WARRANT TO PURCHASE SHARES OF CLASS A COMMON STOCK OF THE AMACORE GROUP, INC. Expires October 6, 2013

Exhibit

10.5

THIS

WARRANT AND THE SHARES OF CLASS A COMMON STOCK ISSUABLE UPON EXERCISE HEREOF

HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE

“SECURITIES ACT”) OR ANY STATE SECURITIES LAWS AND MAY NOT BE SOLD, TRANSFERRED

OR OTHERWISE DISPOSED OF UNLESS REGISTERED UNDER THE SECURITIES ACT AND UNDER

APPLICABLE STATE SECURITIES LAWS OR THE ISSUER SHALL HAVE RECEIVED AN OPINION OF

COUNSEL REASONABLY SATISFACTORY TO THE ISSUER THAT REGISTRATION OF SUCH

SECURITIES UNDER THE SECURITIES ACT AND UNDER THE PROVISIONS OF APPLICABLE STATE

SECURITIES LAWS IS NOT REQUIRED.

WARRANT

TO PURCHASE

SHARES OF

CLASS A COMMON STOCK

OF

Expires

October 6, 2013

|

No.:

W-08-05

|

Number

of Shares: 22,500,000

|

|

Date

of Issuance: October 6, 2008

|

FOR VALUE

RECEIVED, the undersigned, The Amacore Group, Inc., a Delaware corporation

(together with its successors and assigns, the “Issuer”), hereby

certifies that Vicis Capital Master Fund or its registered assigns is entitled

to subscribe for and purchase, during the Term (as hereinafter defined), up to

Twenty-Two Million Five Hundred Thousand (22,500,000) shares (subject to

adjustment as hereinafter provided) of the duly authorized, validly issued,

fully paid and non-assessable Class A Common Stock of the Issuer, par value

$.001 per share (the “Class A Common

Stock”), at an exercise price per share equal to the Warrant Price then

in effect, subject, however, to the provisions and upon the terms and conditions

hereinafter set forth. This Warrant has been executed and delivered

pursuant to the Securities Purchase Agreement dated as of October 6, 2008 (the

“Purchase

Agreement”) by and among the Issuer and the purchaser(s) listed

therein. Capitalized terms used and not otherwise defined herein

shall have the meanings set forth for such terms in the Purchase Agreement.

Capitalized terms used in this Warrant and not otherwise defined herein shall

have the respective meanings specified in Section 8 hereof.

1. Term. The

term of this Warrant shall commence on October 6, 2008 and shall expire at 6:00

p.m., eastern time, on October 6, 2013 (such period being the “Term”).

-1-

2.

Method of Exercise; Payment;

Issuance of New Warrant; Transfer and Exchange.

(a) Time of

Exercise. The purchase rights represented by this Warrant may

be exercised in whole or in part during the Term beginning on the date of

issuance hereof.

(b) Method of

Exercise. The Holder hereof may exercise this Warrant, in

whole or in part, by the surrender of this Warrant (with the exercise form

attached hereto duly executed) at the principal office of the Issuer, and by the

payment to the Issuer of an amount of consideration therefor equal to the

Warrant Price in effect on the date of such exercise multiplied by the number of

shares of Warrant Stock with respect to which this Warrant is then being

exercised, payable at such Holder’s election (i) by certified or official bank

check or by wire transfer to an account designated by the Issuer, (ii) by

“cashless exercise” in accordance with the provisions of subsection (c) of this

Section 2, but only when a registration statement under the Securities Act

providing for the resale of the Warrant Stock is not then in effect, or (iii)

when permitted by clause (ii), by a combination of the foregoing methods of

payment selected by the Holder of this Warrant.

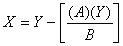

(c) Cashless

Exercise. Notwithstanding any provisions herein to the

contrary and commencing six-months following the Original Issue Date if (i) the

Per Share Market Value of one share of Class A Common Stock is greater than the

Warrant Price (at the date of calculation as set forth below) and (ii) a

registration statement under the Securities Act providing for the resale of the

Warrant Stock is not in effect in accordance with the terms of the Registration

Rights Agreement at the time of exercise, in lieu of exercising this Warrant by

payment of cash, the Holder may exercise this Warrant by a cashless exercise and

shall receive the number of shares of Class A Common Stock equal to an amount

(as determined below) by surrender of this Warrant at the principal office of

the Issuer together with the properly endorsed Notice of Exercise in which event

the Issuer shall issue to the Holder a number of shares of Class A Common Stock

computed using the following formula:

|

Where

|

X

=

|

the

number of shares of Class A Common Stock to be issued to the

Holder.

|

|

Y

=

|

the

number of shares of Class A Common Stock purchasable upon exercise of all

of the Warrant or, if only a portion of the Warrant is being exercised,

the portion of the Warrant being exercised.

|

|

|

A

=

|

the

Warrant Price.

|

|

|

B

=

|

the

Per Share Market Value of one share of Class A Common

Stock.

|

-2-

(d) Issuance of Stock

Certificates. In the event of any exercise of this Warrant in

accordance with and subject to the terms and conditions hereof, certificates for

the shares of Warrant Stock so purchased shall be dated the date of such

exercise and delivered to the Holder hereof within a reasonable time, not

exceeding three (3) Trading Days after such exercise (the “Delivery Date”) or,

at the request of the Holder (provided that a registration statement under the

Securities Act providing for the resale of the Warrant Stock is then in effect),

issued and delivered to the Depository Trust Company (“DTC”) account on the

Holder’s behalf via the Deposit Withdrawal Agent Commission System (“DWAC”) within a

reasonable time, not exceeding three (3) Trading Days after such exercise, and

the Holder hereof shall be deemed for all purposes to be the holder of the

shares of Warrant Stock so purchased as of the date of such

exercise. Notwithstanding the foregoing to the contrary, the Issuer

or its transfer agent shall only be obligated to issue and deliver the shares to

the DTC on a holder’s behalf via DWAC if such exercise is in connection with a

sale and the Issuer and its transfer agent are participating in DTC through the

DWAC system. The Holder shall deliver this original Warrant, or an

indemnification undertaking with respect to such Warrant in the case of its

loss, theft or destruction, at such time that this Warrant is fully

exercised. With respect to partial exercises of this Warrant, the

Issuer shall keep written records for the Holder of the number of shares of

Warrant Stock exercised as of each date of exercise.

(e) Compensation for Buy-In on

Failure to Timely Deliver Certificates Upon Exercise.

(i) The

Issuer understands that a delay in the delivery of the shares of Class A Common

Stock upon exercise of this Warrant beyond the Delivery Date could result in

economic loss to the Holder. If the Issuer fails to deliver to the

Holder such shares via DWAC or a certificate or certificates pursuant to this

Section hereunder by the Delivery Date, the Issuer shall pay to the Holder, in

cash, for each $500 of Warrant Shares (based on the Closing Price of the Class A

Common Stock on the date such Securities are submitted to the Issuer’s transfer

agent), $5 per Trading Day (increasing to $10 per Trading Day five (5) Trading

Days after such damages have begun to accrue and increasing to $15 per Trading

Day ten (10) Trading Days after such damages have begun to accrue) for each

Trading Day after the Delivery Date until such certificate is delivered (which

amount shall be paid as liquidated damages and not as a

penalty). Nothing herein shall limit a Holder’s right to pursue

actual damages for the Issuer’s failure to deliver certificates representing any

Securities as required by the Transaction Documents, and the Holder shall have

the right to pursue all remedies available to it at law or in equity including,

without limitation, a decree of specific performance and/or injunctive relief.

Notwithstanding anything to the contrary contained herein, the Holder shall be

entitled to withdraw an Exercise Notice, and upon such withdrawal the Issuer

shall only be obligated to pay the liquidated damages accrued in accordance with

this Section 2(e)(i) through the date the Exercise Notice is

withdrawn.

-3-

(ii) In

addition to any other rights available to the Holder, if the Issuer fails to

cause its transfer agent to transmit to the Holder a certificate or certificates

representing the Warrant Stock pursuant to an exercise on or before the Delivery

Date, and if after such date the Holder is required by its broker to purchase

(in an open market transaction or otherwise) shares of Class A Common Stock to

deliver in satisfaction of a sale by the Holder of the Warrant Stock which the

Holder anticipated receiving upon such exercise (a “Buy-In”), then the

Issuer shall (1) pay in cash to the Holder the amount by which (x) the Holder’s

total purchase price (including brokerage commissions, if any) for the shares of

Class A Common Stock so purchased exceeds (y) the amount obtained by multiplying

(A) the number of shares of Warrant Stock that the Issuer was required to

deliver to the Holder in connection with the exercise at issue times (B) the

price at which the sell order giving rise to such purchase obligation was

executed, and (2) at the option of the Holder, either reinstate the portion of

the Warrant and equivalent number of shares of Warrant Stock for which such

exercise was not honored or deliver to the Holder the number of shares of Class

A Common Stock that would have been issued had the Issuer timely complied with

its exercise and delivery obligations hereunder. For example, if the

Holder purchases Class A Common Stock having a total purchase price of $11,000

to cover a Buy-In with respect to an attempted exercise of shares of Class A

Common Stock with an aggregate sale price giving rise to such purchase

obligation of $10,000, under clause (1) of the immediately preceding sentence

the Issuer shall be required to pay the Holder $1,000. The Holder shall provide

the Issuer written notice indicating the amounts payable to the Holder in

respect of the Buy-In, together with applicable confirmations and other evidence

reasonably requested by the Issuer. Nothing herein shall limit a

Holder’s right to pursue any other remedies available to it hereunder, at law or

in equity including, without limitation, a decree of specific performance and/or

injunctive relief with respect to the Issuer’s failure to timely deliver

certificates representing shares of Class A Common Stock upon exercise of this

Warrant as required pursuant to the terms hereof.

(f) Transferability of

Warrant. Subject to Section 2(h) hereof, this Warrant may be

transferred by a Holder, in whole or in part, subject only to the restrictions

specified in the Purchase Agreement. If transferred pursuant to this

paragraph, this Warrant may be transferred on the books of the Issuer by the

Holder hereof in person or by duly authorized attorney, upon surrender of this

Warrant at the principal office of the Issuer, properly endorsed (by the Holder

executing an assignment in the form attached hereto) and upon payment of any

necessary transfer tax or other governmental charge imposed upon such

transfer. This Warrant is exchangeable at the principal office of the

Issuer for Warrants to purchase the same aggregate number of shares of Warrant

Stock, each new Warrant to represent the right to purchase such number of shares

of Warrant Stock as the Holder hereof shall designate at the time of such

exchange. All Warrants issued on transfers or exchanges shall be

dated the Original Issue Date and shall be identical with this Warrant except as

to the number of shares of Warrant Stock issuable pursuant thereto.

(g) Continuing Rights of

Holder. The Issuer will, at the time of or at any time after

each exercise of this Warrant, upon the request of the Holder hereof,

acknowledge in writing the extent, if any, of its continuing obligation to

afford to such Holder all rights to which such Holder shall continue to be

entitled after such exercise in accordance with the terms of this Warrant, provided that if any

such Holder shall fail to make any such request, the failure shall not affect

the continuing obligation of the Issuer to afford such rights to such

Holder.

-4-

(h) Compliance with Securities

Laws.

(i) The

Holder of this Warrant, by acceptance hereof, acknowledges that this Warrant and

the shares of Warrant Stock to be issued upon exercise hereof are being acquired

solely for the Holder’s own account and not as a nominee for any other party,

and for investment, and that the Holder will not offer, sell or otherwise

dispose of this Warrant or any shares of Warrant Stock to be issued upon

exercise hereof except pursuant to an effective registration statement, or an

exemption from registration, under the Securities Act and any applicable state

securities laws.

(ii) Except

as provided in paragraph (iii) below, this Warrant and all certificates

representing shares of Warrant Stock issued upon exercise hereof shall be

stamped or imprinted with a legend in substantially the following

form:

THIS

WARRANT AND THE SHARES OF COMMON STOCK ISSUABLE UPON EXERCISE HEREOF HAVE NOT

BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES

ACT”) OR ANY STATE SECURITIES LAWS AND MAY NOT BE SOLD, TRANSFERRED OR OTHERWISE

DISPOSED OF UNLESS REGISTERED UNDER THE SECURITIES ACT AND UNDER APPLICABLE

STATE SECURITIES LAWS OR THE ISSUER SHALL HAVE RECEIVED AN OPINION OF COUNSEL

REASONABLY SATISFACTORY TO THE ISSUER THAT REGISTRATION OF SUCH SECURITIES UNDER

THE SECURITIES ACT AND UNDER THE PROVISIONS OF APPLICABLE STATE SECURITIES LAWS

IS NOT REQUIRED.

(iii) The

Issuer agrees to reissue this Warrant or certificates representing any of the

Warrant Stock, without the legend set forth above if at such time, prior to

making any transfer of any such securities, the Holder shall give written notice

to the Issuer describing the manner and terms of such transfer. Such

proposed transfer will not be effected until: (a) either (i) the Issuer has

received an opinion of counsel reasonably satisfactory to the Issuer, to the

effect that the registration of such securities under the Securities Act is not

required in connection with such proposed transfer, (ii) a registration

statement under the Securities Act covering such proposed disposition has been

filed by the Issuer with the Securities and Exchange Commission and has become

effective under the Securities Act, (iii) the Issuer has received other evidence

reasonably satisfactory to the Issuer that such registration and qualification

under the Securities Act and state securities laws are not required, or (iv) the

Holder provides the Issuer with reasonable assurances that such security can be

sold pursuant to Rule 144 under the Securities Act; and (b) either (i) the

Issuer has received an opinion of counsel reasonably satisfactory to the Issuer,

to the effect that registration or qualification under the securities or “blue

sky” laws of any state is not required in connection with such proposed

disposition, or (ii) compliance with applicable state securities or “blue sky”

laws has been effected or a valid exemption exists with respect

thereto. The Issuer will respond to any such notice from a holder

within three (3) Trading Days. In the case of any proposed transfer

under this Section 2(h), the Issuer will use reasonable efforts to comply with

any such applicable state securities or “blue sky” laws, but shall in no event

be required, (x) to qualify to do business in any state where it is not then

qualified, (y) to take any action that would subject it to tax or to the general

service of process in any state where it is not then subject, or (z) to comply

with state securities or “blue sky” laws of any state for which registration by

coordination is unavailable to the Issuer. The restrictions on

transfer contained in this Section 2(h) shall be in addition to, and not by way

of limitation of, any other restrictions on transfer contained in any other

section of this Warrant. Whenever a certificate representing the

Warrant Stock is required to be issued to a the Holder without a legend, in lieu

of delivering physical certificates representing the Warrant Stock, the Issuer

shall cause its transfer agent to electronically transmit the Warrant Stock to

the Holder by crediting the account of the Holder’s Prime Broker with DTC

through its DWAC system (to the extent not inconsistent with any provisions of

this Warrant or the Purchase Agreement).

-5-

(i) Accredited Investor

Status. In no event may the Holder exercise this Warrant in

whole or in part unless the Holder is an “accredited investor” as defined in

Regulation D under the Securities Act.

(j) No Mandatory

Redemption. This Warrant may not be called or redeemed by the

Issuer without the written consent of the Holder, except as provided in Section

7.14 of the Purchase Agreement.

3. Stock Fully Paid;

Reservation and Listing of Shares; Covenants.

(a) Stock Fully

Paid. The Issuer represents, warrants, covenants and agrees

that all shares of Warrant Stock which may be issued upon the exercise of this

Warrant or otherwise hereunder will, when issued in accordance with the terms of

this Warrant, be duly authorized, validly issued, fully paid and non-assessable

and free from all taxes, liens and charges created by or through the

Issuer. The Issuer further covenants and agrees that during the

period within which this Warrant may be exercised, the Issuer will at all times

have authorized and reserved for the purpose of the issuance upon exercise of

this Warrant a number of authorized but unissued shares of Class A Common Stock

equal to at least one hundred percent (100%) of the number of shares of Class A

Common Stock issuable upon exercise of this Warrant without regard to any

limitations on exercise.

(b) Reservation. If

any shares of Class A Common Stock required to be reserved for issuance upon

exercise of this Warrant or as otherwise provided hereunder require registration

or qualification with any Governmental Authority under any federal or state law

before such shares may be so issued, the Issuer will in good faith use its best

efforts as expeditiously as possible at its expense to cause such shares to be

duly registered or qualified. If the Issuer shall list any shares of

Class A Common Stock on any securities exchange or market it will, at its

expense, list thereon, and maintain and increase when necessary such listing,

of, all shares of Warrant Stock from time to time issued upon exercise of this

Warrant or as otherwise provided hereunder (provided that such Warrant Stock has

been registered pursuant to a registration statement under the Securities Act

then in effect), and, to the extent permissible under the applicable securities

exchange rules, all unissued shares of Warrant Stock which are at any time

issuable hereunder, so long as any shares of Class A Common Stock shall be so

listed. The Issuer will also so list on each securities exchange or

market, and will maintain such listing of, any other securities which the Holder

of this Warrant shall be entitled to receive upon the exercise of this Warrant

if at the time any securities of the same class shall be listed on such

securities exchange or market by the Issuer.

-6-

(c) Loss, Theft, Destruction of

Warrants. Upon receipt of evidence satisfactory to the Issuer

of the ownership of and the loss, theft, destruction or mutilation of any

Warrant and, in the case of any such loss, theft or destruction, upon receipt of

indemnity or security satisfactory to the Issuer or, in the case of any such

mutilation, upon surrender and cancellation of such Warrant, the Issuer will

make and deliver, in lieu of such lost, stolen, destroyed or mutilated Warrant,

a new Warrant of like tenor and representing the right to purchase the same

number of shares of Class A Common Stock.

(d) Payment of

Taxes. The Issuer will pay any documentary stamp taxes

attributable to the initial issuance of the Warrant Stock issuable upon exercise

of this Warrant; provided, however, that the

Issuer shall not be required to pay any tax or taxes which may be payable in

respect of any transfer involved in the issuance or delivery of any certificates

representing Warrant Stock in a name other than that of the Holder in respect to

which such shares are issued.

4. Adjustment of Warrant Price

and Number of Shares Issuable Upon Exercise. The Warrant Price

and the number of shares of Warrant Stock that may be purchased upon exercise of

this Warrant shall be subject to adjustment from time to time as set forth in

this Section 4. Upon each adjustment of the Warrant Price, the Holder of this

Warrant shall thereafter be entitled to purchase, at the Warrant Price resulting

from such adjustment, the number of shares of Class A Common Stock obtained by

multiplying the Warrant Price in effect immediately prior to such adjustment by

the number of shares purchasable pursuant hereto immediately prior to such

adjustment, and dividing the product thereof by the Warrant Price resulting from

such adjustment.

(a)

Adjustment Due to Dividends,

Stock Splits, Etc. If, at any time on or after the Original Issuance

Date, the number of outstanding shares of Class A Common Stock is increased by a

(i) dividend payable in any kind of shares of capital stock of the Corporation,

(ii) stock split, (iii) combination, (iv) reclassification or (v) other similar

event, the Conversion Price shall be proportionately reduced by multiplying the

Warrant Price by a fraction of which the numerator shall be the number of

outstanding shares of Class A Common Stock immediately before such event and of

which the denominator shall be the number of outstanding shares of Class A

Common Stock immediately after such event, or if the number of outstanding

shares of Class A Common Stock is decreased by a reverse stock split,

combination or reclassification of shares, or other similar event, the

Conversion Price shall be proportionately increased by multiplying the Warrant

Price by a fraction of which the numerator shall be the number of outstanding

shares of Class A Common Stock immediately before such event and of which the

denominator shall be the number of outstanding shares of Class A Common Stock

immediately after such event. In such event, the Issuer shall notify the

Corporation's Transfer Agent of such change on or before the effective date

thereof.

-7-

(b)

Adjustment Due to Merger,

Consolidation, Etc. If, at any time after the Original Issuance Date,

there shall be (i) any reclassification or change of the outstanding shares of

Class A Common Stock, (ii) any consolidation or merger of the Corporation with

any other entity (other than a merger in which the Corporation is the surviving

or continuing entity and its capital stock is unchanged), (iii) any sale or

transfer of all or substantially all of the assets of the Corporation, (iv) any

share exchange or tender offer pursuant to which all of the outstanding shares

of Common Stock are effectively converted into other securities or property; or

(v) any distribution of the Corporation’s assets to holders of the Class A

Common Stock as a liquidation or partial liquidation dividend or by way of

return of capital (each of (i) - (v) above being a “Corporate Change”),

then the Holder shall have the right thereafter to receive, upon exercise of

this Warrant, the same amount and kind of securities, cash or property as it

would have been entitled to receive upon the occurrence of such Corporate Change

if it had been, immediately prior to such Corporate Change, the holder of the

number of shares of Warrant Stock then issuable upon exercise in full of this

Warrant, and in any such case, appropriate provisions (in form and substance

reasonably satisfactory to the Holder) shall be made with respect to the rights

and interests of the Holder to the end that the economic value of the Warrant

Stock is in no way diminished by such Corporate Change and that the provisions

hereof including, without limitation, in the case of any such consolidation,

merger or sale in which the successor entity or purchasing entity is not the

Issuer, an immediate adjustment of the Warrant Price so that the Warrant Price

immediately after the Corporate Change reflects the same relative value as

compared to the value of the surviving entity’s common stock that existed

immediately prior to such Corporate Change and the value of the Class A Common

Stock immediately prior to such Corporate Change. If holders of Class

A Common Stock are given any choice as to the securities, cash or property to be

received in a Corporate Change, then the Holder shall be given the same choice

as to the consideration it receives upon any exercise of this Warrant following

such Corporate Change.

(c)

Adjustment Due to Dilutive

Issuances. Except for any Qualified Issuance (as hereinafter

defined), if at any time the Issuer shall offer, issue or agree to issue any

Class A Common Stock or securities convertible into or exercisable for shares of

Class A Common Stock (or modify any of the foregoing which may be outstanding at

any time prior to the Issuance Date) to any person or entity at a price per

share or conversion or exercise price per share which shall be less than the

Warrant Price then in effect, then, for each such occasion, the Warrant Price

shall be adjusted to equal such other lower price per share, and, as to shares

of Class A Common Stock, if any, that were previously issued upon exercise of

this Warrant, the Issuer shall issue additional shares of Class A Common Stock

to the Holder so that the average per share purchase price of the shares of

Class A Common Stock issued to the Holder upon the exercise of the Warrant is

equal to such other lower price per share. For purposes of this

Section “Qualified Issuance” shall mean (i) the grant,

issuance or exercise of any convertible securities pursuant to a qualified or

non-qualified stock option plan of the Issuer or any other bona fide employee

benefit plan or incentive arrangement, adopted or approved by the Board and

approved by the Issuer’s shareholders, as may be amended from time to time, (ii)

the grant, issuance or exercise of any convertible securities in connection with

the hire or retention of any officer, director or key employee of the Issuer,

provided such grant is approved by the Board, or (iii) the issuance of any

shares of Class A Common Stock pursuant to the grant or exercise of convertible

securities outstanding as of the date hereof (exclusive of any subsequent

amendments thereto).

-8-

(d)

Other

Adjustments. If the Issuer takes any action affecting the

Class A Common Stock after the date hereof that would be covered by this Section

4, but for the manner in which such action is taken or structured, and such

action would in any way diminish the value of the Warrant or Warrant Stock, then

the Warrant Price shall be adjusted in such manner as the Board shall in good

faith determine to be equitable under the circumstances.

(e)

Purchase

Rights. In addition to any adjustments pursuant to subsections

(a)-(d) above, if at any time the Issuer are grants, issues or sells any

options, convertible securities or rights to purchase stock, warrants,

securities or other property pro rata to the record holders of any class of

shares of common stock (the “Purchase Rights”),

then the Holder will be entitled to acquire, upon the terms applicable to such

Purchase Rights, the aggregate Purchase Rights which the Holder could have

acquired if the Holder had held the proportionate number of shares of Class A

Common Stock acquirable upon complete exercise of this Warrant (without regard

to any limitations on the exercise of this Warrant) immediately before the date

on which a record is taken for the grant, issuance or sale of such Purchase

Rights, or, if no such record is taken, the date as of which the record holders

of shares of Class A Common Stock are to be determined for the grant, issue or

sale of such Purchase Rights.

(f)

Redemption

Right. No sooner than fifteen (15) days nor later than ten

(10) days prior to the consummation of a Corporate Change that constitutes a

change of control, but not prior to the public announcement of such change of

control, the Issuer shall deliver written notice thereof via facsimile and

overnight courier to the Holder (a “Change in Control

Notice”). At any time during the period beginning after the

Holder’s receipt of a Change of Control Notice and ending ten (10) Trading Days

after the consummation of such change of control, the Holder may require the

Issuer to redeem all or any portion of this Warrant by delivering written notice

thereof (“Change in

Control Redemption Notice”) to the Issuer, which Change of Control

Redemption Notice shall indicate the amount the Holder is electing to be

redeemed. Any such redemption shall be in cash in the amount equal to

the value of the remaining unexercised portion of this Warrant on the date of

such consummation, which value shall be determined by use of the Black Scholes

Option Pricing Model reflecting (A) a risk-free interest rate corresponding to

the U.S. Treasury rate for a period equal to the remaining term of

this Warrant as of such date of request and (B) an expected volatility equal to

the 100-day volatility obtained from the HVT function on Bloomberg for the

100-day period ending on the date of the Change of Control Redemption

Notice.

5.

Notice of

Adjustments. Whenever the Warrant Price or Warrant Share

Number shall be adjusted pursuant to Section 4 hereof (for purposes of this

Section 5, each an “adjustment”), the

Issuer shall cause its Chief Financial Officer to prepare and execute a

certificate setting forth, in reasonable detail, the event requiring the

adjustment, the amount of the adjustment, the method by which such adjustment

was calculated (including a description of the basis on which the Board made any

determination hereunder), and the Warrant Price and Warrant Share Number after

giving effect to such adjustment, and shall cause copies of such certificate to

be delivered to the Holder of this Warrant promptly after each

adjustment. Any dispute between the Issuer and the Holder of this

Warrant with respect to the matters set forth in such certificate may at the

option of the Holder of this Warrant be submitted to a national or regional

accounting firm reasonably acceptable to the Issuer and the Holder, provided that the

Issuer shall have ten (10) days after receipt of notice from such Holder of its

selection of such firm to object thereto, in which case such Holder shall select

another such firm and the Issuer shall have no such right of

objection. The firm selected by the Holder of this Warrant as

provided in the preceding sentence shall be instructed to deliver a written

opinion as to such matters to the Issuer and such Holder within thirty (30) days

after submission to it of such dispute. Such opinion shall be final

and binding on the parties hereto. The costs and expenses of the

initial accounting firm shall be paid equally by the Issuer and the Holder and,

in the case of an objection by the Issuer, the costs and expenses of the

subsequent accounting firm shall be paid in full by the Issuer.

-9-

6.

Fractional

Shares. No fractional shares of Warrant Stock will be issued

in connection with any exercise hereof, but in lieu of such fractional shares,

the Issuer shall round the number of shares to be issued upon exercise up to the

nearest whole number of shares.

7.

Ownership

Caps and Certain Exercise Restrictions.

(a) Notwithstanding

anything to the contrary set forth in this Warrant, at no time may a Holder of

this Warrant exercise any portion of this Warrant if the number of shares of

Class A Common Stock to be issued pursuant to such exercise would exceed, when

aggregated with all other shares of Class A Common Stock beneficially owned by

such Holder at such time, the number of shares of Class A Common Stock which

would result in such Holder beneficially owning (as determined in accordance

with Section 13(d) of the Exchange Act and the rules thereunder) in

excess of 4.99% of the then issued and outstanding shares of Class A Common

Stock; provided, however, that upon a

holder of this Warrant providing the Issuer with sixty-one (61) days notice

(pursuant to Section 12 hereof) (the “Waiver Notice”) that

such Holder would like to waive this Section 7(a) with regard to any or all

shares of Class A Common Stock issuable upon exercise of this Warrant, this

Section 7(a) will be of no force or effect with regard to all or a portion of

the Warrant referenced in the Waiver Notice; provided, further, that this

provision shall be of no further force or effect during the sixty-one (61) days

immediately preceding the expiration of the term of this Warrant. In

all circumstances, exercise of this Warrant shall be deemed to be the Holder’s

representation that such exercise conforms to the provisions of this Section

7(a) and the Issuer shall be under no obligation to verify or ascertain

compliance by the Holder with this provision.

(b) The

Holder may not exercise the Warrant hereunder to the extent such exercise would

result in the Holder beneficially owning (as determined in accordance with

Section 13(d) of the Exchange Act and the rules thereunder) in excess of 9.99%

of the then issued and outstanding shares of Class A Common Stock, including

shares issuable upon exercise of the Warrant held by the Holder after

application of this Section; provided, however, that upon a

holder of this Warrant providing the Issuer with a Waiver Notice that such

holder would like to waive this Section 7(b) with regard to any or all shares of

Class A Common Stock issuable upon exercise of this Warrant, this Section 7(b)

shall be of no force or effect with regard to those shares of Warrant Stock

referenced in the Waiver Notice; provided, further, that this

provision shall be of no further force or effect during the sixty-one (61) days

immediately preceding the expiration of the term of this Warrant. In

all circumstances, exercise of this Warrant shall be deemed to be the Holder’s

representation that such exercise conforms to the provisions of this Section

7(b) and the Issuer shall be under no obligation to verify or ascertain

compliance by the Holder with this provision.

-10-

8. Definitions. For

the purposes of this Warrant, the following terms have the following

meanings:

“Additional Shares of Common

Stock” means all shares of Class A Common Stock issued by the Issuer

after the Original Issue Date, and all shares of Other Common, if any, issued by

the Issuer after the Original Issue Date, except for those issued in a Permitted

Financing.

“Board” shall mean the

Board of Directors of the Issuer.

“Capital Stock” means

and includes (i) any and all shares, interests, participations or other

equivalents of or interests in (however designated) corporate stock, including,

without limitation, shares of preferred or preference stock, (ii) all

partnership interests (whether general or limited) in any Person which is a

partnership, (iii) all membership interests or limited liability company

interests in any limited liability company, and (iv) all equity or ownership

interests in any Person of any other type.

“Certificate of

Incorporation” means the Certificate of Incorporation of the Issuer as in

effect on the Original Issue Date, and as hereafter from time to time amended,

modified, supplemented or restated in accordance with the terms hereof and

thereof and pursuant to applicable law.

“Class A Common Stock”

means the Class A Common Stock, $0.001 par value per share, of the Issuer and

any other Capital Stock into which such stock may hereafter be

changed.

“Governmental

Authority” means any governmental, regulatory or self-regulatory entity,

department, body, official, authority, commission, board, agency or

instrumentality, whether federal, state or local, and whether domestic or

foreign.

“Holders” mean the

Persons who shall from time to time own any Warrant. The term

“Holder” means one of the Holders.

“Independent

Appraiser” means a nationally recognized or major regional investment

banking firm or firm of independent certified public accountants of recognized

standing (which may be the firm that regularly examines the financial statements

of the Issuer) that is regularly engaged in the business of appraising the

Capital Stock or assets of corporations or other entities as going concerns, and

which is not affiliated with either the Issuer or the Holder of any

Warrant.

-11-

“Issuer” means The

Amacore Group, Inc., a Delaware corporation, and its successors.

“Original Issue Date”

means October 6, 2008.

“OTC Bulletin Board”

means the over-the-counter electronic bulletin board.

“Other Common” means

any other Capital Stock of the Issuer of any class which shall be authorized at

any time after the date of this Warrant (other than Class A Common Stock) and

which shall have the right to participate in the distribution of earnings and

assets of the Issuer without limitation as to amount.

“Outstanding Common

Stock” means, at any given time, the aggregate amount of outstanding

shares of Class A Common Stock, assuming full exercise, conversion or exchange

(as applicable) of all options, warrants and other Securities which are

convertible into or exercisable or exchangeable for, and any right to subscribe

for, shares of Class A Common Stock that are outstanding at such

time.

“Person” means an

individual, corporation, limited liability company, partnership, joint stock

company, trust, unincorporated organization, joint venture, Governmental

Authority or other entity of whatever nature.

“Per Share Market

Value” means on any particular date (a) the last closing bid price per

share of the Class A Common Stock on such date on the OTC Bulletin Board or

another registered national stock exchange on which the Class A Common Stock is

then listed, or if there is no such price on such date, then the closing bid

price on such exchange or quotation system on the date nearest preceding such

date, or (b) if the Class A Common Stock is not listed then on the OTC Bulletin

Board or any registered national stock exchange, the last closing bid price for

a share of Class A Common Stock in the over-the-counter market, as reported by

the OTC Bulletin Board or in the National Quotation Bureau Incorporated or

similar organization or agency succeeding to its functions of reporting prices)

at the close of business on such date, or (c) if the Class A Common Stock is not

then reported by the OTC Bulletin Board or the National Quotation Bureau

Incorporated (or similar organization or agency succeeding to its functions of

reporting prices), then the “Pink Sheet” quotes for the applicable Trading Days

preceding such date of determination, or (d) if the Class A Common Stock is not

then publicly traded the fair market value of a share of Class A Common Stock as

determined by an Independent Appraiser selected in good faith by the Holder;

provided, however, that the

Issuer, after receipt of the determination by such Independent Appraiser, shall

have the right to select an additional Independent Appraiser, in which case, the

fair market value shall be equal to the average of the determinations by each

such Independent Appraiser; and provided, further that all

determinations of the Per Share Market Value shall be appropriately adjusted for

any stock dividends, stock splits or other similar transactions during such

period. The determination of fair market value by an Independent

Appraiser shall be based upon the fair market value of the Issuer determined on

a going concern basis as between a willing buyer and a willing seller and taking

into account all relevant factors determinative of value, and the determination

of the additional Independent Appraiser, if any, or of the Independent

Appraisers otherwise shall be final and binding on all parties. In

determining the fair market value of any shares of Class A Common Stock, no

consideration shall be given to any restrictions on transfer of the Class A

Common Stock imposed by agreement or by federal or state securities laws, or to

the existence or absence of, or any limitations on, voting rights.

-12-

“Purchase Agreement”

means the Securities Purchase Agreement dated as of October 6, 2008, among the

Issuer and the Holder.

“Securities” means any

debt or equity securities of the Issuer, whether now or hereafter authorized,

any instrument convertible into or exchangeable for Securities or a Security,

and any option, warrant or other right to purchase or acquire any

Security. “Security” means one of the Securities.

“Securities Act” means

the Securities Act of 1933, as amended, or any similar federal statute then in

effect.

“Subsidiary” means any

corporation at least 50% of whose outstanding Voting Stock shall at the time be

owned directly or indirectly by the Issuer or by one or more of its

Subsidiaries, or by the Issuer and one or more of its Subsidiaries.

“Term” has the meaning

specified in Section 1 hereof.

“Trading Day” means

(a) a day on which the Class A Common Stock is traded on the OTC Bulletin Board,

or (b) if the Class A Common Stock is not traded on the OTC Bulletin Board, a

day on which the Class A Common Stock is quoted in the over-the-counter market

as reported by the National Quotation Bureau Incorporated (or any similar

organization or agency succeeding its functions of reporting prices); provided, however, that in the

event that the Class A Common Stock is not listed or quoted as set forth in (a)

or (b) hereof, then Trading Day shall mean any day except Saturday, Sunday and

any day which shall be a legal holiday or a day on which banking institutions in

the State of New York are authorized or required by law or other government

action to close.

“Voting Stock” means,

as applied to the Capital Stock of any corporation, Capital Stock of any class

or classes (however designated) having ordinary voting power for the election of

a majority of the members of the Board of Directors (or other governing body) of

such corporation, other than Capital Stock having such power only by reason of

the happening of a contingency.

“Warrants” means the

Warrants issued and sold pursuant to the Purchase Agreement, including, without

limitation, this Warrant, and any other warrants of like tenor issued in

substitution or exchange for any thereof pursuant to the provisions of Section

2(c), 2(d) or 2(e) hereof or of any of such other Warrants.

-13-

“Warrant Price”

initially means $0.375, as such price may be adjusted from time to time as shall

result from the adjustments specified in this Warrant, including Section 4

hereto.

“Warrant Share Number”

means at any time the aggregate number of shares of Warrant Stock which may at

such time be purchased upon exercise of this Warrant, after giving effect to all

prior adjustments and increases to such number made or required to be made under

the terms hereof.

“Warrant Stock” means

Class A Common Stock issuable upon exercise of any Warrant or Warrants or

otherwise issuable pursuant to any Warrant or Warrants.

9. Other

Notices. In case at any time:

|

|

(a)

|

the

Issuer shall make any distributions to the holders of Class A Common

Stock; or

|

|

|

(b)

|

the

Issuer shall authorize the granting to all holders of its Class A Common

Stock of rights to subscribe for or purchase any shares of Capital Stock

of any class or other rights; or

|

|

|

(c)

|

there

shall be any reclassification of the Capital Stock of the Issuer;

or

|

|

|

(d)

|

there

shall be any capital reorganization by the Issuer;

or

|

|

|

(e)

|

there

shall be any (i) consolidation or merger involving the Issuer or (ii)

sale, transfer or other disposition of all or substantially all of the

Issuer’s property, assets or business (except a merger or other

reorganization in which the Issuer shall be the surviving corporation and

its shares of Capital Stock shall continue to be outstanding and unchanged

and except a consolidation, merger, sale, transfer or other disposition

involving a wholly-owned subsidiary);

or

|

|

|

(f)

|

there

shall be a voluntary or involuntary dissolution, liquidation or winding-up

of the Issuer or any partial liquidation of the Issuer or distribution to

holders of Class A Common Stock;

|

then, in

each of such cases, the Issuer shall give written notice to the Holder of the

date on which (i) the books of the Issuer shall close or a record shall be taken

for such dividend, distribution or subscription rights or (ii) such

reorganization, reclassification, consolidation, merger, disposition,

dissolution, liquidation or winding-up, as the case may be, shall take

place. Such notice also shall specify the date as of which the

holders of Class A Common Stock of record shall participate in such dividend,

distribution or subscription rights, or shall be entitled to exchange their

certificates for Class A Common Stock for securities or other property

deliverable upon such reorganization, reclassification, consolidation, merger,

disposition, dissolution, liquidation or winding-up, as the case may

be. Such notice shall be given at least twenty (20) days prior to the

action in question and not less than ten (10) days prior to the record date or

the date on which the Issuer’s transfer books are closed in respect

thereto. This Warrant entitles the Holder to receive copies of all

financial and other information distributed or required to be distributed to the

holders of the Class A Common Stock.

-14-

10. Amendment and

Waiver. Any term, covenant, agreement or condition in this

Warrant may be amended, or compliance therewith may be waived (either generally

or in a particular instance and either retroactively or prospectively), by a

written instrument or written instruments executed by the Issuer and the Holder;

provided, however, that no such

amendment or waiver shall reduce the Warrant Share Number, increase the Warrant

Price, shorten the period during which this Warrant may be exercised or modify

any provision of this Section 10 without the consent of the Holder of this

Warrant. No consideration shall be offered or paid to any person to

amend or consent to a waiver or modification of any provision of this Warrant

unless the same consideration is also offered to all holders of the

Warrants.

11. Governing Law;

Jurisdiction. This Warrant shall be governed by and construed

in accordance with the internal laws of the State of New York, without giving

effect to any of the conflicts of law principles which would result in the

application of the substantive law of another jurisdiction. This

Warrant shall not be interpreted or construed with any presumption against the

party causing this Warrant to be drafted. The Issuer and the Holder

agree that venue for any dispute arising under this Warrant will lie exclusively

in the state or federal courts located in New York County, New York, and the

parties irrevocably waive any right to raise forum non conveniens or any

other argument that New York is not the proper venue. The Issuer and

the Holder irrevocably consent to personal jurisdiction in the state and federal

courts of the state of New York. The Issuer and the Holder consent to

process being served in any such suit, action or proceeding by mailing a copy

thereof to such party at the address in effect for notices to it under this

Warrant and agrees that such service shall constitute good and sufficient

service of process and notice thereof. Nothing in this Section 11

shall affect or limit any right to serve process in any other manner permitted

by law. The Issuer agrees to pay all costs and expenses of

enforcement of this Warrant, including, without limitation, reasonable

attorneys’ fees and expenses. The parties hereby waive all rights to

a trial by jury.

12. Notices. Any

notice, demand, request, waiver or other communication required or permitted to

be given hereunder shall be in writing and shall be effective (a) upon hand

delivery by telecopy or facsimile at the address or number designated below (if

delivered on a business day during normal business hours where such notice is to

be received), or the first business day following such delivery (if delivered

other than on a business day during normal business hours where such notice is

to be received) or (b) on the second business day following the date of mailing

by express courier service, fully prepaid, addressed to such address, or upon

actual receipt of such mailing, whichever shall first occur. The

addresses for such communications shall be as set forth in the Purchase

Agreement. Any party hereto may from time to time change its address

for notices by giving written notice of such changed address to the other party

hereto.

-15-

13. Warrant

Agent. The Issuer may, by written notice to each Holder of

this Warrant, appoint an agent having an office in New York, New York for the

purpose of issuing shares of Warrant Stock on the exercise of this Warrant

pursuant to subsection (b) of Section 2 hereof, exchanging this Warrant pursuant

to subsection (d) of Section 2 hereof or replacing this Warrant pursuant to

subsection (d) of Section 3 hereof, or any of the foregoing, and thereafter any

such issuance, exchange or replacement, as the case may be, shall be made at

such office by such agent.

14. Remedies. The

Issuer stipulates that the remedies at law of the Holder of this Warrant in the

event of any default or threatened default by the Issuer in the performance of

or compliance with any of the terms of this Warrant are not and will not be

adequate and that, to the fullest extent permitted by law, such terms may be

specifically enforced by a decree for the specific performance of any agreement

contained herein or by an injunction against a violation of any of the terms

hereof or otherwise.

15. Successors and

Assigns. This Warrant and the rights evidenced hereby shall

inure to the benefit of and be binding upon the successors and assigns of the

Issuer, the Holder hereof and (to the extent provided herein) the Holders of

Warrant Stock issued pursuant hereto, and shall be enforceable by any such

Holder or Holder of Warrant Stock.

16. Modification and

Severability. If, in any action before any court or agency

legally empowered to enforce any provision contained herein, any provision

hereof is found to be unenforceable, then such provision shall be deemed

modified to the extent necessary to make it enforceable by such court or

agency. If any such provision is not enforceable as set forth in the

preceding sentence, the unenforceability of such provision shall not affect the

other provisions of this Warrant, but this Warrant shall be construed as if such

unenforceable provision had never been contained herein.

17. Headings. The

headings of the Sections of this Warrant are for convenience of reference only

and shall not, for any purpose, be deemed a part of this Warrant.

18. Registration

Rights. The Holder of this Warrant is entitled to the benefit

of certain registration rights with respect to the shares of Warrant Stock

issuable upon the exercise of this Warrant pursuant to that certain Registration

Rights Agreement, dated October 6, 2008, by and among the Issuer and the Holder

(the “Registration

Rights Agreement”) and the registration rights with respect to the shares

of Warrant Stock issuable upon the exercise of this Warrant by any subsequent

Holder may only be assigned in accordance with the terms and provisions of the

Registrations Rights Agreement.

[REMAINDER

OF PAGE INTENTIONALLY LEFT BLANK]

-16-

IN

WITNESS WHEREOF, the Issuer has executed this Warrant as of the day and year

first above written.

| THE AMACORE GROUP, INC. | |||

|

|

By:

|

/s/ Xxx Xxxxxx | |

| Name: Xxx Xxxxxx | |||

| Title: President and Chief Executive Officer | |||

-17-

WARRANT

EXERCISE FORM

The

undersigned _______________, pursuant to the provisions of the within Warrant,

hereby elects to purchase _____ shares of Class A Common Stock of The Amacore

Group, Inc. covered by the within Warrant.

|

Dated:

_________________

|

Signature

|

___________________________

|

|

|

Address

|

_____________________

|

||

|

_____________________

|

Number of

shares of Class A Common Stock beneficially owned or deemed beneficially owned

by the Holder on the date of Exercise: _________________________

The

undersigned is an “accredited investor” as defined in Regulation D under the

Securities Act of 1933, as amended.

|

|

The

undersigned intends that payment of the Warrant Price shall be made as

(check one):

|

Cash

Exercise_______

Cashless

Exercise_______

If the

Holder has elected a Cash Exercise, the Holder shall pay the sum of $________ by

certified or official bank check (or via wire transfer) to the Issuer in

accordance with the terms of the Warrant.

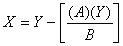

If the

Holder has elected a Cashless Exercise, a certificate shall be issued to the

Holder for the number of shares equal to the whole number portion of the product

of the calculation set forth below, which is ___________. The

Company shall pay a cash adjustment in respect of the fractional portion of the

product of the calculation set forth below in an amount equal to the product of

the fractional portion of such product and the Per Share Market Value on the

date of exercise, which product is ____________.

Where:

The

number of shares of Class A Common Stock to be issued to the Holder

__________________(“X”).

The

number of shares of Class A Common Stock purchasable upon exercise of all of the

Warrant or, if only a portion of the Warrant is being exercised, the portion of

the Warrant being exercised ___________________________ (“Y”).

-18-

The

Warrant Price ______________ (“A”).

The Per

Share Market Value of one share of Class A Common

Stock _______________________ (“B”).

ASSIGNMENT

FOR VALUE

RECEIVED, _________________ hereby sells, assigns and transfers unto

__________________ the within Warrant and all rights evidenced thereby and does

irrevocably constitute and appoint _____________, attorney, to transfer the said

Warrant on the books of the within named corporation.

|

Dated:

_________________

|

Signature

|

___________________________

|

|

|

Address

|

_____________________

|

||

|

_____________________

|

PARTIAL

ASSIGNMENT

FOR VALUE

RECEIVED, _________________ hereby sells, assigns and transfers unto

__________________ the right to purchase _________ shares of Warrant Stock

evidenced by the within Warrant together with all rights therein, and does

irrevocably constitute and appoint ___________________, attorney, to transfer

that part of the said Warrant on the books of the within named

corporation.

|

Dated:

_________________

|

Signature

|

___________________________

|

|

|

Address

|

_____________________

|

||

|

_____________________

|

FOR USE

BY THE ISSUER ONLY:

This

Warrant No. W-___ canceled (or transferred or exchanged) this _____ day of

___________, _____, shares of Class A Common Stock issued therefor in the name

of _______________, Warrant No. W-_____ issued for ____ shares of Class A Common

Stock in the name of _______________.

-19-