RESTRICTED STOCK AWARD AGREEMENT MARKET-BASED VESTING

Exhibit 10.2.13

RESTRICTED STOCK AWARD AGREEMENT

MARKET-BASED VESTING

2014 LONG-TERM INCENTIVE PLAN

1.Grant of Award. Pursuant to the Paycom Software, Inc. 2014 Long-Term Incentive Plan (the “Plan”) for Employees, Contractors, and Outside Directors of Paycom Software, Inc., a Delaware corporation (the “Company”), the Company grants to

%%FIRST_NAME%% %%MIDDLE_NAME%% %%LAST_NAME%%

(the “Participant”)

an Award of Restricted Stock in accordance with Section 6.4 of the Plan. The number of shares of Common Stock awarded under this Restricted Stock Award Agreement – Market-Based Vesting (this “Agreement”) is %%TOTAL_SHARES_GRANTED,’999,999,999’%-% shares (the “Awarded Shares”). The “Date of Grant” of this Award is %%OPTION_DATE,’MONTH DD, YYYY’%-%.

2.Subject to Plan; Purpose; Definitions.

a.This Agreement is subject to the terms and conditions of the Plan, and the terms of the Plan shall control to the extent not otherwise inconsistent with the provisions of this Agreement. To the extent the terms of the Plan are inconsistent with the provisions of the Agreement, this Agreement shall control. This Agreement is subject to any rules promulgated pursuant to the Plan by the Board or the Committee and communicated to the Participant in writing.

b.The Awarded Shares provided for in this Agreement are intended to: (i) provide the Participant with a long-term stake in the Company; (ii) provide the Participant with an incentive to contribute to the Company’s overall performance; and (iii) develop and maintain stockholders of the Company whose interests are aligned with the Company’s interests. The Participant acknowledges that the Company is distinct from its Subsidiaries and that the Participant’s employer is not the Company, but a Subsidiary of the Company. The Participant further acknowledges and agrees that (x) the Awarded Shares provided for herein are entirely supplemental to, and independent of, any wage or other compensation provided to the Participant by any of the Subsidiaries in consideration of the Participant’s services, and this Award is expressly contingent upon each of the terms, conditions and requirements provided for herein, and (y) the Company would not have granted this Award to the Participant, but for the Participant’s agreement to be bound by the terms, conditions and requirements provided for herein, including, without limitation, the provisions set forth in Section 4 of this Agreement.

c.The capitalized terms used herein that are defined in the Plan shall have the same meanings assigned to them in the Plan; provided, that the following terms shall have the meanings set forth below:

i.“Appraised Value” means the value ascribed to a share of the subject Equity Securities as set forth in the most recent written appraisal previously issued by an independent Person selected by the audit committee of the Company nationally recognized as having experience in providing investment banking or similar appraisal or valuation services and with expertise generally in the valuation of securities; provided, that it being

understood that neither the Board nor the audit committee shall have any obligation to obtain any such appraisal more than once per calendar year.

ii. “Clawback” shall have the meaning set forth in Section 4(b).

iii.“Clawback Period” shall mean the period beginning on the Date of Grant and ending on the sixtieth (60th) day following the three (3) year anniversary of the date of the Participant’s Termination of Service.

iv.“Confidential Information” means trade secrets, confidential or proprietary information, and all other information, documents or materials owned, developed or possessed by Paycom that are not generally known to the public or within the industry of Paycom. Confidential Information includes, but is not limited to, Paycom’s customer names and Paycom’s customer contact person names; Paycom’s customers’ nonpublic personal information; Paycom’s pricing information, pricing promotions, and pricing strategies; Paycom’s customer pricing; Paycom’s lead lists; Paycom’s prospective customer information, including prospective customer contact information, prospective customer pricing, prospective customer preferences, prospective customer feedback, and prospective customer timing needs; Paycom’s customers’ employee information, including Paycom’s customers’ employee salary information and Paycom’s customers’ employees’ personally identifiable information; information concerning Paycom’s employee salary information, compensation information, commission policies, bonus policies, benefits policies (but specifically excluding the Participant’s own individual salary, benefits, bonus and compensation information); Paycom employees’ personally identifiable information; Paycom’s employees’ performance information, whether aggregated or individualized; information pertaining to Paycom customer complaints, whether aggregated or individualized; information pertaining to any Paycom customer’s requests for additional functionality, whether aggregated or individualized; information pertaining to any Paycom customer’s use of a specific payroll processing system or provider; Paycom’s marketing promotions and strategies; Paycom’s sales promotions and strategies; Paycom’s reputation management activities and strategies; Paycom’s competitive advantage analyses; Paycom’s competitive disadvantage analyses; Paycom’s product development information, including specifications, design and pricing structure; Paycom’s nonpublic financial information; Paycom’s licensee relationships; Paycom’s proprietary technology and proprietary file formats, including its application program interface (API), database structure, file formats, converter files and information security protocols; Paycom’s referral source relationships, including brokers, accountants and other referral source relationships; Paycom’s business processes; and/or any and all material nonpublic information with respect to any aspect of Paycom’s business. Confidential Information shall not include any information that is or becomes generally publicly available (other than as a result of violation of this Agreement by the Participant).

v.“Demotion” means (a) a material decrease in the compensation (exclusive of commissions and bonuses) of the Participant, provided that, a decrease in compensation that is uniformly applied to Employees, Contractors or Outside Directors who are similarly situated to the Participant (as determined by the Company in its sole discretion) shall not constitute a Demotion; (b) a diminution of the Participant’s position to a lower position within Paycom; or (c) a material diminution of the Participant’s authority, duties or responsibilities, with notice to the Participant that, based on the Participant’s performance, the Participant will have materially less authority or be responsible for materially lesser duties or responsibilities, in each case as determined by the Company, in its sole discretion.

vi. “Equity Securities” means, as applicable, (a) any capital stock or other share capital, (b) any securities (other than debt securities) directly or indirectly convertible into or exchangeable for any capital stock, membership interests or other share capital or containing any profit participation features, (c) any rights or options directly or indirectly to subscribe for or to purchase any capital stock, other share capital or securities containing any profit participation features or to subscribe for or to purchase any securities (other than debt securities) directly or indirectly convertible into or exchangeable for any capital stock, other share capital or securities (other than debt securities) containing any profit participation features, (d) any share appreciation rights, phantom share rights or other similar rights, or (e) any Equity Securities as defined in clauses (a) through (d) above issued or issuable with respect to the securities referred to in clauses (a) through (d) above in connection with a combination of shares, recapitalization, merger, consolidation or other reorganization.

vii.“Equity Securities Value Per Share” means, for any class or series of Equity Securities of the Company, for any date, the price determined by the first of the following clauses that applies: (a) if such Equity Securities are then listed or quoted on a Trading Market, the arithmetic average of the VWAP of a share of such Equity Securities on each of the twenty (20) consecutive Trading Days immediately preceding such date; (b) if the Equity Securities are not then listed or quoted for trading on a Trading Market and if prices for such Equity Securities are then reported on the OTC Bulletin Board (or a similar organization or agency succeeding to its functions of reporting prices), the arithmetic average of the closing bid price per share of such Equity Securities so reported on each of the twenty (20) consecutive Trading Days immediately preceding such date; or (c) in all other cases, the Appraised Value of a share of such Equity Securities.

viii.“First Stock Price Threshold” means $520.00.

ix. “Forfeiture Activities” shall have the meaning set forth in Section 4(e).

x. “Material Contact” means, with respect to any Paycom customer or prospective Paycom customer, the Participant, during the term of the Participant’s service with Paycom: (a) directly interacted with such customer or prospective customer; (b) supervised an Employee who interacted with such customer or prospective customer; or (c) obtained or received nonpublic information from Paycom specifically related to such customer or prospective customer, including, without limitation, as a result of the Participant’s attendance at or access to meetings or discussions in which said customer or prospective customer was specifically discussed.

xi. “Paycom” means the Company and its Subsidiaries collectively.

xii.“Relevant Paycom Customer” means any Paycom customer that maintains an office located within the Territory and with which the Participant had Material Contact.

xiii.“Relevant Paycom Employee” means an Employee (a) with whom the Participant directly interacted during the time that the Participant was employed by (or if the Participant is a Contractor or an Outside Director, was providing services to) Paycom; (b) whom the Participant directly supervised or who reported directly to the Participant or the Participant’s direct reports; or (c) about whom the Participant obtained or received

nonpublic information from Paycom specifically related to such Employee’s performance or employment.

xiv.“Relevant Prospective Customer” means any Paycom prospective customer that maintains an office located within the Territory and with which the Participant had Material Contact.

xv.“Second Stock Price Threshold” means $600.00.

xvi. “Territory” shall mean a geographic area or areas located within any of the following territorial areas: (i) a one hundred (100) mile radius or radii of any office location(s) in which the Participant worked during the Participant’s tenure with Paycom; and (ii) if applicable, a fifty (50) mile radius or radii of any sales territory(ies) boundary(ies) assigned to the Participant during the Participant’s tenure with Paycom. Notwithstanding the foregoing, Territory shall be limited to only include areas located within the United States of America.

xvii.“Trading Day” means each Monday, Tuesday, Wednesday, Thursday and Friday, other than any day on which securities are not traded on the applicable Trading Market or in the applicable securities market.

xviii.“Trading Market” means the primary securities exchange on which the Common Stock is listed or quoted for trading on the date in question.

xix.“VWAP” means the daily volume weighted average price of a share of the Common Stock for such date on the Trading Market on which the Common Stock is then listed or quoted for trading as reported by Bloomberg L.P. (or successor thereto) using its “Volume at Price” function (based on a Trading Day from 9:30 a.m. (New York City time) to 4:00 p.m. (New York City time)).

xx.“VWAP Value” means, as of any date, the arithmetic average of the VWAP on each of the twenty (20) consecutive Trading Days immediately preceding such date.

3.Vesting. Except as specifically provided in this Agreement and subject to certain restrictions and conditions set forth in the Plan, the Awarded Shares shall vest as set forth below. Any Awarded Shares that become vested in accordance with this Section 3 shall be referred to as “Vested Shares” and any Awarded Shares that, at the particular time of determination, have not become vested in accordance with this Section 3 shall be referred to as “Non-Vested Shares.” The Awarded Shares shall vest as follows:

a.One-half (1/2) of the Awarded Shares shall vest on the first date, if any, that the VWAP Value equals or exceeds the First Stock Price Threshold, provided that (A) the Participant is employed by (or if the Participant is a Contractor or an Outside Director, is providing services to) the Company or a Subsidiary on that date and (B) such date occurs on or before the eighth (8th) anniversary of the Date of Grant; and

b.One-half (1/2) of the Awarded Shares shall vest on the first date, if any, that the VWAP Value equals or exceeds the Second Stock Price Threshold, provided that (A) the Participant is employed by (or if the Participant is a Contractor or an Outside Director, is providing

services to) the Company or a Subsidiary on that date and (B) such date occurs on or before the eighth (8th) anniversary of the Date of Grant;

Notwithstanding the foregoing, all Awarded Shares not previously vested shall immediately become vested in full upon a Termination of Service as a result of the Participant’s death or Total and Permanent Disability. In addition, in the event that (i) a Change in Control occurs, and (ii) this Agreement is not assumed by the surviving corporation or its parent, or the surviving corporation or its parent does not substitute its own restricted shares, then immediately prior to the effective date of such Change in Control, all Awarded Shares not previously vested shall thereupon immediately become fully vested.

4.Forfeiture of Awarded Shares. Notwithstanding anything herein to the contrary, Awarded Shares shall be forfeited and shall cease to be outstanding as set forth below:

a.Awarded Shares that are not vested in accordance with Section 3 shall be forfeited on the earlier of (i) the eighth (8th) anniversary of the Date of Grant with respect to all Awarded Shares; (ii) the date of the Participant’s Termination of Service with respect to all Awarded Shares; or (iii) the date of the Participant’s Demotion with respect to all Awarded Shares. Upon forfeiture, all of the Participant’s rights with respect to the forfeited Awarded Shares shall cease and terminate, without any further obligations on the part of the Company.

b.The Participant acknowledges that: (i) Paycom continually develops Confidential Information, and that the Participant has had and will continue to have access to Confidential Information which, if disclosed, would unfairly and inappropriately assist in competition against the Company or any of its Subsidiaries, (ii) the Participant has generated and will continue to generate goodwill for Paycom in the course of the Participant’s service; and (iii) the Company has an interest in maintaining stockholders whose interests are aligned with Paycom’s interests. Accordingly, if at any time during the Clawback Period, the Company determines that the Participant has engaged in Forfeiture Activities, all Awarded Shares (whether or not vested and whether then held by the Participant or any other Person) shall be subject to the following provisions (collectively, the “Clawback”):

1. If the Participant has engaged in Forfeiture Activities and has not transferred any of the Awarded Shares, then the Participant shall forfeit all of the Awarded Shares;

2.If the Participant has engaged in Forfeiture Activities and has transferred all of the Awarded Shares, then the Participant shall pay to the Company an amount equal to the gross proceeds received in respect of such transferred Awarded Shares; or

3.If the Participant has engaged in Forfeiture Activities and has transferred some, but not all, of the Vested Shares, then the Participant shall (x) forfeit all of the non-transferred Vested Shares, (y) pay to the Company an amount equal to the gross proceeds received in respect of any transferred Vested Shares, and (z) forfeit all Non-Vested Shares.

The Clawback set forth in this Section 4(b) shall survive the Participant’s Termination of Service and the termination of this Agreement.

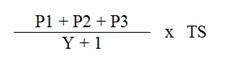

c.In the event the Company is unable to conclusively establish the amount of the gross proceeds received by the Participant in respect of the Participant’s transferred Vested Shares, then such amount shall be deemed to be an amount calculated based on the following formula:

where

|

|

P1 |

= the Equity Securities Value Per Share as of the last Trading Day of the calendar year in which the Date of Grant occurred; |

|

|

P2 |

=the sum of the Equity Securities Value Per Share as of the last Trading Day of each calendar year that has elapsed following the year in which the Date of Grant occurred but prior to the date that the Company delivers written notice to the Participant of its intent to enforce the Clawback; |

|

|

P3 |

=the Equity Securities Value Per Share as of the Trading Day immediately prior to the date that the Company delivers written notice to the Participant of its intent to enforce the Clawback; |

|

|

Y |

=the number of calendar-year-ends that have occurred between the Date of Grant and the date that the Company delivers written notice to the Participant of its intent to enforce the Clawback; and |

|

|

TS |

=the number of transferred Vested Shares. |

d.The Company shall deliver prompt written notice to the Participant of the Company’s intent to enforce the Clawback. Upon forfeiture, all of the Participant’s rights with respect to the forfeited Awarded Shares shall cease and terminate, without any further obligations on the part of the Company. The Company shall not initiate enforcement of its right of Clawback beyond the Clawback Period; provided, however, the Company may continue its enforcement of any right of Clawback beyond the Clawback Period.

e.The Participant shall have engaged in “Forfeiture Activities” if the Participant, subject to the restrictions of any applicable law (including the right to engage in conduct protected by Section 7 of the National Labor Relations Act): (i) during the term of the Participant’s service with Paycom or during the two (2) year period following a Termination of Service (A) directly or indirectly hires or solicits any Relevant Paycom Employee to leave the employ of Paycom; (B) directly or indirectly solicits or encourages any Relevant Paycom Customer to cease doing business with, or materially alter its business relationship with Paycom; (C) directly or indirectly solicits or encourages any Relevant Prospective Customer to cease doing business with, or materially alter its business relationship with Paycom; (D) directly or indirectly solicits or encourages any Relevant Paycom Customer to purchase the same or similar goods or services, or a combination thereof, as those offered by Paycom from an entity or Person other than Paycom; or (E) directly or indirectly solicits or encourages any Relevant Prospective Customer to purchase the same or similar goods or services, or a combination thereof, as those offered by Paycom from an entity or Person other than Paycom (ii) during the term of the Participant’s service with Paycom or during the two (2) year period following a Termination of Service, makes or solicits or encourages others to make or solicit directly or indirectly any derogatory, negative, unflattering, critical, insulting, offensive, deprecating, belittling, harmful, undesirable or intentionally misleading statement or communication, including statements or communications made on social media, in a text or similar message, in an e-mail or in any other form whatsoever, about the Company, its Subsidiaries or any of their respective officers, directors, employees, businesses, products, services or activities; or (iii) during the term of the Participant’s service with Paycom or during the three (3) year period following a Termination of Service, discloses to any Person or entity or uses, other than as required by applicable law or for the proper performance of his or her duties and responsibilities to Paycom, any Confidential Information obtained by or known to the Participant. The determination of

whether the Participant has engaged in Forfeiture Activities will be made by Paycom in its sole and absolute discretion. The restrictions set forth in this Section 4(e) shall survive the Participant’s Termination of Service and the termination of this Agreement.

f.Notwithstanding Section 4(e), the Participant shall not have engaged in Forfeiture Activities by providing truthful testimony or information compelled by valid legal process, or by reporting possible violations of applicable law or making other disclosures that are protected under the whistleblower provisions of applicable law, to the Securities and Exchange Commission, the Equal Employment Opportunity Commission, the National Labor Relations Board, the Occupational Safety and Health Commission or any similar state agency. Further, the Participant shall not have engaged in Forfeiture Activities and will not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that: (i) is made (A) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney; and (B) solely for the purpose of reporting or investigating a suspected violation of law; or (ii) is made in a complaint or other document that is filed under seal in a lawsuit or other proceeding. If the Participant files a lawsuit for retaliation against the Company or any of its Subsidiaries for reporting a suspected violation of law, the Participant shall not have engaged in Forfeiture Activities and may disclose the Company and its Subsidiaries’ trade secrets to the Participant’s attorney and use the trade secret information in the court proceeding if the Participant: (x) files any document containing the trade secret under seal; and (y) does not disclose the trade secret, except pursuant to court order.

5.Restrictions on Awarded Shares. The Participant shall not be permitted to sell, transfer, offer, pledge, hypothecate, loan, margin, assign, gift or otherwise encumber or dispose of, either voluntarily or involuntarily, or to enter into any contract, option, right, warrant or other arrangement or understanding with respect to the foregoing any of the Non-Vested Shares until such shares become Vested Shares in accordance with Section 3. The Committee may in its sole discretion, remove any or all of such restrictions (or any other restrictions contained herein) on any Awarded Shares whenever it may determine that, by reason of changes in applicable law or changes in circumstances after the date of this Agreement, such action is appropriate.

6.Legend. The following legend shall be placed on all certificates issued representing Awarded Shares:

On the face of the certificate:

“Transfer of this stock is restricted in accordance with conditions printed on the reverse of this certificate.”

On the reverse:

“The shares of stock evidenced by this certificate are subject to and transferable only in accordance with that certain Paycom Software, Inc. 2014 Long-Term Incentive Plan and that certain restricted stock award agreement, by and between the company and the participant, DATED AS OF %%OPTION_DATE,’MONTH DD, YYYY’%-%, copies of

which are on file at the principal office of the Company in Oklahoma City, Oklahoma. No transfer or pledge of the shares evidenced hereby may be made except in accordance with and subject to the provisions of said Plan. By acceptance of this certificate, any holder, transferee or pledgee hereof agrees to be bound by all of the provisions of said Plan.”

The following legend shall be inserted on a certificate evidencing Common Stock issued under the Plan if the shares were not issued in a transaction registered under the applicable federal and state securities laws:

“Shares of stock represented by this certificate have been acquired by the holder for investment and not for resale, transfer or distribution, have been issued pursuant to exemptions from the registration requirements of applicable state and federal securities laws, and may not be offered for sale, sold or transferred other than pursuant to effective registration under such laws, or in transactions otherwise in compliance with such laws, and upon evidence satisfactory to the Company of compliance with such laws, as to which the Company may rely upon an opinion of counsel satisfactory to the Company.”

All Awarded Shares owned by the Participant shall be subject to the terms of this Agreement and shall be represented by a certificate or certificates bearing the foregoing legend.

7.Delivery of Certificates; Registration of Shares. The Company shall deliver certificates for Awarded Shares to the Participant or shall register such Awarded Shares in the Participant’s name, free of restriction under this Agreement, promptly after, and only after, such Awarded Shares have become Vested Shares in accordance with Section 3. In connection with any issuance of a certificate for Restricted Stock, the Participant shall endorse such certificate in blank or execute a stock power in a form satisfactory to the Company in blank and deliver such certificate and executed stock power to the Company.

8.Rights of a Stockholder. Except as provided in Section 4 and Section 5 above, the Participant shall have, with respect to his Awarded Shares, all of the rights of a stockholder of the Company, including the right to vote the shares, and the right to receive any dividends thereon, subject to the provisions of this Section 8. Any stock dividends paid with respect to Awarded Shares shall at all times be treated as Awarded Shares and shall be subject to all restrictions placed on such Awarded Shares; any such stock dividends paid with respect to such Awarded Shares shall vest as the related Awarded Shares become vested. Any cash dividends paid with respect to Non-Vested Shares shall at all times be subject to the provisions of this Agreement (including the vesting and forfeiture provisions set forth above); any such cash dividends paid with respect to such Non-Vested Shares shall vest as such shares become Vested Shares, and shall be paid to the Participant on the date the Non-Vested Shares to which such cash dividends relate become Vested Shares.

9.Voting. The Participant, as record holder of the Awarded Shares, has the exclusive right to vote, or consent with respect to, such Awarded Shares until such time as the Awarded Shares are transferred in accordance with this Agreement; provided that this Section 9 shall not create any voting right where the holders of such Awarded Shares otherwise have no such right.

10.Adjustment to Number of Awarded Shares. The number of Awarded Shares shall be subject to adjustment in accordance with Articles 11-13 of the Plan.

11.Adjustment to the Stock Price Thresholds. In the event that any dividend or other distribution (whether in the form of cash, shares of Common Stock, other securities, or other property), recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, or exchange of Common Stock or other securities of the Company, or other change in the corporate structure of the Company affecting the Common Stock occurs or similar transaction, the Committee, in order to prevent diminution or enlargement of the benefits or potential benefits intended to be made available under the Agreement (and in manner that will not provide the Participant with any greater benefit or potential benefits than intended to be made available under the Agreement), shall appropriately adjust the First Stock Price Threshold and the Second Stock Price Threshold.

12.Specific Performance. The parties acknowledge that remedies at law will be inadequate remedies for breach of this Agreement and consequently agree that this Agreement shall be enforceable by specific performance. The remedy of specific performance shall be cumulative of all of the rights and remedies at law or in equity of the parties under this Agreement.

13.Participant’s Representations. Notwithstanding any of the provisions hereof, the Participant hereby agrees that he or she will not acquire any Awarded Shares, and that the Company will not be obligated to issue any Awarded Shares to the Participant hereunder, if the issuance of such shares shall constitute a violation by the Participant or the Company of any provision of any law or regulation of any governmental authority. Any such determination by the Company shall be final, binding, and conclusive. The rights and obligations of the Company and the rights and obligations of the Participant are subject to all applicable laws.

14.Investment Representation. Unless the Awarded Shares are issued in a transaction registered under applicable federal and state securities laws, by his or her execution hereof, the Participant represents and warrants to the Company that all Common Stock which may be purchased and or received hereunder will be acquired by the Participant for investment purposes for his or her own account and not with any intent for resale or distribution in violation of federal or state securities laws. Unless the Common Stock is issued to him or her in a transaction registered under the applicable federal and state securities laws, all certificates issued with respect to the Common Stock shall bear an appropriate restrictive investment legend and shall be held indefinitely, unless they are subsequently registered under the applicable federal and state securities laws or the Participant obtains an opinion of counsel, in form and substance satisfactory to the Company and its counsel, that such registration is not required.

15.Participant’s Acknowledgments. The Participant acknowledges that a copy of the Plan has been made available for his review by the Company, and represents that he is familiar with the terms and provisions thereof, and hereby accepts this Award subject to all the terms and provisions thereof. The Participant hereby agrees to accept as binding, conclusive, and final all decisions or interpretations of the Committee or the Board, as appropriate, upon any questions arising under the Plan or this Agreement.

16.Law Governing. This Agreement shall be governed by, construed, and enforced in accordance with the laws of the State of Delaware (excluding any conflict of laws rule or principle of Delaware law that might refer the governance, construction, or interpretation of this agreement to the laws of another state).

17.No Right to Continue Service or Employment. Nothing herein shall be construed to confer upon the Participant the right to continue in the employ or to provide services to the Company or any Subsidiary, whether as an Employee or as a Contractor or as an Outside Director, or interfere with or restrict in any way the right of the Company or any Subsidiary to discharge the Participant as an Employee, Contractor, or Outside Director at any time.

18.Legal Construction. In the event that any one or more of the terms, provisions, or agreements that are contained in this Agreement shall be held by a court of competent jurisdiction to be invalid, illegal, or unenforceable in any respect for any reason, the invalid, illegal, or unenforceable term, provision, or agreement shall not affect any other term, provision, or agreement that is contained in this Agreement and this Agreement shall be construed in all respects as if the invalid, illegal, or unenforceable term, provision, or agreement had never been contained herein.

19.Covenants and Agreements as Independent Agreements. Each of the covenants and agreements that are set forth in this Agreement shall be construed as a covenant and agreement independent of any other provision of this Agreement. The existence of any claim or cause of action of the Participant against Paycom, whether predicated on this Agreement or otherwise, shall not constitute a defense to the enforcement by the Company of the covenants and agreements that are set forth in this Agreement.

20.Entire Agreement. This Agreement together with the Plan supersede any and all other prior understandings and agreements, either oral or in writing, between the parties with respect to the subject matter hereof and constitute the sole and only agreements between the parties with respect to the said subject matter. All prior negotiations and agreements between the parties with respect to the subject matter hereof are merged into this Agreement. Each party to this Agreement acknowledges that no representations, inducements, promises, or agreements, orally or otherwise, have been made by any party or by anyone acting on behalf of any party, which are not embodied in this Agreement or the Plan and that any agreement, statement or promise that is not contained in this Agreement or the Plan shall not be valid or binding or of any force or effect.

21.Parties Bound. The terms, provisions, and agreements that are contained in this Agreement shall apply to, be binding upon, and inure to the benefit of the parties and their respective heirs, executors, administrators, legal representatives, and permitted successors and assigns, subject to the limitation on assignment expressly set forth herein. No Person shall be permitted to acquire any Awarded Shares without first executing and delivering an agreement in the form satisfactory to the Company making such Person or entity subject to the restrictions on transfer contained herein.

22.Modification. No change or modification of this Agreement shall be valid or binding upon the parties unless the change or modification is in writing and signed by the parties. Notwithstanding the preceding sentence, the Company may amend the Plan to the extent permitted by the Plan.

23.Headings. The headings that are used in this Agreement are used for reference and convenience purposes only and do not constitute substantive matters to be considered in construing the terms and provisions of this Agreement.

24.Gender and Number. Words of any gender used in this Agreement shall be held and construed to include any other gender, and words in the singular number shall be held to include the plural, and vice versa, unless the context requires otherwise.

25.Notice. Any notice required or permitted to be delivered hereunder shall be in writing and shall be deemed to have been given (a) when delivered by hand (with written confirmation of receipt); (b) when received by the addressee if sent by a nationally recognized overnight courier (receipt requested); or (c) on the third (3rd) day after the date mailed, by certified or registered mail (in each case, return receipt requested, postage pre-paid). Notices must be sent to the respective parties at the following addresses (or at such other addresses as they have theretofore specified by written notice delivered in accordance herewith:

Notice to the Company shall be addressed and delivered as follows:

0000 X. Xxxxxxxx Xx.

Oklahoma City, OK 73142

Attn: Chief Financial Officer

Notice to the Participant shall be addressed and delivered as set forth on the signature page.

26.Tax Requirements. The Participant is hereby advised to consult immediately with his or her own tax advisor regarding the tax consequences of this Agreement, the method and timing for filing an election to include this Agreement in income under Section 83(b) of the Code, and the tax consequences of such election. By execution of this Agreement, the Participant agrees that if the Participant makes such an election, the Participant shall provide the Company with written notice of such election in accordance with the regulations promulgated under Section 83(b) of the Code. The Company or, if applicable, any Subsidiary (for purposes of this Section 26, the term “Company” shall be deemed to include any applicable Subsidiary), shall have the right to deduct from all amounts paid in cash or other form in connection with the Plan, any Federal, state, local, or other taxes required by law to be withheld in connection with this Award. The Participant receiving shares of Common Stock issued under the Plan shall pay to the Company, in accordance with the provisions of this Section 25, the amount of any taxes that the Company is required to withhold in connection with the Participant’s income arising with respect to this Award. Such payment must be made prior to the delivery of any certificate representing shares of Common Stock, as follows: (i) if the Participant is a Reporting Participant and/or is subject to the Company’s “Xxxxxxx Xxxxxxx Policy” at the time of vesting of Awarded Shares, then the tax withholding obligation must be satisfied by the Company’s withholding of a number of shares to be delivered upon the vesting of such Awarded Shares, which shares so withheld have an aggregate Fair Market Value that equals (but does not exceed) the required tax withholding payment (the “Net Settlement of Shares”), provided that, the Committee (excluding the Participant if the Participant is a member of the Committee) may, in its sole discretion, instead require the satisfaction of the tax withholding obligation in accordance with (ii)(A), (ii)(B) or (ii)(D) below; or (ii) if the Participant is neither a Reporting Participant nor subject to the Company’s “Xxxxxxx Xxxxxxx Policy” at the time of vesting of Awarded Shares, then such payment may be made (A) by the delivery of cash to the Company in an amount that equals or exceeds (to avoid the issuance of fractional shares) the required tax withholding obligations of the Company; (B) if the Company, in its sole discretion, so consents in writing, the actual delivery by the Participant to the Company of shares of Common Stock, other than Restricted Stock or Common Stock that the Participant has acquired from the Company within six (6) months prior thereto, which shares so delivered have an aggregate Fair Market Value that equals or exceeds (to avoid the issuance of fractional shares) the required tax withholding payment; (C) if the Company, in its sole discretion, so consents in writing, by the Net Settlement of Shares;

or (D) any combination of (A), (B), or (C). The Company may, in its sole discretion, withhold any such taxes from any other cash remuneration otherwise paid by the Company to the Participant.

* * * * * * * * * *

[Remainder of Page Intentionally Left Blank.

Signature Page Follows]

%%EMPLOYEE_IDENTIFIER%-% %%OPTION_DATE,’MONTH DD, YYYY’%-%

Each party to this Agreement consents to the use of electronic signatures in the execution of this Agreement. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original but all of which together will constitute one and the same instrument. A PDF, scanned item, or other reproduction of this Agreement and/or its signature page may be executed by one or more of the parties, and an executed copy of such signature page of this Agreement may be delivered by one or more of the parties by email or similar instantaneous electronic transmission pursuant to which the signature of, or on behalf of, the party is set forth electronically on the signature page, and such execution and delivery shall be considered valid, legally binding and effective for all purposes.

|

COMPANY:

|

|

PARTICIPANT:

%%FIRST_NAME%% %%MIDDLE_ NAME%% %%LAST_NAME%%

|

|

|

|

|

|

Signature |

|

Signature |

|

Name: Xxxxx Xxxxxx |

|

Date: |

|

Title: Chief Financial Officer |

|

Address: %%ADDRESS_LINE_1%-% |

|

|

|

%%CITY%-% %%STATE%-% %%ZIPCODE%-% |

|

|

|

|

%%EMPLOYEE_IDENTIFIER%-% %%OPTION_DATE,’MONTH DD, YYYY’%-%

Signature Page to

Restricted Stock Award Agreement – Market-Based Vesting