SHARE EXCHANGE AGREEMENT AND PLAN OF REORGANIZATION BY AND BETWEEN

Exhibit 10.23

SHARE EXCHANGE AGREEMENT AND PLAN OF REORGANIZATION

BY AND BETWEEN

MID-HEAVEN SINCERITY INTERNATIONAL RESOURCES INVESTMENT CO., LTD

AND

THE STOCKHOLDERS OF

MID-HEAVEN SINCERITY INTERNATIONAL RESOURCES INVESTMENT CO., LTD

DATED DECEMBER 31, 2018

SHARE EXCHANGE AGREEMENT AND PLAN OF REORGANIZATION

This SHARE EXCHANGE AGREEMENT AND PLAN OF REORGANIZATION (this “Agreement”) is entered on December 31, 2018, by and among Mid-Heaven Sincerity International Resources Investment Co., Ltd, a company incorporated under the laws of the British Virgin Islands (“Mid-Heaven”), Smartheat Inc., a Nevada corporation (“Purchaser”), and each of the shareholders of Mid-Heaven listed on Schedule 2.1 hereto (the “Mid-Heaven Shareholders”).

RECITALS

WHEREAS, Mid-Heaven is a BVI company that is engaged, through its subsidiaries, in the manufacture and sale of Boric Acid and Lithium Carbonate;

WHEREAS, Purchaser, Mid-Heaven and the Mid-Heaven Shareholders have agreed to the acquisition by Purchaser of all of the issued and outstanding capital stock of Mid-Heaven pursuant to a voluntary share exchange transaction (the “Share Exchange”) between Purchaser and Mid-Heaven upon the terms and subject to the conditions set forth herein;

WHEREAS, in furtherance thereof, the Board of Directors of Purchaser has approved the Share Exchange in accordance with the applicable provisions of the NRS and upon the terms and subject to the conditions set forth herein;

WHEREAS, in furtherance thereof, the Board of Directors and shareholders of Mid-Heaven have each approved the Share Exchange in accordance with the applicable provisions of the laws of the BVI and upon the terms and subject to the conditions set forth herein;

WHEREAS, notwithstanding the fact that the Purchaser cannot issue its Common Stock to the Majority Shareholders until the number of shares of its authorized Common Stock is increased it is the intent of the Parties for the acquisition to take place on December 31, 2018 and for the Mid-Haven Shareholders to exercise such control over the Purchaser had certificates been issued to the Mid-Haven Shareholders on the Closing Date, and

WHEREAS, for United States federal income tax purposes, the parties intend that the Share Exchange shall constitute a tax-free reorganization within the meaning of Sections 368 and 1032 of the Code.

NOW, THEREFORE, in consideration of the premises, and the mutual covenants and agreements contained herein, the parties do hereby agree as follows:

ARTICLE I. DEFINITIONS

(a) “Affiliate” shall mean, as to any Person, any other Person controlled by, under the control of, or under common control with, such Person. As used in this definition, “control” shall mean possession, directly or indirectly, of the power to direct or cause the direction of management or policies (whether through ownership of securities or partnership or

other ownership interests, by contract or otherwise), provided that, in any event, any Person which owns or holds directly or indirectly five per cent (5%) or more of the voting securities or five per cent (5%) or more of the partnership or other equity interests of any other Person (other than as a limited partner of such other Person) will be deemed to control such other Person.

(b) “Agreement” means this Share Exchange Agreement and Plan of Reorganization.

(c) “Applicable Law” or “Applicable Laws” means any and all laws, ordinances, constitutions, regulations, statutes, treaties, rules, codes, licenses, certificates, franchises, permits, principles of common law, requirements and Orders adopted, enacted, implemented, promulgated, issued, entered or deemed applicable by or under the authority of any Governmental Body having jurisdiction over a specified Person or any of such Person’s properties or assets.

(d) “BVI” shall mean the British Virgin Islands.

(e) “Best Efforts” means the efforts that a prudent Person desirous of achieving a result would use in similar circumstances to achieve that result as expeditiously as possible, provided, however, that a Person required to use Best Efforts under this Agreement will not be thereby required to take actions that would result in a Material Adverse Effect in the benefits to such Person of this Agreement and the Share Exchange.

(f) “Breach” means any breach of, or any inaccuracy in, any representation or warranty or any breach of, or failure to perform or comply with, any covenant or obligation, in or of this Agreement or any other Contract.

(g) “Business” means the manufacture and sale of Boric Acid and Lithium Carbonate as presently conducted by Qing Hai.

(h) “Business Day” means any day other than (a) Saturday or Sunday or (b) any other day on which major money center banks in New York, New York are permitted or required to be closed.

(i) “Closing” shall mean the completion of the Share Exchange and the consummation of the transactions set forth herein.

(j) “Closing Date” shall mean December 31, 2018.

(k) “Code” shall mean the Internal Revenue Code of 1986, as amended.

(l) “Confidential Information” means any information pertaining to the business, operations, marketing, customers, financing, forecasts and plans of any Party provided to or learned by any other Party during the course of negotiation of the Share Exchange. Any such information shall be treated as Confidential Information irrespective of whether such information has been marked “confidential” or in a similar manner.

(m) “Consent” means any approval, consent, license, permits, ratification, waiver or other authorization.

(n) “Contract” means any agreement, contract, lease, license, consensual obligation, promise, undertaking, understanding, commitment, arrangement, instrument or document (whether written or oral and whether express or implied), whether or not legally binding.

(o) “Distribution Compliance Period” shall have the meaning set forth in Section 3.1(e).

(p) “Employee Benefit Plan” has the meaning set forth in ERISA Section 3(3).

(q) “Encumbrance” means and includes:

(i) with respect to any personal property, any security or other property interest or right, claim, lien, pledge, option, charge, security interest, contingent or conditional sale, or other title claim or retention agreement or lease or use agreement in the nature thereof, interest or other right or claim of third parties, whether voluntarily incurred or arising by operation of law, and including any agreement to grant or submit to any of the foregoing in the future; and

(ii) with respect to any Real Property (whether and including owned real estate or Real Estate subject to a Real Property Lease), any mortgage, lien, easement, interest, right-of-way, condemnation or eminent domain proceeding, encroachment, any building, use or other form of restriction, encumbrance or other claim (including adverse or prescriptive) or right of Third Parties (including Governmental Bodies), any lease or sublease, boundary dispute, and agreements with respect to any real property including: purchase, sale, right of first refusal, option, construction, building or property service, maintenance, property management, conditional or contingent sale, use or occupancy, franchise or concession, whether voluntarily incurred or arising by operation of law, and including any agreement to grant or submit to any of the foregoing in the future.

(r) “ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and the rules and regulations issued by the Department of Labor pursuant to ERISA or any successor law.

(s) “Exchange Act” means the Securities Exchange Act of 1934, as amended.

(t) “GAAP” means at any particular time generally accepted accounting principles in the United States, consistently applied on a going concern basis, using consistent audit scope and materiality standards.

(u) “Governing Documents” means with respect to any particular entity, the articles or certificate of incorporation and the bylaws (or equivalent documents for entities of foreign jurisdictions); all equity holders’ agreements, voting agreements, voting trust agreements, joint venture agreements, registration rights agreements or other agreements or documents relating to the organization, management or operation of any Person or relating to the rights, duties and obligations of the equity holders of any Person; and any amendment or supplement to any of the foregoing.

(v) “Governmental Authorization” means any Consent, license, registration or permit issued, granted, given or otherwise made available by or under the authority of any Governmental Body or pursuant to any Applicable Law.

(w) “Governmental Body” means: (i) nation, state, county, city, town, borough, village, district, tribe or other jurisdiction; (ii) federal, state, local, municipal, foreign, tribal or other government; (iii) governmental or quasi-governmental authority of any nature (including any agency, branch, department, board, commission, court, tribunal or other entity exercising governmental or quasi-governmental powers); (iv) multinational organization or body; (v) body exercising, or entitled or purporting to exercise, any administrative, executive, judicial, legislative, police, regulatory or taxing authority or power; or (vi) official of any of the foregoing.

(x) “Improvements” means all buildings, structures, fixtures and improvements located on Land, including those under construction.

(y) “IRS” means the United States Internal Revenue Service and, to the extent relevant, the United States Department of the Treasury.

(z) “Knowledge” means actual knowledge without independent investigation.

(aa) “Land” means all parcels and tracts of land in which any Person has an ownership or leasehold interest.

(bb) “Material Adverse Effect” or “Material Adverse Change” means, in connection with any Person, any event, change or effect that is materially adverse, individually or in the aggregate, to the condition (financial or otherwise), properties, assets, liabilities, revenues, income, business, operations, results of operations or prospects of such Person, taken as a whole.

(cc) “NRS” shall mean the Nevada Revised Statutes, as amended.

(dd) “Order” means any writ, directive, order, injunction, judgment, decree, ruling, assessment or arbitration award of any Governmental Body or arbitrator.

(ee) “Ordinary Course of Business” means an action taken by a Person if that action: (i) is consistent in nature, scope and magnitude with the past practices of such Person and is taken in the ordinary course of the normal, day-to-day operations of such Person; (ii) does not

require authorization by the board of directors or shareholders of such Person (or by any Person or group of Persons exercising similar authority) and does not require any other separate or special authorization of any nature; and (iii) is similar in nature, scope and magnitude to actions customarily taken, without any separate or special authorization, in the ordinary course of the normal, day-to-day operations of other Persons that are in the same line of business as such Person.

(ff) “Party” or “Parties” means Mid-Heaven and/or Purchaser.

(gg) “Person” shall mean an individual, company, partnership, limited liability company, limited liability partnership, joint venture, trust or unincorporated organization, joint stock company or other similar organization, government or any political subdivision thereof, or any other legal entity.

(hh) “Mid-Heaven” has the meaning set forth in the preamble to this Agreement.

(ii) “Mid-Heaven Balance Sheet” has the meaning set forth in Section 4.6(a).

(jj) “Mid-Heaven Board” has the meaning set forth in Section 4.4.

(kk) “Mid-Heaven Employee Plans” has the meaning set forth in Section 4.16(a).

(ll) “Mid-Heaven Shareholders” has the meaning set forth in the preamble to this Agreement.

(mm) “Mid-Heaven Tax Affiliate” shall mean any Affiliate of Mid-Heaven to which Mid-Heaven would be required to consolidate and report in returns under the Code.

(nn) “Qing Hai” has the meaning set forth in Section 4.6.

(oo) “Qing Hai Financial Information” has the meaning set forth in Section 4.6.

(pp) “Qing Hai Intellectual Property” has the meaning set forth in Section 4.12(a).

(qq) “Proceeding” means any action, arbitration, audit, hearing, investigation, litigation or suit (whether civil, criminal, administrative, judicial or investigative, whether formal or informal, whether public or private) commenced, brought, conducted or heard by or before, or otherwise involving, any Governmental Body or arbitrator.

(rr) “Purchaser” has the meaning set forth in the Preamble.

(ss) “Purchaser Balance Sheet” has the meaning set forth in Section 5.1(f)(ii).

(tt) “Purchaser Business” means Purchaser’s business in selling existing inventory in PHEs, PHE Units and Heat Pumps and servicing existing clients.

(uu) “Purchaser Common Stock” means the common stock, par value $.001 per share, of Purchaser.

(vv) “Purchaser Contracts” has the meaning set forth in Section 5.1(o).

(ww) “Purchaser Employee Plans” has the meaning set forth in Section 5.1(r)(i).

(xx) “Purchaser Financial Information” has the meaning set forth in Section 5.1(f).

(aaa) “Purchaser Intellectual Property” has the meaning set forth in Section 5.1(m).

(bbb) “Purchaser SEC Reports” has the meaning set forth in Section 5.1(n).

(ccc) “Real Property” means any Land and Improvements and all privileges, rights, easements, and appurtenances belonging to or for the benefit of any Land, including all easements appurtenant to and for the benefit of any Land (a “Dominant Parcel”) for, and as the primary means of access between, the Dominant Parcel and a public way, or for any other use upon which lawful use of the Dominant Parcel for the purposes for which it is presently being used is dependent, and all rights existing in and to any streets, alleys, passages and other rights-of-way included thereon or adjacent thereto (before or after vacation thereof) and vaults beneath any such streets.

(eee) “Real Property Lease” means any lease, rental agreement or rights to use land pertaining to the occupancy of any improved space on any Land.

(fff) “Representative” means with respect to a particular Person, any director, officer, manager, employee, agent, consultant, advisor, accountant, financial advisor, legal counsel or other Representative of that Person.

(hhh) “SEC” means the United States Securities and Exchange Commission.

(iii) “Securities Act” means the Securities Act of 1933, as amended.

(jjj) “Security Interest” means any mortgage, pledge, security interest, Encumbrance, charge, claim, or other lien, other than: (a) mechanic’s, materialmen’s and similar

liens; (b) liens for Taxes not yet due and payable or for Taxes that the taxpayer is contesting in good faith through appropriate Proceedings; (c) liens arising under worker’s compensation, unemployment insurance, social security, retirement and similar legislation; (d) liens arising in connection with sales of foreign receivables; (e) liens on goods in transit incurred pursuant to documentary letters of credit; (f) purchase money liens and liens securing rental payments under capital lease arrangements; and (g) other liens arising in the Ordinary Course of Business and not incurred in connection with the borrowing of money.

(kkk) “Share Exchange” has the meaning set forth in the preamble to this Agreement.

(lll) “Shares” has the meaning set forth in Section 2.1.

(mmm) “Subsidiary” means with respect to any Person (the “Owner”), any corporation or other Person of which securities or other interests having the power to elect a majority of that corporation’s or other Person’s board of directors or similar governing body, or otherwise having the power to direct the business and policies of that corporation or other Person (other than securities or other interests having such power only upon the happening of a contingency that has not occurred), are held by the Owner or one or more of its Subsidiaries.

(nnn) “Tangible Personal Property” means all machinery, equipment, tools, furniture, office equipment, computer hardware, supplies, materials, vehicles and other items of tangible personal property of every kind owned or leased by a Party (wherever located and whether or not carried on a Party’s books), together with any express or implied warranty by the manufacturers or sellers or lessors of any item or component part thereof and all maintenance records and other documents relating thereto.

(ooo) “Tax” or “Taxes” means, with respect to any Person, (i) all income taxes (including any tax on or based upon net income, gross income, gross receipts, income as specially defined, earnings, profits or selected items of income, earnings or profits) and all gross receipts, sales, use, ad valorem, transfer, franchise, license, withholding, payroll, employment, excise, severance, stamp, occupation, commercial rent, premium, property or windfall profit taxes, alternative or add-on minimum taxes, customs duties and other taxes, fees, assessments or charges of any kind whatsoever, together with all interest and penalties, additions to tax and other additional amounts imposed by any taxing authority (domestic or foreign) on such person (if any), (ii) all value added taxes and (iii) any liability for the payment of any amount of the type described in clauses (i) or (ii) above as a result of (A) being a “transferee” (within the meaning of Section 6901 of the Code or any Applicable Law) of another person, (B) being a member of an affiliated, combined or consolidated group or (C) a contractual arrangement or otherwise.

(ppp) “Tax Return” means any return, declaration, report, claim for refund, or information return or statement relating to Taxes, including any schedule or attachment thereto, and including any amendment thereof.

(qqq) “Third Party” means a Person that is not a Party to this Agreement.

ARTICLE II. THE SHARE EXCHANGE

2.1 The Share Exchange. Upon the terms and subject to the conditions set forth in this Agreement and in accordance with the NRS, at the Closing, the Parties shall cause the Share Exchange to be consummated by taking all appropriate actions to ensure that the shareholders of Mid-Heaven listed on Schedule 2.1 deliver all of the issued and outstanding shares of capital stock of Mid-Heaven to Purchaser, duly executed and endorsed in blank (or accompanied by duly executed stock powers duly endorsed in blank), in proper form for transfer in exchange for the issuance of an aggregate of 186,588,264 shares of Purchaser Common Stock (the “Shares”) to the three shareholders of Mid-Heaven listed on Schedule 2.1.

2.2 Tax Free Reorganization. The Parties each hereby agree to use their Best Efforts and to cooperate with each other to cause the Share Exchange to be a tax-free reorganization within the meaning of Sections 368 and 1032 of the Code.

2.3 Closing. The Closing will occur via e-mail and facsimile on December 31, 2018 at 8:00 a.m. EST or such later date and time to be agreed upon by the parties (the “Closing Date”), following satisfaction or waiver of the conditions set forth in Article VIII.

2.4 Reorganization.

(a) As of the Closing, Mr. Weiguo, Xx. Xxxx, Xxx Xx, and Mr. Qingtai Kong shall resign from the board of directors of the Purchaser and Xx. Xxx Xxxxx, Xx. Xxxxx Xxxxx, Mr. Xing Xxx Xx, and Xx. Xxxxx Xxxxx shall be appointed as the directors of the Purchaser until their respective successors have been duly elected or appointed and qualified or until their earlier death, resignation or removal in accordance with Purchaser’s Articles of Incorporation and Bylaws.

(b) The nominees of Mid-Heaven shall, as of the Closing, be appointed as the officers of the Purchaser until their successors have been duly elected or appointed and qualified or until their earlier death, resignation or removal in accordance with the Purchaser’s Articles of Incorporation and Bylaws. As of the Closing, Xx. Xxxxxxx Xxxxxx, Ms. Hunajun Ai and Xx. Xxxxxxx Xxxx shall resign from all positions they hold as officers of Purchaser. Xx. Xxx Xxxxx shall be appointed Chairman of the Board, Xx. Xxxxx Xxxxx shall be appointed Chief Executive Officer and Secretary and Xx. Xx Xxxx Xxxx shall be appointed Chief Financial Officer and Treasurer of the Purchaser.

(c) If at any time after the Closing, any party shall consider that any further deeds, assignments, conveyances, agreements, documents, instruments or assurances in law or any other things are necessary or desirable to vest, perfect, confirm or record in the Purchaser the title to any property, rights, privileges, powers and franchises of Mid-Heaven by reason of, or as a result of, the Share Exchange, or otherwise to carry out the provisions of this Agreement, the remaining parties, as applicable, shall execute and deliver, upon request, any instruments or assurances, and do all other things necessary or proper to vest, perfect, confirm or record title to such property, rights, privileges, powers and franchises in the Purchaser, and otherwise to carry out the provisions of this Agreement.

ARTICLE III. COMPLIANCE WITH APPLICABLE SECURITIES LAWS

3.1 Covenants, Representations and Warranties of the Mid-Heaven Shareholders.

(a) The three shareholders of Mid-Heaven listed on Schedule 2.1 acknowledge and agree that they are acquiring the Shares for investment purposes and will not offer, sell or otherwise transfer, pledge or hypothecate any of the Shares issued to them (other than pursuant to an effective Registration Statement under the Securities Act) directly or indirectly unless:

(i) the sale is to Purchaser;

(ii) the Shares are sold in a transaction that does not require registration under the Securities Act, or any applicable United States state laws and regulations governing the offer and sale of securities, and the vendor has furnished to Purchaser an opinion of counsel to that effect or such other written opinion as may be reasonably required by Purchaser.

(b) The three shareholders of Mid-Heaven acknowledge and agree that the certificates representing the Shares shall bear a restrictive legend, substantially in the following form:

“The securities represented by this stock certificate have not been registered under the Securities Act of 1933, as amended (the “Securities Act”) or applicable state securities laws, and shall not be sold, pledged, hypothecated, donated, or otherwise transferred (whether or not for consideration) by the holder except upon the issuance to the Company of a favorable opinion of its counsel or the submission to the Company of such other evidence as may be satisfactory to counsel for the Company, to the effect that any such transfer shall not be in violation of the Securities Act or applicable state securities laws.”

(c) The three shareholders of Mid-Heaven represent and warrant that they:

(i) are not aware of any advertisement of any of the shares being issued hereunder; and

(d) acknowledge and agree that Purchaser will refuse to register any transfer of the shares not made pursuant to an effective registration statement under the Securities Act or

pursuant to an available exemption from the registration requirements of the Securities Act and in accordance with applicable state and provincial securities laws.

(e) acknowledge and agree to Purchaser making a notation on its records or giving instructions to the registrar and transfer agent of Purchaser in order to implement the restrictions on transfer set forth and described herein.

ARTICLE IV. REPRESENTATIONS AND WARRANTIES OF MID-HEAVEN

As a material inducement for Purchaser to enter into this Agreement and to consummate the transactions contemplated hereby, Mid-Heaven makes the following representations and warranties as of the date hereof and as of the Closing Date, each of which is relied upon by Purchaser regardless of any investigation made or information obtained by Purchaser (unless and to the extent specifically and expressly waived in writing by Purchaser on or before the Closing Date):

4.1 Organization and Good Standing.

(a) Mid-Heaven is a corporation duly organized, validly existing and in good standing under the laws of the BVI and all of the subsidiaries of Mid-Haven (the “Subsidiaries”) are duly organized, validly existing and in good standing under the laws of the Peoples Republic China. Each Subsidiary is duly qualified to do business in the People’s Republic of China and is in good standing under the laws of each jurisdiction in which either the ownership or use of the properties owned or used by it, requires such qualification and the failure to be so qualified would have a Material Adverse Effect on Mid-Heaven.

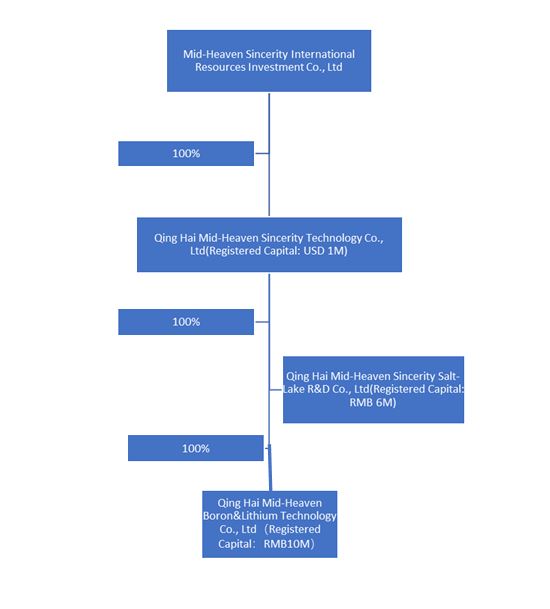

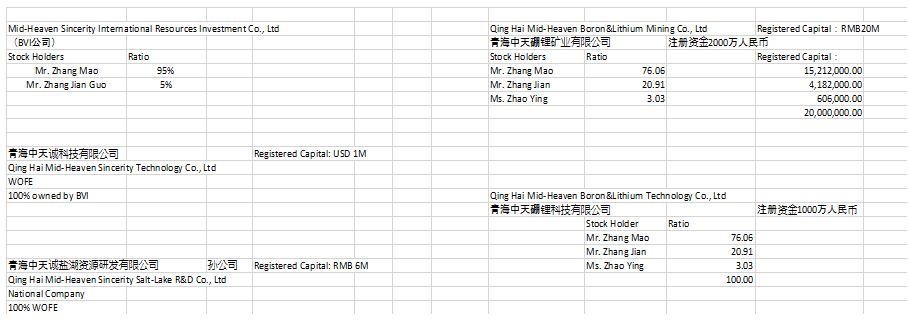

(b) Schedule 4.1 sets forth all of the Subsidiaries and ownership thereof. Mid-Heaven does not presently own or control, directly or indirectly, any interest in any other corporation, partnership, trust, joint venture, association, or other entity other than as set forth therein.

4.2 Corporate Documents. Schedule 2.1 consists of a true and correct copy of a shareholder list setting forth all shareholders of Mid-Heaven.

4.3 Capitalization of Mid-Heaven. The entire authorized capital stock of Mid-Heaven and its Subsidiaries are set forth in Schedule 4.3. All of Mid-Heaven’s and its Subsidiaries issued and outstanding shares, and registered capital, as the case may be have been duly authorized, are validly issued, fully paid and nonassessable, and are held by the Mid-Heaven Shareholders listed on the shareholder list attached as Schedule 2.1 and as set forth for the Subsidiaries as set forth in Schedule 4.3.

4.4 Authorization of Transaction. Mid-Heaven has full power and authority to execute and deliver this Agreement and to perform its obligations hereunder. This Agreement has been duly and validly authorized by all necessary action on the part of Mid-Heaven in accordance with Applicable Laws and Mid-Heaven’s Governing Documents. This Agreement

constitutes the valid and legally binding obligation of Mid-Heaven, enforceable in accordance with its terms and conditions. The Board of Directors of Mid-Heaven (the “Mid-Heaven Board”) has duly and validly authorized the execution and delivery of this Agreement and approved the consummation of the transactions contemplated hereby, and has taken all corporate actions required to be taken by the Mid-Heaven Board for the consummation of the Share Exchange.

4.5 Noncontravention. Neither the execution and delivery of this Agreement, nor consummation of the Share Exchange, by Mid-Heaven will:

(a) violate any Applicable Law, Order, stipulation, charge or other restriction of any Governmental Body to which Mid-Heaven is subject or any provision of its Governing Documents; or

(b) conflict with, result in a Breach of, constitute a default under, result in the acceleration of, create in any Person the right to accelerate, terminate, modify or cancel, or require any notice under any contract, lease, sublease, license, sublicense, franchise, permit, indenture, agreement or mortgage for borrowed money, instrument of indebtedness, Security Interest or other arrangement to which Mid-Heaven is a party or by which it is bound or to which any of its assets is subject (or result in the imposition of any Security Interest upon any of its assets), except where the violation, conflict, Breach, default, acceleration, termination, modification, cancellation, failure to give notice, or Security Interest would not have a Material Adverse Effect on the financial condition of Mid-Heaven or on the ability of the Parties to consummate the Share Exchange.

4.6 Qing Hai Financial Information. Mid-Haven has provided the Purchaser with the following pro forma financial information for Qing Hai Mid-Heaven Boron & Lithium Technology Co., Ltd, its operating subsidiary (“Qing Hai”) (the “Qing Hai Financial Information”):

(a) balance sheets and statements of income, stockholders’ equity and cash flow as of and for the years ended December 31, 2016 (the “December 2016 Balance Sheet” and December 31, 2017 (the “Qing Hai 2017 Balance Sheet” together with the December 2016 Balance Sheet, the “Balance Sheets”)).

4.7 Events Subsequent to Qing Hai Balance Sheet. Since the date of the Qing Hai 2017 Balance Sheet (the “Balance Sheet Date”), there has not been, occurred or arisen, with respect to Mid-Heaven or Qing Hai any of the following except as disclosed in Schedule 4.7:

(a) any change or amendment in its Governing Documents;

(b) any reclassification, split up or other change in, or amendment of or modification to, the rights of the holders of any of its capital stock;

(c) any direct or indirect redemption, purchase or acquisition by any Person of any of its capital stock or of any interest in or right to acquire any such stock;

(d) any issuance, sale, or other disposition of any capital stock, or any grant of any options, warrants, or other rights to purchase or obtain (including upon conversion, exchange, or exercise) any capital stock;

(e) any declaration, set aside, or payment of any dividend or any distribution with respect to its capital stock (whether in cash or in kind) or any redemption, purchase, or other acquisition of any of its capital stock;

(f) the organization of any Subsidiary or the acquisition of any shares of capital stock by any Person or any equity or ownership interest in any business;

(g) any damage, destruction or loss of any of the its properties or assets whether or not covered by insurance;

(h) any material sale, lease, transfer, or assignment of any of its assets, tangible or intangible, other than for a fair consideration in the Ordinary Course of Business;

(i) the execution of, or any other commitment to any agreement, contract, lease, or license (or series of related agreements, contracts, leases, and licenses) outside the Ordinary Course of Business;

(j) any acceleration, termination, modification, or cancellation of any agreement, contract, lease, or license (or series of related agreements, contracts, leases, and licenses) involving more than $10,000 to which it is a party or by which it is bound;

(k) any Security Interest or Encumbrance imposed upon any of its assets, tangible or intangible;

(l) any grant of any license or sublicense of any rights under or with respect to any material Mid-Heaven Intellectual Property;

(m) any sale, assignment or transfer (including transfers to any employees, Affiliates or shareholders) of any material Wing Hai Intellectual Property;

(n) any capital expenditure (or series of related capital expenditures) involving more than $250,000 and outside the Ordinary Course of Business;

(o) any capital investment in, any loan to, or any acquisition of the securities or assets of, any other Person (or series of related capital investments, loans, and acquisitions) involving more than $250,000 and outside the Ordinary Course of Business;

(p) any issuance of any note, bond, or other debt security or created, incurred, assumed, or guaranteed any indebtedness for borrowed money or capitalized lease obligation involving more than $250,000;

(q) any delay or postponement of the payment of accounts payable or other liabilities, other than those being contested in good faith;

(r) any cancellation, compromise, waiver, or release of any right or claim (or series of related rights and claims) involving more than $25,000 and outside the Ordinary Course of Business;

(s) any loan to, or any entrance into any other transaction with, any of its directors, officers, and employees;

(t) the adoption, amendment, modification, or termination of any bonus, profit-sharing, incentive, severance, or other plan, contract, or commitment for the benefit of any of its directors, officers, and employees (or taken away any such action with respect to any other Employee Benefit Plan);

(u) any employment contract or collective bargaining agreement, written or oral, or modified the terms of any existing such contract or agreement;

(v) any increase in the base compensation of any of its directors, officers, and employees that is greater than Twenty-Five Thousand Dollars ($25,000) per annum;

(w) any charitable or other capital contribution in excess of $2,500;

(x) any taking of other action or entrance into any other transaction other than in the Ordinary Course of Business, or entrance into any transaction with any insider of Mid-Heaven, except as disclosed in this Agreement and the Disclosure Schedules;

(y) any other event or occurrence that may have or could reasonably be expected to have a Material Adverse Effect on Mid-Heaven; or

(z) any agreement or commitment, whether in writing or otherwise, to do any of the foregoing.

4.8 Tax Matters.

(a) Mid-Heaven and each of its Subsidiaries:

(i) have timely paid or caused to be paid all material Taxes required to be paid by it or them though the date hereof and as of the Closing Date (including any Taxes shown due on any Tax Return);

(ii) have filed or caused to be filed in a timely and proper manner (within any applicable extension periods) all Tax Returns required to be filed by it or them with the appropriate Governmental Body in all jurisdictions in which such Tax Returns are required to be filed; and all tax returns filed on behalf of Mid-Heaven and each of its Subsidiaries were complete and correct in all material respects; and

(iii) have not requested or caused to be requested any extension of time within which to file any Tax Return, which Tax Return has not since been filed.

(b)

(i) have not been notified by any Governmental Body that any material issues have been raised (and no such issues are currently pending) by any Governmental Body in connection with any Tax Return filed by or on behalf of Mid-Heaven; there are no pending Tax audits and no waivers of statutes of limitations have been given or requested with respect to Mid-Heaven or the Subsidiaries; no Tax liens have been filed against Mid-Heaven or the Subsidiaries or unresolved deficiencies or additions to Taxes have been proposed, asserted or assessed against Mid-Heaven.

(ii) Full and adequate accrual has been made (A) on the Qing Hai Balance Sheet, and the books and records of Qing Hai for all income taxes currently due and all accrued Taxes not yet due and payable by Mid-Heaven for all periods ending on or prior to the Balance Sheet Date, and (B) on the books and records of Qing Hai for all Taxes payable by Qing Hai for all periods beginning after the Balance Sheet Date.

(iii) Mid-Heaven and each of its Subsidiaries has not incurred any liability for Taxes from and after the Balance Sheet Date other than Taxes incurred in the Ordinary Course of Business and consistent with past practices.

(ii) Mid-Heaven and each of its Subsidiaries has complied in all material respects with all Applicable Laws relating to the collection or withholding of Taxes (such as Taxes or withholding of Taxes from the wages of employees).

(iii) Mid-Heaven and each of its Subsidiaries does not have any liability in respect of any Tax sharing agreement with any Person.

(iv) Mid-Heaven and each of its Subsidiaries has not incurred any liability to make any payments either alone or in conjunction with any other payments that would constitute a “parachute payment” within the meaning of Section 280G of the Code (or any corresponding provision of state local or foreign Applicable Law related to Taxes).

(v) No claim has been made within the last three years by any taxing authority in a jurisdiction in which Mid-Heaven or each of its Subsidiaries does not file Tax Returns that Mid-Heaven or each of its Subsidiaries is or may be subject to taxation by that jurisdiction.

(vi) The consummation of the Share Exchange will not trigger the realization or recognition of intercompany gain or income to Mid-Heaven or any Mid-Heaven Tax Affiliate under the Federal consolidated return regulations with respect to Federal, state or local taxes.

(vii) Mid-Heaven is not currently, nor has it been at any time during the

previous five years, a “U.S. real property holding corporation” and, therefore, the Shares are not “U.S. real property interests,” as such terms are defined in Section 897 of the Code.

4.9 Title to Assets. Mid-Heaven and each of its Subsidiaries have good and marketable title to, or a valid leasehold interest in, the properties and assets owned or leased and used by it or them to operate the Business in the manner presently operated , as reflected in the Qing Hai Financial Information.

4.10 Leased Real Property. Mid-Heaven and Subsidiaries have provided Purchaser with a complete and accurate list of all leasehold interests and all rights to use any Real Property.

4.11 Condition of Facilities.

(a) Use of the Real Property of Mid-Heaven and its Subsidiaries for the various purposes for which they are presently being used is permitted as of right under all Applicable Laws related to zoning and is not subject to “permitted nonconforming” use or structure classifications. All Improvements are in compliance with all Applicable Laws, including those pertaining to zoning, building and the disabled, are in good repair and in good condition, ordinary wear and tear excepted, and are free from latent and patent defects. No part of any Improvement encroaches on any real property not included in the Real Property of Mid-Heaven or any of its Subsidiaries and there are no buildings, structures, fixtures or other Improvements primarily situated on adjoining property which encroach on any part of the Land.

(b) Each item of Tangible Personal Property is in good repair and good operating condition, ordinary wear and tear excepted, is suitable for immediate use in the Ordinary Course of Business and is free from latent and patent defects. No item of Tangible Personal Property is in need of repair or replacement other than as part of routine maintenance in the Ordinary Course of Business. All Tangible Personal Property used in the Business is in the possession of Mid-Heaven and/or each of its Subsidiaries.

4.12 Mid-Heaven Intellectual Property.

(a) Mid-Heaven and each of its Subsidiaries own, or license or otherwise possess legal enforceable rights to use all: (i) trademarks and service marks (registered or unregistered), trade dress, trade names and other names and slogans embodying business goodwill or indications of origin, all applications or registrations in any jurisdiction pertaining to the foregoing and all goodwill associated therewith; (ii) material patentable inventions, technology, computer programs and software (including password unprotected interpretive code or source code, object code, development documentation, programming tools, drawings, specifications and data) and all applications and patents in any jurisdiction pertaining to the foregoing, including re-issues, continuations, divisions, continuations-in-part, renewals or extensions; (iii) trade secrets, including confidential and other non-public information (iv) copyrights in writings, designs, software programs, mask works or other works, applications or registrations in any jurisdiction for the foregoing and all moral rights related thereto; (v) databases and all database rights; and (vi) Internet web sites, domain names and applications and registrations pertaining thereto (collectively, “Mid-Heaven Intellectual Property”) that are

used in the Business except for any such failures to own, be licensed or possess that would not be reasonably likely to have a Material Adverse Effect.

(b) Except as may be evidenced by patents issued after the date hereof, there are no conflicts with or infringements of any material Mid-Heaven Intellectual Property by any third party and the conduct of the Business as currently conducted does not conflict with or infringe any proprietary right of a third party.

(c) Mid-Heaven owns or has the right to use all software currently used in and material to the Business.

4.13 Affiliate Transactions. No officer, director or employee of Mid-Heaven or any of its Subsidiaries or any member of the immediate family of any such officer, director or employee, or any entity in which any of such persons owns any beneficial interest (other than any publicly held corporation whose stock is traded on a national securities exchange or in the over-the-counter market and less than one percent of the stock of which is beneficially owned by any of such persons), has any agreement with Mid-Heaven or any Subsidiary or any interest in any of their property of any nature, used in or pertaining to the Business (other than the ownership of capital stock of the corporation as disclosed in Section 4.3). None of the foregoing Persons has any direct or indirect interest in any competitor, supplier or customer of Mid-Heaven or in any Person from whom or to whom Mid-Heaven leases any property or transacts business of any nature.

4.14 Powers of Attorney. There are no outstanding powers of attorney executed on behalf of Mid-Heaven or any of its Subsidiaries.

4.15 Litigation.

(a) There is no pending or, to the Knowledge of Mid-Heaven, threatened Proceeding:

(i) by or against Mid-Heaven or its Subsidiaries or that otherwise relates to or may affect the Business that, if adversely determined, would have a Material Adverse Effect; or

(ii) that challenges, or that may have the effect of preventing, delaying, making illegal or otherwise interfering with, the Share Exchange.

(iii) to the Knowledge of Mid-Heaven, no event has occurred or circumstance exists that is reasonably likely to give rise to or serve as a basis for the commencement of any such Proceeding. Mid-Heaven has delivered to Purchaser copies, if any, of all pleadings, correspondence and other documents relating to each Proceeding.

(b) To the Knowledge of Mid-Heaven:

(i) there is no material Order to which Mid-Heaven or the Business is

subject; and

(ii) no officer, director, agent or employee of Mid-Heaven or any Subsidiary is subject to any Order that prohibits such officer, director, agent or employee from engaging in or continuing any conduct, activity or practice relating to the Business.

(c) Mid-Heaven and each of its Subsidiaries has been and is in compliance with all of the terms and requirements of each Order to which it or the Business is or has been subject;

(d) No event has occurred or circumstance exists that is reasonably likely to constitute or result in (with or without notice or lapse of time) a violation of or failure to comply with any term or requirement of any Order to which Mid-Heaven, each of its Subsidiaries or the Business is subject; and

(e) Neither Mid-Heaven nor any Subsidiary have received any notice or other communication (whether oral or written) from any Governmental Body or any other Person regarding any actual, alleged, possible or potential violation of, or failure to comply with, any term or requirement of any Order to which Mid-Heaven or the Business is subject.

4.16 Employee Benefits.

(a) Mid-Haven has delivered to Purchaser all material (i) Employee Benefit Plans of Mid-Heaven and Subsidiaries, (ii) bonus, stock option, stock purchase, stock appreciation right, incentive, deferred compensation, supplemental retirement, severance, and fringe benefit plans, programs, policies or arrangements, and (iii) employment or consulting agreements, for the benefit of, or relating to, any current or former employee (or any beneficiary thereof) of Mid-Heaven and each Subsidiary, in the case of a plan described in (i) or (ii) above, that is currently maintained by Mid-Heaven or any Subsidiary or with respect to which Mid-Heaven or any Subsidiary has an obligation to contribute, and in the case of an agreement described in (iii) above, that is currently in effect (the “Mid-Heaven Employee Plans”).

(b) There is no Proceeding pending or, to Mid-Heaven’s knowledge, threatened against the assets of any Mid-Heaven Employee Plan or, with respect to any Mid-Heaven Employee Plan, against Mid-Heaven, other than Proceedings that would not reasonably be expected to result in a Material Adverse Effect, and to Mid-Heaven’s Knowledge there is no Proceeding pending or threatened in writing against any fiduciary of any Mid-Heaven Employee Plan other than Proceedings that would not reasonably be expected to result in a Material Adverse Effect.

(c) Each of the Mid-Heaven Employee Plans has been operated and administered in all material respects in accordance with its terms and applicable law.

(d) No director, officer, or employee of Mid-Heaven will become entitled to retirement, severance or similar benefits or to enhanced or accelerated benefits (including any acceleration of vesting or lapsing of restrictions with respect to equity-based awards) under any

Mid-Heaven Employee Plan solely as a result of consummation of the Share Exchange.

4.17 Insurance. Mid-Heaven has delivered to Purchaser an accurate and complete description of all policies of insurance of any kind or nature, including, but not limited to, fire, liability, workmen’s compensation and other forms of insurance owned or held by or covering Mid-Heaven and each Subsidiary or all or any portion of their respective property and assets.

4.18 Employees. To the Knowledge of Mid-Heaven, no officer, director, agent, employee, consultant or contractor of Mid-Heaven or any Subsidiary is bound by any Contract that purports to limit the ability of such officer, director, agent, employee, consultant or contractor (i) to engage in or continue or perform any conduct, activity, duties or practice relating to the Business or (ii) to assign to Mid-Heaven or to any other Person any rights to any invention, improvement, or discovery. No former or current employee of Mid-Heaven is a party to, or is otherwise bound by, any Contract that in any way adversely affected, affects, or will affect the ability of Mid-Heaven or Purchaser to conduct the Business as heretofore carried on by Mid-Heaven and it Subsidiaries.

4.19 Labor Relations. Neither Mid-Heaven nor any Subsidiary are a party to any collective bargaining or similar agreement other than as all workers receive in the Peoples Republic of China. To the Knowledge of Mid-Heaven, there are no strikes, work stoppages, unfair labor practice charges or grievances pending or threatened against Mid-Heaven or any Subsidiary by any employee of Mid-Heaven or any other Person or entity.

4.20 Legal Compliance. To the Knowledge of Mid-Heaven, Mid-Heaven and each Subsidiary are in material compliance with all Applicable Laws (including rules and regulations thereunder) of any Governmental Bodies having jurisdiction over Mid-Heaven and each Subsidiary, including any requirements relating to antitrust, consumer protection, currency exchange, equal opportunity, health, occupational safety, pension and securities matters.

4.21 Brokers’ Fees. Mid-Heaven has no liability or obligation to pay any fees or commissions to any broker, finder or agent with respect to the Share Exchange for which Mid-Heaven could become liable or obligated.

4.22 Undisclosed Liabilities. To the Knowledge of Mid-Heaven, Mid-Heaven and the Subsidiaries do not have any liability (and to the Knowledge of Mid-Heaven, there is no basis for any present or future Proceeding, charge, complaint, claim, or demand against any of them giving rise to any liability), except for

(a) liabilities reflected or reserved against in the Qing Hai Balance Sheet;

(b) liabilities which have arisen in the Ordinary Course of Business since the date of the Qing Hai Balance Sheet; or

(c) as otherwise disclosed to Purchaser.

4.23 Disclosure. The representations and warranties of Mid-Heaven contained in this

Agreement do not contain any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements and information contained herein not misleading.

ARTICLE V. REPRESENTATIONS AND WARRANTIES OF PURCHASER

As a material inducement for Mid-Heaven to enter into this Agreement and to consummate the transactions contemplated hereby, Purchaser hereby makes the following representations and warranties as of the date hereof and as of the Closing Date, each of which is relied upon by Mid-Heaven regardless of any investigation made or information obtained by Mid-Heaven (unless and to the extent specifically and expressly waived in writing by Mid-Heaven on or before the Closing Date):

5.1 Representations of Purchaser Concerning the Transaction.

(a) Organization and Good Standing.

(i) Purchaser is a corporation duly organized, validly existing and in good standing under the laws of State of Nevada. Purchaser is duly qualified to do business as a foreign corporation and is in good standing under the laws of each state or other jurisdiction in which either the ownership or use of the properties owned or used by it, or the nature of the activities conducted by it, requires such qualification and the failure to be so qualified would have a Material Adverse Effect on Purchaser.

(ii) Each subsidiary of the Purchaser is a corporation duly organized, validly existing and in good standing under the laws of State of Nevada. Each such subsidiary is duly qualified to do business as a foreign corporation and is in good standing under the laws of each state or other jurisdiction in which either the ownership or use of the properties owned or used by it, or the nature of the activities conducted by it, requires such qualification and the failure to be so qualified would have a Material Adverse Effect on Purchaser.

(b) Authorization of Transaction. Purchaser has the corporate power to execute, deliver and perform this Agreement, the Related Agreements, and, subject to the satisfaction of the conditions precedent set forth herein, has taken all action required by law, its Governing Documents or otherwise, to authorize the execution and delivery of this Agreement and such related documents. The execution and delivery of this Agreement has been approved by the Board of Directors of Purchaser. This Agreement is a valid obligation of Purchaser and is legally binding in accordance with its terms.

(c) Capitalization of Purchaser. The entire authorized capital stock of Purchaser consists of 75,000,000 shares of common stock having a par value of $.001 per share, of which 75,000,000 shares are issued and outstanding. All issued and outstanding shares of Purchaser Common Stock have been duly authorized, are validly issued, fully paid and nonassessable. There are no outstanding or authorized options, warrants, rights, contracts, calls, puts, rights to subscribe, conversion rights or other agreements or commitments to which Purchaser is a party or which are binding upon Purchaser providing for the issuance, disposition or acquisition of any of its capital stock, nor any outstanding or authorized stock appreciation,

phantom stock or similar rights with respect to Purchaser.

(d) Noncontravention. Neither the execution and delivery of this Agreement, nor consummation of the Share Exchange, will:

(i) violate any Applicable Law, Order, stipulation, charge or other restriction of any Governmental Body to which Purchaser is subject or any provision of its Governing Documents; or

(ii) conflict with, result in a Breach of, constitute a default under, result in the acceleration of, create in any Person the right to accelerate, terminate, modify or cancel, or require any notice under any contract, lease, sublease, license, sublicense, franchise, permit, indenture, agreement or mortgage for borrowed money, instrument of indebtedness, Security Interest, or other arrangement to which Purchaser is a party or by which it is bound or to which any of its assets is subject (or result in the imposition of any Security Interest upon any of its assets), except where the violation, conflict, Breach, default, acceleration, termination, modification, cancellation, failure to give notice, or Security Interest would not have a Material Adverse Effect on the financial condition of Purchaser or on the ability of the Parties to consummate the Share Exchange.

(e) Affiliate Transactions. No officer, director or employee of Purchaser or any member of the immediate family of any such officer, director or employee, or any entity in which any of such persons owns any beneficial interest (other than any publicly-held corporation whose stock is traded on a national securities exchange or in the over-the-counter market and less than one percent of the stock of which is beneficially owned by any of such Persons), has any agreement with Purchaser or any interest in any of their property of any nature, used in or pertaining to the Purchaser Business. None of the foregoing Persons has any direct or indirect interest in any competitor, supplier or customer of Purchaser or in any Person from whom or to whom Purchaser leases any property or transacts business of any nature.

(f) Purchaser Financial Information. The Purchaser’s Financial Information is set forth in its reports with the Securities and Exchange Commission (collectively, the “Purchaser Financial Information”):

(i) audited balance sheet and statements of income, changes in stockholders’ equity and cash flow as of and for the fiscal years ended December 31, 20116 and December 31, 2017, for Purchaser and unaudited quarterly balance sheets for the years ended 2016, 2017 and 2018; and

The audited balance sheet dated as of December 31, 2017, of Purchaser shall be referred to as the “Purchaser Balance Sheet.” Purchaser Financial Information presents fairly the financial condition of Purchaser as of such dates and the results of operations of Purchaser for such periods, in accordance with GAAP and are consistent with the books and records of Purchaser (which books and records are correct and complete).

(g) Events Subsequent to Purchaser Balance Sheet. Since the date of the

Purchaser Balance Sheet, there has not been, except as disclosed in its reports with the Securities and Exchange Commission occurred or arisen, with respect to Purchaser:

(i) any change or amendment in its Governing Documents,;

(ii) any reclassification, split-up or other change in, or amendment of or modification to, the rights of the holders of any of its capital stock,;

(iii) any direct or indirect redemption, purchase or acquisition by any Person of any of its capital stock or of any interest in or right to acquire any such stock;

(iii) any issuance, sale, or other disposition of any capital stock, or any grant of any options, warrants, or other rights to purchase or obtain (including upon conversion, exchange, or exercise) any capital stock;

(iv) any declaration, set aside, or payment of any dividend or any distribution with respect to its capital stock (whether in cash or in kind) or any redemption, purchase, or other acquisition of any of its capital stock;

(v) the organization of any Subsidiary or the acquisition of any shares of capital stock by any Person or any equity or ownership interest in any business, other than the organization of a wholly owned Subsidiary for the express purpose of effecting the name change of the Purchaser through a parent-Subsidiary merger under the NRS;

(vi) any damage, destruction or loss of any of its properties or assets whether or not covered by insurance;

(vii) any sale, lease, transfer or assignment of any of its assets, tangible or intangible, other than for a fair consideration in the Ordinary Course of Business;

(viii) the execution of, or any other commitment to any agreement, contract, lease, or license (or series of related agreements, contracts, leases, and licenses) outside the Ordinary Course of Business;

(ix) any acceleration, termination, modification, or cancellation of any agreement, contract, lease or license (or series of related agreements, contracts, leases, and licenses) involving more than $10,000 to which it is a party or by which it is bound;

(x) any Security Interest or Encumbrance imposed upon any of its assets, tangible or intangible;

(xi) any grant of any license or sublicense of any rights under or with respect to any Purchaser Intellectual Property;

(xii) any sale, assignment or transfer (including transfers to any employees, affiliates or shareholders) of any Purchaser Intellectual Property;

(xiii) any capital expenditure (or series of related capital expenditures) involving more than $10,000 and outside the Ordinary Course of Business;

(xiv) any capital investment in, any loan to, or any acquisition of the securities or assets of, any other Person (or series of related capital investments, loans and acquisitions) involving more than $10,000 and outside the Ordinary Course of Business;

(xv) any issuance of any note, bond or other debt security, or created, incurred, assumed, or guaranteed any indebtedness for borrowed money or capitalized lease obligation involving more than $25,000;

(xvi) any delay or postponement of the payment of accounts payable or other liabilities;

(xvii) any cancellation, compromise, waiver or release of any right or claim (or series of related rights and claims) involving more than $25,000 and outside the Ordinary Course of Business;

(xviii) any loan to, or any entrance into any other transaction with, any of its directors, officers and employees either involving more than $500 individually or $2,500 in the aggregate;

(xix) the adoption, amendment, modification or termination of any bonus, profit-sharing, incentive, severance, or other plan, contract or commitment for the benefit of any of its directors, officers and employees (or taken away any such action with respect to any other Employee Benefit Plan);

(xx) any employment contract or collective bargaining agreement, written or oral, or modified the terms of any existing such contract or agreement;

(xxi) any increase in the base compensation of any of its directors, officers and employees;

(xxii) any charitable or other capital contribution in excess of $2,500;

(xxiii) any taking of other action or entrance into any other transaction other than in the Ordinary Course of Business, or entrance into any transaction with any insider of Purchaser, except as disclosed in this Agreement and the Disclosure Schedules;

(xxiv) any other event or occurrence that may have or could reasonably be expected to have an Material Adverse Effect on Purchaser (whether or not similar to any of the foregoing); or

(xxv) any agreement or commitment, whether in writing or otherwise, to do any of the foregoing.

(h) Tax Matters.

(i) Purchaser:

(A) has timely paid or caused to be paid all Taxes required to be paid by it though the date hereof and as of the Closing Date (including any Taxes shown due on any Tax Return);

(B) has filed or caused to be filed in a timely and proper manner (within any applicable extension periods) all Tax Returns required to be filed by it with the appropriate Governmental Body in all jurisdictions in which such Tax Returns are required to be filed; and all tax returns filed on behalf of Purchaser and each Purchaser Tax Affiliate were completed and correct in all material respects; and

(C) has not requested or caused to be requested any extension of time within which to file any Tax Return, which Tax Return has not since been filed.

(ii) Purchaser has previously delivered true, correct and complete copies of all Federal Tax Returns filed by or on behalf of Purchaser through the date hereof for the periods ending after December 31, 2017.

(iii)

(A) Purchaser has not been notified by the IRS or any other Governmental Body that any issues have been raised (and no such issues are currently pending) by the IRS or any other Governmental Body in connection with any Tax Return filed by or on behalf of Purchaser or any Purchaser Tax Affiliate; there are no pending Tax audits and no waivers of statutes of limitations have been given or requested with respect to Purchaser or any Purchaser Tax Affiliate (for years that it was a Purchaser Tax Affiliate); no Tax liens have been filed against Purchaser or unresolved deficiencies or additions to Taxes have been proposed, asserted or assessed against Purchaser or any Purchaser Tax Affiliate (for the years that it was a Purchaser Tax Affiliate).

(B) Full and adequate accrual has been made (i) on the Purchaser Balance Sheet, and the books and records of Purchaser for all income Taxes currently due and all accrued Taxes not yet due and payable by Purchaser for all periods ending on or prior to the Purchaser Balance Sheet Date, and (ii) on the books and records of Purchaser and for all Taxes payable by Purchaser for all periods beginning after the Purchaser Balance Sheet Date.

(C) Purchaser has not incurred any liability for Taxes from and after the Purchaser Balance Sheet Date other than Taxes incurred in the Ordinary Course of Business and consistent with past practices.

(D) Purchaser has not (i) made an election (or had an election made on its behalf by another person) to be treated as a “consenting corporation” under Section 341(f)

of the Code or (ii) a “personal holding company” within the meaning of Section 542 of the Code.

(E) Purchaser has complied in all material respects with all Applicable Laws relating to the collection or withholding of Taxes (such as Taxes or withholding of Taxes from the wages of employees).

(F) Purchaser has no liability in respect of any Tax sharing agreement with any Person and all Tax sharing agreements to which Purchaser has been bound have been terminated.

(G) Purchaser has not incurred any Liability to make any payments either alone or in conjunction with any other payments that:

(1) shall be non-deductible under, or would otherwise constitute a “parachute payment” within the meaning of Section 280G of the Code (or any corresponding provision of state local or foreign income Tax Law); or

(2) are or may be subject to the imposition of an excise Tax under Section 4999 of the Code.

(H) Purchaser has not agreed to (nor has any other Person agreed to on its behalf) and is not required to make any adjustments or changes on, before or after the Closing Date, to its accounting methods pursuant to Section 481 of the Code, and the Internal Revenue Service has not proposed any such adjustments or changes in the accounting methods of Purchaser.

(I) No claim has been made within the last three years by any taxing authority in a jurisdiction in which Purchaser does not file Tax Returns that Purchaser is or may be subject to taxation by that jurisdiction.

(J) The consummation of the Share Exchange will not trigger the realization or recognition of intercompany gain or income to Purchaser under the Federal consolidated return regulations with respect to Federal, state or local Taxes.

(K) Purchaser is not currently, nor has it been at any time during the previous five years, a “U.S. real property holding corporation” and, therefore, the Purchaser Common Stock is not “U.S. real property interests,” as such terms are defined in Section 897 of the Code.

(i) Title to Assets. Purchaser has good and marketable title to, or a valid leasehold interest in, the properties and assets owned or leased and used by it to operate the Purchaser Business in the manner presently operated by Purchaser, as reflected in Purchaser Financial Information.

(j) Real Property. Purchaser does not own or hold an ownership interest in any Real Property.

(k) Leased Real Property. Except as set forth in its reports with the Securities and Exchange Commission, Purchaser does not own or a leasehold interest in any Real Property.

(l) Condition of Facilities.

(i) Use of the Real Property of Purchaser for the various purposes for which it is presently being used is permitted as of right under all Applicable Laws related to zoning and is not subject to “permitted nonconforming” use or structure classifications. All Improvements are in compliance with all Applicable Laws, including those pertaining to zoning, building and the disabled, are in good repair and in good condition, ordinary wear and tear excepted, and are free from latent and patent defects. To the Knowledge of Purchaser, no part of any Improvement encroaches on any real property not included in the Real Property of Purchaser, and there are no buildings, structures, fixtures or other Improvements primarily situated on adjoining property which encroach on any part of the Land.

(ii) Each item of Tangible Personal Property is in good repair and good operating condition, ordinary wear and tear excepted, is suitable for immediate use in the Ordinary Course of Business and is free from latent and patent defects. No item of Tangible Personal Property is in need of repair or replacement other than as part of routine maintenance in the Ordinary Course of Business. All Tangible Personal Property used in the Purchaser Business is in the possession of Purchaser.

(m) Purchaser Intellectual Property.

(i) Purchaser owns, or is licensed or otherwise possesses legal enforceable rights to use all: (i) trademarks and service marks (registered or unregistered), trade dress, trade names and other names and slogans embodying business goodwill or indications of origin, all applications or registrations in any jurisdiction pertaining to the foregoing and all goodwill associated therewith; (ii) patentable inventions, technology, computer programs and software (including password unprotected interpretive code or source code, object code, development documentation, programming tools, drawings, specifications and data) and all applications and patents in any jurisdiction pertaining to the foregoing, including re-issues, continuations, divisions, continuations-in-part, renewals or extensions; (iii) trade secrets, including confidential and other non-public information (iv) copyrights in writings, designs, software programs, mask works or other works, applications or registrations in any jurisdiction for the foregoing and all moral rights related thereto; (v) databases and all database rights; and (vi) Internet Web sites, domain names and applications and registrations pertaining thereto (collectively, “Purchaser Intellectual Property”) that are used in the Purchaser Business except for any such failures to own, be licensed or possess that would not be reasonably likely to have a Material Adverse Effect.

(ii) Purchaser owns or has the right to use all software currently used in and material to the Purchaser Business.

(n) SEC Reports and Financial Statements. Since inception, Purchaser has

filed with the SEC all reports and other filings required to be filed by Purchaser in accordance with the Securities Act and the Exchange Act and the rules and regulations promulgated thereunder (the “Purchaser SEC Reports”). As of their respective dates, Purchaser SEC Reports complied in all material respects with the applicable requirements of the Securities Act, the Exchange Act and the respective rules and regulations promulgated thereunder applicable to such Purchaser SEC Reports and, except to the extent that information contained in any Purchaser SEC Report has been revised or superseded by a later Purchaser SEC Report filed and publicly available prior to the date of this Agreement, none of the Purchaser SEC Reports contained any untrue statement of a material fact or omitted to state any material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading. The financial statements of Purchaser included in Purchaser SEC Reports were prepared from and are in accordance with the accounting books and other financial records of Purchaser, were prepared in accordance with GAAP (except, in the case of unaudited statements, as permitted by the rules of the SEC) applied on a consistent basis during the periods involved (except as may be indicated in the notes thereto) and presented fairly the consolidated financial position of Purchaser and its consolidated subsidiaries as of the dates thereof and the consolidated results of their operations and cash flows for the periods then ended (subject, in the case of unaudited statements, to normal year-end audit adjustments). Except as set forth in the Purchaser SEC Reports, Purchaser has no liabilities or obligations of any nature (whether accrued, absolute, contingent or otherwise) other than liabilities or obligations incurred in the Ordinary Course of Business. The Purchaser SEC Reports accurately disclose (i) the terms and provisions of all stock option plans, (ii) transactions with Affiliates, and (iii) all material contracts required to be disclosed pursuant to Item 601(b)(10) of Regulation S-K promulgated by the SEC.

(o) Contracts. The SEC Reports contain is a true, complete and accurate list of all written or oral contracts, understandings, agreements and other arrangements (including a brief description of all such oral arrangements) executed by an officer or duly authorized employee of Purchaser or to which Purchaser is a party either:

(i) involving more than $10,000, or

(ii) in the nature of a collective bargaining agreement, employment agreement, or severance agreement with any of its directors, officers and employees.

Purchaser has delivered or will, prior to Closing, deliver to Mid-Heaven a correct and complete copy of each Contract (redacted copies for names are acceptable) listed in Schedule 5.1(o) (the “Purchaser Contracts”). Except as disclosed in Schedule 5.1(o): (i) Purchaser has fully complied with all material terms of Purchaser Contracts; (ii) to the Knowledge of Purchaser, other parties to Purchaser Contracts have fully complied with the terms of Purchaser Contracts; and (iii) there are no disputes or complaints with respect to nor has Purchaser received any notices (whether oral or in writing) that any other party to Purchaser Contracts is terminating, intends to terminate or is considering terminating, any of Purchaser Contracts listed or required to be listed in Schedule 5.1(o).

(p) Powers of Attorney. There are no outstanding powers of attorney executed

on behalf of Purchaser.

(q) Litigation.

(i) There is no pending or, to Purchaser’s Knowledge, threatened Proceeding:

(A) by or against Purchaser or that otherwise relates to or may affect the Purchaser Business which, if adversely determined, would have a Material Adverse Effect; or

(B) that challenges, or that may have the effect of preventing, delaying, making illegal or otherwise interfering with, the Share Exchange.

To the Knowledge of Purchaser, no event has occurred or circumstance exists that is reasonably likely to give rise to or serve as a basis for the commencement of any such Proceeding.

(ii)

(A) there is no material Order to which Purchaser or the Purchaser Business is subject; and

(B) to the Knowledge of Purchaser, no officer, director, agent or employee of Purchaser is subject to any Order that prohibits such officer, director, agent or employee from engaging in or continuing any conduct, activity or practice relating to the Purchaser Business.

(iii)

(A) Purchaser has been and is in compliance with all of the terms and requirements of each Order to which it or the Purchaser Business is or has been subject;

(B) No event has occurred or circumstance exists that is reasonably likely to constitute or result in (with or without notice or lapse of time) a violation of or failure to comply with any term or requirement of any Order to which Purchaser or the Purchaser Business is subject; and

(C) Purchaser has not received any notice, or received but subsequently resolved to the satisfaction of the Governmental Body or other Person whether oral or written) from any Governmental Body or any other Person regarding any actual, alleged, possible or potential violation of, or failure to comply with, any term or requirement of any Order to which Purchaser or the Purchaser Business is subject.

(r) Employee Benefits.

(i) Purchaser has no (A) Employee Benefit Plans, (B) bonus, stock option, stock purchase, stock appreciation right, incentive, deferred compensation, supplemental retirement, severance, and fringe benefit plans, programs, policies or arrangements, and (C) employment or consulting agreements, for the benefit of, or relating to, any current or former employee (or any beneficiary thereof) of Purchaser, in the case of a plan described in (A) or (B) above, that is currently maintained by Purchaser or with respect to which Purchaser has an obligation to contribute, and in the case of an agreement described in (C) above, that is currently in effect (the “Purchaser Employee Plans”).

(ii) No director, officer, or employee of Purchaser will become entitled to retirement, severance or similar benefits or to enhanced or accelerated benefits (including any acceleration of vesting or lapsing of restrictions with respect to equity-based awards) under any Purchaser Employee Plan solely as a result of consummation of the Share Exchange.

(s) Insurance. Purchaser has provided an accurate and complete description of all policies of insurance of any kind or nature, including, but not limited to, fire, liability, workmen’s compensation and other forms of insurance owned or held by or covering Purchaser or all or any portion of its property and assets.

(t) Employees. To the Knowledge of Purchaser, no officer, director, agent, employee, consultant or contractor of Purchaser is bound by any Contract that purports to limit the ability of such officer, director, agent, employee, consultant or contractor (i) to engage in or continue or perform any conduct, activity, duties or practice relating to the Purchaser Business or (ii) to assign to Purchaser or to any other Person any rights to any invention, improvement or discovery. No former or current employee of Purchaser is a party to, or is otherwise bound by, any Contract that in any way adversely affected, affects, or will affect the ability of Purchaser to conduct the Purchaser Business.

(u) Labor Relations. Purchaser is not a party to any collective bargaining or similar agreement. To the Knowledge of Purchaser, there are no strikes, work stoppages, unfair labor practice charges or grievances pending or threatened against Purchaser by any employee of Purchaser or any other person or entity.

(v) Legal Compliance. To the Knowledge of Purchaser, Purchaser is in material compliance with all Applicable Laws of any Governmental Bodies having jurisdiction over Purchaser, including any requirements relating to antitrust, consumer protection, currency exchange, equal opportunity, health, occupational safety, pension and securities matters.

(w) Brokers’ Fees. Purchaser has no liability or obligation to pay any fees or commissions to any broker, finder or agent with respect to the Share Exchange for which Purchaser could become liable or obligated.

(x) Undisclosed Liabilities. Purchaser has no liability (and to the Knowledge of Purchaser, there is no basis for any present or future Proceeding, charge, complaint, claim or demand against any of them giving rise to any liability), except for:

(i) liabilities reflected or reserved against in the Purchaser Balance Sheet; or

(ii) liabilities which have arisen in the Ordinary Course of Business since the date of the Purchaser Balance Sheet.

(y) Disclosure. The representations and warranties of Purchaser contained in this Agreement do not contain any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements and information contained herein not misleading.

ARTICLE VI. ACCESS TO INFORMATION AND DOCUMENTS

6.1 Access to Information. Between the date hereof and the Closing Date, each Party will give to the other and its counsel, accountants and other Representatives full access to all the properties, documents, contracts, personnel files and other records and shall furnish copies of such documents and with such information with respect to its affairs as may from time to time be reasonably requested. Each Party will disclose to the other and make available to such Party and its Representatives all books, contracts, accounts, personnel records, letters of intent, papers, records, communications with regulatory authorities and other documents relating to the business and operations of Mid-Heaven or Purchaser, as the case may be. In addition, Mid-Heaven shall make available to Purchaser all such banking, investment and financial information as shall be necessary to allow for the efficient integration of Mid-Heaven’s banking, investment and financial arrangements with those of Purchaser at the Closing. Access of Purchaser pursuant to the foregoing shall be granted at a reasonable time and upon reasonable notice.

6.2 Effect of Access.

(a) Nothing contained in this Article VI shall be deemed to create any duty or responsibility on the part of either Party to investigate or evaluate the value, validity or enforceability of any Contract or other asset included in the assets of the other Party.

(b) With respect to matters as to which any Party has made express representations or warranties herein, the Parties shall be entitled to rely upon such express representations and warranties irrespective of any investigations made by such Parties, except to the extent that such investigations result in actual knowledge of the inaccuracy or falsehood of particular representations and warranties.

ARTICLE VII. COVENANTS

7.1 Preservation of Business.

(a) Prior to the Closing or the termination of this Agreement, Mid-Heaven will use its Best Efforts to preserve the Business, to keep available to Purchaser the services of