EX-10.17 20 dex1017.htm COUNTY ECONOMIC DEVELOPMENT GRANT AGREEMENT COUNTY ECONOMIC DEVELOPMENT GRANT AGREEMENT

Exhibit 10.17

COUNTY ECONOMIC DEVELOPMENT GRANT AGREEMENT

THIS COUNTY ECONOMIC DEVELOPMENT GRANT AGREEMENT (this “Agreement”) is made as of August 2, 2007 (the “Effective Date”) by and between BEXAR COUNTY, TEXAS, a political subdivision of the State of Texas (the “County”) and RACKSPACE US, INC. (“Rackspace”). The County and Rackspace may be referred to herein from time to time as a “Party” or collectively as the “Parties”.

WITNESSETH:

WHEREAS, the Parties have entered into that certain Walzem Road Redevelopment Project Master Economic Incentives Agreement of even date herewith (the “Master Agreement”) with the City of San Antonio, Texas, a Texas home rule municipality (“City of San Antonio”), the City of Windcrest, Texas, a Texas general law municipality (“City of Windcrest”), the Windcrest Economic Development Company, LLC, a Texas limited liability company (the “Developer”), and the Windcrest Economic Development Corporation (“Windcrest EDC”), a Section 4B corporation created pursuant to the authority of the Development Corporation Act of 1979, as amended, Texas Revised Civil Statutes Annotated, Article 5190.6 (the “EDC Act”); and

WHEREAS, pursuant to the Master Agreement, Windcrest EDC will lease to Rackspace that certain tract of land and improvements commonly known as the Windsor Park Mall (the “Leased Property”) into which Rackspace will locate its U.S. corporate headquarters pursuant to the lease agreement to be entered into between Windcrest EDC, as landlord, and Rackspace, as tenant (the “Mall Lease”); and

WHEREAS, the parties to the Master Agreement expect the implementation of the Mall Lease to exempt the Leased Property, the Real Property Improvements and/or the Personal Property Improvements (as those terms are defined in the Master Agreement) from property taxes during the term of the Mall Lease pursuant to Section 5190.6-4B(k) of the EDC Act and any other applicable successor statute making the Mall Lease exempt from property taxes (“Section 4B(k) of the EDC Act”), said tax exemption being one of the incentives to induce Rackspace to locate its corporate headquarters into the Leased Property; and

WHEREAS, the parties to the Master Agreement desire to provide for a partial “make whole” agreement to protect Rackspace from any changes in law or interpretation adversely affecting the tax exemption under Section 4B(k) of the EDC Act; and

WHEREAS, the County is authorized by the provisions of Article III, Section 52-a of the Texas Constitution and Section 381.004 of the Texas Local Government Code (the “Code”) to provide economic development grants to promote local economic development and to stimulate business and commercial activity in the County; and

WHEREAS, the County seeks to induce Rackspace to create or relocate at least 4,500 full-time jobs in the County, in connection with the Master Agreement and Mall Lease; and

WHEREAS, the County has determined that making economic development grants to Rackspace in accordance with this Agreement and the Master Agreement will further the objectives

- 1 -

of the County, will benefit the County and its inhabitants, and will promote state and local economic development and stimulate business and commercial activity in the County; and

WHEREAS, pursuant to Section 3.12 of the Master Agreement, the Parties have agreed to enter into this Agreement; and

WHEREAS, on the Effective Date, the commitments contained in this Agreement shall become legally binding obligations of the Parties.

NOW THEREFORE, in consideration of the foregoing and the mutual agreements, covenants and payments herein and other valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties agree as follows:

ARTICLE I

DEFINITIONS

1.1 Defined Terms. Wherever used in this Agreement, the following terms shall have the meanings ascribed to them:

“Ad Valorem Taxes” means those ad valorem property taxes assessed by the Commissioners Court for and on behalf of Bexar County, and shall not include taxes levied by the Commissioners Court for and on behalf of the Bexar County Hospital District operating as University Health System, the Bexar County Flood Control District, or any other taxing entity.

“Annexed Area” means the property described in Exhibit “A”.

“Base Year Value” means the Taxable Value of the Annexed Area as determined by the Bexar County Appraisal District as of January 1, 2007.

“Calendar Year” shall mean January 1 through December 31 of a given year.

“Commissioners Court” means the Bexar County Commissioners Court.

“Event of Bankruptcy or Insolvency” shall mean the dissolution or termination of Rackspace’s existence as a going business, insolvency, appointment of receiver for any significant part of Rackspace’s property and such appointment is not terminated within ninety (90) days after such appointment is initially made, any general assignment for the benefit of creditors, or the commencement of any proceeding under any bankruptcy or insolvency laws by or against Rackspace and such proceeding is not dismissed within ninety (90) days after the filing thereof.

“Governmental Authority” means any Federal, State, or local governmental entity having jurisdiction.

“Governmental Rule” means any applicable law, rule or regulation of a Governmental Authority.

- 2 -

“Grant(s)” shall have the meaning ascribed to it in Section 5.1.

“Impositions” shall mean all taxes, assessments, use and occupancy taxes, charges, excises, license and permit fees, and other charges by public or governmental authority, general and special, which are or may be assessed, charged, levied, or imposed by any public or governmental authority on Rackspace in relation to the Leased Property and Improvements.

“Improvements” shall mean the real property improvements to be developed and constructed by Rackspace or the Developer on the Annexed Area.

“Taxable Value” shall mean the appraised value as certified by the Bexar Appraisal District as of January 1 of a given year.

1.2 Other Defined Terms. Capitalized terms used herein and not defined herein shall have the meaning ascribed to such terms in the Master Agreement.

ARTICLE II

GENERAL PROVISIONS

2.1 Recitals. The recitals to this Agreement and the Master Agreement are incorporated herein for all purposes.

2.2 Purpose. The specific purpose of this Agreement is to grant economic benefits to Rackspace as necessary to induce Rackspace to locate its corporate headquarters onto the Leased Property. This action will be a significant contribution toward a broader purpose to stimulate and encourage business and commercial activity in the County, to retain job opportunities, build the sales and property tax base and promote a partnership relationship with the private sector businesses that will bring additional employment projects into the County.

2.3 Term. The term of this Agreement shall begin on the first day of the Exemption Period (the “Commencement Date”) and continue for a period of ten (10) years, ending on December 31st of the tenth year (the “Expiration Date”), unless sooner terminated as provided herein, and regardless of whether the Leased Property is actually exempt during such period. Pursuant to the Master Agreement, the Exemption Period will begin on January 1 of the calendar year designated by Rackspace, which may be designated to begin on January 1 after the completion of substantial construction of the first phase of the renovation of the Leased Property and the Exemption Period (and, therefore, the term of this Agreement) must begin no later than January 1, 2010.

- 3 -

ARTICLE III

REPRESENTATIONS AND WARRANTIES

3.1 Representations of Rackspace. Rackspace hereby makes the following representations, warranties and covenants to County as of the Effective Date unless another date is expressly stated to apply:

| (a) | Existence. Rackspace is a limited partnership duly created and validly existing under the laws of the State of Texas. Rackspace Managed Hosting is a name registered in the State of Texas as a d/b/a of Macro Holdings, Inc., the general partner of Rackspace. Rackspace has all requisite power and authority to enter into this Agreement. |

| (b) | Authorization. The execution, delivery and performance by Rackspace of this Agreement have been duly authorized by all necessary action and will not violate the organizational documents of Rackspace or result in the breach of or constitute a default under any loan or credit agreement, or other material agreement to which Rackspace is a party or by which Rackspace or its material assets may be bound or affected. The execution of this Agreement by Rackspace does not require any consent or approval that has not been obtained, including without limitation the consent or approval of any Governmental Authority. |

| (c) | Enforceable Obligations. Assuming due authorization, execution and delivery by each signatory Party hereto and thereto, this Agreement, all documents executed by Rackspace pursuant hereto and all obligations of Rackspace hereunder and thereunder are enforceable against Rackspace in accordance with their terms, except as such enforcement may be limited by bankruptcy, insolvency, reorganization or other similar laws affecting the enforcement of creditor’s rights generally and by general equity principles (regardless of whether such enforcement is considered in a proceeding in equity or at law). |

| (d) | No Legal Bar. The execution and delivery of this Agreement and the performance of its obligations hereunder by Rackspace will not conflict with any provision of any law, regulation or Governmental Rules to which Rackspace is subject or conflict with, or result in a breach of, or constitute a default under any of the terms, conditions or provisions of any agreement or instrument to which Rackspace is a party or by which it is bound or any order or decree applicable to Rackspace. |

| (e) | Litigation. There are no legal actions or proceedings pending or, to the knowledge of Rackspace, threatened against Rackspace which, if adversely determined, would materially and adversely affect the ability of Rackspace to fulfill its obligations under this Agreement or the financial condition, business or prospects of Rackspace. |

| (f) | Documents. All documents made available by Rackspace to County including without limitation all financial documents relating to Rackspace are true, correct and complete copies of the instruments which they purport to be and accurately depict the subject matter addressed therein. |

- 4 -

| (g) | Knowledge. Rackspace has no knowledge of any facts or circumstances which presently evidence, or with the passage of time would evidence, that any of the representations made by Rackspace under this Agreement are in any way inaccurate, incomplete or misleading. |

3.2 Representations of County. County hereby makes the following representations, warranties and covenants to Rackspace as of the Effective Date unless another date is expressly stated to apply:

| (a) | Existence. County is a political subdivision of the State of Texas. |

| (b) | Power and Authority. Pursuant to Chapter 381 of the Code, County has all requisite power and authority to enter into this Agreement and perform all of its obligations hereunder. The execution and performance by County of this Agreement has been duly authorized by the Commissioners Court and does not require the consent or approval of any other person which has not been obtained, including, without limitation, any Governmental Authority. |

| (c) | No Legal Bar. The execution and performance by County of this Agreement does not and will not violate any provisions of any contract, agreement, instrument or current Governmental Rule to which County is a party or is subject. |

| (d) | Litigation. Except such matters which have been disclosed in writing to Rackspace, there are no legal actions or proceedings pending known to County which, if adversely determined, would materially and adversely affect the ability of County to fulfill its obligations under this Agreement. |

| (e) | Enforceable Obligations. Assuming (i) due authorization, execution and delivery by each Party hereto and thereto, (ii) the enforceability of the Agreement and the actions of County authorized by the Code, this Agreement, each document executed by County pursuant hereto and all obligations of County hereunder and thereunder are enforceable against County in accordance with their terms. |

3.3 Disclaimer. RACKSPACE ACKNOWLEDGES THAT, EXCEPT FOR COUNTY’S REPRESENTATIONS CONTAINED WITHIN THIS AGREEMENT, NEITHER COUNTY NOR ANY AFFILIATE OF COUNTY NOR ANY RELATED PARTY OF COUNTY HAS MADE ANY REPRESENTATION OR WARRANTY WHATSOEVER (WHETHER EXPRESS OR IMPLIED) REGARDING THE LEASED PROPERTY PROJECT, THE CODE, ANY ACTIONS AUTHORIZED BY THE CODE, THE SUBJECT MATTER OF THIS AGREEMENT OR ANY EXHIBIT HERETO, OTHER THAN THE OBLIGATIONS EXPRESSLY CONTAINED IN THIS AGREEMENT.

- 5 -

ARTICLE IV

CONDITIONS TO ANNUAL GRANTS

4.1 Conditions. The obligation for County to pay any and all of the Grants hereunder shall be conditioned upon compliance with and satisfaction of each of the conditions set forth below:

| (a) | Payment. Payment of any Grant hereunder shall not occur until after (i) the Commencement Date, (ii) the Leased Property or Mall Lease is not tax exempt under Section 4B(k) of the EDC Act during all or any portion of the term of this Agreement, and (iii) Rackspace has paid Ad Valorem Taxes on the Taxable Value of the Leased Property, and all of the Ad Valorem Taxes collected by the County on the Taxable Value of the Leased Property are above the Base Year Value. |

| (b) | Use. From and after the Effective Date and continuing during the term of this Agreement until the Expiration Date, the Leased Property shall be used and maintained as an information technology services business, including acting as the U.S. corporate headquarters for such business, and the business operations of any assignee, tenant or subtenant of Rackspace approved by the City of Windcrest and located at the Leased Property (“Business Activities”), which Business Activities shall not cease for a period of more than three (3) months except in connection with, and to the extent of an event of, Force Majeure. |

| (c) | Prohibition on Default. Rackspace shall not have an uncured breach or default of this Agreement. |

ARTICLE V

ECONOMIC DEVELOPMENT GRANTS

5.1 Grants. Subject to the conditions in Article IV and Section 5.6 and Rackspace’s continued fulfillment of all the terms of this Agreement and of the Master Agreement, in the event it is determined that Section 4B(k) of the EDC Act does not apply or exempt the Leased Property, the Real Property Improvements or the Personal Property Improvements from property taxes, the County will make a grant (the “Grant”) to Rackspace of the property taxes the County collects in the Annexed Area (less the amount of property taxes the County collects or would have collected in the Base Tax Year in the Annexed Area) for ten (10) tax years following the first day of the Exemption Period. Ad valorem taxes eligible under this Agreement shall be the ad valorem taxes levied by the Commissioners Court for and on behalf of Bexar County only, and shall not include taxes levied by the Commissioners Court for and on behalf of the Bexar County Hospital District operating as University Health System, the Bexar County Flood Control District, or any other taxing entity. The terms of this Agreement shall be Rackspace’s sole recourse against the County in the event that the Leased Property, the Real Property

- 6 -

Improvements or the Personal Property Improvements becomes subject to taxation. In addition, the first Grant payment shall include any Ad Valorem Taxes on the Leased Property paid by Rackspace to the County for tax years which were previously treated as exempt under Section 4B(K) of the EDC Act but are thereafter required to be paid (including those paid by PILOT payment). The Grants shall be paid on March 1 of the Calendar Year immediately following the Calendar Year for which the Grant applies, provided the County has actually received payment of ad valorem taxes assessed against the Annexed Area for such Calendar Year. For illustration purposes only, and without taking into account taxes actually collected, adjustments or other factors that might affect the Grant as described elsewhere in this Agreement, assume that the Taxable Value of the Annexed Area for Calendar Year 2010 is $50 million and the Base Year Value for the Annexed Area is $1 million, then the amount of the grant for Calendar Year 2010 would be the County’s tax rate for Tax Year 2010 multiplied by $49 Million Dollars, and would be paid on March 1, 2011. For further illustration purposes only, assume that the Mall Lease is treated as exempt under Section 4B(K) of the EDC Act for Calendar Years 2010 and 2011 and it is subsequently determined that Section 4B(K) of the EDC Act is unconstitutional and Rackspace is required to pay the County $200,000 in taxes for Calendar Years 2010 and 2011, the first Grant will include $200,000 paid for Calendar Years 20 10 and 2011. In all events, Grants under this Agreement will cease on the earliest of (a) when Rackspace begins to once again receive exemptions under Section 4B(K) of the EDC Act, (b) when previous exemptions under Section 4B(K) of the EDC Act and Grants under this Agreement and the City Economic Development Grant Agreement for the Leased Property are equal to the tax savings that the exemption under Section 4B(K) of the EDC Act would have provided to Rackspace if available for the full Exemption Period, (c) when ten (10) Grants have been made, or (d) when the Term hereof has expired.

5.2 Limit of Obligation. The Grants made hereunder shall be paid solely from lawfully available funds that have been appropriated by the County from property taxes collected from the Annexed Area. Consequently the County shall have no obligation or liability to pay any Grants unless the County appropriates funds to make such payment during the tax year in which such Grant is payable, provided, however, that the County acknowledges its current intent to make such appropriations when Grants are required to be paid hereunder. Under no circumstances shall the County’s obligations hereunder be deemed to create any debt within the meaning of any constitutional or statutory provision. Further, the County shall not be obligated to pay any commercial bank, lender or similar institution for any loan or credit agreement made by Rackspace. None of the County’s obligations under this Agreement shall be pledged or otherwise encumbered in favor of any commercial lender and/or similar financial institution.

5.3 Other Agreements. The County agrees it will not enter into any Economic Development Grants or other arrangements affecting any of the Annexed Area other than the Leased Premises that have the effect of reducing or committing the property tax and sales tax revenues therefrom to other purposes not specifically provided for in this Agreement if such grant or arrangement, without the prior consent of Rackspace, would either (i) provide the described incentive for a period lasting longer than five years after completion of construction of the incentivized improvement(s), or (ii) constitute an abatement, cumulatively with all other incentives or exemptions in effect on such property, in excess of fifty percent (50%) of the expected tax value of the Annexed Area other than the Leased Premises after construction of all

- 7 -

anticipated improvement(s). Notwithstanding the foregoing, however, the County may make CDBG or EDA grants, a grant of its general funds, or another type of grant or incentive in the Annexed Area if it will not adversely affect the value of (or impair the ability of the County to pay) the Grants to Rackspace hereunder.

5.4 Restoration of Exemption. The County shall take any actions necessary within its authority under Section 4B(k) of the EDC Act or its successor, as may be amended from time to time, to enable the leasehold interest in the Mall Lease to again become exempt from taxes. Should the leasehold interest in the Mall Lease thereafter become exempt, no further Grants shall be required so long as the leasehold interest in the Mall Lease remains exempt.

5.5 Tax Protest. In the event a taxpayer other than Rackspace timely and properly protests or contests the taxation and/or the Taxable Value of a property in the Annexed Area, the obligation of the County to provide Grant(s) shall not be abated hereunder, but if any protest or motion with the Bexar Appraisal District results in a final determination that changes the Taxable Value or tax liability after a Grant has been paid for such Tax Year, the Grant for such Tax Year shall be adjusted (increased or decreased as the case may be) accordingly on the following Grant payment date. If there are no further Grants to be paid, then the Party owed an adjustment shall be paid directly by the other Party. Rackspace shall notify the County in writing in the event of a protest or contest by Rackspace, and the obligation of the County to provide Grant(s) shall be abated hereunder until a final determination has been made of such protest or contest and the Expiration Date shall automatically be extended during the abatement, if necessary.

5.6 Rackspace Obligation. Rackspace agrees that from the Commencement Date and throughout the term hereof, one-hundred percent (100%) of all employment positions at the Rackspace Corporate Headquarters Property (as that term is defined in the Master Agreement) shall be paid a minimum wage, not including benefits, of at least nine dollars and ninety-three cents ($9.93) per hour (or a salary that satisfies that requirement). Rackspace further agrees that within one year of the commencement of Business Activities at the Rackspace Corporate Headquarters Property, seventy percent (70%) of all new and existing employees at the Rackspace Corporate Headquarters Property shall be paid a minimum wage, not including benefits, of at least eleven dollars and forty-five cents ($11.45) per hour (or a salary that satisfies that requirement).

5.7 Recapture.

| (a) | Termination and Recapture of Grants in Event of Cessation of Business Activities. If Rackspace, a Related Organization, or a City of Windcrest or County-approved assignee or subtenant as provided below occupies and uses the Leased Property for Business Activities and subsequently all or substantially all Business Activities (or a substantial portion thereof) ceases conducting Business Activities (or a substantial portion thereof) at the Leased Property for a continuous period of three (3) months (hereinafter referred to as a “Cessation of Business Activities”) during the Exemption Period for any reason, except if such cessation is caused by a Force Majeure, then the County shall have the right to terminate this |

- 8 -

| Agreement upon delivery of the notices and expiration of the Cure Period as provided below. Said termination shall be effective for the calendar year during which such Cessation of Business Activities occurred. Upon said termination, all Grants for such calendar year and all Grants for previous calendar years in which the Cessation of Business Activities occurred shall be recaptured by a PILOT payment being paid by Rackspace to the County within ninety (90) calendar days from the date Rackspace is notified of termination and any applicable Cure Period has expired and a written notice of recapture from the County is received. In the event the Cessation of Business Activities is caused by a Force Majeure, Rackspace shall have the right to continue or to terminate this Agreement, for all or any remaining portion of the Leased Property, without recapture or other penalty. |

| (b) | Termination and Recapture of Grants for Failure to Maintain Employment Commitment. If Rackspace, a Related Organization, or a City of Windcrest or County-approved assignee or subtenant as provided below fails to satisfy the Employment Commitment during a calendar year in the Exemption Period, then for each such calendar year of noncompliance, the Grant shall be reduced in the following tax year by the same percentage as the deficiency in the Employment Commitment, subject to a floor of fifty percent (50%). For example, if Rackspace creates and retains ninety percent (90%) of the minimum number of full-time employee positions required to comply with the Employment Commitment in a given year, Rackspace shall be entitled to ninety percent (90%) of the Grant for that following year. Since the Employment Commitment contains a requirement that the median salary be not less than $51,000, when calculating the Employment Commitment, the lowest paying jobs will be excluded from the number of jobs counted toward satisfying the Employment Commitment to the extent necessary to cause the median salary of all employees to equal or exceed $51,000. If Rackspace fails to create and retain at least fifty percent (50%) of the minimum number of full-time employee positions required to comply with the Employment Commitment in a given year then, at the option of the County, the County may terminate this Agreement. Said termination shall be effective for the calendar year during which at least fifty percent (50%) of the minimum number of full-time employee positions required to comply with the Employment Commitment have not been created or retained by Rackspace. Upon said termination, all Grants for that calendar year and all Grants preceding the calendar year in which such failure to meet the Employment Commitment occurred shall be recaptured by a PILOT payment being paid by Rackspace to the County within ninety (90) calendar days from the date Rackspace is notified of termination and any applicable Cure Period has expired and a written notice of recapture from the County is received. In the event such a failure to create and retain at |

- 9 -

| least fifty percent (50%) of the minimum number of full-time employee positions required to comply with the Employment Commitment is caused by an event of Force Majeure, Rackspace shall have the right to continue or to terminate this Agreement, for all of or any remaining portion of the Leased Property, without recapture or other penalty, provided that if Rackspace elects to continue this Agreement after an event of Force Majeure that reduces its ability to perform hereunder then its obligations hereunder shall be equitably and proportionally reduced so long as the event of Force Majeure continues plus such time as is required to recover from such event of Force Majeure as is reasonable under the circumstances. For example, if a building previously housing 20% of Rackspace’s work force is destroyed, the Employment Commitment would be proportionately reduced until such time as that building is rebuilt. Rackspace may count employees of a subtenant or Related Organization that are located on a fulltime basis on the Leased Property as if they were Rackspace employees (including the median salary calculations) for purposes of the Employment Commitment. |

| (c) | Cure Period and Declaration of Default. During the Exemption Period the County may declare a default if Rackspace fails to comply with any of the conditions set forth in Sections 5.6(a) or 5.6(b) (but only below the 50% requirement) of this Agreement. Should County determine that Rackspace is in default under any of the terms set forth in Sections 5.6(a) or 5.6(b) (but only below the 50% requirement) of this Agreement, the County will notify Rackspace in writing, and if said default is not cured within sixty (60) calendar days from the date of such notice (hereinafter the “Cure Period”), then the County shall have the right to terminate this Agreement upon ten (l0) calendar days prior written notice. The County shall have the option, to be exercised reasonably and in good faith, to extend the Cure Period if Rackspace commences to cure said default within the Cure Period and Rackspace is diligently pursuing such cure. If this Agreement is terminated as a result of a default described under this Section 5.6(c), the County shall have the right to recapture by PILOT payment from Rackspace all Grants previously made under this Agreement and said PILOT payment shall be paid to the County within ninety (90) calendar days of the date Rackspace receives said written notification of recapture. |

| (d) | Recapture Beyond the Term. If Rackspace relocates or there is a Cessation of Business Activities at the Leased Property (other than as a result of a Force Majeure) during the last four (4) years of the Exemption Period and the one (1) year period after the Exemption Period, then the County shall also have the right to recapture (by PILOT payment, if necessary) from Rackspace the percentage of all previous Grants shown below: |

| 11th year of Exemption Period | 100 | % | |

| 12th year of Exemption Period | 80 | % | |

| 13th year of Exemption Period | 60 | % | |

| 14th year of Exemption Period | 40 | % | |

| 15th year after Exemption Period | 20 | % |

- 10 -

| (e) | Additional Rights to Terminate. If during the Term (a) Rackspace allows its PILOT payment to become delinquent or there is a default; and (b) Rackspace does not cure such delinquency or default within sixty (60) calendar days following Rackspace’s receipt of written notice of such delinquency of default from the County, the County shall have the right to terminate this Agreement and all Grants previously made under this Agreement will be recaptured and paid to the County (by PILOT payment, if necessary) within ninety (90) calendar days of the date Rackspace receives said notice of termination and written notification of recapture. |

| (f) | Liquidated Damages. The Parties recognize, agree, and stipulate that the financial, civic, and social benefits to the County from the presence of Rackspace on the Leased Property are great, but that the precise value of those benefits is difficult to quantify due to the number of citizens and businesses that rely upon and benefit from the presence of Rackspace on the Leased Property. Accordingly, the magnitude of the damages that would result from a violation of this Section 5.6 would be very significant in size but difficult to quantify including, without limitation, damages to the reputation and finances of the County. Therefore, the Parties agrees that in the event of a violation of this Section 5.6 including, without limitation, any such breach arising pursuant to the provisions of section 365(g) of the United States Bankruptcy Code or similar provision of any successor thereto, the County will be entitled to recover from Rackspace the recaptured Grants provided for in this Section 5.6, which are stipulated to be reasonable estimated damages in the event of a violation of Section 5.6 hereof, as reasonable liquidated damages and not as a penalty. The Parties hereby acknowledge that they have negotiated the above amounts in an attempt to make a good faith effort in qualifying the amount of damages due to a violation of Section 5.6 hereof despite the difficulty in making such determination. Accordingly, in the event the County collects the above referenced liquidated damages then the County hereby waives any right to collect additional monetary damages (other than legal fees and expenses) including lost or prospective profits, or for any other special, indirect, incidental, consequential, exemplary, or punitive damages. |

| (g) | Other Remedies Available. Subject to the preceding paragraph, the County shall have the right to take appropriate action to which it may be entitled, at law or in equity, against Rackspace, in addition to termination and/or recapture as described in this Agreement, in order to recover any recapture of Grants that the County is entitled to receive pursuant to this Agreement. |

- 11 -

5.8 Audits. Rackspace shall cause its outside auditing firm to calculate the number of employees meeting the Employment commitment and the median salary of such employees as of December 31 or each year and shall certify such numbers to the County. The County shall, at its expense, have the right to cause its auditor to audit Rackspace’s and any other entities’ books and records which make up part of the calculation of the Employment Commitment, and for the sole purpose of calculating the Employment Commitment.

ARTICLE VI

TERMINATION

6.1 Termination. In addition to the recapture and termination rights contained in Section 5.6, this Agreement shall terminate upon the occurrence of any one or more of the following:

| (a) | the Expiration Date; |

| (b) | the execution by all Parties of a written agreement terminating this Agreement; |

| (c) | at the option of a Party in the event the other Party breaches any of the terms or conditions of this Agreement and such breach is not cured within thirty (30) days after written notice thereof, or, if such breach is not susceptible of cure within 30 days, such period of time thereafter as the breaching party diligently pursues the cure thereof, but in any event if such breach is not cured within one hundred eighty (180) days after written notice thereof; |

| (d) | at the option of County, if Rackspace suffers an Event of Bankruptcy or Insolvency; |

| (e) | at the option of County, if any Ad Valorem Taxes owed to the County by Rackspace shall become delinquent (provided, however Rackspace retains the right to timely and properly protest and contest any such Ad Valorem Taxes); |

| (f) | any subsequent Federal or State legislation or any decision by a court of competent jurisdiction declares or renders this Agreement invalid, illegal or unenforceable. |

6.2 Repayment of the Grant(s). In the event the Agreement is terminated by the County pursuant to Section 6.l(c) because Rackspace has failed to indemnify the County pursuant to Article VII of this Agreement, then Rackspace shall immediately refund to the County an amount equal to the sum of all annual Grants paid by the County to Rackspace immediately proceeding the date of such termination, plus, interest at the rate periodically announced by the Wall Street Journal as the prime or base commercial lending rate, or if the Wall Street Journal shall ever cease to exist or cease to announce a prime or base lending rate,

- 12 -

then at the annual rate of interest from time to time announced by Citibank, N.A. (or by any other New York money center bank selected by the County) as its prime or base commercial lending rate, from the date of termination until paid.

ARTICLE VII

INDEMNIFICATION, ATTORNEYS FEES, & OTHER REMEDIES

7.1 RACKSPACE COVENANTS AND AGREES TO FULLY INDEMNIFY AND HOLD HARMLESS THE COUNTY AND THE ELECTED OFFICIALS, EMPLOYEES, OFFICERS, DIRECTORS, VOLUNTEERS AND REPRESENTATIVES OF THE COUNTY, INDIVIDUALLY OR COLLECTIVELY, FROM AND AGAINST ANY AND ALL COSTS, CLAIMS, LIENS, DAMAGES, LOSSES, EXPENSES, FEES, FINES, PENALTIES, PROCEEDINGS, ACTIONS, DEMANDS, CAUSES OF ACTION, LIABILITY AND SUITS OF ANY KIND AND NATURE, INCLUDING BUT NOT LIMITED TO, PERSONAL OR BODILY INJURY, DEATH AND PROPERTY DAMAGE, MADE UPON THE COUNTY, DIRECTLY OR INDIRECTLY ARISING OUT OF, RESULTING FROM OR RELATED TO RACKSPACE’S ACTIVITIES UNDER THIS AGREEMENT, INCLUDING ANY ACTS OR OMISSIONS OF RACKSPACE, ANY AGENT, OFFICER, DIRECTOR, REPRESENTATIVE, EMPLOYEE, CONSULTANT, CONTRACTOR OR SUBCONTRACTOR OF RACKSPACE, AND THEIR RESPECTIVE OFFICERS, AGENTS, EMPLOYEES, DIRECTORS AND REPRESENTATIVES WHILE IN THE EXERCISE OR PERFORMANCE OF THE RIGHTS OR DUTIES UNDER THIS AGREEMENT, ALL WITHOUT, HOWEVER, WAIVING ANY GOVERNMENTAL IMMUNITY AVAILABLE TO THE COUNTY UNDER TEXAS LAW AND WITHOUT WAIVING ANY DEFENSES OF THE PARTIES UNDER TEXAS LAW. THE PROVISIONS OF THIS INDEMNIFICATION ARE SOLELY FOR THE BENEFIT OF THE COUNTY AND NOT INTENDED TO CREATE OR GRANT ANY RIGHTS, CONTRACTUAL OR OTHERWISE, TO ANY OTHER PERSON OR ENTITY. RACKSPACE SHALL PROMPTLY ADVISE THE COUNTY IN WRITING OF ANY CLAIM OR DEMAND AGAINST THE COUNTY OR RACKSPACE KNOWN TO RACKSPACE RELATED TO OR ARISING OUT OF RACKSPACE’S ACTIVITIES UNDER THIS AGREEMENT AND SHALL SEE TO THE INVESTIGATION AND DEFENSE OF SUCH CLAIM OR DEMAND AT RACKSPACE’S COST. THE COUNTY SHALL HAVE THE RIGHT, AT ITS OPTION AND AT ITS OWN EXPENSE, TO PARTICIPATE IN SUCH DEFENSE WITHOUT RELIEVING RACKSPACE OF ANY OF ITS OBLIGATIONS UNDER THIS PARAGRAPH. RACKSPACE FURTHER AGREES TO DEFEND, AT ITS OWN EXPENSE AND ON BEHALF OF THE COUNTY AND IN THE NAME OF THE COUNTY, ANY CLAIM OR LITIGATION BROUGHT AGAINST THE COUNTY AND ITS ELECTED OFFICIALS, EMPLOYEES, OFFICERS, DIRECTORS AND REPRESENTATIVES, IN CONNECTION WITH ANY SUCH INJURY, DEATH, OR DAMAGE FOR WHICH THIS INDEMNITY SHALL APPLY, AS SET FORTH ABOVE.

- 13 -

RACKSPACE’S OBLIGATIONS UNDER THIS SUBSECTION SHALL SURVIVE THE TERMINATION OF THIS AGREEMENT.

7.2 Independent Contractor. It is expressly understood and agreed that Rackspace is and shall be deemed to be an independent contractor and operator responsible to the County for its respective acts or omissions and that the County shall in no way be responsible therefore.

7.3 Attorney Fees and Expenses. In the event that Rackspace should default under any of the provisions of this Agreement and the County should employ attorneys or incur other expenses for the collection of the payments due under this Agreement or the enforcement of performance or observance of any obligation or agreement on the part of Rackspace herein contained, Rackspace agrees to pay to the County reasonable fees of such attorneys and such other expenses so incurred by the County.

7.4 Non Waiver of Remedies. No remedy herein conferred upon or reserved to the County is intended to be exclusive of any other available remedy or remedies, but each and every such remedy shall be cumulative and shall be in addition to every other remedy given under this Agreement or now or hereafter existing at law or in equity or by statute.

7.5 Waiver of Consequential Damages. Rackspace waives all present and future claims for consequential damages against County and the appointed or elected officials, members, agents, employees, officers, directors and representatives of County arising from or related to this Agreement, and such waiver shall survive any termination of this Agreement.

7.6 Release of Existing Claims. Rackspace hereby releases any and all presently existing claims of every kind or character which Rackspace has or may have under or pursuant to this Agreement against County its appointed or elected officials, members, agents, employees, officers, directors and representatives, individually and collectively.

ARTICLE VIII

MISCELLANEOUS

8.1 Binding Agreement; Assignment. The terms and conditions of this Agreement are binding upon the successors and permitted assigns of the Parties hereto. This Agreement may not be assigned by Rackspace without the prior written consent of the County.

8.2 Limitation on Liability. It is understood and agreed among the parties that Rackspace and the County, in satisfying the conditions of this Agreement, have acted independently, and assume no responsibilities or liabilities to third parties in connection with these actions.

8.3 No Joint Venture. It is acknowledged and agreed by the Parties that the terms hereof are not intended to and shall not be deemed to create a partnership or joint venture among the Parties.

- 14 -

8.4 Notice. Any notice required or permitted to be delivered hereunder shall be deemed received (i) three (3) days after deposit into the United States Mail, postage prepaid, certified mail, return receipt requested, addressed to the Party at the address set forth below or (ii) on the day actually received if sent by courier or otherwise hand delivered.

| RACKSPACE | RACKSPACE US, INC. | |

| Xx. Xxxx Xxxxxxxxxx | ||

| General Counsel | ||

| 0000 Xxxxxxxxx Xxxxx, Xxxxx 000 | ||

| Xxx Xxxxxxx, Xxxxx 00000 | ||

| Fax: (000) 000-0000 | ||

| With a copy to: | Xxxxxxx & Xxxxxx, Xxxxxx, Xxxxx LLP | |

| 000 Xxxxxxx Xxxxxx, Xxxxx 0000 | ||

| Xxx Xxxxxxx, Xxxxx 00000 | ||

| Attn: Xxxxxxx X. Xxxxxx | ||

| County | Bexar County Courthouse | |

| 100 Dolorosa, Suite 1.20 | ||

| Xxx Xxxxxxx, Xxxxx 00000 | ||

| Attn: County Judge | ||

| With a copy to: | Bexar County District Attorney’s Office | |

| Bexar County Justice Center | ||

| 000 Xxxxxxxx | ||

| Xxx Xxxxxxx, Xxxxx 00000 | ||

| Attn: Civil Section |

8.5 Conflict. If there is any conflict between this Agreement and the Master Agreement, the terms of this Agreement shall control.

8.6 Governing Law. This Agreement shall be governed by the laws of the State of Texas; and venue for any action concerning this Agreement shall be exclusively in the State District Court of Bexar County, Texas. The Parties agree to submit to the jurisdiction of said courts.

8.7 Amendment. This Agreement may only be amended by a written agreement executed by the Parties.

8.8 Legal Construction. In the event anyone or more of the provisions contained in this Agreement shall for any reason be held to be invalid, illegal, or unenforceable in any respect, such invalidity, illegality, or unenforceability shall not affect other provisions, and it is the intention of the Parties to this Agreement that in lieu of each provision that is found to be illegal, invalid, or unenforceable, a provision shall be added to this Agreement which is legal, valid and enforceable and is as similar in terms as possible to the provision found to be illegal, invalid or unenforceable.

- 15 -

8.9 Captions. All descriptive headings and captions herein are inserted for convenience only and shall not be considered in interpreting or construing this Agreement.

8.10 Exhibits. The exhibits to this Agreement are incorporated herein by reference for all purposes wherever reference is made to the same.

8.11 Survival of Covenants. Any of the representations, warranties, covenants, and obligations of the Parties, as well as any rights and benefits of the Parties, pertaining to a period of time following the termination of this Agreement (specifically including, but without limitation, Sections 5.6, 5.7(d), and 7.1 of this Agreement) shall survive termination.

8.12 Counterparts. This Agreement may be executed in counterparts. Each of the counterparts shall be deemed an original instrument, but all of the counterparts shall constitute one and the same instrument.

8.13 Force Majeure. “Force Majeure” means the occurrence of any of the following events that results in the impossibility of performance: war, domestic terrorist acts, riots, strikes, embargoes, acts of God, earthquakes, fires, hurricanes, tornadoes, floods, wash outs, and unusually severe weather, interruption or unavailability of utilities, or due to failure of performance by suppliers.

8.14 Assignment. This Agreement is not assignable without consent of the City of Windcrest or the County except to a Related Organization.

[Signatures and acknowledgments of Parties on following pages]

- 16 -

IN WITNESS WHEREOF, this Agreement is EXECUTED in multiple originals effective this 24th day of July, 2007.

| COUNTY OF BEXAR | ||

| By: | /s/ Xxxxxx X. Xxxxx | |

| XXXXXX X. XXXXX, | ||

| County Judge | ||

| 7/24/07 |

| ATTEST: |

| /s/ Xxxxxx Xxxxxxxx |

| XXXXXX XXXXXXXX |

| County Clerk |

| APPROVED AS TO LEGAL FORM: | ||

| XXXXX X. XXXX | ||

| Criminal District Attorney | ||

| Bexar County, Texas | ||

| By: | /s/ Xxxxx Xxxxxxxx | |

| Xxxxx Xxxxxxxx, | ||

| Assistant Criminal District Attorney | ||

| Civil Section |

| APPROVED AS TO FINANCIAL CONTENT: |

| /s/ Xxxxx X. Xxxxxxxx |

| XXXXX X. XXXXXXXX, |

| County Auditor |

| /s/ Xxxxx Xxxxx |

| XXXXX XXXXX, |

| Executive Director of Planning/Budget Officer |

| Planning and Resource Management Dept. |

S-1

| APPROVED: |

| /s/ Xxxxx Xxxxxxx |

| XXXXX XXXXXXX, |

| Executive Director of Economic Development |

S-2

EXECUTED in multiple originals as of the Effective Date.

| RACKSPACE US, INC. | ||

| By: | /s/ Xxxxxx Xxxxxx | |

| Name: | Xxxxxx Xxxxxx | |

| Title: | Executive Chairman |

S-3

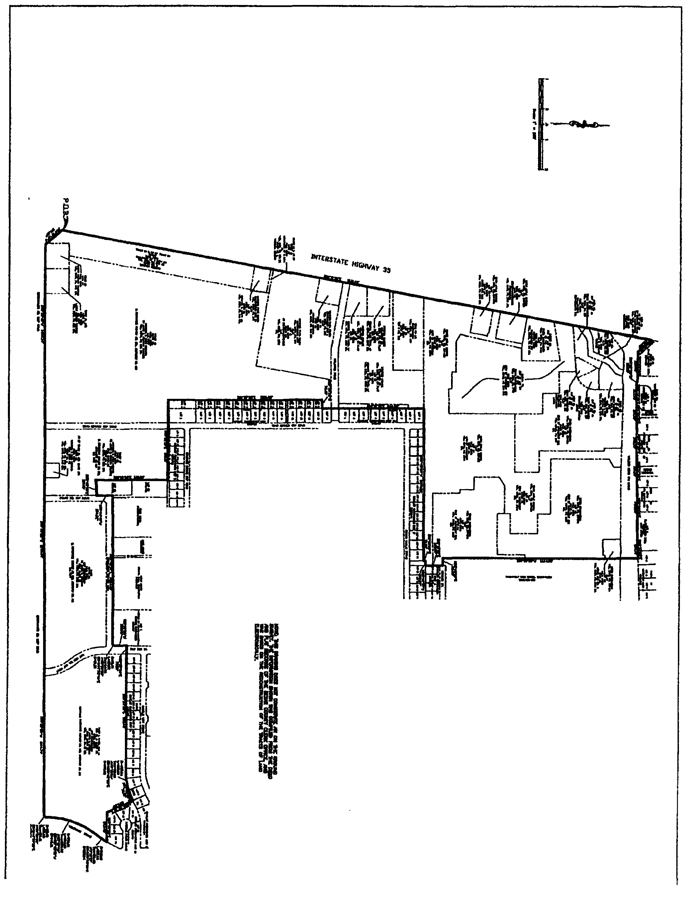

EXHIBIT “A”

Annexed Area

A-1

Date: 05/22/07

Job No. 07031

229.131 acres

City of Windcrest

Annexation Boundary

LEGAL DESCRIPTION OF 229.131 ACRES OF LAND DESCRIBING 229.131 ACRES OF LAND, MORE OR LESS, SITUATED IN THE XXXXXXXX XXXXXXXXX SURVEY XX. 000, XXXXXXXX XX. 000, XXXXX XXXXXX, XXXXX, CONSISTING OF THE FOLLOWING TRACTS OF LAND AS DESCRIBED IN THE BEXAR COUNTY CLERK’S OFFICE AND REFERENCED IN BEXAR COUNTY APPRAISAL DISTRICT: A 21.846 ACRE TRACT OF LAND, DESCRIBED IN VOLUME 6060, PAGE 12 OFFICIAL PUBLIC RECORDS OF SAID COUNTY, KNOWN AS P-10B, 5.16 ACRES & P-10C, 16.667 ACRES, XXX 00 N.C.B 15783, NFP PARTNERSHIP, ACCORDING TO SAID APPRAISAL DISTRICT, A 16.285 ACRE TRACT OF LAND, DESCRIBED IN VOLUME 6290, PAGE 1126 OFFICIAL PUBLIC RECORDS OF SAID COUNTY, KNOWN AS P-10C, 15.724 ACRES, N.C.B. 15821, XXXXX X. XXXXXXX TRUSTEE FOR NFP PARTNERSHIP, ACCORDING TO SAID APPRAISAL DISTRICT, A 16.285 ACRE TRACT OF LAND, TRACT NO.4 DESCRIBED IN VOLUME 8017, PAGE 508, OFFICIAL PUBLIC RECORDS OF SAID COUNTY, KNOWN AS XXXXX 00, X.X.X. 00000, 9.415 ACRES, VIRGINIA & XXXX XXXXXXX, ACCORDING TO SAID APPRAISAL DISTRICT, A 0.3587 ACRE TRACT OF LAND, DESCRIBED IN VOLUME 6039, PAGE 545, OFFICIAL PUBLIC RECORDS OF SAID COUNTY, KNOWN AS PT. OF XXXXX 00 XXX XXXXX 00X, X.X.X. 00000, 0.273 ACRE, VIRGINIA & XXXX XXXXXXX, ACCORDING TO SAID APPRAISAL DISTRICT, A 62.411 ACRE TRACT OF LAND DESCRIBED IN VOLUME 6697, PAGE 546, OFFICIAL PUBLIC RECORDS OF SAID COUNTY, KNOWN AS PART OF TRACT 13, N.C.B. 121.90, 51.353 ACRES, XXXXX .X. XXXXXXX, ACCORDING TO SAID APPRAISAL DISTRICT, ALSO KNOWN AS XXXXX 00X, X.X.X. 00000, 2.262 ACRES, VIRGlNIA & XXXX XXXXXXX, ACCORDING TO SAID APPRAISAL DISTRICT, A 0.995 ACRE TRACT OF LAND, DESCRIBED IN VOLUME 5555, PAGE 586, OFFICIAL PUBLIC RECORDS OF SAID COUNTY, KNOWN AS XXXXX 00, X.X.X. 00000, 1.0 ACRE, XXXXX XXXXXXX TRUSTEE, ACCORDING TO SAID APPRAISAL DISTRICT, A 0.881 ACRE TRACT OF LAND, DESCRIBED IN VOLUME 5555, PAGE 578, OFFICIAL PUBLIC RECORDS OF SAID COUNTY, KNOWN AS XXXXX 00, X.X.X. 00000, 0.826 ACRE, XXXXX XXXXXXX TRUSTEE, ACCORDING TO SAID APPRAISAL DISTRICT, A 10.74 ACRE TRACT OF LAND, TRACT NO.2 DESCRIBED IN VOLUME 8017, PAGE 508 DEED RECORDS OF SAID COUNTY, KNOWN AS XXXXX 00 & XXXX XX XXXXX 00, X.X.X. 00000, 7.25 ACRES, XXXXXXXX XXXXXXX, ACCORDING TO SAID APPRAISAL DISTRICT, A 0.659 ACRE TRACT OF LAND, CONVEYED TO XXXXXXX X. SIFT JR., DESCRIBED IN VOLUME 7262, PAGE 240 OFFICIAL PUBLIC RECORDS OF SAID COUNTY, BEING XXX 00, X.X.X.00000, XXXXXXX XXXX XXXXX SUBDIVISION UNIT 1A, RECORDED IN VOLUME 9537, PAGE 203 PLAT RECORDS OF SAID COUNTY,

1 of 6

A 0.09 ACRE TRACT OF LAND OUT OF THE ABOVE MENTIONED 10.74 ACRE TRACT OF LAND, KNOWN AS PART OF XXXXX 00, X.X.X. 00000, 0.09 ACRE, XXXXXXXX XXXXXXX, ACCORDING TO SAID APPRAISAL DISTRICT, A 11.547 ACRE TRACT OF LAND, CONTAINING A 10.470 ACRE TRACT, LOT 41, AND A 0.917 ACRE TRACT, XXX 00, XX XXX XXXXXXX XXXX XXXXX SUBDIVISION UNIT 1 RECORDED IN VOLUME 9525, PAGE 170 PLAT RECORDS OF SAID COUNTY, (LOT 41, N.C.B. 12190, CONVEYED TO AT HOLDING-NOVEMBER, LLC., 10.47 ACRES, DESCRIBED IN VOLUME 10172, PAGE 1968, OFFICIAL PUBLIC RECORDS OF SAID COUNTY), (LOT 40, N.C.B. 12190, XXXXXXXX XXXXXXX, VOLUME 6697, PAGE 538 DEED RECORDS OF SAID COUNTY), A 11.5178 ACRE TRACT OF LAND, CONTAINING A 1.0000 ACRE TRACT-LOT 47, A 1.0000 ACRE TRACT-LOT 48, A 9.5178 ACRE XXXXX-XXX 00, X.X.X. 00000 OF THE WINDSOR SQUARE WAL-MART III RECORDED IN VOLUME 9560, PAGE 80 PLAT RECORDS OF SAID COUNTY, (LOTS 47, 48,49, CONVEYED TO GIGANTE FLEA MARKET LP, DESCRIBED IN VOLUME 11001, PAGE 1363 OFFICIAL PUBLIC RECORDS OF SAID COUNTY), A 3.753 ACRE TRACT OF LAND, BEING XXX 00 X.X.X. 00000, OF THE TOY R US SUBDIVISION RECORDED IN VOLUME 9520, PAGE 187 PLAT RECORDS OF SAID COUNTY, KNOWN AS XXX 00 X.X.X. 00000, 3.753 ACRES, TOYS “R” US INC, ACCORDING TO SAID APPRAISAL DISTRICT, A 24.313 ACRE TRACT OF LAND CONVEYED TO THE CITY OF WINDCREST EDC, DESCRIBED IN VOLUME 12721, PAGE 2244 OFFICIAL PUBLIC RECORDS OF SAID COUNTY, BEING LOT 44, OF THE SIMON APPLE GARDEN RECORDED IN VOLUME 9551, PAGES 187-188 PLAT RECORDS OF SAID COUNTY, A 0.777 ACRE TRACT OF LAND CONVEYED TO MONTE MAC NO. 2 DESCRIBED IN VOLUME 8630, PAGE 1604 OFFICIAL PUBLIC RECORDS OF SAID COUNTY, BEING LOT 45 OF THE SIMON APPLE GARDEN RECORDED IN VOLUME 9551, PAGE 188 PLAT RECORDS OF SAID COUNTY, A 1188 ACRE TRACT OF LAND, CONVEYED TO DlCKER-XXXXXXXXXX PROPERTIES, DESCRIBED IN VOLUME 8630, PAGE 1600 OFFICIAL RECORDS OF SAID COUNTY, BEING XXX 00, X.X.X. 00000, OF THE SIMON APPLE GARDEN VOLUME 9551, PAGE 188 PLAT RECORDS OF SAID COUNTY, A 2.6424 ACRE TRACT OF LAND, CONVEYED TO HUNTER ROAD PROPERTIES INC., DESCRIBED IN VOLUME 10005, PAGE 100 OFFICIAL PUBLIC RECORDS OF SAID COUNTY, BEING OUT OF LOT 24 OF THE SIMON SUBDIVISION RECORDED IN VOLUME 7800, PAGE 9-13 PLAT RECORDS OF SAID COUNTY, A 11.5384 ACRE TRACT OF LAND, CONVEYED TO THE CITY OF WINDCREST EDC, DESCRIBED IN VOLUME 12703, PAGE 299 OFFICIAL PUBLIC RECORDS OF SAID COUNTY, BEING OUT OF XXX 00, X.X.X. 00000, OF THE SIMON SUBDIVISION RECORDED IN VOLUME 7800, PAGE 9-13 PLAT RECORDS OF SAID COUNTY, ALL OF THAT RESUBDlVlSION PLAT OF SIMON SUBDIVISION RECORDED IN VOLUME 7800, PAGE 187, CONTAINING XXX 00, X 00 XXXX XXXXXXXX EASEMENT, AND LOT 30, A 11.088 ACRE TRACT OF LAND, CONVEYED TO THE CITY OF WINDCREST EDC, DESCRIBED IN VOLUME 12639, PAGE 597 OFFICIAL PUBLIC RECORDS OF SAID COUNTY, BEING XXX 00, X.X.X. 00000, SIMON SUBDIVISION RECORDED IN VOLUME 9522, PAGE 105-106 PLAT RECORDS OF SAID COUNTY,

2 of 6

A 13.745 ACRE TRACT OF LAND, CONVEYED TO THE CITY OF WINDCREST EDC, DESCRIBED IN VOLUME 12639, PAGE 1596 OFFICIAL PUBLIC RECORDS OF SAID COUNTY, BEING XXX 00, X.X.X. 00000, SIMON SUBDIVISION RECORDED IN VOLUME 9522, PAGE 105-106 PLAT RECORDS OF SAID COUNTY, A 0.544 ACRE TRACT OF LAND, CONVEYED TO MONTE MAC NO. 2 DESCRIBED IN VOLUME 8630, PAGE 1604 OFFICIAL PUBLIC RECORDS OF SAID COUNTY, BEING XXX 00, X.X.X. 00000, OF THE SIMON SUBDIVISION RECORDED IN VOLUME 9522, PAGE 108 PLAT RECORDS OF SAID COUNTY, A 8.093 ACRE TRACT OF LAND, CONVEYED TO THE CITY OF WINDCREST EDC, DESCRIBED IN VOLUME 12639, PAGE 1569 OFFICIAL RECORDS OF SAID COUNTY, BEING XXX 00, X.X.X. 00000 OF THE SIMON SUBDIVISION RECORDED IN VOLUME 9522, PAGE 108 PLAT RECORDS OF SAID COUNTY, TOGETHER WITH THE ABOVE MENTIONED TRACTS OF LAND THE FOLLOWING ROADS ARE TO BE INCLUDED IN THIS DESCRIPTION-XXXXXX DRIVE APPROXIMATELY 750.466 LINEAR FEET NORTH OF XXXXXXXXXX ROAD, EXCALIBUR APPROXIMATELY 1257.073 LINEAR FEET WEST OF XXXXXX ROAD, XXXXX ROAD APPROXIMATELY 562.442 LINEAR FEET NORTH OF XXXXXXXXXX ROAD, XXXX XXXXXX APPROXIMATELY 1053.031 LINEAR FEET XXXXX XX XXXXXXXXXX XXXX, XXXXXXX XXXX 0000.000 LINEAR FEET XXXX XX XXXXXXXXXX XXXXXXX 00, XXXXXX XXXX 1858.845 LINEAR FEET XXXX XX XXXXXXXXXX XXXXXXX 00, BEING MORE PARTICULARY DESCRIBED AS FOLLOWS:

BEGINNING at a point on the East right-of-way line of Interstate Highway 35 & the northeast cut back of Xxxxxxxxxx Road for the southwest corner of said 10.74 acre tract;

THENCE along the East right-of-way line of Interstate Highway 35 N10°11’06”E, a distance of 5111.43 feet to a point for northern most corner of this tract herein described and being the northeast cut back of Walzem Road, for the southwest corner of K-JO Subdivision recorded in Volume 9570, Page 186 Plat Records of said county;

THENCE along the north right-of-way line of Walzem Road (Variable Width) and including approximately 1858.845 Linear Feet of said road east of Interstate Highway 35 the following calls: S39°55’03”E, a distance of 151.56 feet, S89°49’16”E., a distance of 239.02 feet, S69°27’56”E, a distance of 29.38 feet, S89°57’19”E, a distance of 167.90 feet, N89°13’31“E, a distance of I51.98 feet, N89°15’33”E, a distance of 343.97 feet, N89°17’24”E, a distance of 136.00 feet, N89°14’22”E, a distance of 496.88 feet, N88°17’25”E, a distance of 166.71 feet to a point for the northeast corner of this tract herein described and being in the south line of Xxx 0, Xxxxx 00 xx xxx Xxxxxxxxx Xxxx 00 recorded in Volume 6200, Page 212 Plat Records of said county;

THENCE crossing Walzem Road in a southwesterly direction with the common line of Roosevelt High School Subdivision recorded in Volume 9566, Page 132-133 Plat Records of said county and said Xxxx 00, 00, 00 xx xxx Xxxxx Xxxxxxxxxxx X00x00’23”W, a distance of 1664.95 feet to a point for an interior corner of this tract herein described;

3 of 6

THENCE N89°48’06”E, a distance of 63.83 feet to a point for a corner of this tract herein described;

THENCE in a southeasterly direction along the common line of Camelot Subdivision Unit 4 recorded in Volume 6500, Page 191 Plat Records of said county, and said Lot 37, of the Simon Subdivision, Lot 44, of said Simon Apple Subdivision, S00°l0’06”E, a distance of 149.97 feet to a point in the south line of said Camelot Subdivision Unit 4;

THENCE S89°41’15”W, a distance of 39.97 feet to a point for an interior corner of this tract herein described;

THENCE S00°03’37”E, a distance of 15.94 feet to a point of for a corner of this tract herein described;

THENCE in a westerly direction along the common line of said Lot 44, of the Simon Apple Garden, and Camelot Subdivision Unit 7 recorded in Volume 6500, Page 144 Plat Records of said county S89°45’28”W, a distance of 1281.92 feet to a point for an interior corner of this tract herein described and being northwest corner of Camelot Subdivision Xxxx 0X recorded in Volume 6500, Page 16 Plat Records of said county;

THENCE in a southeasterly direction S00°17’10”E, a distance of 864.82 feet along east line of said Windsor Square Wal-Mart III and the west line of said Camelot Subdivision Xxxx 0X to the southwest corner of Xxx 00, Xxxxx 0, for a corner of this tract herein described;

THENCE S89°50’34”W, a distance of 75.00 feet to a point for an interior corner of this tract herein described and being the northwest corner of a called 0.126 acre tract described in Volume 1916, Page 130 Official Public Records of said county;

THENCE crossing the remaining portion of said 64.411 acre tract, and being the west line of the following tracts of land: 0.126 acre tract previously mentioned, a 0.126 acre tract recorded in Volume 9196, Page 210, a 0.126 acre tract recorded in Volume 11455, Page 583, a 0.126 acre tract recorded in Volume 9196, Page 194, a 0.127 acre tract recorded in Volume 9196, Page 186, a 0.131 acre tract recorded in Volume 9196, Page 178, a 0.131 acre tract recorded in Volume 9196, Page 162, a 0.131 acre tract recorded in volume 9196, Page 170, a 0.131 acre tract recorded in Volume 9196, Page 154, a 0.131 acre tract recorded in Volume 9196, Page 146, a 0.131 acre tract recorded in Volume 9196, Page 138, a 0.147 acre tract recorded in Volume 9196, Page 122, a 0.147 acre tract recorded in Volume 10724, Page 709, a 0.398 acre tract and a 0.138 acre tract recorded in Volume 9388, Page 2016, S00°07’38”E, a distance of 13115.48 feet to a point for an interior corner of this tract herein described and being the southwest corner of said 0.398 acre tract Official Public Records of said county;

THENCE in a southeasterly direction continuing across said 64.411 acre tract and the north line of said 16.285 acre tract S89°51’18”E, a distance of 681.11 feet to a point for a corner of this tract herein described;

4 of 6

THENCE in a southeasterly direction along the common line of said 16.285 acre tract and the west line of Xxx 00 & Xxx 00 xx xxx Xxxxxxxxxx Xxxxxx Subdivision recorded in Volume 9515, Page 50 Plat Records of said county, S00° 12’30”E, a distance of 600.00 feet to a point for an interior corner of this tract herein described;

THENCE in a easterly direction along south line of said Xxx 00 xx xxx Xxxxxxxxxx Xxxxxx Xxxxxxxxxxx X00x00’30”E, a distance of 130.00 feet to a point for a corner of this tract herein described in the west right-of-way line of Xxxxx Road (50’-55’ R.O.W.);

THENCE in a northerly direction along the east line of above mentioned Xxx 00, X00x00’00”X, a distance of 134.32 to a point for the intersection of the west line of Xxxxx Road and the north line of Excalibur;

THENCE in a northeasterly direction along the north right-of-way line of Excalibur (50’-55’ R.O.W.) and along the south line of the following tracts: a 3.131 acre tract of land recorded in Volume 12629, Page 1456, a 1.680 acre tract recorded in Volume 10249, Page 841, a 4.947 acre tract recorded in Volume 7442, Page 1598 Official Public records of said county, a 2.783 acre tract known as Lot 2 of the Gospel Hall Subdivision recorded in Volume 9558, Page 182 Plat Records of said county, a 2.7225 acre tract known as Lot 1 of the Prince of Peace Lutheran Church Subdivision recorded in Volume 6200, Page 37 Plat Records of said county, N89°46’19”E, a distance of 1257.25 feet to a point and the beginning of a curve to the left;

THENCE 23.52 feet along the arc of said curve to the left, having a radius of 15.00 feet, a central angle of 89°50’23”, whose chord bears N44°52’46”E, a distance of 21.18 feet to a point;

THENCE N00o02”26”W, a distance of 108.96 feet to a point on the east line of said Lot 1 of the Prince of Peace Lutheran Church Subdivision and the west line of Ray Bon (60’ R.O.W.), for a corner of this tract herein described;

THENCE crossing said Ray Bon Drive N89°57’34”E, a distance of 72.57 feet to a point and being the northwest corner of said 21.846 acre tract;

THENCE in a northeasterly direction along the north line of said 21.846 acre tract and the south line of Camelot Subdivision Xxxx 00 recorded in Volume 5970, Page 27 Plat Records of said county, and Camelot Subdivision Unit 8 recorded in Volume 5870, Page 23-24 Plat Records of said county, N89°54‘30”E, a distance of 990.40 feet to a point for the beginning of a curve to the left;

THENCE 189.20 feet along the arc of said curve to the left, having a radius of 487.84 feet, a central angle of 22°13’16”, whose chord bears N78°47’52”E, a distance of 188.02 feet to a point for an angle point and being the northeast corner of said 21.846 acre tract and the northwest corner of Camelot Subdivision Unit 13 recorded in Volume 6100, Page 49 Plat Records of said county;

5 of 6

THENCE in a southeasterly direction along the common line of said 21.846 acre tract and said Xxxxxxx Xxxxxxxxxxx Xxxx 00, X00x00’06”E, a distance of 239.55 feet to a point for an angle point;

THENCE along the south line of said Xxxxxxx Xxxxxxxxxxx Xxxx 00, X00x00’55”E, a distance of 247.43 feet to a point for the beginning of a curve to the right on the west right-of-way line of Midcrown Drive;

THENCE along the east line of said 21.846 acre tract and the west line of Midcrown Drive the following three curves: 112.66 feet along the arc of said curve to the right, having a radius of 700.00 feet a central angle of 09°13‘17”, whose chord bears S33°59’31”W, a distance of 112.54 feet to a point for the beginning of a reverse curve to the left, and continuing along said curve to the left with a arc length of 454.03 feet, a radius of 700.00 feet, a central angle of 37°09’46”, whose chord bears S17°48’51” W, a distance of 446.11 feet to a point for the beginning of a reverse curve to the right, and continuing along said curve to the right with a arc length of 39.68 feet, a radius of 25.00 feet, a central angle of 90°56’02”, whose chord bears S44°09’52’W, a distance of 35.64 feet to a point on the north right-of-way line of Xxxxxxxxxx Road;

THENCE along the north right-of-way line of Xxxxxxxxxx Road and the south line of said 21.846 acre tract, said 16.285 acre tract, said 0.358 acre tract, said 16.285 acre tract, said 62.411 acre tract, said 0.995 acre tract, said 0.881 acre tract, said 10.74 acre tract, the following calls;

S89°37’59’W, a distance of 1144.74 feet to a point;

S89°44’25”W, a distance of 2193.34 feet to a point;

S89°59’40”W, a distance of 1460.54 feet to a point;

N40°01” 16”W, a distance of 186.27 feet to the POINT OF BEGINNING and containing 229.131 acres of land more or less.

This description does not constitute an on the ground survey. The information referenced above was compiled from the Deed and Plat Records of the Bexar County Clerk Office, and was based on the reconstruction of said tracts of land electronically.

6 of 6