LOAN AGREEMENT Dated as of July 5, 2016 Between HGREIT II COTTONWOOD CENTER LLC, a Delaware limited liability company, as Borrower and PRINCIPAL LIFE INSURANCE COMPANY, an Iowa corporation, as Lender

Exhibit 10.26

Dated as of July 5, 2016

Between

HGREIT II COTTONWOOD CENTER LLC, a Delaware limited liability company,

as Borrower

and

PRINCIPAL LIFE INSURANCE COMPANY, an Iowa corporation,

as Lender

as Lender

Premises: 2755, 2795, 2825 and 0000 Xxxx Xxxxxxxxxx Xxxxxxx

Xxxxxxxxxx Xxxxxxx, Xxxx 00000

Loan Number: 757840

TABLE OF CONTENTS

I. | DEFINITIONS; PRINCIPLES OF CONSTRUCTION | ||||

Section 1.1 | Definitions | 1 | |||

Section 1.2 | Principles of Construction | 13 | |||

II. | GENERAL TERMS | ||||

Section 2.1 | Loan Commitment; Disbursement to Borrower | 13 | |||

Section 2.2 | Interest; Loan Payments; Late Payment Charge | 13 | |||

Section 2.3 | Prepayments | 15 | |||

III. | REPRESENTATIONS AND WARRANTIES | ||||

Section 3.1 | Borrower Representations | 16 | |||

Section 3.2 | Survival | 21 | |||

IV. | BORROWER COVENANTS | ||||

Section 4.1 | Affirmative Covenants | 22 | |||

Section 4.2 | Negative Covenants | 26 | |||

V. | INSURANCE; CASUALTY; CONDEMNATION | ||||

Section 5.1 | Insurance | 32 | |||

Section 5.2 | Casualty | 36 | |||

Section 5.3 | Condemnation | 36 | |||

Section 5.4 | Restoration | 37 | |||

VI. | RESERVE FUNDS | ||||

Section 6.1 | Tax and Insurance Escrow Fund | 41 | |||

Section 6.2 | Property Reserves Escrow Fund | 42 | |||

Section 6.3 | Miscellaneous | 42 | |||

VII. | DEFAULTS | ||||

Section 7.1 | Events of Default | 43 | |||

Section 7.2 | Remedies | 47 | |||

Section 7.3 | Payment of Costs; Remedies Cumulative; Waivers | 47 | |||

VIII. | Assignment of Leases and Rents | ||||

Section 8.1 | License to Collect Rents | 48 | |||

Section 8.2 | Enforcement; Lender Liability | 50 | |||

Section 8.3 | Lease(s) Approval | 50 | |||

Section 8.4 | Rights of Lender | 52 | |||

IX. | SPECIAL PROVISIONS | ||||

Section 9.1 | Fees and Taxes | 53 | |||

X. | RECOURSE OBLIGATIONS | ||||

Section 10.1 | Non-Recourse | 53 | |||

-2-

Section 10.2 | Release of Liability | 56 | |||

XI. | MISCELLANEOUS | ||||

Section 11.1 | Waiver | 56 | |||

Section 11.2 | Estoppel | 56 | |||

Section 11.3 | Successors and/or Assigns | 56 | |||

Section 11.4 | Inconsistencies | 56 | |||

Section 11.5 | Governing Law/Jurisdiction | 57 | |||

Section 11.6 | Proceedings | 57 | |||

Section 11.7 | Joint and Several | 57 | |||

Section 11.8 | Headings, etc. | 57 | |||

Section 11.9 | Counterparts | 57 | |||

Section 11.10 | Integration | 58 | |||

Section 11.11 | Schedules Incorporated | 58 | |||

Section 11.12 | No Joint Venture or Partnership | 58 | |||

Section 11.13 | Waiver of Counterclaim | 58 | |||

Section 11.14 | Capitalized Terms | 58 | |||

Section 11.15 | No Liability of Lender | 58 | |||

Section 11.16 | No Third Parties Benefited | 58 | |||

Section 11.17 | Time is of the Essence | 59 | |||

Section 11.18 | Severability of Provisions | 59 | |||

Section 11.19 | Preferences | 59 | |||

Section 11.20 | Lender's Form W-9 | 59 | |||

Section 11.21 | Component Notes | 59 | |||

Section 11.22 | Replacement Note | 60 | |||

Section 11.23 | Confidentiality | 60 | |||

Section 11.24 | Partial Release | 60 | |||

Schedules

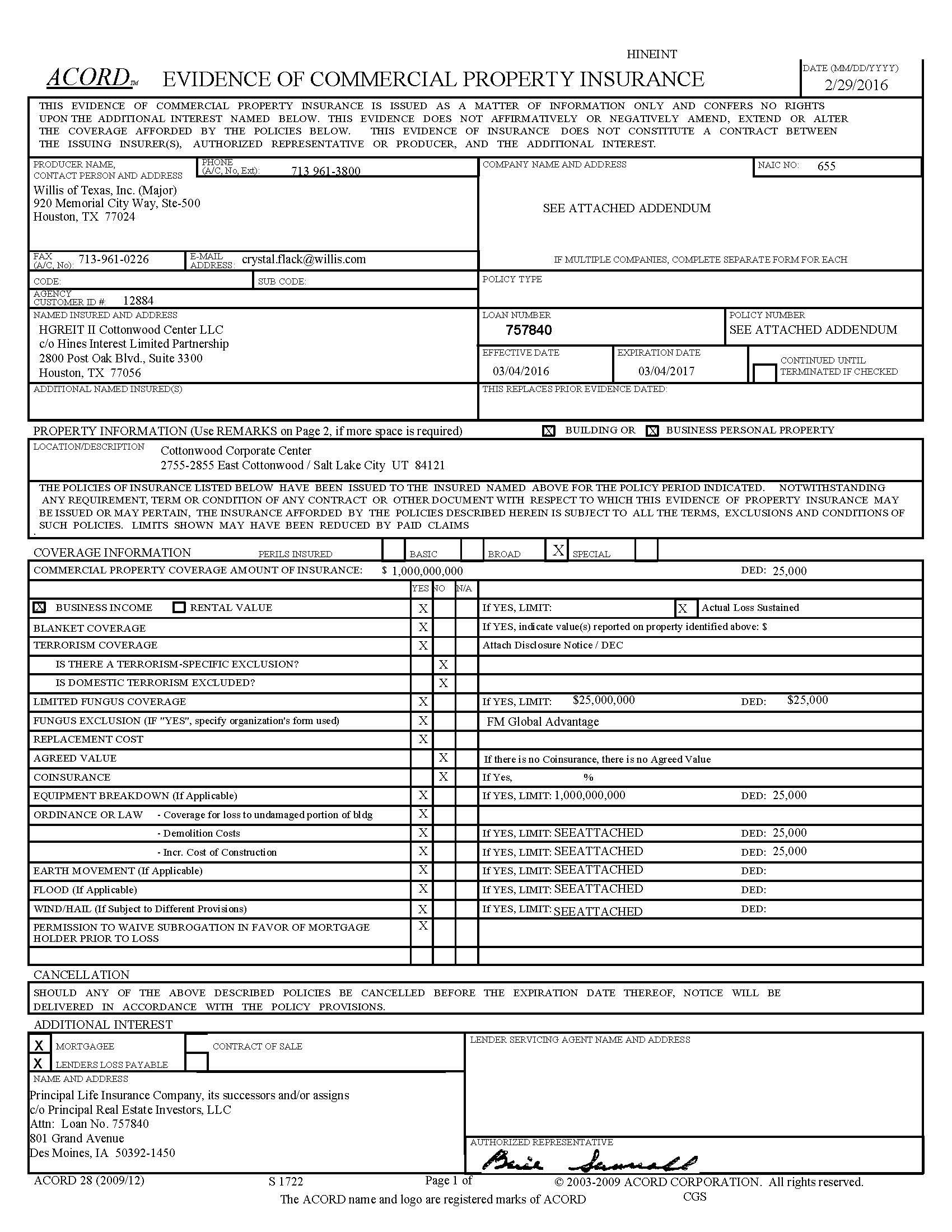

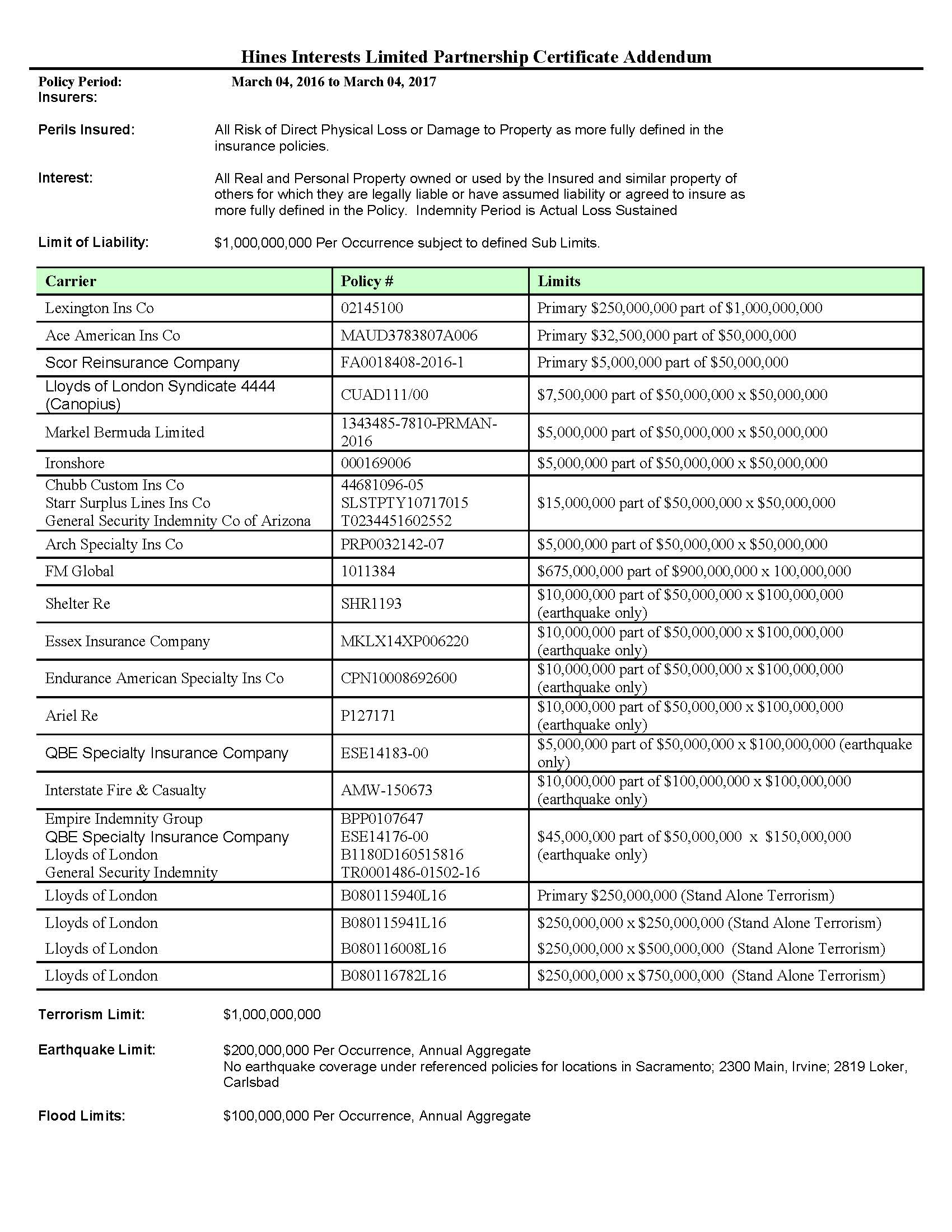

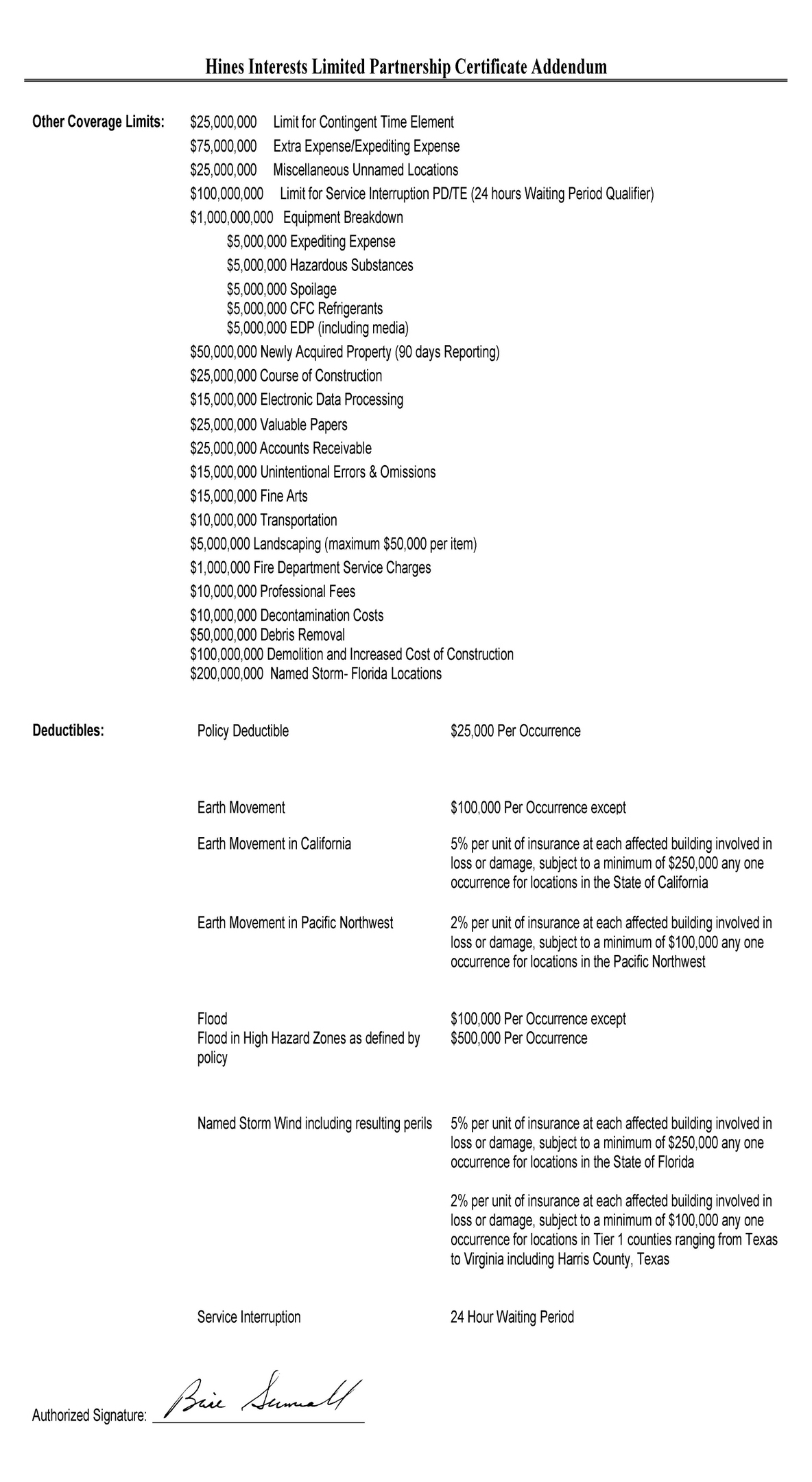

Schedule I Certified Evidence of Insurance

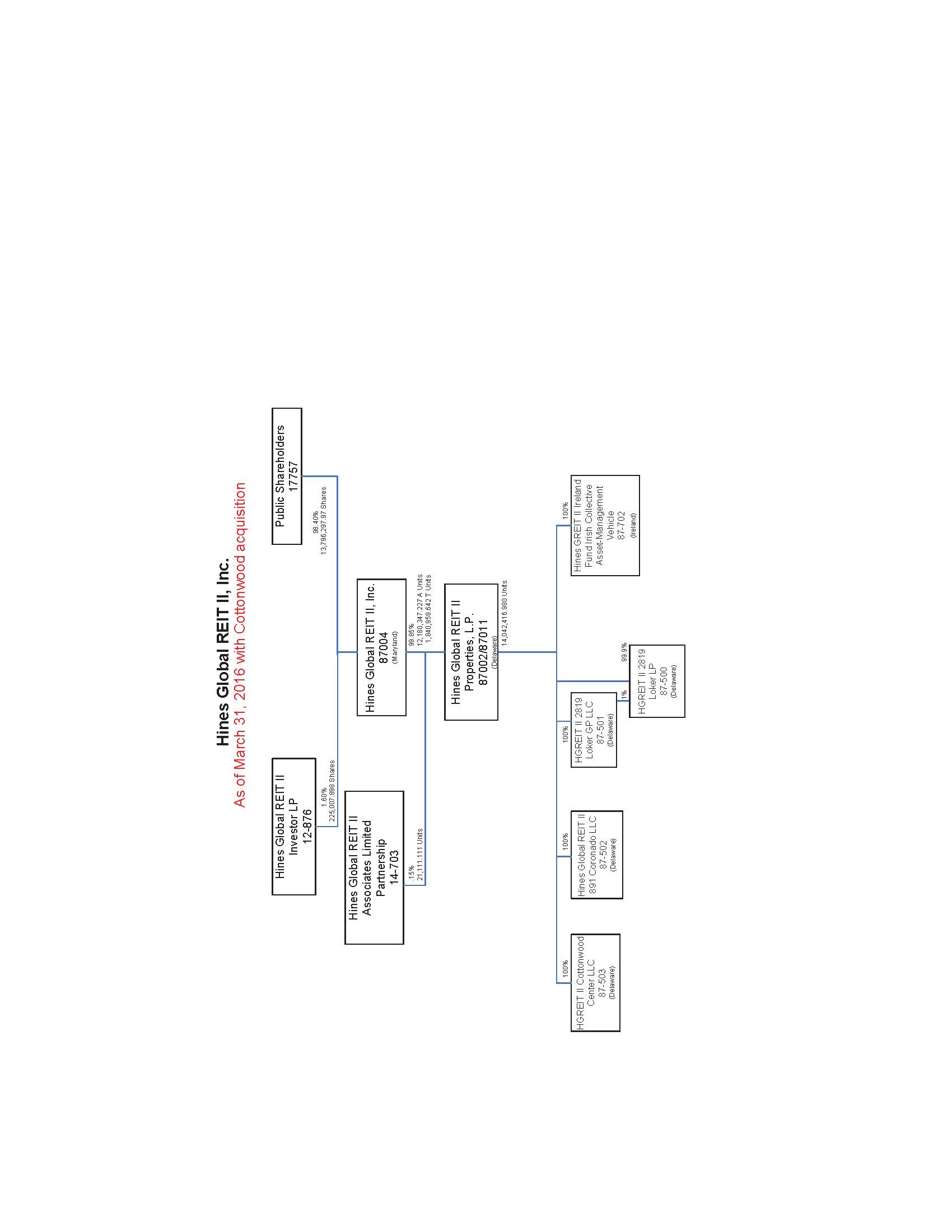

Schedule II Certified Organizational Chart

Schedule III Intentionally Deleted

Schedule IV Property Reserves Escrow Fund

THIS LOAN AGREEMENT ("Agreement"), made as of the date set forth on the cover page hereof, is by and between PRINCIPAL LIFE INSURANCE COMPANY, an Iowa corporation (together with its successors and/or assigns "Lender"), and HGREIT II COTTONWOOD CENTER LLC, a Delaware limited liability company ("Borrower").

RECITALS

A. Borrower desires to obtain the Loan (as hereinafter defined) from Lender;

B. Lender is willing to make the Loan to Borrower, subject to and in accordance with the terms of this Agreement and the other Loan Documents (as hereinafter defined);

NOW, THEREFORE, in consideration of the making of the Loan by Lender, and the covenants, agreements, representations and warranties set forth in this Agreement, the parties hereby covenant, agree, represent and warrant as follows:

ARTICLE I. DEFINITIONS; PRINCIPLES OF CONSTRUCTION

Section 1.1 Definitions. For all purposes of this Agreement, except as otherwise expressly required or unless the context clearly indicates a contrary intent:

"Affiliate(s)" means any Person(s) directly or indirectly Controlling, Controlled by, or under common Control with Borrower.

"Alteration" shall mean any installation, improvement, repair or maintenance to the Improvements (and shall specifically not include any demolition or expansion of the Improvements).

"Approved Accounting Method" means generally accepted accounting principles, a tax basis of accounting or, if acceptable to Lender in its reasonable discretion, other sound methods of accounting, in each case consistently applied.

"Award" shall mean any compensation paid by any Governmental Authority in connection with a Condemnation in respect of all or any part of the Premises.

"Business Day(s)" shall mean any day other than a Saturday, Sunday or any other day on which federally insured depository institutions in New York, New York are authorized or obligated by law, governmental decree or executive order to be closed.

"Casualty" shall have the meaning set forth in Section 5.2 of this Agreement.

"Casualty Retainage" shall have the meaning set forth in Section 5.4(b)(v) of this Agreement.

-2-

"Chief Executive Office of Borrower" shall mean 0000 Xxxx Xxx Xxxxxxxxx, Xxxxx 0000, Xxxxxxx, Xxxxx 00000.

"Closing Date" means July 5, 2016.

"Code" means the Internal Revenue Code of 1986, as amended, and as it may be further amended from time to time, any successor statutes thereto, together with applicable United States Department of Treasury regulations issued pursuant thereto in temporary or final form.

"Collateral" means, collectively, the Premises, the Reserve Funds and all proceeds and products of the foregoing, all whether now owned or hereafter acquired by Borrower, and all other property of Borrower which is or hereafter may become subject to a lien in favor of Lender as security for the repayment of the Loan.

"Component Notes" shall have the meaning set forth in Section 11.21 of this Agreement.

"Condemnation" shall mean a permanent or temporary taking by any Governmental Authority as the result of or in lieu of or in anticipation of (as reasonably determined by Lender and/or as evidenced by affirmative written statements to such effect from the Governmental Authority) the exercise of the right of condemnation or eminent domain, of all or any part of the Premises, or any interest therein or right accruing thereto, including any right of access thereto or any change of grade affecting the Premises or any part thereof.

"Condemnation Proceeds" shall have the meaning set forth in Section 5.4(b) of this Agreement.

"Contest Requirements" means (i) such contest may be made without the payment of the amount contested or the amount contested has been paid pending resolution of such contest; (ii) such contest shall prevent, during the period of such contest, the sale or forfeiture of the Premises or any part thereof, or any interest therein, to satisfy such contested lien, claim, charge or unpaid tax; (iii) Borrower has given written Notice to Lender of its intended action with respect to such contest and provides Lender promptly with copies of all notices, pleadings and other communications sent or received with respect to such contest; (iv) Borrower shall have either: (A) obtained a bond over such lien, claim, charge or unpaid tax from a bonding company reasonably acceptable to Lender, obtained title insurance over, or deposited funds in escrow with a title company or other escrow agent which has the effect of removing such lien or preventing the collection of the lien, claim, charge or unpaid tax so contested, or (B) provided to Lender a cash deposit or letter of credit acceptable to Lender in the amount of the lien, claim, charge or unpaid tax; (v) Borrower shall pay all costs and expenses incidental to such contest; and (vi) in the event of a final, non-appealable ruling or adjudication adverse to Borrower, Borrower shall promptly pay such lien, claim, charge or unpaid tax, shall indemnify and hold Lender and the Premises harmless from any loss or damage arising from such contest and shall take whatever action necessary to prevent sale, forfeiture or any other loss or damage to the Premises or to the Lender.

-3-

"Control" (and terms correlative thereto) when used with respect to any specified Person(s) means the power to direct or cause the direction of the management, policies or activities of such Person(s), directly or indirectly, whether through the ownership of voting securities or other beneficial interests, by contract or otherwise.

"Conveyance Date" means the date Lender acquires title to the Premises after an Event of Default.

"Default Rate" means a rate equal to the lesser of (i) four percent (4%) per annum above the then applicable interest rate payable under the Note or (ii) the maximum rate allowed by applicable law.

"Defaulting Guarantor" is defined in Section 7.1 of this Agreement.

"DSC Ratio" shall mean, with respect to any applicable period of time, the ratio of the annual net operating income from the Lease(s) to the annual regularly scheduled Monthly Payments, as reasonably determined by Lender. Only net operating income from executed Lease(s) in effect on the Premises which (i) are deemed approved (in accordance with Section 8.3 of this Agreement) or acceptable to Lender, or do not require Lender's approval, (ii) have no uncured defaults, and (iii) have not had an event occur which has not otherwise been remedied or waived in a commercially reasonable manner, and which at the time of Lender's determination, with the passage of time or giving of notice or both, would become a default, shall be used in Lender's determination of the annual net operating income.

"Easements" is defined in Section 4.1.6 of this Agreement.

"Embargoed Person" means (i) any person, entity, country, government or governmental agency or entity thereof that is or becomes subject to trade restrictions , embargo, or economic sanction pursuant to applicable United States law, regulation or Executive Order, including but not limited to, the International Emergency Economic Powers Act, 50 U.S.C. §1701 et seq., The Trading with the Enemy Act, 50 U.S.C. App. 1 et seq., and any Executive Orders or regulations promulgated thereunder; and (ii) any person identified on the Specially Designated Nationals and Blocked Persons List or Consolidated Sanctions List maintained by OFAC (as hereinafter defined) and/or on any other similar list maintained by OFAC.

"Entity(ies)" means a (a) corporation, (b) limited partnership, limited liability partnership or general partnership, (c) limited liability company, or (d) trust.

"Environmental Activity or Condition" has the meaning set forth in the Environmental Indemnity.

"Environmental Indemnity" shall mean that certain Environmental Indemnity Agreement from Borrower and Guarantor to Lender in connection with the Loan dated of even

-4-

date herewith, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time.

"ERISA" means the Employee Retirement Income Security Act of 1974, as amended.

"Escrow Interest Calculation" means interest shall be credited on or before the tenth (10th) of each calendar month on the average balance of the cash portion of the applicable escrow for the preceding calendar month or any portion of such preceding calendar month at a rate equal to the thirty-day average of the daily 30-day Commercial Paper Rate as published in The Wall Street Journal or similar financial publication, less 100 basis points; provided, however, that interest shall cease to be credited on any portion of the escrow at such time as it has been disbursed to Borrower or otherwise applied on behalf of Borrower in any manner expressly provided for in this Agreement or in the other Loan Documents. In no event shall the Escrow Interest Calculation be less than 0.00%.

"Escrow Release" shall have the meaning set forth in Schedule IV, if any, of this Agreement.

"Event of Default" shall have the meaning set forth in Section 7.1 of this Agreement.

"Extraordinary Rental Payments" shall mean (i) any prepaid monthly rental payments under the Lease(s) in excess of one regular monthly payment amount under the applicable Lease(s) (except for customary Security Deposits), (ii) lease termination payments for Lease(s) which equal or exceed the Threshold Amount, (iii) once the lease termination payments, calculated on a cumulative basis over a calendar year, have reached the Threshold Amount, any further lease termination payments for Lease(s) in the same calendar year (including the lease termination payment that caused the Threshold Amount to be reached), and (iv) purchase option exercise payments.

"Force Majeure" shall mean a delay due to acts of God, governmental restrictions, stays, judgments, orders, decrees, enemy actions (including acts of terrorism), civil commotion, fire, casualty, strikes, work stoppages, shortages of labor or materials or other causes beyond the reasonable control of Borrower, provided that adverse economic conditions, inflation, and other conditions of general applicability shall not be deemed a cause beyond the reasonable control of Borrower, and lack of funds in and of itself shall not be deemed a cause beyond the reasonable control of Borrower.

"Governmental Authority" means (i) any national, federal, state, regional or local government, or any other political subdivision of any of the foregoing, in each case with jurisdiction over Borrower and/or the Premises, or (ii) any Person(s) with jurisdiction over Borrower and/or the Premises exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government.

"Governmental Incentive Financing" means any financing or similar incentive or development program entered into by Borrower voluntarily (or for which Borrower is permitted

-5-

to decline to enter into), which results in a lien, encumbrance or special assessment on the Premises in favor of a governmental agency or authority, including, without limitation, a PACE Loan.

"Guarantor" means, individually and collectively, Xxxxx Global Reit II, Inc., a Maryland corporation, and permitted successors and/or assigns.

"Guaranty" means that certain Guaranty, dated as of the date hereof, executed and delivered by Guarantor in connection with the Loan to and for the benefit of Lender, as same may be amended, restated, replaced, supplemented or otherwise modified from time to time.

"Hazardous Substances" shall have the meaning set forth in the Environmental Indemnity.

"Immediate Family Member(s)" shall have the meaning set forth in Section 4.2.3(b)(iv) of this Agreement.

"Improvements" shall have the meaning set forth in the Mortgage.

"Indebtedness" means the Loan Amount outstanding from time to time together with all accrued and unpaid interest thereon, interest accrued at the Default Rate (if any), Late Charges (if any), the Prepayment Premium (if any), and all other obligations and liabilities of Borrower due or to become due to Lender pursuant to the Loan Documents.

"Insurance Proceeds" shall have the meaning set forth in Section 5.4(b) of this Agreement.

"Interest Owner(s)" means any Person(s) owning an interest (directly or indirectly) in Borrower, but specifically excluding any shareholder(s) of Guarantor other than a single shareholder that owns fifty percent (50%) or more interest.

"Interest Period" shall mean, with respect to any Payment Date, the period commencing on (and including) the first calendar day of the preceding calendar month and terminating on (and including) the last calendar day of the preceding calendar month; provided, however, that no Interest Period shall end later than the Maturity Date (other than for purposes of calculating interest at the Default Rate), and the initial Interest Period shall begin on August 1, 2016 and shall end on August 31, 2016.

"Land" shall have the meaning set forth in the Mortgage.

"Late Charge" means the lesser of: three percent (3%) of the amount not paid as required under the Loan Documents or the maximum amount permitted by applicable law.

"Lease(s)" means all leases and all other tenancies, rental arrangements, license agreements, concession agreements, storage agreements, subleases, and guarantees of the

-6-

performance or obligations of any tenants thereunder affecting the Premises, or any part thereof, now existing or which may be executed at any time in the future prior to the Maturity Date, and all amendments, extensions and renewals of said leases, subleases, and guarantees and any of them.

"Lease Modification" means all lease extensions, renewals, amendments or modifications of Lease(s).

"Legal Requirements" means all applicable requirements of law and ordinance, and all rules and regulations, now or hereafter enacted, by authorities having jurisdiction over the Premises and the use thereof, including but not limited to all covenants, conditions and restrictions of record pertaining to the Premises, the Improvements, and the use thereof.

"Lessee Documents" shall have the meaning set forth in Section 8.3(f) of this Agreement.

"Loan" shall mean the loan made by Lender to Borrower in the Loan Amount which is evidenced by the Note and secured by the Mortgage and the other Loan Documents.

"Loan Amount" means $78,000,000.00.

"Loan Documents" shall mean this Agreement, the Mortgage, the Guaranty (if any), the Note and any other instrument or agreement executed by Borrower which evidences or secures the Loan (other than the Environmental Indemnity), as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time, but excluding any mortgage loan application, term sheet or loan commitment.

"Management Agreement" shall mean that certain Property Management and Leasing Agreement dated July 5, 2016 between Borrower and Manager and any replacement thereof entered into in accordance with this Agreement.

"Manager" shall mean Xxxxx Interests Limited Partnership or any New Manager pursuant to Section 4.2.1 of this Agreement.

"Material Adverse Effect" means a material adverse effect upon (i) the business or the financial position or results of operation of Borrower or the Premises, (ii) the ability of Borrower or Guarantor (if any) to perform, or of Lender to enforce, any of the Loan Documents or Environmental Indemnity to which Borrower or Guarantor (if any) is a party, (iii) the value or use of the Premises, or (iv) the lien of the Mortgage or Borrower's title to the Premises.

"Maturity Date" means August 1, 2023 or such earlier date as a result of acceleration or otherwise.

"Monthly Payment" shall mean principal and interest in an amount equal to $328,010.40.

-7-

"Mortgage" shall mean that certain Deed of Trust, Assignment of Leases and Rents, Fixture Filing and Security Agreement from Borrower to Trustee for the benefit of Lender in connection with the Loan dated the date hereof, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time.

"Net Proceeds" shall have the meaning set forth in Section 5.4(b) of this Agreement.

"Net Proceeds Deficiency" shall have the meaning set forth in Section 5.4(b)(vii) of this Agreement.

"New Manager" shall have the meaning set forth in Section 4.2.1 of this Agreement.

"Note" shall mean that certain Secured Promissory Note, dated the date hereof, in the Loan Amount, made by Borrower in favor of Lender in connection with the Loan, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time in accordance with the terms and conditions of the Loan Documents.

"Notice" means each notice, consent, request, report or other communication under this Agreement, the Environmental Indemnity or any other Loan Document which any party hereto may desire or be required to give to the other. A Notice shall be deemed to be an adequate and sufficient Notice if given in writing and service is made by either (i) registered or certified mail, postage prepaid, in which case Notice shall be deemed to have been received three (3) Business Days following deposit to United States mail; or (ii) a nationally recognized overnight air courier, next day delivery, prepaid, in which case such Notice shall be deemed to have been received one (1) Business Day following delivery to such nationally recognized overnight air courier. All Notices shall be addressed to Borrower at its Chief Executive Office, or to Lender at c/o Principal Real Estate Investors, LLC, 000 Xxxxx Xxxxxx, Xxx Xxxxxx, Xxxx 00000-0000, Attn: Commercial Mortgage Servicing, with reference to the applicable loan number, or to such other place as either party may by written notice to the other hereafter designate as a place for service of Notice. Borrower shall not be permitted to designate more than two places for service of Notice concurrently.

"OFAC" means the Office of Foreign Assets Control, United States Department of the Treasury.

"Open Period" shall mean the period beginning on the Payment Date in the month which is four months prior to the Maturity Date and ending on the Maturity Date.

"Operation Expenses" means expenses for the operation, maintenance, taxes, assessments, utility charges and insurance attributable to the Premises including sufficient reserves for the same or replacements or renewals thereof provided that any payments to parties affiliated with Borrower shall be considered an Operation Expense only to the extent that the amount expended for such expense does not exceed the then current market rate for such expense; provided Lender has approved all payments due under the Management Agreement.

-8-

"PACE Loan" shall mean any Property-Assessed Clean Energy loan or any similar financing.

"Payment Date" means the first day of each calendar month during the term of the Loan.

"Permitted Encumbrances" means (i) all title exceptions set forth in the Title Insurance Policy, (ii) the lien and security interests created by the Loan Documents, (iii) the Lease(s), (iv) Easements, (v) liens, if any, for taxes or charges imposed by any Governmental Authority (other than liens securing any Governmental Incentive Financing), not yet due or delinquent or which are being disputed by Borrower in accordance with this Agreement, (vi) any liens or other charges (other than mechanics' or materialmans' liens) during the period they are being contested in accordance with the Contest Requirements, and (vii) any title matters or exceptions approved in writing by Lender subsequent to the Closing Date. In no event shall a mechanic's or materialman's lien (or any memorandum thereof) be deemed to be Permitted Encumbrances.

"Permitted Transfer" shall mean those Transfers permitted in Section 4.2.3 of this Agreement or as otherwise expressly permitted in writing by Lender.

"Person(s)" means any natural person, Entity(ies), joint venture, estate, unincorporated association, any federal, state, county or municipal government or any bureau, department or agency thereof and any fiduciary acting in such capacity on behalf of any of the foregoing.

"Personal Property" shall have the meaning set forth in the granting clause of the Mortgage.

"Policies" or "Policy" shall have the meaning set forth in Section 5.1(b)(i) of this Agreement.

"Premises" means the Land, the Improvements and the property, rights and interests described in the Mortgage.

"Prepayment Premium" shall mean the greater of (i) one percent (1%) of the outstanding principal amount of the Loan, or (ii) a premium calculated as provided in subparagraphs (1)-(3) below:

(1) Determine the "Reinvestment Yield." The Reinvestment Yield will be equal to the yield on a United States Treasury Issue with similar remaining time to the Maturity Date as reasonably selected by Lender within two weeks prior to the date of prepayment plus fifty (50) basis points and converted to an equivalent monthly compounded nominal yield. In the event there is no market activity involving the United States Treasury Issue at the time of prepayment, Lender shall choose a comparable Treasury Bond, Note or Xxxx which Lender reasonably deems to be similar to the United States Treasury Issue's characteristics (i.e., rate, remaining time to maturity, yield).

-9-

(2) Calculate the "Present Value of the Loan." The Present Value of the Loan is the present value of the payments remaining to be made hereunder (all installment payments and any remaining payment due on the Maturity Date) discounted at the Reinvestment Yield for the number of months remaining from the date of prepayment to the Maturity Date. In the event of a partial prepayment as a result of the terms of this Agreement, the Present Value of the Loan shall be calculated in accordance with the preceding sentence multiplied by the fraction which results from dividing the principal amount to be prepaid by the principal balance of the Loan immediately prior to the prepayment.

(3) Subtract the principal amount to be prepaid from the Present Value of the Loan (or portion thereof as provided above) as of the date of prepayment. Any resulting positive differential shall be the premium.

"Qualified Institution" shall mean a bank, saving and loan association, investment bank, or commercial credit corporation that is domiciled in the United States, qualifies for federal insurance and is otherwise acceptable to Lender.

"Qualifying Manager" shall mean a successor property manager acceptable to Lender in Lender's reasonable discretion or a reputable management company having at least seven (7) years' experience in the management of commercial properties with similar uses and quality as the Premises and in the jurisdiction in which the Premises is located.

"REA" shall mean any reciprocal easement agreement or declaration of covenants, conditions or restrictions or such other similar agreement or declaration which at any time affects the Premises, as the same may be amended, restated, supplemented or otherwise modified from time to time, if and to the extent any such an agreement(s) or declaration(s) exists.

"Recourse Obligations" shall have the meaning set forth in Article X of this Agreement.

"Regular Interest Rate" shall mean a fixed rate per annum equal to 2.98%.

"Release" shall have the meaning set forth in Section 11.24 of this Agreement.

"Release Parcel" shall have the meaning set forth in Section 11.24 of this Agreement.

"Remaining Premises" shall have the meaning set forth in Section 11.24 of this Agreement.

"Rents" means all rents or other income or payments, regardless of type or source of payment (including but not limited to common area maintenance charges, security deposits (to the extent not applied in accordance with the terms of the applicable Lease(s)), storage fees, lease termination payments, purchase option payments, refunds of any type, prepayment of rents, settlements of litigation or settlements of past due rents and any letter of credit and any proceeds derived from any letter of credit) which may now or hereafter be or become due or owing to Borrower under the Lease(s), or on account of the use and operation of the Premises.

-10-

"Required Entity Status" shall mean the type of entity status the Borrower is required to maintain throughout the term of the Loan, which for this Loan shall be a Single-Purpose Entity.

"Reserve Funds" shall mean the escrows and deposits described in Article VI of this Agreement.

"Restoration" shall have the meaning set forth in Section 5.2 of this Agreement.

"Security Deposits" means all security deposits held or to be held with respect to the Premises, pursuant to the applicable Lease(s).

"Single-Purpose Entity" means a corporation, limited partnership, limited liability company, or business trust which:

(1) | is and will be organized solely for the purpose of acquiring, developing, owning, holding, selling, leasing, financing, managing and operating the Premises, entering into and performing its obligations under the Loan Documents, refinancing the Premises in connection with a permitted repayment of the Loan, and transacting lawful business that is incidental, necessary and appropriate to accomplish the foregoing; |

(2) | does not and will not engage in any business unrelated to the matters listed in paragraph (1) above; |

(3) | does not and will not own any assets other than (a) the Premises and (b) incidental Personal Property necessary for the ownership, management and operation of the Premises, and now holds and will hold the Premises and such assets in its own name; |

(4) | does and will do all things necessary to observe its organizational formalities and preserve its existence, and does not and will not engage in, seek or consent to nor will it allow any constituent party to engage in, seek or consent to, any dissolution, winding up, liquidation, consolidation or merger, and, except as otherwise expressly permitted by the Loan Documents, does not and will not engage in, seek or consent to any asset sale, transfer of partnership, membership, shareholder, beneficial interests, or any material amendment of its limited partnership agreement, articles of incorporation and bylaws, articles of organization, certificate of formation, operating agreement, trust agreement, trust certificate, or other organizational documents (as applicable) without first obtaining Lender's reasonable approval; |

(5) | has at all times been, is and intends to remain solvent and has paid and intends to pay its debts and liabilities from its own funds and assets as the same shall become due (and with respect to Borrower, to the extent there is sufficient cash flow from the operation of the Premises to do so), and does maintain and intends to maintain adequate capital for the normal obligations reasonably foreseeable in a business of its size and character and in light of its contemplated business operations; provided, however, that the foregoing shall not require its members, partners or shareholders to make additional capital contributions to such entity, |

-11-

and provided further that the fact that the value of the Premises is ever less than the outstanding balance of the Loan shall not violate this Section;

(6) | does and will maintain its accounts, books, financial statements and records, as well as its organizational documents and other corporate documents, as official records, separate from those of any other Person(s) (including not listing Borrower's assets as assets on the financial statement of any other Person(s); provided, however, that Borrower's assets may be included in a consolidated financial statement of its Affiliates provided that (a) appropriate notation shall be made on such consolidated financial statements to indicate the separateness of Borrower and such Affiliates and to indicate that Borrower's assets and credit are not available to satisfy the debts and other obligations of such Affiliates or any other Person and (b) such assets shall be listed on Borrower's own separate balance sheet). Borrower will file its own tax returns (to the extent Borrower is required to file any such tax returns) and will not file a consolidated federal income tax return with any other Person(s) unless Borrower is a disregarded Entity for federal income tax purposes; |

(7) | does not commingle and will not commingle its funds or assets with those of any other Person; |

(8) | does and will conduct its business in its own name; |

(9) | does and will pay the salaries of its employees from its own funds; |

(10) | does not have and will not incur any indebtedness other than (A) the Indebtedness, (B) commercially reasonable unsecured trade payables (not to exceed two percent (2%) of the principal amount of the Loan) in the ordinary course of business relating to the ownership, management and operation of the Premises which are not evidenced by a note, which are paid no later than the due date thereof and which amounts are normal and reasonable under the circumstances, and (C) such other liabilities that are expressly permitted pursuant to this Agreement; |

(11) | does not have and will not acquire, assume, guarantee or become obligated for the debts, obligations or securities of any other Person or hold itself out to be responsible for or have its credit available to satisfy the debts or obligations of any other Person, except for the Indebtedness; |

(12) | does and will at all times hold itself out to the public to be, and does identify and will identify itself as, a separate and distinct Entity under its own name and not as a division or part of any other Person(s) and has corrected and will correct any known misunderstanding regarding its status as a separate and distinct Entity; |

(13) | does not have and will not make loans or advances to any Person(s); |

(14) | does and will maintain an arms-length relationship with its Affiliates; and |

(15) | if Borrower is a single member limited liability company, it must have at least two (2) Special Members, one of which, upon the dissolution of such sole member or the withdrawal or the disassociation of the sole member from Borrower, shall immediately become the sole member of Borrower, and the other of which shall become the sole member of Borrower if the first such Special Member no longer is available to serve as such sole member. |

-12-

"Special Member" means a Person(s) who is not a member of the limited liability company but has agreed to act as a Special Member under the terms of the operating agreement with only the rights and duties expressly set forth therein and only upon the occurrence of certain events that cause the member to cease to be a member of the limited liability company.

"State" means the state where the Premises is located.

"Subordination of Management Fees Agreement" shall mean any Assignment of Management Agreement and Subordination of Management Fees Agreement among Lender, Borrower and any Manager in connection with the Loan, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time.

"Tax and Insurance Escrow Fund" shall have the meaning set forth in Section 6.1 of this Agreement.

"Threshold Amount" shall mean for Alterations: $2,000,000.00; for Casualty: $2,000,000.00; for Condemnation: $1,000,000.00; and for lease termination payments (as set forth in the definition for Extraordinary Rental Payments): $250,000.00; provided however, at any time that an Event of Default has occurred and is continuing under the Loan Documents, each Threshold Amount shall be $0.00.

"Title Insurance Policy" means a loan policy of title insurance for the Premises issued to Lender insuring the first priority lien in favor of Lender created by the Mortgage.

"Transfer" shall have the meaning set forth in Section 4.2.3(a) of this Agreement.

"Trustee" means Fidelity National Title Insurance Company, or such other Trustee as may be appointed by Lender as provided in the Mortgage.

"UCC" means Uniform Commercial Code as in effect in the State.

"U.S. Publicly-Traded Entity" means a Person (other than a natural person) whose securities are listed on a national securities exchange, or quoted on an automated quotation system, in the United States.

Section 1.2 Principles of Construction . All references to sections are to sections in this Agreement unless otherwise specified. All uses of the word "including" shall mean "including, without limitation" unless the context shall indicate otherwise. Unless otherwise specified, the words "hereof," "herein" and "hereunder" and words of similar import when used in this Agreement shall refer to this Agreement as a whole and not to any particular provision of this Agreement. Unless otherwise specified, all meanings attributed to defined terms herein shall be equally applicable to both the singular and plural forms of the terms so defined.

-13-

ARTICLE II. GENERAL TERMS

Section 2.1 Loan Commitment; Disbursement to Borrower.

2.1.1 The Loan. Subject to and upon the terms and conditions set forth herein, Lender has made and Borrower has accepted the Loan on the Closing Date in the Loan Amount. Borrower has requested and has received a disbursement of the Loan on the Closing Date. Any portion of the Loan borrowed and repaid hereunder in respect of the Loan may not be reborrowed. The foregoing will not be deemed to limit or restrict the disbursement to Borrower of any escrows, holdbacks, accounts, reserves or Insurance Proceeds or Awards that are to be disbursed to Borrower under other provisions of this Agreement or the other Loan Documents. The Loan shall be evidenced by the Note, this Agreement and the other Loan Documents and shall be secured by the Mortgage and the other Loan Documents.

2.1.2 Use of Proceeds. Borrower shall use the proceeds of the Loan disbursed to it (a) to pay to Lender the amounts due under the Loan Documents, and (b) for Borrower's general business purposes (including acquisition of Borrower's interest in the Premises or repayment of a previous financing arrangement, if applicable). No part of the proceeds of the Note may be used for the purpose of buying or carrying "margin stock" within the meaning of Regulation U of the Board of Governors of the Federal Reserve System.

Section 2.2 Interest; Loan Payments; Late Payment Charge.

2.2.1 Interest; Payments Generally. Interest on the outstanding principal balance of the Loan pursuant to the Note shall accrue at the Regular Interest Rate and shall be calculated in accordance with Section 2.2.2. A payment of interest from the Closing Date to and including July 31, 2016, shall be paid on the Closing Date calculated by multiplying the actual number of days elapsed in the period for which interest is being calculated by a daily rate based on the Regular Interest Rate and a 360-day year. All amounts due under the Note shall be payable without setoff, counterclaim or any other deduction whatsoever.

2.2.2 Interest Calculation. Interest on the outstanding principal balance of the Loan shall be calculated by multiplying (a) thirty (30) days by (b) a daily rate by (c) the outstanding principal balance of the Loan based on a 360-day year composed of twelve 30-day months.

2.2.3 Making of Payments. Each Monthly Payment shall be paid in lawful money of the United States of America by automated clearing house transfer through such bank or financial institution as shall be approved in writing by Lender in Lender's reasonable discretion, shall be made to an account designated by Lender, or shall be made in such other manner as Lender may direct from time to time in the ordinary course of business. Any other monthly deposits or payments Borrower is required to make to Lender under the terms of the Loan Documents shall be made by the same payment method and on the same date as the Monthly Payment. Lender has the right, upon five (5) Business Days prior Notice to Borrower, to require a change in the method of payment. For purposes of making a Monthly Payment

-14-

hereunder, but not for purposes of calculating interest accrual periods, if the day on which such Monthly Payment is due is not a Business Day, then amounts due on such date shall be due on the immediately succeeding Business Day. Notwithstanding the foregoing sentence, with regard to the payment due on the Maturity Date or any other payment in full of the Indebtedness, the payment shall be made by Borrower in funds immediately available to Lender by 3:00 p.m., New York City time on the date such payment is due to Lender by deposit to such account as Lender may designate by written Notice to Borrower.

2.2.4 Payments Before Maturity Date. Borrower shall pay to Lender on the Payment Date occurring on September 1, 2016 and on each Payment Date thereafter up to but not including the Maturity Date, an amount equal to the Monthly Payment, which payments shall be applied first to accrued and unpaid interest for the prior Interest Period and the balance, if any, to the outstanding principal balance of the Loan.

2.2.5 Payment on Maturity Date. Borrower shall pay to Lender on the Maturity Date the outstanding principal balance of the Loan, all accrued and unpaid interest (including accrued and unpaid interest to and including the Maturity Date) and all other amounts due hereunder and under the Note, the Mortgage and the other Loan Documents.

2.2.6 Payments after Default. Upon the occurrence and during the continuance of an Event of Default, interest on the outstanding principal balance of the Loan and, to the extent permitted by law, overdue interest and other amounts due in respect of the Loan, shall accrue at the Default Rate, calculated from the date on which the Event of Default occurred until the earlier of the date the Event of Default is waived or the date upon which the Indebtedness is paid in full. Any such amount shall be secured by the Mortgage and the other Loan Documents to the extent permitted by applicable law. This paragraph and paragraph 2.2.7 shall not be construed as an agreement or privilege to extend the date of the payment of the Indebtedness, nor as a waiver of any other right or remedy accruing to Lender by reason of the occurrence and continuance of any Event of Default; and Lender retains its rights under the Note to accelerate and to continue to demand payment of the Indebtedness upon the occurrence and during the continuance of any Event of Default.

2.2.7 Late Payment Charge. If any principal, interest or any other sums due under the Loan Documents is not paid by Borrower on or prior to the date on which it is due, excluding the payment of the Loan due at maturity, whether by acceleration or otherwise, Borrower shall pay to Lender within five (5) days after demand the Late Charge in order to defray the expense incurred by Lender in handling and processing such delinquent payment and to compensate Lender for the loss of the use of such delinquent payment. Any such amount shall be secured by the Mortgage and the other Loan Documents to the extent permitted by applicable law. Notwithstanding the foregoing, during the period that interest at the Default Rate is accruing upon amounts due under the Loan Documents, no Late Charges (other than Late Charges already assessed by Lender) shall be incurred by or assessed against Borrower.

2.2.8 Usury Savings. Notwithstanding anything herein or in any of the other Loan Documents or the Environmental Indemnity to the contrary, no provision contained herein

-15-

or therein which purports to obligate Borrower to pay any amount of interest or any fees, costs or expenses which are in excess of the maximum permitted by applicable law, shall be effective to the extent it calls for the payment of any interest or other amount in excess of such maximum. All agreements between Borrower and Lender, whether now existing or hereafter arising and whether written or oral, are hereby limited so that in no contingency, whether by reason of demand for payment or acceleration of the maturity hereof or otherwise, shall the interest contracted for, charged or received by Lender exceed the maximum amount permissible under applicable law. If, from any circumstance whatsoever, interest would otherwise be payable to Lender in excess of the maximum lawful amount, the interest payable to Lender shall be reduced to the maximum amount permitted under applicable law; and if from any circumstance Lender shall ever receive anything of value deemed interest by applicable law in excess of the maximum lawful amount, an amount equal to any excessive interest shall, at the option of Lender, be refunded to Borrower or be applied to the reduction of the unpaid balance of the Loan Amount, without a Prepayment Premium and not to the payment of interest or, if such excessive interest exceeds the unpaid balance of the Loan Amount such excess shall be refunded to Borrower. This paragraph shall control all agreements between Borrower and Lender.

Section 2.3 Prepayments.

2.3.1 Prepayment During the Open Period. Borrower shall not have the right or privilege to prepay all or any portion of the unpaid principal balance of the Note until the Open Period, except as otherwise specifically set forth in this Agreement, including without limitation, Section 2.3.2. From and after the commencement of the Open Period, the principal balance of the Note may be prepaid, at par, in whole but not in part, upon: (a) not less than thirty (30) days prior written Notice to Lender specifying the date on which prepayment is to be made, provided Borrower may send subsequent notices changing the date of prepayment to a date no earlier than three (3) days after delivery of such notice and/or retracting such prepayment; (b) payment of all accrued and unpaid interest on the outstanding principal balance of the Note to and including the date on which prepayment is to be made; and (c) payment of all other Indebtedness then due under the Loan Documents. Lender shall not be obligated to accept any prepayment of the principal balance of the Note unless it is accompanied by all sums due in connection therewith.

2.3.2 Prepayment Prior To Open Period. In addition to the Loan prepayment rights expressly set forth in this Agreement, including, without limitation Section 2.3.1, Section 5.4(c), and Section 11.24, prior to the Open Period, Borrower may prepay the principal balance of the Note in full (or in part in connection with the release of a Release Parcel if permitted by the terms of this Agreement), in accordance with the requirements of clauses (a) – (c) of Section 2.3.1 hereof; provided further, that such prepayment is accompanied by payment of the Prepayment Premium.

2.3.3 Release on Payment in Full. Lender shall, at the expense of Borrower, upon payment in full of all principal and interest due on the Loan and all other amounts due and payable under the Loan Documents in accordance with the terms and provisions of the Note and this Agreement, release the lien of the Mortgage on the Premises and remit any remaining Reserve Funds to Borrower. No voluntary or involuntary prepayment of anything less than the

-16-

full amount of the Loan and all other amounts due and payable under the Loan Documents in accordance with the terms and provisions of the Note and this Agreement shall give rise to any obligation on the part of Lender to release the lien of the Mortgage on the Premises, except as provided in Section 11.24.

ARTICLE III. REPRESENTATIONS AND WARRANTIES

Section 3.1 Borrower Representations. Borrower represents and warrants as of the Closing Date that:

3.1.1 Organization. Borrower is and, until the Indebtedness is paid in full, will continue to (a) be a duly organized and validly existing Entity in good standing under the laws of the state of its formation, (b) if applicable, be duly qualified to transact business in each jurisdiction in which the nature of its business, the Premises or any of the other Collateral makes such qualification necessary, (c) have the requisite Entity power and authority to carry on its business as now being conducted, (d) have the requisite Entity power to execute, deliver and perform its obligations under the Loan Documents and Environmental Indemnity, and (e) comply with the provisions of all of its organizational documents and the Legal Requirements of the state of its formation. Schedule II includes a Certified Organizational Chart that sets forth the ownership interest (and relationship) of each Interest Owner in Borrower with a direct or indirect ownership of twenty percent (20%) or more.

3.1.2 Required Entity Status. Borrower complies with the provisions and requirements of the Required Entity Status.

3.1.3 Authorization. The execution, delivery and performance of the Loan Documents and Environmental Indemnity and the borrowing evidenced by the Note (i) are within the applicable powers of the Borrower and any Person(s) executing on behalf of Borrower; (ii) have been authorized by all requisite action; and (iii) will not violate, conflict with, result in a breach of or constitute (with notice or lapse of time or both) a default under any governing instrument of Borrower or any Entity(ies) executing on behalf of Borrower, or any indenture, agreement or other instrument to which Borrower or any Person(s) executing on behalf of Borrower is a party or by which each such party or any of their respective assets or the Premises is or may be bound or affected.

3.1.4 Enforceability. To the best of Borrower's knowledge, the Loan Documents and Environmental Indemnity constitute the legal, valid and binding obligations of Borrower, enforceable against Borrower in accordance with their respective terms, except as may be limited by (i) bankruptcy, insolvency, reorganization or other similar laws affecting the rights of creditors generally, and (ii) general principles of equity (regardless of whether considered in a proceeding in equity or at law).

3.1.5 Financial Condition. (i) Borrower is solvent, and will not become insolvent as a result of incurring the Indebtedness, and no bankruptcy, reorganization, insolvency or similar proceeding under any state or federal law with respect to the Borrower, Guarantor or

-17-

any owner of a direct interest in Borrower has been initiated, (ii) Borrower has not entered into this Loan transaction with the intent to hinder, delay or defraud any creditor, (iii) Borrower has received reasonably equivalent value for the making of the Loan, and (iv) Borrower has no known contingent liabilities which could reasonably be expected to have a Material Adverse Effect. All financial statements heretofore delivered to Lender by or on behalf of Borrower are true and correct in all material respects, have been prepared in accordance with the Approved Accounting Method consistently applied, fairly present the respective financial conditions of the subjects thereof as of the dates thereof and for the periods covered thereby, and no material adverse change has occurred in the financial conditions presented therein since the respective dates thereof.

3.1.6 Litigation. To the best of Borrower's knowledge, there are no pending actions, suits or proceedings at law or in equity by or before any Governmental Authority, arbitrator or other authority or, to the knowledge of Borrower, threatened in writing against Borrower or any Interest Owner(s) or the Premises that could reasonably be expected to have a Material Adverse Effect.

3.1.7 Not Foreign Person. Borrower is not a "foreign person" within the meaning of the Code.

3.1.8 ERISA. Until the Indebtedness is paid in full: (i) Borrower is not and will not be an "employee benefit plan" as defined in Section 3(3) of ERISA, which is subject to Title I of ERISA or a "plan" as defined in and subject to Section 4975 of the Code, (ii) the assets of Borrower do not and will not constitute "plan assets" of one or more such plans for purposes of Title I of ERISA or Section 4975 of the Code, (iii) transactions by or with Borrower are not and will not be subject to state statutes applicable to Borrower regulating investments of and fiduciary obligations with respect to employee benefit plans or any governmental plans, (iv) Borrower has made and will continue to make all required contributions to all employee benefit plans, if any, established for or on behalf of Borrower or to which Borrower is required to contribute, (v) Borrower has and will continue to administer each such plan, if any, in accordance with its terms and the applicable provisions of ERISA and any other federal or state law, and (vi) Borrower has not and will not permit any liability under Sections 4201, 4243, 4062 or 4069 of Title IV of ERISA or taxes or penalties relating to any employee benefit plan or multi-employer plan to become delinquent or assessed, respectively, which would have a Material Adverse Effect.

3.1.9 OFAC. Until the Indebtedness is paid in full:

(A) Borrower has complied and will continue to comply with all requirements of law relating to money laundering, anti-terrorism, trade embargos and economic sanctions, now or hereafter in effect;

(B) None of (i) the Borrower, (ii) any Person having a twenty percent (20%) or greater economic interest in the Borrower, or (iii) any Person otherwise controlling the Borrower, is or will become an Embargoed Person;

-18-

(C) Borrower will not use the proceeds of the Loan to finance or otherwise facilitate, directly or indirectly, any transaction or dealing with an Embargoed Person;

(D) Borrower's profits are not and will not be predominantly derived from dealings with Embargoed Persons, including but not limited to activities in countries subject to United States embargoes administered by OFAC; and

(E) Borrower has made and will make appropriate inquiries, including inquiries about Persons having an ownership interest in the Borrower, to ensure the foregoing representations and warranties remain true and correct at all times.

The foregoing representations shall not apply to the extent that any such Person's ownership interest in Borrower is held solely through a U.S. Publicly-Traded Entity and is less than twenty percent (20%).

3.1.10 Investment Company Act. Borrower is not and, until the Indebtedness is paid in full, Borrower will not be (i) an "investment company" or a company "controlled" by an "investment company," within the meaning of the Investment Company Act of 1940, as amended, or (ii) subject to any other federal or state law or regulation which purports to restrict or regulate its ability to borrow money.

3.1.11 Agreements. Borrower is not a party to any agreement or instrument or subject to any restriction which could reasonably be expected to have a Material Adverse Effect. Borrower is not in default (beyond any grace or notice and cure periods) in any respect in the performance, observance or fulfillment of any of the material obligations, covenants or conditions contained in any indenture, agreement or instrument to which it is a party or by which Borrower or the Premises is bound.

3.1.12 No Defaults. To the best of Borrower's knowledge, no default or Event of Default exists under or with respect to any Loan Document or the Environmental Indemnity.

3.1.13 Title. Borrower owns good, indefeasible, marketable and insurable fee simple title to the Premises, free and clear of all liens, other than the Permitted Encumbrances. Borrower has the right to mortgage, grant, bargain, sell, pledge, assign, warrant, transfer and convey good title to the Premises. There are not now, and there will not be any outstanding options or agreements to purchase or rights of first refusal to purchase affecting the Premises, except those tenant purchase rights, if any, as previously approved by Lender in writing.

3.1.14 Condemnation. Borrower has not received written or verbal notice that (i) a Condemnation has been commenced or is contemplated with respect to all or any portion of the Premises, or (ii) a relocation of roadways providing direct access to the Premises has been commenced or is contemplated.

-19-

3.1.15 Liens. All costs and expenses of any and all labor, materials, supplies and equipment used on or prior to the date hereof in the construction of the Improvements have been paid in full. Borrower (or a prior owner of the Premises) has paid in full for, and Borrower is the owner of, all furnishings, fixtures and equipment (other than tenants' property), if any, used in connection with the operation of the Premises, free and clear of any and all security interests, liens or encumbrances, except the Permitted Encumbrances, except for immaterial equipment leases.

3.1.16 Separate Assessment. The Premises is and, until the Indebtedness is paid in full, will be assessed for real estate tax purposes as one or more wholly independent tax lot or lots, separate from any adjoining land or improvements not constituting a part of such lot or lots, and no other land or improvements not constituting part of the Premises is or will be assessed and taxed together with the Premises or any portion thereof.

3.1.17 Enforceability of Lien. To the best of Borrower's knowledge, upon recordation in the appropriate real property records in the State and the payment of all applicable filing fees related thereto, the Mortgage securing the Loan establishes and creates a valid, effective, and enforceable first mortgage lien on and a security interest in, or claim to the Premises as security for the repayment of the Indebtedness, subject only to the Permitted Encumbrances. To the best of Borrower's knowledge, all Personal Property and fixtures covered by the Mortgage are (or will be) subject to a UCC financing statement to be filed and/or recorded, as appropriate, for such recordation or filing in all places necessary to perfect a valid first priority lien with respect to the rights and property that are the subject of the Mortgage to the extent governed by the UCC.

3.1.18 Flood. To the best of Borrower's knowledge, except as shown on the survey delivered to Lender in connection with the closing of the Loan, no portion of the Improvements is located in an area identified by the Secretary of Housing and Urban Development or the Federal Emergency Management Agency or any successor thereto as an area having special flood hazards, or, if now or hereafter located within any such area, Borrower has either elevated such Improvements to applicable minimum elevation or has obtained and will maintain applicable flood hazard insurance.

3.1.19 Permits, Licenses, Approvals. To the best of Borrower's knowledge, (i) Borrower has obtained and will maintain all necessary certificates, licenses, permits and other approvals, governmental and otherwise, necessary for the operation of the Premises and the conduct of its business, and (ii) the Land and the Improvements and the intended use thereof by Borrower comply with all applicable Legal Requirements.

3.1.20 Encroachments. Except as shown on the Survey, none of the Improvements lie or will lie outside of the boundaries of the Land or the applicable building restriction lines to the extent that such could reasonably be expected to have a Material Adverse Effect. Except as shown on the Survey, no improvements on adjoining properties now or will encroach upon the Land so as to adversely affect the value or marketability of the Premises

-20-

except those which are insured against by the Title Insurance Policy or otherwise approved by Lender in writing.

3.1.21 Access/Utilities. All public roads and streets necessary for service of and access to the Premises for the current or contemplated use thereof have been completed and are physically and legally open for use by the public. All utility services necessary and sufficient for the full use, occupancy, operation and disposition of the Land and the Improvements for their intended purposes are available to the Premises, including water, storm sewer, sanitary sewer, gas, electric, cable and telephone facilities, through public rights-of-way or perpetual private easements.

3.1.22 Physical Condition. Except as disclosed in the physical condition report delivered to Lender in connection with the closing of the Loan, to the best of Borrower's knowledge, as of the Closing Date, (i) the Premises is free from (a) unrepaired damage caused by a Casualty, and (b) material structural defects and (ii) all building systems contained in the Premises are in good working order in all material respects, subject to ordinary wear and tear.

3.1.23 No Prior Assignment. As of the Closing Date, Lender is the assignee of all of Borrower's interest under the Lease(s), and as of the Closing Date, there are no other assignments of any of the lessor's interest in the Lease(s) or any of the Rents due or to become due and payable thereunder.

3.1.24 Security Deposits. Borrower is in possession of the Security Deposits, if any, all of which are held in compliance with all applicable Legal Requirements.

3.1.25 Lease(s). Except as otherwise disclosed to Lender in writing, (a) Borrower is the sole owner of the entire lessor's interest in the Lease(s); (b) the Lease(s) are the valid, binding and enforceable obligations of Borrower and the applicable tenant or lessee thereunder; (c) except for first and/or last month's rents and Security Deposits collected in accordance with prevailing renting practices, none of the Rents have been collected for more than one (1) month in advance; (d) the premises demised under the Lease(s) have been completed and the tenants under the Lease(s) have accepted the same and have taken possession of the same on a rent-paying basis except as previously disclosed in writing to Lender; (e) there exists no offset or defense to the payment of any portion of the Rents except as previously disclosed in writing to Lender; (f) no Lease contains an option to purchase, right of first refusal to purchase, right of first offer to purchase, expansion right, or any other similar provision except as previously disclosed in writing to Lender; (g) no Person(s) has any possessory interest in, or right to occupy the Premises, except under and pursuant to the Permitted Encumbrances; (h) all leasing broker fees and commissions payable by Borrower on or prior to the Closing Date with respect to the Lease(s) have been paid in full, in cash or other form of immediately available funds except as previously disclosed in writing to Lender; (i) Borrower has delivered to Lender copies of all Lease(s) of all or any portion of the Premises; (j) to the best of Borrower's knowledge, there are no illegal activities or activities relating to illegal controlled substances at the Premises; and (k) Borrower has not received any notice of termination or intent to vacate from any tenant except as previously disclosed in writing to Lender.

-21-

3.1.26 Special Assessments. There are no pending or, to the knowledge of Borrower, proposed special or other assessments for public improvements or otherwise affecting the Premises, nor, to the knowledge of Borrower, are there any contemplated improvements to the Premises that may result in such special or other assessments.

3.1.27 REA. The REA, if any, is in full force and effect and neither Borrower nor, to the best of Borrower's knowledge, any other party to the REA, is in default thereunder, and to the best of Borrower's knowledge after due inquiry, there are no conditions which, with the passage of time or the giving of notice, or both, would constitute a default thereunder. Except as set forth in the Title Insurance Policy, the REA has not been modified, amended or supplemented in any respect.

3.1.28 Margin Stock. Neither the Borrower nor any subsidiary of Borrower is engaged principally, or as one of its important activities, in the business of extending credit for the purpose, whether immediate, incidental or ultimate, of buying or carrying "margin stock" within the meaning of Regulation U of the Board of Governors of the Federal Reserve System.

Section 3.2 Survival. Borrower agrees that (i) all of the representations and warranties of Borrower set forth in Section 3.1 and elsewhere in this Agreement and in the other Loan Documents shall survive for so long as any Indebtedness remains owing to Lender under this Agreement or any of the other Loan Documents by Borrower; (ii) the representations and warranties set forth in the Environmental Indemnity shall survive as stated therein; and (iii) Borrower will not take any action, or fail to take any action, the effect of which would be to make any of the representations and warranties of Borrower set forth in Section 3.1 no longer true. The fact tht the value of the Premises is ever less than the outstanding balance of the Loan shall not constitute a breach of Section 3.1.5, nor shall any partner of member (direct or indirect) in Borrower be obligated to contribute capital to Borrower to prevent a breach of Section 3.1.5. All representations, warranties, covenants and agreements made by Borrower in this Agreement, in the other Loan Documents and the Environmental Indemnity shall be deemed to have been relied upon by Lender notwithstanding any investigation hereafter made by Lender or on its behalf. Borrower will promptly notify Lender in writing if any of the representations, warranties or covenants in this Agreement, in the other Loan Documents and the Environmental Indemnity are no longer true or have been breached or if Borrower has a reasonable basis to believe that they may no longer be true or have been breached. In addition, Borrower will, at the request of Lender, provide such information as may be reasonably requested by Lender to determine Borrower's compliance with the terms hereof.

-22-

ARTICLE IV. BORROWER COVENANTS

Section 4.1 Affirmative Covenants. From the Closing Date and until (i) the payment and performance in full of all obligations of Borrower under the Loan Documents or (ii) the earlier release of the lien of the Mortgage encumbering the Premises in accordance with the terms of this Agreement and the other Loan Documents, Borrower hereby covenants and agrees with Lender that:

4.1.1 Perform Loan Documents. Borrower shall observe, perform and satisfy all the terms, provisions, covenants and conditions of, and shall pay when due all costs, fees, charges and expenses to the extent required under the Loan Documents and the Environmental Indemnity, including but not limited to any continuing obligations set forth in Article III of this Agreement that are to be observed, performed and satisfied until the Indebtedness is paid in full.

4.1.2 Liens/Business Operations. Borrower shall pay before delinquency any indebtedness permitted to be incurred by Borrower pursuant to the Loan Documents and any other claims which could become a lien on the Premises (unless otherwise specifically permitted in this Agreement, the Environmental Indemnity or the other Loan Documents), and upon request of Lender exhibit satisfactory evidence of the discharge thereof. Borrower shall manage, operate and maintain the Premises and keep the Premises, including but not limited to, the Improvements, in good condition and repair (ordinary wear and tear excepted) and free from mechanics' liens or other liens or claims for liens, provided however, that notwithstanding anything in this Agreement or the other Loan Documents to the contrary, Borrower may in good faith, with reasonable diligence and upon written Notice to Lender within twenty (20) days after Borrower has knowledge of such lien or claim, contest the validity or amount of any such lien or claim and defer payment and discharge thereof during the pendency of such contest in the manner provided by law, provided that the Contest Requirements are satisfied.

4.1.3 Business; Compliance. Borrower shall comply, and use commercially reasonable efforts to cause each lessee or other user of the Premises to comply, with the Legal Requirements. Borrower shall not commit, permit or suffer to exist, any act or omission affording the federal government or any state or local government the right of forfeiture as against (a) the Premises or any part thereof or (b) any monies paid in performance of Borrower's obligations under the Loan Documents. Borrower shall, if other than a natural person, do all things necessary to preserve and keep in full force and effect its existence, franchises, rights and privileges under the laws of the state of its formation and, if other than its state of formation, the State. Borrower shall notify Lender at least thirty (30) days prior to (i) any relocation of the Chief Executive Office of Borrower or any change in Borrower's state of formation, and/or (ii) if Borrower is a natural person, any relocation of Borrower's principal residence. In addition, Borrower shall give Lender prior written Notice of its intent to change its name and shall comply with the terms and conditions of Section 4.2.3. of this Agreement in connection therewith.

4.1.4 Taxes. Borrower shall pay or cause to be paid before any penalty attaches or interest accrues all general taxes, special taxes, assessments (including assessments for benefits from public works or improvements whenever begun or completed), utility charges,

-23-

water charges, sewer service charges, common area maintenance charges, if any, vault or space charges and all other like charges against or affecting the Premises or against any Personal Property, or which might become a lien on the Premises (except those taxes and assessments that may be impounded and paid directly to the taxing authority in accordance with Section 6.1 of this Agreement), and shall, within ten (10) Business Days following Lender's written request, furnish to Lender a duplicate receipt or other verification of such payment. If any such tax, assessment or charge may legally be paid in installments, Borrower may, at its option, pay such tax, assessment or charge in installments. Notwithstanding the foregoing or anything to the contrary in this Agreement or the other Loan Documents, if Borrower desires to contest any tax, assessment or charge relating to the Premises, Borrower may do so in the manner provided by law; provided, however, that the Contest Requirements are satisfied.

4.1.5 Alterations. Unless otherwise specifically set forth herein and except for any Lender approval required in connection with any Property Reserves Escrow Fund, Borrower shall obtain Lender's prior written consent (which consent shall not be unreasonably withheld, conditioned or delayed) to (a) any Alterations to any Improvements on the Premises that could upon completion thereof, reasonably be expected to have a Material Adverse Effect, (b) any demolition, reduction or expansion of the gross leasable area of the Improvements, (c) any Alterations for which the cost will exceed the Threshold Amount, or (d) any other Alterations other than those listed in the following sentence. Notwithstanding the foregoing, Lender's consent shall not be required in connection with any Alterations which are (i) tenant improvement work performed pursuant to the terms of any Lease executed on or before the Closing Date, (ii) (a) tenant improvement work performed pursuant to the terms and provisions of a Lease entered into by Borrower in accordance with the terms of this Agreement, or (b) tenant improvement work which is commercially reasonable to facilitate re-letting of any portion of the Premises, either of which does not materially adversely affect (x) any structural component of any Improvements, (y) any mechanical, electrical, utility or heating, cooling or ventilation system contained in any Improvements, or (z) the exterior (including the roof) of any building constituting a part of any Improvements, (iii) performed in connection with the restoration of the Premises after the occurrence of a Casualty or Condemnation in accordance with the terms and provisions of this Agreement, or (iv) required under Legal Requirements. If the total unpaid amounts due and payable with respect to Alterations to the Improvements at the Premises (other than amounts to be paid or reimbursed by tenants under the Lease(s)) shall at any time exceed the Threshold Amount, Borrower shall promptly notify Lender and upon Lender's reasonable request shall deliver to Lender, as security for the payment of such amounts and as additional security for Borrower's obligations under the Loan Documents, any of the following: (i) a cash deposit, (ii) a letter of credit acceptable to Lender, (iii) a completion bond from a bonding company reasonably acceptable to Lender, or (iv) a completion and/or payment guaranty from Guarantor, in form and substance reasonably acceptable to Lender; provided no additional security shall be required to the extent of escrows already deposited with Lender for tenant improvements or related deposits. All Alterations shall be completed on a timely basis subject to Force Majeure, in a good workmanlike manner and in accordance with all Legal Requirements. So long as no Event of Default then exists under the Loan Documents, Lender shall release said additional security from time to time upon receipt of acceptable written evidence of payment of actual costs for the Alterations together with those items as Lender

-24-

reasonably deems necessary in its discretion. Funds held as additional security for Alterations that exceed the Threshold Amount shall be subject to the applicable terms of Article VI of this Agreement.

4.1.6 REA/Easements. Borrower shall (i) promptly and faithfully observe, perform and comply with all the material terms, covenants and provisions of the REA on its part to be observed, performed and complied with, at the times set forth therein and to do all things necessary to preserve unimpaired its rights thereunder; (ii) not do, permit, suffer or refrain from doing anything under the REA, the result of which could reasonably be expected to have a Material Adverse Effect; (iii) not cancel, surrender, modify, amend or in any way alter or permit the alteration of any of the terms of the REA and not to release any party thereto other than Borrower from any obligation imposed upon it thereby, if such cancellation, surrender, modification, amendment, alteration or release could reasonably be expected to result in a Material Adverse Effect; and (iv) give Lender prompt written Notice of any material default of which Borrower has knowledge by any party to the REA and promptly deliver to Lender copies of each notice of such material default and, after the occurrence and during the continuance of an Event of Default, copies of all notices, communications, plans, specifications and other similar instruments received or delivered by Borrower in connection with the REA. Notwithstanding anything to the contrary contained in this Section 4.1.6, Borrower shall have the right to make non-material amendments to the REA without the consent of Lender if the same could not reasonably be expected to result in a Material Adverse Effect and Borrower shall have the right to otherwise amend the REA with the prior written consent of Lender, such consent not to be unreasonably withheld, conditioned or delayed. In addition, Borrower shall have the right to enter into easements or other similar agreements ("Easements") relating to the use or development of the Premises without Lender's prior written consent, if said Easements do not or could not reasonably be expected to (a) have a Material Adverse Effect, (b) adversely affect access to the Premises, or (c) require any lessee's prior consent that has not been obtained by Borrower. Recorded copies of all amendments to the REA and recorded copies of all Easements entered into by Borrower must be delivered to Lender promptly in accordance with the Notice provisions.

4.1.7 Financial Reporting. Borrower shall keep adequate books and records of account of the Premises and its own financial affairs, and shall cause Guarantor to keep books and records of account of its own financial affairs, sufficient to permit the preparation of financial statements therefrom in accordance with the Approved Accounting Method, consistently applied and shall furnish to Lender the following, which shall be prepared, dated and certified by Borrower as true, correct and complete in the form reasonably required by Lender, unless otherwise specified below:

(a) Within 90 days after the end of each fiscal year for Borrower, detailed financial reports covering the full and complete operation of the Premises, prepared in accordance with the Approved Accounting Method, including, without limitation, income and expense statements;

-25-

(b) Within 15 days after any written request by Lender, the reports described in paragraph (a) above, prepared on a quarterly basis, and said reports may be internally prepared by Borrower;

(c) Within 90 days after the end of each fiscal year for Borrower, a detailed rent roll of the leasing status of the Premises as of the end of such year identifying the lessee (and assignee, subtenants and licensees, if any) and location of demised premises; square footage leased; base and additional rental amounts including any increases; rental concessions, allowances, abatements and/or rental deferments (both upcoming and expired); pass-through amounts; purchase options; commencement and expiration dates; early termination dates; renewal options and annual renewal rents; total net rentable area of the Premises; the existence of any affiliation between Borrower and tenant; and a detailed listing of tenant defaults;

(d) Within 15 days following Lender's written request, (i) a detailed annual budget for the current fiscal year, for Lender's review, but not approval, to include, without limitation, a comparison showing corresponding information for Borrower's preceding fiscal year; (ii) a copy of Borrower's and Guarantor's (if any) most currently completed signed federal income tax return; (iii) detailed annual financial reports for Borrower and any Guarantor for the immediately preceding fiscal year; (iv) if applicable and required to be furnished by the lessee pursuant to the terms of its lease, a listing of sales volumes attained by lessees of the Premises under percentage leases for the immediately preceding year; and (v) an aged accounts receivable report; and

(e) Such other financial statements, and such other information and reports (including background and credit reports which may be obtained by Lender at Lender's cost) as may, from time to time, reasonably be required by Lender.

4.1.8 Required Entity Status. Borrower shall comply with the provisions and requirements of the Required Entity Status.