SECOND AMENDMENT

Exhibit 10.1

SECOND AMENDMENT

THIS SECOND AMENDMENT (this “Amendment”) is made and entered into as of September 21, 2016, by and between XXXXXX 333 TWIN DOLPHIN PLAZA, LLC, a Delaware limited liability company (“Landlord”), and COHERUS BIOSCIENCES, INC., a Delaware corporation (“Tenant”).

| A. | Landlord and Tenant are parties to that certain lease dated July 6, 2015 (as amended pursuant to that certain First Amendment dated August 10, 2015) the “Lease”). Pursuant to the Lease, Landlord has leased to Tenant space currently containing approximately 27,532 rentable square feet (the “Existing Premises”) described as Suite No. 600 on the sixth floor of the building commonly known as 333 Twin Dolphin located at 000 Xxxx Xxxxxxx Xxxxx, Xxxxxxx Xxxx, Xxxxxxxxxx (the “Building”). |

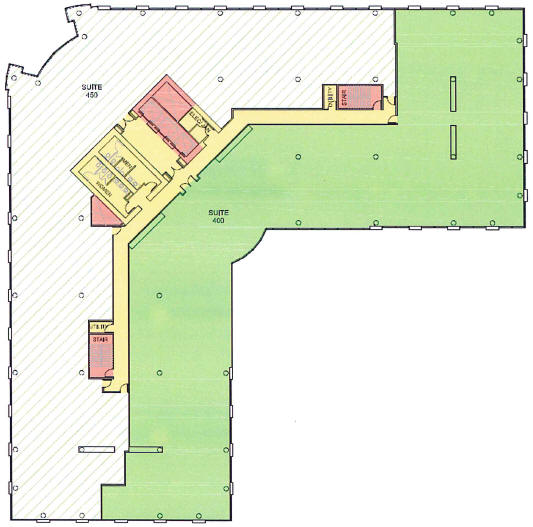

| B. | The parties wish to expand the Premises (defined in the Lease) to include additional space, containing approximately 12,809 rentable square feet described as Suite No. 450 on the fourth floor of the Building and shown on Exhibit A attached hereto (the “Expansion Space”), on the following terms and conditions. |

NOW, THEREFORE, in consideration of the above recitals which by this reference are incorporated herein, the mutual covenants and conditions contained herein and other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Landlord and Tenant agree as follows:

| 1. | Expansion. Effective as of the earlier of (i) the first date on which Tenant conducts business in the Expansion Space pursuant to this Amendment, or (ii) November 1, 2016 (such earlier date being the “Expansion Effective Date”), the Premises shall be increased from 27,532 rentable square feet on the sixth floor to 40,341 rentable square feet on the fourth and sixth floors by the addition of the Expansion Space, and, from and after the Expansion Effective Date, the Existing Premises and the Expansion Space shall collectively be deemed the Premises. The term of the Lease for the Expansion Space (the “Expansion Term”) shall commence on the Expansion Effective Date and, unless sooner terminated in accordance with the Lease, end on the last day of the term of the Lease for the Existing Premises (which the parties acknowledge is November 30, 2022). From and after the Expansion Effective Date, the Expansion Space shall be subject to all the terms and conditions of the Lease except as provided herein. Except as may be expressly provided herein, (a) Tenant shall not be entitled to receive, with respect to the Expansion Space, any allowance, free rent or other financial concession granted with respect to the Existing Premises, and (b) no representation or warranty made by Landlord with respect to the Existing Premises shall apply to the Expansion Space. Notwithstanding the foregoing, Tenant may enter the Expansion Space as of the date hereof (and prior to the Expansion Effective Date), solely for the purpose of performing Tenant Improvement Work (defined below) and installing telecommunications and data cabling, equipment, furnishings and other personal property in the Expansion Space. Other than the obligation to pay Monthly Rent with respect to the Expansion Space, all of Tenant’s obligations under the Lease and hereunder shall apply during any period of such early entry prior to the Expansion Effective Date. |

| 2. | Base Rent. With respect to the Expansion Space during the Expansion Term, the schedule of Base Rent shall be as follows: |

| Period During Expansion Term |

Annual Rate Per Square Foot (rounded to the nearest 100th of a dollar) |

Monthly Base Rent | ||

| Expansion Effective Date-December 31, 2017 | $58.80 | $62,764.10 | ||

| January 1, 2018- December 31, 2018 |

$60.56 | $64,647.02 | ||

| January 1, 2019- December 31, 2019 |

$62.38 | $66,586.43 | ||

| January 1, 2020- December 31, 2020 |

$64.25 | $68,584.03 | ||

| January 1, 2021- December 31, 2021 |

$66.18 | $70,641 .55 | ||

| January 1, 2022- November 30, 2022 |

$68.17 | $72,760.79 |

All such Base Rent shall be payable by Tenant in accordance with the terms of the Lease. Notwithstanding the foregoing, Base Rent for the Expansion Space shall be abated, in the amount of $62,764.10 per month, for the first five (5) full calendar months of the Expansion Term; provided, however, that if a Default exists when any such abatement would otherwise apply, such abatement shall be deferred until the date, if any, on which such Default is cured.

| 3. | Letter of Credit. Section 6.6 of Exhibit F to the Lease (entitled, “Reduction in Letter of Credit Amount”) is hereby amended and restated as follows: |

“Notwithstanding the foregoing, provided that no Default (defined in Section 19.1) occurs on or before the applicable reduction date below (each a ‘Reduction Date’), then Tenant shall be entitled to a reduction in the Letter of Credit Amount as follows: (a) as of the last day of the thirty-sixth (36th) full calendar month of the Expansion Term, the Letter of Credit Amount shall be reduced to $641,770.92, (b) as of the last day of the forty-eighth (48th) full calendar month of the Expansion Term, the Letter of Credit Amount shall be reduced to $494,474.72, and (c) as of the last day of the sixtieth (60th) full calendar month of the Expansion Term, the Letter of Credit Amount shall be reduced to $342,773.40. Notwithstanding any contrary provision hereof, if a Default occurs at any time, Tenant shall have no further right to reduce the Letter of Credit Amount. Any reduction in the Letter of Credit Amount shall be accomplished by Tenant’s delivery to Landlord of a substitute letter of credit in the reduced amount or an amendment to the existing Letter of Credit reflecting the reduced amount.”

| 4. | Tenant’s Share. With respect to the Expansion Space during the Expansion Term, Tenant’s Share shall be 7.0075%. |

| 5. | Expenses and Taxes. With respect to the Expansion Space during the Expansion Term, Tenant shall pay for Tenant’s Share of Expenses and Taxes in accordance with the terms of the Lease; provided, however, that, with respect to the Expansion Space during the Expansion Term, the Base Year for Expenses and Taxes shall be 2017. |

| 6. | Improvements to Expansion Space. |

| 6.1 | Configuration and Condition of Expansion Space. Tenant acknowledges that it has inspected the Expansion Space and agrees to accept it in its existing configuration and condition (or in such other configuration and condition as any existing tenant of the Expansion Space may cause to exist in accordance with its lease), without any representation by Landlord regarding its configuration or condition and without any obligation on the part of Landlord (other than Landlord’s repair and maintenance obligations set forth in Section 7.1 of the Lease) to perform or pay for any alteration or improvement, except as may be otherwise expressly provided in this Amendment. |

| 6.2 | Responsibility for Improvements to Expansion Space. Tenant shall be entitled to perform improvements to the Expansion Space, and to receive an allowance from Landlord for such improvements, in accordance with Exhibit B attached hereto. |

2

| 7. | Other Pertinent Provisions. Landlord and Tenant agree that, effective as of the date of this Amendment (unless different effective date(s) is/are specifically referenced in this Section), the Lease shall be amended in the following additional respects: |

| 7.1 | California Public Resources Code § 25402.10. If Tenant (or any party claiming by, through or under Tenant) pays directly to the provider for any energy consumed at the Building, Tenant, promptly upon request, shall deliver to Landlord (or, at Landlord’s option, execute and deliver to Landlord an instrument enabling Landlord to obtain from such provider) any data about such consumption that Landlord, in its reasonable judgment, is required to disclose to a prospective buyer, tenant or mortgage lender under California Public Resources Code § 25402.10 or any similar law. |

| 7.2 | California Civil Code Section 1938. Pursuant to California Civil Code § 1938, Landlord hereby states that the Expansion Space has not undergone inspection by a Certified Access Specialist (CASp) (defined in California Civil Code § 55.52). |

| 7.3 | Parking. As of the Expansion Effective Date, the reference to “Ninety (90) unreserved parking spaces” set forth in Section 1.9 of the Lease shall be deemed amended and restated as “133 unreserved parking spaces”. |

| 7.4 | Right of First Offer. Section 5 of Exhibit F to the Lease is hereby deleted and of no further force or effect. |

| 8. | Right of First Offer. |

| 8.1. | Grant of Option; Conditions. |

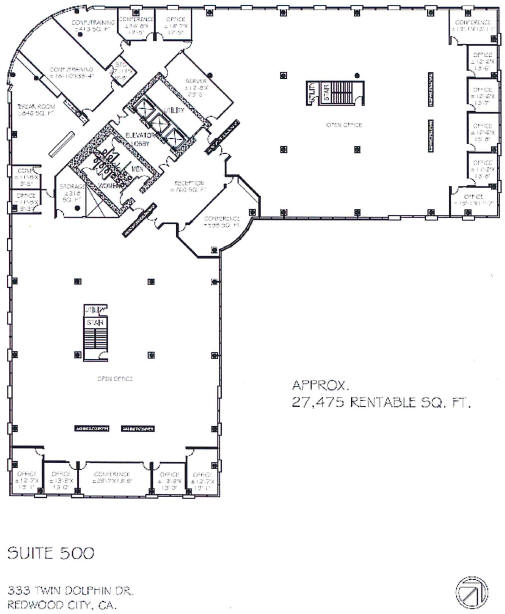

| A. | Subject to the terms of this Section 8, Tenant shall have a right of first offer (“Right of First Offer”) with respect to each of the following suites (and with respect to each portion of each such suite) (each such suite or portion thereof, a “Potential Offering Space”): (i) the 27,475 rentable square feet known as Suite No. 500 on the 5th floor of the Building shown on the demising plan attached hereto as Exhibit C, and (ii) the 14,278 rentable square feet known as Suite No. 400 on the 4th floor of the Building shown on the demising plan attached hereto as Exhibit C. Tenant’s Right of First Offer shall be exercised as follows: At any time after Landlord has determined that a Potential Offering Space has become Available (defined below), but before leasing such Potential Offering Space to a third party, Landlord, subject to the terms of this Section 8, shall provide Tenant with a written notice (for purposes of this Section 8, an “Advice”) advising Tenant of the material terms on which Landlord is prepared to lease such Potential Offering Space (sometimes referred to herein as an “Offering Space”) to Tenant, which terms shall be consistent with Section 8.2 below. For purposes hereof, a Potential Offering Space shall be deemed to become “Available” as follows: (i) if such Potential Offering Space is not leased to a third party as of the date of mutual execution and delivery of this Amendment, such Potential Offering Space shall be deemed to become Available when Landlord has located a prospective tenant that may be interested in leasing such Potential Offering Space; and (ii) if such Potential Offering Space is leased to a third party as of the date of mutual execution and delivery of this Amendment, such Potential Offering Space shall be deemed to become Available when Landlord has determined that such third-party tenant, and any occupant of such Potential Offering Space claiming under such third-party tenant, will not extend or renew the term of its lease, or enter into a new lease, for such Potential Offering Space. Upon receiving an Advice, Tenant may lease the Offering Space, in its entirety only, under the terms set forth in the Advice, by delivering to Landlord a written notice of exercise (for purposes of this Section 8, a “Notice of Exercise”) within five (5) days after receiving the Advice. |

| B. | If Tenant receives an Advice but does not deliver a Notice of Exercise within the period of time required under Section 8.1.A above, Landlord may lease the Offering Space to any party on any terms determined by Landlord in its sole and absolute discretion. |

| C. | Notwithstanding any contrary provision hereof, (i) Landlord shall not be required to provide Tenant with an Advice if any of the following conditions exists when Landlord would otherwise deliver the Advice; and (ii) if Tenant receives an Advice from Landlord, Tenant shall not be entitled to lease the Offering Space based on such Advice if any of the following conditions exists: |

| (1) | a Default (as defined in the Lease) exists; |

| (2) | 33% or more of the Premises is sublet; |

3

| (3) | the Lease has been assigned (other than pursuant to a Permitted Transfer, as defined in the Lease); or |

| (4) | Tenant is not occupying the Premises. |

If, by operation of the preceding sentence, Landlord is not required to provide Tenant with an Advice, or Tenant, after receiving an Advice, is not entitled to lease the Offering Space based on such Advice, then Landlord may lease the Offering Space to any party on any terms determined by Landlord in its sole and absolute discretion.

| 8.2 | Terms for Offering Space. |

| A. | The term for the Offering Space shall be coterminous with the term for the balance of the Premises. |

| B. | The term for the Offering Space shall commence on the commencement date stated in the Advice and thereupon the Offering Space shall be considered a part of the Premises subject to the provisions of the Lease; provided, however, that the provisions of the Advice shall prevail to the extent they conflict with the provisions of the Lease. |

| C. | Tenant shall pay Monthly Rent for the Offering Space in accordance with the provisions of the Advice. The Advice shall reflect the Prevailing Market (defined in Section 8.5 below) rate for the Offering Space as determined in Landlord’s reasonable judgment. |

| D. | Except as may be otherwise provided in the Advice, (i) the Offering Space (including improvements and personalty, if any) shall be accepted by Tenant in its configuration and condition existing on the earlier of the date Tenant takes possession of the Offering Space or the commencement date for the Offering Space; and (ii) if Landlord is delayed in delivering possession of the Offering Space by any holdover or unlawful possession of the Offering Space by any party, Landlord shall use reasonable efforts to obtain possession of the Offering Space and any obligation of Landlord to tender possession of, permit entry to, or perform alterations to the Offering Space shall be deferred until after Landlord has obtained possession of the Offering Space. |

| 8.3 | Termination of Right of First Offer; One-Time Right. |

| A. | Notwithstanding any contrary provision hereof, Landlord shall not be required to provide Tenant with an Advice, and Tenant shall not be entitled to exercise its Right of First Offer, after November 30, 2021. |

| B. | Notwithstanding any contrary provision hereof, Landlord shall not be required to provide Tenant with an Advice, and Tenant shall not be entitled to exercise its Right of First Offer, with respect to any Potential Offering Space after the date, if any, on which Landlord becomes entitled to lease such Potential Offering Space to a third party under Section 8.1.B or 8.1.C above. |

| 8.4 | Offering Amendment. If Tenant validly exercises its Right of First Offer, Landlord, within a reasonable period of time thereafter, shall prepare and deliver to Tenant an amendment (the “Offering Amendment”) adding the Offering Space to the Premises on the terms set forth in the Advice and reflecting the changes in the Base Rent, the rentable square footage of the Premises, Tenant’s Share, and other appropriate terms in accordance with this Section 8. Tenant shall execute and return the Offering Amendment to Landlord within 15 days after receiving it, but an otherwise valid exercise of the Right of First Offer shall be fully effective whether or not the Offering Amendment is executed. |

| 8.5 | Definition of Prevailing Market. For purposes of this Section 8, “Prevailing Market” means the arms-length, fair-market, annual rental rate per rentable square foot, under renewal and expansion leases and amendments entered into on or about the date on which the Prevailing Market is being determined hereunder, for space comparable to the Offering Space in the Building and office buildings comparable to the Building in the Redwood City, California area. The determination of Prevailing Market shall take into account (i) any material economic differences between the terms of the Lease and any comparison lease or amendment, such as rent abatements, construction costs and other concessions, and the manner, if any, in which the landlord under any such lease is reimbursed for operating expenses and taxes; and (ii) any material differences in configuration or condition between the Offering Space and any comparison space. |

4

| 8.6 | Subordination. Notwithstanding any contrary provision hereof, if Landlord, as permitted under Section 8.1.B or 8.1.C above, leases any Potential Offering Space to a third party on terms including a right of first offer, right of first refusal, expansion option or other expansion right with respect to any other Potential Offering Space (and if, in the case of any such lease permitted under Section 8.1.B above, such expansion ‘right was disclosed in the Advice received by Tenant), then Tenant’s Right of First Offer with respect to such other Potential Offering Space shall be subject and subordinate to such expansion right in favor of such third party. |

| 9. | Extension Option. |

| 9.1 | Grant of Option; Conditions. Tenant shall have the right (the “Extension Option”) to extend the Term for the Premises (as then defined) for one (1) additional period of five (5) years beginning on the day immediately following the Expiration Date of the Lease and ending on the fifth anniversary of such expiration date (the “Extension Term”), if: |

| (a) | not less than 12 and not more than 15 full calendar months before the expiration date of the Lease, Tenant delivers written notice to Landlord (the “Extension Notice”) electing to exercise the Extension Option and stating Tenant’s estimate of the Prevailing Market (defined in Section 9.5 below) rate for the Extension Term; |

| (b) | no Default (as defined in the Lease) exists when Tenant delivers the Extension Notice; |

| (c) | no more than 33% of the Premises is sublet when Tenant delivers the Extension Notice; and |

| (d) | the Lease has not been assigned (other than pursuant to a Permitted Transfer, as defined in the Lease) before Tenant delivers the Extension Notice. |

| 9.2 | Terms Applicable to Extension Term. |

| A. | During the Extension Term, (a) the Base Rent rate per rentable square foot shall be equal to the Prevailing Market rate per rentable square foot; (b) Base Rent shall increase, if at all, in accordance with the increases assumed in the determination of Prevailing Market rate; and (c) Base Rent shall be payable in monthly installments in accordance with the terms and conditions of the Lease (as amended). |

| B. | During the Extension Term, Tenant shall pay Tenant’s Share of Expenses and Taxes for the Premises in accordance with the Lease (as amended). |

| 9.3 | Procedure for Determining Prevailing Market. |

| A. | Initial Procedure. Within 30 days after receiving the Extension Notice, Landlord shall give Tenant either (i) written notice (“Landlord’s Binding Notice”) accepting Tenant’s estimate of the Prevailing Market rate for the Extension Term stated in the Extension Notice, or (ii) written notice (“Landlord’s Rejection Notice”) rejecting such estimate and stating Landlord’s estimate of the Prevailing Market rate for the Extension Term. If Landlord gives Tenant a Landlord’s Rejection Notice, Tenant, within 15 days thereafter, shall give Landlord either (i) written notice (“Tenant’s Binding Notice”) accepting Landlord’s estimate of the Prevailing Market rate for the Extension Term stated in such Landlord’s Rejection Notice, or (ii) written notice (“Tenant’s Rejection Notice”) rejecting such estimate. If Tenant gives Landlord a Tenant’s Rejection Notice, Landlord and Tenant shall work together in good faith to agree in writing upon the Prevailing Market rate for the Extension Term. If, within 30 days after delivery of a Tenant’s Rejection Notice, the parties fail to agree in writing upon the Prevailing Market rate, the provisions of Section 9.3.B below shall apply. |

5

| B. | Dispute Resolution Procedure. |

| (1) | If, within 30 days after delivery of a Tenant’s Rejection Notice, the parties fail to agree in writing upon the Prevailing Market rate, Landlord and Tenant, within five (5) days thereafter, shall each simultaneously submit to the other, in a sealed envelope, its good faith estimate of the Prevailing Market rate for the Extension Term (collectively, the “Estimates”). Within seven (7) days after the exchange of Estimates, Landlord and Tenant shall each select a broker or agent (an “Agent”) to determine which of the two Estimates most closely reflects the Prevailing Market rate for the Extension Term. Each Agent so selected shall be licensed as a real estate broker or agent and in good standing with the California Department of Real Estate, and shall have had at least five (5) years’ experience within the previous 10 years as a commercial real estate broker or agent working in Redwood City, CA with working knowledge of current rental rates and leasing practices relating to buildings similar to the Building. |

| (2) | If each party selects an Agent in accordance with Section 9.3.B.1 above, the parties shall cause their respective Agents to work together in good faith to agree upon which of the two Estimates most closely reflects the Prevailing Market rate for the Extension Term. The Estimate, if any, so agreed upon by such Agents shall be final and binding on both parties as the Prevailing Market rate for the Extension Term and may be entered in a court of competent jurisdiction. If the Agents fail to reach such agreement within 20 days after their selection, then, within 10 days after the expiration of such 20-day period, the parties shall instruct the Agents to select a third Agent meeting the above criteria (and if the Agents fail to agree upon such third Agent within 10 days after being so instructed, either party may cause a court of competent jurisdiction to select such third Agent). Promptly upon selection of such third Agent, the parties shall instruct such Agent (or, if only one of the parties has selected an Agent within the 7-day period described above, then promptly after the expiration of such 7-day period the parties shall instruct such Agent) to determine, as soon as practicable but in any case within 14 days after his selection, which of the two Estimates most closely reflects the Prevailing Market rate. Such determination by such Agent (the “Final Agent”) shall be final and binding on both parties as the Prevailing Market rate for the Extension Term and may be entered in a court of competent jurisdiction. If the Final Agent believes that expert advice would materially assist him, he may retain one or more qualified persons to provide such expert advice. The parties shall share equally in the costs of the Final Agent and of any experts retained by the Final Agent. Any fees of any other broker, agent, counsel or expert engaged by Landlord or Tenant shall be borne by the party retaining such broker, agent, counsel or expert. |

| C. | Adjustment. If the Prevailing Market rate has not been determined by the commencement date of the Extension Term, Tenant shall pay Base Rent for the Extension Term upon the terms and conditions in effect during the last month ending on or before the expiration date of the Lease until such time as the Prevailing Market rate has been determined. Upon such determination, the Base Rent for the Extension Term shall be retroactively adjusted. If such adjustment results in an under- or overpayment of Base Rent by Tenant, Tenant shall pay Landlord the amount of such underpayment, or receive a credit in the amount of such overpayment, with or against the next Base Rent due under the Lease. |

| 9.4 | Extension Amendment. If Tenant is entitled to and properly exercises its Extension Option, and if the Prevailing Market rate for the Extension Term is determined in accordance with Section 9.3 above, Landlord, within a reasonable time thereafter, shall prepare and deliver to Tenant an amendment (the “Extension Amendment”) reflecting changes in the Base Rent, the Term, the expiration date of the Lease, and other appropriate terms in accordance with this Section 9, and Tenant shall execute and return (or provide Landlord with reasonable objections to) the Extension Amendment within 15 days after receiving it. Notwithstanding the foregoing, upon determination of the Prevailing Market rate for the Extension Term in accordance with Section 9.3 above, an otherwise valid exercise of the Extension Option shall be fully effective whether or not the Extension Amendment is executed. |

| 9.5 | Definition of Prevailing Market. For purposes of this Extension Option, “Prevailing Market” shall mean the arms-length, fair-market, annual rental rate per rentable square foot under extension and renewal leases and amendments entered into on or about the |

6

| date on which the Prevailing Market is being determined hereunder for space comparable to the Premises in the Building and office buildings comparable to the Building in the Redwood City, California area. The determination of Prevailing Market shall take into account (i) any material economic differences between the terms of the Lease and any comparison lease or amendment, such as rent abatements, construction costs and other concessions, and the manner, if any, in which the landlord under any such lease is reimbursed for operating expenses and taxes; (ii) any material differences in configuration or condition between the Premises and any comparison space, including any cost that would have to be incurred in order to make the configuration or condition of the comparison space similar to that of the Premises; and (iii) any reasonably anticipated changes in the Prevailing Market rate from the time such Prevailing Market rate is being determined and the time such Prevailing Market rate will become effective under the Lease. |

| 9.6 | Intentionally Omitted. |

| 10. | Miscellaneous. |

| 10.1 | This Amendment and the attached exhibits, which are hereby incorporated into and made a part of this Amendment, set forth the entire agreement between the parties with respect to the matters set forth herein. There have been no additional oral or written representations or agreements. Tenant shall not be entitled, in connection with entering into this Amendment, to any free rent, allowance, alteration, improvement or similar economic incentive to which Tenant may have been entitled in connection with entering into the Lease, except as may be otherwise expressly provided in this Amendment. |

| 10.2 | Except as herein modified or amended, the provisions, conditions and terms of the Lease shall remain unchanged and in full force and effect. |

| 10.3 | In the case of any inconsistency between the provisions of the Lease and this Amendment, the provisions of this Amendment shall govern and control. |

| 10.4 | Submission of this Amendment by Landlord is not an offer to enter into this Amendment but rather is a solicitation for such an offer by Tenant. Landlord shall not be bound by this Amendment until Landlord has executed and delivered it to Tenant. |

| 10.5 | Capitalized terms used but not defined in this Amendment shall have the meanings given in the Lease. |

| 10.6 | Tenant shall indemnify and hold Landlord, its trustees, members, principals, beneficiaries, partners, officers, directors, employees, mortgagee(s) and agents, and the respective principals and members of any such agents harmless from all claims of any brokers (other than Newmark Cornish & Xxxxx) claiming to have represented Tenant in connection with this Amendment. Landlord shall indemnify and hold Tenant, its trustees, members, principals, beneficiaries, partners, officers, directors, employees, and agents, and the respective principals and members of any such agents harmless from all claims of any brokers claiming to have represented Landlord in connection with this Amendment. Tenant acknowledges that any assistance rendered by any agent or employee of any affiliate of Landlord in connection with this Amendment has been made as an accommodation to Tenant solely in furtherance of consummating the transaction on behalf of Landlord, and not as agent for Tenant. |

[SIGNATURES ARE ON FOLLOWING PAGE]

7

IN WITNESS WHEREOF, Landlord and Tenant have duly executed this Amendment as of the day and year first above written.

| LANDLORD: | ||||||||||

| XXXXXX 333 TWIN DOLPHIN PLAZA, LLC, a Delaware limited liability company | ||||||||||

| By: | Xxxxxx Pacific Properties, L.P., a Maryland limited partnership, its sole member |

|||||||||

| By: | Xxxxxx Pacific Properties, Inc., a Maryland corporation its general partner | |||||||||

| By: | /s/ Xxxx X. Lammas | |||||||||

| Name: | Xxxx X. Lammas | |||||||||

| Title: | Chief Operating Officer, Chief Financial Officer and Treasurer | |||||||||

| TENANT: | ||

| COHERUS BIOSCIENCES, INC., a Delaware corporation | ||

| By: | /s/ Xxxxxx X. Xxxxxxx | |

| Name: | Xxxxxx X. Xxxxxxx | |

| Title: | Chief Executive Officer and President | |

8

EXHIBIT A

OUTLINE AND LOCATION OF EXPANSION SPACE

EXHIBIT B

EXPANSION WORK LETTER

As used in this Exhibit B (this “Expansion Work Letter”), the following terms shall have the following meanings:

| (i) | “Tenant Improvements” means all improvements to be constructed in the Expansion Space pursuant to this Expansion Work Letter; |

| (ii) | “Tenant Improvement Work” means the construction of the Tenant Improvements, together with any related work (including demolition) that is necessary to construct the Tenant Improvements; |

| (iii) | “law” means Law; and |

| (iv) | “Agreement” means the amendment of which this Expansion Work Letter is a part. |

| 1. | ALLOWANCE. |

| 1.1 | Allowance. Tenant shall be entitled to a one-time tenant improvement allowance (for purposes of this Exhibit B, the “Allowance”) in the amount of $192,135.00 to be applied toward (i) the Allowance Items (defined in Section 1.2 below) and/or (ii) at the written request of Tenant, towards Base Rent as the same becomes due hereunder (provided, however, that the amounts applied pursuant to this Section 1.1(ii) shall not exceed $62,764.10). Tenant shall be responsible for all costs associated with the Tenant Improvement Work, including the costs of the Allowance Items, to the extent such costs exceed the lesser of (a) the then available Allowance, or (b) the aggregate amount that Landlord is required to disburse for such purpose pursuant to this Expansion Work Letter. Notwithstanding any contrary provision of this Agreement, if Tenant fails to use the entire Allowance by October 31, 2017, the unused amount shall revert to Landlord and Tenant shall have no further rights with respect thereto. |

| 1.2 | Disbursement of Allowance. |

1.2.1 Allowance Items. Except as otherwise provided in this Expansion Work Letter, the Allowance shall be disbursed by Landlord only for the following items (for purposes of this Exhibit B, the “Allowance Items”): (a) the fees of Tenant’s architect and engineers, if any, and any Review Fees (defined in Section 2.3 below); (b) [Intentionally Omitted]; (c) plan-check, permit and license fees relating to performance of the Tenant Improvement Work; (d) the cost of performing the Tenant Improvement Work, including after hours charges, testing and inspection costs, freight elevator usage, hoisting and trash removal costs, and contractors’ fees and general conditions (and expressly including, without limitation, all costs associated with wiring, electronic security, core drilling, window shade installation and kitchen casework); (e) the cost of any change to the base, shell or core of the Expansion Space or Building required by Tenant’s plans and specifications (for purposes of this Exhibit B, the “Plans”) (including if such change is due to the fact that such work is prepared on an unoccupied basis), including all direct architectural and/or engineering fees and expenses incurred in connection therewith; (f) the cost of any change to the Plans or the Tenant Improvement Work required by law; (g) the Coordination Fee (defined in Section 2.3 below); (h) sales and use taxes; and (i) all other costs expended by Landlord in connection with the performance of the Tenant Improvement Work.

1.2.2 Disbursement. Subject to the terms hereof, Landlord shall make monthly disbursements of the Allowance for Allowance Items as follows:

1.2.2.1 Monthly Disbursements. Not more frequently than once per calendar month, Tenant may deliver to Landlord: (i) a request for payment of Tenant’s contractor, approved by Tenant, in AIA G-702/G-703 format or another format reasonably requested by Landlord, showing the schedule of values, by trade, of percentage of completion of the Tenant Improvement Work, detailing the portion of the work completed and the portion not completed (which approved request shall be deemed Tenant’s approval and acceptance of the work and materials described therein); (ii) copies of all third-party contracts (including change orders) pursuant to which Allowance Items have been incurred (collectively, for purposes of this Exhibit B, the “Tenant Improvement Contracts”); (iii) copies of invoices for all labor and materials provided to the Expansion Space and covered by such request for payment; (iv) executed conditional mechanic’s lien releases from all parties who have provided such labor or materials to the Expansion Space (along with executed unconditional mechanic’s lien releases for any prior payments made pursuant to this paragraph) satisfying California Civil Code §§ 8132 and/or 8134, as applicable; and (v) all other information reasonably requested by Landlord. Subject to the terms hereof, within 30 days after receiving such materials, Landlord shall deliver a check to Tenant, payable jointly to Tenant and its contractor, in the amount of the lesser of (a) Landlord’s Share (defined below) of the amount requested by Tenant pursuant to the preceding sentence, less a 10% retention (the aggregate

amount of such retentions shall be referred to in this Expansion Work Letter as the “Final Retention”), or (b) the amount of any remaining portion of the Allowance (not including the Final Retention). Landlord’s payment of such amounts shall not be deemed Landlord’s approval or acceptance of the work or materials described in Tenant’s payment request. As used in this Section 1.2.2.1, “Landlord’s Share” means the lesser of (i) 100%, or (ii) the percentage obtained by dividing the Allowance by the estimated sum of all Allowance Items, as determined based on the Tenant Improvement Contracts.

1.2.2.2 Final Retention. Subject to the terms hereof, Landlord shall deliver to Tenant a check for the Final Retention, together with any other undisbursed portion of the Allowance required to pay for the Allowance Items, within 30 days after the latest of (a) the completion of the Tenant Improvement Work in accordance with the approved plans and specifications; (b) Landlord’s receipt of (i) copies of all Tenant Improvement Contracts; (ii) copies of invoices for all labor and materials provided to the Expansion Space; (iii) executed unconditional mechanic’s lien releases satisfying California Civil Code § 8134 for all prior payments made pursuant to Section 1.2.2.1 above (to the extent not previously provided to Landlord), together with executed unconditional final mechanic’s lien releases satisfying California Civil Code § 8138 for all labor and materials provided to the Expansion Space subject to the Final Retention; (iv) a certificate from Tenant’s architect, in a form reasonably acceptable to Landlord, certifying that the Tenant Improvement Work has been substantially completed; (v) evidence that all governmental approvals required for Tenant to legally occupy the Expansion Space have been obtained; and (vi) any other information reasonably requested by Landlord; (c) Tenant’s delivery to Landlord of “as built” drawings (in CAD format, if requested by Landlord); or (d) Tenant’s compliance with Landlord’s standard “close-out” requirements regarding city approvals, closeout tasks, Tenant’s contractor, financial close-out matters, and Tenant’s vendors. Landlord’s payment of the Final Retention shall not be deemed Landlord’s approval or acceptance of the work or materials described in Tenant’s payment requests.

| 2. | MISCELLANEOUS. |

2.1 Applicable Lease Provisions. Without limitation, the Tenant Improvement Work shall be subject to Sections 7.2, 7.3 and 8 of this Agreement.

2.2 Plans and Specifications. Landlord shall provide Tenant with notice approving or disapproving any proposed plans and specifications for the Tenant Improvement Work within the Required Period (defined below) after the later of Landlord’s receipt thereof from Tenant or the mutual execution and delivery of this Agreement. As used herein, “Required Period” means (a) 15 business days in the case of construction drawings, and (b) 10 business days in the case of any other plans and specifications (including a space plan). Any such notice of disapproval shall describe with reasonable specificity the basis for Landlord’s disapproval and the changes that would be necessary to resolve Landlord’s objections.

2.3 Review Fees; Coordination Fee. Tenant shall reimburse Landlord, upon demand, for any fees reasonably incurred by Landlord for review of the Plans by Landlord’s third party consultants (for purposes of this Exhibit B, the “Review Fees”). In consideration of Landlord’s coordination of the Tenant Improvement Work, Tenant shall pay Landlord a fee (for purposes of this Exhibit B, the “Coordination Fee”) in an amount equal to 2.00% of the cost of the Tenant Improvement Work (other than the Coordination Fee).

2.4 Tenant Default. Notwithstanding any contrary provision of this Agreement, if Tenant defaults under this Agreement before the Tenant Improvement Work is completed, then (a) Landlord’s obligations under this Expansion Work Letter shall be excused, and Landlord may cause Tenant’s contractor to cease performance of the Tenant Improvement Work, until such default is cured, and (b) Tenant shall be responsible for any resulting delay in the completion of the Tenant Improvement Work.

2.5 Other. This Expansion Work Letter shall not apply to any space other than the Expansion Space.

EXHIBIT C

OUTLINE AND LOCATION OF POTENTIAL OFFERING SPACE

EXHIBIT C

OUTLINE AND LOCATION OF POTENTIAL OFFERING SPACE