Share purchase agreement

Exhibit 4.16

01 November 2022

between

BULAWAYO MINING COMPANY LIMITED

and

CALEDONIA MINING CORPORATION PLC

CONTENTS

CLAUSE

| 3 | ||

| 5 | ||

| 5 | ||

| 6 | ||

| 7 | ||

| 8 | ||

| 9 | ||

| 9 | ||

| 10 | ||

| 10 | ||

| 11 | ||

| 11 | ||

| 11 | ||

| 12 | ||

| 12 | ||

| 12 | ||

| 13 | ||

| 13 | ||

| 13 |

SCHEDULES

| 14 | ||

| 15 | ||

| 17 |

This document is dated 01 November 2022.

Parties

|

(1) |

Bulawayo Mining Company Limited incorporated and registered in England with company number 10820387 whose registered office is at 000 Xxxxxxxxx, Xxxxxx Xxxxx, Xxxxxx, Xxxxxxx XX0X 0XX (Seller); and |

|

(2) |

Caledonia Mining Corporation Plc incorporated and registered in Jersey with company number 120924 whose registered office is at B006 Millais House, Castle Quay, Jersey, Channel Islands JE2 3EF (Buyer). |

BACKGROUND

The Seller has agreed to sell, and the Buyer has agreed to buy, the Sale Shares subject to the terms and conditions of this Agreement.

Agreed terms

|

1. |

|

1.1 |

The definitions and rules of interpretation in this clause apply in this Agreement. |

Business Day: a day other than a Saturday, Sunday or public holiday in England when banks in London are open for business.

CA 2006: the Companies Act 2006.

Claim: a claim for breach of any of the Warranties.

Company: Motapa Mining Company UK Limited, a company incorporated and registered in England and Wales, further details of which are set out in Schedule 1.

Completion: completion of the sale and purchase of the Sale Shares in accordance with this Agreement.

Completion Date: the date of this Agreement.

Connected: has, in relation to a person, the meaning given in section 1122 of the Corporation Tax Act 2010.

Disclosed: fully, clearly, accurately and fairly disclosed (with sufficient details to identify the nature and scope of the matter disclosed) by the Seller to the Buyer in the Disclosure Letter (or the documents annexed to it).

Disclosure Letter: the letter in the agreed form described as such from the Seller to the Buyer executed and delivered immediately before the signing of this Agreement.

Encumbrance: any interest or equity of any person (including any right to acquire, option or right of pre-emption) or any mortgage, charge, pledge, lien, assignment, hypothecation, security interest, title retention or any other security agreement or arrangement.

Group: the Company and the Subsidiary, with each being a Group Company. Initial Purchase Price: has the meaning given in clause 3.1(a).

Insolvency Proceedings means any formal insolvency proceedings whether in or out of court, including proceedings or steps leading to any form of bankruptcy, liquidation, administration, receivership or scheme with creditors, moratorium, stay or limitation of creditors' rights, interim or provisional supervision by a court or court appointee or any distress, execution or other process levied; or any winding up, striking off or dissolution (whether or not due to insolvency); or any event analogous to any of those events in any jurisdiction.

Lease: the registered mining lease numbered 22 in terms of the Mines and Minerals Act (Chapter 21:05) in respect of the area situate in the mining district of Matabeleland North covering 2,224 hectares over the area known as Motapa and which is warranted by the Seller to be duly held by the Subsidiary.

Loan Notes: the US$7,250,000 guaranteed loan notes to be issued by the Buyer to the Seller on Completion pursuant to the loan note instrument in the agreed form.

PCG Letter: the letter in the agreed form to be executed by Metallon Corporation Limited in favour of the Buyer guaranteeing the Seller’s obligations under this Agreement.

Purchase Price: is the aggregate purchase price payable pursuant to clause 3.1.

Sale Shares: the 100 ordinary shares of £1 each in the Company, all of which have been issued and are fully paid.

Seller’s Group: the Seller, any subsidiary of the Seller, any holding company of the Seller and any subsidiary of such holding company (each as defined in section 1159 of the CA 2006) but excluding the Company and the Subsidiary.

Subsidiary: Arraskar Investments (Private) Limited, a company incorporated and registered in Zimbabwe with company number 5030/2016, further details of which are set out in Schedule 1.

Subsidiary Shares: the 2 ordinary shares of US$1 each in the Subsidiary, all of which have been issued and are fully paid and are held by the Company.

Warranties: the warranties set out in Schedule 3.

|

1.2 |

References to clauses and Schedules are to the clauses of and Schedules to this Agreement and references to paragraphs are to paragraphs of the relevant Schedule. |

|

1.3 |

The Schedules form part of this Agreement and shall have effect as if set out in full in the body of this Agreement. Any reference to this Agreement includes the Schedules. |

|

1.4 |

This Agreement shall be binding on and enure to the benefit of the Parties to this Agreement and their respective successors and permitted assigns, and references to a Party shall include that Party's successors and permitted assigns. |

|

1.5 |

A reference to a company shall include any company, corporation or other body corporate, wherever and however incorporated or established. |

|

1.6 |

A reference to a holding company or a subsidiary means a holding company or a subsidiary (as the case may be) as defined in section 1159 of the CA 2006 and a member of its group, group company or group means, save for in respect of the Seller (whose group is defined above), in relation to a company, any subsidiary or any holding company from time to time of that company, and any subsidiary from time to time of a holding company of that company. |

|

1.7 |

Unless expressly provided otherwise in this Agreement, a reference to writing or written includes email. |

|

1.8 |

Any words following the terms including, include, in particular, for example or any similar expression shall be construed as illustrative and shall not limit the sense of the words, description, definition, phrase or term preceding those terms. |

|

1.9 |

References to a document in agreed form are to that document in the form agreed by the Parties and initialled by them or on their behalf for identification. |

|

1.10 |

Unless the context requires otherwise, a reference to any legislation or legislative provision includes: |

|

(a) |

such legislation or legislative provision as amended, extended or re-enacted from time to time; |

|

(b) |

all subordinate legislation made from time to time under that legislation or legislative provision. |

|

2. |

At Completion, the Seller shall sell, and the Buyer shall buy, the Sale Shares with full title guarantee and free from all Encumbrances, together with all rights attached or accruing to them.

|

3. |

|

3.1 |

The consideration for the sale of the Sale Shares is US$8,250,000 (Purchase Price) which shall be paid by the Buyer as follows: |

|

(a) |

US$1,000,000 to be paid in cash on Completion (Initial Purchase Price); and |

|

(b) |

US$7,250,000 to be satisfied by the issue of the Loan Notes. |

|

4. |

|

4.1 |

Completion shall take place on the Completion Date at such place as the Parties shall agree. |

|

4.2 |

At Completion the Seller shall comply with its obligations as set out in Schedule 2. |

|

4.3 |

Subject to the Seller complying with clause 4.2, at Completion: |

|

(a) |

the Buyer, or its solicitors on the instruction of the Buyer shall pay the Initial Purchase Price by electronic transfer of immediately available funds to the following bank account of the Seller: |

Account holder and address: Metallon Corporation Limited of 00X Xx Xxxxx Xxxxxx,XX0X0XX

Bank Name - Silicon Valley Bank

Bank Address - 00000 Xxxxxx Xxxxx, Xxxxx Xxxxx, XX 00000, XXX Bank Account/IBAN - 000 000 0000

SWIFT/BIC – XXXXXX0X

Routing & Transit: 1211 40399

Payment in accordance with this clause shall be a good and valid discharge of the Buyer's obligation to pay the Initial Purchase Price;

|

(b) |

the Buyer shall deliver to the Seller: |

|

(i) |

a copy of the duly executed loan note instrument and a duly executed loan note certificate in the name of the Seller in respect of the Loan Notes; |

|

(ii) |

a certified copy of the resolutions adopted by the Buyer's board of directors approving the execution and delivery of this Agreement and any other documents to be delivered by the Buyer at Completion; and |

|

(iii) |

confirmation from the Buyer, in a form satisfactory to the Seller, that the Buyer has taken its own independent legal advice in respect of the regulatory consents required in respect of the change of control of the holder of the Lease. |

|

4.4 |

The parties hereby agree that should, upon Completion, the Buyer fail to make payment of the Initial Purchase Price, the Seller shall be entitled to terminate this Agreement by notice in writing to the Seller in which case the provisions of clause 4.5 shall apply. |

|

4.5 |

If this Agreement is terminated under clause 4.4, the parties shall have no further liability or obligation under this Agreement except in respect of those provisions of this Agreement which are expressed to survive termination of this Agreement. |

|

5. |

|

5.1 |

The Seller warrants to the Buyer that each Warranty is true, accurate and not misleading on the date of this Agreement and at the Completion Date. |

|

5.2 |

Warranties qualified by the expression so far as the Seller is aware (or any similar expression) are deemed to be given to the reasonable knowledge, information and belief of the Seller after they have made the relevant enquiries. |

|

5.3 |

Each of the Warranties is separate and, unless expressly provided otherwise, is not limited by reference to any other Warranty or any other provision in this Agreement. |

|

5.4 |

The Seller will have no liability in respect of any Claim if the fact, matter or circumstance giving rise to such Claim has been Disclosed provided that the Seller may not Disclose any fact, matter or circumstance in relation to Warranties in paragraphs 1 and 2.1 to 2.4 of Schedule 3. |

|

5.5 |

The Seller shall not be liable for any Claim if the matter giving rise to the Claim was actually known to the Buyer or any of its employees or advisors at the date of this Agreement. |

|

5.6 |

Each party warrants to the other that the following warranties are true, accurate and not misleading on the date of this Agreement: |

|

(a) |

it is validly incorporated, in existence and duly registered under the laws of its jurisdiction and has full power to conduct its business as conducted on the date of this Agreement; |

|

(b) |

it is solvent and able to pay (and has not stopped or suspended paying) its debts as and when they fall due; |

|

(c) |

it is not the subject of any Insolvency Proceedings; and |

|

(d) |

compliance with the terms of this Agreement and the documents referred to in it will not require it to obtain any consent or approval of, or give any notice to or make any registration with, any governmental or other authority which has not been obtained or made at the date of this Agreement both on an unconditional basis and on a basis which cannot be revoked. |

|

5.7 |

The Buyer warrants at the date of this Agreement that: |

|

(a) |

the Buyer will have available on an unconditional basis the necessary cash resources to meet its obligations when they arise under this Agreement or under any of the documents referred to in it; |

|

(b) |

it has the requisite power and authority to enter into and perform this Agreement and the documents referred to in it to which it is a party, and they constitute valid, legal and binding obligations on them in accordance with their respective terms; and |

|

(c) |

the execution and performance by it of this Agreement and the documents referred to in it to which it is a party will not breach or constitute a default under its articles of association, or any agreement, instrument, order, judgment or other restriction which binds it. |

|

6. |

|

6.1 |

The aggregate liability of the Seller for all Claims shall not exceed an amount equal to the Purchase Price. |

|

6.2 |

The Seller shall not be liable for a Claim unless notice in writing of the Claim, summarising the nature of the Claim (in so far as it is known to the Buyer) and, as far as is reasonably practicable, the amount claimed, has been given by or on behalf of the Buyer to the Seller on or before the third anniversary of Completion and the Seller has not remedied the Claim, to the extent that it is reasonably capable of remedy, within 20 Business Days. |

|

6.3 |

The Seller shall have no liability in respect of any Claim to the extent that the Claim is not previously satisfied, withdrawn or settled, unless legal proceedings in respect of any such Claim have been issued and served within six (6) months after the date on which the notice referred to in clause 6.2 is given provided that, in the case of a contingent liability, the six (6) month period shall commence on the date that the relevant contingent liability becomes an actual liability and is due and payable. For the purposes of this clause, legal proceedings shall not be deemed to have been started unless a statement of claim is both properly issued and validly served on the Seller. |

|

6.4 |

The Seller shall not be liable for any Claim if and to the extent that the Claim has arisen as a result of: |

|

(a) |

any act, omission or transaction of the Buyer or any member of the Buyer's Group or, after Completion, any of the Group Companies; or |

|

(b) |

the passing of, or any change in, after the date of this Agreement, any applicable law including (without prejudice to the generality of the foregoing) any increase in the rates of tax or any imposition of tax or any withdrawal of relief from tax not actually (or prospectively) in effect at the date of this Agreement; |

|

(c) |

any change after the date of this Agreement of any generally accepted interpretation or application of any legislation; or |

|

(d) |

any change after the date of this Agreement of any generally accepted accounting principles, procedure or practice. |

|

6.5 |

The Buyer shall not be entitled to recover damages or obtain payment, reimbursement, restitution or indemnity more than once in respect of the same Losses under this Agreement or any other document referred to in this Agreement. |

|

6.6 |

Nothing in this Agreement or any other document shall be deemed to relieve or abrogate the Buyer of its common law duty to mitigate its losses. |

|

6.7 |

Nothing in this clause 6 applies to exclude or limit the Seller's liability if and to the extent that a Claim arises or is delayed as a result of dishonesty, fraud, wilful misconduct or wilful concealment by the Seller (or the Seller's agents or advisers). |

|

7. |

|

7.1 |

The Seller covenants that at Completion: |

|

(a) |

no Group Company is indebted to it (or any of member of the Seller’s Group or person connected to it) in any way (whether actually or contingently); |

|

(b) |

neither it nor any member of the Seller’s Group or any person connected to it will be indebted to any Group Company; |

|

(c) |

neither it nor any member of the Seller’s Group nor any person connected to it has any outstanding claims of any nature whatsoever against the Group; and |

|

(d) |

there are no agreements or arrangements under which the Group has any obligation of any nature whatsoever to or in respect of it, any member of the Seller’s Group or any person connected to it |

but to the extent that any such liability or claim exists or may exist, it hereby irrevocably and unconditionally waives (and/or shall procure the waiver of) its rights and/or the rights of any of the Seller’s Group or persons connected to it in respect of such liability, agreement, arrangement, obligation, amount or claim and hereby releases (and/or shall procure the release of) the Group from any liability whatsoever in respect thereof and agrees to fully indemnify the Buyer and the Group and to hold each of them harmless in respect of the same.

|

7.2 |

The Buyer waives any Claim it may have, in terms of this Agreement, whereby the independent legal advice referred to in clause 4.3(b)(iii) proves to be incorrect, therein causing the cancellation of the Lease and/or the transaction set out herein. |

|

8. |

|

8.1 |

As long as the Seller remains the registered holder of any of the Sale Shares after Completion, the Seller will: |

|

(a) |

hold those Sale Shares and all dividends or distributions (whether of income or capital) in respect of them, and all other rights arising out of or in connection with them, on trust for the Buyer; |

|

(b) |

at all times deal with and dispose of those Sale Shares, and all such dividends, distributions and rights, as the Buyer directs by written notice, save for whereby such instructions would be unlawful in respect of the Seller; |

|

(c) |

not exercise any rights attaching to the Sale Shares or exercisable in the Seller’s capacity as registered holder of the Sale Shares without the Buyer’s prior written consent; |

|

(d) |

act promptly in accordance with the Buyer’s instructions in relation to any rights exercisable or anything received by the Seller in the Seller’s capacity as registered holder of the Sale Shares; and |

|

(e) |

ratify and confirm whatever the Buyer does or purports to do in good faith in the exercise of any power conferred by the power of attorney in clause 8.2. |

|

8.2 |

The Seller irrevocably and by way of security appoints the Buyer as its attorney (with full powers of substitution and delegation) to exercise all rights in relation to the Sale Shares registered in its name as the Buyer in its absolute discretion sees fit, from Completion to the earlier of (a) the date falling 12 months from the date of this Agreement and (b) the date on which the Buyer or its nominee is entered in the register of members of the Company as the holder of all those Sale Shares. |

|

8.3 |

For the purposes of clause 8.2, the Seller authorises in respect of the Sale Shares: |

|

(a) |

the Company to send any notices, documents, dividends and other distributions in respect of their holdings of the Sale Shares to the Buyer; and |

|

(b) |

the Buyer to exercise any of the powers conferred on it by clause 8.2 by any of its directors or its company secretary who has been authorised for that purpose by its board of directors or otherwise. |

|

9. |

|

9.1 |

The obligations of the Buyer under this Agreement and Loan Note shall remain in force and extend to the ultimate balance of the Purchase Price as a continuing covering guarantee until they are discharged in full, regardless of any intermediate payment or discharge in part. The Buyer shall have no right to withdraw from or terminate this Agreement at any time before the discharge in full of its obligations. |

|

9.2 |

This Agreement shall be enforceable against the Buyer in accordance with the terms hereof, whether as a guarantee, an indemnity or otherwise, regardless of any invalidity or unenforceability, for any reason whatsoever, in whole or in part. |

|

10. |

|

10.1 |

The Buyer waives any right it may have whereby an event of default under the Loan Note has occurred, if a written demand for the immediate repayment of all amounts outstanding under the Loan Note has been issued, of first requiring the holder of the Loan Note (or any trustee or agent on its behalf) to proceed against or enforce any other right or security interest or claim payment from any person before claiming from the Buyer under this Agreement. This waiver applies irrespective of any law or any provision of the Loan Note to the contrary. |

|

11. |

|

11.1 |

Except to the extent required by law or any legal, regulatory or stock exchange authority of competent jurisdiction: |

|

(a) |

the Seller shall not (and shall procure that no other member of the Seller’s Group shall) at any time disclose to any person (other than the Seller's professional advisers) the terms of this Agreement or any other confidential information relating to the Company, the Subsidiary, the Lease or the Buyer, or make any use of such information other than to the extent necessary for the purpose of exercising or performing its rights and obligations under this Agreement; and |

|

(b) |

neither Party shall make any public announcement, communication or circular concerning this Agreement without the prior written consent of the other Party, not to be unreasonably withheld. |

|

11.2 |

Notwithstanding clause 11.1(b), the Buyer may, at any time after Completion, announce its acquisition of the Sale Shares to any employees, clients, customers or suppliers of the Buyer or any member of its group without limitation. |

|

12. |

|

12.1 |

At its own expense, the Seller shall (and shall use reasonable endeavours to procure that any relevant third Party shall) promptly execute and deliver such documents and perform such acts as the Buyer may reasonably require from time to time for the purpose of giving full effect to this Agreement. |

|

12.2 |

The Buyer acknowledges and agrees that the Buyer shall be responsible for ensuring that: |

|

(a) |

all necessary and relevant regulatory consents in connection with the transfer of the Sale Shares and the continued operation of the Group Companies have been obtained; and |

|

(b) |

from Completion all entries and filings to any public body or company register required to be made under applicable law are made, |

and the Seller shall bear no responsibility or have any liability in respect of any such matters.

|

13. |

This Agreement constitutes the entire agreement between the Parties and supersedes and extinguishes all previous discussions, correspondence, negotiations, drafts, agreements, promises, assurances, warranties, representations and understandings between them, whether written or oral, relating to its subject matter.

|

14. |

|

14.1 |

No variation of this Agreement shall be effective unless it is in writing and signed by the Parties (or their authorised representatives). |

|

14.2 |

No failure or delay by a Party to exercise any right or remedy provided under this Agreement or by law shall constitute a waiver of that or any other right or remedy, nor shall it prevent or restrict the further exercise of that or any other right or remedy. No single or partial exercise of such right or remedy shall prevent or restrict the further exercise of that or any other right or remedy. A waiver of any right or remedy under this Agreement or by law is only effective if it is in writing. |

|

14.3 |

Except as expressly provided in this Agreement, the rights and remedies provided under this Agreement are in addition to, and not exclusive of, any rights or remedies provided by law. |

|

15. |

|

15.1 |

A notice given to a Party under or in connection with this Agreement shall be in writing and shall be delivered by hand or sent by pre-paid first-class post (or another next working day delivery service) in either case to that Party's registered office or sent by email to the address specified in this clause (or to such other address or email address as that Party may notify to the other Party in accordance with this Agreement). The email addresses for service of notices are: |

|

(a) |

Seller: xxxxxxxx@xxxxxxx.xx.xx |

|

(b) |

Buyer: xxxxxxxx@xxxxxxxxxxxxxxx.xxx |

|

15.2 |

A notice is deemed to have been received if delivered by hand, at the time the notice is left at the proper address, or if sent by email, at the time of transmission, or if sent by pre-paid first class post (or another next working day delivery service), on the second Business Day after posting, unless such deemed receipt would occur outside business hours (meaning 9.00 am to 5.30 pm Monday to Friday on a day that is not a public holiday in the place of receipt), in which case receipt will occur when business hours resume in the place of receipt. |

|

15.3 |

This clause 15 does not apply to the service of any proceedings or other documents in any legal action. |

|

16. |

If any provision or part-provision of this Agreement is or becomes invalid, illegal or unenforceable, it shall be deemed deleted, but that shall not affect the validity and enforceability of the rest of this Agreement.

|

17. |

|

17.1 |

This Agreement shall be binding upon each party’s successors and personal representatives (as the case may be). |

|

17.2 |

Neither Party shall be entitled to assign or otherwise transfer its rights and benefits under this Agreement or any document entered into pursuant to this Agreement without the written consent of the other Party. |

|

18. |

This Agreement does not give rise to any rights under the Contracts (Rights of Third Parties) Act 1999 to enforce any term of this Agreement.

|

19. |

|

19.1 |

This Agreement and any dispute or claim (including non-contractual disputes or claims) arising out of or in connection with it or its subject matter or formation shall be governed by and construed in accordance with the law of England and Wales. |

|

19.2 |

The parties submit to the exclusive jurisdiction of the courts of England and Wales should any dispute arise under or in connection with this Agreement. |

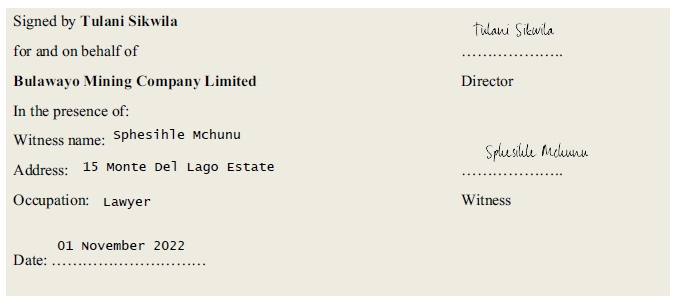

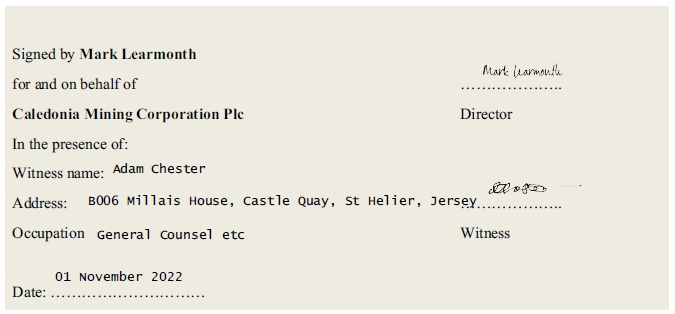

This Agreement has been entered into and delivered as a deed on the date stated at the beginning of it.

Schedule 1 Particulars of the Company and Subsidiary

|

The Company |

The Subsidiary |

|

|

Registered name: |

Motapa Mining Company UK Limited |

Arraskar Investments (Private) Limited |

|

Registration number: |

13178541 |

5030/2016 |

|

Place of incorporation: |

Zimbabwe |

|

|

Date of incorporation: |

4 February 2021 |

5 August 2016 |

|

Registered office: |

000 Xxxxxxxxx Xxxxx 00, Xxxxxx Xxxxx, Xxxxxx, Xxxxxx Xxxxxxx, XX0X 0XX |

13th Floor, CABS Centre, 00 Xxxxx Xxxx Xxxxxx, Xxxxxx |

|

Issued share capital: |

Amount: £100 Divided into: 100 ordinary shares of £1 each |

Amount: US$2 Divided into: 2 ordinary shares of US$1 each |

|

Registered shareholder (and, in respect of the Company, number of Sale Shares held): |

The Seller |

Motapa Mining Company UK Limited - 2 ordinary shares of US$1 each |

|

Beneficial owners of Sale Shares (if different) and number of Sale Shares beneficially owned: |

N/A |

N/A |

|

Directors and shadow directors: |

Xxxxxx Sikwila |

Xxxxxx Sikwila Siphesihle Mchunu |

|

Secretary: |

None |

None |

|

Registered charges: |

None |

None |

|

Encumbrances over shares: |

None |

None |

Schedule 2 Seller's Completion obligations

At Completion, the Seller shall deliver to the Buyer:

|

1. |

a duly executed letter from Xxxxxx Xxxxxxx, Bulawayo Mining Company (UK) Limited and the Seller to the Company in the agreed form confirming they have no legal or beneficial in the Sale Shares; |

|

2. |

a duly executed stock transfer form in respect of the transfer of the Sale Shares from Xxxxxx Xxxxxxx (as nominee) to the Seller together with the original share certificates or an indemnity, in agreed form, for any lost or damaged certificates; |

|

3. |

the duly executed PCG Letter; |

|

4. |

the share certificates for the Sale Shares or indemnities, in agreed form, for any lost or damaged certificates; |

|

5. |

a certified copy of the register of members of the Company showing the Seller as the legal holder of the Sale Shares; |

|

6. |

a transfer of the Sale Shares, in agreed form, executed by the Seller in favour of the Buyer; |

|

7. |

the share certificates for the Subsidiary Shares or indemnities, in agreed form, for any lost or damaged certificates; |

|

8. |

the registers, minute books and other records required to be kept by the Company under the CA 2006 and the same in respect of the Subsidiary under Zimbabwe law, in each case properly written up as at the Completion Date, together with the common seals (if any), certificates of incorporation and any certificates of incorporation on change of name for each of the Company and the Subsidiary; |

|

9. |

the security code and authentication code used by the Company for making electronic filings with the Registrar of Companies, together with confirmation as to whether the Company has joined the Companies House Protected Online Filing Scheme; |

|

10. |

xxxx executed letters of resignation, in agreed form, from each of the directors and the company secretary resigning from their respective offices with the Company and the Subsidiary; |

|

11. |

a letter, in agreed form, from the Seller confirming that it has ceased to be a person with significant control (within the meaning of section 790C of the CA 2006) in relation to the Company; |

|

12. |

a certified copy of resolutions, in agreed form, of the directors and shareholders of the Company and Subsidiary approving the transfer of the Sale Shares in accordance with this Agreement and a change of registered office, and appointment of new directors nominated by the Buyer; |

|

13. |

a certified copy of resolutions, in agreed form, of the directors of the Seller approving the execution and delivery of this Agreement and any other documents to be delivered by the Seller at Completion; and |

|

14. |

the duly executed Disclosure Letter. |

|

1. |

Power to sell the Sale Shares |

|

1.1 |

The Seller has the requisite power and authority and has obtained all necessary consents to enter into and perform this Agreement and the documents referred to in it to which it is a party, and they constitute valid, legal and binding obligations of the Seller in accordance with their respective terms. |

|

1.2 |

The execution and performance by the Seller of this Agreement and the documents referred to in it to which the Seller is a party will not breach or constitute a default under its articles of association, or any agreement, instrument, order, judgment or other restriction which binds the Seller. |

|

2. |

Shares in the Company and the Subsidiary |

|

2.1 |

The Sale Shares and the Subsidiary Shares constitute the whole of the allotted and issued share capital of the Company and the Subsidiary, respectively, and are fully paid or credited as fully paid. |

|

2.2 |

At Completion, the Seller is the sole legal and beneficial owner of the Sale Shares and is entitled to transfer the legal and beneficial title to the Sale Shares to the Buyer free from all Encumbrances, without the consent of any other person, or approval of any court, government or local agency or body. |

|

2.3 |

No person has any right to require at any time the transfer, creation, issue or allotment of any share, loan capital or other securities of the Company or the Subsidiary (or any rights or interest in them), and no person has agreed to confer or has claimed any such right. |

|

2.4 |

No Encumbrance has been granted to any person or otherwise exists affecting the Sale Shares or the Subsidiary Shares or any unissued shares, debentures or other unissued securities of the Company or the Subsidiary, and no commitment to create any such Encumbrance has been given, nor has any person claimed any such rights. |

|

2.5 |

Neither the Company nor the Subsidiary has purchased, redeemed, reduced, repaid or forfeited any of its share capital. |

|

2.6 |

Aside from the Subsidiary, the Company has no other subsidiaries and there are no other group companies. |

|

3. |

Constitutional and corporate documents |

|

3.1 |

A copy of the articles of association of the Company and the memorandum and articles of association of the Subsidiary have been Disclosed, and such copy documents are true, accurate and complete. |

|

3.2 |

All returns, particulars, resolutions and other documents that the Company and the Subsidiary are required by law to file with, or deliver to, any authority have been correctly made up and duly filed or delivered. |

|

3.3 |

All deeds and documents belonging to the Company (or to which it is a party) or the Subsidiary (or to which it is a party) are in the Company's or the Subsidiary’s respective possession. |

|

3.4 |

All accounting, financial and other records of the Company and the Subsidiary (including its statutory books and registers): |

|

(a) |

have been properly prepared and maintained; |

|

(b) |

constitute an accurate record of all matters required by law to appear in them, and comply with any requirements of applicable law; |

|

(c) |

do not contain any material inaccuracies or discrepancies; and |

|

(d) |

are in the possession of the Company or the Subsidiary as the case may be. |

|

4. |

Information |

|

4.1 |

The particulars set out in Schedule 1 are true, accurate and complete. |

|

4.2 |

All information given by or on behalf of the Seller to the Buyer (or its agents or advisers) in the course of the negotiations leading up to this Agreement was, when given, and is, so far as the Seller is aware, now true, accurate and complete. |

|

4.3 |

As far as the Seller is aware all information Disclosed is true, accurate and complete. |

|

5. |

Compliance and consents |

|

5.1 |

The Company and the Subsidiary have at all times conducted themselves in accordance with, and have acted in compliance with, all applicable laws and regulations. |

|

5.2 |

The Company and the Subsidiary hold all licences, consents, permits and authorities which they are required to hold (Consents). |

|

5.3 |

As far as the Seller is aware, each of the Consents is valid and subsisting, neither the Company nor the Subsidiary is in breach of the terms or conditions of the Consents (or any of them) and there is no reason as far as the Seller is aware why any of the Consents may be revoked or suspended (in whole or in part) or may not be renewed on the same terms. |

|

6. |

Disputes and investigations |

|

6.1 |

Neither the Company, the Subsidiary nor any of their directors nor any other person for whose acts the Company or the Subsidiary may be vicariously liable, is engaged or involved in any of the following matters (such matters being referred to in this paragraph 6 as Proceedings): |

|

(a) |

any litigation, or any administrative, arbitration or other proceedings, claims, actions or hearings; or |

|

(b) |

any dispute with, or any investigation, inquiry or enforcement proceedings by, any governmental, regulatory or similar body |

relating to or concerning the Company or the Subsidiary or their assets.

|

6.2 |

No Proceedings have been threatened or are pending by or against the Company, the Subsidiary, any of their directors or any person for whose acts the Company or the Subsidiary may be vicariously liable, and there are no circumstances likely to give rise to any such Proceedings. |

|

6.3 |

Neither the Company nor the Subsidiary is affected by any subsisting or pending judgment, order, or other decision or ruling of any court, tribunal or arbitrator, or any governmental, regulatory or similar body, nor have they given any undertaking in connection with any Proceedings which remains in force. |

|

6.4 |

Neither the Seller, nor any member of the Seller’s Group, has a claim of any nature against the Company or the Subsidiary, nor has it assigned to any person the benefit of any such claim. |

|

7. |

Contracts and trading |

|

7.1 |

The Company and the Subsidiary are dormant companies and have never traded or incurred any liabilities, actual or contingent, or have any outstanding capital commitments. |

|

7.2 |

Neither the Company nor the Subsidiary is a party to any contract, agreement, arrangement, understanding or commitment whether with the Seller or any other member of the Seller’s Group or any person Connected with the Seller or otherwise and there is no outstanding indebtedness or other liability owed to the Seller or any person connected with the Seller. |

|

7.3 |

No Group Company has or has ever had any employees or has appointed any consultants. |

|

8. |

Effect of sale of the Sale Shares |

|

8.1 |

As far as the Seller is aware, the acquisition of the Sale Shares by the Buyer will not: |

|

(a) |

relieve any person of any obligation to the Company or the Subsidiary, or enable any person to determine any such obligation, or any right or benefit enjoyed by the Company or the Subsidiary, or to exercise any other right in respect of the Company or the Subsidiary; or |

|

(b) |

result in the loss of, or any default under, any Consent (as defined in paragraph 5.2 of this Schedule 3). |

|

9. |

Finance and guarantees |

|

9.1 |

Neither the Company nor the Subsidiary have any indebtedness. |

|

9.2 |

There are no Encumbrances over any of the Company's or the Subsidiary’s assets. |

|

9.3 |

No Encumbrance, guarantee, indemnity or other similar arrangement has been entered into, given or agreed to be given by the Company or the Subsidiary: |

|

(a) |

or any third party, in each case in respect of any indebtedness or other obligations of the Company or the Subsidiary; or |

|

(b) |

in respect of any indebtedness or other obligations of any third party. |

|

9.4 |

Neither the Company nor the Subsidiary has any outstanding loan capital, nor has it lent any money that has not been repaid, and there are no debts owing to the Company or the Subsidiary. |

|

9.5 |

No insolvency event has occurred which is continuing in relation to the Company or the Subsidiary or the Seller nor will any insolvency event of the Seller’s Group (if any) affect the transactions in this Agreement. |

|

9.6 |

No Group Company has any bank accounts. |

|

10. |

Accounts |

|

10.1 |

The first accounts of the Company for the period ended 28 February 2022 (Company Accounts Date) and the accounts of the Subsidiary for the financial year ended 31 December 2021 (Subsidiary Accounts Date): |

|

(a) |

have been properly prepared in accordance with IFRS and practices and all material applicable laws as at the Company Accounts Date and Subsidiary Accounts Date, respectively; and |

|

(b) |

give a true and fair view of the assets and liabilities and state of affairs of the Company and the Subsidiary as at the Company Accounts Date and Subsidiary Accounts Date, respectively, and their respective profit or loss and cash flows for the period or financial year (as the case may be) ended on that date. |

|

10.2 |

The Company did not have at the Company Accounts Date any material liability (whether actual, deferred, contingent or disputed) or commitment which, in accordance with IFRS and practices (on the basis on which the accounts for the period ended on the Company Accounts Date have been |

prepared), should have been disclosed or provided for in those accounts and which has not been so disclosed or provided for.

|

10.3 |

The Subsidiary did not have at the Subsidiary Accounts Date any material liability (whether actual, deferred, contingent or disputed) or commitment which, in accordance with IFRS and practices (on the basis on which the accounts for the year ended on the Subsidiary Accounts Date have been prepared), should have been disclosed or provided for in those accounts and which has not been so disclosed or provided for. |

|

11. |

Assets |

|

11.1 |

The only assets held by the Company are the Subsidiary Shares. |

|

11.2 |

The only asset held by the Subsidiary is the Lease which has been duly registered in the name of the Subsidiary in accordance with applicable law by the Mining Affairs Board of Zimbabwe. |

|

11.3 |

A true, accurate, complete and up to date copy of the Lease has been Disclosed. |

|

12. |

Tax |

|

12.1 |

All amounts due to be paid by the Company and the Subsidiary to the relevant taxation authority (being any government, state or municipality or any local, state, federal or other fiscal, revenue, customs or excise authority, body or official competent to impose, administer, xxxx, assess or collect tax) on or before the date of this Agreement have been so paid. |

|

13. |

Sanctions |

As far as the Seller is aware, no Group Company (nor, to the extent that it relates to the business of a Group Company, any officer, employee or agent acting on behalf of the relevant Group Company):

|

13.1 |

is listed on any list of persons subject to economic or financial sanctions, or is otherwise subject to trade embargoes or related restrictive measures issued or maintained by, or on behalf of; |

|

13.2 |

has had any dealings with any individual or entity (whether a supplier, vendor, customer or other contractor) listed on any list of persons subject to economic or financial sanctions, or who is otherwise subject to trade embargoes or related restrictive measures issued or maintained by, or on behalf of; or |

|

13.3 |

has engaged in any activity in violation or circumvention of any laws or regulations relating to economic or financial sanctions, trade embargoes or related restrictive measures imposed, administered or enforced from time to time by, |

the United Kingdom, the United States of America, the United Nations, the European Union (or any of its Member States) or any other governmental authority with jurisdiction over the Company or the Subsidiary (or any part of its business or operations).

|

14. |

Anti-Corruption |

|

14.1 |

As far as the Seller is aware, the Company, the Subsidiary, the Seller, and the officers, directors, employees, shareholders, partners, contractors, sub-contractors, intermediaries, representatives and agents of each of the Company, the Subsidiary and the Seller in the course of their respective duties to such companies have complied with: |

|

(a) |

all applicable anti-bribery and/or anti-corruption laws, statutes, codes and regulations (collectively, Anti-Corruption Laws) of any jurisdiction in which the relevant Group Company or the Seller conducts its business; and |

|

(b) |

any relevant anti-bribery and anti-corruption obligations pursuant to any contract between the relevant Group Company or the Seller and any third party. |

|

14.2 |

So far as the Seller is aware, none of the officers, directors, employees, shareholders, partners, contractors, sub-contractors, representatives and agents of any Group Company have, in the course of their activities relating to the business of any Group Company, and the Seller has not: |

|

(a) |

offered, paid, promised to pay or authorised the payment of (whether directly or indirectly) anything of value to any other person as an inducement or reward for a person to improperly perform or omit a relevant function or activity, to influence the acts or decisions of a government official in that person’s official capacity, to use that person’s influence with a government or its instrumentality to influence an official act or decision, to secure an improper advantage; or |

|

(b) |

the purpose was to obtain or retain business, to direct business to any person, or to influence any official actions or decisions with respect to the Lease; and |

|

(c) |

such offer, payment, promise of payment, or authorization of payment was unlawful under any applicable laws or regulations, including but not limited to, Anti-Corruption Laws. |

For the purposes of this paragraph 14.2 a function or activity is a "relevant function or activity" if such function or activity is commercial or public in nature and expected to be performed in good faith or impartially or in a position of trust including but not limited to any official duties of a public official that is required by law and a “government official” includes any officer, employee, or agent of (i) any national, regional, or local government or any department, agency, or instrumentality thereof; (ii) any public international organization; (iii) any political party or

candidate for political office; (iv) any state-owned enterprise; or (v) any person acting in an official capacity for or on behalf of the foregoing governmental entities, public international organizations, political parties or candidates, or state-owned enterprises.

|

14.3 |

No Group Company, nor any of the officers, directors, employees or agents of any Group Company is involved in any investigation, inquiry, claim or proceedings in relation to any alleged bribery or corruption offence or similar conduct, nor so far as the Seller is aware are any such investigations, inquiries, claims or proceedings pending or threatened by or against any Group Company or any officer, director, employee or agent of any Group Company, nor so far as the Seller is aware are there any facts or circumstances which may give rise to any such investigations, inquiries, claims or proceedings being commenced by or against any of the foregoing persons. |

|

15. |

Environmental |

For the purposes of this paragraph 15:

Environmental Laws means any statute, common law, rule, regulation, treaty, directive, direction, decision of the court, bye-law, order, notice or demand (in each case having the force of law) of any governmental, statutory or regulatory authority, agency or body in any relevant jurisdiction at the date of this Agreement and concerning Environmental Matters or the environment;

Environmental Licence means any agreement, permission, permit, licence, authorisation, consent, exemption or other approval required by any Group Company pursuant to any Environmental Law.

No Group Company nor the Seller or any member of the Seller’s Group has conducted any mining or other operations whatsoever on the area covered by the Lease and therefore as far as the Seller is aware neither it nor they have any liability or obligations in respect of Environmental Laws or Environmental Licences.