AMENDMENT AND INTERIM IMPLEMENTATION AGREEMENT amongst ATLATSA RESOURCES CORPORATION and N1C RESOURCES INC. and N2C RESOURCES INC and RUSTENBURG PLATINUM MINES LIMITED

Exhibit 4.40

EXECUTION VERSION

AMENDMENT AND INTERIM IMPLEMENTATION AGREEMENT

amongst

ATLATSA RESOURCES CORPORATION

and

N1C RESOURCES INC.

and

N2C RESOURCES INC

and

RUSTENBURG PLATINUM MINES LIMITED

(in its capacity as co-shareholder and preference shareholder of Holdco, Senior Agent, Senior Facilities Lender and OCSF Lender)

and

PLATEAU RESOURCES PROPRIETARY LIMITED

and

BOKONI PLATINUM HOLDINGS PROPRIETARY LIMITED

and

BOKONI PLATINUM MINE PROPRIETARY LIMITED

and

MICAWBER 634 PROPRIETARY LIMITED

and

MICAWBER 603 PROPRIETARY LIMITED

and

PELAWAN FINANCE SPV PROPRIETARY LIMITED

and

THE TRUSTEES FOR THE TIME BEING OF THE PELAWAN TRUST

and

THE TRUSTEES FOR THE TIME BEING OF THE PELAWAN DIVIDEND TRUST

Table of Contents

| Page No | ||||||

| 1. | PART 1: DEFINITIONS AND INTERPRETATION |

1 | ||||

| 2. | PART 2: INTRODUCTION |

12 | ||||

| 3. | PART 3: CONDITIONS PRECEDENT |

13 | ||||

| 4. | PART 4: AMENDMENTS TO THE FINANCE DOCUMENTS AND RPM FINANCE DOCUMENTS AND TERMINATION OF THE OCSF AGREEMENT |

14 | ||||

| 5. | PART 5: IMPLEMENTATION |

28 | ||||

| 6. | PART 6: MISCELLANEOUS PROVISIONS |

33 | ||||

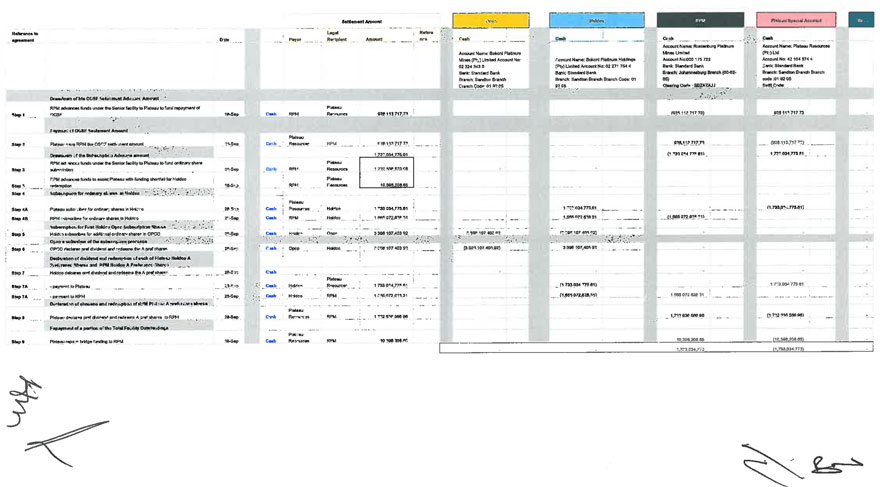

| Schedule 1 Interim Funds Flow Statement |

43 | |||||

| Schedule 2 Term Sheet |

46 | |||||

| SIGNATURE PAGE | 59 | |||||

|

| 1. PART 1: DEFINITIONS AND INTERPRETATION | ||||||

| 1.1 |

Words and expressions not otherwise defined in this Agreement shall bear the meaning given to them in the June 2009 Senior Facilities Agreement (as defined below). In addition, unless otherwise stated or inconsistent with the context in which they appear, the following words and expressions used in this Agreement (including without limitation, in clauses 4.1 to 4.7) bear the following meanings and other words derived from the same origins as such words (that is, cognate words) shall bear corresponding meanings: | |||||

| 1.1.1 |

“Accrued Notional Interest Amount” | on the date of calculation, the aggregate notional interest amount on the Loans, calculated in accordance with clauses 4.1.2.6.4 and 4.1.2.6.5; | ||||

| 1.1.2 |

“Accrued Notional Interest Reference Amount” | an amount of R226,532,264.58; | ||||

| 1.1.3 |

“Additional Advance Amounts” | the aggregate of the Subscription Advance Amount, the OSCF Settlement Advance Amount and the Additional SFA Advance Amounts; | ||||

| 1.1.4 |

“Additional SFA Advance Amounts” | the amount of R295 870 924.16; | ||||

| 1.1.5 |

“AFSA” | Arbitration Foundation of Southern Africa; | ||||

| 1.1.6 |

“Agreement” | this amendment and interim implementation agreement, including all Schedules, as amended from time to time; | ||||

| 1.1.7 |

“Atlatsa” |

Atlatsa Resources Corporation (previously known as Anooraq Resources Corporation), registration number 10022-2033, a public company incorporated in accordance with the laws of British Columbia, Canada; | ||||

1

|

| 1.1.8 |

“Business Day” |

any day which is not a Saturday, Sunday or gazetted public holiday in South Africa; | ||||

| 1.1.9 |

“Companies Act” |

the Companies Act, 71 of 2008; | ||||

| 1.1.10 |

“Conditions Precedent” | the conditions precedent set out in clause 3; | ||||

| 1.1.11 |

“First Holdco Opco Subscription Agreement” | the first subscription agreement entered into, or to be entered into, between Holdco and Opco, on or about the Signature Date, in terms of which Holdco subscribes for and Opco issues and allots the First Holdco Opco Subscription Shares; | ||||

| 1.1.12 |

“First Holdco Opco Subscription Price” | the aggregate subscription price for the First Holdco Opco Subscription Shares, being R3,398,107,403.92; | ||||

| 1.1.13 |

“First Holdco Opco Subscription Shares” | 100 ordinary shares of R1,00 each in the authorised share capital of Opco, to be issued and allotted to Holdco pursuant to the First Holdco Opco Subscription Agreement; | ||||

| 1.1.14 |

“First Plateau Holdco Subscription Agreement” | the first subscription agreement entered into, or to be entered into, between Plateau and Holdco, on or about the Signature Date, in terms of which Plateau subscribes for and Holdco issues and allots the Plateau Holdco Subscription Shares; | ||||

| 1.1.15 |

“First Plateau Holdco Subscription Price” | the aggregate subscription price for the First Plateau Holdco Subscription Shares, being me Subscription Advance Amount; | ||||

2

|

| 1.1.16 |

“First Plateau Holdco Subscription Shares” | 51 ordinary shares of R1,00 each in the authorised share capital of Holdco, to be issued and allotted to Plateau pursuant to the First Plateau Holdco Subscription Agreement; | ||||

| 1.1.17 |

“First RPM Holdco Subscription Agreement” | the first subscription agreement entered into, or to be entered into, between RPM and Holdco, on or about the Signature Date, in terms of which RPM subscribes for and Holdco issues and allots the First RPM Holdco Subscription Shares; | ||||

| 1.1.18 |

“First RPM Holdco Subscription Price” | the aggregate subscription price for the First RPM Holdco Subscription Shares, being R1,665,072,628.31; | ||||

| 1.1.19 |

“First RPM Holdco Subscription Shares” | 49 ordinary shares of R1,00 each in the authorised share capital of Holdco, to be issued and allotted to RPM pursuant to the First RPM Holdco Subscription Agreement; | ||||

| 1.1.20 |

“Holdco” | Bokoni Platinum Holdings Proprietary Limited, registration number 2007/016711/07, a private company incorporated in accordance with the laws of South Africa; | ||||

| 1.1.21 |

“Holdco Opco A Preference Share Subscription Agreement” | the subscription agreement entered into between Holdco and Opco on or about 12 June 2009, in terms of which Holdco subscribed for and Opco issued and alloted the Holdco Opco A Preference Shares; | ||||

3

|

| 1.1.22 |

“Holdco Opco A Preference Dividend” | the A Preference Dividend, as defined in Schedule 2 of the Holdco Opco A Preference Share Subscription Agreement; | ||||

| 1.1.23 |

“Holdco Opco A Preference Shares” | the A Preference Shares, as defined in Schedule 2 of the Holdco Opco A Preference Share Subscription Agreement; | ||||

| 1.1.24 |

“Holdco Opco Redemption Amount” | the Redemption Amount, as defined in Schedule 2 of the Holdco Opco A Preference Share Subscription Agreement; | ||||

| 1.1.25 |

“Implementation Bank” |

The Standard Bank of South Africa Limited; | ||||

| 1.1.26 |

Income Tax Act” | the Income Tax Act, 58 of 1962; | ||||

| 1.1.27 |

“Insolvency Act” | the Insolvency Act, 24 of 1936; | ||||

| 1.1.28 |

“Interim Closing Date” | 28 September 2012 or such other date as RPM and Plateau may agree to in writing; | ||||

| 1.1.29 |

“Interim Funds Flow Statement” | the Interim Funds Flow Statement attached as Schedule 1 to this Agreement; | ||||

| 1.1.30 |

“Interim Implementation Steps” |

the steps set out in clause 5.2, in the sequence reflected in such clause; | ||||

| 1.1.31 |

“June 2009 Senior Facilities Agreement” | the ZAR750,000,000 (inclusive of capitalised interest) term facility agreement dated 12 June 2009, between (as at the Signature Date), amongst | ||||

4

|

| others, ▇▇▇▇▇▇▇, ▇▇▇ Resources, N2C Resources, the Borrower and RPM in its capacity as lender, senior agent and security agent, as amended from time to time; | ||||||

| 1.1.32 |

“Lender” |

the Lender, as defined in the Senior Facilities Agreement; | ||||

| 1.1.33 |

“N1C Resources” | N1C Resources Inc., registration number CR-94610, a limited liability company incorporated in accordance with the laws of the Cayman Islands; | ||||

| 1.1.34 |

“N2C Resources” | N2C Resources Inc., registration number CR-94611, a limited liability company incorporated in accordance with the laws of the Cayman Islands; | ||||

| 1.1.35 |

“New Senior Facilities Agreement” | the new senior facilities agreement to be entered into between, amongst others, the parties to the June 2009 Senior Facilities Agreement after the Signature Date, in terms of which RPM, as original lender, will advance to Plateau, as borrower, an amount of up to R2,300,000,000, including capitalised interest, (plus a further amount, to be agreed between the parties to this agreement, to facilitate the capitalisation of the Holdco Group), on the terms set out in that agreement; | ||||

| 1.1.36 |

“New Senior Facilities Utilisation Date” | the date on which the first amount is advanced to Plateau under the New Senior Facilities Agreement; | ||||

| 1.1.37 |

“OCSF Agreement” | the OCSF Agreement, as defined in the RPM Funding Common Terms Agreement; | ||||

| 1.1.38 |

“OCSF Facility” | the OCSF Facility, as defined in the RPM Funding Common Terms Agreement; | ||||

5

|

| 1.1.39 |

“OCSF Lender” | RPM, in its capacity as lender under the OCSF Facility; | ||||

| 1.1.40 |

“OCSF Settlement Advance Amount” | an amount equivalent to the OCSF Settlement Amount; | ||||

| 1.1.41 |

“OCSF Settlement Amount” | the amount required to be repaid by Plateau to the OSCF Lender to settle all amounts outstanding under the OSCF Facility on the Interim Closing Date, being the amount referred to in clause 4.2.2.1.2; | ||||

| 1.1.42 |

“Opco” | Bokoni Platinum Mines Proprietary Limited, registration number 2007/016001/07, a private company incorporated in accordance with the laws of South Africa; | ||||

| 1.1.43 |

“Opco Security SPV” |

Micawber 603 Proprietary Limited, registration number 2007/019599/07, a private company incorporated in accordance with the laws of South Africa; | ||||

| 1.1.44 |

“Parties” | collectively, ▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇, ▇▇▇ Resources, N2C Resources, RPM, the Lender, the OSCF Lender, the Senior Agent, Opco Security SPV, Plateau Security SPV, Holdco, Opco, Pelawan SPV, Pelawan Dividend Trust, Pelawan Trust and a “Party” shall mean each or any of them, as the context requires; | ||||

| 1.1.45 |

“Pelawan SPV” | Pelawan Finance SPV Proprietary Limited (formerly Central Plaza Investments 78 Proprietary Limited), registration number 2006/032879/07, a private company incorporated in accordance with the laws of South Africa; | ||||

6

|

| 1.1.46 |

“Pelawan Dividend Trust” | the trustees for the time being of the Pelawan Dividend Trust, established in accordance with the trust deed with Master’s reference number IT8410/2004; | ||||

| 1.1.47 |

“Pelawan Trust” | the trustees for the time being of the Pelawan Trust, established in accordance with the trust deed dated 2 September 2004, Master’s reference number IT8411/2004; | ||||

| 1.1.48 |

“Plateau” | Plateau Resources Proprietary Limited, registration number 1996/013879/07, a private company incorporated in accordance with the laws of South Africa; | ||||

| 1.1.49 |

“Plateau Holdco A Preference Share Subscription Agreement” | the subscription agreement entered into between Plateau and Holdco on or about 12 June 2009, in terms of which Plateau subscribes for and Holdco issues and allots the Plateau Holdco A Preference Shares; | ||||

| 1.1.50 |

“Plateau Holdco A Preference Dividend” | the A Preference Dividend, as defined in Schedule 2 of the Plateau Holdco A Preference Share Subscription Agreement; | ||||

| 1.1.51 |

“Plateau Holdco A Preference Shares” | the A Preference Shares, as defined in the Plateau Holdco A Preference Share Subscription Agreement; | ||||

7

|

| 1.1.52 |

“Plateau Holdco Redemption Amount” | the Redemption Amount, as defined in the Plateau Holdco A Preference Share Subscription Agreement; | ||||

| 1.1.53 |

“Plateau Security SPV” | Micawber 634 Proprietary Limited, registration number 2007/025445/07, a private company incorporated in accordance with the laws of South Africa; | ||||

| 1.1.54 |

“RPM” | Rustenburg Platinum Mines Limited, registration number 1931/003380/06, a public company incorporated in accordance with the laws of South Africa; | ||||

| 1.1.55 |

“RPM Funding Common Terms Agreement” | the RPM Funding Common Terms Agreement dated 12 June 2009 between, amongst RPM, Plateau, Atlatsa, Pelawan SPV, N1C Resources, N2C Resources, Pelawan, Pelawan Trust, Opco Security SPV and Plateau Security SPV; | ||||

| 1.1.56 |

“RPM Holdco A Preference Share Subscription Agreement” | the subscription agreement entered into between RPM and Holdco on or about 12 June 2009, in terms of which RPM subscribed for and Holdco issued and allotted the RPM Holdco A Preference Shares; | ||||

| 1.1.57 |

“RPM Holdco A Preference Dividend” | the A Preference Dividend, as defined in Schedule 2 of the RPM Holdco A Preference Share Subscription Agreement; | ||||

8

|

| 1.1.58 |

“RPM Holdco A Preference Shares” | the A Preference Shares, as defined in Schedule 2 of the RPM Holdco A Preference Share Subscription Agreement; | ||||

| 1.1.59 |

“RPM Holdco Redemption Amount” | the Redemption Amount, as defined in Schedule 2 of the RPM Holdco A Preference Share Subscription Agreement; | ||||

| 1.1.60 |

“RPM Plateau A Preference Share Subscription Agreement” | the subscription agreement entered into between RPM and Plateau on or about 12 June 2009, in terms of which RPM subscribed for and Holdco issued and allotted the RPM Plateau A Preference Shares; | ||||

| 1.1.61 |

“RPM Plateau A Preference Dividend” | the A Preference Dividend, as defined in Schedule 2 of the RPM Plateau A Preference Share Subscription Agreement; | ||||

| 1.1.62 |

“RPM Plateau A Preference Shares” | the A Preference Shares, as defined in Schedule 2 of the RPM Plateau A Preference Share Subscription Agreement; | ||||

| 1.1.63 |

“RPM Plateau Redemption Amount” | the Redemption Amount, as defined in Schedule 2 of the RPM Plateau A Preference Share Subscription Agreement; | ||||

| 1.1.64 |

“Schedule” | a schedule to this Agreement; | ||||

9

|

| 1.1.65 |

“Security Agent” | the Security Agent, as defined in the June 2009 Senior Facilities Agreement; | ||||

| 1.1.66 |

“Senior Agent” | the Senior Agent, as defined in the June 2009 Senior Facilities Agreement; | ||||

| 1.1.67 |

“Signature Date” | the date on which this Agreement is signed (whether or not in counterpart) by the last signing of the Parties; | ||||

| 1.1.68 |

“South Africa” | the Republic of South Africa; | ||||

| 1.1.69 |

“Subscription Advance Amount” | the amount of R1,733,034,775.61; | ||||

| 1.1.70 |

“Term Sheet” | the term sheet entitled ‘Project Kingpin’, initialled by AAPL and Atlatsa on or about December 2011, attached hereto as Schedule 2; | ||||

| 1.1.71 |

“Total Facility Outstandings” | mean, at any time, and in relation to the June 2009 Senior Facility Agreement, the aggregate of all amounts of principal (including capitalised interest), accrued and unpaid interest and all and any other amounts due and payable to the Senior Finance Parties by Plateau under the June 2009 Senior Facilities Agreement including, without limitation, any bona fide claim for direct damages or restitution and any claim as a result of any recovery by Plateau of a payment or discharge on the grounds of preference, and any amounts which would be included in any of the above but for any discharge, non-provability or unenforceability of those amounts in any insolvency or other proceedings; | ||||

| 1.1.72 |

“VAT” | value-added tax in terms of the VAT Act; | ||||

| 1.1.73 |

“VAT Act” | the Value Added Tax Act, 89 of 1991; | ||||

10

|

| 1.2 | If any provision in a definition is a substantive provision conferring rights or imposing obligations on any Party, notwithstanding that it is only in the definition clause, effect shall be given to it as if it were a substantive provision of this Agreement. |

| 1.3 | Any reference to an enactment is to that enactment as at the Signature Date and, in the event that any right and/or obligation shall arise in terms of this Agreement, in respect of and/or in connection with such enactment after the Signature Date, such reference shall be to that enactment as amended and/or replaced as at the date for performance of such right and/or obligation. |

| 1.4 | Any reference in this Agreement to this Agreement or to any other agreement shall be construed as a reference to this Agreement or such other agreement as the same may have been (including at any time prior to the Signature Date), or may from time to time be, amended, varied, novated or supplemented. |

| 1.5 | Unless inconsistent with the context, an expression which denotes: |

| 1.5.1 | any gender includes the other genders; |

| 1.5.2 | a natural person includes an artificial person and vice versa; |

| 1.5.3 | the singular includes the plural and vice versa. |

| 1.6 | Where any term is defined within the context of any particular clause in this Agreement, the term so defined, unless it is clear from the clause in question that the term so defined has limited application to the relevant clause, shall bear the meaning ascribed to it for all purposes in terms of this Agreement, notwithstanding that that term has not been defined in this interpretation clause. |

| 1.7 | The rule of construction that, in the event of ambiguity, a contract shall be interpreted against the Party responsible for the drafting or preparation of such contract, shall not apply. |

| 1.8 | Where any number of days is prescribed, those days shall be reckoned exclusively of the first and inclusively of the last day unless the last day falls on a day which is not a Business Day, in which event the last day shall be the next succeeding Business Day. |

11

|

| 1.9 | The Schedules to this Agreement forms an integral part hereof and words and expressions defined in this Agreement shall bear, unless the context otherwise requires, the same meaning in such Schedules. |

| 1.10 | If any words and expressions defined in clause 1.1 above are used in any clause in this Agreement which contains amendments to any Finance Document or RPM Finance Document (“Amended Finance Document”), such words and expressions shall be deemed to be included by reference, as defined terms, into such Amended Finance Document. |

| 2. | PART 2: INTRODUCTION |

| 2.1 | As part of a broader restructure of the funding arrangements in relation to the Borrower and the Holdco Group, and as interim implementation steps, the Parties wish to: |

| 2.1.1 | declare dividends in respect of the preference shares issued by each of Plateau, Holdco and Opco and redeem such preference shares; |

| 2.1.2 | record certain amendments to the interest rate applicable to the amounts outstanding under the OCSF Facility and under the June 2009 Senior Facilities Agreement; |

| 2.1.3 | repay the amounts outstanding under the OCSF Facility and terminate the OCSF Facility; and |

| 2.1.4 | enable utilisations of the Additional SFA Advance Amount, for the same purposes as utilisations under the OCSF Facility were permitted prior to its termination. |

| 2.2 | In order to give effect to the redemption of the preference shares, repayment of the amounts outstanding under the OCSF Facility and replacement of the terminated OCSF Facility on the Interim Closing Date in accordance with this Agreement, including the Interim Implementation Steps, read with the Interim Funds Flow Statement, Plateau has requested the Lender to amend the June 2009 Senior Facilities Agreement to increase the amount available for utilisation by Plateau under the June 2009 Senior Facilities Agreement in order to (i) enable the advance of the Subscription Advance Amount and the OCSF Settlement |

12

|

| Advance Amount and use of such amounts in accordance with the Interim Implementation Steps and (ii) allow further utilisations under the June 2009 Senior Facilities Agreement in order to replace the amounts which would have been available under the OCSF Facility prior to its termination in accordance with this Agreement. |

| 2.3 | The Parties accordingly wish to enter into this Agreement on the terms set out below. |

| 3. | PART 3: CONDITIONS PRECEDENT |

| 3.1 | This entire Agreement (save in respect of clauses 1 to 3 (both inclusive) and clause 6, which shall be of immediate force and effect) shall be subject to the fulfilment of the Conditions Precedent by not later than 26 September 2012, or such later date as the Parties may agree in writing, that: |

| 3.1.1 | the Parties shall respectively have obtained all necessary corporate authorisations (including all board and shareholder resolutions, including all required resolutions under sections 44, 45 and 46 of the Companies Act) required to enter into this Agreement and to give effect to the Interim Implementation Steps; |

| 3.1.2 | Plateau has delivered a copy of the constitutional documents of Plateau or, if the Senior Agent already has a copy, a certificate of an authorised signatory of the Company confirming that the copy in the Senior Agent’s possession is still correct, complete and in full force and effect as at a date no earlier than the Signature Date; |

| 3.1.3 | a specimen of the signature of each person authorised on behalf of Plateau to sign this Agreement; |

| 3.1.4 | a certificate of an authorised signatory of Plateau certifying that each copy document specified in this clause 3.1 is correct, complete and in full force and effect as at a date no earlier than the Signature Date; |

| 3.1.5 | a copy of any other authorisation or other document, opinion or assurance which the Senior Agent has notified Plateau is necessary or desirable in connection with the entry into and performance of, and the transactions |

13

|

| contemplated by, this Agreement or for the validity and enforceability of this Agreement; |

| 3.1.6 | RPM, Plateau, Holdco and Opco have instructed the Implementation Bank to give effect to the Interim Implementation Steps in accordance with the Interim Funds Flow Statement, and the Implementation Bank has agreed to do so, on terms acceptable to RPM; and |

| 3.1.7 | RPM and Plateau have received a copy of this Agreement, signed by each Party. |

| 3.2 | The Conditions Precedent above are imposed for the benefit of all the Parties, and may not be waived except by unanimous written agreement amongst the Parties at any time prior to the dates respectively specified for their fulfilment. |

| 3.3 | The Parties shall use their respective reasonable commercial endeavours to procure the fulfilment of the Conditions Precedent as soon as reasonably possible after the Signature Date. |

| 3.4 | If any Condition Precedent shall not have been fulfilled, or waived by the Party, or Parties, entitled to effect such waiver, as the case may be, by the date specified in clause 3.1 for its fulfilment (or such later date as the Parties may have in writing agreed), this Agreement (save in respect of clauses 1 to 3 (both inclusive) and clause 6, which shall remain of full force and effect, shall lapse and shall be of no force and effect and none of the Parties shall have any claim against the others of them in terms hereof or arising from the failure of the Conditions Precedent, save for a claim arising as a result of a Party’s failure to fulfil-comply with its obligations under this clause 3. |

| 4. | PART 4: AMENDMENTS TO THE FINANCE DOCUMENTS AND RPM FINANCE DOCUMENTS AND TERMINATION OF THE OCSF AGREEMENT |

| 4.1 | AMENDMENTS TO THE JUNE 2009 SENIOR FACILITIES AGREEMENT |

| 4.1.1 | General |

| 4.1.1.1 | Pursuant to clause 40 (Amendments and waivers) of the June 2009 Senior Facilities Agreement, the Lenders have consented to the |

14

|

| amendments to the June 2009 Senior Facilities Agreement contemplated by this Agreement. Accordingly, RPM in its capacity as Senior Agent is authorised to execute this Agreement on behalf of the Finance Parties. |

| 4.1.1.2 | The amendments set out in this clause 4.1 will amend the June 2009 Senior Facilities Agreement on and with effect from the Interim Closing Date. |

| 4.1.2 | Amendments and terms applicable to the Additional Advance Amount |

The June 2009 Senior Facilities Agreement and, to the extent applicable, each other Finance Document and each other RPM Finance Document shall be deemed to be amended, in all respects, as specifically set out in this clause 4.1.2 below and to give effect to the principles set out in this clause 4.1.2 below.

| 4.1.2.1 | Increase of the Total Commitments |

| 4.1.2.1.1 | The definition of “Commitments” is amended by adding the following sub-paragraph as sub-paragraph (a)(i) immediately after sub-paragraph (a) of this definition: |

(a)(i) in relation to RPM, as the sole Lender as at 28 September 2012, an amount equal to the Additional Advance Amounts; and”.

| 4.1.2.1.2 | The definition of “Total Commitments” is deleted and replaced with the following: |

“Total Commitments” means the aggregate of the Commitments, being R 525,725,465.76 plus the Additional Advance Amounts.”

| 4.1.2.2 | Availability Period |

| 4.1.2.2.1 | In relation to the Subscription Advance Amount and the OCSF Settlement Advance Amount, the Availability Period shall be a |

15

|

| period commencing at 07h00 on the Interim Closing Date and terminating at 17h00 on the Interim Closing Date. |

| 4.1.2.2.2 | In relation to the Additional SFA Advance Amounts, the Availability Period shall be the period commencing on the Interim Closing Date and terminating on the earlier of (i) the New Senior Facilities Utilisation Date and (ii) 31 August 2013. |

| 4.1.2.3 | Purpose |

| 4.1.2.3.1 | The Subscription Advance Amount and the OCSF Settlement Advance Amount may be drawn down on the Interim Closing Date and, notwithstanding any provision to the contrary in the June 2009 Senior Facilities Agreement or any other Finance Document: |

| 4.1.2.3.1.1 | the OCSF Settlement Advance Amount may be used only for the purposes of implementing step 2 of the Interim Implementation Steps set out below (Payment of the OCSF Settlement Amount); and |

| 4.1.2.3.1.2 | the Subscription Advance Amount may be used for only for the purposes of implementing step 4 of the Interim Implementation Steps set out below (Subscription for ordinary shares in Holdco). |

| 4.1.2.3.2 | The Additional SFA Advance Amount is intended to replace amounts that were available for utilisation under the OSCF Facility immediately prior to its termination in accordance with clause 4.3 below. As such: |

| 4.1.2.3.2.1 | an amount of R267,870,824.16 of the Additional SFA Advance Amount may be utilised at any time during the Availability Period referred to in clause 4.1.2.2.2 and, notwithstanding any provision to the contrary in the June 2009 Senior Facilities Agreement, any other Finance Document or any other RPM Finance Document, may be |

16

|

| used for any purpose for which the amounts drawn down under the OSCF Facility (as defined in the OCSF Agreement) were permitted to be used; |

| 4.1.2.3.2.2 | an amount of R28,000,000 of the Additional SFA Advance Amount (“Guarantee Facility Portion”) may be utilised at any time during the Availability Period referred to in clause 4.1.2.2.2 and, notwithstanding any provision to the contrary in the June 2009 Senior Facilities Agreement, any other Finance Document or any other RPM Finance Document, may be used for any purpose for which the amounts drawn down under the Guarantee Facility (as defined in the OCSF Facility Agreement) were permitted to be used. |

| 4.1.2.4 | Utilisation Request and utilisation conditions |

| 4.1.2.4.1 | Notwithstanding any provision to the contrary in the June 2009 Senior Facilities Agreement Plateau shall only be entitled to deliver a Utilisation Request in relation to the advance of the Subscription Advance Amount and the OCSF Settlement Advance Amount (in substantially the form attached as Schedule 3 to the June 2009 Senior Facilities Agreement) provided that such delivery is made to the Senior Agent by no later than 11h00 on the Business Day immediately preceding the Interim Closing Date (or such later time as the Agent may agree to in writing). |

| 4.1.2.4.2 | In addition and notwithstanding any provision to the contrary in the June 2009 Senior Facilities Agreement, Plateau shall only be entitled to deliver a Utilisation Request in relation to each advance of the Additional SFA Advance Amount (or any part thereof), which Utilisation Request must be substantially the form of Schedule 3 to the June 2009 Senior Facilities Agreement and must be delivered by no later than 10 Business Days prior to the proposed Utilisation Date (or such other period |

17

|

| as the Lender and Plateau may agree in writing); provided that such Utilisation Request must also (i) specify the amount of the Additional SFA Advance Amount requested for utilization, (ii) specify if any Guarantee Facility Portion is requested, (iii) specify the purpose for which the Additional SFA Advance Amount will be used and (iv) confirm that each of the conditions of clause 6 of the OCSF Agreement (and incorporated into the June 2009 Senior Facilities Agreement by reference in terms of clause 4.1.2.4.3 below) have been complied with. |

| 4.1.2.4.3 | The provisions of clause 6 of the OCSF Agreement (Drawdowns) shall apply (mutatis mutandis) to any utilization of the Additional SFA Advance Amount (or any part thereof); provided that the provisions of such clause 6 which relate specifically to the Guarantee Facility (as defined in the OCSF Agreement) shall apply (mutatis mutandis) to the Guarantee Facility Portion. |

| 4.1.2.5 | Terms of advance |

| 4.1.2.5.1 | On the Interim Closing Date, the Lender will advance and lend to Plateau, who shall borrow from the Lender an amount equal to the aggregate of the Subscription Advance Amount and the OCSF Settlement Advance Amount. |

| 4.1.2.5.2 | Utilisations under of the Additional SFA Advance Amount shall be made in accordance with the provisions of clause 4.1.2.4 above. |

| 4.1.2.5.3 | Save as otherwise expressly set out in this Agreement, the Lender will advance and Plateau shall borrow and repay the Additional Advance Amounts advanced by the Lender on the same terms and conditions as the other amounts advanced to Plateau under the June 2009 Senior Facilities Agreement as at the Signature Date. |

18

|

| 4.1.2.5.4 | The Additional Advance Amounts advanced by the Lender shall be added to the principal amount of the Loan, a portion of which will be repaid by Plateau to the Senior Agent on the Interim Closing Date in accordance with Step 9 of the Interim Implementation Steps (Repayment of a portion of the Total Facility Outstandings) and the balance of which will be repaid by Plateau to the Senior Agent on the dates referred to in clause 10.1(a) of the June 2009 Senior Facilities Agreement (as amended, including pursuant to an amendment dated 11 August 2011). For this purpose the amount of each payment made by Plateau on such dates shall be increased pro rata by the Additional Advance Amounts which are outstanding as at the relevant payment date. |

| 4.1.2.5.5 | Interest on the Additional Advance Amounts advanced by the Lender shall accrue at the rate referred to in clause 4.1.2.6 and shall be repaid on the same dates specified in the June 2009 Senior Facilities Agreement (as amended, including pursuant to an amendment dated 11 August 2011). |

| 4.1.2.6 | Interest Rate |

| 4.1.2.6.1 | Clauses 14.1 and 14.2 of the June 2009 Senior Facilities Agreement are amended as set out below. |

| 4.1.2.6.2 | Having regard to the interest rate principles agreed in the Term Sheet, the Parties agree that: |

| 4.1.2.6.2.1 | for the period commencing on 1 July 2011 up to and including 30 April 2012, the aggregate accrued interest in relation to the Loans is nil; and |

| 4.1.2.6.2.2 | for the period commencing on 1 May 2012 to 27 September 2012, the aggregate accrued interest relation to the Loans is an amount of R81,007,438.94, which amount shall be capitalised to the Loans outstandings on 27 September 2012. |

19

|

| 4.1.2.6.3 | From the period commencing on 28 September 2012 to the earlier of (i) the New Senior Facilities Utilisation Date; and (ii) the Termination Date, being (as at the Signature Date) 30 June 2018 (“the Interest Adjustment Period”), interest on each Loan for each Interest Period shall be calculated as set out below. |

| 4.1.2.6.4 | A notional calculation will be made, in terms of which a notional interest rate is calculated to be the percentage rate per annum which is (unless stated to be zero in clause 4.1.2.6.5): |

| 4.1.2.6.4.1 | the applicable JIBAR, plus or minus (as the case may be) |

| 4.1.2.6.4.2 | the applicable Margin, |

which notional interest shall be notionally applied to the Loans as if it accrues on the Loans, in each case, on a day to day basis at a notional interest rate, is calculated, in arrears, and compounded at the end of each Interest Period.

| 4.1.2.6.5 | The above notional interest rate and Margin in relation to each Loan will be calculated on a sliding scale with reference to the Total Facility Outstandings, in accordance with the following matrix (provided that the notional interest rate and Margin in relation to any Loan shall never be less than zero): |

| Total Facility Outstandings |

2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |||||||

| Up to ZAR1,000,000,000 |

zero interest |

zero interest |

zero Interest |

JIBAR minus 5.14% |

JIBAR minus 3.11% |

JIBAR minus 0.96% |

JIBAR plus 1.30% | |||||||

| From (and including) ZAR1,000,000,000 up to ZAR2,000,000,000 |

JIBAR minus 0.73% |

JIBAR minus 1.25% |

JIBAR plus 3.02% |

JIBAR plus 2.36% |

JIBAR plus 4.39% |

JIBAR plus 6.54% |

JIBAR plus 6.30% | |||||||

| From (and including) ZAR2,000,000,000 |

JIBAR plus 9.27% |

JIBAR plus 8.75% |

JIBAR plus 8.02% |

JIBAR plus 7.36% |

JIBAR plus 11.89% |

JIBAR plus 11.54% |

JIBAR plus 11.30% | |||||||

20

|

| 4.1.2.7 | On the date upon which the Accrued Notional Interest Amount has reached an aggregate amount equal to the Accrued Notional Interest Reference Amount, interest shall begin to accrue on (and shall be due and payable in respect of) the Loans at the same rate of interest as the notional rate of interest set out in clauses 4.1.2.6.4 and 4.1.2.6.5, which interest shall be calculated on the same basis as the notional interest calculations set out in such clauses above. |

| 4.1.2.8 | If on the New Senior Facilities Agreement Utilisation Date, the Accrued Notional Interest Amount (ie the “Actual Notional Interest Amount”) is less than an amount equal to the Accrued Notional Interest Reference Amount, the notional interest rate and principles referred to in clauses 4.1.2.6.4 and 4.1.2.6.5 shall apply (mutatis mutandis) to the loans advanced under the New Senior Facilities Agreement (“New Senior Facilities Loans”) and other amounts outstanding under the New Senior Facilities Agreement, until the aggregate of the notional interest amount on the New Senior Facilities Loans plus the Actual Notional Interest Amount is equal to the Accrued Notional Interest Reference Amount, following which the provisions of clause 9 of the New Senior Facilities Agreement shall apply to the New Senior Facilities Loans and other amounts outstanding under the New Senior Facilities Agreement. |

| 4.1.2.9 | Representations |

Plateau (for itself and on behalf of each Obligor) confirms to the Lender that on the Signature Date and the Interim Closing Date, the Repeating Representations:

| 4.1.2.9.1 | are true; and |

| 4.1.2.9.2 | would also be true if references to the June 2009 Senior Facilities Agreement were construed as references to such agreement, as amended by this Agreement. |

Each Repeating Representation is applied to the circumstances existing at the time the Repeating Representation is made.

21

|

| 4.1.2.10 | Security |

On the Interim Closing Date, Plateau (for itself and as agent for each other Obligor) confirms that:

| 4.1.2.10.1 | any Security created by it under the Transaction Security Documents extends to the obligations of the Obligors under the Finance Documents (including the June 2009 Senior Facilities Agreement and each other Finance Document or RPM Finance Document, as amended by this Agreement), subject to any limitations set out in the Transaction Security Documents; |

| 4.1.2.10.2 | the obligations of the Obligors arising under the June 2009 Senior Facilities Agreement as amended by this Agreement (and arising under any other Finance Document or RPM Finance Document, as amended by this Agreement) are included in the secured obligations (as the same may be defined in the respective Transaction Security Documents) subject to any limitations set out in the Transaction Security Documents; and |

| 4.1.2.10.3 | the Security created under the Transaction Security Documents continues in full force and effect on the terms of the respective Transaction Security Documents. |

| 4.1.2.11 | Miscellaneous |

| 4.1.2.11.1 | This Agreement is a Finance Document. |

| 4.1.2.11.2 | Except as expressly otherwise provided in this Agreement, no amendment, variation or change is made to any Finance Document and all the Finance Documents remain in full force and effect in accordance with their terms. |

| 4.1.2.11.3 | Except to the extent expressly waived in this Agreement, no waiver of any provision of any Finance Document is given by the terms of this Agreement and the Finance Parties expressly |

22

|

| reserve all their rights and remedies in respect of any breach of, or other Default under, the Finance Documents. |

| 4.2 | AMENDMENTS TO THE OCSF AGREEMENT |

| 4.2.1 | General |

| 4.2.1.1 | The provisions of this clause 4.2 are supplemental to and amend the OCSF Agreement pursuant to clause 23.3 (General) of the RPM Funding Common Terms Agreement. |

| 4.2.1.2 | The amendments set out in this clause 4.1 will amend the OCSF Agreement on and with effect from the Interim Closing Date. |

| 4.2.2 | Amendments |

The OCSF Agreement and, to the extent applicable, each of the other Finance Document and RPM Finance Document shall be deemed to be amended, in all respects, as specifically set out in this clause 4.2.2 below and to give effect to the principles set out in this clause 4.2.2 below.

| 4.2.2.1 | Interest Rate and OCSF Settlement Amount |

| 4.2.2.1.1 | The Interest Rate applicable to the capital amounts outstanding under the OCSF Facility shall be calculated in accordance with clause 4.1.2.6 and for the periods referred to in clause 4.1.2.6, as if all capital amounts outstanding under the OCSF Facility constituted a Loan under the June 2009 Senior Facilities Agreement during such periods. Therefore (and having regard to the interest rate principles agreed in the Term Sheet), the Parties agree: |

| 4.2.2.1.1.1 | for the period commencing on 1 July 2011 up to and including 30 April 2012, the aggregate accrued interest in relation to the amounts outstanding under the OCSF Facility is nil; and |

| 4.2.2.1.1.2 | for the period commencing on 1 May 2012 to 27 September 2012, the aggregate accrued interest in |

23

|

| relation to amounts outstanding under the OCSF Facility is capitalized to the capital amounts outstanding under the OCSF Facility on 27 September 2012. |

| 4.2.2.1.2 | Having regard to the amendment referred to in clause 4.2.2.1.1 above, the OCSF Settlement Amount as at 27 September 2012 is an amount of R928,113,717.73. |

| 4.3 | TERMINATION OF THE OCSF AGREEMENT |

| 4.3.1 | On the Interim Closing Date and immediately after implementation of Step 2 of the Interim Implementation Steps, the Parties agree that the OCSF Agreement shall be terminated. |

| 4.3.2 | The termination of the OCSF Agreement referred to above shall be without prejudice to any Parties rights, remedies or obligations which have arisen under any the OCSF Agreement (or any other Finance Document or RPM Finance Document) or by operation of law, on or before the Interim Closing Date, including in relation to the amendments to the OCSF Facility Agreement set out in clause 4.2 above. |

| 4.4 | AMENDMENTS TO THE RPM FUNDING LOAN AGREEMENT |

| 4.4.1 | In this clause 4.4, references to “Loans” and “RPM OCSF Tranches” shall be to those terms, as defined in the RPM Funding Loan Agreement. |

| 4.4.2 | Having regard to the interest rate principles agreed in the Term Sheet, the Parties agree that: |

| 4.4.2.1 | for the period commencing on 1 July 2011 up to and including 30 April 2012, the aggregate accrued interest in relation to the Loans and the RPM OCSF Tranches is nil; and |

| 4.4.2.2 | for the period commencing on 1 May 2012 to 27 September 2012, the aggregate accrued interest in relation to the Loans and the RPM OCSF Tranches is an amount of R76,100,437.19, which amount shall be capitalized to the Loans and RPM OCSF Tranche outstandings on 27 September 2012. |

24

|

| 4.4.3 | From the period commencing on 28 September 2012 to the date of repayment, the interest rate applicable to the Loans and the RPM OCSF Tranches (as amended by the provisions of this clause 4.4) shall be zero. |

| 4.4.4 | The Additional SFA Advance Amount available for utilisation under the June 2009 Senior Facilities Agreement is intended to replace amounts that were available for utilisation under the OSCF Facility immediately prior to its termination in accordance with clause 4.3. In addition, the advance of the OCSF Settlement Advance Amount creates a Loan under the June 2009 Senior Facilities Agreement which replace the advances under the OCSF Facility. As such, references in (i) the Opco Funding Loan Agreement, (ii) the Global Intercreditor Agreement, (iii) the RPM Funding Common Terms Agreement (iv) any other Finance Document or (v) any other RPM Finance Document to the OCSF Facility and amounts utilised under the OCSF Facility (including references to the OCSF Tranches, and all derivative and related definitions and concepts) shall (mutatis mutandis) be construed and implemented in all respects as references to the June 2009 Senior Facilities Agreement and the Additional Advance Amounts (or relevant part thereof) advanced by RPM under the June 2009 Senior Facilities Agreement. |

| 4.4.5 | Notwithstanding any provision to the contrary in the RPM Funding Loan Agreement, all references to Senior Debt Payment Dates shall be construed as references to the Senior Debt Payment Dates in the June 2009 Senior Facilities Agreement (as amended) and not to Schedule 1 to the RPM Funding Loan Agreement. |

| 4.5 | AMENDMENTS TO THE PLATEAU FUNDING LOAN AGREEMENT |

| 4.5.1 | In this clause 4.5, references to “Loans” and “Plateau OCSF Tranches” shall be to those terms, as defined in the Plateau Funding Loan Agreement. |

| 4.5.2 | Having regard to the interest rate principles agreed in the Term Sheet, the Parties agree that: |

25

|

| 4.5.2.1 | for the period commencing on 1 July 2011 up to and including 30 April 2012, the aggregate accrued interest in relation to the Loans and the Plateau OCSF Tranches is nil; and |

| 4.5.2.2 | for the period commencing on 1 May 2012 to 27 September 2012, the aggregate accrued interest in relation to the Loans and the Plateau OCSF Tranches is an amount of R79,206,569.26, which amount shall be capitalized to the Loans and Plateau OCSF Tranche outstandings on 27 September 2012. |

| 4.5.3 | From the period commencing on 28 September 2012 to the date of repayment, the interest rate applicable to the Loans and the Plateau OCSF Tranches (as amended by the provisions of this clause 4.5) shall be zero. |

| 4.5.4 | The Additional SFA Advance Amount available for utilisation under the June 2009 Senior Facilities Agreement is intended to replace amounts that were available for utilisation under the OSCF Facility immediately prior to its termination in accordance with clause 4.3 above. In addition, the advance of the OCSF Settlement Advance Amount creates a Loan under the June 2009 Senior Facilities Agreement which replace the advances under the OCSF Facility. As such, references in (i) the Opco Funding Loan Agreement, (ii) the Global Intercreditor Agreement, (iii) the RPM Funding Common Terms Agreement (iv) any other Finance Document or (v) any other RPM Finance Document to the OCSF Facility and amounts utilised under the OCSF Facility (including references to the OCSF Tranches, and all derivative and related definitions and concepts) shall (mutatis mutandis) be construed and implemented in all respects as references to the June 2009 Senior Facilities Agreement, the Additional Advance Amounts (or relevant part thereof) advanced by RPM under the June 2009 Senior Facilities Agreement. |

| 4.5.5 | Notwithstanding any provision to the contrary in the Plateau Funding Loan Agreement, all references to Senior Debt Payment Dates shall be construed as references to the Senior Debt Payment Dates in the June 2009 Senior Facilities Agreement (as amended) and not to Schedule 1 to the Plateau Funding Loan Agreement. |

26

|

| 4.6 | AMENDMENTS TO THE OPCO FUNDING LOAN AGREEMENT |

| 4.6.1 | In this clause 4.6 references to “Loans” and “Opco OCSF Tranches” shall be to those terms, as defined in the Opco Funding Loan Agreement. |

| 4.6.2 | Having regard to the interest rate principles agreed in the Term Sheet, the Parties agree that: |

| 4.6.2.1 | for the period commencing on 1 July 2011 up to and including 30 April 2012, the aggregate accrued interest in relation to the Loans and the Opco OCSF Tranches is nil; and |

| 4.6.2.2 | for the period commencing on 1 May 2012 to 27 September 2012, the aggregate accrued interest in relation to the Loans and the Opco OCSF Tranches is an amount of R155,307,006.25, which amount shall be capitalized to the Loans and Opco OCSF Tranche outstandings on 27 September 2012. |

| 4.6.3 | From the period commencing on 28 September 2012 to the date of repayment, the interest rate applicable to the Loans and the Opco OCSF Tranches (as amended by the provisions of this clause 4.64.4) shall be zero. |

| 4.6.4 | The Additional SFA Advance Amount available for utilisation under the June 2009 Senior Facilities Agreement is intended to replace amounts that were available for utilisation under the OSCF Facility immediately prior to its termination in accordance with clause 4.3 above. In addition, the advance of the OCSF Settlement Advance Amount creates a Loan under the June 2009 Senior Facilities Agreement which replace the advances under the OCSF Facility. As such, references in (i) the Opco Funding Loan Agreement, (ii) the Global Intercreditor Agreement, (iii) the RPM Funding Common Terms Agreement (iv) any other Finance Document or (v) any other RPM Finance Document to the OCSF Facility and amounts utilised under the OCSF Facility (including references to the OCSF Tranches, and all derivative and related definitions and concepts) shall (mutatis mutandis) |

27

|

| be construed and implemented in all respects as references to the June 2009 Senior Facilities Agreement, the Additional Advance Amounts (or relevant part thereof) advanced by RPM under the June 2009 Senior Facilities Agreement. |

| 4.6.5 | Notwithstanding any provision to the contrary in the Opco Funding Loan Agreement, all references to Senior Debt Payment Dates shall be construed as references to the Senior Debt Payment Dates in the June 2009 Senior Facilities Agreement (as amended ) and not to Schedule 1 to the Opco Funding Loan Agreement. |

| 4.7 | AMENDMENTS TO GLOBAL INTERCREDITOR AGREEMENT, RPM FUNDING COMMON TERMS AGREEMENT AND OTHER FINANCE DOCUMENTS |

The Parties agree that even though not each Finance Document or RPM Finance Document is expressly amended by this Agreement, each such Finance Document and RPM Finance Document shall be construed and implemented with reference to and incorporating the principles and amendments set out in this Agreement, mutatis mutandis.

| 5. | PART 5: IMPLEMENTATION |

| 5.1 | COMPOSITE AND INDIVISIBLE TRANSACTION |

The Interim Implementation Steps referred to in clause 5.2 form part of a composite and indivisible transaction. If any of these Interim Implementation Steps cannot be or are not completed, for any reason whatsoever, on the Interim Closing Date, none of the transactions shall be completed and this Agreement shall terminate, save in respect of clauses 1 to 3 (both inclusive) and clause 6, which shall remain of full force and effect, provided that such termination shall be without prejudice to any rights in law or in terms of this Agreement which any Party may have against any other.

28

|

| 5.2 | IMPLEMENTATION PROCESS |

On the Interim Closing Date, the Parties will proceed with the steps set out below, in sequential order on the basis that no Party is obliged to implement any step unless each preceding step has been completed.

| 5.2.1 | Step 1 - Draw down of the OCSF Settlement Advance Amount |

Plateau shall drawdown the OCSF Settlement Advance Amount from the Lender in accordance with the terms and conditions of the June 2009 Senior Facilities Agreement, as amended (including the amendments referred to in clause 4.1). [Refer to Step 1 of the Interim Funds Flow Statement.]

| 5.2.2 | Step 2 - Payment of the OCSF Settlement Amount |

Plateau shall use the OSCF Settlement Advance Amount received under Step 1 above to repay the OCSF Settlement Amount to the OCSF Lender in cash in immediately accessible funds by way of electronic funds transfer to the OCSF Lender. [Refer to Step 2 of the Interim Funds Flow Statement.]

| 5.2.3 | Step 3 - Draw down of the Subscription Advance Amount |

Plateau shall draw down the Subscription Advance Amount from the Lender in accordance with the terms and conditions of the June 2009 Senior Facilities Agreement, as amended (including the amendments referred to in clause 4.1. [Refer to Step 3 of the Interim Funds Flow Statement.]

| 5.2.4 | Step 4 - Subscription for ordinary shares in Holdco |

| 5.2.4.1 | Step 4A |

| 5.2.4.1.1 | Plateau shall use the Subscription Advance Amount to pay the First Plateau Holdco Subscription Price in cash in immediately accessible funds by way of electronic funds transfer to Holdco in respect of the First Plateau Holdco Subscription Shares [Refer to Step 4A of the Funds Flow Statement]. |

29

|

| 5.2.4.1.2 | Holdco shall allot and issue the First Plateau Holdco Subscription Shares to Plateau. Holdco shall update its member’s register to reflect Plateau’s increased holding of ordinary shares and deliver to Plateau share certificates in respect of the First Plateau Holdco Subscription Shares. |

| 5.2.4.2 | Step 4B |

| 5.2.4.2.1 | RPM shall pay the First RPM Holdco Subscription Price in cash in immediately accessible funds by way of electronic funds transfer to Holdco in respect of the First RPM Holdco Subscription Shares. [Refer to Step 4B of the Interim Funds Flow Statement.] |

| 5.2.4.2.2 | Holdco shall allot and issue the First RPM Holdco Subscription Shares to RPM. Holdco shall update its member’s register to reflect RPM’s increased holding of ordinary shares and deliver to RPM share certificates in respect of the First RPM Holdco Subscription Shares. |

| 5.2.5 | Step 5 - Subscription for First Holdco Opco Subscription Shares |

| 5.2.5.1 | Holdco shall use the aggregate proceeds of the First Plateau Holdco Subscription Price and the First RPM Holdco Subscription Price to pay the First Holdco Opco Subscription Price in cash in immediately accessible funds by way of electronic funds transfer to Opco in respect of the First Holdco Opco Subscription Shares. [Refer to Step 5 of the Interim Funds Flow Statement.] |

| 5.2.5.2 | Opco shall allot and issue the First Holdco Opco Subscription Shares to Holdco. Opco shall update its member’s register to reflect Holdco’s increased holding of ordinary shares and deliver to Holdco share certificates in respect of the First Holdco Opco Subscription Shares. |

30

|

| 5.2.6 | Step 6 - Opco’s utilisation of subscription proceeds |

| 5.2.6.1 | Step 6A - Declaration of a dividend and redemption of Holdco Opco A Preference Shares |

Opco shall use the proceeds of the First Holdco Opco Subscription Price to:

| 5.2.6.1.1 | declare and pay the Holdco Opco A Preference Dividend to Holdco; and |

| 5.2.6.1.2 | pay the Holdco Opco Redemption Amount to Holdco in respect of the redemption of the Holdco Opco A Preference Shares. |

[Refer to Step 6A of the Interim Funds Flow Statement.]

| 5.2.6.2 | Step 6B - Surrender of share certificates in respect of the Holdco Opco A Preference Shares |

Against receipt of the aggregate of the Holdco Opco A Preference Dividend and the Holdco Opco Redemption Amount, Holdco shall surrender the share certificates in respect of the Holdco Opco A Preference Shares to Opco.

| 5.2.7 | Step 7 - Declaration of dividend and redemption of each of Plateau Holdco A Preference Shares and RPM Holdco A Preference Shares |

| 5.2.7.1 | Step 7A: Declaration of dividend and redemption |

Holdco shall use the proceeds of the aggregate of the Holdco Opco A Preference Dividend and the Holdco Opco Redemption Amount received pursuant to Step 6 above to:

| 5.2.7.1.1 | declare and pay the Plateau Holdco A Preference Dividend to Plateau; |

| 5.2.7.1.2 | declare and pay the RPM Holdco A Preference Dividend to RPM; |

31

|

| 5.2.7.1.3 | pay the Plateau Holdco Redemption Amount to Plateau in respect of the redemption of the Plateau Holdco A Preference Shares; and |

| 5.2.7.1.4 | pay the RPM Holdco Redemption Amount to RPM in respect of the redemption of the RPM Holdco A Preference Shares; |

[Refer to Step 7A of the Interim Funds Flow Statement.]

| 5.2.7.2 | Step 7B - Surrender of share certificates in respect of the Plateau Holdco A Preference Shares |

Against receipt of the aggregate of the Plateau Holdco A Preference Dividend and the Plateau Holdco Redemption Amount, Plateau shall surrender the share certificates in respect of the Plateau Holdco A Preference Shares to Holdco.

| 5.2.7.3 | Step 7C - Surrender of share certificates in respect of the RPM Holdco A Preference Shares |

Against receipt of the aggregate of the RPM Holdco A Preference Dividend and the RPM Holdco Redemption Amount, RPM shall surrender the share certificates in respect of the RPM Holdco A Preference Shares to Holdco.

| 5.2.8 | Step 8 - Declaration of dividend and redemption of RPM Plateau A Preference Shares |

| 5.2.8.1 | Step 8A - Declaration of a dividend and redemption of RPM Plateau A Preference Shares |

Plateau shall use the proceeds of the Plateau Holdco A Preference Dividend and the Plateau Holdco Redemption Amount received pursuant to Step 7A above other than an amount of R10 398 208.65 (“Retained Amount”) to:

| 5.2.8.1.1 | declare and pay the RPM Plateau A Preference Dividend to RPM; and |

32

|

| 5.2.8.1.2 | pay the RPM Plateau Redemption Amount to RPM in respect of the redemption of the RPM Plateau A Preference Shares. |

[Refer to Step 8A of the Interim Funds Flow Statement.]

| 5.2.8.2 | Step 8B - Surrender of share certificates in respect of the RPM Plateau A Preference Shares |

Against receipt of the aggregate of the RPM Plateau A Preference Dividend and the RPM Plateau Redemption Amount, RPM shall surrender the share certificates in respect of the RPM Plateau A Preference Shares to Plateau.

| 5.2.9 | Step 9 - Repayment of a portion of the Total Facility Outstandings |

Plateau shall use the Retained Amount referred to in Step 8 to repay a portion of the Total Facility Outstandings.

[Refer to Step 9 of the Interim Funds Flow Statement.]

| 5.3 | GENERAL PROVISIONS APPLICABLE TO IMPLEMENTATION |

| 5.3.1 | Each Party agrees that its signature of this Agreement constitutes an irrevocable instruction to the Implementation Bank to transfer funds on the Interim Closing Date in accordance with the Interim Funds Flow Statement. |

| 5.3.2 | Save for the amendments to the June 2009 Senior Facilities Agreement and the OCSF Agreement referred to in clauses 4.1 and 4.2, and the termination of the OCSF Agreement referred to in clause 4.3, Transaction Documents shall remain in full force and effect. |

| 6. | PART 6: MISCELLANEOUS PROVISIONS |

| 6.1 | CONFIDENTIALITY |

| 6.1.1 | For the purposes of this clause 6.1, “Confidential Information” means the details of the negotiations leading to the Term Sheet, this Agreement, the terms of the Interim Implementation Steps and the Transaction Documents and/or the information in respect of Anglo American Platinum Limited |

33

|

| and/or Atlatsa obtained by the Parties during the course of such negotiations and/or pursuant to the conclusion or implementation of the Interim Implementation Steps (in so far as such is confidential in nature) (“the Confidential Information”). |

| 6.1.2 | Each of the Parties undertakes to the other that it will keep all Confidential Information confidential and to use it only for the purposes of the proposed transactions under the Transaction Documents and to disclose it only to its officers, directors, employees, consultants and professional advisers who: |

| 6.1.2.1 | are required to know (and then only to the extent that each such person is so required); |

| 6.1.2.2 | are aware that the Confidential Information should be kept confidential; |

| 6.1.2.3 | are aware of the disclosing Party’s undertaking in relation to such information in terms of this Agreement; and |

| 6.1.2.4 | have been directed by the disclosing Party to keep the Confidential Information confidential and have undertaken to keep the Confidential Information confidential. |

| 6.1.3 | The obligations of the Parties in relation to the maintenance and non-disclosure of Confidential Information in terms of this Agreement do not extend to information: |

| 6.1.3.1 | that is disclosed to the disclosing Party in terms of this Agreement but at the time of such disclosure such information is known to be in the lawful possession or control of the disclosing Party and not subject to an obligation of confidentiality; |

| 6.1.3.2 | that is or becomes public knowledge, otherwise than pursuant to a breach of this Agreement by the disclosing Party; or |

| 6.1.3.3 | that is required by the provisions of any law, or during any court proceedings, or by the rules or regulations of any recognised stock exchange to be disclosed. In addition, the provisions of this clause 6 |

34

|

| shall not restrict the disclosure of Confidential Information to prospective investors for the purposes of raising capital or to any person pursuant to a bona fide due diligence investigation into the Party or its business or affairs. |

| 6.1.4 | A breach of this clause 6.1 shall not entitle any Party to cancel this Agreement or any other Transaction Document. |

| 6.2 | BREACH |

| 6.2.1 | If a Party breaches any provision of this Agreement and remains in breach of such provision for 10 Business Days after written notice to that Party requiring that Party to rectify that breach, the aggrieved Party shall be entitled (without derogating from any of its other rights or remedies under this Agreement or at law), at its option: |

| 6.2.1.1 | to ▇▇▇ for immediate specific performance of any of the defaulting Party’s obligations under this Agreement, whether or not such obligation is then due; or |

| 6.2.1.2 | to cancel this Agreement, in which case written notice of the cancellation shall be given to the defaulting Party, and the cancellation shall take effect on the giving of the notice, provided that no Party shall be entitled to cancel this Agreement unless the breach is a material breach, |

and in either event the aggrieved Party shall be entitled to claim any damages it has suffered, provided that any such damages shall sound in money and shall be payable in cash.

| 6.2.2 | Notwithstanding the provisions of clause 6.2.1.2, neither of the Parties shall be entitled to cancel this Agreement after the Closing Date. |

| 6.3 | ARBITRATION |

| 6.3.1 | separate, divisible agreement |

This clause is a separate, divisible agreement from the rest of this Agreement and shall:

35

|

| 6.3.1.1 | not be or become void, voidable or unenforceable by reason only of any alleged misrepresentation, mistake, duress, undue influence, impossibility (initial or supervening), illegality, immorality, absence of consensus, lack of authority or other cause relating in substance to the rest of the Agreement and not to this clause. The Parties intend that any such issue shall at all times be and remain subject to arbitration in terms of this clause; |

| 6.3.1.2 | remain in effect even if the Agreement terminates or is cancelled. |

| 6.3.2 | disputes subject to arbitration |

Save as may be expressly provided for elsewhere in this Agreement for the resolution of particular disputes, any other dispute arising out of or in connection with this Agreement or the subject matter of this Agreement, including without limitation, any dispute concerning:

| 6.3.2.1 | the existence of the Agreement apart from this clause; |

| 6.3.2.2 | the interpretation and effect of the Agreement; |

| 6.3.2.3 | the Parties’ respective rights or obligations under the Agreement; |

| 6.3.2.4 | the rectification of the Agreement; |

| 6.3.2.5 | the breach, termination or cancellation of the Agreement or any matter arising out of the breach, termination or cancellation; |

| 6.3.2.6 | damages arising in delict, compensation for unjust enrichment or any other claim, whether or not the rest of the Agreement apart from this clause is valid and enforceable, |

shall be referred to arbitration in terms of this 6.2.

| 6.3.3 | appointment of arbitrator |

| 6.3.3.1 | The Parties shall agree on the arbitrator who shall be an attorney or advocate on the panel of arbitrators of AFSA. If agreement is not reached within 10 Business Days after any Party calls in writing for |

36

|

| such agreement, the arbitrator shall be an attorney or advocate nominated by the Registrar of AFSA for the time being. |

| 6.3.3.2 | The request to nominate an arbitrator shall be in writing outlining the claim and any counterclaim of which the Party concerned is aware and, if desired, suggesting suitable nominees for appointment as arbitrator, and a copy shall be furnished to the other Parties who may, within 7 days, submit written comments on the request to the addressee of the request with a copy to the first Party. |

| 6.3.4 | venue and period for completion of arbitration |

The arbitration shall be held in Johannesburg and the Parties shall endeavour to ensure that it is completed within 90 days after notice requiring the claim to be referred to arbitration is given.

| 6.3.5 | Arbitration Act - rules |

The arbitration shall be governed by the Arbitration ▇▇▇, ▇▇▇▇, or any replacement Act and shall take place in accordance with the Commercial Arbitration Rules of AFSA.

| 6.3.6 | Application to court for urgent interim relief |

Nothing contained in this clause 6.3 shall prohibit a Party from approaching any court of competent jurisdiction for urgent interim relief pending determination of the dispute by arbitration.

| 6.4 | POSTAL ADDRESSES AND ADDRESSES FOR SERVICE OF LEGAL DOCUMENTS |

| 6.4.1 | The Parties choose the following addresses at which notices in connection with this Agreement and/or documents in legal proceedings in connection with this Agreement may be served (i.e. their domicilia citandi et executandi): |

37

|

| 6.4.1.1 | in the case of RPM: |

| physical address: |

▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇ | |

| ▇▇▇▇▇▇▇▇▇▇▇▇ | ||

| ▇▇▇▇▇▇▇▇▇▇▇▇ | ||

| fax number: |

(▇▇▇) ▇▇▇ ▇▇▇▇ | |

and shall be marked for the attention of: The Company Secretary, the Finance Director and the Financial Controller;

| 6.4.1.2 | in the case of the Atlatsa (and each other party for whom no specific address is provided for in this clause 6.4): |

| physical address: |

▇▇▇ ▇▇▇▇▇, ▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇ | |

| ▇▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇ | ||

| ▇▇▇▇▇▇▇ | ||

| fax number: |

(▇▇▇) ▇▇▇ ▇▇▇▇ | |

and shall be marked for the attention of: The Company Secretary;

| 6.4.1.3 | in the case of the Plateau: |

| physical address: |

▇▇▇ ▇▇▇▇▇, ▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇ | |

| ▇▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇ | ||

| ▇▇▇▇▇▇▇ | ||

| fax number: |

(▇▇▇) ▇▇▇ ▇▇▇▇ | |

and shall be marked for the attention of: The Company Secretary;

| 6.4.1.4 | in the case of the N2C Resources: |

| physical address: |

▇▇▇ ▇▇▇▇▇, ▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇ | |

| ▇▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇ | ||

| ▇▇▇▇▇▇▇ | ||

| fax number: |

(▇▇▇) ▇▇▇ ▇▇▇▇ | |

and shall be marked for the attention of: The Company Secretary;

38

|

| 6.4.1.5 | in the case of the Holdco: |

| physical address: |

▇▇▇ ▇▇▇▇▇, ▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇ | |

| ▇▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇ | ||

| ▇▇▇▇▇▇▇ | ||

| fax number: |

(▇▇▇) ▇▇▇ ▇▇▇▇ | |

and shall be marked for the attention of: The Company Secretary;

| 6.4.1.6 | in the case of the Opco: |

| physical address: |

▇▇▇ ▇▇▇▇▇, ▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇ | |

| ▇▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇ | ||

| ▇▇▇▇▇▇▇ | ||

| fax number: |

(▇▇▇) ▇▇▇ ▇▇▇▇ | |

and shall be marked for the attention of: The Managing Director;

| 6.4.2 | The notice shall be deemed to have been duly given: |

| 6.4.2.1 | 5 Business Days after posting, if posted by registered post (airmail, if available) to the Party’s address in terms of clause 6.4.1; |

| 6.4.2.2 | on delivery, if delivered to the Party’s physical address in terms of clause 6.4.1 between 08h30 and 17h00 on a Business Day (or on the first Business Day after that if delivered outside such hours); |

| 6.4.2.3 | on despatch, if sent to the Party’s then fax number or e-mail address between 08h30 and 17h00 on a Business Day (or on the first Business Day after that if despatched outside such hours); |

unless the addressor is aware, at the time the notice would otherwise be deemed to have been given, that the notice is unlikely to have been received by the addressee through no act or omission of the addressee.

| 6.4.3 | A Party may change that Party’s address for this purpose to another physical address in South Africa, by notice in writing to the other Parties such change to be effective only on and with effect from the 7th Business Day after the giving of such notice. |

39

|

| 6.4.4 | Notwithstanding anything to the contrary herein contained, a written notice or communication actually received by a Party shall be an adequate service of such written notice or communication to that Party notwithstanding that the notice or communication was not sent to or delivered or served at that Party’s chosen domicilium citandi et executandi. |

| 6.5 | GENERAL |

| 6.5.1 | entire contract |

This Agreement (read with the other Transaction Documents) contains all the express provisions agreed on by the Parties with regard to the subject matter of the Agreement and supersedes and novates in its entirety any previous understandings or agreements between the Parties in respect thereof, and the Parties waive the right to rely on any alleged provision not expressly contained in the Transaction Documents.

| 6.5.2 | no stipulation for the benefit of a third person |

Save as is expressly provided for in this Agreement, no provision of this Agreement constitutes a stipulation for the benefit of a third person (ie a stipulatio ▇▇▇▇▇▇) which, if accepted by the person, would bind any Party in favour of that person.

| 6.5.3 | no representations |

A Party may not rely on any representation which allegedly induced that Party to enter into this Agreement, unless the representation is recorded in this Agreement.

| 6.5.4 | variation, cancellation and waiver |

No contract varying, adding to, deleting from or cancelling this Agreement, and no waiver of any right under this Agreement, shall be effective unless reduced to writing and signed by or on behalf of the relevant Parties to which such term of the Agreement or right relates.

40

|

| 6.5.5 | indulgences |

The grant of any indulgence, extension of time or relaxation of any provision by a Party under this Agreement shall not constitute a waiver of any right by the grantor or prevent or adversely affect the exercise by the grantor of any existing or future right of the grantor.

| 6.5.6 | cession and delegation |

A Party may not cede any or all of that Party’s rights or delegate any or all of that Party’s obligations under this Agreement without the prior written consent of the other Parties.

| 6.5.7 | applicable law |

This Agreement is to be governed, interpreted and implemented in accordance with the laws of South Africa.

| 6.5.8 | costs |

Any costs, including all legal costs on an attorney and own client basis and VAT, incurred by a Party arising out of or in connection with a breach by another Party shall be borne by the Party in breach.

| 6.5.9 | signature in counterparts |

This Agreement may be executed in counterparts, each of which shall be deemed to be an original and which together shall constitute one and the same agreement.

| 6.5.10 | independent advice |

Each of the Parties hereby respectively agrees and acknowledges that:

| 6.5.10.1 | it has been free to secure independent legal advice as to the nature and effect of each provision of this Agreement and that it has either taken such independent legal advice or has dispensed with the necessity of doing so; and |

41

|

| 6.5.10.2 | each provision of this Agreement (and each provision of the Schedules) is fair and reasonable in all the circumstances and is part of the overall intention of the Parties in connection with this Agreement. |

| 6.5.11 | co-operation |

Each of the Parties undertakes at all times to act in good faith and to do all such things, perform all such acts and take all such steps, and to procure the doing of all such things, within its power and control, as may be open to it and necessary for and incidental to the putting into effect or maintenance of the terms, conditions and import of this Agreement and the Transaction Documents.

| 6.5.12 | contract override |

In relation to the implementation of the Interim Implementation Steps prior to and on the Interim Closing Date, in the event of any conflict between the provisions of this Agreement and any other Transaction Document, the provisions of this Agreement shall prevail.

| 6.5.13 | counterparts |

This Agreement and/or any document required to be signed by any Party in accordance with the Implementation Process, may be executed in counterparts, all of which together constitute one and the same instrument. A facsimile shall constitute a valid counterpart for all such purposes.

42

|

Schedule 1

Interim Funds Flow Statement

| Before |

After |

|||||||||||||||||||||||||||||||||||||||

| Pleateu/RPM | Pleateu/Holdco | RPM/Holdco | Holdco | Opco | Pleateu/RPM | Pleateu/Holdco | RPM/Holdco | Holdco | Opco | |||||||||||||||||||||||||||||||

| A preference |

1,722,636,567 | 1,733,034,776 | 1,665,072,628 | 3,398,107,404 | 3,398,107,404 | |||||||||||||||||||||||||||||||||||

| OCSF balance |

928,113,718 | |||||||||||||||||||||||||||||||||||||||

| Senior facility |

679,603,703 | 3,330,353,988 | ||||||||||||||||||||||||||||||||||||||

| Shareholder loans |

||||||||||||||||||||||||||||||||||||||||

| OCSF Tranche |

388,569,974 | 853,724,093 | 1,742,294,067 | 1,742,294,067 | ||||||||||||||||||||||||||||||||||||

| Senior tranche |

653,453,080 | 627,827,598 | 1,281,280,678 | 1,281,280,678 | ||||||||||||||||||||||||||||||||||||

| After interim funding |

||||||||||||||||||||||||||||||||||||||||

| Ordinary shares |

1,733,034,776 | 1,665,072,628 | 3,398,107,404 | 3,398,107,404 | ||||||||||||||||||||||||||||||||||||

| Consolidated interest free shareholder loan |

1,542,023,054 | 1,481,551,691 | 3,023,574,745 | 3,023,574,745 | ||||||||||||||||||||||||||||||||||||

| 3,330,353,988 | 3,275,057,830 | 3,146,624,319 | 6,421,682,149 | 6,421,682,149 | 3,330,353,988 | 3,275,057,830 | 3,146,624,319 | 6,421,682,149 | 6,421,682,149 | |||||||||||||||||||||||||||||||

| Check |

— | — | — | — | — | |||||||||||||||||||||||||||||||||||

| Senior facility |

3,330,353,988 | |||||||||||||||||||||||||||||||||||||||

| Settlement of purchase price for properties |

1,700,000,000 | |||||||||||||||||||||||||||||||||||||||

| net amount |

1,630,353,988 | |||||||||||||||||||||||||||||||||||||||

| Less: *notional interest benefit |

(226,532,265 | ) | ||||||||||||||||||||||||||||||||||||||

| Starting balance should be under term sheet |

1,403,821,723 | |||||||||||||||||||||||||||||||||||||||

|

|

|

43

|

|

INTERIM CLOSING FLOW OF FUNDS

|

44

|

|

Figures to Update

| Advance to |

||||

| Plateau |

||||

| OCSF |

928,113,718 | |||

| A preference |

||||

| shares |

1,722,636,567 | |||

|

|

|

|||

| 2,650,750,285 | ||||

|

|

|

|||

| RPM |

||||

| A preference |

||||

| shares |

1,665,072,628 | |||

| Plateau |

||||

| A preference |

||||

| shares |

1,733,034,776 | |||

|

45

|

|

Schedule 2

Term Sheet

|

|

PLATINUM |

Project Kingpin

Term Sheet

December 2011

Strictly private and confidential

46

|

|

47 |

|

|

PLATINUM |

Definitions and interpretations commencing on page 8 of this Term Sheet apply throughout, including the cover pages, unless the context indicates a contrary intention.

Terms and conditions

This document (the “Term Sheet”) contains a summary of the key terms and conditions of the proposed refinancing and capitalisation of Bokoni Platinum Holdings (Proprietary) Limited (“BHL”) (“the Transaction”).

The following terms (read together with the Annexures hereto) represent the proposed key terms and conditions upon which Anglo American Platinum Limited (“Amplats”) and Anooraq Resources Corporation (“ARQ”) (the “Parties”) Intend to implement the Transaction.

The terms and conditions contained in this Term Sheet are subject to:

| • | Satisfactory Transaction Documents being prepared and concluded between the Parties; |

| • | Fulfillment of the conditions precedent specified In the Transaction Documents; |

| • | Legal counsel’s advice In general and well as any specific legal, tax and/or regulatory advice relating to issues that may arise out of the Transaction; |

| • | Amendment of the agreement regarding ARQ’s option to acquire a share in Amplats’ Polokwane smelter; and |

| • | Amplats receiving legal opinion confirming that the Transaction does not trigger any obligations under the respective South African and/or Canadian take-over codes as Amplats does not wish to trigger a mandatory offer to ARQ minorities in any jurisdiction. |

In the event that the Parties do not fulfill the conditions precedent to the Transaction Documents referred to above, then the provisions of this Term Sheet shall not have any force or effect.

| 2 |

|

|

48 |

|

PLATINUM |

Definitions and interpretations commencing on page 8 of this Term Sheet apply throughout, including the cover pages, unless the context indicates a contrary intention.

| PARTIES | ▇ |

▇▇▇▇▇▇▇ Resources Corporation and its subsidiaries; and

| ||||||||||

| Ÿ |

Anglo American Platinum Limited and its subsidiaries. | |||||||||||

| BACKGROUND | Ÿ |

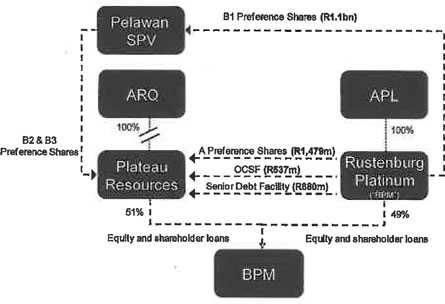

Amplats has material financial exposure to ARQ through a number of funding Instruments. The current amount owing to RPM in terms of various Plateau funding facilities is approximately R2.8 billion as at 31 August 2011 (refer to Annexure A). In addition, Amplats also holds the R1.1 billion B1 Preference Shares into Pelawan SPV. The Parties are seeking to restructure the ARQ capital structure on the terms and conditions set out In this Term Sheet. | ||||||||||

| THE TRANSACTION | Ÿ |

The Transaction contemplated comprises an inter-conditional set of transactions including:

| ||||||||||

| Ÿ |

Sale by ARQ of its 51% attributable interest in Paschaskraal, ▇▇ ▇▇▇▇ and Boikgantsho farms’ resources (refer to Annexure B) to Amplats for an aggregate purchase consideration of R1,700 million in exchange for a reduction, for an equal value in the following order: | |||||||||||

| Ÿ |

the A Preference Shares; and | |||||||||||

| Ÿ |

OCSF; | |||||||||||

| Ÿ |

Provision by Amplats of further funding to ARQ under the consolidated debt facility to support the BHL’s capital investment programme; | |||||||||||

| Ÿ |

Restructure of the B Preference Shares; and | |||||||||||

| Ÿ |