COMMITTED EQUITY FACILITY AGREEMENT

Exhibit 10.3

COMMITTED EQUITY FACILITY AGREEMENT

This Committed Equity Facility Agreement (the “Agreement”) is dated as of April 30, 2015 and effective as of August 6, 2015 (the “Effective Date”), by and between TCA GLOBAL CREDIT MASTER FUND, LP, a limited partnership organized and existing under the laws of the Cayman Islands (the “Investor”) and GROWLIFE, INC., a corporation incorporated under the laws of the State of Delaware (the “Company”).

RECITALS

WHEREAS, the parties desire that, upon the terms and subject to the conditions contained herein, the Company shall issue and sell to the Investor, from time to time as provided herein, and the Investor shall purchase from the Company, up to Three Million and No/100 United States Dollars (US$3,000,000) of the Company’s common stock, $0.0001 par value per share (the “Common Stock”);

WHEREAS, such investments will be made in reliance upon the provisions of Regulation D (“Regulation D”) of the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder (collectively, the “Securities Act”), or upon such other exemption from the registration requirements of the Securities Act as may be available with respect to any or all of the transactions to be entered into hereunder; and

NOW, THEREFORE, in consideration of the premises and the mutual covenants of the parties hereinafter expressed and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto, each intending to be legally bound, agree as follows:

ARTICLE I

CERTAIN DEFINITIONS

For purposes of this Agreement, except as otherwise expressly provided or otherwise defined elsewhere in this Agreement, or unless the context otherwise requires, the capitalized terms in this Agreement shall have the meanings assigned to them in this Article as follows:

1.1 “Advance” shall mean the portion of the Commitment Amount requested by the Company in the Advance Notice.

1.2 “Advance Fee” shall mean an amount in United States funds equal to five percent (5%) of the gross amount of each Advance.

1.3 “Advance Notice” shall mean a written notice in the form of Exhibit ”A” attached hereto, executed by an officer of the Company and delivered to the Investor and setting forth the Advance amount that the Company requests from the Investor.

1

1.4 “Advance Notice Date” shall mean each date the Company delivers (in accordance with Section 2.1 of the Agreement) to the Investor an Advance Notice requiring the Investor to advance funds to the Company, subject to the terms of this Agreement.

1.5 “Affiliate” shall have the meaning set forth in Rule 405 of the Securities Act.

1.6 “Agreement” shall have the meaning set forth in the preamble paragraph hereto.

1.7 “By-Laws” shall have the meaning set forth in Section 4.4.

1.8 “Certificate of Incorporation” shall have the meaning set forth in Section 4.4.

1.9 “Claims” shall have the meaning set forth in Section 5.1.

1.10 “Clearing Date” shall mean the date on which the Estimated Advance Shares have been deposited into the Investor’s brokerage account and the Investor’s broker has confirmed with the Investor that such Estimated Advance Shares have cleared into Investor’s brokerage account and the Investor may execute trades of such Estimated Advance Shares.

1.11 “Closing” shall mean one of the closings of a purchase and sale of Common Stock pursuant to Section 2.2.

1.12 “Closing Date” shall have the meaning set forth in Section 2.2(a).

1.13 “Commitment Amount” shall mean the aggregate amount of up to Three Million and No/100 United States Dollars (US$3,000,000)which the Investor has agreed to provide to the Company in order to purchase the Shares pursuant to the terms and conditions of this Agreement.

1.14 “Commitment Period” shall mean the period commencing on the Effective Date, and expiring upon the termination of this Agreement in accordance with Section 10.2.

1.15 “Common Stock” shall have the meaning set forth in the recitals of this Agreement.

1.16 “Company” shall have the meaning set forth in the preamble paragraph hereto.

1.17 “Company Indemnitees” shall have the meaning set forth in Section 5.2.

1.18 “Condition Satisfaction Date” shall have the meaning set forth in Article VII.

1.19 “Consolidation Event” shall have the meaning set forth in Section 6.8.

2

1.20 “Effective Date” shall have the meaning set forth in the preamble paragraph hereto.

1.21 “Environmental Laws” shall have the meaning set forth in Section 4.9.

1.22 “Estimated Advance Shares” shall have the meaning set forth in Section 2.1(c).

1.23 “Exchange Act” shall mean the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

1.24 “Exchange Cap” shall have the meaning set forth in Section 2.1(d).

1.25

1.26 “Indemnified Liabilities” shall have the meaning set forth in Section 5.1.

1.27 “Indemnitee” shall have the meaning set forth in Section 5.3.

1.28 “Indemnitor” shall have the meaning set forth in Section 5.3.

1.29 “Investor” shall have the meaning set forth in the preamble paragraph hereto.

1.30 “Investor Indemnitees” shall have the meaning set forth in Section 5.1.

1.31 “Knowledge” shall mean the actual or constructive knowledge of the applicable party.

1.32 “Market Price” shall mean, with respect to each Advance Notice, the lowest VWAP of the Common Stock on the applicable Advance Notice Date.

1.33 “Material Adverse Effect” shall mean any condition, circumstance, or situation that has resulted in, or would reasonably be expected to result in: (i) a material adverse effect on the legality, validity or enforceability of this Agreement or the transactions contemplated herein; (ii) a material adverse effect on the results of operations, assets, business or condition (financial or otherwise) of the Company, taken as a whole; or (iii) a material adverse effect on the Company’s ability to perform in any material respect on a timely basis its obligations under this Agreement.

1.34 “Maximum Advance Amount” shall mean, for each Advance Notice, no more than fifteen percent (15%) of the average daily volume of shares of Common Stock traded during the immediately preceding five (5) consecutive Trading Days applicable to the relevant Advance Notice.

3

1.35 “Ownership Limitation” shall have the meaning set forth in Section 2.1(a).

1.36 “Par Value Payment” shall have the meaning set forth in Section 2.1(c).

1.37 “Person” shall mean an individual, a corporation, a partnership, an association, a trust or other entity or organization, including a government or political subdivision or an agency or instrumentality thereof.

1.38 “Preferred Stock” shall have the meaning set forth in Section 4.4.

1.39 “Principal Market” shall mean the Nasdaq Global Select Market, the Nasdaq Global Market, the Nasdaq Capital Market, the OTC Bulletin Board, the OTC Markets, the NYSE Euronext or the New York Stock Exchange, whichever is at the time the principal trading exchange or market for the Common Stock.

1.40 “Purchase Price” shall mean, with respect to each Advance Notice, ninety percent (90%) of the net aggregate sales proceeds received by Investor from the sale of Estimated Advance Shares during an applicable Selling Period, less any fees, including the Advance Fee, which may be due and payable to Investor in connection with each Advance Notice.

1.41 “Registrable Securities” shall mean: (i) the Shares; and (ii) any securities issued or issuable with respect to the Shares by way of exchange, stock dividend or stock split or in connection with a combination of shares, recapitalization, merger, consolidation or other reorganization or otherwise. As to any particular Registrable Securities, once issued such securities shall cease to be Registrable Securities when: (a) the Registration Statement has been declared effective by the SEC and such Registrable Securities have been disposed of pursuant to the Registration Statement; (b) such Registrable Securities have been sold under circumstances under which all of the applicable conditions of Rule 144 (or any similar provision then in force) under the Securities Act (“Rule 144”) are met; or (c) in the opinion of counsel to the Company such Registrable Securities may permanently be sold without registration or without any time, volume or manner of sale limitations pursuant to Rule 144.

1.42 “Registration Limitation” shall have the meaning set forth in Section 2.1(a).

1.43 “Registration Rights Agreement” shall mean the Registration Rights Agreement dated the date hereof, regarding the filing of the Registration Statement for the resale of the Registrable Securities, entered into between the Company and the Investor.

1.44 “Registration Statement” shall mean a registration statement on Form S-1 or Form S-3 or on such other form promulgated by the SEC for which the Company then qualifies and which counsel for the Company shall deem appropriate, and which form shall be available

4

for the registration of the resale by the Investor of the Registrable Securities under the Securities Act.

1.45 “Regulation D” shall have the meaning set forth in the recitals of this Agreement.

1.46

1.47 “SEC” shall mean the United States Securities and Exchange Commission.

1.48 “SEC Documents” shall have the meaning set forth in Section 4.3.

1.49 “Securities Act” shall have the meaning set forth in the recitals of this Agreement.

1.50 “Selling Period” shall mean the five (5) consecutive Trading Days immediately following the Clearing Date associated with the applicable Advance Notice.

1.51 “Settlement Document” shall have the meaning set forth in Section 2.2(a).

1.52 “Shares” shall mean the shares of Common Stock to be issued from time to time hereunder pursuant to Advances, and shall include any Estimated Advance Shares issued and delivered under this Agreement from time to time.

1.53

1.54 “Trading Day” shall mean any day during which the Principal Market shall be open for business.

1.55 “VWAP” means, for any Trading Day, the daily volume weighted average price of the Common Stock for such date on the Principal Market as reported by Bloomberg L.P. (based on a Trading Day from 9:00 a.m. (New York City time) to 4:02 p.m. (New York City time)).

ARTICLE II

ADVANCES

2.1 Advances; Mechanics. Subject to the terms and conditions of this Agreement (including, without limitation, the conditions of Article VII hereof), the Company, at its sole and exclusive option, may issue and sell to the Investor, and the Investor shall purchase from the Company, shares of Common Stock on the following terms:

(a) Advance Notice. At any time during the Commitment Period, the Company may require the Investor to purchase shares of Common Stock by delivering an Advance Notice to the Investor, subject to the conditions set forth in Article VII; provided,

5

however, that: (i) the amount for each Advance as designated by the Company in the applicable Advance Notice shall not be more than the Maximum Advance Amount; (ii) the aggregate amount of the Advances pursuant to this Agreement shall not exceed the Commitment Amount; (iii) in no event shall the number of Shares issuable to the Investor pursuant to an Advance cause the aggregate number of Shares beneficially owned (as calculated pursuant to Section 13(d) of the Exchange Act) by the Investor and its Affiliates to exceed 4.99% of the then outstanding Common Stock (the “Ownership Limitation”); (iv) if the Common Stock is listed or quoted on The Nasdaq Stock Market or any other U.S. national securities exchange during the Commitment Period, in no event shall the number of shares of Common Stock issuable to the Investor pursuant to an Advance Notice cause the aggregate number of shares of Common Stock that would be issued pursuant to this Agreement, together with all shares of Common Stock issued pursuant to any transactions that may be aggregated with the transactions contemplated by this Agreement under applicable rules of The Nasdaq Stock Market or any other Principal Market on which the Common Stock may be listed or quoted, to exceed the Exchange Cap; and (v) in no event shall the aggregate offering price or number of Shares, as the case may be, exceed the aggregate offering price or number of Shares, as the case may be, available for issuance under the Registration Statement (the “Registration Limitation”). In connection with each Advance Notice delivered by the Company, if any portion of the applicable Advance, or the Shares issuable to Investor pursuant to such Advance, would result in any of the limitations set forth in this Section 2.1(a) to be exceeded, such portion of such Advance shall be void ab initio and automatically be deemed to be withdrawn by the Company with no further action required by the Company or the Investor, and the amount of proceeds ultimately due to the Company under such Advance shall be reduced accordingly. Upon the written or oral request of the Investor, the Company shall confirm orally or in writing to the Investor, within two (2) Trading Days of such request, the number of shares of Common Stock then issued and outstanding, or any other information the Investor may request, so that the Investor may properly analyze and make the determinations required to insure that none of the limitations set forth in this Section 2.1(a) shall ever be exceeded.

(b) Date of Delivery of Advance Notice. Advance Notices shall be delivered in accordance with the instructions set forth on the bottom of Exhibit ”A”. An Advance Notice shall be deemed delivered on: (i) the Trading Day it is received by the Investor, if such Advance Notice is received prior to 5:00 pm, Eastern Time; or (ii) the immediately succeeding Trading Day if such Advance Notice is received by Investor after 5:00 pm, Eastern Time, on a Trading Day or at any time on a day which is not a Trading Day. No Advance Notice may be deemed delivered on a day that is not a Trading Day, or if positive receipt of such Advance Notice is not acknowledged by the Investor. Unless the parties agree in writing otherwise, there shall be a minimum of five (5) Trading Days between a Closing Date and a subsequent Advance Notice Date. Delivery of an Advance Notice by the Company shall be deemed a representation and confirmation from the Company for the benefit of Investor that: (x) the Company has obtained all permits and qualifications, if any, required for the issuance and transfer of the Shares applicable to such Advance, or shall have the availability of exemptions therefrom; (y) the sale and issuance of such Shares shall be legally permitted by all laws and regulations to which the Company is

6

subject; and (z) all conditions to an Advance under Article VII have been fully satisfied in all material respects as of each Condition Satisfaction Date.

(c) Delivery of Estimated Advance Shares. On an Advance Notice Date, the Company shall deliver to the Investor’s brokerage account (pursuant to instructions provided by the Investor) a number of Shares equal to: (x) the dollar amount of the Advance indicated in the applicable Advance Notice (the numerator); divided by (y) the Market Price (the denominator); multiplied by (z) two hundred percent (200%) (the “Estimated Advance Shares”). In lieu of delivering physical certificates representing the Estimated Advance Shares issuable in accordance with this Section 2.1(c), and provided that the Company’s transfer agent is then participating in the Depository Trust Company (“DTC”) Fast Automated Securities Transfer (“FAST”) program, upon request of the Investor, the Company shall cause the Company’s transfer agent to electronically transmit the applicable Estimated Advance Shares by crediting the account of the Investor’s prime broker with DTC through its Deposit Withdrawal Agent Commission (“DWAC”) system, and provide proof satisfactory to the Investor of such delivery. No fractional shares shall be issued, and any fractional amounts shall be rounded to the next highest whole number of Shares. Any certificates evidencing Shares delivered pursuant hereto shall be free of restrictive legends. The Company acknowledges that a Closing may be delayed if Estimated Advance Shares are sent via physical delivery in certificate form. The Company understands that if for any reason shares of its Common Stock are not able to be delivered electronically, then significant transaction delays may occur, impacting the ability of transfer agents, brokers, counterparties and intermediaries to deliver and clear shares promptly. This may ultimately delay any applicable Advance Notice Date, Clearing Date, and Closing Date related to an Advance Notice. Furthermore, the Company understands that additional costs may be associated with the delivery of shares of its Common Stock when issued and/or delivered in certificate form and acknowledges that any related reasonable fees will be borne by the Company in full. Upon request, the Investor shall deliver to the Company such evidence of any of said reasonable fees as may be requested by the Company. The Company shall pay any reasonable payments incurred under this Section in immediately available funds upon demand. On the Trading Day immediately following the Clearing Date applicable to the then applicable Advance Notice, the Investor shall acknowledge consideration by allocating funds in the Investor’s brokerage account in an amount equal to the par value of the Estimated Advance Shares (“Par Value Payment”), which Par Value Payment shall be held in the Investor’s brokerage account for the duration of the Selling Period and adjusted at the Closing as hereinafter set forth. Under no circumstances shall the Par Value Payment exceed the amount of the Advance specified in the Advance Notice and no Advance Notice shall be delivered to the Investor if the Company’s Common Stock is trading at or below its par value. The Company acknowledges and agrees that, notwithstanding anything contained in this Agreement to the contrary, the Investor may sell Shares of the Company’s Common Stock relating to a particular Advance Notice, including, without limitation, all of the Estimated Advance Shares in the Investor’s brokerage account on the Clearing Date with respect to such Advance Notice, at any time after the Advance Notice is received by the Investor. If the amount of Estimated Advance Shares due to be delivered to the Investor pursuant to a particular Advance Notice would result in the Investor exceeding the

7

Ownership Limitation, then the amount of the Advance requested in the Advance Notice shall be automatically reduced and the Estimated Advance Shares shall be automatically reduced to an amount that would allow for delivery by the Company to Investor of Estimated Advance Shares for the full two hundred percent (200%) contemplated hereby, without exceeding the Ownership Limitation (such new Share amount, if applicable, shall replace the amount of “Estimated Advance Shares” determined above).

(d) Exchange Cap. If the Common Stock is listed or quoted on The Nasdaq Stock Market or any other U.S. national securities exchange during the Commitment Period, the Company shall not issue or sell any shares of Common Stock pursuant to this Agreement, and the Investor shall not purchase or acquire any shares of Common Stock pursuant to this Agreement, to the extent that after giving effect thereto, the aggregate number of all shares of Common Stock that would be issued pursuant to this Agreement, together with all shares of Common Stock issued pursuant to any transactions that may be aggregated with the transactions contemplated by this Agreement under applicable rules of The Nasdaq Stock Market or any other Principal Market on which the Common Stock may be listed or quoted, would exceed the maximum number of shares of Common Stock that the Company may issue pursuant to this Agreement and the transactions contemplated hereby without: (i) breaching the Company’s obligations under the applicable rules of The Nasdaq Stock Market or any other Principal Market on which the Common Stock may be listed or quoted; or (ii) obtaining stockholder approval under the applicable rules of The Nasdaq Stock Market or any other Principal Market on which the Common Stock may be listed or quoted (the “Exchange Cap”). In such a circumstance, any portion of the applicable Advance, or the Shares issuable to Investor pursuant to such Advance, that would exceed the Exchange Cap to be exceeded shall be void ab initio and automatically be deemed to be withdrawn by the Company with no further action required by the Company or the Investor, unless and until the Company elects to solicit stockholder approval of the transactions contemplated by this Agreement and the stockholders of the Company have in fact approved the transactions contemplated by this Agreement in accordance with the applicable rules and regulations of The Nasdaq Stock Market, any other Principal Market on which the Common Stock may be listed or quoted, and the Certificate of Incorporation and Bylaws of the Company.

2.2 Closings. The Closing of a request for an Advance shall occur the “Closing Date” (as hereinafter defined). Each Closing shall take place on a Closing Date in accordance with the procedures set forth below. In connection with each Closing, the Company and the Investor shall fulfill each of its obligations as set forth below:

(a) Settlement Document and Delivery of Share Proceeds. Subject to the terms and conditions of this Agreement, the Investor shall promptly notify the Company in writing (which notification may be by e-mail) of the occurrence of the Clearing Date associated with an Advance Notice. The Selling Period with respect to such Advance Notice shall begin on the first (1st) Trading Day immediately following the applicable Clearing Date. During the Selling Period, the Investor shall use its good faith efforts to sell Estimated Advance Shares in an amount that would generate net sales proceeds of up to the Advance amount requested in the

8

applicable Advance Notice, subject to then existing market circumstances and conditions and volume limitations resulting therefrom. The Company acknowledges and agrees that the Investor shall have no liability of any nature or kind in connection with the number of Estimated Advance Shares sold or which Investor elects to sell or may be able to sell during the Selling Period. In no event shall Investor sell Estimated Advance Shares during an applicable Selling Period which generate net sales proceeds in excess of the Advance amount requested in the applicable Advance Notice. At the end of the Selling Period for any applicable Advance Notice and upon the completion of the settlement of all trades that occurred during the applicable Selling Period, the Investor shall deliver to the Company a written document (each a “Settlement Document”) setting forth: (i) the number of Estimated Advance Shares originally delivered to the Investor or the Investor’s brokerage account under the applicable Advance Notice; (ii) the aggregate number of such Estimated Advance Shares sold during the Selling Period (as supported by a reconciliation and/or brokerage account statement) applicable to such Advance Notice; (iii) the average per-share price obtained by the Investor from the sale of the Estimated Advance Shares, (iv) the commissions and fees associsted therewith, and (v) the net sales proceeds received by Investor from the sale of such Estimated Advance Shares sold during the Selling Period applicable to such Advance Notice. The Settlement Document shall be in the form attached hereto as Exhibit ”B”. Within one (1) Trading Day after delivery of the Settlement Document for an applicable Advance Notice (each, a “Closing Date”), the Investor shall transfer and deliver to the Company, by wire transfer of immediately available funds to an account designated in writing by the Company: (y) the Purchase Price for the applicable Advance Notice; less (z) any Par Value Payment previously made to the Company. In the event that the Investor is no longer able, due to time constraints beyond its control, to perform a wire on any particular Trading Day, then the wire will be promptly executed on the next following Trading Day. To the extent the Purchase Price for any applicable Advance Notice is less than the amount of the Advance requested by the Company for such applicable Advance Notice, such applicable Advance Notice shall be automatically deemed to be modified and revised as of each Closing Date to an Advance amount equal to the Purchase Price.

(b) Excess Estimated Advance Shares. If the number of Estimated Advance Shares initially delivered to the Investor for an applicable Advance Notice pursuant to Section 2.1(c) is greater than the aggregate number of Shares sold by the Investor for such applicable Advance Notice, then the Investor shall deliver to the Company any excess Estimated Advance Shares associated with such requested Advance, unless the parties mutually agree for the Investor to retain such excess Estimated Advance Shares to apply to the next requested Advance. Any excess Estimated Advance Shares retained by the Investor pursuant to the immediately preceding sentence shall only be applied by Investor to the next requested Advance, if any, and shall not be sold by the Investor for any other purpose.

(c) Additional Documents. On or prior to each Closing Date, each of the Company and the Investor shall deliver to the other all documents, instruments and writings required to be delivered by either of them pursuant to this Agreement in order to implement and effect the transactions contemplated herein.

9

(d) Outstanding Fees or Payments. To the extent the Company has not paid any fees, expenses, or other amounts due to the Investor in accordance with this Agreement, then the amount of such fees, expenses, or other amounts due may be withheld by the Investor from the Purchase Price applicable to any Advance Notice and used to pay for any such fees, expenses or other amounts due. If in the event that on a Closing Date the amount of the requested Advance has been reduced to a dollar amount that does not exceed the initial Par Value Payment made by the Investor, then that difference, up to the full Par Value Payment, will be required to be returned and paid by the Company to the Investor on the next following Trading Day via wire transfer, if applicable. If there are any fees, expenses, costs, or other amounts (including any portion of the Par Value Payment per the immediately preceding sentence) which are due by the Company to Investor in accordance with this Agreement, no subsequent Advance Notice(s) may be deemed delivered and the Investor has no obligation to accept subsequent Advance Notice(s) if any such fees, expenses, costs, or other amounts (including any portion of the Par Value Payment per the immediately preceding sentence) are then outstanding and due to the Investor in accordance with this Agreement. Notwithstanding anything contained herein to the contrary, without the express written consent of the Company (which consent may have been provided by the Company prior to the date hereof), the Investor shall not withhold from the Purchase Price applicable to any Advance Notice any fees, expenses, interest, principal or any other amount whatsoever which may be otherwise owed to the Investor by the Company pursuant to any other agreement. The Investor hereby acknowledges and agrees that the existence of any outstanding obligations owed under any other agreement are entirely separate and distinct from the obligations owed under the Agreement and the Registration Rights Agreement.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF INVESTOR

Investor hereby represents and warrants to, and agrees with, the Company that the following are true and correct as of the Effective Date:

3.1 Organization and Authorization. The Investor is duly organized, validly existing and in good standing under the laws of the Cayman Islands and has all requisite power and authority to purchase and hold the Shares. The decision to invest and the execution and delivery of this Agreement by such Investor, the performance by such Investor of its obligations hereunder and the consummation by such Investor of the transactions contemplated hereby have been duly authorized and requires no other proceedings on the part of the Investor. The undersigned has the right, power and authority to execute and deliver this Agreement and all other instruments on behalf of the Investor. This Agreement has been duly executed and delivered by the Investor and, assuming the execution and delivery hereof and acceptance thereof by the Company, will constitute the legal, valid and binding obligations of the Investor, enforceable against the Investor in accordance with its terms.

10

3.2 Evaluation of Risks. The Investor has such knowledge and experience in financial, tax and business matters as to be capable of evaluating the merits and risks of, and bearing the economic risks entailed by, an investment in the Company and of protecting its interests in connection with this transaction. It recognizes that its investment in the Company involves a high degree of risk.

3.3 Investment Purpose. The securities are being purchased by the Investor for its own account, and for investment purposes. The Investor agrees not to assign or in any way transfer the Investor’s rights to the securities or any interest therein and acknowledges that the Company will not recognize any purported assignment or transfer except in accordance with applicable Federal and state securities laws. No other person has or will have a direct or indirect beneficial interest in the securities. The Investor agrees not to sell, hypothecate or otherwise transfer the Investor’s securities unless the securities are registered under Federal and applicable state securities laws or unless, in the opinion of counsel satisfactory to the Company, an exemption from such laws is available.

3.4 Investor Status. The Investor is an “Accredited Investor” as that term is defined in Rule 501(a)(3) of Regulation D of the Securities Act.

3.5 No Legal Advice From the Company. The Investor acknowledges that it had the opportunity to review this Agreement and the transactions contemplated by this Agreement with its own legal counsel and investment and tax advisors. The Investor is relying solely on such counsel and advisors and not on any statements or representations of the Company or any of the Company’s representatives or agents for legal, tax or investment advice with respect to this investment, the transactions contemplated by this Agreement or the securities laws of any jurisdiction.

3.6 Not an Affiliate. The Investor is not an officer, director or a Person that directly or indirectly, through one or more intermediaries, controls or is controlled by, or is under common control with the Company or any Affiliate of the Company.

3.7 Trading Activities. The Investor’s trading activities with respect to the Company’s Common Stock shall be in compliance with all applicable federal and state securities laws, rules and regulations and the rules and regulations of the Principal Market on which the Common Stock is listed or traded. Neither the Investor nor its Affiliates has an open short position in the Common Stock, and the Investor agrees that it shall not, and that it will cause its Affiliates not to engage in any short sales of the Common Stock during the Commitment Period; provided that the Company acknowledges and agrees that upon receipt of an Advance Notice the Investor has the right to sell the Shares to be issued to the Investor pursuant to the Advance Notice prior to receiving such Shares, subject to the limitations set forth in this Section.

11

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

Except as stated below, on the disclosure schedules attached hereto, if any, the Company hereby represents and warrants to the Investor that the following are true and correct as of the Effective Date:

4.1 SEC Documents; Financial Statements. The Common Stock is registered pursuant to Section 12(g) of the Exchange Act, the Company is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act, and the Company has timely filed all reports, schedules, forms, statements and other documents required to be filed by it with the SEC under the Exchange Act (all of the foregoing filed within the two (2) years preceding the Effective Date or such period as the Company was required to file them or amended after the Effective Date, and all exhibits included therein and financial statements and schedules thereto and documents incorporated by reference therein, being hereinafter referred to as the “SEC Documents”) except as set forth on Schedule 4.1 attached hereto. The Company is not current with its filing obligations under the Exchange Act. As of their respective dates, the SEC Documents complied in all material respects with the requirements of the Exchange Act and the rules and regulations of the SEC promulgated thereunder applicable to the SEC Documents, and none of the SEC Documents, at the time they were filed with the SEC, contained any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading. As of their respective dates, the financial statements of the Company included in the SEC Documents complied as to form in all material respects with applicable accounting requirements and the published rules and regulations of the SEC with respect thereto. Such financial statements have been prepared in accordance with generally accepted accounting principles, consistently applied, during the periods involved (except: (i) as may be otherwise indicated in such financial statements or the notes thereto; or (ii) in the case of unaudited interim statements, to the extent they may exclude footnotes or may be condensed or summary statements) and fairly present the financial position of the Company as of the dates thereof and the results of its operations and cash flows for the periods then ended (subject, in the case of unaudited statements, to normal year-end audit adjustments). No other information provided by or on behalf of the Company to the Investor which is not included in the SEC Documents contains any untrue statement of a material fact or omits to state any material fact necessary in order to make the statements therein, in the light of the circumstance under which they are or were made, not misleading. The Company was never a shell company as defined under Rule 405 of the Exchange Act.

4.2 Organization and Qualification. The Company is duly incorporated, validly existing and in good standing under the laws of the jurisdiction of its incorporation and has all requisite corporate power to own its properties and to carry on its business as now being conducted. Each of the Company and its subsidiaries is duly qualified as a foreign corporation to do business and is in good standing in every jurisdiction in which the nature of the business conducted by it makes such qualification necessary, except to the extent that the failure to be so qualified or be in good standing would not have a Material Adverse Effect.

12

4.3 Authorization, Enforcement, Compliance with Other Instruments. (i) The Company has the requisite corporate power and authority to enter into and perform this Agreement and any related agreements, in accordance with the terms hereof and thereof; (ii) the execution and delivery of this Agreement and any related agreements by the Company and the consummation by it of the transactions contemplated hereby and thereby, have been duly authorized by the Company’s Board of Directors and no further consent or authorization is required by the Company, its Board of Directors or its stockholders; (iii) this Agreement and any related agreements have been duly executed and delivered by the Company; (iv) this Agreement and assuming the execution and delivery thereof and acceptance by the Investor, any related agreements, constitute the valid and binding obligations of the Company enforceable against the Company in accordance with their terms, except as such enforceability may be limited by general principles of equity or applicable bankruptcy, insolvency, reorganization, moratorium, liquidation or similar laws relating to, or affecting generally, the enforcement of creditors’ rights and remedies.

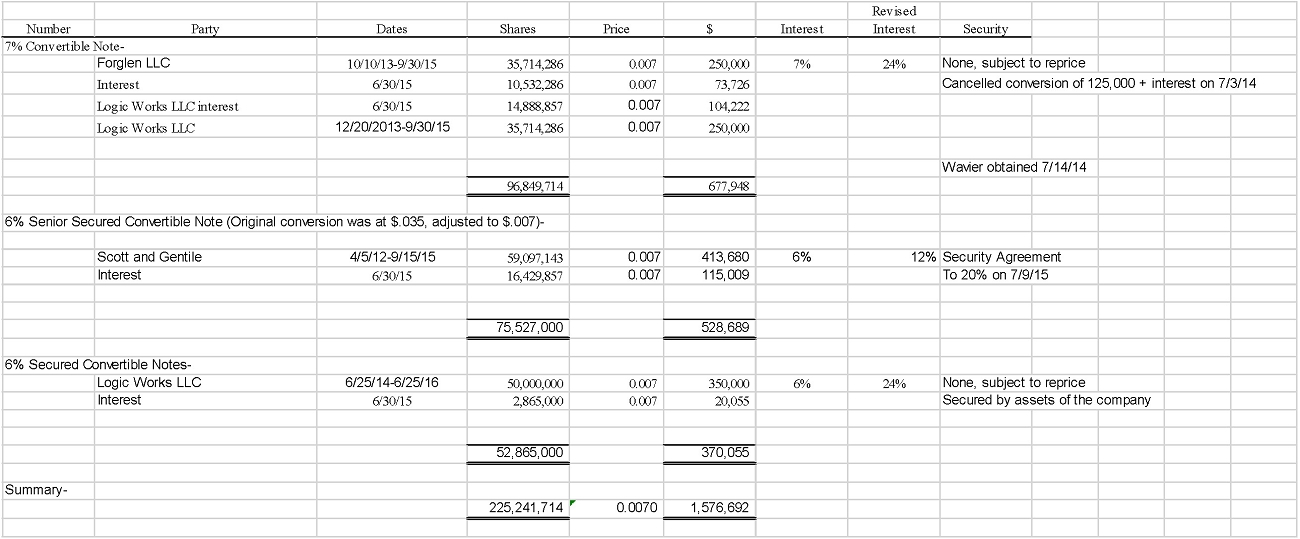

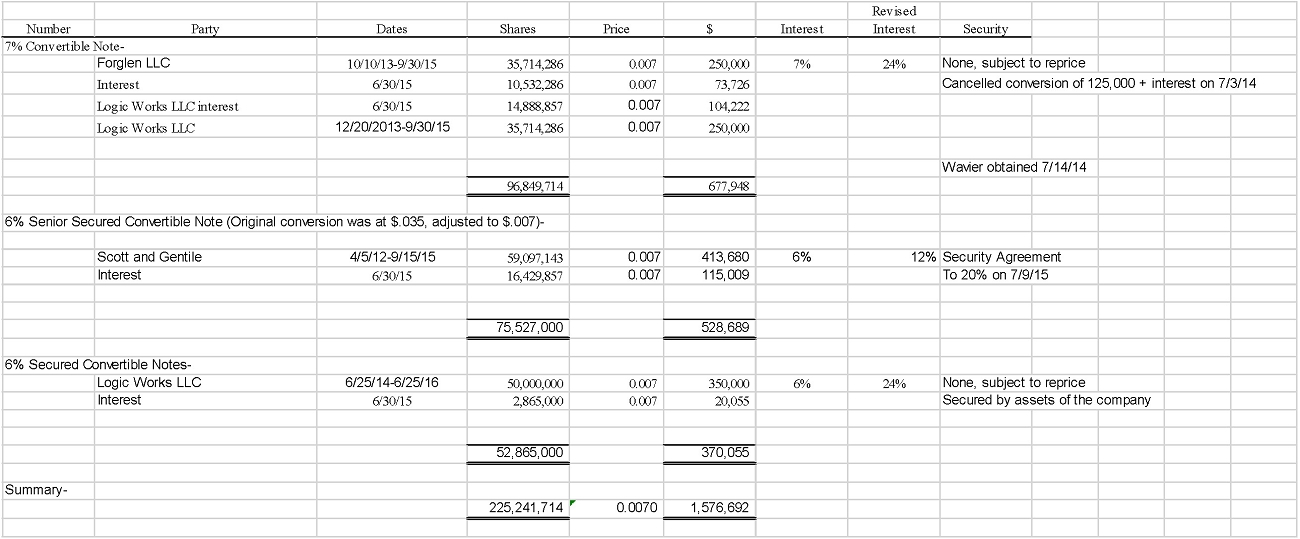

4.4 Capitalization. The authorized capital stock of the Company consists of three billion three million (3,003,000,000) shares, of which three billion (3,000,000,000) shares are designated as Common Stock, and three million (3,000,000) shares of the Company’s preferred stock, $0.0001 par value per share (the “Preferred Stock”). The Company has which eight hundred seventy-nine million three hundred and forty-three thousand seven hundred and seventy-one (879,343,771) shares of Common Stock issued and outstanding as of the Effective Date, and zero (0) shares of Preferred Stock issued and outstanding as of the Effective Date. All of such outstanding shares have been validly issued and are fully paid and nonassessable. The Common Stock not currently quoted or listed on any stock exchange at this time but continues to trade on the “grey sheets” under the trading symbol “PHOT.” Except as disclosed in the SEC Documents, no shares of Common Stock are subject to preemptive rights or any other similar rights or any liens or encumbrances suffered or permitted by the Company. Except as disclosed in the SEC Documents or Schedule 4.4 attached hereto, as of the date hereof: (i) there are no outstanding options, warrants, scrip, rights to subscribe to, calls or commitments of any character whatsoever relating to, or securities or rights convertible into, any shares of capital stock of the Company or any of its subsidiaries, or contracts, commitments, understandings or arrangements by which the Company or any of its subsidiaries is or may become bound to issue additional shares of capital stock of the Company or any of its subsidiaries, or options, warrants, scrip, rights to subscribe to, calls or commitments of any character whatsoever relating to, or securities or rights convertible into, any shares of capital stock of the Company or any of its subsidiaries; (ii) there are no outstanding debt securities; (iii) there are no outstanding registration statements; and (iv) there are no agreements or arrangements under which the Company or any of its subsidiaries is obligated to register the sale of any of their securities under the Securities Act (except pursuant to this Agreement). There are no securities or instruments containing anti-dilution or similar provisions that will be triggered by this Agreement or any related agreement or the consummation of the transactions described herein or therein. The Company has furnished or made available to the Investor true and correct copies of the Company’s Certificate of

13

Incorporation, as amended and as in effect on the date hereof (the “Certificate of Incorporation”), and the Company’s By-laws, as in effect on the date hereof (the “By-laws”), and the terms of all securities convertible into or exercisable for Common Stock and the material rights of the holders thereof in respect thereto.

4.5 No Conflict. The execution, delivery and performance of this Agreement by the Company and the consummation by the Company of the transactions contemplated hereby will not: (i) result in a violation of the Certificate of Incorporation, any certificate of designations of any outstanding series of Preferred Stock of the Company or By-laws; or (ii) conflict with or constitute a default (or an event which with notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any material agreement, indenture or instrument to which the Company or any of its subsidiaries is a party, or result in a violation of any material law, rule, regulation, order, judgment or decree (including federal and state securities laws and regulations and the rules and regulations of the Principal Market on which the Common Stock is quoted) applicable to the Company or any of its subsidiaries or by which any material property or asset of the Company is bound or affected and which would cause a Material Adverse Effect. Except as disclosed in the SEC Documents, neither the Company nor its subsidiaries is in violation of any term of or in default under its Certificate of Incorporation or By-laws or their organizational charter or by-laws, respectively, or any material contract, agreement, mortgage, indebtedness, indenture, instrument, judgment, decree or order or any statute, rule or regulation applicable to the Company or its subsidiaries that would cause a Material Adverse Effect. The business of the Company and its subsidiaries is not being conducted in violation of any material law, ordinance or regulation of any governmental entity. Except as specifically contemplated by this Agreement and as required under the Securities Act and any applicable state securities laws, the Company is not required to obtain any consent, authorization or order of, or make any filing or registration with, any court or governmental agency in order for it to execute, deliver or perform any of its obligations under or contemplated by this Agreement in accordance with the terms hereof or thereof. All consents, authorization, orders, filings and registrations which the Company is required to make or obtain pursuant to the preceding sentence have been obtained or effected on or prior to the date hereof. The Company and its subsidiaries are not aware of any fact or circumstance which might give rise to any of the foregoing.

4.6 No Default. The Company is not in default in the performance or observance of any material obligation, agreement, covenant or condition contained in any indenture, mortgage, deed of trust or other material instrument or agreement to which it is a party or by which it is or its property is bound, and neither the execution, nor the delivery by the Company, nor the performance by the Company of its obligations under this Agreement or any of the exhibits or attachments hereto, will conflict with or result in the breach or violation of any of the terms or provisions of, or constitute a default or result in the creation or imposition of any lien or charge on any assets or properties of the Company, under its Certificate of Incorporation, By-Laws, any material indenture, mortgage, deed of trust or other material agreement applicable to the Company or instrument to which the Company is a party or by which it is bound, or any statute,

14

or any decree, judgment, order, rules or regulation of any court or governmental agency or body having jurisdiction over the Company or its properties, in each case which default, lien or charge is likely to cause a Material Adverse Effect.

4.7 Intellectual Property Rights. The Company and its subsidiaries own or possess adequate rights or licenses to use all material trademarks, trade names, service marks, service ▇▇▇▇ registrations, service names, patents, patent rights, copyrights, inventions, licenses, approvals, governmental authorizations, trade secrets and rights necessary to conduct their respective businesses as now conducted. The Company and its subsidiaries do not have any knowledge of any infringement by the Company or its subsidiaries of trademark, trade name rights, patents, patent rights, copyrights, inventions, licenses, service names, service marks, service ▇▇▇▇ registrations, trade secret or other similar rights of others, and, to the Knowledge of the Company, there is no claim, action or proceeding being made or brought against, or to the Company’s Knowledge, being threatened against the Company or its subsidiaries, regarding trademark, trade name, patents, patent rights, invention, copyright, license, service names, service marks, service ▇▇▇▇ registrations, trade secret or other infringement; and the Company is not aware of any facts or circumstances which might give rise to any of the foregoing.

4.8 Employee Relations. Neither the Company nor any of its subsidiaries is involved in any labor dispute nor, to the Knowledge of the Company or any of its subsidiaries, is any such dispute threatened. None of the Company’s or its subsidiaries’ employees is a member of a union and the Company and its subsidiaries believe that their relations with their employees are good.

4.9 Environmental Laws. The Company and its subsidiaries are: (i) in compliance with any and all applicable material foreign, federal, state and local laws and regulations relating to the protection of human health and safety, the environment or hazardous or toxic substances or wastes, pollutants or contaminants (“Environmental Laws”); (ii) have received all permits, licenses or other approvals required of them under applicable Environmental Laws to conduct their respective businesses; and (iii) are in compliance with all terms and conditions of any such permit, license or approval, in each case except where such noncompliance or nonreceipt would not, individually or in the aggregate, have a Material Adverse Effect.

4.10 Title. Except as set forth on Schedule 4.10 attached hereto, the Company has good and marketable title to its properties and material assets owned by it, free and clear of any pledge, lien, security interest, encumbrance, claim or equitable interest, other than such as are not material to the business of the Company. Any real property and facilities held under lease by the Company and its subsidiaries are held by them under valid, subsisting and enforceable leases with such exceptions as are not material and do not interfere with the use made and proposed to be made of such property and buildings by the Company and its subsidiaries.

4.11 Insurance. The Company and each of its subsidiaries are insured by insurers of recognized financial responsibility against such business and product losses and risks and in such

15

amounts as management of the Company believes to be prudent and customary for similarly situated companies in the businesses in which the Company and its subsidiaries are engaged. The Company does not have any reason to believe that it will not be able to renew its existing insurance coverage as and when such coverage expires or to obtain similar coverage from similar insurers as may be necessary to continue its business at a cost that would not have a Material Adverse Effect.

4.12 Regulatory Permits. The Company and its subsidiaries possess all material certificates, authorizations and permits issued by the appropriate federal, state or foreign regulatory authorities necessary to conduct their respective businesses, and neither the Company nor any such subsidiary has received any notice of proceedings relating to the revocation or modification of any such certificate, authorization or permit.

4.13 Internal Accounting Controls. The Company and each of its subsidiaries maintain a system of internal accounting controls sufficient to provide reasonable assurance that: (i) transactions are executed in accordance with management’s general or specific authorizations; (ii) transactions are recorded as necessary to permit preparation of financial statements in conformity with generally accepted accounting principles and to maintain asset accountability; (iii) access to assets is permitted only in accordance with management’s general or specific authorization; and (iv) the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with respect to any differences. Notwithstanding the foregoing, in the Company’s Quarterly Report on Form 10-Q for the quarter-ended September 30, 2014, the Company concluded that its internal controls were not effective.

4.14 No Material Adverse Breaches, etc. Except as set forth in the SEC Documents, neither the Company nor any of its subsidiaries is subject to any charter, corporate or other legal restriction, or any judgment, decree, order, rule or regulation which, in the judgment of the Company’s officers, has or is expected in the future to have a Material Adverse Effect on the Company or its subsidiaries, taken as a whole.

4.15 Absence of Litigation. Except as set forth in the SEC Documents and Schedule 4.15 attached hereto, there is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending against or affecting the Company, the Common Stock or any of the Company’s subsidiaries, wherein an unfavorable decision, ruling or finding would have a Material Adverse Effect.

4.16 Subsidiaries. Except as disclosed in the SEC Documents, the Company does not presently own or control, directly or indirectly, any interest in any other Person.

4.17 Tax Status. Except as disclosed in the SEC Documents and as set forth on Schedule 4.17 attached hereto, the Company and each of its subsidiaries has made or filed all foreign, federal and state income and all other tax returns, reports and declarations required by

16

any jurisdiction to which it is subject and (unless and only to the extent that the Company and each of its subsidiaries has set aside on its books provisions reasonably adequate for the payment of all unpaid and unreported taxes) has paid all taxes and other governmental assessments and charges that are material in amount, shown or determined to be due on such returns, reports and declarations, except those being contested in good faith, and the Company and its subsidiaries have set aside on their respective books provision reasonably adequate for the payment of all taxes for periods subsequent to the periods to which such returns, reports or declarations apply. There are no unpaid taxes in any material amount claimed to be due by the taxing authority of any jurisdiction, and the officers of the Company know of no basis for any such claim. The disclosures set forth in this Section 4.17 are qualified in their entirety by reference to Schedule 4.17 attached hereto and incorporated herein by reference

4.18 Certain Transactions. Except as set forth in the SEC Documents, none of the officers, directors, or employees of the Company is presently a party to any transaction with the Company (other than for services as employees, officers and directors), including any contract, agreement or other arrangement providing for the furnishing of services to or by, providing for rental of real or personal property to or from, or otherwise requiring payments to or from any officer, director or such employee or, to the Knowledge of the Company, any corporation, partnership, trust or other entity in which any officer, director, or any such employee has a substantial interest or is an officer, director, trustee or partner.

4.19 The Shares. The Shares have been duly authorized and, when issued, delivered and paid for pursuant to this Agreement, will be validly issued and fully paid and non-assessable, free and clear of all liens, claims and encumbrances of any nature or kind, and will be issued in compliance with all applicable United States federal and state securities laws. The capital stock of the Company, including the Common Stock, shall conform in all material respects to the description thereof to be contained in the Registration Statement. Neither the stockholders of the Company, nor any other Person, have any preemptive rights or rights of first refusal with respect to the Shares or, except as set forth in the SEC Documents, other rights to purchase or receive any of the Shares or any other securities or assets of the Company, and no Person has the right, contractual or otherwise, to cause the Company to issue to it, or register pursuant to the Securities Act, any shares of capital stock or other securities or assets of the Company upon the issuance or sale of the Shares. The Company is not obligated to offer the Shares on a right of first refusal basis or otherwise to any third parties including, without limitation, to current or former shareholders of the Company, underwriters, brokers, or agents.

4.20 Dilution. The Company is aware and acknowledges that issuance of the Shares could cause dilution to existing shareholders and could significantly increase the outstanding number of shares of Common Stock.

4.21 Acknowledgment Regarding Investor’s Purchase of Shares. The Company acknowledges and agrees that the Investor is acting solely in the capacity of an arm’s length investor with respect to this Agreement and the transactions contemplated hereunder. The

17

Company further acknowledges that the Investor is not acting as a financial advisor or fiduciary of the Company (or in any similar capacity) with respect to this Agreement and the transactions contemplated hereunder and any advice given by the Investor or any of its representatives or agents in connection with this Agreement and the transactions contemplated hereunder is merely incidental to the Investor’s purchase of the Shares hereunder. The Company is aware and acknowledges that it may not be able to request Advances under this Agreement until a Registration Statement becomes effective, and only in compliance with the rules of the Principal Market. The Company further is aware and acknowledges that any fees paid pursuant to Section 12.4 hereunder shall be earned as of the Effective Date and are not refundable or returnable under any circumstances.

ARTICLE V

INDEMNIFICATION

The Investor and the Company covenant to the other the following with respect to itself:

5.1 Indemnification by the Company. In consideration of the Investor’s execution and delivery of this Agreement, and in addition to all of the Company’s other obligations under this Agreement, the Company shall, and does hereby agree to, defend, protect, indemnify and hold harmless the Investor, and all of the Investor’s affiliates and subsidiaries, and each Person who controls the Investor within the meaning of Section 15 of the Securities Act or Section 20 of the Exchange Act, and the officers, directors, partners, members, employees and agents of each of them (collectively, the “Investor Indemnitees”), from and against any and all actions, causes of action, suits, claims, demands, threats and proceedings (collectively, the “Claims”), and the Company agrees to reimburse the Investor Indemnitees, or any of them, for any and all losses, costs, penalties, fees, liabilities, obligations, judgments, expenses, and damages, including, without limitation, reasonable attorneys’ fees, paralegals’ fees and other costs, expenses and disbursements reasonably incurred by the Investor Indemnities, or any of them, in connection with investigating, defending or settling any such Claims, including such expenses incurred throughout all trial and appellate levels and administrative and bankruptcy proceedings (collectively, the “Indemnified Liabilities”), suffered or incurred by the Investor Indemnitees, or any of them, as a result of, or arising out of, or relating to: (a) any untrue statement or alleged untrue statement of a material fact contained in the Registration Statement for the registration of the Shares as originally filed or in any amendment thereof, or in any related prospectus, or in supplement, or in any amendment thereof or supplement thereto, or arising out of or which are based upon the omission or alleged omission to state therein a material fact required to be stated therein or necessary to make the statements therein not misleading; provided, however, that the Company will not be liable in any such case to the extent that any such Indemnified Liabilities arise out of or are based upon any such untrue statement or alleged untrue statement or omission or alleged omission made therein in reliance upon and in conformity with written information furnished to the Company by or on behalf of the Investor specifically for inclusion therein; (b) any misrepresentation or breach of any representation or warranty made by the Company in this

18

Agreement or any other certificate, instrument or document contemplated hereby or thereby; (c) any breach of any covenant, agreement or obligation of the Company contained in this Agreement or any other certificate, instrument or document contemplated hereby or thereby; and (d) any Claim brought or made against the Investor Indemnitees, or any of them, not arising out of any action or inaction of an Investor Indemnitee, and arising out of or resulting from the execution, delivery, performance or enforcement of this Agreement or any other instrument, document or agreement executed pursuant hereto or thereto by any of the Investor Indemnitees. To the extent that the foregoing undertaking by the Company may be unenforceable for any reason, the Company shall make the maximum contribution to the payment and satisfaction of each of the Indemnified Liabilities, which is permissible under applicable law.

5.2 Indemnification by Investor. In consideration of the Company’s execution and delivery of this Agreement, and in addition to all of the Investor’s other obligations under this Agreement, the Investor shall, and does hereby agree to, defend, protect, indemnify and hold harmless the Company, and all of the Company’s subsidiaries, and each Person who controls the Company within the meaning of Section 15 of the Securities Act or Section 20 of the Exchange Act, and the officers, directors, partners, members, employees and agents of each of them (collectively, the “Company Indemnitees”), from and against any and all Claims, and the Investor agrees to reimburse the Company Indemnitees, or any of them, for any and all Indemnified Liabilities, suffered or incurred by the Company Indemnitees, or any of them, as a result of, or arising out of, or relating to: (a) any untrue statement or alleged untrue statement of a material fact contained in the Registration Statement for the registration of the Shares as originally filed or in any amendment thereof, or in any related prospectus, or in any amendment thereof or supplement thereto, or arising out of or which are based upon the omission or alleged omission to state therein a material fact required to be stated therein or necessary to make the statements therein not misleading, but only to the extent that any such untrue statement or alleged untrue statement or omission or alleged omission was in connection with information furnished to the Company by Investor specifically for inclusion therein; provided, however, that the Investor will not be liable in any such case to the extent that any such Indemnified Liabilities arise out of or are based upon any such untrue statement or alleged untrue statement or omission or alleged omission made therein by the Company; (b) any misrepresentation or breach of any representation or warranty made by the Investor in this Agreement or any other certificate, instrument or document contemplated hereby or thereby; (c) any breach of any covenant, agreement or obligation of the Investor contained in this Agreement or any other certificate, instrument or document contemplated hereby or thereby; and (d) any Claim brought or made against the Company Indemnitees, or any of them, not arising out of any action or inaction of a Company Indemnitee, and arising out of or resulting from the execution, delivery, performance or enforcement of this Agreement or any other instrument, document or agreement executed pursuant hereto or thereto by any of the Company Indemnitees. To the extent that the foregoing undertaking by the Investor may be unenforceable for any reason, the Investor shall make the maximum contribution to the payment and satisfaction of each of the Indemnified Liabilities, which is permissible under applicable law.

19

5.3 Notice of Claim. For purposes of this Article V, a party that is subject to a Claim and entitled to indemnification hereunder is sometimes hereinafter referred to as the “Indemnitee,” and the party having the obligation to indemnify the other is sometimes hereinafter referred to as the “Indemnitor.” Promptly after receipt by an Indemnitee of notice of the commencement of any Claim involving an Indemnified Liability, such Indemnitee shall, if an Indemnified Liability in respect thereof is to be made against any Indemnitor, deliver to the Indemnitor a written notice of the commencement thereof; provided, however, that the failure to so notify the Indemnitor: (i) will not relieve the Indemnitor of liability under this Article V, unless and to the extent the Indemnitor did not otherwise learn of such Claim and such failure results in the forfeiture by the Indemnitor of substantial rights and defenses; and (ii) will not, in any event, relieve the Indemnitor from any obligations to the Indemnitee, other than those indemnity obligations provided in this Article V. In the case of parties indemnified pursuant to Section 5.1 above, counsel to the Indemnitee shall be selected by the Company, and, in the case of parties indemnified pursuant to Section 5.2 above, counsel to the Indemnitee shall be selected by the Investor. An Indemnitor may participate, at its own expense, in the defense of any such Claim; provided, however, that counsel to the Indemnitor shall not (except with the consent of the Indemnitee) also be counsel to the Indemnitee. In no event shall the Indemnitor be liable for fees and expenses of more than one counsel (in addition to any local counsel) separate from their own counsel for all Indemnitees in connection with any one action or separate but similar or related actions in the same jurisdiction arising out of the same general allegations or circumstances. The Indemnitee shall cooperate fully with the Indemnitor in connection with any negotiation or defense of any Claim, and the Indemnitee shall furnish to the Indemnitor all information reasonably available to the Indemnitee which relates to such Claim. The Indemnitor shall keep the Indemnitee fully apprised at all times as to the status of the defense or any settlement negotiations with respect thereto. An Indemnitor will not, without the prior written consent of the Indemnitee, settle or compromise or consent to the entry of any judgment with respect to any pending or threatened Claim in respect of which indemnification or contribution may be sought under this Agreement (whether or not the Indemnitees are actual or potential parties to such Claim) unless: (i) such settlement, compromise or consent includes an unconditional release of each Indemnitee from all liability arising out of such Claim; and (ii) such settlement, compromise or consent does not include a statement as to or an admission of fault, culpability or a failure to act by or on behalf of any Indemnitee. Following indemnification as provided for hereunder, the Indemnitor shall be subrogated to all rights of the Indemnitee with respect to all third parties, firms or corporations relating to the matter for which indemnification has been made.

5.4 Contribution. In the event that the indemnity provided in Section 5.1 or Section 5.2 is unavailable to or insufficient to hold harmless an Indemnitee for any reason, the Company and the Investor, as applicable, severally agree to contribute to the aggregate Indemnified Liabilities to which the Company and the Investor may be subject, as applicable, in such proportion as is appropriate to reflect the relative benefits received by the Company on the one hand and by the Investor on the other from transactions contemplated by this Agreement. If the allocation provided by the immediately preceding sentence is unavailable for any reason, the

20

Company and the Investor severally shall contribute in such proportion as is appropriate to reflect not only such relative benefits but also the relative fault of the Company on the one hand and of the Investor on the other in connection with the statements or omissions which resulted in such Indemnified Liabilities as well as any other relevant equitable considerations. Benefits received by the Company shall be deemed to be equal to the total proceeds from the offering (net of underwriting discounts and commissions but before deducting expenses) received by it, and benefits received by the Investor shall be deemed to be equal to the total discounts received by the Investor. Relative fault shall be determined by reference to, among other things, whether any untrue or any alleged untrue statement of a material fact or the omission or alleged omission to state a material fact relates to information provided by the Company on the one hand or the Investor on the other, the intent of the parties and their relative knowledge, access to information and opportunity to correct or prevent such untrue statement or omission. The Company and the Investor agree that it would not be just and equitable if contribution were determined by pro rata allocation or any other method of allocation which does not take account of the equitable considerations referred to above. The aggregate amount of Indemnified Liabilities incurred by an Indemnitee and referred to above in this Article V shall be deemed to include any legal or other expenses reasonably incurred by such Indemnitee in investigating, preparing or defending against any litigation, or any investigation or proceeding by any governmental agency or body, commenced or threatened, or any claim whatsoever based upon any such untrue or alleged untrue statement or omission or alleged omission. Notwithstanding the provisions of this Section 5.4, the Investor shall not be required to contribute any amount in excess of the amount by which the Purchase Price for Shares actually purchased pursuant to this Agreement exceeds the amount of any damages which the Investor has otherwise been required to pay by reason of such untrue or alleged untrue statement or omission or alleged omission. No Person guilty of fraudulent misrepresentation (within the meaning of Section 11(f) of the Securities Act) shall be entitled to contribution from any Person who was not guilty of such fraudulent misrepresentation. For purposes of this Article V, each Person who controls the Investor within the meaning of Section 15 of the Securities Act or Section 20 of the Exchange Act and each director, officer, employee and agent of the Investor shall have the same rights to contribution as the Investor, and each Person who controls the Company within the meaning of Section 15 of the Securities Act or Section 20 of the Exchange Act, each officer of the Company who shall have signed the Registration Statement and each director of the Company shall have the same rights to contribution as the Company, subject in each case to the applicable terms and conditions of this Section 5.4.

5.5 Remedies. The remedies provided for in this Article V are not exclusive and shall not limit any rights or remedies which may otherwise be available to any Indemnitee.

5.6 Survival. The obligations of the parties to indemnify or make contribution under this Article V shall survive termination of this Agreement.

21

ARTICLE VI

COVENANTS OF THE COMPANY

6.1 Registration Rights. The Company shall cause the Registration Rights Agreement to remain in full force and effect and the Company shall comply in all material respects with the terms thereof.

6.2 Listing of Common Stock. The Company shall, within ninety (90) days from the Effective Date, use its best efforts to obtain approval for the listing and quotation of the Common Stock on a Principal Market, including the OTC Markets and thereafter shall take all necessary steps to maintain the Common Stock’s authorization for quotation on a Princiapl Trading Market

6.3 Exchange Act Registration. The Company will cause its Common Stock to continue to be registered under the Exchange Act, will file, within ninety (90) days from the Effective Date, any and all periodic reports required under the Exchange Act to become current with the Buyer’s reporting requirements under the Exchange Act and thereafter will file in a timely manner all reports and other documents required of it as a reporting company under the Exchange Act and will not take any action or file any document (whether or not permitted by Exchange Act or the rules thereunder) to terminate or suspend such registration or to terminate or suspend its reporting and filing obligations under said Exchange Act.

6.4 Transfer Agent Instructions. Not later than two (2) business days after each Advance Notice Date and prior to each Closing and resale of the Common Stock by the Investor, the Company will deliver instructions to its transfer agent to issue shares of Common Stock free of restrictive legends.

6.5 Corporate Existence. The Company will take all steps necessary to preserve and continue the corporate existence of the Company.

6.6 Notice of Certain Events Affecting Registration; Suspension of Right to Make an Advance. The Company will immediately notify the Investor upon its becoming aware of the occurrence of any of the following events in respect of a Registration Statement or related prospectus relating to an offering of Registrable Securities: (i) receipt of any request for additional information by the SEC or any other Federal or state governmental authority, during the period of effectiveness of the Registration Statement, for amendments or supplements to the Registration Statement or related prospectus; (ii) the issuance by the SEC or any other Federal or state governmental authority of any stop order suspending the effectiveness of the Registration Statement or the initiation of any proceedings for that purpose; (iii) receipt of any notification with respect to the suspension of the qualification or exemption from qualification of any of the Registrable Securities for sale in any jurisdiction or the initiation or threatening of any proceeding for such purpose; (iv) the happening of any event that makes any statement made in the Registration Statement or related prospectus or any document incorporated or deemed to be incorporated therein by reference untrue in any material respect or that requires the making of any changes in the Registration Statement, related prospectus or such other documents so that, in

22

the case of the Registration Statement, it will not contain any untrue statement of a material fact or omit to state any material fact required to be stated therein or necessary to make the statements therein not misleading, and that in the case of the related prospectus, it will not contain any untrue statement of a material fact or omit to state any material fact required to be stated therein or necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading; and (v) the Company’s reasonable determination that a post-effective amendment to the Registration Statement would be appropriate, in which event the Company will promptly make available to the Investor any such supplement or amendment to the Registration Statement and related prospectus. The Company shall not deliver to the Investor any Advance Notice during the continuation of any of the foregoing events.

6.7 Expectations Regarding Advance Notices. Within ten (10) days after the commencement of each calendar quarter occurring subsequent to the commencement of the Commitment Period, the Company must notify the Investor, in writing, as to its reasonable expectations as to the dollar amount it intends to raise during such calendar quarter, if any, through the issuance of Advance Notices. Such notification shall constitute only the Company’s good faith estimate and shall in no way obligate the Company to raise such amount, or any amount, or otherwise limit its ability to deliver Advance Notices.

6.8 Consolidation; Merger. The Company shall not, at any time after the Effective Date, effect any merger or consolidation of the Company with or into, or a transfer of all or substantially all the assets of the Company to, another entity (a “Consolidation Event”), unless the resulting successor or acquiring entity (if not the Company) assumes by written instrument the obligation to deliver to the Investor such shares of stock and/or securities as the Investor is entitled to receive pursuant to this Agreement.

6.9 Issuance of the Company’s Common Stock. The sale of the shares of Common Stock by the Company to the Investor hereunder shall be made in accordance with the provisions and requirements of the Securities Act and Regulation D and any applicable state securities law.

6.10 Expenses. The Company, whether or not the transactions contemplated hereunder are consummated or this Agreement is terminated, will pay all expenses incident to the performance of its obligations hereunder, including, without limitation: (i) the preparation, printing and filing of the Registration Statement and each amendment and supplement thereto, of each related prospectus and of each amendment and supplement thereto; (ii) the preparation, issuance and delivery of any Shares issued pursuant to this Agreement; (iii) all fees and disbursements of the Company’s counsel, accountants and other advisors; (iv) the qualification of the Shares under securities laws in accordance with the provisions of this Agreement, including filing fees in connection therewith; (v) the fees and expenses incurred in connection with the listing or qualification of the Shares for trading on the Principal Market; or (vi) filing fees of the SEC, the Principal Market and any other regulatory or governmental body or authority.

23

6.11 Compliance with Laws. The Company will not, directly or indirectly, take any action designed to cause or result in, or that constitutes or might reasonably be expected to constitute, the stabilization or manipulation of the price of any security of the Company or which caused or resulted in, or which would in the future reasonably be expected to cause or result in, stabilization or manipulation of the price of any security of the Company.

6.12 Opinion of Counsel. Prior to the date of the first Advance Notice, the Investor shall have received an opinion letter from counsel to the Company reasonably acceptable to the Investor, containing, at a minimum, the opinions set forth in Exhibit ”C” attached hereto.

6.13 Review of Public Disclosures. To the Knowledge of the Company, none of the public disclosures made by the Company, including, without limitation, press releases, investor relations materials, and scripts of analysts meetings and calls will contain any untrue statements of material fact, nor will they omit to state any material fact required to be stated therein necessary to make the statements made in light of the circumstances under which they were made, not misleading.

6.14 Opinion of Counsel Concerning Resales. Provided that the Investor’s resale of Common Stock received pursuant to this Agreement may be freely sold by the Investor either pursuant to an effective Registration Statement, in accordance with Rule 144, or otherwise, the Company shall obtain for the Investor, at the Company’s expense, any and all opinions of counsel which may be required by the Company’s transfer agent to issue such shares free of restrictive legends, or to remove legends from such shares.

6.15 Sales. Without the written consent of the Investor, the Company will not, directly or indirectly, offer to sell, sell, contract to sell, grant any option to sell or otherwise dispose of any shares of Common Stock (other than the Shares offered pursuant to the provisions of this Agreement) or securities convertible into or exchangeable for Common Stock, warrants or any rights to purchase or acquire Common Stock, during the period beginning on the 5th Trading Day immediately prior to an Advance Notice Date and ending on the 2nd Trading Day immediately following the corresponding Closing Date.

6.16 ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇. Notwithstanding any other provision of this Agreement, the Company shall not deliver an Advance Notice during any period in which the Investor is in possession of material non-public information.

ARTICLE VII

CONDITIONS FOR ADVANCE AND CONDITIONS FOR CLOSING

The right of the Company to deliver an Advance Notice and the obligations of the Investor hereunder to acquire Shares and pay for Shares of the Company’s Common Stock is

24

subject to the satisfaction by the Company, on each Advance Notice Date and on each Closing Date (a “Condition Satisfaction Date”), of each of the following conditions:

7.1 Accuracy of the Company’s Representations and Warranties. The representations and warranties of the Company shall be true and correct in all material respects.

7.2 Registration of the Common Stock with the SEC. The Company shall have filed with the SEC a Registration Statement with respect to the resale of the Registrable Securities in accordance with the terms of the Registration Rights Agreement. As set forth in the Registration Rights Agreement, the Registration Statement shall have been declared effective by the SEC and shall remain effective on each Condition Satisfaction Date, and: (i) neither the Company nor the Investor shall have received notice that the SEC has issued or intends to issue a stop order with respect to the Registration Statement, or that the SEC otherwise has suspended or withdrawn the effectiveness of the Registration Statement, either temporarily or permanently, or intends or has threatened to do so (unless the SEC’s concerns have been addressed and the Investor is satisfied, in its sole discretion, that the SEC no longer is considering or intends to take such action); and (ii) no other suspension of the use or withdrawal of the effectiveness of the Registration Statement or related prospectus shall exist. The Registration Statement must have been declared effective by the SEC prior to the first Advance Notice Date.

7.3 Authority. The Company shall have obtained all permits and qualifications required by any applicable state for the offer and sale of the Shares, or shall have the availability of exemptions therefrom. The sale and issuance of the Shares shall be legally permitted by all laws and regulations to which the Company is subject.