AMENDED AND RESTATED SHARE EXCHANGE

AMENDED AND RESTATED

SHARE EXCHANGE

This Amended and Restated Share Exchange Agreement (the “Agreement”), is dated as of April 30, 2014, among eWellness Healthcare Corporation (f/k/a Dignyte, Inc.), a Nevada corporation (“Dignyte”), ▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇▇-▇▇▇▇▇▇▇, an individual currently residing in Flagstaff, AZ being the owner of record of 10,000,000 common shares of Dignyte, eWellness Corporation, a Nevada corporation (“eWellness”); and the persons listed in Exhibit A hereof, being the owners of record of all of the issued and outstanding stock of eWellness (the “Shareholders”). Capitalized words have the meaning set forth in Section 18, unless otherwise defined herein.

R E C I T A L S

A. WHEREAS, Dignyte, eWellness and the Shareholders have heretofore entered into a Share Exchange Agreement duly executed as of April 11, 2014 (the “Initial Agreement”), establishing and providing for, among other things, the share exchange between the parties.

B. Under the Initial Agreement, Dignyte was required to conduct the transactions contemplated thereunder in compliance with Rule 419 (“Rule 419”) of Regulation C under the Securities Act of 1933, as amended (the “Securities Act”); however, since the transaction was not completed within the requisite time frame of Rule 419, Dignyte is no longer permitted to conduct a 419 transaction and therefore is no longer required to comply with Rule 419 (the “419 Transaction”);

C. To accomplish the goals originally contemplated upon entering into the Initial Agreement, the parties have agreed that Dignyte: (i) shall file a registration statement on Form 8-A (“Form 8A”) to register its common stock pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended, (ii) will terminate the 419 Transaction and attempt to convert it into a private offering of the number of shares subscribed for in the 419 Transaction to the same purchasers who participated in the 419 Transaction (the “Dignyte Converted Offering”) and (iii) file a Registration Statement on Form S-1 to register for resale the shares of common stock included in the Dignyte Converted Offering and sold pursuant to the Financing, as hereinafter defined (the “Combined Registration Statement”).

D. The Shareholders currently own 100% of the issued and outstanding capital stock of eWellness.

E. In order to complete a strategy to become a publicly traded/listed company in the U.S., the Shareholders have agreed to sell to Dignyte, and Dignyte has agreed to purchase from the Shareholders 100% of the common stock of eWellness (the “eWellness Stock”) in exchange for shares of the outstanding common shares of Dignyte (the “Dignyte Stock”), pursuant to the terms and conditions set forth in this Agreement.

F. eWellness will become a wholly owned subsidiary of Dignyte.

G. Digntye, eWellness and the Shareholders desire to amend and restate the Initial Agreement to read in its entirety as set forth herein (the “Agreement”).

NOW, THEREFORE, in consideration of the mutual representations, warranties, covenants and agreements contained in this Agreement, the parties agree as follows:

| 1 |

| 1. | Exchange of Stock. |

| (a) | The Shareholders agree to transfer to Dignyte, and Dignyte agrees to purchase from the Shareholders, all of the Shareholders’ right, title and interest in the eWellness Stock, representing 100% of the issued and outstanding stock of eWellness, free and clear of all mortgages, liens, pledges, security interests, restrictions, encumbrances, or adverse claims of any nature. | |

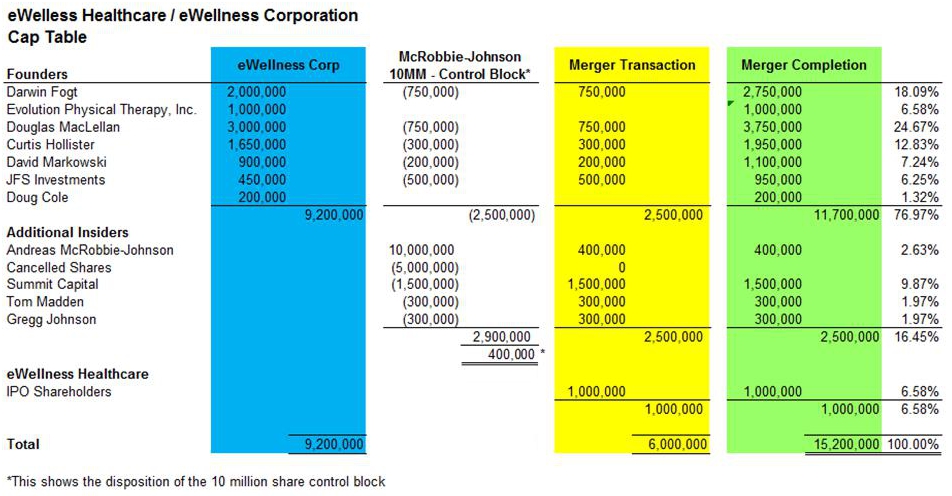

| (b) | At the Closing (as defined in Section 2 below), upon surrender by the Shareholders of the certificates evidencing the eWellness Stock, duly endorsed for transfer to Dignyte or accompanied by stock powers executed in blank by the Shareholders, Dignyte will cause 9,200,000 shares (subject to adjustment for fractionalized shares as set forth below) of the common voting stock, par value $.001 of Dignyte (the “Dignyte Stock”) to be issued to the Shareholders (or their designees), in exchange for 9,200,000 shares of the common stock of eWellness, representing 100% of the issued and outstanding common stock of eWellness, as further set forth on the capitalization table annexed hereto as Schedule 1(b) and made a part hereof (the “Capitalization Table”). The Dignyte Stock will be issued to the Shareholders on a pro rata basis, in the same proportion as the percentage of their ownership interest in eWellness, as set forth on Exhibit A (subject to adjustment as set forth below), at the Closing. As a result of the exchange of the eWellness Stock for the Dignyte Stock, eWellness will become a wholly owned subsidiary of Dignyte. “Surviving Company” refers to the combined entity following the Closing. | |

| (c) | Directors of Dignyte at Closing Date. On the Closing Date, the current directors of the Dignyte shall appoint ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ and ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ to serve as members of Dignyte’s Board, with ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ serving as Chairman, to be effective immediately upon the Closing (the “Effective Time”). All of the members of Dignyte’s Board as of the day immediately before the Closing Date shall tender their resignation as a director of Dignyte to be effective at the Effective Time. | |

| (d) | Officers of Dignyte at Closing Date. On the Closing Date, ▇▇. ▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇▇-▇▇▇▇▇▇▇ and ▇▇. ▇▇▇▇▇ ▇. ▇▇▇▇▇ shall resign from each officer position held at Dignyte and Dignyte’s Board shall appoint ▇▇▇▇▇▇ ▇▇▇▇ to serve as the President, Chief Executive Officer, ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ to serve as Chief Financial Officer, Treasurer and Secretary, ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ to serve as CTO and ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ to serve as Chairman of the Board and assistant Secretary. | |

| (e) | Section 368 Reorganization. For U.S. federal income tax purposes, the Share Exchange is intended to constitute a “reorganization” within the meaning of Section 368(a)(1)(B) of the Code. The parties to this Agreement hereby adopt this Agreement as a “plan of reorganization” within the meaning of Sections 1.368-2(g) and 1.368-3(a) of the United States Treasury Regulations. Notwithstanding the foregoing or anything else to the contrary contained in this Agreement, the parties acknowledge and agree that no party is making any representation or warranty as to the qualification of the Share Exchange as a reorganization under Section 368 of the Code or as to the effect, if any, that any transaction consummated prior to the Closing Date has or may have on any such reorganization status. The parties acknowledge and agree that each (i) has had the opportunity to obtain independent legal and tax advice with respect to the transaction contemplated by this Agreement, and (ii) is responsible for paying its own Taxes, including without limitation, any adverse Tax consequences that may result if the transaction contemplated by this Agreement is not determined to qualify as a reorganization under Section 368 of the Code. |

| 2 |

| 2. | Closing. |

| (a) | The parties to this Agreement will hold a closing (the “Closing”) for the purpose of executing and exchanging all of the documents contemplated by this Agreement and otherwise effecting the transactions contemplated by this Agreement. The Closing will be held as soon as possible and it is currently anticipated that it will occur on or before May 15, 2014, or as soon thereafter as is practicable at ▇▇▇▇▇▇ ▇▇▇▇▇▇▇ ▇▇▇▇▇ LLP, ▇▇▇ ▇▇▇▇ ▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇, ▇▇▇ ▇▇▇▇, ▇▇ ▇▇▇▇▇, unless another place or time is mutually agreed upon in writing by the parties. All proceedings to be taken and all documents to be executed and exchanged at the Closing will be deemed to have been taken, delivered and executed simultaneously, and no proceeding will be deemed taken nor documents deemed executed or delivered until all have been taken, delivered and executed. If agreed to by the parties, the Closing may take place through the exchange of documents by fax and/or express courier. | |

| (b) | With the exception of any stock certificates which must be in their original form, any copy, fax, e-mail or other reliable reproduction of the writing or transmission required by this Agreement or any signature required thereon may be used in lieu of an original writing or transmission or signature for any and all purposes for which the original could be used, provided that such copy, fax, e-mail or other reproduction is a complete reproduction of the entire original writing or transmission or original signature, and the originals are promptly delivered thereafter. |

| 3. | Representations and Warranties of Dignyte. |

Dignyte represents and warrants as follows:

| (a) | Dignyte is a corporation duly organized, validly existing, and in good standing under the laws of the State of Nevada and is licensed or qualified as a foreign corporation in all states in which the nature of its business or the character or ownership of its properties makes such licensing or qualification necessary. | |

| (b) | Dignyte has all requisite authority and power (corporate and other), governmental licenses, authorizations, consents and approvals to enter into this Agreement and to consummate the transactions contemplated by this Agreement and to perform its obligations under this Agreement other than (i) the filing of a Form 8A; (ii) the filing of a Form 8-K with the Commission within four (4) business days after the execution of this Agreement and of the Closing Date; and (iii) any filing required by FINRA. The execution, delivery and performance by Dignyte of this Agreement has been duly authorized by all necessary corporate action and do not require from Dignyte’s Board any consent or approval that has not been validly and lawfully obtained. Except as provided for in the first sentence of this paragraph, the execution, delivery and performance by Dignyte of this Agreement requires no authorization, consent, approval, license, exemption of or filing or registration with any Governmental Authority or other Person other than such other customary filings with the Commission for transactions of the type contemplated by this Agreement. |

| 3 |

| (c) | No Violation. Neither the execution nor the delivery by Dignyte of this Agreement, nor the consummation or performance by Dignyte of the transactions contemplated hereby or thereby will, directly or indirectly, (a) contravene, conflict with, or result in a violation of any provision of the Organizational Documents of Dignyte; (b) contravene, conflict with, constitute a default (or an event or condition which, with notice or lapse of time or both, would constitute a default) under, or result in the termination or acceleration of, or result in the imposition or creation of any Lien under, any agreement or instrument to which Dignyte is a party or by which the properties or assets of Dignyte are bound; (c) contravene, conflict with, or result in a violation of, any Law or Order to which Dignyte, or any of the properties or assets owned or used by Dignyte, may be subject; or (d) contravene, conflict with, or result in a violation of, the terms or requirements of, or give any Governmental Authority the right to revoke, withdraw, suspend, cancel, terminate or modify, any licenses, permits, authorizations, approvals, franchises or other rights held by Dignyte or that otherwise relate to the business of, or any of the properties or assets owned or used by, Dignyte, except, in the case of clauses (b), (c), or (d), for any such contraventions, conflicts, violations, or other occurrences as would not have a Material Adverse Effect. | |

| (d) | Binding Obligations. Assuming this Agreement has been duly and validly authorized, executed and delivered by the parties hereto and thereto other than Dignyte, this Agreement is duly authorized, executed and delivered by Dignyte and constitutes the legal, valid and binding obligations of Dignyte, enforceable against Dignyte in accordance with their respective terms, except as such enforcement is limited by general equitable principles, or by bankruptcy, insolvency and other similar Laws affecting the enforcement of creditors rights generally. | |

| (e) | Securities Laws. Assuming the accuracy of the representations and warranties of the Shareholders, contained in Section 4 and Exhibits D and E, the issuance of the Dignyte Stock pursuant to this Agreement will be when issued in accordance with the terms of this Agreement, issued in accordance with exemptions from the registration and prospectus delivery requirements of the Securities Act and the registration permit or qualification requirements of all applicable state securities laws. | |

| (f) | The authorized capital stock of Dignyte consists of 100,000,000 shares of common stock, $0.001 par value per share, of which, 11,000,000 shares are issued and outstanding. Dignyte also has 10,000,000 shares of blank check preferred stock authorized with none issued or outstanding. To the knowledge of Dignyte, all issued and outstanding shares of Dignyte’s common stock are fully paid and nonassessable. | |

| (g) | Other than as set forth on Schedule 3(c) attached hereto, there are no subscription rights, options, warrants, convertible securities, or other rights (contingent or otherwise) presently outstanding, for the purchase, acquisition, or sale of the capital stock of Dignyte, or any securities convertible into or exchangeable for capital stock of Dignyte or other securities of Dignyte, from or by Dignyte. There are no outstanding obligations of Dignyte to retire, repurchase, redeem or otherwise acquire any of its outstanding shares of capital stock of, or other ownership interests in, Dignyte or to provide funds to or make any investment (in the form of a loan, capital contribution or otherwise) in any other Person and there will be none of the foregoing outstanding at the Closing. |

| 4 |

| (b) | Dignyte has no subsidiaries. | |

| (e) | The execution of this Agreement and performance by Dignyte hereunder has been duly authorized by all requisite corporate action on the part of Dignyte, and this Agreement constitutes a valid and binding obligation of Dignyte, and Dignyte’s performance hereunder will not violate any provision of any charter, bylaw, indenture, mortgage, lease, or agreement, or any order, judgment, decree, or, to Dignyte’s knowledge any law or regulation, to which any property of Dignyte is subject or by which Dignyte is bound. | |

| (f) | As set forth on Schedule 3(f), Dignyte has minimal assets and liabilities. Any liabilities shall not be greater than $50,000.00 at closing. It is also anticipated that Dignyte shall have approximately $62,861.00 in cash at closing, assuming the completion of all of its current initial public offering. | |

| (g) | There is no litigation or proceeding pending or to Dignyte’s knowledge threatened against or relating to Dignyte, its properties or business. | |

| (h) | Other than professional retainer agreements for the provision of legal and accounting services to Dignyte, Dignyte is not a party to any material contract. For purposes of this Agreement “material” shall mean any contract, debt, liability, claim or other obligation valued or otherwise worth $2,000 or more. | |

| (i) | Other than ▇▇. ▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇▇-▇▇▇▇▇▇▇ and ▇▇. ▇▇▇▇▇ ▇. ▇▇▇▇▇, Dignyte has no officers, directors or employees. | |

| (j) | Other than ▇▇. ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇ who owns 10,000,000 shares of Dignyte’s common stock, no current officer, director, affiliate or person known to Dignyte to be the record or beneficial owner of in excess of 5% of Dignyte’s common stock, or any person known to be an associate of any of the foregoing is a party adverse to Dignyte or has a material interest adverse to Dignyte in any material pending legal proceeding. | |

| (k) | Dignyte has filed in correct form all federal, state, and other tax returns of every nature required to be filed by it and has paid all taxes and all assessments, fees and charges which it is obligated to pay by federal, state or other taxing authority to the extent that such taxes, assessments, fees and charges have become due. Dignyte has also paid all taxes which do not require the filing of returns and which are required to be paid by it. To the extent that tax liabilities have accrued, but have not become payable, they have been adequately reflected as liabilities on the books of Dignyte. |

| 5 |

| (l) | Dignyte will be provided the opportunity to perform all due diligence investigations of eWellness and its business and valuations as it deems necessary or appropriate and to ask questions of the officers and directors of eWellness. Dignyte will have access to all documents and information about eWellness and will review sufficient information to allow it to evaluate the merits and risks of the transactions contemplated by this Agreement. | |

| (o) | Dignyte is acquiring the eWellness Shares to be transferred to it under this Agreement for investment and not with a view to the sale or distribution thereof. | |

| (p) | Dignyte is a publicly reporting company pursuant to Section 15(d) of the Securities Exchange Act of 1934, as amended (the “Act”) and is in compliance with all reporting requirements of the Act. Dignyte’s Form 10-K for the period ending December 31, 2013, and any other periodic filings made by Dignyte as filed with the Commission, including all exhibits, documents and attachments thereto, are true and correct in all material respects and do not contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make any statement therein not materially misleading. | |

| (q) | Compliance with Laws. The business and operations of Dignyte have been and are being conducted in accordance with all applicable Laws and Orders. Dignyte has not received notice of any violation (or any Proceeding involving an allegation of any violation) of any applicable Law or Order by or affecting Dignyte and, to the knowledge of Dignyte, no Proceeding involving an allegation of violation of any applicable Law or Order is threatened or contemplated. Dignyte is not subject to any obligation or restriction of any kind or character, nor is there, to the knowledge of Dignyte, any event or circumstance relating to Dignyte that materially and adversely affects in any way its business, properties, assets or prospects or that prohibits Dignyte from entering into this Agreement or would prevent or make burdensome its performance of or compliance with all or any part of this Agreement or the consummation of the transactions contemplated hereby. | |

| (r) | No Brokers or Finders. Except as disclosed in Schedule 3(r), no Person has, or as a result of the transactions contemplated herein will have, any right or valid claim against Dignyte for any commission, fee or other compensation as a finder or broker, or in any similar capacity. | |

| (s) | Changes. Except as set forth on Schedule 3(s), Dignyte has conducted its business in the usual and ordinary course of business consistent with past practice. | |

| (t) | Interested Party Transactions. Except as set forth on Schedule 3(t), no officer, director or stockholder of Dignyte or any Affiliate or “associate” (as such term is defined in Rule 405 of the Commission under the Securities Act) of any such Person, has or has had, either directly or indirectly, (1) an interest in any Person which (a) furnishes or sells services or products which are furnished or sold or are proposed to be furnished or sold by Dignyte, or (b) purchases from or sells or furnishes to, or proposes to purchase from, sell to or furnish Dignyte any goods or services; or (2) a beneficial interest in any contract or agreement to which Dignyte is a party or by which it may be bound or affected. | |

| (u) | Governmental Inquiries. Dignyte has provided to the Shareholders a copy of each material written inspection report, questionnaire, inquiry, demand or request for information received by Dignyte from any Governmental Authority, and Dignyte’s response thereto, and each material written statement, report or other document filed by Dignyte with any Governmental Authority. |

| 6 |

| (v) | Bank Accounts and Safe Deposit Boxes. Except as set forth on Schedule 3(v), Dignyte does not have any bank or other deposit or financial account, nor does Dignyte have any lock boxes or safety deposit boxes. | |

| (w) | Title to Properties. Dignyte owns (with good and marketable title in the case of real property) or holds under valid leases the rights to use all real property, plants, machinery, equipment and other personal property, if any, as set forth in its financial statements included in its Form 10-K for the year ended December 31, 2013 as filed with the Commission, free and clear of all Liens, except Permitted Liens. For purposes of this Agreement, “Permitted Liens” means with respect to any Person (A) such imperfections of title, easements, encumbrances or restrictions which do not materially impair the current use of such Person’s or any of its Subsidiary’s assets, (B) materialmen’s, mechanics’, carriers’, workmen’s, warehousemen’s, repairmen’s and other like Liens arising in the ordinary course of business, or deposits to obtain the release of such Liens, (C) Liens for Taxes not yet due and payable, or being contested in good faith, and (D) purchase money Liens incurred in the ordinary course of business. | |

| (x) | Dignyte has no stock option plans providing for the grant by Dignyte of stock options to directors, officers or employees. | |

| (y) | Money Laundering Laws. The operations of Dignyte is and has been conducted at all times in compliance with applicable financial recordkeeping and reporting requirements of the Currency and Foreign Transactions Reporting Act of 1970, as amended, the money laundering statutes of all U.S. and non-U.S. jurisdictions, the rules and regulations thereunder and any related or similar rules, regulations or guidelines, issued, administered or enforced by any Governmental Authority (collectively, the “Money Laundering Laws”) and no Proceeding involving Dignyte with respect to the Money Laundering Laws is pending or, to the knowledge of Dignyte, threatened. | |

| (z) | Board Recommendation. Dignyte’s Board, by unanimous written consent, has determined that this Agreement and the transactions contemplated by this Agreement are advisable and in the best interests of Dignyte’s stockholders and has duly authorized this Agreement and the transactions contemplated by this Agreement. | |

| (aa) | Certain Registration Matters. Except as set forth on Schedule 3(aa), Dignyte has not granted or agreed to grant any person any rights (including “piggy-back registration rights) to have any securities of Dignyte registered with the Commission or any other Governmental Authority that have not been satisfied. |

| 4. | Representations and Warranties of the Shareholders and eWellness. |

The Shareholders and eWellness, severally and not jointly, represent and warrant as follows:

| (a) | eWellness is a corporation duly organized, validly existing, and in good standing under the laws of Nevada and is licensed or qualified as a foreign corporation in all places in which the nature of its business or the character or ownership of its properties makes such licensing or qualification necessary. The authorized capital stock of eWellness consists of 100,000,000 shares of common stock, $0.001 par value per share, of which, 9,200,000 shares are issued and outstanding. To the knowledge of eWellness and the Shareholders, all issued and outstanding shares of eWellness’s common stock are fully paid and nonassessable. |

| 7 |

| (b) | There are no agreements purporting to restrict the transfer of the eWellness Shares, nor any voting agreements, voting trusts or other arrangements restricting or affecting the voting of the eWellness Shares. The eWellness Shares held by the Shareholders are duly and validly issued, fully paid and non-assessable, and issued in full compliance with all federal, state, and local laws, rules and regulations. Other than as set forth on Schedule 4(c) attached hereto, there are no subscription rights, options, warrants, convertible securities, or other rights (contingent or otherwise) presently outstanding, for the purchase, acquisition, or sale of the capital stock of eWellness, or any securities convertible into or exchangeable for capital stock of eWellness or other securities of eWellness, from or by eWellness. | |

| (c) | The Shareholders have full right, power and authority to sell, transfer and deliver the eWellness Shares, and upon delivery of the certificates therefor as contemplated in this Agreement, the Shareholders will transfer to Dignyte valid and marketable title to the eWellness Shares, including all voting and other rights to the eWellness Shares free and clear of all pledges, liens, security interests, adverse claims, options, rights of any third party, or other encumbrances. Each of the Shareholders owns and holds that number and percentage of eWellness Shares that are listed opposite their names on Exhibit A attached hereto. | |

| (d) | There is no litigation or proceeding pending, or to any eWellness Shareholder’s knowledge, threatened, against or relating to eWellness or to the eWellness Shares. | |

| (e) | eWellness has filed in correct form all tax returns of every nature required to be filed by it in its home jurisdiction or otherwise and has paid all taxes as shown on such returns and all assessments, fees and charges received by it to the extent that such taxes, assessments, fees and charges have become due. eWellness has also paid all taxes which do not require the filing of returns and which are required to be paid by it. To the extent that tax liabilities have accrued, but have not become payable, they have been adequately reflected as liabilities on the books of eWellness. | |

| (f) | The financial statements of eWellness as at December 31, 2013 and for the two fiscal years then ended, that have been provided to Dignyte have been prepared consistent with U.S. Generally Accepted Accounting Principles (“GAAP”) and fairly present the assets and liabilities of eWellness as of the date of such statements. | |

| (g) | The current residence address or principal place of business (for any non-individual shareholder) of the Shareholders is as listed on Exhibit A attached hereto. | |

| (h) | The Shareholders have had the opportunity to perform all due diligence investigations of Dignyte and its business as they have deemed necessary or appropriate and to ask questions of Dignyte’s officers and directors and have received satisfactory answers to all of their questions. The Shareholders have had access to all documents and information about Dignyte, including, but not limited to, Dignyte’s current and periodic reports filed with the U.S. Securities and Exchange Commission, and have reviewed sufficient information to allow them to evaluate the merits and risks of the acquisition of the Dignyte Stock. |

| 8 |

| (i) | The Shareholders are acquiring the Dignyte Stock for their own account (and not for the account of others) for investment and not with a view to the distribution therefor. The Shareholders will not sell or otherwise dispose of the Dignyte Stock without registration under the Securities Act of 1933, as amended, or an exemption therefrom, and the certificate or certificates representing the Dignyte Stock will contain a legend to the foregoing effect. By its execution of this Agreement, the Shareholder represents and warrants to the Dignyte that the Shareholder is an Accredited Investor and/or not U.S. Person. | |

| (j) | Additional Representations and Warranties of the Shareholder as an Accredited Investor. The Shareholder further makes the representations and warranties to Dignyte set forth on Exhibit D. | |

| (k) | Additional Representations and Warranties of the Shareholder as a Non-U.S. Person. The Shareholder further makes the representations and warranties to Dignyte set forth on Exhibit E. | |

| (l) | Stock Legends. The Shareholder hereby agrees with Dignyte as follows: |

| i. | Securities Act Legend - Accredited Investor. The certificate(s) evidencing the Digynte Stock issued to the Shareholder, and each certificate issued in transfer thereof, will bear the following legend: |

THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR ANY STATE SECURITIES LAWS AND NEITHER SUCH SECURITIES NOR ANY INTEREST THEREIN MAY BE OFFERED, SOLD, PLEDGED, ASSIGNED OR OTHERWISE TRANSFERRED EXCEPT (1) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS OR (2) PURSUANT TO AN AVAILABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS, IN WHICH CASE THE HOLDER MUST, PRIOR TO SUCH TRANSFER, FURNISH TO DIGNYTE AN OPINION OF COUNSEL, WHICH COUNSEL AND OPINION ARE REASONABLY SATISFACTORY TO DIGNYTE, THAT SUCH SECURITIES MAY BE OFFERED, SOLD, PLEDGED, ASSIGNED OR OTHERWISE TRANSFERRED IN THE MANNER CONTEMPLATED PURSUANT TO AN AVAILABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS.

| 9 |

| ii. | Securities Act Legend - Non-U.S. Person. The certificate(s) evidencing the Dignyte Stock issued to the Shareholder and each certificate issued in transfer thereof, will bear the following legend: |

THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR ANY STATE SECURITIES LAWS AND NEITHER SUCH SECURITIES NOR ANY INTEREST THEREIN MAY BE OFFERED, SOLD, PLEDGED, ASSIGNED OR OTHERWISE TRANSFERRED EXCEPT (1) IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S PROMULGATED UNDER THE SECURITIES ACT, AND BASED ON AN OPINION OF COUNSEL, WHICH COUNSEL AND OPINION ARE REASONABLY SATISFACTORY TO DIGNYTE, THAT THE PROVISIONS OF REGULATION S HAVE BEEN SATISFIED, (2) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS OR (3) PURSUANT TO AN AVAILABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS, IN WHICH CASE THE HOLDER MUST, PRIOR TO SUCH TRANSFER, FURNISH TO DIGNYTE AN OPINION OF COUNSEL, WHICH COUNSEL AND OPINION ARE REASONABLY SATISFACTORY TO DIGNYTE, THAT SUCH SECURITIES MAY BE OFFERED, SOLD, PLEDGED, ASSIGNED OR OTHERWISE TRANSFERRED IN THE MANNER CONTEMPLATED PURSUANT TO AN AVAILABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS. HEDGING TRANSACTIONS INVOLVING THE SECURITIES REPRESENTED BY THIS CERTIFICATE MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE SECURITIES ACT.

| iii. | Other Legends. The certificate(s) representing such Dignyte Stock, and each certificate issued in transfer thereof, will also bear any other legend required under any applicable Law, including, without limitation, any U.S. state corporate and state securities law, or contract. | |

| iv. | Opinion. The Shareholder will not transfer any or all of Dignyte’s Stock pursuant to Regulation S or absent an effective registration statement under the Securities Act and applicable state securities law covering the disposition of the Shareholder’s Dignyte Stock, as the case may be, without first providing Dignyte with an opinion of counsel (which counsel and opinion are reasonably satisfactory to Dignyte) to the effect that such transfer will be made in compliance with Regulation S or will be exempt from the registration and the prospectus delivery requirements of the Securities Act and the registration or qualification requirements of any applicable U.S. state securities laws. | |

| v. | Consent. The Shareholders understand and acknowledge that Dignyte may refuse to transfer the Dignyte Stock, unless the Shareholders comply with this Section 4(l) and any other restrictions on transferability set forth in Exhibits D and E. The Shareholders consent to Dignyte making a notation on its records or giving instructions to any transfer agent of Dignyte’s Common Stock in order to implement the restrictions on transfer of the Dignyte Stock. |

| 10 |

| (m) | The Shareholder understands that the Dignyte Stock are being offered and sold to the Shareholder in reliance upon the truth and accuracy of the representations, warranties, agreements and understandings of the Shareholder set forth in this Agreement, in order that Dignyte may determine the applicability and availability of the exemptions from registration of the Dignyte Stock on which Dignyte is relying. |

| 5. | Conduct Prior to the Closing. |

Dignyte, eWellness and the Shareholders covenant that between the date of this Agreement and the Closing as to each of them:

| (a) | Other than as contemplated herein, no change will be made in the charter documents, by-laws, or other corporate documents of Dignyte or eWellness. | |

| (b) | Dignyte, eWellness and the Shareholders will each use its best efforts to maintain and preserve Dignyte and eWellness’s business organization, employee relationships, and goodwill intact, and will not enter into any material commitment except in the ordinary course of business. | |

| (c) | None of the Shareholders will sell, transfer, assign, hypothecate, lien, or otherwise dispose or encumber the eWellness Shares owned by them. | |

| (d) | The Shareholders and eWellness will use their best efforts to maintain and preserve the business organization, employee relationships and goodwill intact of eWellness, and will not allow eWellness to enter into any material commitment except in the ordinary course of business. | |

| (e) | Intentionally Left Blank. | |

| (f) | Each of Dignyte and eWellness will conduct its respective business in the ordinary course and in such a manner so that the representations and warranties contained herein shall continue to be true and correct in all material respects as of the Closing as if made at and as of the Closing Without the prior written consent of Dignyte or eWellness, except as required or specifically contemplated hereby, each party shall not undertake or fail to undertake any action if such action or failure would render any of said warranties and representations untrue in any material respect as of the Closing. | |

| (g) | Parties hereto shall give to the representative of the other parties prompt written notice of the occurrence or existence of any event, condition or circumstance occurring which would constitute a violation or breach of this Agreement by such party or which would render inaccurate in any material respect any of such party’s representations or warranties herein. |

| 11 |

| 6. | Conditions to Obligations of the Shareholders and eWellness. |

The Shareholders and eWellness’s obligations to complete the transactions contemplated herein are subject to fulfillment on or before the Closing of each of the following conditions, unless waived in writing by the Shareholders or eWellness, as appropriate:

| (a) | The representations and warranties of Dignyte set forth herein will be true and correct at the Closing as though made at and as of that date, except as affected by the transactions contemplated hereby. | |

| (b) | Dignyte will have performed all covenants required by this Agreement to be performed by it on or before the Closing. | |

| (c) | Dignyte shall have received consent from at least 85% of the participants of the 419 Transaction to instead participate and invest in the Dignyte Converted Offering, which consent shall also include such participants acknowledgement and agreement to the Dignyte Lock Up. | |

| (d) | This Agreement will have been approved by the Board of Directors of Dignyte. | |

| (e) | Dignyte will have delivered to the Shareholders and eWellness the documents set forth below in form and substance reasonably satisfactory to counsel for eWellness and the Shareholders, to the effect that: |

| i. | Dignyte is a corporation duly organized, validly existing, and in good standing by providing a certificate of good standing from Nevada’s Secretary of State; | |

| ii. | Dignyte’s authorized capital stock is as set forth herein; | |

| iii. | Certified copies of the resolutions of the board of directors of Dignyte authorizing the execution of this Agreement and the consummation hereof; | |

| iv. | A certificate executed by an officer of Dignyte, certifying the satisfaction of the conditions specified in Sections 6(a), (b) and (c) relating to Dignyte; | |

| v. | A Secretary’s Certificate, dated the Closing Date certifying attached copies of (A) the Organizational Documents of Dignyte, as amended to reflect the Name Change, as hereinafter defined (B) the resolutions of Dignyte’s Board approving this Agreement and the transactions contemplated hereby, including those actions specified in Section 6(g) below; (C) the resolution from ▇▇. ▇▇▇▇▇▇▇▇-▇▇▇▇▇▇▇ and (D) the incumbency of each authorized officer of Dignyte signing this Agreement and any other agreement or instrument contemplated hereby to which Dignyte is a party; | |

| vi. | Each of this Agreement and any related agreement to which Dignyte is a party, duly executed; and, | |

| vii. | Any further document as may be reasonably requested by counsel to the Shareholders and eWellness in order to substantiate any of the representations or warranties of Dignyte set forth herein |

| 12 |

| (f) | There will have occurred no material adverse change in the business, operations or prospects of Heritage. | |

| (g) | Dignyte will have received written consent (in a form acceptable to counsel for the Shareholders and eWellness) from ▇▇. ▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇▇-▇▇▇▇▇▇▇ agreeing to cancel back to Dignyte at or prior to Closing 5,000,000 shares of Dignyte Common Stock he owns. ▇▇. ▇▇▇▇▇▇▇▇ shall also agree to transfer 3,100,000 shares of his Dignyte common stock to parties designated by eWellness and 1,500,000 shares of his common stock to Summit Capital. | |

| (h) | Dignyte Board Resolutions (i) appointing ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ to serve as Chairman of Dignyte to be effective at the Effective Time; (ii) appointing ▇▇▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ and ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ as members of Dignyte’s Board; (iii) accepting the resignation of ▇▇▇▇▇▇▇ ▇ ▇▇▇▇▇▇▇▇-▇▇▇▇▇▇▇, Dignyte’s sole director and of ▇▇▇▇▇▇▇ ▇ ▇▇▇▇▇▇▇▇-▇▇▇▇▇▇▇ and ▇▇▇▇▇ ▇. ▇▇▇▇▇ from all of their respective positions with Dignyte, and (iv) appointing ▇▇▇▇▇▇ ▇▇▇▇ as President, Chief Executive Officer, ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ as Chief Financial Officer, Secretary and Treasurer, ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ as CTO and ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ as Chairman of the Board and assistant Secretary of Dignyte to be effective at the Closing. | |

| (i) | A statement from Dignyte’s transfer agent regarding the number of issued and outstanding shares of common stock immediately before the Closing. | |

| (j) | Dignyte shall have filed the Form 8A. | |

| (k) | The written resignation of the following persons from Dignyte on the Closing Date: |

| i. | ▇▇▇▇▇▇▇ ▇ ▇▇▇▇▇▇▇▇-▇▇▇▇▇▇▇, as Dignyte’s sole director and from each of his positions as CEO and President; and, | |

| ii. | ▇▇▇▇▇ ▇. ▇▇▇▇▇ as CFO and Chief Accounting Officer. |

| 7. | Conditions to Obligations of Dignyte |

Dignyte’s obligation to complete the transaction contemplated herein will be subject to fulfillment on or before the Closing of each of the following conditions, unless waived in writing by the Dignyte, as appropriate:

| (a) | The representations and warranties of the Shareholders and eWellness set forth herein will be true and correct at the Closing as though made at and as of that date, except as affected by the transactions contemplated hereby. | |

| (b) | The Shareholders and eWellness will have performed all covenants required by this Agreement to be performed by them on or before the Closing. | |

| (c) | This Agreement will have been approved by the Board of Directors of eWellness. |

| 13 |

| (d) | eWellness and/or the Shareholders will have delivered to Dignyte the documents set forth below in form and substance reasonably satisfactory to counsel for Dignyte, to the effect that: |

| (i) | eWellness is a corporation duly organized, validly existing, and in good standing; | |

| (ii) | eWellness’s authorized capital stock is owned as set forth herein and in Exhibit A; and | |

| (iii) | Certified copies of the resolutions of the board of directors of eWellness authorizing the execution of this Agreement and the consummation hereof; | |

| (iv) | A certificate executed by an officer of eWellness, certifying the satisfaction of the conditions specified in Sections 7(a) and (b) relating to eWellness; | |

| (v) | Copies of the Lock Up Agreement from each of eWellness’ Affiliates; | |

| (vi) | each of this Agreement and any related agreement to which eWellness and the Shareholder is a party, duly executed; and, | |

| (vii) | Any further document as may be reasonably requested by counsel to Dignyte in order to substantiate any of the representations or warranties of the Shareholders and eWellness set forth herein |

| (e) | There will have occurred no material adverse change in the business, operations or prospects of eWellness. | |

| (f) | Dignyte shall have filed the Form 8A. | |

| (g) | There must not have been made or threatened by any Person any claim asserting that such Person (a) is the holder of, or has the right to acquire or to obtain beneficial ownership of the Shares or any other stock, voting, equity, or ownership interest in, eWellness, or (b) is entitled to all or any portion of Dignyte Stock. | |

| (h) | Dignyte shall have received Proof of closing of the Financing. | |

| (i) | Intentionally Left Blank. |

| 8. | Additional Covenants. |

| (a) | Private Financing. Prior to the Closing, eWellness shall complete a private financing pursuant to which it shall receive aggregate gross proceeds of up to $1,200,000 as consideration for the issuance of at least $100,000 in convertible promissory notes, which are convertible into an aggregate of at least 200,000 shares of eWellness Common Stock (the “Financing”). |

| 14 |

| (b) | Between the date of this Agreement and the Closing, the Shareholders, with respect to eWellness, eWellness with respect to itself and Dignyte, with respect to itself, will, and will cause their respective representatives to, (i) afford the other parties and their representatives access to their personnel, properties, contracts, books and records, and other documents and data, as reasonably requested by the other party; (ii) furnish the other parties and their representatives with copies of all such contracts, books and records, and other existing documents and data as they may reasonably request in connection with the transaction contemplated by this Agreement; and (iii) furnish the other parties and their representatives with such additional financial, operating, and other data and information as they may reasonably request. The Shareholders will cause eWellness to provide to Dignyte and Dignyte will provide to the Shareholders, complete copies of all material contracts and other relevant information on a timely basis in order to keep the other parties fully informed of the status of their respective businesses and operations. | |

| (c) | eWellness will deliver copies of its corporate books and records to Dignyte at Closing. | |

| (d) | Other than as set forth in Section 10 below, the parties agree that they will not make, and the Shareholders will not permit eWellness to make, any public announcements relating to this Agreement or the transactions contemplated herein without the prior written consent of the other parties, except as may be required upon the written advice of counsel to comply with applicable laws or regulatory requirements after consulting with the other parties hereto and seeking their consent to such announcement. | |

| (e) | Intentionally Left Blank. | |

| (f) | Between the date of this Agreement and the Closing Date, eWellness will permit Dignyte and its representatives reasonable access to all of the books and records of eWellness reasonably necessary for the preparation and amendment of the Proxy Statement and such other filings or submissions in accordance with the Commission rules and regulations as are necessary to consummate the transactions contemplated by this Agreement and as are necessary to respond to requests of the Commission’s staff. | |

| (g) | Cooperation; Consents. Prior to the Closing, each party shall cooperate with the other parties and shall (i) in a timely manner make all necessary filings with, and conduct negotiations with, all authorities and other Persons the consent or approval of which, or the license or permit from which is required for the consummation of the transactions contemplated hereby and (ii) provide to each other party such information as the other party may reasonably request in order to enable it to prepare such filings and to conduct such negotiations. | |

| (h) | Name Change. Prior to the Closing, Dignyte shall have taken all steps necessary, including shareholder approval, to amend its articles of incorporation to change its corporate name to eWellness Healthcare Corporation (the “Name Change”). |

| 15 |

| (i) | Lock Up Agreements. |

| i. | eWellness hereby covenants and agrees that it shall require each of its Affiliates to enter into a Lock Up Agreement in the form attached hereto as Exhibit F. | |

| ii. | Dignyte hereby covenants and agrees that it shall require each participant of the Dignyte Converted Offering to agree to the Dignyte Lock Up in writing, whether through a Lock Up Agreement in a form substantially similar to the one attached hereto as Exhibit F or as a term included in such participant’s consent to participate in the Dignyte Converted Offering that is reasonably satisfactory to eWellness. |

| 9. | Expenses. |

Except as otherwise expressly provided in this Agreement, each party to this Agreement will bear its respective expenses incurred in connection with the preparation, execution, and performance of this Agreement and the transactions contemplated by this Agreement, including all fees and expenses of agents, representatives, counsel, and accountants. In the event of termination of this Agreement, the obligation of each party to pay its own expenses will be subject to any rights of such party arising from a breach of this Agreement by another party.

| 10. | Public Announcements and Filings. |

(a) Dignyte shall promptly, but no later than four (4) business days following the effective date of this Agreement, issue a press release disclosing the transactions contemplated hereby. Dignyte shall also file with the Commission a Form 8-K describing the material terms of the transactions contemplated hereby as soon as practicable following the Closing Date but in no event more than four (4) business days following the Closing Date. Prior to the Closing Date, Dignyte and eWellness shall consult with each other in issuing the Form 8-K, the press release and any other press releases or otherwise making public statements or filings and other communications with the Commission or any regulatory agency or stock market or trading facility with respect to the transactions contemplated hereby and neither party shall issue any such press release or otherwise make any such public statement, filings or other communications without the prior written consent of the other, which consent shall not be unreasonably withheld or delayed, except that no prior consent shall be required if such disclosure is required by law, in which case the disclosing party shall provide the other party with prior notice of no less than three (3) calendar days, of such public statement, filing or other communication and shall incorporate into such public statement, filing or other communication the reasonable comments of the other party.

(b) The Surviving Company shall, not later than 90 days following the date of this Agreement, prepare and file with the Commission a “resale” Registration Statement providing for the resale of all Registrable Securities by means of an offering to be made on a continuous basis pursuant to Rule 415. The Registration Statement shall be on Form S-1 (or another appropriate form in accordance herewith).

| 11. | Confidentiality. |

(a) Dignyte, eWellness and the Shareholders will maintain in confidence, and will cause their respective directors, officers, employees, agents, and advisors to maintain in confidence, any written, oral, or other information obtained in confidence from another party in connection with this Agreement or the transactions contemplated by this Agreement, unless (x) such information is already known to such party or to others not bound by a duty of confidentiality or such information becomes publicly available through no fault of such party, (y) the use of such information is necessary or appropriate in obtaining any consent or approval required for the consummation of the transactions contemplated by this Agreement, or (z) the furnishing or use of such information is required by or necessary or appropriate in connection with legal proceedings.

| 16 |

(b) In the event that any party is required to disclose any information of another party pursuant to clause (y) or (z) of Section 11(a), the party requested or required to make the disclosure (the “disclosing party”) shall provide the party that provided such information (the “providing party”) with prompt notice of any such requirement so that the providing party may seek a protective order or other appropriate remedy and/or waive compliance with the provisions of this Section 11(b). If, in the absence of a protective order or other remedy or the receipt of a waiver by the providing party, the disclosing party is nonetheless, in the opinion of counsel, legally compelled to disclose the information of the providing party, the disclosing party may, without liability hereunder, disclose only that portion of the providing party’s information which such counsel advises is legally required to be disclosed, provided that the disclosing party exercises its reasonable efforts to preserve the confidentiality of the providing party’s information, including, without limitation, by cooperating with the providing party to obtain an appropriate protective order or other relief assurance that confidential treatment will be accorded the providing party’s information.

(c) If the transactions contemplated by this Agreement are not consummated, each party will return or destroy all of such written information each party has regarding the other party.

| 12. | Termination. |

a. This Agreement may be terminated at any time prior to the Closing Date contemplated hereby by:

| i. | mutual agreement of Dignyte and eWellness; | |

| ii. | Dignyte, if there has been a material breach by eWellness or any of the Shareholders of any material representation, warranty, covenant or agreement set forth in this Agreement on the part of eWellness or the Shareholders that is not cured, to the reasonable satisfaction of Dignyte, within ten business days after notice of such breach is given by Dignyte; | |

| iii. | eWellness, if there has been a material breach by Dignyte of any material representation, warranty, covenant or agreement set forth in this Agreement on the part of Dignyte that is not cured by the breaching party, to the reasonable satisfaction of eWellness, within ten business days after notice of such breach is given by Dignyte; | |

| iv. | Dignyte or eWellness, if the entire Transaction, is not closed by July 1, 2014, unless the parties hereto agree to extend such date in writing; | |

| v. | Dignyte or eWellness if any permanent injunction or other order of a governmental entity of competent authority preventing the consummation of the Transaction contemplated by this Agreement has become final and non-appealable. |

| 17 |

b. Effect of Termination. In the event of the termination of this Agreement as provided in Section 12, this Agreement will be of no further force or effect, provided, however, that no termination of this Agreement will relieve any party of liability for any breaches of this Agreement that are based on a wrongful refusal or failure to perform any obligations.

| 13. | Expenses. |

Whether or not the Closing is consummated, each of the parties will pay all of his, her, or its own legal and accounting fees and other expenses incurred in the preparation of this Agreement and the performance of the terms and provisions of this Agreement.

| 14. | Survival of Representations and Warranties. |

The representations and warranties of the Shareholders and Dignyte set out in this Agreement will survive Closing for a period twelve months.

| 15. | Waiver. |

Any failure on the part of the parties hereto to comply with any of their obligations, agreements, or conditions hereunder may be waived in writing by the party to whom such compliance is owed.

| 16. | Brokers. |

Each party agrees to indemnify and hold harmless the other parties against any fee, loss, or expense arising out of claims by brokers or finders employed or alleged to have been employed by the indemnifying party.

| 17. | Notices. |

All notices and other communications under this Agreement must be in writing and will be deemed to have been given if delivered in person or sent by prepaid first-class certified mail, return receipt requested, or recognized commercial courier service, as follows:

| If to Dignyte, to: | |

| ▇▇▇▇▇ ▇▇▇▇▇▇▇, Esq. | |

| Legal & Compliance, LLC | |

| ▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇ | |

| ▇▇▇▇ ▇▇▇▇ ▇▇▇▇▇, ▇▇ ▇▇▇▇▇ | |

| (▇▇▇) ▇▇▇-▇▇▇▇ | |

| If to the Shareholders or eWellness to: | |

| eWellness Corporation | |

| c/o ▇▇▇▇▇▇ ▇▇▇▇▇▇▇ ▇▇▇▇▇ LLP | |

| ▇▇▇ ▇▇▇▇ ▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇ | |

| ▇▇▇ ▇▇▇▇, ▇▇ ▇▇▇▇▇ | |

| Attn: ▇▇▇▇▇ ▇▇▇▇▇▇▇ | |

| ▇▇▇-▇▇▇-▇▇▇▇ |

| 18 |

| 18. | Definitions. |

Unless the context otherwise requires, the terms defined in this Section 18 will have the meanings herein specified for all purposes of this Agreement, applicable to both the singular and plural forms of any of the terms herein defined.

| a. | “Accredited Investor” has the meaning set forth in Regulation D under the Securities Act and set forth on Exhibit B. | |

| b. | “Affiliate” shall mean, with respect to any Person, any other Person that (a) directly or indirectly, whether through one or more intermediaries or otherwise, controls or is controlled by or is under common control with such Person. For purposes of this definition, “control” (including with correlative meanings “controlled by” and “under common control with”) of a Person means the power, direct or indirect, to direct or cause the direction of the management and policies of such Person, whether through ownership of voting securities, by contract or otherwise. For the purposes of this definition, a Person shall be deemed to control any of his or her immediate family members. | |

| c. | “Code” means the Internal Revenue Code of 1986, as amended. | |

| d. | “Commission” means the Securities and Exchange Commission or any other federal agency then administering the Securities Act and the Exchange Act. | |

| e. | “Convertible Securities” refers to any securities of eWellness or Dignyte which would entitle the holder thereof to acquire at any time shares of either entity’s common stock, including, without limitation, any debt, preferred stock, right, option, warrant or other instrument that is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, such common stock. | |

| f. | “Digntye Lock Up” refers to the participants, their assignees or nominees, in the Dignyte Converted Offering agreement not to sell, transfer, hypothecate or otherwise assign (collectively, “Transfer”) 50% of the equity securities such participant(s) received in the Dignyte Converted Offering until April 25, 2015, or such earlier time as the Surviving Company may, in its sole discretion, determine. | |

| g. | “Exhibits” means the several exhibits referred to and identified in this Agreement. | |

| h. | “FINRA” means the Financial Industry Regulatory Authority. |

| 19 |

| i. | “GAAP” means, with respect to any Person, United States generally accepted accounting principles applied on a consistent basis with such Person’s past practices. | |

| j. | “Governmental Authority” means any federal or national, state or provincial, municipal or local government, governmental authority, regulatory or administrative agency, governmental commission, department, board, bureau, agency or instrumentality, political subdivision, commission, court, tribunal, official, arbitrator or arbitral body, in each case whether U.S. or non-U.S. | |

| k. | “Laws” means, with respect to any Person, any U.S. or non-U.S. federal, national, state, provincial, local, municipal, international, multinational or other law (including common law), constitution, statute, code, ordinance, rule, regulation or treaty applicable to such Person. | |

| l. | “Lien” means any mortgage, pledge, security interest, encumbrance, lien or charge of any kind, including, without limitation, any conditional sale or other title retention agreement, any lease in the nature thereof and the filing of or agreement to give any financing statement under the Uniform Commercial Code of any jurisdiction and including any lien or charge arising by Law. | |

| m. | “Material Adverse Effect” means any event, change or effect that is materially adverse to the condition (financial or otherwise), properties, assets, liabilities, business, operations or results of operations of a party to this Agreement, taken as a whole. | |

| n. | “Order” means any award, decision, injunction, judgment, order, ruling, subpoena, or verdict entered, issued, made, or rendered by any Governmental Authority. | |

| o. | “Organizational Documents” means (a) the articles or certificate of incorporation and the by-laws or code of regulations of a corporation; (b) the partnership agreement and any statement of partnership of a general partnership; (c) the limited partnership agreement and the certificate of limited partnership of a limited partnership; (d) the articles or certificate of formation and operating agreement of a limited liability company; (e) any other document performing a similar function to the documents specified in clauses (a), (b), (c) and (d) adopted or filed in connection with the creation, formation or organization of a Person; and (f) any and all amendments to any of the foregoing. | |

| p. | “Person” means all natural persons, corporations, business trusts, associations, companies, partnerships, limited liability companies, joint ventures and other entities, governments, agencies and political subdivisions. | |

| q. | “Proceeding” means any action, arbitration, audit, hearing, investigation, litigation, or suit (whether civil, criminal, administrative or investigative) commenced, brought, conducted, or heard by or before, or otherwise involving, any Governmental Authority. | |

| r. | “Registrable Securities” means all of the shares of common stock issued pursuant to the Financing and the Dignyte Converted Offering, including the shares of common stock underlying any Convertible Securities issued pursuant thereto. | |

| s. | “Regulation S” means Regulation S under the Securities Act, as the same may be amended from time to time, or any successor statute. | |

| t. | “Securities Act” means the Securities Act of 1933, as amended, or any similar federal statute, and the rules and regulations of the Commission thereunder, all as the same will be in effect at the time. | |

| u. | “Taxes” means all foreign, federal, state or local taxes, charges, fees, levies, imposts, duties and other assessments, as applicable, including, but not limited to, any income, alternative minimum or add-on, estimated, gross income, gross receipts, sales, use, transfer, transactions, intangibles, ad valorem, value-added, franchise, registration, title, license, capital, paid-up capital, profits, withholding, payroll, employment, unemployment, excise, severance, stamp, occupation, premium, real property, recording, personal property, federal highway use, commercial rent, environmental (including, but not limited to, taxes under Section 59A of the Code) or windfall profit tax, custom, duty or other tax, governmental fee or other like assessment or charge of any kind whatsoever, together with any interest, penalties or additions to tax with respect to any of the foregoing; and “Tax” means any of the foregoing Taxes. |

| 20 |

| v. | “U.S.” means the United States of America. | |

| w. | “U.S. Person” has the meaning set forth in Regulation S under the Securities Act and set forth on Exhibit C hereto. |

| 19. | Signature. By signing the Signature Pages attached hereto, each of Dignyte, eWellness and the Shareholders agree that they have reviewed and agree with the information set forth in the Capitalization Table. |

| 20. | General Provisions. |

| (a) | This Agreement will be governed by and under the laws of the State of Nevada, USA without giving effect to conflicts of law principles. If any provision hereof is found invalid or unenforceable, that part will be amended to achieve as nearly as possible the same effect as the original provision and the remainder of this Agreement will remain in full force and effect. | |

| (b) | Any dispute arising under or in any way related to this Agreement will be submitted to binding arbitration before a single arbitrator by the American Arbitration Association in accordance with the Association’s commercial rules then in effect. The arbitration will be conducted in Las Vegas, Nevada. The decision of the arbitrator will set forth in reasonable detail the basis for the decision and will be binding on the parties. The arbitration award may be confirmed by any court of competent jurisdiction. | |

| (c) | In any adverse action, the parties will restrict themselves to claims for compensatory damages and/or securities issued or to be issued and no claims will be made by any party or affiliate for lost profits, punitive or multiple damages. | |

| (d) | This Agreement constitutes the entire agreement and final understanding of the parties with respect to the subject matter hereof and supersedes and terminates all prior and/or contemporaneous understandings and/or discussions between the parties, whether written or verbal, express or implied, relating in any way to the subject matter hereof. This Agreement may not be altered, amended, modified or otherwise changed in any way except by a written agreement, signed by both parties. | |

| (e) | No party may assign any of its rights under this Agreement without the prior consent of the other parties. Subject to the preceding sentence, this Agreement will apply to, be binding in all respects upon, and inure to the benefit of and be enforceable by the respective successors and permitted assigns of the parties. Other than as expressly stated herein, nothing expressed or referred to in this Agreement will be construed to give any Person other than the parties to this Agreement any legal or equitable right, remedy, or claim under or with respect to this Agreement or any provision of this Agreement. This Agreement and all of its provisions and conditions are for the sole and exclusive benefit of the parties to this Agreement and their successors and assigns |

| 21 |

| (g) | The parties agree to take any further actions and to execute any further documents which may from time to time be necessary or appropriate to carry out the purposes of this Agreement. | |

| (h) | The headings of the Sections, paragraphs and subparagraphs of this Agreement are solely for convenience of reference and will not limit or otherwise affect the meaning of any of the terms or provisions of this Agreement. The references in this Agreement to Sections, unless otherwise indicated, are references to sections of this Agreement. | |

| (i) | This Agreement may be executed in counterparts, each one of which will constitute an original and all of which taken together will constitute one document. This Agreement may be executed by delivery of a signed signature page by fax to the other parties hereto and such fax execution and delivery will be valid in all respects and deemed to be an original thereof. | |

| (j) | The rights and remedies of the parties to this Agreement are cumulative and not alternative. Neither the failure nor any delay by any party in exercising any right, power, or privilege under this Agreement or the documents referred to in this Agreement will operate as a waiver of such right, power, or privilege, and no single or partial exercise of any such right, power, or privilege will preclude any other or further exercise of such right, power, or privilege or the exercise of any other right, power, or privilege. To the maximum extent permitted by applicable law, (a) no claim or right arising out of this Agreement or the documents referred to in this Agreement can be discharged by one party, in whole or in part, by a waiver or renunciation of the claim or right unless in writing signed by the other party; (b) no waiver that may be given by a party will be applicable except in the specific instance for which it is given; and (c) no notice to or demand on one party will be deemed to be a waiver of any obligation of such party or of the right of the party giving such notice or demand to take further action without notice or demand as provided in this Agreement or the documents referred to in this Agreement. | |

| (k) | The headings of Sections in this Agreement are provided for convenience only and will not affect its construction or interpretation. All references to “Section” or “Sections” refer to the corresponding Section or Sections of this Agreement. All words used in this Agreement will be construed to be of such gender or number as the circumstances require. Unless otherwise expressly provided, the word “including” does not limit the preceding words or terms. |

SIGNATURE PAGE FOLLOWS

| 22 |

EXECUTED as of the date first written above by:

| eWellness Healthcare Corporation | ||

| (f/k/a DIGNYTE, INC.) | ||

| By: | ||

| ▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇▇-▇▇▇▇▇▇▇, | ||

| as CEO | ||

| By: | ||

| ▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇▇-▇▇▇▇▇▇▇, | ||

| in his personal capacity | ||

| eWellness Corporation | ||

| By | ||

| ▇▇. ▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇▇▇, Chairman | ||

Shareholder signature page follows

| 23 |

COUNTERPART SIGNATURE PAGE

IN WITNESS WHEREOF, the parties have executed and delivered this Share Exchange Agreement as of the date first written above.

| SHAREHOLDER: | ||

| By: | ||

| Name: | ||

Circle the category under which you are an “accredited investor” pursuant to Exhibit B:

| 1 | 2 | 3 | 7 | 8 |

PRINT EXACT NAME IN WHICH YOU WANT

THE SECURITIES TO BE REGISTERED

| Attn: | ||

| Address: | ||

| Phone No. | ||

| Facsimile No. |

| 24 |

Exhibit A

to

| Shareholder Name and Address | No. of eWellness Shares | No. of Dignyte Shares | % of Shares to be Issued | |||||||||

| ▇▇▇▇▇▇ ▇▇▇▇ | ||||||||||||

| 2,000,000 | 2,000,000 | 21.74 | % | |||||||||

| Evolution Physical Therapy | ||||||||||||

| 1,000,000 | 1,000,000 | 10.87 | % | |||||||||

| ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ | ||||||||||||

| 3,000,000 | 3,000,000 | 32.61 | % | |||||||||

| ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ | ||||||||||||

| 1,650,000 | 1,650,000 | 17.93 | % | |||||||||

| ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ | ||||||||||||

| 900,000 | 900,000 | 9.78 | % | |||||||||

| JFS Investments | ||||||||||||

| 450,000 | 450,000 | 4.89 | % | |||||||||

| ▇▇▇▇▇▇▇ ▇▇▇▇ | ||||||||||||

| 200,000 | 200,000 | 2.17 | % | |||||||||

| Total | 9,200,000 | 9,200,000 | 100.0 | % | ||||||||

| 25 |

EXHIBIT B

Definition of “Accredited Investor”

The term “accredited investor” means:

The term “accredited investor” means:

| (1) | A bank as defined in Section 3(a)(2) of the Securities Act, or a savings and loan association or other institution as defined in Section 3(a)(5)(A) of the Securities Act, whether acting in its individual or fiduciary capacity; a broker or dealer registered pursuant to Section 15 of the Securities Exchange Act of 1934; an insurance company as defined in Section 2(13) of the Securities Act; an investment company registered under the Investment Company Act of 1940 (the “Investment Company Act”) or a business development company as defined in Section 2(a)(48) of the Investment Company Act; a Small Business Investment Company licensed by the U.S. Small Business Administration under Section 301(c) or (d) of the Small Business Investment Act of 1958; a plan established and maintained by a state, its political subdivisions or any agency or instrumentality of a state or its political subdivisions for the benefit of its employees, if such plan has total assets in excess of US $5,000,000; an employee benefit plan within the meaning of the Employee Retirement Income Security Act of 1974 (“ERISA”), if the investment decision is made by a plan fiduciary, as defined in Section 3(21) of ERISA, which is either a bank, savings and loan association, insurance company, or registered investment advisor, or if the employee benefit plan has total assets in excess of US $5,000,000 or, if a self-directed plan, with investment decisions made solely by persons that are accredited investors. |

| (2) | A private business development company as defined in Section 202(a)(22) of the Investment Advisers Act of 1940. |

| (3) | An organization described in Section 501(c)(3) of the Internal Revenue Code, corporation, Massachusetts or similar business trust, or partnership, not formed for the specific purpose of acquiring the securities offered, with total assets in excess of US $5,000,000. |

| (4) | A director or executive officer of Dignyte. |

| (5) | A natural person whose individual net worth, or joint net worth with that person’s spouse, at the time of his or her purchase exceeds US $1,000,000. |

| (6) | A natural person who had an individual income in excess of US $200,000 in each of the two most recent years or joint income with that person’s spouse in excess of US $300,000 in each of those years and has a reasonable expectation of reaching the same income level in the current year. |

| 26 |

| (7) | A trust, with total assets in excess of US $5,000,000, not formed for the specific purpose of acquiring the securities offered, whose purchase is directed by a sophisticated person as described in Rule 506(b)(2)(ii) (i.e., a person who has such knowledge and experience in financial and business matters that he is capable of evaluating the merits and risks of the prospective investment). |

| (8) | An entity in which all of the equity owners are accredited investors. (If this alternative is checked, the Shareholder must identify each equity owner and provide statements signed by each demonstrating how each is qualified as an accredited investor.) |

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

| 27 |

EXHIBIT C

Definition of “U.S. Person”

| (1) | “U.S. person” (as defined in Regulation S) means: |

| (i) | Any natural person resident in the United States; | |

| (ii) | Any partnership or corporation organized or incorporated under the laws of the United States; | |

| (iii) | Any estate of which any executor or administrator is a U.S. person; | |

| (iv) | Any trust of which any trustee is a U.S. person; | |

| (v) | Any agency or branch of a foreign entity located in the United States; | |

| (vi) | Any non-discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary for the benefit or account of a U.S. person; | |

| (vii) | Any discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary organized, incorporated, or (if an individual) resident in the United States; and | |

| (viii) | Any partnership or corporation if: (A) organized or incorporated under the laws of any foreign jurisdiction; and (B) formed by a U.S. person principally for the purpose of investing in securities not registered under the Securities Act, unless it is organized or incorporated, and owned, by accredited investors (as defined in Rule 501(a)) who are not natural persons, estates or trusts. |

| (2) | Notwithstanding paragraph (1) above, any discretionary account or similar account (other than an estate or trust) held for the benefit or account of a non-U.S. person by a dealer or other professional fiduciary organized, incorporated, or (if an individual) resident in the United States shall not be deemed a “U.S. person.” |

| (3) | Notwithstanding paragraph (1), any estate of which any professional fiduciary acting as executor or administrator is a U.S. person shall not be deemed a U.S. person if: |

| (i) | An executor or administrator of the estate who is not a U.S. person has sole or shared investment discretion with respect to the assets of the estate; and | |

| (ii) | The estate is governed by foreign law. |

| (4) | Notwithstanding paragraph (1), any trust of which any professional fiduciary acting as trustee is a U.S. person shall not be deemed a U.S. person if a trustee who is not a U.S. person has sole or shared investment discretion with respect to the trust assets, and no beneficiary of the trust (and no settler if the trust is revocable) is a U.S. person. |

| 28 |

| (5) | Notwithstanding paragraph (1), an employee benefit plan established and administered in accordance with the law of a country other than the United States and customary practices and documentation of such country shall not be deemed a U.S. person. |

| (6) | Notwithstanding paragraph (1), any agency or branch of a U.S. person located outside the United States shall not be deemed a “U.S. person” if: |

| (i) | The agency or branch operates for valid business reasons; and | |

| (ii) | The agency or branch is engaged in the business of insurance or banking and is subject to substantive insurance or banking regulation, respectively, in the jurisdiction where located. |

| (7) | The International Monetary Fund, the International Bank for Reconstruction and Development, the Inter-American Development Bank, the Asian Development Bank, the African Development Bank, the United Nations, and their agencies, affiliates and pension plans, and any other similar international organizations, their agencies, affiliates and pension plans shall not be deemed “U.S. persons.” |

| 29 |

EXHIBIT D

ACCREDITED INVESTOR REPRESENTATIONS

The Shareholders further represent and warrant to Dignyte as follows:

| 1. | Each Shareholder qualifies as an Accredited Investor on the basis set forth on its signature page to this Agreement. |

| 2. | Each Shareholder has sufficient knowledge and experience in finance, securities, investments and other business matters to be able to protect such Shareholder’s interests in connection with the transactions contemplated by this Agreement. |

| 3. | Each Shareholder has consulted, to the extent that it has deemed necessary, with its tax, legal, accounting and financial advisors concerning its investment in Dignyte Stock. |

| 4. | Each Shareholder understands the various risks of an investment in Dignyte Stock and can afford to bear such risks for an indefinite period of time, including, without limitation, the risk of losing its entire investment in Dignyte Stock. |

| 5. | The Shareholder has had access to Dignyte’s publicly filed reports with the Commission. Each Shareholder has been furnished during the course of the transactions contemplated by this Agreement with all other public information regarding Dignyte that such person or entity has requested and all such public information is sufficient for such person or entity to evaluate the risks of investing in Dignyte Stock. |

| 6. | Each Shareholder has been afforded the opportunity to ask questions of and receive answers concerning Dignyte and the terms and conditions of the issuance of Dignyte Stock. |

| 7. | Each Shareholder is not relying on any representations and warranties concerning Dignyte made by Dignyte or any officer, employee or agent of Dignyte, other than those contained in this Agreement. |

| 8. | Each Shareholder is acquiring Dignyte Stock for its own account, for investment and not for distribution or resale to others. |

| 9. | Each Shareholder will not sell or otherwise transfer Dignyte Stock, unless either (a) the transfer of such securities is registered under the Securities Act or (b) an exemption from registration of such securities is available. |

| 10. | Each Shareholder understands and acknowledges that Dignyte is under no obligation to register Dignyte Stock for sale under the Securities Act. |

| 11. | Each Shareholder consents to the placement of a legend on any certificate or other document evidencing Dignyte Stock substantially in the form set forth in Section 4(l). |

| 30 |

| 12. | Each Shareholder represents that the address furnished on its signature page to this Agreement is its principal business address. | |

| 13. | Each Shareholder understands and acknowledges that Dignyte Stock have not been recommended by any federal or state securities commission or regulatory authority, that the foregoing authorities have not confirmed the accuracy or determined the adequacy of any information concerning Dignyte that has been supplied to such Shareholder and that any representation to the contrary is a criminal offense. | |

| 14. | Each Shareholder acknowledges that the representations, warranties and agreements made by such Shareholder herein shall survive the execution and delivery of this Agreement and the purchase of Dignyte Stock. |

| 31 |

EXHIBIT E

NON U.S. PERSON REPRESENTATIONS