RETIREMENT AND TRANSITION SERVICES AGREEMENT THIS RETIREMENT AND TRANSITION SERVICES AGREEMENT (this “Agreement”) is made and entered into this 15th day of April 2021, by and between MITCHELL B. LEWIS (“Executive”) and BLUELINX CORPORATION, a Georgia...

RETIREMENT AND TRANSITION SERVICES AGREEMENT THIS RETIREMENT AND TRANSITION SERVICES AGREEMENT (this “Agreement”) is made and entered into this 15th day of April 2021, by and between XXXXXXXX X. XXXXX (“Executive”) and BLUELINX CORPORATION, a Georgia corporation (“Company”). The term “Company,” when used in this Agreement, includes its parent, subsidiaries or affiliates (including specifically BlueLinx Holdings Inc.) and their respective predecessors, successors, and assigns. Executive and Company are sometimes hereinafter referred to together as the “Parties” and individually as a “Party.” BACKGROUND: A. Executive is employed as the President and Chief Executive Officer of Company. The terms of Executive’s employment are governed by that certain Employment Agreement dated January 15, 2014 by and among Company, Executive and, with respect to Sections 3(a), 3(b) and 3(e) therein, BlueLinx Holdings Inc., as amended by that certain First Amendment to Employment Agreement dated June 8, 2018 by and between Company and Executive (the “Employment Agreement”). B. Executive’s employment will terminate in certain capacities as of the Retirement Date (as defined below) and all remaining employment capacities as of the Termination Date (as defined below). NOW, THEREFORE, FOR AND IN CONSIDERATION of the premises, the mutual promises, covenants and agreements contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows: 1. Retirement. Executive will retire as President and Chief Executive Officer of Company effective on the date that a new Chief Executive Officer and President takes office (the “Retirement Date”); provided however, that Executive shall remain an employee of Company through December 31, 2021 (the “Termination Date”) in order to continue providing transition services as contemplated in Section 2 below. Until the Retirement Date and except as otherwise stated herein, Executive’s employment will continue to be governed by this Agreement and his Employment Agreement; thereafter and through the Termination Date and except as otherwise stated herein, Executive’s employment will be governed by this Agreement. Though Executive shall remain employed at Company through the Termination Date, Executive agrees to resign from any corporate office or official position of any kind that he holds with Company, in each case, effective as of the Retirement Date; provided, however, that Executive shall remain a director of the Board until the next annual meeting of the stockholders of BlueLinx Holdings Inc. as further described in Section 3 below. DocuSign Envelope ID: 64FD2F5B-9B7A-4B97-8625-78EDBBD0A716

2. Transition Services. Executive will remain President and Chief Executive Officer of Company until the Retirement Date and will perform such duties and functions in his normal capacity as the President and Chief Executive Officer. Thereafter and through the Termination Date, Executive shall remain an employee of Company and perform such additional services as the successor President and Chief Executive Officer and/or Board shall reasonably request from time to time. 3. Continuance as Director. Executive shall remain a director of BlueLinx Holdings Inc.’s Board of Directors (“Board”) until the next annual meeting of stockholders of BlueLinx Holdings Inc. for no additional compensation. After the Termination Date and for so long as Executive is a non-employee director of the Board, Executive will be paid as a non-employee director of the Board under the Board compensation program. 4. Future Cooperation. Executive agrees that for the period beginning on the Termination Date and ending on December 31, 2023, upon reasonable advance notice by Company, Executive will make himself reasonably available to Company for the purposes of: (a) providing information regarding the projects and files on which Executive worked for the purpose of transitioning such projects; (b) providing information regarding any other matter, file, project, customer and/or client with whom or with respect to which Executive was directly involved or otherwise had knowledge about while employed by, or providing services to, Company; and (c) cooperating in the investigation, negotiations and/or defense of any claims of which he may have knowledge, including, but not limited to providing truthful testimony. In the event Executive is subpoenaed by any person or entity to give testimony which in any way relates to Executive’s employment by Company, Executive agrees to provide prompt notice of such request to Company and will use his reasonable best efforts to make no disclosures until Company has a reasonable opportunity to contest the right of the requesting person or entity to such disclosure. However, no notice shall be required if Executive is prohibited by law from providing such notice. Company shall promptly reimburse Executive for any reasonable expense that he incurs in connection with providing the cooperation called for under this Section 4. 5. Compensation. (a) In exchange for Executive’s transition services contemplated in this Agreement, Executive’s confirmation of the continued effect of his restrictive covenants, full release of Company in a form of Release reasonably agreed to between the Company and Executive (the “Release”) to be executed by Executive, and Executive’s agreement to perform the other duties and obligations of Executive contained herein, Company will provide the additional consideration set forth below, subject to ordinary and lawful deductions and Sections 5(b) and (c) below. (i) Company shall pay Executive his annual base salary through June 30, 2021 in accordance with Company’s normal bi-weekly payroll practices; (ii) Company shall pay Executive $20,000 per month and provide such benefits as other salaried employees of Company receive from July 1, 2021 through December 31, 2021 for the transition services described in Section 2 above in accordance with Company’s normal bi-weekly payroll practices; DocuSign Envelope ID: 64FD2F5B-9B7A-4B97-8625-78EDBBD0A716

(iii) Company shall pay to Executive a pro rata bonus, which equals the bonus that would be payable to Executive under the terms of Company’s annual bonus plan for fiscal year 2021 had Executive remained employed at Company as President and CEO through the end of fiscal year 2021 (if any), multiplied by 50%. The pro rata bonus amount, if any, shall be based on Executive’s base salary and bonus percentage as of March 31, 2021 and be paid at the time that 2021 annual bonuses are paid to other participants in such bonus plan; (iv) (a) Company shall (a) ensure that all performance-based restricted stock units granted to Executive in 2018 and 2019 continue to vest in accordance with their terms and, if Executive is no longer employed by Company at the time such restricted stock units vest, then such restricted stock units shall continue to vest in accordance with their terms and become non-forfeitable in the same manner and at the same time as if Executive had remained employed by Company, and (b) ensure that all time-based restricted stock units granted to Executive in 2018, 2019 and 2020 that are scheduled to vest in (1) 2021 vest in accordance with their terms and become non-forfeitable on their scheduled vesting date, and (2) 2022 vest and become non-forfeitable on the same scheduled vesting date as the time-based restricted stock units described in Section 5(a)(iv)(b)(1) above, and (c) ensure that all other time-based and/or performance-based restricted stock units granted to Executive as of the date of this Agreement and scheduled to vest after 2022 will be forfeited on the Termination Date. For purposes of clarity, all restricted stock units held by Executive as of the date hereof that are scheduled to vest in June 2021 shall not be considered additional consideration; and (v) If, after the Termination Date, Executive timely elects to continue health (medical and dental) plan coverage for himself and/or any qualified beneficiary under the federal Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA), Company will pay a portion of the monthly COBRA premiums equal to Company’s portion of the health insurance premium Company is paying on Executive’s behalf while an active employee as of the Termination Date for eighteen (18) months following the date Executive’s participation in Company’s health plans as an active employee ends (or, if earlier, until Executive becomes eligible for health insurance coverage through a new employer), along with any monthly administrative charges (up to 2% of the entire monthly premium), to the extent permitted by law without adverse tax consequences to Company. During this eighteen (18) month period, Executive will be required to pay the employee portion of the COBRA premium each month. The portion of the premium Company pays on Executive’s behalf will be included in Executive’s taxable income. (b) Notwithstanding anything else contained herein to the contrary, no payments shall be made or benefits delivered under this Agreement (other than payments required to be made by Company pursuant to Section 6 below) unless: (i) within twenty-one (21) days of Executive’s receipt of this Agreement, Executive has signed and delivered to Company this Agreement and the Release, and Executive does not revoke such Release during the applicable revocation period, and; (ii) with respect to any payments made or benefits delivered after June 30, 2021, on the Termination Date, Executive re-executes and delivers to Company the Release (the “Updated Release”). Executive agrees and acknowledges that he would not be entitled to the consideration described herein absent execution of this Agreement, the Release, and expiration of DocuSign Envelope ID: 64FD2F5B-9B7A-4B97-8625-78EDBBD0A716

the applicable revocation periods without Executive having revoked the Release, and with respect to any payments made or benefits delivered after June 30, 2021, the Updated Release. Any payments obligated to be made, or benefits to be delivered, under this Agreement within the period after the Termination Date and prior to the Release Effective Date shall be accumulated and paid in a lump sum, on the first regular payroll date occurring after the Release Effective Date. The “Release Effective Date” shall be the day following the expiration of the applicable revocation period without Executive having elected to revoke the Release. (c) As a further condition to receipt of the payments and benefits in Section 5(a) above, Executive acknowledges that these payments are in lieu of any other amounts that he may claim to be owed to him upon the termination of his employment relationship with Company, other than those specifically set forth in this Agreement, including without limitation any severance, notice rights, payments (including special or annual bonus), and other amounts to which Executive may be entitled under his Employment Agreement or the laws of Georgia or any other jurisdiction, and Executive agrees not to pursue or claim any of the payments, benefits or rights set forth therein. (d) If Company is required to prepare an accounting restatement due to material noncompliance by Company, as a result of misconduct, with any financial reporting requirement under the federal securities laws, Executive, to the extent required by law, will reimburse Company for (i) any bonus or other incentive-based or equity-based compensation received by Executive from Company (including such compensation payable in accordance with this Section 5 and Section 6) during the 12-month period following the first public issuance or filing with the Securities and Exchange Commission (whichever first occurs) of the financial document embodying that financial reporting requirement; and (ii) any profits realized by Executive from the sale of Company securities during that 12-month period. 6. Other Benefits. (a) Nothing in this Agreement or the Release shall: (i) alter or reduce any vested, accrued benefits (if any) Executive may be entitled to receive under any 401(k) plan established by Company; or (ii) affect Executive’s right (if any) to elect and pay for continuation of Executive’s health insurance coverage pursuant to COBRA. (b) Company shall pay Executive: (i) any base salary that accrues through the Termination Date and is unpaid as of the Termination Date; and DocuSign Envelope ID: 64FD2F5B-9B7A-4B97-8625-78EDBBD0A716

(ii) any reimbursable expenses that Executive incurs before the Termination Date but are unpaid as of the Termination Date (subject to Company’s expense reimbursement policy). (c) Company shall continue to provide Executive with customary and appropriate Directors and Officers Liability Coverage for the six (6) year period which immediately follows the date that his service as a member of the Board ends. 7. Confidentiality; Non-Solicitation; Continuation of Restrictive Covenants. (a) Executive acknowledges and agrees that, except as specifically set forth below, Section 7 of the Employment Agreement (and any related definitions) shall survive the termination of the Employment Agreement and the termination of his employment and are incorporated into this Agreement by reference. Executive hereby agrees to continue to abide by the obligations in Section 7 of the Employment Agreement, as amended hereby. (b) Confidential Information and Trade Secrets. Section 7(a)(i) of the Employment Agreement is hereby amended and restated as follows: “(i) Executive shall hold in a fiduciary capacity for the benefit of Company all Confidential Information and Trade Secrets. During Executive’s employment and for a period of two (2) years immediately following his termination of employment for any reason, Executive shall not, without the prior written consent of Company or as may otherwise be required by law or legal process, use, communicate or divulge Confidential Information other than as necessary to perform Executive’s duties for Company; provided, however, that if the Confidential Information is deemed a trade secret under Georgia law, then the period for nondisclosure shall continue for the applicable period under Georgia Trade Secret laws in effect at the time of Executive’s termination. In addition, except as necessary to perform Executive’s duties for Company, during Executive’s employment and thereafter for the applicable period under the Georgia Trade Secret laws in effect at the time of Executive’s termination, Executive will not, directly or indirectly, transmit or disclose any Trade Secrets to any person or entity, and will not, directly or indirectly, make use of any Trade Secrets, for himself or herself or any other person or entity, without the express written consent of Company. This provision will apply for so long as a particular Trade Secret retains its status as a trade secret under applicable law. The protection afforded to Trade Secrets and/or Confidential Information by this Agreement is not intended by the parties hereto to limit, and is intended to be in addition to, any protection provided to any such information under any applicable federal, state or local law. Pursuant to the Defend Trade Secrets Act of 2016, Executive understands that: An individual may not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that: (a) is made (i) in confidence to a federal, state, or local government official, either directly or indirectly, or to an DocuSign Envelope ID: 64FD2F5B-9B7A-4B97-8625-78EDBBD0A716

attorney; and (ii) solely for the purpose of reporting or investigating a suspected violation of law; or (b) is made in a complaint or other document that is filed under seal in a lawsuit or other proceeding. Further, an individual who files a lawsuit for retaliation by an employer for reporting a suspected violation of law may disclose the employer's trade secrets to the attorney and use the trade secret information in the court proceeding if the individual: (a) files any document containing the trade secret under seal; and (b) does not disclose the trade secret, except pursuant to court order.” (c) Definitions. For purposes of this Agreement (including Section 7(b) hereof), the following capitalized terms shall have the following meanings. “Confidential Information” means knowledge or data relating to Company that is not generally known to persons not employed or otherwise engaged by Company, is not generally disclosed by Company, and is the subject of reasonable efforts to keep it confidential. Confidential Information includes, but is not limited to, information regarding product or service cost or pricing, information regarding personnel allocation or organizational structure, information regarding the business operations or financial performance of Company, sales and marketing plans, and strategic initiatives (independent or collaborative), information regarding existing or proposed methods of operation, current and future development and expansion or contraction plans, sale/acquisition plans and non-public information concerning the legal or financial affairs of Company. Confidential Information does not include information that has become generally available to the public by the act of one who has the right to disclose such information without violating any right or privilege of Company. This definition is not intended to limit any definition of confidential information or any equivalent term under applicable federal, state or local law. “Person” means: any individual or any corporation, partnership, joint venture, limited liability company, association or other entity or enterprise. “Trade Secrets” means all secret, proprietary or confidential information regarding Company, BHI or any of their respective subsidiaries and affiliates or that meets the definition of “trade secrets” within the meaning set forth in O.C.G.A. § 10-1-761. 8. Governing Law. This Agreement shall be deemed to have been jointly drafted by the Parties and shall not be construed against either Party. This Agreement shall be governed by the law of the State of Georgia, and the Parties agree that any actions arising out of or relating to this Agreement or Executive’s employment with Company must be brought exclusively in either the United States District Court for the Northern District of Georgia, or the State or Superior Courts of Xxxx County, Georgia. Notwithstanding the pendency of any proceeding, either Party shall be entitled to injunctive relief in a state or federal court located in Xxxx County, Georgia upon a showing of irreparable injury. The Parties consent to personal jurisdiction and venue solely within these forums and solely in Xxxx County, Georgia and waive all otherwise possible objections thereto. The existence of any claim or cause of action by Executive against Company, including any dispute relating to the termination of Executive’s employment or under this Agreement, shall not constitute a defense to enforcement of said covenants by injunction. DocuSign Envelope ID: 64FD2F5B-9B7A-4B97-8625-78EDBBD0A716

9. Severability. Whenever possible, each provision of this Agreement is to be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Agreement is held to be invalid, illegal or unenforceable in any respect under any applicable law or rule in any jurisdiction, that invalidity, illegality, or unenforceability is not to affect any other provision or any other jurisdiction, and this Agreement is to be reformed, construed and enforced in the jurisdiction as if the invalid, illegal or unenforceable provision had never been contained therein. To the extent any provision of the Release is deemed to be illegal, invalid, or unenforceable and Executive sues the Company, then Company may, at its sole option, void this Agreement, in which case Executive shall immediately return any payments received under Section 5 above to Company. 10. Return of all Property and Information of Company. Executive agrees to return or destroy all property of Company on or before the Termination Date that is not otherwise utilized to fulfil Executive’s duties as a member of the Board. Such property includes, but is not limited to, the original and any copy (regardless of the manner in which it is recorded) of all non-public information provided by Company or any subsidiary thereof to Executive or which Executive has developed or collected in the scope of Executive’s employment related to Company as well as all Company-issued equipment, supplies, accessories, vehicles, keys, instruments, tools, devices, computers, cell phones, electronic devices, materials, documents, plans, records, notebooks, drawings, or papers. Executive may only retain information relating to Executive’s continued service as a member of the Board and Executive’s benefit plans and compensation to the extent needed to prepare Executive’s tax returns. 11. No Reliance Upon Other Statements. This Agreement is entered into without reliance upon any statement or representation of any Party hereto or any Party hereby released other than the statements and representations contained in writing in this Agreement and the enclosed Release. 12. Entire Agreement. This Agreement, the Release, and Section 7 of the Employment Agreement (which are incorporated herein by this reference), contain the entire agreement and understanding concerning the subject matter hereof between the Parties hereto. No waiver, termination or discharge of this Agreement, or any of the terms or provisions hereof, shall be binding upon either Party hereto unless confirmed in writing. This Agreement may not be modified or amended, except by a writing executed by both Parties hereto. No waiver by either Party hereto of any term or provision of this Agreement or of any default hereunder shall affect such Party’s rights thereafter to enforce such term or provision or to exercise any right or remedy in the event of any other default, whether or not similar. Notwithstanding the foregoing, the Employment Agreement will remain in effect until the Retirement Date to the extent the terms of the Employment Agreement are not inconsistent with the terms of this Agreement and, if inconsistent, the terms of this Agreement will control. 13. Further Assurance. Upon the reasonable request of the other Party, each Party hereto agrees to take any and all actions, including, without limitation, the execution of certificates, documents or instruments, necessary or appropriate to give effect to the terms and conditions set forth in this Agreement. DocuSign Envelope ID: 64FD2F5B-9B7A-4B97-8625-78EDBBD0A716

14. No Pending Claims or Assignments. Neither Party may assign this Agreement, in whole or in part, without the prior written consent of the other Party, and any attempted assignment not in accordance herewith shall be null and void and of no force or effect. Executive represents and warrants that Executive has no claims or causes of action against Company which are not released in the Release. Executive also represents and warrants that Executive has not filed any claims, charges, lawsuits, or similar matters of any kind against Company in any forum, and that Company’s obligations under this Agreement are conditioned upon this representation. 15. Binding Effect. This Agreement shall be binding on and inure to the benefit of the Parties and their respective heirs, representatives, successors and permitted assigns. 16. Indemnification. Company understands and agrees that any indemnification obligations under its governing documents or the indemnification agreement between Company and Executive with respect to Executive’s service as an officer of Company remain in effect and survive the termination of Executive’s employment under this Agreement as set forth in such governing documents or indemnification agreement. 17. Nonqualified Deferred Compensation. (a) Any payment or benefit provided pursuant to or in connection with this Agreement is intended to comply with the “short term deferral” exception from Section 409A of the Internal Revenue Code of 1986 (“Section 409A”) specified in Treas. Reg. § 1.409A-1(b)(4) (or any successor provision) or the “separation pay plan” exception specified in Treas. Reg. § 1.409A-1(b)(9) (or any successor provision), or both of them, and shall be interpreted in a manner consistent with the applicable exceptions. If any payment or benefit provided pursuant to or in connection with this Agreement is considered to be deferred compensation subject to Section 409A, it shall be paid and provided in a manner, and at such time and form, as complies with the applicable requirements of Section 409A to avoid the unfavorable tax consequences provided therein for non-compliance. Executive and Company agree that Executive’s termination of employment is an involuntary separation from service under Section 409A. (b) Neither Company nor Executive shall take any action to accelerate or delay the payment of any monies and/or provision of any benefits in any manner which would not be in compliance with Section 409A (including any transition or grandfather rules thereunder). (c) Because Executive is a “specified employee” for purposes of Section 409A(a)(2)(B)(i), any payments or benefits provided pursuant to or in connection with Executive’s “Separation from Service” (as determined for purposes of Section 409A) that constitute deferred compensation subject to Section 409A (“Covered Payments”) shall not be made until the earlier of (i) Executive’s death or (ii) six months after Executive’s Separation from Service (the “409A Deferral Period”) as required by Section 409A. Covered Payments otherwise due to be made in installments or periodically during the 409A Deferral Period (“Delayed Payments”) shall be accumulated and paid in a lump sum as soon as the 409A Deferral Period ends, and the balance of the payment shall be made as otherwise scheduled. Any Delayed Payments in the form of benefits subject to the rule may be provided under the 409A Deferral Period at Executive’s expense, with Executive having a right to reimbursement from Company once the 409A Deferral Period ends, and the balance of the benefits shall be provided as otherwise scheduled. Any Delayed Payments DocuSign Envelope ID: 64FD2F5B-9B7A-4B97-8625-78EDBBD0A716

shall bear interest at the United States 5-year Treasury Rate plus 2%, which accumulated interest shall be paid to Executive as soon as the 409A Deferral Period ends. (d) For purposes of this Agreement, all rights to payments and benefits hereunder shall be treated as rights to receive a series of separate payments and benefits to the fullest extent allowed by Section 409A. (e) If any payment or benefit under this Agreement is subject to and not exempt from Section 409A and is contingent on the delivery of a release by Executive and such payment or benefit could be made in either of two years, the payment will be made or the benefit will be delivered in the subsequent year to the extent necessary to comply with Section 409A. (f) Notwithstanding any other provision of this Agreement, Company shall not be liable to Executive if any payment or benefit which is to be provided pursuant to this Agreement and which is considered deferred compensation subject to Section 409A otherwise fails to comply with, or be exempt from, the requirements of Section 409A. Executive shall be solely responsible for the tax consequences with respect to any payment or benefit provided pursuant to or in connection with this Agreement, and in no event shall Company have any responsibility or liability if this Agreement does not meet any applicable requirements of Section 409A. 18. Counterparts. This Agreement may be executed in any number of counterparts and by the Parties hereto in separate counterparts, with the same effect as if the Parties had signed the same document. All such counterparts shall be deemed an original, shall be construed together, and shall constitute one and the same instrument, with original signature, photocopy signature, fax signature, or electronic signature permitted and accepted. 19. Protected Rights. Executive understands that nothing contained in this Agreement limits Executive’s ability to file a charge or complaint with the Equal Employment Opportunity Commission, the National Labor Relations Board, the Occupational Safety and Health Administration, the Securities and Exchange Commission or any other federal, state or local governmental agency or commission (“Government Agencies”). Executive further understands that this Agreement does not limit Executive’s ability to communicate with any Government Agencies or otherwise participate in any investigation or proceeding that may be conducted by any Government Agencies, including providing documents or other information, without notice to Company. This Agreement does not limit Executive’s right to receive an award for information provided to any Government Agencies. [Signatures Appear on Following Page] DocuSign Envelope ID: 64FD2F5B-9B7A-4B97-8625-78EDBBD0A716

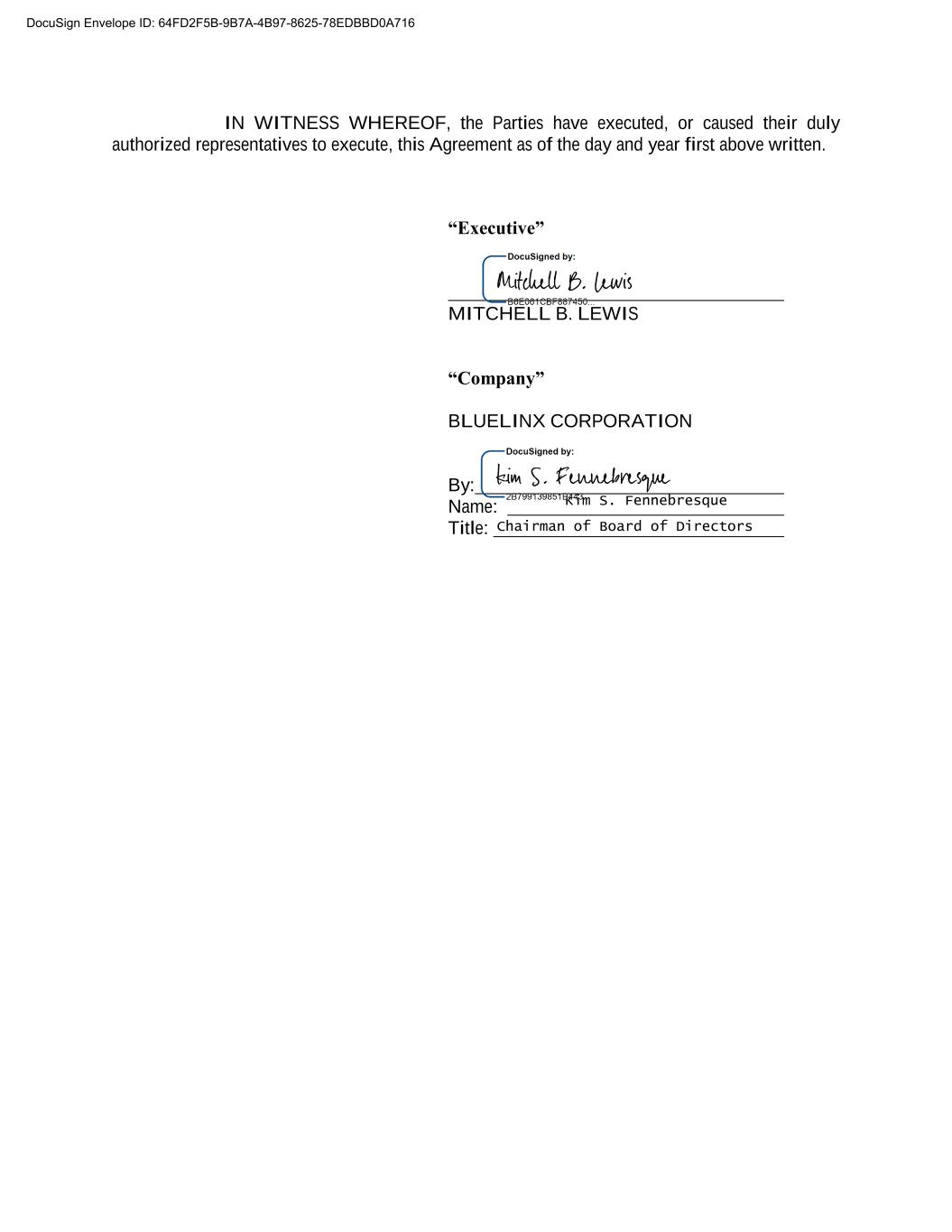

IN WITNESS WHEREOF, the Parties have executed, or caused their duly authorized representatives to execute, this Agreement as of the day and year first above written. “Executive” XXXXXXXX X. XXXXX “Company” BLUELINX CORPORATION By: Name: Title: DocuSign Envelope ID: 64FD2F5B-9B7A-4B97-8625-78EDBBD0A716 Chairman of Board of Directors Xxx X. Xxxxxxxxxxxx