SIXTH AMENDMENT TO LEASE

ORIGINAL

SIXTH AMENDMENT TO LEASE

This Sixth Amendment to Lease (“Amendment”) made and entered into this 7th day of March, 2012, between and among BRANDYWINE OPERATING PARTNERSHIP, L.P. (“Landlord”) and ACCOLADE, INC. (“Tenant”).

WHEREAS, Landlord leases certain premises consisting of 30,617 rentable square feet (“RSF”) of space commonly referred to as Suites 300 and 450 (collectively, “Original Premises”) located at 000 X. Xxxxxxxxxx Xxxx, Xxxxxxxx Xxxxxxx, Xxxxxxxxxxxx 00000 (“Original Building”), to Tenant pursuant to that certain Lease dated February 22, 2007, as amended by First Amendment to Lease dated July 24, 2008, as amended by Second Amendment to Lease dated March 3, 2009, as amended by Third Amendment to Lease dated August 5, 2010, as amended by Fourth Amendment to Lease dated August 10, 2011 and as amended by Fifth Amendment to Lease dated January 31, 2012, hereinafter collectively referred to as “Lease”;

1. Incorporation of Recitals. The recitals set forth above, the Lease, and the exhibits attached hereto are hereby incorporated herein by reference as if set forth in full in the body of this Amendment. Capitalized terms not otherwise defined herein shall have the meanings given to them in the Lease.

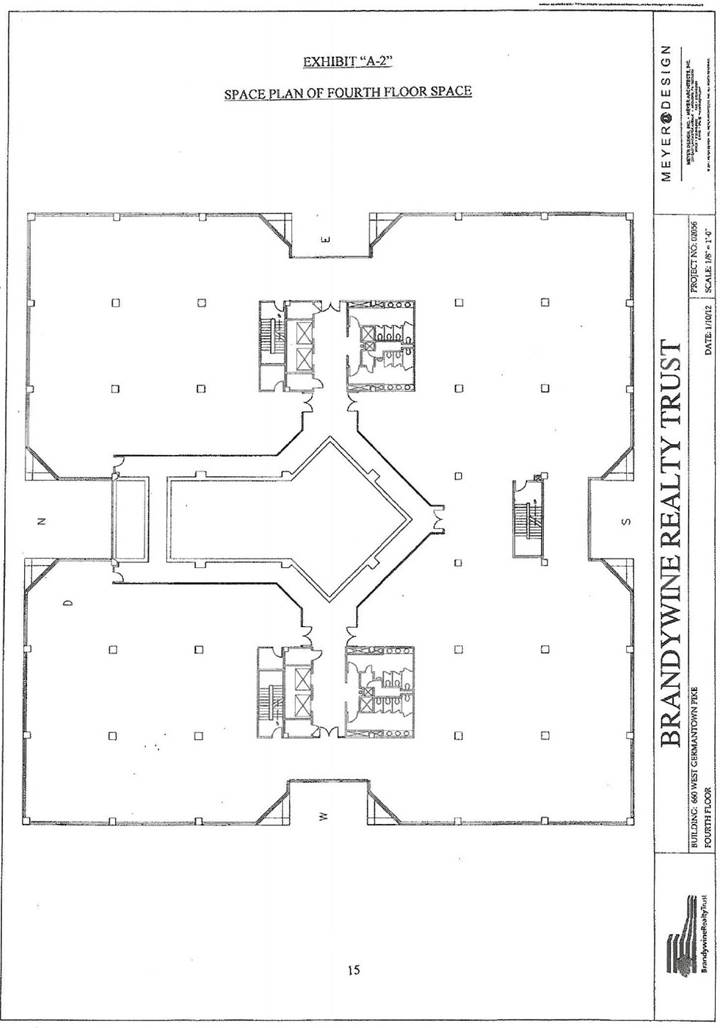

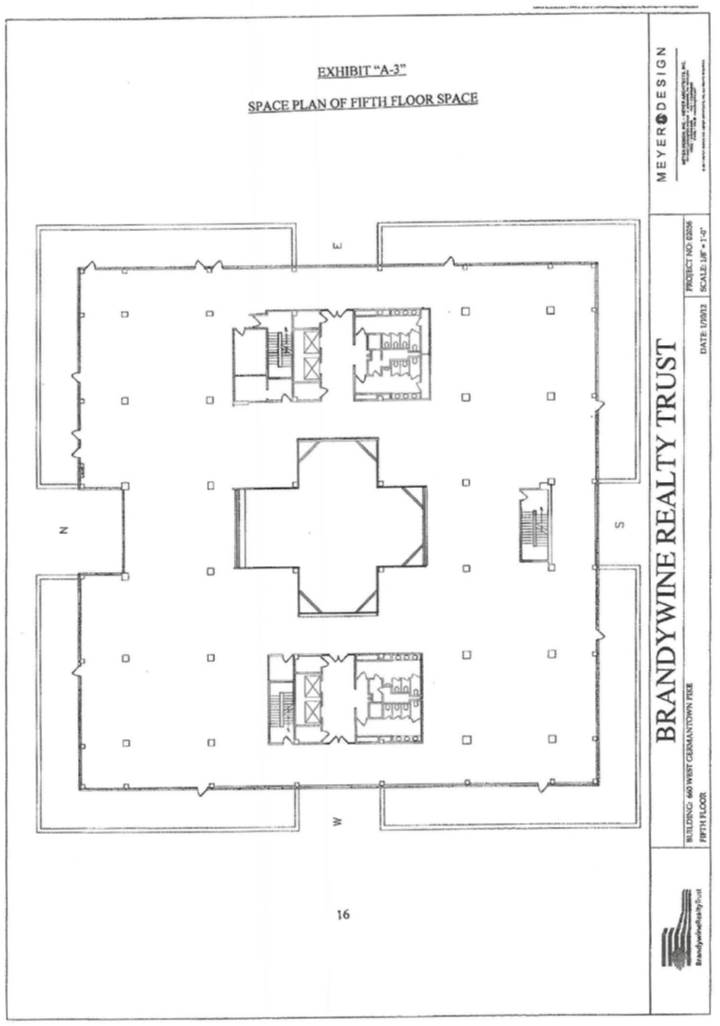

(a) The Lease is hereby amended to provide that Landlord hereby demises and lets unto Tenant, and Tenant hereby leases and hires from Landlord, a total of 89,878 RSF of space (“New Premises”), located on the third, fourth and fifth floors of 000 X. Xxxxxxxxxx Xxxx, Xxxxxxxx Xxxxxxx, XX 00000 (“New Building”), as shown on Exhibits “A-1”, “A-2” and “A-3”, attached hereto and made a part hereof. The breakdown of the New Premises is as follows: (a) 30,836 RSF of space will be located on the third floor of the Building (“Third Floor Space”), (b) 31,446 RSF of space will be located on the fourth floor of the Building (“Fourth Floor Space”) and (c) 27,596 RSF of space will be located on the fifth floor of the Building (“Fifth Floor Space”). The New Premises shall collectively be known as Suite 500 for mailing and notice purposes. Tenant shall determine, in its sole discretion, and shall notify Landlord of such determination in writing no later than March 7, 2012, of the order in which the Third Floor Space, Fourth Floor Space, and Fifth Floor Space shall be substantially completed and delivered to Tenant.

(b) The term of the Lease for the initial floor of the New Premises to be occupied by Tenant (“Initial Floor Space”) shall commence (“Initial Floor Space Commencement Date”) on the date which is the earlier of (i) when Tenant, with Landlord’s prior consent, assumes possession of the Initial Floor Space for its Permitted Uses, or (ii) upon substantial completion of the improvements required to be made to the Initial Floor Space by Landlord under Article 3(a). It is estimated that the Initial Floor Space Commencement Date shall be on or about July 1, 2012. So long as this Amendment is signed by Tenant by March 7, 2012, and the Milestones as referenced in Article 3(b) are met, and absent any Tenant’s Delay or force majeure event, if the Initial Floor Space Commencement Date does not occur by July 1, 2012, Tenant shall be entitled to a day for day Fixed Rent abatement for the Initial Floor Space for each day after July 1, 2012 until the Initial Floor Space Commencement Date occurs. Such abatement shall automatically apply to the first date following any free Fixed Rent period for the Initial Floor Space.

(c) The term of the Lease for the second floor of the New Premises to be occupied by Tenant

(i.e., the floor that Tenant occupies directly after the Initial Floor Space) (“Subsequent Floor Space”) shall commence (“Subsequent Floor Space Commencement Date”) on the date which is the earlier of (i) when Tenant, with Landlord’s prior consent, assumes possession of the Subsequent Floor Space for its Permitted Uses, or (ii) upon substantial completion of the improvements required to be made to the Subsequent Floor Space by Landlord under Article 3(a). It is estimated that the Subsequent Floor Space Commencement Date shall be on or about September 1, 2012. So long as this Amendment is signed by Tenant by March 7, 2012, and the Milestones as referenced in Article 3(b) are met, and absent any Tenant’s Delay or force majeure event, if the Subsequent Floor Space does not occur by September 1, 2012, Tenant shall be entitled to a day for day Fixed Rent abatement for the Subsequent Floor Space for each day after September 1, 2012 until the Subsequent Floor Space Commencement Date occurs. If the Subsequent Floor Space is still not substantially completed by September 30, 2012, Tenant shall be entitled to a two day Fixed Rent abatement for the Subsequent Floor Space for each day after September 30, 2012 until the Subsequent Floor Space Commencement Date occurs. Such abatement shall automatically apply to the first date following any free Fixed Rent period for the Subsequent Floor Space.

(d) The term of the Lease for the final floor of the New Premises to be occupied by Tenant (“Final Floor Space”) shall commence (“Final Floor Space Commencement Date”) on the date which is the earlier of (i) when Tenant, with Landlord’s prior consent, assumes possession of the Final Floor Space for its Permitted Uses, or (ii) upon substantial completion of the improvements required to be made to the Final Floor Space by Landlord under Article 3(a). It is estimated that the Final Floor Space Commencement Date shall be on or about March 1, 2013.

(e) Tenant and its authorized agents, employees and contractors, shall have the right, at Tenant’s own risk, expense and responsibility, at all reasonable times (to be coordinated with Landlord) two weeks prior to the Initial Floor Space Commencement Date, the Subsequent Floor Space Commencement Date and the Final Floor Space Commencement Date, whichever applies, to enter the relevant floor of the New Premises for the purpose of taking measurements and installing its furnishings, data and communications lines, fixtures and equipment.

(f) Substantial completion means that the initial improvements called for by this Amendment have been completed to the extent that the Initial Floor Space, Subsequent Floor Space or Final Floor Space, whichever is applicable, may be occupied by Tenant for its Permitted Uses, subject only to completion of minor finishing, adjustment of equipment, and other minor construction aspects which do not interfere with Tenant’s access to the applicable space of the New Premises for its Permitted Uses, and Landlord has procured a temporary or permanent certificate of occupancy permitting the occupancy of Initial Floor Space, Subsequent Floor Space or Final Floor Space, whichever is applicable, if required by law (hereafter, “substantial completion”).

(g) The expiration date of the Lease for the New Premises shall be on the last day of the calendar month, one hundred and eighty (180) months following the Initial Floor Space Commencement Date.

(h) It is the mutual intention of Landlord and Tenant that the New Premises shall be leased to and occupied by Tenant on and subject to all of the terms, covenants and conditions of the Lease except as otherwise expressly provided to the contrary in this Amendment.

(i) On or before eight (8) months following the Initial Floor Space Commencement Date (estimated to be on or about February 28, 2013), Tenant shall surrender the Original Premises in the condition required under the Lease. Upon Tenant’s delivery of the Original Premises to Landlord in accordance with the requirements of the Lease, Landlord shall release any claims that it may have against Tenant with respect to any matters arising under the Lease relating to the Original Premises or the Original Building except for any Rent due for the period prior to the date that Tenant surrenders the Original Premises that has not yet been invoiced or billed or claims that may hereafter arise for indemnification with respect to injury to persons or property relating to the Original Premises or Original Building occurring on or prior to the date of Tenant’s delivery of the Original Premises to Landlord in accordance with the requirements of the Lease. Upon Tenant’s delivery of the Original Premises to Landlord in accordance with the requirements of the Lease, Tenant shall release any claims that it may have against Landlord with respect to any matters arising under the Lease relating to the Original Premises or the

Original Building, other than claims that may arise for indemnification with respect to injury to persons or property relating to the Original Premises or the Original Building occurring on or prior to the date of Tenant’s delivery of the Original Premises to Landlord in accordance with the requirements of the Lease.

(j) Following the dual execution of this Amendment, Landlord shall market the Original Premises for lease to a new tenant. Should Landlord sign a lease with a new tenant for the Original Premises and construction is required to prepare the Original Premises for the new tenant’s occupancy, then Landlord’s Work to the Initial Floor Space, the Subsequent Floor Space and/or the Final Floor Space, at Landlord’s option, shall be accelerated in accordance with Landlord’s need to commence its work at the Original Premises. In this situation, the Final Floor Space shall be substantially completed by Landlord before Tenant is required to vacate the Original Premises.

(k) The Initial Floor Space Commencement Date, the Subsequent Floor Space Commencement Date, the Final Floor Space Commencement Date and the date that the Lease expires shall be confirmed by Landlord and Tenant by the execution of a Confirmation of Lease Term in the form attached hereto as Exhibit “B”. If Tenant fails to execute or object to the Confirmation of Lease Term within ten (10) business days of its delivery, Landlord’s determination of such dates shall be deemed accepted.

3. Landlord’s Work.

(a) Landlord shall construct and do such other work (collectively, the “Landlord’s Work”) in substantial conformity with the plans and outline specifications of the plans prepared by and dated , which will be attached hereto, made a part hereof and collectively marked as Exhibit “C-1”. Landlord shall only be responsible for payment of a maximum cost of $34.00 per rentable square foot for the design and construction of Landlord’s Work (the “Landlord Allowance”). All costs of the Landlord’s Work in excess of the Landlord Allowance shall be borne by Tenant, and shall be paid to Landlord within thirty (30) days of delivery of an invoice and reasonable documentation therefor. Should Landlord not require usage of the full amount of the Landlord Allowance in the performance of Landlord’s Work, Tenant may choose to use up to $5.00 per RSF of any excess Landlord Allowance for the purchase of architectural fees, furniture, fixtures and equipment or towards the cost of Tenant’s relocation from the Original Premises to the New Premises. No portion of any excess Landlord Allowance may be applied to Rent. Any excess Landlord Allowance used by Tenant for the purchase of architectural fees, furniture, fixtures and equipment or towards its relocation shall be paid to Tenant within 30 days of written request by Tenant but not sooner than the Initial Floor Space Commencement Date, but in any event shall be requested within six (6) months of the Final Floor Space Commencement Date or forfeited. Any excess Landlord Allowance shall be reimbursed to Tenant upon submission to Landlord of reasonable paid invoices. In addition to the Landlord’s Work, the New Building and the New Premises shall be delivered to Tenant with the “Base Building Conditions” as set forth on Exhibit “C-2”, attached hereto and made a part hereof. Tenant may request that Landlord use overtime labor to complete the Landlord’s Work and/or the Base Building Conditions so long as Tenant pays for the increased costs to be incurred by Landlord for such overtime labor.

(b) Tenant’s construction approval dates (“Milestones”) are as follows:

(i) Tenant shall approve preliminary plans for the Initial Floor Space by February 29, 2012 (Landlord acknowledges that the preliminary plans for the Initial Floor Space were approved by Tenant on February 29, 2012);

(ii) Tenant shall approve preliminary plans for the Subsequent Floor Space by March 30, 2012, unless Landlord signs a lease with a new tenant for the Original Premises, in which case, Tenant shall approve preliminary plans for the Subsequent Floor Space within five (5) business days of Landlord’s written notice to Tenant of such new lease for the Original Premises;

(iii) Tenant shall approve permitted plans for the Initial Floor Space by March 15, 2012 and permitted plans for the Subsequent Floor Space by April 15, 2012;

(iv) Tenant shall approve permitted plans for the Final Floor Space by the 120th day prior to the desired occupancy date of the Final Floor Space, but in no event later than November 30, 2012;

(v) Tenant shall deliver to Landlord signed/sealed Tele/Data plans for the Initial Floor Space by March 15, 2012 and signed/sealed Tele/Data plans for the Subsequent Floor Space by April 15, 2012. Tenant understands and acknowledges that its compliance with the Tele/Data requirements as set forth on Exhibit “D”, attached hereto is a prerequisite to the substantial completion of Landlord’s Work for the Initial Floor Space (and for the Subsequent Floor Space should Landlord sign a lease with a new tenant for the Original Premises). Tenant covenants that it will comply in good faith with the terms of Exhibit “D”; and

(vi) Tenant shall deliver to Landlord its finish specifications by March 15, 2012.

If Tenant misses any of the Milestones referenced in this Article 3(b), then notwithstanding anything to the contrary contained in Article 2, the date of the Final Floor Space Commencement Date shall be on March 1, 2013, the date of the Initial Floor Space Commencement Date shall be on July 1, 2012 and the date of the Subsequent Floor Space Commencement Date shall be on September 1, 2012; however, the dates in this paragraph are subject to change should Landlord require to enter the Original Premises earlier than the date intended herein due to Landlord executing a lease with a new tenant and needing to perform construction to the Original Premises. If Tenant misses any, of the Milestones referenced in this Article 3(b), then the Fixed Rent abatements referenced in Article 2(b) and (c) shall no longer be available to Tenant under this Amendment with respect to the specific floor or floors in which the Milestone or Milestones were missed.

(c) If any material revision or supplement to Landlord’s Work is deemed necessary by Landlord, those revisions and supplements shall be submitted to Tenant for approval, which approval shall not be unreasonably withheld or delayed. If Landlord shall be delayed in such “substantial completion” as a result of (i) Tenant’s request for materials, finishes or installations other than Landlord’s standard; (ii) Tenant’s changes in said plans; (iii) the performance or completion of any work, labor or services by a party employed by Tenant; (iv) Tenant’s failure to approve final plans, working drawings or reflective ceiling plans within the time frame stated by Landlord in its reasonable discretion; or (v) Tenant’s failure to meet any of the Milestones referenced in Article 3(b) above (each, a “Tenant’s Delay”); then the Initial Floor Space Commencement Date, the Subsequent Floor Space Commencement Date, and/or the Final Floor Space Commencement Date, whichever is/are applicable and the payment of Fixed Rent hereunder shall be accelerated by the number of days of such delay. If any change, revision or supplement to the scope of Landlord’s Work is requested by Tenant, then such increased costs associated with such requested change over and above the Landlord Allowance shall be paid by Tenant upfront and such occurrence shall not change the Initial Floor Space Commencement Date, the Subsequent Floor Space Commencement Date, and/or the Final Floor Space Commencement Xxxx, whichever is/are applicable, and shall not alter Tenant’s obligations under the Lease. Notwithstanding anything to the contrary stated in Article 2(b), (c) or (d) above, the Initial Floor Space Commencement Date, the Subsequent Floor Space Commencement Date, and/or the Final Floor Space Commencement Date, whichever is/are applicable, shall commence on the date the Initial Floor Space, the Subsequent Floor Space and/or the Final Floor Space would have been delivered to Tenant but for Tenant’s Delay or Tenant’s change order. Landlord’s Work constitutes an Alteration under Article 8 of the Lease.

4. Fixed Rent.

(a) Tenant shall pay to Landlord Fixed Rent for the Initial Floor Space as follows. Month 1 in this Article 4(a) commences on the Initial Floor Space Commencement Date and Month 180 in this Article 4(a) expires on the last day of the 180th calendar month following the Initial Floor Commencement Date:

|

TIME |

|

PER |

|

MONTHLY |

|

ANNUAL |

| |||

|

PERIOD |

|

RSF |

|

INSTALLMENT |

|

FIXED RENT |

| |||

|

|

|

|

|

|

|

|

| |||

|

Months 1-12 |

|

$ |

0.00 |

|

$ |

0.00 |

|

$ |

0.00 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 13-24 |

|

$ |

28.00 |

|

$ |

73,374.00 |

|

$ |

880,488.00 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 25-36 |

|

$ |

28.56 |

|

$ |

74,841.48 |

|

$ |

898,097,76 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 37-48 |

|

$ |

29.13 |

|

$ |

76,335.17 |

|

$ |

916,021.98 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 49-60 |

|

$ |

29.71 |

|

$ |

77,855.06 |

|

$ |

934,260.66 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 61-72 |

|

$ |

30.30 |

|

$ |

79,401.15 |

|

$ |

952,813.80 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 73-84 |

|

$ |

30.91 |

|

$ |

80,999.66 |

|

$ |

971,995.86 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 85-96 |

|

$ |

31.53 |

|

$ |

82,624.37 |

|

$ |

991,492.38 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 97-108 |

|

$ |

32.16 |

|

$ |

84,275.28 |

|

$ |

1,011,303.30 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 109-120 |

|

$ |

32.80 |

|

$ |

85,952.40 |

|

$ |

1,031,428.80 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 121-132 |

|

$ |

33.46 |

|

$ |

87,681.93 |

|

$ |

1,052,183.10 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 133-144 |

|

$ |

34.13 |

|

$ |

89,437.66 |

|

$ |

1,073,251.90 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 145-156 |

|

$ |

34.81 |

|

$ |

91,219.60 |

|

$ |

1,094,635.20 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 157-168 |

|

$ |

35.51 |

|

$ |

93,053.95 |

|

$ |

1,116,647.40 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 169-180 |

|

$ |

36.22 |

|

$ |

94,914.51 |

|

$ |

1,138,974.10 |

|

Tenant shall only be required to pay for electricity and gas utilities for the Initial Floor Space during Months I to 12. Commencing on Month 13 until the expiration of the Lease, Tenant shall be required to pay for utility charges pursuant to Article 5 herein and Recognized Expenses pursuant to Article 6 herein.

(b) Tenant shall pay to Landlord Fixed Rent for the Subsequent Floor Space as follows. Month 1 in this Article 4(b) commences on the Subsequent Floor Space Commencement Date and (notwithstanding anything to the contrary contained herein) Month 180 in this Article 4(b) expires on the last day of the 180th calendar month following the Initial Floor Commencement Date:

|

TIME |

|

PER |

|

MONTHLY |

|

ANNUAL |

| |||

|

PERIOD |

|

RSF |

|

INSTALLMENT |

|

FIXED RENT |

| |||

|

|

|

|

|

|

|

|

| |||

|

Months 1-12 |

|

$ |

0.00 |

|

$ |

0.00 |

|

$ |

0.00 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 13-24 |

|

$ |

28.00 |

|

$ |

64,390.67 |

|

$ |

772,688.00 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 25-36 |

|

$ |

28.56 |

|

$ |

65,678.48 |

|

$ |

788,141.76 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 37-48 |

|

$ |

29.13 |

|

$ |

66,989.29 |

|

$ |

803,871.48 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 49-60 |

|

$ |

29.71 |

|

$ |

68,323.10 |

|

$ |

819,877.16 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 61-72 |

|

$ |

30.30 |

|

$ |

69,679.90 |

|

$ |

836,158.80 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 73-84 |

|

$ |

30.91 |

|

$ |

71,082.70 |

|

$ |

852,992.36 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 85-96 |

|

$ |

31.53 |

|

$ |

72,508.49 |

|

$ |

870,101.88 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Months 97-108 |

|

$ |

32.16 |

|

$ |

73,957.28 |

|

$ |

887,487.36 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 109-120 |

|

$ |

32.80 |

|

$ |

75,429.07 |

|

$ |

905,148.80 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 121-132 |

|

$ |

33.46 |

|

$ |

76,946.85 |

|

$ |

923,362.16 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 133-144 |

|

$ |

34.13 |

|

$ |

78,487.62 |

|

$ |

941,851.48 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 145-156 |

|

$ |

34.81 |

|

$ |

80,051.40 |

|

$ |

960,616.76 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 157-168 |

|

$ |

35.51 |

|

$ |

81,661.16 |

|

$ |

979,933.96 |

|

|

|

|

|

|

|

|

|

| |||

|

Months 169-180 |

|

$ |

36.22 |

|

$ |

83,293.93 |

|

$ |

999,527.12 |

|

Tenant shall only be required to pay for electricity and gas utilities for the Subsequent Floor Space during the first 12 months following the substantial completion of the Subsequent Floor Space. Commencing on the 13th month following the commencement of the Subsequent Floor Space, Tenant shall pay for utility charges pursuant to Article 5 herein and Recognized Expenses pursuant to Article 6 herein.

(c) Tenant shall pay to Landlord Fixed Rent for the Final Floor Space as follows. Month 180 in this Article 4(c) expires on the last day of the 180th calendar month following the Initial Floor Commencement Date:

|

TIME |

|

PER |

|

MONTHLY |

|

ANNUAL |

| |||

|

PERIOD |

|

RSF |

|

INSTALLMENT |

|

FIXED RENT |

| |||

|

|

|

|

|

|

|

|

| |||

|

3/1/13*-2/28/14 |

|

$ |

0.00 |

|

$ |

0.00 |

|

$ |

0.00 |

|

|

|

|

|

|

|

|

|

| |||

|

3/1/14-6/30/14 |

|

$ |

28.00 |

|

$ |

71,950.67 |

|

$ |

863,408.00 |

|

|

|

|

|

|

|

|

|

| |||

|

7/1/14-6/30/15 |

|

$ |

28.56 |

|

$ |

73,389.68 |

|

$ |

880,676.16 |

|

|

|

|

|

|

|

|

|

| |||

|

7/1/15-6/30/16 |

|

$ |

29.13 |

|

$ |

74,854.39 |

|

$ |

898,252.68 |

|

|

|

|

|

|

|

|

|

| |||

|

7/1/16-6/30/17 |

|

$ |

29.71 |

|

$ |

76,344.80 |

|

$ |

916,137.56 |

|

|

|

|

|

|

|

|

|

| |||

|

7/1/17-6/30/18 |

|

$ |

30.30 |

|

$ |

77,860.90 |

|

$ |

934,330.80 |

|

|

|

|

|

|

|

|

|

| |||

|

7/1/18-6/30/19 |

|

$ |

30.91 |

|

$ |

79,428.40 |

|

$ |

953,140.76 |

|

|

|

|

|

|

|

|

|

| |||

|

7/1/19-6/30/20 |

|

$ |

31.53 |

|

$ |

81,021.59 |

|

$ |

972,259.08 |

|

|

|

|

|

|

|

|

|

| |||

|

7/1/20-6/30/21 |

|

$ |

32.16 |

|

$ |

82,640.48 |

|

$ |

991,685.76 |

|

|

|

|

|

|

|

|

|

| |||

|

7/1/21-6/30/22 |

|

$ |

32.80 |

|

$ |

84,285.07 |

|

$ |

1,011,420.80 |

|

|

|

|

|

|

|

|

|

| |||

|

7/1/22-6/30/23 |

|

$ |

33.46 |

|

$ |

85,981.04 |

|

$ |

1,031,772.50 |

|

|

|

|

|

|

|

|

|

| |||

|

7/1/23-6/30/24 |

|

$ |

34.13 |

|

$ |

87,702.72 |

|

$ |

1,052,432.60 |

|

|

|

|

|

|

|

|

|

| |||

|

7/1/24-6/30/25 |

|

$ |

34.81 |

|

$ |

89,450.09 |

|

$ |

1,073,401.10 |

|

|

|

|

|

|

|

|

|

| |||

|

7/1/25-6/30/26 |

|

$ |

35.51 |

|

$ |

91,248.86 |

|

$ |

1,094,986.30 |

|

|

|

|

|

|

|

|

|

| |||

|

7/1/26-Month 180 |

|

$ |

36.22 |

|

$ |

93,073.33 |

|

$ |

1,116,879.90 |

|

Tenant shall only be required to pay for electricity and gas utility charges for the Final Floor Space between Tenant’s occupancy of the Final Floor Space (* which is subject to change should Landlord require Tenant to move into the Final Floor Space prior to March 1, 2013 to commence construction for a new tenant of the Original Premises) and February 28, 2014. Commencing on March 1, 2014 and continuing until the expiration of the Lease, Tenant shall pay for utility charges pursuant to Article 5 herein and Recognized Expenses pursuant to Article 6 herein.

(d) Tenant shall pay to Landlord without notice or demand, and without set-off, the annual Fixed Rent payable in the monthly installments of Fixed Rent as set forth above, in advance on the first day of each calendar month during the term of the Lease for the New Premises by (i) check sent to Landlord c/o Brandywine Realty Trust, X.X. Xxx 00000, Xxxxxx, XX 00000-0000 or (ii) wire transfer of immediately available funds to the account at Xxxxx Fargo Bank, Salem NJ account no. 2030000359075 ABA #000000000; such transfer to be confirmed by Landlord’s accounting department upon written request by Tenant. All payments must include the following information: Building #586 and Lease # . The Lease number will be provided to Tenant by Landlord within a reasonable period of time following the execution of this Amendment.

(e) Notwithstanding anything to the contrary contained in this Amendment, Tenant shall remain obligated to pay Rent for the Original Premises for the first eight months following the Initial Floor Commencement Date.

5. Utilities. Article 5 of the Lease is hereby deleted and replaced with the following:

Landlord shall not be liable for any interruption or delay in electric or any other utility service for any reason unless caused by the negligence or willful misconduct of Landlord (or any third party acting on behalf of the Landlord). Landlord shall have the right, upon not less than thirty (30) days advanced written notice to Tenant, to change the electric, water, sewer, gas and other utility providers to the Project or New Building at any time, so long as any new provider is of the same commercially reasonable quality as the previous utility provider, and such change does not unreasonably disrupt Tenant’s business operations. Unless specifically set forth to the contrary in this Amendment, Tenant shall pay to Landlord, as Additional Rent all charges incurred by Landlord, or its agent for electricity, water, sewer and gas; such charges for electricity to the New Premises shall be measured by meters installed by Landlord as a part of the Base Building Conditions as outlined in Exhibit “C-2” (two (2) meters per floor), such charges for the New Premises water, sewer and gas shall be based upon Tenant’s Share and such charges for the New Building’s common areas shall be based on Tenant’s Share. The aforesaid electricity charges shall commence upon occupancy by Tenant of the New Premises. Landlord shall have the right to estimate the above referenced charges but shall be required to reconcile on an annual basis based on invoices received for such period. Notwithstanding anything to the contrary in the Lease, utility charges are not included as a Recognized Expenses under Article 6 of this Amendment.

6. Additional Rent. Article 4 of the Lease is hereby deleted and replaced with the following:

(a) Commencing on January 1, 2014, and in each calendar year thereafter during the term of the Lease, Tenant shall pay in advance on a monthly basis to Landlord, Tenant’s Share of the “Recognized Expenses”, without deduction, counterclaim or setoff, to the extent such Recognized Expenses exceed the Recognized Expenses in calendar year 2013 (“Base Year”). Tenant’s Share of the Third Floor Space is 19.97%, which is 30,836/154,392, which Share may increase or decrease as the Building size increases or decreases. Tenant’s Share of the Fourth Floor Space is 20.37%, which is 31,446/154,392, which Share may increase or decrease as the Building size increases or decreases. Tenant’s Share of the Fifth Floor Space is 17.87%, which is 27,596/154,392, which Share may increase or decrease as the Building size increases or decreases. Tenant’s Share of the New Premises (inclusive of the amounts for each of the spaces listed herein) is 58.21%, which is 89,878/154,392, which Share may increase or decrease as the New Building size increases or decreases. Recognized Expenses are (i) all reasonable operating costs and expenses related to the maintenance, operation and repair of the New Building incurred by Landlord, including but not limited to management and general administrative payroll fees not to exceed five (5%) percent of Rent; and capital expenditures and capital repairs and replacements shall be included as operating expenses solely to the extent

of the amortized costs of same over the useful life of the improvement in accordance with generally accepted accounting principles such useful life not to exceed five (5) years; (ii) all insurance premiums payable by Landlord for insurance with respect to the Project and (iii) Taxes payable on the Project (To the extent charges are incurred to the Project, such charges shall be equitably allocated to the New Building and thereafter to the Tenant, bases on Tenant’s Share). Taxes shall be defined as all taxes, assessments and other governmental charges (“Taxes”), including special assessments for public improvements or traffic districts which are levied or assessed against the Project during the Term or, if levied or assessed prior to the Term, which properly are allocable to the Term, and real estate tax appeal expenditures incurred by Landlord to the extent of any reduction resulting thereby. Nothing herein contained shall be construed to include as Taxes: (A) any inheritance, estate, succession, transfer, gift, franchise, corporation, net income or profit tax or capital levy that is or may be imposed upon Landlord or (B) any transfer tax or recording charge resulting from a transfer of the Building or the Project; provided, however, that if at any time during the Term the method of taxation prevailing at the commencement of the Term shall be altered so that in lieu of or as a substitute for the whole or any part of the taxes now levied, assessed or imposed on real estate as such there shall be levied, assessed or imposed (i) a tax on the rents received from such real estate, or (ii) a license fee measured by the rents receivable by Landlord from the Premises or any portion thereof, or (iii) a tax or license fee imposed upon Premises or any portion thereof, then the same shall be included in the computation of Taxes hereunder.

(b) Each of the Recognized Expenses shall for all purposes be treated and considered as Additional Rent. Tenant shall pay, in monthly installments in advance, on account of Tenant’s Share of Recognized Expenses, the estimated amount of the increase of such Recognized Expenses for such year in excess of the Base Year as determined by Landlord in its reasonable discretion. Prior to the end of the calendar year in which the Lease commences and thereafter for each successive calendar year (each, a “Lease Year”), or part thereof, Landlord shall send to Tenant a statement of projected increases in Recognized Expenses in excess of the Base Year and shall indicate what Tenant’s Share of Recognized Expenses shall be. The Base Year shall be adjusted to exclude from the Base Year “extraordinary items” incurred in such calendar year. For purposes or this subparagraph, extraordinary items shall mean either (X) cost increases over the prior calendar year of eleven and one quarter percent (11.25%) or more, or (Y) items which increase Landlord’s total expenses and such items have not been included in the determination of expenses by the Landlord (or the Landlord’s predecessor in interest) for the prior three years of operating the Building. As soon as administratively available, Landlord shall send to Tenant a statement of actual for Recognized Expenses for the prior Lease Year showing the Share due from Tenant. In the event the amount prepaid by Tenant exceeds the amount that was actually due then Landlord shall issue a credit to Tenant in an amount equal to the over charge, which credit Tenant may apply to future payments on account of Recognized Expenses until Tenant has been fully credited with the over charge. If the credit due to Tenant is more than the aggregate total of future rental payments, Landlord shall pay to Tenant the difference between the credit in such aggregate total. In the event Landlord has undercharged Tenant, then Landlord shall send Tenant an invoice with the additional amount due, which amount shall be paid in full by Tenant within thirty (30) days of receipt.

(c) Tenant shall have the right, at its sole cost and expense, within ninety (90) days from receipt of Landlord’s statement of Recognized Expenses, to audit or have its appointed accountant audit Landlord’s records related to Recognized Expenses provided that any such audit may not occur more frequently than once each calendar year nor apply to any year prior to the year of the statement being reviewed. In the event Tenant’s audit discloses any discrepancy, Landlord and Tenant shall use their best efforts to resolve the dispute and make an appropriate adjustment, failing which, they shall submit any such dispute to arbitration pursuant to the rules and under the jurisdiction of the American Arbitration Association in Philadelphia, Pennsylvania. The decision rendered in such arbitration shall be final, binding and non-appealable. The expenses of arbitration, other than individual legal and accounting expenses, which shall be the respective parties’ responsibility, shall be divided equally between the parties. In the event, by agreement or as a result of an arbitration decision it is determined that the actual Recognized Expenses exceeded those claimed by the Landlord by more than ten percent (10%), the actual, reasonable hourly costs to Tenant of Tenant’s audit (including legal and accounting costs) shall be reimbursed by Landlord. In the event Tenant utilizes a contingent fee auditor and Landlord is responsible for the payment of such auditor, Landlord shall only pay the reasonable hourly fee of such auditor. In the event, by agreement or as a result of an arbitration decision it is determined that the actual Recognized Expenses are less than those claimed by the

Landlord, then Tenant shall receive a credit of future Recognized Expenses. In the event it is determined that the amount paid by Tenant on account of Recognized Expenses was less than the amount to which Landlord is entitled hereunder for the applicable Lease Year, Tenant shall pay to Landlord such deficiency within thirty (30) days after such determination is made.

(d) In calculating the Recognized Expenses, if for thirty (30) or more days during the preceding Lease Year less than ninety-five (95%) percent of the rentable area of the New Building shall have been occupied by tenants, then the Recognized Expenses attributable to the New Building shall be deemed for such Lease Year to be amounts equal to the Recognized Expenses which would normally be expected to be incurred had such occupancy of the New Building been at least ninety-five (95%) percent throughout such year, as reasonably determined by New Landlord (i.e., taking into account that certain expenses depend on occupancy (e.g., janitorial) and certain expenses do not (e.g., landscaping)). Furthermore, if New Landlord shall not furnish any item or items of Recognized Expenses to any portions of the New Building because such portions are not occupied or because such item is not required by the tenant of such portion of the New Building, for the purposes of computing Recognized Expenses, an equitable adjustment shall be made so that the item of Recognized Expense in question shall be shared only by tenants actually receiving the benefits thereof; and

7. Tenant’s Notice Address. After Tenant surrenders the Original Premises, Tenant’s notice address shall be:

000 X. Xxxxxxxxxx Xxxx, Xxxxx 000

Xxxxxxxx Xxxxxxx, XX 00000

8. Relocation. Article 25 of the Lease is hereby deleted.

9. Brokerage Commission. Landlord and Tenant mutually represent and warrant to each other that they have not dealt, and will not deal, with any real estate broker or sales representative in connection with this proposed transaction except for Site Selection Group, LLC (national broker) and Gola Corporate Real Estate (local broker.) Each party agrees to indemnify, defend and hold harmless the other and their directors, officers and employees from and against all threatened or asserted claims, liabilities, costs and damages (including reasonable attorney’s fees and disbursements) which may occur as a result of a breach of this representation. Landlord will pay the local broker a commission pursuant to a separate agreement.

10. Representations: Landlord and Tenant each hereby confirm that (i) the Lease is in full force and effect and Tenant is currently in possession of the Original Premises; (ii) there are no defaults by Landlord or Tenant under the Lease; and Tenant’s Security Deposit for the New Premises is $136,748.94. Notwithstanding anything in the Lease to the contrary, Tenant’s Security Deposit shall not be reduced below $136,748.94 during the Lease term.

11. Early Termination.

Tenant shall have two (2) termination rights. The first termination right shall be the right to terminate the Lease for the New Premises on the last day of the 60th month following the Initial Floor Space Commencement Date (“First Termination Right”). The second termination right shall be the right to terminate the Lease for the New Premises on the last day of the 108th month following the Initial Floor Space Commencement Date (“Second Termination Right”). Both termination rights are subject to Tenant (i) not then being in an Event of Default (as defined in Article 18 of the Lease, as amended by Article 9 of the First Amendment to Lease) under the Lease beyond any applicable notice and cure period nor ever having been in an Event of Default under the Lease beyond any applicable notice and cure period, (ii) giving Landlord not less than eighteen (18) months prior written notice, and (iii) paying to Landlord, within thirty (30) days of such notice, a termination payment (“Termination Payment”). The Termination Payment consists of two parts: (a) New Premises - a pro rata percentage (based upon how much time is remaining in the Lease term) of free Fixed Rent received by Tenant, the unamortized architectural and legal fees, the unamortized Landlord Allowance and the unamortized cost of brokerage fees, all amortized at 8.4% interest plus 30 months of the then current Fixed Rent for the New Premises if Tenant is exercising the First Termination Right or 12 months of the then current Fixed Rent for the New Premises if Tenant is exercising the Second Termination Right, and (b) Original Premises- the unamortized free Fixed Rent and fifty percent (50%) of tenant improvement costs and broker commissions for the Lease for the Original

Premises, amortized at 10%. Upon the completion of Landlord’s Work and the payment of all invoices related thereto, the unamortized costs of this transaction for the New Premises and the unamortized cost of the Lease for the Original Premises will be calculated and submitted to Tenant by way of an amortization schedule. Failure to provide written notice and payment within the prescribed time frames will be considered by Landlord, without the necessity of additional notice, as a waiver of this right to terminate. Tenant acknowledges and agrees that the Termination Payment is not a penalty and is fair and reasonable compensation to Landlord for the loss of expected rentals from Tenant over the remainder of the scheduled term.

12. Renewal.

Provided Tenant is not in default at the time of exercise, and Tenant is occupying 100% of the New Premises, and the Lease is in full force and effect, Tenant shall have the right to renew the Lease for two (2) term(s) of five (5) years each beyond the end of the current term (each, a “Renewal Term”). Tenant shall furnish written notice of intent to renew at least twelve (12) months prior to the expiration of the applicable term, failing which, such renewal right shall be deemed waived; time being of the essence. The terms and conditions of the Lease during each Renewal Term shall remain unchanged, except that the annual Fixed Rent for each Renewal Term shall be the lower of (i) the Fixed Rent for the term expiring, or (ii) 95% of Fair Market Rent (as such term is hereinafter defined). Anything herein contained to the contrary notwithstanding, Tenant shall have no right to renew the term hereof other than or beyond the two (2) consecutive five (5) year terms hereinabove described. It shall be a condition of each such Renewal Term that Landlord and Tenant shall have executed, not less than nine (9) months prior to the expiration of the then expiring term hereof, an appropriate amendment to the Lease, in form and content satisfactory to each of them, memorializing the extension of the term hereof for the next ensuing Renewal Term.

For purposes of this Lease, “Fair Market Rent” shall mean the base rent for comparable space. In determining the Fair Market Rent, Landlord, Tenant and any appraiser shall take into account applicable measurement and the loss factors, applicable lengths of lease term, differences in size of the space demised, the location of the Building and comparable buildings, amenities in the Building and comparable buildings, the ages of the Building and comparable buildings, differences in base years or stop amounts for operating expenses and tax escalations and other factors normally taken into account in determining Fair Market Rent. The Fair Market Rent shall reflect the level of improvement made or to be made by Landlord to the space and the Recognized Expenses and Taxes under this Lease. If Landlord and Tenant cannot agree on the Fair Market Rent, the Fair Market Rent shall be established by the following procedure: (1) Tenant and Landlord shall agree on a single MAI certified appraiser who shall have a minimum of ten (10) years experience in real estate leasing in the market in which the New Premises is located, (2) Landlord and Tenant shall each notify the other (but not the appraiser), of its determination of such Fair Market Rent and the reasons therefor, (3) during the next seven (7) days both Landlord and Tenant shall prepare a written critique of the other’s determination and shall deliver it to the other party, (4) on the tenth (10th) day following delivery of the critiques to each other, Landlord’s and Tenant’s determinations and critiques (as originally submitted to the other party, with no modifications whatsoever) shall be submitted to the appraiser, who shall decide whether Landlord’s or Tenant’s determination of Fair Market Rent is more correct. The determinations so chosen shall be the Fair Market Rent. The appraiser shall not be empowered to choose any number other than the Landlord’s or Tenant’s. The fees of the appraiser shall be paid by the non-prevailing party.

13. Right of Expansion. Subject to (a) Tenant not being in default at the time of exercise; (b) Tenant being in occupancy of 100% of the New Premises; (c) the existing rights of other tenants within the New Building; (d) such limitations as are imposed by other existing tenant leases in the New Building; and (e) Tenant notifying Landlord in writing that it requires additional space, Landlord shall notify Tenant in writing with regard to space (other than space that is available at the time that this Amendment is executed) that is or Landlord expects to become vacant and available for lease in the New Building. Tenant shall have ten (10) days next following Landlord’s delivery of such notice within which to accept such terms, time being of the essence. Should Tenant elect in writing to exercise this option and there remain at least eight (8) years left of the Lease, Tenant shall receive the same rental rate then in effect under the current Lease and a pro rata tenant improvement allowance based upon the remaining time left in the Lease. If less than eight years remain on the Lease term, Tenant shall have the right to lease such additional space at ninety five percent (95%) of Fair Market Rent (as defined in Article 12 above). In either case, the parties shall negotiate the terms of a new lease or an amendment to the Lease to memorialize their agreement. In the

absence of any further agreement by the parties, if less than 8 years remain on the Lease, such additional space shall be delivered in an “AS —IS” condition, except as expressly agreed by Landlord and Tenant, and subject to Landlord’s representations and warranties in the Lease, and Rent for such additional space shall commence on that date which is the earlier of: (x) Tenant’s occupancy thereof, and (y) five (5) days after Landlord delivers such additional space to Tenant free of other tenants and occupants. If Tenant shall not accept Landlord’s terms within such ten (10) day period, or if the parties shall not have executed and delivered a mutually satisfactory new lease or lease amendment within sixty (60) days next following Landlord’s original notice under this Article 13, then Tenant’s right to lease such space shall lapse and terminate, and Landlord may, at its discretion, lease such space on such terms and conditions as Landlord shall determine. Tenant’s rights hereunder shall not include the right to lease less than all of the space identified in Landlord’s notice.

14. Signage. Landlord shall provide Tenant with standard identification signage on all New Building directories and at the entrance to the Third Floor Space, the Fourth Floor Space and the Fifth Floor Space. Tenant will be named as the top position on the New Building monument sign located outside of the New Building provided Tenant remains in occupancy of 100% of the New Premises. Should Tenant lease 100% of the New Building, Tenant, at Tenant’s sole cost and expense, may erect a sign on the exterior of the New Building, so long as the sign is in accordance with township regulations and is approved by Landlord and the township. So long as Tenant leases 100% of the New Premises, Landlord shall not permit another tenant of the New Building to erect any signage on the exterior of the New Building. Additionally, should Tenant lease 100% of the New Premises, Landlord, at Tenant’s expense, shall add the word “Accolade” and “660” on each traffic directional sign within the Project. No other signs shall be placed, erected or maintained by Tenant at any place upon the New Premises, New Building or Project.

15. Parking. Upon the Initial Floor Commencement Date, and so long as Tenant continues to Lease 100% of the New Premises, Tenant shall be entitled to ten (10) reserved parking spaces near the main entrance of the New Building, the exact locations of which to be mutually agreed upon by Landlord and Tenant. Tenant acknowledges and agrees that Landlord shall only provide signage for Tenant’s reserved parking spaces and shall not have a duty to monitor or enforce who parks in such reserved spots. Tenant shall also have the right, in common with other tenants of the Building and Landlord, to use the designated parking areas of the New Building for the unreserved parking of automobiles of Tenant and its employees and business visitors, incident to Tenant’s permitted use of the Premises; provided that Landlord shall have the right to restrict or limit Tenant’s utilization of the parking areas in the event the same become overburdened and in such case to equitably allocate on proportionate basis or assign parking spaces among Tenant and the other tenants of the Building. Notwithstanding the foregoing, at no time shall Tenant be required to reduce its parking to less than 5 spaces per 1,000 RSF (this fraction is based upon Tenant leasing 89,878 RSF of space in the New Building) (this number excludes the aforementioned reserved parking spaces). Landlord represents that the total amount of parking spaces available for all of the tenants at the New Building as of the date that this Amendment is executed is 649. Landlord will endeavor, at no additional cost to Tenant, to expand the existing parking lot at the New Building so that Tenant will have six parking spaces per 1,000 RSF (this fraction is based upon Tenant leasing 89,878 RSF of space in the New Building).

16. Assignment and Subletting. Article 9 of the Lease is hereby amended as follows: Landlord shall not have the right to recapture on subleases of less than ninety percent (90%) of any of the Third Floor Space, the Fourth Floor Space or the Fifth Floor Space.

17. Permitted Use. Tenant’s use of the New Premises shall be limited to general office use (including a 24 hour, 7 day per week call center) and storage incidental thereto (“Permitted Use”).

18. Subordination; Rights of Mortgagee. The following shall be added to Article 15 of the Lease:

There is not currently a mortgage on the New Building. Landlord shall endeavor to deliver a subordination, attornment and nondisturbance agreement (“Nondisturbance Agreement”) from any future Landlord’s Mortgagee, on each such mortgagee’s standard form, which shall provide, inter alia, that the leasehold estate granted to Tenant under the Lease will not be terminated or disturbed by reason of the foreclosure of the mortgage held by Landlord’s Mortgagee, so long as Tenant shall not be in default under the Lease and shall pay all sums due under the

Lease without offsets or defenses thereto and shall fully perform and comply with all of the terms, covenants and conditions of the Lease on the part of Tenant to be performed and/or complied with, and in the event a mortgagee or its respective successor or assigns shall enter into and lawfully become possessed of the New Premises covered by the Lease and shall succeed to the rights of Landlord hereunder, Tenant will attorn to the successor as its landlord under the Lease and, upon the request of such successor landlord, Tenant will execute and deliver an attornment agreement in favor of the successor landlord.

19. Environmental Matters. The following paragraphs are hereby added to Article 7 of the Lease:

(a) Tenant shall defend, indemnify and hold harmless Landlord, Brandywine Realty Services Corp. and Brandywine Realty Trust and their respective employees and agents from and against any and all third-party claims, actions, damages, liability and expense (including all attorney’s, consultant’s and expert’s fees, expenses and liabilities incurred in defense of any such claim or any action or proceeding brought thereon) arising from Tenant’s storage and use of hazardous substances in the New Premises including, without limitation, any and all costs incurred by Landlord because of any investigation of the Project or any cleanup, removal or restoration of the Project to remove or remediate hazardous or hazardous wastes deposited by Tenant. Without limitation of the foregoing, if Tenant, its officers, employees, agents, contractors, licensees or invitees cause contamination of the New Premises by any hazardous substances, Tenant shall promptly at its sole expense, take any and all necessary actions to return the New Premises to the condition existing prior to such contamination, or in the alternative take such other remedial steps as may be required by law or recommended by Landlord’s environmental consultant.

(b) Landlord has not used, generated, manufactured, produced, stored, released, discharged or disposed of on, under or about the New Premises or transported to or from the New Premises, any hazardous substances or allowed any other entity or person to do so to its knowledge. Landlord has no knowledge that any hazardous substances has been produced, stored, released, discharged or disposed of on, under or about the New Building by any entity or person.

(c) Landlord shall defend, indemnify and hold harmless Tenant and its respective employees and agents from and against any and all third-party claims, actions, damages, liability and expense (including all attorney’s, consultant’s and expert’s fees, expenses and liabilities incurred in defense of any such claim or any action or proceeding brought thereon) arising from Landlord (or its agents and contractors) use of hazardous substances in the New Premises, New Building or Project including, without limitation, any and all costs incurred by Tenant because of any investigation of the New Premises or any cleanup, removal or restoration of the New Premises to remove or remediate hazardous or hazardous wastes deposited by Landlord. Without limitation of the foregoing, if Landlord, its officers, employees, agents, contractors, licensees or invitees cause contamination of the New Premises, New Building or Project by any hazardous substances, Landlord shall promptly at its sole expense, take any and all necessary actions to return the New Premises, New Building and/or Project to the condition existing prior to such contamination, or in the alternative, take such other remedial steps as may be required by law or recommended by Tenant’s environmental consultant.

20. Security System. The New Building has and shall continue to have for the duration of the term of this Amendment a perimeter access security system with swipe card access that is monitored by a central station security company. Tenant shall have the right at its cost, to install a proximity card security system for its exclusive use at the New Building. The system shall be a stand-alone system or one that can be linked with the New Building’s proximity card security system. If linked with New Building’s system, maintenance and monitoring shall be provided by Tenant.

22. Landlord Representations and Warranties. Landlord represents and warrants to Tenant that (i) the New Building has fiber optics installed for Verizon and AT&T as telecom provider(s), (ii) the New Building has and will continue to have during the term of this Amendment, fully redundant electrical service, and that the New Building has dual power feeds from the same substation, (iii) the New Building is serviced by two (2) 13,000 volt electric lines, and (iv) the New Building has a HVAC system in good operational condition operating via water source heat pumps.

23. Emergency Backup Generator. In accordance with the terms and conditions of the Fifth Amendment to Lease, Tenant may install emergency backup generators, fuels tanks and pad sites at mutually agreeable locations at or near the New Building.

24. CAD Drawings. Following the execution of this Amendment, Landlord shall, at Landlord’s sole cost and expense, furnish to Tenant, New Building scaled CAD of the proposed New Premises, which shall depict among other things, the current configuration and ceiling heights.

25. Janitorial Services. Landlord shall provide Tenant with janitorial services for the New Premises Monday through Friday of each week in accordance with the guidelines set forth in Exhibit “E,” attached hereto and made a part hereof.

26. Binding Effect. Except as expressly amended hereby, the Lease remains in full force and effect in accordance with its terms. If any term of the Lease conflicts with any term in this Amendment, the term in this Amendment will control. Tenant specifically acknowledges and agrees that Article 18 of the Lease as amended by Article 9 of the First Amendment to Lease concerning Confession of Judgment is and shall remain in full force and effect in accordance with its terms.

|

WITNESS: |

|

LANDLORD: | |||

|

|

|

|

BRANDYWINE OPERATING PARTNERSHIP, L.P. | ||

|

|

|

|

| ||

|

|

|

|

By: |

Brandywine Realty Trust, | |

|

|

|

|

|

its general partner | |

|

|

|

|

| ||

|

|

|

|

| ||

|

/s/ [ILLEGIBLE] |

|

By: |

/s/ Xxxxxx Xxxxxxx | ||

|

[ILLEGIBLE] |

|

Name |

XXXXXX XXXXXXX | ||

|

|

|

|

Title |

VICE PRESIDENT-ASSET MANAGER | |

|

|

|

|

| ||

|

|

|

|

| ||

|

ATTEST: |

|

TENANT: | |||

|

|

|

||||

|

|

|

| |||

|

|

|

| |||

|

/s/ Xxxx Xxxxx |

|

By: |

/s/ Xxxxxx X. Xxxxx | ||

|

Name: |

Xxxx Xxxxx |

|

Name: |

XXXXXX X. XXXXX | |

|

Title: |

CFO |

|

Title: |

CEO | |

EXHIBIT “B”

Tenant: ACCOLADE, INC.

New Premises: Xxxxx 000, 000 X. Xxxxxxxxxx Xxxx, Xxxxxxxx Xxxxxxx, Xxxxxxxxxxxx 00000

Square Footage: 89,878 RSF

CONFIRMATION OF LEASE TERM

THIS MEMORANDUM is made as of the day of , 2013, between BRANDYWINE OPERATING PARTNERSHIP, L.P., a Delaware limited partnership, with an office at 000 X. Xxxxxxxxx Xxxxxx, Xxxxx 000, Xxxxxx, XX 00000 (“Landlord”), and ACCOLADE, INC., a Delaware corporation with an office (“Tenant”), who entered into a Sixth Amendment to Lease (“Amendment”) dated for reference purposes as of , 2012, covering certain premises located at Xxxxx 000, 000 X. Xxxxxxxxxx Xxxx, Xxxxxxxx Xxxxxxx, Xxxxxxxxxxxx 00000. All capitalized terms, if not defined herein, shall be defined as they are defined in the Amendment.

1. The Parties to this Memorandum hereby agree that the date of is the Initial Floor Space Commencement Date, the date of is the Subsequent Floor Space Commencement Date, the date of is the Final Floor Space Commencement Date and the date of is the expiration date of the Lease.

2. Tenant hereby confirms the following:

(a) That it has accepted possession of the New Premises pursuant to the terms of the Amendment;

(b) That to the best of Tenant’s knowledge, the improvements, including the Landlord’s Work required to be furnished according to the Amendment by Landlord have been Substantially Completed;

(c) That to the best of Tenant’s knowledge, Landlord has fulfilled all of its duties of an inducement nature or are otherwise set forth in the Amendment;

(d) That to the best of Tenant’s knowledge, there are no offsets or credits against rentals;

(e) That to the best of Tenant’s knowledge, there is no default by Landlord under the Lease and the Lease is in full force and effect.

3. Landlord hereby confirms to Tenant that its Building Number is 586 and its Lease Number is . This information must accompany each Rent check or wire payment.

4. Tenant’s Notice Address is: Tenant’s Billing Address is:

5. This Memorandum, each and all of the provisions hereof, shall inure to the benefit, or bind, as the case may require, the parties hereto, and their respective successors and assigns, subject to the restrictions upon assignment and subletting contained in the Lease.

|

WITNESS: |

|

LANDLORD: | |||

|

|

|

BRANDYWINE OPERATING PARTNERSHIP, L.P. | |||

|

|

|

|

|

| |

|

|

|

By: |

Brandywine Realty Trust, | ||

|

|

|

|

its general partner | ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

By: |

| ||

|

|

|

Name |

| ||

|

|

|

Title |

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

ATTEST: |

|

TENANT: | |||

|

|

|

||||

|

|

|

| |||

|

|

|

| |||

|

|

|

By: |

|

| |

|

Name: |

|

|

Name: |

|

|

|

Title: |

Secretary |

|

Title: |

|

|

EXHIBIT “C-2”

BASE BUILDING CONDITIONS

The New Building and New Premises shall be delivered with the following Base Building Conditions:

1, The New Building and the New Premises shall be delivered in conformance with the American’s with Disabilities Act (“ADA”) and all applicable local, federal and state building codes, which shall include but shall not be limited to all common areas, ingress / egress to and from the New Premises and the front entrance, elevators, parking areas, ramps and restrooms. Such compliance with regard to the New Premises shall be the responsibility of Landlord prior to Tenant’s occupancy of the specific floors of the New Premises. Notwithstanding the foregoing, following the Initial Floor Space Commencement Date, the Subsequent Floor Commencement Date and/or the Final Floor Space Commencement Date, whichever has/have occurred, Tenant shall not be required to make any structural changes or system repairs, replacements or alterations to the New Premises as a result of any changes to the ADA, unless the need for the same results from Tenant’s specific use of the New Premises, as opposed to general office use.

2. The New Premises shall be delivered with electric capacity of at least five (5) xxxxx per rentable square foot including code compliant distribution panels, which electric service shall be exclusive of HVAC and any other New Building systems.

3. All windows, windowsills, exterior walls and floors shall be delivered free of leaks and seepage in good working order and condition. Landlord will patch all windowsills that were previously interrupted by a partition wall. Refinishing the windowsills on the third, fourth and fifth floors will be part of the tenant work. The stain on the third and fourth floors will match the building standard doors. The stain on the windowsills on the fifth floor, will be darker and will be a selection mutually agreed to by Landlord and Tenant. Landlord shall replace any scratched or defective glass if required by Tenant.

4. All window blinds shall be in good condition or shall be replaced by the Landlord.

6. Landlord shall remove all abandoned voice/data cabling and inactive electrical outlets within the ceiling, walls and floor. Removal and patching of tele/data jacks (if not reused by Tenant) will be part of the tenant work.

7. Landlord will provide New Building common area signage to meet all applicable codes (i.e. restroom signage, exiting signage). Landlord shall deliver the New Premises with all New Building systems including the HVAC system in good working condition.

8. Landlord will install 2 meters per floor to measure the New Premises’ electrical usage.

In addition, Landlord will have completed the following base New Building items prior to Tenant’s occupancy:

· Demo of all interior partitions, ceilings, lights, and bathrooms on all six (6) floors;

· The entire parking lot will be resurfaced and striped. Curbing will be installed throughout the Project;

· Clean up the existing landscaping;

· Pressure wash the entire New Building and seal coat the exterior brick;

· Repaint the existing roof screen;

· Install a new water source heat pump system, replacing the primary central plant and heat pumps;

· Upgrade the existing elevator system including new cabs and drop existing shaft to the lower level on the west side of the elevator cabs

· Construct an amenities area on the terrace level including a fitness center, cafe, conference center and multimedia room (“Amenities”). Landlord to complete construction of such New Building Amenities within four (4) months after the Initial Floor Space Commencement Date (estimated to be October 31, 2012). So long as this Amendment is executed by Tenant on or before March 7, 2012, and absent any Tenant Delay or force majeure event, and subject to receiving all approvals from any applicable governmental entity with respect to the plans and permits to operate a cafe in the New Building, if the Amenities are not substantially completed by October 31, 2012, Tenant shall be entitled one (1) business day Fixed Rent abatement for each two (2) business day after October 31, 2012 until the Amenities are substantially completed. Notwithstanding the foregoing, Landlord makes no representation that the café will be operating as a food service area, just substantially completed, provided, however, that the fitness center, conference center and multimedia room shall be fully operational.

EXHIBIT “D”

TENANT’S TELE/DATA REQUIREMENTS:

Tenant’s requirements for installing voice and data cabling in commercial offices in Plymouth Township are outlined in detail by the Code Enforcement Office for Plymouth Township. This information is available on-line at xxx.xxxxxxxxxxxxxxxx.xxx or by calling the Plymouth Township Code Enforcement Office at 610-277-4104.

Tenant shall provide Landlord with its signed and sealed Tele/Data drawings and a copy of its contract with the Tele/Data vendor retained by Tenant for the Initial Floor Space no later March 15, 2012 and for the Subsequent Floor Space by April 15, 2012.

EXHIBIT “E”

CLEANING SPECIFICATIONS

DAILY

Empty Trash and Recycle

Remove Spots/Spills from Carpet

Remove Visible Debris/Litter from Carpet

Spot Clean Desks and Tables

Straighten Chair — Furniture

Turn Off Lights

TWICE PER WEEK

Vacuum Carpet

WEEKLY

Dust Desks and Computer Monitors

Clean Wastebaskets

Clean Light Fixtures and Vents

Clean Telephones

Clean Walls, Switch Plates and Baseboards

Dust File Cabinets, Partitions and Bookshelves

Clean Chairs

Clean Doors

Clean Tables

Dust Pictures and Surfaces Over 5’

Dust Window Xxxxx, Ledges and Radiators

Spot Clean Side Light Glass

RESTROOM CLEANING SPECIFICIATIONS

THREE TIMES DAILY

Sinks

Floors

Counters

Trash Receptacle

Toilet/Urinals

Dispensers

Door

Spot Clean Walls

Spot Clean Partitions

WEEKLY

Dust Lights

Dust Surfaces Over 5’

Ceiling Vents

Clean Walls

Clean Partitions

FLOOR CARE SPECIFICIATIONS

DAILY

Spot Clean Carpet

WEEKLY

Burnish Polished Surfaces

MONTHLY

Machine Scrub Restroom Floors

Scrub and Recoat Copy Room Floors

Scrub and Recoat Kitchenette Floors

ONCE EVERY FOUR MONTHS

Shampoo Conference Room Carpets

YEARLY

Strip and Refinish all vinyl tile

THE COST FOR ANY CLEANING OVER AND ABOVE THE STANDARD CLEANING SPECIFICATIONS IS TO BE BORNE BY THE TENANT.