OFFICE LEASE between THE NORTHWESTERN MUTUAL LIFE INSURANCE COMPANY (Landlord) and ZILLOW, INC. (Tenant) 1301 Second Avenue Seattle, Washington IRE 334246

Exhibit 10.10

between

THE NORTHWESTERN MUTUAL LIFE INSURANCE COMPANY (Landlord)

and

ZILLOW, INC. (Tenant)

▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇

▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇

IRE 334246

TABLE OF CONTENTS

| ARTICLE |

PAGE | |||||

| ARTICLE 1. |

BASIC LEASE INFORMATION | 5 | ||||

| 1.1 |

Basic Lease Information | 5 | ||||

| 1.2 |

Exhibits | 7 | ||||

| ARTICLE 2. |

AGREEMENT | 7 | ||||

| ARTICLE 3. |

DELIVERY OF PREMISES | 7 | ||||

| 3.1 |

Delivery of Possession | 7 | ||||

| 3.2 |

Early Entry | 8 | ||||

| ARTICLE 4. |

MONTHLY BASE RENT | 8 | ||||

| 4.1 |

Monthly Base Rent | 8 | ||||

| ARTICLE 5. |

OPERATING EXPENSES | 9 | ||||

| 5.1 |

Operating Expenses | 9 | ||||

| 5.2 |

Estimated Payments for Operating Expenses | 10 | ||||

| 5.3 |

Annual Settlement of Operating Expenses | 11 | ||||

| 5.4 |

Final Proration of Operating Expenses | 11 | ||||

| 5.5 |

Occupancy Variance | 11 | ||||

| 5.6 |

Real Estate Taxes | 11 | ||||

| 5.7 |

Estimated Payments of Real Estate Taxes | 11 | ||||

| 5.8 |

Final Proration of Real Estate Taxes | 12 | ||||

| 5.9 |

Other Taxes | 12 | ||||

| 5.10 |

Additional Rent | 12 | ||||

| ARTICLE 6. |

INSURANCE | 13 | ||||

| 6.1 |

Landlord’s Insurance | 13 | ||||

| 6.2 |

Tenant’s Insurance | 13 | ||||

| 6.3 |

Forms of Policies | 13 | ||||

| 6.4 |

Waiver of Subrogation | 14 | ||||

| 6.5 |

Adequacy of Coverage | 14 | ||||

| 6.6 |

Certain Insurance Risks | 14 | ||||

| ARTICLE 7. |

USE | 14 | ||||

| ARTICLE 8. |

COMPLIANCE WITH LAWS AND THE DECLARATION | 14 | ||||

| ARTICLE 9. |

HAZARDOUS SUBSTANCES | 15 | ||||

| ARTICLE 10. |

ASSIGNMENT AND SUBLETTING | 16 | ||||

| 10.1 |

General | 16 | ||||

| 10.2 |

Submission of Information | 16 | ||||

| 10.3 |

Payments to Landlord | 17 | ||||

| 10.4 |

Prohibited Transfers | 17 | ||||

| 10.5 |

Permitted Transfer | 17 | ||||

| 10.6 |

Condition | 17 | ||||

| 10.7 |

Remedies | 17 | ||||

| 10.8 |

Effect on Options | 17 | ||||

| ARTICLE 11. |

RULES AND REGULATIONS | 17 | ||||

| ARTICLE 12. |

COMMON AREAS AND BUILDING AMENITIES | 18 | ||||

| 12.1 |

Common Areas | 18 | ||||

| 12.2 |

Building Amenities | 18 | ||||

| ARTICLE 13. |

LANDLORD’S SERVICES | 18 | ||||

| 13.1 |

Landlord’s Repair and Maintenance | 18 | ||||

| 13.2 |

Landlord’s Other Services | 18 | ||||

| 13.3 |

Tenant’s Costs | 19 | ||||

| 13.4 |

Limitation on Liability | 19 | ||||

i

| ARTICLE 14. |

TENANT’S CARE OF THE PREMISES | 20 | ||||

| ARTICLE 15. |

ALTERATIONS | 21 | ||||

| 15.1 |

General | 21 | ||||

| 15.2 |

Free-Standing Partitions | 21 | ||||

| 15.3 |

Removal | 21 | ||||

| 15.4 |

ADA Compliance | 21 | ||||

| 15.5 |

Telecommunication Lines | 21 | ||||

| ARTICLE 16. |

MECHANICS’ LIENS | 22 | ||||

| ARTICLE 17. |

END OF TERM | 22 | ||||

| ARTICLE 18. |

EMINENT DOMAIN | 23 | ||||

| ARTICLE 19. |

DAMAGE AND DESTRUCTION | 23 | ||||

| ARTICLE 20. |

SUBORDINATION | 24 | ||||

| ARTICLE 21. |

RIGHTS RESERVED BY LANDLORD | 24 | ||||

| 21.1 |

Access | 24 | ||||

| 21.2 |

General Matters | 25 | ||||

| 21.3 |

Changes to the Project | 25 | ||||

| ARTICLE 22. |

INDEMNIFICATION, WAIVER AND RELEASE | 25 | ||||

| 22.1 |

Tenant’s Indemnification | 25 | ||||

| 22.2 |

Waiver and Release | 26 | ||||

| 22.3 |

Landlord’s Indemnification | 26 | ||||

| ARTICLE 23. |

QUIET ENJOYMENT | 26 | ||||

| ARTICLE 24. |

EFFECT OF SALE | 26 | ||||

| ARTICLE 25. |

DEFAULT | 26 | ||||

| 25.1 |

Events of Default by Tenant | 26 | ||||

| 25.2 |

Landlord’s Remedies | 28 | ||||

| 25.3 |

Damages; No Termination | 28 | ||||

| 25.4 |

Damages upon Termination | 29 | ||||

| 25.5 |

Cumulative Remedies | 29 | ||||

| 25.6 |

Waiver of Redemption/Mitigation | 29 | ||||

| ARTICLE 26. |

LANDLORD’S LIEN | 29 | ||||

| ARTICLE 27. |

PARKING | 29 | ||||

| ARTICLE 28. |

INTENTIONALLY OMITTED | 30 | ||||

| ARTICLE 29. |

SIGNS | 30 | ||||

| ARTICLE 30. |

LETTER OF CREDIT | 30 | ||||

| ARTICLE 31. |

EARLY TERMINATION | 30 | ||||

| ARTICLE 32 |

RIGHT OF FIRST OFFER | 30 | ||||

| 32.1 |

Notice to Tenant | 31 | ||||

| 32.2 |

ROFO Election | 31 | ||||

| 32.3 |

Addition to Premises | 31 | ||||

| ARTICLE 33 |

OPTION TO RENEW THE TERM | 31 | ||||

| ARTICLE 34. |

MISCELLANEOUS | 32 | ||||

| 34.1 |

No Offer | 32 | ||||

| 34.2 |

Joint and Several Liability | 32 | ||||

| 34.3 |

No Construction Against Drafting Party | 32 | ||||

| 34.4 |

Time of the Essence | 32 | ||||

ii

| 34.5 |

No Recordation | 33 | ||||

| 34.6 |

No Waiver | 33 | ||||

| 34.7 |

Limitation on Recourse | 33 | ||||

| 34.8 |

Estoppel Certificates | 33 | ||||

| 34.9 |

WAIVER OF JURY TRIAL | 33 | ||||

| 34.10 |

No Merger | 33 | ||||

| 34.11 |

Holding Over | 33 | ||||

| 34.12 |

Notices | 34 | ||||

| 34.13 |

Mortgagee Protection | 34 | ||||

| 34.14 |

Severability | 34 | ||||

| 34.15 |

Written Amendment Required | 34 | ||||

| 34.16 |

Captions | 34 | ||||

| 34.17 |

Authority | 34 | ||||

| 34.18 |

Brokers | 35 | ||||

| 34.19 |

Governing Law | 35 | ||||

| 34.20 |

No Easements for Air or Light | 35 | ||||

| 34.21 |

Tax Credits | 35 | ||||

| 34.22 |

Financial Reports | 35 | ||||

| 34.23 |

Landlord’s Fees | 35 | ||||

| 34.24 |

Non-waiver | 35 | ||||

| 34.25 |

Presumption | 35 | ||||

| 34.26 |

No Right to Terminate | 36 | ||||

| 34.27 |

No Liability for Crimes | 36 | ||||

| 34.28 |

Binding Effect | 36 | ||||

| 34.29 |

Confidentiality | 36 | ||||

| 34.30 |

Force Majeure | 36 | ||||

| 34.31 |

Interest | 37 | ||||

| 34.32 |

Entire Agreement | 37 | ||||

| 34.33 |

Business Restriction Representation and Warranty | 37 | ||||

| 34.34 |

Lender’s Request for Landlord’s Consent | 37 | ||||

| 34.35 |

Relocation | 37 | ||||

| 34.36 |

Green Provision | 37 | ||||

| 34.37 |

Attorneys’ Fees and Expenses | 37 | ||||

| 34.38 |

Transportation Management Plan | 38 | ||||

| 34.39 |

Furniture | 38 |

| Exhibits |

||

| Exhibit A |

Legal Description of the Land | |

| Exhibit B |

Layout of the Premises | |

| Exhibit C |

Work Letter | |

| Exhibit D |

Commencement Date Certificate | |

| Exhibit E |

Rules and Regulations | |

| Exhibit F |

Intentionally Omitted | |

| Exhibit G |

Tenant Estoppel Certificate | |

| Exhibit H |

Landlord’s Subordination and Consent Agreement | |

| Exhibit I |

Green Addendum | |

| Exhibit J |

Subordination, Non-Disturbance and Attornment Agreement | |

| Exhibit K |

Letter of Credit | |

| Exhibit L |

List of Furniture Leased to Tenant | |

iii

IRE 334246

THIS OFFICE LEASE (“Lease”) is entered into by and between Landlord and Tenant on the date set forth in the following Basic Lease Information. Landlord and Tenant hereby agree as follows:

ARTICLE 1. BASIC LEASE INFORMATION.

1.1 Basic Lease Information. In addition to the terms that are defined elsewhere in this Lease, the following terms shall have the meaning set forth below:

| (a) | Lease Date: ▇▇▇▇▇ ▇▇, ▇▇▇▇ |

| (▇) | Landlord: The Northwestern Mutual Life Insurance Company |

Type of legal entity and state of formation: a Wisconsin corporation

| (c) | Landlord’s Address for receipt of notice: |

The Northwestern Mutual Life Insurance Company

c/o Northwestern Investment Management Company

▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇ ▇.▇., ▇▇▇▇▇ ▇▇▇▇

▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇

Attn: Regional Manager

Fax: ▇▇▇-▇▇▇-▇▇▇▇

with a copy to:

Northwestern Investment Management Company

▇▇▇ ▇▇▇▇ ▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇

▇▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇

Attn: Managing Director-Asset Management

Fax: ▇▇▇-▇▇▇-▇▇▇▇

| (d) | Tenant: Zillow, Inc. |

Type of legal entity and state of formation: a Washington corporation

| (e) | Tenant’s Address for receipt of notice: |

Prior to the Commencement Date:

Zillow, Inc.

▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇

▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇

Attn: General Counsel

Fax: (▇▇▇)▇▇▇-▇▇▇▇

After the Commencement Date:

Zillow, Inc.

▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇ ▇▇▇▇▇

▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇-▇▇▇▇

Attn: General Counsel

Fax: (▇▇▇) ▇▇▇-▇▇▇▇

with a copy to: Zillow, Inc.

▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇ ▇▇▇▇▇

▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇-▇▇▇▇

Attn: VP, Finance

Fax: (▇▇▇) ▇▇▇-▇▇▇▇

It is specifically understood and agreed that all service of process may be served upon the registered agent maintained by Tenant in the State of Washington pursuant to Washington law, and if no such registered agent is required or maintained, service of process may be made upon Tenant at the Premises in accordance with Washington law.

5

| (f) | Land: The parcel of land located at the Building Address upon which the Building is situated. The land is legally described on Exhibit A. |

| (g) | Project: Two (2) commercial condominium units known as the Office Unit and the Garage Unit, which are part of the commercial condominium created and governed by the terms of that certain Condominium Declaration for Washington Mutual – Seattle Art Museum Project recorded in the real property records of King County, Washington under Recorder’s No. 20060329000201 (the “Declaration”). The Project is part of the building located at ▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇▇, ▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ (the “Building”) which is situated on the Land. |

| (h) | Building: As defined above. |

| (i) | Building Address: ▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ |

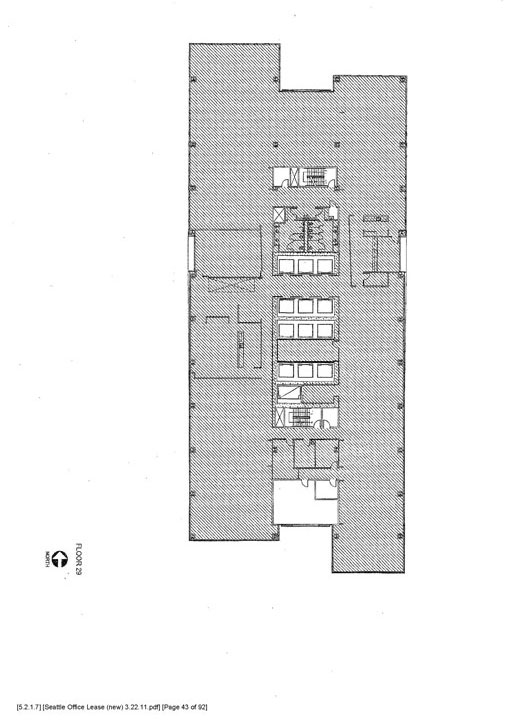

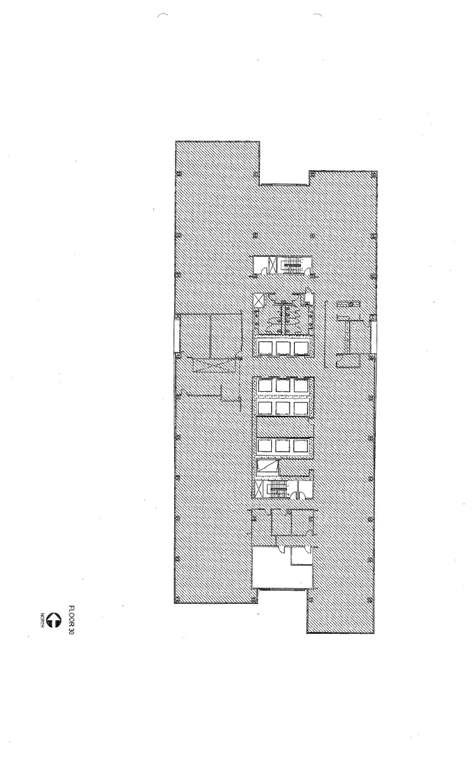

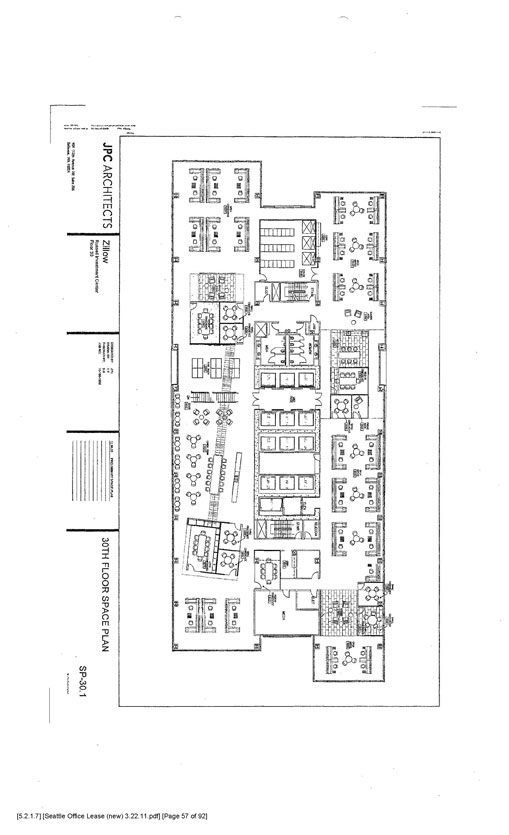

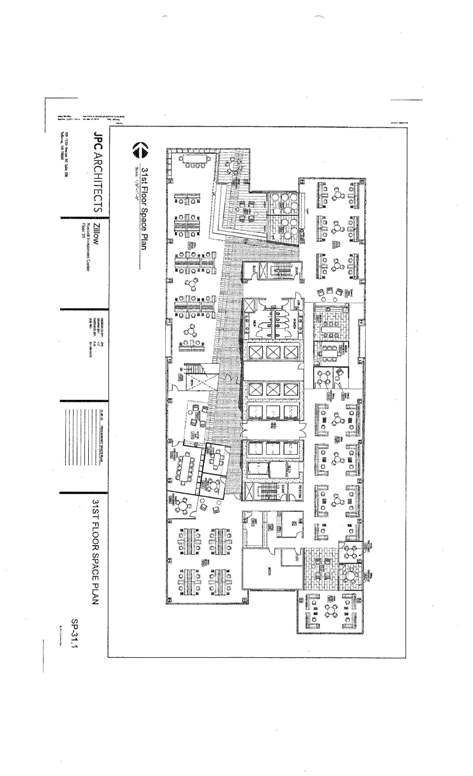

| (▇) | Premises: Floors 29, 30 and 31, as further shown on Exhibit B to this Lease. |

| (k) | Rentable Area of the Premises: 65,609 rentable square feet, which Landlord and Tenant hereby conclusively agree shall be the Rentable Area of the Premises for all purposes of this Lease. |

| (l) | Term: 137 months, beginning on the Commencement Date and ending on the Expiration Date, as the same may be extended pursuant to Article 33 of this Lease. |

| (m) | Commencement Date: The earlier of: (a) July 1, 2011, or (b) Substantial Completion of the TI Work. See Article 3.1 of this Lease. |

| (n) | Expiration Date: November 30, 2022, as the same may be extended pursuant to Article 33 of this Lease. |

| (o) | Letter of Credit: See Article 30 of this Lease. |

| (p) | Monthly Base Rent: $138,489.66 commencing December 1, 2012. |

| (q) | Additional Rent: Any amounts that this Lease requires Tenant to pay in addition to Monthly Base Rent. |

| (r) | Rent: Collectively, the Monthly Base Rent and Additional Rent. |

| (s) | Tenant’s Proportionate Share: Seven and fifty-two one hundredths Percent (7.52%), which is the ratio of the Rentable Area of the Premises (65,609 square feet) to the rentable square footage of the Office Unit (872,026 square feet). |

| (t) | Parking Spaces: 41 parking stalls, 38 of which shall be unreserved and 3 of which may be reserved at the election of Tenant. See Article 27 of this Lease. |

| (u) | Parking Charge: current market rates (for reserved spaces it shall be 175% of the rate for unreserved spaces), subject to the Rules and Regulations; provided, that Tenant shall not be charged for its Parking Spaces during the first full twelve months of its occupancy. |

| (v) | Landlord’s Broker: CB ▇▇▇▇▇▇▇ ▇▇▇▇▇ |

| (w) | Tenant’s Broker: ▇▇▇▇▇ ▇▇▇▇▇▇▇▇ |

| (x) | Use: The permitted use of the Premises is general office purposes. |

If any other provision of this Lease conflicts with that which is set forth in this Article 1.1, such other provision will prevail.

6

1.2 Exhibits. The following exhibits are attached to this Lease and are made part hereof:

Exhibit A Legal Description of the Land

Exhibit B Layout of the Premises

Exhibit C Work Letter

Exhibit D Commencement Date Certificate

Exhibit E Rules and Regulations

Exhibit F Intentionally Omitted

Exhibit G Tenant Estoppel Certificate

Exhibit H Landlord’s Subordination and Consent Agreement

Exhibit I Green Addendum

Exhibit J Subordination, Non-Disturbance and Attornment Agreement

Exhibit K Letter of Credit

Exhibit L List of Furniture Leased to Tenant

ARTICLE 2. AGREEMENT.

Landlord is the owner of the Project which is part of the Building. Landlord shall fully perform its obligations and enforce its rights under the Declaration for the benefit of Tenant hereunder. If any obligation of Landlord under this Lease is the obligation of the owners association formed under the Declaration (the “Association”), Landlord shall cause the Association to perform such obligation, including without limitation by voting in a manner consistent with the performance of such obligation by the Association, but in no event shall Landlord be required to vote or exercise its rights under the Declaration in a commercially unreasonable manner.

Landlord leases the Premises to Tenant, and Tenant leases the Premises from Landlord, pursuant to the terms and conditions of this Lease. The duration of this Lease shall be the Term, as the same may be extended pursuant to Article 33 hereof. The Term shall commence on the Commencement Date and shall expire on the Expiration Date, except as may be otherwise set forth in this Lease.

Landlord grants to Tenant the rights under this Lease to use, in common with Landlord and other tenants and occupants of the Building and their respective employees and invitees and all others to whom Landlord has or may hereafter grant rights to use the same, the Common Areas (as defined in Article 12.1 below), including the public walkways and public passageways of the Project, the Building lobby (but not for advertising or promotional purposes), entrances, stairs and elevators and, if the Premises include less than an entire floor of the Building, the common lobbies, hallways and toilets and other common facilities of such floor. Landlord grants to Tenant the rights under this Lease to use, in common with Landlord and other tenants and occupants of the Building and all others to whom Landlord has or may hereafter grant rights to use the same, the Building Amenities (as defined in Article 12.2 below). No easement, license or other right to light, air or view is created by this Lease.

ARTICLE 3. DELIVERY OF PREMISES.

3.1 Delivery of Possession. Landlord shall construct or install in the Premises all improvements to be constructed or installed by Landlord according to the Work Letter attached to this Lease as Exhibit C (such improvements described herein and in the Work Letter as the “Landlord’s Work”). Tenant shall construct or install in the Premises all improvements to be constructed or installed by Tenant according to the Work Letter attached to this Lease as Exhibit C (such improvements described herein and in the Work Letter as the “TI Work”). The TI Work shall be deemed substantially complete when the TI Work is completed except for Punch List items, as such term is defined in the Work Letter. Tenant shall execute the Commencement Date Certificate attached to this Lease as Exhibit D within fifteen (15) days of Landlord’s request.

Tenant acknowledges that, except for the express representations or warranties of Landlord contained in this Lease, neither Landlord nor its agents or employees have made any representations or warranties as to the suitability or fitness of the Premises for the conduct of Tenant’s business or for any other purpose, nor has Landlord or its agents or employees agreed to undertake any alterations or construct any tenant improvements to the Premises except as

7

expressly provided in this Lease and the Work Letter. The taking of possession of the Premises by Tenant shall conclusively establish that the Premises and the Building were in satisfactory condition at such time, subject to Punch List items.

3.2 Early Entry. Tenant shall have the right to enter the Premises after the completion of the Landlord’s Work and prior to the Commencement Date for the purpose of constructing and installing the TI Work and fixtures, furniture, equipment and telephone systems and for any other purpose permitted by Landlord. Such entry prior to the Commencement Date shall be at Tenant’s sole risk and subject to all the terms and provisions of this Lease, including the terms and provisions of Article 6.2 and Article 15, below, as though the Commencement Date had occurred, except for the payment of Rent. All rights of Tenant under this Article 3.2 shall be subject to the requirements of all applicable building codes, zoning requirements, and federal, state, and local, rules and regulations (“Laws”). Landlord has the right to impose additional conditions on Tenant’s early entry that Landlord, in its reasonable discretion, deems appropriate, including without limitation, an indemnification of Landlord and proof of insurance, and Landlord shall further have the right to require that Tenant execute an early entry agreement containing such conditions prior to Tenant’s early entry.

ARTICLE 4. MONTHLY BASE RENT.

4.1 Monthly Base Rent. Commencing on December 1, 2012, and throughout the remainder of the Term, as the same may be extended pursuant to Article 33 hereof, Tenant shall pay Monthly Base Rent to Landlord in the amount and for the time periods described as follows:

| Period |

Annual Base Rent | Monthly Base Rent | ||||||

| December 1, 2012 to November 30, 2013 |

$ | 1,661,875.97 | $ | 138,489.66 | ||||

| December 1, 2013 to November 30, 2014 |

$ | 1,727,484.97 | $ | 143,957.08 | ||||

| December 1, 2014 to November 30, 2015 |

$ | 1,793,093.97 | $ | 149,424.50 | ||||

| December 1, 2015 to November 30, 2016 |

$ | 1,858,702.97 | $ | 154,891.91 | ||||

| December 1, 2016 to November 30, 2017 |

$ | 1,924,311.97 | $ | 160,359.33 | ||||

| December 1, 2017 to November 30, 2018 |

$ | 1,989,920.97 | $ | 165,826.78 | ||||

| December 1, 2018 to November 30, 2019 |

$ | 2,055,529.97 | $ | 171,294.16 | ||||

| December 1, 2019 to November 30, 2020 |

$ | 2,121,138.97 | $ | 176,761.58 | ||||

| December 1, 2020 to November 30, 2021 |

$ | 2,186,747.97 | $ | 182,229.00 | ||||

| December 1, 2021 to November 30, 2022 |

$ | 2,252,356.97 | $ | 187,696.41 | ||||

Monthly Base Rent shall be paid in advance on or before the first day of each calendar month of the Term commencing December 1, 2012, and shall be accompanied by any applicable rent, sales, use or other tax which is based on the amount and/or payment of Rent payable pursuant to this Lease. If the Term commences on a day other than the first day of a calendar month or ends on a day other than the last day of a calendar month, then Monthly Base Rent for such calendar month will be appropriately prorated based on the actual number of calendar days in such calendar month. If the Term commences on a day other than the first day of a calendar month, then the prorated Monthly Base Rent for such month will be paid on or before the first day of the Term. Monthly Base Rent shall be paid to Landlord, without written notice or demand and without deduction or offset, except as specifically set forth herein, as an independent covenant of Tenant, in lawful money of the United States of America at Landlord’s address set forth in Article 1.1 herein or to such other address as Landlord may from time to time designate in writing.

All Rent shall be payable by Tenant to Landlord at the office of Landlord or at such other place as Landlord may designate from time to time, in lawful money of the United States of America, without offset, abatement, counterclaim or deduction, except as specifically set forth herein. All Rent shall be paid by either good and sufficient check or a wire transfer of immediately available funds to Landlord’s account, which account information will be given to Tenant at Landlord’s option. At Landlord’s further option, all Rent shall be paid directly to Landlord by electronic transfer of funds using the Automated Clearing House System.

If Tenant fails to pay any Rent within three (3) days of when due, the unpaid amounts will be subject to a late payment charge equal to the greater of (i) five percent (5%) of the unpaid amounts or (ii) Two Hundred Fifty Dollars ($250.00). This late payment charge is intended to compensate Landlord for its additional administrative costs resulting from Tenant’s failure, and has been agreed upon by Landlord and Tenant as a reasonable estimate of the additional administrative costs that will be incurred by Landlord as a result of Tenant’s failure. The actual cost in each instance is extremely difficult, if not impossible, to determine. This late payment

8

charge will be paid to Landlord together with such unpaid amounts and interest pursuant to Article 34.32 below. The payment of this late payment charge will not constitute a waiver by Landlord of any Event of Default by Tenant under this Lease. Any payments of any kind returned for insufficient funds will be subject to an additional charge of Sixty Dollars ($60.00).

ARTICLE 5. OPERATING EXPENSES.

5.1 Operating Expenses.

(a) In addition to Monthly Base Rent, beginning on December 1, 2012, Tenant shall pay Tenant’s Proportionate Share of the Operating Expenses of the Project. If Operating Expenses are calculated for a partial calendar year, an appropriate proration shall be made. Notwithstanding the foregoing, subsequent to calendar year 2013, Operating Expenses controllable by Landlord (i.e., Operating Expenses other than the cost of electricity, water, waste disposal, and other utilities costs and the costs of insurance obtained with respect to the Project) shall not increase during the original Term on an annual basis by more than three percent (3%) on a compounding (i.e., the three percent (3%) cap is applied to the most recent calendar year controllable Operating Expenses) and cumulative (i.e., if controllable Operating Expenses increase less than three percent (3%) from one calendar year [for purposes of this Article 5.1(a) herein called “Calendar Year One”] to the next [for purposes of this Article 5.1(a) herein called “Calendar Year Two”], then controllable Operating Expenses for the third calendar year [for purposes of this Article 5.1(a) herein called “Calendar Year Three”] may increase by three percent (3%), plus the difference between (1) the actual increase from Calendar Year One to Calendar Year Two and (2) three percent (3%)) basis.

(b) As used in this Lease, the term “Operating Expenses” means:

(1) All costs, except for Real Estate Taxes (defined in Article 5.6, below), of management, operation, and maintenance of the Project, including, without limitation, wages, salaries and compensation of employees up to and including the level of building manager; costs of consulting, accounting, legal, janitorial, maintenance, guard, and other services; management fees and costs (charged by Landlord, any affiliate of Landlord, or any other entity managing the Project and determined at a rate consistent with prevailing market rates for comparable services and projects)that part of office rent or rental value of space in the Project used or furnished by Landlord to enhance, manage, operate, and maintain the Project; electricity, water, waste disposal, and other utilities costs; materials and supplies costs; costs for the purchase, installation and maintenance of artwork in the Common Areas; costs of maintenance and repairs; costs of capital replacements (as opposed to capital improvements); costs of insurance obtained with respect to the Project; subject to Article 5.1(c), below, depreciation on personal property and equipment; and any other costs, charges, and expenses that under generally accepted accounting principles would be regarded as management, maintenance and/or operating expenses; and

(2) The cost of capital improvement(s) (including the cost of rental of equipment in lieu of a purchase), amortized on a straight-line basis over the reasonable useful life thereof, as determined by Landlord, which capital improvement is made (i) with the reasonable expectation of reducing Operating Expenses, (ii) for the purpose of complying with Laws now or hereafter applicable to the Premises or the Project, or any part thereof, after the Commencement Date, or (iii) for the general benefit or convenience of all tenants of the Project.

(c) The Operating Expenses will not include:

| (1) | depreciation on the Project (other than depreciation on personal property, equipment, window coverings on exterior windows provided by Landlord and carpeting in public corridors and Common Areas); |

| (2) | advertising costs, finders’ fees and real estate brokers’ commissions; |

| (3) | ground lease or mortgage payments; |

| (4) | capital items other than those referred to in Article 5.1(b)(2) above; |

| (5) | costs of replacements to personal property and equipment for which depreciation costs are included as an Operating Expense; |

| (6) | the cost of repairs due to casualty or condemnation that are reimbursed by third parties; |

| (7) | any cost due to Landlord’s breach of this Lease; |

9

| (8) | structural repairs to the Project, other than those necessitated by Tenant’s negligence or willful misconduct; |

| (9) | Expenses which are separately metered or calculated for the Premises or other leased area of the Project, which expenses will be billed separately to Tenant or a tenant of such other leased area, as applicable; |

| (10) | Costs, fines or penalties incurred due to violation of any applicable law by (i) Landlord or (ii) another tenant of the Project if such tenant’s lease permits Landlord to recover such costs, fines or penalties from such tenant; |

| (11) | Expenses incurred by Landlord in connection with leases of space within the Project other than the Premises or the improvement or renovation of such spaces, including leasing commissions, attorneys’ fees arising from lease disputes and other specific costs with respect to such other leases; |

| (12) | Repairs or replacements to the extent that the cost of the same is recovered by Landlord pursuant to construction warranties; |

| (13) | Interest on debt or retirement of debt; |

| (14) | Legal fees and disbursements relating to legal matters other than such fees and costs directly relating to Operating Expenses in connection with the Project; |

| (15) | Landlord’s general overhead and any other expense not directly related to the Project or the Premises; and |

| (16) | Stock options, bonuses and similar payments made to employees of Landlord. |

| (17) | the cost of any items for which Landlord is reimbursed by insurance or otherwise compensated by third parties, or which are paid directly by any third party without reimbursement by Landlord; |

| (18) | legal fees and related expenses incurred by Landlord (together with any damages awarded against Landlord) due to the gross negligence or willful misconduct of Landlord; |

| (19) | costs incurred in relocating any tenant; |

| (20) | advertising and promotional expenses incurred in procuring tenants or marketing or selling the Building or the Project; |

| (21) | salaries of executives or employees above the level of general manager; |

(d) Tenant acknowledges that Landlord has not made any representation or given Tenant any assurances with respect to the Operating Expenses, other than estimating that the Operating Expenses and Real Estate Taxes for 2011 will be approximately $9.79/RSF.

5.2 Estimated Payments for Operating Expenses. During each calendar year or partial calendar year in the Term beginning as of December 1, 2012, in addition to Monthly Base Rent, Tenant shall pay to Landlord on the first day of each month an amount equal to 1/12 of the product of Tenant’s Proportionate Share multiplied by the Estimated Operating Expenses, defined below, for such calendar year. Estimated Operating Expenses for any calendar year means Landlord’s reasonable estimate of Operating Expenses for such calendar year and will be subject to revision according to the further provisions of this Article 5.2 and Article 5.3, below. During any partial calendar year during the Term, Estimated Operating Expenses will be estimated on a full-year basis. During each December during the Term, or as soon after each December as practicable, Landlord will give Tenant written notice of the Estimated Operating Expenses for the ensuing calendar year. On or before the first day of each month during the ensuing calendar year (or each month of the Term, if a partial calendar year), Tenant shall pay to Landlord 1/12 of the product of Tenant’s Proportionate Share multiplied by the Estimated Operating Expenses for such calendar year; however, if such written notice is not given in December, Tenant shall continue to make monthly payments on the basis of the prior year’s Estimated Operating Expenses until the month after such written notice is given, at which time Tenant shall commence making monthly payments based upon the revised Estimated Operating Expenses. In the month Tenant first makes a payment based upon the revised Estimated Operating Expenses, Tenant shall pay to Landlord for each month which has elapsed since December the difference between the amount payable based upon the revised Estimated Operating Expenses and the amount payable based upon the prior year’s Estimated Operating Expenses. If at any time or times it reasonably appears to Landlord that the actual Operating Expenses for any calendar year will vary from the Estimated Operating Expenses for such calendar year, Landlord may, by written notice to Tenant, revise the Estimated Operating Expenses for such calendar year, and subsequent payments by Tenant in such calendar year will be based upon such revised Estimated Operating Expenses.

10

5.3 Annual Settlement of Operating Expenses. Within one hundred twenty (120) days after the end of each calendar year during the Term or as soon after such one hundred twenty (120) day period as practicable, Landlord shall deliver to Tenant a statement of amounts payable under Article 5.1, above, for such calendar year prepared and certified by Landlord or its agents. Such certified statement shall be final and binding upon Tenant unless Tenant objects to it in writing to Landlord within thirty (30) days after it is given to Tenant and/or engages an auditor as provided below. If such statement shows an amount owing by Tenant that is less than the estimated payments previously made by Tenant for such calendar year, the excess shall be held by Landlord and credited against the next payment of Rent; however, if the Term has ended and there is no Event of Default at the end, Landlord shall refund the excess to Tenant. If such statement shows an amount owing by Tenant that is more than the estimated payments previously made by Tenant for such calendar year, Tenant shall pay the deficiency to Landlord within thirty (30) days after the delivery of such statement. Provided no Event of Default exists under this Lease, Tenant shall have ninety (90) days after receipt of the statement to have an independent certified public accountant from a reputable local or national firm which is not working for Tenant on a contingency fee basis, complete an audit of Landlord’s books and records on Operating Expenses, during normal business hours upon reasonable advance written notice at Landlord’s local office. Tenant shall deliver to Landlord a copy of the results of such audit within ten (10) days of receipt by Tenant. Tenant shall pay all costs and expenses of such audit; provided, however, that, if the result of such audit establishes that Landlord must either credit or reimburse Tenant more than five percent (5%) of the estimated payments made by Tenant, Landlord shall reimburse Tenant for the costs and expenses of such audit, either by credit against the next payment of Rent or refund as set forth above.

5.4 Final Proration of Operating Expenses. If the Term ends on a day other than the last day of a calendar year, the amount of increase (if any) in the Operating Expenses payable by Tenant applicable to the calendar year in which this Lease ends shall be calculated on the basis of the number of days of the Term falling within such calendar year, and Tenant’s obligation to pay any increase, or Landlord’s obligation to refund any overage, shall survive the expiration or other termination of this Lease.

5.5 Occupancy Variance. Operating Expenses which vary with occupancy and are attributable to any part of the Term in which less than ninety-five percent (95%) of the rentable area of the Office Unit is occupied by tenants shall be adjusted by Landlord to the amount that Landlord reasonably believes they would have been if ninety-five percent (95%) of the rentable area of the Office Unit had been occupied.

5.6 Real Estate Taxes.

(a) In addition to Monthly Base Rent, beginning on December 1, 2012, Tenant shall pay Tenant’s Proportionate Share of the Real Estate Taxes of the Project. If Real Estate Taxes are calculated for a partial calendar year, an appropriate proration shall be made.

(b) As used in this Lease, the term “Real Estate Taxes” means all real estate taxes, personal property taxes and special assessments (and water and sewer use charges, transit, transportation or carpool charges, fire protection charges and any other taxes, fees or charges which may be levied in whole or in part, in lieu of or in addition to real property taxes and included in the tax ▇▇▇▇ for the Project, including, but not limited to, the downtown Seattle Metropolitan Improvement District assessments), which may be levied or assessed by any lawful authority against the land, buildings and other improvements from time to time comprising the Project (including, but not limited to, the Office Unit and the Garage Unit) and any reasonable costs and expenses incurred by Landlord in any effort to protest or minimize real estate taxes or special assessments, including, but not limited to, reasonable attorneys’ fees, appraiser fees and expert fees.

5.7 Estimated Payments of Real Estate Taxes. During each calendar year or partial calendar year in the Term beginning as of December 1, 2012, in addition to Monthly Base Rent, Tenant shall pay to Landlord on the first day of each month an amount equal to 1/12 of the product of Tenant’s Proportionate Share multiplied by the Estimated Real Estate Taxes, defined below, for such calendar year. The Estimated Real Estate Taxes for any calendar year means Landlord’s reasonable estimate of Real Estate Taxes for such calendar year and will be subject to revisions according to the further provisions of this Article 5.7 and Article 5.8, below. During any partial calendar year during the Term, estimated Real Estate Taxes will be estimated on a full year basis. During each December during the Term, or soon after each December as practicable,

11

Landlord will give Tenant written notice of Estimated Real Estate Taxes for the ensuing calendar year. On or before the first day of each month during the ensuing calendar year (or each month of the Term, if a partial calendar year), Tenant shall pay Landlord 1/12 of the product of Tenant’s Proportionate Share multiplied by the Estimated Real Estate Taxes for such calendar year; however, if such written notice is not given in December, Tenant shall continue to make monthly payments on the basis of the prior year’s Estimated Real Estate Taxes until the month after such written notice is given, at which time, Tenant shall commence making monthly payments based upon a revised Estimated Real Estate Taxes. In the month Tenant first makes a payment based upon a revised Estimated Real Estate Taxes, Tenant shall pay to Landlord for each month which has elapsed since December the difference between the amount payable based upon the revised Estimated Real Estate Taxes and the amount payable based upon the prior year’s Estimated Real Estate Taxes. If at any time or times it reasonably appears to Landlord that the actual Real Estate Taxes for any calendar year will vary from the Estimated Real Estate Taxes for such calendar year, Landlord may, by written notice to Tenant, revise the Estimated Real Estate Taxes for such calendar year, and subsequent payments by Tenant in such calendar year will be based upon the revised Estimated Real Estate Taxes.

5.8 Final Proration of Real Estate Taxes. If the Term ends on a day other than the last day of a calendar year, the amount of increase (if any) in the Real Estate Taxes payable by Tenant applicable to the calendar year in which this Lease ends shall be calculated on the basis of the number of days of the Term falling within such calendar year, and Tenant’s obligation to pay any increase, or Landlord’s obligation to refund any overage, shall survive the expiration or other termination of this Lease.

5.9 Other Taxes.

(a) Tenant shall reimburse Landlord upon demand for any and all taxes payable by Landlord (other than as set forth in Article 5.9(b) below), whether or not now customary or within the contemplation of Landlord and Tenant:

| (1) | upon or measured by rent, including without limitation, any gross revenue tax, excise tax, or value added tax levied by the federal government or any other governmental body with respect to the receipt of rent; and |

| (2) | upon this transaction or any document to which Tenant is a party creating or transferring an interest or an estate in the Premises. |

| (3) | upon a reassessment of the Project or Building by a taxing authority having jurisdiction over the same. |

(b) Tenant will not be obligated to pay any inheritance tax, gift tax, franchise tax, federal income tax (based on net income), profit tax, or capital levy imposed upon Landlord; provided, however, that Tenant shall pay any tax or excise on Rent or other amounts payable by Tenant to Landlord levied or assessed against Landlord on account of Rent.

(c) Tenant shall pay promptly when due all taxes, charges or other governmental impositions assessed against, levied upon or otherwise imposed upon or with respect to Tenant’s fixtures, furnishings, personal property, systems and equipment located in or exclusively serving the Premises, and any improvements made by Tenant to the Premises under or pursuant to the provisions of this Lease. If any of such taxes are levied or assessed against Landlord or Landlord’s property or if the assessed value of the Premises is increased by the inclusion therein of a value placed upon such property of Tenant, and if Landlord, after written notice to Tenant, pays the taxes based upon such increased assessment, which Landlord shall have the right to do regardless of the validity thereof, but only under proper protest if requested by Tenant, Tenant shall, upon demand, repay to Landlord the taxes so levied against Landlord, or the portion of such taxes resulting from such increased in the assessment. Tenant shall pay any rent tax, sales tax, service tax, transfer tax, value added tax or any other applicable tax on the Rent, utilities or services herein, the privilege of renting, using or occupying the Premises, or collecting Rent therefrom, or otherwise respecting this Lease or any other document entered into in connection herewith.

5.10 Additional Rent. Amounts payable by Tenant pursuant to this Article 5 shall be payable as Additional Rent, without deduction or offset except as otherwise expressly provided in this Lease. If Tenant fails to pay any amounts due according to this Article 5, Landlord shall have all the rights and remedies available to it under this Lease and/or applicable law.

12

ARTICLE 6. INSURANCE.

6.1 Landlord’s Insurance. At all times during the Term, Landlord shall procure and keep in full force and effect the following insurance:

| (a) | All-Risk property insurance insuring the Building and all improvements therein, including the Landlord’s Work, the TI Work and those tenant improvements and alterations of which Landlord had notice and which became Landlord’s property upon installation pursuant to the terms of this Lease, its equipment and common area furnishings, all with such coverages, amounts and deductibles consistent with what prudent and commercially reasonable landlords are carrying on Class A buildings of comparable age and size in the Building’s immediate area in downtown Seattle; |

| (b) | Commercial General Liability insurance with coverage for death and bodily injury, property damage or destruction (including loss of use), product and completed operations liability, contractual liability, fire legal liability, personal injury liability and advertising injury liability; and |

| (c) | Such other insurance as Landlord reasonably determines from time to time is consistent with what prudent and commercially reasonable landlords are carrying on Class A buildings of comparable age and size in the Building’s immediate area in downtown Seattle. |

6.2 Tenant’s Insurance. Tenant shall, at its sole cost and expense, keep in full force and effect the following insurance:

| (a) | All-Risk property insurance on Tenant’s Property for the full replacement value. Such policy shall contain an agreed amount endorsement in lieu of a coinsurance clause. “Tenant’s Property” is defined to be personal property of Tenant located in or on the Premises, Common Areas or Building and those tenant improvements or alterations to the Premises which do not become Landlord’s property upon installation pursuant to the terms of this Lease or were made by Tenant and of which Landlord did not have notice, excluding that which may be insured by Landlord’s All-Risk property insurance as set forth in Article 6.1(a) above; |

| (b) | Commercial General Liability insurance insuring Tenant against any liability arising out of its use, occupancy or maintenance of the Premises or the business operated by Tenant pursuant to the Lease. Such insurance shall be in the amount of at least $3,000,000 per occurrence (which amount may be reasonably changed by Landlord at any time during the Term). Such policy shall name Landlord, Landlord’s wholly-owned subsidiaries, affiliates and agents and any mortgagees of Landlord as additional insureds; |

| (c) | Worker’s Compensation and Employer’s Liability insurance as required by state law; |

| (d) | Business Automobile Liability Insurance in the amount of $1,000,000 combined single limit; and |

| (e) | Any other form or forms of insurance or increased amounts of insurance as Landlord or any mortgagees of Landlord may reasonably require from time to time in form, in amounts and for insurance risks against which a prudent tenant would protect itself. |

All such policies shall be written in a form and with an insurance company satisfactory to Landlord and any mortgagees of Landlord, and shall provide that Landlord, and any mortgagees of Landlord, shall receive not less than thirty (30) days prior written notice of any cancellation. Prior to or at the time that Tenant takes possession of the Premises, Tenant shall deliver to Landlord copies of policies or certificates evidencing the existence of the amounts and forms of coverage satisfactory to Landlord. Tenant shall, within thirty (30) days prior to the expiration of such policies, furnish Landlord with renewals or “binders” thereof, or Landlord may order such insurance and charge the cost thereof to Tenant as Additional Rent.

6.3 Forms of Policies. All policies maintained by Tenant will provide that they may not be terminated except after thirty (30) days’ prior written notice to Landlord (ten (10) days’ prior written notice in the event of non-payment of premium). In addition, the insurance

13

certificate shall provide that Tenant’s insurance broker shall endeavor to provide Landlord with ten (10) days’ prior written notice if coverage is to be reduced. All Commercial General Liability and All-Risk property policies maintained by Tenant shall be written as primary policies, not contributing with and not supplemental to the coverage that Landlord may carry.

6.4 Waiver of Subrogation. Notwithstanding that any loss or damage may be due to or result from the negligence of either of the parties hereto, Landlord and Tenant, for themselves and their respective insurers, each waive any and all rights to recover against the other; against any subsidiary or joint venture of such other party; against any other tenant or occupant of the Project; or against the officers, directors, shareholders, partners, employees, agents, customers, invitees, or business visitors of such other party, of such other tenant or occupant of the Project, of any subsidiary or joint venture of such other party, for any loss or damage to the property of such waiving party arising from any cause.

6.5 Adequacy of Coverage. Landlord, its agent and employees make no representation that the limits of liability specified to be carried by Tenant pursuant to this Article 6, are adequate to protect Tenant. If Tenant believes that any of such insurance coverage is inadequate, Tenant will obtain such additional insurance coverage as Tenant deems adequate, at Tenant’s sole expense.

6.6 Certain Insurance Risks. Tenant shall not do nor permit to be done any act or thing upon the Premises or the Project which would (a) jeopardize or be in conflict with fire insurance policies covering the Project or fixtures and property in the Project; (b) increase the rate of fire insurance applicable to the Project to an amount higher than it otherwise would be for general office use of the Project; or (c) subject Landlord to any liability or responsibility for injury to any person or persons or to property by reason of any business or operation being carried on upon the Premises.

ARTICLE 7. USE.

The Premises shall be used only for the purposes designated in Article 1.1(x) and purposes incidental thereto and for no other purpose without the prior written consent of Landlord, which consent may be withheld in Landlord’s sole discretion. Tenant shall use the Premises in a careful, safe, and proper manner. Tenant shall not use or permit the Premises to be used or occupied for any purpose or in any manner that would (i) violate the certificate of occupancy in effect on the date hereof for the Premises or the Project or any part hereof, (ii) be prohibited by any applicable laws, (iii) interfere with or impair the Project’s systems and equipment, or (iv) be for the use or purposes of demonstrations or picketing or for any improper, immoral, unlawful, pornographic, sexually explicit, or objectionable use or purpose. Tenant shall not cause, maintain, or permit any nuisance in, on, or about the Premises. Tenant shall not commit waste or suffer or permit waste to be committed in, on, or about the Premises. Tenant shall conduct its business and control its employees, and agents in such a manner as not to create any nuisance or interfere with, annoy, or disturb any other Tenant or occupant of the Project or Landlord in its operation of the Project.

ARTICLE 8. COMPLIANCE WITH LAWS AND THE DECLARATION.

Except as otherwise specifically set forth in this Lease, Tenant, at its sole cost and expense, shall at all times comply with all Laws (including, without limitation, the ADA ( as hereinafter defined)), statutes, ordinances, and governmental rules and regulations, including, without limitation, the requirements of any board of fire underwriters or other similar body, with any direction or occupancy certificate issued pursuant to any law by any public officer or officers, and with the provisions of the Declaration and all other recorded documents affecting the Premises, insofar as they relate to the condition, use, or occupancy of the Premises, or improvements or alterations made by or for the Tenant.

Landlord represents and warrants to Tenant that, on the date of delivery of possession of the Premises to Tenant, the Premises will be in compliance with the Declaration. Landlord further represents and warrants to Tenant that, to Landlord’s knowledge, on or before the date of delivery of possession of the Premises to Tenant Landlord has not received any uncured written notice of the Premises being in violation of any Laws, ordinances, orders, rules, regulations, and other governmental requirements relating to the use, condition, and occupancy of the Premises for the purposes allowed by this Lease including, without limitation, the certificate of occupancy for the Premises and Building, Environmental Laws (as defined in

14

Article 9), the ADA and all rules, orders, regulations, and requirements of the board of fire underwriters or insurance service office, or any similar body having jurisdiction over the Premises and the Building. For purposes of this Article 8, Landlord’s knowledge is limited to the actual knowledge of ▇▇▇▇▇▇▇ ▇▇▇▇▇▇, Director – Field Asset Management, of Northwestern Investment Management Company, an affiliate of Landlord.

ARTICLE 9. HAZARDOUS SUBSTANCES.

Tenant represents and warrants to Landlord and agrees that, at all times during the term of this Lease and any extensions or renewals thereof, Tenant shall:

| (i) | promptly comply at Tenant’s sole cost and expense, with all laws, orders, rules, regulations, certificates of occupancy, or other requirements, as the same now exist or may hereafter be enacted, amended or promulgated, of any federal, municipal, state, county or other governmental or quasi-governmental authorities and/or any department or agency thereof relating to the manufacturing, processing, distributing, using, producing, treating, storing (above or below ground level), disposing or allowing to be present (the “Environmental Activity”) of hazardous substances in or about the Premises (each, an “Environmental Law”, and all of them, “Environmental Laws”). |

| (ii) | indemnify and hold Landlord, its agents and employees, harmless from any and all demands, claims, causes of action, penalties, liabilities, judgments, damages (including consequential damages) and expenses including, without limitation, court costs and reasonable attorneys’ fees incurred by Landlord as a result of (a) Tenant’s failure or delay in properly complying with any Environmental Law, or (b) any adverse effect which results from the Environmental Activity, whether of Tenant or Tenant’s subtenants or any of their respective agents, employees, contractors or invitees, with or without Tenant’s consent, which has caused, either intentionally or unintentionally, such Environmental Activity. If any action or proceeding is brought against Landlord, its agents or employees by reason of any such claim, Tenant, upon notice from Landlord, will defend such claim at Tenant’s expense with counsel reasonably satisfactory to Landlord. This indemnity obligation by Tenant of Landlord will survive the expiration or earlier termination of this Lease. |

| (iii) | promptly disclose to Landlord by delivering, in the manner prescribed for delivery of notice in this Lease, a copy of any forms, submissions, notices, reports, or other written documentation (each, a “Communication”) relating to any Environmental Activity by Tenant or any of Tenant’s subtenants or any of their respective agents, employees, contractors or invitees, whether any such Communication is delivered to Tenant or any of its subtenants or is requested of Tenant or any of its subtenants by any federal, municipal, state, county or other government or quasi-governmental authority and/or any department or agency thereof. |

| (iv) | in the event there is a release of any hazardous substance as a result of or in connection with any Environmental Activity by Tenant or any of Tenant’s subtenants or any of their respective agents, employees, contractors or invitees, which must be remediated under any Environmental Law, Tenant shall immediately notify Landlord and Landlord shall perform the necessary remediation and Tenant shall reimburse Landlord for all costs thereby incurred within fifteen (15) days after delivery of a written demand therefor from Landlord (which shall be accompanied by reasonable substantiation of such costs). In the alternative, Landlord shall have the right to require Tenant, at its sole cost and expense, to perform the necessary remediation in accordance with a detailed plan of remediation which shall have been approved in advance in writing by Landlord. Landlord shall give notice to Tenant within thirty (30) days after Landlord receives notice or obtains knowledge of the required remediation. The rights and obligations of Landlord and Tenant set forth in this subparagraph (iv) shall survive the expiration or earlier termination of this Lease. |

| (v) | notwithstanding any other provisions of this Lease, allow Landlord, and any authorized representative of Landlord, access and the right to enter and inspect |

15

| the Premises for Environmental Activity, at any time deemed reasonable by Landlord, without prior notice to Tenant. |

The term “hazardous substances” as used in the Lease, is defined as follows: any element, compound, mixture, solution, particle or substance, which presents danger or potential danger of damage or injury to health, welfare or to the environment including, but not limited to: (i) those substances which are inherently or potentially radioactive, explosive, ignitable, corrosive, reactive, carcinogenic or toxic and (ii) those substances which have been recognized as dangerous or potentially dangerous to health, welfare or to the environment by any federal, municipal, state, county or other governmental or quasi-governmental authority and/or any department or agency thereof.

Compliance by Tenant with any provision of this Article 9 shall not be deemed a waiver of any other provision of this Lease. Without limiting the foregoing, Landlord’s consent to any Environmental Activity shall not relieve Tenant of its indemnity obligations under the terms hereof.

ARTICLE 10. ASSIGNMENT AND SUBLETTING.

10.1 General. Tenant, for itself, its heirs, distributees, executors, administrators, legal representatives, successors, and assigns, covenants that it shall not assign, mortgage, or encumber this Lease, nor sublease, nor permit the Premises or any part of the Premises to be used or occupied by others, without the prior written consent of Landlord in each instance, which consent shall be given or withheld in Landlord’s commercially reasonable business judgement. Landlord shall have no obligation to grant its consent if there is an existing Event of Default under this Lease or if Landlord has given notice to Tenant of any nonperformance by Tenant under this Lease which, with notice or the passage of time, or both, would constitute an Event of Default under this Lease. Any assignment or sublease in violation of this Article 10 will be voidable, at Landlord’s election. If this Lease is assigned, or if the Premises or any part of the Premises are subleased or occupied by anyone other than Tenant, Landlord may, after any Event of Default by Tenant, collect rent from the assignee, subtenant, or occupant, and apply the net amount collected to Rent. No assignment, sublease, occupancy, or collection shall be deemed (a) a waiver of the provisions of this Article 10; (b) the acceptance of the assignee, subtenant, or occupant as Tenant; or (c) a release of Tenant from the further performance by Tenant of covenants on the part of Tenant contained in this Lease including, without limitation, the covenant to pay Rent. The consent by Landlord to an assignment or sublease will not be construed to relieve Tenant from obtaining Landlord’s prior written consent in writing to any further assignment or sublease. No assignment or subletting shall relieve Tenant from its obligations hereunder, and Tenant shall continue to be liable as a principal, and not as a guarantor or surety, to the same extent as though no assignment or sublease has been made. No permitted subtenant may assign or encumber its sublease or further sublease all or any portion of its subleased space, or otherwise permit the subleased space or any part of its subleased space to be used or occupied by others, without Landlord’s prior written consent in each instance. As a condition to its consent required by this Article 10, Landlord may require Tenant, assignee or subtenant, at the sole cost and expense of such Tenant, assignee or subtenant, to make such alterations to the Premises and the Project that may be necessary in order to comply with the ADA as it applies to the use, occupancy, or alteration of the Premises. In the alternative, Landlord, as a condition to its consent required by this Article 10, may, in its sole discretion, choose to make such alterations on behalf of Tenant in which case Tenant, assignee or subtenant, as the case may be, shall deposit with Landlord 100% of Landlord’s reasonable estimate of the cost of such alterations prior to commencement of construction of the same.

10.2 Submission of Information. If Tenant requests Landlord’s consent to a specific assignment or subletting, Tenant shall submit in writing to Landlord at least thirty (30) days prior to the effective date of the proposed assignment or sublease (a) the name and address of the proposed assignee or subtenant; (b) the business terms of the proposed assignment or sublease; (c) reasonably satisfactory information as to the nature and character of the business of the proposed assignee or subtenant, and as to the nature of its proposed use of the space; (d) banking, financial, or other credit information reasonably sufficient to enable Landlord to determine the financial responsibility and character of the proposed assignee or subtenant; (e) the proposed form of assignment or sublease for Landlord’s reasonable approval, which approval may include requiring Tenant and the assignee or subtenant, as the case may be, including additional terms and conditions in said form of assignment or sublease, and (f) any other information which Landlord may reasonably deem relevant.

16

10.3 Payments to Landlord. If Landlord consents to a proposed assignment or sublease, then Landlord shall have the right to require Tenant to pay to Landlord one–half (1/2) of the total amount of (a) any rent or other consideration paid to Tenant by any proposed transferee that (after deducting the costs of Tenant, if any, in effecting the assignment or sublease, including reasonable alterations costs, commissions and legal fees) is in excess of the Rent allocable to the transferred space then being paid by Tenant to Landlord pursuant to this Lease; (b) any other profit or gain (after deducting any necessary expenses incurred) realized by Tenant from any such sublease or assignment; and (c) Landlord’s reasonable attorneys’ fees and costs incurred in connection with negotiation, review, and processing of the transfer. All such sums payable will be payable to Landlord within ten (10) business days after Tenant’s receipt thereof.

10.4 Prohibited Transfers. The transfer of a majority of the issued and outstanding capital stock of any corporate tenant or subtenant of this Lease, or a majority of the total interest in any partnership or limited liability company tenant or subtenant, however accomplished, and whether in a single transaction or in a series of related or unrelated transactions, will be deemed an assignment of this Lease or of such sublease requiring Landlord’s consent in each instance. For purposes of this Article 10, the sale or transfer of stock of Tenant, Tenant’s parent, or such parent’s parent, through any public exchange, or the redemption or issuance of additional stock of any class shall not be deemed an assignment, subletting, or any other transfer of the Lease or the Premises.

10.5 Permitted Transfer. Notwithstanding anything to the contrary contained in this Article 10, Landlord’s consent shall not be required for an assignment or other transfer of Tenant’s interest under this Lease or a sublease of the entire Premises to an affiliate of Tenant or in connection with a merger or the sale of Tenant’s business or substantially all of Tenant’s assets; provided that (i) Tenant shall notify Landlord in writing of the proposed transaction and the identity of the proposed assignee or sublessee, (ii) at the time of such proposed assignment, transfer or sublease, there shall be no Event of Default under this Lease, (iii) to the extent there is an actual change in the identity of the Tenant, any proposed assignee or transferee shall agree in a writing reasonably acceptable to Landlord that it will assume and be bound by the terms of this Lease, (iv) there shall be no change in use of the Premises, (v) any proposed assignee or transferee shall have a net worth no less than the net worth of Tenant as of the date of execution of this Lease, and (vi) Tenant agrees to make such alterations to the Premises and the Project that may be necessary in order to comply with the ADA as it applies to the use, occupancy, or alteration of the Premises by the assignee or subtenant. As used herein, an “affiliate” shall mean an entity which directly or indirectly controls or is controlled by or is under common control with Tenant. “Controls”, “controlled by” or “under common control” means with regard to a corporation ownership of at least fifty percent (50%) of the issued and outstanding stock or with regard to a corporation and any other entity, ownership or at least fifty percent (50%) of the equity, interest, voting or other decision-making power.

10.6 Condition. It is an express condition of any permitted assignment or sublease that there shall be no Event of Default under this Lease at the time Tenant provides Landlord its request for written consent to such assignment or sublease.

10.7 Remedies. If Tenant believes that Landlord has unreasonably withheld its consent pursuant to this Article 10, Tenant’s sole remedy will be to seek a declaratory judgment that Landlord has unreasonably withheld its consent or an order of specific performance or mandatory injunction of Landlord’s agreement to give its consent; however, Tenant may recover damages if a court of competent jurisdiction determines that Landlord has acted arbitrarily and capriciously in evaluating the proposed assignee’s or subtenant’s creditworthiness, identity, and business character and the proposed use and lawfulness of the use.

10.8 Effect on Options. Any renewal, expansion, right of opportunity or similar option(s) granted to Tenant in this Lease or in any amendments to this Lease, to the extent that such option(s) have not been exercised, shall terminate and be voided in the event this Lease is assigned or two or more Floors of the Premises are sublet, or Tenant’s interest in the Premises are otherwise transferred, unless otherwise agreed to by Landlord.

ARTICLE 11. RULES AND REGULATIONS.

Tenant and its employees, agents, licensees, and visitors shall at all times observe faithfully, and comply strictly with, the Rules and Regulations set forth in Exhibit E. Landlord may

17

from time to time reasonably amend, delete, or modify existing rules and regulations, or adopt reasonable new rules and regulations for the use, safety, cleanliness, and care of the Premises, the Building, and the Project, and the comfort, quiet, and convenience of occupants of the Project; provided such amendments or modifications do not materially interfere with Tenant’s rights under this Lease. Modifications or additions to the Rules and Regulations will be effective upon thirty (30) days’ prior written notice to Tenant from Landlord. In the event of any breach of any of the Rules or Regulations or any amendments or additions thereto, Landlord shall have all remedies that this Lease provides for an Event of Default by Tenant, and shall in addition have any remedies available at law or in equity, including the right to enjoin any breach of such Rules and Regulations. Landlord shall be fair and evenhanded in implementing and enforcing the Rules and Regulations. Landlord shall not be liable to Tenant for violation of such Rules and Regulations by any other person. In the event of any conflict between the provisions of this Lease and the Rules and Regulations, the provisions of this Lease shall govern.

ARTICLE 12. COMMON AREAS AND BUILDING AMENITIES.

12.1 Common Areas. As used in this Lease, the term “Common Areas” means, without limitation, the parking area or parking facility, hallways, entryways, stairs, elevators, driveways, sidewalks, walkways, terraces, docks, loading areas, restrooms, trash facilities, and all other areas and facilities in the Project that are provided and designated from time to time by Landlord for the general nonexclusive use and convenience of Tenant with Landlord and their guests, invitees, employees, licensees, or visitors. Without advance written notice to Tenant, except with respect to matters covered by Article 12(a) below, and without any liability to Tenant in any respect, provided Landlord will take no action permitted under Article 12(a), below, in such a manner as to materially impair or adversely affect Tenant’s substantial benefit and enjoyment of the Premises, Landlord will have the right to:

| (a) | Close off any of the Common Areas to whatever extent required in the reasonable opinion of Landlord to prevent a dedication of any of the Common Areas or the accrual of any rights by any person or the public to the Common Areas; |

| (b) | Temporarily close any of the Common Areas for maintenance, alteration, or improvement purposes; and |

| (c) | Change the size, use, shape, or nature of any such Common Areas, including expanding the Building or other Buildings to cover a portion of the Common Areas, converting Common Areas to a portion of the Building or other Buildings, altering the Common Areas in order to comply with the ADA, or converting any portion of the Building (excluding the Premises) or other Buildings to Common Areas. |

12.2 Building Amenities. Landlord shall make available to Tenant the following for the general nonexclusive use and convenience of Tenant (i) outside garden deck located on the 17th floor, (ii) tenant conference rooms located on the 17th floor, (iii) a fitness center, (iv) secure bike storage, and (v) showers and locker rooms (collectively, “Building Amenities”).

ARTICLE 13. LANDLORD’S SERVICES.

13.1 Landlord’s Repair and Maintenance. Subject to Article 5 above, Landlord shall maintain the Building, Common Areas of the Project, Building Amenities, lobbies, stairs, elevators, corridors, and restrooms, the windows in the Building, the mechanical, plumbing and electrical equipment serving the Building, and the structural elements of the Building in good working order and first class condition consistent with standards customary for Class A buildings of comparable age and size in the Building’s immediate area in downtown Seattle.

13.2 Landlord’s Other Services.

(a) Subject to Article 5 above, Landlord shall make available to the Premises the following services: (1) the base building electrical system to provide an electrical capacity equal to four (4) ▇▇▇▇▇ per useable square foot of the Premises for incidental equipment and lighting associated with office use; (2) heat and air conditioning reasonably required for the comfortable occupation of the Premises during business hours; (3) access and elevator service; (4) hot and cold water for public and private lavatory, drinking and office cleaning use; (5) lighting replacement during business hours (for Building standard lights, but not for any special Tenant lights, which will be replaced at Tenant’s sole cost and expense); (6) restroom supplies; (7) window washing with

18

reasonable frequency, as determined by Landlord; (8) cleaning service five (5) days per week in accordance with standards customary for Class A buildings in the Building’s immediate area in downtown Seattle; and (9) courtesy patrols for the Project in accordance with standards customary for Class A buildings in the Building’s immediate area in downtown Seattle. Landlord may, but will not be obligated to, provide any such services on holidays. Landlord shall allow for a 100A 480V connection to the base building electrical system for a server room, which shall be separately metered. Landlord shall make available the base building electrical system at the Premises to provide power to support Tenant’s server room’s mechanical equipment as described below in Article 13.3. The cost of installing any Landlord approved connection or Landlord approved feeder cable from the ▇▇▇▇ riser to the Premises shall not be a Landlord cost, but shall be paid for out of the Cash Allowance described in the Work Letter Exhibit C. Tenant shall be responsible for distribution of the power.

(b) Tenant will have the right, subject to the procedures established by Landlord from time to time for providing additional or excess services, to purchase for use during business hours and non-business hours the services described in Article 13.2(a)(1) and (2), above, in excess of the amounts Landlord has agreed to furnish so long as (1) Tenant gives Landlord reasonable prior written notice of its desire to do so; (2) the excess services are reasonably available to Landlord and to the Premises; and (3) Tenant pays as Additional Rent (at the time the next payment of Monthly Base Rent is due) the cost of such excess service from time to time charged by Landlord, which cost of such excess service is currently $25 per hour for each floor for which Tenant requests such after-hours service. Landlord will increase the costs for such excess services when Landlord incurs increased costs, plus a reasonable administrative fee to cover Landlord’s costs of providing such excess services.

(c) The term “business hours” means 8:00 a.m. to 6:00 p.m. on Monday through Friday, except State of Washington and federal holidays.

13.3 Tenant’s Costs. Whenever equipment or lighting (other than building standard lights or ordinary office equipment, including computers, copiers, lunch room refrigerators and microwaves) is used in the Premises by Tenant and such equipment or lighting affects the temperature otherwise normally maintained by the design of the Building’s air conditioning system, Landlord shall have the right to charge for supplementary air conditioning facilities in the Premises or otherwise modify the ventilating and air conditioning system serving the Premises; and the actual cost of such facilities, modifications and additional service (including an administrative fee) shall be paid by Tenant as Additional Rent within thirty (30) days of receipt of an invoice. Should Tenant desire any additional service beyond that described in Article 13.2, above, Landlord may, at Landlord’s option upon reasonable advance notice from Tenant to Landlord, (i) refuse to consent to such services or (ii) consent to such services upon such conditions as Landlord elects (including the requirements that submeters be installed at Tenant’s expense, that Tenant pay directly to the provider of such service (in the case of submetered services) or to Landlord, as Additional Rent within thirty (30) days of receipt of an invoice, Landlord’s additional expenses resulting therefrom, and that Tenant pay the cost of all alterations or additions made to accommodate such excess use, including the cost of a submeter and installation of the same). Landlord shall provide 40 tons of chilled water capacity to the Premises for Tenant’s server room and allow the installation of floor mounted air conditioning units and associated ductwork. The cost of installing connections and piping to new equipment shall be paid for out of the Cash Allowance. Tenant shall install metering to monitor use of the Building’s chilled water capacity and electricity. Installation may involve the addition of louvers to the North side of the building, and these louvers shall fit within the footprint of existing architectural louvers between structural grid lines 3 and 4, and shall be covered by the existing louver architectural skin as a visible surface.

13.4 Limitation on Liability. Landlord shall not be in default under this Lease or be liable to Tenant or any other person for direct or consequential damage, or otherwise, for any failure to supply any heat, air conditioning, elevator, cleaning, lighting, security; for surges or interruptions of electricity; or for other services which Landlord has agreed to supply during any period provided that Landlord uses commercially reasonable efforts to supply such services and the failures, surges or interruptions are not due to the gross negligence or intentional misconduct of Landlord or its employees. Landlord will use commercially reasonable efforts to remedy any interruption in the furnishing of such services. Landlord reserves the right temporarily to discontinue such services at such times as may be necessary by reason of accident, repairs, alterations or improvements, strikes, lockouts, riots, acts of God, governmental preemption in connection with a national or local emergency, any rule, order, or regulation of any governmental

19

agency, conditions of supply and demand that make any product unavailable, Landlord’s compliance with any mandatory governmental energy conservation or environmental protection program, or any voluntary governmental energy conservation program at the request of or with consent or acquiescence of Tenant, mandatory or prohibitive injunction issued in connection with the enforcement of the ADA, or any other event or condition beyond the control of Landlord. Landlord shall not be liable to Tenant or any other person or entity for direct or consequential damages resulting from the admission to or exclusion from the Building or Project of any person. In the event of invasion, mob, riot, public excitement, strikes, lockouts, or other circumstances rendering such action advisable in Landlord’s sole opinion, Landlord shall have the right to prevent access to the Building or Project during the continuance of the same by such means as Landlord, in its reasonable discretion, may deem appropriate, including without limitation locking doors and closing parking areas and other Common Areas. Landlord shall not be liable for damages to person or property or for injury to, or interruption of, business for any discontinuance permitted under this Article 13, nor will such discontinuance in any way be construed as an eviction of Tenant or cause an abatement of Rent or operate to release Tenant from any of Tenant’s obligations under this Lease.

ARTICLE 14. TENANT’S CARE OF THE PREMISES.

Tenant shall maintain the Premises (including, but not limited to, Tenant’s equipment, personal property and trade fixtures located in the Premises) in the same condition as at the time they were delivered to Tenant (reasonable wear and tear excluded). Tenant shall immediately advise Landlord of any damage to the Premises, Building or the Project of which Tenant has knowledge. All damage to the Premises, Building or the Project, or the fixtures, appurtenances, and equipment located therein caused by Tenant, its agents, employees, or invitees, to the extent not covered by insurance, shall, at Landlord’s option, either (i) be repaired, restored, or replaced by Landlord at the expense of Tenant, which actual expense (including ten percent (10% of such expense for Landlord’s overhead) shall be collectible by Landlord as Additional Rent and shall be payable by Tenant not more than ten (10) days after delivery to Tenant of a statement for the same; or (ii) be required to be repaired by Tenant, at Tenant’s sole cost and expense, to at least the condition the same were in prior to such damage.

Tenant shall (A) adopt and enforce good housekeeping practices, ventilation and vigilant moisture control within the Premises (particularly in kitchen areas, janitorial closets, bathrooms, in and around water fountains and other plumbing facilities and fixtures, break rooms, in and around outside walls, and in and around HVAC systems and associated drains) for the prevention of mold (such measures, “Mold Prevention Practices”), and (B) regularly monitor the Premises for the presence of mold and conditions that reasonably can be expected to give rise to or be attributed to mold or fungus including, but not limited to, observed or suspected instances of water damage, condensation, seepage, leaks or any other water collection or penetration (from any source, internal or external), mold growth, mildew, repeated complaints of respiratory ailments or eye irritation by Tenant’s employees or any other occupants of the Premises, or any notice from a governmental agency of complaints regarding the indoor air quality at the Premises (the “Mold Conditions”); and (C) immediately notify Landlord in writing if it observes, suspects, has reason to believe or knows of mold or Mold Conditions in, at or about the Premises or a surrounding area. In the event of suspected mold or Mold Conditions in, at or about the Premises and surrounding areas, Landlord may cause an inspection of the Premises to be conducted, during such time as Landlord may designate, to determine if mold or Mold Conditions are present in, at or about the Premises.

20

ARTICLE 15. ALTERATIONS.

15.1 General.