GENERAL SECURITY AGREEMENT

Exhibit 10.21

Dated May 30, 2023

BETWEEN:

BOREALIS FOODS INC. (the “Holdings”);

PGF REAL ESTATE I, INC.,

PGF REAL ESTATE II, INC., BOREALIS IP INC., PALMETTO

GOURMET FOODS (CANADA) INC. and PALMETTO GOURMET

FOODS INC. (collectively the “Grantors” and individually the “Grantor” and

Holdings and Grantors together the “Borrower”)

And

BELPHAR LIMITED as lender

pursuant to the Debenture as defined below

(the “Secured Party”).

RECITALS:

A. The Holdings may become indebted or otherwise obligated to the Secured Party, including under a certain Note Purchase Agreement dated on or around February 8, 2023 (as may be amended, supplemented, restated, replaced, or otherwise modified from time to time, the “Debenture”) pursuant to which convertible notes with an aggregate principal amount of up to $20,000,000 may from time to time be issued to Secured Party (collectively, as at any time amended, restated, supplemented or otherwise modified, each, a “Convertible Note” and collectively, the “Convertible Notes”).

B. The Holdings and Grantors have agreed, as a condition of the Debenture, to enter into this agreement and grant security to the Secured Party, subject to a Lien Subordination Agreement in favor of Centurion Financial Trust (the “First Lender”) dated as of May 30, 2023 (the “Lien Subordination Agreement”).

The parties agree as follows:

ARTICLE

1

INTERPRETATION

1.01 Definitions

Words and expressions defined in the PPSA and the STA are used in this agreement (capitalized or not) with the defined meanings assigned to them in those statutes, unless the context otherwise requires. For greater certainty, in this agreement each of the words “accessions,” “account,” “chattel paper,” “consumer goods,” “document of title,” “equipment,” “goods,” “instruments,” “intangible,” “inventory,” “investment property,” “money,” and “proceeds” has the same meaning as its defined meaning in the PPSA and each of the terms “certificated security,” “entitlement holder,” “financial asset,” “securities account,” “securities intermediary,” “security,” “security entitlement,” and “uncertificated security” has the same meaning as its defined meaning in the STA. In this agreement, in addition to the terms defined above, the following definitions apply: To the extent the jurisdiction governing the security granted is a state of the United States the equivalent term or definition of the applicable Uniform Commercial Code Article 9 (“UCC”) will be substituted.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

“Account Borrower” means a party obligated to pay under any account, chattel paper, or instrument constituting Collateral.

“Collateral” means, collectively, all of each Borrower’s present and after-acquired assets, meaning all personal property (including all accounts, chattel paper, Documents, documents of title, equipment, goods, instruments, intangibles, inventory, investment property, Licences, money, securities, security entitlements, undertaking, proceeds, and Replacements, together with each Borrower’s interest in any of them) but excludes the interest held by the Parent in any subsidiary securities where the Parent holds only a 50% interest and consumer goods and any reference in this agreement to Collateral will, unless the context otherwise requires, be deemed a reference to “Collateral” or any part thereof. For sake of clarity, “Collateral” shall specifically exclude the following: (i) future acquired assets where the source of funding therefor is equity or third-party financing; and (ii) any lease to own equipment; and (iii) any assets which are covered by the Permitted Liens.

“Default” means any “Event of Default” as defined in the Debenture.

“Documents” means all any Borrower’s books, accounts, invoices, letters, papers, security certificates, documents, and other records (including customer lists and records, subject, however, to privacy, confidentiality, and access rights of customers), in any form evidencing or relating to any part of the Collateral, together with all agreements, licences, and other rights and benefits relating to any of them.

“Indemnified Party” has the meaning given to that term in section 3.12 (General indemnity).

“Intellectual Property” means all of any Borrower’s

(a) business and trade names, corporate names, brand names, and slogans,

(b) inventions, patents, patent rights, patent applications (including all reissues, divisions, continuations, continuations-in-part, and extensions of any patent or patent application), unregistered industrial designs, applications for registration of individual designs, and registered designs.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

2

(c) registered copyrights and all registered and unregistered trade-marks (including the goodwill attaching to those trade-marks), registrations, and applications for trade-marks and copyrights,

(d) rights and interests in and to processes, data, trade secrets, designs, know-how, processes, product formulae and information, manufacturing, engineering, and other drawings and manuals, technology, algorithms, blue prints, research and development reports, technical information, technical assistance, engineering data, design and engineering specifications, and similar materials recording or evidencing expertise or information,

(e) other owned intellectual and industrial property rights throughout the world,

(f) licences of the intellectual property listed in paragraphs (b) through (e) above, except for Shrink-Wrap Software,

(g) all future income and proceeds from any of the intellectual property listed in paragraphs (b) through (e) above and the licences listed in paragraph (g) above, and

(h) all rights to damages and profits by reason of the infringement of any of the intellectual property listed in paragraphs (b) through (f) above.

“Law” means

(a) any law (including the common law), statute, by-law, rule, regulation, order, ordinance, treaty, decree, judgment, and

(b) any official directive, protocol, code, guideline, notice, approval, order, policy, or other requirement of any Governmental Body, having the force of law.

“Licence” means (a) any authorization from any Governmental Body having jurisdiction relating to any Borrower or its businesses, undertaking, or properties, (b) any authorization from any Person granting any easement or licence relating to any real or immovable property, and (c) any Intellectual Property licence.

“Lien” means (a) any interest in property created by way of mortgage, pledge, charge, lien, assignment by way of security, hypothecation, security interest, conditional sale agreement, sale/lease back transaction, deposit arrangement, title retention, capital lease, or discount, factoring, or securitization arrangement on recourse terms, (b) any statutory deemed trust or lien, (c) any preference, priority, adverse claim, levy, execution, seizure, attachment, garnishment, or other encumbrance that binds property, (d) any right of set-off intended to secure the payment or performance of an obligation, and (e) any agreement to grant any of the rights or interests described in any of the preceding clauses.

“Material Adverse Effect” has the meaning ascribed to such term in the Debenture.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

3

“Notice” means any notice, request, direction, or other document that a party can or must make or give under this agreement.

“Obligations” means all of each Borrower’s present and future liabilities, obligations, and indebtedness (including all principal, interest, fees, expenses, and other amounts), whether direct or indirect, contingent or absolute, joint or several, matured or unmatured, in any currency, to the Secured Party arising under, in connection with, or relating to the Debenture and any Transaction Document.

“Permitted Liens” means “Permitted Encumbrances” as defined in the Debenture.

“Person” includes

(a) any corporation, company, limited liability company, partnership, Governmental Body, joint venture, fund, trust, association, syndicate, organization, or other entity or group of persons, whether incorporated or not, and

(b) any individual, including in his or her capacity as trustee, executor, administrator, or other legally appointed representative.

“PPSA” means the Personal Property Security Act (Ontario) or as applicable the UCC of the applicable state of the United States and the regulations promulgated thereunder, as amended from time to time and any legislation substituted therefor and any amendments thereto, provided that, if perfection or the effect of perfection or non-perfection or the priority of any Lien created hereunder or under any other Loan Document on the Collateral is governed by the personal property security legislation or other applicable legislation with respect to personal property security in effect in a province or jurisdiction other than Ontario, “PPSA” means the Personal Property Security Act or UCC or such other applicable legislation in effect from time to time in such other jurisdiction for purposes of the provisions hereof relating to such perfection, effect of perfection or non-perfection or priority.

“Receiver” means any privately or court appointed receiver, manager, or receiver and manager for the Collateral or for any of any Borrower’s business, undertaking, or property appointed by the Secured Party under this agreement or by a court on application by the Secured Party.

“Recovery” means any monies received or recovered by the Secured Party after the Security Interest has become enforceable, whether under any enforcement of the Security Interest, by any suit, action, proceeding, or settlement of any claim, or otherwise.

“Related Rights” means all of any Borrower’s rights arising under, by reason of, or otherwise in connection with, any agreement, right, Licence, or permit (including the right to receive payments under any of them).

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

4

“Replacements” means all increases, additions, improvements, and accessions to, and all substitutions for and replacements of, any part of the Collateral in which any Borrower now or later has rights.

“Security Interest” means, collectively, the grants, mortgages, charges, pledges, transfers, assignments, and other security interests created under this agreement as to the Collateral.

“Shrink-Wrap Software” means shrink-wrap or off-the-shelf software used by any Borrower that was readily available for use at the time of purchase or licensing and was not customized for any Borrower.

“STA” means the Securities Transfer Act, 2006 (Ontario).

“Third Party Agreements” means all leases (true or finance), Licences, and other agreements affecting any of any Borrower’s rights, title, or interest in any of the Intellectual Property.

“Transaction Documents” means this agreement and each other agreement, relating to the Debenture, from time to time in effect between any Borrower and the Secured Party (including all Documents).

“undertaking” means all of any Borrower’s present and future real and personal property, businesses, undertaking, and goodwill that are not accounts, chattel paper, Documents, documents of title, equipment, instruments, intangibles, inventory, money, or securities.

Capitalized terms used in this agreement and not otherwise defined have the meanings given to them in the Debenture.

1.02 References to specific terms

(a) Currency. Unless otherwise specified, all dollar amounts expressed in this agreement refer to United States currency.

(b) “Including.” Where this agreement uses the word “including,” it means “including without limitation,” and where it uses the word “includes,” it means “includes without limitation.”

(c) “Knowledge.” Where any representation, warranty, or other statement in this agreement, or in any other document entered into or delivered under this agreement, is expressed by a party to be “to its knowledge,” or is otherwise expressed to be limited in scope to facts or matters known to the party or of which the party is aware, it means the current, actual knowledge of the directors and officers of that party, without the requirement to make any other inquiry or investigation.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

5

(d) Statutes, etc. Unless otherwise specified, any reference in this agreement to a statute includes the regulations, rules, and policies made under that statute and any provision or instrument that amends or replaces that statute or those regulations, rules, or policies.

1.03 Headings

The headings used in this agreement and its division into articles, sections, schedules, exhibits, appendices, and other subdivisions do not affect its interpretation.

1.04 Internal references

References in this agreement to articles, sections, schedules, exhibits, appendices, and other subdivisions are to those parts of this agreement.

1.05 Number and gender

Unless the context requires otherwise, words importing the singular number include the plural and vice versa; words importing gender include all genders.

1.06 Calculation of time

In this agreement, a period of days begins on the first day after the event that began the period and ends at 5:00 p.m. Eastern Time on the last day of the period. If any period of time is to expire, or any action or event is to occur, on a day that is not a Business Day, the period expires, or the action or event is considered to occur, at 5:00 p.m. Eastern Time on the next Business Day.

1.07 Schedules

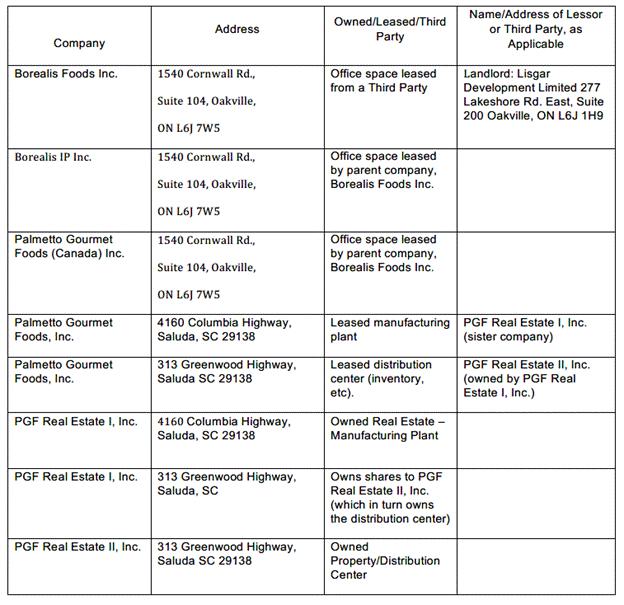

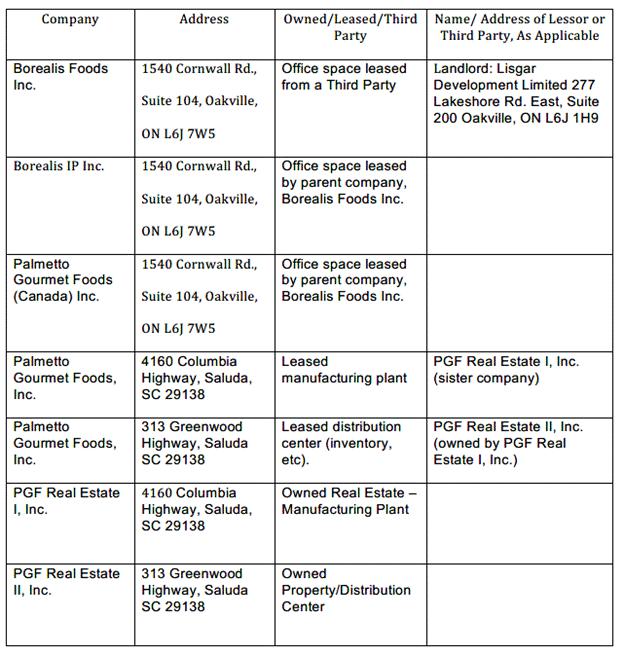

The following are the schedules to this agreement:

Schedule A - Location of Borrower and Collateral

Schedule B - List of Intellectual Property

Schedule C - Locations of Inventory and Equipment

Schedule D - Real Property

ARTICLE

2

GRANT OF SECURITY

2.01 Creation of Security Interest

Subject to the rights of the First Lender as set forth in the Lien Subordination Agreement, as general and continuing security for the due payment, observance, and performance by any Borrowers of all Obligations, the Borrower hereby grants to the Secured Party a Security Interest in the Collateral.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

6

2.02 Attachment

Subject to the rights of the First Lender as set forth in the Lien Subordination Agreement, the parties acknowledge that (a) each Borrower has rights in their respective Collateral, (b) the Secured Party has given value to any Borrowers, (c) the parties have not agreed to postpone the time for attachment of the Security Interest, and (d) the Security Interest is intended to attach (i) as to Collateral in which a Borrower now has rights, when such Borrower executes this agreement and (ii) as to Collateral in which a Borrower subsequently acquires rights, when such Borrower first obtains those rights.

2.03 Release of Collateral

The Secured Party may, at its discretion and at any time, release from the Security Interest any of the Collateral or any other security or surety for the Obligations either with or without sufficient consideration for that Collateral without releasing any other part of the Collateral or any Person from this agreement.

2.04 Account Borrower

Subject to the rights of the First Lender as set forth in the Lien Subordination Agreement, the Secured Party may, if a Default exists, notify and direct any Account Borrower of any Borrower to make payment directly to the Secured Party. The Secured Party may, at its discretion, apply the amounts received from any Account Borrower of any Borrower and any proceeds in accordance with section 7.22 (Application of payments) or hold them as part of the Collateral.

2.05 Leasehold interests

(a) The last day of the term of any lease, sublease, or agreement to lease or sublease now held or subsequently acquired by any Borrower is excluded from the Security Interest and does not form part of the Collateral. However, upon the Security Interest becoming enforceable, such ▇▇▇▇▇▇▇▇ will stand possessed of that last day and hold it in trust for the Security Party and shall assign it as the Secured Party directs.

(b) If any lease, sublease, or agreement to lease or sublease contains a term that provides, in effect, that it may not be assigned, sub-leased, charged, or made the subject of any Lien without the consent of the lessor, the application of the Security Interest to that agreement will be conditional upon obtaining that consent. Such Borrower shall use reasonable efforts to obtain that consent as soon as reasonably practicable.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

7

2.06 Contractual rights

(a) To the extent that the creation of the Security Interest would constitute a breach, or cause the acceleration, of any agreement, right, Licence, or permit to which any Borrower is a party, the Security Interest will not attach to it. However, such Borrower shall hold such contractual rights in trust for the Secured Party and shall assign that agreement, right, Licence, or permit to the Secured Party immediately upon obtaining the consent of the other party.

(b) The Security Interest will nonetheless immediately attach to any Related Rights if, to the extent that, and as at the time that attachment to the Related Rights is not illegal, is not enforceable against the Secured Party or other third parties generally, or would not result in an ineligible transfer or a material loss or expense to any Borrower. Each Borrower shall use reasonable efforts to obtain all required material approvals as soon as reasonably practicable.

(c) To the extent permitted by applicable Law, each Borrower shall hold in trust for the Secured Party and, after a Default occurs, provide the Secured Party with the benefits of, each agreement, right, Licence, or permit and enforce all Related Rights at the direction of and for the benefit of the Secured Party or at the direction of any other Person that the Secured Party may designate.

2.07 Intellectual Property

Subject to the rights of the First Lender as set forth in the Lien Subordination Agreement, the Borrower grants the Security Interest in the Intellectual Property only as security. Before the Security Interest becomes enforceable under this agreement, the Secured Party will not be or be deemed to be the owner of any of the Intellectual Property. Further, the Secured Party will not be deemed to have assumed, or be deemed to be liable for, any covenant, agreement, or other obligation of any Borrower under any agreement, right, Licence, or permit relating to the Intellectual Property to which any Borrower is a party.

2.08 Commingled goods

If the Collateral subsequently becomes part of a product or mass to which the security interest of another secured party attaches, the Security Interest will extend to all accounts, Replacements, or proceeds arising from any dealing with such product or mass.

2.09 Release of Security Interest

In the event of the earlier of: (i) conversion of the Convertible Notes purchased by Secured Party under Debenture into equity in accordance with the conditions of Debenture and Business Combination Agreement as of 23 February 2023 or (ii) the Borrowers satisfying the Obligations in full, the Secured Party shall immediately release the Security Interest and execute and deliver any releases and discharges that any Borrower may reasonably require. The Borrowers shall pay all expenses incurred by the Secured Party in doing so.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

8

ARTICLE

3

BORROWER’S COVENANTS

3.01 Care of Collateral

The Borrowers shall keep the Collateral in good condition, ordinary wear and tear excepted.

3.02 Liens

The Borrowers shall keep the Collateral free of all Liens, except for Permitted Liens. The Borrowers shall defend the title of the Collateral against any Person. The Secured Party may, at any time, contest the validity, effect, perfection, or priority of any Lien. No Lien may rank in priority to or pari passu with the Security Interest, except for the Permitted Liens, including without limitation the rights of the First Lender. Nothing in this agreement is intended to create any rights (including subordination rights or any release of Security Interest) in favour of any Person other than the Secured Party, any Receiver, and the other Indemnified Parties.

3.03 Proceeds held in trust

Subject to terms of the Lien Subordination Agreement, from and after the first date on which the Secured Party exercises any remedies under Article 7 (Rights and Remedies), each Borrower shall hold any accounts, dividends, distributions, interest, proceeds, and other income that it collects in respect of the Collateral as agent and in trust for the Secured Party separate and apart from all its other property. Such Borrower shall pay any such amounts to the Secured Party immediately upon receipt.

3.04 Accessions and fixtures

The Borrowers shall prevent the Collateral from becoming (a) an accession to any personal property not subject to this agreement.

3.05 Notice of change

(a) The Borrowers shall give Notice to the Secured Party

(i) immediately of (A) any material Intellectual Property in which any Borrower acquires rights, (B) any securities and security entitlements in which any Borrower acquires rights, (C) any location at which Documents are situated or (D) any event occurring that, after notice or lapse of time, would constitute a Default,

(ii) at least [*****] Business Days prior to (A) any change of name of any Borrower and (B) any change in or addition to the location of Collateral from those locations referred to in section 5.03 (Location of Collateral), and

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

9

(iii) at least [*****] Business Days prior to (A) the adoption of a French or combined English and French form of name, (B) any change in the jurisdiction where any Borrower is incorporated or continued or where the registered office or chief executive office of any Borrower is located, (C) any change in the jurisdiction where any Borrower has its chief executive office (within the meaning of any applicable PPSA).

(b) Each Borrower hereby authorizes the Secured Party, as such ▇▇▇▇▇▇▇▇’s attorney under this agreement, to revise each schedule to reflect the information provided to the Secured Party under this section.

3.06 Information

Each Borrower shall deliver to the Secured Party any information concerning the Collateral or any Borrower that the Secured Party may reasonably request.

3.07 Documents

Each Borrower shall keep proper Documents and shall keep the Documents at the locations specified in Schedule A (Location of Borrower and Collateral).

3.08 Inspection

Each Borrower shall allow the Secured Party or its representatives, on reasonable notice, (a) to have access at commercially reasonable times to all premises of such Borrower at which Collateral or Documents may be located, (b) to inspect the Collateral and all Documents, (c) to make copies of, and take extracts from any Documents, and (d) to verify the existence and state of the Collateral in any reasonable manner that the Secured Party may consider appropriate. The Secured Party shall keep confidential any information that the Secured Party obtains from that inspection, except as required by the Secured Party in exercising its rights under this agreement.

3.09 Maintenance of Intellectual Property

Each Borrower shall perform all covenants required under any Third Party Agreement (including promptly paying all required fees, royalties, and taxes) to maintain every item of Intellectual Property in full force and effect, except where noncompliance would not have a Material Adverse Effect. Each Borrower shall vigorously protect, preserve, and maintain all of the value of, and all of the right, title, and interest of any Borrower in, the Intellectual Property owned by such Borrower (including the prosecution and defence against any suits concerning the validity, infringement, enforceability, ownership, or other aspects affecting any of the Intellectual Property), except where noncompliance would not have a Material Adverse Effect.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

10

3.10 Delivery of certain Collateral

At the request of the Secured Party, each Borrower shall deliver to the Secured Party all items of Collateral that are chattel paper, instruments, or negotiable documents of title, endorsed to the Secured Party or in blank by an effective endorsement, as the Secured Party may reasonably request.

3.11 Registration

Each Borrower shall make all necessary filings, registrations, and other recordations to protect the interest of the Secured Party in the Collateral (including all recordations in connection with patents, trade-marks, and copyrights forming part of the Intellectual Property), except where noncompliance would not have a Material Adverse Effect. Each Borrower shall cause its representatives to immediately register, file, and record this agreement, or notice of this agreement, on behalf of the Secured Party at all proper offices where, in the opinion of counsel to the Secured Party, registration, filing, or recordation may be necessary or advantageous to create, perfect, preserve, or protect the Security Interest in the Collateral and its priority. Each Borrower shall subsequently cause its representatives to maintain all those registrations, filings, and recordations on behalf of the Secured Party in full force and effect (including by making timely payment of any renewal or maintenance fees).

3.12 General indemnity

(a) Each Borrower shall indemnify the Secured Party, any Receiver, and their respective representatives (each, an “Indemnified Party”) in connection with all claims, losses, and expenses that an Indemnified Party may suffer or incur in connection with

(i) the exercise by the Secured Party or any Receiver of any of its rights under this agreement,

(ii) any breach by any Borrower of the representations or warranties of any Borrower contained in this agreement, or

(iii) any breach by any Borrower of, or any failure by any Borrower to observe or perform, any of the Obligations,

except that any Borrower will not be obliged to indemnify any Indemnified Party to the extent those claims, losses, and expenses are determined by a final judgment to have directly resulted from the wilful misconduct or gross negligence of the Indemnified Party.

(b) The Secured Party will be constituted as the trustee of each Indemnified Party, other than itself, and shall hold and enforce each of the rights of the other Indemnified Parties under this section or their respective benefits.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

11

3.13 Set-off, combination of accounts, and crossclaims

The Secured Party or any assignee of the Secured Party may set off or apply against, or combine with, the Obligations any indebtedness owing by the Secured Party or any assignee of the Secured Party to any Borrower, direct or indirect, extended or renewed, actual or contingent, mutual or not, at any time before, upon, or after maturity, without demand upon or notice to anyone, and the terms of that indebtedness and Obligations will be changed to the extent necessary to permit and give effect to the set-off, application, and combination.

3.14 Limitations on Secured Party’s rights and realization

To the fullest extent permitted by applicable Law, each Borrower shall waive all of the rights, benefits, conditions, warranties, and protections given by the provisions of any existing or future statute that imposes limitations upon the rights of a secured party or upon the methods of realization of Security Interest.

ARTICLE

4

BORROWER’S RIGHTS

4.01 Dealings with Collateral

Except as permitted by the Debenture, no Borrower shall sell, exchange, transfer, assign, or otherwise dispose of, ▇▇▇▇▇ ▇ ▇▇▇▇ on, or deal in any way with the Collateral, or enter into any agreement or undertaking to do so.

ARTICLE

5

▇▇▇▇▇▇▇▇’S REPRESENTATIONS AND WARRANTIES

Each Borrower represents and warrants to the Secured Party as follows, acknowledging that the Secured Party is relying on these representations and warranties:

5.01 Collateral unencumbered

Except for Permitted Liens, each Borrower owns the Collateral free from any mortgage, lien, charge, encumbrance, pledge, security interest, or any other claim.

5.02 Location of Borrower

Schedule A (Location of Borrower and Collateral) lists each Borrower’s full, complete name (including any French name), its registered office, places of business, and the jurisdiction in which it is incorporated and in which its chief executive office (within the meaning of any applicable PPSA) is located.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

12

5.03 Location of Collateral

Schedule A (Location of Borrower and Collateral) lists the locations of the Collateral, except for (a) Collateral that is in transit to and from those locations in the ordinary course of business, (b) equipment that is with repairers for repair and return to any Borrower, (c) Collateral having an aggregate value that is not material, and (d) Collateral that has been disposed of in accordance with the terms of the other Transaction Documents.

ARTICLE

6

ACKNOWLEDGEMENTS

6.01 Construction of terms

The parties have each participated in settling the terms of this agreement. Any rule of legal interpretation to the effect that any ambiguity is to be resolved against the drafting party will not apply in interpreting this agreement.

6.02 No partnership, etc.

Nothing contained in this agreement will create a partnership, joint venture, principal-and-agent relationship, or any similar relationship between the parties.

6.03 No third party beneficiaries

This agreement does not confer any rights or remedies upon any Person other than the parties and their respective heirs, trustees, executors, administrators, and other legally appointed representatives, successors and assigns.

ARTICLE

7

RIGHTS AND REMEDIES

Subject to the rights of the First Lender as set forth in the Lien Subordination Agreement, upon the occurrence of a Default, or if the Security Interest otherwise becomes enforceable, the Secured Party may exercise any of the following rights or remedies:

7.01 Remedies cumulative

The rights, remedies, and powers provided to a party under this agreement are cumulative and in addition to, and are not exclusive of or in substitution for, any rights, remedies, and powers otherwise available to that party.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

13

7.02 Security in addition

This agreement and the Security Interest are in addition to and not in substitution for any other security now or later held by the Secured Party in connection with any Borrower, the Obligations, or the Collateral. The Security Interest does not replace or otherwise affect any existing or future Lien held by the Secured Party. No taking of any suit, action, or proceeding, judicial or extra-judicial, no refraining from doing so, and no dealing with any other security for any Obligations will release or affect (a) the Security Interest or (b) any of the other Liens held by the Secured Party for the payment or performance of the Obligations.

7.03 Non-merger

(a) This agreement will not operate by way of a merger of the Obligations or of any guarantee, agreement, or other document or instrument by which the Obligations now, or at any time subsequently, may be represented or evidenced. Neither the taking of any judgment nor the exercise of any power of seizure or disposition will extinguish the liability of any Borrower to pay and perform the Obligations nor shall the acceptance of any payment or alternate security constitute or create any novation.

(b) The rights, obligations, representations and warranties, and covenants under this agreement will not merge in any judgment.

7.04 Survival

The covenants and agreements in Article 3 survive the termination of this agreement.

7.05 Severability

The invalidity or unenforceability of any particular term of this agreement will not affect or limit the validity or enforceability of the remaining terms.

7.06 Waiver

(a) Requirements. No waiver of satisfaction of a condition or non-performance of an obligation under this agreement is effective unless it is in writing and signed by the party granting the waiver.

(b) Scope of waiver. No waiver by a party will extend to any subsequent non-satisfaction or non-performance of an obligation under this agreement, whether or not of the same or similar nature to that which was waived.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

14

(c) Rights and remedies. No waiver by a party will affect the exercise of any other rights or remedies by that party under this agreement. Any failure or delay by a party in exercising any right or remedy will not constitute, or be deemed to constitute, a waiver by that party of that right or remedy. No single or partial exercise by a party of any right or remedy will preclude any other or further exercise by that party of any right or remedy.

7.07 Acceleration and enforcement

The Obligations will be accelerated and become immediately due and payable in full and the Security Interest will become immediately enforceable without the Secured Party having to take any further action.

7.08 Power of entry

The Secured Party may enter any premises owned, leased, or otherwise occupied by any Borrower or where any Collateral may be located to take possession of, dispose of, disable, or remove any Collateral by any method permitted by applicable Law. Each Borrower shall grant to the Secured Party a licence to occupy any of any Borrower’s premises for the purpose of storing any Collateral and shall, immediately upon demand, deliver to the Secured Party possession of any Collateral at the place specified by the Secured Party.

7.09 Power of sale

(a) The Secured Party may sell, lease, consign, license, assign, or otherwise dispose of any Collateral by public auction, private tender, or private contract, with or without notice, advertising, or any other formality, all of which any Borrower hereby waives to the extent permitted by applicable Law. The Secured Party may establish the terms of disposition (including terms and conditions as to credit, upset, reserve bid, or price). The Secured Party will credit all payments made under those dispositions against the Obligations only as they are actually received. The Secured Party may buy in, rescind, or vary any contract for the disposition of Collateral and may dispose of any Collateral again without being answerable for any resulting loss. Any disposition may take place whether or not the Secured Party has taken possession of the Collateral. The exercise by the Secured Party of any power of sale does not preclude the Secured Party from any further exercise of its power of sale in accordance with this paragraph.

(b) The Secured Party may approach a restricted number of potential purchasers to effect the sale of any Collateral constituting securities under paragraph (a) above. A sale under those circumstances may yield a lower price for Collateral than would otherwise be obtainable if that Collateral was registered and sold in the open market. Each Borrower agrees that

(i) if the Secured Party sells Collateral at a private sale or sales, the Secured Party has the right to rely upon the advice and opinion of any Person who regularly deals in or evaluates securities of the type constituting the Collateral as to the best price obtainable in a commercially reasonable manner, and

(ii) that reliance will be conclusive evidence that the Secured Party handled that sale in a commercially reasonable manner.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

15

7.10 Carrying on business

The Secured Party may carry on, or concur in the carrying on of, all or any part of the businesses or undertaking of any Borrower and may, to the exclusion of all others (including any Borrower), enter upon, occupy, and use any of the premises, buildings, and plant of, occupied or used by any Borrower and may use all or any of those premises and the equipment and other Collateral located on those premises (including fixtures) for whatever time and purposes as the Secured Party sees fit, free of charge. The Secured Party will not be liable to any Borrower for any act, omission, or negligence in doing so or in connection with any rent, charges, costs, depreciation, or damages in connection with that action.

7.11 Pay Liens

The Secured Party may pay any liability owed to any actual or threatened Lien holder against any Collateral, and borrow money to maintain, preserve, or protect any Collateral or to carry on the businesses or undertaking of any Borrower, and may charge and grant further security interests in any Collateral in priority to the Security Interest as security for the money so borrowed. Immediately upon demand by the Secured Party, each Borrower shall reimburse the Secured Party for all those payments and borrowings.

7.12 Dealing with Collateral

(a) As soon as the Secured Party takes possession of any Collateral or appoints a Receiver over any Collateral, all rights of any Borrower in and to that Collateral will cease unless the Secured Party or any Receiver agrees in writing to specifically continue those rights.

(b) The Secured Party may have, enjoy, and exercise all of the rights of and enjoyed by any Borrower in and to the Collateral or incidental, ancillary, attaching, or deriving from the ownership by any Borrower of the Collateral (including the right to (i) enter into agreements and grant licences over or relating to Collateral, (ii) demand, commence, continue, or defend any judicial or administrative proceedings for the purpose of protecting, seizing, collecting, realizing, or obtaining possession or payment of the Collateral, (iii) grant or agree to Liens and grant or reserve profits à prendre, easements, rights of ways, rights in the nature of easements, and licences over or relating to any part of the Collateral, and (iv) give valid receipts and discharges, and to compromise or give time for the payment or performance of all or any part of the accounts or any other obligation of any third party to any Borrower).

(c) The Secured Party may take any actions to maintain, preserve, and protect the Collateral or otherwise deal with any Collateral in the manner, upon the terms, and at the times it deems advisable in its discretion without notice to any Borrower, except as otherwise required by applicable Law (including payments on account of other security interests affecting the Collateral); provided that the Secured Party will not be required to take any of those actions or make any of those expenditures. Any of the amounts that the Secured Party pays (including legal, Receiver’s, accounting, or other professional fees and expenses) will be added to the Obligations and will be secured by this agreement.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

16

(d) The Secured Party may accept the Collateral in satisfaction of the Obligations.

(e) The Secured Party or any Receiver has no obligation to keep Collateral identifiable or to preserve rights against prior secured creditors in connection with any Collateral.

7.13 Powers re leases

The Secured Party may upon any sale by the Secured Party of any leasehold interest under this agreement for the purpose of vesting the one-day residue of the term or its renewal in any purchase, by deed or writing appoint the purchaser or any other Person as a new trustee of the residue or renewal in place of any Borrower and may vest those rights in the new trustee so appointed free from any obligation in that Collateral.

7.14 Dealing with accounts

The Secured Party may collect, sell, or otherwise deal with accounts (including notifying any Person obligated to any Borrower in connection with an account, chattel paper, or an instrument to make payment to the Secured Party of all present and future amounts that are due).

7.15 Collect rents

The Secured Party may collect any rents, income, and profits received in connection with the business of any Borrower or the Collateral, without carrying on the business.

7.16 Dealing with Intellectual Property

The Secured Party may register assignments of the Intellectual Property, and use, sell, assign, license, or sub-license any of the Intellectual Property.

7.17 File claims

The Secured Party may file proofs of claim and other documents in order to have the claims of the Secured Party lodged in any bankruptcy, winding-up, or other judicial proceeding relating to any Borrower or the Collateral.

7.18 Power of attorney

Each Borrower shall appoint the Secured Party, acting by any officer, director, employee, agent, or representative for the time being of the Secured Party located at its address for notices in section 8.09 (Notice), to be its attorney with full power of substitution to do on such Borrower’s behalf anything that such Borrower can lawfully do by an attorney (including to do, make, and execute all agreements, deeds, acts, matters, or things, with the right to use the name of such Borrower) that it deems necessary or expedient and to carry out its obligations under this agreement, to revise and schedule to this agreement and to complete any missing information in this agreement. This power of attorney, being granted by way of security and coupled with an interest, is irrevocable until the Obligations are paid in full.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

17

7.19 Retain services

The Secured Party may retain the services of any lawyers, accountants, appraisers, and other agents, and consultants as the Secured Party deems necessary or desirable in connection with anything done or to be done by the Secured Party or with any of the rights of the Secured Party set out in this agreement and pay their commissions, fees, disbursements (which payments will constitute part of the Secured Party’s disbursements reimbursable by the Borrowers under this agreement). Each Borrower shall immediately on demand reimburse the Secured Party for all those payments.

7.20 Appointment of a Receiver

(a) The Secured Party may

(i) appoint, by instrument in writing, a Receiver for any Borrower, the Collateral, or both any such Borrower and the Collateral, and no such Receiver need be appointed, need its appointment ratified, or need its actions in any way supervised, by a court,

(ii) appoint an officer or employee of the Secured Party as Receiver,

(iii) remove any Receiver and appoint another Receiver, or

(iv) apply, at any time, to any court of competent jurisdiction for the appointment of a Receiver or other official, who may have powers the same as, greater or lesser than, or otherwise different from, those capable of being granted to a Receiver appointed by the Secured Party under this agreement.

(b) If two or more Receivers are appointed to act concurrently, they will act severally and not jointly and severally.

7.21 Effect of appointment of Receiver

Any Receiver will have the rights set out in this Article 7 (Rights and Remedies). In exercising those rights, a Receiver will act as, and for all purposes will be deemed to be, the agent of any Borrower. However, the Secured Party will not be responsible for any act, omission, negligence, misconduct, or default of any Receiver.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

18

7.22 Application of payments

The Secured Party, or any Receiver appointed by the Secured Party in the enforcement of the Security Interest, may hold all payments made in connection with the Obligations and all monies received as security for the Obligations (including each Recovery), or may apply those payments or monies in whatever manner they determine at their discretion. The Secured Party may at any time apply or change any application of those payments, monies, or Recoveries to any parts of the Obligations as the Secured Party may determine at its discretion. Each Borrower will remain liable to the Secured Party for any deficiency. The Secured Party shall pay any surplus funds realized after the satisfaction of all Obligations in accordance with applicable Law.

7.23 Deficiency

If the proceeds of the realization of any Collateral are insufficient to repay all Obligations, the Borrowers shall immediately pay or cause to be paid the deficiency to the Secured Party.

7.24 Limitation of liability

Neither the Secured Party nor any Receiver will be liable for any negligence in accordance with any rent, charges, costs, depreciation, or damages in connection with any of its actions. Neither the Secured Party nor any Receiver will be liable or accountable to any Borrower for any failure to seize, collect, realize, dispose of, enforce, or otherwise deal with any Collateral, nor will any of them be bound to bring any action or proceeding for any of those purposes or to preserve any rights of any Person in any of the Collateral. Neither the Secured Party nor any Receiver will be liable or responsible for any claim, loss, and expense flowing from any failure resulting from any act, omission, negligence, misconduct, or default of the Secured Party, any Receiver, or any of their respective representatives or otherwise. If any Receiver or the Secured Party takes possession of any Collateral, neither the Secured Party nor any Receiver will have any liability as a mortgagee in possession of the Collateral or be accountable for anything except actual receipts. Further, the Secured Party will not be deemed to have assumed, or be deemed to be liable for, any covenant, agreement, or other obligation of any Borrower under any agreement, right, Licence, or permit to which any Borrower is a party.

7.25 Extensions of time

The Secured Party and any Receiver may grant renewals, extensions of time, and other indulgences, take and give up Liens, accept compositions, grant releases and discharges, perfect or fail to perfect any Liens, release any Collateral to third parties, and otherwise deal or fail to deal with the Collateral, other Liens, any Borrower, debtors of any Borrower, guarantors of any Borrower, sureties of any Borrower, and others as the Secured Party or such Receiver may see fit, all without prejudice to the Obligations and the rights of the Secured Party or any Receiver to hold and realize upon the Security Interest. However, no extension of time, forbearance, indulgence, or other accommodation will operate as a waiver, alteration, or amendment of the Secured Party’s rights or otherwise preclude the Secured Party from enforcing those rights and nothing in this agreement obligates the Secured Party to extend the time for payment or satisfaction of any of the Obligations.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

19

7.26 Secured Party or Receiver may perform

If any Borrower fails to perform any Obligations, the Secured Party or any Receiver may perform those Obligations as attorney for any Borrower in accordance with section 7.18 (Power of attorney). The rights conferred on the Secured Party and any Receiver under this agreement are for the purpose of protecting the Security Interest in the Collateral and do not impose any obligation upon the Secured Party or any Receiver to exercise any of those rights. Each Borrower will remain liable under each agreement to which it is party or by which it or any of its businesses, undertaking, and properties is bound and shall perform all of its obligations under each of those agreements; any Borrower will not be released from any of its obligations under any agreement by the exercise of any rights by the Secured Party or any Receiver.

7.27 Validity of sale

No Person dealing with the Secured Party, any Receiver, or any representative of the Secured Party or any Receiver has any obligation to enquire whether the Security has become enforceable, whether any right of the Secured Party or any Receiver has become exercisable, whether any Obligations remain outstanding, or otherwise as to the propriety or regularity of any dealing by the Secured Party or any Receiver with any Collateral or to see to the application of any money paid to the Secured Party or any Receiver. In the absence of fraud on the part of any Person, those dealings will be deemed to be within the rights conferred under this agreement and to be valid and effective accordingly.

7.28 No obligation to advance

Nothing in this agreement obligates the Secured Party to make any loan or accommodation to any Borrower or to extend the time for payment or satisfaction of any Obligation.

ARTICLE

8

GENERAL

8.01 Entire agreement

This agreement together with ▇▇▇▇▇▇▇▇▇ and the other Transaction Documents

(a) constitutes the entire agreement; there are no representations, covenants, or other terms other than those set out in those agreements, and

(b) supersedes any previous discussions, understandings, or agreements, between the parties relating to its subject matter.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

20

8.02 Further assurances

Each party, upon receipt of Notice by another party, shall sign (or cause to be signed) all further documents, do (or cause to be done) all further acts, and provide all reasonable assurances as may reasonably be necessary or desirable to give effect to this agreement and the transactions contemplated by this agreement.

8.03 Amendment

This agreement may only be amended by a written document signed by each of the parties.

8.04 Conflict of terms

If there is any inconsistency between the terms of this agreement and the terms of the Debenture, the terms of the Debenture will prevail. The parties shall take all necessary steps to conform the inconsistent terms to the terms of that agreement.

8.05 Binding effect

This agreement enures to the benefit of and binds the parties and their respective heirs, trustees, executors, administrators, and other legally appointed representatives, successors and assigns.

8.06 Borrower’s amalgamation

If any Borrower amalgamates with any other entity or entities other than pursuant to amalgamation under the BCA, this agreement will continue in full force and effect and will be binding upon the amalgamated entity, and, for greater certainty

(a) the Security Interest will (i) continue to secure all the Obligations, (ii) secure all obligations, of the nature contemplated by the “Obligations” definition, of each other amalgamating entity to the Secured Party, and (iii) secure all obligations, of the nature contemplated by the “Obligations” definition, of the amalgamated entity to the Secured Party arising after the amalgamation,

(b) the Security Interest will (i) continue to attach to the Collateral, (ii) attach to the Collateral of each other amalgamating entity, and (iii) attach to the Collateral of the amalgamated entity after the amalgamation, and

(c) all defined terms and other terms of this agreement will be deemed to have been amended to reflect the amalgamation, to the extent required by the context.

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

21

8.07 Termination

8.08 Assignment

The Secured Party may assign this agreement and the Obligations in whole or in part to any Person without Notice to or the consent of any Borrower. Without the prior written consent of the Secured Party, any Borrower may not assign this agreement.

8.09 Notice

To be effective, a Notice must be in writing and given in the manner contemplated in the Debenture, and the provisions of section 7.8 thereof are incorporated herein mutatis mutandis.

8.10 Governing law

The laws of Ontario and the laws of Canada applicable in that province, excluding any rule or principle of conflicts of law that may provide otherwise, govern this agreement.

8.11 Submission to jurisdiction

The parties irrevocably attorn to the jurisdiction of the courts of the Province of Ontario which will have non-exclusive jurisdiction over any matter arising out of this agreement.

8.12 Counterparts

This agreement may be signed in any number of counterparts, each of which is an original, and all of which taken together constitute one single document.

8.13 Copy of agreement

Each Borrower acknowledges receipt of an executed copy of this agreement and copies of the verification statements relating to the financing statements or financing change statements filed by the Secured Party or its representatives under the PPSA and under the personal property security statutes of other provinces in connection with this agreement.

8.14 Effective date

This agreement is effective as of the date shown at the top of the first page, even if any signatures are made after that date.

[The remainder of this page has been intentionally left blank]

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

22

Signature Page to the General Security Agreement executed by the Borrower _____________, 2023

| BOREALIS FOOD INC. | ||

| By | ||

| Name | ||

| Title | ||

| BOREALIS IP INC. | ||

| By | ||

| Name | ||

| Title | ||

| PALMETTO GOURMET FOODS (CANADA) INC. | ||

| By | ||

| Name | ||

| Title | ||

| PALMETTO GOURMET FOODS, INC. | ||

| By | ||

| Name | ||

| Title | ||

| PGF REAL ESTATE I, INC. | ||

| By | ||

| Name | ||

| Title | ||

| PGF REAL ESTATE II, INC. | ||

| By | ||

| Name | ||

| Title | ||

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

| SECURED PARTY: | BELPHAR LTD. | |

| By | ||

| Name | ||

| Title | ||

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

SCHEDULE A

LOCATION OF BORROWER AND COLLATERAL

|

Grantor |

Jurisdiction of Organization | Chief Executive Office | Tax ID Number | Organizational ID Number |

| Borealis Foods Inc. | Canada |

▇▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇ ▇▇▇ ▇▇▇▇▇▇ |

Canada: [*****] US EIN: [*****] |

[*****] |

| Borealis IP Inc. | Canada |

▇▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇ ▇▇▇ ▇▇▇▇▇▇ |

Canada: [*****] | [*****] |

| Palmetto Gourmet Foods (Canada) Inc. | Canada |

▇▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇ ▇▇▇ ▇▇▇▇▇▇ |

Canada: [*****] | [*****] |

| Palmetto Gourmet Foods, Inc. | South Carolina | ▇▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇ | US EIN: [*****] | [*****] |

| PGF Real Estate I, Inc. | South Carolina | ▇▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇ | US EIN: [*****] | [*****] |

| PGF Real Estate II, Inc. | South Carolina | ▇▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇ | US EIN: [*****] | [*****] |

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

A-1

SCHEDULE B

LIST OF INTELLECTUAL PROPERTY

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

B-1

Schedule C

Locations of Inventory and Equipment

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

C-1

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

C-2

Schedule D

Real Property

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[*****]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

D-1