Exhibit 10.1

Confidential treatment has been requested for portions of this exhibit pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The copy filed herewith omits the information subject to the confidentiality request. Omissions are designated as [**]. A complete version of this exhibit has been filed separately with the Securities and Exchange Commission.

Execution Version

BETWEEN

OTTER TAIL POWER COMPANY, A MINNESOTA

CORPORATION

AND

ASHTABULA WIND III, LLC

Table of Contents.

| ARTICLE 1. DEFINITIONS AND RULES OF INTERPRETATION |

|

5

|

| |

|

|

|

|

| |

1.1.

|

Rules of Construction

|

|

5

|

| |

1.2.

|

Interpretation with Interconnection Agreement

|

|

6

|

| |

1.3.

|

Interpretation of Arrangements for Electric Supply to the Facility

|

|

6

|

| |

1.4.

|

Definitions

|

|

7

|

| |

|

|

|

|

| ARTICLE 2. TERM AND TERM INATION |

19

|

| |

|

|

|

|

| ARTICLE 3. FACILITY DESCRIPTION |

|

19

|

| |

|

|

|

|

| |

3.1.

|

Summary Description

|

|

19

|

| |

3.2.

|

Location

|

|

19

|

| |

3.3.

|

General Design of the Facility

|

|

19

|

| |

|

|

|

|

| ARTICLE 4. [INTENTIONALLY LEFT BLANK] |

|

20

|

| |

|

|

|

|

| ARTICLE 5. DELIVERY AND METERING |

|

20

|

| |

|

|

|

|

| |

5.1.

|

Delivery Arrangements

|

|

20

|

| |

5.2.

|

Availability Reporting

|

|

20

|

| |

5.3.

|

Electric Metering Devices

|

|

20

|

| |

5.4.

|

Adjustment for Inaccurate Meters

|

|

21

|

| |

|

|

|

|

| ARTICLE 6. CONDITIONS PRECEDENT |

|

22

|

| |

|

|

|

|

| |

6.1.

|

Utility Regulatory Commissions Approval

|

|

22

|

| |

|

|

|

|

| ARTICLE 7. SALE AND PURCHASE OF RENEWABLE ENERGY |

|

23

|

| |

|

|

|

|

| |

7.1.

|

Sale and Purchase

|

|

23

|

| |

7.2.

|

Reserved

|

|

23

|

| |

7.3.

|

Title and Risk of Loss

|

|

23

|

| |

7.4.

|

Agc and Company’s Right to Curtail Energy

|

|

23

|

| |

7.5.

|

Scheduling

|

|

24

|

| |

7.6.

|

Availability

|

|

24

|

| |

|

|

|

|

| ARTICLE 8. PAYMENT CALCULATIONS |

|

25

|

| |

|

|

|

| |

8.1.

|

Energy Payment Rate

|

|

25

|

| |

8.2.

|

Curtailment Energy Payment Rate

|

|

26

|

| |

|

|

|

| ARTICLE 9. BILLING AND PAYMENT |

|

28

|

| |

|

|

|

| |

9.1.

|

Billing Invoices

|

|

28

|

| |

9.2.

|

Metered Billing Data

|

|

28

|

| |

9.3.

|

[Intentionally Left Blank]

|

|

28

|

| |

9.4.

|

Payments

|

|

28

|

| |

9.5.

|

Billing Disputes

|

|

29

|

| |

9.6.

|

Netting

|

|

29

|

| |

|

|

|

| ARTICLE 10. OPERATIONS AND MAINTENANCE |

|

30

|

| |

|

|

|

| |

10.1.

|

Maintenance Schedule

|

|

30

|

| |

10.2.

|

Facility Operation

|

|

30

|

| |

10.3.

|

Capacity Resource Capability Verification

|

|

30

|

| |

10.4.

|

Outage and Performance Reporting

|

|

30

|

| |

10.5.

|

Operating Committee and Operating Procedures

|

|

30

|

| |

10.6.

|

Access to Facility

|

|

31

|

| |

10.7.

|

Reliability Standards

|

|

31

|

| |

10.8.

|

Environmental Credits

|

|

31

|

| |

10.9.

|

Availability Reporting

|

|

32

|

| |

10.10.

|

Peak Production Availability

|

|

32

|

| |

|

|

|

| ARTICLE 11. SECURITY FOR PERFORMANCE |

|

32

|

| |

|

|

|

| |

11.1.

|

Security Fund

|

|

32

|

| |

|

|

|

| ARTICLE 12. DEFAULT AND REMEDIES |

|

35

|

| |

|

|

|

| |

12.1.

|

Events of Default of Seller

|

|

35

|

| |

12.2.

|

Unaffiliated Facility Investor’s Right to Cure Default of Seller

|

|

37

|

| |

12.3.

|

Events of Default of Company

|

|

37

|

| |

12.4.

|

Damages Prior to Termination

|

|

38

|

| |

12.5.

|

Termination

|

|

38

|

| |

12.6.

|

Limitation on Damages

|

|

39

|

| |

12.7.

|

[Intentionally Left Blank]

|

|

39

|

| |

12.8.

|

Specific Performance

|

|

39

|

| |

12.9.

|

Remedies Cumulative

|

|

39

|

| |

12.10.

|

Waiver and Exclusion of Other Damages

|

|

39

|

| |

12.11.

|

Payment of Amounts Due to Party

|

|

40

|

| |

12.12.

|

Duty to Mitigate

|

|

40

|

| |

|

|

|

| ARTICLE 13. CONTRACT ADMINISTRATION AND NOTICES |

|

40

|

| |

|

|

|

| |

13.1.

|

Notices in Writing

|

|

40

|

| |

13.2.

|

Representative for Notices

|

|

40

|

| |

13.3.

|

Authority of Representatives

|

|

40

|

| |

13.4.

|

Operating Records

|

|

41

|

| |

13.5.

|

Operating Log

|

|

41

|

| |

13.6.

|

Provision of Real Time Data

|

|

41

|

| |

13.7.

|

Billing and Payment Records

|

|

43

|

| |

13.8.

|

Examination of Records

|

|

43

|

| |

13.9.

|

Exhibits

|

|

43

|

| |

13.10.

|

Dispute Resolution

|

|

43

|

| |

|

|

|

|

| ARTICLE 14. FORCE MAJEURE |

|

44

|

| |

|

|

|

| |

14.1.

|

Definition of Force Majeure

|

|

44

|

| |

14.2.

|

Applicability of Force Majeure

|

|

44

|

| |

14.3.

|

Limitations on Effect of Force Majeure

|

|

45

|

| |

|

|

|

| ARTICLE 15. REPRESENTATIONS, WARRANTIES AND COVENANTS |

|

45

|

| |

|

|

|

| |

15.1.

|

Seller’s Representations, Warranties and Covenants

|

|

45

|

| |

15.2.

|

Company’s Representations, Warranties and Covenants

|

|

46

|

| |

|

|

|

| ARTICLE 16. INSURANCE |

|

47

|

| |

|

|

|

| |

16.1.

|

Evidence of Insurance

|

|

47

|

| |

16.2.

|

Term and Modification of Insurance

|

|

48

|

| |

|

|

|

| ARTICLE 17. INDEMNITY |

|

48

|

| |

|

|

|

| |

17.1.

|

Indemnification

|

|

48

|

| |

17.2.

|

Notice of Claim

|

|

49

|

| |

17.3.

|

Settlement of Claim

|

|

49

|

| |

17.4.

|

Amounts Owed

|

|

49

|

| |

|

|

|

| ARTICLE 18. LEGAL AND REGULATORY COMPLIANCE |

|

49

|

| |

|

|

|

| |

18.1.

|

Compliance With Laws

|

|

49

|

| |

18.2.

|

Officer Certificates

|

|

49

|

| ARTICLE 19. ASSIGNMENT AND OTHER TRANSFER RESTRICTIONS |

|

50

|

| |

|

|

|

| |

19.1.

|

No Assignment Without Consent

|

|

50

|

| |

19.2.

|

Accommodation of Unaffiliated Facility Investor

|

|

50

|

| |

19.3.

|

Change of Control

|

|

51

|

| |

19.4.

|

Notice of Unaffiliated Facility Investor Action

|

|

52

|

| |

19.5.

|

Transfer Without Consent is Null and Void

|

|

52

|

| |

19.6.

|

Subcontracting

|

|

52

|

| |

19.7.

|

Option to Purchase and Right of First Offer

|

|

52

|

| |

|

|

|

| ARTICLE 20. MISCELLANEOUS |

|

53

|

| |

|

|

|

| |

20.1.

|

Waiver

|

|

53

|

| |

20.2.

|

Taxes

|

|

54

|

| |

20.3.

|

Fines and Penalties

|

|

54

|

| |

20.4.

|

Rate Changes

|

|

54

|

| |

20.5.

|

Disclaimer of Third Party Beneficiary Rights

|

|

55

|

| |

20.6.

|

Relationship of the Parties

|

|

55

|

| |

20.7.

|

Equal Employment Opportunity Compliance Certification

|

|

55

|

| |

20.8.

|

Survival of Obligations

|

|

55

|

| |

20.9.

|

Severability

|

|

55

|

| |

20.10.

|

Complete Agreement; Amendments

|

|

56

|

| |

20.11.

|

Binding Effect

|

|

56

|

| |

20.12.

|

Headings

|

|

56

|

| |

20.13.

|

Counterparts

|

|

56

|

| |

20.14.

|

Governing Law

|

|

56

|

| |

20.15.

|

Press Releases and Media Contact

|

|

56

|

| |

20.16.

|

Forward Contract

|

|

56

|

| |

20.17.

|

Confidentiality

|

|

57

|

| |

20.18.

|

Cooperation

|

|

58

|

| |

|

|

|

|

| |

SCHEDULE A (to PPA) RENEWABLE ENERGY PAYMENT RATE

|

|

60

|

| |

EXHIBIT A (to PPA)

|

|

61

|

| |

[INTENTIONALLY LEFT BLANK]

|

|

61

|

| |

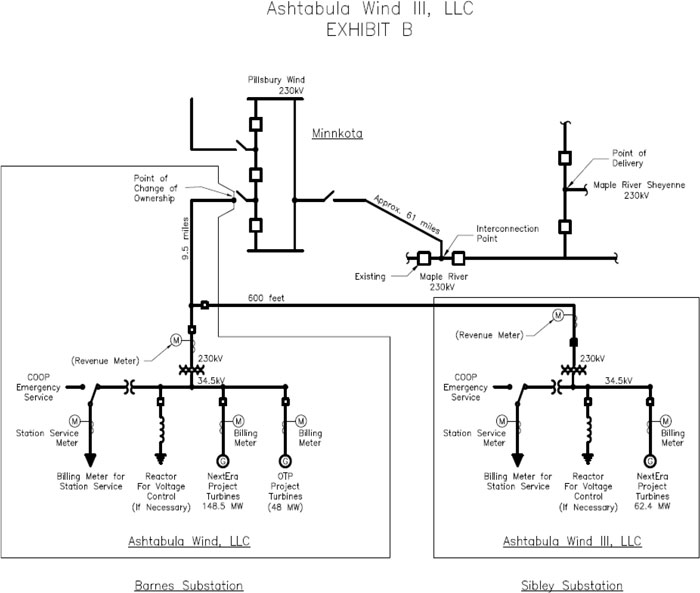

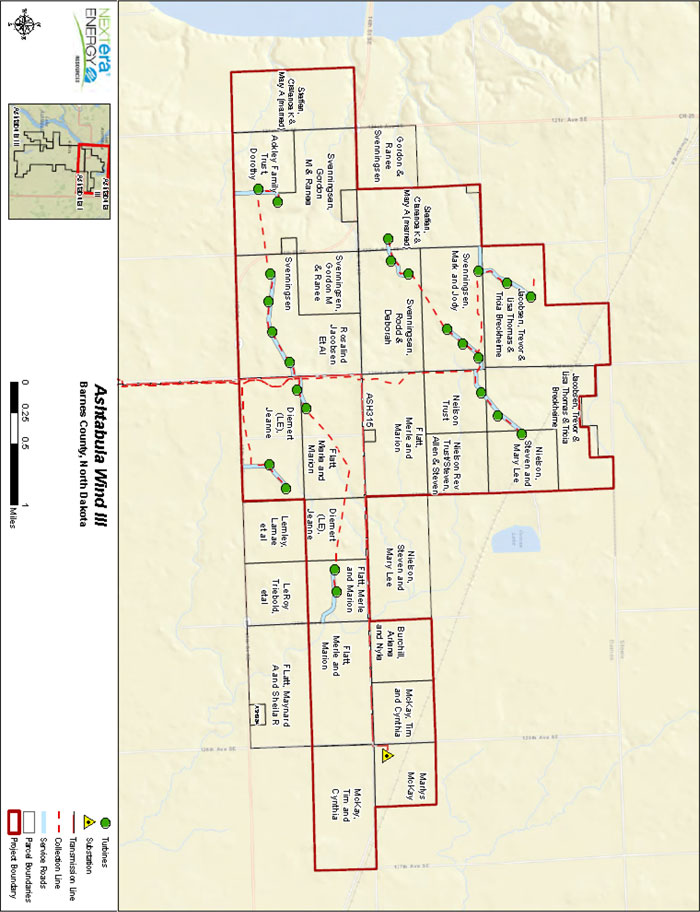

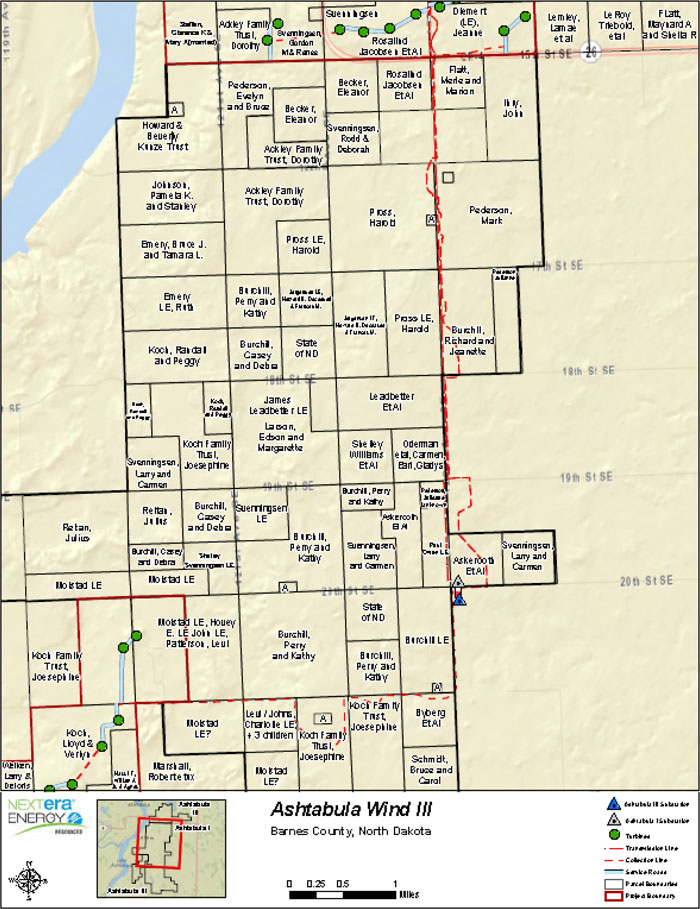

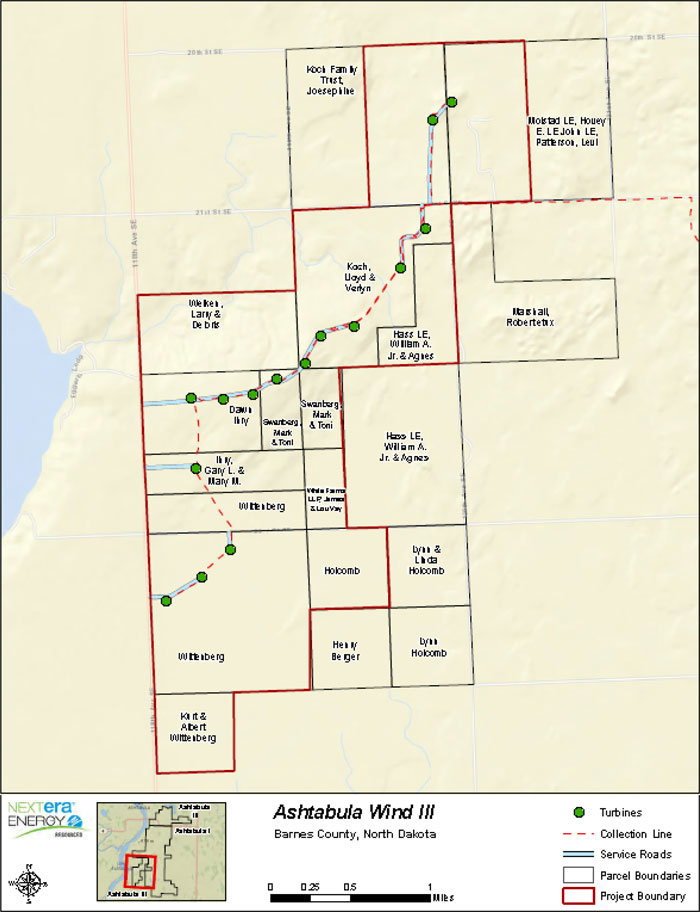

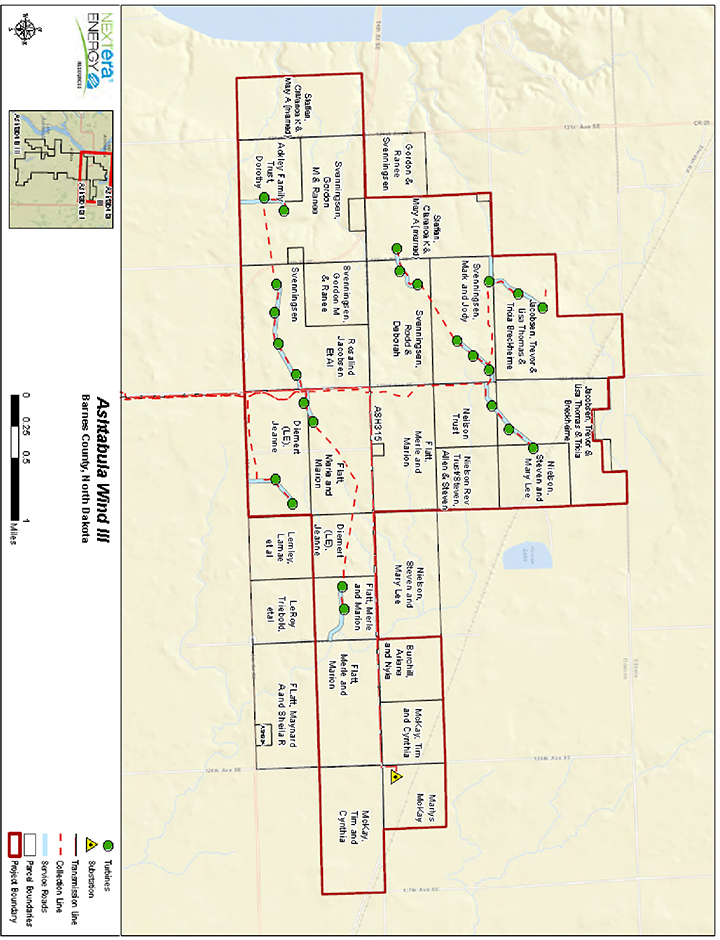

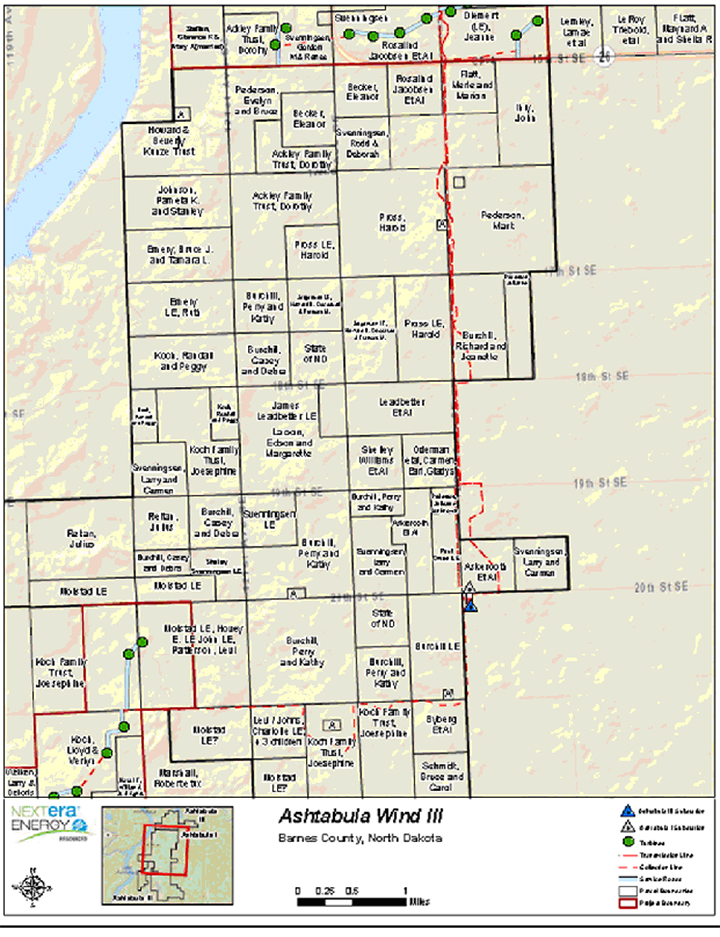

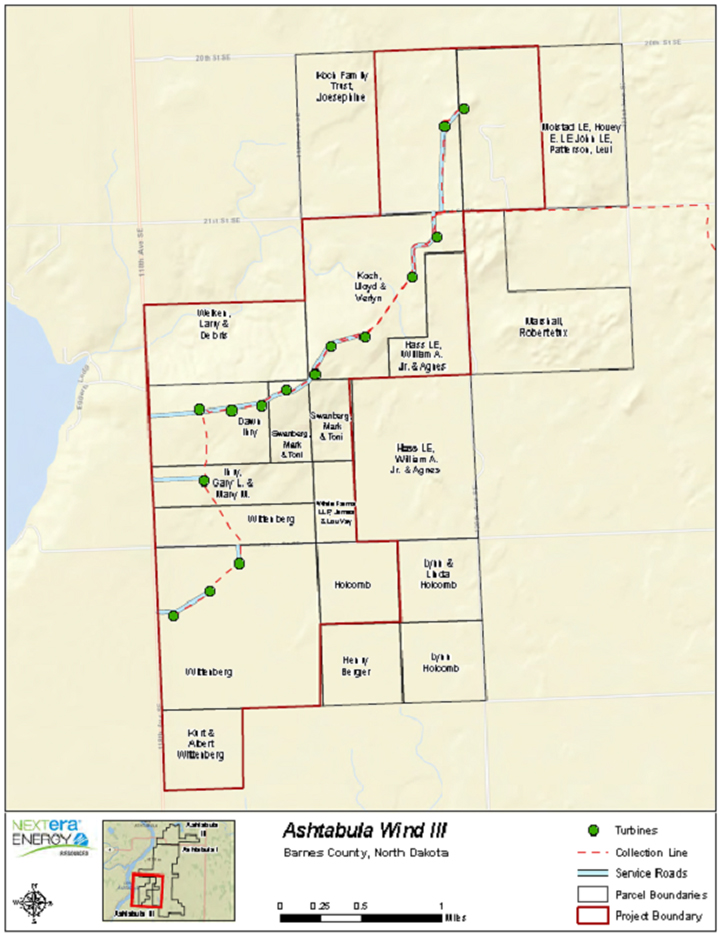

EXHIBIT B (to PPA) FACILITY DESCRIPTION AND SITE MAPS

|

|

62

|

| |

EXHIBIT C (to PPA) Notices and Contact Information

|

|

67

|

| |

EXHIBIT D (to PPA) INSURANCE COVERAGE

|

|

68

|

| |

EXHIBIT E (to PPA)

|

|

69

|

| |

[INTENTIONALLY LEFT BLANK]

|

|

69

|

| |

EXHIBIT F (to PPA) FORM OF LETTER OF CREDIT

|

|

70

|

| |

EXHIBIT G (to PPA) AGC Protocols

|

|

76

|

| |

EXHIBIT H (to PPA) FORM OF GUARANTY

|

|

79

|

| |

EXHIBIT I (to PPA) DATA COLLECTION

|

|

84

|

| |

EXHIBIT J (to PPA) GUARANTEED AVAILABILITY

|

|

85

|

| |

EXHIBIT K (to PPA) OPTION AGREEMENT

|

|

86

|

BETWEEN

ASHTABULA WIND III, LLC, A DELAWARE LIMITED LIABILITY COMPANY

AND OTTER TAIL POWER COMPANY, A MINNESOTA CORPORATION

This Wind Energy Purchase Agreement (this “PPA”) is made this 9th day of May, 2013 (the “Effective Date”), by and between (i) Ashtabula Wind III, LLC (“Seller”), a Delaware limited liability company with a principal place of business in Juno Beach, Florida, and (ii) Otter Tail Power Company, (“Company”), a Minnesota corporation with headquarters in Fergus Falls, Minnesota. Seller and Company are hereinafter referred to individually as a “Party” and collectively as the “Parties”.

WHEREAS Seller owns and operates a renewable wind-energy conversion electric generating facility with an expected total Nameplate Capacity of approximately 62.4 MW, and which is further defined below as the “Facility”; and

WHEREAS Seller desires to sell and deliver to Company at the Point of Delivery the Renewable Energy produced by the Facility and associated Renewable Energy Credits, and Company desires to buy the same from Seller in accordance with the terms and conditions set forth in this PPA.

NOW THEREFORE, in consideration of the mutual covenants herein contained, the sufficiency and adequacy of which are hereby acknowledged, the Parties agree to the following:

Article 1. Definitions and Rules of Interpretation

|

|

1.1.

|

Rules of Construction.

|

The capitalized terms listed in this PPA shall have the meanings set forth herein whenever the terms appear in this PPA, whether in the singular or the plural or in the present or past tense. Other terms used in this PPA but not defined in this PPA shall have meanings as commonly used in the English language and, where such words have a generally accepted meaning in Good Utility Practice, such meaning shall apply. Words not otherwise defined herein that have well known and generally accepted technical or trade meanings are used herein in accordance with such recognized meanings. In addition, the following rules of interpretation shall apply:

(A) The masculine shall include the feminine and neuter.

(B) References to “Articles,” “Sections,” or “Exhibits” shall be to articles, sections, or exhibits of this PPA.

(C) The Exhibits attached hereto are incorporated in and are intended to be a part of this PPA; provided, however, that in the event of a conflict between the terms of any Exhibit and the terms of this PPA, the terms of this PPA shall take precedence.

(D) This PPA was negotiated and prepared by both Parties with the advice and participation of counsel. The Parties have agreed to the wording of this PPA and none of the provisions hereof shall be construed against one Party on the ground that such Party is the author of this PPA or any part hereof.

(E) The Parties shall act reasonably and in accordance with the principles of good faith and fair dealing in the performance of this PPA. Unless expressly provided otherwise in this PPA, (a) when this PPA requires the consent, approval, or similar action by a Party, such consent or approval shall not be unreasonably withheld, conditioned or delayed, and (b) wherever this PPA gives a Party a right to determine, require, specify or take similar action with respect to a matter, such determination, requirement, specification or similar action shall be reasonable.

(F) Use of the words “include” or “including” or similar words shall be interpreted as “include without limitation” or “including, without limitation.”

(G) Use of the words “tax” or “taxes” shall be interpreted to include taxes, fees, surcharges, and the like.

|

|

1.2.

|

Interpretation with Interconnection Agreement.

|

Each Party conducts its operations in a manner intended to comply with FERC Order No. 717-A, Standards of Conduct for Transmission Providers, requiring the separation of its transmission and marketing functions. Moreover, the Parties acknowledge that Company’s transmission function offers interconnection and transmission service on its system in a manner intended to comply with FERC policies and requirements relating to the provision of open-access transmission service. The Parties recognize that Seller has entered into a separate Interconnection Agreement with the Interconnection Provider.

(A) The Parties acknowledge and agree that the Interconnection Agreement shall be a separate and free-standing contract and that the terms of this PPA are not binding upon the Interconnection Provider.

(B) Notwithstanding any other provision in this PPA, nothing in the Interconnection Agreement shall alter or modify Seller’s or Company’s rights, duties and obligations under this PPA. This PPA shall not be construed to create any rights between Seller and the Interconnection Provider.

(C) In the event that the Interconnection Provider is Company or an Affiliate of Company, Seller expressly covenants that, for purposes of this PPA, the Interconnection Provider shall be deemed to be a separate entity and separate contracting party whether or not the Interconnection Agreement is entered into with Company or an Affiliate of Company.

|

|

1.3.

|

Interpretation of Arrangements for Electric Supply to the Facility.

|

This PPA does not provide for the supply of retail power to the Facility, for purposes of turbine unit start-up or shut-down, or for any other purpose (“Station Service”). Seller shall contract with the local utility in whose retail service territory the Facility is located (“Local Provider”) for the supply of Station Service.

(A) Seller’s arrangements for the supply of Station Service to the Facility shall be separate and free-standing arrangements. The terms of this PPA are not binding upon the Local Provider. For purposes of this PPA, the Local Provider shall be deemed to be a separate entity and separate contracting party, whether or not the Local Provider is Company or an Affiliate of Company.

(B) Notwithstanding any other provision in this PPA, nothing in Seller’s arrangements for the supply of Station Service to the Facility shall alter or modify Seller’s or Company’s rights, duties and obligations under this PPA. This PPA shall not be construed to create any rights between Seller and the Local Provider.

(C) Subject to Seller’s right to self-generate and consume energy concurrently generated by the Facility, Seller shall obtain Station Service exclusively from the Local Provider. Seller may obtain Station Service back through the Interconnection Facilities to the extent permitted by Applicable Laws, provided, however, that the amount of energy received by Seller through the Interconnection Facilities shall not be offset against the amount of Renewable Energy delivered to Company at the Point of Delivery for purposes of computing Company’s obligation to purchase Renewable Energy and to receive RECs. Seller may need to arrange at its own expense with the Interconnection Provider or applicable retail service provider to separately measure Station Service received through the Interconnection Facilities.

The following terms shall have the meanings set forth herein:

“Abandonment” means (i) the complete relinquishment of all possession and control of the Facility by Seller, other than a transfer permitted under this PPA.

“Additional Agreements” means the Option Agreement, the Purchase and Sale Agreement and the Common Facilities Letter Agreement.

“Affected Party” shall have the meaning set forth in Section 9.5(B).

“Affiliate” of any named person or entity means any other person or entity that controls, is under the control of, or is under common control with, the named entity. The term “control” (including the terms “controls”, “under the control of” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management of the policies of a person or entity, whether through ownership interest, by contract or otherwise.

“AGC Protocols” means the protocols attached hereto as Exhibit G, as modified in accordance with Section 10.5(C).

“AGC Remote/Local” means a handshake electronic signal sent from the Facility to the EDCC AGC system, and from the EDCC AGC system to the Facility, indicating the Facility is receiving AGC Set-Point locally (from the facility) or remotely (EDCC AGC system) and is following that AGC Set-Point.

“AGC Set-Point” means the Company or Transmission Provider-generated analog or digital signal sent by the SCADA System to the Facility, representing the maximum Renewable Energy output for the Facility. The AGC Set-Point is calculated and communicated electronically through the SCADA System as required by Section 3.3.

“Annual Projected Output” shall have the meaning set forth in Exhibit J, Step 4.

“Applicable Law” means all Applicable Laws, statutes, treaties, codes, ordinances, regulations, certificates, orders, licenses and permits of any Governmental Authority, now in effect or hereafter enacted, amendments to any of the foregoing, interpretations of any of the foregoing by a Governmental Authority having jurisdiction, and all applicable judicial, administrative, arbitration and regulatory decrees, judgments, injunctions, writs, orders, awards or like actions (including those relating to human health, safety, the natural environment or otherwise).

“Automatic Generation Control” or “AGC” means energy management system equipment that automatically adjusts the generation quantity of individual generators within the applicable Balancing Authority with the purpose of interchange balancing. For a generator to be considered capable of AGC by Company, the generator must be capable of accepting AGC Set-Point electronically and regulating the Facility’s energy production based on the AGC Set-Point via the Facility’s SCADA System in accordance with the AGC Protocol. The data points covered under this PPA may overlap data requirements for the Transmission Provider, Interconnection Provider or Company’s wind forecasting group.

“Availability” means, for any Availability Period, the ratio, expressed as a percentage, of (x) the aggregate sum of the turbine-hours in which each of the Wind Turbines at the Facility was available to operate during such Availability Period over (y) number of hours in such Availability Period, as calculated in accordance with Exhibit J. A Wind Turbine shall be deemed not available to operate during hours in which it is (a) in an emergency, stop, service mode or pause state; (b) in “run” status and faulted; (c) included in a Forced Outage; or (d) otherwise not operational or capable of delivering energy to the Point of Delivery; provided, however, that notwithstanding the preceding, for purposes of determining Availability, a Wind Turbine shall be deemed to have been available to operate during hours in which it is not operating due solely to (i) an event of Force Majeure; (ii) a breach or default by Company; (iii) a lack of wind speed, wind speeds above the operating limits of the Wind Turbines, or temperatures above or below (or icing conditions in excess of) the manufacturer’s safe operating specifications; or (iv) a curtailment pursuant to Section 8.2(A) or a Non-Compensable Curtailment other than pursuant to Section 8.2(C)(5) or (6).

“Availability Damages” shall have the meaning set forth in Section 7.6(B).

“Availability Period” means each period of twenty four calendar months, determined on a rolling basis during the Term.

“Availability Shortfall” shall have the meaning set forth in Section 7.6(B).

“Back-Up Metering” shall have the meaning set forth in Section 5.3(C).

“Business Day” means any calendar day that is not a Saturday, a Sunday, or a NERC recognized holiday.

“Capacity” means the output potential a machine or system can produce or carry under specified conditions. The capacity of generating equipment is generally expressed in kilowatts or megawatts. Capacity is also referred to as “capability” in the electric power industry and for the purposes of this PPA the terms are synonymous.

“Capacity Resource” means the amount of net generating Capacity associated with the Facility for which Capacity credit may be obtained under applicable planning reserve procedures and requirements. Initially, such requirements are set forth in Module E of the MISO Tariff and MISO Business Practices Manual for Resource Adequacy.

“Change of Control” means any transfer, sale, assignment, pledge or other disposition of the equity ownership of a Party having the result (directly or indirectly and either immediately or subject to the happening of any contingency) of changing the entity or entities which possess the power (directly or indirectly and either immediately or subject to the happening of any contingency) to direct or cause the direction of the management or policies of such Party (from the entity or entities possessing such power as to such Party as of the date of this Agreement), whether such change is voluntary or involuntary on the part of such Party.

“Claimant” shall have the meaning set forth in Section 9.5(B).

“Close of the Business Day” means 5:00 PM on a non-holiday weekday prevailing time for the location of the Facility.

“Code” means the U.S. Internal Revenue Code of 1986, including applicable rules and regulations promulgated there under, as amended from time to time.

“Commencement Date” means the later of (a) thirty-one (31) calendar days after the Effective Date and (b) the earlier of (i) the first day of the month following receipt of URC Approval and (ii) the first day of the month immediately succeeding the date that both Company and Seller are deemed to have waived their respective rights to terminate this PPA pursuant to Sections 6.1(B), and (C).

“Common Facilities Letter Agreement” means that certain letter agreement, dated as of the date hereof, by and among Seller, Company and Ashtabula Wind, LLC.

“Confidential Information” shall have the meaning set forth in Section 20.17(A).

“Contract Year” means any consecutive twelve (12) month period during the Term of this PPA, commencing with the Commencement Date or any of its anniversaries.

“Control Area” means the system of electrical generation, distribution and transmission facilities within which generation is regulated in order to maintain interchange schedules with other such systems.

“Control Signal” means, for any given Dispatch Interval, a Company-generated analog or digital signal sent to the Facility by Company through the EDCC AGC system instructing the Facility to curtail Renewable Energy output for the Facility as provided in the MISO Setpoint for such Dispatch Interval.

“Credit Rating” means the Applicable Rating assigned by the Rating Agencies to the long-term senior unsecured obligations of a Party (or, with respect to Seller, Seller Parent Guarantor) not supported by third party enhancement. For the purposes hereof, “Applicable Rating” shall mean the following:

(A) if the ratings assigned by the Rating Agencies to the long term senior unsecured obligations of a Party (or, with respect to Seller, Seller Parent Guarantor) not supported by third party enhancement are equivalent, or, if only one Rating Agency has assigned a rating to such obligations, such rating(s) shall constitute the “Applicable Rating”;

(B) if the ratings assigned by the Rating Agencies to the long term senior unsecured obligations of a Party (or, with respect to Seller, Seller Parent Guarantor) not supported by third party enhancement are not equivalent, and two Rating Agencies have assigned ratings to such obligations, the lower of the two ratings shall constitute the “Applicable Rating”;

(C) if the ratings assigned by the Rating Agencies to the long term senior unsecured obligations of a Party (or, with respect to Seller, Seller Parent Guarantor) not supported by third party enhancement are separated by one or more than one level(s) of equivalency, and three Rating Agencies have assigned ratings to such obligations, and two of the three ratings are equivalent, then such equivalent rating shall constitute the “Applicable Rating”;

(D) if the ratings assigned by the Rating Agencies to the long term senior unsecured obligations of a Party (or, with respect to Seller, Seller Parent Guarantor) not supported by third party enhancement are separated by more than one level of equivalency, and three Rating Agencies have assigned ratings to such obligations, and none of the three ratings are equivalent, then the middle level rating shall constitute the “Applicable Rating”;

provided, however, that (i) should a rating from a Rating Agency not be available for the long-term senior unsecured obligations of a Party (or, with respect to Seller, Seller Parent Guarantor) not supported by third party enhancement or should it cease to be available during the Term of this PPA, such Party’s (or, with respect to Seller, Seller Parent Guarantor’s) underlying long term debt rating assigned by such Rating Agency shall be utilized to determine the Applicable Rating; (ii) should neither of the aforementioned ratings be available from a Rating Agency or should they cease to be available during the Term of this PPA, such Party’s (or, with respect to Seller, Seller Parent Guarantor’s) issuer/long term issuer rating assigned by such Rating Agency shall be utilized to determine the Applicable Rating; and (iii) should none of the aforementioned ratings be available from a Rating Agency or should they cease to be available during the Term of this PPA, such Party (or, with respect to Seller, Seller Parent Guarantor) shall be deemed not to have a rating from such Rating Agency.

“Curtailment Energy” shall have the meaning set forth in Section 8.2(A).

“Damage Cap” shall have the meaning set forth in Section 12.6.

“DIR” means a dispatchable intermittent resource pursuant to the MISO Tariff, guidelines and protocols.

“Dispatch Interval” means a 5-minute length of time for which MISO issues DIR dispatch instructions for MISO energy market.

“Dispute” shall have the meaning set forth in Section 13.10(A).

“Dispute Notice” shall have the meaning set forth in Section 13.10(A).

“Economic Curtailment” shall have the meaning set forth in Section 8.2(A).

“EDCC” or “Energy Dispatch Control Center” means Company’s merchant and/or operation representatives responsible for dispatch of generating units, including the Facility.

“Effective Date” shall have the meaning set forth in the introductory paragraph.

“Electric Metering Devices” means the meters, metering equipment and data processing equipment used to measure, record or transmit data relating to the Renewable Energy output from the Facility. Electric Metering Devices include the metering current transformers and the metering voltage transformers.

“Eligible Energy Resource” means any resource that qualifies as a renewable energy resource eligible to be certified to receive, claim, own or use Renewable Energy Credits pursuant to the protocols and procedures developed and approved by the MPUC in the M-RETS Program.

“Emergency” means any condition or situation which in the reasonable judgment of the Interconnection Provider, MISO, or MRO (as communicated to Company) that (i) endangers or might endanger life or property or public safety or (ii) affects or might affect the ability of any participant of MRO, or MISO, to maintain safe, adequate and continuous electric service to the Interconnection Provider’s customers or the customers of any participant of MRO, or MISO, and any emergency as defined in the Interconnection Agreement.

“Energy Resource” means the type of interconnection service which allows Seller to connect the Facility to the transmission or distribution system, as applicable, as an Energy Resource as defined by the MISO Tariff, and be eligible to deliver the Facility’s output using the existing firm or non-firm capacity on the transmission system on an as-available basis.

“Environmental Contamination” means the introduction or presence of Hazardous Materials at such levels, quantities or location, or of such form or character, as to constitute a violation of Applicable Law, and present a material risk under Applicable Laws that the Site will not be available or usable for the purposes contemplated by this PPA.

“ERIS” means interconnection service that allows Seller to connect the Facility and Seller’s System to the Interconnection Provider’s System as an “Energy Resource” as defined in the MISO Tariff and allows the Facility to deliver the Energy and Capacity produced by the Facility using existing firm or non-firm capacity on the transmission system on an as-available basis.

“Escrow Account” shall have the meaning set forth in Section 9.5(B).

“Event of Default” shall have the meaning set forth in Article 12.

“Facility” means Seller’s electric generating facility and Seller’s Interconnection Facilities, as identified and described in Article 3 and Exhibit B to this PPA, including all of the following, the purpose of which is to produce electricity and deliver such electricity to the Interconnection Point: Seller’s equipment, buildings, all of the generation facilities, including generators, turbines, step-up transformers, output breakers, facilities necessary to connect to the Interconnection Point and deliver to the Point of Delivery, protective and associated equipment, improvements, and other tangible assets, contract rights, easements, rights of way, surface use agreements and other interests or rights in real estate reasonably necessary for the construction, operation, and maintenance of the electric generating facility that produces the Renewable Energy subject to this PPA.

“Facility Property” shall have the meaning set forth in Section 19.7.

“FERC” means the Federal Energy Regulatory Commission or any successor agency.

“Fitch” means Fitch Ratings, a part of Fitch Group, a jointly-owned subsidiary of Fimalac, S.A. and Hearst Corporation, and its successors and assigns.

“Force Majeure” shall have the meaning set forth in Section 14.1(A).

“Forced Outage” means any condition at the Facility that requires immediate removal of the Facility, or some part thereof, from service, another outage state, or a reserve shutdown state. This type of outage results from immediate mechanical/electrical/hydraulic control system trips and operator-initiated trips in response to Facility conditions and/or alarms.

“Good Utility Practices” means the practices, methods, and acts (including the practices, methods, and acts engaged in or approved by a significant portion of the wind-energy generation industry, MRO or NERC) that, at a particular time, in the exercise of reasonable judgment in light of the facts known or that should reasonably have been known at the time a decision was made, would have been expected to accomplish the desired result in a manner consistent with Applicable Law, permits, codes, standards, equipment manufacturer’s recommendations, reliability, safety, environmental protection, economy, and expedition. With respect to the Facility, Good Utility Practices includes taking reasonable steps to ensure that:

(A) equipment, materials, resources, and supplies, including spare parts inventories, are available to meet the Facility’s needs;

(B) sufficient operating personnel are available at all times and are adequately experienced and trained and licensed as necessary to operate the Facility properly, efficiently, and in coordination with Company and are capable of responding to reasonably foreseeable Emergency conditions whether caused by events on or off the Site;

(C) preventive, routine, and non-routine maintenance and repairs are performed on a basis that ensures reliable, long-term and safe operation, and are performed by knowledgeable, trained, and experienced personnel utilizing proper equipment and tools;

(D) appropriate monitoring and testing are performed to ensure equipment is functioning as designed;

(E) equipment is not operated in a reckless manner or in a manner unsafe to workers, the general public, or the interconnected system or contrary to Applicable Law, permits or without regard to defined limitations such as, flood conditions, safety inspection requirements, operating voltage, current, volt-ampere reactive (VAr) loading, frequency, rotational speed, polarity, synchronization, and/or control system limits;

(F) equipment and components meet or exceed the standard of durability that is generally used for electric generation operations in the region and will function properly over the full range of ambient temperature and weather conditions reasonably expected to occur at the Site and under both normal and Emergency conditions; and

(G) equipment is operated in accordance with applicable permits, licenses and Applicable Laws.

“Governmental Authority” means any federal, state, local or municipal governmental body; any governmental, quasi-governmental, regulatory or administrative agency, commission, body or other authority exercising or entitled to exercise any administrative, executive, judicial, legislative, policy, regulatory or taxing authority or power; or any court or governmental tribunal.

“Guaranteed Availability” shall have the meaning set forth in Section 7.6(A).

“Hazardous Materials” means any substance, material, gas, or particulate matter that is regulated by any local Governmental Authority, any applicable State, or the United States of America, as an environmental pollutant or dangerous to public health, public welfare, or the natural environment including, without limitation, protection of nonhuman forms of life, land, water, groundwater, and air, including any material or substance that is (i) defined as “toxic,” “polluting,” “hazardous waste,” “hazardous material,” “hazardous substance,” “extremely hazardous waste,” “solid waste” or “restricted hazardous waste” under any provision of local, state, or federal law; (ii) petroleum, including any fraction, derivative or additive; (iii) asbestos; (iv) polychlorinated biphenyls; (v) radioactive material; (vi) designated as a “hazardous substance” pursuant to the Clean Xxxxx Xxx, 00 X.X.X. §0000 et seq. (33 U.S.C. §1251); (vii) defined as a “hazardous waste” pursuant to the Resource Conservation and Xxxxxxxx Xxx, 00 X.X.X. §0000 et seq. (42 U.S.C. §6901); (viii) defined as a “hazardous substance” pursuant to the Comprehensive Environmental Response, Compensation, and Liability Act, 42 U.S.C. §9601 et seq. (42 U.S.C. §9601); (ix) defined as a “chemical substance” under the Toxic Substances Xxxxxxx Xxx, 00 X.X.X. §0000 et seq. (15 U.S.C. §2601); or (x) defined as a pesticide under the Federal Insecticide, Fungicide, and Xxxxxxxxxxx Xxx, 0 X.X.X. §000 et seq. (7 U.S.C. §136).

“Indemnified Party” shall have the meaning set forth in Section 17.1.

“Indemnifying Party” shall have the meaning set forth in Section 17.1.

“Interconnection Agreement” means, collectively, (i) the separate agreement between Seller and Interconnection Provider dated December 14, 2010, for interconnection of the Facility to the Interconnection Provider’s System, and (ii) the separate agreement between Seller (as assignee pursuant to that certain Assignment and Assumption Agreement, dated as December 22, 2010, by and between Ashtabula Wind, LLC, as assignor, and Seller, as assignee) and Interconnection Provider dated October 17, 2008, for interconnection of the Facility to the Interconnection Provider’s System, as such agreements may be amended from time to time. For purposes of this PPA, the Interconnection Agreement shall be interpreted to include any other agreement required by the Interconnection Provider to interconnect the Facility. For the avoidance of doubt, “Interconnection Agreement” excludes any temporary interconnection agreement or any agreement where the Transmission Provider may limit the operational output of the Facility.

“Interconnection Facilities” means Interconnection Provider’s Interconnection Facilities and Seller’s Interconnection Facilities.

“Interconnection Point” means the 230kV terminal dead-end assembly located in the Maple River Substation 230kV substation near Maple River, North Dakota physical point at which electrical interconnection is made between the Facility and the Interconnection Provider’s System as defined in the Interconnection Agreement.

“Interconnection Provider” means MPC, or any successor thereto responsible under the Interconnection Agreement for providing the transmission lines, Interconnection Provider’s Interconnection Facilities and other equipment and facilities with which the Facility interconnects at the Interconnection Point.

“Interconnection Provider’s Interconnection Facilities” means the facilities necessary to connect Interconnection Provider’s existing electric system to the Interconnection Point, including breakers, bus work, bus relays, and associated equipment installed by the Interconnection Provider for the direct purpose of interconnecting the Facility, along with any easements, rights of way, surface use agreements and other interests or rights in real estate reasonably necessary for the construction, operation and maintenance of such facilities. Arrangements for the installation and operation of the Interconnection Provider’s Interconnection Facilities shall be governed by the Interconnection Agreement.

“Interconnection Provider’s System” means the contiguously interconnected electric transmission and sub-transmission facilities, including Interconnection Provider’s Interconnection Facilities, over which the Interconnection Provider has rights (by ownership or contract) to provide bulk transmission of capacity and energy from the Interconnection Point to the Point of Delivery.

“Investment Grade” means, with respect to a Rating Agency, a Credit Rating without any third party enhancements of (a) BBB- or higher by Standard & Poor’s or Fitch, and (b) Baa3 or higher by Moody’s.

“Issuer” shall have the meaning set forth in Section 11.1(E).

“kW” means kilowatt.

“kWh” means kilowatt hour.

“Lender Consent” shall have the meaning set forth in Section 19.2.

“Local Provider” shall have the meaning set forth in Section 1.3.

“MISO” means the Midwest Independent System Operator, Inc., a non-profit, Delaware corporation, or successor organization.

“MISO Setpoint” means, with respect to any Dispatch Interval, the power output setpoint provided by MISO to Company and Seller for the purpose of controlling the net power output of the Facility for such Dispatch Interval.

“MISO Tariff” means the MISO Open Access, Transmission, Energy and Operating Reserves Markets Tariff, as amended from time to time.

“Moody’s” means Xxxxx’x Investor Services, Inc., and its successors and assigns.

“MPC” means Minnkota Power Cooperative, Inc., and its successors and assigns.

“M-RETS Program” means the Midwest Renewable Energy Trading System program.

“MRO” means the Midwest Reliability Organization, a NERC regional reliability counsel, or any successor organization.

“MW” means megawatt or one thousand kW.

“MWh” means megawatt hours.

“Nameplate Capacity” means the designed maximum output of each Wind Turbine as designated by the turbine manufacturer, or the sum of such output for the Facility, which shall equal 62.4 MW.

“NERC” means the North American Electric Reliability Council or any successor organization.

“Network Resource” means the applicable amount of capacity for the Facility that has been designated for resource adequacy as a “Network Resource” under Module E of the MISO Tariff.

“Network Resource Interconnection Service” or “NRIS” means the interconnection of the Facility to the transmission system in a manner that would allow it to qualify as a Network Resource.

“New Joint Transmission Authority” means any independent service organization or other Person that may be created or becomes operational subsequent to the date of this PPA and that is empowered or authorized to plan, coordinate, operate, regulate or otherwise manage any or all of the Interconnection Provider’s system, whether in place of, or in addition to, MRO or MISO.

“Non-Compensable Curtailment” shall have the meaning set forth in Section 8.2(C).

“On-Peak Months” means the months of January, February, June, July, August, September and December.

“Operating Committee” means one representative each from Company and Seller pursuant to Section 10.5.

“Operating Procedures” means those procedures developed pursuant to Section 10.5, if any.

“Operating Records” means all agreements associated with the Facility, operating logs, blueprints for construction, operating manuals, all warranties on equipment, and all documents, whether in printed or electronic format, that Seller uses or maintains for the operation of the Facility.

“Option” shall have the meaning set forth in Section 19.7.

“Option Agreement” means that certain Option Agreement, dated as of the date hereof, by and between Seller and Company, a copy of which is attached hereto as Exhibit K.

“Park Potential” means the number provided to the Company in real time through the Company’s SCADA System in accordance with the AGC Protocols, which depicts Seller’s real time calculation of the Potential Energy capable of being provided by the Facility to Company as measured at the Point of Delivery. Park Potential shall be calculated as the aggregate energy available in real time for delivery at the Point of Delivery using the best-available data obtained through commercially reasonable methods; and shall be dependent upon measured wind speeds, power curves, Wind Turbine availability, and derate(s) and transmission line losses, and any other adjustment necessary to accurately reflect the Potential Energy at the Point of Delivery.

“Party” and “Parties” shall have the meanings set forth in the introductory paragraph.

“Party Representative” and “Parties’ Representatives” shall have the meanings set forth in Section 13.10(A).

“Pending Facility Transaction” or “PFT” shall have the meaning set forth in Section 19.3(B).

“PFT Notice” shall have the meaning set forth in Section 19.3(B)(2).

“Point of Delivery” means the point at the Maple River Substation 230kV line electric system point at which Seller makes available to Company and delivers to Company the Renewable Energy being provided by Seller to Company under this PPA. The Point of Delivery shall be at a location within MISO’s operational control, subject to the MISO Tariff, and specified in Exhibit B to this PPA.

“Potential Energy” means the quantity of the energy that Seller is capable of delivering at the Point of Delivery. In the event that Park Potential is not a reliable proxy for Potential Energy pursuant to Section 8.2(B), Potential Energy shall be calculated as the aggregate energy available for delivery at the Point of Delivery using the best-available data obtained through commercially reasonable methods; and shall be dependent upon measured wind speeds, power curves, Wind Turbine availability, and derate(s) and transmission line losses, and any other adjustment necessary to accurately reflect the Facility’s capability to produce and deliver energy to the Point of Delivery.

“Purchase and Sale Agreement” shall have the meaning set forth in the Option Agreement.

“Rating Agency” means each of Standard & Poor’s, Fitch or Moody’s.

“Renewable Energy” means all electric energy exclusively generated by the Facility (which is electric energy derived from an Eligible Renewable Energy Resource) including any and all associated Renewable Energy Credits and delivered to the Point of Delivery as measured by the Electric Metering Devices installed pursuant to Section 5.3. Renewable Energy shall be of a power quality of 60 cycle, three-phase alternating current that is compliant with the Interconnection Agreement.

“Renewable Energy Credits” or “RECs” shall mean any contractual right to the full set of non-energy attributes, including any and all credits, benefits, emissions reductions, offsets, and allowances, howsoever entitled, directly attributable to a specific amount of capacity and/or electric energy generated from an Eligible Energy Resource, including any and all environmental air quality credits, benefits, emissions reductions, off-sets, allowances, or other benefits as may be created or under any existing or future statutory or regulatory scheme (federal, state, or local) by virtue of or due to the Facility’s actual energy production or the Facility’s energy production capability because of the Facility’s environmental or renewable characteristics or attributes, including any Renewable Energy Credits or similar rights arising out of or eligible for consideration in the M-RETS Program. For the avoidance of doubt, RECs excludes (i) any local, state or federal depreciation deductions, grants available under Section 1603 of the American Recovery and Reinvestment Act, or other tax credits providing a tax benefit to Seller based on ownership of, or energy production from, any portion of the Facility, including the investment tax credit that may be available to Seller with respect to the Facility under Applicable Laws, or cash grants in lieu of such credits or benefits, and (ii) depreciation and other tax benefits arising from ownership or operation of the Facility unrelated to its status as a generator of renewable or environmentally clean energy.

“Renewable Energy Payment Rate” shall have the meaning set forth in Section 8.1.

“Replacement Energy Costs” means the aggregate positive amount equal to (i) the costs incurred by Company, after the Commencement Date, for the Renewable Energy that is necessary to replace that which Seller, in accordance with this PPA, was required to have produced at the Facility and deliver to Company, but failed to so provide, less (ii) the sum of any payments from Company to Seller, under this PPA, that were eliminated as a result of such failure. Replacement Energy Costs include the amounts paid or incurred by Company for replacement renewable energy, or replacement energy plus RECs, transmission of energy, and directly associated transaction costs (including reasonable attorneys’ fees suffered as a result of Seller’s failure to perform), all determined in a commercially reasonable manner and in accord with market value in MISO.

“ROFO” shall have the meaning set forth in Section 19.7.

“ROFO Notice” shall have the meaning set forth in Section 19.7(B).

“SCADA” means supervisory control and data acquisition.

“Scheduled Outage/Derating” means a planned interruption/reduction of the Facility’s generation that both (i) has been coordinated in advance with Company, with a mutually agreed start date and duration, and (ii) is required for inspection or preventive or corrective maintenance.

“Security Fund” means the letter of credit, escrow fund, guaranty and/or other collateral that a Party is required to establish and maintain, pursuant to Article 11, as security for its performance under this PPA.

“Seller’s Interconnection Facilities” means the equipment between the high side disconnect of the step-up transformer and the Interconnection Point, including all related relaying protection and physical structures as well as all transmission facilities required to access the Interconnection Provider’s System at the Interconnection Point, along with any easements, rights of way, surface use agreements and other interests or rights in real estate reasonably necessary for the construction, operation and maintenance of such facilities. On the low side of the step-up transformer it includes Seller’s metering, relays, and load control equipment as provided for in the Interconnection Agreement. This equipment is located within the Facility and is conceptually depicted in Exhibit B to this PPA.

“Seller

Parent Guarantor” means NextEra Energy Capital Holdings, Inc., or any successor thereto.

“Shared Facilities Agreement” means that certain Shared Facilities Agreement, dated as of November 30, 2010, among Ashtabula Wind, LLC and Seller.

“Site” means the parcel of real property on which the Facility is located, including any easements, rights of way, surface use agreements and other interests or rights in real estate reasonably necessary for the construction, operation and maintenance of the Facility. The Site is more specifically described in Section 3.2 and Exhibit B to this PPA.

“Special Facilities Service Agreement” means that certain Service Agreement for Special Facilities Use Service Between Minnkota Power Cooperative, Inc. and Ashtabula Wind III, LLC, dated as of December 14, 2010, by and between MPC and Seller.

“Special Facilities Use Charge” means the collective charge provided for in Section 8.1 of the Specifications for Special Facilities Use Service attached to the Special Facilities Service Agreement.

“Standard & Poor’s” means Standard & Poor’s Rating Service, a division of McGraw Hill Incorporated, and its successors and assigns.

“Station Service” shall have the meaning set forth in Section 1.3.

“Tax Equity Investor” means an equity investor in the Facility that is not an Affiliate of Seller prior to the execution of the Unaffiliated Investment Documents, whose investment in the Facility is intended to be consistent with the Safe Harbor for wind transactions under Revenue Procedure 2007-65 and Announcement 2009-69.

“Term” means the period of time during which this PPA shall remain in full force and effect, and which is further defined in Article 2.

“Transmission Owner” shall have the meaning set forth in the Interconnection Agreement.

“Transmission Provider” means collectively, Transmission Owner and MISO.

“UCP” shall have the meaning set forth in Section 11.1(E)(1).

“Ultimate Parent Entity” shall have the meaning set forth in Section 19.3.

“Unaffiliated Facility Investment” means the obligations pursuant to the Unaffiliated Investment Documents, including distributions, indemnities, principal of, premium and interest on indebtedness, fees, expenses or penalties, amounts due upon acceleration, prepayment or restructuring, swap or interest rate hedging breakage costs and any claims of interest due with respect to any of the foregoing. For the avoidance of doubt, Unaffiliated Facility Investment shall include tax equity transactions.

“Unaffiliated Facility Investor” means, collectively, any lender(s) and any Tax Equity Investors providing any Unaffiliated Facility Investment and any successors and assigns thereof.

“Unaffiliated Investment Documents” means the documents associated with the investment by the Tax Equity Investors and the loan and credit agreements, notes, bonds, indentures, security agreements, lease financing agreements, mortgages, deeds of trust, interest rate exchanges, swap agreements and other documents relating to the development, bridge, construction or permanent debt financing for the Facility, including any credit enhancement, credit support, working capital financing, or refinancing documents, and any and all amendments, modifications, or supplements to the foregoing that may be entered into from time to time at the discretion of Seller, and in compliance with this Agreement, in connection with development, construction, ownership, leasing, operation or maintenance of the Facility.

“Utility Regulatory Commissions” or “URC” means the Minnesota Public Utilities Commission (MPUC), the North Dakota Public Service Commission (NDPSC) and the South Dakota Public Utilities Commission (SDPUC), or any successor agencies.

“URC Approval” shall have the meaning set forth in Section 6.1(A).

“Wind Turbines” means those electric generating devices powered by the wind that are included in the Facility.

Article 2. Term and Termination

This PPA shall become effective as of the date of its execution, and shall remain in full force and effect until the twenty-fifth (25th) anniversary of the Commencement Date, subject to any early termination or extension provisions set forth herein. Applicable provisions of this PPA shall continue in effect after termination, including early termination, to the extent necessary to enforce or complete the duties, obligations or responsibilities of the Parties arising prior to termination and, as applicable, to provide for: final xxxxxxxx and adjustments related to the period prior to termination, repayment of any money due and owing to either Party pursuant to this PPA, repayment of principal and interest associated with security funds, and the indemnifications specified in this PPA.

Article 3. Facility Description

Seller, owns and operates, and maintains the Facility, which consists of 39 GE 1.6 xle wind turbines and associated equipment having a Facility Nameplate Capacity of approximately 62.4 MW. Exhibit B to this PPA, provides a detailed description of the Facility, including identification of the equipment and components which make up the Facility. Within ninety (90) days after the Effective Date, Seller shall provide to Company an as built site plan that identifies the locations of the Wind Turbines that comprise the Facility.

The Facility shall be located on the Site and shall be identified as Seller’s Ashtabula Wind III Facility. The address of the Facility is 00000 00xx Xx XX, Xxxxxxx, XX 00000. A scaled map that identifies the Site, the location of the Facility at the Site, the location of the Interconnection Point and the location of the important ancillary facilities and Interconnection Facilities, is included in Exhibit B to this PPA.

|

|

3.3.

|

General Design of the Facility

|

During the Term, Seller shall maintain the Facility according to Good Utility Practice(s). The Facility shall at all times:

(A) have the required panel space and 125VDC battery supplied voltage to accommodate Company’s metering, generator telemetering equipment and communications equipment;

(B) use communication circuits from the Facility to Company’s EDCC for the purpose of telemetering, supervisory control/data acquisition, and voice communications as required by Company.

(C) be capable of accepting a signal from the Company’s SCADA System designed to limit Renewable Energy output to a level not to exceed the AGC Set-Point, which AGC Set-Point may be increased or decreased in accordance with the AGC Protocols;

(D) have each Wind Turbine equipped with meteorological measurement equipment (e.g. anemometers) which are individually linked to Seller’s plant information system;

(E) send the real time data specified on Exhibit I to Company’s Primary and Backup Transmission Dispatch Center;

(F) be capable of receiving and reacting to the SCADA AGC Set-Point signal; and

(G) be capable of AGC Remote/Local.

Article 4. [Intentionally Left Blank]

Article 5. Delivery and Metering

|

|

5.1.

|

Delivery Arrangements

|

(A) [Intentionally Left Blank]

(B) [Intentionally Left Blank]

(C) Seller shall be responsible for all interconnection, electric losses, transmission and ancillary service arrangements and costs required to deliver, on a firm transmission service basis, the Renewable Energy from the Facility to the Point of Delivery.

(D) Company shall be responsible for all electric losses, transmission and ancillary service arrangements and costs required to receive the Renewable Energy at and beyond the Point of Delivery and deliver such energy to points beyond the Point of Delivery. If at any time during the Term, either Company or the entity owning the transmission facilities at the Point of Delivery ceases to be a member of MISO or the facilities at the Point of Delivery cease to be subject to the MISO Tariff, then the Parties shall cooperate in good faith to amend this PPA in a manner to facilitate the delivery of Renewable Energy from the Point of Delivery to Company’s customers in a manner that preserves the benefits and burdens to both Parties as originally contemplated in this Agreement.

|

|

5.2.

|

Availability Reporting

|

Seller shall be responsible for providing accurate and timely updates on the current availability of the Facility to Company’s EDCC.

|

|

5.3.

|

Electric Metering Devices.

|

(A) The following provisions of this Section shall govern Electric Metering Devices except to the extent the Interconnection Agreement modifies or otherwise conflicts with these provisions.

(B) All Electric Metering Devices used to measure the Renewable Energy made available to Company by Seller under this PPA and to monitor and coordinate operation of the Facility shall be owned, installed, and maintained in accordance with the Interconnection Agreement at no cost to Company under this PPA. If Electric Metering Devices are not installed at the Point of Delivery, meters or meter readings will be adjusted to reflect losses from the Electric Metering Devices to the Point of Delivery based initially on the amount specified by the manufacturer for expected losses, provided, however, that the Operating Committee may revise this loss adjustment based on actual experience. Seller shall provide or arrange with the Interconnection Provider to provide Company access to all Electric Metering Devices for all purposes necessary to perform under this PPA and shall provide Company the reasonable opportunity to be present at any time when such Electric Metering Devices are to be inspected and tested or adjusted. Seller shall provide Company with all authorizations necessary to have access to the Electric Metering Devices, including obtaining any consent or other agreement from the Interconnection Provider necessary to allow Company such access.

(C) Either Company or Seller may elect to install and maintain, at its own expense, backup metering devices (“Back-Up Metering”) in addition to the Electric Metering Devices, which installation and maintenance shall be performed in a manner acceptable to Company. The installing Party, at its own expense, shall inspect and test Back-Up Metering upon installation and at least annually thereafter. The installing Party shall provide the other Party with reasonable advance notice of, and permit a representative of the other Party to witness and verify, such inspections and tests, provided, however, that such Party shall not unreasonably interfere with or disrupt the activities of the installing Party and shall comply with all applicable safety standards. Upon written request, the installing Party shall perform additional inspections or tests of Back-Up Metering and shall permit a qualified representative of the requesting Party to inspect or witness the testing of Back-Up Metering, provided, however, that the requesting Party shall not unreasonably interfere with or disrupt the activities of the installing Party and shall comply with all applicable safety standards. The actual expense of any such requested additional inspection or testing shall be borne by the Party requesting the test, unless, upon such inspection or testing, Back-Up Metering is found to register inaccurately by more than the allowable limits established in this Article, in which event the expense of the requested additional inspection or testing shall be borne by the installing Party. If requested in writing, the installing Party shall provide copies of any inspection or testing reports to the requesting Party.

(D) If any Electric Metering Devices, or Back-Up Metering, are found to be defective or inaccurate outside the bounds of the selected device’s manufacturer’s performance standards, they shall be adjusted, repaired, replaced, and/or recalibrated as near as practicable to a condition of zero error by the Party owning such defective or inaccurate device and at that Party’s expense.

|

|

5.4.

|

Adjustment for Inaccurate Meters

|

If an Electric Metering Device, or Back-Up Metering, fails to register, or if the measurement made by an Electric Metering Device, or Back-Up Metering, is found upon testing to be inaccurate by more than one percent (1.0%), an adjustment shall be made correcting all measurements by the inaccurate or defective Electric Metering Device, or Back-Up Metering, for both the amount of the inaccuracy and the period of the inaccuracy, in the following manner:

(A) In the event that the Electric Metering Device is found to be defective or inaccurate, the Parties shall use Back-up Metering, if installed, to determine the amount of such inaccuracy, provided, however, that Back-Up Metering has been tested and maintained in accordance with the provisions of this Article. If Back-Up Metering is installed on the low side of Seller’s step-up transformer, the Back-Up metering data shall be adjusted for losses in the same manner as for the Electric Metering Devices. In the event that Back-Up Metering is not installed, or Back-Up Metering is also found to be inaccurate by more than one percent (1.0%), the Parties shall use the SCADA data collected at each Wind Turbine in the Facility for the period of inaccuracy, adjusted as agreed by the Parties for losses occurring between each Seller and the Point of Delivery. If such SCADA data is incomplete or unavailable, the Parties shall estimate the amount of the necessary adjustment on the basis of deliveries of Renewable Energy from the Facility and to the Point of Delivery during periods of similar operating conditions when the Electric Metering Device was registering accurately. The adjustment shall be made for the period during which inaccurate measurements were made.

(B) In the event that the Parties cannot agree on the actual period during which the inaccurate measurements were made, the period during which the measurements are to be adjusted shall be the shorter of (i) the last one-half of the period from the last previous test of the Electric Metering Device to the test that found the Electric Metering Device to be defective or inaccurate, or (ii) the one hundred eighty (180) Days immediately preceding the test that found the Electric Metering Device to be defective or inaccurate.

(C) To the extent that the adjustment period covers a period of deliveries for which payment has already been made by Company, Company shall use the corrected measurements as determined in accordance with this Article to recompute the amount due for the period of the inaccuracy and shall subtract the previous payments made by Company for this period from such re-computed amount. If the difference is a positive number, the difference shall be paid by Company to Seller; if the difference is a negative number, that difference shall be paid by Seller to Company, or at the discretion of Company, may take the form of an offset to payments due Seller by Company. Payment of such difference by the owing Party shall be made not later than thirty (30) Days after the owing Party receives notice of the amount due, unless Company elects payment via an offset.

Article 6. Conditions Precedent

|

|

6.1.

|

Utility Regulatory Commissions Approval

|

(A) No earlier than fifteen (15) Days prior to the Effective Date and no later than forty five (45) Days after the Effective Date, Company may request an affirmative determination from the URC that Company’s execution of this PPA is reasonable, in the public interest, and all costs incurred under this PPA are recoverable from Company’s retail customers; provided, however, that the URC approval shall not be deemed to fail to satisfy the requirement of this paragraph merely because it provides that the URC retains ongoing prudency review of Company’s performance hereunder (generally, “URC Approval”). Company shall use commercially reasonable efforts to obtain URC Approval, if requested, and Seller shall cooperate reasonably with Company’s efforts to seek URC Approval. If Company fails to apply for URC Approval within forty-five (45) days following the date of this PPA, Company shall be deemed to have waived its rights under this Section.

(B) In the event that Company timely applies for URC Approval under paragraph (A) of this Section, Company shall have the right to terminate this PPA, without any further financial or other obligation to Seller as a result of such termination, by notice to Seller at any time after the earlier of (i) ten (10) Days following receipt of written orders from the URC, or (ii) six (6) months following the filing of this PPA with the URC; in either case that Company has been unable to obtain URC Approval without conditions unsatisfactory to Company. Absent such notice of termination by Company on or before the referenced date, Company shall be deemed to have waived its rights under this Section, and this PPA shall remain in full force and effect thereafter.

(C) In the event that Company timely applies for URC Approval under paragraph (A) of this Section, Seller shall have the right to terminate this PPA, without any further financial or other obligation to Company as a result of such termination, by notice to Company at any time after the earlier of (i) ten (10) Days following receipt of written orders from the URC, or (ii) six (6) months following the filing of this PPA with the URC; in either case that Company has been unable to obtain URC Approval without conditions reasonably unsatisfactory to Seller. Absent such notice of termination by Seller on or before the referenced date, Seller shall be deemed to have waived its rights under this Section, and this PPA shall remain in full force and effect thereafter.

Article 7. Sale and Purchase of Renewable Energy

Beginning on the Commencement Date, Seller shall generate from the Facility, deliver to the Point of Delivery, and sell to Company, at the applicable price set forth in Section 8.1, all Renewable Energy generated by the Facility. For the avoidance of doubt, except as otherwise expressly provided for herein, this PPA shall not be construed to constitute a ‘take or pay’ contract and Company shall have no obligation to pay for any energy that has not actually been generated by the Facility, measured by the Electric Metering Device(s), and delivered to Company at the Point of Delivery, except as otherwise expressly provided in this PPA.

|

|

7.3.

|

Title and Risk of Loss

|

As between the Parties, Seller shall be deemed to be in control of the Renewable Energy output from the Facility up to and until delivery and receipt at the Point of Delivery and Company shall be deemed to be in control of such Renewable Energy from and after delivery and receipt at the Point of Delivery. Title and risk of loss related to the Renewable Energy shall transfer from Seller to Company at the Point of Delivery.

|

|

7.4.

|

AGC and Company’s Right to Curtail Energy

|

(A) Beginning on the Commencement Date, Company shall dispatch Facility through the EDCC AGC system, pursuant to which Company shall (i) provide to Seller the MISO Set Point for any given Dispatch Interval and (ii) provide to Seller, simultaneously with the provision of the MISO Set Point, a Control Signal for such Dispatch Interval within one (1) minute of Seller’s receipt of the MISO Setpoint for such Dispatch Interval in the event that Seller is to curtail the Facility consistent with such MISO Set Point during such Dispatch Interval. For the avoidance of doubt, in the event that Company does not provide to Seller a Control Signal for any given Dispatch Interval, Seller shall not be required to curtail the Facility during such Dispatch Interval, subject to Company’s rights to curtail pursuant to Section 7.4(B). Company shall compensate Seller as set forth in Section 8.2, for compensable Curtailment Energy associated therewith.

(B) Company may notify Seller, by telephonic communication or through use of the AGC Set Point, to curtail the delivery of Renewable Energy to Company from the Facility and to the Point of Delivery, for any reason and in its sole discretion and Seller shall immediately comply with such notification; provided, however, that no Force Majeure event affecting Seller has occurred and is continuing that prevents compliance with such Company directed curtailment. Company shall compensate Seller as set forth in Section 8.2, for compensable Curtailment Energy associated with curtailments pursuant to this Section 7.4.

(C) Seller shall ensure that, throughout the Term, the SCADA signal is capable of functioning on all AGC Set Points within the margin of error specified in the wind farm control system manufacturer’s energy set point margin of error.

(D) Seller shall ensure that Facility AGC Remote/Local status is in “Remote” set-point control during normal operations.

Company, or Company’s Market Participant (defined in the MISO Tariff or MISO guidelines, protocols or other operating procedures and rules), shall be responsible for the scheduling of all Renewable Energy during the Term, including, without limitation, arranging any Open Access Same Time Information Systems (OASIS), tagging, transmission scheduling, coordinating with MISO with respect to the Facility being a DIR or similar protocols with MISO or any other Persons. Company shall be responsible for the payment of all charges associated with such scheduling activities, including, without limitation, any imbalance charges that are not a result of Seller’s failure to deliver Renewable Energy in accordance with the provisions herein. Company, or Company’s Market Participant, shall be responsible for the energy market settlement of all Renewable Energy during the Term; including all costs associated therewith. Company agrees to retain the registration of the commercial pricing node associated with the Facility in the name of Company or Company’s Market Participant throughout the Term and shall not transfer such registration to any other party without the consent of Seller (not to be unreasonably withheld in the case of a proposed transfer to an Affiliate of Company).

(A) Seller guarantees that, with respect to any Availability Period, the Availability of the Facility shall be at least [**]% (the “Guaranteed Availability”), calculated in accordance with Exhibit J hereto.

(B) If

the Availability in any given Availability Period falls below the Guaranteed Availability for that Availability Period, on a

twenty-four (24) month rolling average basis in accordance with Exhibit

J, utilizing (i) data from the most recent previous 24-month period, or (ii) if the most recent twenty-four (24) months of data

is not then available, the assumed twenty-four (24) month total calculated pursuant to Section 7.6(C) below, the resulting shortfall

shall be the “Availability Shortfall”,

and Seller shall pay Company liquidated damages as calculated pursuant to Exhibit

J hereto (“Availability

Damages”); provided,

however, that the aggregate Availability Damages payable by Seller with respect to any Contract Year shall not exceed

$[**] and the aggregate Availability Damages payable by Seller with respect to the Term shall not exceed

$[**]. Each Party agrees and acknowledges that (a) the damages that Company would incur due to the

Facility’s failure to achieve the Guaranteed Availability would be difficult or impossible to measure with certainty

and (b) the liquidated damages contemplated by this provision are a fair and reasonable calculation of such damages, and (c)

the required payment by Seller of such liquidated damages shall be Company’s sole remedies for such Availability

Shortfall.

[**] Denotes confidential information that has been omitted from the exhibit and filed separately, accompanied by a confidential treatment request, with the Securities and Exchange Commission pursuant to Rule 24b-2 of the Securities Exchange Act of 1934

(C) Upon the commencement of the thirteenth month following the Commencement Date, the Parties shall calculate an assumed twenty-four (24) month Availability in accordance with this Section 7.6(C). It shall be assumed that in the first twelve months

following the Commencement Date (“Initial Period”) the Availability was equal to the greater of (i) the Initial Period’s Availability based upon actual 12-month data for the Initial Period, or (ii) [**] percent ([**]%). This amount shall be doubled to determine a base for 24 months of assumed Availability. Thereafter, each month’s Availability will replace 1/24th of the initial total and for the remainder of the Term actual Renewable Energy delivery data shall be used on a 24-month rolling average basis for the calculation.