FIRST AMENDMENT TO AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT

Exhibit 10.15

FIRST AMENDMENT TO AMENDED AND RESTATED

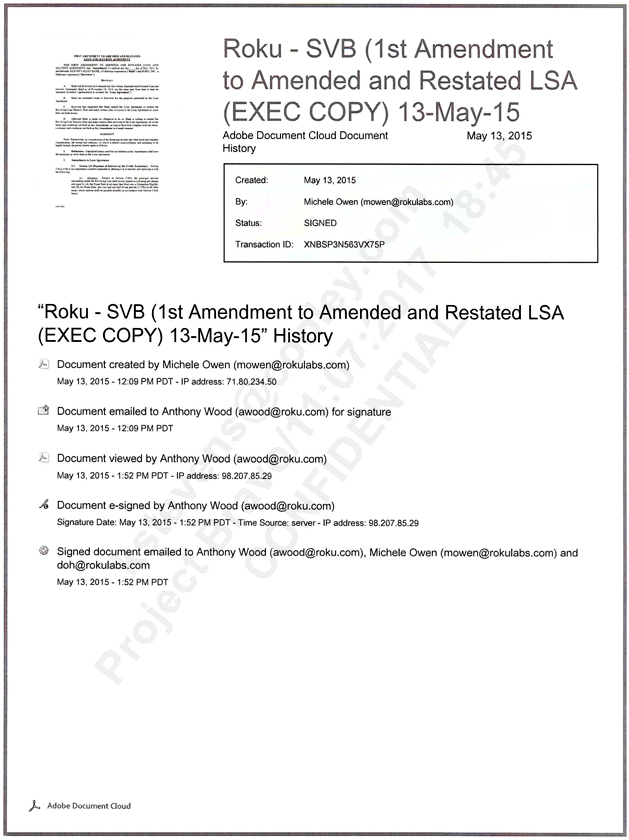

THIS FIRST AMENDMENT TO AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT (this “Amendment”) is entered into this 14th day of May, 2015, by and between SILICON VALLEY BANK, a California corporation (“Bank”) and ROKU, INC., a Delaware corporation (“Borrower”).

RECITALS

A. Bank and Borrower have entered into that certain Amended and Restated Loan and Security Agreement dated as of November 18, 2014, (as the same may from time to time be amended, modified, supplemented or restated, the “Loan Agreement”).

B. Bank has extended credit to Borrower for the purposes permitted in the Loan Agreement.

C. Borrower has requested that Bank amend the Loan Agreement to extend the Revolving Line Maturity Date and make certain other revisions to the Loan Agreement as more fully set forth herein.

D. Although Bank is under no obligation to do so, Bank is willing to extend the Revolving Line Maturity Date and make certain other revisions to the Loan Agreement, all on the terms and conditions set forth in this Amendment, so long as Borrower complies with the terms, covenants and conditions set forth in this Amendment in a timely manner.

AGREEMENT

NOW, THEREFORE, in consideration of the foregoing recitals and other good and valuable consideration, the receipt and adequacy of which is hereby acknowledged, and intending to be legally bound, the parties hereto agree as follows:

1. Definitions. Capitalized terms used but not defined in this Amendment shall have the meanings given to them in the Loan Agreement.

2. Amendments to Loan Agreement.

2.1 Section 2.6 (Payment of Interest on the Credit Extensions). Section 2.6(a) of the Loan Agreement is hereby amended by deleting it in its entirety and replacing it with the following:

(a) Advances. Subject to Section 2.6(b), the principal amount outstanding under the Revolving Line shall accrue interest at a floating per annum rate equal to (A) the Prime Rate at all times that Borrower is Streamline Eligible, and (B) the Prime Rate, plus two and one half of one percent (2.50%) at all other times, which interest shall be payable monthly in accordance with Section 2.6(d) below.

2.2 Section 2.7 (Fees). Section 2.7(a) of the Loan Agreement is hereby amended by deleting it in its entirety and replaced with the following:

(a) Commitment Fee. A fully earned, non-refundable commitment fee of Two Hundred Six Thousand Two Hundred Fifty Dollars ($206,250) (the “Commitment Fee”) of which, (i) Seventy-Five Thousand Dollars ($75,000), was paid by Borrower on November 18, 2014 (and is in addition to the Twenty Thousand Dollars ($20,000) Borrower previously paid to Bank in connection with the extensions of the Revolving Line Maturity Date as set forth in the twelve and thirteenth amendments to the Prior Loan Agreement, dated June 5, 2014 and August 28, 2014, respectively), (ii) Seventy-Five Thousand Dollars ($75,000) shall be paid to Bank on November 18, 2015, and (iii) the balance of Fifty-Six Thousand Two Hundred Fifty Dollars ($56,250) shall be paid to Bank on the earlier of (A) September 30, 2016 or (B) upon termination of the Revolving Line for any reason prior to the Revolving Line Maturity Date;

2.3 Section 6.9 (Financial Covenants). Section 6.9(a) of the Loan Agreement is hereby amended by deleting it in its entirety and replacing it with the following:

(a) Current Ratio. Commencing with the month ending March 31, 2015, a Current Ratio of at least 1.10 to 1.00.

2.4 Section 13 (Definitions).

(a) The following terms and their respective definitions are hereby added to Section 13.1 of the Loan Agreement in alphabetical order:

“Current Assets” are amounts that under GAAP should be included on that date as current assets on Borrower’s consolidated balance sheet.

“Current Ratio” is a ratio of (a) Current Assets to (b) Current Liabilities, minus Deferred Revenue.

(b) The following terms and its respect definitions set forth in Section 13.1 of the Loan Agreement are hereby amended by deleting each in its entirety and replacing each with the following:

“Revolving Line Maturity Date” is June 30, 2017.

“Streamline Eligible” shall mean at all times that Borrower’s Adjusted Quick Ratio for the immediately preceding month is greater than 1.00 to 1.00, as determined by Bank, in its sole discretion (the “Streamline Threshold”); provided, however, Borrower shall not be Streamline Eligible during the continuance of an Event of Default. At any time that Borrower’s Adjusted Quick Ratio is less than or equal to the Streamline Threshold, Borrower will not be Streamline Eligible until the first (1st) day of the first (1st) month following Bank’s confirmation that (a) Borrower’s Adjusted Quick Ratio is greater than the Streamline Threshold as of such date and (b) Borrower’s Adjusted Quick Ratio is greater than the Streamline

2

Threshold at all times during the immediately preceding monthly reporting period as reported in each monthly Compliance Certificate.

2.5 Exhibit B (Compliance Certificate). The Compliance Certificate attached to the Loan Agreement is replaced in its entirety with the Compliance Certificate attached hereto as Exhibit B. From and after the date hereof, all references in the Loan Agreement to the Compliance Certificate shall be deemed to refer to Exhibit B attached hereto.

3. Limitation of Amendments.

3.1 The amendments set forth in Section 2 above are effective for the purposes set forth herein and shall be limited precisely as written and shall not be deemed to (a) be a consent to any amendment, waiver or modification of any other term or condition of any Loan Document, or (b) otherwise prejudice any right or remedy which Bank may now have or may have in the future under or in connection with any Loan Document.

3.2 This Amendment shall be construed in connection with and as part of the Loan Documents and all terms, conditions, representations, warranties, covenants and agreements set forth in the Loan Documents, except as herein amended, are hereby ratified and confirmed and shall remain in full force and effect.

3.3 In addition to those Events of Default specifically enumerated in the Loan Documents, the failure to comply with the terms of any covenant or agreement contained herein shall constitute an Event of Default and shall entitle Bank to exercise all rights and remedies provided to Bank under the terms of any of the other Loan Documents as a result of the occurrence of the same.

4. Representations and Warranties. To induce Bank to enter into this Amendment, Borrower hereby represents and warrants to Bank as follows:

4.1 Immediately after giving effect to this Amendment (a) the representations and warranties contained in the Loan Documents are true, accurate and complete in all material respects as of the date hereof (except to the extent such representations and warranties relate to an earlier date, in which case they are true and correct as of such date), and (b) no Event of Default has occurred and is continuing;

4.2 Borrower has the power and authority to execute and deliver this Amendment and to perform its obligations under the Loan Agreement, as amended by this Amendment;

4.3 The organizational documents of Borrower delivered to Bank on the Effective Date remain true, accurate and complete and have not been amended, supplemented or restated and are and continue to be in full force and effect;

4.4 The execution and delivery by Borrower of this Amendment and the performance by Borrower of its obligations under the Loan Agreement, as amended by this Amendment, have been duly authorized;

3

4.5 The execution and delivery by Borrower of this Amendment and the performance by Borrower of its obligations under the Loan Agreement, as amended by this Amendment, do not and will not contravene (a) any law or regulation binding on or affecting Borrower, (b) any contractual restriction with a Person binding on Borrower, (c) any order, judgment or decree of any court or other governmental or public body or authority, or subdivision thereof, binding on Borrower, or (d) the organizational documents of Borrower;

4.6 The execution and delivery by Borrower of this Amendment and the performance by Borrower of its obligations under the Loan Agreement, as amended by this Amendment, do not require any order, consent, approval, license, authorization or validation of, or filing, recording or registration with, or exemption by any governmental or public body or authority, or subdivision thereof, binding on Borrower, except as already has been obtained or made; and

4.7 This Amendment has been duly executed and delivered by Borrower and is the binding obligation of Borrower, enforceable against Borrower in accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, liquidation, moratorium or other similar laws of general application and equitable principles relating to or affecting creditors’ rights.

5. Integration. This Amendment and the Loan Documents represent the entire agreement about this subject matter and supersede prior negotiations or agreements. All prior agreements, understandings, representations, warranties, and negotiations between the parties about the subject matter of this Amendment and the Loan Documents merge into this Amendment and the Loan Documents.

6. Counterparts. This Amendment may be executed in any number of counterparts and all of such counterparts taken together shall be deemed to constitute one and the same instrument.

7. Effectiveness. This Amendment shall be deemed effective upon (a) the due execution and delivery to Bank of this Amendment by each party hereto, (b) the due execution and delivery to Bank of that certain Addendum to Intellectual Property Security Agreement by each party thereto, (c) the due execution and delivery to Bank of that certain bailee waiver for 0000 Xxxxxxxx Xxxxxxxxxx Xxxxxxxx, Xxxxxxxxxx 00000 by each party hereto, (d) the due execution and delivery to Bank of that certain bailee waiver for 0000 X’Xxxxx Xxxxxx Xxx Xxxx, Xxxxxxxxxx 00000 by each party hereto, (e) the due execution and delivery to Bank of that certain bailee waiver for 00000 Xxxxx Xx Xxxxxx, Xxxxx X, Xxxxxx Xxxxxxxxx, Xxxxxxxxxx 00000 and (f) payment of Bank’s legal fees and expenses in connection with the negotiation and preparation of this Amendment.

[Signature page follows.]

4

IN WITNESS WHEREOF, THE PARTIES HERETO HAVE CAUSED THIS AMENDMENT TO BE DULY EXECUTED AND DELIVERED AS OF THE DATE FIRST WRITTEN ABOVE.

| BORROWER: |

| ROKU, INC. |

| By: /s/ Xxxxxxx Xxxx |

| Name: Xxxxxxx Xxxx |

| Title: CEO |

| BANK: |

| SILICON VALLEY BANK |

| By: /s/ Xxxxxxx Xxxxxx |

| Name: Xxxxxxx Xxxxxx |

| Title: Director |

[Signature Page to First Amendment to Amended and Restated Loan and Security Agreement]

EXHIBIT B

COMPLIANCE CERTIFICATE

TO: SILICON VALLEY BANK Date:

FROM: ROKU, INC.

The undersigned authorized officer of ROKU, INC. (“Borrower”) certifies that under the terms and conditions of the Amended and Restated Loan and Security Agreement between Borrower and Bank (the “Agreement”):

(1) Borrower is in complete compliance for the period ending with all required covenants except as noted below; (2) there are no Events of Default except as noted below; (3) all representations and warranties in the Agreement are true and correct in all material respects on this date except as noted below; provided, however, that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof; and provided, further that those representations and warranties expressly referring to a specific date shall be true, accurate and complete in all material respects as of such date; (4) Borrower, and each of its Subsidiaries, have timely filed all required tax returns and reports, and Borrower has timely paid all foreign, federal, state and local taxes, assessments, deposits and contributions owed by Borrower except as otherwise permitted pursuant to the terms of Section 5.9 of the Agreement; and (5) no Liens have been levied or claims made against Borrower or any of its Subsidiaries relating to unpaid employee payroll or benefits of which Borrower has not previously provided written notification to Bank.

Attached are the required documents supporting the certification. The undersigned certifies that these are prepared in accordance with GAAP consistently applied from one period to the next except as explained in an accompanying letter or footnotes. The undersigned acknowledges that no borrowings may be requested at any time or date of determination that Borrower is not in compliance with any of the terms of the Agreement, and that compliance is determined not just at the date this certificate is delivered. Capitalized terms used but not otherwise defined herein shall have the meanings given them in the Agreement.

Please indicate compliance status by circling Yes/No under “Complies” column.

| Reporting Covenants |

Required |

Complies | ||

| Monthly financial statements with Compliance Certificate | Monthly within 30 days | Yes No | ||

| Annual financial statement (CPA Audited) + XX | XXX within 180 days | Yes No | ||

| Form 10-K | After IPO, FYE within 180 days | Yes No | ||

| Form 10-Q | After IPO, quarterly within 50 days | Yes No | ||

| Merchant Service Processing statement | Monthly within 30 days | Yes No | ||

| A/R, A/P Agings, Inventory Report, and Deferred Revenue (if requested) | Monthly within 30 days | Yes No | ||

| Transaction Report (if Advances are outstanding) | Weekly; or Monthly within 30 days if Streamline Eligible | Yes No | ||

| Board approved annual financial projections | March 31 of each year or more frequently as updated | Yes No |

| Financial Covenants |

Required | Actual | Complies | |||||||||

| Maintain on a Monthly Basis: |

||||||||||||

| Current Ratio of at least* |

1.10:1.00 | :1.00 | Yes No | |||||||||

| * Commencing with the month ending March 31, 2015. |

||||||||||||

| Performance Pricing |

Applies | |||||

| Streamline Eligible |

Prime | Yes No | ||||

| Not Streamline Eligible |

Prime + 2.50% | Yes No | ||||

| Streamline Eligible |

Required | Actual | Complies | |||||||||

| Adjusted Quick Ratio of at least |

1.00 to 1.00 | :1.00 | Yes No | |||||||||

The following financial covenant analysis and information set forth in Schedule 1 attached hereto are true and accurate as of the date of this Certificate.

Other Matters

| Have there been any amendments of or other changes to the capitalization table of Borrower and to the Operating Documents of Borrower or any of its Subsidiaries? If yes, provide copies of any such amendments or changes with this Compliance Certificate. | Yes | No | ||

The following are the exceptions with respect to the certification above: (If no exceptions exist, state “No exceptions to note.”)

|

|

|

|

|

|

| ROKU, INC. | BANK USE ONLY

Received by: AUTHORIZED SIGNER | |

| By: | Date: | |

| Name: | ||

| Title: |

Verified: | |

| AUTHORIZED SIGNER | ||

| Date: | ||

| Compliance Status: Yes No | ||

Schedule 1 to Compliance Certificate

Financial Covenants of Borrower

In the event of a conflict between this Schedule and the Loan Agreement, the terms of the Loan Agreement shall govern.

Dated:

I. Current Ratio (Section 6.9(a))

Required: 1.10 to 1.00.

Actual:

| A. | Aggregate value of Borrower’s current assets | $ | ||

| B. | Aggregate value of Obligations to Bank | $ | ||

| C. | Aggregate value of liabilities that should, under GAAP, be classified as liabilities on Borrower’s consolidated balance sheet, including all Indebtedness, and not otherwise reflected in line B above that matures within one (1) year | $ | ||

| D. | Deferred Revenue | $ | ||

| E. | Current Liabilities (the sum of lines B and C minus line D) | $ | ||

| F. | Current Ratio (line A divided by line E) |

Is line F greater than 1.10 to 1.00?

| No, not in compliance | Yes, in compliance |

II. Adjusted Quick Ratio (Streamline Eligible) Required: Greater than 1.00 to 1.00.

Actual:

| A. | Aggregate value of Borrower’s unrestricted cash maintained with Bank or Bank’s Affiliates | $ | ||

| B. | Aggregate value of Borrower’s net billed accounts receivable | $ | ||

| C. | Quick Assets (the sum of lines A and B) | $ | ||

| D. | Aggregate value of Obligations to Bank that mature within one (1) year | $ | ||

| E. | Aggregate value of liabilities that should, under GAAP, be classified as liabilities on Borrower’s consolidated balance sheet, including all Indebtedness (other than Subordinated Debt), and not otherwise reflected in line D above that matures within one (1) year | $ | ||

| F. | Aggregate value of all outstanding Obligations under the Revolving Line and not otherwise reflected in line D or E above | $ | ||

| G. | Current Liabilities (the sum of lines (D and E), plus F) | $ | ||

| H. | Deferred Revenue | $ | ||

| I. | Adjusted Quick Ratio (line C divided by line G, minus line H) |

Is line I equal greater than the required amount?

| No, not in compliance |

Yes, in compliance |