrower’s and each Guarantor’s assets other than Permitted Liens and the Operating Lender Security Interest (subject to Section 5.1(a) in any event);

(c) Repayment of any amount outstanding and cancellation of the Borrower’s term lending facility with HSBC;

(d) Nothing shall have occurred which FCC shall determine is reasonably likely to have a MAE;

(e) No event shall have occurred and be continuing which constitutes an Event of Default or would constitute an Event of Default but for the requirement that notice be given or time elapse, or both;

(f) All documents required to grant and as necessary pledge the security described in section 2 shall have been executed and delivered to FCC together with confirmation of registration as applicable and shall be in full force and effect, in form and substance satisfactory to FCC;

(g) All other documents and instruments required by the terms hereof shall have been duly executed and delivered by all parties thereto and shall be in full force and effect, in form and substance satisfactory to FCC;

(h) FCC shall be satisfied in all respects with the business, operations and prospects and assets and liabilities (including without limitation as to environmental matters) of the Security Parties, the corporate and capital structure of the Security Parties, the sources of funding available to the Borrower on and after the Closing Date and the proposed disbursement of funds by the Borrower on and following such date;

(i) All consents and approvals necessary or desirable in connection with the completion of the transactions contemplated pursuant to this Credit Agreement and the other Documents shall have been obtained on terms and conditions acceptable to FCC;

(j) FCC must have received and approved the form of lease agreement with the applicable landlords with respect to the Xxxx County Lands and the Presidio Leasehold Lands, and the Canadian Real Property that is subject to a leasehold interest (to be reviewed in advance of funding to ensure mortgages of leased lands or leasehold interests are unaffected by lease agreements);

(k) FCC must have entered into the FCC/Operating Lender Priority Agreement satisfactory to it;

(l) FCC is satisfied that you are in possession of and in good standing/compliance with all necessary permits, licences, authorizations and other approvals required to legally undertake and carry on your business in the province and states where you carry on business;

(m) FCC must be satisfied in its sole discretion, that all regulatory agency requirements relating directly or indirectly to environmental impacts, potential environmental hazards, environmental, health or safety risks or environmental issues related to your current or projected business operations have been met or to past operations that may have caused or contributed to a breach of regulatory requirements have been rectified;

(n) FCC must have reviewed and be satisfied with the organizational documents governing the Borrower and any Guarantors including any applicable partnership agreements, articles of incorporation and bylaws;

(o) FCC must be satisfied in its sole discretion with the lender’s title insurance policies to be obtained in respect of the US Real Property and the US Real Property Deeds of Trust;

5.2 Discretion of FCC

Notwithstanding the non-fulfillment of any term or condition set out above, FCC may make an Advance in its unfettered discretion. The making of any Advance by FCC, either before or after the fulfillment of all applicable conditions, will not constitute an approval, acceptance, or waiver by FCC of any condition, Default or Event of Default.

5.3 Conditions Solely for FCC’s Benefit

All conditions precedent to the obligation of FCC to make any Advance are imposed solely and exclusively for the benefit of FCC and no other Person will have standing to require satisfaction of such conditions or be entitled to assume that FCC will refuse to make any Advance available in the absence of strict compliance with any or all such conditions and no other Person will, under any circumstances, be deemed to be beneficiary of such conditions.

5.4 Langage

The parties have requested that this Agreement and all other Documents be drafted in English. Les parties ont requis que cette convention et tous les autres documents soient rédigés en anglais.

[The remainder of this page has been intentionally left blank]

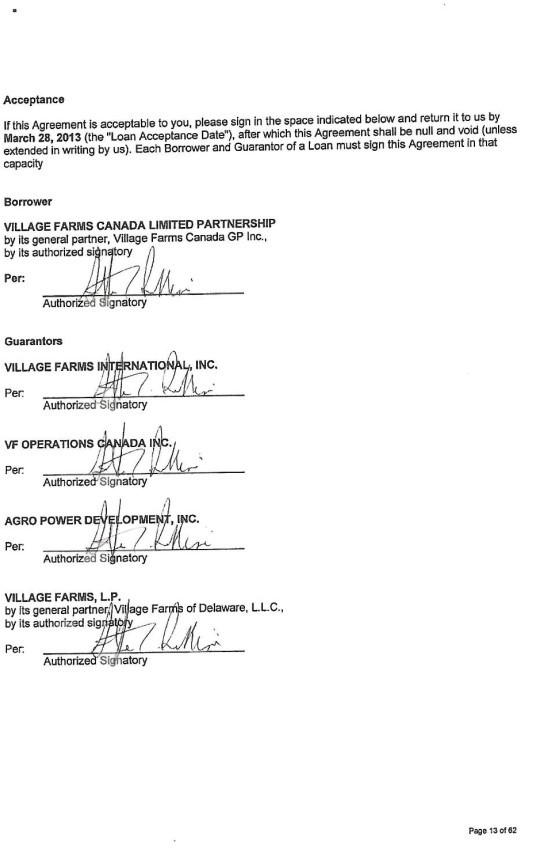

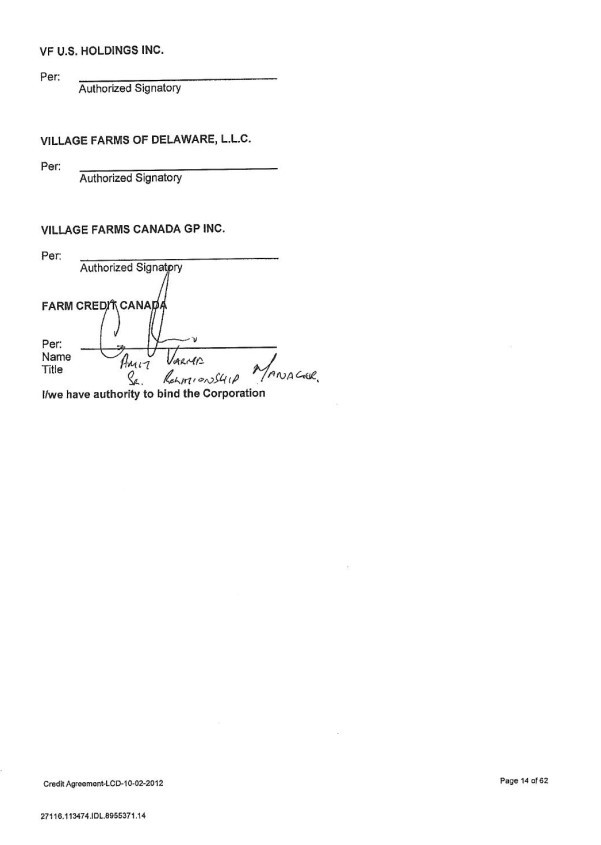

Acceptance

If this Agreement is acceptable to you, please sign in the space indicated below and return it to us by March 28, 2013 (the "Loan Acceptance Date"), after which this Agreement shall be null and void (unless extended in writing by us). Each Borrower and Guarantor of a Loan must sign this Agreement in that capacity

Borrower

VILLAGE FARMS CANADA LIMITED PARTNERSHIP

by its general partner, Village Farms Canada GP Inc.,

by its authorized signatory

Per:

_______________________________________________

Authorized Signatory

Guarantors

VILLAGE FARMS INTERNATIONAL, INC.

Per:

_______________________________________________

Authorized Signatory

VF OPERATIONS CANADA INC.

Per:

_______________________________________________

Authorized Signatory

AGRO POWER DEVELOPMENT, INC.

Per:

_______________________________________________

Authorized Signatory

VILLAGE FARMS, L.P.

by its general partner, Village Farms of

Delaware, L.L.C.,

by its authorized signatory

Per:

_______________________________________________

Authorized Signatory

Schedule A – Special Terms and Conditions

1. U.S. Dollar Loans

You agree that this Loan has been made in U.S. currency and must be repaid in U.S. currency.

You must give FCC written notice at least 3 business days prior to the date any advance is required.

Any prepayment, late payment, or unscheduled payment of this Loan whether voluntary or involuntary will result in a fee payable to FCC equivalent to all costs or losses incurred by FCC as a result of the prepayment, late payment, or unscheduled payment. These costs or losses, will be determined exclusively by FCC and could include foreign exchange losses, foreign currency costs, applicable fees required to change foreign exchange hedging contracts, FCC administrative costs, interest paid on U.S. currency held by FCC for application on a future scheduled payment date, loss of profit, lost interest-bearing days, interest differential and reinvestment or re-lending, and loss on account of funds borrowed, contracted for, or utilized to fund such portion, damages, penalties and expenses, and any other costs reasonably incurred by FCC as a result of the prepayment, late payment or unscheduled payment.

You agree that the initial Interest Rate applicable to this Loan will be Libor on the date of disbursement plus the Interest Spread in accordance with the Grid in section 1.2 above. Interest will be compounded semi-annually not in advance. The Interest Rate for this Loan will be adjusted on the first day of each May, August, November and February following the date of disbursement to be Libor on such day plus the applicable Interest Spread on such day. If the date for adjusting the Interest Rate falls on a weekend or statutory holiday in Canada or the United States, then the Libor used to establish the Interest Rate will be the Libor on the next business day. You will not be advised of any interest rate change, but can obtain the rate applicable to your loan by contacting your Account Manager. At the discretion of FCC, this Loan may be renewed on the Balance Due Date. Information on the current Libor rate is available on the Bloomberg Website located at xxx.xxxxxxxxx.xxx.

The terms of this Loan will be documented by this Credit Agreement. You authorize FCC, upon disbursement, to use the applicable 3 month U.S. dollar LIBOR rate to calculate and then apply the Interest Rate for purposes of this Credit Agreement.

Prepayments

This loan can be prepaid at any time on 2 Banking Days notice, subject to payment to FCC of any costs or losses as set out in the third paragraph of this Schedule A, provided that notwithstanding the second paragraph of this Schedule A, in relation to the prepayment fees, if you repay or prepay the Loan or any part thereof on a day other than the first day of February, May, August or November (each, a “LIBOR Calculation Date”), the costs or losses which you shall be responsible for shall be determined by FCC and shall be limited to the costs or losses suffered or incurred (but only for such losses or expenses suffered or incurred up to the next LIBOR Calculation Date), by reason of the liquidation or redeployment of deposits or other funds acquired by or howsoever deployed by FCC to effect or maintain such portion of the Loan being prepaid or any interest or other charges payable to lenders of funds borrowed by FCC in order to maintain such portion of the Loan being prepaid.

Schedule B – Standard Terms and Conditions

6 Covenants of the Borrower

6.1 Affirmative Covenants

The Borrower covenants and agrees with FCC that until there is no Indebtedness outstanding, the Loan has been terminated, and FCC has no commitment or obligation hereunder:

(a) Payment of Principal, Interest and Expenses

The Borrower shall duly and punctually pay or cause to be paid to FCC, all moneys due to FCC under or by virtue of the Documents, whether principal, interest, fees or other expenses, at the times and places and in the manner provided for herein.

(b) Use of Funds

The Borrower will use and employ the funds received from FCC pursuant to this Credit Agreement solely for the purposes set forth in this Agreement or in the loan approval.

(c) Books and Records

The Borrower shall, and shall cause the Security Parties and each of its and their Subsidiaries, to maintain at all times, a system of accounting established and administered in accordance with the Accounting Standard, consistently applied and in accordance with sound business practices and shall therein make complete, true and correct entries of all dealings and transactions relating to its business. All Financial Statements furnished to FCC shall fairly present the financial condition and the results of the operations of the Borrower and each of its Subsidiaries or the other Security Parties and their Subsidiaries reported upon therein, and all other information, certificates, schedules, reports and other papers and data furnished to FCC will be accurate, complete and correct in all material respects determined, in respect of the Borrower and each other Security Party.

(d) Access and Information

The Borrower shall, and shall cause each of the Security Parties, to discuss and review with FCC and any of their authorized representatives any matters directly relevant to this Credit Agreement and relating to the business of the Security Parties or pertaining to all or any part of its or their properties as FCC may reasonably request, and each of them shall permit any authorized representative of FCC to visit, inspect and have access to its property and assets at any and all reasonable times during normal business hours, subject in any event and so long as there does not exist a Default or Event of Default to food safety regulations and protocol in respect of its real property facilities. The Borrower shall and shall cause each of the Security Parties to permit, at any and all reasonable times during normal business hours, FCC, and its authorized representatives, to examine all of its books of account, records, reports, documents, papers and data and to make copies and take extracts thereof, and to discuss respective business, affairs, finances and accounts with its and their executive officers, senior financial officers, accountants and other financial advisors.

(e) Notices

The Borrower shall promptly give notice to FCC of:

(1) any Default or Event of Default;

(2) any notice of expropriation of any of the assets charged by any of the Security Documents;

(3) any claim, proceeding or litigation in respect of the Borrower or any other Security Party which does or may cause a MAE, whether or not any such claim, proceeding or litigation is covered by insurance;

(4) any violation of any law, statute, rule or regulation which could reasonably be expected to cause a MAE;

(5) any Lien other than Permitted Liens registered against any Collateral;

(6) any MAE;

(7) any default or alleged notice of default issued by the applicable landlords of the Presidio Leasehold Lands and Xxxx County Lands together with such details as are then required by FCC; and

(8) any default or alleged notice of default issued by the Borrower’s operating lender to the Borrower together with such details as are then required by FCC.

(f) Corporate Status and Qualification

The Borrower shall, and shall cause each of the other Security Parties to, at all times, preserve and maintain its existence and to preserve and maintain its qualification to do business where such qualification is necessary and diligently preserve and at all times renew or cause to be preserved and renewed all the rights, powers, privileges, franchises and goodwill owned by them and at all times comply with all laws applicable to it, if, in each case, failure to do so would result in a material adverse effect on the relevant Security Party.

(g) Conduct of Business

The Borrower shall, and shall cause each of the other Security Parties to, conduct its business in the ordinary course and not make any material adverse changes to its business and maintain and operate its properties and assets in a prudent manner and, subject to the terms hereof, take all necessary steps to maintain and preserve its assets and properties and its title thereto.

(h) Government Compliance

The Borrower shall, and shall cause each of the other Security Parties to, comply with all applicable laws, regulations, orders, restrictions and regulations of any Governmental Authority having jurisdiction and obtain and maintain in good standing all material licences, permits, quotas and approvals required (as and when same are, by law, required) from any and all Governmental Authorities, and ensure that its business and operations are at all times in compliance in all respects with all applicable laws, regulations, building codes, ordinances and zoning requirements, the non-compliance with which would have a material adverse effect on such Security Party.

(i) Security

The Borrower shall ensure that the Security Documents create at all times valid, enforceable and perfected charges and security interests on the assets purported to be charged thereby, ranking in priority to all other mortgages, charges, liens and security interests with the exception of Permitted Liens, the Operating Lender Security Interest and any other security interests which, according to the terms of this Credit Agreement, are allowed to rank pari passu with or senior to (in the case of the Operating Lender Security Interest) the charges created by the Security Documents.

(j) Taxes

The Borrower shall, and shall cause each of the other Security Parties to, pay or cause to be paid all Taxes lawfully levied, assessed or imposed upon it or in respect of its property as and when the same shall become due and payable, and exhibit or cause to be exhibited to FCC when required, the receipts and vouchers establishing such payment, and duly observe and conform to all valid requirements of any Governmental Authority relative to its property or rights and relative to all covenants, terms and conditions upon or under which any such property or rights are held; provided, however, that it shall have the right to contest in good faith by appropriate and timely legal proceedings any such taxes or other amounts and, upon such contest, may delay or defer payment or discharge thereof if such contestation will involve no forfeiture of Collateral or the subordination of the charges created by the Security Documents to such taxes unless collateral or other security satisfactory to FCC have been deposited with FCC in respect thereof.

(k) Insurance

The Borrower shall, and shall cause each of the other Security Parties to, maintain or cause to be maintained with reputable insurers, over the insurable Collateral, coverage against risks of loss or damage to its properties, assets and business, (including fire and extended perils, public liability, and damage to property of third parties) of such types as are customary in the case of persons with established reputation engaged in the same or similar businesses, to the full insurable value of such properties and assets, such policies (except third party liability insurance) to contain standard mortgage clauses or other mortgage clauses satisfactory to FCC and shall, otherwise than in respect of damage to or destruction of leased assets, assets secured by Purchase Money Security Interests and such other assets as FCC may in writing agree to exclude, be assigned to and endorsed in favour of FCC, as first mortgagee and first loss payee subject to ranking pari passu with holders of debt secured by the same Collateral pursuant to any intercreditor agreement entered into by FCC with the holders of such debt. For greater certainty, the form of insurance that exists as at the date of this Agreement in respect of the insurable collateral is satisfactory to FCC.

(l) Repairs

The Borrower shall, and shall cause each of the other Security Parties to, at all times, make or cause to be made such expenditures, replacements, repairs, and maintenance as shall be necessary to maintain, preserve and keep at all times the Collateral in good repair, physical condition, working order and a state of good operating efficiency, as would a prudent owner of comparable property conducting a similar business.

(m) Environmental Compliance

The Borrower shall, and shall cause each of the other Security Parties to:

(1) use and operate all of its facilities and properties in compliance with all environmental laws, keep all necessary permits, approvals, certificates, licences and other authorizations relating to environmental matters in effect and remain in compliance therewith, and handle all contaminants in compliance with all applicable environmental laws;

(2) immediately notify FCC and provide copies upon receipt of any written claim, complaint, notice or inquiry to the Security Party relating to the release of contaminants at any facility which would result in the Security Party being in material non-compliance with any environmental law; and

(3) provide such information and certifications which FCC may reasonably and specifically request from time to time to evidence compliance with this section.

(n) Environmental Review

The Borrower shall permit or cause to be permitted, at any and all reasonable times during normal business hours, a representative of FCC to visit and inspect the premises and assets of each Security Party for the purposes of reviewing the environmental status thereof.

(o) Observance of Agreements, etc.

The Borrower shall, and shall cause each of the other Security Parties to, observe and perform in a timely fashion all of its Obligations, the failure of which to perform or observe would have a material adverse effect on such Security Party, and shall provide or cause to be provided to FCC copies of any written communications delivered to it by any of the other parties thereto alleging any default or threatening the exercise of any remedy thereunder.

(p) Rectification of Defaults by FCC

In the event that FCC receives any notice of default or breach by any Security Party of any term, covenant or condition in an agreement which default or breach, in the reasonable opinion of FCC, is likely to have a material adverse effect on the business or operations of such Security Party, or upon a material portion of the Collateral, the Borrower shall permit or cause to be permitted FCC to take any action as FCC in its reasonable opinion may deem necessary or desirable to rectify or prevent such default or breach notwithstanding that the existence of such default or breach or the nature or extent thereof may be questioned or denied by the Borrower or other Security Party, including the absolute and immediate right to enter onto the property of any Security Party or any part thereof to the extent that FCC deem necessary or desirable, but without taking possession thereof, to enable FCC to rectify or prevent any such default or breach, provided always that FCC shall not incur or be subject to any liability under any lease or contract by reason of having taken such action nor shall FCC have any obligation to take any action referred to in this subsection.

(q) Insurance Proceeds

Except for any further insurance proceeds arising from the May 31, 2012 storm (the “2012 Storm”) in Texas relating to business interruption only which shall not need to be remitted to FCC, any physical damage insurance proceeds arising from the damage or destruction of any assets of any Security Party shall be paid to FCC to be applied as a prepayment of Indebtedness owing under the Loan (and which for greater certainty shall include any additional physical damage insurance proceeds in respect of the 2012 Storm). FCC acknowledges that the Borrower may request that the physical damage insurance proceeds be utilized to rebuild damaged facilities (be they from the 2012 Storm or otherwise), and which request, if made, will be considered by FCC, without obligation.

6.2 Financial Statements and Other Information

Until there is no Indebtedness outstanding, the Loan has been terminated, and FCC has no commitment or obligation hereunder, the Borrower(s) and Guarantor(s) shall deliver to FCC annually within 90 days of the Borrower's fiscal year end:

(1) Consolidated Audited Financial Statements for the Borrower and Guarantors prepared by a Qualifying Accounting Firm, and which statements must include a balance, sheet, an income statement, a statement of retained earnings and a statement of changes in financial position, and must be prepared in accordance with IFRS applied on a basis consistent with the statements for the previous fiscal year;

(2) Accountant or financial controller will provide an annual compliance letter for the FCC Loan in a form satisfactory to FCC for Covenants and Conditions accompanying the fiscal year end financial statement. Explanations are to be included for any non-compliance issues. For greater certainty, the form of compliance letter provided to date to FCC is in a form satisfactory to FCC;

(3) Annual budget and cash flow forecast including a detailed Capital Expenditure Budget of the following year to be supplied to FCC within 15 days of approval but not later than 90 days following the fiscal year-end and must be deemed acceptable to FCC. Any subsequent revisions to the budgets must be confirmed in writing and authorized by FCC before changes are implemented.

(4) Such additional financial statement and information as and when requested by FCC acting reasonably.

6.3 Financial Covenants

For as long as this Agreement is in force and any portion of the Loans(s) referred to in this Agreement remains unpaid, the Borrower and the Guarantors shall maintain the following financial covenants:

(1) Current ratio

The Borrower will not permit its Current Ratio to be less than:

1.10:1.00 for its 2013 fiscal year

1.25:1.00 for its 2014 fiscal year; and each fiscal year thereafter;

The Current Ratio is defined as Current Assets divided by Current Liabilities.

(2) Debt Service Coverage ratio

The Borrower will not permit its Debt Service Coverage Ratio to be less than: 1.50:1.00 for its 2013 fiscal year;

1.65:1.00 for its 2014 fiscal year;

1.75:1.00 for its 2015 fiscal year; and each fiscal year thereafter.

The Debt Service Coverage is defined as Earnings Before Interest, Taxes, Depreciation, Amortization (EBITDA) divided by Interest Expense and Current Portion of Long Term Debt (as has been customarily circulated and previously provided to FCC).

(3) Total Debt To Tangible Net Worth

The Borrower will not permit its Total Debt to Tangible Net Worth to exceed 3.00:1.00;

(4) Debt to EBITDA

The Borrower will not permit its ratio of Debt to EBITDA to be greater than: 4.50:1.00 for its 2013 year; and

4.00:1.00 for its 2014 fiscal year and each fiscal year thereafter; EBITDA means the aggregate of the following:

• net income of Village Farms International, Inc. on a consolidated basis, including any business interruption insurance proceeds but excluding insurance proceeds for capital assets, and excluding asset and inventory write downs and incremental costs related to insurance recovery and cleanup of damage resulting from the May 31, 0000 xxxx xxxxx xx Xxxxx, Xxxxx;

• adding back Bank charges for the month, on a consolidated basis;

• adding back expenses related to refinancing;

• adding back the amount of consolidated income tax expense;

• adding back the amount of depreciation expense incurred, on a consolidated basis;

• adding back the amount of amortization expense incurred, on a consolidated basis,

• In each case determined in accordance with IFRS on a consolidated basis, with the exception that the insurance proceeds on capital or fixed assets shall not be included in EBITDA which FCC acknowledges may not be in accordance with IFRS;

These financial covenants shall be measured annually, or more frequently as determined by FCC, if there exists an Event of Default. And for greater certainty, the calculation of these financial covenants shall be measured in the same manner as was presented by the Borrower to FCC and HSBC Bank Canada in the most recent compliance certificate delivered to them (as part of the existing loan requirements).

6.4 Negative Covenants

Until there is no Indebtedness outstanding, the Loan has been terminated, and FCC has no commitment or obligation hereunder, the Borrower will not, and will ensure that each of the Security Parties will not, without the prior written consent of FCC:

(a) No Amalgamation or Merger

Enter into any transaction (whether by way of amalgamation, merger, winding-up, consolidation, liquidation, dissolution, reorganization, transfer, sale, lease, or otherwise) whereby all or substantially all of its undertaking, properties, rights, or assets would become the property of any Person other than the Borrower excepting any transaction between Security Parties and provided that the Borrower has received the prior written consent of FCC;

(b) Change in Control of Borrower or Security Parties

Issue any shares in its capital stock or issue any limited partnership units (or securities convertible or exchangeable into any such shares) or any options to acquire shares or limited partnership units or permit any transfer or any change in the ownership or control of any such shares or limited partnership units (whether by sale, assignment, exchange, transfer, devise, bequest, amalgamation, reorganization, operation of law or otherwise) or take or permit any other action which would result in a Change in Control of the Borrower or any wholly-owned subsidiary or any of the Security Parties;

(c) Environmental Damage

Cause or permit to be caused any environmental damage which would result in a MAE;

(d) Distributions

Declare or pay or make any Distributions, including any payment or repayment of principal, interest, fees or costs with respect to any subordinated debt if there exists any Default or Event of Default or the declaration or payment would cause there to exist a Default or an Event of Default;

(e) Material Change

Make any material change in the nature of its business taken as a whole;

(f) Fiscal Year End

Change its Financial Year end;

(g) Limitation on Liens

Permit the creation, assumption or existence of any Lien upon any assets of a Security Party or any Subsidiary of a Security Party now owned or hereafter acquired except for Permitted Liens and the Operating Lender Security Interest;

(h) Limitation on Investments

Make, directly or indirectly, any investment except an investment made by the Security Party or any Wholly-owned Subsidiary of such Security Party in assets to be used by it or such Wholly-owned Subsidiary to carry on its Core Business;

(i) Limitation on Sale of Assets

Except for the sale of inventory in the ordinary course of its business, permit the sale, assignment, lease or other disposal of all or any part of its business or property, whether now owned or hereafter acquired, provided however, that a Security Party and its Wholly-owned Subsidiaries may do so, so long as no Default or Event of Default then exists or would result therefrom and:

(1) the assets sold, leased or otherwise transferred are done so in the ordinary course of business or consist of surplus or obsolete buildings, machinery, equipment and inventory; or

(2) the assets are sold, leased or otherwise transferred by a Security Party to another Security Party; and

the assets sold, leased or otherwise transferred are done so for a consideration equal to at least the fair market value thereof and if such proceeds and are not utilized, within six (6) months, to acquire other assets for the Core Business operated by the Borrower, then such proceeds shall be applied as a reduction in the current amount owing under the Loan; provided that notwithstanding the foregoing, the sale proceeds of all or any part of the Real Property that is sold shall be applied as a prepayment of indebtedness owing under the Loan.

(j) Creation of Subsidiaries

Not to create any subsidiary unless such subsidiary agrees to become a Security Party at FCC’s request;

(k) Acquisitions

Acquire or enter into any agreement to acquire any shares or other securities or any other interest in any Person or any assets of any Person unless:

(1) In the case of the acquisition of any shares, securities or other interest in any Person, the business of such Person is the same as the Core Business and in the case of acquisition of any assets of any Person, such assets are used and will continue to be used in the Core Business;

Before making any such acquisitions or entering into any such agreement, the Borrower shall have provided to FCC such pro forma financial information as FCC may require that shows that after such acquisition the Borrower and the Security Parties shall be in compliance with their respective covenants under the Documents for the four (4) fiscal quarters following the completion of such acquisition.

(l) Limitation on Financial Assistance

Make loans to or investments in, or provide guarantees or indemnities or otherwise give financial assistance to any Person, other than in the ordinary course of business or among any Security Party where the aggregate value of the loans, investments, guarantees or indemnities exceed CAD1,000,000;

(m) Alterations of Constating Documents

Alter (or allow the alteration of) its constating instruments (including in the case of the Borrower, the limited partnership agreement forming the Borrower and in the case of Village Farms L.P., the limited partnership agreement forming the Village Farms, L.P.) or its corporate organization;

(n) Share or Unit Changes

Change or allow any change to the beneficial ownership of a majority of its share or units as set forth in Schedule “G”;

(o) Funded Debt

Issue, grant, permit or incur any Funded Debt except for the Loan and an operating loan with the Operating Lender;

(p) Real Property Sales

Sell, transfer, assign, convey, lease or otherwise dispose of all or any part of either its legal or beneficial interest in any real property owned by it including the Real Property;

(q) Nature of Business

Change the nature of its business (i.e. greenhouse operation and sale of assets arising therefrom) or expand the jurisdictions outside Canada, the United States or the Dominican Republic;

(r) Name Change

Change its name or the name of any Security Party without providing FCC with at least 30 days prior written notice along with such additional security or assumption agreements as FCC may reasonably require;

(s) Amending Existing Agreements

Amend, terminate or replace any agreement relating to the business carried on by it or the property, assets or undertaking used therein if to do so would have a MAE;

(t) Existing Leases

Amend in any material respect, terminate or surrender the existing leases of the Presidio Leasehold Lands or Xxxx County Lands; or

(u) Operating/Management Agreements

Enter into any operating or management agreement with respect to the operation and management of the business of any Security Party in whole or in part with a Person who is not an officer or holder of equity in a Security Party.

7 Demand and Acceleration

7.1 Events of Default

All Obligations and Indebtedness hereunder or pursuant to any other Document, whether any such Obligation or Indebtedness is absolute or contingent, matured and/or unmatured, shall, at the option of FCC, become immediately due and payable and the Security shall become immediately enforceable when any of the following events (each such event an “Event of Default”) occurs:

(a) Failure to Pay Principal

If the Borrower fails to make payment, within two (2) Banking Days when due of any principal amount of the Indebtedness of the Borrower to FCC;

(b) Failure to Pay Interest or Fees

If the Borrower fails to make payment, within five (5) days of when due of any interest or fee payable under this Agreement or any other Document;

(c) False Representations

If any representation or warranty made or given by any Security Party herein or in any Document is materially false or incorrect, or lacking in any material facts, at the time that it is made or given, so as to make it materially misleading;

(d) Default in Covenants

If any Security Party fails in the observance or performance of any of the terms, conditions, provisions or covenants to be performed or observed by it hereunder or contained in any Document, and such Default shall have continued for a period of thirty (30) days after written notice thereof has been delivered to the Borrower by FCC, or is not capable of being cured within such notice period, in which case an Event of Default shall have occurred upon the breach of such covenant without the requirement of notice or lapse of time;

(e) Cross-Default

If the Borrower, or any Security Party shall default under or any other credit facility, loan or security agreement with FCC or with the Operating Lender or any other lender, under the Borrower’s operating loan with such lender;

(f) Voluntary Proceedings

If:

(1) any Security Party or any Wholly-owned Subsidiary of a Security Party ceases, or threatens to cease, to carry on a material portion of its business;

(2) any proceeding or filing is instituted or made by a Security Party or any Wholly-owned Subsidiary of a Security Party;

(1) seeking liquidation, winding-up, reorganization, arrangement, adjustment, compromise or composition of the Security Party or Wholly-owned Subsidiary’s debt under any law relating to bankruptcy, insolvency or relief of debtors (including without limitation the Bankruptcy and Insolvency Act (Canada) and the Companies’ Creditors Arrangement Act (Canada)) where such liquidation, winding-up, reorganization, arrangement, adjustment, compromise or composition affects any of its properties or assets; or

(2) seeking appointment of a receiver, trustee, liquidator, custodian or other similar official for the Security Party or any Wholly-owned Subsidiary where such appointment would affect any of the Security Party’s properties or assets; or

(3) If a Security Party or a Wholly-owned Subsidiary of a Security Party shall take any corporate action to authorize any of the actions set forth in this paragraph.

(g) Involuntary Proceedings

If any proceeding or filing is instituted or made against any Security Party or any Wholly- owned Subsidiary of a Security Party:

(1) seeking liquidation, winding-up, reorganization, arrangement, adjustment, compromise or composition under any law relating to bankruptcy, insolvency, reorganization or relief of debtors (including without limitation, the Bankruptcy and Insolvency Act (Canada) and the Companies’ Creditors Arrangement Act (Canada)) where such relief, liquidation, winding- up, reorganization, arrangement, adjustment, compromise or composition affects any of the Borrower’s or any other Security Party’s or a Wholly Owned Subsidiary of a Security Party properties or assets; or

(2) seeking appointment of a Receiver, trustee, liquidator, custodian or other similar official where such where such appointment would affect a material portion of the property or assets of a Security Party or a Wholly-owned Subsidiary of a Security Party;

unless the same is being contested actively and diligently in good faith by appropriate and timely proceedings, in a manner satisfactory to FCC in its discretion;

(h) Appointment of Receiver

If a Receiver, liquidator, trustee, or other person or officer with like powers shall be appointed with respect to, or an encumbrancer shall take possession of, any material part of the properties or assets of a Security Party;

(i) Material Adverse Change In Risk

If in FCC’s opinion acting in good faith, there exists a MAE;

(j) Security

If any material provision of this Credit Agreement or any other Document is terminated or becomes illegal, invalid, prohibited or unenforceable in any relevant jurisdiction or any charge created by the Security Documents shall not rank in priority to all other Liens on the undertaking, property and assets of the Security Parties with the exception of Permitted Liens and any other security interests which, according to the terms of this Credit Agreement are allowed to rank pari passu with the charges created by Security Documents;

(k) Judgments

If any final judgement of any court of competent jurisdiction or any final decision of any Governmental Authority is made or entered against any Security Party or any Wholly-owned Subsidiary of a Security Party which, in the reasonable opinion of FCC, will have a material adverse affect on:

(i) a Security Party; or

(ii) the security created by the Security Documents.

(l) Execution, Distress

If any execution, sequestration, distress, or other similar process of any court shall become enforceable against a Security Party or any Wholly-owned Subsidiary of a Security Party having a value in any case of in excess of $100,000 USD;

(m) Change of Control

If there is a Change in Control of any Security Party without the prior written consent of FCC.

7.2 Rights Upon Event of Default

Upon the occurrence of an Event of Default, FCC and a Receiver, as applicable, will to the extent permitted by law have the following rights:

(a) Appointment of Receiver

FCC may by instrument in writing appoint any Person as a Receiver of all or any part of the Collateral. FCC may from time to time remove or replace a Receiver, or make application to any court of competent jurisdiction for the appointment of a Receiver. Any Receiver appointed by FCC will (for purposes relating to responsibility for the Receiver’s acts or omissions) be considered to be the Borrower’s or any other Security Party’s agent as the case may be. FCC may from time to time fix the Receiver’s remuneration and the Borrower will pay FCC the amount of such remuneration. FCC will not be liable to the Borrower or any Security Parties or any other Person in connection with appointing or not appointing a Receiver or in connection with the Receiver’s actions or omissions.

(b) Dealings with the Collateral

FCC or a Receiver may take possession of all or any part of the Collateral and retain it for as long as FCC or the Receiver considers appropriate, receive any rents and profits from the Collateral, carry on (or concur in carrying on) all or any part of the Borrower’s or the Security Parties’ business or refrain from doing so, borrow on the security of the Collateral, repair the Collateral, process the Collateral, prepare the Collateral for sale, lease or other disposition, and sell or lease (or concur in selling or leasing) or otherwise dispose of the Collateral on such terms and conditions (including among other things by arrangement providing for deferred payment) as FCC or the Receiver considers appropriate. FCC or the Receiver may (without charge and to the exclusion of all other Persons including the Borrower and any Security Parties) enter upon any place of business of the Borrower or any Security Parties. Without limitation, FCC or Receiver may enter upon any such place of business for the purpose of exercising remedies in relation to the Collateral that is personal/movable property without taking control or possession of such place of business or being deemed to have done so.

(c) Realization

FCC or a Receiver may use, collect, sell, lease or otherwise dispose of, realize upon, release to any Security Party or other Persons and otherwise deal with, the Collateral in such manner, upon such terms (including among other things by arrangement providing for deferred payment) and at such times as FCC or the Receiver considers appropriate. FCC or the Receiver may make any sale, lease or other disposition of the Collateral in the name of and on behalf of any Security Party. In addition to the foregoing, the Receiver shall have all rights, powers and authorities granted to FCC or FCC under any Security as if all such rights, powers and authorities were set out and repeated herein, together with such additional rights, powers and authorities as may be necessary or desirable to enable FCC and the Receiver to effectively realize upon any Collateral. No such right, power or authority will be exclusive of or dependent upon or merge in any other right, power or authority and one or more of such rights, powers and authorities may be exercised independently or in combination from time to time.

(d) Application of Proceeds After Default

All Proceeds of Collateral received by FCC or a Receiver may be applied to discharge or satisfy any expenses (including among other things the Receiver’s remuneration and other expenses of enforcing FCC’s or any Lender’s rights under this Credit Agreement), Liens, borrowings, taxes and other outgoings affecting the Collateral or which are considered advisable by FCC or the Receiver to preserve, repair, process, maintain or enhance the Collateral or prepare it for sale, lease or other disposition, or to keep in good standing any Liens on the Collateral ranking in priority to any Lien created by the Security or to sell, lease or otherwise dispose of the Collateral. The balance of such Proceeds will be applied to the Obligations in such manner and at such times as FCC consider appropriate and thereafter will be accounted for as required by law.

7.3 Rights Under PPSA

Before and after an Event of Default, FCC or a Receiver will have, in addition to the rights specifically provided in this Credit Agreement, the rights of a secured party under the PPSA (and under the equivalent legislation of any other applicable jurisdiction) as well as the rights recognized at law and in equity.

7.4 Deficiency

The Borrower and the other Security Parties will remain liable to FCC for payment of any Indebtedness that remains outstanding following realization of all or any parts of the Collateral.

7.5 FCC not Liable

Neither FCC nor any Receiver will be liable to any Security Party or any other Person for any failure or delay in exercising any of its rights under this Agreement or under any Security Document (including among other things any failure to take possession of, collect, or sell, lease or otherwise dispose of, any Collateral). Neither FCC, any Receiver or any agent of FCC (including, in Alberta, any sheriff) is required to take, or will have any liability for any failure to take or delay in taking, any steps necessary or advisable to preserve rights against other Persons under any Chattel Paper, Securities or Instrument (as those terms are respectively defined in the PPSA) in possession of FCC, a Receiver or their respective agents.

7.6 Remedies Cumulative

It is expressly understood and agreed that the rights and remedies of FCC under this Credit Agreement and the Security Documents are cumulative and are in addition to and not in substitution of any rights or remedies provided by law and any single or partial exercise by FCC of any right or remedy for a default or breach of any term, covenant, condition or agreement herein contained shall not be deemed to be a waiver of or to alter, affect, or prejudice any other right or remedy or other rights or remedies to which FCC may be lawfully entitled for the same default or breach, and any waiver by FCC of the strict observance, performance or compliance with any term, covenant, condition or agreement which contained and any indulgence granted by FCC shall be deemed not to be a waiver of any subsequent default. In the event that FCC shall have proceeded to enforce any such right, remedy or power contained therein or in the Security Documents and such proceedings shall have been discontinued or abandoned for any reason by written agreement between FCC and any Security Party, then in each such event such Security Party and FCC shall be restored to their former positions and the rights, remedies and powers of FCC shall continue as if no such proceedings have been taken.

8 Representations and Warranties

8.1 Representations and Warranties

The Borrower makes and gives the following representations and warranties to FCC, upon each of which FCC has relied in entering into this Credit Agreement, and each of which will be deemed to be repeated on each Advance:

(a) Incorporation and Corporate Power

Each of the Security Parties is duly incorporated, organized or formed pursuant to the laws of its organization or formation, is properly registered in every jurisdiction it does business and is current in all of its corporate filings, and has all necessary power and authority to own or lease its properties and assets and to carry on its business as now being conducted by it, and to authorize, create, execute, deliver and perform all of its respective obligations under the Documents to which it is party in accordance with their respective terms.

(b) Licences

Each Security Party has obtained all material licences, permits, registrations, and approvals necessary to own its properties and assets and to carry on its business in each jurisdiction in which it does so, except where the failure to do so would not have a MAE.

(c) Due Authorization and No Conflict

Each Security Party has taken or has caused to be taken all necessary action to authorize the creation, execution, delivery and performance of this Credit Agreement, the other Documents and all other instruments contemplated hereunder and the borrowing of money hereunder, and no such action requires the consent or approval of any Governmental Authority or any other Person, nor is any such action in contravention of or in conflict with any applicable law, rule or regulation, or the articles, by-laws, partnership agreement or resolutions of directors, shareholders or partners or shareholders agreement of any Security Parties, or the provisions of any judgment, order, indenture, instrument, agreement or undertaking to which any Security Parties is a party, or by which its assets or properties are bound, except where the failure to do so would not have a MAE.

(d) Compliance with Law

None of the Security Parties is in violation of any terms of its articles of incorporation, amalgamation or formation, partnership agreement, by-laws, resolutions of directors, shareholders or partners, shareholders agreement, or any law, regulation, rule, order, judgment, writ, injunction, decree, determination or award, currently in effect and applicable to it, the violation of which would have a MAE in respect of such Security Party.

(e) Enforceability

Each of the Documents will, when executed and delivered, constitute legal, valid and binding obligations of each party thereto (other than FCC) enforceable against each such party in accordance with the terms thereof.

(f) Taxes

Each Security Party has filed all tax returns required to be filed by it with any Governmental Authority and has paid all Taxes which were due and payable and all assessments and reassessments, and all other Taxes, governmental charges, penalties, interest and fines due and payable by it on or before the date of this Credit Agreement, and there are no agreements, waivers, or other arrangements providing for an extension of time with respect to the filing of any tax return by it or the payment of any tax, governmental charges, penalties, interest or fines against it other than waivers of the normal reassessment period; there are no material actions, suits, proceedings, investigations or claims now threatened or pending against any of the Security Parties which, not resolved in favour of such Security Party, would result in a material liability of such Security Party, in respect of taxes, governmental charges, penalties, interest, fines, assessments and reassessments or any matters under discussion with any Governmental Authority relating to Taxes, governmental charges, penalties, interest, fines, or assessments and reassessments asserted by any such authority which, if not resolved in favour of such Security Party, would result in a material liability of such Security Party, and each Security Party has withheld from each payment to each of its present and former officers, directors, and employees the amount of all Taxes and other amounts, including, but not limited to, income tax and other deductions, required to be withheld therefrom, and has paid the same or will pay the same when due to the proper tax or other receiving officers within the time required under the applicable tax legislation.

(g) No Litigation

There are no actions, suits, proceedings, inquiries or investigations existing, pending or, to the knowledge of the Borrower, threatened against or adversely affecting any of the Security Parties in any court or before any federal, provincial, municipal or governmental department, commission, board, tribunal, bureau or agency, whether Canadian or foreign, or before any arbitrator, which might, if not resolved in favour of such Security Party, cause a MAE.

(h) No Defaults or Events of Defaults

No Default or Event of Default has occurred and is continuing.

(i) Financial Statements