Contract

Creating the Premier Global Market Operator

IntercontinentalExchange Agreement to Acquire NYSE Euronext

DECEMBER 20, 2012

Exhibit 99.1 |

2

This

presentation

may

contain

“forward-looking

statements”

made

pursuant

to

the

safe

harbor

provisions

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

In

some

cases,

you

can

identify

forward-looking

statements

by

words

such

as

“may,”

“hope,”

“will,”

“should,”

“expect,”

“plan,”

“anticipate,”

“intend,”

“believe,”

“estimate,”

“predict,”

“potential,”

“continue,”

“could,”

“future”

or the negative of those terms or other words of similar meaning. You should

carefully read forward-looking statements, including statements that

contain these words, because they discuss our future expectations or state other “forward-looking”

information. Forward-looking statements involve a number of risks and

uncertainties. ICE and NYSE Euronext caution readers that any forward-looking

statement is not a guarantee of future performance and that actual results could

differ materially from those contained in the forward-looking statement. Such

forward-looking statements include, but are not limited to, statements about

the benefits of the proposed merger involving ICE and NYSE Euronext, including

future financial results, ICE’s and NYSE Euronext’s plans, objectives,

expectations and intentions, the expected timing of completion of the transaction and

other statements that are not historical facts. Important factors that could cause

actual results to differ materially from those indicated by such forward-looking

statements are set forth in ICE’s and NYSE Euronext’s filings with the

U.S. Securities and Exchange Commission (the “SEC”). These risks and uncertainties

include, without limitation, the following: the inability to close the merger in a

timely manner; the inability to complete the merger due to the failure of NYSE

Euronext stockholders to adopt the merger agreement or the failure of ICE

stockholders to approve the issuance of ICE common stock in connection with the

merger;

the

failure

to

satisfy

other

conditions

to

completion

of

the

merger,

including

receipt

of

required

regulatory

and

other

approvals;

the

failure

of

the

proposed transaction to close for any other reason; the possibility that any of the

anticipated benefits of the proposed transaction will not be realized; the risk

that integration of NYSE Euronext’s operations with those of ICE will be

materially delayed or will be more costly or difficult than expected; the challenges of

integrating and retaining key employees; the effect of the announcement of the

transaction on ICE’s, NYSE Euronext’s or the combined company’s

respective business relationships, operating results and business generally; the

possibility that the anticipated synergies and cost savings of the merger will

not be realized, or will not be realized within the expected time period; the

possibility that the merger may be more expensive to complete than anticipated,

including

as

a

result

of

unexpected

factors

or

events;

diversion

of

management’s

attention

from

ongoing

business

operations

and

opportunities;

general

competitive, economic, political and market conditions and fluctuations; actions

taken or conditions imposed by the United States and foreign governments;

and adverse outcomes of pending or threatened litigation or government

investigations. In addition, you should carefully consider the risks and uncertainties

and

other

factors

that

may

affect

future

results

of

the

combined

company

described

in

the

section

entitled

“Risk

Factors”

in

the

joint

proxy

statement/prospectus to be delivered to ICE’s and NYSE Euronext’s

respective shareholders, and in ICE’s and NYSE Euronext’s respective filings with the

SEC

that

are

available

on

the

SEC’s

web

site

located

at

xxx.xxx.xxx,

including

the

sections

entitled

“Risk

Factors”

in

ICE’s

Form

10-K

for

the

fiscal

year

ended December 31, 2011, as filed with the SEC on February 8, 2012, and ICE’s

Quarterly Reports on Form 10-Q for the quarters ended June 30, 2012, as

filed

with

the

SEC

on

August

1,

2012

and

September

30,

2012,

as

filed

with

the

SEC

on

November

5,

2012,

and

“Risk

Factors”

in

NYSE

Euronext’s

Form

10-K

for

the

fiscal

year

ended

December

31,

2011,

as

filed

with

the

SEC

on

February

29,

2012.

You

should

not

place

undue

reliance

on

forward-looking

statements, which speak only as of the date of this presentation. Except for any

obligations to disclose material information under the Federal securities laws,

ICE undertakes no obligation to publicly update any forward-looking statements

to reflect events or circumstances after the date of this presentation. Safe

Harbor IntercontinentalExchange |

3

In

connection

with

the

proposed

transaction,

ICE

intends

to

file

with

the

SEC

a

registration

statement

on

Form

S-4,

which

will

include

a

joint

proxy

statement/prospectus

with

respect

to

the

proposed

acquisition

of

NYSE

Euronext.

The

final

joint

proxy

statement/prospectus

will

be

delivered

to

the

stockholders of ICE and NYSE Euronext. Investors and security holders of both ICE

and NYSE Euronext are urged to read the joint proxy statement/prospectus

regarding the proposed transaction carefully and in its entirety, including any documents previously filed with the SEC and incorporated

by reference into the joint proxy statement/prospectus, when it becomes available

because it will contain important information regarding ICE, NYSE Euronext

and the proposed merger. Investors will be able to obtain a free copy of the joint proxy statement/prospectus, as well as other filings containing

information

about

ICE

and

NYSE

Euronext,

without

charge,

at

the

SEC’s

website

at

xxxx://xxx.xxx.xxx.

Investors

may

also

obtain

these

documents,

without

charge, from ICE’s website at xxxx://xxx.xxxxxx.xxx.

Participants in the Merger Solicitation:

ICE, NYSE Euronext and their respective directors, executive officers and other

members of management and employees may be deemed to be participants in the

solicitation of proxies in respect of the transactions contemplated by the merger agreement. You can find information about ICE and ICE’s directors and

executive

officers

in

ICE’s

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2011,

as

filed

with

the

SEC

on

February

8,

2012,

and

ICE’s

proxy

statement for its 2012 annual meeting of stockholders, as filed with the SEC on

March 30, 2012. You can find information about NYSE Euronext and NYSE

Euronext’s directors and executive officers in NYSE Euronext’s Annual

Report on Form 10-K for the year ended December 31, 2011, as filed with the SEC on

February 29, 2012, and NYSE Euronext’s proxy statement for its 2012 annual

meeting of stockholders, filed with the SEC on March 26, 2012. Additional

information about the interests of potential participants will be included in the

joint proxy statement/prospectuses, if and when it becomes available, and the

other relevant documents filed by ICE and NYSE Euronext with the

SEC.

Safe Harbor (continued)

IntercontinentalExchange |

Best-in-class growth leader in global derivatives

markets spanning energy, commodities, credit

and foreign exchange

Global clearing houses and other post-trade

services for futures and OTC markets

Leader in financial reform implementation, from

clearing to transparency and reporting

Focused operator emphasizing growth, expense

discipline, efficient capital deployment and ROIC

Proven M&A integration and delivery of

synergies; innovator in market structure solutions

Iconic brand with global presence and

infrastructure

Global leader in capital raising in 2012

Leading European derivatives complex with

flagship interest rate business

Premier global listings and cash equities venues

Leading U.S. equity options franchise

Global connectivity services with secure, world-

class technology infrastructure

Range of growth and expense reduction

initiatives including Project 14

4

IntercontinentalExchange

Creating a Global Markets and Risk Management Leader

Supports

transformative

opportunities

as

a

global

market

leader,

combining

complementary, high-growth derivatives markets and world class clearing &

risk management solutions with premier listing venues

Enhanced Growth, Diversification, Capital Efficiencies, Cash Flow and Capital

Returns |

$33.12

per

share

offer,

represents

a

38%

current

premium

and

a

28%

premium

to

NYSE

Euronext’s

average

share

price

in 2012

(1)

0.1703

shares

of

ICE

plus

$11.27

per

share

in

cash

(2)

36% pro forma ownership of faster growing derivatives-

oriented company

Opportunity

to

participate

in

value

creation

through

enhanced

growth prospects and ~$450 million in expected combined

cost synergies and increased efficiencies

Future return of capital from ongoing dividend policy now

enhanced by increased growth prospects

Facilitates

clearing

transition;

reduces

operational

complexity

NYSE EURONEXT SHAREHOLDERS

NYSE EURONEXT SHAREHOLDERS

ICE SHAREHOLDERS

ICE SHAREHOLDERS

Expansion into financial derivatives products and pre-

eminent global equities and listings franchise

Access to interest rates, the largest global derivatives

market, at an attractive entry point

Significant value creation from combined synergies

Expanded derivatives clearing through addition of NYSE

Euronext futures markets

Robust earnings accretion and cash flow profile

Initiates capital return with dividend policy implementation

Preserves recurring revenue generation while maintaining

upside potential from market recovery; continued focus on

growth and delivering best-in-class results

MARKET PARTICIPANTS

MARKET PARTICIPANTS

Integrated derivatives clearing platform; efficient deployment of capital at a time

of heightened focus on capital requirements Enables customers to benefit from

the greater scale, consistent platforms and infrastructure of the combined company across

agricultural and energy commodities, credit derivatives, equities and equity

derivatives, foreign exchange and interest rates Access to a global,

multi-asset class platform and a broad suite of pre-trade and post-trade capabilities

Migration to established ICE Clear minimizes transition uncertainty and duplicative

account expenses for market participants Enhances innovation and

competitiveness of U.S. and European rates markets Focus on serving customer

needs around regulatory reforms and market structure improvements Maintaining

strong commitment to and leadership in listings and capital formation in the U.S. and Europe

Beneficial to Shareholders and Market Participants

5

IntercontinentalExchange

(1) Based on ICE’s closing price of $128.31 as of December 19, 2012 (2)

Represents blended consideration – NYSE Euronext shareholders will have the right to elect cash, stock or the blended consideration, subject to pro ration |

Transaction Summary

6

IntercontinentalExchange

PRO FORMA OWNERSHIP

MANAGEMENT

$33.12 per share;

$8.2 billion equity value

(1)

NYSE

Euronext

shareholders

receive

0.1703

shares

of

ICE

and

$11.27

per

share

in

cash

(2)

38% current premium and 28% premium to NYSE Euronext’s 2012 average share

price 33% cash / 67% stock consideration

64% existing ICE shareholders, 36% NYSE Euronext shareholders

Chairman and Chief Executive Officer: Xxxx Xxxxxxxx

President of combined company and CEO of NYSE Group: Xxxxxx Xxxxxxxxxx

Chief Financial Officer: Xxxxx Xxxx

CAPITAL MANAGEMENT

NYSE Euronext dividend to be maintained prior to close

ICE to adopt ~$300 million annual dividend beginning after the close

ANTICIPATED CLOSING

In the second half of 2013, following ICE and NYSE Euronext shareholder votes and

receipt of all applicable regulatory approvals in the U.S. and Europe

STRUCTURE

BOARD OF DIRECTORS

4 members

of

the

NYSE

Euronext

Board

of

Directors

to

be

added

to

the

ICE

Board

of

Directors for a combined Board of 15

GLOBAL FOOTPRINT

Global operations across the Americas, Europe and Asia

Maintain NYSE building and NYSE floor operations in New York

Post-closing ICE will look to optimize the portfolio of global businesses,

including a potential IPO of Euronext subject to regulatory acceptance and

value creation CLEARING

Liffe products currently cleared by LCH.Clearnet and NYSE Liffe Clearing will

transition to ICE Clear Europe

Clearing services to be provided by ICE Clear Europe in mid 2013

FINANCING

Cash on hand and existing line of credit

(1) Based on ICE’s closing price of $128.31 as of December 19, 2012 (2)

Represents blended consideration – NYSE Euronext shareholders will have the right to elect cash, stock or the blended consideration, subject to pro ration |

Compelling Strategic Rationale

7

IntercontinentalExchange

ESTABLISHES PREMIER

GLOBAL MARKETS

OPERATOR

COMPELLING VALUE

CREATION

SIGNIFICANT

SYNERGIES

PROVEN INDUSTRY

CONSOLIDATOR AND

INNOVATOR

Leading global, end-to-end derivatives franchise spanning agricultural and

energy commodities, credit derivatives, equities and equity derivatives,

foreign exchange and interest rates Proven clearing platform to drive growth

initiatives Pre-eminent

global

equities

and

listings

franchise

recognized

around

the

world

Deep and experienced combined management team

Immediate GAAP earnings accretion in excess of 15% in Year 1, higher upon

realization of run-rate synergies

Expected

to

achieve

return

on

invested

capital

above

the

cost

of

investment

by

Year

2

Capitalizes on ICE’s experience and clearing houses in London, New York,

Chicago and Canada Evaluate opportunities to unlock value across current

business units Approximately $450 million in combined annual cost synergies

expected, including $150 million related to NYSE Euronext current cost

savings program, Project 14 Approximately 80% of synergies realizable within

2 years of closing Significant savings related to technology, clearing and

duplicative expenses Proven track record of integrating acquisitions,

realizing synergies and driving shareholder returns Consistent ability to

execute on new initiatives and provide effective solutions for market participants

Acquiring business at right time in the cycle; well positioned for economic /

market recovery LEADING MULTI-ASSET

CLASS RISK

MANAGEMENT AND

MARKET

INFRASTRUCTURE

Enhances innovation and competitiveness of U.S. and European rates

businesses Increases capital and operational efficiencies for

customers Bolsters established infrastructure across global markets

Enhances

capabilities

to

target

the

interest

rate

swaps

clearing

opportunity

Existing and growing Asian presence

STRONG CASH FLOW

AND OPERATING

LEVERAGE

Robust pro forma cash flow profile

Modest combined leverage at closing with rapid projected deleveraging

Maintains

substantial

financial

flexibility

to

pursue

additional

strategic

growth

opportunities |

8

IntercontinentalExchange

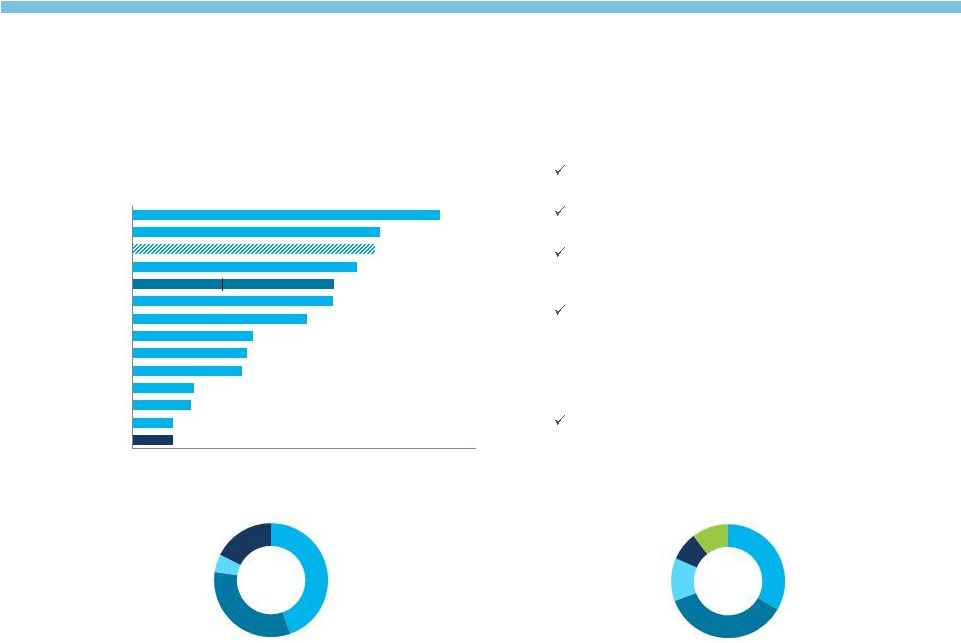

Premier Operator of Global Markets

Combined business well diversified across asset classes, products and

geographies Pro Forma Business Mix: Net Revenues

Pro Forma Geographic Mix: Net Revenues

(1) Includes historical ICE OTC revenues (excluding CDS)

(2) Does not reflect any adjustment for estimated transaction-related non-cash

writedown of deferred revenue (3) LTM volumes as of September 30, 2012; excludes

ICE OTC CDS volumes and Bclear (4) Includes historical ICE OTC Energy

contracts Pro Forma Product Mix: Futures Volumes

(3)

LTM

Volumes

LTM

Volumes

Pro Forma Geographic Mix: Futures Volumes

(3)

LTM Pro Forma Contracts: 1,497mm

LTM Net

Revenues

LTM Pro Forma Net Revenues: $3.8bn

(2)

(4)

Technology Services & Other

16%

(1)

LTM Net

Revenues |

9

IntercontinentalExchange

Commodities

Commodities

Cash & Listings

Cash & Listings

Financial

Financial

Clearing & Data /

Services

Clearing & Data /

Services

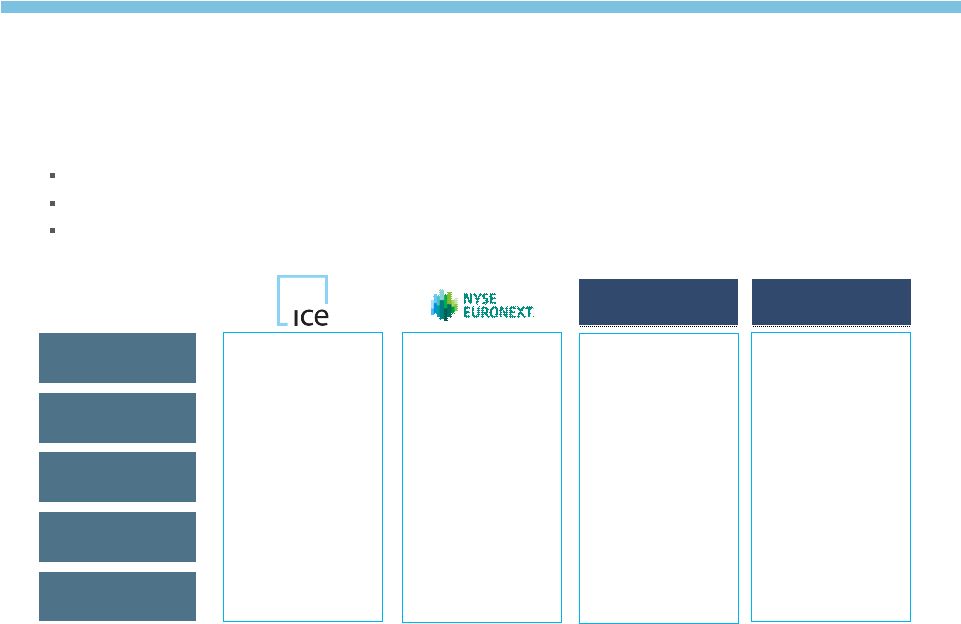

Iconic Global Brands and Deep Infrastructure

ICE and NYSE Euronext have assembled a valuable portfolio of businesses

across global markets through acquisitions, organic initiatives and alliances

Alliances /

Investments

Alliances /

Investments

Winnipeg Commodity

Exchange |

10

IntercontinentalExchange

Currency Pairs

U.S. Dollar

Index

Xxxxxxx Index

Futures

Credit Default

Swaps

Short-Term

Interest Rates

Medium-Term

Interest Rates

Equity Options

MSCI Index

Futures

Equity Index

Options

Xxxxx Crude

WTI Crude

ASCI Crude

Gas Oil

European

Natural Gas

U.K. Electricity

Global Coal

Emissions

Refined Oil

Products

Natural Gas

Liquids

Freight

Iron Ore

Rapeseed

Skimmed Milk

Cocoa

EU Corn

EU Wheat

Robusta Coffee

White Sugar

Integrated Global Markets, Clearing, Technology and Risk Management

Integrated Global Markets, Clearing, Technology and Risk Management

Natural Gas

Power

Oil / Refined

Products

U.S.

Environmental

Natural Gas

Liquids

Liquefied

Natural Gas

Cocoa

Arabica Coffee

Cotton

Raw Sugar

Orange Juice

Barley

Canola Oil

Canadian

Wheat

Corn

Soybean

Gold

Silver

Clearing

Futures & OTC

Clearing Houses

Cetip Partnership

Data / Services

Market Data

Real-time

prices/screens

Indices and end

of day reports

Tick-data, time

and sales

Market price

validations

Forward Curves

eConfirm

Trade Vault

ICE Chat &

Whentech

Chatham Energy

Mobile technology

ICE Link

FIX marketplace

SFTI

NYSE

NYSE Euronext

MKT (SMEs)

NYSE Euronext

Arca (fully

electronic)

ArcaEdge (OTC

equities)

Corpedia

Corporate

Services

Currency Pairs

Credit Default

Swaps

Short-Term

Interest Rates

Medium-Term

Interest Rates

Equity Indexes

Cash Equities

Individual

Equities

Clearing

Proven Futures

& OTC Clearing

House

Interbolsa

Data / Services

Market Data

Real-time

prices/screens

Indices and end

of day reports

Tick-data, time

and sales

Market price

validations

Forward Curves

Market Price

Validation

Bclear –

Processing for

OTC Derivatives

contracts

Commodities

Commodities

Cash &

Listings

Cash &

Listings

Financial

Financial

Clearing &

Data / Svcs

Clearing &

Data / Svcs

Commodities

Commodities

Financial

Financial

Clearing &

Data / Svcs

Clearing &

Data / Svcs

Cash &

Listings

Cash &

Listings

Euronext

•

Amsterdam

•

Brussels

•

Lisbon

•

London

•

Paris

NYSE Euronext

Alternext

(SMEs)

NYSE Euronext

Arca Europe

(fully electronic)

Legacy ICE

Legacy NYSE Euronext

Comprehensive Coverage of Global Financial Markets

Key benchmarks and integrated market infrastructure

Europe and Asia

Americas |

Global Derivatives Contracts Traded

MM of Contracts, 9/30/2012 YTD

3

largest global derivatives complex on a pro

forma basis

Leading global derivatives clearing houses based

in New York, Chicago and London

Entry to largest global derivatives market, with

global OTC interest rate market estimated

at ~ $500

trillion Proven ability to create new products and growth

opportunities:

o

Swaps

o

Options

o

Mid-Curve Options

Further growth opportunities from recent initiatives

including NYPC, NYSE Liffe U.S. and recently

launched MSCI index contracts

Leading Innovator in Global Derivatives Markets

Pro forma ICE will be a leader across financial, energy, equities and commodity

products with access to a premier global interest rates complex

Exchange Traded Interest Rate Futures & Options

11

IntercontinentalExchange

Global OTC Interest Rate Market

Sources: FIA, Bank of International Settlement

(1) Excludes all ICE OTC contracts; including ICE OTC Energy contracts would

increase volumes by 376 million (2) Notional amount outstanding at

6/30/2012 Global OTC Interest Rate Market: $494 Trillion

(2)

2012 YTD Contracts Traded: 2.3 Billion

(1)

(1)

North

America

44%

Europe

33%

Asia Pacific

5%

Other

18%

U.S. Dollar

33%

Euro

36%

Japanese

Yen

12%

Pound

Sterling

8%

Other

11%

294

297

426

450

796

832

879

1,271

1,464

1,473

1,640

1,767

1,804

2,242

0

500

1,000

1,500

2,000

2,500

ICE

MCX

MCX-SX

Dalian Commodity

MICEX

NASDAQ OMX

CBOE

BM&F BOVESPA

NSE

NYSE Euronext

Korea Exchange

Pro Forma

Eurex / ISE

CME

rd

Futures (656)

Equity Options (816) |

ESTABLISHED

INFRASTRUCTURE &

TRANSITION TO ICE

CLEAR EUROPE

Leading global clearing solution for futures and OTC markets already in place in

London Unique experience of managing the transition of OTC and commodity

futures markets from LCH.Clearnet to ICE Clear Europe

Leading

global

clearing

solution

already

in

place,

with

U.S.

and

U.K.

regulated

status

ICE Clear Europe today clears over 65% of ICE’s global business

PROVEN PLATFORM

FOR INNOVATION

Proven track record of bringing innovation and investment to global markets

Leading clearing house for European CDS

Well positioned to capitalize on the IRS clearing opportunity

Proven track record of accelerated new product launches and energy swaps to

futures transition World-class risk management expected to deliver

further capital efficiencies for clearing members ICE Clear Europe has

accepted Euroclear triparty collateral since 2009 and was the first European

clearing house to accept gold as collateral

ACCELERATED PATH TO

NEW CLEARING

TECHNOLOGY

Proven implementation of clearing technology to support initial transition to ICE

Clear Europe, including ICE’s banking systems

Successful implementation of state-of-the-art proprietary clearing

technology platform Rationalization of technology platforms will create

greater market and operating efficiencies Accelerating Innovation and

Integration ICE’s proven experience in establishing and migrating clearing

services and technology will accelerate innovation and integration for

future growth 12

IntercontinentalExchange |

Enhancing Combined Growth Initiatives

13

IntercontinentalExchange

Global Derivatives

Global Derivatives

Capitalize on the IRS clearing

opportunity with further market

build-out

Continued launch of new

derivatives products (e.g., mid-

curve options, swapnote, etc.)

Capitalize on timely transition of

energy swaps to futures

Expand into EU natural gas and

power markets (APX Endex) and

electronic options (WhenTech &

ICE Chat)

Develop NDF FX clearing

Expansion of clearable CDS

(including EU sovereigns), CDS

futures and anticipated launch of

credit SEF

Develop Brazilian energy market

(via BRIX) and fixed income

trading platform

Capitalize on Xxxxxxx Index volume

upside with return of fund flows

Expansion into grains and oilseeds

to extend reach in ag sector

Cash and Listings

Cash and Listings

Capitalize on momentum from new

listings / transfers

Expand into capital markets, board

services and compliance

o

Deepen relationships with

listed issuers and help tap new

adjacencies

Build liquidity centers and

connectivity

o

Offer access to HKEx data

center via Fixnetix

ICE intends to explore an IPO of

Euronext as a Continental

European-based entity following

the closing of the acquisition if

market conditions permit and if

European policy makers are

supportive

Technology and Data Services

Technology and Data Services

Expand managed services offering

o

Enhance ability to manage and

deliver 3rd party solutions,

which clients increasingly value

o

Capitalize on clients’

increased

focus on cost optimization

Capitalize on new global data

agreements

Build technology services pipeline

(e.g., ATG, Xxxxxxx)

Build out network with global

coverage across multiple markets

and asset classes

Extend data services with broader

coverage of market data and

different types

Realize benefits of global

partnerships

o

Tokyo Stock Exchange

o

Warsaw Stock Exchange

o

Bank of China

Continued focus on accelerating growth and efficiencies across all business

lines |

14

IntercontinentalExchange

Well Positioned to Lead Derivatives Industry Evolution

Combination reinforces ICE’s proven industry leadership

Historical Financial Reform Solutions

Historical Financial Reform Solutions

Recent and Current Initiatives

Recent and Current Initiatives

ICE Trade Automation, Clearing and Processing

Infrastructure:

Global trading and clearing platforms for futures and

OTC markets

ICE eConfirm is the leading energy trade data

repository

Straight-through-processing and OTC connectivity

via

ICE

Link

across

buy-

and

sell-side

Transparency and Existing Regulation:

Investments made in technology, regulatory

reporting, market supervision and surveillance tools

Implemented position limits in OTC energy markets

in 2010; U.S.-linked futures in 2008

Standardization, Clearing and Automation:

Enabled clearing for energy swaps, going from 2%

cleared in 2002 to over 97% cleared in 2011

Rapid implementation of CDS clearing through

infrastructure investment and innovation

Unparalleled connectivity for trade processing and

risk

management

from

front-

to

back-office

Transparency, Readiness and Implementation:

Multi-asset OTC clearing services

Continued investments in technology, compliance,

reporting, market supervision and surveillance

Transitioned energy swaps to exchange traded

futures

Poised to offer SEFs for energy and credit

Proactive, effective high frequency trading weighted

volume ratio (WVR) messaging policy

Energy and credit default swaps data repository

(SDR) Trade Vault operational

“Plus One”

pre-clearing credit check provides OTC

swap risk management and continuity

ICE Clear Credit to satisfy financial market utility

standards and CPSS-IOSCO requirements |

$1,373

(1)

2001:

ICE’s business

expands globally

into futures with

acquisition of

London-based

IPE

2007:

Completed

acquisition of

NYBOT

2007: Acquired

Winnipeg

2008: Acquired

YellowJacket

2008: Acquired

Creditex &

launched ICE

Clear Europe

2010: Acquired

Climate

Exchange

2011: Acquired

Ballista

2011: Became

largest

shareholder in

Cetip

2011:

Launched BRIX

2005: ICE IPO

2012:

Acquired

Whentech

2012:

Announced

Acquisition of

NYSE Euronext

Proven Track Record of Successful Acquisitions

History of realizing synergies on or ahead of

schedule

Demonstrated ability to efficiently and

effectively integrate acquisitions while growing

core business

Proven record of driving further growth and

generating premium value for all stockholders

Disciplined approach to acquisitions

(1)

Based on consensus I/B/E/S estimates for FY2012

15

IntercontinentalExchange

2009: Acquired

The Clearing

Corporation and

launched global

CDS clearing |

16

$450 million of cost synergies have been identified including $150 million of

remaining NYSE Euronext Project 14 cost reductions

o

Excluding the remaining Project 14 reductions, $300 million of incremental cost

reductions have been identified Approximately 80% of synergies are expected

to be realized by the end of Year 2 Pro forma 2014E diluted GAAP EPS of

$12.50 reflecting full run-rate synergies (1)

Excludes potential revenue synergies

IntercontinentalExchange

Significant Synergy Opportunities

Full run-rate synergies of approximately $450 million within 3 years of

closing REMAINING PROJECT 14

BUSINESS EFFICIENCIES

Technology, data center optimization, platforms

Business optimization

Organizational efficiencies / infrastructure

Clearing

Technology

Resources reduction

Non-compensation spending

Annual Run-Rate Synergies

Annual Run-Rate Synergies

Description

Description

~$150mm

~$150mm

~$450mm

CORPORATE &

PORTFOLIO

MANAGEMENT

Portfolio management

Resources reduction

Efficiencies and other non-comp spending

Public company expenses and support function overlap

~$150mm

(1)

Based on consensus I/B/E/S estimates for FY2014 for both ICE and NYX and reflecting

certain estimated transaction adjustments, including full $300 million of

incremental synergies and $89 million of pre-tax revenue reduction due to estimated

transaction-related, non-cash writedown of deferred revenue |

Combination increases financial scale while maintaining significant flexibility to

pursue additional strategic opportunities and organic growth initiatives

17

Significant cash expected to be generated which could be used to

further reduce leverage

~$300 million annual dividend to be initiated post-close

Excludes ~$89 million non-cash revenue reduction in 2014 due to the anticipated

balance sheet writedown of NYSE Euronext deferred revenue from original

listing fees and other purchase accounting adjustments (1)

Combined

Combined

Combined with

Synergies

Combined with

Synergies

(1)

Anticipated non-cash balance sheet writedown of NYSE Euronext deferred revenue of

approximately $480 million (2)

ICE Adj. EBITDA is calculated by taking operating income and adding back D&A and

merger expenses (3)

NYSE Euronext Adjusted EBITDA is calculated by taking operating income and adding back

D&A, merger expenses and exit costs and BlueNext tax settlement (4)

Assumes $1.8 billion of additional debt is incurred as part of the transaction

(5)

Assumes $1.1 billion of cash is used for consideration in the transaction

Robust Pro Forma Cash Flow and Operating Leverage

$1,367

$2,390

$3,757

$3,757

$971

$1,049

$2,020

$2,470

$850

$2,482

$5,132

$5,132

$1,241

$341

$521

$521

0.9x

2.4x

2.5x

2.1x

(2)

(3)

LTM Revenues

LTM Adj. EBITDA

9/30/12 Debt

9/30/12 Cash & ST

Investments

Debt /

Adj. EBITDA (x)

(4)

(4)

(5)

(5) |

Continued Focus on Shareholder Value Creation

ROIC = (Operating Income x (1-Tax Rate) ) / (Avg Debt + Avg Shareholders

Equity + Avg Minority Interest -

Avg Cash, Cash Equiv, & ST Investments)

18

IntercontinentalExchange

LTM 2012 ROIC *

Total Shareholder Return (Since 12/31/2005)

(1)

ICE has delivered superior shareholder value through leading returns on invested

capital Prudent manager of shareholder capital with a track record of

disciplined M&A and organic investments Transaction expected to be GAAP

EPS accretive in Year 1 (2014) and to deliver ROIC above cost of investment

by Year 2 (2015)

Committed to return capital to shareholders through implementation of new dividend

policy upon closing *Source: Factset, Company Filings. S&P data represents

only current constituents. S&P 500 ROIC calculated using invested capital weighted average.

ICE LTM data as of 3Q12

(2)

(3)

(1)

Total shareholder return as of December 19, 2012 (2) Peer average includes CME, NYX and NDAQ; LTM data as of

3Q12 (3) Peer average includes CME, NYX and NDAQ; NYSE Euronext

total shareholder return from May 10, 2006 IPO (IPO share price of $61.50) |

19

IntercontinentalExchange

ICE and NYSE Euronext –

A Compelling Combination

Creates an unparalleled operator of global exchanges and

clearing houses for commodities, credit derivatives, equities and

equity derivatives, foreign exchange and interest rates

Strong global presence, infrastructure and brands across

international markets with ability to drive new initiatives on a

combined basis

Unlocks significant value through the achievement of merger

synergies, accretion and return of capital with focus on growth

Creates an efficient clearing model poised for growth as interest

rate markets recover and interest rate swap clearing develops

Enhances innovation and competitiveness within U.S. and

European rate markets

Strengthens the pre-eminent global equities and listings

franchise

Delivers strong operating leverage while preserving healthy

levels of recurring revenues and participation in the eventual

market recovery with exposure to increasing interest rates

Provides for diversification among multiple asset classes and

expands reach into new markets, including the largest asset

class, interest rates, while at cyclical lows

Builds on track record of improving market transparency and

expands resources to address challenges and opportunities in

equity market structure

Completion Timeline

Completion Timeline

Shareholder Votes:

File registration statement on Form S-4 and joint

proxy statement / prospectus

Regulatory Process:

Competition filings in U.S. and Europe

Filings with relevant U.S. and European market

regulators |

| APPENDIX |

21

IntercontinentalExchange

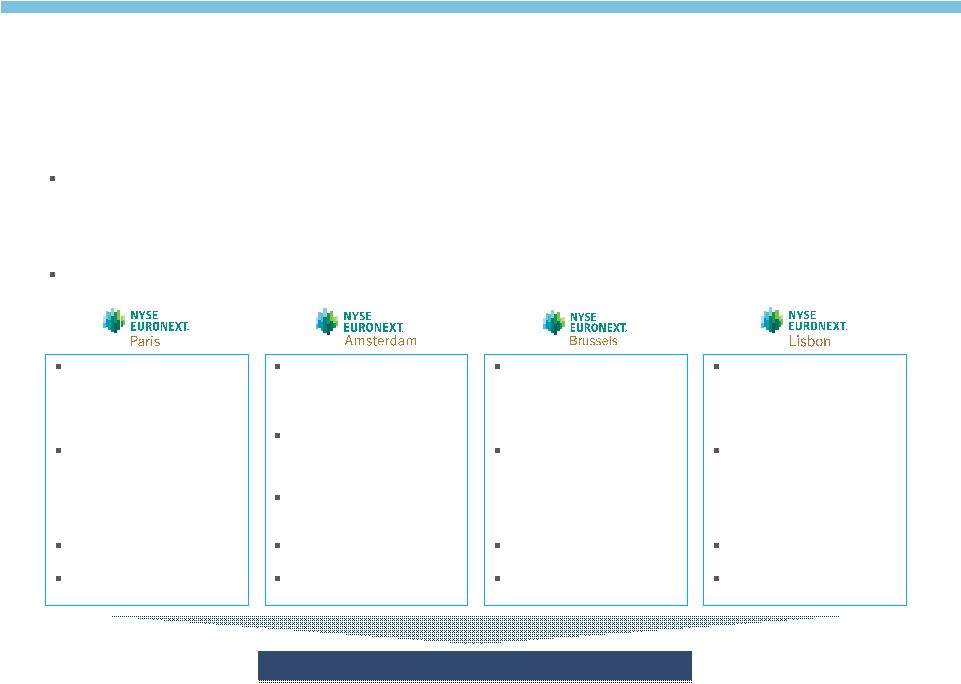

Overview of Euronext

Post-closing ICE will look to optimize the portfolio of global businesses,

including a potential IPO of Euronext

586 listed companies as of

December 2011 (excluding

investment funds)

o

528 domestic

o

58 foreign

Supports the CAC 40 Index

o

Acts as the underlying

regional index for futures

and options contracts

144 listed companies as of

December 2011

o

106 domestic

o

38 foreign

Houses 181 Investment

Funds, 7,908 Structured

products, 123 ETFs and

1,415 Bonds

Supports the AEX Index

148 listed companies as of

October 2012 (excluding

investment funds)

o

118 domestic

o

30 foreign

Supports the BEL 20 Index

o

Blue-chip index for the

Brussels stock market

51 listed companies as of

December 2011 (excluding

investment funds)

o

46 domestic

o

5 foreign

Supports the PSI 20 Index

o

Acts as the underlying

regional index for futures

and options contracts

Euronext assets to potentially include the NYSE Euronext markets

in Paris, Amsterdam, Brussels and Lisbon

o

Includes all cash equities and derivatives products currently offered on the

Continental European markets o

Potential inclusion of the NYSE Euronext technology businesses supporting the

Continental European markets

European management team and independent board will be determined

post-closing LTM Volumes:

Cash Equities: €375 billion

traded

Derivatives: 84.3 million

contracts

LTM Volumes:

Cash Equities: €77 billion

traded

Derivatives: 1.1 million

contracts

LTM Volumes:

Cash Equities: €22 billion

traded

Derivatives: 63,000 contracts

LTM Volumes:

Cash Equities: €969 billion

traded

Derivatives: 90.6 million

contracts

$560 Million of LTM Revenue

$560 Million of LTM Revenue |