AMENDED TRUST DEED OF THE TLHAKANELO EMPLOYEE SHARE TRUST between HARMONY GOLD MINING COMPANY LIMITED and RIANA BISSCHOFF

Exhibit 4.55

EXECUTION – 5 March 2014

AMENDED TRUST DEED OF THE

TLHAKANELO EMPLOYEE SHARE TRUST

between

HARMONY GOLD MINING COMPANY LIMITED

and

RIANA BISSCHOFF

TABLE OF CONTENTS

| 1 |

PARTIES |

1 | ||||

| 2 |

INTERPRETATION |

1 | ||||

| PART I: THE TRUST |

10 | |||||

| 3 |

INTRODUCTION |

10 | ||||

| 4 |

PURPOSE |

10 | ||||

| 5 |

TRUST CONTRIBUTION |

11 | ||||

| 6 |

CREATION AND ADMINISTRATION OF THE TRUST |

11 | ||||

| 7 |

APPOINTMENT OF TRUSTEES |

12 | ||||

| 8 |

CESSATION OF OFFICE OF TRUSTEES |

13 | ||||

| 9 |

SUCCESSION |

14 | ||||

| 10 |

MEETINGS AND PROCEDURES OF TRUSTEES |

14 | ||||

| 11 |

POWERS OF THE TRUSTEES |

15 | ||||

| 12 |

DUTIES OF TRUSTEES |

17 | ||||

| 13 |

PRIVILEGES OF TRUSTEES |

19 | ||||

| 14 |

REMUNERATION OF TRUSTEES |

19 | ||||

| 15 |

INDEMNITY |

19 | ||||

| 16 |

TERMINATION OF TRUST |

20 | ||||

| PART II: PARTICIPATION |

20 | |||||

| 17 |

OBLIGATIONS OF THE PARTICIPANTS |

20 | ||||

| 18 |

ELIGIBILITY |

20 | ||||

| 19 |

OFFERS |

21 | ||||

| 20 |

ACCEPTANCE AND ALLOCATIONS |

23 | ||||

| 21 |

VESTING OF SCHEME SHARES AND SARS |

24 | ||||

| 22 |

RESTRICTIONS |

25 | ||||

| 23 |

DELIVERY OF SCHEME SHARES |

25 | ||||

| 24 |

DELIVERY OF ENTITLEMENT SHARES |

27 | ||||

| 25 |

TAX LIABILITY |

30 | ||||

| 26 |

VOTING RIGHTS |

31 | ||||

| 27 |

DISTRIBUTIONS |

32 | ||||

| 28 |

TERMINATION OF EMPLOYMENT |

32 | ||||

| 29 |

PAYMENTS OF AMOUNTS TO DEPENDANTS OF PARTICIPANTS |

35 | ||||

| 30 |

MEETINGS OF THE PARTICIPANTS |

35 | ||||

| PART III: REGULATORY MATTERS |

37 | |||||

| 31 |

SCHEME LIMITS |

37 | ||||

| 32 |

RECONSTRUCTION OR TAKEOVER |

37 | ||||

| 33 |

VARIATION IN SHARE CAPITAL |

38 | ||||

| 34 |

DISCLOSURE IN ANNUAL FINANCIAL STATEMENTS |

39 | ||||

| 35 |

AMENDMENTS TO THIS TRUST DEED |

39 | ||||

| PART IV: GENERAL |

40 | |||||

| 36 |

DISPUTE RESOLUTION AND DEADLOCKS |

40 | ||||

| 37 |

DOMICILIUM CITANDI ET EXECUTANDI |

40 | ||||

| 38 |

COSTS |

41 | ||||

| 39 |

GENERAL |

41 | ||||

| 40 |

SIGNATURE |

42 | ||||

| 1 | PARTIES |

| 1.1 | The Parties to this Trust Deed are – |

| 1.1.1 | Harmony Gold Mining Company Limited; and |

| 1.1.2 | Xxxxx Xxxxxxxxx. |

| 1.2 | The Parties agree as set out below. |

| 2 | INTERPRETATION |

| 2.1 | In this Trust Deed, unless the context indicates a contrary intention, the following words and expressions bear the meanings assigned to them and cognate expressions bear corresponding meanings – |

| 2.1.1 | “Act” means the Companies Act, No 71 of 2008; |

| 2.1.2 | “Additional Cash Bonus” means, in the event that the Share Price Appreciation is equal to or less than zero, and subject to the conditions contemplated in clause 24.7, a cash bonus by the Company to a Participant in respect of services rendered, in the amount of R18 (eighteen Rand) per SAR; |

| 2.1.3 | “Allocate” means, in relation to a Scheme Share, the act by the Company of issuing a Scheme Share to the Trustees as nominees of the Qualifying Employees, and, in relation to a SAR, the act by the Trustees of granting a SAR to a Qualifying Employee in accordance with the provisions of this Trust Deed, and “Allocated” and “Allocation” shall have a corresponding meaning; |

| 2.1.4 | “Allocation Date” means the date on which an Allocation is made to a Qualifying Employee in accordance with clause 20; |

| 2.1.5 | “Auditors” means the auditors for the time being of the Company; |

| 2.1.6 | “Bad Leaver” means a Participant, whose participation in the Scheme is terminated due to – |

| 2.1.6.1 | the Participant being lawfully dismissed or resigning from his employment with the Company; |

| 2.1.6.2 | there being grounds which would have justified a summary dismissal at law and the Trustees elect to rely on such grounds for the purposes of the Scheme; or |

1

| 2.1.6.3 | a Participant being in breach of any of the provisions of this Trust Deed and failing to remedy such breach within 7 (seven) days after being called upon in writing to do so by the Trustees; |

| 2.1.7 | “Board” means the board of directors for the time being of the Company or any committee thereof to or upon whom the powers of the directors in respect of this Scheme are delegated or are conferred in accordance with the Company’s memorandum of incorporation; |

| 2.1.8 | “Cash Bonus” means, in the event that the Share Price Appreciation is less than R18 (eighteen Rand) but more than zero, and subject to the conditions contemplated in clause 24.5, a cash bonus by the Company to a Participant in respect of services rendered, the amount of which shall be determined in accordance with clause 24.5; |

| 2.1.9 | “Commencement Date” means 15 March 2012; |

| 2.1.10 | “Company” means Harmony Gold Mining Company Limited, registration number 1950/038232/06, a limited liability public company duly incorporated in the Republic of South Africa; |

| 2.1.11 | “Control” means – |

| 2.1.11.1 | the holding of shares or the aggregate of holdings of shares or other securities in the Company entitling the holder thereof to exercise, or cause to be exercised, more than 50% (fifty percent) of the voting rights at shareholders meetings of a company irrespective of whether such holding or holdings confers de facto control; or |

| 2.1.11.2 | the holding or control by a shareholder or member alone or pursuant to an agreement with other shareholders or members of more than 50% (fifty percent) of the voting rights in a company; or |

| 2.1.11.3 | the ability to appoint the majority of the directors of a company; |

| 2.1.12 | “CSDP” means a person that holds in custody and administers securities or an interest in securities and that has been accepted in terms of section 34 of the Securities Services Act, No 36 of 2004 as a participant; |

2

| 2.1.13 | “Delivery Date” means – |

| 2.1.13.1 | in respect of Vested Scheme Shares, a date occurring within 14 (fourteen) days after the Vesting Date of such Scheme Shares, as determined by the Trustees in their Discretion; and |

| 2.1.13.2 | in respect of Scheme Shares which are deemed to have Vested as envisaged in clause 28.2.2.1.1 or 28.2.3.1.1, a date occurring within 30 (thirty) days after the Deemed Vesting Date of such Scheme Shares, as determined by the Trustees in their Discretion; |

| 2.1.14 | “Discretion” means a sole, absolute and unfettered discretion; |

| 2.1.15 | “Dispose” means sell, alienate, transfer, donate, exchange, distribute, or in any manner or otherwise dispose of or enter into any arrangement or transaction whatsoever (whether or not subject to any suspensive or resolutive condition) which may have the same or similar effect as any of the aforementioned sale, alienation, donation, exchange, distribution, transfer or disposal (including, but not limited to, any arrangements or transactions, or the cession of any rights or the granting of any option or any derivative or similar transaction which would have the same or substantially similar economic effect, whether in whole or in part) or realise any value in respect of or in any manner or otherwise dispose of and “Disposal” shall have a corresponding meaning; |

| 2.1.16 | “Election Notice” means a written election notice, in such form as may be prescribed by the Trustees from time to time, duly executed by a Participant in terms of which a Participant makes an election in respect of his (i) Vested Scheme Shares as envisaged in clause 23.1.5 and/or (ii) Entitlement Shares as envisaged in clause 24.1.6; |

| 2.1.17 | “Employee” means a person permanently employed by the Company; |

| 2.1.18 | “Entitlement Shares” means the Ordinary Shares to which a Participant may become entitled pursuant to the Vesting of his SARs, the number of which shall be determined in accordance with clause 24.2; |

| 2.1.19 | “Expert” means an independent person with the appropriate expertise, as determined by the Board, appointed from time to time by the Trustees, upon instructions from the Board in their Discretion, for any purpose under the Scheme; |

3

| 2.1.20 | “Financial Year” means the Company’s financial year commencing on 1 July and ending on 30 June in each year; |

| 2.1.21 | “First Allocation Date” means the date with effect from which the first Allocation of Scheme Shares and SARs under the Scheme is made, being 31 August 2012; |

| 2.1.22 | “Good Leaver” means a Participant whose employment with the Company is terminated due to his retrenchment or retirement; |

| 2.1.23 | “Initial Period” means the period commencing on the date of registration of the Trust Deed with the Master and terminating 6 (six) months thereafter; |

| 2.1.24 | “JSE” means the JSE Limited, registration number 2005/022939/06, a limited liability public company duly incorporated in the Republic of South Africa, licensed to operate an exchange in accordance with the Securities Services Act, No 36 of 2004; |

| 2.1.25 | “Listings Requirements” means the JSE Limited Listings Requirements; |

| 2.1.26 | “Market Value” means the volume-weighted average traded price of an Ordinary Share as quoted on the securities exchange operated by the JSE for the 10 (ten) days immediately preceding the date on which a determination of the Market Value of Shares is to be made; |

| 2.1.27 | “Master” means the Master of the High Court, Johannesburg, or any other person, body or authority provided for in the Trust Property Control Act, No. 57 of 1988; |

| 2.1.28 | “New Qualifying Employees” means Qualifying Employees who are employed by the Company after the first Offer Date; |

| 2.1.29 | “Offer” means an offer made under the Scheme to a Qualifying Employee to receive Scheme Shares and/or SARs, subject to the terms and conditions as set out in this Trust Deed; |

| 2.1.30 | “Offer Date” means the date with effect from which an Offer is made to a Qualifying Employee in accordance with clause 19 as set out in the Offer Letter; |

| 2.1.31 | “Offer Letter” means the letter delivered to each Participant setting out the details of the Offer as envisaged in clause 19.9; |

4

| 2.1.32 | “Offer Price” means the Market Value of an Ordinary Share notionally underlying a SAR on the Offer Date; |

| 2.1.33 | “Ordinary Share” means an ordinary share in the issued share capital of the Company; |

| 2.1.34 | “Participant” means a Qualifying Employee who has received and accepted an Offer and who beneficially owns Scheme Shares and/or holds SARs, and, where required by the context, his heirs, executors, administrators or trustees; |

| 2.1.35 | “Participant Representatives” means the representatives of each of the Unions; |

| 2.1.36 | “Parties” means the Company and the Trustees, and “Party” means any one of them as the context may require; |

| 2.1.37 | “Qualifying Employees” means Employees who are permanently employed by the Company and who do not participate in any of the Company’s other share incentive schemes, and who will be eligible to receive an Offer in terms of the Scheme; |

| 2.1.38 | “Reconstruction” or “Takeover” means any takeover, merger, reconstruction, however effected, including a reverse takeover, reorganisation or scheme of arrangement sanctioned by the court, but does not include any event which does not involve any change in Control of the Company; |

| 2.1.39 | “Rules” means such rules as may established by the Board as envisaged in clause 6.3; |

| 2.1.40 | “SARs” or “Share Appreciation Rights” means a conditional right to receive Ordinary Shares in terms of the Scheme, the number of which shall be determined in accordance with the formula contemplated in clause 24.2. For the avoidance of doubt, it is recorded that, every SAR shall be determined by reference to Ordinary Shares and not cash entitlements; |

| 2.1.41 | “Scheme” means the share incentive scheme created by the Company for the benefit of Qualifying Employees, the terms and conditions of which are set out in this Trust Deed; |

| 2.1.42 | “Scheme Shares” means Ordinary Shares to be offered to Qualifying Employees in terms of the Scheme, which shares, upon issue, shall be subject |

5

| to the terms and conditions of this Trust Deed until such time as the Scheme Shares Vest in the Participant and are delivered to him as envisaged in clause 23.2.1; |

| 2.1.43 | “Settlement Date” means – |

| 2.1.43.1 | in respect of Entitlement Shares, a date occurring within 14 (fourteen) days from the Vesting Date of such Entitlement Shares, as determined by the Trustees in their Discretion; and |

| 2.1.43.2 | in respect of Entitlement Shares which are deemed to have Vested as envisaged in clause 28.2.2.1.2 or 28.2.3.1.2, a date occurring within 30 (thirty) days after the Deemed Vesting Date of such Entitlement Shares, as determined by the Trustees in their Discretion; |

| 2.1.44 | “Share Price Appreciation” means, in respect of a SAR, the amount determined by deducting the Offer Price from the Vesting Price; |

| 2.1.45 | “Subscription Price” means the subscription price payable by a Qualifying Employee in respect of the Scheme Shares to be issued to the Trustees for as nominees of the Qualifying Employee pursuant to the acceptance of an Offer, which subscription price shall be R0.50 (fifty cents) (being the par value of the said Scheme Shares as at the First Allocation Date); |

| 2.1.46 | “Superannuation” means where a Participant’s employment with the Company is terminated due to his/her death, serious disability or serious incapacity; |

| 2.1.47 | “Trust” means the Tlhakanelo Employee Share Trust, being the trust constituted in terms of this Trust Deed, Master’s reference No. IT738/2012; |

| 2.1.48 | “Trust Deed” means this deed of Trust, together with any annexures hereto; |

| 2.1.49 | “Trustees” means the trustees holding office as such from time to time in terms of this Trust Deed, in their capacity as such; |

| 2.1.50 | “Trust Fund” means all property held by or on behalf of the Trustees under the Trust including, but not limited to, the moneys upon which the Trust is settled, all moneys and property paid to or transferred or borrowed and accepted or acquired by the Trustees or held on their behalf under the Trust, all additions or accretions or income in the hands of the Trustees or interest |

6

| thereto, any proceeds of transfer of any property and includes any part or parts thereof. For the avoidance of doubt, neither the Scheme Shares nor the distributions envisaged in clause 27 shall form part of the Trust Fund; |

| 2.1.51 | “Unions” means The National Union of Mine Workers, UASA and Solidarity and such other unions as may be recognised by the Company from time to time; |

| 2.1.52 | “Vest” means, on the relevant Vesting Date, in respect of – |

| 2.1.52.1 | Scheme Shares, that the Participant will be entitled to the release of a number of Scheme Shares (determined in accordance with clause 23.2) on the Delivery Date; and |

| 2.1.52.2 | SARs, that the Participants are entitled to receive Ordinary Shares on the Settlement Date, the number of which shall be determined in accordance with the formula contemplated in clause 24.2, |

and “Vesting” and “Vested” shall have a corresponding meaning;

| 2.1.53 | “Vesting Date” means, in respect of Scheme Shares and SARs, each of the dates envisaged in clause 21.1; and |

| 2.1.54 | “Vesting Price” means the Market Value of an Ordinary Share notionally underlying a SAR on the Vesting Date. |

| 2.2 | In this Trust Deed - |

| 2.2.1 | clause headings and the heading of the Deed are for convenience only and are not to be used in its interpretation; |

| 2.2.2 | an expression which denotes - |

| 2.2.2.1 | any gender includes the other genders; |

| 2.2.2.2 | a natural person includes a juristic person and vice versa; |

| 2.2.2.3 | the singular includes the plural and vice versa; and |

| 2.2.2.4 | a Party includes a reference to that Party’s successors in title and assigns allowed at law. |

| 2.3 | Any reference in this Trust Deed to – |

7

| 2.3.1 | “business hours” shall be construed as being the hours between 08h30 and 17h00 on any business day. Any reference to time shall be based upon South African Standard Time; |

| 2.3.2 | “days” shall be construed as calendar days unless qualified by the word “business”, in which instance a “business day” will be any day other than a Saturday, Sunday or public holiday as gazetted by the government of the Republic of South Africa from time to time; |

| 2.3.3 | “law” means any law of general application and includes the common law and any statute, constitution, decree, treaty, regulation, directive, ordinance, by-law, order or any other enactment of legislative measure of government (including local and provincial government) statutory or regulatory body which has the force of law; |

| 2.3.4 | “person” means any person, company, close corporation, trust, partnership or other entity whether or not having separate legal personality; and |

| 2.3.5 | “writing” means legible writing and in English and includes any form of electronic communication contemplated in the Electronic Communications and Transactions Act, No 25 of 2002. |

| 2.4 | The words “include” and “including” mean “include without limitation” and “including without limitation”. The use of the words “include” and “including” followed by a specific example or examples shall not be construed as limiting the meaning of the general wording preceding it. |

| 2.5 | The words “shall” and “will” and “must” used in the context of any obligation or restriction imposed on a Party have the same meaning. |

| 2.6 | Any substantive provision, conferring rights or imposing obligations on a Party and appearing in any of the definitions in this clause 2 or elsewhere in this Trust Deed, shall be given effect to as if it were a substantive provision in the body of the Deed. |

| 2.7 | Words and expressions defined in any clause shall, unless the application of any such word or expression is specifically limited to that clause, bear the meaning assigned to such word or expression throughout this Trust Deed. |

| 2.8 | Unless otherwise provided, defined terms appearing in this Trust Deed in title case shall be given their meaning as defined, while the same terms appearing in lower case shall be interpreted in accordance with their plain English meaning. |

8

| 2.9 | A reference to any statutory enactment shall be construed as a reference to that enactment as at the Signature Date and as amended or substituted from time to time. |

| 2.10 | Unless specifically otherwise provided, any number of days prescribed shall be determined by excluding the first and including the last day or, where the last day falls on a day that is not a business day, the next succeeding business day. |

| 2.11 | If the due date for performance of any obligation in terms of this Trust Deed is a day which is not a business day then (unless otherwise stipulated) the due date for performance of the relevant obligation shall be the immediately preceding business day. |

| 2.12 | Where figures are referred to in numerals and in words, and there is any conflict between the two, the words shall prevail, unless the context indicates a contrary intention. |

| 2.13 | The rule of construction that this Trust Deed shall be interpreted against the Party responsible for the drafting of this Trust Deed, shall not apply. |

| 2.14 | The expiration or termination of this Trust Deed shall not affect such of the provisions of this Trust Deed as expressly provide that they will operate after any such expiration or termination or which of necessity must continue to have effect after such expiration or termination, notwithstanding that the clauses themselves do not expressly provide for this. |

| 2.15 | Whenever any person is required to act “as an expert and not as an arbitrator” in terms of this Trust Deed, then – |

| 2.15.1 | the determination of the expert shall (in the absence of manifest error) be final and binding; |

| 2.15.2 | subject to any express provision to the contrary, the expert shall determine the liability for his or its charges, which shall be paid accordingly; |

| 2.15.3 | the expert shall be entitled to determine such methods and processes as he or it may, in his or its sole discretion, deem appropriate in the circumstances provided that the expert may not adopt any process which is manifestly biased, unfair or unreasonable; |

9

| 2.15.4 | the expert shall consult with the relevant parties (provided that the extent of the expert’s consultation shall be in his or its sole discretion) prior to rendering a determination; and |

| 2.15.5 | having regard to the sensitivity of any confidential information, the expert shall be entitled to take advice from any person considered by him or it to have expert knowledge with reference to the matter in question. |

| 2.16 | Any reference in this Trust Deed to “this Trust Deed” or any other agreement or document shall be construed as a reference to this Trust Deed or, as the case may be, such other agreement or document, as amended, varied, novated or supplemented from time to time. |

| 2.17 | In this Trust Deed the words “clause” or “clauses” and “annexure” or “annexures” refer to clauses of and annexures to this Trust Deed. |

PART I: THE TRUST

| 3 | INTRODUCTION |

| 3.1 | Whereas the Company wishes to – |

| 3.1.1 | provide a platform for Employee education and appreciation of the corporate financial system; and |

| 3.1.2 | incentivise its Employees, |

the Company hereby establishes the Scheme in order to –

| 3.1.3 | help create awareness among Qualifying Employees of the implications of share ownership in the Company, the particular challenges facing the Company’s shareholders and the future of the Company; and |

| 3.1.4 | incentivise Employees to act in a manner which promotes wealth creation for shareholders by ensuring that Qualifying Employees benefit directly from an increase in the share price as well as the declaration of distributions by the Company in accordance with clause 27. |

| 4 | PURPOSE |

| 4.1 | The Scheme is intended to provide a means by which to reward Qualifying Employees by enabling them to acquire Scheme Shares and Share Appreciation Rights, thereby aligning their interests with that of shareholders by allowing them to benefit from the economic growth of the Company. |

10

| 4.2 | The Trustees’ responsibilities in implementing the Scheme include, inter alia, the administration and management of the Scheme, in terms of which Scheme Shares and Share Appreciation Rights are to be Offered and Allocated to Qualifying Employees. |

| 5 | TRUST CONTRIBUTION |

| 5.1 | The Company hereby makes a capital contribution of R100,000 (one hundred thousand Rand) to the Trust as initial capital. |

| 5.2 | The Company shall from time to time make additional contributions to the Trust in order to enable the Trustees to meet all the expenditure incurred for the proper administration of the Scheme and the execution of their duties as envisaged in this Trust Deed, including the incurral of Scheme administration costs and the costs associated with purchasing Scheme Shares as envisaged in clause 20.2.1. |

| 6 | CREATION AND ADMINISTRATION OF THE TRUST |

| 6.1 | A trust to be known as the “Tlhakanelo Employee Share Trust” is hereby created for the benefit of Qualifying Employees, upon the terms and conditions set out in this Trust Deed. |

| 6.2 | The Trust shall be administered for the purposes, and in the manner as set out in this Trust Deed. |

| 6.3 | The Board shall, subject to the provisions of this Trust Deed and Listings Requirements, be entitled to establish such rules as it may deem necessary for the proper administration of the Scheme and the Trust and to make such determinations and interpretations and to take such steps in connection therewith as it may deem necessary or desirable. |

| 6.4 | The Rules shall be in writing, shall become operative when a copy thereof is received by the Trustees and shall be deemed to form part of this Trust Deed. |

| 6.5 | The Board may delegate or confer, in accordance with the memorandum of incorporation of the Company, some or all of the powers exercisable by them in terms of this Trust Deed to a committee of the Board on such terms and for such period as it may deem fit, provided that it may revoke any such appointment and vary the terms of any delegation or conferral. |

| 6.6 | Subject to the approval of the Commissioner for the South African Revenue Service, the financial year of the Trust shall coincide with the financial year of the Company. |

11

| 7 | APPOINTMENT OF TRUSTEES |

Initial Period

| 7.1 | Xxxxx Xxxxxxxxx (identity number 770922 0033 087) is hereby appointed by the Board to be the Trustee of the Trust during the Initial Period, and she does by her signature to this document, hereby accept such appointment and undertakes to administer the Trust in accordance with the terms of this Trust Deed as soon as Letters of Authority are issued to her. |

| 7.2 | Upon the expiry of the Initial Period, the number of Trustees shall increase to 10 (ten) and the Board and the Participant Representatives shall, as soon as practicably possible thereafter, appoint Trustees in accordance with clause 7.4 below. |

After the Initial Period

| 7.3 | After the Initial Period, there shall at all times be 10 (ten) Trustees on the board of Trustees. |

| 7.4 | After the Initial Period the Trustees shall be appointed as follows - |

| 7.4.1 | 5 (five) Trustees by the Participant Representatives (the “Participant Trustees”); and |

| 7.4.2 | 5 (five) Trustees by the Board (the “Company Trustees”). |

| 7.5 | For the avoidance of doubt, it is recorded that any appointment of a Trustee by the Board or the Participant Representatives in terms of this Trust Deed will at all times be subject to the Master authorising such Trustee to act as trustee of the Trust by issuing Letters of Authority to that Trustee, failing which, such appointment will be of no force or effect. |

| 7.6 | If at any time after the Initial Period the number of Trustees falls below 10 (ten), the Trustees in office at the time shall be entitled to continue to act in all matters affecting the Trust pending the appointment of replacement Trustee/s by the |

12

| Board or the Participant Representatives, as the case may be, and the fact that the number of Trustees falls below 10 (ten) after the Initial Period shall not invalidate any actions taken by the Trustees in office at that time. |

| 7.7 | Notwithstanding anything to the conrtary herein contained and in accordance with the Listings Requirements – |

| 7.7.1 | neither the executive directors of the Company nor the Participants may be appointed as Trustees; |

| 7.7.2 | a Trustee may not be or become a Participant under the Scheme while acting as Trustee; and |

| 7.7.3 | non-executive directors of the Company may be appointed as Trustees provided that they are not Participants. |

| 7.8 | A juristic person may be a Trustee of the Trust. |

| 8 | CESSATION OF OFFICE OF TRUSTEES |

| 8.1 | Each Trustee for the time being and each successor shall remain in office until such Trustee ceases to hold office in terms of clause 8.2. |

| 8.2 | The office of Trustee shall become vacant if – |

| 8.2.1 | the Trustee is found guilty of any offence involving dishonesty; |

| 8.2.2 | the Trustee is liquidated or wound up (provisionally or otherwise) or, in the case of an individual, the Trustee’s estate is sequestrated (provisionally or otherwise); |

| 8.2.3 | the Trustee becomes incapacitated in law to hold the office of trustee; |

| 8.2.4 | the Trustee becomes a Participant or an executive director of the Company; |

| 8.2.5 | the Board or the Participant Representatives, as the case may be, remove the Trustee at any time on 1 (one) calendar month’s notice in writing to such Trustee; |

| 8.2.6 | the Trustee resigns on 1 (one) calendar month’s written notice to (i) the Board, in the case of a Company Trustee, or to the Participant Representatives, in the case of a Participant Trustee and (ii) his co-Trustees; provided that the Board or the Participant Representatives, as the case may be, may, at the request of the Trustee, waive the full notice period; or |

| 8.2.7 | in the case of a Trustee who is a natural person, he is disqualified from acting as a director in terms of the Act. |

13

| 9 | SUCCESSION |

| 9.1 | The Board or the Participant Representatives, as the case may be, will appoint another Trustee (“Replacement Trustee”) to succeed a Trustee who has ceased to hold office as a Company Trustee or Participant Trustee, respectively, in terms of clause 8.2 within 21 (twenty one) days’ of such Trustee ceasing to hold office. If the Board or the Participant Representatives, as the case may be, fails to appoint the Replacement Trustee within the 21 (twenty one) day period, the Trustees then in office shall, in a meeting of Trustees, have the power to appoint the Replacement Trustee. |

| 9.2 | Until the Master issues Letters of Authority to the Replacement Trustee the remaining Trustees may continue to perform all the powers and duties of a Trustee under this Trust Deed, provided that the Replacement Trustee shall take the necessary steps to obtain the Letters of Authority. |

| 9.3 | Subject to the Master issuing Letters of Authority appointing the Trustee nominated by the Board or the Participant Representatives, as the case may be, any Trustee succeeding to office as such shall become bound by the provisions of this Trust Deed and, in his capacity as Trustee, automatically become vested with the assets and liabilities of the Trust and in every way, with immediate effect, take the place of and assume the powers and duties of the Trustee whom he has succeeded. |

| 10 | MEETINGS AND PROCEDURES OF TRUSTEES |

| 10.1 | The Trustees shall regulate their meetings as they deem fit. |

| 10.2 | The Trustees may elect, from amongst themselves, a chairperson from time to time to hold office for such period as they may determine; provided that such chairperson shall not have a second or casting vote. |

| 10.3 | After the Initial Period, the quorum for any meeting of Trustees shall be 4 (four) Trustees, of whom 2 (two) shall be Company Trustees and 2(two) shall be Participant Trustees. |

| 10.4 | Each Trustee shall be entitled to 1 (one) vote at a meeting of the Trustees. |

14

| 10.5 | The decision of the majority of the Trustees present at a quorate meeting shall be deemed to be the decision of all the Trustees. |

| 10.6 | The Trustees shall appoint a secretary to keep written minutes of the meetings of Trustees and to minute all resolutions passed by the Trustees. |

| 10.7 | A resolution in writing signed by all the Trustees shall be valid and effective as if it had been passed at a meeting of the Trustees, even if the Trustees sign more than one document. |

| 10.8 | The Trustees may conduct meetings by using telecommunication equipment. Any resolution passed in that way shall, if subsequently reduced to writing and signed by the relevant Trustees, be as valid and effective as a resolution passed at a conventional meeting of Trustees. |

| 11 | POWERS OF THE TRUSTEES |

| 11.1 | The Trustees shall, in addition to such other powers as may be conferred upon them by law or elsewhere in this Trust Deed, have the following powers – |

| 11.1.1 | to do all things reasonably necessary to give effect to the Scheme; |

| 11.1.2 | to open a CSDP account for purposes of holding the Scheme Shares on behalf of and for the beneficial interest of the Participants; |

| 11.1.3 | for purposes of the Scheme, to borrow or raise monies from the Company only, provided that if the Trustees are able to borrow or raise monies on better terms from a third party than from the Company, the Trustees may borrow or raise monies from such third party with the prior consent of the Board; |

| 11.1.4 | to receive and accept capital contributions from the Company; |

| 11.1.5 | to make Offers and Allocations to Qualifying Employees; |

| 11.1.6 | to receive and accept forfeited Scheme Shares which shall be used by the Trustees for purposes of making future Offers to New Qualifying Employees as envisaged in clause 19.4; |

| 11.1.7 | instead of acting personally, to employ, as far as may reasonably be necessary, and to pay, any attorney or any other person to transact any business or do any act of whatsoever nature required to be done pursuant to this Trust Deed, including the administration of the Trust and the receipt or of payment of money; |

15

| 11.1.8 | to take and act upon any expert or professional advice; |

| 11.1.9 | to delegate to any person the performance of all or any acts or the exercise of all or any Discretions which they are entitled to perform or exercise under this Trust Deed; |

| 11.1.10 | subject to the Trust Property Control Act, No. 57 of 1988, to open and operate banking accounts with registered banks; |

| 11.1.11 | to invest any surplus monies of the Trust in call or deposit accounts with a registered bank; |

| 11.1.12 | to draw, accept, make or endorse cheques, bills of exchange or promissory notes for and on behalf of the Trust; |

| 11.1.13 | to exercise all rights conferred by Xxxxxx Xxxxxx and other assets of the Trust on behalf of the Participants, including voting rights, rights of conversion, rights to take up further allotments by way of capitalisation issues or rights issues and the like, as they may determine in their Discretion; |

| 11.1.14 | to exercise such further rights, powers and authorities as may from time to time be conferred upon them by the Board; |

| 11.1.15 | to repay any loans advanced to the Trust; |

| 11.1.16 | pursuant to the Delivery Date and the Settlement Date, to sell Vested Scheme Shares and/or Entitlement Shares respectively, provided that the Trustees shall only have the power to sell Vested Scheme Shares or Entitlement Shares where instructed to do so by a Participant in terms of this Trust Deed (including a deemed instruction as envisaged in clauses 23.2.2 and 24.3.2) or in order to raise sufficient funds to settle a Participant’s tax liability as envisaged in clause 25; |

| 11.1.17 | to employ accountants, attorneys, agents or brokers to transact all or any business of whatsoever nature required to be done pursuant to this Trust Deed and shall not be responsible for the loss occasioned by the employment of any such accountants, attorneys, agents or brokers; |

| 11.1.18 | to reimburse themselves from the Trust Fund for all reasonable expenses which may be incurred by them in or about the execution of the powers and duties conferred upon them in terms of this Trust Deed; |

16

| 11.1.19 | to have the locus standi in judico and be capable of bringing, defending, opposing, withdrawing, settling, compounding or otherwise acting in connection with any proceedings whatsoever in or before any Court or in any arbitration or before any other forum relating to the Trust or the affairs of the Trust; and |

| 11.1.20 | to exercise each and every power which they may or could require for the due and proper administration of this Trust, and in order to achieve all of the intents and object of this Trust. |

| 11.2 | Without prejudice to anything aforesaid, the Trustees shall have – |

| 11.2.1 | full capacity to contract on behalf of the Trust, subject always to such limitations, if any, as may be imposed by this Trust Deed, provided that they will under no circumstances be personally liable under any such contract; |

| 11.2.2 | legal standing and be capable of bringing, defending, opposing, withdrawing, settling and/or otherwise acting in connection with any proceedings whatsoever in or before any court, arbitration or other forum; provided that all costs reasonably incurred by them in that regard shall be for the account of the Trust. |

| 11.3 | A Trustee who is an attorney or other person engaged in any profession, may be employed in his professional capacity to act, and may charge and be paid by the Trust all reasonable professional charges for any business or act done by him or his firm in pursuance of this Trust Deed. |

| 12 | DUTIES OF TRUSTEES |

| 12.1 | In addition to any other duty imposed by this Trust Deed (whether expressed or implied), the Trustees shall– |

| 12.1.1 | give effect to and implement the provisions of this Trust Deed and administer the Scheme in order to achieve and maintain the object of the Scheme and always subject to the provisions of the Act and the Listings Requirements; |

| 12.1.2 | make Offers and Allocations to Participants as envisaged in this Trust Deed, but always subject to the provisions of the Act and the Listings Requirements; |

| 12.1.3 | open a CSDP account in the name of the Trust and procure that all Scheme |

17

| Shares remain nominally registered in the names of the Trustees (in their capacity as such) for the beneficial interest of the relevant Participants for so long as they remain Scheme Shares, whereafter they shall be delivered to the Participants; |

| 12.1.4 | not pledge or otherwise encumber, or sell, alienate, cede, assign or in any other manner transfer or dispose of any of the Scheme Shares other than in accordance with this Trust Deed; |

| 12.1.5 | cause proper records and books of account to be kept of the business and affairs of the Trust; |

| 12.1.6 | establish and keep updated a register of Participants in which inter alia the following shall be recorded from time to time – |

| 12.1.6.1 | the total number of Allocated Scheme Shares and SARs; |

| 12.1.6.2 | the number of Scheme Shares which each Participant may be entitled to receive in terms of the Scheme and the number of Allocated SARs which may Vest in each Participant; and |

| 12.1.6.3 | the name and identity number of each Participant and his residential address and contact details; |

| 12.2 | ensure that the records, books of account and register referred to above are at all times available for inspection by any member of the Board, the Auditors or other authorised representative of the Company; |

| 12.3 | cause to be prepared and audited, as soon as possible after the end of each Financial Year, the financial statements of the Trust; |

| 12.4 | as soon as possible after the financial statements of the Trust have been audited, deliver to the Board 3 (three) copies of such audited financial statements of the Trust, duly signed by the Trustees and the Auditors; |

| 12.5 | ensure that any dealings in Scheme Shares relating to the Scheme comply with the provisions of paragraphs 3.63 to 3.74 of the Listings Requirements (if applicable); |

| 12.6 | make available upon request the Trust Deed to any Participant in an official language in which that person is familiar; and |

| 12.7 | carry out such duties as may be delegated to them from time to time by resolution of the Board. |

18

| 13 | PRIVILEGES OF TRUSTEES |

A Trustee shall not –

| 13.1 | be obliged to furnish any security to the Master or to any other officer or official for the performance of his duties in terms of this Trust Deed; |

| 13.2 | be disqualified from – |

| 13.2.1 | acting as adviser, agent, broker or attorney to or contracting with the Trust; |

| 13.2.2 | obtaining any remuneration in respect of his services in any capacity referred to in clause 13.2.1. |

| 14 | REMUNERATION OF TRUSTEES |

| 14.1 | The Trustees may receive for their services as Trustees such reasonable remuneration as may from time to time be resolved by the Board from time to time. |

| 14.2 | The Trustees shall be reimbursed from the Trust Fund for all reasonable expenses incurred by them in the execution of their duties as Trustees. |

| 15 | INDEMNITY |

| 15.1 | The Trustees shall not be liable for any loss sustained by the Trust or by any Participant arising from whatsoever cause, save for any loss sustained as a result of gross negligence or the wilful dishonesty of the Trustees, either collectively or individually. |

| 15.2 | A Trustee shall not be liable for any act or dishonesty or other misconduct committed by any other Trustee unless he knowingly allowed it or was an accessory thereto. |

| 15.3 | The Company hereby indemnifies the Trustees against all actions, proceedings, costs, liabilities, claims expenses and demands in respect of any matter or thing done or omitted to be done in any way in the execution of their office as Trustees, otherwise than claims – |

| 15.3.1 | arising out of their gross negligence or wilful dishonesty; and |

| 15.3.2 | in respect of which the Trustees cannot be indemnified by law. |

19

| 15.4 | If the Trustees in good faith make any payment to any person whom they assume to be entitled thereto under this Trust Deed and it is subsequently found that the recipient was not entitled to the payment, the Trustees shall nevertheless not be responsible for the monies so paid. |

| 16 | TERMINATION OF TRUST |

| 16.1 | The Trust shall terminate as soon as all of the following events have taken place, namely – |

| 16.1.1 | it ceases to have any obligations under the Scheme and the Trustees, with the consent of the Board, resolve that the Trust shall terminate; or |

| 16.1.2 | its obligations in terms of the Scheme have been transferred to another share trust established for the Participants. |

| 16.2 | Upon termination, the Trustees shall realise the assets of the Trust (if any), wind-up the affairs of the Trust and pay over to such person nominated by the Company as beneficiary of the Trust, any surplus (after discharging all liabilities) remaining in the Trust. |

| 16.3 | If the Company is placed in liquidation otherwise than as contemplated in clause 32 and save for any rights to claim any payment which the Trust may then have against the Company, this Scheme shall ipso facto lapse as from the date of liquidation. For the purposes hereof “date of liquidation” shall mean the date upon which any application (whether provisional or final) for the liquidation of the Company is lodged at the relevant court. |

PART II: PARTICIPATION

| 17 | OBLIGATIONS OF THE PARTICIPANTS |

Every Participant shall, in addition to and without prejudice to any obligation imposed elsewhere in this Trust Deed, whether express or implied at all times strictly observe the provisions of this Trust Deed.

| 18 | ELIGIBILITY |

Qualifying Employees shall be eligible to and shall participate in the Scheme only if and to the extent that an Offer is made to, and is accepted by them in accordance with clause 20.1.

20

| 19 | OFFERS |

| 19.1 | A total of 4,288,000 (four million two hundred and eighty eight thousand) Scheme Shares and 8,576,000 (eight million five hundred and seventy six thousand) SARs shall be made available for purposes of making Offers to Qualifying Employees in terms of the Scheme. |

First Offers

| 19.2 | As soon as practicably possible after the date on which the Scheme is approved by the shareholders of the Company, the Trustees shall Offer 3,500,000 (three and a half million) Scheme Shares and 7,000,000 (seven million) SARs (or such lower number as may be determined by reference to the relevant number of Qualifying Employees on the First Allocation Date) to Qualifying Employees who qualify as such as at the Offer Date and the First Allocation Date, by delivering to each Qualifying Employee an Offer Letter. |

| 19.3 | The number of Scheme Shares and SARs to be Offered to each Qualifying Employee shall be on a 1:2 ratio (i.e. one Scheme Share for every 2 (two) SARs) and will be determined in accordance with the number of years of a Qualifying Employee’s service with the Company as follows – |

| 19.3.1 | less than 10 (ten) years’ of service: 100 Scheme Shares and 200 SARs; |

| 19.3.2 | 10 (ten) years’ service or more: 110 Scheme Shares and 220 SARs. |

Future Offers

| 19.4 | The remaining 788,000 (seven hundred and eighty eight thousand) Scheme Shares and 1,576,000 (one million five hundred and seventy six thousand) SARs (or such other number as may constitute the balance of the Scheme Shares and SARs after the first Allocation as envisaged in clause 19.2), together with – |

| 19.4.1 | any Scheme Shares and SARs which were not accepted pursuant to the first Offer as envisaged in clause 19.2 or any subsequent Offer; and |

| 19.4.2 | Scheme Shares which have been forfeited in favour of the Trust and a number of SARs equal in number to any SARs which lapsed, as envisaged in clause 28.2.1, |

shall be Offered by the Trustees to New Qualifying Employees who have not previously received an Offer and/or Allocation, during each year following the

21

First Allocation Date until the 4th (fourth) anniversary of the First Allocation Date, by delivering an Offer Letter to each New Qualifying Employee. The Allocation of Scheme Shares and SARs to New Qualifying Employees will be dependent on the availability, at the given time, of unallocated Scheme Shares and SARs.

| 19.5 | The number of Scheme Shares and SARs to be offered to each New Qualifying Employee shall be calculated mutatis mutandis in accordance with clause 19.3 save that the number of Scheme Shares and SARs offered to New Qualifying Employees will reduce by 1/5 (one fifth) on each anniversary of the First Allocation Date. |

| 19.6 | For the avoidance of doubt, subject to clause 19.7, no further Scheme Shares or SARs shall be Offered or Allocated to New Qualifying Employees after the 4th (fourth) anniversary of the First Allocation Date. |

| 19.7 | If, on the 5th (fifth) anniversary of the First Allocation Date there are any unallocated Scheme Shares and SARs, then such Scheme Shares and SARs will be distributed to the Participants who are still employed with the Company at that date, in such manner as may be determined by the Board in its Discretion, pro rata in accordance with the number of Scheme Shares previously Allocated to them (i.e. pursuant to an initial Offer as envisaged in clause 19.2 or a subsequent Offer as envisaged in cause 19.4), it being recorded that such Participants have a vested right in relation to the unallocated Scheme Shares. |

All Offers

| 19.8 | For purposes of making the Offers, the Company will provide the Trustees with a list of the names of the relevant Qualifying Employees eligible to receive an Offer in that year, together with the number of Scheme Shares and SARs to be Offered to each Qualifying Employee. |

| 19.9 | An Offer Letter shall specify the terms of the Offer, including – |

| 19.9.1 | the Offer Date; |

| 19.9.2 | in respect of an Offer of Scheme Shares – |

| 19.9.2.1 | the number of Scheme Shares being offered; |

| 19.9.2.2 | the Vesting Dates; |

| 19.9.2.3 | the Subscription Price payable; and |

22

| 19.9.3 | in respect of an Offer of SARs - |

| 19.9.3.1 | the number of SARs being offered; and |

| 19.9.3.2 | the Vesting Dates. |

| 19.10 | All Offers shall – |

| 19.10.1 | be personal to the Qualifying Employee to whom it is addressed, and may only be accepted by such Qualifying Employee; |

| 19.10.2 | be capable of acceptance in whole and not only in part; |

| 19.10.3 | indicate that, unless the Qualifying Employee specifically rejects the Offer in writing to the Company within 10 (ten) business days of the Offer Date, the Qualifying Employee will be deemed to have accepted the Offer; and |

| 19.10.4 | indicate that upon acceptance of the Offer, the Qualifying Employee will be bound by the provisions of the Trust Deed. |

| 19.11 | The Trustees shall not have any discretion regarding the Allocation of Scheme Shares and SARs to Qualifying Employees. |

| 20 | ACCEPTANCE AND ALLOCATIONS |

| 20.1 | A Qualifying Employee will be deemed to have accepted an Offer unless the Qualifying Employee specifically rejects the Offer in writing to the Company within 10 (ten) business days of the Offer Date. |

| 20.2 | As soon as practically possible after the Offer is accepted and the Subscription Price has been paid, the Scheme Shares and SARs shall be Allocated to the relevant Participant as follows – |

| 20.2.1 | the Company will issue the relevant number of Scheme Shares to the Trustees which Scheme Shares will be held by the Trustees as nominees for the relevant Participant. For the avoidance of doubt, it is recorded that, upon the issue of the Scheme Shares to the Trustees, the registered owner of the said shares will be the Trustees but the beneficial owner of such shares shall be the relevant Participant; and |

| 20.2.2 | the Trustees will Allocate the SARs to the relevant Participant with effect from the date on which the Company issues the relevant Scheme Shares to |

23

| the Trustees as nominees of that Qualifying Employee as envisaged in clause 20.2.1, by delivering a letter of Allocation to the Qualifying Employee. It is recorded that the Entitlement Shares will only be issued by the Company to the Participant pursuant to the Vesting of a SAR in accordance with clause 21. |

| 20.3 | In the case of forfeited Scheme Shares, as envisaged in clause 28.2.1, the Trustees will forthwith hold such Scheme Shares, as beneficial owners of such Scheme Shares, for purposes of making future Offers to New Qualifying Employees as envisaged in clause 19.4. Such forfeited Scheme Shares – |

| 20.3.1 | may not be Disposed of or otherwise encumbered by the Trustees other than in accordance with the Trust Deed; and |

| 20.3.2 | shall, for purposes of making the future Offers to New Qualifying Employees, be subject to the restrictions contained in this Trust Deed. |

| 21 | VESTING OF SCHEME SHARES AND SARS |

| 21.1 | Subject to clause 28, the Scheme Shares and SARs Allocated to a Participant shall Vest in that Participant as follows. Where a Qualifying Employee receives an Allocation – |

| 21.1.1 | on the First Allocation Date, 1/5 (one fifth) of the total number of Scheme Shares and SARs Allocated to that Participant shall Vest in him on each anniversary of the Commencement Date; |

| 21.1.2 | at any time after the First Allocation Date but by no later than the 1st (first) anniversary of the First Allocation Date, 1⁄4 (one forth) of the total number of Scheme Shares and SARs Allocated to that Participant shall Vest in him on each anniversary of the relevant Allocation Date, provided that the last tranche shall Vest no later than the 5th (fifth) anniversary of the First Allocation Date; |

| 21.1.3 | at any time after the 1st (first) anniversary of the First Allocation Date but before but by no later than the 2nd (second) anniversary of the First Allocation Date, 1/3 (one third) of the total number of Scheme Shares and SARs Allocated to that Participant shall Vest in him on each anniversary of the relevant Allocation Date, provided that the last tranche shall Vest no later than the 5th (fifth) anniversary of the First Allocation Date; |

24

| 21.1.4 | at any time after the 2nd (second) anniversary of the First Allocation Date but by no later than the 3rd (third) anniversary of the First Allocation Date, half of the total number of Scheme Shares and SARs Allocated to that Participant shall Vest in him on each anniversary of the relevant Allocation Date, provided that the last tranche shall Vest no later than the 5th (fifth) anniversary of the First Allocation Date; |

| 21.1.5 | at any time after the 3rd (third) anniversary of the First Allocation Date but by no later than the 4th (fourth) anniversary of the First Allocation Date, the total number of Scheme Shares and SARs Allocated to that Participant shall Vest in him in full on the anniversary of the relevant Allocation Date, provided that the Vesting Date shall not be later than the 5th (fifth) anniversary of the First Allocation Date, |

provided further that if the portion of Scheme Shares and/or SARs to Vest result in a fraction of a Scheme Share and/or SAR, such fraction will be rounded up or down, as the case may be, to the nearest whole number.

| 22 | RESTRICTIONS |

| 22.1 | A Participant shall not be entitled to pledge or otherwise encumber, or sell, alienate, cede, assign or in any other manner transfer or dispose of any of his Scheme Shares (or any rights or interest therein or thereto), until the Delivery Date. |

| 22.2 | SARs may not be transferred, ceded (whether as security or as an out-and-out cession), assigned, encumbered or otherwise disposed of by a Participant to any other person. |

| 22.3 | Entitlement Shares may not be transferred, ceded (whether as security or as an out-and-out cession), assigned, encumbered or otherwise disposed of by a Participant to any other person, until the Settlement Date. |

| 23 | DELIVERY OF SCHEME SHARES |

Election

| 23.1 | Within 30 (thirty) days before a Vesting Date, the Trustees will deliver to each relevant Participant a certificate (the “Vesting Certificate”) setting out – |

| 23.1.1 | the Vesting Date; |

25

| 23.1.2 | the estimated value and the number of Scheme Shares which will Vest in the Participant (“Vested Scheme Shares”); |

| 23.1.3 | the estimated amount of employees’ tax, securities transfer tax and any other taxes arising pursuant to the Vesting of the Scheme Shares; |

| 23.1.4 | the fact that the Participant shall be entitled to elect to make payment of the entire tax amount referred to in clause 23.1.3 to the Trustees in cash by a stipulated date, or to have the Trustees sell a sufficient number of Vested Scheme Shares on his behalf in order to settle his tax liability as envisaged in clause 25; |

| 23.1.5 | the fact that the Participant shall be entitled to elect to receive all the Vested Scheme Shares (subject to a sale as envisaged in clause 23.1.4) or to have the Trustees sell all (and not only some) of the Participant’s Vested Scheme Shares on his behalf by delivering an Election Notice to the Trustees by a specified date, which date shall be a date occurring at least 14 (fourteen) days before the Vesting Date; and |

| 23.1.6 | the fact that if the Participant fails to (i) timeously deliver a duly executed Election Notice to the Trustees, that the Participant will be deemed to have elected to have the Trustees sell all of the Participant’s Vested Scheme Shares on his behalf in accordance with clause 23.2.2 or (ii) make an election regarding the settlement of his tax liability as envisaged in clause 23.1.4, that the Participant will be deemed to have elected to have the Trustees sell a sufficient number of his Vested Scheme Shares on his behalf in order to settle his tax liability. |

Sale and delivery of Vested Scheme Shares

| 23.2 | On the Delivery Date, the Trustees shall either – |

| 23.2.1 | if a Participant timeously delivered a duly executed Election Notice and elected to receive all his Vested Scheme Shares, release the relevant number of Vested Scheme Shares from the Scheme and, subject to the provisions of clause 25 deliver the relevant number of Ordinary Shares to the Participant by crediting the Participant’s CSDP account accordingly; or |

| 23.2.2 | if a Participant (i) timeously delivered a duly executed Election Notice and elected to have the Trustees sell all of his Vested Shares or (ii) failed to timeously deliver a duly executed Election Notice, release the relevant number of Vested Scheme Shares from the Scheme and sell such Shares on behalf of the Participant. |

26

| 23.3 | As soon as practicably possible after the Shares are sold on behalf of all the Participants envisaged in clause 23.2.2, the Trustees shall remit the Market Value as at the Vesting Date per Share to each Participant in respect of each Share sold on their behalf, net of any transactional costs and taxes as envisaged in clause 25. |

| 24 | DELIVERY OF ENTITLEMENT SHARES |

Election

| 24.1 | Within 30 (thirty) days before a Vesting Date, the Trustees will deliver to each relevant Participant a certificate (the “Vesting Certificate”) setting out – |

| 24.1.1 | the Vesting Date; |

| 24.1.2 | the estimated value of the Entitlement Shares and the estimated number of Entitlement Shares which the Participant may become entitled to on the Vesting Date; |

| 24.1.3 | the fact that, if following the Vesting of his SARs the Share Price Appreciation is – |

| 24.1.3.1 | less than R18 but more than zero, then the Participant shall be entitled to receive, separate from the right to receive any Entitlement Shares in respect of his Vested SARs, the Cash Bonus per Vested SAR in respect of services rendered; or |

| 24.1.3.2 | equal to or less than zero, then the Participant shall be entitled to receive, separate from the right to receive any Entitlement Shares (if any) in respect of his Vested SARs, an Additional Cash Bonus in the amount of R18 per Vested SAR in respect of services rendered; |

| 24.1.4 | the estimated amount of employees’ tax, securities transfer tax and any other taxes arising pursuant to the Vesting of the SARs; |

| 24.1.5 | the fact that the Participant shall be entitled to elect to make payment of the entire tax amount referred to in clause 24.1.4 to the Trustees in cash by a stipulated date, or to have the Trustees sell a sufficient number of Entitlement Shares on his behalf in order to settle his tax liability as envisaged in clause 25; |

27

| 24.1.6 | the fact that the Participant shall be entitled to elect to receive all the Entitlement Shares (subject to a sale as envisaged in clause 24.1.5) or to have the Trustees sell all (and not only some) of the Participant’s Entitlement Shares on his behalf by delivering an Election Notice to the Trustees by a specified date, which date shall be a date occurring at least 14 (fourteen) days before the Vesting Date; and |

| 24.1.7 | the fact that if the Participant fails to (i) timeously deliver a duly executed Election Notice to the Trustees, that the Participant will be deemed to have elected to have the Trustees sell all of the Participant’s Entitlement Shares on his behalf in accordance with clause 24.3.2 or (ii) make an election regarding the settlement of his tax liability as envisaged in clause 24.1.5, that the Participant will be deemed to have elected to have the Trustees sell a sufficient number of his Entitlement Xxxxxx Xxxxxx on his behalf in order to settle his tax liability. |

Sale and delivery of Entitlement Shares

| 24.2 | Following the Vesting of a SAR, the Participant shall be entitled to such number of Ordinary Shares (and no cash settlement) as may be determined in accordance with the following formula (“Entitlement Shares”) – |

| ||

| Where: | ||

| n = | number of Ordinary Shares that will be delivered to a Participant, subject to the terms and conditions of this Deed and the Rules, rounded up to the nearest integer, provided that if n is less than or equal to zero then no Ordinary Shares will be delivered to the Participant; | |

| SPA = | Vesting Price less the Offer Price, provided that if SPA is more than 32, then SPA shall be equal to 32; | |

| VP = | Vesting Price; and | |

| S = | the number of Vested SARs. | |

28

| 24.3 | On the Settlement Date, the Trustees shall procure that the Company issues the Entitlement Shares to the Participant and shall either – |

| 24.3.1 | if a Participant timeously delivered a duly executed Election Notice and elected to receive all the Entitlement Shares, subject to clause 25, deliver the relevant number of Entitlement Shares to the Participant by crediting the Participant’s CSDP account on the Settlement Date; or |

| 24.3.2 | if a Participant (i) timeously delivered a duly executed Election Notice and elected to have the Trustees sell all of his Entitlement Shares or (ii) failed to timeously deliver a duly executed Election Notice, sell the Entitlement Shares on behalf of the Participant. |

| 24.4 | As soon as practicably possible after the Shares are sold on behalf of all the Participants envisaged in clause 24.3.2, the Trustees shall remit the Market Value as at the Vesting Date per Share to each Participant in respect of each Shares sold on their behalf, net of any transactional costs and taxes as envisaged in clause 25. |

Payment of Cash Bonus

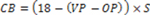

| 24.5 | If following the Vesting of a SAR, the Share Price Appreciation is less than R18 but more than zero, then in addition to receiving the Entitlement Shares, the Participant shall be entitled to a Cash Bonus in respect of the services rendered as may be determined in accordance with the following formula – |

| ||

| Where: | ||

| CB = | cash amount to be paid to a Participant, subject to the terms and conditions of this Deed and the Rules; | |

| VP = | Vesting Price; | |

| OP = | Offer Price; | |

| S = | the number of Vested SARs. | |

| 24.6 | The Trustees shall procure that the Company pays the amount of the Cash Bonus to the Participant on the Settlement Date, subject to the provisions of clause 25. |

29

Payment of Additional Cash Bonus

| 24.7 | If, following the Vesting of a SAR, the Share Price Appreciation is equal to zero or less than zero, then the Participant shall be entitled to receive, separate from the right to receive Entitlement Shares (if any) in respect of his Vested SARs, an Additional Cash Bonus in the amount of R18 per Vested SAR in respect of services rendered. |

| 24.8 | Subject to clause 25, the Trustees shall procure that the Company pays the amount of the Additional Cash Bonus to the Participant on the Settlement Date. |

| 25 | TAX LIABILITY |

| 25.1 | Each Participant shall be liable for any employees’ tax, securities transfer tax, capital gain tax and any other taxes arising pursuant to the – |

| 25.1.1 | delivery of the Scheme Shares on the Delivery Date; |

| 25.1.2 | delivery of the Entitlement Shares, in respect of Vested SARs, on the Settlement Date; |

| 25.1.3 | accrual of any Cash Bonus or Additional Cash Bonus; |

| 25.1.4 | sale of all of the Scheme Shares beneficially owned by the Participant and/or the Participant’s Entitlement Shares, and |

| 25.1.5 | the payment of any amount in terms of this Trust Deed or otherwise arising from his participation in the Scheme, |

regardless of whether the relevant tax liability is legally imposed on the Company, the Trust, the Trustees or the relevant Participant.

| 25.2 | Accordingly, notwithstanding anything to the contrary herein contained, the Trustees shall – |

| 25.2.1 | deduct such amount from the Cash Bonus or the Additional Cash Bonus, as the case may be, payable to the Participant as set out in clauses 24.5 and 24.7 respectively; and/or |

| 25.2.2 | sell such number of the Participant’s Vested Scheme Shares and/or Entitlement Shares; and/or |

| 25.2.3 | procure that the Company deducts such amount from the Participant’s salary, |

30

as may be required in order to settle that Participant’s tax liability (or estimated tax liability, as the case may be), provided that if the Participant timeously delivered a duly executed Election Notice and elected to make payment of such amount to the Trustees in cash (as envisaged in clause 23.1.4 or clause 24.1.5), the Trustees shall not make a deduction or sell any Shares as envisaged in clauses 25.2.1 and/or 25.2.2.

| 25.3 | In the event that, after settling a Participant’s tax liability as envisaged in clause 25.2, it becomes apparent from the relevant tax directive from SARS that the estimated tax amount as envisaged in clause 23.1.3 or 24.1.4 was – |

| 25.3.1 | over estimated, then the Trustees shall procure that that Participant is reimbursed to the extent of the over payment; or |

| 25.3.2 | under estimated, then the Trustees shall procure that the Company deducts the amount to the extent of the under payment from that Participant’s salary. |

| 25.4 | Each Participant hereby – |

| 25.4.1 | irrevocably appoints the Trustees as his agents to give effect to the sale of his Vested Scheme Shares and/or Entitlement Shares as envisaged in this clause 25; and |

| 25.4.2 | authorises the Company to make a deduction from his salary as envisaged in clauses 25.2.3 and 25.3.2. |

| 26 | VOTING RIGHTS |

Although the Participants shall be the beneficial owners of the Scheme Shares, the Participants shall, by accepting the Offer, cede all of their voting rights in respect of the Scheme Shares held by them to the Trustees until such time as the Scheme Shares are delivered to the Participants on the Delivery Date in accordance with clause 23.

31

| 27 | DISTRIBUTIONS |

| 27.1 | Participants shall be entitled to receive all distributions made by the Company in respect of the Scheme Shares, including the dividends declared and paid in respect of the Scheme Shares Allocated to them from time to time. |

| 27.2 | For the avoidance of doubt, it is recorded that the Participants shall not be entitled to receive the distributions made in respect of the Ordinary Shares constituting the reference asset of the SARs. |

| 27.3 | For purposes of determining a Participants liability for the dividend withholding tax imposed in section 64E of the Income Tax Act No. 58 of 1962, the Trustees shall notify the relevant CSDP that – |

| 27.3.1 | the Participants are the beneficial owners of the distributions made in respect of the Scheme Shares, provided that in the case of forfeited Scheme Shares, as envisaged in clause 28.2.1, the Trustees will hold such Scheme Shares as beneficial owners of such Scheme Shares and shall notify the relevant CSDP accordingly; |

| 27.3.2 | it must withhold dividends tax from the payment of any distributions made in respect of the Scheme Shares; and |

| 27.3.3 | the Trustees will accept, in their capacity as nominees of the Participants, any certificates or supporting documentation evidencing the dividends tax withheld by the CSDP and paid to the South African Revenue Service, which information the Trustees shall communicate to the Participants. |

| 27.4 | As soon as practicably possible after the Trustees receive the distribution from the Company, in their capacity as nominees of the Participants, they will pay to each Participant the distribution received in respect of the Scheme Shares beneficially owned by that Participant, provided that if the distribution is a distribution in specie, the Trustees shall either deliver the distribution to the Participant, or if in their Discretion it is impractical to do so, realise the distribution in specie and thereafter distribute the proceeds to the Participant. |

| 28 | TERMINATION OF EMPLOYMENT |

| 28.1 | For the purposes of this Trust Deed, the date of a Participant’s termination of employment will be deemed to be effective from – |

32

| 28.1.1 | in the case of a Bad Leaver or a Good Leaver, the date on which termination of employment is effective; |

| 28.1.2 | in the case of Superannuation, the date on which the Participant dies, is declared seriously disabled or seriously incapacitated by a medical professional; and |

| 28.1.3 | in all other instances, such date as determined by the Trustees, |

herein after referred to as the “Employment Termination Date”.

| 28.2 | Should a Participant’s Employment Termination Date occur at any time after the Allocation Date then the following terms and conditions will apply to any Allocation made to the Participant: |

| 28.2.1 | In the event of a Bad Leaver – |

| 28.2.1.1 | all SARs which have not Vested as at the Employment Termination Date will immediately lapse; and |

| 28.2.1.2 | all Scheme Shares Allocated to him and which have not Vested as at the Employment Termination Date will be immediately forfeited and transferred to the Trustees (and the relevant Bad Leaver shall be obliged to transfer to the Trustees) at the Subscription Price and shall be used by the Trustees for purposes of making future Offers to New Qualifying Employees as envisaged in clause 19.4; and |

| 28.2.1.3 | the Participant shall forthwith cease to be a Participant in the Scheme. |

| 28.2.2 | In the event of a Good Leaver – |

| 28.2.2.1 | Scheme Shares and SARs which have not yet Vested in the Participant on the Employment Termination Date shall be deemed to have Vested in the Participant on that date (“Deemed Vesting Date”) and the Participant – |

| 28.2.2.1.1 | will be deemed to have elected to have the Trustees sell all of his Vested Scheme Shares in accordance with clause 23.1.5 and the Trustees shall, on the Delivery Date, release the relevant number of Vested Scheme Shares from the Scheme and sell such Shares on behalf of the Participant and remit the proceeds of the realisation net of any transactional costs and taxes as envisaged in clause 25, mutatis mutandis in accordance with clauses 23.2.2 and 23.3; and |

33

| 28.2.2.1.2 | will be deemed to have elected to have the Trustees sell all of his Entitlement Shares in accordance with clause 24.1.6 and the Trustees shall, on the Settlement Date, (i) procure that the Company issues the relevant number of Entitlement Shares to the Participant, (ii) sell such Shares on behalf of the Participant and remit the proceeds of the realisation net of any transactional costs and taxes as envisaged in clause 25, mutatis mutandis in accordance with clauses 24.3.2 and 24.4 and (iii) procure that the Company pays any Cash Bonus and/or Additional Cash Bonus to the Participant mutatis mutandis in accordance with clauses 24.5 to 24.8; and |

| 28.2.2.2 | the Participant shall forthwith cease to be a Participant in the Scheme. |

| 28.2.3 | In the event of Superannuation – |

| 28.2.3.1 | Scheme Shares and SARs which have not yet Vested in the Participant on the Deemed Vesting Date shall be deemed to have Vested in the Deemed Vesting Date and the Participant – |

| 28.2.3.1.1 | will be deemed to have elected to have the Trustees sell all of his Vested Scheme Shares in accordance with clause 23.1.5 and the Trustees shall, on the Delivery Date, release the relevant number of Vested Scheme Shares from the Scheme and sell such Shares on behalf of the Participant and remit the proceeds of the realisation net of any transactional costs and taxes as envisaged in clause 25, mutatis mutandis in accordance with clauses 23.2.2 and 23.3; and |

| 28.2.3.1.2 | will be deemed to have elected to have the Trustees sell all of his Entitlement Shares in accordance with clause 24.1.6 and the Trustees shall, on the Settlement Date, (i) procure that the Company issues the relevant number of Entitlement Shares to the Participant, (ii) sell such Shares on behalf of the Participant and remit the proceeds of the realisation net of any transactional costs and taxes as envisaged in clause 25, mutatis mutandis in accordance with clauses 24.3.2 and 24.4 and (iii) procure that the Company pays any Cash Bonus and/or Additional Cash Bonus to the Participant mutatis mutandis in accordance with clauses 24.5 to 24.8; and |

34

| 28.2.3.2 | the Participant shall forthwith cease to be a Participant in the Scheme. |

| 28.2.4 | In the event that the Company and a Participant negotiate an agreement relating to the termination of a Participant’s employment, in a manner that does not constitute the Participant being regarded as a Bad Leaver, such settlement will be negotiated by parties appointed by the Board and the Participant and the outcome of such negotiation confirmed by the Trustees. Upon the Trustees confirming such agreement, the Trust shall be bound by the terms of such negotiated agreement. |

| 29 | PAYMENTS OF AMOUNTS TO DEPENDANTS OF PARTICIPANTS |

If the estate of any Participant is sequestrated and any amount becomes payable or Ordinary Shares become deliverable at any time thereafter by the Trust to such Participant, the Trustees may pay such amount or deliver such Ordinary Shares to any dependant (as determined by the Trustees in their Discretion) of such Participant, and such payment or delivery shall constitute a complete discharge of obligation of the Trust to such Participant.

| 30 | MEETINGS OF THE PARTICIPANTS |

Annual general meeting

| 30.1 | The annual general meeting of the Participants shall be held not later than 4 (four) months after the Trust’s financial year end each year. |

| 30.2 | The notice convening the annual general meeting, containing the agenda, must be furnished to the Participants at least 21 (twenty one) days before the date of the meeting. The non-receipt of such notice does not invalidate the proceedings at such meeting. |

| 30.3 | At least 5% (five percent) of the total number of Participants constitute a quorum at the annual general meeting. Only Participants present in person, via a video conference call facility or represented by proxy, shall be counted towards a quorum. If a quorum is not present after the lapse of 30 (thirty) minutes from the time fixed for the commencement of the meeting, the meeting must be postponed to a date determined by the Trustees, and Participants then present shall constitute a quorum. |

35

| 30.4 | The financial statements and reports of the Trust must be laid before the meeting. |

| 30.5 | Notices of motions to be placed before the annual general meeting must reach the chairperson of the board of Trustees not later than 7 (seven) days prior to the date of the meeting. |

Special general meeting

| 30.6 | The Trustees may call a special general meeting of the Participants if it is deemed necessary. |

| 30.7 | On the written requisition of at least 500 (five hundred) Participants, the Trustees must cause a special general meeting to be called within 30 (thirty) days of the delivery of the written requisition. The requisition must state the object of the meeting and must be signed by all the requisitionists and delivered to the chairperson of the board of Trustees. Only those matters forming part of the objects of the meeting may be discussed. |

| 30.8 | The notice convening a special general meeting, containing the agenda, must be furnished to the Participants at least 14 (fourteen) days before the date of the meeting. The non-receipt of such notice by a Participant will not invalidate the proceedings at such meeting. |

| 30.9 | At least 5% (five percent) of the total number of Participants constitute a quorum. Only Participants present in person, via video conference call facility or represented by proxy, shall be counted towards quorum. If a quorum is not present after the lapse of 30 (thirty) minutes from the time fixed for the commencement of the meeting, the meeting shall be regarded as cancelled. |

Voting at meetings of Participants

| 30.10 | Every Participant who is present at a meeting of the Participants (whether in person or by proxy) shall be entitled to a vote including those present via video conference call facility. Unless otherwise provided in this Trust Deed, all resolutions shall be passed by a majority vote of the Participants. |

| 30.11 | The chairperson of the board of Trustees must determine whether the voting must be by ballot or by a show of hands. In the event of the votes being equal, the chairperson shall have a casting vote. |

36

PART III: REGULATORY MATTERS

| 31 | SCHEME LIMITS |

| 31.1 | General Limit |

Notwithstanding anything to the contrary herein contained, the Trustees shall not make an Offer if at the time of or as a result of the making of such Offer the aggregate number of Scheme Shares which have been Allocated to Participants in terms of the Scheme after deducting any Allocations which have been forfeited, together with the aggregate number of Ordinary Shares in respect of SARs which may Vest, will exceed 12,864,000 (twelve million eight hundred and sixty four thousand) (“the Maximum Threshold”), subject to the provisions of clause 33.1.

| 31.2 | Individual limits |

Notwithstanding anything to the contrary herein contained, the Trustees shall not make any Offer to a single Qualifying Employee if at the time of or as a result of the making of Offer, the aggregate number of Scheme Shares which have been allocated to that Qualifying Employee in terms of the Scheme, together with the aggregate number of Ordinary Shares in respect of which any SARs Allocated to that Participant may Vest, shall exceed 600 (six hundred) (“the Individual Threshold”), subject to the provisions of clause 33.2.

| 32 | RECONSTRUCTION OR TAKEOVER |

| 32.1 | All Scheme Shares and SARs that have not Vested will become immediately Vested in the event of a Reconstruction or Takeover of the Company. |