ASSET PURCHASE AGREEMENT by and among NANOSURFACES SRL, SAMO SPA and KEYSTONE DENTAL, INC. dated as of December 30, 2009

Certain identified information has been excluded from this exhibit (indicated by “[***]”) because it is both not material and is the type that the registrant treats as private or confidential.

Exhibit 10.6

Execution Copy

by and among

NANOSURFACES SRL,

SAMO SPA

and

KEYSTONE DENTAL, INC.

dated as of

December 30, 2009

TABLE OF CONTENTS

| SECTION 1. |

DEFINITIONS | 1 | ||||

| 1.01 |

Definitions | 1 | ||||

| SECTION 2. |

PURCHASE AND SALE OF THE PURCHASED ASSETS | 8 | ||||

| 2.01 |

Purchase and Sale of the Purchased Assets | 8 | ||||

| 2.02 |

Asset Purchase Price | 8 | ||||

| 2.03 |

Payment of Asset Purchase Price | 8 | ||||

| 2.04 |

Contingent Payments | 8 | ||||

| 2.05 |

Payment of Contingent Payments | 9 | ||||

| 2.06 |

Forfeiture of Contingent Payments | 9 | ||||

| 2.07 |

Patent Confirmation | 10 | ||||

| 2.08 |

Delivery of Technical Drawings and Other Development Documentation | 10 | ||||

| 2.09 |

No Assumption of Liabilities | 10 | ||||

| 2.10 |

Waiver of Moral Rights | 10 | ||||

| SECTION 3. |

RIGHT OF FIRST REFUSAL | 10 | ||||

| 3.01 |

Grant of Right of First Refusal | 10 | ||||

| 3.02 |

Notice | 11 | ||||

| 3.03 |

Additional Keystone Right to Purchase New Technology | 11 | ||||

| SECTION 4. |

REPRESENTATIONS AND WARRANTIES OF SAMO | 11 | ||||

| 4.01 |

Organization and Standing | 11 | ||||

| 4.02 |

Corporate Authority | 11 | ||||

| 4.03 |

No Violation | 12 | ||||

| 4.04 |

Consents | 12 | ||||

| 4.05 |

Intellectual Property | 12 | ||||

| 4.06 |

Title to Assets | 14 | ||||

| 4.07 |

Compliance | 14 | ||||

| 4.08 |

Solvency | 14 | ||||

| 4.09 |

Brokerage, Commissions | 14 | ||||

| 4.10 |

Accuracy of Information | 15 | ||||

| SECTION 5. |

REPRESENTATIONS AND WARRANTIES OF BUYER | 15 | ||||

| 5.01 |

Organization and Standing | 15 | ||||

| 5.02 |

Requisite Authority | 15 | ||||

| 5.03 |

No Violation | 15 | ||||

| 5.04 |

Authorizations | 16 | ||||

| SECTION 6. |

COVENANTS | 16 | ||||

| 6.01 |

Confidentiality; Public Announcements | 16 | ||||

| 6.02 |

Prohibition | 17 | ||||

| 6.03 |

Patent Application | 17 | ||||

| 6.04 |

Further Assurances | 17 | ||||

| 6.05 |

Related Agreements | 17 | ||||

| 6.06 |

Non-Competition | 17 | ||||

| 6.07 |

Buyer’s Commercially Reasonable Efforts | 18 | ||||

| SECTION 7. |

CHANGE IN CONTROL | 18 | ||||

| 7.01 |

Effects of Change in Control or IP Transfer | 18 | ||||

| SECTION 8. |

SURVIVAL | 18 | ||||

| 8.01 |

Survival of Covenants, Representations and Warranties | 18 | ||||

| SECTION 9. |

INDEMNIFICATION | 18 | ||||

| 9.01 |

Indemnification by Sellers | 18 | ||||

| 9.02 |

Indemnification Procedure | 19 | ||||

| SECTION 10. |

CERTAIN TAX MATTERS | 19 | ||||

| 10.01 |

Taxes | 19 | ||||

| SECTION 11. |

MISCELLANEOUS | 20 | ||||

| 11.01 |

Interpretation | 20 | ||||

| 11.02 |

Expenses | 20 | ||||

| 11.03 |

Amendment; Waiver | 20 | ||||

| 11.04 |

Parties in Interest; Binding Effect; Assignment | 20 | ||||

| 11.05 |

Cumulative Remedies | 21 | ||||

| 11.06 |

Entire Agreement | 21 | ||||

| 11.07 |

Legal Representation | 21 | ||||

| 11.08 |

Interpretation | 21 | ||||

| 11.09 |

Section and Other Headings, Number | 21 | ||||

| 11.10 |

Notices | 21 | ||||

| 11.11 |

Governing Law | 22 | ||||

| 11.12 |

Dispute Resolution | 22 | ||||

| 11.13 |

Counterparts | 23 | ||||

| 11.14 |

Severability | 23 | ||||

ii

| SCHEDULES |

||

| I | Assigned Know-How | |

| II | Assigned Patents | |

| III | Licensed Know-How | |

| IV | Licensed Patents | |

| V | Purchased Manufacturing Related Equipment and Purchased Process Related Equipment | |

| VI | Smiler Catalogue | |

| VII | Smiler Products | |

| 4.05(c) | License Agreements | |

| 6.06 | Permitted Surface Treatment Technologies |

iii

This Asset Purchase and Sale Agreement (this “Agreement”) is made as of December 30, 2009 (the “Effective Date”) by and among NanoSurfaces S.r.l., an Italian S.r.l. having its registered office in Granarolo Dell’Xxxxxx (BO), Xxx Xxxxxxxxx 00, Xxxxx (“NanoSurfaces”), SAMO S.p.A., an Italian S.p.A. having its registered office in Granarolo Dell’Xxxxxx (BO), Xxx Xxxxxxxxx 00, Xxxxx (“SAMO”, and together with NanoSurfaces, the “Sellers”), and Keystone Dental, Inc., a Delaware corporation having its principal place of business at 000 Xxxxxxxxx Xxxxxxxx, Xxxxxxxxxx, Xxxxxxxxxxxxx, XXX (“Keystone” or “Buyer”).

RECITALS

WHEREAS, Buyer desires to purchase and license from Sellers, and Sellers desire to sell and license to Buyer, all of Sellers’ right, title and interest in and to the Purchased Assets (as defined below), upon the terms and subject to the conditions set forth in this Agreement (the “Asset Sale”);

WHEREAS, in connection with the Asset Sale, on the Effective Date Buyer and NanoSurfaces will enter into that certain Sublicense Agreement (the “Sublicense Agreement”), pursuant to which, among other things, NanoSurfaces shall license the Licensed Know-How and Licensed Patents to Buyer subject to the terms and as further set forth therein;

WHEREAS, in connection with the Asset Sale, Buyer and Sellers will enter into that certain Manufacturing and Support Services Agreement, dated as of the date hereof (the “MSS Agreement”), pursuant to which, among other things, Sellers shall manufacture, finish and supply certain products and provide technical support to Buyer subject to terms and as further set forth therein;

NOW, THEREFORE, in consideration of the premises, the representations and warranties and the mutual covenants set forth herein, and for other good and valuable consideration receipt of which is hereby acknowledged, the parties hereto agree as follows:

SECTION 1.

DEFINITIONS

1.01 Definitions. As used in this Agreement (including the recital and Schedules hereto), the following terms shall have the following meanings (such meanings to be applicable equally to both singular and plural forms of the terms defined):

“Affiliate” means with respect to any Person, any and all Persons, directly or indirectly controlling, controlled by, or under the common control of such Person. Any such Person shall be deemed to be an Affiliate only as long as such control exists. For purposes of this definition, a Person shall be deemed to “control” another Person when the controlling Person (i) is directly or indirectly the legal or beneficial owner of at least fifty percent (50%) of the outstanding voting securities of a corporate entity with the right to vote for the election of the directors (or the equivalent thereof) or comparable voting interest in the Person, or (ii) has possession, directly or indirectly, of the power to direct (or cause the direction of) the management and policies of the other Person, or (iii) has control of the other Person under applicable securities laws or regulations.

“Agreement” has the meaning given to such term in the introductory paragraph hereof.

“Asset Purchase Price” has the meaning given to such term in Section 2.02 hereof.

“Asset Sale” has the meaning given to such term in the recital paragraphs of this Agreement.

“Assigned Know-How” means unpatented technical and other information concerning the pink collar, pink abutment, white titanium technology, Color Anodizing, the consistent application of TiCare, and the cleaning, blasting, and masking technology and related inspection and test methods as further described on Schedule I, whether tangible or in electronic format, now or hereafter owned by SAMO and/or NanoSurfaces which is not in the public domain, including information comprising or relating to concepts, discoveries, data, designs, formulae, ideas, methods, models, assays, research plans, procedures, designs for experiments and tests and results of experimentation and testing (including results of research or development), processes (including manufacturing processes, specifications and techniques), laboratory records, chemical, pharmacological, toxicological, clinical, analytical and quality control data, trial data, case report forms, data analyses, reports, manufacturing data or summaries and information contained in submissions to and information from ethical committees and regulatory authorities. The fact that an item is known to the public shall not be taken to exclude the possibility that a compilation including the item, and/or a development relating to the item, is not known to the public.

“Assigned Patents” means any patent or patent application listed on Schedule II hereto, all patents claiming priority thereto or arising therefrom, and any patent or patent application relating to the pink collar, pink abutment, white titanium, cleaning, blasting, and masking technology, the related inspection and test methods, the consistent application of TiCare which may be subsequently filed by or issued to Sellers after the Effective Date. The term “patent” includes patents and patent applications, whether in the United States or other countries, including all provisionals, and all divisions, continuations, continuations-in-part, reissues, renewals, extensions, supplementary protection certificates of any such patents and patent applications and the foreign and international counterparts of the foregoing.

“Bank Account” means the bank account no. [***] opened by SAMO with BNL GRUPPO BNP PARIBAS - Bologna/Italia, SWIFT code no. [***]

“Bankruptcy Exceptions” has the meaning given to such term in Section 4.02 hereof.

“Bill of Sale and Assignment Agreement” means the Bill of Sale and Assignment Agreement to be entered in by the parties as contemplated herein.

2

“Business Day” means any day other than a Saturday or Sunday that commercial banks in the State of New York and the Republic of Italy may be lawfully open for the conduct of regular banking business and operations,

“Buyer” has the meaning given to such term in the introductory paragraph of this Agreement.

“Buyer Indemnified Parties” has the meaning given to such term in Section 9.01(a) hereof.

“Buyer Notice” means written notice from Buyer notifying a Seller that Xxxxx intends to exercise its Right of First Refusal as to some or all of such Seller’s New Technology with respect to any Proposed Transfer.

“Buyer’s Accountants” has the meaning given to such term in Section 2.05(c) hereof.

“Change in Control” means consummation of: (i) a sale, merger or similar transaction or series of related transactions as a result of which more than 50% of the voting power of Buyer (or the surviving or resulting entity thereof) after giving effect to such transaction is not held, directly or indirectly, by the current shareholders or any of their Affiliates; or (ii) the sale of all or substantially all of the assets of Buyer, taken as a whole, in a transaction or series of related transactions.

“Color Anodizing” means the process used in the color coding of dental implant system components for identification purposes only. The term “color coding” excludes surface treatments which have functions other than for identification purposes only.

“Contingent Payment” has the meaning given to such term in Section 2.04 hereof.

“Contract” means any contract, agreement, license, lease, mortgage, security interest, purchase order, indenture or other understanding, arrangement or similar commitment (whether written or oral, express or implied).

“Cumulative Revenues” has the meaning given to such term in Section 2.05(a) hereof.

“Damages” has the meaning given to such term in Section 9.01(a) hereof.

“Dental Sector” means the manufacturing, sale, use or application of dental implants, prosthetics, abutments and related instruments and products.

“Effective Date” has the meaning given to such term in the introductory paragraph of this Agreement.

“FDA Clearance” has the meaning given to such term in Section 6.07 hereof.

3

“Forfeiture Breach” has the meaning given to such term in Section 2.06 hereof.

“Governmental Entity” means any foreign, domestic, federal, territorial, state or local U.S. or non-U.S. governmental authority, quasi-governmental authority, instrumentality, court or government, self-regulatory organization, commission, tribunal or organization or any political or other subdivision, department, administrative agency or similar body, branch or representative of any of the foregoing, or any direct or indirect contractor or subcontractor with any of the foregoing.

“Improvements” means any and all inventions, modifications or improvements of the Purchased IP, whether patented or unpatented, which may be made, developed or acquired by Sellers.

“Intellectual Property” means all of the following: (a) inventions (whether or not patentable), discoveries, improvements, ideas, know-how, technology, formula methodology, processes, technology, software (including password unprotected interpretive code or source code, object code, development documentation, programming tools, drawings, specifications and data), firmware, system design information and applications and patents in any jurisdiction pertaining to the foregoing, including re-issues, continuations, divisions, continuations-in-part, renewals or extensions; (b) trade secrets and know how, including confidential information and the right in any jurisdiction to limit the use or disclosure thereof; (c) copyrighted and copyrightable writings, designs, hardware schematics and specifications, software, mask works or other works, applications, registrations, and derivative works in any jurisdiction for the foregoing and all moral rights related thereto; (d) database rights; (e) rights under all agreements, including agreements with any Person, relating to the foregoing; (f) books, documents and records pertaining to the foregoing; and (g) claims or causes of action arising out of or related to past, present or future infringement or misappropriation of the foregoing.

“IP Transfer” means the sale, assignment, license, sublicense or transfer of any of the Purchased IP to any Person other than Sellers or any Affiliate of Buyer or Sellers.

“Keystone” has the meaning given to such term in the introductory paragraph of this Agreement.

“Keystone Branded Smiler Implant System” means the Smiler Implant System which will be branded, labeled and packaged as “Keystone” or such other brand as Buyer may choose from time to time.

“Licensed Know-How” means unpatented technical and other information concerning the BioRough surface treatment technologies, the BioSpark surface treatment technologies, the TiCare titanium anodization technologies, the white titanium technology, and the Color Anodizing technology, as further described on Schedule III, whether tangible or in electronic format, now or hereafter owned or licensed by Sellers which is not in the public domain, including information comprising or relating to concepts, discoveries, data, designs, formulae, ideas, methods, models, assays, research plans, procedures, designs for experiments and tests and results of experimentation and testing (including results of research or development), processes (including manufacturing processes, specifications and techniques),

4

laboratory records, chemical, pharmacological, toxicological, clinical, analytical and quality control data, trial data, case report forms, data analyses, reports, manufacturing data or summaries and information contained in submissions to and information from ethical committees and regulatory authorities. The fact that an item is known to the public shall not be taken to exclude the possibility that a compilation including the item, and/or a development relating to the item, is not known to the public.

“Licensed Patents” means any patent or patent application listed on Schedule IV hereto, all patents claiming priority thereto or arising therefrom, and any patent or patent application relating to the BioSpark surface treatment technologies, which may be subsequently filed by or issued to Sellers after the Effective Date. The term “patent” includes patents and patent applications, whether in the United States or other countries, including all provisionals, and all divisions, continuations, continuations-in-part, reissues, renewals, extensions, supplementary protection certificates of any such patents and patent applications and the foreign and international counterparts of the foregoing.

“Lien” means any lease, title retention agreement, conditional sale agreement, equitable interest, deed of trust, license, lien (statutory or other), option, pledge, security interest, mortgage, encumbrance, right of way, easement, encroachment, servitude, right of first option, right of first refusal or similar restriction, including any restriction on use, voting (in the case of any security or equity interest), transfer, receipt of income or exercise of any other attribute of ownership or any other claim or charge, similar in purpose or effect to any of the foregoing or other restriction or limitation whatsoever.

“MSS Agreement” means the Manufacturing and Support Services Agreement to be entered in by and between Sellers and Xxxxx as contemplated herein.

“NanoSurfaces” has the meaning given to such term in the introductory paragraph of this Agreement.

“New Technology” means all Intellectual Property which may be made, developed or acquired by any Seller in the Dental Sector.

“Noncompete Period” means the period beginning on the Effective Date and continuing for a period of ten (10) years thereafter.

“Notice of Allowance” means the U.S. Patent and Trademark Office issuing a notice of allowance for the Patent Application.

“Patent Application” means the pending U.S. Patent Application No. 11/015,882, Publication No. 20050143743, entitled “Osteointegrative interface for implantable prostheses and a method for the treatment of the osteointegrative interface,” to Xxxxxxx Xxxxxx, Xxxxxxx Xxxxxx, Xxxxxx Xxxxxxxx, Xxxxxx Xxxxxxxx and Xxxxxx Xxxxxx.

“Patent Confirmation” has the meaning given to such term in Section 2.07 hereof.

5

“Patent Issuance” means the U.S. Patent and Trademark Office granting and issuing a valid United States patent for the Patent Application.

“Person” means any individual, firm, corporation, partnership, limited liability company, joint venture, trust, business association or other entity, including any Governmental Entity.

“Politecnico” means the Politecnico of Milan, having its registered office in Milano, Xxxxxx Xxxxxxxx xx Xxxxx, 00.

“Politecnico Licenses” means the license agreements, and amendments thereto, between Politecnico and Sellers.

“Post-Issuance Payment” has the meaning given to such term in Section 2.03(b) hereof.

“Proposed Transfer” means any assignment, sale, license, offer to assign, sell or license, disposition of or any other like transfer of any New Technology (or any interest therein) proposed by any Seller, including without limitation, any indirect transfers pursuant to any transfer of the capital stock of any Seller.

“Proposed Transfer Notice” means written notice from a Seller setting forth the terms and conditions of a Proposed Transfer.

“Prospective Transferee” means any person to whom a Seller proposes to make a Proposed Transfer.

“Purchased Assets” means all of Sellers’ right, title and interest in, whether existing as of the date hereof or hereinafter acquired, the Purchased Manufacturing Related Equipment, Purchased Process Related Equipment, Purchased IP, and Records, in connection with the Dental Sector.

“Purchased IP” means the Assigned Know-How, Assigned Patents, Licensed Know-How, Licensed Patents, and Improvements.

“Purchased Manufacturing Related Equipment” means all manufacturing equipment and assets used to produce and inspect dental implants, surgical tools and prosthetics, including tooling used for injection, molding and tooling related to dental prosthetics, as set forth on Schedule V hereto.

“Purchased Process Related Equipment” means all fixtures relating to the cleaning, masking, blasting, surface treatment, inspection, testing and packaging of the Smiler Implant System as set forth on Schedule V hereto.

“Records” means all Technical Drawings and Other Development Documentation, and all books of account, files, records and other documents, whether in hard copy, electronic or magnetic format or otherwise, of Sellers to the extent relating to the Purchased Manufacturing Related Equipment, Purchased Process Related Equipment, and Purchase IP.

6

“Related Agreements” means, collectively, the Sublicense Agreement, the Bill of Sale and Assignment Agreement, the MSS Agreement, and all other agreements, documents, certificates and instruments to be entered into or delivered by any party in connection with the transactions contemplated pursuant to any of the foregoing.

“Right of First Refusal” means the right, but not an obligation, of Buyer, or its permitted transferees or assigns, to purchase or license some or all of the Sellers’ New Technology with respect to a Proposed Transfer, at the same price and on the same terms and conditions specified in the Proposed Transfer Notice.

“SAMO” has the meaning given to such term in the introductory paragraph of this Agreement.

“Seller Indemnifiable Events” has the meaning given to such term in Section 9.01(a) hereof.

“Sellers” has the meaning given to such term in the introductory paragraph of this Agreement.

“Smiler Implant System” means the product line being sold by SAMO as of the date hereof, which product line includes implants, surgical kits, prosthetics and kits.

“Statement” has the meaning given to such term in Section 2.05(c) hereof.

“Sublicense Agreement” means the Sublicense Agreement to be entered in by and between NanoSurfaces and Buyer as contemplated herein.

“Tax Returns” means any report, return, information return, filing, claim for refund or other information, including any schedules or attachments thereto, and any amendments to any of the foregoing required to be supplied to a taxing authority in connection with applicable taxes.

“Technical Drawings and Other Development Documentation” means all design and development documentation for all Smiler Implant System products as listed in Schedule VI and for any related developments, including the 2.9 and 3.3 xx Xxxxxx Implant System and others listed in Schedule VII. This documentation includes, but is not limited to, engineering models and engineering drawings in both native CAD format and in paper form; design specifications; material specifications; design rationales; risk analyses, plans, and reports; test protocols, data and reports; engineering notebooks; design history files; technical files; design verification protocols and reports, design validation protocols and reports; prototypes; information comprising or relating to concepts, ideas, methods, models, research plans; clinical data, case report forms, data analyses, reports; summaries and information contained in submissions to and information from ethical committees and regulatory authorities.

7

“Third Party Claim” has the meaning given to such term in Section 9.01(a) hereof.

“Transfer Taxes” has the meaning given to such term in Section 10.01(a) hereof.

SECTION 2.

PURCHASE AND SALE OF THE PURCHASED ASSETS

2.01 Purchase and Sale of the Purchased Assets.

Upon the terms and subject to the conditions of this Agreement, Sellers hereby sell, convey, assign, license, transfer and deliver to Buyer the Purchased Assets for Buyer’s own use and enjoyment, together with all income and royalties with respect thereto, and Buyer hereby purchases or assumes, as the case may be, from Sellers, all of Sellers’ right, title and interest in and to the Purchased Assets, free and clear of any Liens (other than non-exclusive licenses in respect of which Xxxxx has and will have no obligations) for the Asset Purchase Price (as defined in Section 2.02 below).

2.02 Asset Purchase Price.

The aggregate amount to be paid for the Purchased Assets shall not exceed five million two hundred thousand dollars (US $5,200,000) (the “Asset Purchase Price”), consisting of one million dollars (US $1,000,000) in cash on the Effective Date, one million dollars (US $ 1,000,000) in cash upon the Patent Confirmation, and an amount not to exceed three million two hundred thousand dollars (US $3,200,000) in contingent payments, as further described in Sections 2.03 through 2.07 below.

2.03 Payment of Asset Purchase Price.

(a) On the Effective Date, Buyer shall deliver to SAMO one million dollars (US $1,000,000) in cash by wire transfer of immediately available funds to the Bank Account.

(b) Upon the Patent Confirmation, and in any event not less than three (3) Business Days thereafter, Buyer shall deliver to SAMO one million dollars (US $1,000,000) in cash by wire transfer of immediately available funds to the Bank Account (the “Post-Issuance Payment”), provided that, in the event that the Patent Confirmation is not delivered by Buyer to SAMO within two (2) years and six (6) months following the Effective Date, the Post-Issuance Payment shall be deemed to be forfeited by SAMO.

2.04 Contingent Payments.

Buyer shall pay to SAMO, as additional consideration for the Purchased Assets, an aggregate amount not to exceed three million two hundred thousand (US $3,200,000) in contingent payments (“Contingent Payments”) as follows:

(a) if and when the support services to be provided by Sellers to Buyer, as set forth on Schedule 3.3 of the MSS Agreement, are completed in compliance with the support services timeline, as set forth on Schedule 3.4 of the MSS Agreement, Buyer shall pay to SAMO a Contingent Payment equal to eight hundred thousand dollars (US $800,000), provided, however, that if this Contingent Payment shall not have been made prior to December 31, 2012, then this Contigent Payment shall be made in any event within thirty (30) Business Days of December 31, 2012;

8

(b) if and when the Cumulative Revenues (as defined below) shall equal or exceed five million dollars (US $5,000,000) Buyer shall pay to SAMO a Contingent Payment equal to eight hundred thousand dollars (US $800,000);

(c) if and when the Cumulative Revenues (as defined below) shall equal or exceed ten million dollars (US $10,000,000) Buyer shall pay to SAMO a Contingent Payment equal to eight hundred thousand dollars (US $800,000); and

(d) if and when the Cumulative Revenues (as defined below) shall equal or exceed fifteen million dollars (US $15,000,000) Buyer shall pay to SAMO a Contingent Payment equal to eight hundred thousand dollars (US $800,000).

2.05 Payment of Contingent Payments.

Subject to Section 2.06 below:

(a) Within sixty (60) days following June 30 and December 31 of each year following the Effective Date and until such time as the Contingent Payment set forth in Section 2.04(d) has been paid, Buyer shall deliver to SAMO a statement setting forth a computation of cumulative revenues generated directly from sales by Buyer and its Affiliates of the Keystone Branded Smiler Implant System and any other product of Buyer containing or utilizing any of the Purchased IP (the “Cumulative Revenues”);

(b) Any Contingent Payment payable to SAMO under Section 2.04 shall be paid in cash by wire transfer within sixty (60) days after June 30 or December 31 of each year, following the achievement of the respective payment trigger as set forth in Section 2.04(b) through (d) above;

(c) Upon SAMO’s request, no later than May 31 of each year, Buyer shall cause its independent accounting firm (“Buyer’s Accountants”) to prepare and deliver to SAMO a statement (the “Statement”) setting forth a computation of Cumulative Revenues, which Statement shall be binding and final on the parties hereto for the purpose of determining the Cumulative Revenues and the related Contingent Payment; payments of Contingent Payments which become due to SAMO according to the Statement shall be paid to SAMO within thirty (30) days after the delivery of the Statement to SAMO.

2.06 Forfeiture of Contingent Payments.

In the event of a breach of any of the representations, warranties, covenants, undertakings, agreements or other obligations of Sellers set forth in this Agreement or in any of the Related Agreements, which breach is not cured within thirty (30) days from the date of notification of such breach to Sellers by Buyer (each such breach, a “Forfeiture Breach”), Sellers shall forfeit, and Buyer shall have no further obligation to pay, the next Contingent

9

Payment that becomes due to SAMO by Xxxxx. Any Forfeiture Breach that remains uncured for an additional thirty (30) day period shall result in an additional forfeiture by Sellers of, and Buyer shall have no further obligation to pay, the next Contingent Payment that becomes due to SAMO by Xxxxx. Without limiting the foregoing, the obligation of the Buyer to make Contingent Payments to SAMO shall immediately cease, and no further Contingent Payments shall be due and payable in the event of termination of the MSS Agreement pursuant to Section 8.2(a) thereto.

2.07 Patent Confirmation.

Buyer shall confirm (within thirty (30) days of the grant of the Patent Issuance) that the claims of the Patent Issuance are identical to the claims submitted to the U.S. Patent and Trademark Office on November 25, 2009 with respect to the Patent Application (the “Patent Confirmation”), it being understood that in the event that the claims of the Patent Issuance are not identical to the claims submitted to the U.S. Patent and Trademark Office on November 25, 2009 with respect to the Patent Application, Buyer shall have the right, but not the obligation, in its sole and absolute discretion, to grant the Patent Confirmation.

2.08 Delivery of Technical Drawings and Other Development Documentation. Technical Drawings and Other Development Documentation shall be delivered by the Seller Parties to Buyer within twenty (20) days following the Effective Date, it being understood that each of the documents that is not in English shall be delivered by the Seller Parties to Buyer duly translated into English not later that March 1, 2010. All costs associated with any third-party translation services necessary in order to comply with the obligations to provide English language translations, as set forth herein, shall be borne equally by SAMO and Buyer.

2.09 No Assumption of Liabilities.

In connection with the purchase and sale of the Purchased Assets, Buyer shall not assume any liabilities of Sellers and Sellers expressly retain all liabilities.

2.10 Waiver of Moral Rights.

To the extent permitted under applicable law, Sellers waive any moral rights they may have in the Purchased IP.

SECTION 3.

RIGHT OF FIRST REFUSAL

3.01 Grant of Right of First Refusal.

Each Seller hereby unconditionally and irrevocably grants to Buyer a Right of First Refusal to purchase or license all or any portion of the New Technology that such Seller may propose to transfer in a Proposed Transfer, at the same price and on the same terms and conditions as those offered to the Prospective Transferee.

10

3.02 Notice.

Each Seller proposing to make a Proposed Transfer must deliver a Proposed Transfer Notice to Buyer no later than forty-five (45) days prior to the proposed consummation of such Proposed Transfer. Such Proposed Transfer Notice shall contain the material terms and conditions (including price and form of consideration) of the Proposed Transfer and the identity of the Prospective Transferee. To exercise its Right of First Refusal under this Section 3, Buyer must deliver a Buyer Notice to such Seller within sixty (60) days after delivery of the Proposed Transfer Notice to Buyer.

3.03 Additional Keystone Right to Purchase New Technology.

In addition, in the event that a Seller develops a New Technology and decides not to offer such New Technology to any Prospective Transferee, such Seller agrees to propose to Buyer to purchase such New Technology, under terms and conditions which shall be negotiated in good faith among the Parties, and which shall be consistent with the terms and conditions applied to the sale of the Purchased IP under this Agreement.

SECTION 4.

REPRESENTATIONS AND WARRANTIES OF SAMO

SAMO hereby represents and warrants to Buyer as set forth in this Section 4. Each representation and warranty in this Section 4 is made as of the date hereof, unless a specific date is expressly set forth in this Section 4. Each representation and warranty in this Section 4 shall be construed as a separate representation and warranty and is given subject to the exceptions and disclosures in this Agreement, including the Schedules hereto.

4.01 Organization and Standing.

Each Seller is an entity duly organized, validly existing and in good standing under the laws of the jurisdiction of organization with the requisite corporate power and authority to conduct its business as now being conducted and to own and lease its properties and assets. Each Seller is duly qualified or licensed to do business and is in good standing as a foreign corporation in every jurisdiction in which the character of the properties and assets owned or leased by it or the nature of the business conducted by it makes such qualification necessary, except where the failure to be so qualified and in good standing, would not, individually or in the aggregate, be reasonably likely to have a material adverse effect on Sellers’ ability to consummate the transactions contemplated by this Agreement and the Related Agreements.

4.02 Corporate Authority.

Each Seller has the corporate power and authority to execute, deliver and carry out the terms of this Agreement and each of the Related Agreements to which such Seller is a party and has taken all necessary corporate action to authorize the execution and delivery of this Agreement and the Related Agreements to which such Seller is a party and the consummation of the transactions contemplated hereby and thereby, and no other proceedings or actions on the part of such Seller is necessary to authorize such execution, delivery and consummation. This

11

Agreement and each of the Related Agreements to which each Seller is a party, when executed and delivered, is the legal, valid and binding obligation of such Seller enforceable against such Seller in accordance with their respective terms, except as may be limited by applicable bankruptcy, insolvency, moratorium or similar laws of general application relating to or affecting creditors’ rights generally and except for the limitations imposed by general principles of equity (collectively, the “Bankruptcy Exceptions”).

4.03 No Violation.

Neither the execution, delivery or performance of this Agreement or the Related Agreements to which such Seller is a party, nor the consummation by such Seller of the transactions contemplated hereby or thereby, will (a) violate or conflict with any provision of the organizational documents of such Seller, (b) violate or conflict with any applicable law or any judgment, decree, injunction, regulation or order of any court or Governmental Entity applicable to Sellers or any of Sellers’ assets or properties, including the Purchased Assets, (c) violate, conflict with, result in a breach of or constitute (with due notice or lapse of time or both) a default under, or permit or result in the termination of, or accelerate the maturity of or performance required under any contract, agreement, lease or other similar document or instrument to which such Seller is a party or by which it or any of the Purchased Assets may be bound or affected, or (d) result in the creation of any Lien upon any of the Purchased Assets.

4.04 Consents.

No authorization, consent, approval, license, certificate, permit, order of or from, declaration or filing with or notice to any Governmental Entity or any other Person is necessary for the execution and delivery of this Agreement and the Related Agreements to which such Seller is a party or the consummation by such Seller of the transactions contemplated hereby and thereby.

4.05 Intellectual Property.

(a) Schedules I, II, III and IV set forth a true and complete list of the Intellectual Property relating to the Sellers’ business and activity in the Dental Sector.

(b) Sellers own all right, title and interest in and to, or have valid and enforceable transferable licenses to make, have made, use, sell, offer for sale and/or import all the Purchased IP owned, issued to or controlled by Sellers or used in connection with the conduct and operation of the Sellers’ in the Dental Sector. All of the Purchased IP, including applications, copyrights, patents, know-how and registrations for the Purchased IP in the Sellers’ names, is set forth in Schedules I, II, III and IV. All Purchased IP that is owned by Sellers is valid, subsisting and enforceable (or in the case of applications, properly applied for) and held in the name of the applicable Seller. The true inventor or inventors are named in the Assigned Patents and Licensed Patents and all rights and interests therein have irrevocably been assigned to Sellers. With respect to the Purchased IP, Sellers have legal power to grant the assignment, license and other rights granted to Buyer in this Agreement and the Sublicense Agreement, and Sellers have not made and will not make any commitments to third parties inconsistent with or in derogation of such rights. Each Seller is in compliance in all material respects with all of its

12

contractual obligations relating to the Purchased IP used pursuant to any license or other agreement, including, but not limited to, all obligations owed to the Politecnico pursuant to the Politecnico Licenses. To the knowledge of Sellers, there is no unauthorized use, disclosure, infringement or misappropriation by any third party of any of the Purchased IP that is owned by Seller, including by any employee or former employee of any of Sellers or Sellers Affiliates. Neither the Purchased IP that is owned by Seller, nor the Seller’s use, development, manufacture, marketing, license, sale or intended use of any product, service or publication currently licensed, utilized, sold, provided or furnished by Sellers violates or conflicts with any license or other agreement between Sellers and any third party, or infringes or misappropriates any Intellectual Property or other proprietary right of any third Person. There is no pending or, to the knowledge of Sellers, threatened, claim or litigation contesting the validity, enforceability or ownership of the Purchased IP owned by Sellers or right of Sellers to exercise any rights therein nor, to the knowledge of Sellers, are there any specific facts that would form any reasonable basis for any such claim. There is no claim or proceeding pending against Sellers, or to the knowledge of Sellers threatened, alleging that Sellers have infringed or misappropriated any Intellectual Property rights of any third party.

(c) Other than the Related Agreements, agreements between and Seller and its respective employees and consultants, non-disclosure agreements entered into in the ordinary course of business, and support and maintenance agreements entered into in the ordinary course of business, Schedule 4.05(c) sets forth a complete list of all (i) licenses, sublicenses and other agreements in which Sellers has granted to any Person the right to make, use, sell, offer for sale, have made or import the Purchased IP, (ii) each agreement, contract or license under which any Seller is obligated to pay fees or royalties to any Person in connection with the use of any Purchased IP and (iii) all other consents, indemnifications, forbearances to sue, settlement agreements and licensing or cross-licensing arrangements to which Sellers, as applicable, is a party relating to the Purchased IP.

(d) None of the Purchased IP has been used, divulged, disclosed or appropriated to the detriment of Sellers for the benefit of any Person other than Sellers (for clarity, excluding pursuant to standard non-disclosure provisions entered into in the ordinary course of business). No employee, independent contractor, consultant or agent of Sellers has misappropriated any trade secrets or other confidential information of any other Person in the course of the performance of his or her duties as an employee, independent contractor, consultant or agent of Sellers.

(e) Each employee of, or consultant to, Sellers, or any of Sellers Affiliates, that has performed services relevant to the Purchased IP owned by Sellers or such Affiliate, has signed documents sufficient to assign to Sellers or such Affiliate any and all rights, title and interest in and to any ideas, inventions or improvements or other Intellectual Property comprising or relating to such Purchased IP, including any moral rights Sellers or any of Sellers Affiliates may have in the Purchased IP, and has complied with all obligations concerning their duty of disclosure to the entities responsible for granting intellectual property rights.

13

(f) Each Seller has taken reasonable precautions to protect the secrecy, confidentiality, and value of its material trade secrets and know-how relating to the Purchased IP. Such trade secrets and know-how are not part of the public knowledge or literature, and, to the knowledge of Sellers, have not been used, divulged, or appropriated for the benefit of any Person (other than Sellers), except pursuant to a properly executed standard confidentiality and non-disclosure agreement and, to the knowledge of Sellers, no Person has materially breached such agreement. To Seller’s knowledge, no trade secret is subject to any adverse claim or has been challenged or threatened in any action or proceeding.

(g) The Purchased Assets are not subject to any order, writ, judgment, award, injunction or decree of any Governmental Entity that affects or is reasonably likely to affect the Purchased Assets, or that would or is reasonably likely to interfere with the transactions contemplated by this Agreement or the Related Agreements.

4.06 Title to Assets.

(a) The Purchased Assets (and all items thereof) are in good operating condition and repair and are suitable for their intended use in all material respects. Upon delivery to Buyer of the executed bills of sale or other instruments of transfer in respect of the Purchased Assets and receipt by Sellers of the Asset Purchase Price, legal and valid title to the Purchased Assets will pass to Buyer, free and clear of all Liens (other than non-exclusive licenses in respect of which Buyer has and will have no obligations).

(b) Sellers have good and valid title to or, in the case of property held under lease or license, a valid and subsisting leasehold interest in or a legal, valid and enforceable license or right to use, the Purchased Assets, in each case, free and clear of all Liens (other than non-exclusive licenses in respect of which Buyer has and will have no obligations).

4.07 Compliance.

No Seller has received notice of any material violation of any law, regulation, order or other legal requirement, and no Seller is in material default with respect to any order, writ, judgment, award, injunction or decree of any Governmental Entity applicable to the Purchased Assets.

4.08 Solvency.

Immediately following the Effective Date and after giving effect to all of the transactions contemplated by this Agreement and the Related Agreements, Sellers will not (i) be insolvent (either because its financial condition is such that the sum of its debts, including contingent and other liabilities, is greater than the fair market value of its assets or because the fair saleable value of its assets is less than the amount required to pay its probable liability on its existing debts, including contingent and other liabilities, as they mature); or (ii) have unreasonably small capital for the operation of the businesses in which it is engaged or proposed to be engaged.

4.09 Brokerage, Commissions.

No broker, agent (excluding attorneys) or other intermediary has acted for Sellers in connection with the transactions contemplated in this Agreement and Sellers have not incurred and have no obligation to pay any brokerage or finder’s fees or commissions pursuant to this Agreement or upon the consummation of any of the transactions contemplated in this Agreement.

14

4.10 Accuracy of Information.

None of Sellers’ representations, warranties or statements contained in this Agreement and the Related Agreements, or in the Exhibits or Schedules hereto or thereto, contains any untrue statement of a material fact or omits to state any material fact.

SECTION 5.

REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer hereby represents and warrants to Seller as set forth in this Section 5. Each representation and warranty in this Section 5 is made as of the date hereof, unless a specific date is expressly set forth in this Section 5.

5.01 Organization and Standing.

Buyer is duly organized, validly existing and in good standing under the laws of its state of organization with the requisite power and authority to conduct its business as now being conducted and to own and lease its properties and assets.

5.02 Requisite Authority.

Xxxxx has the requisite power and authority to execute, deliver and carry out the terms of this Agreement and the Related Agreements to which Buyer is a party. The execution, delivery and performance of this Agreement and the Related Agreements to which Xxxxx is a party and the consummation of the transactions contemplated hereby and thereby have been duly and validly authorized by all necessary action on behalf of Buyer. This Agreement constitutes, and the Related Agreements to which Buyer is a party will constitute, when executed and delivered by Xxxxx, the legal, valid and binding obligations of Buyer enforceable against Buyer in accordance with their respective terms, except as may be limited by the Bankruptcy Exceptions.

5.03 No Violation.

Neither the execution, delivery or performance of this Agreement or the Related Agreements to which Buyer is a party, nor the consummation by Buyer of the transactions contemplated hereby or thereby, (a) will violate or conflict with any provision of the organizational documents of Buyer, or (b) will violate or conflict with any applicable law or any judgment, decree, injunction, regulation or order of any court or Governmental Entity applicable to Buyer or any of its assets or properties, other than violations or conflicts that would not have a material adverse effect on Buyer’s ability to consummate the transactions contemplated by this Agreement and the Related Agreements.

15

5.04 Authorizations.

Except for filings and/or recordings of any instruments of conveyance, transfer or assignment as required by the laws of the jurisdictions in which the Purchased Assets are located no authorization, consent, approval, order of or filing with or notice to any Governmental Entity by Buyer is necessary for the execution and delivery of this Agreement and the Related Agreements to which Buyer is a party by Buyer or the consummation by Buyer of the transactions contemplated hereby or thereby, except where the failure to obtain any such consent, waiver, authorization, approval, order, license, certificate, permit or registration or to make such declaration or filing or to provide such notice would not reasonably be expected, individually or in the aggregate, to have a material adverse effect on or otherwise materially impair or materially delay Buyer’s ability to consummate the transactions contemplated by this Agreement and the Related Agreements.

SECTION 6.

COVENANTS

6.01 Confidentiality; Public Announcements.

Each party agrees that the terms and conditions of this Agreement (and all schedules, certificates and deliverables attached hereto or delivered pursuant hereto) and the Related Agreements (and all schedules, certificates and deliverables attached thereto or delivered pursuant thereto) shall be treated as confidential information of all parties and shall not be disclosed to any third party, provided, however, that each party may disclose the term and conditions of this Agreement or the Related Agreements: (i) as required by any court or other governmental body; (ii) as otherwise required by law; (iii) to legal counsel of the parties; (iv) in confidence, to accountants, banks, private investors, and their advisors who have a need to know of such information in order to render services to the disclosing party, and who are under an obligation not to disclose such information or use such information for any purpose other than rendering such services or for the reasons set forth in clauses (i), (ii), (iii), (iv), (v) or (vi) hereof; (v) in connection with the enforcement of this Agreement or the Related Agreements or rights under this Agreement or the Related Agreements; or (vi) in confidence, in connection with an actual or proposed merger, acquisition, or similar transaction, If a party may disclose the terms and conditions of this Agreement or the Related Agreements as provided in (i) or (ii) of the preceding sentence, such party shall use best efforts to give the other party reasonable advance notice of such disclosure so that such other party may seek an appropriate protective order. Each Seller will consult with Buyer before issuing any press release or otherwise making any public statements with respect to this Agreement or the transactions contemplated hereby or the Related Agreements or the transactions contemplated thereby and shall not issue any press release or make any public statements without the prior written consent of Buyer or otherwise disclose this Agreement or the contents hereof or the Related Agreements or the contents thereof, unless in the opinion of counsel to such Seller, such disclosure is required by law (and solely to the extent required).

16

6.02 Prohibition.

Except with respect to the assignment and license granted to Buyer hereby and by the Sublicense Agreement, Sellers agree that they shall be prohibited from granting (i) any assignment, license, rights to, or interests in the Assigned Know-How or Assigned Patents, or any Improvements thereto, and (ii) any assignment, license, rights to, or interests in the Licensed Know-How or Licensed Patents, or any Improvements thereto, in the Dental Sector.

6.03 Patent Application.

The Sellers hereby covenant and agree to perform all affirmative acts in connection with the Patent Application that may be necessary to obtain the Patent Issuance, including but not limited to executing all papers and documents, providing all required information to the patent examiner, responding to all requests of the U.S. Patent and Trademark Office in a timely manner, amending the specification and claims if necessary, and performing all acts required to overcome any and all rejections by the patent examiner of the specification and claims of the Patent Application.

6.04 Further Assurances.

At the request of a party, the other parties shall do and perform or cause to be done and performed all such further acts, and furnish, execute and deliver such other documents, instruments or certificates, including instruments of assignment, transfer, conveyance, endorsement, direction or authorization, as the requesting party or its representatives may reasonably request from time to time to more effectively consummate the transactions contemplated by this Agreement and the Related Agreements and to perfect title of Buyer and its successor and assigns to the Purchased Assets.

6.05 Related Agreements.

Following the Effective Date, Sellers shall comply with the Related Agreements.

6.06 Non-Competition.

Sellers hereby, severally and jointly, agree that they shall not, during the Noncompete Period, in any manner, directly or indirectly, engage in or render services (of a manufacturing, distribution, sales, marketing, executive, administrative, financial or consulting nature) in the Dental Sector, or assist others, directly or indirectly, to engage in any business or activity in the Dental Sector, provided, however, that (i) SAMO shall be permitted to sell its prosthetic components to existing customers as of the Effective Date for a period of six (6) months from the Effective Date, (ii) Sellers shall be permitted to continue to conduct the permitted surface treatment technology activities in compliance with Schedule 6.06 hereto, (iii) Sellers shall be permitted to sell the Smiler Implant System in strict compliance with Section 2.10 of the MSS Agreement, and (iv) Sellers shall not be deemed to be in breach of this Section 6.06 to the extent Sellers are fulfilling their obligations pursuant to the MSS Agreement.

17

6.07 Buyer’s Commercially Reasonable Efforts.

Buyer hereby agrees to use its commercially reasonable efforts to promote the sale of the Keystone Branded Smiler Implant System in order to achieve the revenue milestones associated with the Contingent Payments set forth in Section 2.04 herein.

SECTION 7.

CHANGE IN CONTROL

7.01 Effects of Change in Control or IP Transfer.

In the event of a Change in Control or an IP Transfer all Contingent Payments not yet paid as of such date shall become immediately due and payable by Buyer to SAMO.

SECTION 8.

SURVIVAL

8.01 Survival of Covenants, Representations and Warranties.

The representations and warranties contained in this Agreement shall survive the Effective Date and the transactions contemplated hereby until expiration of the applicable statute of limitations in respect thereof, and the covenants, undertakings, agreements and other obligations of the parties set forth in this Agreement shall survive the Effective Date and the consummation of the transactions contemplated hereby in accordance with their terms.

SECTION 9.

INDEMNIFICATION

9.01 Indemnification by Sellers.

(a) Subject to the terms and conditions of this Section 9, from and after the Effective Date, and notwithstanding any investigation at any time made by or on behalf of Buyer or any other Buyer Indemnified Party or any knowledge or information that Buyer or any other Buyer Indemnified Party may now have or hereafter obtain, Sellers shall jointly and severally indemnify, defend and hold Buyer, its Affiliates, and each of their respective directors, officers, employees, agents, successors and permitted assigns (collectively, the “Buyer Indemnified Parties”), harmless from and against any and all out-of-pocket losses, liabilities, damages, expenses, including reasonable attorneys’ fees, deficiencies, interest, penalties, impositions, assessments or fines (collectively, “Damages”) resulting from any third-party claim, demand, action, suit or proceeding (each “Third-Party Claim”), relating to, arising out of or resulting from:

(i) the breach of any of the representations and warranties, covenants, undertakings, agreements or other obligations of Sellers contained in this Agreement, in any of the Related Agreements;

(ii) the infringement of Intellectual Property rights of third parties due to the use of the Purchased IP; or

18

(iii) the enforcement by such Buyer Indemnified Party against Seller of its indemnification rights under this Section 9.01.

The events and occurrences set forth in clauses (i)-(iii) immediately above are referred to herein collectively as the “Seller Indemnifiable Events.”

9.02 Indemnification Procedure.

If there occurs an event which any Buyer Indemnified Party asserts is an indemnifiable event pursuant to this Section 9, the Buyer Indemnified Party shall promptly notify in writing the Sellers of the occurrence of such event; provided, however, that the failure of the Buyer Indemnified Party to give the Sellers timely notice as provided herein shall not relieve Sellers of Sellers’ obligations under this Section 9, except to the extent Sellers are actually and materially prejudiced thereby. If the Buyer Indemnified Party shall give the Sellers prompt written notice of such Third Party Claim or the commencement of such action, suit or proceeding, and upon written request by the Buyer, the Sellers shall, at Sellers’ election at any time, promptly defend or assume the defense and continue the defense of such Third Party Claim at the Sellers’ expense; provided, that the Sellers shall not consent to the entry of any judgment or enter into any settlement or compromise without the written consent of the Buyer Indemnified Party (such consent not to be unreasonably withheld); provided, however, that no such consent shall be required as long as it is solely a monetary settlement (that will be paid entirely by the Sellers) that provides a full release of the Buyer Indemnified Party with respect to such matter and does not contain an admission of liability on the part of the Buyer Indemnified Party and will not have an ongoing adverse affect on the business or operations of the Buyer Indemnified Party. If the Sellers elect not to defend, fail to undertake or continue such defense, the Buyer shall have the right (but not the obligation) to make and continue such defense as it considers appropriate, and the expenses and costs thereof (including but not limited to reasonable attorneys’ fees, out-of-pocket costs and the costs of an appeal and bond thereof, together with the amounts of any judgment rendered against the Buyer) shall be paid by the Sellers. Notwithstanding the election by the Sellers to assume any defense, the Buyer shall have the right to participate in such defense at its own expense.

SECTION 10.

CERTAIN TAX MATTERS

10.01 Taxes.

(a) Any tax, including, but not limited to, sales tax (imposta di registro), attributable to the sale or transfer of the Purchased Assets (“Transfer Taxes”) shall be borne solely by the Sellers.

(b) Buyer and Sellers agree to furnish or cause to be furnished to each other, upon request, as promptly as practicable, such information and assistance relating to the Purchased Assets (including access to books and Records) as is reasonably necessary for the filing of all Tax Returns, the making of any election relating to taxes, the preparation for any audit by any taxing authority, and the prosecution or defense of any claim, suit or proceeding relating to any tax. Buyer and Sellers shall retain all books and records with respect to taxes pertaining to the Purchased Assets for a period of at least six (6) years following the Effective Date.

19

SECTION 11.

MISCELLANEOUS

11.01 Interpretation.

The use in this Agreement of the word “including” shall mean “including, but not limited to.” The words “herein”, “hereof”, “hereto” and other similar words shall mean this Agreement as a whole, including the Schedules hereto, as the same may be amended, modified or supplemented from time to time. The inclusion of any information on any Schedule shall not, in and of itself, be deemed to be an admission or acknowledgement by Seller that such information is required to be disclosed on such Schedule or that such information is material. The disclosure of an item on any Schedule shall not be deemed to be disclosure thereof for purposes of any other Schedule hereto.

11.02 Expenses.

Except as otherwise provided herein, whether or not the transactions contemplated herein are consummated, each party shall bear its own expenses and the expenses, fees and other costs of its advisors and counselors in connection with this Agreement and the Related Agreements and the transactions contemplated hereby and thereby, including finder’s or broker’s fees, if any.

11.03 Amendment; Waiver.

No modification, alteration or amendment of this Agreement shall be valid or binding unless in writing and signed by the party to be charged with such modification, alteration or amendment. No waiver of any term or condition of this Agreement shall be construed as a waiver of any other term or condition; nor shall any waiver of any default or breach under this Agreement be construed as a waiver of any other default or breach. No waiver shall be binding unless in writing and signed by the party waiving the term, condition, default or breach. Any failure or delay by either party to enforce any of its rights under this Agreement shall not be deemed a continuing waiver or modification hereof and said party, within the time provided by law, may commence appropriate legal proceedings to enforce any or all of such rights.

11.04 Parties in Interest; Binding Effect; Assignment.

This Agreement is for the sole benefit of the parties hereto and shall not create any rights in any person not a party. Nothing in this Agreement is intended to relieve or discharge the obligations or liability of any third persons to Sellers or Buyer. Except as provided in Section 9 hereto, no provision of this Agreement shall give any third persons any right of subrogation or action over or against Sellers or Buyer. Neither party hereto shall be entitled to assign or transfer this Agreement (by operation of law or otherwise) and/or part or all of its rights and obligations hereunder without the prior written consent of the other party. This Agreement will be binding upon, inure to the benefit of, and be enforceable by the successors and permitted assigns of the parties.

20

11.05 Cumulative Remedies

Any and all remedies expressly conferred upon Buyer or its Affiliates pursuant to this Agreement, including pursuant to Section 9 hereof, will be cumulative with, and not exclusive of, any other remedy available to Buyer or such Affiliate, as applicable, pursuant to this Agreement or otherwise, whether at law or in equity. The exercise of any one remedy by Buyer or its Affiliate, as applicable, shall not preclude the exercise by it of any and all other remedies (including, without limitation, specific performance).

11.06 Entire Agreement.

This Agreement, including the Schedules hereto, and the Related Agreements (a) represent the entire understanding and agreement of the parties with respect to the transactions contemplated and subject matters addressed herein and therein, (b) are intended by the parties as a complete and exclusive statement of the terms of their agreement and constitute a fully integrated agreement and (c) supersede and replace all prior negotiations and agreements, whether written or oral, concerning the transactions contemplated and subject matters addressed herein and therein.

11.07 Legal Representation.

Each Seller hereby acknowledges (i) that Xxxxx has advised them to consult with an attorney prior to executing this Agreement and each of the Related Agreements, (ii) that each Seller has had the time and opportunity to consult with and retain legal counsel and (iii) that each Seller has freely elected not to do so.

11.08 Interpretation.

The parties hereto have participated jointly in the negotiation of this Agreement and each of the Related Agreements, thus, it is understood and agreed that the general rule that ambiguities are to be construed against the drafter shall not apply to this Agreement or any of the Related Agreements.

11.09 Section and Other Headings, Number.

The Section and other headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement. Words used in this Agreement in the singular number shall be held to include the plural, and vice versa, unless the context requires otherwise.

11.10 Notices.

All notices or other communications under this Agreement and the Related Agreements shall be in writing and either personally delivered, sent by certified or registered mail (return receipt requested, postage prepaid), sent by reputable overnight delivery service, or sent by facsimile with telephone verification of receipt, to the respective addresses set forth below (or to such other addresses as a party may designate by notice given as aforesaid).

21

| If to Sellers: | If to Buyer: | |

| Nanosurfaces S.r.l. | Keystone Dental, Inc. | |

| Via Matteotti 37 | 000 Xxxxxxxxx Xxxxxxxx | |

| 40057, Granarolo Dell’Xxxxxx (BO) | Burlington, MA 01803 | |

| Italy | USA | |

| Attn: Xxxxx Xxxx | Attn: Xxx Xxxxx | |

| And | ||

| SAMO S.p.A. | ||

| Via Matteotti 37 40057, Granarolo Dell’Xxxxxx (BO) Italy |

||

| Attn: Xxxxx Xxxx | with a copy to: | |

| Xxxxxxx Xxxx & Xxxxxxxxx LLP 000 Xxxxxxx Xxxxxx Xxx Xxxx, XX 00000 XXX | ||

| Attn: Xxxx Xxxxxxxx Xxxx Xxxxxxxx | ||

| Facsimile: (000) 000-0000 | ||

All notices and communications (i) personally delivered shall be deemed given upon receipt, (ii) sent by certified or registered mail shall be deemed given on the third Business Day after mailing, (iii) sent by reputable overnight delivery service shall be deemed given on the first Business Day after timely delivery to the courier, and (iv) sent by facsimile shall be deemed given on the date the sender obtains telephone verification of receipt.

11.11 Governing Law.

This Agreement shall be governed by and construed and enforced in accordance with the laws of the State of New York applicable to contracts made and to be performed within such state without giving effect to the applicable principles of conflicts of law to the extent that the application of the laws of another jurisdiction would be required thereby.

11.12 Dispute Resolution.

In the event of any dispute or disagreement between the parties as to the interpretation of any provision of this Agreement or the performance of obligations hereunder, the matter, upon written request of either party, shall first be referred to representatives of the parties for resolution. The representatives shall promptly meet in a good faith effort to resolve the dispute. If the dispute cannot be resolved by the representatives within thirty (30) days after its submission or if either party does not participate in such resolution procedure, the matter shall be resolved exclusively and definitively by binding arbitration in accordance with the Rules of

22

Arbitration of the International Chamber of Commerce in effect on the date when the request for arbitration is submitted. The seat of such arbitration shall be Geneva, Switzerland. Such arbitration shall be conducted in the English language by three arbitrators named in accordance with such rules. Each party shall bear its own expenses. The cost of the arbitration shall be shared equally by the parties. Each of the parties hereto waives, and agrees not to assert, as a defense in any legal dispute, that such party is not subject thereto or that such action, suit or proceeding may not be brought or is not maintainable in such arbitration or that such party’s property is exempt or immune from execution, that the action, suit or proceeding is brought in an inconvenient forum or that the venue of the action, suit or proceeding is improper. Each party hereto agrees that a final judgment in any action, suit or proceeding described in this Section 10.12 after the expiration of any period permitted for appeal and subject to any stay during appeal shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by applicable laws.

11.13 Counterparts.

This Agreement may be executed in two or more counterparts, each of which shall be deemed an original but all of which taken together shall constitute one and the same instrument.

11.14 Severability.

If any provision of this Agreement shall be held invalid or unenforceable, the remainder of this Agreement shall not be affected thereby and shall be enforced to the greatest extent permitted by applicable law. It is the intent of the parties that the provisions of this Agreement be enforced to the maximum extent possible, and the parties undertake to consult with each other in order to substitute any invalid or unenforceable provision with a valid provision of equivalent effect.

23

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

| BUYER: | ||

| KEYSTONE DENTAL, INC. | ||

| By: | /s/ Xxxxxx X. Xxxxxxxx | |

| Name: Xxxxxx X. Xxxxxxxx Title: Presidente and CEO | ||

| SELLERS:

NANOSURFACES S.r.l. | ||

| By: | /s/ Xxxx Xxxxx Xxxx | |

| Name: Xxxx Xxxxx Xxxx | ||

| Title: Chairman of the Board of Directors | ||

| SAMO S.p.A. | ||

| By: | /s/ Xxxxx Xxxx | |

| Name: Xxxxx Xxxx | ||

| Title: Chairman of the Board of Directors | ||

Schedule I

Assigned Know-How

The following know-how is common to the surface treatments set forth on Schedules II, III and IV.

This shall include but is not limited to:

| a) | Cleaning |

All cleaning processes prior to, between and following any surface treatment process which are necessary to ensure the correct application of a surface treatment or the removal of surface residues prior to processing or packaging.

| b) | Blasting and related processes |

Any blasting or mechanical surface treatment process applied as a step in the surface treatment.

| c) | Masking |

All masking designs and drawings of the masks required to produce dental implant system component.

| d) | Inspection and Test Methods |

The procedures required to ensure the quality and reproducibility of a surface treatment. All design drawings of any fixtures required to carry out inspection and testing.

Schedule II

Assigned Patents

| a) Additional Surface Treatments (pre-treatment for TiCare) |

IT2007BO0436A1, WO2009000774A1 | |

| b) Pink Collar Design Patent |

EU 000594601 | |

| IT 0000090314 | ||

| US 29/274404 (application) | ||

| c) Pink Abutment Design Patent |

EU 000631601 | |

| d) White Titanium design Patent |

EU 000642145 | |

| e) Consistent Application of TiCare Design Patent |

08425676 | |

Schedule III

Licensed Know-How

| a) | BioRough |

All procedures and description of equipment, including the know-how listed in Schedule I, necessary to perform low temperature chemical etching treatment of dental implants, including decontamination and roughening of such implants in the portion intended for integration in the bone, without modifying the surface which will be in contact with the periodontal tissue.

| b) | TiCare |

All procedures and description of equipment, including the know-how listed in Schedule I, necessary to perform electrochemical antibacterial treatments on titanium and alloy, that can provide an antibacterial effect without modifying the superficial morphology of the implant surface intended to be in contact with bone.

| c) | BioSpark |

All procedures and description of equipment, including the know-how listed in Schedule I, necessary to perform a surface modification of titanium and alloys for improving osseointegration properties with, named “bone-integration interface for implantable prosthesis and method for the treatment of such bone-integrate interface”.

| d) | White Titanium |

A description of the process used to produce a white color on the surface of titanium.

| e) | Color Anodizing |

All procedures and description of equipment, including the know-how listed in Schedule I, used in the color coding of dental implant system components for identification purposes only. The term “color coding” excludes surface treatments which have functions other than for identification purposes only.

Schedule IV

Licensed Patents

| a) | BioSpark |

WO 2004/000378 A1 and all related applications and registrations.

EP 1515759B1 (European patent specification), as also filed in France, Italy, Spain, Sweden and Switzerland.

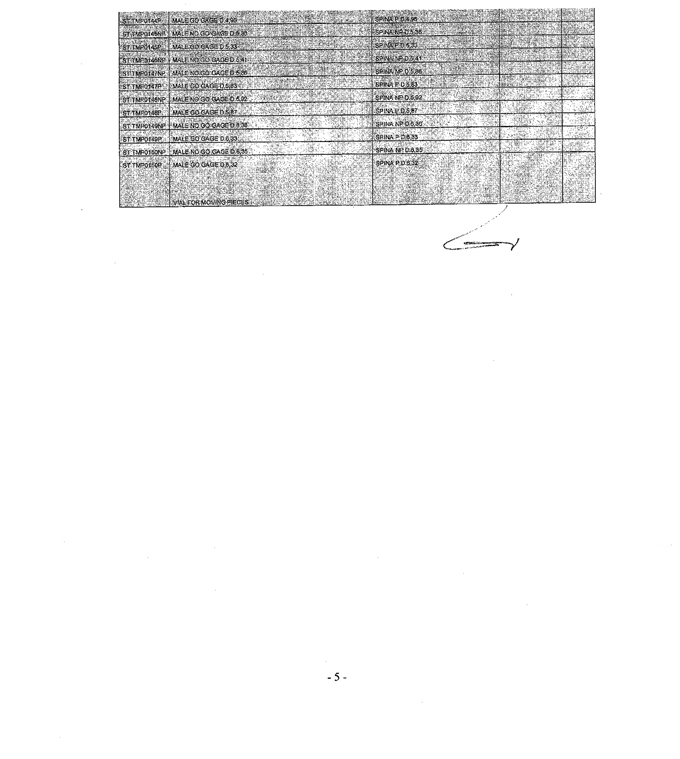

SCHEDULE V

Purchased Manufacturing and Process Related Equipment

LIST:

| PART NUMBER |

DESCRIPTION |

AMOUNT | ||||

| ST MSCSM380_BS | MASK FOR | BIOSPARK TREATMENT | 5 | |||

| ST MSCSM450_BS | MASK FOR | BIOSPARK TREATMENT | 5 | |||

| ST MSCSM550_BS | MASK FOR | BIOSPARK TREATMENT | 5 | |||

| ST MSCSM650_BS | MASK FOR | BIOSPARK TREATMENT | 3 | |||

| ST MSCSM380_BR | MASK FOR | BIOROUGH TREATMENT | 5 | |||

| ST MSCSM450_BR | MASK FOR | BIOROUGH TREATMENT | 6 | |||

| ST MSCSM550_BR | MASK FOR | BIOROUGH TREATMENT | 6 | |||

| ST MSCSM650_BR | MASK FOR | BIOROUGH TREATMENT | 2 | |||

| ST MSCSM380_SB | MASK FOR | SAND-BLASTING | 1 | |||

| ST MSCSM450_SB | MASK FOR | SAND-BLASTING | 1 | |||

| ST MSCSM550_SB | MASK FOR | SAND-BLASTING | 1 | |||

| ST MSCSM650_SB | MASK FOR | SAND-BLASTING | 1 | |||

| ST NAN0012 | MASK FOR | COLOR CODING AND TICARE ABUTMENT AND HEALING SCREW | 200 | |||

| ST NAN0013 | MASK FOR | COLOR CODING AND TICARE ABUTMENT AND HEALING SCREW | 200 | |||

| ST NAN0014 | MASK FOR | COLOR CODING AND TICARE ABUTMENT AND HEALING SCREW | 200 | |||

| ST NAN0015 | MASK FOR | COLOR CODING AND TICARE ABUTMENT AND HEALING SCREW | 200 | |||

| ST MSCTIC00 | MASK FOR | TICARE TREATMENT FOR IMPLANTS | 5 | |||

| ST NAN0022 | MASK FOR | COLOR CODING AND TICARE ABUTMENT AND HEALING SCREW | 200 | |||

| PART NUMBER |

MATERIAL |

REF. DIAMETR |

TREATED PARTS | |||||||

| ST MSCSIVI380_BS | made in | POM | diameter | 3,8 mm | ||||||

| ST MSCSM450_BS | made in | POM | diameter | 4,5 mm | ||||||

| ST MSCSM550_BS | made in | POM | diameter | 5,5 mm | ||||||

| ST MSCSM650_BS | made in | POM | diameter | 6,5 mm | ||||||

| ST MSCSM380_BR | made in | PEEK | diameter | 3,8 mm | ||||||

| ST MSCSM450_BR | made in | PEEK | diameter | 4,5 mm | ||||||

| ST MSCSM550_BR | made in | PEEK | diameter | 5,5 mm | ||||||

| ST MSCSM650_BR | made in | PEEK | diameter | 6,5 mm | ||||||

| ST MSCSM380_SB | made in | STAINLESS STEEL | diameter | 3,8 mm | ||||||

| ST MSCSM450_SB | made in | STAINLESS STEEL | diameter | 4,5 mm | ||||||

| ST MSCSM550_SB | made in | STAINLESS STEEL | diameter | 5,5 mm | ||||||

| ST MSCSM650_SB | made in | STAINLESS STEEL | diameter | 6,5 mm | ||||||

| ST NAN0012 | made in | PEEK | diameter | 3,8 mm | CM38-CG38 | |||||

| ST NAN0013 | made in | PEEK | diameter | 4,5 mm | CM45-CG45 | |||||

| ST NAN0014 | made in | PEEK | diameter | 5,5 mm | CM55-CG55 | |||||

| ST NAN0015 | made in | PEEK | diameter | 6,5 mm | CM65-CG65 | |||||

| ST MSCTIC00 | diameter | 3,8-4,5-5,5-6,5 mm | ||||||||

| ST NAN0022 | diameter | 3,8-4,5-5,5-6,5 mm | CM34-CM56-CG34-CG56 | |||||||

SCHEDULE VII

Developments:

IMPLANT 3.8-4.5-5.5-6.5

| ST CM383xxO | FLAT-CONE (EXTRA SYSTEM WITH A FLT-CONE INSTEAD OF OCTACONE | |

| ST KT3032 | SURGICAL TRAY WITH SINGLE DRILL AND NON STOPPER | |

| ABUTMENTS | POSSIBILITY TO MARKET ALL THE ABUTMENTS WE HAVE ON THE CATALOGUE BOTH WITHOUT TICARE OR WITH TIWHITE (CE MARKED ALREADY) | |

| ANATOMIC HEALING SCREW | ANATOMIC HEALIGN SCREW |

IMPLANT 2.9-3.3

| ST CC32001V | CLOSURE SCREW/CAP (FRICTION) | |

| ST CG23001X | HEALING SCREW | |

| ST CG23002X | HEALING SCREW | |

| ST CG23003X | HEALING SCREW | |

| ST CM23001O | EXTRA SYSTEM ABUTMENT | |

| ST CM23001P | UCLA TITANIUM BASED | |

| ST CM23001PG | UCLA GOLD BASED | |

| ST CM23001Q | BALL ABUTMET | |

| ST CM23002O | EXTRA SYSTEM ABUTMENT | |

| ST CM23002Q | BALL ABUTMET | |

| ST CM2300XW | PREANGLED ABUTMENT (15/20° - 15/2.5 mm - A/B) | |

| ST CM32001M | DRILLABLE ABUTMENT SKIRTED | |

| ST CV23003V | CLOSURE SCREW/CAP (SKIRTED) | |

| ST MP29100S | SMALL DIAMETER IMPLANT | |

| ST MP29115S | SMALL DIAMETER IMPLANT | |

| ST MP29130S | SMALL DIAMETER IMPLANT | |

| ST MP29145S | SMALL DIAMETER IMPLANT | |

| ST MP29160S | SMALL DIAMETER IMPLANT | |

| ST MP29180S | SMALL DIAMETER IMPLANT | |

| ST MP33100S | SMALL DIAMETER IMPLANT | |

| ST MP33115S | SMALL DIAMETER IMPLANT | |

| ST MP33130S | SMALL DIAMETER IMPLANT | |

| ST MP33145S | SMALL DIAMETER IMPLANT | |

| ST MP33160S | SMALL DIAMETER IMPLANT | |

| ST MP33180S | SMALL DIAMETER IMPLANT | |

| ST SAC23001 | ANALOGUE | |

| ST SCM23001 | DIS-MOUNTING TOOL | |

| ST STC32001 | IMPRESSION COPING OPEN TRAY | |

| ST STC32101 | IMPRESSION COPING CLOSED TRAY | |

| PROCESSES White Titanium Process | ||

SCHEDULE 4.05(c)

| 1. | Contratto di Licenza between the Politecnico di Milano and NanoSurfaces S.r.l., dated July 25, 2003, as amended, with respect to patent no. MI 2002A001377 (“BioSpark”). |

| 2. | Contralto per Cessione di Know How between the Politecnico di Milano and NanoSurfaces S.r.l., dated July 25, 2003, as amended, with respect to the “TiCare” know-how. |

| 3. | Contralto per Cessione di Know How between the Politecnico di Milano and NanoSurfaces S.r.l., dated Novembre 21, 2005, as amended, with respect to the “BioRough” know-how. |

SCHEDULE 6.06

Permitted Surface Treatment Technologies

1. Sellers may utilize the Purchased IP for application outside of the dental field.

2. Anodic Spark Deposition (ASD) technology to be used on abutments in the dental field, provided however that this technology cannot result in the color white on any titanium component in the dental field.

3. Chemical etching technology to be used in the dental field, provided that such technology in no way competes with the Purchased IP.