EX-10.2 6 d235923dex102.htm SECOND MORTGAGE LOAN AGREEMENT SECOND MORTGAGE LOAN AGREEMENT Dated as of March 1, 2011 among HRHH HOTEL/CASINO, LLC, a Delaware limited liability company, HRHH CAFE, LLC, a Delaware limited liability company, HRHH...

Exhibit 10.2

SECOND MORTGAGE LOAN AGREEMENT

Dated as of March 1, 2011

among

HRHH HOTEL/CASINO, LLC,

a Delaware limited liability company,

HRHH CAFE, LLC,

a Delaware limited liability company,

HRHH DEVELOPMENT, LLC,

a Delaware limited liability company,

HRHH IP, LLC,

a Delaware limited liability company, and

HRHH GAMING, LLC,

a Nevada limited liability company,

collectively, as Borrower,

and

BROOKFIELD FINANCIAL, LLC – SERIES B,

as Lender

TABLE OF CONTENTS

| Page | ||||||||

| ARTICLE I. DEFINITIONS; PRINCIPLES OF CONSTRUCTION | 1 | |||||||

| Section 1.1 | Definitions | 1 | ||||||

| Section 1.2 | Principles of Construction | 19 | ||||||

| ARTICLE II. GENERAL TERMS | 19 | |||||||

| Section 2.1 | Loan Commitment; Disbursement to Borrowers | 19 | ||||||

| Section 2.2 | Interest Rate | 20 | ||||||

| Section 2.3 | Loan Payment | 21 | ||||||

| Section 2.4 | Prepayments | 22 | ||||||

| Section 2.5 | Release on Payment in Full | 22 | ||||||

| Section 2.6 | Cash Management | 22 | ||||||

| ARTICLE III. REPRESENTATIONS AND WARRANTIES | 22 | |||||||

| Section 3.1 | Representations of Borrowers | 22 | ||||||

| Section 3.2 | Survival of Representations | 23 | ||||||

| ARTICLE IV. COVENANTS OF BORROWERS | 23 | |||||||

| Section 4.1 | Affirmative Covenants | 23 | ||||||

| Section 4.2 | Negative Covenants | 27 | ||||||

| ARTICLE V. INSURANCE; CASUALTY; CONDEMNATION; RESTORATION | 30 | |||||||

| Section 5.1 | Insurance | 30 | ||||||

| Section 5.2 | Casualty | 30 | ||||||

| Section 5.3 | Condemnation | 30 | ||||||

| Section 5.4 | Restoration | 31 | ||||||

| ARTICLE VI. Mortgage reserve funds | 31 | |||||||

| Section 6.1 | [Intentionally Omitted] | 31 | ||||||

| ARTICLE VII. DEFAULTS | 31 | |||||||

| Section 7.1 | Event of Default | 31 | ||||||

| Section 7.2 | Remedies | 32 | ||||||

| ARTICLE VIII. SPECIAL PROVISIONS | 34 | |||||||

| Section 8.1 | Exculpation | 34 | ||||||

| Section 8.2 | Servicer | 35 | ||||||

| ARTICLE IX. MISCELLANEOUS | 35 | |||||||

| Section 9.1 | Survival | 35 | ||||||

| Section 9.2 | Lender’s Discretion | 35 |

| Section 9.3 | Governing Law | 35 | ||||||

| Section 9.4 | Modification, Waiver in Writing | 37 | ||||||

| Section 9.5 | Delay Not a Waiver | 37 | ||||||

| Section 9.6 | Notices | 38 | ||||||

| Section 9.7 | Trial by Jury | 39 | ||||||

| Section 9.8 | Headings | 39 | ||||||

| Section 9.9 | Severability | 39 | ||||||

| Section 9.10 | Preferences | 39 | ||||||

| Section 9.11 | Waiver of Notice | 40 | ||||||

| Section 9.12 | Remedies of Borrowers | 40 | ||||||

| Section 9.13 | Expenses; Indemnity | 40 | ||||||

| Section 9.14 | Schedules Incorporated | 41 | ||||||

| Section 9.15 | Offsets, Counterclaims and Defenses | 41 | ||||||

| Section 9.16 | No Joint Venture or Partnership; No Third Party Beneficiaries | 41 | ||||||

| Section 9.17 | Publicity | 42 | ||||||

| Section 9.18 | Waiver of Marshalling of Assets | 42 | ||||||

| Section 9.19 | Waiver of Counterclaim | 42 | ||||||

| Section 9.20 | Conflict; Construction of Documents; Reliance | 43 | ||||||

| Section 9.21 | Prior Agreements | 43 | ||||||

| Section 9.22 | Joint and Several Liability | 43 | ||||||

| Section 9.23 | Certain Additional Rights of Lender (VCOC) | 43 | ||||||

| Section 9.24 | Note Register | 44 | ||||||

| Section 9.25 | Conflicts | 44 | ||||||

| Section 9.26 | Successors and Assigns | 44 | ||||||

| ARTICLE X. FIRST MORTGAGE LOAN | 44 | |||||||

| Section 10.1 | Independent Approval Rights | 44 | ||||||

| ARTICLE XI. CONTRIBUTION AGREEMENT | 45 | |||||||

| Section 11.1 | Contribution Generally | 45 | ||||||

| Section 11.2 | Reimbursement Contribution | 45 | ||||||

| Section 11.3 | Defaulting Borrower | 45 | ||||||

| Section 11.4 | Maximum Liability | 46 | ||||||

| Section 11.5 | Applicable Contributions | 46 | ||||||

| Section 11.6 | Reimbursement Contribution as Asset | 46 | ||||||

| Section 11.7 | Subordination | 46 | ||||||

| Section 11.8 | Waivers | 46 |

SCHEDULES

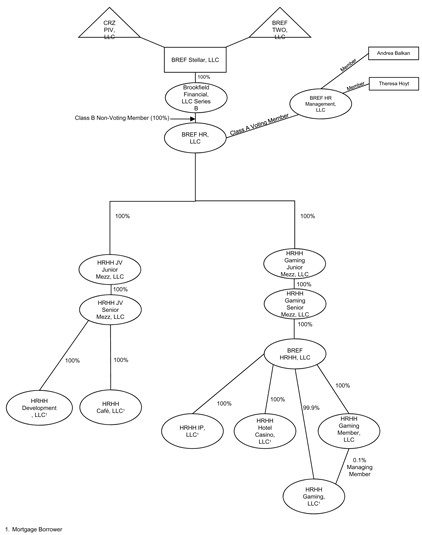

| Schedule I | – | Organizational Chart | ||

| Schedule II | – | Allocated Loan Amounts |

SECOND MORTGAGE LOAN AGREEMENT

THIS SECOND MORTGAGE LOAN AGREEMENT, dated as of March 1, 2011 (as amended, restated, replaced, supplemented or otherwise modified from time to time, this “Agreement”), among BROOKFIELD FINANCIAL, LLC – SERIES B, a Delaware limited liability company, having an address at c/o Brookfield Real Estate Financial Partners LLC, Three World Financial Center, ▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇ ▇▇▇▇▇, ▇▇▇ ▇▇▇▇, ▇▇▇ ▇▇▇▇ ▇▇▇▇▇ (together with its successors and permitted assigns, “Lender”), and HRHH HOTEL/CASINO, LLC, a Delaware limited liability company, HRHH CAFE, LLC, a Delaware limited liability company, HRHH DEVELOPMENT, LLC, a Delaware limited liability company, HRHH IP, LLC, a Delaware limited liability company, and HRHH GAMING, LLC, a Nevada limited liability company, each having its principal place of business at c/o Brookfield Real Estate Financial Partners LLC, Three World Financial Center, ▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇ ▇▇▇▇▇, ▇▇▇ ▇▇▇▇, ▇▇▇ ▇▇▇▇ ▇▇▇▇▇ (each, individually, a “Borrower”, and collectively, “Borrowers”), jointly and severally.

W I T N E S S E T H:

WHEREAS, Vegas HR Private Limited, a Singapore corporation (“First Mortgage Lender”), has made a loan (the “First Mortgage Loan”) to Borrowers subject to and in accordance with the terms and conditions of the Fourth Amended and Restated Loan Agreement (the “First Mortgage Loan Agreement”), dated as of the date hereof, between Borrowers and First Mortgage Lender, which First Mortgage Loan is evidenced and secured by the First Mortgage (as hereinafter defined) encumbering the Collateral (as hereinafter defined) and certain real and personal property as therein described, and the other First Mortgage Loan Documents (as hereinafter defined); and

WHEREAS, Lender is making a loan to Borrowers in the original principal amount of Thirty Million Dollars ($30,000,000) (the “Loan”) subject to and in accordance with this Agreement, which Loan will be evidenced and secured by the Mortgage (as hereinafter defined) encumbering the Collateral, the lien of which Mortgage is subordinate to the lien of the First Mortgage and the other Loan Documents (as hereinafter defined).

NOW, THEREFORE, in consideration of the foregoing and the covenants, agreements, representations and warranties set forth in this Agreement, and for Ten Dollars ($10.00) and other good and valuable consideration, the receipt and legal sufficiency of which are hereby acknowledged, the parties hereto hereby covenant, agree, represent and warrant as follows:

ARTICLE I.

DEFINITIONS; PRINCIPLES OF CONSTRUCTION

Section 1.1 Definitions. For all purposes of this Agreement, except as otherwise expressly required or unless the context clearly indicates a contrary intent:

“Accrued Interest” shall mean, as of any date of determination, the cumulative interest accrued and unpaid as of such date on the Outstanding Principal Balance at the Interest Rate in accordance with Section 2.2 hereof.

“Affiliate” shall mean, as to any Person, any other Person that, directly or indirectly, is in Control of, is Controlled by or is under common Control with such Person or is a director or officer of such Person or of an Affiliate of such Person.

“Agreement” shall have the meaning set forth in the introductory paragraph hereto.

“Allocable Principal Balance” shall have the meaning set forth in Section 11.2 hereof.

“Alternative Minimum Rating Requirement” shall mean a long term unsecured debt rating at least equal to the greater of (a) A1 by ▇▇▇▇▇’▇, ▇▇- by ▇▇▇▇▇ and A+ by S&P or (b) the long term unsecured debt rating of the second bank or financial institution listed below assuming such banks are at the time of determination listed in descending order of their respective long term unsecured debt ratings by S&P: Deutsche Bank AG, Credit Suisse International, Barclays Bank PLC, ▇▇ ▇▇▇▇▇▇ Chase Bank, N.A., and ▇▇▇▇▇ Fargo Bank, N.A.

“Applicable Contribution” shall have the meaning set forth in Section 11.5 hereof.

“Applicable Interest Rate” shall mean the Interest Rate.

“Assignment Agreement” shall have the meaning set forth in Section 9.24 hereof.

“Available Cash Flow” shall mean, with respect to each Payment Date, the amounts available to be disbursed to Lender pursuant to clauses (x) and (xi) of Section 2.6.2(b) of the First Mortgage Loan Agreement.

“Award” shall mean any compensation paid by any Governmental Authority in connection with a Condemnation of all or any part of any Property.

“Bankruptcy Code” shall mean 11 U.S.C. § 101 et seq., as the same may be amended from time to time.

“Borrower” and “Borrowers” shall have the meanings set forth in the introductory paragraph hereto, together with its or their successors and permitted assigns.

“Brookfield Equity Reserve” shall have the meaning set forth in the First Mortgage Loan Agreement.

“Business Day” shall mean any day other than a Saturday, Sunday or any other day on which national banks in New York, New York are not open for business.

“Cash Management Account” shall have the meaning set forth in Section 2.6.2(c).

“Cash Profit and Loss Statement” shall have the meaning assigned to such term in the First Mortgage Loan Agreement.

“Casualty” shall have the meaning set forth in Section 5.2 hereof.

“Closing Date” shall mean February 28, 2011.

2

“Code” shall mean the Internal Revenue Code of 1986, as amended, as it may be further amended from time to time, and any successor statutes thereto, and applicable U.S. Department of Treasury regulations issued pursuant thereto in temporary or final form.

“Collateral” shall mean (i) the “Collateral” as defined in the Mortgage, and (ii) all other collateral for the Loan granted in the Loan Documents.

“Condemnation” shall mean a temporary or permanent taking by any Governmental Authority as the result or in lieu or in anticipation of the exercise of the right of condemnation or eminent domain, of all or any part of any Property, or any interest therein or right accruing thereto, including any right of access thereto or any change of grade affecting such Property or any part thereof.

“Constituent Member” shall mean, with respect to any Person, any direct member or partner in such Person or any Person that, directly or indirectly through one or more other partnerships, limited liability companies, corporations or other entities is a stockholder, member or partner in such Person.

“Contribution” shall have the meaning set forth in Section 11.2 hereof.

“Control” shall mean the possession, directly or indirectly, of the power to direct or cause the direction of management, policies or activities of a Person, whether through ownership of voting securities, by contract or otherwise. “Controlled” and “Controlling” shall have correlative meanings.

“Debt” shall mean the outstanding principal amount set forth in, and evidenced by, this Agreement and the Note, together with all interest accrued and unpaid thereon (including, without limitation, the Accrued Interest, as provided in this Agreement) and all other sums due to Lender in respect of the Loan under the Note, this Agreement, the Mortgage and the other Loan Documents.

“Debt Service” shall mean, with respect to any particular period of time, interest and principal payments due under this Agreement and the Note.

“Default” shall mean the occurrence of any event hereunder or under any other Loan Document which, but for the giving of notice or passage of time, or both, would be an Event of Default.

“Defaulting Borrower” shall have the meaning set forth in Section 11.3 hereof.

“Eligible Account” shall mean a separate and identifiable “deposit account”, as such term is defined in any applicable Uniform Commercial Code, from all other funds held by the holding institution that is either (a) an account or accounts maintained with a federal or state chartered depository institution or trust company which complies with the definition of Eligible Institution or (b) a segregated trust account or accounts maintained with a federal or state chartered depository institution or trust company acting in its fiduciary capacity which, in the case of a state chartered depository institution or trust company, is subject to regulations substantially similar to 12 C.F.R. §9.10(b), having in either case a combined capital and surplus

3

of at least $50,000,000 and subject to supervision or examination by federal and state authority. An Eligible Account will not be evidenced by a certificate of deposit, passbook or other instrument.

“Eligible Institution” shall mean a depository institution or trust company, the short term unsecured debt obligations or commercial paper of which are rated at least “A-1” by S&P, “P-1” by Moody’s and “F-1+” by Fitch in the case of accounts in which funds are held for thirty (30) days or less (or, in the case of accounts in which funds are held for more than thirty (30) days, the long term unsecured debt obligations of which are rated at least “AA” by Fitch and S&P and “Aa2” by Moody’s), provided that in the event (a) any depository institution or trust company in which the Lockbox Account or Cash Management Account is held is required to be an Eligible Institution in order to cause any such account to be maintained as an Eligible Account and such depository institution or trust company does not qualify as an Eligible Institution because it no longer satisfies the above-stated minimum long term unsecured debt rating or (b) Borrower is unable to locate a depository institution or trust company that satisfies the minimum long term unsecured debt rating in connection with the replacement of the then-existing Lockbox Account or Cash Management Account, an Eligible Institution shall mean a depository institution or trust company, the short term unsecured debt obligations or commercial paper of which are rated at least “A-1” by S&P, “P-1” by Moody’s and “F-1+” by Fitch in the case of accounts in funds which are held for thirty (30) days or less or in the case of accounts in which funds are held for more than thirty (30) days, and the long term unsecured debt obligations of which are at least equal to the Alternative Minimum Rating Requirement.

“Embargoed Person” shall have the meaning set forth in Section 3.1.7 hereof.

“Event of Default” shall have the meaning set forth in Section 7.1(a) hereof.

“First Mezzanine Borrower” and “First Mezzanine Borrowers” shall mean, individually or collectively, as applicable, HRHH Gaming Senior Mezz, LLC, a Delaware limited liability company, and HRHH JV Senior Mezz, LLC, a Delaware limited liability company, each in its capacity as a borrower under the First Mezzanine Loan, together with its or their successors or permitted assigns.

“First Mezzanine Debt” shall mean the “Debt” as defined in the First Mezzanine Loan Note.

“First Mezzanine Event of Default” shall mean an “Event of Default” as defined in the First Mezzanine Loan Note.

“First Mezzanine Lender” shall mean BREF Stellar, LLC, a Delaware limited liability company (as successor-in-interest to Column Financial, Inc.), in its capacity as holder of the First Mezzanine Loan, together with its successors and assigns.

“First Mezzanine Loan” shall mean the loan in the outstanding principal amount of One Hundred Seventy-Nine Million Five Hundred Fifty-Four Thousand, Three Hundred Ninety-Three and 67/100 Dollars ($179,554,393.67) made by First Mezzanine Lender to First Mezzanine Borrowers pursuant to the First Mezzanine Loan Note.

4

“First Mezzanine Loan Note” shall mean that certain Amended and Restated First Mezzanine Promissory Note dated as the date hereof in the original principal amount of $179,554,393.67 made by HRHH JV Senior Mezz, LLC, a Delaware limited liability company, and HRHH Gaming Senior Mezz, LLC, and Delaware limited liability company, for the benefit of Lender, as the same may be amended, restated, replaced, severed, assigned, supplemented or otherwise modified from time to time.

“First Mortgage” shall mean that certain first priority Construction Deed of Trust, Assignment of Leases and Rents, Security Agreement and Financing Statement (Fixture Filing), dated as of February 2, 2007, from Borrowers to First Mortgage Lender, recorded in the Office of the County Recorder, ▇▇▇▇▇ County, Nevada (the “Official Records”) on February 5, 2007, in Book 20070205, as Instrument No. 0002473, as amended by that certain Modification of Construction Deed of Trust, Assignment of Leases and Rents, Security Agreement and Financing Statement (Fixture Filing) and Other Loan Documents, dated as of November 6, 2007, recorded in the Official Records on November 15, 2007, in Book 20071115, as Instrument No. 0004497, and by that certain Second Modification of Construction Deed of Trust, Assignment of Leases and Rents, Security Agreement and Financing Statement (Fixture Filing) and Second Modification of Assignment of Leases and Rents, dated as of December 24, 2009, recorded in the Official Records on December 28, 2009, in Book 20091228, as Instrument No. 0002658, and by that certain Third Modification of Construction Deed of Trust, Assignment of Leases and Rents, Security Agreement and Financing Statement (Fixture Filing) and Third Modification of Assignment of Leases and Rents, dated as of the date hereof and to be recorded in the Official Records, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time.

“First Mortgage Debt” shall mean the “Debt” as defined in the First Mortgage Loan Agreement.

“First Mortgage Default” shall mean a “Default” under and as defined in the First Mortgage Loan Agreement.

“First Mortgage Event of Default” shall mean an “Event of Default” under and as defined in the First Mortgage Loan Agreement.

“First Mortgage Lender” shall mean Vegas HR Private Limited, a Singapore corporation (as successor-in-interest to Column Financial, Inc.), in its capacity as holder of the First Mortgage Loan, together with its successors and assigns.

“First Mortgage Loan” shall mean that certain first priority mortgage loan made on February 2, 2007 by First Mortgage Lender to Borrowers pursuant to the First Mortgage Loan Agreement in the aggregate outstanding principal amount of Eight Hundred Sixty Eight Million Five Hundred Thirty Two Thousand Two Hundred Eighty-Eight and 03/100 Dollars ($868,532,288.03), pursuant to and as evidenced and/or secured by the First Mortgage Loan Documents.

“First Mortgage Loan Agreement” shall have the meaning set forth in the recitals hereof.

5

“First Mortgage Loan Documents” shall mean, collectively, the First Mortgage Loan Agreement and any and all other documents defined as “Loan Documents” in the First Mortgage Loan Agreement, in each case as the same hereafter may be amended, restated, replaced, supplemented or otherwise modified from time to time.

“Fiscal Year” shall mean each twelve (12) month period commencing on January 1 and ending on December 31 during each year of the term of the Loan.

“Fitch” shall mean Fitch, Inc.

“Funding Borrower” shall have the meaning set forth in Section 11.2 hereof.

“GAAP” shall mean generally accepted accounting principles in the United States of America as of the date of the applicable financial report.

“Gaming Authority” shall mean any of the Nevada Gaming Commission, the Nevada State Gaming Control Board, the ▇▇▇▇▇ County Liquor and Gaming Licensing Board and any other Governmental Authority and/or regulatory authority or body or any agency which has, or may at any time after the Closing Date have, jurisdiction over the gaming activities or the sale or distribution of liquor at any of the Properties, or any successor to any such authority.

“Governmental Approvals” shall mean all approvals, consents, waivers, orders, acknowledgments, authorizations, permits and licenses required under applicable Legal Requirements to be obtained from any Governmental Authority for the use, occupancy and operation of the Improvements located on the Properties.

“Governmental Authority” shall mean any court, board, agency, commission, office or other authority of any nature whatsoever for any governmental ▇▇▇▇ (▇▇▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇, ▇▇▇▇ or otherwise) whether now or hereafter in existence.

“Improvements” shall have the meaning set forth in the granting clause of the Mortgage with respect to each Property.

“Indebtedness” of a Person, at a particular date, means the sum (without duplication) at such date of (a) all indebtedness or liability of such Person (including, without limitation, amounts for borrowed money and indebtedness in the form of mezzanine debt and preferred equity); (b) obligations evidenced by bonds, debentures, notes, or other similar instruments; (c) obligations for the deferred purchase price of property or services (including trade obligations for which such Person or its assets are liable); (d) obligations under letters of credit (for which such Person is liable if such amounts were advanced thereunder or for which such Person is liable to reimburse); (e) obligations under acceptance facilities; (f) all guaranties, endorsements (other than for collection or deposit in the ordinary course of business) and other contingent obligations to purchase, to provide funds for payment, to supply funds, to invest in any Person or entity, or otherwise to assure a creditor against loss for which funds are required to be paid; and (g) obligations secured by any Liens, for which such Person or its assets are liable.

“Indemnified Liabilities” shall have the meaning set forth in Section 9.13(b) hereof.

6

“Independent Director” or “Independent Manager” shall mean an individual who has prior experience as an independent director, independent manager or independent member with at least three years of employment experience and who is provided by CT Corporation, Corporation Service Company, National Registered Agents, Inc., Wilmington Trust Company, ▇▇▇▇▇▇▇ Management Company, Lord Securities Corporation or, if none of those companies is then providing professional Independent Directors or Independent Managers, another nationally recognized company reasonably approved by Lender, provided that any such provider (i) is not an Affiliate of Borrower and (ii) provides professional Independent Directors or Independent Managers and other corporate services in the ordinary course of its business, and which individual is duly appointed as an Independent Director or Independent Manager and is not, and has never been, and will not while serving as Independent Director or Independent Manager be, any of the following:

(i) a member, partner, equityholder, manager, director, officer or employee of Borrower or any of its respective equityholders or Affiliates, (other than as an Independent Director, Independent Manager, springing member or special member of any Borrower or an Affiliate of any Borrower and that is required by a creditor to be a single purpose bankruptcy remote entity, provided that such Independent Director or Independent Manager is employed by a company that routinely provides professional Independent Directors or Independent Managers in the ordinary course of its business);

(ii) a creditor, supplier or service provider (including provider of professional services) to Borrower or any of its respective equityholders or Affiliates (other than as an Independent Director, Independent Manager, springing member or special member of the Borrower or any equity holder or an Affiliate of the Borrower);

(iii) a family member of any such member, partner, equityholder, manager, director, officer, employee, creditor, supplier or service provider; or

(iv) a Person that controls (whether directly, indirectly or otherwise) any of (i), (ii) or (iii) above.

A natural person who otherwise satisfies the foregoing definition and satisfies subparagraph (i)(b) by reason of being the Independent Director or Independent Manager of a “special purpose entity” affiliated with Borrower shall be qualified to serve as an Independent Director or Independent Manager of Borrower, provided that the fees that such individual earns from serving as an Independent Directors or Independent Manager of Affiliates of any Borrower in any given year constitute in the aggregate less than five percent (5%) of such individual’s annual income for that year.

For purposes of this paragraph, a “special purpose entity” is an entity, whose organizational documents contain restrictions on its activities and impose requirements intended to preserve such entity’s separateness that are substantially similar to those contained in the definition of the Special Purpose Entity of this Agreement.

“Insurance Proceeds” shall have the meaning assigned to such term in the First Mortgage Loan Agreement.

7

“Interest Period” shall mean, with respect to any Payment Date, the period commencing on the first (1st) day of the calendar month that precedes the month in which such Payment Date occurs and terminating on and including the last day of the calendar month that precedes the month in which such Payment Date occurs.

“Interest Rate” shall have the meaning set forth in Section 2.2.1 hereof.

“IP” shall have the meaning assigned to such term in the First Mortgage Loan Agreement.

“Lease” shall mean any lease, sublease or subsublease, letting, license, concession or other agreement (whether written or oral and whether now or hereafter in effect) pursuant to which any Person is granted a possessory interest in, or right to use or occupy all or any portion of any space in any Property, and (a) every modification, amendment or other agreement relating to such lease, sublease, subsublease, or other agreement entered into in connection with such lease, sublease, subsublease, or other agreement, and (b) every guarantee of the performance and observance of the covenants, conditions and agreements to be performed and observed by the other party thereto. The foregoing definition expressly excludes ordinary course hotel room rentals.

“Legal Requirements” shall mean all federal, state, county, municipal and other governmental statutes, laws, rules, orders, regulations, ordinances, judgments, decrees and injunctions of Governmental Authorities affecting the Collateral or any part thereof, or the construction, use, alteration or operation thereof, or any part thereof, whether now or hereafter enacted and in force, including, without limitation, the Americans with Disabilities Act of 1990, as amended, and all permits, licenses and authorizations and regulations relating thereto, including, without limitation, all Governmental Approvals, and all covenants, agreements, restrictions and encumbrances contained in any instruments, either of record or known to any Borrower, at any time in force affecting the Collateral or any part thereof.

“Lender” shall have the meaning set forth in the introductory paragraph hereto.

“Lien” shall mean any mortgage, deed of trust, lien, pledge, negative pledge, hypothecation, assignment, security interest, put, call, option, warrant, proxy, voting agreement or any other encumbrance, charge or transfer of, on or affecting any Borrower, the Collateral or any portion of either of the foregoing or any interest therein, including, without limitation, any conditional sale or other title retention agreement, any financing lease having substantially the same economic effect as any of the foregoing, the filing of any financing statement, and mechanic’s, materialmen’s and other similar liens and encumbrances. For the avoidance of doubt, “Lien” shall be deemed not to include any Permitted IP Encumbrances.

“Liquidation Event” shall have the meaning set forth in Section 2.4.2(a) hereof.

“Loan” shall mean the loan made by Lender to Borrowers pursuant to this Agreement in a maximum principal amount of Thirty Million and No/100 Dollars ($30,000,000), which is evidenced by the Note.

8

“Loan Documents” shall mean, collectively, this Agreement, the Note, the Mortgage and all other documents executed and/or delivered in connection with the Loan, in each case, as the same hereafter may be amended, restated, replaced, supplemented or otherwise modified from time to time.

“Material Action” shall mean any action to consolidate or merge the applicable Special Purpose Entity with or into any Person, or sell all or substantially all of the assets of such Special Purpose Entity, or to institute proceedings to have the Special Purpose Entity be adjudicated bankrupt or insolvent, or consent to (or solicit or cause to be solicited petitioning creditors for) the institution of bankruptcy or insolvency proceedings against the Special Purpose Entity or file a petition seeking, or consent to, reorganization or relief with respect to the Special Purpose Entity under any applicable federal or state law relating to bankruptcy, or consent to the appointment of a receiver, liquidator, assignee, trustee, sequestrator (or other similar official) of the Special Purpose Entity or any part of its property, or make any assignment for the benefit of creditors of the Special Purpose Entity, or admit in writing the Special Purpose Entity’s inability to pay its debts generally as they become due, or declare or effectuate a moratorium on the payment of any obligation, or take action in furtherance of any such action, or, to the fullest extent permitted by law, dissolve or liquidate the Special Purpose Entity.

“Maturity Date” shall mean March 1, 2018, or such other date on which the final payment of principal of the Note becomes due and payable as therein or herein provided, whether at such stated maturity date, by declaration of acceleration, or otherwise.

“Maximum Legal Rate” shall mean the maximum non-usurious interest rate, if any, that at any time or from time to time may be contracted for, taken, reserved, charged or received on the indebtedness evidenced by the Note and as provided for herein or the other Loan Documents, under the laws of such state or states whose laws are held by any court of competent jurisdiction to govern the interest rate provisions of the Loan.

“Mezzanine Borrower” or “Mezzanine Borrowers” shall mean, individually or collectively, as the context may require, First Mezzanine Borrowers and Second Mezzanine Borrowers.

“Mezzanine Event of Default” shall mean any First Mezzanine Event of Default and/or Second Mezzanine Event of Default, as applicable.

“Mezzanine Lender” or “Mezzanine Lenders” shall mean, individually or collectively, as the context may require, First Mezzanine Lender and Second Mezzanine Lender, and each of First Mezzanine Lender and/or Second Mezzanine Lender.

“Mezzanine Loan” or “Mezzanine Loans” shall mean, individually or collectively, as the context may require, the First Mezzanine Loan and the Second Mezzanine Loan, and each of the First Mezzanine Loan and/or the Second Mezzanine Loan.

“Mezzanine Loan Documents” shall mean all documents evidencing and/or securing the Mezzanine Loans and all documents executed and/or delivered in connection therewith, and as the same hereafter may be amended, restated, replaced, supplemented or otherwise modified from time to time.

9

“Monthly Debt Service Payment Amount” shall mean, with respect to each Payment Date, an amount equal to one hundred percent (100%) of Available Cash Flow (if any) on such Payment Date.

“Moody’s” shall mean ▇▇▇▇▇’▇ Investors Service, Inc.

“Mortgage” shall mean that certain Second Deed of Trust, Assignment of Leases and Rents, Security Agreement and Financing Statement (Fixture Filing), dated as of the date hereof, from Borrowers to Lender, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time.

“Net Proceeds” shall have the meaning assigned to such term in the First Mortgage Loan Agreement.

“Note” shall mean that certain Promissory Note dated as of the date hereof in the original principal amount of $30,000,000 made by Borrowers for the benefit of Lender, as the same may be amended, restated, replaced, severed, assigned, supplemented or otherwise modified from time to time.

“Notice” shall have the meaning set forth in Section 9.6 hereof.

“NRS” shall mean the Nevada Revised Statutes, as amended from time to time.

“Obligations” shall mean, collectively, Borrowers’ obligations for the payment of the Debt and the performance of the Other Obligations.

“Other Charges” shall mean all ground rents, maintenance charges, impositions other than Taxes, and any other charges, including, without limitation, vault charges and license fees for the use of vaults, chutes and similar areas adjoining any Property, now or hereafter levied or assessed or imposed against such Property or any part thereof.

“Other Obligations” shall mean (a) the performance of all obligations of each Borrower contained herein; (b) the performance of each obligation of each Borrower contained in any other Loan Document; and (c) the performance of each obligation of each Borrower contained in any renewal, extension, amendment, modification, consolidation, change of, or substitution or replacement for, all or any part of this Agreement, the Note or any other Loan Documents.

“Outstanding Principal Balance” shall mean, as of any date, the outstanding principal balance of the Loan.

“Payment Date” shall mean the first (1st) day of each calendar month during the term of the Loan or, if such day is not a Business Day, the immediately preceding Business Day.

“Permitted Encumbrances” shall mean, with respect to a Property, collectively (a) the Liens and security interests created by the First Mortgage Loan Documents, the Loan Documents and the Mezzanine Loan Documents, (b) all Liens, encumbrances and other matters disclosed in the title insurance policy relating to such Property (as updated by endorsements issued or searches conducted in connection with the closing of the restructuring of the First Mortgage

10

Loan), (c) Liens, if any, for Taxes imposed by any Governmental Authority not yet delinquent, (d) such other title and survey exceptions, documents, agreements or instruments as First Mortgage Lender has approved or may approve in writing in First Mortgage Lender’s reasonable discretion, (e) easements, restrictions, covenants and/or reservations which are necessary for the operation of such Property that do not and would not have a material adverse effect on (i) the business operations, economic performance, assets, financial condition, equity, contingent liabilities, material agreements or results of operations of any Borrower or any Property or (ii) the value of, or cash flow from, any Property, (f) zoning restrictions and/or laws affecting such Property that do not and would not have a material adverse effect on (i) the business operations, economic performance, assets, financial condition, equity, contingent liabilities, material agreements or results of operations of any Borrower or any Property or (ii) the value of, or cash flow from, any Property, (g) the Liens securing any existing or any permitted equipment leases, and (h) any other Liens which are being duly contested in accordance with the provisions of Section 4.1.1 or 4.1.2 hereof or Section 3.6(b) of the Mortgage, but only for so long as such contest shall be permitted pursuant to said Section 4.1.1 or 4.1.2 hereof or Section 3.6(b) of the Mortgage, as applicable.

“Permitted IP Encumbrances” shall mean, with respect to the IP, collectively (a) the Liens and security interests created by the First Mortgage Loan Documents, the Loan Documents and the Mezzanine Loan Documents, (b) such other Liens or security interests as Lender may approve in writing in Lender’s sole discretion, and (c) any other IP Agreements permitted under this Agreement.

“Person” shall mean any individual, corporation, partnership, joint venture, limited liability company, estate, trust, unincorporated association, any federal, state, county or municipal government or any bureau, department or agency thereof and any fiduciary acting in such capacity on behalf of any of the foregoing.

“Policies” shall have the meaning assigned to such term in the First Mortgage Loan Agreement.

“Prescribed Laws” shall mean, collectively, (a) the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (Public Law 107-56) (The USA PATRIOT Act), (b) Executive Order No. 13224 on Terrorist Financing, effective September 24, 2001, and relating to Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism, (c) the International Emergency Economic Power Act, 50 U.S.C. §1701 et. seq., and (d) all other Legal Requirements relating to money laundering or terrorism.

“Prior Day’s Cash Receipts” shall have the meaning assigned to such term in the Mortgage Loan Agreement.

“Property” and “Properties” shall mean, individually and collectively, each and every one of the Hotel/Casino Property, the Cafe Property and the Adjacent Property (each as defined in the Mortgage).

11

“Publicly Traded Company” shall mean any Person with a class of securities traded on a national or international securities exchange and/or registered under Section 12(b) or 12(g) of the Securities Exchange Act or 1934.

“Register” shall have the meaning set forth in Section 9.24 hereof.

“Reimbursement Contribution” shall have the meaning set forth in Section 11.2 hereof.

“Rents” shall mean, with respect to each Property, all rents (including, without limitation, percentage rents), rent equivalents, moneys payable as damages (including payments by reason of the rejection of a Lease in a bankruptcy action) or in lieu of rent or rent equivalents, royalties (including, without limitation, all oil and gas or other mineral royalties and bonuses), income, receivables, receipts, revenues (including liquor revenues), deposits (including, without limitation, security deposits, utility deposits and deposits for rental of rooms, but excluding deposits for rental of banquet space or business or conference meeting rooms), accounts, cash, issues, profits, charges for services rendered, all other amounts payable as rent under any Lease or other agreement relating to any Property (including without limitation any liquor management agreement and any future gaming Lease or sublease), and other payments and consideration of whatever form or nature received by or paid to or for the account of or benefit of any Borrower or any of its agents or employees from any and all sources arising from or attributable to any Property and/or the Improvements thereon, and proceeds, if any, from business interruption or other loss of income insurance, including, without limitation, all hotel receipts, revenues and net credit card receipts collected from guest rooms, restaurants, bars, meeting rooms, banquet rooms and recreational facilities, revenues from telephone services, internet services, laundry services and television, all receivables, customer obligations, installment payment obligations and other obligations now existing or hereafter arising or created out of the sale, lease, sublease, license, concession or other grant of the right of the use and occupancy of any Property or rendering of services by any Borrower or any operator or manager of the hotel or the commercial space located in any of the Improvements or acquired from others (including, without limitation, from the rental of any office space, retail space, guest rooms or other space, halls, stores, and offices, and deposits securing reservations of such space), net license, lease, sublease and net concession fees and rentals, health club membership fees, food and beverage wholesale and retail sales, service charges and vending machine sales.

“Restoration” shall have the meaning assigned to such term in the First Mortgage Loan Agreement.

“Restoration Threshold” shall mean Ten Million Dollars ($10,000,000.00).

“Restoration Value Threshold” shall mean that (i) in the case of a Condemnation, the Net Proceeds are less than 15% of the then current fair market value of the applicable Property, and (ii) in the case of a Casualty, the Net Proceeds are less than 30% of the then current fair market value of the applicable Property.

“Restricted Party” shall mean, collectively, each Borrower and each Mezzanine Borrower.

12

“S&P” shall mean Standard & Poor’s Ratings Group, a division of the ▇▇▇▇▇▇-▇▇▇▇ Companies.

“Sale or Pledge” shall mean a voluntary or involuntary sale, conveyance, assignment, transfer, encumbrance or pledge of, or a grant of option with respect to, a legal or beneficial interest.

“Second Mezzanine Borrower” and “Second Mezzanine Borrowers” shall mean, individually or collectively, as applicable, HRHH Gaming Junior Mezz, LLC, a Delaware limited liability company, and HRHH JV Junior Mezz, LLC, a Delaware limited liability company, each in its capacity as a borrower under the Second Mezzanine Loan, together with its or their successors or permitted assigns.

“Second Mezzanine Debt” shall mean the “Debt” as defined in the Second Mezzanine Loan Note.

“Second Mezzanine Event of Default” shall mean an “Event of Default” as defined in the Second Mezzanine Loan Note.

“Second Mezzanine Lender” shall mean BREF Stellar, LLC, a Delaware limited liability company (as successor-in-interest to Column Financial, Inc.), in its capacity as holder of the Second Mezzanine Loan, together with its successors and assigns.

“Second Mezzanine Loan” shall mean the loan in the outstanding principal amount of Eighty-Nine Million Three Hundred Sixty Thousand Four Hundred Eight and 51/100 Dollars ($89,360,408.51), made by Second Mezzanine Lender to Second Mezzanine Borrowers pursuant to the Second Mezzanine Loan Note.

“Second Mezzanine Loan Note” shall mean that certain Second Amended and Restated Second Mezzanine Promissory note dated as of the date hereof in the original principal amount of $89,360,408.51, made by HRHH JV Junior Mezz, LLC, a Delaware limited liability company, and HRHH Gaming Junior Mezz, LLC, a Delaware limited liability company, for the benefit of NRFC HRH Holdings, LLC, a Delaware limited liability company, as the same may be amended, restated, replaced, severed, assigned, supplemented or otherwise modified from time to time.

“Second Mezzanine Loan Documents” shall mean the Second Mezzanine Loan Agreement and all other documents evidencing and/or securing the Second Mezzanine Loan, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time.

“Servicer” shall have the meaning set forth in Section 8.2 hereof.

“Servicing Agreement” shall have the meaning set forth in Section 8.2 hereof.

“Special Purpose Entity” shall mean a limited partnership or limited liability company that since the date of its formation and at all times on and after the date thereof, has complied with and shall at all times comply with the following requirements:

13

(a) was, is and will be organized solely for the purpose of (i) (A) acquiring, owning, holding, selling, transferring, managing and operating the Collateral, (B) entering into the Loan Documents (as and when executed), including any predecessor loan agreement and documents related thereto, (C) refinancing the Collateral in connection with repayment of the Loan, and/or (D) transacting lawful business that is incident, necessary and appropriate to accomplish any of the foregoing; or (ii) acting as a general partner of the limited partnership that owns the Collateral or managing member of the limited liability company that owns the Collateral;

(b) has not been and is not engaged in, and will not engage in, any business unrelated to (i) the acquisition, ownership, management, sale, transfer or operation of the Collateral, (ii) acting as general partner of the limited partnership that owns the Collateral, or (iii) acting as managing member of the limited liability company that owns the Collateral;

(c) has not had, does not have, and will not have, any assets other than those related to the Collateral, or, if such entity is a general partner in a limited partnership, its general partnership interest in the limited partnership that owns the Collateral, or, if such entity is a managing member of a limited liability company, its membership interest in the limited liability company that owns the Collateral;

(d) has not engaged, sought or consented to, and to the fullest extent permitted by law, will not engage in, seek or consent to, any: (i) dissolution, winding up, liquidation, consolidation, merger or sale of all or substantially all of its assets outside of its ordinary course of business and other than as expressly permitted in this Agreement; (ii) other than as expressly permitted in this Agreement, transfer of partnership or membership interests (if such entity is a general partner in a limited partnership or a managing member in a limited liability company); or (iii) amendment of its limited partnership agreement, articles of organization, certificate of formation or operating agreement (as applicable) with respect to the matters set forth in this definition unless Lender issues its prior written consent, which consent shall not be unreasonably withheld;

(e) if such entity is a limited partnership, has had, now has, and will have, as its only general partners, Special Purpose Entities that are limited liability companies;

(f) if such entity is a limited liability company with more than one member, has had, now has and will have at least one member that is a Special Purpose Entity that is a corporation that has at least two (2) Independent Directors that will not cause or allow the taking of any Material Action with respect to the limited liability company or its subsidiary(ies) without the unanimous consent of each Independent Director or a limited liability company that has at least two (2) Independent Managers that will not cause or allow the taking of any Material Action with respect to the limited liability company or its subsidiary(ies) without the unanimous consent of each Independent Manager and that, in either instance, owns at least one-tenth of one percent (.10%) of the equity of the limited liability company;

(g) if such entity is a limited liability company with only one member, has been, now is, and will be, a limited liability company organized in the State of Delaware (i) that has as its only member a non-managing member; (ii) that has at least two (2) Independent Managers and has not caused or allowed and will not cause or allow the taking of any “Material Action” (as

14

defined in such entity’s operating agreement) without the unanimous affirmative vote of one hundred percent (100%) of the member and such entity’s two (2) Independent Managers; (iii) that has at least one (1) springing member (or two (2) springing members if such springing members are natural persons who will replace a member of such entity seriatim not simultaneously) that will become a member of such entity upon the occurrence of an event causing the member to cease to be a member of such limited liability company; and (iv) whose membership interests constitute and will constitute “certificated securities” (as defined in the Uniform Commercial Code of the States of New York and Delaware);

(h) if such entity is (i) a limited liability company, has had, now has and will have an operating agreement, or (ii) a limited partnership, has had, now has and will have a limited partnership agreement, that, in each case, provides that such entity will not: (A) to the fullest extent permitted by law, take any actions described in clause (d)(i) above; (B) engage in any other business activity, or amend its organizational documents with respect to the matters set forth in this definition, in each instance, without the prior written consent of Lender, which consent shall not be unreasonably withheld; or (C) without the affirmative vote of two (2) Independent Managers and of all the partners or members of such entity, as applicable (or the vote of two (2) Independent Managers of its general partner or managing member, if applicable), file a bankruptcy or insolvency petition or otherwise institute (solicit or cause to be solicited petitioning creditors for) insolvency proceedings with respect to itself or to any other entity in which it has a direct or indirect legal or beneficial ownership interest;

(i) has been, is and will remain solvent and has paid and will pay its debts and liabilities (including, as applicable, shared personnel and overhead expenses) from its assets as the same have or shall become due, and has maintained, is maintaining and will maintain adequate capital for the normal obligations reasonably foreseeable in a business of its size and character and in light of its contemplated business operations; provided, however, this provision shall not require the equity owner(s) of such entity to make any additional capital contributions; and provided further that in the event a Funding Borrower makes any Contribution to the other Borrower by paying any of the debts and liabilities of such other Borrower such Contribution shall not in and of itself be deemed to violate the provisions of this clause (i) and shall entitle such Funding Borrower to the benefits set forth in Article XI of this Agreement;

(j) has not failed and will not fail to correct any known misunderstanding regarding the separate identity of such entity;

(k) other than as and to the extent provided in the First Mortgage Loan Agreement with respect to one or more Borrowers, has maintained and will maintain its accounts, books and records separate from any other Person (except other Borrowers) and has filed and will file its own tax returns, except to the extent that it has been or is (i) required to file consolidated tax returns by law; or (ii) treated as a “disregarded entity” for tax purposes and is not required to file tax returns under applicable law;

(l) has maintained and will maintain its own (except with the other Borrower) records, books, resolutions (if any) and agreements;

15

(m) other than as and to the extent provided in the First Mortgage Loan Agreement with respect to one or more Borrowers, (i) has not commingled and will not commingle its funds or assets with those of any other Person; and (ii) has not participated and will not participate in any cash management system with any other Person;

(n) has held and will hold its assets in its own name;

(o) has conducted and will conduct its business in its name or in a name franchised or licensed to it by an entity other than an Affiliate of any Borrower, except for services rendered under a business management services agreement with an Affiliate that complies with the terms contained in clause (dd) below, so long as the manager, or equivalent thereof, under such business management services agreement holds itself out as an agent of such Borrower;

(p) has maintained and will maintain its financial statements, accounting records and other entity documents separate from any other Person and has not permitted and will not permit its assets to be listed as assets on the financial statement of any other entity except as required by GAAP (or such other accounting basis acceptable to Lender); provided, however, that a Borrower’s assets may be included in a consolidated financial statement of its Affiliate, provided that (i) an appropriate notation shall be made on such consolidated financial statements to indicate its separateness from such Affiliate and to indicate that its assets and credit are not available to satisfy the debts and other obligations of such Affiliate or of any other Person and (ii) such assets shall also be listed on such Special Purpose Entity’s own separate balance sheet;

(q) has paid and will pay its own liabilities and expenses, including the salaries of its own employees (if any), out of its own funds and assets, and has maintained and will maintain, or will enter into a contract with an Affiliate to maintain, which contract shall be reasonably satisfactory to Lender in form and substance and shall be subject to the requirements of clause (dd) below, a sufficient number of employees (if any) in light of its contemplated business operations; provided, however, this provision shall not require the equity owner(s) of such entity to make any additional capital contributions; and provided further that in the event any Funding Borrower makes any Contribution to any Borrower by paying any of the liabilities and expenses of such other Borrower such Contribution shall not in and of itself be deemed to violate the provisions of this clause (q) and shall entitle such Funding Borrower to the benefits set forth in Article XI of this Agreement;

(r) has observed and will observe all Delaware partnership or limited liability company formalities, as applicable;

(s) has not incurred and will not incur any Indebtedness other than (i) the Debt, and (ii) unsecured trade payables and operational debt not evidenced by a note and in an aggregate amount not exceeding $50,000; provided that any Indebtedness incurred pursuant to subclause (ii) shall be (A) paid within sixty (60) days of the date incurred (other than attorneys’ and other professional fees) and (B) incurred in the ordinary course of business;

(t) except as contemplated under Article XI with respect to the other Borrower, has not assumed or guaranteed or become obligated for, and will not assume or guarantee or become obligated for, the debts of any other Person and has not held out and will not hold out its credit or

16

assets as being available to satisfy the obligations of any other Person except as permitted pursuant to this Agreement; except, if such entity is a general partner of a limited partnership, in such entity’s capacity as general partner of such limited partnership;

(u) has not acquired and will not acquire obligations or securities of its partners, members or shareholders or any other Affiliate except with respect to the ownership of the limited liability company interests or partnership interests (as applicable) of the Special Purpose Entities as shown on the organizational chart attached to this Agreement as Schedule I;

(v) has allocated and will allocate fairly and reasonably any overhead expenses that are shared with any Affiliate, including, but not limited to, paying for shared office space and services performed by any employee of an Affiliate; provided, however, to the extent invoices for such services are not allocated and separately billed to each entity, there is a system in place that provides that the amount thereof that is to be allocated among the relevant parties will be reasonably related to the services provided to each such party; and provided further in the event a Funding Borrower makes any Contribution to the other Borrower by paying any such overhead expenses of the other Borrower such Contribution shall not in and of itself be deemed to violate the provisions of this clause (v) and shall entitle such Funding Borrower to the benefits set forth in Article XI of this Agreement;

(w) has maintained and used, now maintains and uses and will maintain and use separate invoices and checks bearing its name. The invoices and checks utilized by the Special Purpose Entity or utilized to collect its funds or pay its expenses have borne and shall bear its own name and have not borne and shall not bear the name of any other entity unless such entity is clearly designated as being the Special Purpose Entity’s agent;

(x) except as provided in the First Mortgage Loan Documents, the Loan Documents, and/or the Mezzanine Loan Documents, as applicable, has not pledged and will not pledge its assets to secure the obligations of any other Person;

(y) has held itself out and identified itself and will hold itself out and identify itself as a separate and distinct entity under its own name or in a name franchised or licensed to it by an entity other than an Affiliate of any Borrower and not as a division or department of any other Person, except for services rendered under a business management services agreement with an Affiliate that complies with the terms contained in clause (dd) below, so long as the manager, or equivalent thereof, under such business management services agreement holds itself out as an agent of such Borrower;

(z) except and to the extent as provided in the First Mortgage Loan Agreement, has maintained and will maintain its assets in such a manner that it will not be costly or difficult to segregate, ascertain or identify its individual assets from those of any other Person;

(aa) has not made and will not make loans to, or own or acquire any stock or securities of, any Person or hold evidence of indebtedness issued by any other Person or entity (other than cash and investment grade securities issued by an entity that is not an Affiliate of or subject to common ownership with such entity);

17

(bb) has not identified and will not identify its partners, members or shareholders, or any Affiliate of any of them, as a division or department of it, and has not identified itself and shall not identify itself as a division of any other Person;

(cc) except for capital contributions and capital distributions expressly permitted under the terms and conditions of its organizational documents and properly reflected in its books and records, has not entered into or been a party to and will not enter into or be a party to, any transaction with its partners, members, shareholders or Affiliates except in the ordinary course of its business and on terms which are commercially reasonable and are no less favorable to it than would be obtained in a comparable arm’s length transaction with an unrelated third party;

(dd) except with respect to any indemnity provided to the Independent Managers (it being acknowledged and agreed that any such indemnification obligations as may be owed to the Independent Managers shall be expressly subject and subordinated to the payment in full of the Loan and the Mezzanine Loans), has not had and will not have any obligation to indemnify, and has not indemnified and will not indemnify, its partners, officers, directors or members, as the case may be, unless such an obligation was and is fully subordinated to the Debt and will not constitute a claim against it in the event that cash flow in excess of the amount required to pay the Debt is insufficient to pay such obligation;

(ee) does not and will not have any of its obligations guaranteed by any Affiliate;

(ff) has complied and will comply with all of the terms and provisions contained in its organizational documents since its formation;

(gg) has not and will not form, acquire or hold any subsidiary or own any other entity; and

(hh) has no material contingent or actual obligations not related to its purpose set forth in subparagraph (a) of this definition of Special Purpose Entity.

“Standstill Agreement” shall mean that certain Mortgage Standstill and Subordination Agreement dated as of the date hereof between First Mortgage Lender and Lender.

“State” shall mean the State of Nevada.

“Taxes” shall mean all real estate and personal property taxes, assessments, water rates or sewer rents, now or hereafter levied or assessed or imposed against any Property or part thereof, together with all interest and penalties thereon.

“Transfer” shall have the meaning set forth in Section 4.2.5(b) hereof.

“Transfer Restricted Party” shall mean, collectively, each Borrower and each Mezzanine Borrower and each Constituent Member thereof.

“UCC” or “Uniform Commercial Code” shall mean the Uniform Commercial Code as in effect in the State of Nevada, the State of New York or the State of Delaware, as applicable.

18

“UCC Financing Statements” shall mean the UCC Financing Statement delivered in connection with the Mortgage and the other Loan Documents and filed in the applicable filing offices.

“Uniform System of Accounts” shall mean the most recent edition of the Uniform System of Accounts for Hotels, as adopted by the American Hotel and Motel Association.

Section 1.2 Principles of Construction.

(a) All references to sections, subsections, clauses, exhibits and schedules are to sections, subsections, clauses, exhibits and schedules in or to this Agreement unless otherwise specified. All uses of the word “including” shall mean “including, without limitation” unless the context shall indicate otherwise. Unless otherwise specified, the words “hereof,” “herein” and “hereunder” and words of similar import when used in this Agreement shall refer to this Agreement as a whole and not to any particular provision of this Agreement. All uses in this Agreement of the phrase “any Borrower” shall be deemed to mean “any one or more of the Borrowers including all of the Borrowers”. All uses in this Agreement of the phrase “any Property” or “any of the Properties” shall be deemed to mean “any one or more of the Properties including all of the Properties”. All uses in this Agreement of the phrase “the IP” shall be deemed to mean “all or any part of the IP”. Unless otherwise specified, all meanings attributed to defined terms herein shall be equally applicable to both the singular and plural forms of the terms so defined.

(b) With respect to terms defined by cross-reference to the First Mortgage Loan Documents and/or the Mezzanine Loan Documents, as applicable, such defined terms shall have the definitions set forth in the First Mortgage Loan Documents and/or the Mezzanine Loan Documents as of the date hereof, and no modifications to the First Mortgage Loan Documents and/or the Mezzanine Loan Documents, as the case may be, shall have the effect of changing such definitions for the purpose of this Agreement unless Lender expressly agrees that such definitions as used in this Agreement have been revised or Lender consents to the modification documents. With respect to any provisions incorporated by reference herein from the First Mortgage Loan Agreement, such provisions shall be deemed a part of this Agreement notwithstanding the fact that the First Mortgage Loan shall no longer be effective for any reason.

ARTICLE II.

GENERAL TERMS

Section 2.1 Loan Commitment; Disbursement to Borrowers.

2.1.1 Agreement to Lend and Borrow. Subject to and upon the terms and conditions set forth in this Agreement and the other Loan Documents, Lender agreed to make and Borrowers jointly and severally agreed to accept the Loan on the Closing Date.

2.1.2 Loan.

(a) Borrowers hereby acknowledge and agree that, on the Closing Date, Lender made the Loan to Borrowers in the principal amount of $30,000,000.00, which

19

represented a full disbursement of all proceeds of the Loan. The Loan is evidenced by the Note and this Agreement, is secured by the Mortgage and the other Loan Documents and shall be repaid with interest, costs and charges as more particularly set forth in the Note, this Agreement, the Mortgage and the other Loan Documents. Principal amounts of the Loan which are repaid for any reason may not be re-borrowed.

(b) At Borrowers’ direction, the proceeds of the Loan were deposited in the Brookfield Equity Reserve to fund trade payables, settlements and other obligations relating to the Properties, capital expenditures and extraordinary expenses as set forth in the First Mortgage Loan Agreement.

Section 2.2 Interest Rate.

2.2.1 Interest Generally.

(a) Interest on the Outstanding Principal Balance shall accrue from the date hereof to and excluding the Maturity Date at the Interest Rate.

(b) Interest shall not capitalize and shall be payable as and when provided in Section 2.4.1 of the First Mortgage Loan Agreement in an amount as may be necessary for Lender to receive an annual internal rate of return equal to fifteen percent (15%) and calculated in accordance with Schedule III attached hereto (the “Interest Rate”).

2.2.2 Interest Calculation. Interest on the Outstanding Principal Balance shall be calculated in accordance with Schedule III attached hereto.

2.2.3 [Intentionally Omitted].

2.2.4 Usury Savings. This Agreement, the Note and the other Loan Documents are subject to the express condition that at no time shall any Borrower be obligated or required to pay interest on the Outstanding Principal Balance at a rate which could subject Lender to either civil or criminal liability as a result of being in excess of the Maximum Legal Rate. If, by the terms of this Agreement or the other Loan Documents, any Borrower is at any time required or obligated to pay interest on the Outstanding Principal Balance at a rate in excess of the Maximum Legal Rate, the Applicable Interest Rate shall be deemed to be immediately reduced to the Maximum Legal Rate and all previous payments in excess of the Maximum Legal Rate shall be deemed to have been payments in reduction of principal and not on account of the interest due hereunder. All sums paid or agreed to be paid to Lender for the use, forbearance, or detention of the sums due under the Loan, shall, to the extent permitted by applicable law, be amortized, prorated, allocated, and spread throughout the full stated term of the Loan until payment in full so that the rate or amount of interest on account of the Loan does not exceed the Maximum Legal Rate of interest from time to time in effect and applicable to the Loan for so long as the Loan is outstanding.

20

Section 2.3 Loan Payment.

2.3.1 Payments Generally.

(a) On each Payment Date commencing with the Payment Date occurring in April, 2011 and on each Payment Date thereafter to and including the Maturity Date, Borrowers shall make a payment to Lender in respect of the Loan in the amount of the Monthly Debt Service Payment Amount with respect to such Payment Date, which payments shall be applied by Lender to the Loan as provided in Section 2.3.5 hereof. For the avoidance of doubt, Borrowers’ obligation to make each such payment of the Monthly Debt Service Payment Amount is only to the extent of Available Cash Flow therefor and in the event that there is no Available Cash Flow as of any Payment Date, no payment shall be required to be made by Borrowers hereunder.

(b) For purposes of making payments hereunder, but not for purposes of calculating Interest Periods, if the day on which any such payment (including, without limitation, payments due on the Maturity Date) is due is not a Business Day, then amounts due on such date shall be due on the immediately preceding Business Day. Interest shall be payable at the rates set forth in this Agreement through and including the day immediately preceding the Maturity Date. All amounts due pursuant to this Agreement and the other Loan Documents shall be payable without setoff, counterclaim, defense or any other deduction whatsoever.

(c) Lender shall have the right from time to time, in its sole discretion, upon not less than ten (10) days prior written notice to Borrowers, to change the monthly Payment Date to a different calendar day and Lender and Borrowers shall promptly execute an amendment to this Agreement to evidence any such changes.

2.3.2 Payment on Maturity Date. Borrowers shall pay to Lender on the Maturity Date the Outstanding Principal Balance, all accrued and unpaid interest (including, without limitation, all Accrued Interest), and all other amounts due hereunder and under the Note, the Mortgage and the other Loan Documents (provided that Borrowers’ obligation to pay all such amounts on the Maturity Date is only to the extent of Available Cash Flow therefor and in the event that Available Cash Flow is insufficient therefor, Borrowers shall have no obligation or liability to Lender whatsoever in respect of such insufficiency).

2.3.3 [Intentionally Omitted].

2.3.4 Method and Place of Payment. Except as otherwise specifically provided herein, all payments and prepayments under this Agreement and the Note shall be made to Lender not later than 2:00 P.M., New York City time, on the date when due and shall be made in lawful money of the United States of America in immediately available funds at Lender’s office at Brookfield Financial, LLC—Series B, c/o Brookfield Financial Real Estate Financial Partners LLC, Three World Financial Center, ▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇ ▇▇▇▇▇, ▇▇▇ ▇▇▇▇, ▇▇▇ ▇▇▇▇ ▇▇▇▇▇, Attention: ▇▇▇▇▇▇▇ ▇▇▇▇, or as otherwise directed by Lender, and any funds received by Lender after such time shall, for all purposes hereof, be deemed to have been paid on the next succeeding Business Day.

21

2.3.5 Application of Payments. Notwithstanding anything to the contrary contained in this Agreement, all amounts received by Lender in respect of Monthly Debt Service Payment Amounts and all other payments of principal received by Lender shall be applied first to the Outstanding Principal Balance and then to Accrued Interest and all other sums then due under the Loan.

Section 2.4 Prepayments. Any and all prepayments, whether voluntary or involuntary, shall be applied in accordance with Sections 2.4.1 and 2.6.2 of the First Mortgage Loan Agreement.

Section 2.5 Release on Payment in Full. Upon the written request and payment by Borrowers of the customary recording fees and the actual out-of-pocket third-party costs and expenses of Lender and upon payment in full of all principal and interest due on the Loan and all other amounts due and payable under the Loan Documents in accordance with the terms and provisions of the Note and this Agreement or otherwise in accordance with the terms and provisions of the Standstill Agreement, Lender shall release the Lien of the Mortgage and the other Loan Documents.

Section 2.6 Cash Management. Borrowers shall comply, at all times during the term of the Loan, with Section 2.6 of the First Mortgage Loan Agreement.

ARTICLE III.

REPRESENTATIONS AND WARRANTIES.

Section 3.1 Representations of Borrowers. Each Borrower represents and warrants as to itself to such Borrower’s knowledge (as defined in Section 4.3 of the First Mortgage Loan Agreement) that as of the date hereof:

3.1.1 Organization. Such Borrower is duly qualified to do business and is in good standing in each jurisdiction where it is required to be so qualified in connection with its assets, businesses and operations. The sole business of such Borrower is the ownership and management of its respective Property or the IP. The ownership interests of such Borrower are as set forth on the organizational chart attached hereto as Schedule I.

3.1.2 Proceedings. Such Borrower has taken all necessary action to authorize the execution, delivery and performance of this Agreement and the other Loan Documents. This Agreement and the other Loan Documents have been duly executed and delivered by or on behalf of such Borrower and constitute legal, valid and binding obligations of such Borrower enforceable against such Borrower in accordance with their respective terms, subject only to applicable bankruptcy, insolvency and similar laws affecting rights of creditors generally, and subject, as to enforceability, to general principles of equity (regardless of whether enforcement is sought in a proceeding in equity or at law).

3.1.3 No Conflicts. The execution, delivery and performance of this Agreement and the other Loan Documents by such Borrower will not materially conflict with or result in a material breach of any of the terms or provisions of, or constitute a default under, or result in the creation or imposition of any lien, charge or encumbrance (other than pursuant to the Loan Documents) upon any of the property or assets of such Borrower pursuant to the terms of any

22

indenture, mortgage, deed of trust, loan agreement, partnership agreement, management agreement or other agreement or instrument to which such Borrower is a party or by which any of such Borrower’s property or assets is subject, nor will such action result in any violation of the provisions of any statute or any order, rule or regulation of any Governmental Authority having jurisdiction over such Borrower or any of such Borrower’s properties or assets, and any consent, approval, authorization, order, registration or qualification of or with any such Governmental Authority necessary to permit the execution, delivery and performance by such Borrower of this Agreement or any other Loan Documents has been obtained and is in full force and effect.

3.1.4 Not a Foreign Person. No Borrower is a “foreign person” within the meaning of §1445(f)(3) of the Code.

3.1.5 Embargoed Person. From the Closing Date and at all times throughout the term of the Loan, including after giving effect to any Transfers permitted pursuant to the Loan Documents, (a) none of the funds or other assets of any Borrower shall constitute property of, or shall be beneficially owned, directly or indirectly, by, any Person subject to trade restrictions under United States law, including, but not limited to, the International Emergency Economic Powers Act, 50 U.S.C. § 1701 et seq., The Trading with the Enemy Act, 50 U.S.C. App. 1 et seq., and any Executive Orders or regulations promulgated under any such United States laws (each, an “Embargoed Person”), with the result that the Loan made by Lender is or would be in violation of law; (b) no Embargoed Person shall have any interest of any nature whatsoever in any Borrower, with the result that the Loan is or would be in violation of law; and (c) none of the funds of any Borrower shall be derived from any unlawful activity with the result that the Loan is or would be in violation of law; provided, however, that Borrowers’ representation in this clause (c) shall not extend to gaming revenues generated at the Property from the general public unless any Restricted Party has actual knowledge that such revenues are derived from any unlawful activity.

Section 3.2 Survival of Representations. Borrowers agree that all of the representations and warranties of any Borrower set forth in Section 3.1 hereof and elsewhere in this Agreement and in the other Loan Documents shall survive for so long as any amount remains owing to Lender under this Agreement or any of the other Loan Documents by Borrowers. All representations, warranties, covenants and agreements made in this Agreement or in the other Loan Documents by any Borrower shall be deemed to have been relied upon by Lender notwithstanding any investigation heretofore or hereafter made by Lender or on its behalf.

ARTICLE IV.

COVENANTS OF BORROWERS

Section 4.1 Affirmative Covenants. From the Closing Date and until payment and performance in full of all obligations of Borrowers under the Loan Documents or the earlier release of the Lien of the Mortgage encumbering the Collateral (and all related obligations) in accordance with the terms of this Agreement and the other Loan Documents, Borrowers hereby jointly and severally covenant and agree with Lender that:

23

4.1.1 Existence; Compliance with Legal Requirements. Each Borrower shall do or cause to be done all things necessary to preserve, renew and keep in full force and effect its existence, rights, licenses, permits and franchises necessary for the conduct of its business and comply in all material respects with all Legal Requirements applicable to such Borrower or the Collateral, including, without limitation, Prescribed Laws. Borrowers shall not, and shall not permit any other Borrower to, amend or modify the organizational documents of such Borrower in any respect without Lender’s prior written consent. After prior notice to Lender, any Borrower, at its own expense, may contest by appropriate legal proceeding promptly initiated and conducted in good faith and with due diligence, the validity of any Legal Requirement, the applicability of any Legal Requirement to such Borrower or its Property or any alleged violation of any Legal Requirement, provided that (a) no Event of Default, First Mortgage Event of Default, First Mezzanine Event of Default or Second Mezzanine Event of Default has occurred and remains uncured; (b) such proceeding shall be permitted under and be conducted in accordance with the provisions of any instrument to which such Borrower is subject and shall not constitute a default thereunder and such proceeding shall be conducted in accordance with all applicable statutes, laws and ordinances; (c) neither any Property nor any part thereof or interest therein will be in imminent danger of being sold, forfeited, terminated, cancelled or lost; (d) such Borrower shall promptly upon final determination thereof comply with any such Legal Requirement determined to be valid or applicable or cure any violation of any Legal Requirement; (e) such proceeding shall suspend the enforcement of the contested Legal Requirement against such Borrower and its Property; and (f) such Borrower shall furnish such security as may be required in the proceeding, or as may be reasonably requested by Lender, to insure compliance with such Legal Requirement, together with all interest and penalties payable in connection therewith. Following any non-compliance with such Legal Requirement as determined by a court of competent jurisdiction, Lender may apply any such security, as necessary to cause compliance with such Legal Requirement at any time when, in the reasonable judgment of Lender, the validity, applicability or violation of such Legal Requirement is finally established or any Property (or any part thereof or interest therein) shall be in imminent danger of being sold, forfeited, terminated, cancelled or lost.