CONFORMED COPY Incorporating Amendment No. 2 to Credit Agreement, dated March 5, 2020 EXHIBIT E CONFORMED COPY Incorporating Amendment No. 2, dated March 5, 2020; and Amendment No. 3, dated July 23, 2020 AMENDED AND RESTATED PLEDGE AND SECURITY...

CONFORMED COPY Incorporating Amendment No. 2 to Credit Agreement, dated March 5, 2020 EXHIBIT E CONFORMED COPY Incorporating Amendment No. 2, dated March 5, 2020; and Amendment No. 3, dated July 23, 2020 AMENDED AND RESTATED PLEDGE AND SECURITY AGREEMENT THIS AMENDED AND RESTATED PLEDGE AND SECURITY AGREEMENT (as the same may be amended, restated, supplemented or otherwise modified from time to time, this “Security Agreement ”) is entered into as of November 6, 2018 by and among Xxxxxx Bros. Co., a Delaware corporation (the “Borrower ”), Xxxx Assets Co., a Delaware corporation (“Xxxx Assets ”), China Mist Brands, Inc., a Delaware corporation (“China Mist ”), Coffee Bean International, Inc., an Oregon corporation (“Coffee Bean ”), FBC Finance Company, a California corporation (“FBC ”), and Coffee Bean Holding Co., Inc., a Delaware corporation (“Coffee Bean Holdings ”, and together with the Borrower, Xxxx Assets, China Mist, Coffee Bean, and FBC, each an “Initial Grantor ”; the Initial Grantors, together with any additional Subsidiaries, whether now existing or hereafter formed or acquired which become parties to this Security Agreement from time to time, in accordance with the terms of the Credit Agreement (as defined below), by executing a Supplement hereto in substantially the form of Annex I (each, a “Security Agreement Supplement ”), collectively, the “Grantors ”), and JPMorgan Chase Bank, N.A., in its capacity as administrative agent (the “Administrative Agent ”) for itself and for the Secured Parties (as defined in the Credit Agreement identified below). PRELIMINARY STATEMENTS WHEREAS, the Initial Grantors, the Lenders party thereto and the Administrative Agent are entering into an Amended and Restated Credit Agreement dated as of November 6, 2018 (as the same may be amended, restated, supplemented or otherwise modified from time to time, the “Credit Agreement ”), which Credit Agreement amends and restates in its entirety the Existing Credit Agreement (as defined in the Credit Agreement) ; WHEREAS, the Credit Agreement, among other things, re-evidences the Borrower’s outstanding obligations under the Existing Credit Agreement and provides, subject to the terms and conditions thereof, for extensions of credit and other financial accommodations to be made by the Lenders to or for the benefit of the Borrower ; WHEREAS, as a condition precedent to the effectiveness of the Existing Credit Agreement, certain of the Initial Grantors entered into the Pledge and Security Agreement, dated as of March 2, 2015 with the Administrative Agent (as amended, restated, supplemented or otherwise modified prior to the date hereof, the “ Existing Security Agreement ”); and WHEREAS, the Initial Grantors wish to reaffirm their obligations under the Existing Security Agreement, amend and restate the Existing Security Agreement and continue to secure their obligations to the Secured Parties pursuant to the terms of this Security Agreement; ACCORDINGLY, to induce the Administrative Agent and the Lenders to enter into and extend credit to the Borrower under the Credit Agreement, the Grantors and the Administrative Agent, on behalf of the Secured Parties, hereby agree as follows: - 254669812v.1ACTIVE 254669812v.9

ARTICLE I DEFINITIONS 1.1. Terms Defined in Credit Agreement . All capitalized terms used herein and not otherwise defined shall have the meanings assigned to such terms in the Credit Agreement. 1.2. Terms Defined in UCC . The following terms are used herein as defined in Article 9 of the UCC: Accounts, Chattel Paper, Commercial Tort Claims, Deposit Accounts, Documents, Equipment, Farm Products, General Intangibles, Goods, Instruments, Inventory, Investment Property, Letter-of-Credit Rights, Supporting Obligations and Tangible Chattel Paper. The terms “Securities” and “Securities Accounts” are used herein as defined in Article 8 of the UCC. 1.3. Definitions of Certain Terms Used Herein . As used in this Security Agreement, in addition to the terms defined above and in the Preliminary Statements, the following terms shall have the following meanings: “Article ” means a numbered article of this Security Agreement, unless another document is specifically referenced. “Collateral ” shall have the meaning set forth in Article II . “Collateral Access Agreement ” means any landlord waiver or other agreement, in form and substance reasonably satisfactory to the Administrative Agent in its Permitted Discretion , among the Administrative Agent, the applicable Grantor and any third party (including any bailee, consignee, customs broker, or other similar Person) in possession of any Collateral or any landlord of any real property where any Collateral is located, as such landlord waiver or other agreement may be amended, restated, supplemented or otherwise modified from time to time. “Collateral License ” means any written inbound license or agreement under which a Grantor is authorized to use intellectual property in connection with any manufacture, marketing, distribution or disposition of Inventory. “Collateral Report ” means any certificate (including any Borrowing Base Certificate) , report or other document delivered by any Grantor to the Administrative Agent or any Lender with respect to the Collateral pursuant to any Loan Document. “Control ” shall have the meaning set forth in Article 8 or, if applicable, in Section 9-104, 9-105, 9-106 or 9-107 of Article 9 of the UCC. “Copyright Security Agreement ” means each Copyright Security Agreement, substantially in the form attached as Exhibit J , executed and delivered by the Grantors, or any of them, and the Administrative Agent. “Copyrights ” means, with respect to any Person, all of such Person’s right, title, and interest in and to the following: (a) all copyrights, rights and interests in copyrights, works protectable by copyright, copyright registrations, and copyright applications; (b) all renewals of any of the foregoing; (c) all income, royalties, damages, and payments now or hereafter due and/or payable under any of the foregoing, including, without limitation, damages or payments for past or future infringements for any of the foregoing; (d) the right to xxx for past, present, and future infringements of any of the foregoing; and (e) all rights corresponding to any of the foregoing throughout the world. 2- -

“Default ” means any event or condition which constitutes an Event of Default or which upon notice, lapse of time or both would, unless cured or waived, become an Event of Default. “Deposit Account Control Agreement ” means an agreement, in form and substance reasonably satisfactory to the Administrative Agent in its Permitted Discretion , among any Grantor, a banking institution holding such Grantor’s funds, and the Administrative Agent with respect to collection and control of all deposits and balances held in a deposit account maintained by such Grantor with such banking institution. “Excluded Accounts ” means a , collectively, Deposit Account Accounts and/ or Securities Account containing not more than $50,000 at any one time; provided , however , that the aggregate amount of funds and the fair market value of all other assets contained in Accounts having a 30-day average balance of less than $100,000 in the aggregate for all such Deposit Accounts and/ or Securities Accounts referred to above shall not exceed $ 250,000 at any one time . “Excluded Collateral ” means, collectively, (a) [intentionally omitted], (b) Intentionally Omitted, (b) voting Equity Interests of any CFC or Domestic Subsidiary HoldCo, solely to the extent that (i) such Equity Interests represent more than 65% of the outstanding voting Equity Interests of such CFC or Domestic Subsidiary HoldCo, and (ii) pledging or hypothecating more than 65% of the total outstanding voting Equity Interests of such CFC or Domestic Subsidiary HoldCo would result in adverse tax consequences (as reasonably determined by the Borrower in consultation with the Administrative Agent ) or the costs to any of the Grantors of providing such pledge are unreasonably excessive (as determined by the Administrative Agent in consultation with the Borrower) in relation to the benefits to the Administrative Agent, the other Lenders of the security afforded thereby (which pledge, if reasonably requested by the Administrative Agent, shall be governed by the laws of the jurisdiction of such Subsidiary); (c) any rights or interest in any contract, lease, permit, license, or license agreement covering real or personal property if under the terms of such contract, lease, permit, license, or license agreement, or applicable law with respect thereto, the grant of a security interest or lien therein is prohibited or restricted as a matter of law or under the terms of such contract, lease, permit, license, or license agreement, or would invalidate any such contract, lease, permit, license or license agreement, and such prohibition or restriction has not been waived or the consent of the other party to such contract, lease, permit, license, or license agreement has not been obtained (provided that, (i) the foregoing exclusions of this clause (c) shall in no way be construed (A) to apply to the extent that any described prohibition or restriction is ineffective under Section 9-406, 9-407, 9-408, or 9-409 of the UCC or other applicable law, or (B) to apply to the extent that any consent or waiver has been obtained that would permit the Administrative Agent’s security interest or lien to attach notwithstanding the prohibition or restriction on the pledge of such contract, lease, permit, license, or license agreement and (ii) the foregoing exclusions of clauses (b) and this clause (c) shall in no way be construed to limit, impair, or otherwise affect any of the Administrative Agent’s or any Lender’s continuing security interests in and liens upon any rights or interests of any Grantor in or to (A) monies due or to become due under or in connection with any described contract, lease, permit, license, license agreement, or Equity Interests (including any Accounts or Equity Interests), or (B) any proceeds from the sale, license, lease, or other dispositions of any such contract, lease, permit, license, license agreement, or Equity Interests); (d) any United States intent-to-use trademark or service xxxx applications to the extent that, and solely during the period in which, the grant of a security interest therein would impair the validity or enforceability of a registration issuing from such intent-to-use trademark or service xxxx applications under applicable federal law, provided that upon submission and acceptance by the United States Patent and Trademark Office of an amendment to allege use pursuant to 15 U.S.C. Section 1051(c) or a statement of use pursuant to 15 U.S.C. Section 1051(d) (or any successor provisions), such intent-to-use trademark or service xxxx application shall be considered 3- -

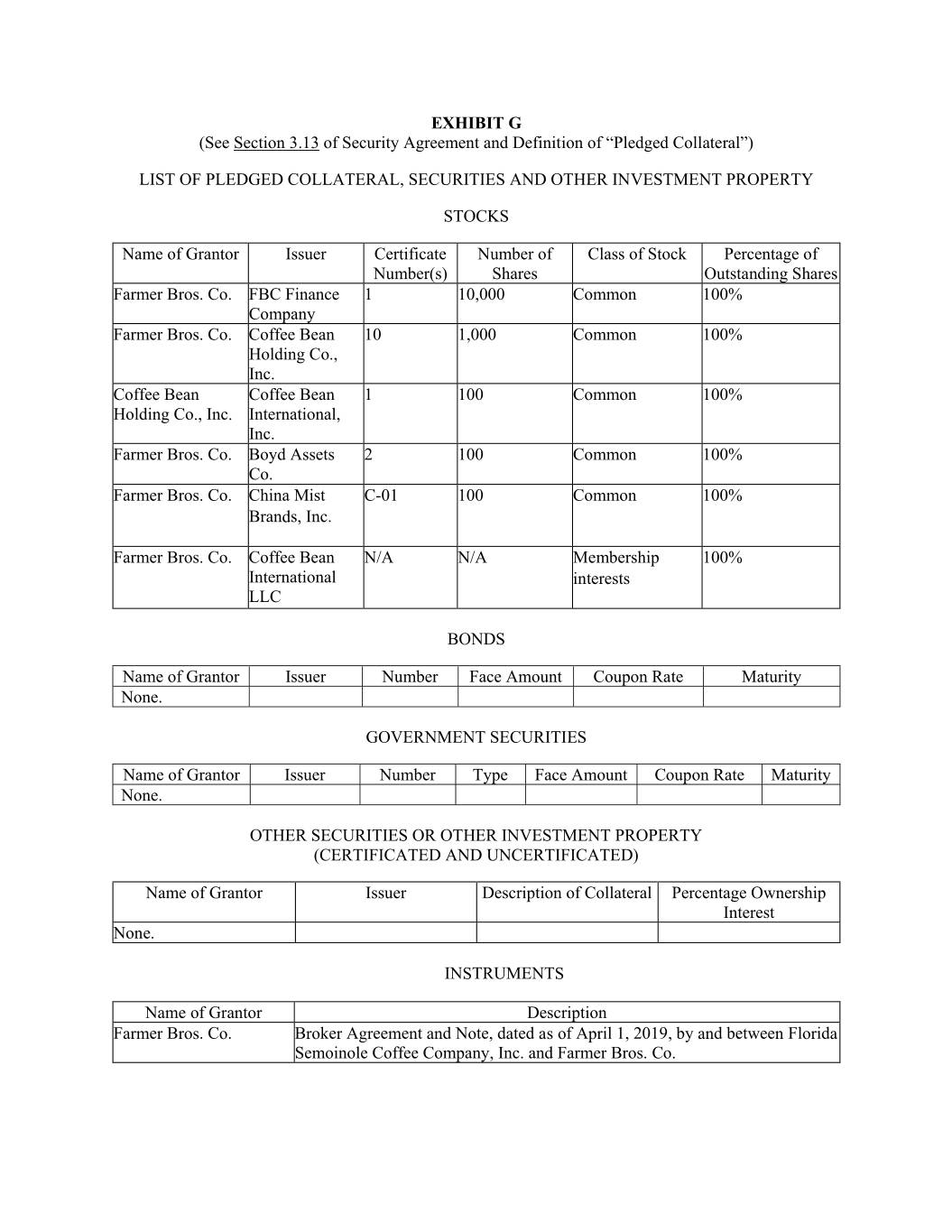

Collateral; (e) [intentionally omitted]; (f) motor vehicles, aircraft and other assets subject to certificates of title; (g) Excluded Deposit and Securities Accounts; and (h) margin stock (as defined in Regulation U). “Excluded Deposit and Securities Accounts ” means the collective reference to: (a) Deposit Accounts of Grantors specially and exclusively used for payroll, payroll taxes, trust or fiduciary purposes and other employee wage and benefit payments to or for the Grantors’ employees (provided that the amount on deposit in such accounts does not exceed the then current amount of such payroll, payroll taxes and other employee wage and benefit obligations), and (b) Deposit Accounts specially and exclusively used for taxes, including sales taxes (provided that the amount on deposit in such accounts does not exceed the then current amount of such tax obligations). “Exhibit ” refers to a specific exhibit to this Security Agreement, unless another document is specifically referenced. “Fixtures ” shall have the meaning set forth in Article 9 of the UCC. “Gem Note” means that certain Broker Agreement and Note dated as of April 1, 2019 , by and between the Borrower and Florida Seminole Coffee Company, Inc. “Lenders ” means the lenders party to the Credit Agreement and their successors and assigns. “Licenses ” means, with respect to any Person, all of such Person’s right, title, and interest in and to (a) any and all written licensing agreements or other grants of rights with respect to its Patents, Copyrights, or Trademarks, (b) all income, royalties, damages, claims, and payments now or hereafter due or payable under and with respect thereto, including, without limitation, damages and payments for past and future breaches thereof, and (c) all rights to xxx for past, present, and future breaches thereof. “Patent Security Agreement ” shall mean each Patent Security Agreement, substantially in the form attached as Exhibit K , executed and delivered by the Grantors, or any of them, and the Administrative Agent. “Patents ” means, with respect to any Person, all of such Person’s right, title, and interest in and to: (a) any and all patents and patent applications; (b) all inventions and improvements claimed therein; (c) all reissues, divisions, continuations, renewals, extensions, and continuations-in-part thereof; (d) all income, royalties, damages, claims, and payments now or hereafter due or payable under and with respect thereto, including, without limitation, damages and payments for past and future infringements thereof; (e) all rights to xxx for past, present, and future infringements thereof; and (f) all rights corresponding to any of the foregoing throughout the world. “Pledged Collateral ” means all Instruments, Securities and other Investment Property of the Grantors to the extent constituting Collateral, whether or not physically delivered to the Administrative Agent pursuant to this Security Agreement. “Receivables ” means the Accounts, Chattel Paper, Documents, Investment Property, Instruments and any other rights or claims to receive money which are General Intangibles or which are otherwise included as Collateral. “Section ” means a numbered section of this Security Agreement, unless another document is specifically referenced. “Stock Rights ” means all dividends, instruments or other distributions and any other right or property which the Grantors shall receive or shall become entitled to receive for any reason whatsoever 4- -

invoices and Collateral Reports with respect thereto furnished to the Administrative Agent by such Grantor from time to time. (b) As of the Effective Date, no Grantor has any Collateral evidenced or represented by any Tangible Chattel Paper in excess of $250,000 individually or $500,000 in the aggregate other than the Tangible Chattel Paper listed on Exhibit C . All action required under Section 4.4 of this Security Agreement has been duly taken by such Grantor. (c) As to Accounts of the Borrower and the Domestic Subsidiary Guarantors included as Eligible Accounts in the Borrowing Base Certificate most recently delivered to the Administrative Agent pursuant to Section 5.01(h) of the Credit Agreement, except (x) as disclosed on the most recent Collateral Report and (y) as it relates to any eligibility criteria subject to the Administrative Agent’s discretion, (i) to each Grantor’s knowledge, such Accounts are Eligible Accounts and (ii) such Accounts represent bona fide sales of Inventory or rendering of services to Account Debtors in the ordinary course of such Grantor’s business. (d) In addition, to each Grantor’s knowledge, with respect to all of its Accounts, the amounts shown on all invoices, statements and Collateral Reports with respect thereto are actually and absolutely owing to such Grantor as indicated thereon and are not in any way contingent. 3.9. Inventory . All Inventory of such Grantor (i) is of good and merchantable quality and free from known defects (other than defects arising in the ordinary course of such Grantor’s business) except , solely in the case of (x) any Inventory that was not identified by the Borrower as Eligible Inventory in the most recent Collateral Report and (y) as it relates to any eligibility criteria subject to the Administrative Agent’s discretion, to the extent the failure of which would not reasonably be expected to have a Material Adverse Effect, (ii) as of the Effective Date, is (other than Inventory in transit) located at one of such Grantor’s locations set forth on Exhibit A or at any other location permitted by Section 4.1(g) , and (iii) has been produced in all material respects in accordance with the Federal Fair Labor Standards Act of 1938, as amended, and all rules, regulations and orders thereunder. 3.10. Intellectual Property . As of the Effective Date, such Grantor does not have any interest in, or title to, any registered Patent, Trademark or Copyright (or application for such registration) except as set forth in Exhibit D . This Security Agreement and each Copyright Security Agreement, Patent Security Agreement and Trademark Security Agreement is effective to create a valid and continuing Lien and, upon filing of appropriate financing statements in the offices listed on Exhibit H , Copyright Security Agreements with the United States Copyright Office, and Patent Security Agreements and Trademark Security Agreements with the United States Patent and Trademark Office, perfected first priority security interests (subject only to Liens permitted by Section 4.1(e) ) in favor of the Administrative Agent on such Grantor’s United States Patents, Trademarks and Copyrights and such perfected security interests are enforceable in accordance with their terms as such as against any and all creditors of and purchasers from such Grantor subject to applicable bankruptcy law and general principles of equity. 3.11. Filing Requirements . None of the Collateral owned by it is of a type for which security interests or liens may be perfected by filing under any federal statute except: (a) for Patents, Trademarks and Copyrights held by such Grantor and described in Exhibit D ; (b) for Patents, Trademarks and Copyrights acquired after the date hereof Effective Date and disclosed to Administrative Agent in accordance with Section 4.7(c) ; and (c) to the extent notified in writing to the Administrative Agent within five (5) Business Days of any Grantor acquiring any such assets. Notwithstanding anything contained in the Loan Documents to the contrary, no Grantor shall be required to take any action required 8- -

ARTICLE IV COVENANTS From the date of this Security Agreement and thereafter until this Security Agreement is terminated pursuant to the terms hereof, each of the Initial Grantors agrees that, and from and after the effective date of any Security Agreement Supplement applicable to any Grantor (and after giving effect to supplements to each of the Exhibits hereto with respect to such subsequent Grantor as attached to such Security Agreement Supplement) and thereafter until this Security Agreement is terminated pursuant to the terms hereof, each such subsequent Grantor agrees that: 4.1. General . (a) Collateral Records . Such Grantor will maintain complete and accurate books and records with respect to the Collateral owned by it consistent with past practices, and furnish to the Administrative Agent, with sufficient copies for each of the Secured Parties, such reports relating to such Collateral as the Administrative Agent shall from time to time reasonably request. (b) Authorization to File Financing Statements; Ratification . Such Grantor hereby authorizes the Administrative Agent to file, and if requested (subject to the exceptions and qualifications otherwise set forth herein and in any other Loan Document) will deliver to the Administrative Agent, all financing statements and other documents and take such other actions as may from time to time reasonably be requested by the Administrative Agent in order to maintain a first priority perfected security interest in and, if applicable, Control of, the Collateral owned by such Grantor, subject to Liens permitted under Section 4.1(e) , provided that nothing herein shall be deemed to constitute an agreement to subordinate any of the Liens of the Administrative Agent under the Loan Documents to any Liens otherwise permitted under Section 4.1(e) . Any financing statement filed by the Administrative Agent may be filed in such offices as the Administrative Agent reasonably determines to be appropriate to perfect the security interest of the Administrative Agent under this Security Agreement and may (i) indicate or describe such Grantor’s Collateral (1) as all assets of such Grantor or words of similar effect, regardless of whether any particular asset comprised in the Collateral falls within the scope of Article 9 of the UCC of such jurisdiction, or (2) by any other description which reasonably approximates the description contained in this Security Agreement, and (ii) contain any other information required by part 5 of Article 9 of the UCC for the sufficiency or filing office acceptance of any financing statement or amendment, including whether such Grantor is an organization, and the type of such Grantor’s organization. Such Grantor also agrees to furnish any such information described in the foregoing sentence to the Administrative Agent promptly upon request. Such Grantor also ratifies its authorization for the Administrative Agent to have filed in any UCC jurisdiction any initial financing statements or amendments thereto if filed prior to the date hereof Effective Date . (c) Further Assurances . Such Grantor also agrees to take any and all actions necessary to defend title to the Collateral against all persons and to defend the security interest of the Administrative Agent in its Collateral and the priority thereof against any Lien not expressly permitted hereunder. (d) Disposition of Collateral . Such Grantor will not sell, lease or otherwise dispose of the Collateral owned by it except for Dispositions specifically permitted pursuant to Section 6.05 of the Credit Agreement. (e) Liens . Such Grantor will not create, incur, or suffer to exist any Lien on the Collateral owned by it except (i) the security interest created by this Security Agreement, and (ii) other Liens permitted under Section 6.02 of the Credit Agreement; provided , that nothing herein shall be 10 - -

deemed to constitute an agreement to subordinate any of the Liens of the Administrative Agent under the Loan Documents to any Liens otherwise permitted under Section 6.02 of the Credit Agreement. (f) Other Financing Statements . Such Grantor will not authorize the filing of any financing statement naming it as debtor covering all or any portion of the Collateral owned by it, except for financing statements (i) naming the Administrative Agent on behalf of the Secured Parties as the secured party, and (ii) in respect to other Liens permitted by Section 4.1(e) . Such Grantor acknowledges that it is not authorized to file any financing statement covering all or any portion of the Collateral, or any amendment or termination statement with respect to any financing statement referred to in clause (i), above, without the prior written consent of the Administrative Agent, subject to such Grantor’s rights under Section 9-509(d)(2) of the UCC. (g) Locations. Such Grantor will not (i) maintain any Collateral (other than Collateral in transit in the ordinary course of business) owned by it in an amount in excess of $1,000,000 in value for all such Collateral at any location other than (x) those locations listed on Exhibit A and (y) any locations notified to the Administrative Agent in a report delivered at the time of submission to the Administrative Agent of the next Borrowing Base Certificate in accordance with the terms of the Credit Agreement ( and such Grantor will concurrently therewith obtain a Collateral Access Agreement for each such location to the extent required by Section 4.13), (ii) change its principal place of business or chief executive office from the location identified on Exhibit A, other than as permitted by Section 4.15 or (iii) maintain any tangible Collateral at any locations outside of the United States. 4.2. Receivables . (a) Certain Agreements on Receivables . Such Grantor will not make or agree to make any discount, credit, rebate or other reduction in the original amount owing on a Receivable or accept in satisfaction of a Receivable less than the original amount thereof, except that, prior to the occurrence of an Event of Default that is continuing , such Grantor may reduce the amount of Accounts arising from the sale of Inventory or the rendering of services in accordance with its present policies and in the ordinary course of business and as otherwise permitted under the Credit Agreement. (b) Collection of Receivables . Except as otherwise provided in this Security Agreement, such Grantor will collect and enforce, at such Grantor’s sole expense, all amounts due or hereafter due to such Grantor under the Receivables owned by it in accordance with past practice and in the ordinary course of business. (c) Electronic Chattel Paper . Such Grantor shall take all steps requested by the Administrative Agent in its reasonable discretion to grant the Administrative Agent Control of all electronic chattel paper valued in excess of $500,000 in the aggregate for all such electronic chattel paper in accordance with the UCC and all “transferable records” as defined in each of the Uniform Electronic Transactions Act and the Electronic Signatures in Global and National Commerce Act. (d) Delivery of Invoices. Such Grantor will deliver to the Administrative Agent promptly upon its request after the occurrence and during the continuation of an Event of Default duplicate invoices with respect to each Account owned by it and, after acceleration of the Obligations, bearing such language of assignment as the Administrative Agent shall specify. (e) Disclosure of Counterclaims on Receivables. If (i) any discount, credit or agreement to make a rebate or to otherwise reduce the amount owing on any Receivable (to the extent constituting an Eligible Account) owned by such Grantor exists or (ii) if, to the knowledge of such Grantor, any dispute, setoff, claim, counterclaim or defense exists or has been asserted or threatened with respect to any such Receivable (to the extent constituting an Eligible Account), then, in each case, such 11 - -

Grantor will, at the time of submission to the Administrative Agent of the next Borrowing Base Certificate in accordance with the terms of the Credit Agreement , disclose such fact to the Administrative Agent in writing. 4.3. Intentionally Omitted Inventory . (a) Maintenance of Goods. Such Grantor will do all things necessary to maintain, preserve, protect and keep its Eligible Inventory in good and saleable condition, except for damaged or defective goods arising in the ordinary course of such Grantor’s business. (b) Returned Inventory. Such Grantor shall promptly report to the Administrative Agent any return of Inventory (to the extent constituting Eligible Inventory) involving an amount in excess of $1,000,000. Each such report shall indicate the reasons for the returns and the locations and condition of such returned Inventory. Each such report shall indicate the reasons for the returns and the locations and condition of the returned Inventory. In the event any Account Debtor returns Inventory to such Grantor when an Event of Default has occurred and is continuing , such Grantor , upon the request of the Administrative Agent, shall: (i) hold the returned Inventory in trust for the Administrative Agent; (ii) segregate all returned Inventory from all of its other property; (iii) dispose of the returned Inventory solely according to the Administrative Agent’s written instructions; and (iv) not issue any credits or allowances with respect thereto without the Administrative Agent’s prior written consent. All returned Inventory shall be subject to the Administrative Agent’s Liens thereon. Whenever any Eligible Inventory is returned, the related Account shall be deemed ineligible to the extent of the amount owing by the Account Debtor with respect to such returned Inventory and such returned Inventory shall not be Eligible Inventory. (c) Inventory Count; Perpetual Inventory System. Such Grantor will conduct a physical count of its Inventory at least once per fiscal year, and upon the occurrence and during the continuation of an Event of Default , at such other times as the Administrative Agent requests. Such Grantor, at its own expense, shall deliver to the Administrative Agent the results of such physical count once per fiscal year, and upon the occurrence and during the continuation of an Event of Default, the results of any additional physical counts requested by the Administrative Agent . Such Grantor will maintain a perpetual inventory reporting system at all times. 4.4. Delivery of Instruments, Securities, Chattel Paper and Documents . Such Grantor will (a) deliver to the Administrative Agent promptly upon execution of this Security Agreement the originals of all Tangible Chattel Paper, Securities (to the extent certificated) and Instruments constituting Collateral owned by it (if any then exist), in each case solely to the extent such item of Tangible Chattel Paper, Security, or Instrument exceeds $250,000 individually or $500,000 in the aggregate, (b) hold in trust for the Administrative Agent upon receipt and promptly thereafter deliver to the Administrative Agent any such Chattel Paper, Securities (to the extent certificated) and Instruments (other than the Gem Note to the extent the aggregate outstanding principal amount thereunder does not exceed $ 300,000) constituting Collateral, in each case solely to the extent such item of Chattel Paper, Security, or Instrument exceeds $250,000 individually or $500,000 in the aggregate and (c) upon the Administrative Agent’s request, deliver to the Administrative Agent (and thereafter hold in trust for the Administrative Agent upon receipt and promptly deliver to the Administrative Agent) any Document evidencing or constituting Collateral. 4.5. Uncertificated Pledged Collateral . Such Grantor will permit the Administrative Agent from time to time to cause the appropriate issuers (and, if held with a securities intermediary, such securities intermediary) of uncertificated securities or other types of Pledged Collateral owned by it not represented by certificates to xxxx their books and records with the numbers and face amounts of all such uncertificated securities or other types of Pledged Collateral not represented by certificates and all 12 - -

a first priority security interest (subject only to Liens permitted by Section 4.1(e) ) in such commercial tort claim. 4.9. Letter-of-Credit Rights . If such Grantor is or becomes the beneficiary of a letter of credit not constituting a Supporting Obligation in respect of any Collateral (other than any such letters of credit not in excess of $250,000 individually or $500,000 in the aggregate), it shall promptly, and in any event within five (5) Business Days after becoming a beneficiary, notify the Administrative Agent thereof and upon the reasonable request of the Administrative Agent, use commercially reasonable efforts to cause the issuer and/or confirmation bank to (i) consent to the assignment of any Letter-of-Credit Rights to the Administrative Agent and (ii) agree to direct all payments thereunder to a Deposit Account at the Administrative Agent or subject to a Deposit Account Control Agreement for application to the Secured Obligations, in accordance with Section 2.18 of the Credit Agreement, all in form and substance reasonably satisfactory to the Administrative Agent. 4.10. Federal, State or Municipal Claims . Such Grantor will promptly notify the Administrative Agent of any Collateral with a face value in excess of $250,000 individually or $500,000 in the aggregate which constitutes a claim against the United States government or any state or local government or any instrumentality or agency thereof, the assignment of which claim is restricted by federal, or, to the knowledge of such Grantor, state or municipal law. 4.11. Intentionally Omitted . 4.12. Insurance . (a) In the event any Collateral is located in any area that has been designated by the Federal Emergency Management Agency as a “Special Flood Hazard Area” , such Grantor shall purchase and maintain flood insurance on such Collateral (including any personal property which is located on any real property leased by such Grantor within a “Special Flood Hazard Area”). The minimum amount of flood insurance required by this Section shall be in an amount equal to the lesser of the aggregate of all Lenders’ Commitments or the total replacement cost value of such Collateral. (a) [Reserved]. (b) All insurance policies required hereunder and under Section 5.10 of the Credit Agreement shall, within 45 days of the date hereof Effective Date (or such longer period as agreed by the Administrative Agent in its sole discretion), name the Administrative Agent (for the benefit of the Administrative Agent and the Secured Parties) as an additional insured or as lender loss payee, as applicable, and shall contain lender loss payable clauses, through endorsements in form and substance reasonably satisfactory to the Administrative Agent, which provide that: (i) all proceeds thereunder with respect to any Collateral shall be payable to the Administrative Agent; (ii) no such insurance shall be affected by any act or neglect of the insured or owner of the property described in such policy; and (iii) such policy and lender loss payable or mortgagee clauses may be canceled, amended, or terminated only upon at least thirty (30) days’ prior written notice given to the Administrative Agent. (c) All premiums on any such insurance shall be paid when due (subject to any grace periods provided by the terms of such policy) by such Grantor, and copies of the policies delivered to the Administrative Agent. If such Grantor fails to obtain any insurance as required by this Section, the Administrative Agent may obtain such insurance at the Borrower’s expense. By purchasing such insurance, the Administrative Agent shall not be deemed to have waived any Default arising from any Grantor’s failure to maintain such insurance or pay any premiums therefor. 15 - -

4.13. Collateral Access Agreements . After the occurrence of an Event of Default that is continuing, upon request by the Administrative Agent, such Grantor shall use commercially reasonable efforts to obtain a Collateral Access Agreement from the lessor of each leased property, mortgagee of owned property or bailee or consignee with respect to any warehouse, processor or converter facility or other location where Inventory in excess of $ 5,000,000 1,000,000 is stored or located, which agreement or letter shall provide access rights, contain a waiver or subordination of all Liens or claims that the landlord, mortgagee, bailee or consignee may assert against the Inventory at that location, and shall otherwise be reasonably satisfactory in form and substance to the Administrative Agent. 4.14. Deposit Account Control Agreements . After the occurrence of an Event of Default that is continuing, such Such Grantor will provide to the Administrative Agent promptly upon the Administrative Agent’s reasonable request, a Deposit Account Control Agreement or a securities account control agreement (in each case in form and substance reasonably satisfactory to the Administrative Agent in its Permitted Discretion ), as applicable, duly executed on behalf of each financial institution holding a Deposit Account or Securities Account of such Grantor as set forth in this Security Agreement; provided , however , that no such Deposit Account Control Agreement or securities account control agreement shall be required (a) in respect of any Excluded Account or any Excluded Deposit and Securities Account ., (b) for the 60 day period (or such longer period as agreed by the Administrative Agent in its sole discretion) after the Third Amendment Effective Date in respect of any Deposit Account or Securities Account (other than any Excluded Account or any Excluded Deposit and Securities Account) in existence on the Third Amendment Effective Date, or (c) for the 60 day period (or such longer period as agreed by the Administrative Agent in its sole discretion) after (x) the establishment thereof in respect of any Deposit Account or Securities Account (other than any Excluded Account or any Excluded Deposit and Securities Account) not in existence on the Third Amendment Effective Date, (y) the date any Grantor becomes a party to this Agreement pursuant to Section 5.11 of the Credit Agreement in respect of any Deposit Account or Securities Account (other than any Excluded Account or any Excluded Deposit and Securities Account) of such Grantor, or (z) the date the applicable Deposit Account or Securities Account is no longer an Excluded Account or an Excluded Deposit Account or Securities Account. 4.15. Change of Name or Location . Such Grantor shall not (a) change its name as it appears in official filings in the state of its incorporation or organization, (b) change its chief executive office, principal place of business, mailing address, corporate offices, or the location of its records concerning the Collateral as set forth in this Security Agreement, (c) change the type of entity that it is, (d) change its federal employer identification number or organization identification number, if any, issued by its state of incorporation or other organization, or (e) change its state of incorporation or organization, in each case, unless the Administrative Agent shall have received at least ten (10) days’ prior written notice of such change and the Administrative Agent shall have acknowledged (such acknowledgment not to be unreasonably withheld or delayed by Administrative Agent) in writing that either (1) such change will not adversely affect the validity, perfection or priority of the Administrative Agent’s security interest in the Collateral, or (2) any reasonable action requested by the Administrative Agent in connection therewith has been completed or taken (including any action to continue the perfection of any Liens in favor of the Administrative Agent, on behalf of the Secured Parties, in any Collateral) or will be taken within any time period reasonably specified by the Administrative Agent, provided that, any new location shall be in the continental U.S. 4.16. Securities . Each Grantor shall ensure that any Equity Interest which is included within the Collateral shall at no time constitute a Security and the issuer of any such Equity Interest shall at no time take any action to have such interests treated as a Security unless (i) all certificates or other documents constituting such Security have been delivered to the Administrative Agent and such Security is properly defined as such under Article 8 of the UCC of the applicable jurisdiction, whether as a result of actions by the issuer thereof or otherwise, or (ii) the Administrative Agent has entered into a control 16 - -

records relating thereto, or both, and to conduct sales of the Collateral, without any obligation to pay any Grantor for such use and occupancy; (c) Intentionally omitted; (d) take, or cause an issuer of Pledged Collateral to take, any and all actions necessary to enable the Administrative Agent to consummate a sale or other disposition of the Pledged Collateral; provided , that, no Grantor shall be required to take any actions to register or qualify any Pledged Collateral under any federal or state securities laws or any other similar or equivalent rules or regulations; and (e) at its own expense, cause the independent certified public accountants then engaged by each Grantor to prepare and deliver to the Administrative Agent and each Secured Party, at any time, and from time to time, promptly upon the Administrative Agent’s request, the following reports with respect to the applicable Grantor: (i) a reconciliation of all Accounts; (ii) an aging of all Accounts; (iii) trial balances; and (iv) a test verification of such Accounts. 5.4. Grant of Intellectual Property License . For the purpose of enabling the Administrative Agent to exercise the rights and remedies under this Article V at such time as the Administrative Agent shall be lawfully entitled to exercise such rights and remedies, each Grantor hereby (a) grants to the Administrative Agent, for the benefit of the Administrative Agent and the other Secured Parties, an irrevocable (subject to termination under Section 8.14 ), nonexclusive license (exercisable without payment of royalty or other compensation or charge to any Grantor) or other right to use, license or sublicense, following the occurrence and during the continuance of an Event of Default, each Grantor’s labels, Patents, Copyrights, rights of use of any name, trade secrets, trade names, Trademarks, service marks, customer lists, advertising matter and any other intellectual property rights or any property of a similar nature, as it pertains to the Collateral, in completing production of, advertising for sale, and selling any Collateral, now owned or hereafter acquired by such Grantor, and wherever the same may be located, and including in such license access to all media in which any of the licensed items may be recorded or stored and to all computer software and programs used for the compilation or printout thereof and (b) irrevocably agrees that the Administrative Agent may sell any of such Grantor’s Inventory directly to any person, including without limitation persons who have previously purchased such Grantor’s Inventory from such Grantor and in connection with any such sale or other enforcement of the Administrative Agent’s rights under this Security Agreement, may sell Inventory which bears any Trademark owned by or licensed to such Grantor and any Inventory that is covered by any Copyright owned by or licensed to such Grantor and the Administrative Agent may (but shall have no obligation to) finish any work in process and affix any Trademark owned by or licensed to such Grantor and sell such Inventory as provided herein. ARTICLE VI ACCOUNT VERIFICATION; ATTORNEY IN FACT; PROXY 6.1. Account Verification . The Administrative Agent may at any time during the continuance of an Event of Default, in the Administrative Agent’s own name, in the name of a nominee of the Administrative Agent, or in the name of any Grantor communicate (by mail, telephone, facsimile or otherwise) with the account debtors Account Debtors of any such Grantor, parties to contracts with any such Grantor and obligors in respect of Instruments of any such Grantor to verify with such Persons, to the Administrative Agent’s satisfaction, the existence, amount, terms of, and any other matter relating to, Accounts, Instruments, Chattel Paper, payment intangibles and/or other Receivables. 19 - -

6.2. Authorization for Administrative Agent to Take Certain Action . (a) Subject to paragraph (b) below, each Grantor irrevocably authorizes the Administrative Agent at any time and from time to time in the sole discretion of the Administrative Agent and appoints the Administrative Agent as its attorney in fact (i) to execute on behalf of such Grantor as debtor and to file financing statements necessary or desirable in the Administrative Agent’s sole discretion to perfect and to maintain the perfection and priority of the Administrative Agent’s security interest in the Collateral, (ii) when an Event of Default has occurred and is continuing, to endorse and collect any cash proceeds of the Collateral, (iii) to file a carbon, photographic or other reproduction of this Security Agreement or any financing statement with respect to the Collateral as a financing statement and to file any other financing statement or amendment of a financing statement (which does not add new collateral or add a debtor) in such offices as the Administrative Agent in its sole discretion deems necessary or desirable to perfect and to maintain the perfection and priority of the Administrative Agent’s security interest in the Collateral, (iv) to contact and enter into one or more agreements with the issuers of uncertificated securities which are Pledged Collateral or with securities intermediaries holding Pledged Collateral as may be necessary or advisable to give the Administrative Agent Control over such Pledged Collateral, (v) to apply the proceeds of any Collateral received by the Administrative Agent to the Secured Obligations as provided in Section 7.2 , (vi) to discharge past due taxes, assessments, charges, fees or Liens on the Collateral (except for such Liens that are specifically permitted hereunder), (vii) to contact account debtors Account Debtors for any reason, (viii) to demand payment or enforce payment of the Receivables in the name of the Administrative Agent or such Grantor and to endorse any and all checks, drafts, and other instruments for the payment of money relating to the Receivables, (ix) to sign such Grantor’s name on any invoice or xxxx of lading relating to the Receivables, drafts against any account debtor Account Debtor of such Grantor, assignments and verifications of Receivables, (x) to exercise all of such Grantor’s rights and remedies with respect to the collection of the Receivables and any other Collateral, (xi) to settle, adjust, compromise, extend or renew the Receivables, (xii) to settle, adjust or compromise any legal proceedings brought to collect Receivables, (xiii) to prepare, file and sign such Grantor’s name on a proof of claim in bankruptcy or similar document against any account debtor Account Debtor of such Grantor, (xiv) to prepare, file and sign such Grantor’s name on any notice of Lien, assignment or satisfaction of Lien or similar document in connection with the Receivables, (xv) to change the address for delivery of mail addressed to such Grantor to such address as the Administrative Agent may designate and to receive, open and dispose of all mail addressed to such Grantor, and (xvi) to do all other acts and things necessary to carry out this Security Agreement; and such Grantor agrees to reimburse the Administrative Agent on demand for any payment made or any expense incurred by the Administrative Agent in connection with any of the foregoing; provided that, this authorization shall not relieve such Grantor of any of its obligations under this Security Agreement, the Credit Agreement or any other Loan Document. (b) All acts of said attorney or designee are hereby ratified and approved. The powers conferred on the Administrative Agent, for the benefit of the Administrative Agent and the other Secured Parties, under this Section 6.2 are solely to protect the Administrative Agent’s interests in the Collateral and shall not impose any duty upon the Administrative Agent or any other Secured Party to exercise any such powers. The Administrative Agent agrees that, except for the powers granted in Section 6.2(a)(i) -(v) and Section 6.2(a)(xvi) , it shall not exercise any power or authority granted to it unless an Event of Default has occurred and is continuing. 6.3. Proxy . EACH GRANTOR HEREBY IRREVOCABLY CONSTITUTES AND APPOINTS THE ADMINISTRATIVE AGENT AS ITS PROXY AND ATTORNEY-IN-FACT (AS SET FORTH IN SECTION 6.2 ABOVE) WITH RESPECT TO ITS PLEDGED COLLATERAL, INCLUDING THE RIGHT TO VOTE ANY OF THE PLEDGED COLLATERAL, WITH FULL POWER OF SUBSTITUTION TO DO SO. IN ADDITION TO THE RIGHT TO VOTE ANY OF THE 20 - -

PLEDGED COLLATERAL, THE APPOINTMENT OF THE ADMINISTRATIVE AGENT AS PROXY AND ATTORNEY-IN-FACT SHALL INCLUDE THE RIGHT TO EXERCISE ALL OTHER RIGHTS, POWERS, PRIVILEGES AND REMEDIES TO WHICH A HOLDER OF ANY OF THE PLEDGED COLLATERAL WOULD BE ENTITLED (INCLUDING GIVING OR WITHHOLDING WRITTEN CONSENTS OF SHAREHOLDERS, CALLING SPECIAL MEETINGS OF SHAREHOLDERS AND VOTING AT SUCH MEETINGS). SUCH PROXY SHALL BE EFFECTIVE, AUTOMATICALLY AND WITHOUT THE NECESSITY OF ANY ACTION (INCLUDING ANY TRANSFER OF ANY OF THE PLEDGED COLLATERAL ON THE RECORD BOOKS OF THE ISSUER THEREOF) BY ANY PERSON (INCLUDING THE ISSUER OF THE PLEDGED COLLATERAL OR ANY OFFICER OR AGENT THEREOF), UPON THE OCCURRENCE AND DURING THE CONTINUATION OF AN EVENT OF DEFAULT. 6.4. Nature of Appointment; Limitation of Duty . THE APPOINTMENT OF THE ADMINISTRATIVE AGENT AS PROXY AND ATTORNEY-IN-FACT IN THIS ARTICLE VI IS COUPLED WITH AN INTEREST AND SHALL BE IRREVOCABLE UNTIL THE DATE ON WHICH THIS SECURITY AGREEMENT IS TERMINATED IN ACCORDANCE WITH SECTION 8.14 . NOTWITHSTANDING ANYTHING CONTAINED HEREIN, NONE OF THE ADMINISTRATIVE AGENT, ANY LENDER, ANY OTHER SECURED PARTY, ANY OF THEIR RESPECTIVE AFFILIATES, OR ANY OF THEIR OR THEIR AFFILIATES’ RESPECTIVE OFFICERS, DIRECTORS, EMPLOYEES, AGENTS OR REPRESENTATIVES SHALL HAVE ANY DUTY TO EXERCISE ANY RIGHT OR POWER GRANTED HEREUNDER OR OTHERWISE OR TO PRESERVE THE SAME AND SHALL NOT BE LIABLE FOR ANY FAILURE TO DO SO OR FOR ANY DELAY IN DOING SO, EXCEPT IN RESPECT OF DAMAGES ATTRIBUTABLE SOLELY TO ITS OWN GROSS NEGLIGENCE OR WILLFUL MISCONDUCT AS DETERMINED BY A COURT OF COMPETENT JURISDICTION IN A FINAL AND NON-APPEALABLE JUDGMENT; PROVIDED THAT, IN NO EVENT SHALL THEY BE LIABLE FOR ANY PUNITIVE, EXEMPLARY, INDIRECT OR CONSEQUENTIAL DAMAGES. ARTICLE VII COLLECTION AND APPLICATION OF COLLATERAL PROCEEDS; DEPOSIT ACCOUNTS 7.1. Collection of Receivables . The Administrative Agent may at any time after the occurrence and during the continuance of an Event of Default, by giving each Grantor prior written notice, elect to require that the Receivables be paid directly to the Administrative Agent for the benefit of the Secured Parties. In such event, each Grantor shall, and shall permit the Administrative Agent to, promptly notify the account debtors Account Debtors or obligors under the Receivables owned by such Grantor of the Administrative Agent’s interest therein and direct such account debtors or Account Debtors or obligors to make payment of all amounts then or thereafter due under such Receivables directly to the Administrative Agent. Upon receipt of any such notice from the Administrative Agent, each Grantor shall thereafter hold in trust for the Administrative Agent, on behalf of the Secured Parties, all amounts and proceeds received by it with respect to the Receivables and immediately and at all times thereafter deliver to the Administrative Agent all such amounts and proceeds in the same form as so received, whether by cash, check, draft or otherwise, with any necessary endorsements. The Administrative Agent shall hold and apply funds so received as provided by the terms of Section 7.2 hereof. 7.2. Application of Proceeds; Deficiency . The Administrative Agent may require all cash proceeds of the Collateral to be deposited in a special non-interest bearing cash collateral account with the Administrative Agent and held there as security for the Secured Obligations. No Grantor shall have any control whatsoever over such cash collateral account. Any such proceeds of the Collateral shall be applied in the order set forth in Sections 2.18 and 7.02 of the Credit Agreement unless a court of competent jurisdiction shall otherwise direct. The balance, if any, after all of the Secured Obligations 21 - -

have been satisfied and applied in accordance with Sections 2.18 and 7.02 of the Credit Agreement, shall be deposited by the Administrative Agent into such Grantor’s general operating account with the Administrative Agent or as instructed in writing by such Grantor. The Grantors shall remain liable, jointly and severally, for any deficiency if the proceeds of any sale or disposition of the Collateral are insufficient to pay all Secured Obligations, including any attorneys’ fees and other expenses incurred by the Administrative Agent or any other Secured Party to collect such deficiency. ARTICLE VIII GENERAL PROVISIONS 8.1. Waivers . Each Grantor hereby waives notice of the time and place of any public sale or the time after which any private sale or other disposition of all or any part of the Collateral may be made. To the extent such notice may not be waived under applicable law, any notice made shall be deemed reasonable if sent to the Grantors, addressed as set forth in Article IX , at least ten days prior to (i) the date of any such public sale or (ii) the time after which any such private sale or other disposition may be made. To the maximum extent permitted by applicable law, each Grantor waives all claims, damages, and demands against the Administrative Agent or any other Secured Party arising out of the repossession, retention or sale of the Collateral, except such as arise solely out of the gross negligence or willful misconduct of the Administrative Agent or such other Secured Party as determined by a court of competent jurisdiction in a final and non-appealable judgment. To the extent it may lawfully do so, each Grantor absolutely and irrevocably waives and relinquishes the benefit and advantage of, and covenants not to assert against the Administrative Agent or any other Secured Party, any valuation, stay, appraisal, extension, moratorium, redemption or similar laws and any and all rights or defenses it may have as a surety now or hereafter existing which, but for this provision, might be applicable to the sale of any Collateral made under the judgment, order or decree of any court, or privately under the power of sale conferred by this Security Agreement, or otherwise. Except as otherwise specifically provided herein, each Grantor hereby waives presentment, demand, protest or any notice (to the maximum extent permitted by applicable law) of any kind in connection with this Security Agreement or any Collateral. Without limiting any other waiver or provision , each Grantor waives, to the maximum extent permitted by law, (a) all benefits or defenses directly or indirectly arising under California Civil Code §§ 2787, 2799, 2808, 2815, 2819, 2820, 2821, 2822, 2838, 2839, 2847, 2848, and 2855, Chapter 2 of Title 14 of the California Civil Code, and California Code of Civil Procedure §§ 580a, 580b, 580c, 580d, and 726 or any similar laws of any other applicable jurisdiction, (b) all rights and defenses arising out of an election of remedies by the creditor, even though that election of remedies, such as a nonjudicial foreclosure with respect to security for a guaranteed obligation, has destroyed the guarantor’s rights of subrogation and reimbursement against the principal by the operation of Section 580d of the California Code of Civil Procedure or otherwise and (c) any defense arising by reason of or deriving from (i) any claim or defense based upon an election of remedies by the Secured Parties or (ii) any election by the Secured Parties under the Bankruptcy Code, to limit the amount of, or any collateral securing, its claim against any Grantor. 8.2. Limitation on Administrative Agent’s and Other Secured Parties’ Duty with Respect to the Collateral . The Administrative Agent shall have no obligation to clean-up or otherwise prepare the Collateral for sale. The Administrative Agent and each other Secured Party shall use reasonable care with respect to the Collateral in its possession or under its control. Neither the Administrative Agent nor any other Secured Party shall have any other duty as to any Collateral in its possession or control or in the possession or control of any agent or nominee of the Administrative Agent or such other Secured Party, or any income thereon or as to the preservation of rights against prior parties or any other rights pertaining thereto. To the extent that applicable law imposes duties on the Administrative Agent to exercise remedies in a commercially reasonable manner, each Grantor acknowledges and agrees that it is 22 - -

commercially reasonable for the Administrative Agent (i) to fail to incur expenses deemed significant by the Administrative Agent to prepare Collateral for disposition or otherwise to transform raw material or work in process into finished goods or other finished products for disposition, (ii) to fail to obtain third party consents for access to Collateral to be disposed of, or to obtain or, if not required by other law, to fail to obtain governmental or third party consents for the collection or disposition of Collateral to be collected or disposed of, (iii) to fail to exercise collection remedies against account debtors Account Debtors or other Persons obligated on Collateral or to remove Liens on or any adverse claims against Collateral, (iv) to exercise collection remedies against account debtors Account Debtors and other Persons obligated on Collateral directly or through the use of collection agencies and other collection specialists, (v) to advertise dispositions of Collateral through publications or media of general circulation, whether or not the Collateral is of a specialized nature, (vi) to contact other Persons, whether or not in the same business as such Grantor, for expressions of interest in acquiring all or any portion of the Collateral, (vii) to hire one or more professional auctioneers to assist in the disposition of Collateral, whether or not the Collateral is of a specialized nature, (viii) to dispose of Collateral by utilizing Internet sites that provide for the auction of assets of the types included in the Collateral or that have the reasonable capacity of doing so, or that match buyers and sellers of assets, (ix) to dispose of assets in wholesale rather than retail markets, (x) to disclaim disposition warranties, such as title, possession or quiet enjoyment, (xi) to purchase insurance or credit enhancements to insure the Administrative Agent against risks of loss, collection or disposition of Collateral or to provide to the Administrative Agent a guaranteed return from the collection or disposition of Collateral, or (xii) to the extent deemed appropriate by the Administrative Agent, to obtain the services of other brokers, investment bankers, consultants and other professionals to assist the Administrative Agent in the collection or disposition of any of the Collateral. Each Grantor acknowledges that the purpose of this Section 8.2 is to provide non-exhaustive indications of what actions or omissions by the Administrative Agent would be commercially reasonable in the Administrative Agent’s exercise of remedies against the Collateral and that other actions or omissions by the Administrative Agent shall not be deemed commercially unreasonable solely on account of not being indicated in this Section 8.2 . Without limitation upon the foregoing, nothing contained in this Section 8.2 shall be construed to grant any rights to any Grantor or to impose any duties on the Administrative Agent that would not have been granted or imposed by this Security Agreement or by applicable law in the absence of this Section 8.2 . 8.3. Compromises and Collection of Collateral . The Grantors and the Administrative Agent recognize that setoffs, counterclaims, defenses and other claims may be asserted by obligors with respect to certain of the Receivables, that certain of the Receivables may be or become uncollectible in whole or in part and that the expense and probability of success in litigating a disputed Receivable may exceed the amount that reasonably may be expected to be recovered with respect to a Receivable. In view of the foregoing, each Grantor agrees that the Administrative Agent may at any time and from time to time, if an Event of Default has occurred and is continuing, compromise with the obligor on any Receivable, accept in full payment of any Receivable such amount as the Administrative Agent in its sole discretion shall determine or abandon any Receivable, and any such action by the Administrative Agent shall be commercially reasonable so long as the Administrative Agent acts in good faith based on information known to it at the time it takes any such action. 8.4. Secured Party Performance of Debtor Obligations . Without having any obligation to do so, the Administrative Agent may perform or pay any obligation which any Grantor has agreed to perform or pay in this Security Agreement and the Grantors shall reimburse the Administrative Agent for any amounts paid by the Administrative Agent pursuant to this Section 8.4 . The Grantors’ obligation to reimburse the Administrative Agent pursuant to the preceding sentence shall be a Secured Obligation payable on demand. 23 - -

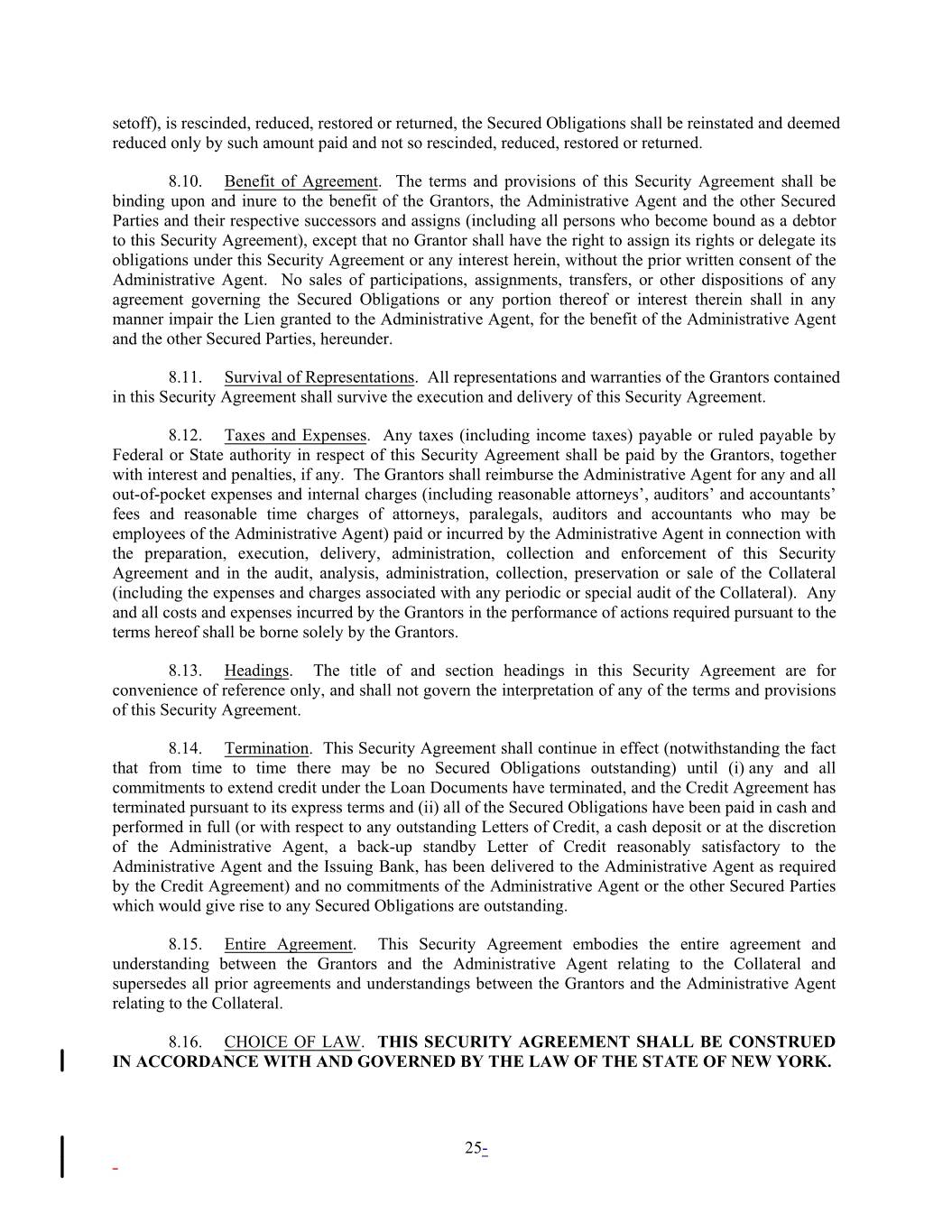

setoff), is rescinded, reduced, restored or returned, the Secured Obligations shall be reinstated and deemed reduced only by such amount paid and not so rescinded, reduced, restored or returned. 8.10. Benefit of Agreement . The terms and provisions of this Security Agreement shall be binding upon and inure to the benefit of the Grantors, the Administrative Agent and the other Secured Parties and their respective successors and assigns (including all persons who become bound as a debtor to this Security Agreement), except that no Grantor shall have the right to assign its rights or delegate its obligations under this Security Agreement or any interest herein, without the prior written consent of the Administrative Agent. No sales of participations, assignments, transfers, or other dispositions of any agreement governing the Secured Obligations or any portion thereof or interest therein shall in any manner impair the Lien granted to the Administrative Agent, for the benefit of the Administrative Agent and the other Secured Parties, hereunder. 8.11. Survival of Representations . All representations and warranties of the Grantors contained in this Security Agreement shall survive the execution and delivery of this Security Agreement. 8.12. Taxes and Expenses . Any taxes (including income taxes) payable or ruled payable by Federal or State authority in respect of this Security Agreement shall be paid by the Grantors, together with interest and penalties, if any. The Grantors shall reimburse the Administrative Agent for any and all out-of-pocket expenses and internal charges (including reasonable attorneys’, auditors’ and accountants’ fees and reasonable time charges of attorneys, paralegals, auditors and accountants who may be employees of the Administrative Agent) paid or incurred by the Administrative Agent in connection with the preparation, execution, delivery, administration, collection and enforcement of this Security Agreement and in the audit, analysis, administration, collection, preservation or sale of the Collateral (including the expenses and charges associated with any periodic or special audit of the Collateral). Any and all costs and expenses incurred by the Grantors in the performance of actions required pursuant to the terms hereof shall be borne solely by the Grantors. 8.13. Headings . The title of and section headings in this Security Agreement are for convenience of reference only, and shall not govern the interpretation of any of the terms and provisions of this Security Agreement. 8.14. Termination . This Security Agreement shall continue in effect (notwithstanding the fact that from time to time there may be no Secured Obligations outstanding) until (i) any and all commitments to extend credit under the Loan Documents have terminated, and the Credit Agreement has terminated pursuant to its express terms and (ii) all of the Secured Obligations have been paid in cash and performed in full (or with respect to any outstanding Letters of Credit, a cash deposit or at the discretion of the Administrative Agent, a back-up standby Letter of Credit reasonably satisfactory to the Administrative Agent and the Issuing Bank, has been delivered to the Administrative Agent as required by the Credit Agreement) and no commitments of the Administrative Agent or the other Secured Parties which would give rise to any Secured Obligations are outstanding. 8.15. Entire Agreement . This Security Agreement embodies the entire agreement and understanding between the Grantors and the Administrative Agent relating to the Collateral and supersedes all prior agreements and understandings between the Grantors and the Administrative Agent relating to the Collateral. 8.16. CHOICE OF LAW . THIS SECURITY AGREEMENT SHALL BE CONSTRUED IN ACCORDANCE WITH AND GOVERNED BY THE LAW OF THE STATE OF NEW YORK. 25 - -

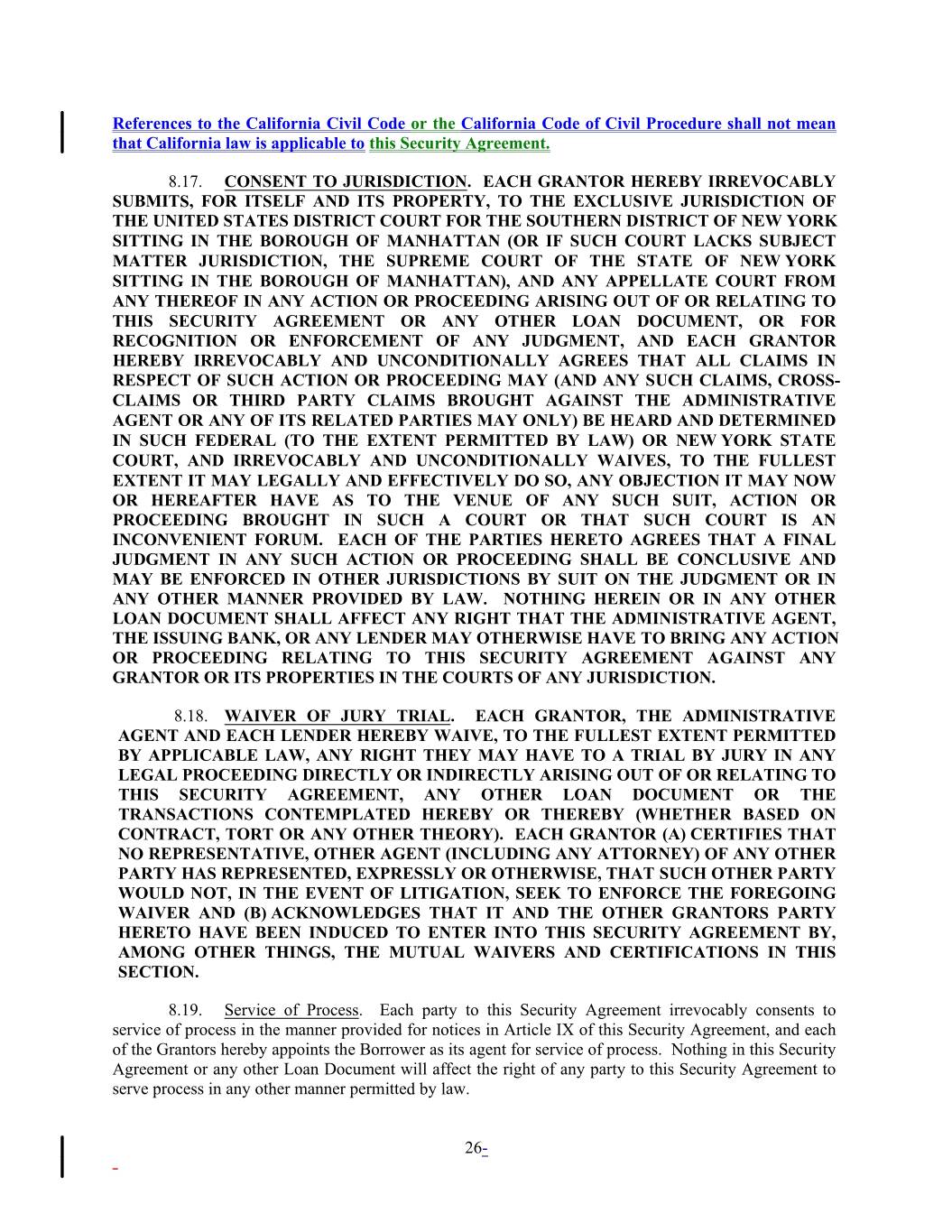

References to the California Civil Code or the California Code of Civil Procedure shall not mean that California law is applicable to this Security Agreement. 8.17. CONSENT TO JURISDICTION . EACH GRANTOR HEREBY IRREVOCABLY SUBMITS, FOR ITSELF AND ITS PROPERTY, TO THE EXCLUSIVE JURISDICTION OF THE UNITED STATES DISTRICT COURT FOR THE SOUTHERN DISTRICT OF NEW YORK SITTING IN THE BOROUGH OF MANHATTAN (OR IF SUCH COURT LACKS SUBJECT MATTER JURISDICTION, THE SUPREME COURT OF THE STATE OF NEW YORK SITTING IN THE BOROUGH OF MANHATTAN), AND ANY APPELLATE COURT FROM ANY THEREOF IN ANY ACTION OR PROCEEDING ARISING OUT OF OR RELATING TO THIS SECURITY AGREEMENT OR ANY OTHER LOAN DOCUMENT, OR FOR RECOGNITION OR ENFORCEMENT OF ANY JUDGMENT, AND EACH GRANTOR HEREBY IRREVOCABLY AND UNCONDITIONALLY AGREES THAT ALL CLAIMS IN RESPECT OF SUCH ACTION OR PROCEEDING MAY (AND ANY SUCH CLAIMS, CROSS- CLAIMS OR THIRD PARTY CLAIMS BROUGHT AGAINST THE ADMINISTRATIVE AGENT OR ANY OF ITS RELATED PARTIES MAY ONLY) BE HEARD AND DETERMINED IN SUCH FEDERAL (TO THE EXTENT PERMITTED BY LAW) OR NEW YORK STATE COURT, AND IRREVOCABLY AND UNCONDITIONALLY WAIVES, TO THE FULLEST EXTENT IT MAY LEGALLY AND EFFECTIVELY DO SO, ANY OBJECTION IT MAY NOW OR HEREAFTER HAVE AS TO THE VENUE OF ANY SUCH SUIT, ACTION OR PROCEEDING BROUGHT IN SUCH A COURT OR THAT SUCH COURT IS AN INCONVENIENT FORUM. EACH OF THE PARTIES HERETO AGREES THAT A FINAL JUDGMENT IN ANY SUCH ACTION OR PROCEEDING SHALL BE CONCLUSIVE AND MAY BE ENFORCED IN OTHER JURISDICTIONS BY SUIT ON THE JUDGMENT OR IN ANY OTHER MANNER PROVIDED BY LAW. NOTHING HEREIN OR IN ANY OTHER LOAN DOCUMENT SHALL AFFECT ANY RIGHT THAT THE ADMINISTRATIVE AGENT, THE ISSUING BANK, OR ANY LENDER MAY OTHERWISE HAVE TO BRING ANY ACTION OR PROCEEDING RELATING TO THIS SECURITY AGREEMENT AGAINST ANY GRANTOR OR ITS PROPERTIES IN THE COURTS OF ANY JURISDICTION. 8.18. WAIVER OF JURY TRIAL . EACH GRANTOR, THE ADMINISTRATIVE AGENT AND EACH LENDER HEREBY WAIVE, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT THEY MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS SECURITY AGREEMENT, ANY OTHER LOAN DOCUMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY (WHETHER BASED ON CONTRACT, TORT OR ANY OTHER THEORY). EACH GRANTOR (A) CERTIFIES THAT NO REPRESENTATIVE, OTHER AGENT (INCLUDING ANY ATTORNEY) OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT AND THE OTHER GRANTORS PARTY HERETO HAVE BEEN INDUCED TO ENTER INTO THIS SECURITY AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION. 8.19. Service of Process . Each party to this Security Agreement irrevocably consents to service of process in the manner provided for notices in Article IX of this Security Agreement, and each of the Grantors hereby appoints the Borrower as its agent for service of process. Nothing in this Security Agreement or any other Loan Document will affect the right of any party to this Security Agreement to serve process in any other manner permitted by law. 26 - -

EXHIBIT F Exhibit A to Security Agreement [See attached.]

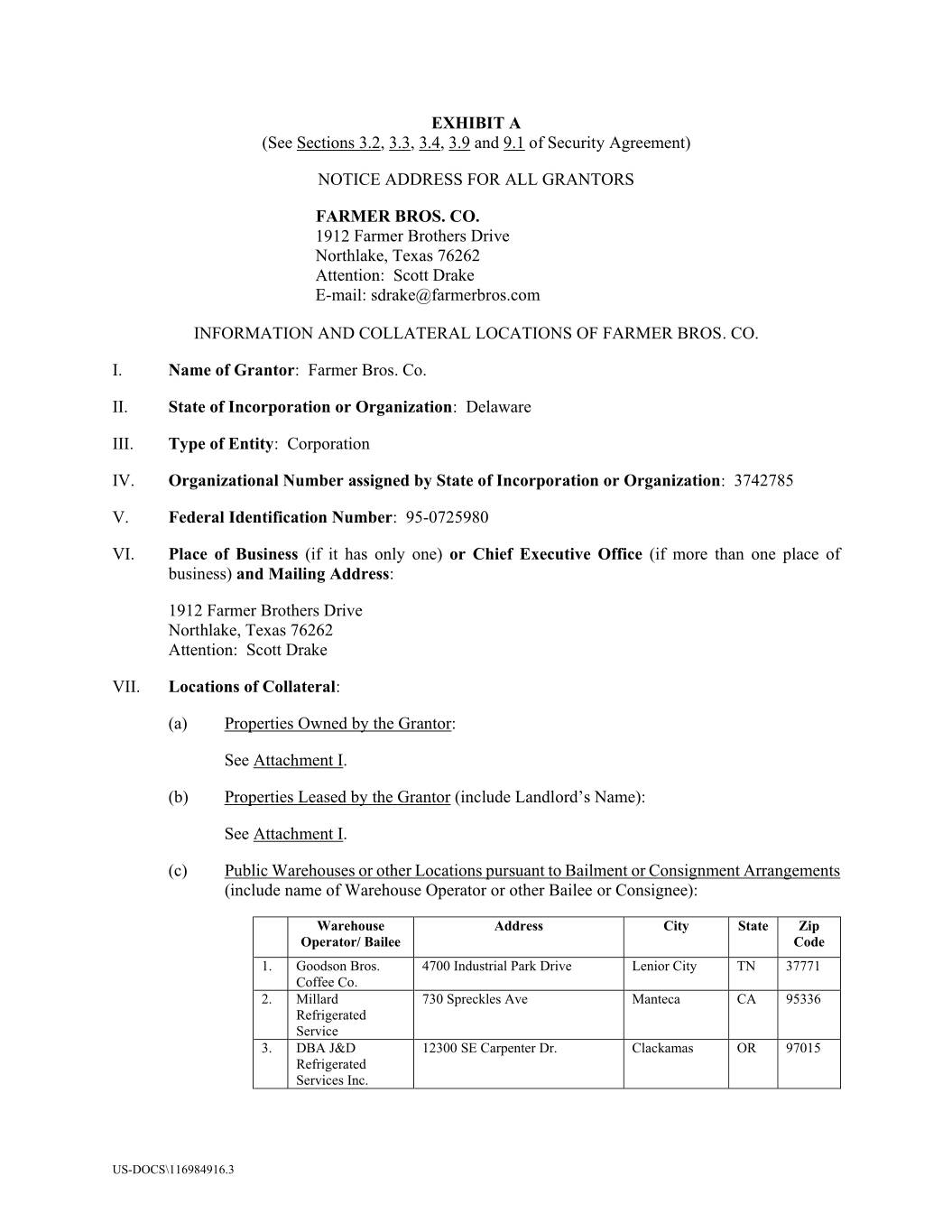

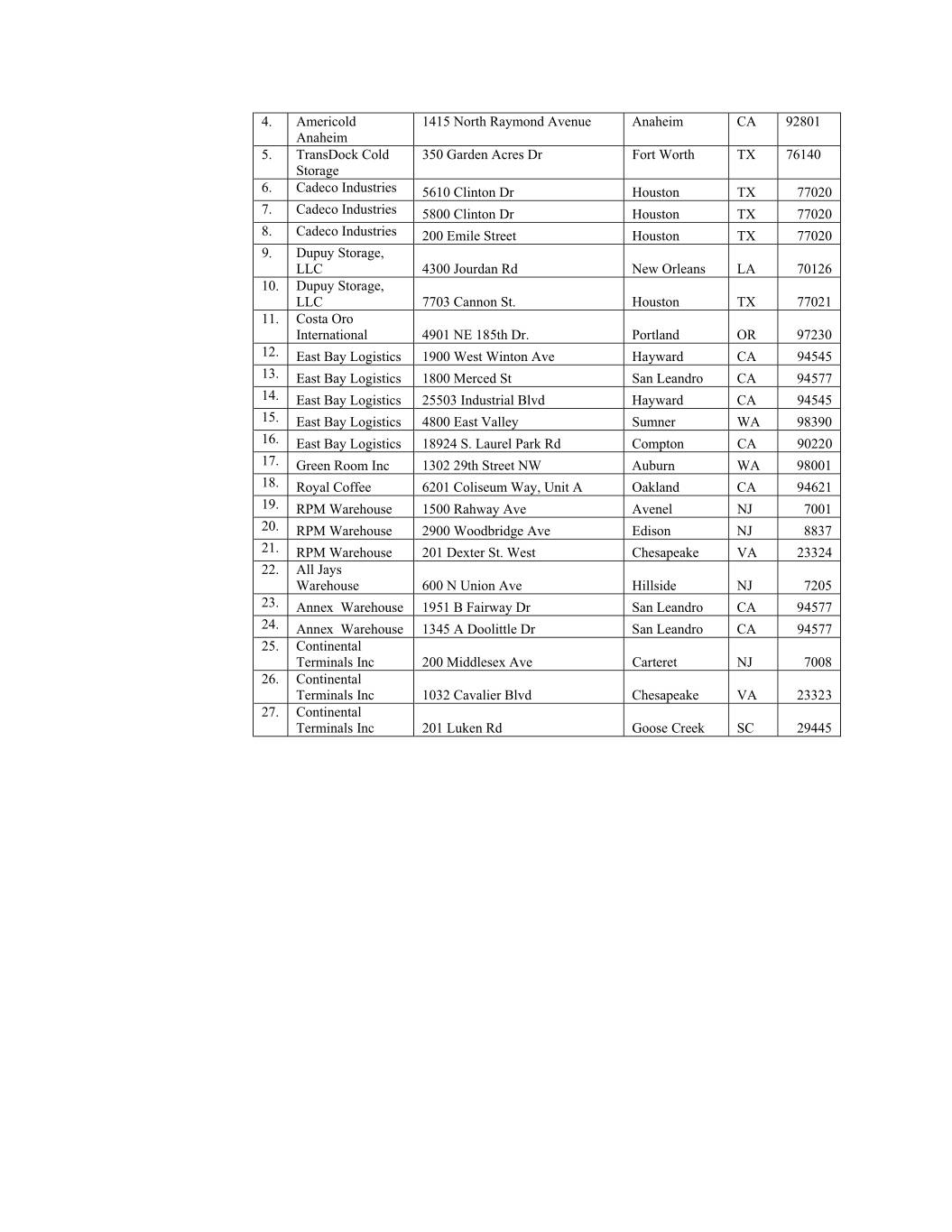

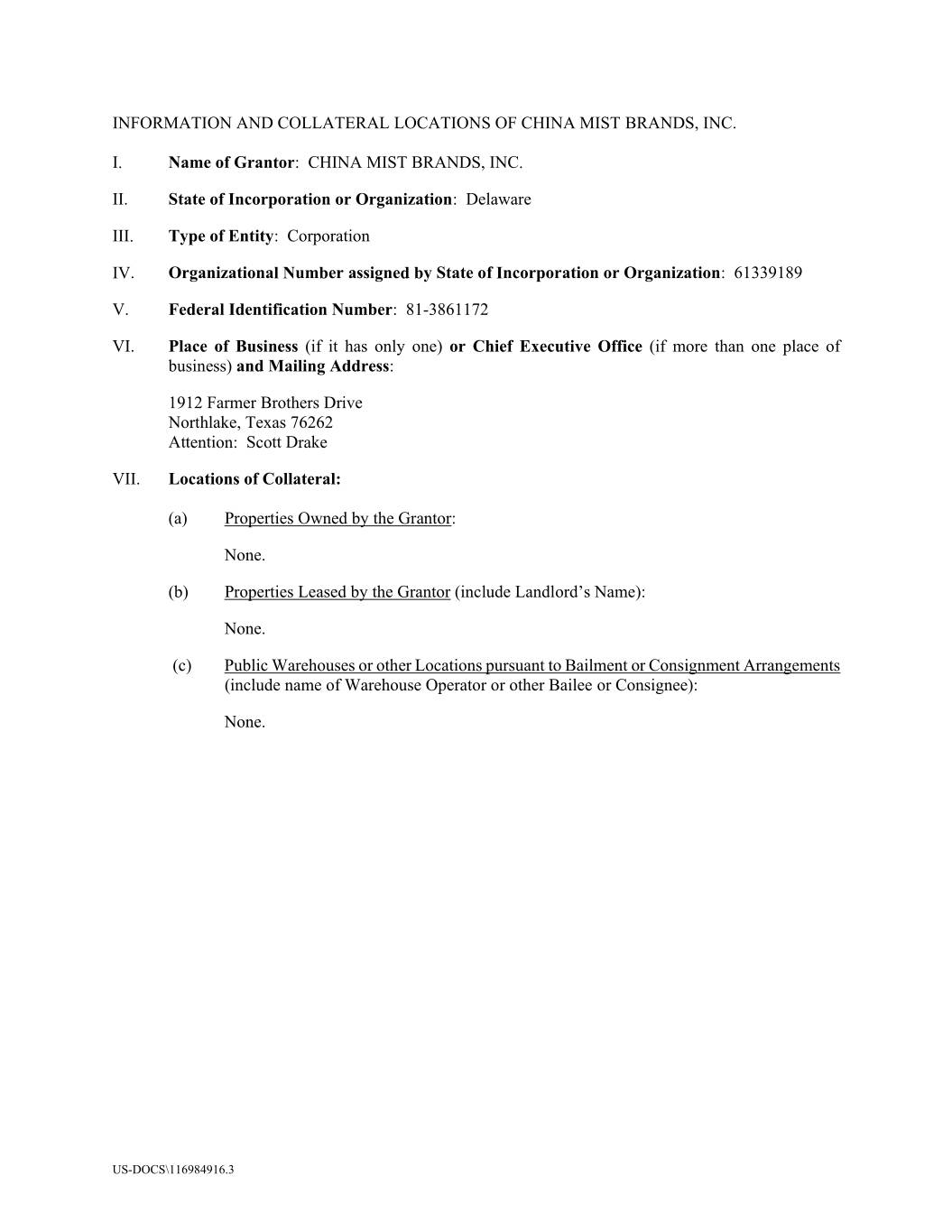

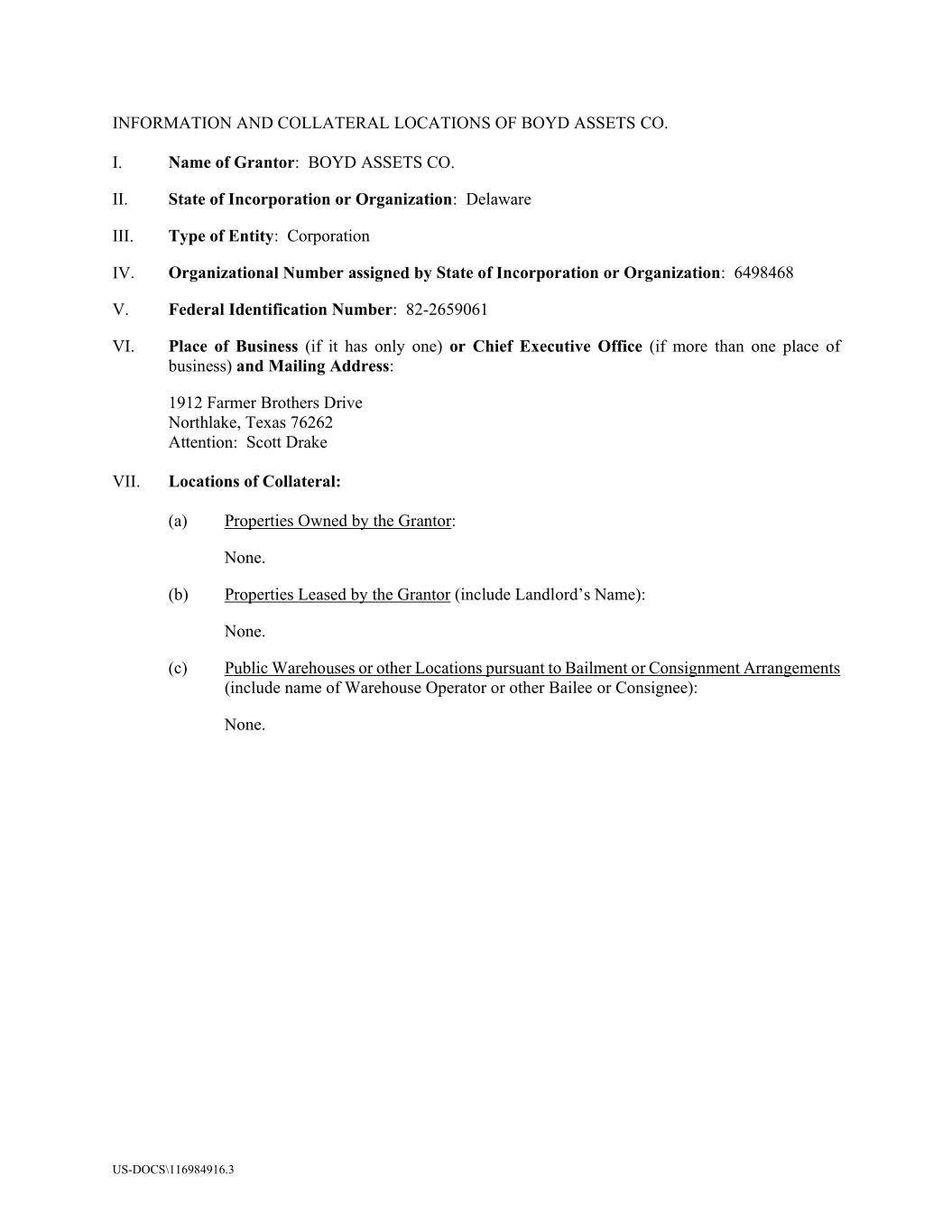

EXHIBIT A (See Sections 3.2, 3.3, 3.4, 3.9 and 9.1 of Security Agreement) NOTICE ADDRESS FOR ALL GRANTORS XXXXXX BROS. CO. 0000 Xxxxxx Xxxxxxxx Xxxxx Xxxxxxxxx, Xxxxx 00000 Attention: Xxxxx Xxxxx E-mail: xxxxxx@xxxxxxxxxx.xxx INFORMATION AND COLLATERAL LOCATIONS OF XXXXXX BROS. CO. I. Name of Grantor : Xxxxxx Bros. Co. II. State of Incorporation or Organization : Delaware III. Type of Entity : Corporation IV. Organizational Number assigned by State of Incorporation or Organization : 3742785 V. Federal Identification Number : 00-0000000 VI. Place of Business (if it has only one) or Chief Executive Office (if more than one place of business) and Mailing Address : 0000 Xxxxxx Xxxxxxxx Xxxxx Xxxxxxxxx, Xxxxx 00000 Attention: Xxxxx Xxxxx VII. Locations of Collateral : (a) Properties Owned by the Grantor: See Attachment I. (b) Properties Leased by the Grantor (include Landlord’s Name): See Attachment I. (c) Public Warehouses or other Locations pursuant to Bailment or Consignment Arrangements (include name of Warehouse Operator or other Bailee or Consignee): Warehouse Address City State Zip Operator/ Bailee Code 1. Xxxxxxx Bros. 0000 Xxxxxxxxxx Xxxx Xxxxx Xxxxxx Xxxx XX 00000 Coffee Co. 2. Xxxxxxx 000 Xxxxxxxxx Xxx Xxxxxxx XX 00000 Refrigerated Service 3. DBA J&D 00000 XX Xxxxxxxxx Xx. Xxxxxxxxx XX 00000 Refrigerated Services Inc. US-DOCS\116984916.3

4. Americold 0000 Xxxxx Xxxxxxx Xxxxxx Xxxxxxx XX 00000 Anaheim 5. TransDock Cold 000 Xxxxxx Xxxxx Xx Xxxx Xxxxx XX 00000 Storage 6. Cadeco Industries 0000 Xxxxxxx Xx Xxxxxxx XX 00000 7. Cadeco Industries 0000 Xxxxxxx Xx Xxxxxxx XX 00000 8. Cadeco Industries 000 Xxxxx Xxxxxx Xxxxxxx XX 00000 9. Dupuy Storage, LLC 0000 Xxxxxxx Xx Xxx Xxxxxxx XX 00000 10. Dupuy Storage, LLC 0000 Xxxxxx Xx. Xxxxxxx XX 00000 11. Costa Oro International 0000 XX 000xx Xx. Xxxxxxxx XX 00000 12. East Bay Logistics 0000 Xxxx Xxxxxx Xxx Xxxxxxx XX 00000 13. East Bay Logistics 0000 Xxxxxx Xx Xxx Xxxxxxx XX 00000 14. East Bay Logistics 00000 Xxxxxxxxxx Xxxx Xxxxxxx XX 00000 15. East Bay Logistics 0000 Xxxx Xxxxxx Xxxxxx XX 00000 16. East Bay Logistics 00000 X. Xxxxxx Xxxx Xx Xxxxxxx XX 00000 17. Green Room Inc 0000 00xx Xxxxxx XX Xxxxxx XX 00000 18. Royal Coffee 0000 Xxxxxxxx Xxx, Xxxx X Xxxxxxx XX 00000 19. RPM Warehouse 0000 Xxxxxx Xxx Xxxxxx XX 0000 20. RPM Warehouse 0000 Xxxxxxxxxx Xxx Xxxxxx XX 0000 21. RPM Warehouse 000 Xxxxxx Xx. Xxxx Xxxxxxxxxx XX 00000 22. All Jays Warehouse 000 X Xxxxx Xxx Xxxxxxxx XX 0000 23. Annex Warehouse 0000 X Xxxxxxx Xx Xxx Xxxxxxx XX 00000 24. Annex Warehouse 0000 X Xxxxxxxxx Xx Xxx Xxxxxxx XX 00000 25. Continental Terminals Inc 000 Xxxxxxxxx Xxx Xxxxxxxx XX 0000 26. Continental Terminals Inc 0000 Xxxxxxxx Xxxx Xxxxxxxxxx XX 00000 27. Continental Terminals Inc 000 Xxxxx Xx Xxxxx Xxxxx XX 00000

ATTACHMENT I – OWNED AND LEASED PROPERTIES XXXXXX BROS. CO . – OWNED and LEASED PROPERTIES Owned = O Bran Warehouse Address City State Zip Leased = X xx # Xxxx 00. X 0 Xxx Xxxxx 0000 Xxxxxx Xx. Xxx Xxxxx XX 00000 29. O 3 Lake Havasu 0000 Xxxxxxxx Xx Xxxx Xxxxxx XX 00000 30. L 4 Hayward 00000 Xxxxxxx Xxxx. Xxxxxxx XX 00000 31. L 5 Tempe (Phoenix) 000 X. Xxxxxxx Xxxxx Xxxxx XX 00000 32. O 6 Tucson 0000 X. Xxxxx Xxxx. Xxxxxx XX 00000 33. L 7 San Xxxx Obispo 0000 Xxxxx Xx Xxxxx 000 Xxx Xxxx XX 00000 Xxxxxx 00. O 8 Stockton 0000 Xxxx Xx. Xxxxxxxx XX 00000 35. O 9 Fresno 0000 X. Xxxxxx Xxxx Xxxxxx XX 00000 36. O 10 Sacramento 0000 Xxxxxxx Xxx. Xxxxxxxxxx XX 00000 37. O 11 Bakersfield 0000 Xxxxxxx Xx. Xxxxxxxxxxx XX 00000 38. L 12 Eureka 000 X. Xxxxxx Xxx. Xxxxxx XX 00000 39. Storage 14 Santa Xxxx 0000 X. Xxxxx Xxxxxx Xxxxx XX 00000 40. O 15 Castroville 00000 Xxxxxxxxxx Xxxx. Xxxxxxxxxxx XX 00000 41. O 16 Idaho Falls 000 X. Xxxxxx Xxx. Xxxxx Xxxxx XX 00000 42. Storage 00 Xxxxx Xxxxx 0000 Xxxxx Xxx 00, Xxxx #00 Xxxxxxx XX 00000 43. O 17 Xxxxxx City 0000 Xxxxxxxxxx Xxx Xxxxxx Xxxx XX 00000 44. O 18 Albuquerque 0000 Xxxxxx Xxxx. Xxxxxxxxxxx XX 00000 45. O 19 Chico (Leased to 000 Xxxx Xxx. Xxx. 000 Xxxxx XX 00000 Little Red Hen Nursery) 46. O 20 Valley 0000 Xxxxxx Xxx. Xxxxxx XX 00000 47. O 22 Flagstaff 0000 X. Xxxxxxxx Xx. Xxxxxxxxx XX 00000 48. O 24 Victorville 00000 Xxxx Xx. Xxxxxxxxxxx XX 00000 00. X 00 Xxxx Xxxx Xxxx 0000 Xx. 0000 Xxxx Xxxx Xxxx Xxxx XX 00000 50. L 28 Springfield 0000 Xxxxxxxxxxxx Xx. Xxxxxxxxxxx XX 00000 51. O 30 El Paso 0000 Xxx Xxxxxxx Xx. Xx Xxxx XX 00000 52. O 31 Bishop 000 X. Xxxxxx Xx. Xxxxxx XX 00000 53. L 32 Medford 000 X. Xxxxx Xx. Xxxxxxx Xxxxx XX 00000 54. L 33 Amarillo 0000 XX 00xx Xxx Xxxxxxxx XX 00000 55. L 34 Roswell 000 X. Xxxxxxx Xxxxxxx XX 00000 56. L 36 Little Rock 0000 Xxxxxx Xx. Xxxxxx Xxxx XX 00000 57. L 37 Bismarck 0000 0xx Xxxxxx XX Xxxxxx XX 00000 58. O 38 Santa Xxx 0000 X. Xxxxxxxxxx Xxx. Xxxxx Xxx XX 00000 59. O 39 Billings 0000 Xxxxxxxxxx Xxx. Xxxxxxxx XX 00000 60. L 41 Odessa 0000 X. 0 xx Xxxxxx Xxxxxx XX 00000 61. L 42 Kent 00000 00xx Xxxxxx Xxxxx Xxxx XX 00000 62. L 43 Moline 0000 00xx Xxx. Xxxxxx XX 00000 63. O 44 Spokane E 00000 Xxxxxxxxxx Xx. Xxxxxxx XX 00000 64. O 46 Yakima 0000 X. 00xx Xx. Xxxxx Xxx XX 00000 65. Storage 46 Yakima 0000 X Xxxxxxxxxx Xxxxxx Xxxxxxxxx XX 00000 66. L 47 Eugene 0000 Xxxx X Xxxxxxx Xxxx Xxxxxx XX 00000 67. L 49 Madison 0000 Xxx Xxxxx Xxxxx Xxxxxxx XX 00000 68. O 50 Portland 0000 XX 00xx Xx. Xxxxxxxx XX 00000 US-DOCS\116984916.3

69. O 52 Elko X.X.Xxx 67 89803 000 X. X Xx. Xxxx XX 00000 70. O 53 Grand Junction 0000 Xxxxxxx Xxxxx Xxxxxxxx XX 00000 71. O 55 Omaha 0000 Xxxxxxxx Xxx. Xxxxxxx Xxxxxx XX 00000 72. L 56 Fargo 000 00xx Xx. X.X. Xxxx X. X. X Xxxxx XX 00000 73. L 57 Casper 2080 Fairgrounds, Xxx 0 Xxxxxx XX 00000 74. L 58 Denver 0000 Xxxxxx Xx. Xxxxxx XX 00000 75. Storage 58 X. Xxxxxx ( Denver) 000 Xxxxx Xxxxxx Xxxxx Xxxxxx XX 00000 76. L 59 Corpus Christi 0000 Xxx Xx. Xxxxxx Xxxxxxx XX 00000 77. L 60 Boise 0000 Xxxxxx Xxxxxx Xxxxx XX 00000 78. L 62 Wichita Falls 0000 Xxxxxxx Xxxxx Xxxxxxx Xxxxx XX 00000 79. Storage 62 Wichita Falls- 0000 Xxxxxxxxxx Xxxxx Xxxx 00 Xxxxxxx XX 00000 Abilene 80. O 63 Memphis 0000 X. Xxxxxx Xx. Xxx. 0 Xxxxxxx XX 00000 81. O 66 San Antonio 0000 Xxxxxx Xxxx Xxxx. Xxx Xxxxxxx XX 00000 82. O 67 Palm Springs 00000 Xxxxxxxxx Xxx Xxxxxxxx XX 00000 Palms 83. L 69 Rochester 0000 Xxx Xxxxxxxx Xx #000 Xxxxxxxxx XX 00000 84. O 72 St. Louis 00000 Xxxxxxxxx Xx. Xxxxxxxxx XX 00000 85. O 73 Rapid City 0000 Xxxxx Xxxxx Xxxxx Xxxx XX 00000 86. O 74 Kansas City 0 X.X. Xxxxxxx Xx. Xxx'x Xxxxxx XX 00000 87. O 75 Blaine 0000 00 xx Xxxx X.X. Xxxxxx XX. 00000 88. O 81 Austin (Round 0000 Xxxxx Xxxxx Xxxxx Xxxx XX 00000 Rock) 89. L 83 Shreveport 0000 Xxxxx Xx. Xxxxxxxxxx XX 00000 90. O 85 McAllen 0000 X. Xxxxxx XxXxxxx XX 00000 91. L 88 Springdale 000 Xxxxxxx Xxxxxx Xxxxxxxxxx XX 00000 92. L 101 Missoula 0000 Xxxxxx Xx. Xxxx X Xxxxxxxx XX 00000 93. L 000 Xxxxx Xxxxx 000 Xxxx Xxxxxxxx Xxxxx Xxxxx XX 00000 94. L 108 Evansville 0000 X. Xxxxxxxx Xxx. Xxxxxxxxxx XX 00000 95. L 111 Duluth 0000 Xxxxxxxxxx Xx. Xxxxxx XX 00000 96. O 117 Santa Fe Springs 0000 Xxxx Xxxxx Xx. Xxxxx Xx XX 00000 Springs 97. O 124 Rialto 0000 X. Xxxxx Xxx. Xxxxxxxxxxx XX 00000 98. L 140 Houston 0000 Xxxx xx XX Xxxx, Xxx. 000 Xxxxxxx XX 00000 99. X 000 Xxxxxxxxx-XX (Xx 000 Xxxxxxxxx Xxx Xxxxxxxxx XX 00000 137) 100. L 000 Xxxxxxxxx-XX 00 Xxxxx Xxxxxx Xxxxxxxxx XX 00000 (Br 134) 101. L 213 Merrillville – 0000 X. 00xx Xxxxx Xxxxxxxxxxxx XX 00000 Truck Storage 102. L 216 Little Chute 0000 Xxxxxxxx Xxxxx Xxxxxx Xxxxx XX 00000 (Weston move) 103. L 218 Grand Rapids / 0000 Xxxxxx Xxxxxxxxx Xxx. 000 Xxxxxxx XX 00000 Wyoming & 504 104. L 219 Saginaw 0000 Xxxxxxx Xxxxxx Xxxx. Xxxxxxx XX 00000 105. L 222 Grand Forks 0000 X. 00xx Xx. Xxxxx Xxxxx XX 00000 106. L 226 Lima 0000 Xxxx Xxxxxx Xxxx XX 00000 107. L 229 Tulsa 00000-00 X. Xxxx Xxxxx XX 00000 108. L 230 Wichita 000 X. Xxxxxxxxxx Xxxxxxx XX 00000 US-DOCS\116984916.3

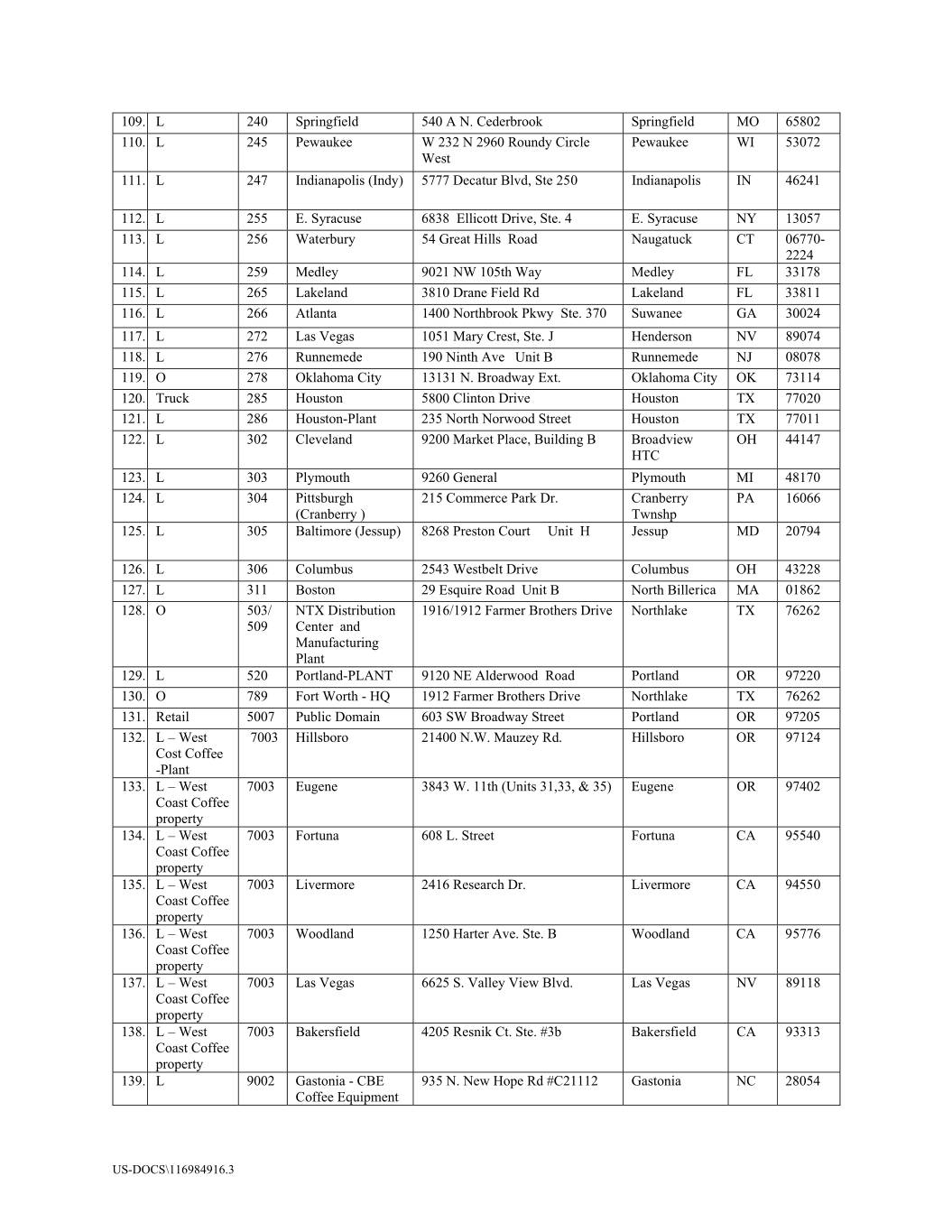

109. L 240 Springfield 000 X X. Xxxxxxxxxx Xxxxxxxxxxx XX 00000 110. L 000 Xxxxxxxx X 232 N 0000 Xxxxxx Xxxxxx Xxxxxxxx XX 00000 West 111. L 247 Indianapolis (Indy) 0000 Xxxxxxx Xxxx, Xxx 000 Xxxxxxxxxxxx XX 00000 112. L 000 X. Xxxxxxxx 0000 Xxxxxxxx Xxxxx, Xxx. 0 X. Xxxxxxxx XX 00000 113. X 000 Xxxxxxxxx 00 Xxxxx Xxxxx Xxxx Xxxxxxxxx XX 00000- 2224 114. L 259 Medley 0000 XX 000xx Xxx Xxxxxx XX 00000 115. L 265 Lakeland 0000 Xxxxx Xxxxx Xx Xxxxxxxx XX 00000 116. L 266 Atlanta 0000 Xxxxxxxxxx Xxxx Xxx. 000 Xxxxxxx XX 00000 117. L 272 Las Vegas 0000 Xxxx Xxxxx, Xxx. X Xxxxxxxxx XX 00000 118. L 276 Runnemede 000 Xxxxx Xxx Xxxx X Xxxxxxxxx XX 00000 119. O 278 Oklahoma City 00000 X. Xxxxxxxx Xxx. Xxxxxxxx Xxxx XX 00000 120. Truck 285 Houston 0000 Xxxxxxx Xxxxx Xxxxxxx XX 00000 121. L 286 Houston-Plant 000 Xxxxx Xxxxxxx Xxxxxx Xxxxxxx XX 00000 122. L 302 Cleveland 0000 Xxxxxx Xxxxx, Xxxxxxxx X Xxxxxxxxx XX 00000 HTC 123. L 303 Plymouth 9260 General Xxxxxxxx XX 00000 124. L 304 Pittsburgh 000 Xxxxxxxx Xxxx Xx. Xxxxxxxxx XX 00000 (Cranberry ) Twnshp 125. L 305 Baltimore (Jessup) 0000 Xxxxxxx Xxxxx Xxxx X Xxxxxx XX 00000 126. L 306 Columbus 0000 Xxxxxxxx Xxxxx Xxxxxxxx XX 00000 127. L 311 Boston 00 Xxxxxxx Xxxx Xxxx X Xxxxx Xxxxxxxxx XX 00000 128. O 503/ NTX Distribution 0000/0000 Xxxxxx Xxxxxxxx Xxxxx Xxxxxxxxx XX 00000 509 Center and Manufacturing Plant 129. L 520 Portland-PLANT 0000 XX Xxxxxxxxx Xxxx Xxxxxxxx XX 00000 130. O 789 Fort Worth - HQ 0000 Xxxxxx Xxxxxxxx Xxxxx Xxxxxxxxx XX 00000 131. Retail 5007 Public Domain 000 XX Xxxxxxxx Xxxxxx Xxxxxxxx XX 00000 132. L – West 7003 Hillsboro 00000 X.X. Xxxxxx Xx. Xxxxxxxxx XX 00000 Cost Coffee -Plant 133. L – West 7003 Eugene 3843 W. 11th (Units 31,33, & 35) Xxxxxx XX 00000 Coast Coffee property 134. L – West 7003 Fortuna 000 X. Xxxxxx Xxxxxxx XX 00000 Coast Coffee property 135. L – West 7003 Livermore 0000 Xxxxxxxx Xx. Xxxxxxxxx XX 00000 Coast Coffee property 136. L – West 7003 Woodland 0000 Xxxxxx Xxx. Xxx. X Xxxxxxxx XX 00000 Coast Coffee property 137. L – West 7003 Las Vegas 0000 X. Xxxxxx Xxxx Xxxx. Xxx Xxxxx XX 00000 Coast Coffee property 138. L – West 7003 Bakersfield 0000 Xxxxxx Xx. Xxx. #0x Xxxxxxxxxxx XX 00000 Coast Coffee property 139. L 9002 Gastonia - CBE 000 X. Xxx Xxxx Xx #X00000 Xxxxxxxx XX 00000 Coffee Equipment US-DOCS\116984916.3

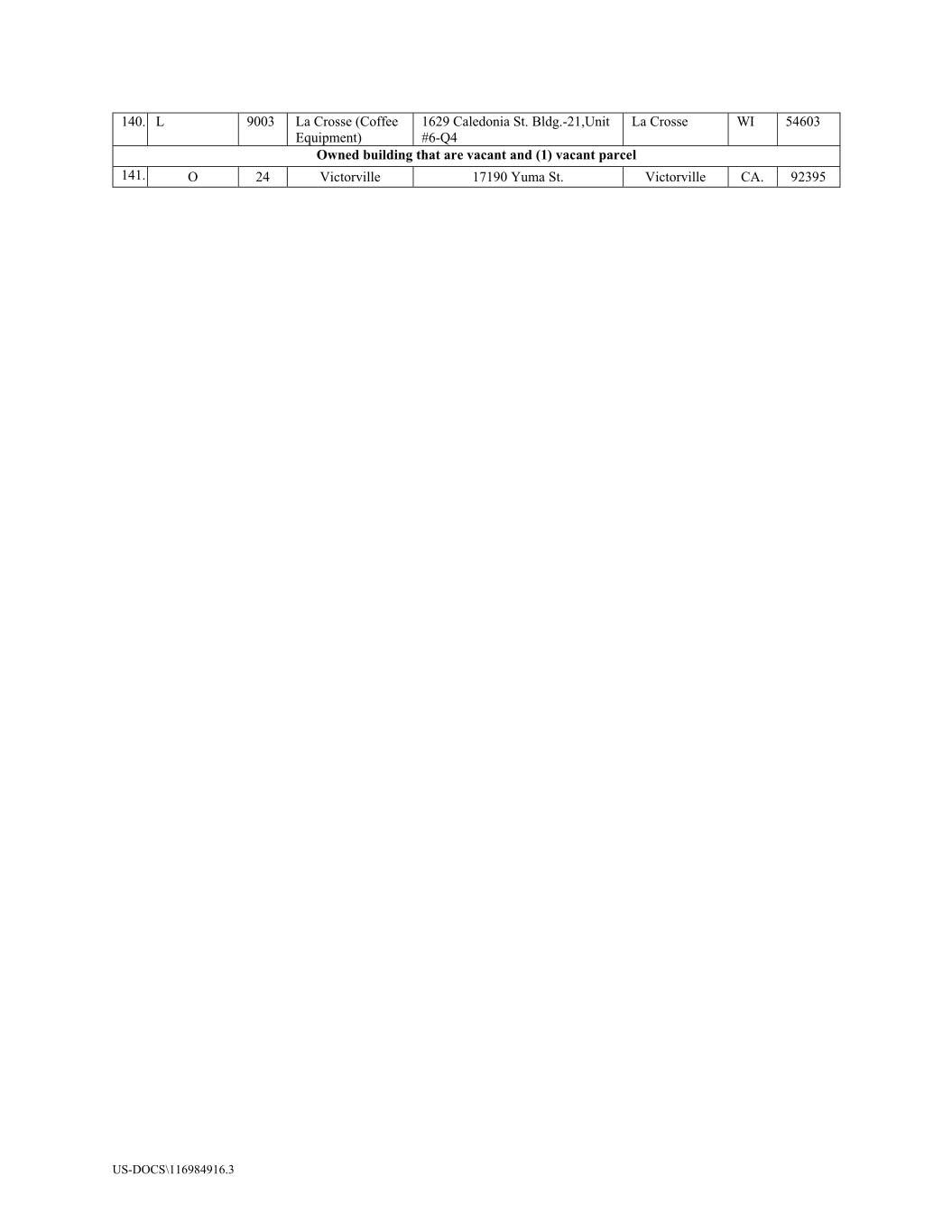

140. L 0000 Xx Xxxxxx (Coffee 0000 Xxxxxxxxx Xx. Xxxx.-00,Xxxx Xx Xxxxxx XX 00000 Equipment) #6-Q4 Owned building that are vacant and (1) vacant parcel 141. O 24 Victorville 00000 Xxxx Xx. Xxxxxxxxxxx XX. 00000 US-DOCS\116984916.3

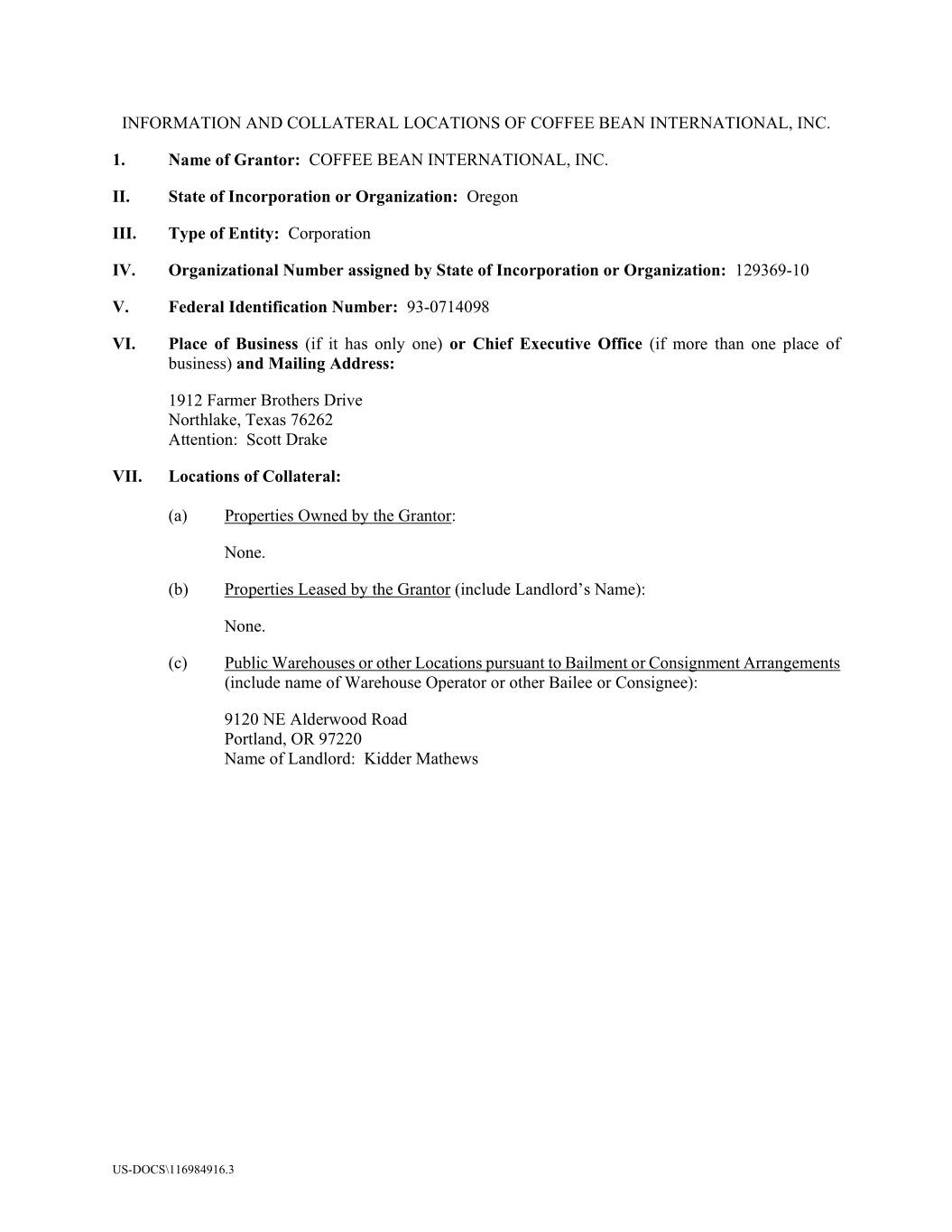

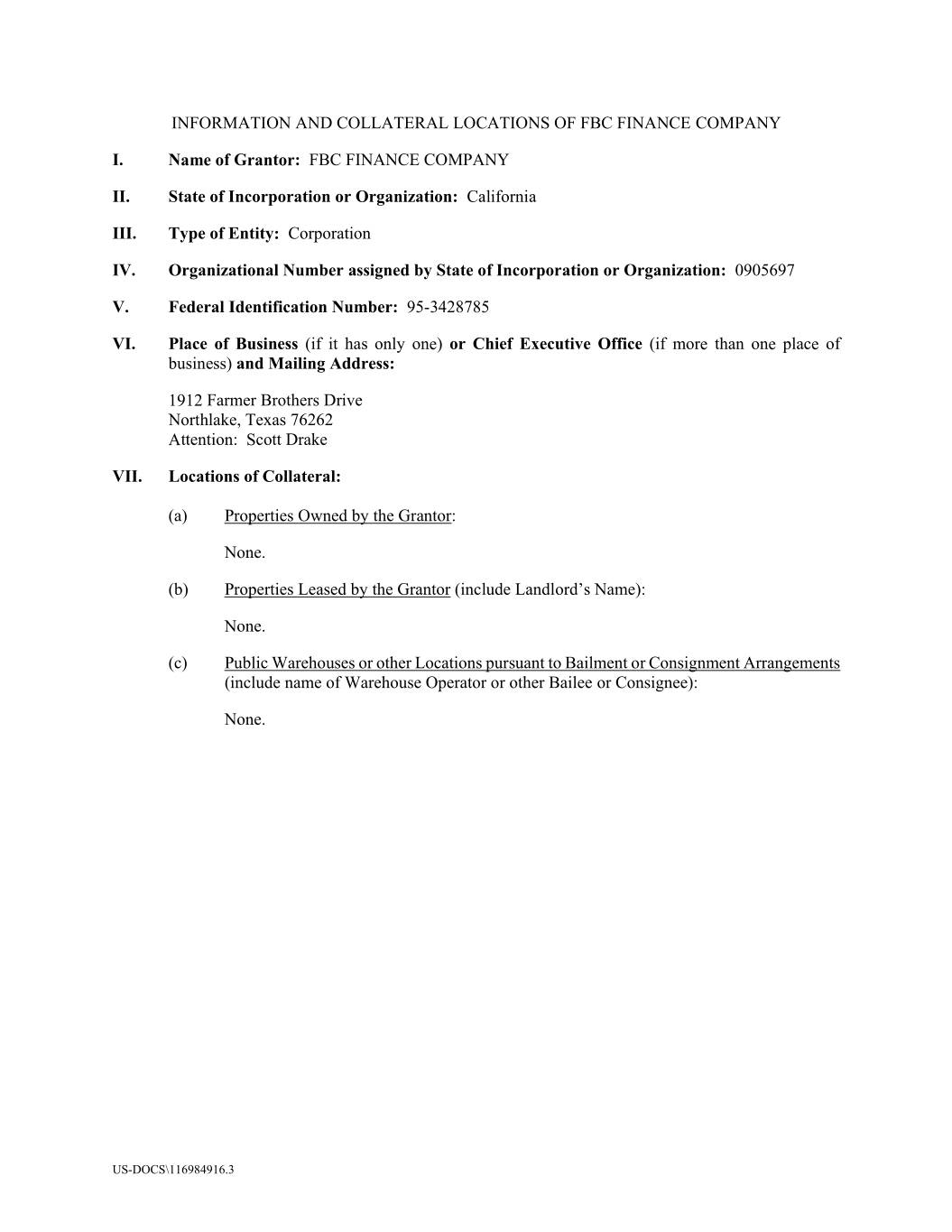

INFORMATION AND COLLATERAL LOCATIONS OF COFFEE BEAN INTERNATIONAL, INC. 1. Name of Grantor: COFFEE BEAN INTERNATIONAL, INC. II. State of Incorporation or Organization: Oregon III. Type of Entity: Corporation IV. Organizational Number assigned by State of Incorporation or Organization: 129369-10 V. Federal Identification Number: 00-0000000 VI. Place of Business (if it has only one) or Chief Executive Office (if more than one place of business) and Mailing Address: 0000 Xxxxxx Xxxxxxxx Xxxxx Xxxxxxxxx, Xxxxx 00000 Attention: Xxxxx Xxxxx VII. Locations of Collateral: (a) Properties Owned by the Grantor: None. (b) Properties Leased by the Grantor (include Landlord’s Name): None. (c) Public Warehouses or other Locations pursuant to Bailment or Consignment Arrangements (include name of Warehouse Operator or other Bailee or Consignee): 0000 XX Xxxxxxxxx Xxxx Xxxxxxxx, XX 00000 Name of Landlord: Xxxxxx Xxxxxxx US-DOCS\116984916.3