Contract

EXECUTION VERSION SIXTH AMENDMENT SIXTH AMENDMENT (this “Sixth Amendment”), dated as of December 9, 2022 (the “Sixth Amendment Effective Date”), to the Credit Agreement, dated as of July 18, 2013 (as amended by the First Amendment, dated as of October 20, 2014, the Second Amendment, dated as of July 18, 2017, the Third Amendment, dated as of June 30, 2020, the Fourth Amendment, dated as of June 10, 2021, the Fifth Amendment, dated as of February 16, 2022, and as further amended, supplemented or otherwise modified prior to the date hereof, the “Credit Agreement”; the Credit Agreement, as modified by the Sixth Amendment, the “Amended Credit Agreement”), among M/I HOMES, INC., an Ohio corporation (the “Borrower”), the several banks and other financial institutions or entities from time to time party thereto (the “Lenders”), PNC BANK, NATIONAL ASSOCIATION, as administrative agent (the “Administrative Agent”), and the other agents party thereto. W I T N E S S E T H: WHEREAS, pursuant to the Credit Agreement, the Lenders have agreed to make, and have made, certain extensions of credit to the Borrower; WHEREAS, (a) Section 2.21 of the Credit Agreement permits the Borrower to increase the Total Commitments available under the Credit Agreement and (b) Section 10.1 of the Credit Agreement permits the Borrower to amend the Credit Agreement, with the written consent of the Administrative Agent, the Required Lenders and each affected Lender, to (i) extend the expiration date of any Lender’s Commitment and (ii) extend the final maturity date of any Loan; WHEREAS, pursuant to Sections 2.21 and 10.1 of the Credit Agreement, the Borrower has requested that (a) the Total Commitments under the Credit Agreement be increased by $100,000,000 (such additional Commitments, the “Increased Commitments”) and (b) the Credit Agreement be amended to (i) extend the termination date applicable to the Commitments (including the Increased Commitments) and (ii) make certain other modifications as set forth herein; WHEREAS, (a) each Lender party to the Credit Agreement immediately prior to the Sixth Amendment Effective Date has agreed to extend the maturity date of their existing Commitments and (b) certain Lenders have agreed, upon the terms and subject to the conditions set forth herein, to provide the Increased Commitments (such Lenders, the “Increasing Lenders”); and WHEREAS, the Borrower, the Administrative Agent and the Lenders are willing to agree to this Sixth Amendment and the Amended Credit Agreement on the terms set forth herein. NOW, THEREFORE, in consideration of the premises and mutual covenants contained hereinafter set forth, the parties hereto agree as follows: SECTION 1. Definitions. Unless otherwise defined herein, terms defined in the Amended Credit Agreement and used herein shall have the meanings given to them in the Amended Credit Agreement. SECTION 2. Amendments. (a) Credit Agreement. The Credit Agreement is hereby amended as of the Sixth Amendment Effective Date to delete the stricken text (indicated textually in the same manner as the following example: stricken text) and to add the double-underlined text (indicated textually in the same

5 SECTION 7. Consent to Extension of the Termination Date. As of the Sixth Amendment Effective Date, the Termination Date with respect to the Commitments of the Lenders (including, for the avoidance of doubt, the Increased Commitments) is hereby extended to December 9, 2026. SECTION 8. Effect of Amendment. (a) Except as expressly set forth herein, this Sixth Amendment shall not by implication or otherwise limit, impair, constitute a waiver of or otherwise affect the rights and remedies of the Lenders or the Administrative Agent under the Credit Agreement or any other Loan Document, and shall not alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement or any other provision of the Credit Agreement or of any other Loan Document, all of which are ratified and affirmed in all respects and shall continue in full force and affect. Nothing herein shall be deemed to entitle the Borrower to a consent to, or a waiver, amendment, modification or other change of, any of the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement or any other Loan Document in similar or different circumstances. Nothing in this Sixth Amendment shall be deemed to be a novation of any obligations under the Credit Agreement or any other Loan Document. (b) On and after the Sixth Amendment Effective Date, each reference in the Credit Agreement to “this Agreement”, “hereunder”, “hereof”, “herein”, or words of like import, and each reference to the Credit Agreement in any other Loan Document shall be deemed a reference to the Amended Credit Agreement. This Sixth Amendment shall constitute a “Loan Document” for all purposes of the Amended Credit Agreement and the other Loan Documents (as defined in the Amended Credit Agreement). SECTION 9. General. (a) GOVERNING LAW ; Waiver of Jury Trial; Jurisdiction. THIS SIXTH AMENDMENT AND THE RIGHTS AND OBLIGATIONS OF THE PARTIES UNDER THIS SIXTH AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED AND INTERPRETED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK. The provisions of Sections 10.12 and 10.16 of the Credit Agreement as amended by this Amendment are incorporated herein by reference, mutatis mutandis. (b) Costs and Expenses. Subject to Section 5 hereof, the Borrower agrees to reimburse the Administrative Agent for its reasonable and documented out-of-pocket expenses in connection with this Sixth Amendment, including the reasonable fees, charges and disbursements of counsel for the Administrative Agent. (c) Counterparts; Electronic Execution. This Sixth Amendment may be executed by one or more of the parties to this Sixth Amendment on any number of separate counterparts, and all of said counterparts taken together shall be deemed to constitute one and the same instrument. The words “execute,” “execution,” “signed,” “signature” and words of like import herein shall be deemed to include electronic signatures, the electronic matching of assignment terms and contract formations on electronic platforms approved by the Administrative Agent, or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act.

[Sixth Amendment to M/I Homes Credit Agreement] IN WITNESS WHEREOF, the parties hereto have caused this Sixth Amendment to be duly executed and delivered by their respective duly authorized officers as of the day and year first above written. M/I HOMES, INC., as Borrower By: /s/ Xxxx Xxxxxxxxxx Name: Xxxx Xxxxxxxxxx Title: Vice President and Treasurer

[Sixth Amendment to M/I Homes Credit Agreement] PNC BANK, NATIONAL ASSOCIATION, as the Administrative Agent, a Lender and an Issuing Lender By: /s/ X. Xxxxxxx Xxxxxx Name: X. Xxxxxxx Xxxxxx Title: Senior Vice President

[Sixth Amendment to M/I Homes Credit Agreement] XXXXX FARGO BANK, N.A., as a Lender and an Issuing Lender By: /s/ Xxxx Xxxxxx Name: Xxxx Xxxxxx Title: Vice President

[Sixth Amendment to M/I Homes Credit Agreement] FIFTH THIRD BANK, NATIONAL ASSOCIATION, as a Lender By: /s/ Xxx Xxxxx Name: Xxx Xxxxx Title: Senior Vice President

[Sixth Amendment to M/I Homes Credit Agreement] THE HUNTINGTON NATIONAL BANK, as a Lender and an Issuing Lender By: /s/ Xxxx X. Xxxxx Name: Xxxx X. Xxxxx Title: Assistant Vice President

[Sixth Amendment to M/I Homes Credit Agreement] REGIONS BANK, as a Lender and an Issuing Lender By: /s/ Xxxxxx Xxxxxx Name: Xxxxxx Xxxxxx Title: Vice President

[Sixth Amendment to M/I Homes Credit Agreement] CITIBANK, N.A., as a Lender By: /s/ Xxxxxxx Xxxxxxxxx Name: Xxxxxxx Xxxxxxxxx Title: Vice President

[Sixth Amendment to M/I Homes Credit Agreement] JPMORGAN CHASE BANK, N.A., as a Lender By: /s/ Xxxxxxx Xxxx Name: Xxxxxxx Xxxx Title: Executive Director

[Sixth Amendment to M/I Homes Credit Agreement] U.S. BANK NATIONAL ASSOCIATION, as a Lender and an Issuing Lender By: /s/ Xxxxxxx Xxxxxxxx Name: Xxxxxxx Xxxxxxxx Title: Senior Vice President

[Sixth Amendment to M/I Homes Credit Agreement] COMERICA BANK, as a Lender and an Issuing Lender By: /s/ Xxxxxxx Xxxxxxx Name: Xxxxxxx Xxxxxxx Title: Vice President

[Sixth Amendment to M/I Homes Credit Agreement] FLAGSTAR BANK, N.A., formerly known as FLAGSTAR BANK, FSB, as a Lender and an Issuing Lender By: /s/ Xxxx Xxxxxxxx Name: Xxxx Xxxxxxxx Title: First Vice President

[Sixth Amendment to M/I Homes Credit Agreement] TEXAS CAPITAL BANK, formerly known as TEXAS CAPITAL BANK, N.A., as a Lender By: /s/ Xxxxx Xxxxxxxx Name: Xxxxx Xxxxxxxx Title: Vice President

EXHIBIT A AMENDED CREDIT AGREEMENT [See attached.]

EXHIBIT A $550,000,000650,000,000 CREDIT AGREEMENT among M/I HOMES, INC., as Borrower, and The Several Lenders from Time to Time Parties Hereto, and PNC BANK, NATIONAL ASSOCIATION, as Swingline Lender, an Issuing Lender and Administrative Agent and XXXXX FARGO BANK, NATIONAL ASSOCIATION, as Syndication Agent and CITIBANK, N.A., FIFTH THIRD BANK, NATIONAL ASSOCIATION, THE HUNTINGTON NATIONAL BANK, REGIONS BANK, CITIBANK, N.A., JPMORGAN CHASE BANK, N.A., U.S. BANK NATIONAL ASSOCIATION, COMERICA BANK and FLAGSTAR BANK, N.A., and THE HUNTINGTON NATIONAL BANK, as Co-Documentation Agents Dated as of July 18, 2013 as Amended by the First Amendment, Dated as of October 20, 2014, as amended by the First Amendment, dated as of October 20, 2014, as further Aamended by the Second Amendment, Ddated as of July 18, 2017, as further Aamended by the Third Amendment, Ddated as of June 30, 2020, andas further Aamended by the Fourth Amendment, Ddated as of June 10, 2021, as further amended by the Fifth Amendment, dated as of February 16, 2022, and as further amended by the Sixth Amendment, dated as of December 9, 2022

PNC CAPITAL MARKETS LLC, XXXXX FARGO SECURITIES, LLC, FIFTH THIRD BANK, NATIONAL ASSOCIATION, THE HUNTINGTON NATIONAL BANK, REGIONS CAPITAL MARKETS, A DIVISION OF REGIONS BANK, CITIBANK, N.A., CITIBANK, N.A., FIFTH THIRD BANK, NATIONAL ASSOCIATION, JPMORGAN CHASE BANK, N.A., and U.S. BANK NATIONAL ASSOCIATION and, XXXXX FARGO SECURITIES, LLC, as Joint Lead Arrangers and Joint Bookrunners

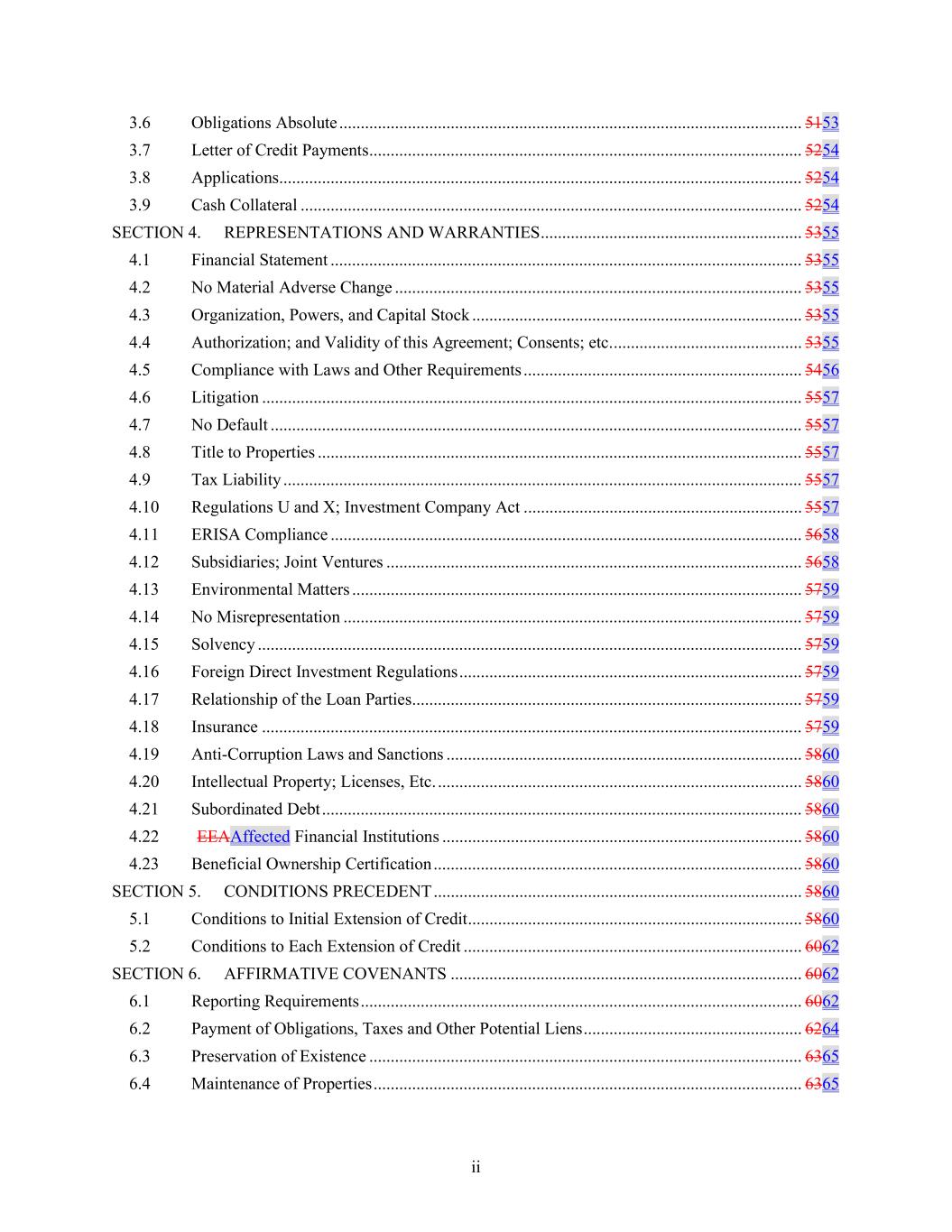

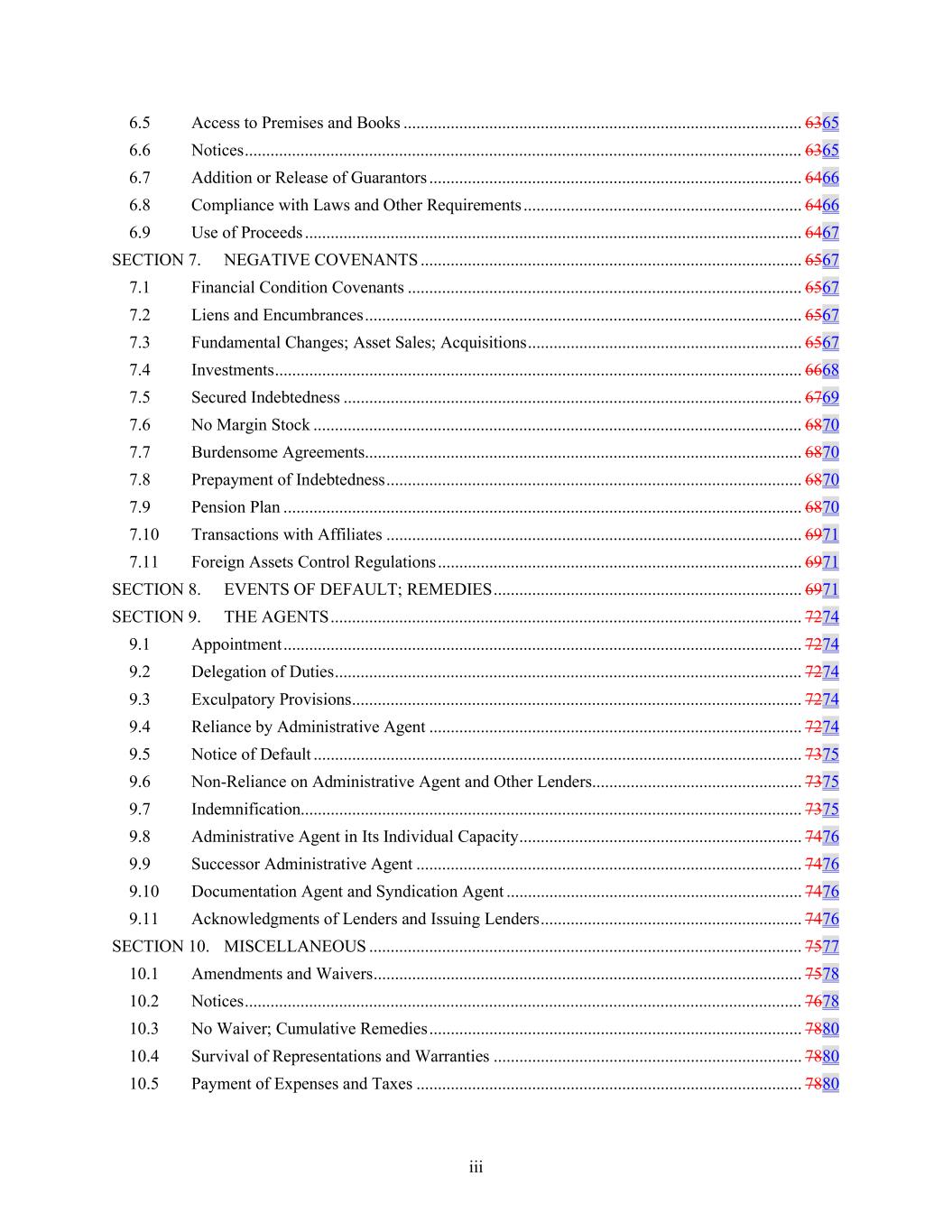

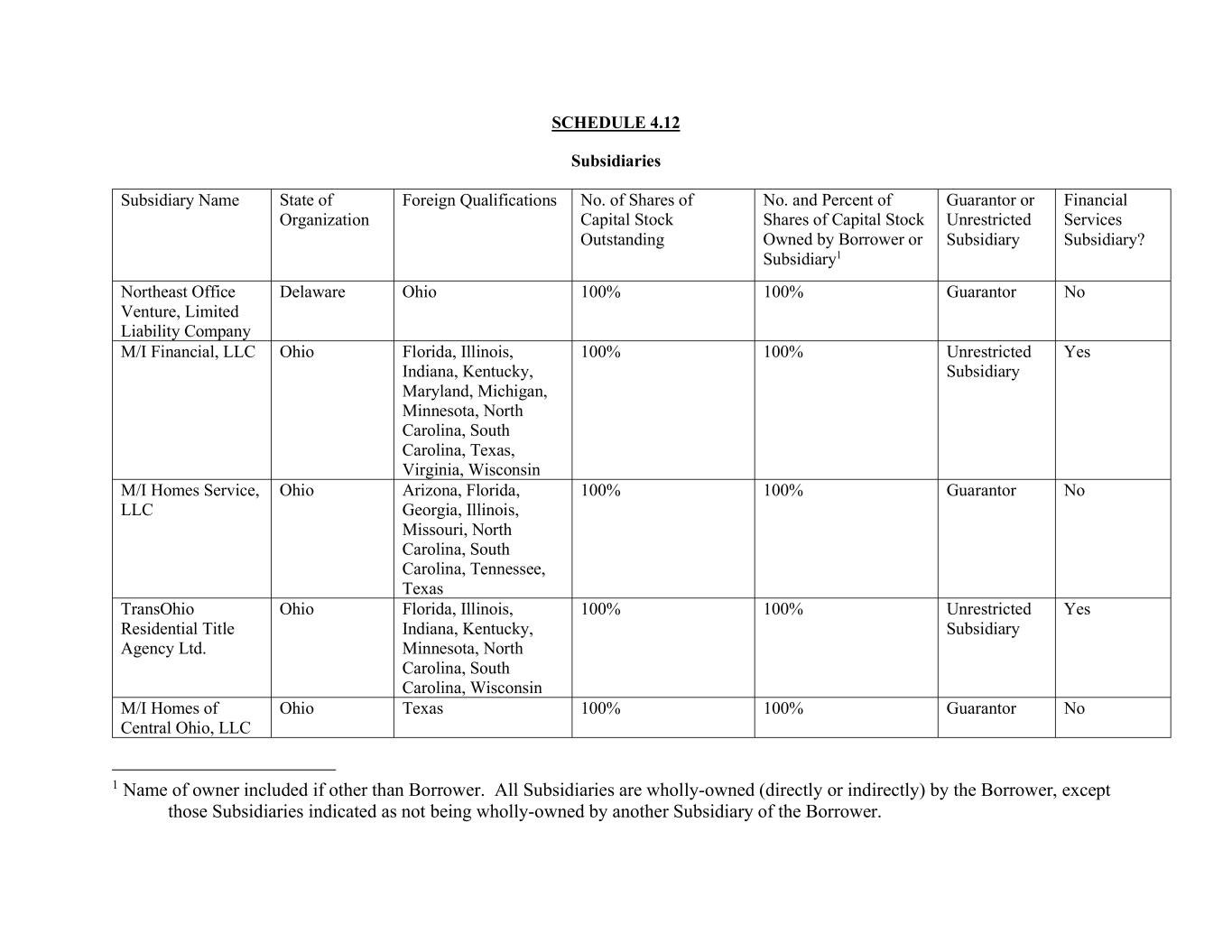

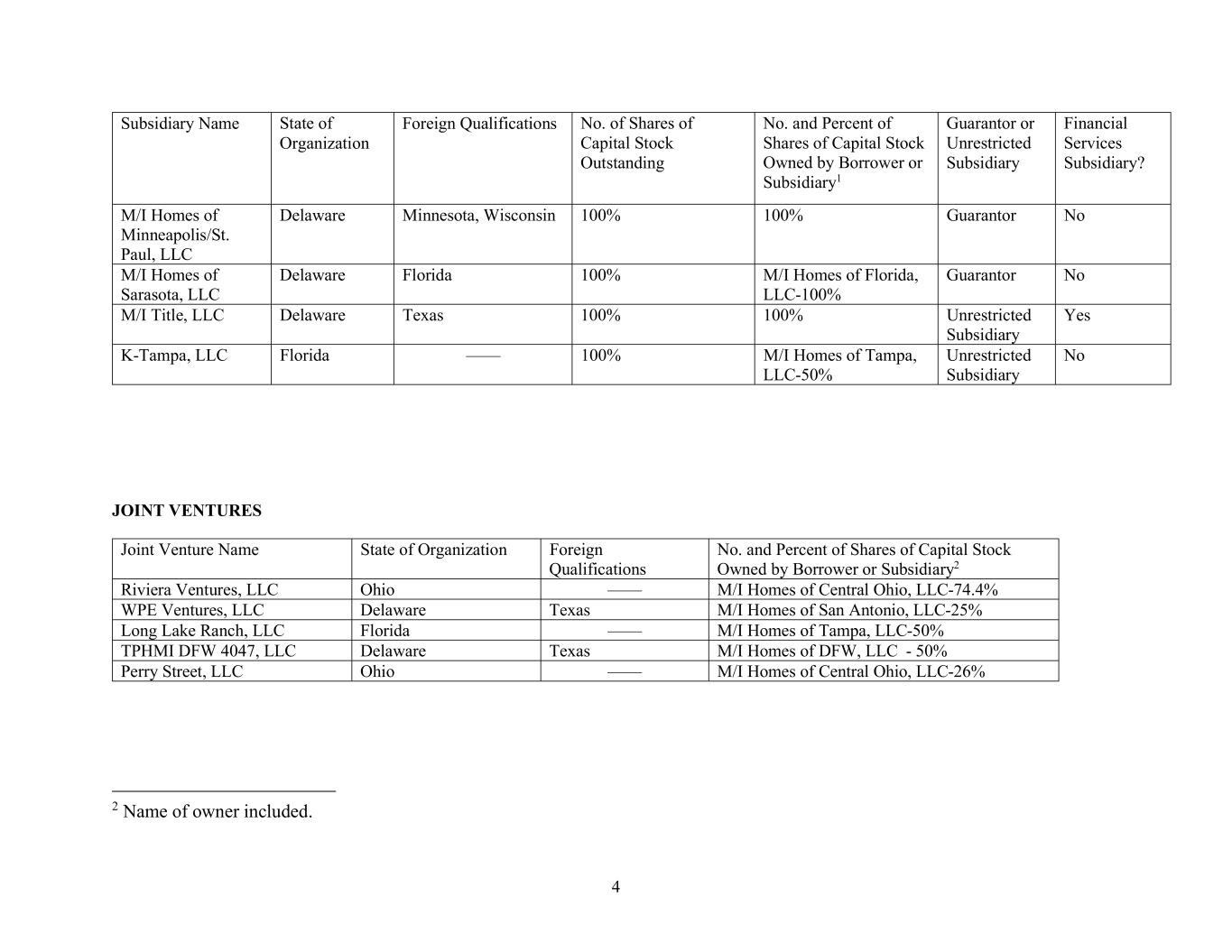

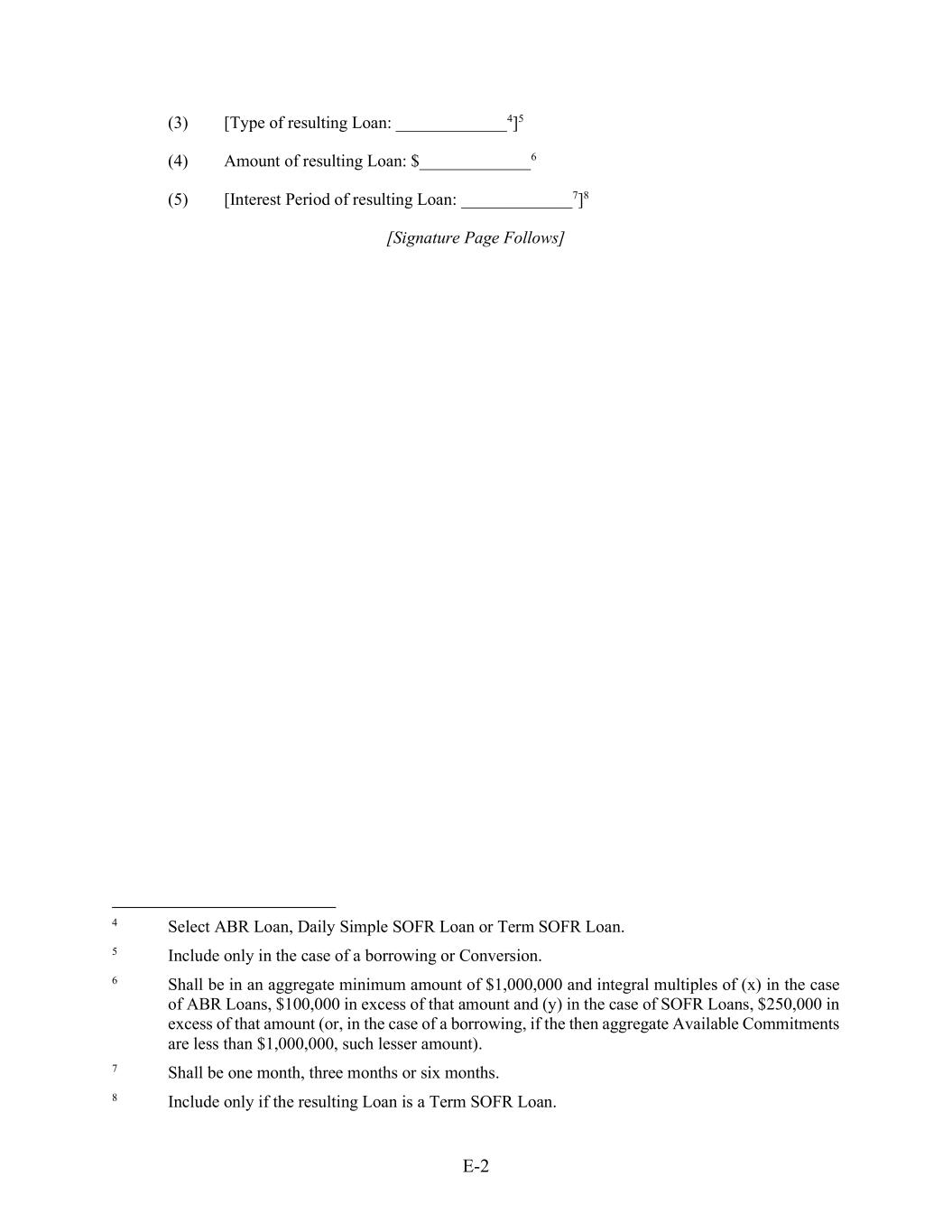

v SCHEDULES: 1.1A Commitments 1.1B Existing Liens 1.1C Initial Guarantors 1.1D Existing Letters of Credit 1.1E Issuing Lender Addresses 1.1F Issuing Lender Limits 4.11 Pension Plans 4.12 Subsidiaries 4.21 Subordinated Debt 6.1(f) Format of Joint Venture Reporting 7.5 Secured Indebtedness EXHIBITS: A Form of Guarantee Agreement B Form of Compliance Certificate C Form of Borrowing Base Certificate D Form of Assignment and Assumption E Form of New Lender Supplement F Form of Legal Opinion of Vorys, Xxxxx, Xxxxxxx and Xxxxx LLP G Form of Exemption Certificates H Form of Notice of Borrowing or Continuation or Conversion

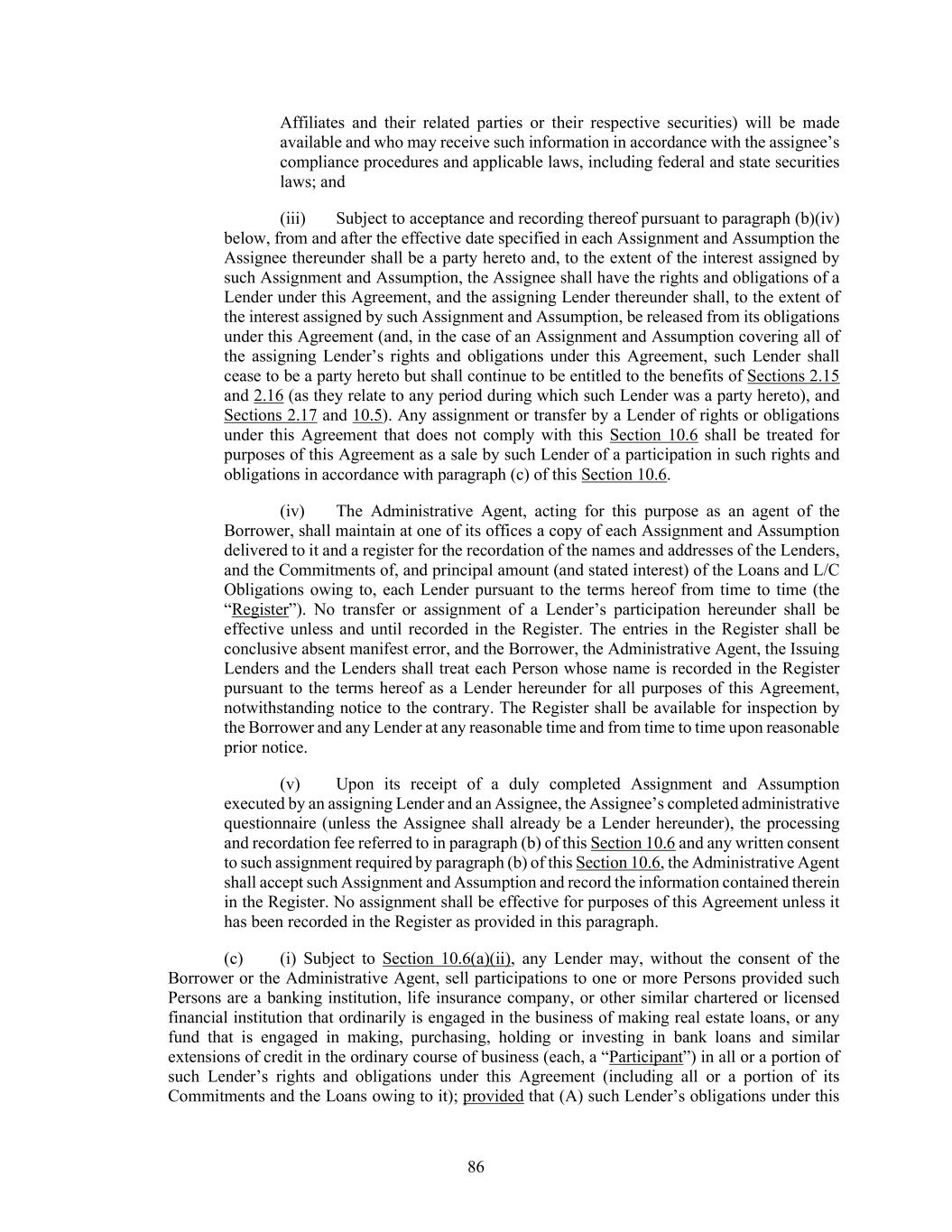

1 CREDIT AGREEMENT, dated as of July 18, 2013, as amended by the First Amendment, dated as of October 20, 2014, the Second Amendment, dated as of July 18, 2017, the Third Amendment, dated as of June 30, 2020 and, the Fourth Amendment, dated as of June 10, 2021, the Fifth Amendment, dated as of February 16, 2022, and the Sixth Amendment, dated as of December 9, 2022 (collectively, this “Agreement”), among M/I HOMES, INC., an Ohio corporation (the “Borrower”), the several banks and other financial institutions or entities from time to time parties to this Agreement (the “Lenders”) and PNC BANK, NATIONAL ASSOCIATION, as Swingline Lender, an Issuing Lender and Administrative Agent (each as hereinafter defined). The parties hereto hereby agree as follows: SECTION 1. DEFINITIONS 1.1 Defined Terms. As used in this Agreement, the terms listed in this Section 1.1 shall have the respective meanings set forth in this Section 1.1.“ABR”: for any day, a fluctuating rate per annum (rounded upwards, if necessary, to the next 1/16 of 1%) equal to the greatest of (a) the Prime Rate in effect on such day, (b) the New York Fed Bank Rate in effect on such day plus ½ of 1% and (c) the Adjusted Daily LIBO RateSimple SOFR in effect on such day plus 1.0% so long as Adjusted Daily Simple SOFR is offered, ascertainable and not unlawful. Any change in the ABR due to a change in the Prime Rate, the New York Fed Bank Rate or suchAdjusted Daily LIBO RateSimple SOFR shall be effective as of the opening of business on the day of such change in the Prime Rate, the New York Fed Bank Rate or suchAdjusted Daily LIBO RateSimple SOFR, respectively. Notwithstanding anything to the contrary contained herein, at any time that ABR determined in accordance with the foregoing is less than 1.25%, such rate shall be deemed 1.25% for purposes of this Agreement. “ABR Loan”: any Revolving Loan (or any portion thereof) bearing interest at a rate based on ABR. “Acquired Company”: a Person acquired in a consummated Acquisition by the Borrower or any Guarantor. “Acquisition”: any transaction, or any series of related transactions, by which the Borrower or any Guarantor (i) acquires all or substantially all of the assets of any firm, corporation or division thereof, whether through purchase of assets, merger or otherwise or (ii) directly or indirectly acquires (in one transaction or as the most recent transaction in a series of transactions) at least a majority (in number of votes or by percentage of voting power) of the Voting Stock of another Person. “Adjustment Date”: as defined in the Applicable Pricing Grid. “Adjusted Daily Simple SOFR”: for purposes of any calculation, the rate per annum equal to the greater of (a) the sum of (i) Daily Simple SOFR for such calculation plus (ii) the SOFR Adjustment and (b) the Floor. “Adjusted Term SOFR”: for purposes of any calculation, the rate per annum equal to the greater of (a) the sum of (i) Term SOFR for such calculation plus (ii) the SOFR Adjustment and(b) the Floor. “Administrative Agent”: PNC Bank, National Association, together with its affiliates, successors and assigns, as the administrative agent for the Lenders under this Agreement and the other Loan Documents. “Additional Lender”: as defined in Section 2.22(d).

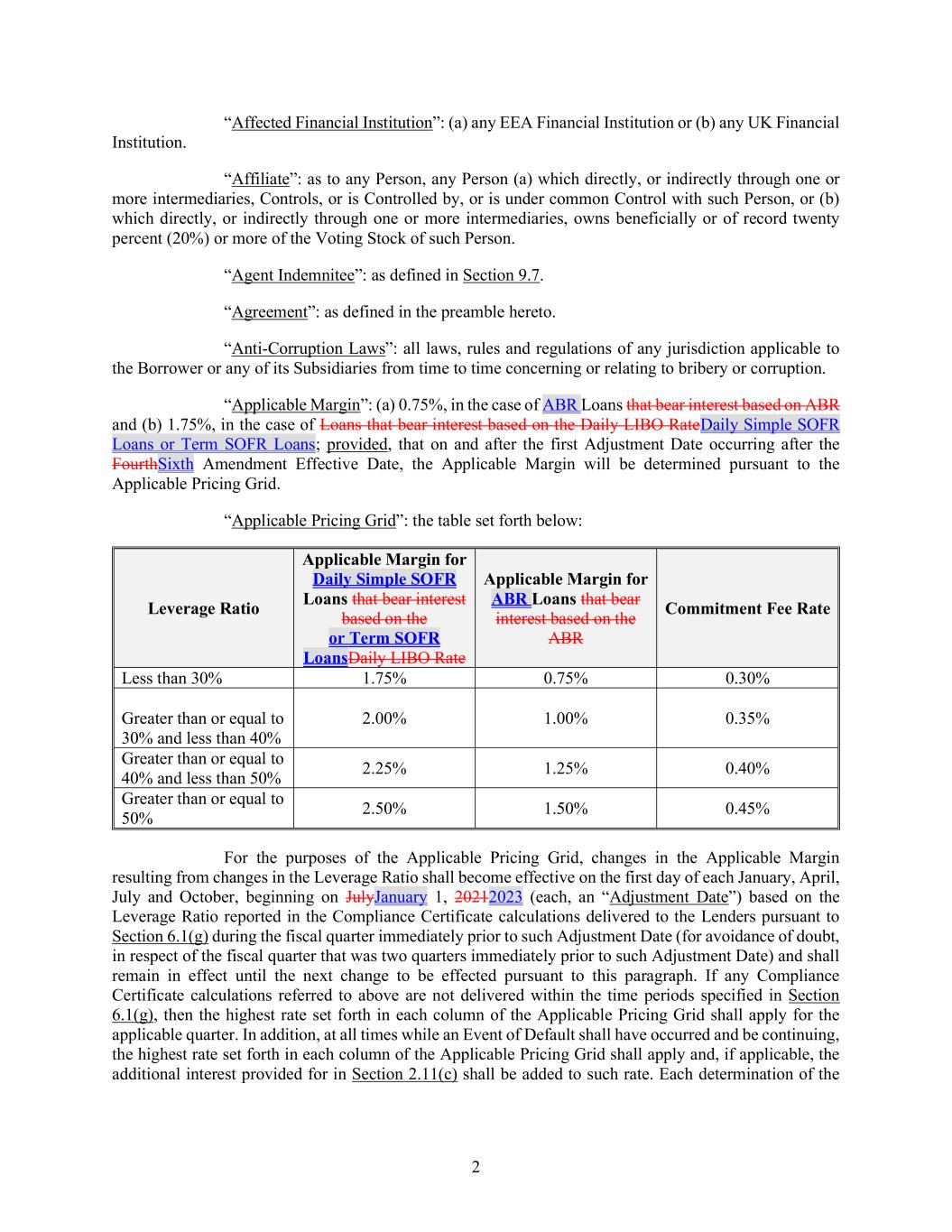

2 “Affected Financial Institution”: (a) any EEA Financial Institution or (b) any UK Financial Institution. “Affiliate”: as to any Person, any Person (a) which directly, or indirectly through one or more intermediaries, Controls, or is Controlled by, or is under common Control with such Person, or (b) which directly, or indirectly through one or more intermediaries, owns beneficially or of record twenty percent (20%) or more of the Voting Stock of such Person. “Agent Indemnitee”: as defined in Section 9.7. “Agreement”: as defined in the preamble hereto. “Anti-Corruption Laws”: all laws, rules and regulations of any jurisdiction applicable to the Borrower or any of its Subsidiaries from time to time concerning or relating to bribery or corruption. “Applicable Margin”: (a) 0.75%, in the case of ABR Loans that bear interest based on ABR and (b) 1.75%, in the case of Loans that bear interest based on the Daily LIBO RateDaily Simple SOFR Loans or Term SOFR Loans; provided, that on and after the first Adjustment Date occurring after the FourthSixth Amendment Effective Date, the Applicable Margin will be determined pursuant to the Applicable Pricing Grid. “Applicable Pricing Grid”: the table set forth below: Leverage Ratio Applicable Margin for Daily Simple SOFR Loans that bear interest based on the or Term SOFR LoansDaily LIBO Rate Applicable Margin for ABR Loans that bear interest based on the ABR Commitment Fee Rate Less than 30% 1.75% 0.75% 0.30% Greater than or equal to 30% and less than 40% 2.00% 1.00% 0.35% Greater than or equal to 40% and less than 50% 2.25% 1.25% 0.40% Greater than or equal to 50% 2.50% 1.50% 0.45% For the purposes of the Applicable Pricing Grid, changes in the Applicable Margin resulting from changes in the Leverage Ratio shall become effective on the first day of each January, April, July and October, beginning on JulyJanuary 1, 20212023 (each, an “Adjustment Date”) based on the Leverage Ratio reported in the Compliance Certificate calculations delivered to the Lenders pursuant to Section 6.1(g) during the fiscal quarter immediately prior to such Adjustment Date (for avoidance of doubt, in respect of the fiscal quarter that was two quarters immediately prior to such Adjustment Date) and shall remain in effect until the next change to be effected pursuant to this paragraph. If any Compliance Certificate calculations referred to above are not delivered within the time periods specified in Section 6.1(g), then the highest rate set forth in each column of the Applicable Pricing Grid shall apply for the applicable quarter. In addition, at all times while an Event of Default shall have occurred and be continuing, the highest rate set forth in each column of the Applicable Pricing Grid shall apply and, if applicable, the additional interest provided for in Section 2.11(c) shall be added to such rate. Each determination of the

3 Leverage Ratio pursuant to the Applicable Pricing Grid shall be made in a manner consistent with the determination thereof pursuant to Section 7.1(a). “Application”: an application, in such customary form as an Issuing Lender may specify from time to time, requesting such Issuing Lender to open a Letter of Credit. “Approved Fund”: any entity that is engaged in making, purchasing, holding or investing in bank loans and similar extensions of credit in the ordinary course of business and that is administered or managed by (a) a Lender, (b) an Affiliate of Lender or (c) an entity or an Affiliate of an entity that administers or manages a Lender. “Arrangers”: collectively, the Joint Lead Arrangers and Joint Bookrunners identified on the cover page of this Agreement and the Fourth Amendment Arrangers. “Assignee”: as defined in Section 10.6(b). “Assignment and Assumption”: an Assignment and Assumption, substantially in the form of Exhibit D. “Authorized Financial Officer”: any of the chief financial officer, treasurer, assistant treasurer or controller of the Borrower. “Available Commitment”: as to any Lender at any time, an amount equal to the excess, if any, of (a) such Xxxxxx’s Commitment then in effect over (b) such Lender’s Percentage Interest of the Outstanding Amount. “Available Tenor”: as of any date of determination and with respect to the then-current Benchmark, as applicable, (x) if the then current Benchmark is a term rate or is based on a term rate, any tenor for such Benchmark that is or may be used for determining the length of an iInterest pPeriod pursuant to this Agreement as of such date and not including, for the avoidance of doubt, any tenor for such Benchmark that is then-removed pursuant to paragraph (f) of Section 2.13, or (y) if the then current Benchmark is not a term rate nor based on a term rate, any payment period for interest calculated with reference to such Benchmark pursuant to this Agreement as of such date. For the avoidance of doubt, the Available Tenor for the Daily LIBO Rate is one month. “Bail-In Action”: the exercise of any Write-Down and Conversion Powers by the applicable Resolution Authority in respect of any liability of an Affected Financial Institution. “Bail-In Legislation”: (a) with respect to any EEA Member Country implementing Article 55 of Directive 2014/59/EU of the European Parliament and of the Council of the European Union, the implementing law, regulation, rule or requirement for such EEA Member Country from time to time which is described in the EU Bail-In Legislation Schedule and (b) with respect to the United Kingdom, Part I of the United Kingdom Banking Act 2009 (as amended from time to time) and any other law, regulation or rule applicable in the United Kingdom relating to the resolution of unsound or failing banks, investment firms or other financial institutions or their affiliates (other than through liquidation, administration or other insolvency proceedings). “Bankruptcy Event”: with respect to any Person, such Person becomes the subject of a bankruptcy or insolvency proceeding, or has had a receiver, conservator, trustee, administrator, custodian, assignee for the benefit of creditors or similar Person charged with the reorganization or liquidation of its business appointed for it, or, in the good faith determination of the Administrative Agent, has taken any action in furtherance of, or indicating its consent to, approval of, or acquiescence in, any such proceeding

4 or appointment, provided that a Bankruptcy Event shall not result solely by virtue of any ownership interest, or the acquisition of any ownership interest, in such Person by a Governmental Authority or instrumentality thereof, provided, further, that such ownership interest does not result in or provide such Person with immunity from the jurisdiction of courts within the United States or from the enforcement of judgments or writs of attachment on its assets or permit such Person (or such Governmental Authority or instrumentality) to reject, repudiate, disavow or disaffirm any contracts or agreements made by such Person. “Basel III”: the third of the so-called Basel Accords issued by the Basel Committee on Banking Supervision. “Benchmark”: initially, USD LIBORAdjusted Term SOFR or Adjusted Daily Simple SOFR, as applicable; provided that if a Benchmark Transition Event, a Term SOFR Transition Event or an Early Opt-in Election, as applicable, and its related Benchmark Replacement Date have occurred with respect to USD LIBORAdjusted Term SOFR or Adjusted Daily Simple SOFR, as applicable, or the then- current Benchmark, then “Benchmark” means the applicable Benchmark Replacement to the extent that such Benchmark Replacement has replaced such prior benchmark rate pursuant to paragraph (c) of Section 2.13. “Benchmark Replacement”: for any Available Tenor, the first alternative set forth in the order below that can be determined by the Administrative Agent for the applicable Benchmark Replacement Date: (1) the sum of: (a) Term SOFR and (b) the related Benchmark Replacement Adjustment; (2) the sum of: (a) Daily Simple SOFR and (b) the related Benchmark Replacement Adjustment; (3) “Benchmark Replacement”: for any Available Tenor, the sum of: (a) the alternate benchmark rate that has been selected by the Administrative Agent and the Borrower as the replacement for the then-current Benchmark for the applicable Corresponding Tenor giving due consideration to (i) any selection or recommendation of a replacement benchmark rate or the mechanism for determining such a rate by the Relevant Governmental Body or (ii) any evolving or then-prevailing market convention for determining a benchmark rate as a replacement for the then-current Benchmark for U.S. dollar-denominated syndicated credit facilities at such time and (b) the related Benchmark Replacement Adjustment; provided that, in the case of clause (1), such Unadjusted Benchmark Replacement is displayed on a screen or other information service that publishes such rate from time to time as selected by the Administrative Agent in its reasonable discretion; provided, further, that, with respect to a Term SOFR Transition Event, on the applicable Benchmark Replacement Date, the “Benchmark Replacement” shall revert to and shall be determined as set forth in clause (1) of this definition. Ifif the Benchmark Replacement as determined pursuant to clause (1), (2) or (3) above would be less than the Floor, the Benchmark Replacement will be deemed to be the Floor for the purposes of this Agreement and the other Loan Documents; provided, further, that any such Benchmark Replacement shall be administratively feasible as determined by the Administrative Agent in its sole discretion. “Benchmark Replacement Adjustment”: with respect to any replacement of the then- current Benchmark with an Unadjusted Benchmark Replacement for any applicable Available Tenor for any setting of such Unadjusted Benchmark Replacement, means: (1) for purposes of clauses (1) and (2) of the definition of “Benchmark Replacement,” the applicable amount(s) set forth below:

5 Available Tenor Benchmark Replacement Adjustment (%)* One-Week 0.03839 (3.839 basis points) One-Month 0.11448 (11.448 basis points) Two-Months 0.18456 (18.456 basis points) Three-Months 0.26161 (26.161 basis points) Six-Months 0.42826 (42.826 basis points) * These values represent the ARRC/ISDA recommended spread adjustment values available here: xxxxx://xxxxxx.xxxxx.xx/xxxxxxxxxxxx/xxxxx/00/XXXX-Xxxxxxxxx-XXXXX- Cessation_Announcement_20210305.pdf (2) for purposes of clause (3) of the definition of “Benchmark Replacement,” Adjustment”: with respect to any replacement of the then-current Benchmark with an Unadjusted Benchmark Replacement, the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected by the Administrative Agent and the Borrower for the applicable Corresponding Tenor giving due consideration to (i) any selection or recommendation of a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement by the Relevant Governmental Body on the applicable Benchmark Replacement Date or (ii) any evolving or then-prevailing market convention for determining a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement for U.S. dollar-denominated syndicated credit facilities; provided that, if the then-current Benchmark is a term rate, more than one tenor of such Benchmark is available as of the applicable Benchmark Replacement Date and the applicable Unadjusted Benchmark Replacement will not be a term rate, the Available Tenor of such Benchmark for purposes of this definition of “Benchmark Replacement Adjustment” shall be deemed to be the Available Tenor that has approximately the same length (disregarding business day adjustments) as the payment period for interest calculated with reference to such Unadjusted Benchmark Replacement. provided that, (x) in the case of clause (1) above, such adjustment is displayed on a screen or other information service that publishes such Benchmark Replacement Adjustment from time to time as selected by the Administrative Agent in its reasonable discretion and (y) if the then-current Benchmark is a term rate, more than one tenor of such Benchmark is available as of the applicable Benchmark Replacement Date and the applicable Unadjusted Benchmark Replacement will not be a term rate, the Available Tenor of such Benchmark for purposes of this definition of “Benchmark Replacement Adjustment” shall be deemed to be the Available Tenor that has approximately the same length (disregarding business day adjustments) as the payment period for interest calculated with reference to such Unadjusted Benchmark Replacement. “Benchmark Replacement Conforming Changes”: with respect to any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definition of “ABR,” the definition of “Business Day,” the timing and frequency of determining rates and making payments of interest, timing of borrowing requests or prepayment, conversion or continuation notices, length of lookback periods, the applicability of breakage provisions, and other technical, administrative or operational matters) that the Administrative Agent decides may be appropriate to reflect the adoption and implementation of such Benchmark Replacement and to permit the administration thereof by the Administrative Agent in a manner substantially consistent with market practice (or, if the Administrative Agent decides that adoption of any portion of such market practice is not administratively feasible or if the

6 Administrative Agent determines that no market practice for the administration of such Benchmark Replacement exists, in such other manner of administration as the Administrative Agent decides is reasonably necessary in connection with the administration of this Agreement and the other Loan Documents). “Benchmark Replacement Date”: the earliest to occur of the following events with respect to the then-current Benchmark: (1) in the case of clause (1) or (2) of the definition of “Benchmark Transition Event,” the later of (a) the date of the public statement or publication of information referenced therein (which the parties acknowledge occurred on March 5, 2021 with respect to USD LIBOR as a result of the Cessation Announcements) and (b) the date on which the administrator of such Benchmark (or the published component used in the calculation thereof) permanently or indefinitely ceases to provide all Available Tenors of such Benchmark (or such component thereof); or (2) in the case of clause (3) of the definition of “Benchmark Transition Event,” the date determined by the Administrative Agent, which date shall promptly follow the date of the public statement or publication of information referenced therein;. (3) in the case of a Term SOFR Transition Event, the date that is set forth in the Term SOFR Notice provided to the Lenders and the Borrower pursuant to Section 2.13, which date shall be at least 30 days from the date of the Term SOFR Notice; or (4) in the case of an Early Opt-in Election, the sixth (6th) Business Day after the date notice of such Early Opt-in Election is provided to the Lenders, so long as the Administrative Agent has not received, by 5:00 p.m. (New York City time) on the fifth (5th) Business Day after the date notice of such Early Opt-in Election is provided to the Lenders, written notice of objection to such Early Opt-in Election from Lenders comprising the Required Lenders. For the avoidance of doubt, (i) if the event giving rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Reference Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Reference Time for such determination and (ii) the “Benchmark Replacement Date” will be deemed to have occurred in the case of clause (1) or (2) with respect to any Benchmark upon the occurrence of the applicable event or events set forth therein with respect to all then-current Available Tenors of such Benchmark (or the published component used in the calculation thereof). “Benchmark Transition Event”: a date and time determined by the Administrative Agent, which date shall be at the end of an Interest Period and no later than the occurrence of one or more of the following events with respect to the then-current Benchmark: (1) a public statement or publication of information by or on behalf of the administrator of such Benchmark (or the published component used in the calculation thereof) announcing that such administrator has ceased or will cease to provide all Available Tenors of such Benchmark (or such component thereof), permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof); (2) a public statement or publication of information by a Relevant Governmental Body having jurisdiction over the Administrative Agent, the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof), the Federal Reserve Board, the Federal Reserve Bank of New York, an insolvency official with jurisdiction over the administrator for such

7 Benchmark (or such component), a resolution authority with jurisdiction over the administrator for such Benchmark (or such component) or a court or an entity with similar insolvency or resolution authority over the administrator for such Benchmark (or such component), which states that the administrator of such Benchmark (or such component) has ceased or will cease to provide all Available Tenors of such Benchmark (or such component thereof) permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof); or (3) a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof) or a Relevant Governmental Body having jurisdiction over the Administrative Agent announcing that all Available Tenors of such Benchmark (or such component thereof) are no longer representative. For the avoidance of doubt, a “Benchmark Transition Event” will be deemed to have occurred with respect to any Benchmark if a public statement or publication of information set forth above has occurred with respect to each then-current Available Tenor of such Benchmark (or the published component used in the calculation thereof). The parties hereto acknowledge that a Benchmark Transition Event as defined in clauses (1) and (2) above occurred on March 5, 2021 with respect to USD LIBOR as a result of the Cessation Announcements, but no related Benchmark Replacement Date occurred as of such date. “Benchmark Unavailability Period”: the period (if any) (x) beginning at the time that a Benchmark Replacement Date pursuant to clauses (1) or (2) of that definition has occurred if, at such time, no Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Loan Document in accordance with Section 2.13 and (y) ending at the time that a Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Loan Document in accordance with Section 2.13. “Beneficial Ownership Certification”: a certification regarding beneficial ownership as required by the Beneficial Ownership Regulation. “Beneficial Ownership Regulation”: 31 C.F.R. § 1010.230. “Benefit Plan”: any of (a) an “employee benefit plan” (as defined in Section 3(3) of ERISA) that is subject to Title I of ERISA, (b) a “plan” as defined in and subject to Section 4975 of the Code or (c) any Person whose assets include (for purposes of Section 3(42) of ERISA or otherwise for purposes of Title I of ERISA or Section 4975 of the Code) the assets of any such “employee benefit plan” or “plan.” “Benefitted Lender”: as defined in Section 10.7(a). “Board”: the Board of Governors of the Federal Reserve System of the United States (or any successor). “Borrower”: as defined in the preamble hereto. “Borrowing Base”: as of any date, an amount calculated as follows (with each of the following included only to the extent such assets are assets of Loan Parties and are not encumbered by Liens (other than, to the extent any of the following constitute Qualified Real Property Inventory, those Permitted Liens specified in the definition of “Qualified Real Property Inventory”): (a) 100% of Unrestricted Cash to the extent it exceeds the Required Liquidity; plus

8 (b) 100% of the amount of Escrow Proceeds Receivable; plus (c) 90% of the book value of Units Under Contract; plus (d) subject to the limitations set forth below, 80% of the book value of Speculative Units; plus (e) subject to the limitations set forth below, 80% of the book value of Model Units; plus (f) 65% of the book value of Finished Lots; plus (g) subject to the limitations set forth below, 65% of the book value of Lots Under Development; plus (h) subject to the limitation set forth below, 50% of the book value of Entitled Land that is not included in the Borrowing Base clauses (a) through (g). Notwithstanding the foregoing: (i) the advance rate for Speculative Units shall decrease to 0% for any Unit that has been a Speculative Unit for more than 360 days; (ii) the advance rate for Model Units shall decrease to 0% for any Unit that has been a Model Unit for more than 180 days following the sale of the last production Unit in the applicable project relating to such Model Unit; (iii) the Borrowing Base shall not include any amount under clause (h) under the Borrowing Base to the extent that such amount exceeds 25% of the total Borrowing Base; and (iv) the Borrowing Base shall be reduced by the amount, if any, by which the total under clauses (f), (g) and (h) under the Borrowing Base exceeds 50% of the total Borrowing Base. “Borrowing Base Availability”: as of any date, the lesser of (a) the Commitments minus the Outstanding Amount and (b) the excess, if positive, of the Borrowing Base calculated in the most recently delivered Borrowing Base Certificate minus the Borrowing Base Debt on such date. “Borrowing Base Certificate”: a certificate duly executed by an Authorized Financial Officer substantially in the form of Exhibit C. “Borrowing Base Debt”: as of any date, (a) Consolidated Debt minus (b) Subordinated Debt (other than that portion of Subordinated Debt due within one year as a regularly scheduled principal payment) minus (c) amounts due under mortgage notes secured by any office property used for the operation of the business of the Loan Parties and their respective Subsidiaries. “Borrowing Date”: any Business Day specified by the Borrower as a date on which the Borrower requests the relevant Lenders to make Loans hereunder. “Business Day”: a day other than a Saturday, Sunday or other daya legal holiday on which commercial banks in New York City are authorized or required by law to be closed, or are in fact closed, for business in Pittsburgh, Pennsylvania (or, if otherwise, the Funding Office at such time), provided that

9 with respect to notices and determinations, when used in connection with, and payments of principal and interest on, Loans (other than any Loans that bear interest based on ABR pursuant to the terms of this Agreement), such day is also a day for trading by and between banks in Dollar deposits in the interbank eurodollar market. an amount that bears interest at a rate based on SOFR or any direct or indirect calculation or determination of SOFR, the term “Business Day” means any such day that is also a U.S. Government Securities Business Day. “Capital Stock”: any and all shares, interests, rights to purchase, warrants, options, participations or other equivalents of or interests in (however designated) equity of any Person, including any preferred stock, but excluding any debt securities convertible into such equity. “Capitalized Lease”: of a Person means any lease of property by such Person as lessee which would be capitalized on a balance sheet of such Person prepared in accordance with GAAP. “Capitalized Lease Obligations”: any obligations under a lease that is required to be capitalized for financial reporting purposes in accordance with GAAP. “Cash Collateralize”: to pledge and deposit with or deliver to the Administrative Agent, for the benefit of one or more of the Issuing Lenders or Lenders, as collateral for L/C Obligations or obligations of Lenders to fund participations in respect of L/C Obligations, cash or deposit account balances or, if the Administrative Agent and each applicable Issuing Lender shall agree in their sole discretion, other credit support, in each case pursuant to documentation in form and substance satisfactory to the Administrative Agent and each applicable Issuing Lender. “Cash Collateralized” shall have a meaning correlative to the foregoing. “Cash Collateral” shall have a meaning correlative to the foregoing and shall include the proceeds of such cash collateral and other credit support. “Cash Equivalents”: (a) securities, certificates and notes with maturities of 364 days or less from the date of acquisition that are within one of the following classifications: (i) securities issued or fully guaranteed or insured by the United States Government or any agency thereof, (ii) mortgage backed securities issued or fully guaranteed or insured by the Federal Home Loan Mortgage Corporation, Federal National Mortgage Association, or a similar government sponsored enterprise or mortgage agency, (iii) securities issued by States, territories and possessions of the United States and their political subdivisions (municipalities), with ratings of at least “A” or the equivalent thereof by Standard & Poor’s Financial Services LLC or Xxxxx’x Investors Services, Inc., (iv) time deposits, certificates of deposit, bankers’ acceptances, or similar short-term notes issued by a commercial bank domiciled and registered in the United States with capital and surplus in excess of $200 million, and which has (or the holding company of which has) a commercial paper rating of at least A-l or the equivalent thereof by Standard & Poor’s Financial Services LLC or P-l or the equivalent thereof by Xxxxx’x Investors Services, Inc., or (v) commercial paper of a domestic issuer rated at least A-l or the equivalent thereof by Standard & Poor’s Financial Services LLC or P-l or the equivalent thereof by Xxxxx’x Investors Services, Inc.; and (b) money market mutual funds which invest in securities listed in (a)(i) through (v) above with a weighted average maturity of less than one year. “CDD”: a Community Development District and/or Community Development Authority or similar governmental or quasi-governmental entity created under state or local statutes to encourage planned community development and to allow for the construction and maintenance of long-term infrastructure through alternative financing sources, including the tax-exempt and/or the taxable bond markets. “Change in Status”: the occurrence of any of the following events with respect to a Subsidiary that, immediately prior to such event, is a Guarantor: (a) all of the assets of such Subsidiary are sold or otherwise disposed of in a transaction in compliance with the terms of this Agreement; (b) all of the

10 Capital Stock of such Subsidiary held by the Borrower or any Restricted Subsidiary is sold or otherwise disposed of to any Person other than a Borrower or a Restricted Subsidiary in a transaction in compliance with the terms of this Agreement; or (c) such Subsidiary is designated an Unrestricted Subsidiary (or otherwise ceases to be a Restricted Subsidiary, including by way of liquidation or merger) in compliance with the terms of this Agreement. “Change of Control”: (a) any Person or group (as that term is understood under Section 13(d) of the Exchange Act and the rules and regulations thereunder) shall have acquired beneficial ownership (within the meaning of Rule 13d-3 under the Exchange Act) of a percentage (based on voting power, in the event different classes of stock shall have different voting powers) of the voting stock of the Borrower equal to at least fifty percent (50%); or (b) as of any date a majority of the board of directors of the Borrower consists of individuals who were not either (i) directors of the Borrower as of the corresponding date of the previous year, (ii) selected or nominated to become directors by the board of directors of the Borrower of which a majority consisted of individuals described in clause (b)(i) above or (iii) selected or nominated to become directors by the board of directors of the Borrower of which a majority consisted of individuals described in clause (b)(i) above and individuals described in clause (b)(ii) above. “Closing Date”: the date on which the conditions precedent set forth in Section 5.1 shall have been satisfied, which date is July 18, 2013. “Co-Documentation Agent”: the Co-Documentation Agents identified on the cover page of this Agreement. “Code”: the Internal Revenue Code of 1986, as amended from time to time. “Commitment”: as to any Lender, the obligation of such Lender to make Revolving Loans and participate in Swingline Loans and Letters of Credit in an aggregate principal and/or face amount not to exceed the amount set forth under the heading “Commitment” opposite such Xxxxxx’s name on Schedule 1.1A or in the Assignment and Assumption pursuant to which such Lender became a party hereto, as the same may be changed from time to time pursuant to the terms hereof. The amount of the Total Commitments on the FourthSixth Amendment Effective Date is $550,000,000650,000,000. “Commitment Period”: the period from and including the Closing Date to the Termination Date. “Commitment Fee Rate”: 0.30% per annum; provided, that on and after the first Adjustment Date occurring after the FourthSixth Amendment Effective Date, the Commitment Fee Rate will be determined pursuant to the Applicable Pricing Grid. “Competitor”: any Person that is itself, or is owned or Controlled by, a Person that is (i) listed on the most recent Builder 100 list published by Builder magazine, ranked by revenues or closings (or if such list is no longer published, identified in such other published list or through such other means as is mutually agreed by the Administrative Agent and the Borrower) or any Affiliate of such Person or (ii) engaged primarily in the business of investing in distressed real estate and is not a banking institution, life insurance company, fund or other similar financial institution that ordinarily is engaged in the business of making real estate loans in the ordinary course of business. “Compliance Certificate”: a certificate duly executed by an Authorized Financial Officer substantially in the form of Exhibit B. “Conforming Changes”: with respect to either the use or administration of Adjusted Daily Simple SOFR or Adjusted Term SOFR or the use, administration, adoption or implementation of any

11 Benchmark Replacement, any technical, administrative or operational changes (including changes to the definition of “ABR,” the definition of “Business Day,” the definition of “Interest Period,” the definition of “U.S. Government Securities Business Day,” the timing and frequency of determining rates and making payments of interest, timing of borrowing requests or prepayment, conversion or continuation notices, the applicability and length of lookback periods, the applicability of breakage provisions, and other technical, administrative or operational matters) that the Administrative Agent decides may be appropriate to reflect the adoption and implementation of Adjusted Daily Simple SOFR, Adjusted Term SOFR or such Benchmark Replacement and to permit the use and administration thereof by the Administrative Agent in a manner substantially consistent with market practice (or, if the Administrative Agent decides that adoption of any portion of such market practice is not administratively feasible or if the Administrative Agent determines that no market practice for the administration of Adjusted Daily Simple SOFR, Adjusted Term SOFR or such Benchmark Replacement exists, in such other manner of administration as the Administrative Agent decides is reasonably necessary in connection with the administration of this Agreement and the other Loan Documents). “Consolidated Debt”: at any date, without duplication: (a) all funded debt of the Loan Parties and their respective Subsidiaries (other than Unrestricted Subsidiaries) determined on a consolidated basis in accordance with GAAP; plus (b) funded debt of each Joint Venture with recourse to or guaranteed (including in the form of re-margin guarantees) by the Borrower or any other Loan Party; plus (c) the sum of (i) all reimbursement obligations with respect to drawn Performance Letters of Credit (excluding any portion of the actual or potential reimbursement obligations that are secured by cash collateral) and (ii) all reimbursement obligations with respect to drawn Financial Letters of Credit (excluding any portion of the actual or potential reimbursement obligations that are secured by cash collateral) and, without duplication, the maximum amount available to be drawn under all Financial Letters of Credit (excluding any portion of the actual or potential reimbursement obligations that are secured by cash collateral), in each case issued for the account of, or guaranteed by, any Loan Party or any of its Subsidiaries (other than Unrestricted Subsidiaries); plus (d) funded debt of Unrestricted Subsidiaries or third parties with recourse to or guaranteed (including in the form of re-margin guarantees) by any Loan Party or any of its Subsidiaries (other than Unrestricted Subsidiaries); plus (e) (e) the net aggregate Swap Termination Value of all agreements relating to Hedging Obligations of the Loan Parties and their respective Subsidiaries (other than Unrestricted Subsidiaries); plus (f) Contingent Obligations of the Loan Parties and their respective Subsidiaries (other than Unrestricted Subsidiaries) to the extent of amounts then due and payable. Notwithstanding the foregoing, “Consolidated Debt” shall exclude (i) Indebtedness of a Loan Party to another Loan Party, (ii) except as otherwise provided in the foregoing clauses (c) and (d), Indebtedness of Unrestricted Subsidiaries that otherwise is consolidated under GAAP, (iii) (x) Capitalized Lease Obligations pertaining to Model Units and (y) at any time, up to $15,000,000 of Capitalized Lease Obligations not described in sub-clause (x) of this clause (iii), (iv) liabilities relating to real estate not owned as determined under GAAP and (v) at any time, up to $75,000,000 in aggregate principal amount of Non- Recourse Indebtedness of the Loan Parties and their respective Subsidiaries (other than Unrestricted Subsidiaries).

12 For the avoidance of doubt, notwithstanding any other provision contained in this Agreement and solely of the purposes of this definition of “Consolidated Debt” and any financial calculations required by this Agreement that uses such definition, “Consolidated Debt” shall be computed to exclude all operating leases and financing or capital leases under GAAP as in effect on January 1, 2015 (including, without limitation, Accounting Standards Codification 840). “Consolidated EBITDA”: for any period, (a) the Consolidated Net Income of the Loan Parties and their respective Subsidiaries (other than Unrestricted Subsidiaries) plus (b) to the extent deducted from revenues in determining Consolidated Net Income of the Loan Parties and their respective Subsidiaries: (i) Consolidated Interest Expense, (ii) expense for income taxes paid or accrued, (iii) depreciation, (iv) amortization, (v) non-cash (including impairment) charges, (vi) extraordinary losses and (vii) loss (gain) on early extinguishment of indebtedness, minus (c) to the extent added to revenues in determining Consolidated Net Income, non-cash gains and extraordinary gains (including for the avoidance of doubt, gains relating to the release of any tax valuation asset reserves); provided, however, that Consolidated EBITDA shall include net income of any Unrestricted Subsidiary or Joint Venture only to the extent distributed to Loan Parties. “Consolidated Interest Expense”: for any period, the consolidated interest expense and capitalized interest and other interest charges amortized to cost of sales of Loan Parties and their respective Subsidiaries (other than Unrestricted Subsidiaries) for such period, determined on a consolidated basis in accordance with GAAP. “Consolidated Interest Incurred”: for any period, the aggregate amount (without duplication and determined in each case in accordance with GAAP) of interest (excluding interest of a Loan Party to another Loan Party) incurred, whether such interest was expensed or capitalized, paid, accrued, or scheduled to be paid or accrued during such period by the Loan Parties and their respective Subsidiaries (other than Unrestricted Subsidiaries) during such period, including (a) the interest portion of all deferred payment obligations, and (b) all commissions, discounts, and other fees and charges (excluding premiums) owed with respect to bankers’ acceptances and letter of credit financings (including, without limitation, letter of credit fees) and Hedging Obligations, in each case to the extent attributable to such period; provided, however, that the Consolidated Interest Incurred of any Subsidiary shall only be included in the amount of the Loan Parties’ pro-rata share of interest. For purposes of this definition, interest on Capital Leases shall be deemed to accrue at an interest rate reasonably determined by the Borrower to be the rate of interest implicit in such Capital Leases in accordance with GAAP. “Consolidated Net Income”: for any period, the net income (or loss) attributable to the Loan Parties and their respective Subsidiaries (other than Unrestricted Subsidiaries) for such period, determined on a consolidated basis in accordance with GAAP. For the avoidance of doubt, the calculation of Consolidated Net Income will exclude the net income (or loss) of Joint Ventures and Unrestricted Subsidiaries that otherwise would be consolidated under GAAP. “Consolidated Tangible Net Worth”: at any date, the consolidated stockholders equity, less Intangible Assets, of the Loan Parties and their respective Subsidiaries (other than Unrestricted Subsidiaries) determined in accordance with GAAP on a consolidated basis, all determined as of such date. For the avoidance of doubt, the calculation of Consolidated Tangible Net Worth will exclude (i) the stockholders’ equity (less Intangible Assets) of Joint Ventures and Unrestricted Subsidiaries that otherwise would be consolidated under GAAP and (ii) any intercompany liabilities of Joint Ventures and Unrestricted Subsidiaries. “Construction Bonds”: bonds issued by surety bond companies for the benefit of, and as required by, municipalities or other political subdivisions to secure the performance by Borrower or any Subsidiary of its obligations relating to lot improvements and subdivision development and completion.

13 “Contingent Obligation”: of any Person, any agreement, undertaking or arrangement by which such Person assumes, guarantees, endorses, contingently agrees to purchase or provide funds for the payment of, or otherwise becomes or is contingently liable upon, the monetary obligation or monetary liability of any other Person, or agrees to maintain the net worth or working capital or other financial condition of any other Person, or otherwise assures any creditor of such other Person against loss, including, without limitation, any comfort letter, operating agreement, take-or-pay contract, “put” agreement or other similar arrangement; provided that Contingent Obligations shall not include (i) obligations in respect of Financial Letters of Credit, (ii) re-margin guarantees and (iii) guarantees of payment of funded debt. “Continue”, “Continuation” and “Continued” each refers to the continuation of a Term SOFR Loan from one Interest Period to another Interest Period pursuant to Section 2.9. “Contractual Obligation”: any provision of any security issued by such Person or of any agreement, instrument or other undertaking to which such Person is a party or by which it or any of its property is bound. “Control”: the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of a Person, whether through the ability to exercise voting power, by contract or otherwise. “Controlling” and “Controlled” have meanings correlative thereto. “Convert”, “Conversion” and “Converted” each refers to the conversion of a Loan of one Type into a Loan of another Type pursuant to Section 2.10. “Corresponding Tenor”: with respect to any Available Tenor means, as applicable, either a tenor (including overnight) or an interest payment period having approximately the same length (disregarding business day adjustment) as such Available Tenor. “Credit Party”: the Administrative Agent, the Issuing Lenders, the Swingline Lender or any other Lender and, for the purposes of Section 10.13 only, any other Agent and the Arrangers. “Daily LIBO Rate”: for any day, the greater of (a) 0.25% and (b) a rate per annum determined for such day in accordance with the following formula: Eurodollar Base Rate 1.00 - Eurocurrency Reserve Requirements “Daily Simple SOFR”: for any day, (a “SOFR, with the conventions for this rate (which will include a lookback) being established Rate Day”), the interest rate per annum determined by the Administrative Agent equal to SOFR for the day (the “SOFR Determination Date”) that is two (2) Business Days prior to (i) such SOFR Rate Day if such SOFR Rate Day is a Business Day or (ii) the Business Day immediately preceding such SOFR Rate Day if such SOFR Rate Day is not a Business Day. If SOFR for any SOFR Determination Date has not been published or replaced with a Benchmark Replacement by 5:00 p.m. (Pittsburgh, Pennsylvania time) on the second Business Day immediately following such SOFR Determination Date, then SOFR for such SOFR Determination Date will be SOFR for the first Business Day preceding such SOFR Determination Date for which SOFR was published in accordance with the conventions for this rate selected or recommended by the Relevant Governmental Body for determining “definition of “SOFR”; provided that SOFR determined pursuant to this sentence shall be used for purposes of calculating Daily Simple SOFR” for business loans; provided, that if the Administrative Agent decides that any such convention is not administratively feasible for the Administrative Agent, then the Administrative Agent may establish another convention in its reasonable discretion. for no more than three (3) consecutive SOFR Rate Days. If and when Daily Simple SOFR as determined above changes, any

14 applicable rate of interest based on Daily Simple SOFR will change automatically without notice to the Borrower, effective on the date of any such change. “Daily Simple SOFR Loan”: any Revolving Loan or any portion thereof (other than an ABR Loan) bearing interest at a rate based on Adjusted Daily Simple SOFR. “Default”: any event or circumstance that, with the giving of notice or passage of time, or both, would become an Event of Default. “Defaulting Lender”: any Lender that (a) has failed, within two Business Days of the date required to be funded or paid, to (i) fund any portion of its Loans, (ii) fund any portion of its participations in Letters of Credit or Swingline Loans or (iii) pay over to any Credit Party any other amount required to be paid by it hereunder, unless, in the case of clause (i) above, such Lender notifies the Administrative Agent in writing that such failure is the result of such Xxxxxx’s good faith determination that a condition precedent to funding (specifically identified and including the particular default, if any) has not been satisfied, (b) has notified the Borrower or any Credit Party in writing, or has made a public statement to the effect, that it does not intend or expect to comply with any of its funding obligations under this Agreement (unless such writing or public statement indicates that such position is based on such Xxxxxx’s good faith determination that a condition precedent (specifically identified and including the particular default, if any) to funding a loan under this Agreement cannot be satisfied) or generally under other agreements in which it commits to extend credit, (c) has failed, within three Business Days after request by a Credit Party, acting in good faith, to provide a certification in writing from an authorized officer of such Lender that it will comply with its obligations (and is financially able to meet such obligations) to fund prospective Loans and participations in then outstanding Letters of Credit and Swingline Loans under this Agreement, provided that such Lender shall cease to be a Defaulting Lender pursuant to this clause (c) upon such Credit Party’s receipt of such certification in form and substance satisfactory to it and the Administrative Agent, (d) has become the subject of a Bankruptcy Event or (e) has, or has a direct or indirect parent company that has, become the subject of a Bail-In Action. “Dollars” and “$”: dollars in lawful currency of the United States. “Early Opt-in Election”: if the then-current Benchmark is USD LIBOR, the occurrence of: (1) a notification by the Administrative Agent to (or the request by the Borrower to the Administrative Agent to notify) each of the other parties hereto that at least five currently outstanding U.S. dollar-denominated syndicated credit facilities at such time contain (as a result of amendment or as originally executed) a SOFR-based rate (including SOFR, a term SOFR or any other rate based upon SOFR) as a benchmark rate (and such syndicated credit facilities are identified in such notice and are publicly available for review), and (2) the joint election by the Administrative Agent and the Borrower to trigger a fallback from USD LIBOR and the provision by the Administrative Agent of written notice of such election to the Lenders. “EEA Financial Institution”: (a) any credit institution or investment firm established in any EEA Member Country which is subject to the supervision of an EEA Resolution Authority, (b) any entity established in an EEA Member Country which is a parent of an institution described in clause (a) of this definition, or (c) any financial institution established in an EEA Member Country which is a Subsidiary of an institution described in clauses (a) or (b) of this definition and is subject to consolidated supervision with its parent.

15 “EEA Member Country”: any of the member states of the European Union, Iceland, Liechtenstein, and Norway. “EEA Resolution Authority”: any public administrative authority or any Person entrusted with public administrative authority of any EEA Member Country (including any delegee) having responsibility for the resolution of any EEA Financial Institution. “Eligible Assignee”: any of (i) a Lender or a Lender Affiliate, (ii) a commercial bank organized under the laws of the United States, or any State thereof, and having (x) total assets in excess of $1,000,000,000 and (y) a combined capital and surplus of at least $250,000,000; (iii) a commercial bank organized under the laws of any other country which is a member of OECD, or a political subdivision of any such country, and having (x) total assets in excess of $1,000,000,000 and (y) a combined capital and surplus of at least $250,000,000, provided that such bank is acting through a branch or agency located in the country in which it is organized or another country which is also a member of OECD; (iv) a life insurance company organized under the laws of any State of the United States, or organized under the laws of any country and licensed as a life insurer by any State within the United States and having admitted assets of at least $1,000,000,000; (v) a nationally or internationally recognized investment banking company or other financial institution in the business of making, investing in or purchasing loans, or an Affiliate thereof organized under the laws of any State of the United States or any other country which is a member of OECD, and licensed or qualified to conduct such business under the laws of any such State and having (1) total assets of at least $1,000,000,000 and (2) a net worth of at least $250,000,000; or (vi) an Approved Fund. Notwithstanding the foregoing, the following shall not be “Eligible Assignees”: (a) any Defaulting Lender, (b) the Borrower or any of its Affiliates and (c) Competitors identified to the Administrative Agent and the Lenders from time to time. “Entitled Land”: Qualified Real Property Inventory comprised of land where all requisite zoning requirements and land use requirements have been satisfied, and all requisite approvals have been obtained from all applicable Governmental Authorities (other than approvals which are simply ministerial and non-discretionary in nature or otherwise not material) in order to develop the land as a residential housing project. “Environmental Laws”: any and all foreign, Federal, state, local or municipal laws, rules, orders, regulations, statutes, ordinances, codes, decrees, requirements of any Governmental Authority or other Requirement of Law (including common law) regulating, relating to or imposing liability or standards of conduct concerning protection of human health or safety, or the environment, as now or may at any time hereafter be in effect. “ERISA”: the Employee Retirement Income Security Act of 1974, as amended from time to time. “ERISA Affiliate”: (a) any entity, whether or not incorporated, that is under common control with a Loan Party within the meaning of Section 4001 of ERISA; (b) any corporation which is a member of a controlled group of corporations within the meaning of Section 414(b) of the Code of which a Loan Party is a member; (c) any trade or business (whether or not incorporated) which is a member of a group of trades or businesses under common control within the meaning of Section 414(c) of the Code of which a Loan Party is a member; and (d) with respect to any Loan Party, any member of an affiliated service group within the meaning of Section 414(m) or (o) of the Code of which that Loan Party, any corporation described in clause (b) above or any trade or business described in clause (c) above is a member. Any former ERISA Affiliate of any Loan Party shall continue to be considered an ERISA Affiliate of the Loan Party within the meaning of this definition with respect to the period such entity was an ERISA Affiliate of the Loan Party and with respect to liabilities arising after such period for which the Loan Party could be liable under the Code or ERISA.

16 “ERISA Event”: (a) the failure of any Plan to comply with any material provisions of ERISA and/or the Code (and applicable regulations under either) or with the material terms of such Plan; (b) the existence with respect to any Plan of a non-exempt Prohibited Transaction; (c) any Reportable Event; (d) the failure of any Loan Party or ERISA Affiliate to make by its due date a required installment under Section 430(j) of the Code with respect to any Pension Plan or any failure by any Pension Plan to satisfy the minimum funding standards (within the meaning of Sections 412 or 430 of the Code or Section 302 of ERISA) applicable to such Pension Plan, whether or not waived in accordance with Section 412(c) of the Code or Section 302(c) of ERISA; (e) a determination that any Pension Plan is, or is expected to be, in “at risk” status (within the meaning of Section 430 of the Code or Section 303 of ERISA); (f) the filing pursuant to Section 412 of the Code or Section 302 of ERISA of an application for a waiver of the minimum funding standard with respect to any Pension Plan; (g) the occurrence of any event or condition that might constitute grounds under XXXXX for the termination of, or the appointment of a trustee to administer, any Pension Plan or the incurrence by any Loan Party or any ERISA Affiliate of any liability under Title IV of ERISA with respect to the termination of any Pension Plan, including but not limited to the imposition of any Lien in favor of the PBGC or any Pension Plan; (h) the receipt by any Loan Party or any ERISA Affiliate from the PBGC or a plan administrator of any notice relating to an intention to terminate any Pension Plan or to appoint a trustee to administer any Pension Plan; (i) the failure by any Loan Party or any ERISA Affiliate to make any required contribution to a Multiemployer Plan pursuant to Sections 431 or 432 of the Code; (j) the incurrence by any Loan Party or any ERISA Affiliate of any liability with respect to the withdrawal or partial withdrawal (within the meaning of Sections 4203 and 4205 of ERISA) from any Multiemployer Plan; (k) the receipt by any Loan Party or any ERISA Affiliate of any notice, or the receipt by any Multiemployer Plan from a Loan Party or any ERISA Affiliate of any notice, concerning the imposition of Withdrawal Liability or a determination that a Multiemployer Plan is, or is expected to be, “insolvent” (within the meaning of Section 4245 of ERISA), in “endangered,” “critical” or “critical and declining” status (within the meaning of Sections 431 or 432 of the Code or Sections 304 or 305 of ERISA), or terminated (within the meaning of Section 4041A of ERISA) or that it intends to terminate or has terminated under Section 4041A or 4042 of ERISA; (l) the failure by any Loan Party or any ERISA Affiliate to pay when due (after expiration of any applicable grace period) any installment payment with respect to Withdrawal Liability under Section 4219(c) of ERISA; (m) the withdrawal by any Loan Party or any ERISA Affiliate from any Pension Plan with two or more contributing sponsors or the termination of any such Pension Plan resulting in liability to any Loan Party or any ERISA Affiliate pursuant to Section 4063 or 4064 of ERISA; (n) the imposition of liability on any Loan Party or any ERISA Affiliate pursuant to Section 4062(e) or 4069 of ERISA or by reason of the application of Section 4212(c) of ERISA; (o) the occurrence of an act or omission that could give rise to the imposition on any Loan Party or any ERISA Affiliate of fines, penalties, taxes, payments or related charges under Chapter 43 of Title 26 of the Code or under Section 409, Section 502(c), (i) or (l), or Section 4071 of ERISA; (p) the assertion of a material claim (other than routine claims for benefits) against any Plan or the assets thereof, or against any Loan Party or any ERISA Affiliate in connection with any Plan; (q) receipt from the IRS of notice of the failure of any Pension Plan (or any other Plan intended to be qualified under Section 401(a) of the Code) to qualify under Section 401(a) of the Code, or the failure of any trust forming part of any Pension Plan (or any other Plan) to qualify for exemption from taxation under Section 501(a) of the Code; or (r) the imposition of a Lien pursuant to Section 430(k) of the Code or pursuant to ERISA with respect to any Pension Plan. “Erroneous Payment”: as defined in Section 9.11(a). “Erroneous Payment Notice”: as defined in Section 9.11(a). “Escrow Proceeds Receivable”: funds unconditionally due to the Borrower or any Guarantor held in escrow following the sale and conveyance of title of a Unit to a buyer.

17 “EU Bail-In Legislation Schedule”: the EU Bail-In Legislation Schedule published by the Loan Market Association (or any successor Person), as in effect from time to time. “Eurocurrency Reserve Requirements”: for any day, the aggregate (without duplication) of the maximum rates (expressed as a decimal fraction) of reserve requirements in effect on such day (including basic, supplemental, marginal and emergency reserves) under any regulations of the Board or other Governmental Authority having jurisdiction with respect thereto dealing with reserve requirements prescribed for eurocurrency funding (currently referred to as “Eurocurrency Liabilities” in Regulation D of the Board) maintained by a member bank of the Federal Reserve System. “Eurodollar Base Rate”: for any day, a rate per annum equal to the rate of interest published on such day (or if such day is not a Business Day, the immediately preceding Business Day) in The Wall Street Journal “Money Rate” listing under the caption “London Interbank Offered Rates” for a one month period (or, if no such rate is published therein for any reason, then the Eurodollar Base Rate will be the eurodollar rate for a one month period as published in another publication selected by the Administrative Agent). “Event of Default”: any of the events specified in Section 8. “Exchange Act”: the Securities Exchange Act of 1934, as amended. “Existing Credit Agreement”: Credit Agreement, dated as of June 9, 2010, among the Borrower, the lenders party thereto from time to time, PNC Bank, National Association, as administrative agent, and the other agents party thereto (as amended, supplemented or otherwise modified from time to time prior to the Closing Date). “Existing Letters of Credit”: the letters of credit issued and outstanding immediately prior to the Closing Date and set forth on Schedule 1.1D. “Existing Notes”: (i) the 5.625% Senior Notes due 2025 issued under and pursuant to an Indenture, dates as of August 3, 2017, among the Borrower, the guarantors named therein and U.S. Bank National Association, as trustee and (ii) the 4.95% Senior Notes due 2028 issued under and pursuant to an Indenture, dated as of January 22, 2020, among the Borrower, the guarantors named therein and U.S. Bank National Association, as trustee. “Existing Termination Date”: as defined in Section 2.22(a). “Extending Lender”: as defined in Section 2.22(b). “FATCA”: Sections 1471 through 1474 of the Code, as of the date of this Agreement (or any amended or successor version that is substantively comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof and any agreements entered into pursuant to Section 1471(b)(1) of the Code. “Federal Funds Effective Rate”: for any day, an interest rate per annum equal to the rate calculated by the New York Fed based on such day’s (or, if such day is not a Business Day, the most recently occurring Business Day’s) federal funds transactions by depository institutions (as determined in such manner as the New York Fed shall set forth on its public website from time to time) and published on the next succeeding Business Day by the New York Fed as the federal funds effective rate.; provided that (a) if such day is not a Business Day, the Federal Funds Effective Rate for such day shall be such rate on such transactions on the next preceding Business Day as so published on the next succeeding Business Day, (b) if no such rate is so published on such next succeeding Business Day, the Federal Funds Effective Rate

18 for such day shall be the average of the quotations for such day on such transactions received by the Administrative Agent from three Federal Funds brokers of recognized standing selected by the Administrative Agent and (c) if the Federal Funds Rate shall be less than zero, such rate shall be deemed zero for purposes of this Agreement. “Financial Letter of Credit”: a letter of credit that is not a Performance Letter of Credit. “Financial Letter of Credit Sublimit”: at any time, a dollar amount equal to the lesser of (a) 25% of the aggregate Commitments outstanding at such time and (b) the L/C Commitment. “Financial Services Subsidiary”: a Subsidiary engaged exclusively in mortgage banking (including mortgage origination, loan servicing, mortgage broker and title and escrow businesses), master servicing and related activities, including, without limitation, a Subsidiary which facilitates the financing of mortgage loans and mortgage-backed securities and the securitization of mortgage-backed bonds and other activities ancillary thereto. Any Financial Services Subsidiary may execute and deliver to the Administrative Agent a supplement to the Guarantee Agreement and become a Guarantor. “Finished Lots”: Entitled Land with respect to which (a) development has been completed to such an extent that permits to allow use and construction, including building, sanitary sewer and water, are entitled to be obtained for a Unit on such Entitled Land and (b) start of construction has not occurred. “First Amendment”: that certain First Amendment, dated as of the First Amendment Effective Date, by and among the Borrower, the Administrative Agent and the other parties thereto. “First Amendment Effective Date”: October 20, 2014. “Floor”: the benchmark rate floor, if any, provided in this Agreement initially (as of the execution of this Agreement, the modification, amendment or renewal of this Agreement or otherwise) with respect to USD LIBORAdjusted Daily Simple SOFR and Adjusted Term SOFR or, if no floor is specified, 0.25%. “Foreign Benefit Arrangement”: any employee benefit arrangement mandated by non-US law that is maintained or contributed to by any Loan Party or any ERISA Affiliate or any other entity related to a Loan Party on a controlled group basis. “Foreign Plan”: each “employee benefit plan” (within the meaning of Section 3(3) of ERISA, whether or not subject to ERISA) that is not subject to US law and is maintained or contributed to by any Loan Party or ERISA Affiliate or any other entity related to a Loan Party on a controlled group basis. “Foreign Plan Event”: with respect to any Foreign Benefit Arrangement or Foreign Plan, (a) the failure to make or, if applicable, accrue in accordance with normal accounting practices, any employer or employee contributions required by applicable law or by the terms of such Foreign Benefit Arrangement or Foreign Plan; (b) the failure to register or loss of good standing with applicable regulatory authorities of any such Foreign Benefit Arrangement or Foreign Plan required to be registered; or (c) the failure of any Foreign Benefit Arrangement or Foreign Plan to comply with any material provisions of applicable law and regulations or with the material terms of such Foreign Benefit Arrangement or Foreign Plan. “Fourth Amendment”: that certain Fourth Amendment, dated as of the Fourth Amendment Effective Date, by and among the Borrower, the Administrative Agent and the other parties thereto.