RESTRICTED STOCK AWARD AGREEMENT MAY 2, 2017 PERFORMANCE-BASED AWARD (“ROIC”)

Exhibit 10.10

RESTRICTED STOCK AWARD AGREEMENT

MAY 2, 2017 PERFORMANCE-BASED AWARD (“ROIC”)

THIS RESTRICTED STOCK AWARD AGREEMENT (this “Agreement”) is made effective and entered into as of May 2, 2017, by and between PIER 1 IMPORTS, INC., a Delaware corporation (the “Company”), and Xxxxxxxx X. Xxxxx (the “Grantee”).

WHEREAS, pursuant to the provisions of the Pier 1 Imports, Inc. 2015 Stock Incentive Plan (the “Plan”), the Committee that administers the Plan has the authority to grant Awards under the Plan to employees of the Company and its Affiliates; and

WHEREAS, the Committee has determined that the Grantee be granted a Restricted Stock Award under the Plan for the number of shares and upon the terms set forth below;

NOW, THEREFORE, the Company and the Grantee hereby agree as follows:

1. Grant of Award. The Grantee is hereby granted a Restricted Stock Award under the Plan (this “Award”), subject to the terms and conditions hereinafter set forth, with respect to a maximum Two Hundred Thirty-Six Thousand Three Hundred Ninety (236,390) restricted shares of Common Stock. Restricted shares of Common Stock covered by this Award (the “Performance-Based Shares”) shall be represented by a stock certificate registered in the Grantee’s name, or by uncertificated shares designated for the Grantee in book-entry form on the records of the Company’s transfer agent, in each case subject to the restrictions set forth in this Agreement. Any stock certificate issued shall bear the following or a similar legend:

“The transferability of this certificate and the shares of Common Stock represented hereby are subject to the terms, conditions and restrictions (including forfeiture) contained in the Pier 1 Imports, Inc. 2015 Stock Incentive Plan and the Restricted Stock Award Agreement entered into between the registered owner and Pier 1 Imports, Inc. A copy of such plan and agreement is on file in the offices of Pier 1 Imports, Inc., 000 Xxxx 0 Xxxxx, Xxxx Xxxxx, Xxxxx 00000.”

Any Common Stock certificates or book-entry uncertificated shares evidencing such shares shall be held in custody by the Company or, if specified by the Committee, with a third party custodian or trustee, until the restrictions thereon shall have lapsed, and, as a condition of this Award, the Grantee shall deliver a stock power, duly endorsed in blank, relating to any certificated restricted shares of Common Stock covered by this Award.

2. Transfer Restrictions. Except as expressly provided in this Agreement and the Plan, this Award and the Performance-Based Shares are non-transferable otherwise than by will or by the laws of descent and distribution, and may not otherwise be assigned, pledged or hypothecated or otherwise disposed of and shall not be subject to execution, attachment or similar process. Upon any attempt to effect any such disposition, or upon the levy of any such process, this Award shall immediately become null and void and the Performance-Based Shares shall be forfeited.

1

3. Restrictions.

(a) Certain Definitions. For purposes of this Award, the term:

“Cause” is as defined in the Executive Severance Agreement between the Company and Grantee, dated March 30, 2017 (“ESA”).

“Closing Price(s)” means on any date the closing sale price per share (or if no closing sale price is reported, the average of the bid and ask prices or, if more than one in either case, the average of the average bid and the average ask prices) on that date as reported in the composite transactions table for the principal U.S. national or regional securities exchange on which the common stock is listed for trading. If the common stock is not listed for trading on a U.S. national or regional securities exchange on the relevant date, then the “Closing Price” of the common stock will be the average of the bid and ask prices (or, if more than one in either case, the average of the average bid and the average ask prices) for the common stock in the over-the-counter market on the relevant date as reported by OTC Markets Group Inc. or similar organization. If the common stock is not so quoted, the “Closing Price” of the common stock will be such other amount as the Committee may ascertain reasonably to represent such “Closing Price.” The Closing Price shall be determined without reference to extended or after-hours trading.

“Final Stock Price” means the average of the Closing Prices for the 20 Trading Days (as herein defined) during the 20-trading-day-period ending on and including the last Trading Day of the Measurement Period (as hereinafter defined).

“Good Reason” is as defined in the ESA.

“Initial Stock Price” means the average of the Closing Prices for the 20 Trading Days during the 20-trading-day-period beginning on and including the first Trading Day of the Measurement Period.

“Invested Capital” means for any particular fiscal year, the sum of the Company’s (i) average of the beginning and ending fiscal year inventory balances, plus (ii) the average of the beginning and ending fiscal year net fixed asset balances, less (iii) the average of the beginning and ending fiscal year accounts payable balances.

“Measurement Period” means the Company’s three (3) fiscal years beginning on and including February 26, 2017 and ending on and including February 29, 2020.

“NOPAT” means the Company’s operating income, for any particular fiscal year, less taxes, with taxes being the product of applying the Company’s effective tax rate for the applicable fiscal year to the Company’s operating income for that fiscal year.

“Peer Group” means the companies in the Xxxxxxx 1000 Specialty Retail Index as constituted on the first day of the Measurement Period, with the addition of any other specialty retailers included in the Company’s peer group for executive compensation purposes and not included in the Xxxxxxx 1000 Specialty Retail Index. The Company’s peer group for executive

compensation purposes shall be as determined by the Committee prior to or within sixty (60) days of the first day of the Measurement Period.

2

“ROIC” means the Company’s return on invested capital calculated by dividing NOPAT by Invested Capital.

“TSR” means a company’s total shareholder return, calculated by dividing (i) the sum of (A) the cumulative amount of such company’s dividends for the Measurement Period, assuming same day reinvestment into the common stock of the company on the ex-dividend date, plus (B) the difference of (1) the Final Stock Price for such company, minus (2) the Initial Stock Price for such company, by (ii) the Initial Stock Price for such company.

The TSR of a component company in the Peer Group and of the Company shall be adjusted to take into account stock splits, reverse stock splits, and special dividends that occur during the Measurement Period. The determination of TSR shall be subject to the following additional adjustments:

| (i) | If during the Measurement Period two component companies of the Peer Group merge or otherwise combine into a single entity, the surviving entity shall remain a component company of the Peer Group and the non-surviving entity shall be removed from the Peer Group. |

| (ii) | If during the Measurement Period a component company of the Peer Group merges into or otherwise combines with an entity that is not a component company of the Peer Group, such component company shall be removed from the Peer Group. |

| (iii) | If during the Measurement Period a component company of the Peer Group files a petition for reorganization under ch. 11 of the U.S. Bankruptcy Code or liquidation under ch. 7 of the U.S. Bankruptcy Code, such component company shall remain as part of the Peer Group and be designated with a TSR of negative 100%. |

| (iv) | If a component company of the Peer Group becomes a debtor entity operating under the protection of the U.S. Bankruptcy Code during the Measurement Period and subsequently emerges from bankruptcy protection during the Measurement Period, such component company shall not be reintroduced into the Peer Group. |

“Trading Day(s)” means a day on which (i) trading in the common stock generally occurs on the New York Stock Exchange or, if the common stock is not then listed on the New York Stock Exchange, on the principal other U.S. national or regional securities exchange on which the common stock is then listed or, if the common stock is not then listed on a U.S. national or regional securities exchange, on the principal other market on which the common stock is then traded, and (ii) a Closing Price for the common stock is available on such securities exchange or market.

For purposes of the definition of Invested Capital, NOPAT and ROIC, the “Company” includes the Company’s consolidated subsidiaries.

(b) Vesting. The target amount of Performance-Based Shares under this Award is One Hundred Seven Thousand Four Hundred Fifty (107,450) Performance-Based Shares (the “Target Performance-Based Shares”). Provided that (y) the Company’s three-year average ROIC for the

3

Measurement Period equals or exceeds the threshold percentage as shown on the table set forth on the execution page hereof (the “Execution Page”), and (z) the Grantee is employed by the Company or an Affiliate on the date of filing of the Company’s Annual Report on Form 10-K with the Securities and Exchange Commission (“SEC”) for the Company’s fiscal year ending February 29, 2020, and subject to the other terms and conditions of this Agreement, the restrictions on the Performance-Based Shares covered by this Award shall lapse and such shares shall vest over a range from 50% to 200% of the Target Performance-Based Shares as shown on the table set forth on the Execution Page. Any fractional shares created by such vesting will be rounded down to the nearest whole share.

The determination by the Committee with respect to the achieving of condition (y) above shall be effective upon the filing of the Company’s Annual Report on Form 10-K with the SEC for fiscal year 2020.

(c) TSR Modifier. Any Performance-Based Shares which vest under this Award will be increased or decreased by ten percent (10%) as shown in the following table:

| Company’s Percentile Rank (as determined below) Within Peer Group |

Modification of Vested Shares | |

| 75% and above | + 10%* | |

| above 25% and below 75% | no modification | |

| 25% and below | -10% |

| * | Provided the Company’s absolute TSR is not negative |

Any fractional shares created by such modification of vested shares will be rounded down to the nearest whole share.

The annual equivalent return (“AER”) of the TSR shall be calculated for the Company and each component company of the Peer Group over the Measurement Period. Each AER shall be ranked from highest to lowest. The percentile rank of the AER of the Company shall then be determined relative to the AER ranking of each component company in the Peer Group (the “Company’s Percentile Rank”). The Company’s Percentile Rank shall then be utilized, as shown in the table above, to determine the percentage, if any, of the modification of Performance-Based Shares that vested under this Award. The AER calculations shall be derived utilizing a calculation consistent with the annual equivalent return calculation employed by Bloomberg L.P.’s comparative total return (COMP) function as of the date of this Agreement. Performance-Based Shares that vest under this Award will not be modified upward if the Company’s absolute TSR is negative.

(d) Corporate Change. A pro rata portion of the restrictions on the Target Performance-Based Shares shall lapse and such pro rata portion of shares shall vest upon (i) a Corporate Change (as defined in the Plan) AND (ii) the occurrence of one of the following: (a) the Performance-Based Shares covered by this Award are not assumed by the surviving or acquiring entity or otherwise equitably converted or substituted in connection with the Corporate Change, or (b) the Performance-Based Shares covered by this Award are assumed by the

4

surviving or acquiring entity or otherwise equitably converted or substituted in connection with the Corporate Change and the termination of Grantee’s employment by the Company (or the surviving or acquiring entity) without Cause or Grantee’s resignation for Good Reason occurs within one year after the effective date of the Corporate Change. The pro rata portion of shares under this Section 3(d) shall be calculated based on the portion of the Measurement Period that has elapsed at the time of such vesting associated with a Corporage Change.

(e) Termination of Employment. Upon termination of employment of the Grantee with the Company or any Affiliate of the Company (or the successor of any such company) for any reason other than as specified in Section 3(d) above, the Grantee shall forfeit all rights in the Performance-Based Shares to the extent not vested, and the ownership of such shares shall immediately vest in the Company. For purposes of this Award, no termination of Grantee’s employment shall occur as a result of the transfer of Grantee between the Company and any Affiliate or as a result of the transfer of the Grantee between two Affiliates. The cessation of a relationship between the Company and an Affiliate with which the Grantee is employed whereby such company is no longer an Affiliate shall constitute a termination of employment of the Grantee.

4. Voting and Dividend Rights. With respect to the Performance-Based Shares for which the restrictions have not lapsed, the Grantee shall have the right to vote such shares, but shall not receive any cash dividends paid with respect to such shares. Any dividend or distribution payable with respect to the Performance-Based Shares that shall be paid in shares of Common Stock shall be subject to the same restrictions provided for herein. Any other form of dividend or distribution payable on shares of the Performance-Based Shares, and any consideration receivable for or in conversion of or exchange for the Performance-Based Shares, unless otherwise determined by the Committee, shall be subject to the terms and conditions of this Agreement, with such modifications thereof as the Committee may provide in its absolute discretion.

5. Distribution Following End of Restrictions. Upon expiration of the restrictions provided in Section 3 hereof as to the Performance-Based Shares and after modification of the number of such shares provided in Section 3(c) hereof, if any, the Company in its sole discretion will either cause a certificate evidencing such amount of Common Stock to be delivered to the Grantee (or in the case of the Grantee’s death after such events cause such certificate to be delivered to the Grantee’s legal representative, beneficiary or heir) or provide book-entry uncertificated shares designated for the Grantee (or, in the case of the Grantee’s death after such events, provide book-entry uncertificated shares designated for Grantee’s legal representative, beneficiary or heir) on the records of the Company’s transfer agent free of the legend or restriction regarding transferability, as the case may be; provided, however, that the Company shall not be obligated to issue any fractional shares of Common Stock. All Performance-Based Shares which do not vest as provided in Section 3 hereof, shall be forfeited by the Grantee along with all rights thereto, and the ownership of such shares shall immediately vest in the Company. All vested Performance-Based Shares which are not distributed due to a modification as provided in Section 3(c) hereof, shall be forfeited by the Grantee along with all rights thereto, and the ownership of such shares shall immediately vest in the Company.

5

6. Tax Withholding. The obligation of the Company to deliver any certificate or book-entry uncertificated shares to the Grantee pursuant to Section 5 hereof shall be subject to the receipt by the Company from the Grantee of any minimum withholding taxes required as a result of the grant of the Award or lapsing of restrictions thereon. The Grantee may satisfy all or part of such withholding tax requirement by electing to require the Company to purchase that number of unrestricted shares of Common Stock designated by the Grantee at a price equal to the Fair Market Value on the date of lapse of the restrictions or, if such day was not a Trading Day, on the first preceding Trading Day. The Company shall have the right, but not the obligation, to sell or withhold such number of unrestricted shares of Common Stock distributable to the Grantee as will provide assets for payment of any tax so required to be paid by the Company for Grantee unless, prior to such sale or withholding, Grantee shall have paid to the Company the amount of such tax. Any balance of the proceeds of such a sale remaining after the payment of such taxes shall be paid over to Grantee. In making any such sale, the Company shall be deemed to be acting on behalf and for the account of Grantee.

7. Securities Laws Requirements. The Company shall not be required to issue shares pursuant to this Award unless and until (a) such shares have been duly listed upon each stock exchange on which the Company’s Common Stock is then listed, and (b) the Company has complied with applicable federal and state securities laws. The Committee may require the Grantee to furnish to the Company, prior to the issuance of any shares of Common Stock in connection with this Award, an agreement, in such form as the Committee may from time to time deem appropriate, in which the Grantee represents that the Performance-Based Shares acquired by Grantee under this Award are being acquired for investment and not with a view to the sale or distribution thereof.

8. Incorporation of Plan Provisions. This Agreement is made pursuant to the Plan and is subject to all of the terms and provisions of the Plan as if the same were fully set forth herein, and receipt of a copy of the Plan is hereby acknowledged. Capitalized terms not otherwise defined herein shall have the same meanings set forth for such terms in the Plan. If there is any conflict between this Agreement and the Plan, the Plan controls.

9. Miscellaneous. This Agreement (a) shall be binding upon and inure to the benefit of any successor of the Company, (b) shall be governed by the laws of the State of Delaware, and any applicable laws of the United States, and (c) may not be amended without the written consent of both the Company and the Grantee. No contract or right of employment shall be implied by this Agreement, nor shall this Agreement interfere with or restrict in any way the rights of the Grantee’s employer to discharge the Grantee at any time for any reason whatsoever, with or without cause. The terms and provisions of this Agreement shall constitute an instruction by the Grantee with respect to any uncertificated Performance-Based Shares.

This Award along with all other Awards received by the Grantee (including any proceeds, gains or other economic benefit actually or constructively received by the Grantee upon any receipt or exercise of any Award) shall be subject to the provisions of the Company’s claw-back policy as set forth in Section 10 of the Company’s Code of Business Conduct and Ethics (as amended from time to time) including any amendments of such claw-back policy adopted to comply with the requirements of the Xxxx-Xxxxx Xxxx Street Reform and Consumer Protection Act and any rules or regulations promulgated thereunder.

6

EXECUTION PAGE OF RESTRICTED STOCK AWARD AGREEMENT

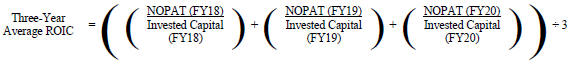

10. Certain Additional Information. This Section 10 sets forth certain information referred to in Section 3 of this Agreement. For purposes of this Agreement, three-year average ROIC shall be expressed as follows:

| Performance-Based Award Vesting Schedule | ||

| 3–Year Average ROIC 2/26/17 – 2/29/20 (FY18 – FY20) |

Percent of Target Performance-Based Shares Vested | |

| Less than % |

0% | |

|

* % - % |

50% - 74% | |

|

* % - % |

75% - 99% | |

|

* % - % |

100% - 124% | |

|

* % - % |

125% - 149% | |

|

* % - % |

150% - 174% | |

|

* % - % |

175% - 199% | |

|

%+ |

200% | |

| * | Vesting of shares between the minimum and maximum three-year average ROIC targets in each band shall be interpolated. For example, if three-year average ROIC is %, then 62% of the Target Performance-Based Shares would vest. If three-year average ROIC is %, then 162% of the Target Performance-Based Shares would vest. |

IN WITNESS WHEREOF, the parties hereto have executed this Agreement on the date first above written.

| COMPANY: | GRANTEE: | |||

| Pier 1 Imports, Inc. | ||||

| By: | /s/ Xxxxxxx X. Xxxxxxxxx |

/s/ Xxxxxxxx X. Xxxxx | ||

| Xxxxxxx X. Xxxxxxxxx | Xxxxxxxx X. Xxxxx | |||

| Executive VP—Human Resources | President and CEO | |||

7