PRE-FUNDED WARRANT TO PURCHASE STOCK

Exhibit 4.1

PRE-FUNDED WARRANT TO PURCHASE STOCK

Company: Verastem, Inc., a Delaware corporation

Warrant No. 2023-[___]

Number of Shares: [___], subject to adjustment

Type/Series of Stock: Common Stock, $0.0001 par value per share

Issue Date: June 21, 2023

Expiration Date: The first date on which no shares of Common Stock are issuable upon an exercise of this Warrant. See also Section 4.1(b).

THIS WARRANT CERTIFIES THAT, for good and valuable consideration, [___] (together with any successor or permitted assignee or transferee of this warrant to purchase stock (this “Warrant”) or of any shares issued upon exercise hereof, “Holder”) is entitled, at any time on or after the above-referenced Issue Date, to purchase up to the above-stated number of fully paid and non-assessable shares (the “Shares”) of the above-stated Type/Series of Stock (the “Class”) of the above-named company (the “Company”) until this Warrant is exercised in full, all as set forth above and as adjusted pursuant to Section 2 of this Warrant, subject to the provisions and upon the terms and conditions set forth in this Warrant. The aggregate exercise price of this Warrant of $9.75, except for a nominal exercise price of $0.001 per Warrant Share (as defined below), was paid to the Company on or prior to the date of issuance of this Warrant, and consequently, no additional consideration (other than the nominal exercise price of $0.001 per Warrant Share) shall be required to be paid by Holder to effect any exercise of this Warrant. Holder shall not be entitled to return or refund of all, or any portion, of such prepaid aggregate exercise price under any circumstance or for any reason whatsoever, including in the event this Warrant shall not have been exercised prior to the Expiration Date. The remaining unpaid exercise price per share of Common Stock under this Warrant shall be $0.001, subject to adjustment as provided herein (the “Warrant Price” or “Exercise Price”).

SECTION 1. EXERCISE.

1.1 Method of Exercise; Delivery of Warrant Shares. Holder may at any time and from time to time exercise this Warrant, in whole or in part, by delivering to the Company the original of this Warrant together with a duly executed Notice of Exercise in substantially the form attached hereto as Appendix 1 and, unless Holder is exercising this Warrant pursuant to a cashless exercise set forth in Section 1.2, wire transfer of same-day funds (to an account designated by the Company), or other form of payment acceptable to the Company for the aggregate Warrant Price for the Shares being purchased (such date of delivery, the “Exercise Date”). Notwithstanding any contrary provision herein, if this Warrant was originally executed and/or delivered electronically, in no event shall Holder be required to surrender or deliver an ink-signed paper copy of this Warrant in connection with its exercise hereof or of any rights hereunder, nor shall Holder be required to surrender or deliver a paper or other physical copy of this Warrant in connection with any exercise hereof. Execution and delivery of the Exercise Notice shall have the same effect as cancellation of the original Warrant and issuance of a new warrant evidencing the right to purchase the remaining number of Warrant Shares (any such new warrant, a “New Warrant”), which New Warrant shall in all other respects be identical with this Warrant. The Company shall cause the shares underlying the Warrant (the “Warrant Shares”) purchased hereunder to be transmitted by the Transfer Agent to the Holder by the date that is the earliest of (i) two (2) Trading Days after the delivery to the Company of the Notice of Exercise and (ii) the number of Trading Days comprising the Standard Settlement Period after the delivery to the Company of the Notice of Exercise (such date, the “Warrant Share Delivery Date”). Upon delivery of the Notice of Exercise, the Holder shall be deemed for all corporate purposes to have become the holder of record of the Warrant Shares with respect to which this Warrant has been exercised, irrespective of the date of delivery of the Warrant Shares, provided that payment of the aggregate Exercise Price (other than in the case of a cashless exercise) is received within the earlier of (i) two (2) Trading Days and (ii) the number of Trading Days comprising the Standard Settlement Period following delivery of the Notice of Exercise. If the Company fails to cause the Transfer Agent to transmit to the Holder the Warrant Shares pursuant to this section by the Warrant Share Delivery Date, then the Holder will have the right to rescind such exercise.

“Standard Settlement Period” means the standard settlement period, expressed in a number of Trading Days, on the Company’s primary Trading Market with respect to the Common Stock as in effect on the date of delivery of the Notice of Exercise.

“Trading Day” means a day on which the Common Stock is traded on a Trading Market.

“Transfer Agent” means Computershare Trust Company, N.A., the Company’s transfer agent and registrar for the Common Stock, and any successor appointed in such capacity, or if none, the Company.

1.2 Cashless Exercise. On any exercise of this Warrant, in lieu of payment of the aggregate Warrant Price in the manner as specified in Section 1.1 above, but otherwise in accordance with the requirements of Section 1.1, Holder may elect to receive Shares equal to the value of this Warrant, or portion hereof as to which this Warrant is being exercised. Thereupon, the Company shall issue to the Holder such number of fully paid and non-assessable Shares as are computed using the following formula:

X = Y(A-B)/A

where:

| X = | the number of Shares to be issued to the Holder; |

| Y = | the number of Shares with respect to which this Warrant is being exercised (inclusive of the Shares surrendered to the Company in payment of the aggregate Warrant Price); |

| A = | the fair market value (as determined pursuant to Section 1.3 below) of one Share; and |

| B = | the Warrant Price. |

1.3 Fair Market Value. If shares of the Class are then traded or quoted on a nationally recognized securities exchange, inter-dealer quotation system or over-the-counter market (a “Trading Market”), the fair market value of a Share shall be the closing price or last sale price of a share of the Class reported for the Business Day (as defined below) immediately before the date on which Holder delivers this Warrant together with its Notice of Exercise to the Company. If shares of the Class are not then traded in a Trading Market, the Board of Directors of the Company shall determine the fair market value of a Share in its reasonable good faith judgment.

2

1.4 Delivery of New Warrant. Within a reasonable time after Holder exercises this Warrant in the manner set forth in Section 1.1 or 1.2 above, if this Warrant has not been fully exercised and has not expired, the Company shall deliver to Holder a New Warrant of like tenor representing the Shares not so acquired, which may be delivered electronically.

1.5 Replacement of Warrant. On receipt of evidence reasonably satisfactory to the Company of the loss, theft, destruction or mutilation of this Warrant and, in the case of loss, theft or destruction, on delivery of an indemnity agreement reasonably satisfactory in form, substance and amount to the Company or, in the case of mutilation, on surrender of this Warrant to the Company for cancellation, the Company shall, within a reasonable time, execute and deliver to Holder, in lieu of this Warrant, a new warrant of like tenor and amount.

1.6 Treatment of Warrant Upon Acquisition of Company.

(a) Acquisition. For the purpose of this Warrant, “Acquisition” means any transaction or series of related transactions involving: (i) the sale, lease, exclusive license, or other disposition of all or substantially all of the assets of the Company; (ii) any merger or consolidation of the Company into or with another person or entity (other than a merger or consolidation effected exclusively to change the Company’s domicile), or any other corporate reorganization, in which the stockholders of the Company in their capacity as such immediately prior to such merger, consolidation or reorganization, own less than a majority of the Company’s (or the surviving or successor entity’s) outstanding voting power immediately after such merger, consolidation or reorganization (or, if such Company stockholders beneficially own a majority of the outstanding voting power of the surviving or successor entity as of immediately after such merger, consolidation or reorganization, such surviving or successor entity is not the Company); or (iii) any sale or other transfer by the stockholders of the Company of shares representing at least a majority of the Company’s then-total outstanding combined voting power.

(b) Treatment of Warrant at Acquisition. In the event of an Acquisition and if Holder has not exercised this Warrant pursuant to Section 1 above as to all Shares, then, following such Acquisition, the Holder shall receive upon exercise hereof the kind and amount of securities, cash or other property which the Holder would have been entitled to receive (the “Alternate Consideration”) pursuant to such Acquisition if such exercise had taken place immediately prior to such Acquisition. In any such case, appropriate adjustment (as reasonably determined in good faith by the Board of Directors of the Company) shall be made in the application of the provisions set forth herein with respect to the rights and interests thereafter of the Holder, to the end that the provisions set forth herein (including provisions with respect to changes in and other adjustments of the Exercise Price) shall thereafter be applicable, as nearly as reasonably may be, in relation to any securities, cash or other property thereafter deliverable upon the exercise of this Warrant. The Company shall not effect any Acquisition in which the Company is not the surviving entity or the Alternate Consideration includes securities of another entity unless any successor to the Company, surviving entity or other person (including any purchaser of assets of the Company) shall assume the obligation to deliver to the Holder such Alternate Consideration as, in accordance with the foregoing provisions, the Holder may be entitled to receive, and the other obligations under this Warrant.

3

1.7 Limitations on Exercise.

Notwithstanding anything to the contrary herein, the Company shall not effect any exercise of this Warrant, and the holder shall not be entitled to exercise this Warrant, for a number of Warrant Shares in excess of that number of Warrant Shares which, upon giving effect or immediately prior to such exercise, would cause (i) the aggregate number of shares of Common Stock beneficially owned by the Holder, its Affiliates and any Persons who are members of a Section 13(d) group with such Holder or its Affiliates to exceed 9.99% (the “Maximum Percentage”) of the total number of issued and outstanding shares of Common Stock of the Company following such exercise, or (ii) the combined voting power of the securities of the Company beneficially owned by the Holder and its Affiliates and any other Persons who are members of a Section 13(d) group with such Holder or its Affiliates to exceed the Maximum Percentage of the combined voting power of all of the securities of the Company then outstanding following such exercise. For purposes of this paragraph, beneficial ownership and whether a Holder is a member of a Section 13(d) group shall be calculated and determined in accordance with Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules promulgated thereunder. For purposes of this Warrant, in determining the number of outstanding shares of Common Stock, the Holder may rely on the number of outstanding shares of Common Stock as reflected in (x) the Company’s most recent Quarterly Report on Form 10-Q or Annual Report on Form 10-K, as the case may be, filed with the Commission prior to the date hereof, (y) a more recent public announcement by the Company or (z) any other notice by the Company or the Transfer Agent setting forth the number of shares of Common Stock outstanding. Upon the written request of the Holder, the Company shall within three (3) Trading Days confirm in writing or by electronic mail to the Holder the number of shares of Common Stock then outstanding. In any case, the number of outstanding shares of Common Stock shall be determined after giving effect to the conversion or exercise of securities of the Company, including this Warrant, by the Holder since the date as of which such number of outstanding shares of Common Stock was reported. By written notice to the Company, the Holder may from time to time increase or decrease the Maximum Percentage to any other percentage not in excess of 19.99% specified in such notice; provided that any such increase or decrease will not be effective until the sixty-first (61st) day after such notice is delivered to the Company. For purposes of this Section 1.7, the aggregate number of shares of Common Stock or voting securities beneficially owned by the Holder and its Affiliates and any other Persons who are members of a Section 13(d) group with such Holder or its Affiliates shall include the shares of Common Stock issuable upon: (x) the exercise of this Warrant with respect to which such determination is being made plus the remaining unexercised and non-cancelled portion of this Warrant but taking into account the limitations on exercise contained herein, but shall exclude the number of shares of Common Stock which would otherwise be issuable upon exercise of the remaining unexercised and non-cancelled portion of this Warrant but for the limitations on exercise contained herein; and (y) the exercise or conversion of the unexercised, non-converted or non-cancelled portion of any other securities of the Company beneficially owned by the Holder or any of its Affiliates and other Persons who are members of a Section 13(d) group with such Holder or its Affiliates that do not have voting power (including without limitation any securities of the Company which would entitle the holder thereof to acquire at any time Common Stock, including without limitation any debt, preferred stock, right, option, warrant or other instrument that is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock), but shall exclude any such securities subject to any further limitation on conversion or exercise analogous to the limitation contained herein.

SECTION 2. ADJUSTMENTS TO THE SHARES AND WARRANT PRICE.

2.1 Stock Dividends, Splits, Etc. If the Company declares or pays a dividend or distribution on the outstanding shares of the Class payable in additional shares of the Class or other securities or property (other than cash), then upon exercise of this Warrant, for each Share acquired, Holder shall receive, without additional cost to Holder, the total number and kind of securities and property which Holder would have received had Holder owned the Shares of record as of the date the dividend or distribution occurred. If the Company subdivides the outstanding shares of the Class by reclassification or otherwise into a greater number of shares, the number of Shares purchasable hereunder shall be proportionately increased and the Warrant Price shall be proportionately decreased. If the outstanding shares of the Class are combined or consolidated, by reclassification or otherwise, into a lesser number of shares, the Warrant Price shall be proportionately increased and the number of Shares shall be proportionately decreased.

4

2.2 Reclassification, Exchange, Combinations or Substitution. Upon any event whereby all of the outstanding shares of the Class are reclassified, exchanged, combined, substituted, or replaced for, into, with or by Company securities of a different class and/or series, then from and after the consummation of such event, this Warrant will be exercisable for the number, class and series of Company securities that Holder would have received had the Shares been outstanding on and as of the consummation of such event, and subject to further adjustment thereafter from time to time in accordance with the provisions of this Warrant. The provisions of this Section 2.2 shall similarly apply to successive reclassifications, exchanges, combinations, substitutions, replacements or other similar events.

2.3 Adjustment for Cash Distributions.

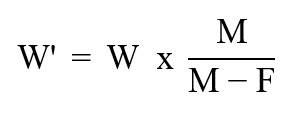

(a) If the Company, prior to the exercise in whole or expiration of this Warrant, pays a cash distribution to all holders of its Common Stock, then the number of Warrant Shares issuable upon the exercise of this Warrant shall be adjusted in accordance with the formula:

where:

W’ = the adjusted number of Warrant Shares issuable upon exercise of the Warrant;

W = the number of Warrant Shares then issuable upon exercise of the Warrant;

M = the fair market value (as determined pursuant to Section 1.3) per Share on the applicable record date; and

F = the amount of cash or fair market value on the record date of the evidences of its indebtedness, assets, rights, warrants or other securities to be distributed in respect of one Share as determined in good faith by the Board of Directors of the Company.

(b) The adjustment pursuant to this Section 2.3 shall be made successively whenever any such distribution is made and shall become effective immediately after the record date for the determination of holders entitled to receive the distribution.

2.4 No Fractional Share. No fractional Share shall be issuable upon exercise of this Warrant and the number of Shares to be issued shall be rounded down to the nearest whole Share. If a fractional Share interest arises upon any exercise of the Warrant, the Company shall eliminate such fractional Share interest by paying Holder in cash the amount computed by multiplying the fractional interest by (i) the fair market value (as determined in accordance with Section 1.3 above) of a full Share, less (ii) the then-effective Warrant Price.

5

2.5 Notice/Certificate as to Adjustments. Upon each adjustment of the Warrant Price, Class and/or number of Shares, the Company, at the Company’s expense, shall notify Holder in writing within a reasonable time setting forth the adjustments to the Warrant Price, Class and/or number of Shares and facts upon which such adjustment is based. The Company shall, upon written request from Xxxxxx, furnish Holder with a certificate of its Chief Financial Officer, including computations of such adjustment and the Warrant Price, Class and number of Shares in effect upon the date of such adjustment.

2.6 Purchase Rights. If at any time the Company grants, issues or sells any options, convertible securities or rights to purchase stock, warrants, securities or other property pro rata to the record holders of any class of Common Stock (the “Purchase Rights”), then Holder will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which Holder could have acquired if Holder had held the number of shares of Common Stock acquirable upon complete exercise of this Warrant (without regard to any limitations or restrictions on exercise of this Warrant, including without limitation, the Maximum Percentage) immediately before the date on which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the grant, issue or sale of such Purchase Rights (provided, however, that to the extent that Holder’s right to participate in any such Purchase Right would result in Holder, its Affiliates and any Persons who are members of a Section 13(d) group with such Holder or its Affiliates exceeding the Maximum Percentage then the Holder shall not be entitled to participate in such Purchase Right to such extent (and shall not be entitled to beneficial ownership of such shares of Common Stock as a result of such Purchase Right (and beneficial ownership) to such extent) and such Purchase Right to such extent shall be held in abeyance for the benefit of Holder until such time or times as its right thereto would not result in Holder, its Affiliates and any Persons who are members of a Section 13(d) group with such Holder or its Affiliates exceeding the Maximum Percentage, at which time or times the Holder shall be granted such right (and any Purchase Right granted, issued or sold on such initial Purchase Right or on any subsequent Purchase Right held similarly in abeyance) to the same extent as if there had been no such limitation).

2.7 Registration Under the Securities Act. This Warrant, as initially issued by the Company, is offered and sold pursuant to the Registration Statement (as defined below). As of the Issue Date, the Warrant Shares are issuable under the Registration Statement. Accordingly, the Warrant and, assuming issuance pursuant to the Registration Statement or an exchange meeting the requirements of Section 3(a)(9) of the Exchange Act as in effect on the Issue Date, the Warrant Shares, are not “restricted securities” under Rule 144 promulgated under the Securities Act of 1933, as amended.

“Registration Statement” means the Company’s registration statement on Form S-3 (File No. 333-258372), which was declared effective by the Securities and Exchange Commission on April 6, 2022.

2.8 No Voting Rights. Holder, as a Holder of this Warrant, will not have any voting rights until the exercise of this Warrant.

SECTION 3. REPRESENTATIONS AND COVENANTS OF THE COMPANY.

3.1 Representations and Warranties. The Company represents and warrants to, and agrees with, the Holder as follows:

6

(a) All Shares which may be issued upon the exercise of this Warrant shall, upon issuance, be duly authorized, validly issued, fully paid and non-assessable, and free of any liens and encumbrances except for restrictions on transfer provided for herein or under applicable federal and state securities laws. The Company covenants that it shall at all times cause to be reserved and kept available out of its authorized and unissued capital stock such number of shares of the Class and other securities as will be sufficient to permit the exercise in full of this Warrant. The Company will take all such reasonable action as may be necessary to assure that such Warrant Shares may be issued as provided herein without violation of any applicable law or regulation, or of any requirements of the Trading Market upon which the Common Stock may be listed.

3.2 Notice of Certain Events. If the Company proposes at any time to:

(a) declare any dividend or distribution upon the outstanding shares of the Class, whether in cash, property, stock, or other securities and whether or not a regular cash dividend;

(b) offer for subscription or sale pro rata to the holders of the outstanding shares of the Class any additional shares of any class or series of the Company’s stock (other than pursuant to contractual pre-emptive rights);

(c) effect any reclassification, exchange, combination, substitution, reorganization or recapitalization of the outstanding shares of the Class; or

(d) effect an Acquisition or to liquidate, dissolve or wind up;

then, in connection with each such event, the Company shall give Holder notice thereof at the same time and in the same manner as it gives notice thereof to holders of the outstanding shares of the Class.

The Company will also provide information requested by Xxxxxx from time to time, within a reasonable time following each such request, that is reasonably necessary to enable Holder to comply with Holder’s accounting or reporting requirements.

SECTION 4. MISCELLANEOUS.

4.1 Term; Automatic Cashless Exercise Upon Expiration.

(a) Term. Subject to the provisions of Section 1.6 above, this Warrant is exercisable in whole or in part at any time and from time to time on or before 6:00 PM, Eastern time, on the Expiration Date and shall be void thereafter.

(b) Automatic Cashless Exercise upon Expiration. In the event that, upon the Expiration Date, the fair market value of one Share as determined in accordance with Section 1.3 above is greater than the Warrant Price in effect on such date, then this Warrant shall automatically be deemed on and as of such date to be exercised pursuant to Section 1.2 above as to all Shares for which it shall not previously have been exercised, and the Company shall, within a reasonable time, deliver a certificate representing the Shares issued upon such exercise to Holder.

4.2 Compliance with Securities Laws on Transfer. Subject to compliance with all applicable securities laws, the Company shall, or will cause its Transfer Agent to, record the transfer of all or any portion of this Warrant in its or their records, upon surrender of this Warrant, and payment for all applicable transfer taxes (if any). Upon any such registration or transfer, a New Warrant to purchase Common Stock in substantially the form of this Warrant evidencing the portion of this Warrant so transferred shall be issued to the transferee, and a New Warrant evidencing the remaining portion of this Warrant not so transferred, if any, shall be issued to the transferring Holder. The acceptance of the New Warrant by the transferee thereof shall be deemed the acceptance by such transferee of all of the rights and obligations in respect of the New Warrant that the Holder has in respect of this Warrant. The Company shall, or will cause its Transfer Agent to, prepare, issue, and deliver at the Company’s own expense any New Warrant under this Section 4.2. Until due presentment for registration of transfer, the Company may treat the registered Holder hereof as the owner and holder of this Warrant for all purposes and the Company shall not be affected by any notice to the contrary.

7

4.3 Notices. All notices and other communications hereunder from the Company to the Holder, or vice versa, shall be deemed delivered and effective (i) when given personally, (ii) on the third (3rd) Business Day after being mailed by first-class registered or certified mail, postage prepaid, (iii) upon actual receipt if given by facsimile or electronic mail and such receipt is confirmed in writing by the recipient, or (iv) on the first Business Day following delivery to a reliable overnight courier service, courier fee prepaid, in any case at such address as may have been furnished to the Company or Holder, as the case may be, in writing by the Company or such Holder from time to time in accordance with the provisions of this Section 4.3. All notices to Holder shall be addressed as follows until the Company receives notice of a change of address in connection with a transfer or otherwise:

[___]

Attn: [____]

[Address]

Telephone: [____]

Email address: [____]

Notice to the Company shall be addressed as follows until Xxxxxx receives notice of a change in address:

Attn: Vice President, Finance

110 Xxxxxxxx Xxxxxx, Xxxxx 000

Needham, MA 02494

Telephone: (000) 000-0000

Email: xxxxxxxx@xxxxxxxx.xxx

With a copy (which shall not constitute notice) to:

Ropes & Gray LLP

Attn: Xxxxxx X. Xxxxxxxxx

Prudential Tower

800 Xxxxxxxx Xxxxxx

Boston, MA 02199

Telephone: (000) 000-0000

Email: xxxxxx.xxxxxxxxx@xxxxxxxxx.xxx

4.4 Amendment and Waiver. This Warrant and any term hereof may be amended or otherwise changed, waived, discharged or terminated (either generally or in a particular instance and either retroactively or prospectively) only by an instrument in writing signed by the party against which enforcement of such amendment or other change, waiver, discharge or termination is sought.

8

4.5 Attorneys’ Fees. In the event of any dispute between the parties concerning the terms and provisions of this Warrant, the party prevailing in such dispute shall be entitled to collect from the other party all costs incurred in such dispute, including reasonable attorneys’ fees.

4.6 Counterparts; Facsimile/Electronic Signatures. This Warrant may be executed by one or more of the parties hereto in any number of separate counterparts, all of which together shall constitute one and the same instrument. The Company, Xxxxxx and any other party hereto may execute this Warrant by electronic means and each party hereto recognizes and accepts the use of electronic signatures and the keeping of records in electronic form by any other party hereto in connection with the execution and storage hereof. To the extent that this Warrant or any agreement subject to the terms hereof or any amendment hereto is executed, recorded or delivered electronically, it shall be binding to the same extent as though it had been executed on paper with an original ink signature, as provided under applicable law, including, without limitation, any state law based on the Uniform Electronic Transactions Act. The fact that this Warrant is executed, signed, stored or delivered electronically shall not prevent the transfer by any Holder of this Warrant pursuant to, or the enforcement of, the terms hereof.

4.7 Headings. The headings in this Warrant are for purposes of reference only and shall not limit or otherwise affect the meaning of any provision of this Warrant.

4.8 Business Days. “Business Day” is any day that is not a Saturday, Sunday or a day on which the Nasdaq Capital Market and commercial banks in the City of New York are closed.

SECTION 5. GOVERNING LAW, VENUE, JURY TRIAL WAIVER, AND JUDICIAL REFERENCE.

5.1 Governing Law. This Warrant shall be governed by and construed in accordance with the laws of the Commonwealth of Massachusetts, without giving effect to its principles regarding conflicts of law.

5.2 Jurisdiction and Venue. The Company and Holder each submit to the exclusive jurisdiction of the state and federal courts in the State of New York; provided, however, that nothing in this Warrant shall be deemed to operate to preclude Holder from bringing suit or taking other legal action in any other jurisdiction to enforce a judgment or other court order in favor of Xxxxxx. The Company expressly submits and consents in advance to such jurisdiction in any action or suit commenced in any such court, and the Company hereby waives any objection that it may have based upon lack of personal jurisdiction, improper venue, or forum non conveniens and hereby consents to the granting of such legal or equitable relief as is deemed appropriate by such court. The Company hereby waives personal service of the summons, complaints, and other process issued in such action or suit and agrees that service of such summons, complaints, and other process may be made in accordance with Section 4.3 of this Warrant.

9

5.3 Jury Trial Waiver. TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, THE COMPANY AND HOLDER EACH WAIVE THEIR RIGHT TO A JURY TRIAL OF ANY CLAIM OR CAUSE OF ACTION ARISING OUT OF OR BASED UPON THIS WARRANT, INCLUDING CONTRACT, TORT, BREACH OF DUTY AND ALL OTHER CLAIMS. THIS WAIVER IS A MATERIAL INDUCEMENT FOR THE PARTIES’ AGREEMENT TO THIS WARRANT. EACH PARTY HAS REVIEWED THIS WAIVER WITH ITS COUNSEL.

5.4 Survival. This Section 5 shall survive the termination of this Warrant.

[Remainder of page left blank intentionally]

[Signature page follows]

10

IN WITNESS WHEREOF, the parties have caused this Warrant to Purchase Stock to be executed by their duly authorized representatives effective as of the Issue Date written above.

| “COMPANY” | ||

| VERASTEM, INC. | ||

| By: | ||

| Name: | Xxxxx Xxxxxxx | |

| Title: | Chief Executive Officer | |

| “HOLDER” | ||

| [___] | ||

| By: | ||

| Name: | ||

| Title: | ||

[Signature Page to the Pre-Funded Warrant]

APPENDIX 1

FORM OF NOTICE OF EXERCISE

1. The undersigned Holder hereby exercises its right to purchase ___________ shares of the Common Stock of Verastem, Inc. (the “Company”) in accordance with the attached Pre-Funded Warrant To Purchase Stock (the “Warrant”), and tenders payment of the aggregate Warrant Price for such shares as follows:

¨ Wire transfer of immediately available funds to the Company’s account

¨ Cashless Exercise pursuant to Section 1.2 of the Warrant

¨ Other [Describe] __________________________________________

2. Please deliver to the Holder Shares in accordance with the terms of the Warrant. The Warrant Shares shall be delivered to the following DWAC Account Number:________________.

3. By its delivery of this Exercise Notice, the undersigned represents and warrants to the Company that in giving effect to the exercise evidenced hereby the Holder will not beneficially own in excess of the number of shares of Common Stock (as determined in accordance with Section 13(d) of the Securities Exchange Act of 1934, as amended) permitted to be owned under Section 1.7 of the Warrant to which this notice relates.

Capitalized terms used herein and not otherwise defined herein have the respective meanings set forth in the Warrant.

| HOLDER: | ||

| By: | ||

| Name: | ||

| Title: | ||

| (Date): | ||

Schedule 1