QUOTE INDEMNIFICATION AGREEMENT ***Note: The Required Disclaimer on Exhibit A and the Terms and Conditions of Gartner’s consent to quote on Exhibit B are not negotiable and may not be changed. ***

Exhibit 23.3

QUOTE INDEMNIFICATION AGREEMENT

***Note: The Required Disclaimer on Exhibit A and the Terms and Conditions of Gartner’s

consent to quote on Exhibit B are not negotiable and may not be changed. ***

THIS QUOTE INDEMNIFICATION AGREEMENT (the “Agreement”) is made as of the 27th day of February, 2017 by and between Presidio, Inc., a Delaware corporation with offices at Xxx Xxxx Xxxxx, Xxx Xxxx, Xxx Xxxx 00000 (the “Issuer”) and Gartner, Inc., a Delaware corporation with offices at 00 Xxx Xxxxxxx Xxxx, Xxxxxxxx, Xxxxxxxxxxx 00000-0000 (“Gartner”).

Gartner hereby consents to the quotation by Issuer in its Registration Statement on Form S-1 to be filed with the Securities and Exchange Commission on or around February 27, 2017 (the “Filing”), of the Gartner material set forth on the attached Exhibit A (the “Gartner Material”).

In consideration of Gartner’s consent, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Issuer hereby acknowledges and agrees to the terms and conditions set forth on the attached Exhibit B.

In witness whereof, the Issuer and Gartner have executed this Agreement as of the date set forth above.

| Presidio, Inc. | Gartner, Inc. | |||||||

| By: | /s/ Xxxxxx Xxxxxxx | By: | /s/ Xxxxx Xxxxxxx | |||||

| Name: | Xxxxxx Xxxxxxx | Name: | Xxxxx Xxxxxxx | |||||

| Its duly authorized: | SVP & General Counsel | Its duly authorized: | Yes | |||||

| Date: | 2/27/17 | Date: | 2/27/17 | |||||

| Gartner – Generic Indemnification Agreement – US Public Offering | ||||||||

Exhibit A

Gartner Material

See attached for quoted material.

Required Disclaimer (to appear on the same page as the reference to the Gartner Reports):

The Gartner Report(s) described herein, (the “Gartner Report(s)”) represent(s) research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. (“Gartner”), and are not representations of fact. Each Gartner Report speaks as of its original publication date (and not as of the date of this Prospectus) and the opinions expressed in the Gartner Report(s) are subject to change without notice.

Gartner – Generic Indemnification Agreement – US Public Offering

Exhibit B

Terms and Conditions of Gartner’s consent to quote:

| a. | The Gartner Material shall be presented in the Filing as representing research opinion or viewpoints published by Gartner, and not as a representation of fact. |

| b. | The disclaimer set forth on Exhibit A shall be included in the Filing on the same page as the Gartner Material, or in the vicinity thereof, and in the same font size. |

| x. | Xxxxxxx disclaims all warranties, express or implied, statutory or otherwise, including, without limitation, any implied warranties of merchantability of fitness for a particular purpose, and warranties as to accuracy, completeness or adequacy of the Gartner Material. |

| d. | The Gartner Material speaks as of its original publication date (and not as of the date of the Filing) and that the opinions expressed in the Gartner Material are subject to change without notice. |

| x. | Xxxxxxx shall have no liability for errors, omissions or inadequacies in the Gartner Material or for any interpretations of the Gartner Material. |

| f. | Issuer agrees to indemnify and hold harmless Gartner, its subsidiaries and their respective directors, officers, directors, shareholders, employees and agents, from and against any and all claims, liabilities, demands, causes of action, damages, losses and expenses (including reasonable attorney’s fees and costs) arising, directly or indirectly, and without limitation, out of or in connection with the Filing. |

| g. | Issuer agrees that this Agreement shall be governed by and construed in accordance with the laws of the State of Connecticut, without reference to conflict of law principles. |

Gartner – Generic Indemnification Agreement – US Public Offering

Exhibit A

BASIS OF PRESENTATION

* * * * * *

| • | We calculate total addressable market (“TAM”) amounts using a methodology combining calculations of Gartner, Inc. and the Company’s management. The data underlying the TAM amounts were calculated by Gartner, and the Company’s management used the TAM amounts to calculate the compound annual growth rate (“CAGR”) between certain periods. In calculating TAM amounts with respect to the Digital Infrastructure, Cloud and Security components, Gartner excluded certain sub-components from the Security TAM that because they are not part of our solution set: Consumer Security Software, Data Loss Prevention, Endpoint Protection Platform (Enterprise), Identity Governance and Administration, IPS Equipment, Other Identity Access Management, Other Security Software, Secure E-Mail Gateway, Secure Web Gateway, Security Information and Event Management (SIEM), Security Testing, VPN/Firewall Equipment, and Web Access Management (WAM). Our management then calculated CAGR using the revised TAM amounts, resulting in the amounts reported in this prospectus for TAM CAGR in this prospectus. See “Prospectus Summary—Market Overview” and “Business—Market Overview.” |

MARKET, INDUSTRY AND OTHER DATA

This prospectus contains industry and market data, forecasts and projections that are based on internal data and estimates, independent industry publications, reports by market research firms and other independent sources, such as Gartner. Although we believe them to be accurate, there can be no assurance as to the accuracy or completeness of such information. Although we are responsible for all of the disclosures contained in this prospectus, we have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. In addition, while we believe that the industry information included herein is generally reliable, such information is inherently imprecise. While we are not aware of any misstatements regarding the industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the caption “Risk Factors” in this prospectus.

* * * * * *

The Gartner Reports described herein (the “Gartner Reports”), which were prepared for us in connection with this prospectus, represent research opinions or viewpoints published, as part of a syndicated subscription service, by Gartner and are not representations of fact. The Gartner Reports speak as of their original publication date (and not as of the date of this prospectus) and the opinions expressed in the Gartner Reports are subject to change without notice.

In certain instances where the Gartner Reports are identified as the sources of market and industry data contained in this prospectus, the applicable report is identified by superscript notations. The sources of these data are provided below:

| (1) | Gartner, Market Databook, 2Q16 Update, dated as of June 29, 2016. |

| (2) | Gartner, 2016 CIO Agenda: A U.S. Perspective, dated as of February 19, 2016. |

| (3) | Gartner, Report to Presidio, dated as of May 10, 2016. |

| (4) | Gartner, Forecast: Information Security, Worldwide, 2014-2020, 2Q16 Update, dated as of August 25, 2016. |

| (5) | Gartner, Market Share: IT Services, 2015, dated as of April 6, 2016. |

| (6) | Gartner, Market Trends: Cloud Adoption Trends Favor Public Cloud with a Hybrid Twist, dated as of August 4, 2016. |

| (7) | Gartner, Market Databook, 4Q13 Update, dated as of December 24, 2013. |

In the Gartner Reports, the market and industry data presented is based on end-user spending and represents calendar year data.

Unless otherwise indicated, in this prospectus, companies in the geographic market of the United States and Canada (the “North American IT market”) are divided into four categories. These categories are those used by Gartner, and are based on the size of the company. SOHO (Small Office/Home Office) companies are characterized by one-nine employees. Small businesses are characterized by 10-99 employees and less than $50 million in revenue. Midsize, or middle market, companies are characterized by 100-1,000 employees and $50 million to $1 billion in revenue. Large, or enterprise, companies are characterized by over 1,000 employees and more than $1 billion in revenue.

Unless otherwise indicated, in this prospectus, spend in the North American IT market is divided into five categories:

| • | The “Data Center Systems / Network” category includes servers, external controller-based storage, enterprise network equipment and unified communications; |

| • | The “Devices” category includes PCs, tablets, phones and printers; |

| • | The “Software” category includes enterprise application software (enterprise resource planning (“ERP”), human resources (“HR”), collaborative, client relationship management (“CRM”) and engineering software) and infrastructure software (application development, information management, enterprise system management, security system software and operating systems); |

| • | The “IT Services” category includes business IT services (consulting, implementation, IT outsourcing and “business process outsourcing”) and IT product support (software support and hardware support); and |

| • | The “Communications Services” category includes enterprise fixed and mobile services (wide area network (“WAN”), core network, voice services, mobile data services, etc.) and consumer fixed and mobile services (fixed-line voice services, broadband, mobile access and traffic fees, etc.). |

PROSPECTUS SUMMARY

Company Overview

* * * * * *

Our strategic focus on the middle market and high-growth solutions areas has enabled us to achieve 11% annualized growth in our revenue from our fiscal year ended June 30, 2012 to our fiscal year ended June 30, 2016.

2

Over the same period, we have significantly outpaced the overall IT market growth rate, according to Gartner. We believe that we are well positioned for continued success as IT becomes more transformative and complex, driving demand for our solutions.

* * * * * *

Market overview

We operate in the large and growing North American IT market. According to Gartner, the overall North American IT market is expected to grow to $1.3 trillion by 2020, representing a 2.6% CAGR from 2015, and the IT Services sub-market is expected to grow by 5.3% over the same period, to $497 billion. Our primary focus is on the attractive middle market of the overall North American IT market, which, according to Gartner, is projected to grow from $226 billion in 2015 to $293 billion in 2020, representing a 5.3% CAGR. The middle market is one of the fastest growing segments of the overall North American IT market in part because its companies often employ smaller internal IT teams that do not have the broad expertise required to keep pace with increasingly complex IT environments and constant technology changes. Industry dynamics continue to favor services-led solutions providers, as businesses increasingly rely on us to advise them on complex IT projects, enabling them to better focus on their core capabilities and enhance productivity.

While we primarily focus our operations on the U.S. middle market, we have generated sales in and have operations in Canada, the only other country included in Gartner’s North American IT market measurements. Our total sales outside the United States represented approximately 2% of our total revenue for each of the fiscal years ended June 30, 2016, June 30, 2015, and June 30, 2014, and the growth rates of the overall North American IT market and the IT Services sub-market generally indicate a growing market for our business.

We believe that growth in IT spending will continue to be driven by the adoption of new technologies and market-related trends in cloud, security and IoT and the desire to integrate people, process and technology into digital business models. These trends reflect expanding IT complexity that organizations must manage to remain competitive; however, many middle-market companies lack the resources to design, integrate and manage full life cycle solutions across multiple technology silos to capitalize on these new technologies. A recent survey by Gartner2 predicted that the four biggest drivers of increased IT budget spend would be in the areas of analytics, infrastructure and datacenter, security and cloud, all of which are areas addressed by our core solutions.

| 1 | See Gartner note (1) in the section titled “Market, Industry and Other Data.” |

| 2 | See Gartner note (2) in the section titled “Market, Industry and Other Data.” |

3

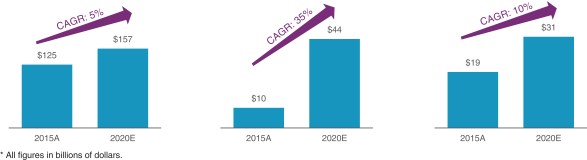

Because of our strategic focus on high-growth solutions areas, our North American TAM is expected to grow at a 9% CAGR from $154 billion in 2015 to $232 billion in 2020, according to Gartner and management estimates.3

| Digital Infrastructure TAM

|

Cloud TAM

|

Security TAM |

Specific components of our TAM are as follows:

Digital infrastructure solutions: Gartner and management estimate that our addressable enterprise-class infrastructure market was $125 billion in 2015 and is projected to grow at a 5% CAGR through 2020. Gartner defines infrastructure solutions as infrastructure services, infrastructure consulting, network services, data center outsourcing, enterprise network outsourcing, data center systems support and network systems support, as well as IoT implementation and consulting. Gartner defines enterprise-class as “the ability of a given tool or product to handle complex processes or services.” We believe key emerging trends driving this growth include increased infrastructure requirements for cloud (public, private and multi) usage including integration of Software-as-a-Service (“SaaS”) applications into environments, low-latency requirements, software-defined networks (“SDN”), IoT-connected devices and data management strategies supporting data analytics. We enable businesses to capitalize on these emerging trends by designing and deploying new solutions and by refreshing and replacing their inflexible or under-provisioned existing networks and infrastructure.

Cloud solutions: Over the past several years, the SaaS, Platform-as-a-Service (“PaaS”) and Infrastructure-as-a-Service (“IaaS”) markets have provided a viable complement to traditional on premise, enterprise-class infrastructure solutions. Clients are deploying multi-cloud solutions that drive increased demand for private clouds, networking, storage and virtualization, as well as public-cloud integration. Gartner estimates that the North American cloud infrastructure opportunity was approximately $10 billion in 2015 and is projected to grow at a CAGR of more than 35% through 2020. Gartner defines cloud solutions as cloud computing services.

Security solutions: The information security market has been driven by an increase in threats and targeted attacks over the last several years. This is due to the substantial increase in sophistication of attacks (including organized crime and state-sponsored entities) and client adoption of new technologies such as cloud computing and IoT that have created new security exposures for businesses. Security attacks have affected nearly every organization, making security a top priority for senior management teams and boards of directors. Despite years of effort and an estimated tens of billions of dollars spent annually,4 we believe that most organizations are still not sufficiently protected against cyberattacks. Additionally, heightened sensitivity around data security has introduced new regulation and contractual requirements in a number of the industries we serve. According to Gartner and management estimates, the North American security market was $19 billion in 2015, with a projected CAGR of more than 10% through 2020.5 Gartner defines security solutions as consulting, hardware support, implementation and IT outsourcing.

| 3 | See Gartner note (3) in the section titled “Market, Industry and Other Data.” |

| 4 | See Gartner note (4) in the section titled “Market, Industry and Other Data.” |

| 5 | See Gartner note (4) in the section titled “Market, Industry and Other Data.” |

4

We believe that we are well positioned within the fragmented North American IT Services market—where no individual company has over 5% market share, according to Gartner.6 We have become a trusted advisor to our middle-market clients by providing enterprise-class, vendor-agnostic and end-to-end solutions through our national team of engineers and strong local relationships. We believe that our value proposition will allow us to take market share because local and regional service providers lack our scale, technology expertise and end-to-end solution capabilities and the larger national and global firms do not have the focus, local relationships and organizational structure to provide solutions to the middle market.

Our Solutions

We consider ourselves to be a leading provider of end-to-end and innovative IT solutions across our three solution areas: (i) Digital Infrastructure, (ii) Cloud and (iii) Security. Due to the accelerated growth and adoption of cloud and security solutions, as seen in Gartner’s projected growth in our total addressable markets, we expect Cloud and Security to continue to drive a mix shift in our revenue base over time.

* * * * * *

Cloud solutions: … A recent survey by Gartner7 indicated that 71% of organizations currently deploy or plan to deploy cloud services by the end of 2017.

* * * * * *

Our History

Since our founding in 2004, the hallmarks of our culture have centered around client service and collaboration. Our business model has been defined by delivering engineering- and services-led solutions using a cost-effective, localized model that leverages a powerful OEM vendor ecosystem. This formula has driven our internal organic growth while at the same time setting the criteria for identifying acquisition opportunities. From our 2012 fiscal year to our 2016 fiscal year, we have grown our revenue from $1.76 billion to $2.71 billion, representing an 11% CAGR, which is significantly faster than U.S. IT spending and U.S. real GDP, which have grown at 2.1% and 1.9%, respectively, over the same periods, according to Gartner8 and the Bureau of Economic Analysis, respectively.9

BUSINESS

Company Overview

* * * * * *

Our strategic focus on the middle market and high-growth solutions areas has enabled us to achieve 11% annualized growth in our revenue from our fiscal year ended June 30, 2012 to our fiscal year ended June 30, 2016. Over the same period, we have significantly outpaced the overall IT market growth rate, according to Gartner. We believe that we are well positioned for continued success as IT becomes more transformative and complex, driving demand for our solutions.

* * * * * *

| 6 | See Gartner note (5) in the section titled “Market, Industry and Other Data.” |

| 7 | See Gartner note (6) in the section titled “Market, Industry and Other Data.” |

| 8 | See Gartner note (7) in the section titled “Market, Industry and Other Data.” |

| 9 | Source: Bureau of Economic Analysis—U.S. Department of Commerce, “NIPA Tables.” |

5

Market overview

We operate in the large and growing North American IT market. According to Gartner, the overall North American IT market is expected to grow to $1.3 trillion by 2020, representing a 2.6% CAGR from 2015, and the IT Services sub-market is expected to grow by 5.3% over the same period, to $497 billion. Our primary focus is on the attractive middle market of the overall North American IT market, which, according to Gartner, is projected to grow from $226 billion in 2015 to $293 billion in 2020, representing a 5.3% CAGR. The middle market is one of the fastest growing segments of the overall North American IT market in part because its companies often employ smaller internal IT teams that do not have the broad expertise required to keep pace with increasingly complex IT environments and constant technology changes. Industry dynamics continue to favor services-led solutions providers, as businesses increasingly rely on us to advise them on complex IT projects, enabling them to better focus on their core capabilities and enhance productivity.

While we primarily focus our operations on the U.S. middle market, we have generated sales in and have operations in Canada, the only other country included in Gartner’s North American IT market measurements. Our total sales outside the United States represented approximately 2% of our total revenue for each of the fiscal years ended June 30, 2016, June 30, 2015, and June 30, 2014, and the growth rates of the overall North American IT market and the IT Services sub-market generally indicate a growing market for our business.

We believe that growth in IT spending will continue to be driven by the adoption of new technologies and market-related trends in cloud, security and IoT and the desire to integrate people, process and technology into digital business models. These trends reflect expanding IT complexity that organizations must manage to remain competitive; however, many middle-market companies lack the resources to design, integrate and manage full life cycle solutions across multiple technology silos to capitalize on these new technologies. A recent survey by Gartner11 predicted that the four biggest drivers of increased IT budget spend would be in the areas of analytics, infrastructure and datacenter, security and cloud, all of which are areas addressed by our core solutions.

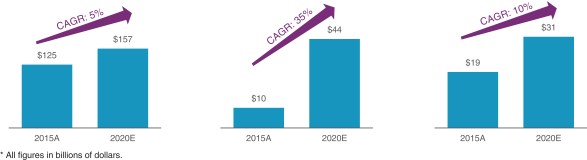

Because of our strategic focus on high-growth solutions areas, our North American TAM is expected to grow at a 9% CAGR from $154 billion in 2015 to $232 billion in 2020, according to Gartner and management estimates.12

| 10 | See Gartner note (1) in the section titled “Market, Industry and Other Data.” |

| 11 | See Gartner note (2) in the section titled “Market, Industry and Other Data.” |

| 12 | See Gartner note (3) in the section titled “Market, Industry and Other Data.” |

6

| Digital Infrastructure TAM

|

Cloud TAM

|

Security TAM |

Specific components of our TAM are as follows:

Digital infrastructure solutions: Gartner and management estimate that our addressable enterprise-class infrastructure market was $125 billion in 2015 and is projected to grow at a 5% CAGR through 2020. Gartner defines infrastructure solutions as infrastructure services, infrastructure consulting network services, data center outsourcing, enterprise network outsourcing, data center systems support and network systems support, as well as IoT implementation and consulting. Gartner defines enterprise-class as “the ability of a given tool or product to handle complex processes or services.” We believe key emerging trends driving this growth include increased infrastructure requirements for cloud (public, private and multi) usage including integration of SaaS applications into environments, low-latency requirements, SDN, IoT-connected devices and data management strategies supporting data analytics. We enable businesses to capitalize on these emerging trends by designing and deploying new solutions and by refreshing and replacing their inflexible or under-provisioned existing networks and infrastructure.

Cloud solutions: Over the past several years, the SaaS, PaaS and IaaS markets have provided a viable complement to traditional on premise, enterprise-class infrastructure solutions. Clients are deploying multi-cloud solutions that drive increased demand for private clouds, networking, storage and virtualization, as well as public-cloud integration. Gartner estimates that the North American cloud infrastructure opportunity was approximately $10 billion in 2015 and is projected to grow at a CAGR of more than 35% through 2020. Gartner defines cloud solutions as cloud computing services.

Security solutions: The information security market has been driven by an increase in threats and targeted attacks over the last several years. This is due to the substantial increase in sophistication of attacks (including organized crime and state-sponsored entities) and client adoption of new technologies such as cloud computing and IoT that have created new security exposures for businesses. Security attacks have affected nearly every organization, making security a top priority for senior management teams and boards of directors. Despite years of effort and an estimated tens of billions of dollars spent annually,13 we believe that most organizations are still not sufficiently protected against cyberattacks. Additionally, heightened sensitivity around data security has introduced new regulation and contractual requirements in a number of the industries we serve. According to Gartner and management estimates, the North American security market was $19 billion in 2015, with a projected CAGR of more than 10% through 2020.14 Gartner defines security solutions as consulting, hardware support, implementation and IT outsourcing.

We believe that we are well positioned within the fragmented North American IT Services market—where no individual company has over 5% market share, according to Gartner.15 We have become a trusted advisor to our middle-market clients by providing enterprise-class, vendor-agnostic and end-to-end solutions through our national

| 13 | See Gartner note (4) in the section titled “Market, Industry and Other Data.” |

| 14 | See Gartner note (4) in the section titled “Market, Industry and Other Data.” |

| 15 | See Gartner note (5) in the section titled “Market, Industry and Other Data.” |

7

team of engineers and strong local relationships. We believe that our value proposition will allow us to take market share because local and regional service providers lack our scale, technology expertise and end-to-end solution capabilities and the larger national and global firms do not have the focus, local relationships and organizational structure to provide solutions to the middle market.

Our Solutions

We consider ourselves to be a leading provider of end-to-end and innovative IT solutions across our three solution areas: (i) Digital Infrastructure, (ii) Cloud and (iii) Security. Due to the accelerated growth and adoption of cloud and security solutions, as seen in Gartner’s projected growth in our total addressable markets, we expect Cloud and Security to continue to drive a mix shift in our revenue base over time.

* * * * * *

Cloud solutions: … A recent survey by Gartner16 indicated that 71% of organizations currently deploy or plan to deploy cloud services by the end of 2017.

* * * * * *

Our History

Since our founding in 2004, the hallmarks of our culture have centered around client service and collaboration. Our business model has been defined by delivering engineering- and services-led solutions using a cost-effective, localized model that leverages a powerful OEM vendor ecosystem. This formula has driven our internal organic growth while at the same time setting the criteria for identifying acquisition opportunities. From our 2012 fiscal year to our 2016 fiscal year, we have grown our revenue from $1.76 billion to $2.71 billion, representing an 11% CAGR, which is significantly faster than U.S. IT spending and U.S. real GDP, which have grown at 2.1% and 1.9%, respectively, over the same periods, according to Gartner17 and the Bureau of Economic Analysis, respectively.18

EXPERTS

* * * * * *

Certain statistical and market data contained herein have been derived from and included herein in reliance upon, the market research report prepared by Gartner, Inc., an independent provider of research and analysis on the global IT industry, commissioned by the Company and issued on May 10, 2016 and upon the authority of said firm as experts with respect to the matters covered by its report.

Index to Exhibits

* * * * * *

| 23.3 | Consent of Gartner, Inc. |

| * | To be filed by amendment. |

| 16 | See Gartner note (6) in the section titled “Market, Industry and Other Data.” |

| 17 | See Gartner note (7) in the section titled “Market, Industry and Other Data.” |

| 18 | Source: Bureau of Economic Analysis—U.S. Department of Commerce, “NIPA Tables.” |

8