PLATFORM AGREEMENT

| Confidential Materials omitted and filed separately with the Securities and Exchange Commission. Double asterisks denote omissions. |

Exhibit 10.11

Confidential - Execution Version |

THIS PLATFORM AGREEMENT (“Agreement”), dated as of June 23, 2009 (the “Effective Date”), is by and between CALANDO PHARMACEUTICALS, INC., a Delaware corporation having its principal place of business at 000 Xxxxx Xxxx Xxxxxx, Xxxxxxxx, Xxxxxxxxxx 00000 (hereinafter referred to as “Calando”), and CERULEAN PHARMA INC., a Delaware corporation, having its principal place of business at 000 Xxxxx Xxxxxx, Xxxxxxxxx, Xxxxxxxxxxxxx 00000 (hereinafter referred to as “Cerulean”).

INTRODUCTION

WHEREAS, Calando possesses certain proprietary cyclodextrin-based polymer drug delivery systems; and

WHEREAS, Cerulean is engaged in the research, development and commercialization of nanopharmaceuticals and desires to license such drug delivery systems upon the terms and conditions set forth herein;

NOW, THEREFORE, in consideration of the mutual covenants and promises contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Calando and Cerulean agree as follows:

SECTION 1. DEFINITIONS

As used in this Agreement, the following terms, whether used in the singular or plural, shall have the following meanings:

1.1 “Affiliate” means any entity which directly or indirectly controls, is controlled by or is under common control with another entity. For purposes of this Section 1.1, “control” means (a) in the case of corporate entities, direct or indirect ownership of at least fifty percent (50%) of the stock or shares entitled to vote for the election of directors and (b) in the case of non-corporate entities, direct or indirect ownership of at least fifty percent (50%) of the equity interest with the power to direct the management and policies of such non-corporate entities. The Parties acknowledge that, in the case of certain entities organized under the laws of certain countries, the maximum percentage ownership permitted by law for a foreign investor may be less than fifty percent (50%), and in such case such lower percentage shall be substituted in the preceding sentence; provided, that such foreign investor has the power to direct the management and policies of such entity.

1.2 “Annual Net Sales” means the worldwide aggregate Net Sales of a Licensed Product during a calendar year.

1.3 “Arrowhead” means Arrowhead Research Corporation, a Delaware corporation.

1.4 “Assigned IP” means (a) the Assigned Patent Rights; (b) the Patent Files; (c) all inventions disclosed in the Assigned Patent Rights (other than those disclosed as prior art of a Third Party); and (d) the right to recover for past infringement of the Assigned Patent Rights.

1.5 “Assigned Patent Rights” means the Patent Rights set forth in Exhibit A and all Counterparts thereof.

1.6 “Calando Indemnitees” means Calando, its Affiliates, and the agents, directors, officers and employees of Calando and its Affiliates.

1.7 “Calando Liabilities” means any and all liabilities or obligations (whether known or unknown, absolute or contingent, liquidated or unliquidated, due or to become due and accrued or unaccrued, and whether claims with respect thereto are asserted before or after the Effective Date) of Calando.

1.8 “Caltech” means California Institute of Technology.

1.9 “Caltech Agreement” means that License Agreement between Caltech and Calando (formerly known as Insert Therapeutics, Inc.), dated May 22, 2000, as amended on December 10, 2001, January 13, 2003 and June 19, 2009.

1.10 “Caltech Joint Patent Rights” means the subset of the Licensed Patent Rights set forth in Exhibit B and all Counterparts thereof.

1.11 “Caltech Sole Patent Rights” means the subset of the Licensed Patent Rights set forth in Exhibit C and all Counterparts thereof.

1.12 “Cerulean Indemnitees” means Cerulean, its Affiliates, and the agents, directors, officers and employees of Cerulean and its Affiliates.

1.13 “Change of Control” means (a) the closing of a merger, tender offer, share exchange, reorganization, consolidation or other similar transaction involving Cerulean in which the persons who beneficially own Cerulean’s voting securities immediately prior to such transaction would, immediately after such transaction, beneficially own less than fifty percent (50%) of the voting securities of the surviving entity; or (b) a sale or other transfer to a Third Party of all or substantially all of Cerulean’s assets or business relating to this Agreement. For purposes hereof, “beneficial ownership” shall have the meaning provided in Rule 13d-3 under the Securities Exchange Act of 1934.

1.14 “Clinical Trial” means any clinical trial of a Licensed Product or any other administration of a Licensed Product prior to receipt of a Regulatory Approval.

1.15 “Collective Patent Rights” means the Assigned Patent Rights and the Licensed Patent Rights.

1.16 “Combination Therapy” means a Licensed Product and a separate pharmaceutical product sold by Cerulean or its Affiliates in combination for co-administration.

1.17 “Commercially Reasonable Efforts” means, with respect to a Licensed Product, taking such actions, exerting such effort and employing such resources as would normally be taken, exerted or employed by a comparably-sized company in the biotechnology industry for a product of similar market potential at a similar stage of its product life as such Licensed Product,

2

taking into account the phase of development of, and technical risks relating to, the product, the development and proprietary positions of third parties, the regulatory structure involved, the likely cost of goods, the competitiveness and size of the relevant marketplace, and the potential profitability of the product, when utilizing sound and reasonable scientific, business and medical practice and judgment.

1.18 “Confidential Information” means, with respect to a Party (the “Disclosing Party”) all proprietary information, patentable or otherwise, of the Disclosing Party (whether owned by the Disclosing Party or disclosed by a Third Party to the Disclosing Party under an obligation of confidentiality) which is disclosed by or on behalf of such Party to the other Party (the “Receiving Party”) pursuant to and in contemplation of this Agreement, including information pertaining to chemical substances, therapeutic agents, pharmaceutical compositions, drug delivery systems, formulations, processes, techniques, methodologies, data, reports, know-how, expertise, sources of supply, patent positioning and business plans. Confidential Information of the Disclosing Party includes “Proprietary” Information of the “Discloser”, each as defined in the Prior Confidentiality Agreement. The elements of Assigned IP described in Sections 1.4(a), (b) and (c) shall be treated as Confidential Information of Cerulean, except to the extent they have been or are later disclosed by the publication of any patent or patent application. Any sublicense agreements disclosed by a Party to the other Party pursuant to Section 3.3 shall be treated as Confidential Information of the Party entering into such sublicense agreement.

1.19 “Control” or “Controlled” means, with respect to an entity and an item of Know-How or any intellectual property right, the possession of the right (whether by ownership, license or otherwise (other than pursuant to a license granted under this Agreement)) by such entity or its Affiliates, to assign, or grant a license, sublicense or other right to or under, such Know-How or intellectual property right as provided for herein without violating the terms of any agreement or other arrangement with any Third Party.

1.20 “Counterparts” means:

(a) with respect to a patent, the following items, collectively: any patent applications from which such patent issued, and all patents and patent applications described in clause (b) with respect to each such patent application;

(b) with respect to a patent application (including any provisional application), the following items, collectively: (i) all divisionals, continuations and continuations-in-part of such patent application; (ii) any patents (including certificates of correction) issuing from such patent application or any patent application described in clause (i); (iii) all patents and patent applications based on, corresponding to or claiming the priority date(s) of any of the patents and patent applications described in clauses (i) or (ii); (iv) any substitutions, extensions (including supplemental protection certificates), registrations, confirmations, reissues, re-examinations and renewals of any of the patents described in clauses (ii) or (iii); and (iv) foreign counterparts of any of the foregoing.

1.21 “Covered” means, with respect to a particular Licensed Product and patent, that, but for a license granted to a Party under a Valid Claim included in such patent, or, with respect to an Assigned Patent Right, but for the assignment of such patent, the manufacture, use, offer for sale, sale or importation of such Licensed Product would infringe such Valid Claim.

3

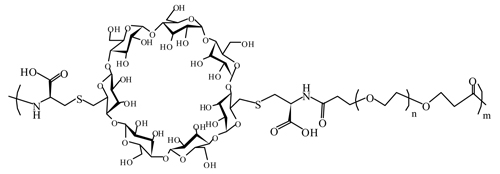

1.22 “Cyclodextrin System” means any cyclodextrin-based polymer drug delivery system developed by Calando prior to the Effective Date and any improvements thereto developed during the Term.

1.23 “Cytolysin/Tubulysin Agreement” means the Joint Development Agreement Relating to Cytolysin/Tubulysin between Calando and R&D dated January 31, 2009.

1.24 “FDA” means the United States Food and Drug Administration or any successor agency thereto.

1.25 “Field” means the treatment and/or prevention of disease in humans.

1.26 “First Commercial Sale” means, with respect to a Licensed Product in a country, the first bona fide sale of a Licensed Product following the first receipt of a Regulatory Approval for such Licensed Product to permit use or consumption of such Licensed Product by the general public in such country. Transfers of Licensed Products for Clinical Trial purposes shall not be considered a First Commercial Sale.

1.27 “IND” means a United States investigational new drug application or its equivalent or any corresponding application of another country.

1.28 “IT-101” means the product licensed to Cerulean as the “Licensed Product” pursuant to the IT-101 Agreement.

1.29 “IT-101 Agreement” means the IT-101 Agreement entered into by the Parties on the Effective Date.

1.30 “Know-How” means any ideas, concepts, discoveries, developments, information and inventions, whether or not patentable, including materials, products, laboratory, pre-clinical and clinical data, expertise, know-how, processes, techniques, and any other scientific or technical information.

1.31 “Knowledge” means (a) with respect to Calando, the actual knowledge of the following individuals (together with any knowledge that a person in such person’s position would be expected to obtain given the exercise of reasonably prudent scientific and business diligence in accordance with the standards of companies in the biotechnology industry): [**] (collectively, the “Calando Representatives”); and (b) with respect to Cerulean, the actual knowledge of the following individuals (together with any knowledge that a person in such person’s position would be expected to obtain given the exercise of reasonably prudent scientific and business diligence in accordance with the standards of companies in the biotechnology industry): [**].

1.32 “Licensed IP” means, collectively, the Licensed Know-How and Licensed Patent Rights.

4

1.33 “Licensed Know-How” means all Know-How Controlled by Calando as of the Effective Date or during the Term which both (a) relates to the Cyclodextrin System and/or Calando’s research and development of Licensed Products or IT-101 and (b) is necessary or reasonably useful to (i) conduct research and development on the Cyclodextrin System, including making improvements thereto, or (ii) research, develop, make, have made, use, market, offer to sell, distribute, sell and/or import Licensed Products or IT-101. Without limiting the generality of the foregoing, Licensed Know-How shall include all Know-How developed, applied or acquired by Calando prior to the Effective Date that (A) pertains to the use of the Cyclodextrin System, (B) is a process for manufacturing the cyclodextrin polymer, or precursors thereto, employed in the Cyclodextrin System, (C) is a process for conjugating or complexing therapeutic agents to the cyclodextrin polymer employed in the Cyclodextrin System, or (D) is data generated by Calando in its research and development of Licensed Products or IT-101.

1.34 “Licensed Patent Rights” means all Patent Rights Controlled by Calando as of the Effective Date or during the Term which both (a) relate to the Cyclodextrin System and/or Calando’s research and development of Licensed Products or IT-101 and (b) are necessary or reasonably useful to (i) conduct research and development on the Cyclodextrin System, including making improvements thereto, or (ii) research, develop, make, have made, use, market, offer to sell, distribute, sell and/or import Licensed Products or IT-101. Without limiting the generality of the foregoing, Licensed Patent Rights shall include the Caltech Joint Patent Rights, the Caltech Sole Patent Rights and the RNAi Patent Rights. For the sake of clarity, the Licensed Patent Rights exclude the Assigned Patent Rights.

1.35 “Licensed Product” means any Product, other than IT-101, in which no therapeutic agent is a Retained Therapeutic Agent.

1.36 “NDA” means a United States new drug application or its equivalent or any corresponding application of another country.

1.37 “Net Sales” means, with respect to a Licensed Product, the gross amount invoiced by Cerulean or its Affiliates on sales or other dispositions of such Licensed Product to a Third Party less the sum of (a) commercially reasonable trade, cash and quantity discounts, (b) credit or allowances given or made for recall, rejection or return of previously sold Licensed Products, (c) commercially reasonable rebates, chargebacks or retroactive price reductions, (d) out-of-pocket charges for insurance, postage, handling, freight and other transportation costs which are invoiced by Cerulean or its Affiliates, (e) government-mandated rebates and (f) customs, duties, surcharges, sales, transfer and other excise taxes levied on the sale, transportation, delivery or use of such Licensed Product, including any tax such as a value added or similar tax or government charge, borne by the seller thereof, other than franchise or income tax of any kind whatsoever.

Net Sales shall not include any transfers of a Licensed Product for clinical trial purposes or any transfers of reasonable quantities of a Licensed Product as samples or as donations.

Net Sales shall not include any transfer between Cerulean and any of its Affiliates for resale. If Cerulean or an Affiliate sells a Licensed Product to a distributor or other Third Party, Net Sales shall be based on the gross amount invoiced by Cerulean or the Affiliate from the sale of Licensed Product to such distributor or Third Party.

5

If Cerulean or any of its Affiliates makes a sale of a Licensed Product for other than monetary value, such Licensed Product shall be deemed sold hereunder. The gross revenues to be included in Net Sales for any such deemed sales shall be the average price of “arms length” sales by Cerulean and its Affiliates during the calendar quarter in which such deemed sale occurs or, if no such “arms length” sales occurred during such period, during the last calendar quarter in which such “arms length” sales occurred.

If the Licensed Product is sold in combination with another pharmaceutical product as part of a Combination Therapy in a country, then, for the purpose of calculating royalties owed under this Agreement on sales of such Licensed Product, Net Sales shall be the lesser of:

| (i) | Net Sales of such Licensed Product in such country, or |

| (ii) | the product of: |

(A) Net Sales of such Combination Therapy (calculated applying the definition of Net Sales hereunder to such Combination Therapy in the same manner as applied to Licensed Product) in such country, and

(B) the fraction A/(A+B), where A is the average invoice price of such Licensed Product in such country, and B is the average invoice prices of the other pharmaceutical product(s) in such Combination Therapy in such country; provided, however, that, if in a specific country the other pharmaceutical product(s) in such Combination Therapy are not sold separately in such country but the Licensed Product is sold separately in such country, the fraction shall be A/C, where A is the average invoice price of the Licensed Product in such country and C is the invoice price of the Combination Therapy; provided, further, however, that, if in a specific country the Licensed Product is not sold separately in such country but the other pharmaceutical products are sold separately in such country, the fraction shall be C-B/C, where B is the average invoice price of the other pharmaceutical product(s) in the Combination Therapy in such country and C is the invoice price of the Combination Therapy in such country; and provided, further, however, that, if in a specific country neither the Licensed Product nor any of the other pharmaceutical products are sold separately in such country, then the fraction shall be negotiated in good faith by the Parties.

1.38 “Party” means Calando or Cerulean; “Parties” means Calando and Cerulean.

1.39 “Patent Files” means, with regard to the Assigned Patent Rights, the following as in existence on the Effective Date: (a) the complete file histories; (b) all correspondence between Calando and Calando’s outside counsel related to the subject matter of such rights; (c) all internal Calando correspondence related to the subject matter of such rights; (d) copies of prior art searches and search results related to the subject matter of such rights; (e) copies of publications identified in prior art searches; and (f) all opinions or other analyses related to the subject matter of such rights.

6

1.40 “Patent Right” means any patent application (including any provisional application) or patent, and any Counterpart thereof.

1.41 “Phase 3 Clinical Trial” means a human clinical trial that is prospectively designed to demonstrate statistically whether a Licensed Product is safe and effective to prevent or treat a particular indication in a manner sufficient to obtain Regulatory Approval to market such Licensed Product, or that is otherwise described in 21 CFR 312.21(c) or its foreign counterpart.

1.42 “Prior Confidentiality Agreement” means the Mutual Confidentiality Agreement between the Parties dated February 4, 2009.

1.43 “Product” means a pharmaceutical composition containing a therapeutic agent(s) conjugated or complexed to the Cyclodextrin System.

1.44 “R&D” means R&D Pharmaceuticals, GmbH.

1.45 “R&D SGE Agreement” means the Joint Development Agreement relating to Second Generation Epothilones between Calando and R&D dated January 31, 2009.

1.46 “Regulatory Approval” means, with respect to a Licensed Product in a country or regulatory jurisdiction, any and all approvals (including any applicable governmental price and reimbursement approvals), licenses, registrations, or authorizations of the relevant Regulatory Authority necessary for the manufacture, use, storage, import, transport, promotion, marketing and sale of such Product in such country, including approvals of NDAs.

1.47 “Regulatory Authority” means any applicable government regulatory authority involved in granting approvals for the marketing and/or pricing of a pharmaceutical product in a country or regulatory jurisdiction, including the FDA and foreign equivalents thereof.

1.48 “Relevant Agreement” means each agreement, other than a confidentiality agreement, between Calando and an Affiliate of Calando or a Third Party currently in effect, whether or not relating to the Cyclodextrin System or Licensed Products, including any agreement regarding evaluation, research, development, collaboration, material transfer, manufacture, license, joint venture, non-competition, clinical trial, lease of real property or equipment, line of credit, bank loan or other loan.

1.49 “Required Third Party Payments” means payments (including upfront payments, annual maintenance fees, milestones and earned royalties) made by Cerulean or any of its Affiliates to a Third Party to license Know-How or Patent Rights in order to research, develop, make, have made, use, market, offer to sell, distribute, sell and import Licensed Products in the Field.

1.50 “Requisite Debt Holder Consent and Release” means that each holder of a promissory note of which Calando is the maker (each a “Note” and, collectively, the “Notes”) has irrevocably, in writing, (a) consented to the transactions contemplated by this Agreement and (b) released Cerulean and its Affiliates from, and agreed not to assert against Cerulean or its Affiliates or any of their respective assets (including the Licensed IP, Assigned IP and the

7

Inventory), any Liens, claims, rights or other interests it has or may have (i) in connection with or as a result of the transactions contemplated hereby, (ii) in, against or relating to any of the Licensed IP, Assigned IP and the Inventory and/or (iii) relating to the Notes or any stock into which the Notes can be converted.

1.51 “Requisite Stockholder Approval” means the approval of the license of the Licensed Patent Rights and Licensed Know-How and sale of the Assigned IP and the Inventory by Calando to Cerulean as contemplated by this Agreement by (a) a majority of the votes represented by the outstanding shares of capital stock of Calando entitled to vote thereon and (b) a majority of the votes represented by the outstanding shares of capital stock of Calando entitled to vote thereon, other than shares of such capital stock held by Arrowhead.

1.52 “Retained Product” means any Product in which each therapeutic agent is a Retained Therapeutic Agent.

1.53 “Retained Therapeutic Agent” means cytolysin (as defined in the Cytolysin/Tubulysin Agreement), tubulysin (as defined in the Cytolysin/Tubulysin Agreement), any SGE or any nucleic acid.

1.54 “RNAi Patent Rights” means the subset of the Licensed Patent Rights set forth in Exhibit D and all Counterparts thereof.

1.55 “SGE” has the meaning given such term in the R&D SGE Agreement.

1.56 “Sublicense Income” means all amounts received by Cerulean or any of its Affiliates to the extent attributable to a license or sublicense granted to a Third Party of any of the Assigned Patent Rights, Licensed Patent Rights or Licensed Know-How (such Third Party, a “Sublicensee”), including upfront payments, annual maintenance fees, milestone payments (including for development, performance and sales milestones) and earned royalties, but:

(a) amounts received by Cerulean or its Affiliates as payments for performing research, development (other than development milestone payments referenced in the foregoing paragraph of this Section 1.56), manufacturing or commercialization activities undertaken by Cerulean or any of its Affiliates for, or in collaboration with, such Sublicensee will be excluded; provided, that such deduction to Sublicense Income is an amount no greater than the fully-burdened cost for Cerulean or its Affiliates in connection with such activities and all out-of-pocket costs paid by Cerulean or its Affiliates to Third Parties in connection with such activities;

(b) amounts received by Cerulean or its Affiliates from such Sublicensee as the purchase price for Cerulean’s or any of its Affiliates’ debt or equity securities will be excluded; provided, that, with respect to any such securities which are publicly traded on any securities exchange or NASDAQ, such deduction to Sublicense Income is an amount no greater than the fair market value of such debt or equity securities;

(c) if such Sublicensee will also pay an earned royalty on its sale of a Licensed Product, then amounts paid by such Sublicensee to Cerulean or its Affiliates as a transfer price to purchase the relevant Licensed Product or any component thereof will be excluded; and

8

(d) if such Sublicensee will not also pay an earned royalty on its sale of a Licensed Product, then amounts paid by such Sublicensee to Cerulean or its Affiliates as a transfer price to purchase the relevant Licensed Product or any component thereof will be excluded, but only up to the actual cost of goods of such Licensed Product or component.

1.57 “Third Party” means any person other than the Parties and their Affiliates.

1.58 “Valid Claim” means a claim of an unexpired issued patent which has not been withdrawn, cancelled or disclaimed nor held invalid or unenforceable by a court of competent jurisdiction in an unappealed or unappealable decision.

1.59 Other Defined Terms. The word “person” means any entity or individual. Each of the following definitions is set forth in the section of this Agreement indicated below:

| Definition |

Section | |

| Arrowhead Guarantee | 2.3(c) | |

| Bankruptcy Code | 3.4 | |

| Xxxx of Sale | 2.3(e) | |

| Breaching Party | 12.2 | |

| Calando Representatives | 1.32 | |

| Caltech Side Letter | 2.3(d) | |

| Disclosing Party | 1.18 | |

| Escrow Agent | 8.7(a) | |

| Escrow Agreement | 8.7(a) | |

| FTE Hour | 4.1(b) | |

| Full Access Notebooks | 8.7(b) | |

| Initial Payment | 5.1 | |

| Inventory | 2.1(a) | |

| Inventory Price | 2.1(a) | |

| Joint IP | 7.1 | |

9

| Lien | 2.3(h) | |

| Losses | 10.1 | |

| Non-Breaching Party | 12.2 | |

| Non-Prosecuting Party | 7.2(d) | |

| Note(s) | 1.50 | |

| Partial Access Notebooks | 8.7(c) | |

| Patent Assignment | 2.3(e) | |

| Prosecuting Party | 7.2(d) | |

| Receiving Party | 1.18 | |

| Restricted Access Notebooks | 8.7(d) | |

| Royalty Payment Date | 5.6 | |

| Sale Event | 13.1 | |

| Sublicensee | 1.57 | |

| Term | 12.1 | |

SECTION 2. ASSET SALE AND TRANSFER

2.1 Inventory.

(a) Calando hereby irrevocably and unconditionally sells, transfers, conveys, assigns and delivers to Cerulean, and Cerulean hereby purchases from Calando, all right, title and interest in and to, [**] of capped beta cyclodextrin, for an aggregate purchase price of [**] U.S. Dollars (US $[**]), and [**] of poly-beta-cyclodextrin-PEG, for an aggregate purchase price of [**] U.S. Dollars (US $[**]) (such material, collectively, the “Inventory”). The total purchase price of One Hundred Forty-Three Thousand U.S. Dollars (US $143,000) (the “Inventory Price”) shall be paid by Cerulean to Calando on the Effective Date via wire transfer of immediately available funds to an account designated by Calando.

(b) The Parties agree and acknowledge that Cerulean’s payment for the Inventory is in addition to the Initial Payment and is inclusive of all excise, sales, use, transfer and other taxes and duties (if any) imposed with respect to the Inventory or its sale by any governmental authority (all of which shall be the responsibility of, and will be paid by, Calando).

10

(c) Title to and possession of the Inventory will be delivered to Cerulean, free and clear of any encumbrances, on the Effective Date in its current location and condition at the premises of Cambrex Corporation (or one of its Affiliates) in Xxxxxxx City, Iowa. Cerulean shall be responsible for all expenses and fees related to the storage, removal and transportation of the Inventory from and after the Effective Date, while Calando shall be responsible for all expenses and fees related to the storage, removal and transportation of the Inventory prior to the Effective Date. Risk of loss or damage, liability for, and responsibility to insure the Inventory will pass to Cerulean on the Effective Date.

2.2 Patent Rights.

(a) Calando hereby irrevocably and unconditionally sells, transfers, conveys, assigns and delivers to Cerulean, and Cerulean hereby purchases from Calando, all right, title and interest in and to the Assigned IP.

(b) The Parties agree and acknowledge that Cerulean’s payment for the Assigned IP is included in the Initial Payment and shall be allocated to the Assigned IP for tax purposes.

2.3 Calando Closing Conditions. Unless waived by Cerulean, as of the Effective Date, Calando shall have:

(a) obtained the Requisite Stockholder Approval and the Requisite Debt Holder Consent and Release;

(b) delivered to Cerulean a certificate of good standing of Calando in its jurisdiction of organization and the various foreign jurisdictions in which it is qualified, certified charter documents and a certificate as to the incumbency of officers and the adoption of authorizing resolutions;

(c) provided Cerulean with a guarantee and indemnification from Arrowhead, in form and substance reasonably acceptable to Cerulean, in which Arrowhead (i) guarantees Calando’s performance under this Agreement, (ii) makes the same representations and warranties to Cerulean as Calando makes to Cerulean under Section 9.1 or clauses (i)-(k) of Section 9.2, and (iii) agrees to indemnify Cerulean to the same extent as Calando indemnifies Cerulean pursuant to Section 10.2 from any Losses relating to or in connection with a Third Party claim arising out of any breach by Arrowhead of its representations or warranties as described in clause (ii), and for which indemnification Calando and Arrowhead shall be jointly and severally liable to Cerulean and the Cerulean Indemnitees (the “Arrowhead Guarantee”);

(d) provided to Cerulean a letter agreement executed by Calando and Caltech in the form attached as Exhibit E (the “Caltech Side Letter”);

(e) executed and delivered to Cerulean a xxxx of sale substantially in the form attached hereto as Exhibit F (the “Xxxx of Sale”), a patent assignment in the form attached hereto as Exhibit G (the “Patent Assignment”), and such other instruments of conveyance as Cerulean may reasonably request in order to effect the sale, transfer, conveyance and assignment to Cerulean of valid ownership to the Assigned IP and Inventory;

11

(f) made the Patent Files available to Cerulean, it being understood that Calando and Cerulean shall each be obligated to Calando’s outside patent counsel for [**] U.S. Dollars, which amount represents [**] percent ([**]%) of the cost of certain foreign patent filings required to be made in June 2009 in respect of the Assigned Patent Rights;

(g) recertified the Inventory prior to the Effective Date in accordance with the testing procedures proscribed by Cerulean, and provided Cerulean with the results thereof;

(h) supplied Cerulean with documentation, in form and substance reasonably acceptable to Cerulean, pursuant to which the appropriate Affiliate of Cambrex Corporation acknowledges that the ownership of the Inventory has been transferred to Cerulean and releases such Inventory from any claim, liability, mortgage, pledge, security interest, encumbrance, license, charge, encumbrance or other lien of any kind (whether arising by contract or by operation of law) (each, a “Lien”);

(i) made available to Cerulean copies of all laboratory notebooks, raw data, summary data and reports pertaining to the Cyclodextrin System or the Licensed Products, or the research, development or manufacture of the Cyclodextrin System or the Licensed Products, it being understood that the terms and conditions of Section 8.7 shall apply with respect to the laboratory notebooks; and

(j) supplied Cerulean with letters of access, in form and substance reasonably acceptable to Cerulean, addressed to all Third Party contractors and vendors identified by Cerulean pertaining to the research, development or manufacture of the Cyclodextrin System or the Licensed Products.

2.4 Cerulean Closing Conditions. As of the Effective Date, Cerulean shall have:

(a) delivered to Calando a certificate of good standing of Cerulean in its jurisdiction of organization and the various foreign jurisdictions in which it is qualified and a certificate as to the incumbency of officers and the adoption of authorizing resolutions;

(b) executed and delivered to Calando the CalTech Side Letter; and

(c) executed and delivered to Calando the Xxxx of Sale and the Patent Assignment.

2.5 Non-Assumption of Liabilities. Notwithstanding anything to the contrary, Cerulean shall not assume, or become responsible for, and Calando shall remain responsible for, the Calando Liabilities.

SECTION 3. LICENSES

3.1 Grant to Cerulean. Calando hereby grants to Cerulean an exclusive (even as to Calando, but subject to Section 12.2(b)), transferable (as permitted pursuant to Section 13.1), irrevocable and perpetual (subject to each Party’s termination rights in Section 12), royalty-bearing, worldwide license, with the right to grant sublicenses, under the Licensed Patent Rights and under all intellectual property rights in the Licensed Know-How, solely in order to (a)

12

conduct research and development on the Cyclodextrin System, including making improvements thereto, in order to research, develop, make, have made, use, market, offer to sell, distribute, sell and import Licensed Products in the Field, (b) research, develop, make, have made, use, market, offer to sell, distribute, sell and import Licensed Products in the Field, and (c) use, copy, modify and distribute the Licensed Know-How for such purposes.

3.2 Grant to Calando. Cerulean hereby grants to Calando an exclusive (even as to Cerulean), transferable (as permitted pursuant to Section 13.1), irrevocable, perpetual, royalty-free, worldwide license, with the right to grant sublicenses, under the Assigned Patent Rights solely to the extent necessary to research, develop, make, have made, use, market, offer to sell, distribute, sell and import Retained Products.

3.3 Sublicenses. All sublicenses granted pursuant to Section 3.1 or 3.2 shall be consistent with the terms and conditions of this Agreement and the Party granting such sublicense shall incorporate terms and conditions into its sublicense agreements sufficient to enable such Party to comply with this Agreement. Such Party shall furnish the other Party with a copy of each executed sublicense agreement within [**] business days after its execution.

3.4 Section 365(n) of the Bankruptcy Code. All rights and licenses granted under or pursuant to any section of this Agreement are and shall otherwise be deemed to be for purposes of Section 365(n) of the Bankruptcy Code licenses of rights of “intellectual property” as defined in Section 101(35A) of the United States Bankruptcy Code (Title 11, U.S.C.), as amended (the “Bankruptcy Code”). The Parties shall retain and may fully exercise all of their respective rights and elections under the Bankruptcy Code. Upon the bankruptcy of a Party, the non-bankrupt Party shall further be entitled to a complete duplicate of, or complete access to, any such intellectual property, and such, if not already in its possession, shall be promptly delivered to the non-bankrupt Party, unless the bankrupt Party elects to continue, and continues, to perform all of its obligations under this Agreement.

3.5 Patent Marking. Cerulean and Calando shall xxxx the appropriate U.S. patent number(s) on Licensed Products or on Retained Products, respectively, made or sold in the United States in accordance with all applicable government laws, rules and regulations.

SECTION 4. POST-CLOSING ASSISTANCE AND COVENANTS

4.1 Technology Transfer.

(a) Within the first [**] months following the Effective Date, Calando shall, and shall cause its employees to, provide to Cerulean, upon Cerulean’s request, such scientific, technical and other assistance as is reasonably necessary for Cerulean to exploit the Licensed Know-How; provided, however, that this Section 4.1(a) shall not require Calando to maintain employment of any employees; provided, further, that Calando shall use commercially reasonable efforts to assist Cerulean in entering into employment or consulting arrangements (at Cerulean’s sole cost) with any former employees of Calando. In addition, Calando shall reasonably assist Cerulean in interacting with Calando’s Third Party contractors and vendors to facilitate Cerulean’s ability to develop the Licensed Products and exploit the Licensed Know-How; provided, that Calando makes no representations or warranties as to such Third Party

13

contractors’ or vendors’ intentions to conduct business with Cerulean following the Effective Date. To the extent that Cerulean hires or engages the services of any former employee of Calando or any Third Party contractor or vendor of Calando for purposes contemplated under this Agreement, Calando hereby waives any obligations of confidentiality or non-use or any non-competition restrictions imposed on such employees, contractors or vendors to the extent that they pertain to Licensed Products or the use of the Cyclodextrin System in connection with Licensed Products.

(b) Cerulean shall reimburse Calando (i) for the assistance described in Section 4.1(a) at the rate of [**] U.S. Dollars (US $[**]) for each hour of scientific, technical or other work in providing such assistance (each, an “FTE Hour”) and (ii) for all reasonable out-of-pocket expenses incurred by Calando in providing such assistance, to the extent such assistance and expenses have been approved by Cerulean in writing in advance of incurrence. Within [**] days after the end of each calendar month during such [**] month period, Calando shall provide to Cerulean a report of the number of FTE Hours actually devoted, and the expenses actually incurred, by Calando for such assistance during such just-ended calendar month, and an invoice for the amount to be reimbursed by Cerulean as provided hereunder. Cerulean shall pay such invoice within [**] days after receipt. For the sake of clarity, there shall be no double payments for any assistance which may be provided under both this Agreement and the IT-101 Agreement.

(c) Calando shall keep true and accurate books of accounts and other records containing all information and data which may be necessary to ascertain and verify the amounts payable under this Section 4.1. During the first [**] months after the Effective Date, Cerulean shall have a [**] right to have an independent certified public accountant inspect such books and records of Calando. Any such independent certified accountant shall be reasonably acceptable to Calando, shall execute a standard form of confidentiality agreement with Calando, and shall be permitted to share with Cerulean solely its findings with respect to the accuracy of the amounts reported as payable under this Section 4.1.

4.2 Caltech Agreements.

(a) Calando shall not amend, restate, alter, waive or otherwise change any of the terms and conditions of the Caltech Agreement or Caltech Side Letter without the prior written approval of Cerulean, which approval shall not be unreasonably withheld, conditioned or delayed. Calando shall provide Cerulean with a copy of any proposed or executed amendment, restatement, alteration, waiver or other change of the terms and conditions of the Caltech Agreement or Caltech Side Letter. Further, Calando shall not assign (other than in connection with a Sale Event) or terminate the Caltech Agreement or Caltech Side Letter without the prior written approval of Cerulean, which approval shall not be unreasonably withheld, conditioned or delayed.

(b) Calando shall use commercially reasonable efforts to satisfy all of its obligations under and to take all steps necessary to maintain in full force and effect the Caltech Agreement or Caltech Side Letter. Calando shall provide Cerulean with written notice of any claim of a breach under, or any threat or notice of termination of, the Caltech Agreement or Caltech Side Letter.

14

4.3 SGE Agreement. Upon Cerulean’s request, Calando shall use commercially reasonable efforts to assist Cerulean in the negotiation of an agreement among Calando, Cerulean and R&D, pursuant to which Cerulean shall obtain rights to the SGEs on terms and conditions comparable to those in this Agreement.

4.4 Further Assurances. At any time and from time to time hereafter, each Party, at the other Party’s request and without further consideration, shall execute and deliver, or cause to be duly executed and delivered (including by its Affiliates and employees), such further instruments and do and cause to be done such further acts and things, including the filing of such assignments, agreements, documents and instruments, as may be necessary or as the requesting Party may reasonably request in connection with this Agreement or to carry out more effectively the provisions and purposes hereof, or to better assure and confirm the rights and remedies of the Parties under this Agreement, including to more effectively transfer, convey and assign to Cerulean, and to confirm Cerulean’s title to, all of the Assigned IP and Inventory, to put Cerulean in actual possession and control thereof, to assist Cerulean in exercising all rights with respect thereto and to carry out the purpose and intent of this Agreement. Other than those obligations expressly set forth herein, Cerulean shall not assume or agree to perform, pay or discharge, and Calando shall remain unconditionally liable, for the Calando Liabilities.

SECTION 5. FEES AND ROYALTIES

5.1 Fees. In addition to the Inventory Price, Cerulean shall pay on the Effective Date a one-time, non-refundable, non-creditable purchase and license fee in the amount of One Million U.S. Dollars (US $1,000,000) (the “Initial Payment”). In addition, Cerulean shall reimburse Calando for [**] U.S. Dollars ($[**]), which amount represents the cost incurred by Calando in recertifying the Inventory and certain of the inventory being transferred under the IT-101 Agreement. The foregoing amounts shall be distributed as follows: (a) [**] U.S. Dollars ($[**]) shall be paid by Cerulean directly to the applicable Third Party as set forth in Exhibit H, on behalf of Calando, on the Effective Date; (b) [**] U.S. Dollars [**] Cents ($[**]), which amount represents the legal fees incurred by Calando in connection with its negotiation of this Agreement and the IT-101 Agreement, shall be paid by Cerulean directly to [**], on behalf of Calando, on the Effective Date; and (c) [**] ($[**]) shall be paid by Cerulean to Calando via wire transfer of immediately available funds to an account designated by Calando, on the Effective Date.

5.2 Development Milestones.

(a) For each Licensed Product developed by Cerulean or an Affiliate of Cerulean that reaches the following development milestones, Cerulean shall pay the applicable non-refundable milestone payment set forth below, subject to Sections 5.2(b) and 5.2(c), within [**] days of the occurrence of such event to Calando via wire transfer of immediately available funds to an account designated by Calando:

| Milestone Event: |

Milestone Payment: | |||

| (i) The filing of the first IND with any Regulatory Authority |

|

Two Hundred Fifty Thousand U.S. Dollars (US $250,000) |

| |

| [**] |

[**] U.S. Dollars (US $[** | ]) | ||

| [**] |

[**] U.S. Dollars (US $[** | ]) | ||

| [**] |

[**] U.S. Dollars (US $[** | ]) | ||

15

(b) Such milestone payments shall be made only if, upon the occurrence of such milestone event, a Valid Claim of a Collective Patent Right exists in any country of the world. All development milestone payments made with respect to a Licensed Product shall be fully credited to all royalties due under Section 5.5 with respect to such Licensed Product.

(c) If, following the achievement of any such milestone event for a particular Licensed Product, Cerulean or its Affiliate decides not to progress such Licensed Product further through the development or commercialization process for any reason, then the milestone payments already paid by Cerulean with respect to such failed Licensed Product shall be fully credited against future milestone payments due under this Section 5.2 with respect to the next Licensed Product progressed through such milestone event(s).

5.3 Sales Milestones.

(a) For each Licensed Product developed by Cerulean or an Affiliate of Cerulean which reaches the following sales thresholds, Cerulean shall pay the applicable non-refundable, non-creditable milestone payment set forth below, subject to Section 5.3(b), within [**] days after the occurrence of such event to Calando via wire transfer of immediately available funds to an account designated by Calando:

| Milestone Event: |

Milestone Payment: | |||

| (i) Annual Net Sales of [**] U.S. Dollars (US $[**]) |

[**] U.S. Dollars (US $ | [** | ]) | |

| (ii) Annual Net Sales of [**] U.S. Dollars (US $[**]) |

[**] U.S. Dollars (US $ | [** | ]) | |

(b) Such milestone payments shall be made only if, upon the occurrence of such milestone event, a Valid Claim of a Collective Patent Right exists in any country of the world. Each such payment shall be made once for each such Licensed Product to reach the relevant milestone event.

5.4 Sublicense Income. With respect to Licensed Products developed and sold by a Sublicensee, Cerulean shall pay to Calando [**] percent ([**]%) of all Sublicense Income; provided, however, that (a) such payments shall be made only if, at the time of Cerulean’s or its Affiliate’s receipt of Sublicense Income, a Valid Claim of a Collective Patent Right exists in any country of the world; and (b) the percentage of Sublicense Income due Calando for earned royalties (but not for upfront payments, milestones or maintenance fees) will be capped at the royalty rates under Section 5.5 that would apply if such sales were made by Cerulean or an Affiliate of Cerulean.

16

5.5 Royalties.

(a) Base Rate.

(i) For each Licensed Product sold by Cerulean or an Affiliate of Cerulean, Cerulean shall pay to Calando (subject to Sections 5.2(b), 5.5(b), 5.5(c) and 5.5(d)) the following tiered earned royalties on Annual Net Sales (on a Licensed Product-by-Licensed Product basis) of each Licensed Product whose manufacture, use or sale, at the time of sale and in the country of sale, is, or would be if such manufacture or use occurred in the country of sale, Covered by a Valid Claim of a Collective Patent Right:

| Annual Net Sales Tiers: |

Royalty Rate: | |||

| The portion of Annual Net Sales which is less than or equal to US $[**] |

[** | ]% | ||

| The portion of Annual Net Sales which is greater than US $[**], but less than or equal to US $[**] |

[** | ]% | ||

| The portion of Annual Net Sales which is greater than US $[**] |

[** | ]% | ||

(ii) For each Licensed Product sold by Cerulean or an Affiliate of Cerulean, Cerulean shall pay to Calando (subject to Sections 5.2(b), 5.5(b), 5.5(c) and 5.5(d)) the following tiered earned royalties on Annual Net Sales (on a Licensed Product-by-Licensed Product basis) of each Licensed Product whose manufacture, use or sale, at the time of sale and in the country of sale, is not, and would not be if such manufacture or use occurred in the country of sale, Covered by a Valid Claim of a Collective Patent Right:

| Annual Net Sales Tiers: |

Royalty Rate: | |||

| The portion of Annual Net Sales which is less than or equal to US $[**] |

[** | ]% | ||

| The portion of Annual Net Sales which is greater than US $[**], but less than or equal to US $[**] |

[** | ]% | ||

| The portion of Annual Net Sales which is greater than US $[**] |

[** | ]% | ||

(b) Royalty Term.

(i) Royalties on such Licensed Product whose manufacture, use or sale, at the time of sale and in the country of sale, is, or would be if such manufacture or use occurred in the country of sale, Covered by a Valid Claim of a Collective Patent Right shall be payable until the expiration of such Valid Claim.

17

(ii) Royalties on such Licensed Product whose manufacture, use or sale, at the time of sale and in the country of sale, is not, and would not be if such manufacture or use occurred in the country of sale, Covered by a Valid Claim of a Collective Patent Right shall be payable if such sale occurs within the first ten (10) years after the First Commercial Sale of such Licensed Product in such country; provided, however, that, at the time of such manufacture, use or sale, a Valid Claim of a Collective Patent Right exists in any country of the world.

(iii) Once the royalty obligations hereunder end with respect to a Licensed Product in a country of sale, Cerulean shall have a fully paid-up, non-exclusive, perpetual license, under the Licensed Patent Rights, and under all intellectual property rights in the Licensed Know-How, to research, develop, make, have made, use, market, offer to sell, distribute, sell and import such Licensed Product in any country in order to sell such Licensed Product in the Field in such country and to use, copy, modify and distribute the Licensed Know-How for such purposes.

(c) The obligation to pay royalties shall be imposed only once, at the point of the first sale, with respect to a particular unit of Licensed Product.

(d) Cerulean shall be entitled to deduct from the royalty payments it makes pursuant to Section 5.5(a) with respect to a Licensed Product [**] percent ([**]%) of Required Third Party Payments with respect to such Licensed Product; provided, that, in no event shall a deduction under this Section 5.5(d) reduce any royalty payment payable by Cerulean pursuant to Section 5.5(a) by more than [**] percent ([**]%). Cerulean shall be entitled to carry forward any unused amounts against future royalty payments payable by Cerulean hereunder with respect to such Licensed Product, until such unused amounts are fully offset.

(e) Calando shall remain solely responsible for any payments owed under the Caltech Agreement.

5.6 Reports and Payment. Commencing with the calendar quarter in which the First Commercial Sale of a Licensed Product occurs in any country in the world and continuing during the Term, Cerulean shall deliver to Calando, within [**] days after the end of each calendar quarter (the “Royalty Payment Date”), (a) a written report showing Cerulean’s computation of Sublicense Income due under this Agreement for such calendar quarter on a Licensed Product-by-Licensed Product basis, (b) a written report showing Cerulean’s computation of royalties due under this Agreement for such calendar quarter on a country-by-country and a Licensed Product-by-Licensed Product basis and (c) payment of the Sublicense Income and royalties shown to be due under this Agreement for such calendar quarter via wire transfer of immediately available funds to an account designated by Calando. With respect to sales of Licensed Products invoiced in United States Dollars, the sales and royalties payable shall be expressed in United States Dollars. With respect to sales of Licensed Products invoiced in a currency other than United States Dollars, the sales and royalties payable shall be expressed in their United States Dollar equivalent calculated using the applicable conversion rates for buying United States Dollars published by The Wall Street Journal on the last business day of the calendar quarter to which the royalty report relates. All Sublicense Income and royalty payments shall be made in United States Dollars.

18

5.7 Right to Setoff. If Calando and/or Arrowhead fails to indemnify a Cerulean Indemnitee as contractually provided for in Section 10.2, then Cerulean may, at its option and upon written notice to Calando, setoff such amount from any amounts owed by Cerulean to Calando pursuant to Sections 5.2, 5.3, 5.4 or 5.5 of this Agreement.

5.8 Tax Withholding. Cerulean shall use reasonable and legal efforts to reduce tax withholding payments to be made to Calando. Notwithstanding the foregoing, if Cerulean concludes that tax withholdings under the laws of any country are required with respect to payments to Calando, Cerulean shall withhold the required amount and pay it to the appropriate governmental authority. In any such case, Cerulean shall promptly provide Calando with original receipts or other evidence reasonably desirable and sufficient to allow Calando to document such tax withholdings for purposes of claiming foreign tax credits and similar benefits.

5.9 Records. Cerulean shall keep, and shall require its Affiliates and Sublicensees to keep, true and accurate books of accounts and other records containing all information and data which may be necessary to ascertain and verify the royalties and other amounts payable by Cerulean under this Agreement. During the Term and for a period of [**] years thereafter, Calando shall have the right from time to time (not to exceed [**]) (a) to have an independent certified public accountant inspect such books and records of Cerulean and its Affiliates or (b) to require that Cerulean have an independent certified public accountant inspect such books and records of the Sublicensees. Any such independent certified public accountant shall be reasonably acceptable to Cerulean, shall execute a standard form of confidentiality agreement with Cerulean, shall be permitted to share with Cerulean its findings, and shall be permitted to share with Calando solely its findings with respect to the accuracy of the amounts reported as payable under this Agreement. If such audit determines that the royalties paid to Calando pursuant to Section 5.5 for any such audited period were understated, then Cerulean shall, within [**] days of receipt of the audit report, pay to Calando the entirety of such understated amount, plus interest accruing from the Royalty Payment Date until the date that such understated amount is paid at an interest rate equal to the lesser of (i) [**] percent ([**]%) per annum or (ii) the highest interest rate allowable by law. If such audit determines that the royalties paid to Calando pursuant to Section 5.5 for any such audited period were understated by an amount equal to or greater than [**] percent ([**]%) of what was owed, then Cerulean shall reimburse Calando for any reasonable out-of-pocket costs of such audit paid by Calando.

SECTION 6. DILIGENCE

6.1 Diligence. Cerulean, through itself, its Affiliates or sublicensees, shall use Commercially Reasonable Efforts to develop Licensed Products in the Field and, following the First Commercial Sale of a Licensed Product in a particular country, to make such Licensed Product commercially available in such country. In addition, if, at any time prior to the fourth (4th) anniversary of the Effective Date, there occurs a Change of Control of Cerulean, then Cerulean (or its successor, as applicable), together with its Affiliates and sublicensees, shall expend a minimum of Seven Hundred Fifty Thousand U.S. Dollars (US $750,000) to research, develop, manufacture and/or commercialize the Cyclodextrin System and/or Licensed Products,

19

during each Diligence Period; provided, however, that, in lieu of such expenditure, Cerulean (or its successor, as applicable) may pay such amount (or any portion of such amount not so expended) to Calando within [**] days after the end of such Diligence Period. Such amount shall be pro-rated for any Diligence Period which is less than twelve months in length. “Diligence Period” means the twelve (12) month period beginning upon such Change of Control, and each succeeding twelve (12) month period thereafter, but no Diligence Period shall begin after, or extend past, the fourth (4th) anniversary of the Effective Date.

6.2 Performance Reports. Cerulean agrees to provide [**] performance reports to Calando within [**] calendar days of a written request by Calando, which shall be no more frequent than [**]. These performance reports shall describe all research and development efforts for Licensed Products (on a Licensed Product-by-Licensed Product basis) since the last performance report. After the [**], such Licensed Product need not be included in subsequent [**] reports; provided, however, that Cerulean shall continue to report on all other Licensed Products.

6.3 Conformity with Caltech Agreement. If, and to the extent, that Caltech, pursuant to Section 5.2 of the Caltech Agreement, requires Calando to report on the progress of introducing commercial Licensed Products in the United States, Calando shall promptly (but in any event within [**] business days) report such requirement to Cerulean and Cerulean shall promptly (within [**] days thereafter) provide a written report thereof to Calando and Calando shall promptly (but in any event within [**] business days) provide such report to Caltech.

6.4 Compliance with Laws. Each Party shall, and shall ensure that its Affiliates and sublicensees shall, comply with all applicable laws in exercising their rights and fulfilling their obligations under this Agreement.

SECTION 7. INTELLECTUAL PROPERTY

7.1 Ownership. As between the Parties, (a) all Know-How developed, conceived or reduced to practice after the Effective Date solely by employees and consultants of Cerulean or its Affiliates, and all intellectual property rights in the foregoing, shall be owned solely by Cerulean, and (b) all Know-How developed, conceived or reduced to practice after the Effective Date solely by employees and consultants of Calando or its Affiliates, and all intellectual property rights in the foregoing, shall be owned solely by Calando. While the Parties do not anticipate that any Know-How will be jointly developed, if any Know-How is developed, conceived or reduced to practice after the Effective Date jointly by employees and consultants of Cerulean or its Affiliates, on the one hand, and Calando or its Affiliates, on the other hand, such Know-How and all intellectual property rights therein (such Know-How and intellectual property rights, collectively, “Joint IP”), shall be owned jointly by Cerulean and Calando, on the basis of an undivided interest. Subject to the licenses granted to Cerulean pursuant to Section 3.1 and pursuant to the IT-101 Agreement, each Party shall have the right to fully exploit the Joint IP, and to sublicense such Party’s rights under the Joint IP, without a duty to account to the other Party. If any patentable Joint IP is conceived or reduced to practice, the Parties shall negotiate in good faith reasonable rights and responsibilities of the Parties to prosecute and enforce such Joint IP. Inventorship, for the purposes of this Section 7.1, shall be determined by the Parties in good faith in accordance with United States patent laws.

20

7.2 Patent Prosecution.

(a) Assigned Patent Rights. Cerulean shall have the sole right, at its own expense and in its own name, to prepare, file, prosecute and maintain the Assigned Patent Rights. If Cerulean determines to discontinue the prosecution or maintenance of any patent application or patent within such Assigned Patent Rights, Cerulean shall promptly notify Calando, sufficiently in advance of any deadlines to ensure that no rights with respect thereto are lost, and thereupon, Calando shall have the right, at its own expense, to prosecute and maintain any such Patent Right.

(b) RNAi Patent Rights. Calando shall have the sole right, at its own expense and in its own name, to prepare, file, prosecute and maintain the RNAi Patent Rights.

(c) Caltech Patent Rights. The Parties agree and acknowledge that, with respect to the Caltech Joint Patent Rights and the Caltech Sole Patent Rights, as set forth in the Caltech Agreement, Caltech has the right to prosecute such Patent Rights, Calando has the right to comment on such prosecution and Calando pays the patent costs thereof, but that:

(i) Calando shall use reasonable efforts to cause Caltech to promptly provide Calando with copies of all material correspondence received from any patent counsel or patent authority pertaining to such Patent Rights;

(ii) Calando shall promptly provide Cerulean with copies of all correspondence received by Calando from Caltech from any patent counsel or patent authority pertaining to such Patent Rights;

(iii) Calando shall provide Cerulean, sufficiently in advance of any deadline for Cerulean to comment, with copies of all patent applications and other submissions and correspondence with any patent counsel or patent authority pertaining to such Patent Rights, and shall use reasonable efforts to ensure that Caltech gives due consideration to Cerulean’s comments; and

(iv) in the event of the bankruptcy or other insolvency of Calando or a termination, for any reason, of the Caltech Agreement, as between the Parties, the provisions of the Caltech Side Letter shall supersede any conflicting provisions of this Section 7.2(c) and the Caltech Agreement.

(d) Other Licensed Patent Rights. Calando shall have the initial right, at its own expense and in its own name, to prepare, file, prosecute and maintain any Licensed Patent Rights other than the Caltech Joint Patent Rights, Caltech Sole Patent Rights and RNAi Patent Rights. If Calando determines not to prepare or file any patent application covering any Licensed Know-How or determines to discontinue the prosecution or maintenance of any patent application or patent within such Licensed Patent Rights, Calando shall promptly notify Cerulean, sufficiently in advance of any deadlines to ensure that no rights with respect thereto are lost, and thereupon, Cerulean shall have the right, at its own expense, to prepare, file, prosecute and maintain any such Patent Right. With respect to the preparation, filing, prosecution and maintenance of such Licensed Patent Rights:

(i) the Party not preparing, filing, prosecuting or maintaining such patent or patent application (the “Non-Prosecuting Party”) shall, at the reasonable request of the other Party (the “Prosecuting Party”), assist and cooperate in the filing, prosecution and maintenance of such Patent Rights;

21

(ii) the Prosecuting Party shall provide the Non-Prosecuting Party, sufficiently in advance of any deadline for the Non-Prosecuting Party to comment, with copies of all patent applications and other submissions and correspondence with any patent counsel or patent authority pertaining to such Patent Rights;

(iii) the Prosecuting Party shall give due consideration to the Non-Prosecuting Party’s comments, but the Prosecuting Party shall have the final say in determining whether or not to incorporate such comments;

(iv) each Party shall promptly provide the other with copies of all correspondence received from any patent counsel or patent authority pertaining to such Patent Rights; and

(v) if Cerulean is preparing, filing, prosecuting or maintaining Licensed Patent Rights, Cerulean may fully credit any out-of-pocket expenses incurred by Cerulean in connection therewith against any other payments due by Cerulean hereunder.

7.3 Enforcement.

(a) Notice. Each Party shall promptly (but within no more than [**] days) report in writing to the other Party during the Term any suspected infringement of the Collective Patent Rights (including any “patent certification” filed in the United States under 21 U.S.C. §355(b)(2) or 21 U.S.C. §355(j)(2) or similar provisions in other jurisdictions), any declaratory judgment, opposition, or similar action alleging the invalidity, unenforceability or non-infringement of the Collective Patent Rights, or any suspected unauthorized use or misappropriation of any Licensed Know-How or of the other Party’s Confidential Information, of which it becomes aware, and shall provide the other Party with all available evidence supporting such suspected infringement, action or unauthorized use or misappropriation.

(b) Enforcement of Assigned Patent Rights. Cerulean shall have the sole right to initiate an appropriate suit anywhere in the world against any Third Party who at any time is suspected of infringing all or any portion of the Assigned Patent Rights.

(c) Enforcement of RNAi Patent Rights. Calando shall have the sole right to initiate an appropriate suit anywhere in the world against any Third Party who at any time is suspected of infringing all or any portion of the RNAi Patent Rights.

(d) Enforcement of Licensed Patent Rights other than RNAi Patent Rights.

(i) Cerulean shall have the first right to initiate an appropriate suit anywhere in the world against any Third Party who at any time is suspected of infringing all or any portion of the Licensed Patent Rights other than the RNAi Patent Rights, or using without proper authorization all or any portion of the Licensed Know-How, by researching, developing,

22

making, having made, using, marketing, offering to sell, distributing, selling or importing any product that falls within the scope of the definition of “Licensed Product” (but not a product that falls within the scope of the definition of “Retained Product”). Calando shall join as a party to any such suit brought by Cerulean, if requested by Cerulean, but shall be under no obligation to participate except to the extent that such participation is required as the result of being a named party to the suit. Upon Cerulean’s request, Calando shall provide reasonable assistance to Cerulean in connection therewith at no charge to Cerulean except for reimbursement of Calando’s reasonable out-of-pocket expenses (including reasonable attorneys’ fees) incurred in rendering such assistance. Any recoveries resulting from such action (whether in the form of damages, royalties, settlement payments or otherwise) shall first be applied to reimburse Cerulean for all out-of-pocket expenses incurred in connection with such proceeding (and any out-of-pocket expenses of Calando paid by Cerulean) and (A) to the extent that the remaining recovery represents lost profits, such remaining recovery shall be retained by Cerulean, with Calando entitled to receive an amount equal to the royalties that would have been due Calando on sales of the relevant Licensed Product lost by Cerulean as a result of the infringement and (B) to the extent that the remaining recovery represents punitive or other damages, Cerulean shall be entitled to [**] percent ([**]%) of such remaining recovery and Calando shall be entitled to [**] percent ([**]%) of such remaining recovery.

(ii) If, within [**] days after notification of an infringement of the Licensed Patent Rights with respect to which Cerulean would have the first right to bring suit as described in Section 7.3(d)(i), Cerulean has not been successful in persuading the alleged infringer to desist and is not diligently pursuing an infringement action or suit, or has notified Calando of its intent not to bring action or suit against the alleged infringer, then Caltech or Calando may institute an action or suit against such Third Party, in accordance with their rights of priority under Sections 6.1 and 6.2 of the Caltech Agreement, subject to the following if Calando institutes such action or suit:

(A) Prior to taking any action, Calando shall confer with Cerulean and give due consideration to Cerulean’s reasons for not pursuing such alleged infringer.

(B) The action or suit shall be brought in the name of Caltech and/or Calando and Calando shall bear the entire cost of such action or suit. Calando shall promptly provide Cerulean with copies of all litigation pleadings and other documents submitted to the court.

(C) With respect to any consideration received by Calando in connection with such action or suit, Calando shall first be entitled to deduct its litigation expenses and legal fees (including any incurred as part of an indemnification of Cerulean). All remaining recovery shall be split equally between Calando and Cerulean.

(D) If it shall be necessary for Calando to join Cerulean as a party to an action or suit because Cerulean constitutes a legally indispensable party, Calando shall have the right to so join Cerulean; provided, that Calando indemnifies Cerulean for all outside costs and expenses (including reasonable attorneys fees) thereby incurred by Cerulean.

23

(iii) Calando shall have the sole right to initiate an appropriate suit anywhere in the world against any Third Party who at any time is suspected of infringing all or any portion of the Licensed Patent Rights other than the RNAi Patent Rights, or using without proper authorization all or any portion of the Licensed Know-How, by researching, developing, making, having made, using, marketing, offering to sell, distributing, selling or importing any product that falls within the scope of the definition of “Retained Product” (but not a product that falls within the definition of “Licensed Product”).

(iv) The Party enforcing such Licensed Patent Rights or Licensed Know-How pursuant to Section 7.3(d)(i), (ii) or (iii) shall have the sole and exclusive right to select counsel for any such suit referred and shall, except as provided herein, pay all expenses of the suit, including attorneys’ fees and court costs. Neither Party shall settle any suit described in this Section 7.3 involving rights of the other Party without obtaining the prior written consent of such other Party, which consent shall not be unreasonably withheld.

7.4 Power of Attorney. Calando hereby constitutes and appoints the President of Cerulean with full power of substitution, the true and lawful attorney-in-fact and agent of Calando, to execute, acknowledge, verify, swear to, deliver, record and file, in Calando’s or its assignee’s name, place and stead, all in accordance with the terms of this Agreement, all instruments, documents and certificates which may from time to time be required by the laws of the governmental authority to prosecute, maintain and enforce the Licensed Patent Rights other than the RNAi Patent Rights, and to prepare and file any patent applications covering Licensed Know-How, in each case to the extent Calando or its assignee has such right pursuant to this Section 7. The power of attorney granted herein will be deemed to be coupled with an interest, will survive and not be affected by the dissolution, bankruptcy or legal disability of Calando and will extend to its successors and assigns. If required, Calando shall execute and deliver to Cerulean within [**] days after the receipt of a request therefor, such further designations, powers of attorney or other instruments as Cerulean will reasonably deem necessary for the purposes described in this Section 7.4.

7.5 Claimed Infringement. If a Third Party at any time provides written notice of a claim, or brings an action, suit or proceeding, against either Party or any of its Affiliates or sublicensees, claiming infringement of such Third Party’s Patent Rights or unauthorized use or misappropriation of such Third Party’s Know-How, arising out of the research or development of the Cyclodextrin System or the research, development, making, having made, use, marketing, offering to sell, distribution, sale or importation of Licensed Products, such Party shall promptly notify the other Party of the claim or the commencement of such action, suit or proceeding, enclosing a copy of the claim and all papers served and such Party shall have the sole right and responsibility to take any action it deems appropriate with respect such claim, action, suit or proceeding.

SECTION 8. CONFIDENTIAL INFORMATION

8.1 Treatment of Confidential Information. Each Receiving Party shall maintain in confidence the Confidential Information of the Disclosing Party and shall not disclose, divulge or otherwise communicate such Confidential Information to others, or use it for any purpose, except to exercise its rights or fulfill its obligations under this Agreement. Each Receiving Party shall

24

exercise every reasonable precaution to prevent and restrain the unauthorized disclosure of such Confidential Information by any of its directors, officers, employees, consultants, subcontractors, sublicensees or agents.

8.2 Release from Restrictions. The provisions of Section 8.1 shall not apply to any Confidential Information of the Disclosing Party which:

(a) was known or used by the Receiving Party or any of its Affiliates prior to its date of disclosure to the Receiving Party, as demonstrated by competent evidence of the Receiving Party;

(b) either before or after the date of the disclosure to the Receiving Party is lawfully disclosed to the Receiving Party or any of its Affiliates by a Third Party rightfully in possession of, and with the right to disclose, such Confidential Information;

(c) either before or after the date of the disclosure to the Receiving Party becomes published or generally known to the public through no fault or omission on the part of the Receiving Party or its Affiliates;

(d) is required to be disclosed by the Receiving Party to comply with applicable laws or regulations, to defend or prosecute litigation or arbitration, to file for patent protection as permitted hereunder or to file for Regulatory Approval as permitted hereunder; provided, however, that (i) with respect to a disclosure to comply with laws or regulations or to defend or prosecute litigation or arbitration, then, to the extent permitted by law, the Receiving Party shall provide the Disclosing Party with prompt notice of any such requirement, and (ii) with respect to any disclosure under this clause (d), then, where available, the Receiving Party shall take reasonable and lawful actions to avoid and/or minimize the degree of such disclosure; or

(e) is independently developed by the Receiving Party or any of its Affiliates without reference to the Confidential Information of the Disclosing Party;

provided, however, that Calando may not rely on the provisions of Section 8.2(a) or (b) with respect to the Assigned IP.

8.3 Permitted Disclosure. The Receiving Party may provide the Disclosing Party’s Confidential Information to the directors, employees, consultants and advisors of the Receiving Party and its Affiliates, and to its then-current and potential licensees who have a need to know such Confidential Information for purposes of the Receiving Party granting licenses or sublicenses under Collective Patent Rights or Licensed Know-How as permitted herein; provided, that such persons shall (a) execute or have executed an agreement in reasonable form whereby they agree to be bound by an obligation, or (b) be bound by ethical or fiduciary obligations, in each case to maintain the confidentiality of the Disclosing Party’s Confidential Information at least to the same extent as if they were parties hereto.

8.4 Publicity. No Party shall have the right to make any public announcements with respect to this Agreement, nor publicly disclose the terms of this Agreement, without the prior written consent of the other Party, except as follows:

(a) On the first business day following the execution of this Agreement, each Party shall issue its press release attached hereto as Exhibit I.

25

(b) Each Party may disclose the terms of this Agreement to the extent such disclosure is required by law (including by rules or regulations of any securities exchange or NASDAQ) or to defend or prosecute litigation or arbitration; provided, that, prior to such disclosure, to the extent permitted by law or such rules or regulations, the disclosing Party promptly notifies the other Party of such requirement and gives such other Party an opportunity to comment on the disclosure to be made, the disclosing Party furnishes only those terms of this Agreement that the disclosing Party is legally required to furnish and the disclosing Party requests, and use reasonable efforts to obtain, confidential treatment of financial and other commercially sensitive terms.

(c) Each Party may make subsequent disclosures of information which has been previously publicly disclosed in accordance with this Agreement.

(d) Calando may disclose this Agreement to (i) Calando’s then-current and potential Third Party licensors or licensees of the Collective Patent Rights, and (ii) Calando’s then-current and potential investors and acquirers; provided, that such persons are bound to maintain the confidentiality of this Agreement to the same extent as if they were parties hereto and Calando shall not disclose the financial and other commercially sensitive terms of this Agreement to any licensee outside the Field.

(e) Cerulean may disclose this Agreement to (i) Cerulean’s then-current and potential licensors or licensees of the Collective Patent Rights, and (ii) Cerulean’s then-current and potential investors and acquirers; provided, that such persons are bound to maintain the confidentiality of this Agreement to the same extent as if they were parties hereto.

(f) From and after the Effective Date, Cerulean shall have the right to make and control all disclosures regarding Licensed Products.

8.5 Enforcement. The provisions of Section 8 of this Agreement are necessary for the protection of the business and goodwill of the Parties and are considered by the Parties to be reasonable for such purpose. The Receiving Party agrees that any breach of Section 8 of this Agreement may cause the Disclosing Party substantial and irreparable injury and, therefore, in the event of any such breach, in addition to other remedies which may be available, the Disclosing Party may have the right to specific performance and other injunctive and equitable relief.

8.6 Caltech Name. Except as may be required by law, Cerulean shall not, without having first obtained written approval from Caltech, use the name of Caltech, or California Institute of Technology, in any advertising or publicity material, or make any form of representation or statement which would constitute an express or implied endorsement by Caltech of any Licensed Product.

26

8.7 Laboratory Notebooks. The laboratory notebooks of Calando shall be made available to Cerulean upon the following terms and conditions: