DANAHER CORPORATION 2007 OMNIBUS INCENTIVE PLAN, AS AMENDED AND RESTATED PERFORMANCE STOCK UNIT AGREEMENT Unless otherwise defined herein, the terms defined in the Danaher Corporation 2007 Omnibus Incentive Plan, As Amended and Restated (the “Plan”)...

▇▇▇▇▇▇▇ CORPORATION 2007 OMNIBUS INCENTIVE PLAN, AS AMENDED AND RESTATED PERFORMANCE STOCK UNIT AGREEMENT Unless otherwise defined herein, the terms defined in the ▇▇▇▇▇▇▇ Corporation 2007 Omnibus Incentive Plan, As Amended and Restated (the “Plan”) will have the same defined meanings in this Performance Stock Unit Agreement (the “Agreement”). I. NOTICE OF GRANT Name: Employee ID: The undersigned Participant has been granted an Award of Performance Stock Units, subject to the terms and conditions of the Plan and this Agreement, as follows (each of the following capitalized terms are defined terms having the meaning indicated below): Date of Grant: Target PSUs: TSR Performance Period: ROIC Performance Period: Vesting Conditions: Per this Agreement (including Addendum A) II. AGREEMENT 1. Grant of PSUs. ▇▇▇▇▇▇▇ Corporation (the “Company”) hereby grants to the Participant named in this Grant Notice (the “Participant”), an Award of Performance Stock Units (or “PSUs”) to acquire a number of shares of Common Stock (the “Shares”) set forth in the Grant Notice, subject to the terms and conditions of this Agreement and the Plan, which are incorporated herein by reference. When used in this Agreement, the term “Performance Period” means the period beginning on the earlier of the beginning date of the TSR Performance Period or the beginning date of the ROIC Performance Period, and ending on the later of the ending date of the TSR Performance Period or the ending date of the ROIC Performance Period. 2. Vesting. (a) Vesting Schedule. Except as may otherwise be set forth in this Agreement or in the Plan, the Award shall vest with respect to the number of PSUs, if any, as determined pursuant to the terms of Addendum A, which is incorporated by reference herein and made a part of this Agreement (such terms are referred to herein as the “Vesting Conditions”); provided that (except as set forth in Sections 4(b) and 4(c) below) the Award shall not vest with respect to any PSUs under the terms of this Agreement unless the Participant continues to be actively employed with the Company or an Eligible Subsidiary from the Date of Grant through the date on which the Compensation Committee (the “Committee”) of the Company’s Board of Directors determines the number of PSUs that vest pursuant to the Vesting Conditions (the “Certification Date”). The Committee shall determine how many PSUs vest pursuant to the Vesting Conditions and such determination shall be final and conclusive. Until the Committee has made such a determination, none of the Vesting Conditions will be considered to have

2 been satisfied. Such certification shall occur, if at all, no later than four (4) calendar months following the last day of the Performance Period (the “Certification End Date”). (b) Fractional PSU Vesting. In the event the Participant is vested in a fractional portion of a PSU (a “Fractional Portion”), such Fractional Portion will be rounded up and converted into a whole Share and issued to the Participant; provided that to the extent rounding a fractional share up would result in the imposition of either (i) individual tax and penalty interest charges imposed under Section 409A of the U.S. Internal Revenue Code of 1986 (“Section 409A”), or (ii) adverse tax consequences if the Participant is located outside of the United States, the fractional share will be rounded down without the payment of any consideration in respect of such fractional share. 3. Form and Timing of Payment; Conditions to Issuance of Shares. (a) Form and Timing of Payment. The Award of PSUs represents the right to receive a number of Shares equal to the number of PSUs that vest pursuant to the Vesting Conditions. Unless and until the PSUs have vested in the manner set forth herein, the Participant shall have no right to payment of any such PSUs. Prior to actual issuance of any Shares underlying the PSUs, such PSUs will represent an unsecured obligation of the Company, payable (if at all) only from the general assets of the Company. Subject to the other terms of the Plan and this Agreement, with respect to any PSUs that vest in accordance with this Agreement (other than in cases where the Participant dies during employment, which is addressed in Section 4(b) below), the underlying Shares will be paid to the Participant in whole Shares (and related Dividend Equivalent Rights will also be paid) as soon as practicable (but in any event within 90 days) following the fifth anniversary of the commencement date of the Performance Period (the “Commencement Date”), and such payment shall not be conditioned on continuation of the Participant’s active employment with the Company or an Eligible Subsidiary following the Certification Date. Shares shall not be issued under the Plan unless the issuance and delivery of such Shares comply with (or are exempt from) all applicable requirements of law, including (without limitation) the Securities Act, the rules and regulations promulgated thereunder, state securities laws and regulations, and the regulations of any stock exchange or other securities market on which the Company’s securities may then be traded. The Committee may require the Participant to take any reasonable action in order to comply with any such rules or regulations. (b) Acknowledgment of Potential Securities Law Restrictions. Unless a registration statement under the Securities Act covers the Shares issued upon vesting of a PSU, the Committee may require that the Participant agree in writing to acquire such Shares for investment and not for public resale or distribution, unless and until the Shares subject to the PSUs are registered under the Securities Act. The Committee may also require the Participant to acknowledge that the Participant shall not sell or transfer such Shares except in compliance with all applicable laws, and may apply such other restrictions as it deems appropriate. The Participant acknowledges that the U.S. federal securities laws prohibit trading in the stock of the Company by persons who are in possession of material, non-public information, and also acknowledges and understands the other restrictions set forth in the Company’s ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇ Policy. 4. Termination. (a) General. In the event the Participant’s active employment or other active service-providing relationship, as applicable, with the Company or an Eligible Subsidiary terminates (the date of any such termination is referred to as the “Termination Date”) for any reason (other than death, Early Retirement or Normal Retirement) whether or not in breach of applicable labor laws, unless contrary to applicable law and unless otherwise provided by the Administrator either initially or subsequent to the grant of the PSUs, all PSUs that are unvested as of the Termination Date shall

3 automatically terminate as of the Termination Date and the Participant’s right to receive further PSUs under the Plan shall also terminate as of the Termination Date. The Committee shall have discretion to determine whether the Participant has ceased to be actively employed by (or, if the Participant is a consultant or director, has ceased actively providing services to) the Company or Eligible Subsidiary, and the effective date on which such active employment (or active service-providing relationship, as applicable) terminated. The Participant’s active employer-employee or other active service-providing relationship, as applicable, will not be extended by any notice period mandated under applicable law (e.g., active employment shall not include a period of “garden leave,” paid administrative leave or similar period pursuant to applicable law). Unless the Committee provides otherwise (1) termination of the Participant’s employment will include instances in which Participant is terminated and immediately rehired as an independent contractor, and (2) the spin-off, sale, or disposition of the Participant’s employer from the Company or an Eligible Subsidiary (whether by transfer of shares, assets or otherwise) such that the Participant’s employer no longer constitutes an Eligible Subsidiary will constitute a termination of employment or service. (b) Death. (i) In the event the Participant’s active employment or other active service-providing relationship with the Company or an Eligible Subsidiary terminates as a result of death prior to the conclusion of the Performance Period, unless contrary to applicable law and unless otherwise provided by the Administrator either initially or subsequent to the grant of the Award, the Participant’s estate will become vested in the portion of the Award determined by multiplying (1) the amount of Target PSUs (and related Dividend Equivalent Rights) subject to such Award, times (2) the quotient of the number of complete twelve-month periods between and including the Commencement Date and the Termination Date (provided that any partial twelve-month period between and including the Commencement Date and the Termination Date shall also be considered a complete twelve-month period for purposes of this pro- ration methodology), divided by the total number of twelve-month periods in the Performance Period. With respect to any PSUs that vest pursuant to this Section 4(b), the underlying Shares (and related Dividend Equivalent Rights) will be paid to the Participant’s estate as soon as reasonably practicable (but in any event within 90 days) following the Participant’s death. (ii) In the event the Participant’s active employment or other active service-providing relationship with the Company or an Eligible Subsidiary terminates as a result of death following the conclusion of the Performance Period but prior to the date the Shares (and related Dividend Equivalent Rights) underlying vested PSUs are issued and paid, unless contrary to applicable law and unless otherwise provided by the Administrator either initially or subsequent to the grant of the Award, the underlying Shares (and related Dividend Equivalent Rights) will be paid to the Participant’s estate as soon as reasonably practicable (but in any event within 90 days) following the later of (i) the Participant’s death, and (ii) the Certification End Date. (iii) For avoidance of doubt, in all other situations, if the Participant dies after the Participant’s active employment or other active service-providing relationship with the Company or an Eligible Subsidiary terminates but prior to the date the Shares (and related Dividend Equivalent Rights) underlying vested PSUs are issued and paid, the underlying Shares (and related Dividend Equivalent Rights) will be paid to the Participant’s estate as soon as reasonably practicable (but in any event within 90 days) following the fifth anniversary of the Commencement Date. (iv) Notwithstanding the foregoing and for the avoidance of doubt, upon termination of employment by reason of the Participant’s death, if as of the date of death the Participant also qualifies for Early Retirement or Normal Retirement as reflected below, the Participant’s estate shall be entitled to the most favorable terms of both applicable termination provisions.

4 (c) Retirement. In the event the Participant’s active employment or other active service- providing relationship, as applicable, with the Company or an Eligible Subsidiary terminates prior to the Certification Date as a result of Normal Retirement or Early Retirement, the unvested portion of the PSUs held by the Participant for at least six (6) months prior to Normal Retirement or Early Retirement date will continue to vest in accordance with Section 2 subject to actual performance to be measured as of the end of the Performance Period. (d) Gross Misconduct. If the Participant’s employment with the Company or an Eligible Subsidiary is terminated for Gross Misconduct as determined by the Administrator, the Administrator in its sole discretion may provide that all, or any portion specified by the Administrator, of the Participant’s unvested PSUs shall automatically terminate as of the time of termination without consideration. The Participant acknowledges and agrees that the Participant’s termination of employment shall also be deemed to be a termination of employment by reason of the Participant’s Gross Misconduct if, after the Participant’s employment has terminated, facts and circumstances are discovered or confirmed by the Company that would have justified a termination for Gross Misconduct. (e) Violation of Post-Termination Covenant. To the extent that any of the Participant’s unvested PSUs remain outstanding under the terms of the Plan or this Agreement after the Termination Date, any unvested PSUs shall expire as of the date the Participant violates any covenant not to compete or other post-termination covenant that exists between the Participant on the one hand and the Company or any Subsidiary of the Company, on the other hand. (f) Substantial Corporate Change. Upon a Substantial Corporate Change, the Participant’s unvested PSUs will terminate unless provision is made in writing in connection with such transaction for the assumption or continuation of the PSUs, or the substitution for such PSUs of any options or grants covering the stock or securities of a successor employer corporation, or a parent or subsidiary of such successor, with appropriate adjustments as to the number and kind of shares of stock and prices, in which event the PSUs will continue in the manner and under the terms so provided. (g) Non-Transferability of PSUs. Unless the Committee determines otherwise in advance in writing, PSUs may not be transferred in any manner otherwise than by will or by the applicable laws of descent or distribution. The terms of the Plan and this Agreement shall be binding upon the executors, administrators, heirs and permitted successors and assigns of the Participant. 5. Amendment of PSUs or Plan. (a) The Plan and this Agreement constitute the entire understanding of the parties with respect to the subject matter hereof and supersede in their entirety all prior undertakings and agreements of the Company and the Participant with respect to the subject matter hereof. The Participant expressly warrants that the Participant is not accepting this Agreement in reliance on any promises, representations, or inducements other than those contained herein. The Board may amend, modify or terminate the Plan or any Award in any respect at any time; provided, however, that modifications to this Agreement or the Plan that materially and adversely affect the Participant’s rights hereunder can be made only in an express written contract signed by the Company and the Participant. Notwithstanding anything to the contrary in the Plan or this Agreement, the Company reserves the right to revise this Agreement and the Participant’s rights under outstanding PSUs as it deems necessary or advisable, in its sole discretion and without the consent of the Participant, (1) upon a Substantial Corporate Change, (2) as required by law, or (3) to comply with Section 409A or to otherwise avoid imposition of any additional tax or income recognition under Section 409A in connection with this Award.

5 (b) The Participant acknowledges and agrees that if the Participant changes classification from a full-time employee to a part-time employee the Committee may in its sole discretion reduce or eliminate the Participant’s unvested PSUs. 6. Tax Obligations. (a) Withholding Taxes. Regardless of any action the Company or any Subsidiary employing the Participant (the “Employer”) takes with respect to any or all federal, state, local or foreign income tax, social insurance, payroll tax, payment on account or other tax related items (“Tax-Related Items”), the Participant acknowledges that the ultimate liability for all Tax-Related Items associated with the PSUs is and remains the Participant’s responsibility and that the Company and the Employer (i) make no representations or undertakings regarding the treatment of any Tax-Related Items in connection with any aspect of the PSUs, including, but not limited to, the grant or vesting of the PSUs, the delivery of the Shares, the subsequent sale of Shares acquired at vesting and the receipt of any dividends or dividend equivalents; and (ii) do not commit to structure the terms of the grant or any aspect of the PSUs to reduce or eliminate the Participant’s liability for Tax-Related Items. Further, if the Participant is subject to tax in more than one jurisdiction, Participant acknowledges that the Company and/or the Employer (or former employer, as applicable) may be required to withhold or account for Tax-Related Items in more than one jurisdiction. (i) This Section 6(a)(i) shall apply to the Participant only if the Participant is not subject to Section 16 of the Securities Exchange Act of 1934 as of the date the relevant PSU first becomes includible in the gross income of Participant for purposes of Tax Related ITems. The Participant shall, no later than the date as of which the value of a PSU first becomes includible in the gross income of the Participant for purposes of Tax-Related Items, pay to the Company and/or the Employer, or make arrangements satisfactory to the Administrator regarding payment of, all Tax-Related Items required by applicable law to be withheld by the Company and/or the Employer with respect to the PSU. The obligations of the Company under the Plan shall be conditional on the making of such payments or arrangements, and the Company and/or the Employer shall, to the extent permitted by applicable law, have the right to deduct any such Tax-Related Items from any payment of any kind otherwise due to the Participant. The Company shall have the right to require the Participant to remit to the Company an amount in cash sufficient to satisfy any applicable withholding requirements related thereto. With the approval of the Administrator, the Participant may satisfy the foregoing requirement by either (i) electing to have the Company withhold from delivery of Shares or (ii) delivering already owned unrestricted Shares, in each case, having a value up to the maximum amount of tax required to be withheld in the applicable jurisdiction (or such other rate that will not cause adverse accounting consequences for the Company). Any such Shares shall be valued at their Fair Market Value on the date as of which the amount of Tax-Related Items to be withheld is determined. Such an election may be made with respect to all or any portion of the Shares to be delivered pursuant to an Award. The Company may also use any other method or combination of methods of obtaining the necessary payment or proceeds, as permitted by applicable law, to satisfy its withholding obligation with respect to any PSU. (ii) This Section 6(a)(ii) shall apply to the Participant only if the Participant is subject to Section 16 of the Securities Exchange Act of 1934 as of the date the relevant PSU first becomes includible in the gross income of the Participant for purposes of Tax-Related Items. All Tax- Related Items legally payable by the Participant in respect of the PSUs shall be satisfied by the Company, withholding a number of the Shares that would otherwise be delivered to the Participant upon the vesting or settlement of the PSUs with a Fair Market Value, determined as of the date of the relevant taxable event, equal to the minimum statutory withholding amount that applies to the Participant, rounded up to the nearest whole share (“Net Settlement”). The Net Settlement mechanism described in this paragraph was approved by the Committee prior to the Date of Grant in a manner intended to constitute “approval in

6 advance” by the Committee for purposes of Rule 16b3-(e) under the Securities Exchange Act of 1934, as amended. (iii) If the obligation for Tax Related-Items is satisfied by withholding in net settlement, for tax purposes, the Participant shall be deemed to have been issued the full number of Shares issued upon vesting of the PSUs notwithstanding that a number of the Shares are held back solely for the purpose of paying the Tax Related-Items. (b) Code Section 409A. Payments made pursuant to this Plan and the Agreement are intended to qualify for an exemption from or comply with Section 409A. Notwithstanding any provision in the Agreement, the Company reserves the right, to the extent the Company deems necessary or advisable in its sole discretion, to unilaterally amend or modify the Plan and/or this Agreement to ensure that all PSUs granted to Participants who are United States taxpayers are made in such a manner that either qualifies for exemption from or complies with Section 409A; provided, however, that the Company makes no representations that the Plan or the PSUs shall be exempt from or comply with Section 409A and makes no undertaking to preclude Section 409A from applying to the Plan or any PSUs granted thereunder. If this Agreement fails to meet the requirements of Section 409A, neither the Company nor any of its Eligible Subsidiaries shall have any liability for any tax, penalty or interest imposed on the Participant by Section 409A, and the Participant shall have no recourse against the Company or any of its Eligible Subsidiaries for payment of any such tax, penalty or interest imposed by Section 409A. Notwithstanding anything to the contrary in this Agreement, these provisions shall apply to any payments and benefits otherwise payable to or provided to the Participant under this Agreement. For purposes of Section 409A, each “payment” (as defined by Section 409A) made under this Agreement shall be considered a “separate payment.” In addition, for purposes of Section 409A, payments shall be deemed exempt from the definition of deferred compensation under Section 409A to the fullest extent possible under (i) the “short-term deferral” exemption of Treasury Regulation § 1.409A-1(b)(4), and (ii) (with respect to amounts paid as separation pay no later than the second calendar year following the calendar year containing the Participant’s “separation from service” (as defined for purposes of Section 409A)) the “two years/two-times” involuntary separation pay exemption of Treasury Regulation § 1.409A-1(b)(9)(iii), which are hereby incorporated by reference. For purposes of making a payment under this Agreement, if any amount is payable as a result of a Substantial Corporate Change, such event must also constitute a “change in ownership or effective control” of the Company or a “change in the ownership of a substantial portion of the assets” of the Company within the meaning of Section 409A. If the Participant is a “specified employee” as defined in Section 409A (and as applied according to procedures of the Company and its Subsidiaries) as of the Participant’s separation from service, to the extent any payment under this Agreement constitutes deferred compensation (after taking into account any applicable exemptions from Section 409A), and such payment is payable by reason of a separation from service, then to the extent required by Section 409A, no payments due under this Agreement may be made until the earlier of: (i) the first day of the seventh month following the Participant’s separation from service, or (ii) the Participant’s date of death; provided, however, that any payments delayed during this six-month period shall be paid in the aggregate in a lump sum, without interest, on the first day of the seventh month following the Participant’s separation from service. 7. Rights as Shareholder; Dividends. The Participant shall have no rights as a shareholder of the Company, no dividend rights (except as expressly provided in this Section 7 with respect to Dividend Equivalent Rights) and no voting rights, with respect to the PSUs or any Shares underlying or issuable in respect of such PSUs until such Shares are actually issued to the Participant. No adjustments will be made

7 for dividends or other rights of a holder for which the record date is prior to the date of issuance of the stock certificate or book entry evidencing such Shares. If on or after the Date of Grant and prior to the date the Shares underlying vested PSUs are issued to the Participant a record date occurs with respect to a cash dividend declared by the Board on the shares of Company Common Stock, the Participant will be credited with dividend equivalents equal to (i) the per share cash dividend paid by the Company on its Common Stock with respect to such record date, multiplied by (ii) the total number of PSUs subject to the Award that vest (a “Dividend Equivalent Right”); provided that any Dividend Equivalent Rights credited pursuant to the foregoing provisions of this Section 7 shall be subject to the same vesting, payment and other terms, conditions and restrictions as the PSUs to which they relate and for the avoidance of doubt shall only vest and be paid if and when the PSUs to which such Dividend Equivalent Rights relate vest and the underlying shares are issued; and provided further that Dividend Equivalent Rights that vest and are paid shall be paid in cash. 8. No Employment Contract. Nothing in the Plan or this Agreement constitutes an employment or service contract between the Company and the Participant and this Agreement shall not confer upon the Participant any right to continuation of employment or service with the Company or any of its Eligible Subsidiaries, nor shall this Agreement interfere in any way with the Company’s or any of its Eligible Subsidiaries right to terminate the Participant’s employment or service or at any time, with or without cause (subject to any employment or service agreement the Participant may otherwise have with the Company or an Eligible Subsidiary thereof and/or applicable law). 9. Board Authority. The Board and/or the Committee shall have the power to interpret this Agreement and to adopt such rules for the administration, interpretation and application of the Agreement as are consistent therewith and to interpret or revoke any such rules (including, but not limited to, the determination of whether any PSUs have vested). All interpretations and determinations made by the Board and/or the Committee in good faith shall be final and binding upon the Participant, the Company and all other interested persons and such determinations of the Board and/or the Committee do not have to be uniform nor do they have to consider whether Plan participants are similarly situated. 10. Headings. The captions used in this Agreement and the Plan are inserted for convenience and shall not be deemed to be a part of the PSUs for construction and interpretation. 11. Electronic Delivery. (a) If the Participant executes this Agreement electronically, for the avoidance of doubt the Participant acknowledges and agrees that the Participant’s execution of this Agreement electronically (through an on-line system established and maintained by the Company or a third party designated by the Company, or otherwise) shall have the same binding legal effect as would execution of this Agreement in paper form. The Participant acknowledges that upon request of the Company the Participant shall also provide an executed, paper form of this Agreement. (b) If the Participant executes this Agreement in paper form, for the avoidance of doubt the parties acknowledge and agree that it is their intent that any agreement previously or subsequently entered into between the parties that is executed electronically shall have the same binding legal effect as if such agreement were executed in paper form. (c) If the Participant executes this Agreement multiple times (for example, if the Participant first executes this Agreement in electronic form and subsequently executes this Agreement in paper form), the Participant acknowledges and agrees that (i) no matter how many versions of this Agreement are executed and in whatever medium, this Agreement only evidences a single Award relating to the number of PSUs set forth in the Grant Notice and (ii) this Agreement shall be effective as of the

8 earliest execution of this Agreement by the parties, whether in paper form or electronically, and the subsequent execution of this Agreement in the same or a different medium shall in no way impair the binding legal effect of this Agreement as of the time of original execution. (d) The Company may, in its sole discretion, decide to deliver by electronic means any documents related to the PSUs, to participation in the Plan, or to future awards granted under the Plan, or otherwise required to be delivered to the Participant pursuant to the Plan or under applicable law, including but not limited to, the Plan, the Agreement, the Plan prospectus and any reports of the Company generally provided to shareholders. Such means of electronic delivery may include, but do not necessarily include, the delivery of a link to the Company’s intranet or the internet site of a third party involved in administering the Plan, the delivery of documents via electronic mail (“e-mail”) or such other means of electronic delivery specified by the Company. By executing this Agreement, the Participant hereby consents to receive such documents by electronic delivery. At the Participant’s written request to the Secretary of the Company, the Company shall provide a paper copy of any document at no cost to the Participant. 12. Data Privacy. The Company is located at ▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇, ▇▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇, ▇.▇., ▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇ of America and grants PSUs under the Plan to employees of the Company and its Subsidiaries in its sole discretion. In conjunction with the Company’s grant of the PSUs under the Plan and its ongoing administration of such awards, the Company is providing the following information about its data collection, processing and transfer practices (“Personal Data Activities”). In accepting the grant of the PSUs, the Participant expressly and explicitly consents to the Personal Data Activities as described herein. (a) Data Collection, Processing and Usage. The Company collects, processes and uses the Participant's Personal Information, including the Participant’s name, home address, email address, and telephone number, date of birth, social insurance/passport number or other identification number (e.g. resident registration number), salary, citizenship, job title, any Shares or directorships held in the Company, and details of all PSUs or any other equity compensation awards granted, canceled, exercised, vested, or outstanding in the Participant’s favor, which the Company receives from the Participant or the Employer (“Personal Information”). In granting the PSUs under the Plan, the Company will collect the Participant's Personal Information for purposes of allocating Shares and implementing, administering and managing the Plan. The Company’s legal basis for the collection, processing and usage of the Participant's Personal Information is the Participant’s consent. (b) Stock Plan Administration Service Provider. The Company transfers the Participant's Personal Information to Fidelity Stock Plan Services LLC, an independent service provider based in the United States, which assists the Company with the implementation, administration and management of the Plan (the “Stock Plan Administrator”). In the future, the Company may select a different Stock Plan Administrator and share the Participant's Personal Information with another company that serves in a similar manner. The Stock Plan Administrator will open an account for the Participant to receive and trade Shares acquired under the Plan. The Participant will be asked to agree on separate terms and data processing practices with the Stock Plan Administrator, which is a condition to the Participant’s ability to participate in the Plan. (c) International Data Transfers. The Company and the Stock Plan Administrator are based in the United States. The Participant should note that the Participant’s country of residence may have enacted data privacy laws that are different from the United States. The Company’s legal basis for the transfer of the Participant's Personal Information to the United States is the Participant’s consent.

9 (d) Voluntariness and Consequences of Consent Denial or Withdrawal. The Participant’s participation in the Plan and the Participant’s grant of consent is purely voluntary. The Participant may deny or withdraw the Participant’s consent at any time. If the Participant does not consent, or if the Participant later withdraws the Participant’s consent, the Participant may be unable to participate in the Plan. This would not affect the Participant’s existing employment or salary; instead, the Participant merely may forfeit the opportunities associated with the Plan. (e) Data Subjects Rights. The Participant may have a number of rights under the data privacy laws in the Participant’s country of residence. For example, the Participant’s rights may include the right to (i) request access or copies of personal data the Company processes, (ii) request rectification of incorrect data, (iii) request deletion of data, (iv) place restrictions on processing, (v) lodge complaints with competent authorities in the Participant’s country of residence, and/or (vi) request a list with the names and addresses of any potential recipients of the Participant's Personal Information. To receive clarification regarding the Participant’s rights or to exercise the Participant’s rights, the Participant should contact the Participant’s local human resources department. 13. Waiver of Right to Jury Trial. EACH PARTY, TO THE FULLEST EXTENT PERMITTED BY LAW, WAIVES ANY RIGHT OR EXPECTATION AGAINST THE OTHER TO TRIAL OR ADJUDICATION BY A JURY OF ANY CLAIM, CAUSE OR ACTION ARISING WITH RESPECT TO THE PSUS OR HEREUNDER, OR THE RIGHTS, DUTIES OR LIABILITIES CREATED HEREBY. 14. Agreement Severable. In the event that any provision of this Agreement shall be held invalid or unenforceable, such provision shall be severable from, and such invalidity or unenforceability shall not be construed to have any effect on, the remaining provisions of this Agreement. 15. Governing Law and Venue. The laws of the State of Delaware (other than its choice of law provisions) shall govern this Agreement and its interpretation. For purposes of litigating any dispute that arises with respect to the PSUs, this Agreement or the Plan, the parties hereby submit to and consent to the jurisdiction of the State of Delaware, and agree that such litigation shall be conducted in the courts of New Castle County, or the United States Federal court for the District of Delaware, and no other courts; and waive, to the fullest extent permitted by law, any objection that the laying of the venue of any legal or equitable proceedings related to, concerning or arising from such dispute which is brought in any such court is improper or that such proceedings have been brought in an inconvenient forum. Any claim under the Plan, this Agreement or any Award must be commenced by the Participant within twelve (12) months of the earliest date on which the Participant’s claim first arises, or the Participant’s cause of action accrues, or such claim will be deemed waived by the Participant. 16. Nature of PSUs. In accepting the PSUs, the Participant acknowledges and agrees that: (a) the Plan is established voluntarily by the Company, it is discretionary in nature and may be modified, amended, suspended or terminated by the Company at any time, to the extent permitted by the Plan; (b) the award of PSUs is exceptional, voluntary and occasional and does not create any contractual or other right to receive future awards of PSUs or benefits in lieu of PSUs, even if PSUs have been awarded in the past; (c) all decisions with respect to future equity awards, if any, shall be at the sole discretion of the Company;

10 (d) the Participant’s participation in the Plan is voluntary; (e) the award of PSUs and the Shares subject to the PSUs, and the income from and value of same, are an extraordinary item that (i) does not constitute compensation of any kind for services of any kind rendered to the Company or any Subsidiary, and (ii) is outside the scope of the Participant’s employment or service contract, if any; (f) the award of PSUs and the Shares subject to the PSUs, and the income from and value of same, are not part of normal or expected compensation or salary for any purposes, including, but not limited to, calculating any severance, resignation, termination, redundancy, end of service payments, bonuses, holiday pay, long-service awards, pension or retirement or welfare benefits or similar payments and in no event should be considered as compensation for, or relating in any way to, past services for the Company or any Subsidiary; (g) the award of PSUs and any Shares acquired under the Plan, and the income from and value of same, are not intended to replace or supplement any pension rights or compensation (h) unless otherwise expressly agreed with the Company, the PSUs and the Shares subject to the PSUs, and the income from and value of same, are not granted as consideration for, or in connection with, any service the Participant may provide as a director of any Subsidiary; (i) the future value of the underlying Shares is unknown and cannot be predicted with certainty; (j) the value of the Shares acquired upon vesting/settlement of the PSUs may increase or decrease in value; (k) in consideration of the award of PSUs, no claim or entitlement to compensation or damages shall arise from termination of the PSUs or from any diminution in value of the PSUs or the Shares upon vesting of the PSUs resulting from termination of the Participant’s employment or continuous service with the Company or any Subsidiary (for any reason whatsoever and whether or not in breach of applicable labor laws of the jurisdiction where the Participant is employed or the terms of the Participant’s employment agreement, if any), and in consideration of the grant of the PSUs, the Participant agrees not to institute any claim against the Company or any Subsidiary; if, notwithstanding the foregoing, any such claim is found by a court of competent jurisdiction to have arisen, then, by signing this Agreement/electronically accepting this Agreement, Participant shall be deemed to have irrevocably waived the Participant’s entitlement to pursue or seek remedy for any such claim; and (l) neither the Company, the Employer nor any other Eligible Subsidiary shall be liable for any foreign exchange rate fluctuation between the Participant's local currency and the United States Dollar that may affect the value of the PSUs or of any amounts due to the Participant pursuant to the settlement of the PSUs or the subsequent sale of any Shares acquired upon vesting. 17. Language. The Participant acknowledges that the Participant is proficient in the English language and understands the terms of this Agreement. If Participant has received the Plan, this Agreement or any other document related to the Plan translated into a language other than English and if the meaning of the translated version is different than the English version, the English version will control, unless otherwise prescribed by applicable law.

11 18. Severability. The provisions of this Agreement are severable and if any one or more provisions are determined to be illegal or otherwise unenforceable, in whole or in part, the remaining provisions shall nevertheless be binding and enforceable. 19. Waiver. The Participant acknowledges that a waiver by the Company of breach of any provision of this Agreement shall not operate or be construed as a waiver of any other provision of this Agreement, or of any subsequent breach by Participant or any other participant. 20. ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇/Market Abuse Laws. By accepting the PSUs, the Participant acknowledges that the Participant is bound by all the terms and conditions of any Company ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇ policy as may be in effect from time to time. The Participant further acknowledges that, depending on the Participant's country, the Participant may be or may become subject to ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇ restrictions and/or market abuse laws, which may affect the Participant’s ability to accept, acquire, sell or otherwise dispose of Shares, rights to Shares (e.g., PSUs) or rights linked to the value of Shares under the Plan during such times as the Participant is considered to have “inside information” regarding the Company (as defined by the laws in the applicable jurisdictions). Local ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇ laws and regulations may prohibit the cancellation or amendment of orders the Participant placed before the Participant possessed inside information. Furthermore, the Participant could be prohibited from (i) disclosing the inside information to any third party, which may include fellow employees and (ii) “tipping” third parties or causing them otherwise to buy or sell securities. Any restrictions under these laws or regulations are separate from and in addition to any restrictions that may be imposed under any Company ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇ policy as may be in effect from time to time. The Participant acknowledges that it is the Participant’s personal responsibility to comply with any applicable restrictions, and the Participant should speak to the Participant’s personal advisor on this matter. 21. Legal and Tax Compliance; Cooperation. If the Participant resides or is employed outside of the United States, the Participant agrees, as a condition of the grant of the PSUs, to repatriate all payments attributable to the Shares and/or cash acquired under the Plan (including, but not limited to, dividends and any proceeds derived from the sale of Shares acquired pursuant to the PSUs) if required by and in accordance with local foreign exchange rules and regulations in the Participant 's country of residence (and country of employment, if different). In addition, the Participant also agrees to take any and all actions, and consent to any and all actions taken by the Company and its Eligible Subsidiaries, as may be required to allow the Company and its Eligible Subsidiaries to comply with local laws, rules and regulations in the Participant's country of residence (and country of employment, if different). Finally, the Participant agrees to take any and all actions as may be required to comply with the Participant's personal legal and tax obligations under local laws, rules and regulations in the Participant 's country of residence (and country of employment, if different). 22. Private Offering. The grant of the PSUs is not intended to be a public offering of securities in the Participant's country of residence (and country of employment, if different). The Company has not submitted any registration statement, prospectus or other filing with the local securities authorities with respect to the grant of the PSUs (unless otherwise required under local law). No employee of the Company is permitted to advise the Participant on whether the Participant should acquire Shares under the Plan or provide the Participant with any legal, tax or financial advice with respect to the grant of the PSUs. Investment in Shares involves a degree of risk. Before deciding to acquire Shares pursuant to the PSUs, the Participant should carefully consider all risk factors and tax considerations relevant to the acquisition of Shares under the Plan or the disposition of them. Further, the Participant should carefully review all of the materials related to the PSUs and the Plan, and the Participant should consult with the Participant's personal legal, tax and financial advisors for professional advice in relation to the Participant's personal circumstances.

12 23. Foreign Asset/Account Reporting Requirements and Exchange Controls. The Participant's country may have certain foreign asset/ account reporting requirements and exchange controls which may affect the Participant's ability to acquire or hold Shares under the Plan or cash received from participating in the Plan (including any dividends paid on Shares, sale proceeds resulting from the sale of Shares acquired under the Plan) in a brokerage or bank account outside the Participant's country. The Participant may be required to report such accounts, assets, or transactions to the tax or other authorities in the Participant's country. The Participant may be required to repatriate sale proceeds or other funds received as a result of the Participant's participation in the Plan to the Participant's country through a designated bank or broker within a certain time after receipt. The Participant acknowledges that it is the Participant's responsibility to be compliant with such regulations and the Participant should consult the Participant’s personal legal advisor for any details. 24. Imposition of Other Requirements. The Company reserves the right to impose other requirements on the Participant's participation in the Plan, on the PSUs and on any Shares subject to the PSUs, to the extent the Company determines it is necessary or advisable for legal or administrative reasons and provided the imposition of the term or condition will not result in any adverse accounting expense to the Company, and to require the Participant to sign any additional agreements or undertakings that may be necessary to accomplish the foregoing. 25. Recoupment. The PSUs granted pursuant to this Agreement are subject to the terms of the ▇▇▇▇▇▇▇ Corporation Recoupment Policy in the form approved by the Committee from time to time (including any successor thereto, the “Policy”) if and to the extent such Policy by its terms applies to the PSUs, and to the terms required by applicable law; and the terms of the Policy and such applicable law are incorporated by reference herein and made a part hereof. For purposes of the foregoing, the Participant expressly and explicitly authorizes the Company to issue instructions, on the Participant's behalf, to any brokerage firm and/or third party administrator engaged by the Company to hold the Participant's Shares and other amounts acquired pursuant to the Participant's PSUs, to re-convey, transfer or otherwise return such Shares and/or other amounts to the Company upon the Company's enforcement of the Policy. To the extent that the Agreement and the Policy conflict, the terms of the Policy shall prevail. 26. Notices. The Company may, directly or through its third party stock plan administrator, endeavor to provide certain notices to Participant regarding certain events relating to awards that the Participant may have received or may in the future receive under the Plan, such as notices reminding the Participant of the vesting or expiration date of certain awards. The Participant acknowledges and agrees that (1) the Company has no obligation (whether pursuant to this Agreement or otherwise) to provide any such notices; (2) to the extent the Company does provide any such notices to the Participant the Company does not thereby assume any obligation to provide any such notices or other notices; and (3) the Company, its Subsidiaries and the third party stock plan administrator have no liability for, and the Participant has no right whatsoever (whether pursuant to this Agreement or otherwise) to make any claim against the Company, any of its Subsidiaries or the third party stock plan administrator based on any allegations of, damages or harm suffered by the Participant as a result of the Company’s failure to provide any such notices or the Participant’s failure to receive any such notices. Participant further agrees to notify the Company upon any change in the Participant’s residence or address. 27. Limitations on Liability. Notwithstanding any other provisions of the Plan or this Agreement, no individual acting as a director, employee, or agent of the Company or any of its Subsidiaries will be liable to the Participant or the Participant’s spouse, beneficiary, or any other person or entity for any claim, loss, liability, or expense incurred in connection with the Plan, nor will such individual be personally liable because of any contract or other instrument the Participant executes in such other capacity. No member of the Board or of the Committee will be liable for any action or

13 determination (including, but limited to, any decision not to act) made in good faith with respect to the Plan or any PSUs. 28. Consent and Agreement With Respect to Plan. The Participant (a) acknowledges that the Plan and the prospectus relating thereto are available to the Participant on the website maintained by the Stock Plan Administrator; (b) represents that the Participant has read and is familiar with the terms and provisions thereof, has had an opportunity to obtain the advice of counsel of the Participant’s choice prior to executing this Agreement and fully understands all provisions of the Agreement and the Plan; (c) accepts these PSUs subject to all of the terms and provisions thereof; (d) consents and agrees to all amendments that have been made to the Plan since it was adopted in 2007 (and for the avoidance of doubt consents and agrees to each amended term reflected in the Plan as in effect on the date of this Agreement), and consents and agrees that all options, restricted stock units and PSUs, if any, held by the Participant that were previously granted under the Plan as it has existed from time to time are now governed by the Plan as in effect on the date of this Agreement (except to the extent the Committee has expressly provided that a particular Plan amendment does not apply retroactively); and (e) agrees to accept as binding, conclusive and final all decisions or interpretations of the Committee upon any questions arising under the Plan or this Agreement.

14 [If the Agreement is signed in paper form, complete and execute the following:] PARTICIPANT ▇▇▇▇▇▇▇ CORPORATION Signature Signature Print Name Print Name Title Residence Address Declaration of Data Privacy Consent. By providing the additional signature below, the undersigned explicitly declares the Participant’s consent to the data processing operations described in Section 12 of this Agreement. This includes, without limitation, the transfer of the Participant’s Personal Information to, and the processing of such data by, the Company, the Employer or, as the case may be, the Stock Plan Administrator in the United States. The undersigned may withdraw the Participant’s consent at any time, with future effect and for any or no reason as described in Section 13 of this Agreement. PARTICIPANT: Signature

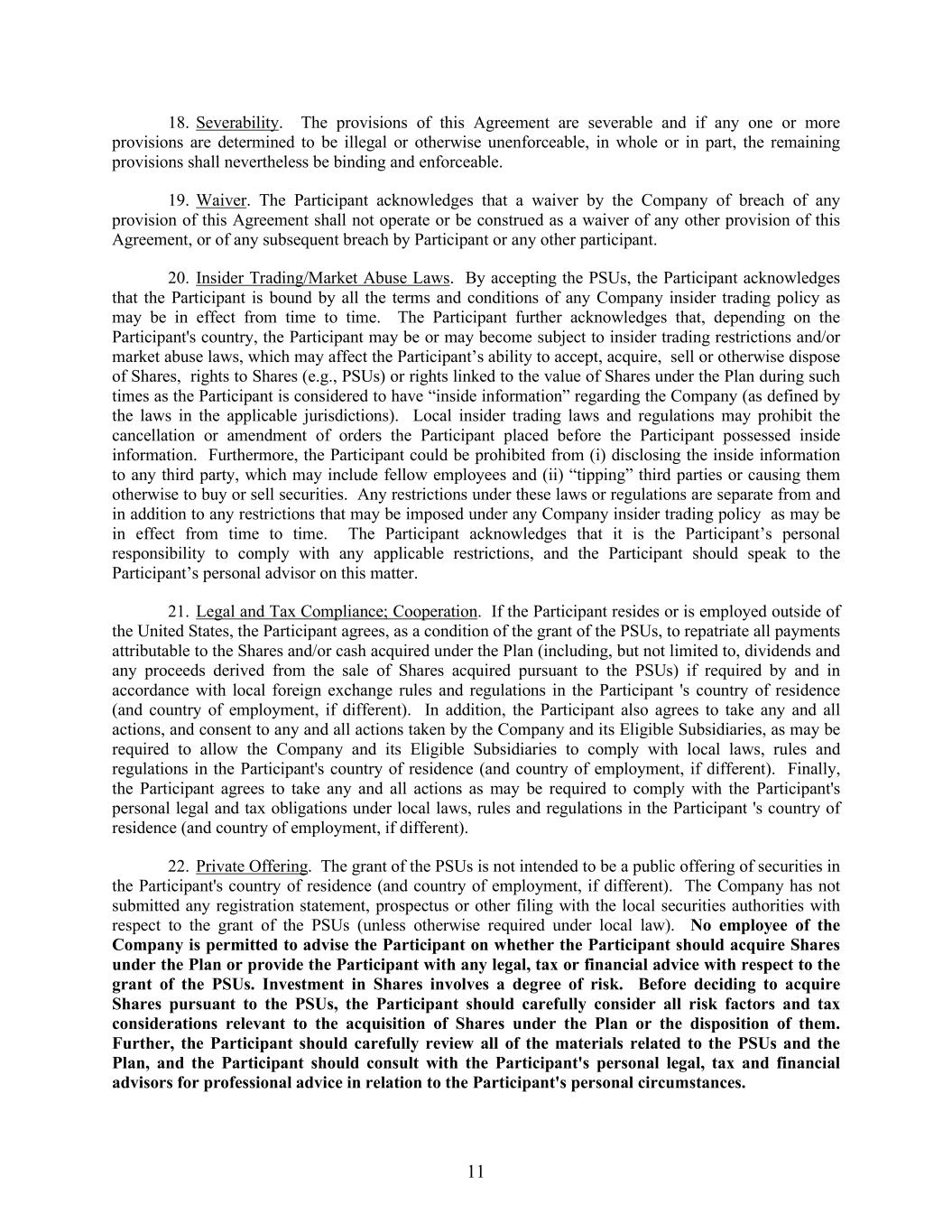

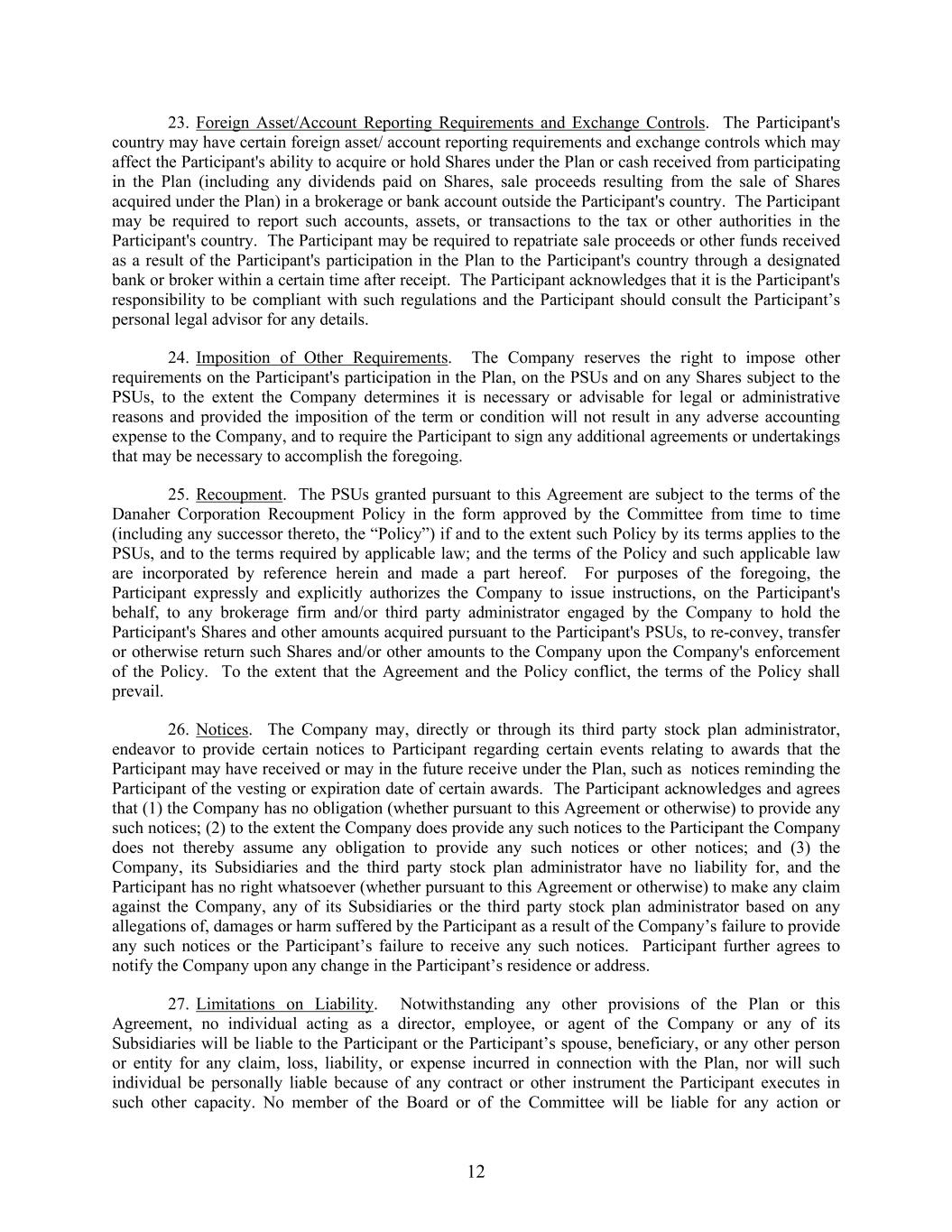

15 ADDENDUM A PERFORMANCE VESTING REQUIREMENTS 1. Performance Criteria. For the avoidance of doubt, terms defined in the Agreement will have the same definition in this Addendum A. The percentage of Target PSUs (and related Dividend Equivalent Rights) awarded hereunder that vest will be determined based on the Company’s (1) relative total shareholder return (“TSR”) percentile for the TSR Performance Period, and (2) return on invested capital (“ROIC”) performance for the ROIC Performance Period, determined as follows: (a) First, a preliminary vesting percentage of Target PSUs will be determined based on TSR percentile rank, per the table below (for TSR Percentile Rank performance between the levels indicated below, the portion of the PSUs that vest will be determined on a straight-line basis (i.e., linearly interpolated) between the two nearest levels indicated below): TSR Percentile Rank Preliminary Vesting Percentage of Target PSUs Based on TSR 75th percentile and above 200% 55th percentile 100% 35th percentile 50% Below 35th percentile 0% (b) The final percentage of Target PSUs (and related Dividend Equivalent Rights) awarded hereunder that vest is equal to the product of (i) the preliminary vesting percentage of Target PSUs identified in Section 1(a) of this Addendum A, and (ii) the applicable ROIC Modifier Factor identified per the table below based on the Company’s Three Year Average ROIC Change: Three Year Average ROIC Change ROIC Modifier Factor At or above + 200 basis points 110% Below + 200 basis points and above zero basis points 100% At or below zero basis points 90% All PSUs that do not vest will terminate. (c) Notwithstanding the foregoing: (i) if the Company’s TSR for the TSR Performance Period is positive, the minimum final vesting percentage shall be twenty-five percent (25%) of the Target PSUs; (ii) if the Company’s TSR for the TSR Performance Period is negative, the maximum final vesting percentage shall be one hundred percent (100%) of the Target PSUs; (iii) the final vesting percentage cannot exceed two hundred percent (200%) of the Target PSUs; and

16 (iv) for the avoidance of doubt, with respect to Section 1(c)(i), (ii) and (iii) above, the ROIC Modifier Factor shall not apply if such factor would reduce the final vesting percentage below 25% in the case of (i) above, increase the final vesting percentage above 100% in the case of (ii) above or increase the final vesting percentage above 200% in any circumstance. 2. Definitions. For purposes of the Award, the following definitions will apply: • “Adjusted Invested Capital” means the average of the quarter-end balances for each fiscal quarter of the ROIC Performance Period of (a) the sum of (i) the Company’s GAAP total stockholders’ equity and (ii) the Company’s GAAP total short-term and long-term debt; less (b) the Company’s GAAP cash and cash equivalents; but excluding in all cases the impact of (1) any business acquisition by the Company for a purchase price equal to or greater than $250 million and consummated during the ROIC Performance Period, (2) any business sale, divestiture or disposition by the Company during the ROIC Performance Period, and (3) all Company investments in marketable or non-marketable securities that are consummated during the ROIC Performance Period. • “Adjusted Net Income” means the Company’s GAAP net income from continuing operations for the ROIC Performance Period, but excluding the Adjustment Items. • “Adjustment Items” with respect to the ROIC Performance Period means (1) unusual or infrequently occurring items in accordance with GAAP; (2) the impact of any change in accounting principles that occurs during the ROIC Performance Period and the cumulative effect thereof, to the extent such change was not considered in establishing target performance levels (the Administrator may either apply the changed accounting principle to the calculation of Adjusted Net Income for the Baseline Year, or exclude the impact of the change in accounting principle from the calculation of Adjusted Net Income for the ROIC Performance Period); (3) goodwill and other intangible impairment charges; (4) gains or charges associated with (i) the sale or divestiture (in any manner) of any interest in a business or (ii) losing control of a business, as well as the gains or charges associated with the operation of any business (a) as to which control is or was lost in the ROIC Performance Period, or (b) as to which the Company divested or divests its interest in the ROIC Performance Period; (5) gains or charges related to the sale or impairment of assets; (6)(i) transaction costs directly related to the acquisition of a business during the ROIC Performance Period for a purchase price equal to or greater than $250 million, (ii) gains and charges associated with any business acquired by the Company during the ROIC Performance Period for a purchase price equal to or greater than $250 million, and (iii) gains or charges related to Company investments in marketable or non-marketable securities (regardless of whether such investments are consummated during or prior to the ROIC Performance Period); (7) the impact of any discrete income tax charges or benefits recorded in the ROIC Performance Period; (8) all non-cash amortization charges; and (9) all after-tax interest expense; provided, that with respect to the gains and charges referred to in sections (3), (4), (5) and (7), only gains or charges that individually or as part of a series of related items exceed $10 million during the ROIC Performance Period are excluded. • “Beginning Price” means, with respect to the Company and any other Comparison Group member, the average of the closing market prices of such company’s common stock on the principal exchange on which such stock is traded for the twenty (20) consecutive trading days ending with the last trading day before the beginning of the TSR Performance Period. For the purpose of determining Beginning Price, the value of dividends and other distributions shall be

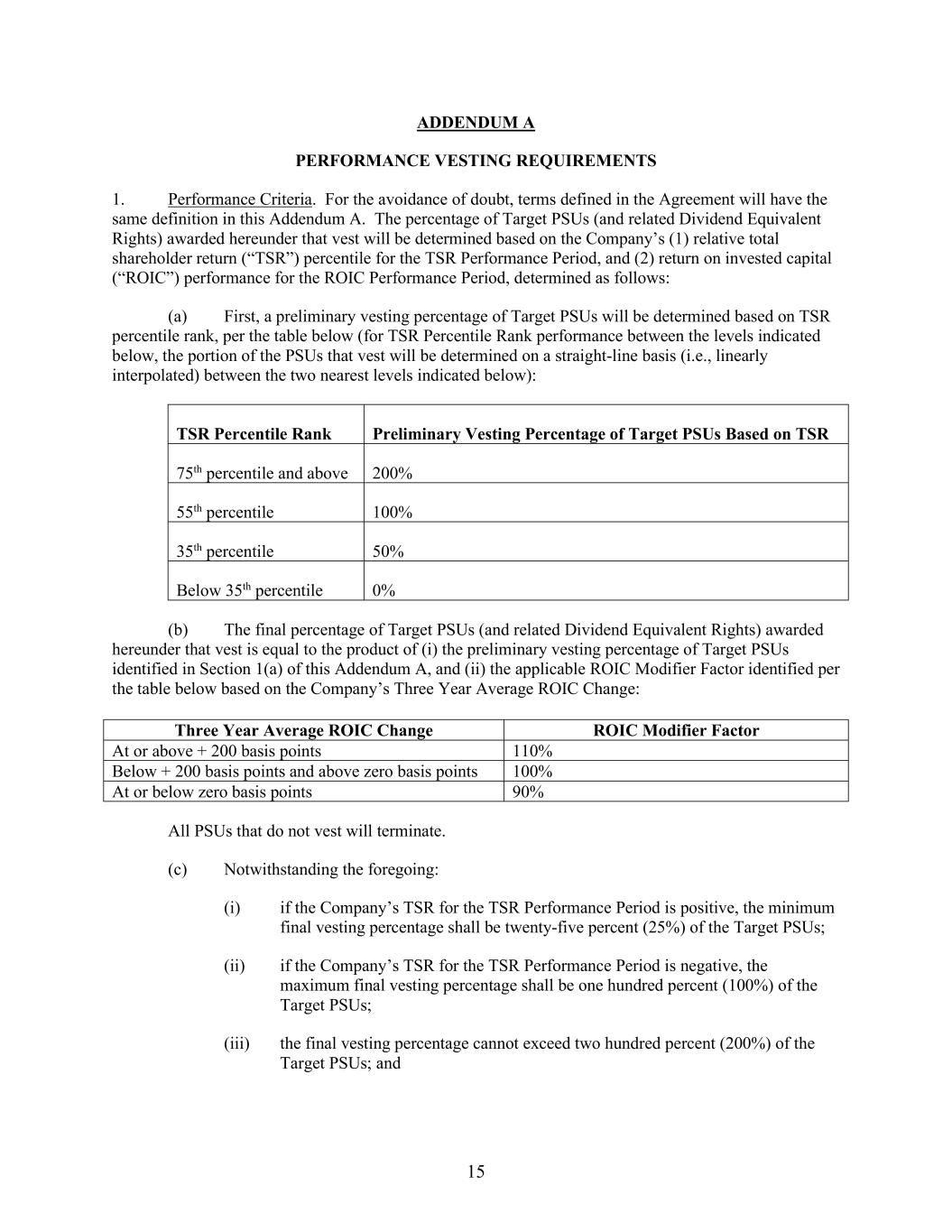

17 determined by treating them as reinvested in additional shares of stock at the closing market price on the ex-dividend date. • “Comparison Group” means the Company and each other company included in the Standard & Poor’s 500 index on the first day of the TSR Performance Period and, except as provided below, the common stock (or similar equity security) of which is continually listed or traded on a national securities exchange from the first day of the TSR Performance Period through the last trading day of the TSR Performance Period. In the event a member of the Comparison Group files for bankruptcy or liquidates due to an insolvency, such company shall continue to be treated as a Comparison Group member, and such company’s Ending Price will be treated as $0 if the common stock (or similar equity security) of such company is no longer listed or traded on a national securities exchange on the last trading day of the TSR Performance Period (and if multiple members of the Comparison Group file for bankruptcy or liquidate due to an insolvency, such members shall be ranked in order of when such bankruptcy or liquidation occurs, with earlier bankruptcies/ liquidations ranking lower than later bankruptcies/liquidations). In the event of a formation of a new parent company by a Comparison Group member, substantially all of the assets and liabilities of which consist immediately after the transaction of the equity interests in the original Comparison Group member or the assets and liabilities of such Comparison Group member immediately prior to the transaction, such new parent company shall be substituted for the Comparison Group member to the extent (and for such period of time) as its common stock (or similar equity securities) are listed or traded on a national securities exchange but the common stock (or similar equity securities) of the original Comparison Group member are not. In the event of a merger or other business combination of two Comparison Group members (including, without limitation, the acquisition of one Comparison Group member, or all or substantially all of its assets, by another Comparison Group member), the surviving, resulting or successor entity, as the case may be, shall continue to be treated as a member of the Comparison Group, provided that the common stock (or similar equity security) of such entity is listed or traded on a national securities exchange through the last trading day of the TSR Performance Period. With respect to the preceding two sentences, the applicable stock prices shall be equitably and proportionately adjusted to the extent (if any) necessary to preserve the intended incentives of the awards and mitigate the impact of the transaction. • “Ending Price” means, with respect to the Company and any other Comparison Group member, the average of the closing market prices of such company’s common stock on the principal exchange on which such stock is traded for the twenty (20) consecutive trading days ending on the last trading day of the TSR Performance Period. For the purpose of determining Ending Price, the value of dividends and other distributions shall be determined by treating them as reinvested in additional shares of stock at the closing market price on the ex-dividend date. • “ROIC Performance Period” means the ROIC Performance Period specified in the Grant Notice. • “Three Year Average ROIC Change” means (1) the quotient of (a) the Company’s Adjusted Net Income for the ROIC Performance Period divided by three, divided by (b) the Company’s Adjusted Invested Capital for the ROIC Performance Period, less (2) the quotient of (x) the Company’s Adjusted Net Income for the year immediately preceding the Date of Grant (the “Baseline Year”), divided by (y) the Company’s Adjusted Invested Capital for the Baseline Year.

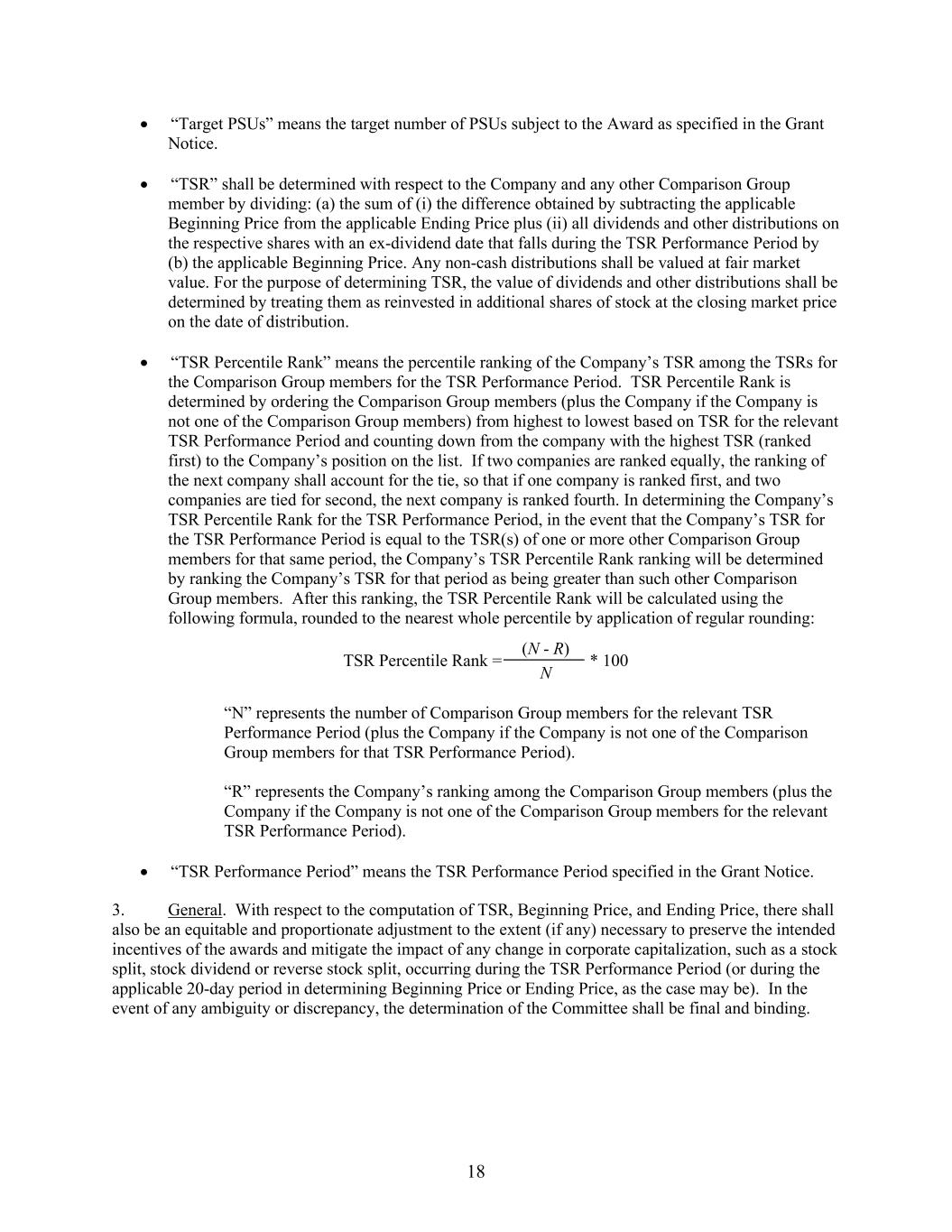

18 • “Target PSUs” means the target number of PSUs subject to the Award as specified in the Grant Notice. • “TSR” shall be determined with respect to the Company and any other Comparison Group member by dividing: (a) the sum of (i) the difference obtained by subtracting the applicable Beginning Price from the applicable Ending Price plus (ii) all dividends and other distributions on the respective shares with an ex-dividend date that falls during the TSR Performance Period by (b) the applicable Beginning Price. Any non-cash distributions shall be valued at fair market value. For the purpose of determining TSR, the value of dividends and other distributions shall be determined by treating them as reinvested in additional shares of stock at the closing market price on the date of distribution. • “TSR Percentile Rank” means the percentile ranking of the Company’s TSR among the TSRs for the Comparison Group members for the TSR Performance Period. TSR Percentile Rank is determined by ordering the Comparison Group members (plus the Company if the Company is not one of the Comparison Group members) from highest to lowest based on TSR for the relevant TSR Performance Period and counting down from the company with the highest TSR (ranked first) to the Company’s position on the list. If two companies are ranked equally, the ranking of the next company shall account for the tie, so that if one company is ranked first, and two companies are tied for second, the next company is ranked fourth. In determining the Company’s TSR Percentile Rank for the TSR Performance Period, in the event that the Company’s TSR for the TSR Performance Period is equal to the TSR(s) of one or more other Comparison Group members for that same period, the Company’s TSR Percentile Rank ranking will be determined by ranking the Company’s TSR for that period as being greater than such other Comparison Group members. After this ranking, the TSR Percentile Rank will be calculated using the following formula, rounded to the nearest whole percentile by application of regular rounding: TSR Percentile Rank = (N - R) * 100 N “N” represents the number of Comparison Group members for the relevant TSR Performance Period (plus the Company if the Company is not one of the Comparison Group members for that TSR Performance Period). “R” represents the Company’s ranking among the Comparison Group members (plus the Company if the Company is not one of the Comparison Group members for the relevant TSR Performance Period). • “TSR Performance Period” means the TSR Performance Period specified in the Grant Notice. 3. General. With respect to the computation of TSR, Beginning Price, and Ending Price, there shall also be an equitable and proportionate adjustment to the extent (if any) necessary to preserve the intended incentives of the awards and mitigate the impact of any change in corporate capitalization, such as a stock split, stock dividend or reverse stock split, occurring during the TSR Performance Period (or during the applicable 20-day period in determining Beginning Price or Ending Price, as the case may be). In the event of any ambiguity or discrepancy, the determination of the Committee shall be final and binding.