VA780NY Thank you for choosing Jackson National Life Insurance Company of New York®, hereinafter also referred to as "the Company" or "Jackson of NY®." READ YOUR CONTRACT CAREFULLY. This annuity contract is issued by the Company and is a legal...

VA780NY

Thank you for choosing Xxxxxxx National Life Insurance Company of New York®, hereinafter also

referred to as "the Company" or "Xxxxxxx of NY®."

READ YOUR CONTRACT CAREFULLY.

This annuity contract is issued by the Company and is a legal agreement between the Owner ("You")

and Xxxxxxx of NY.

THE VALUE OF AMOUNTS ALLOCATED TO THE SEPARATE ACCOUNT DURING THE

ACCUMULATION AND ANNUITY PERIODS IS NOT GUARANTEED AND MAY INCREASE OR

DECREASE BASED UPON THE INVESTMENT EXPERIENCE OF THE FUND(S) UNDERLYING THE

SEPARATE ACCOUNT.

IF THE ACTUAL INVESTMENT RATES EXPERIENCED BY THE SEPARATE ACCOUNT ASSETS

ARE LESS THAN [1.00%], VARIABLE ANNUITY PAYMENTS WILL DECREASE OVER TIME.

PLEASE REVIEW THE CONTRACT DATA PAGES FOR CONTRACT CHARGES.

NOTICE OF RIGHT TO EXAMINE CONTRACT

YOU MAY RETURN THIS CONTRACT TO THE SELLING PRODUCER OR XXXXXXX NATIONAL

LIFE INSURANCE COMPANY OF NEW YORK WITHIN 20 DAYS (60 DAYS IF IT WAS PURCHASED

AS A REPLACEMENT CONTRACT) AFTER YOU RECEIVE IT. UPON RECEIPT OF THIS

CONTRACT, THE COMPANY WILL REFUND THE SEPARATE ACCOUNT CONTRACT VALUE

DETERMINED AS OF THE BUSINESS DAY ON WHICH THE CONTRACT IS RETURNED TO THE

SELLING PRODUCER OR THE COMPANY, INCLUDING ANY FEES OR OTHER CHARGES

DEDUCTED FROM THE PREMIUMS OR IMPOSED UNDER THE CONTRACT. UPON SUCH

REFUND, THIS CONTRACT SHALL BE VOID.

Please Note: The Company reserves the right to allocate initial Premium and any subsequent Premium

received during the "Notice of Right to Examine Contract" period to a money market Investment

Division and will allocate the Separate Account Contract Value to the Investment Divisions specified by

the Contract Owner when the "Notice of Right to Examine Contract" period has expired.

INDIVIDUAL DEFERRED

VARIABLE ANNUITY CONTRACT

(FLEXIBLE PREMIUM).

DEATH BENEFIT AVAILABLE.

INCOME OPTIONS AVAILABLE.

NONPARTICIPATING.

This Contract is signed by the Company

President

Secretary

Home Office: Service Center:

[0000 Xxxxxxxxxxx Xxxxxx [P.O. Box 24068

Purchase, New York 10577] Lansing, MI 48909-4068

1-800-599-5651

xxx.xxxxxxx.xxx]

DRAFT 2 07/01/16

VA780NY 2

TABLE OF CONTENTS

Provision Page Number

Contract Data Pages [3a

Definitions 4

General Provisions 7

Accumulation Provisions 11

Withdrawal Provisions 12

Death Benefit Provisions 14

Income Provisions 17

Termination Provision 21]

If You have questions about this Contract including requests for information about coverage or

complaint resolutions, You may contact our Service Center as specified on the cover page of

the Contract.

VA780NY-FB1 3a

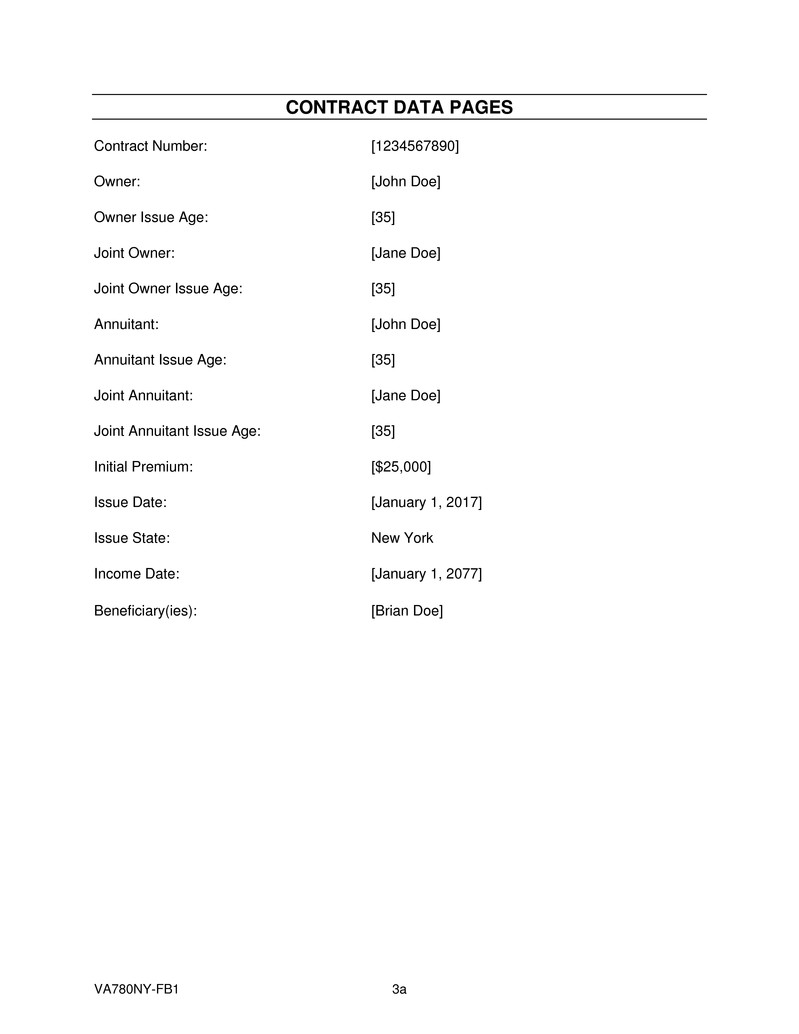

CONTRACT DATA PAGES

Contract Number: [1234567890]

Owner: [Xxxx Xxx]

Owner Issue Age: [35]

Joint Owner: [Xxxx Xxx]

Joint Owner Issue Age: [35]

Annuitant: [Xxxx Xxx]

Annuitant Issue Age: [35]

Joint Annuitant: [Xxxx Xxx]

Joint Annuitant Issue Age: [35]

Initial Premium: [$25,000]

Issue Date: [January 1, 2017]

Issue State: New York

Income Date: [January 1, 2077]

Beneficiary(ies): [Xxxxx Xxx]

VA780NY-FB1 3b

CONTRACT DATA PAGES (CONT'D)

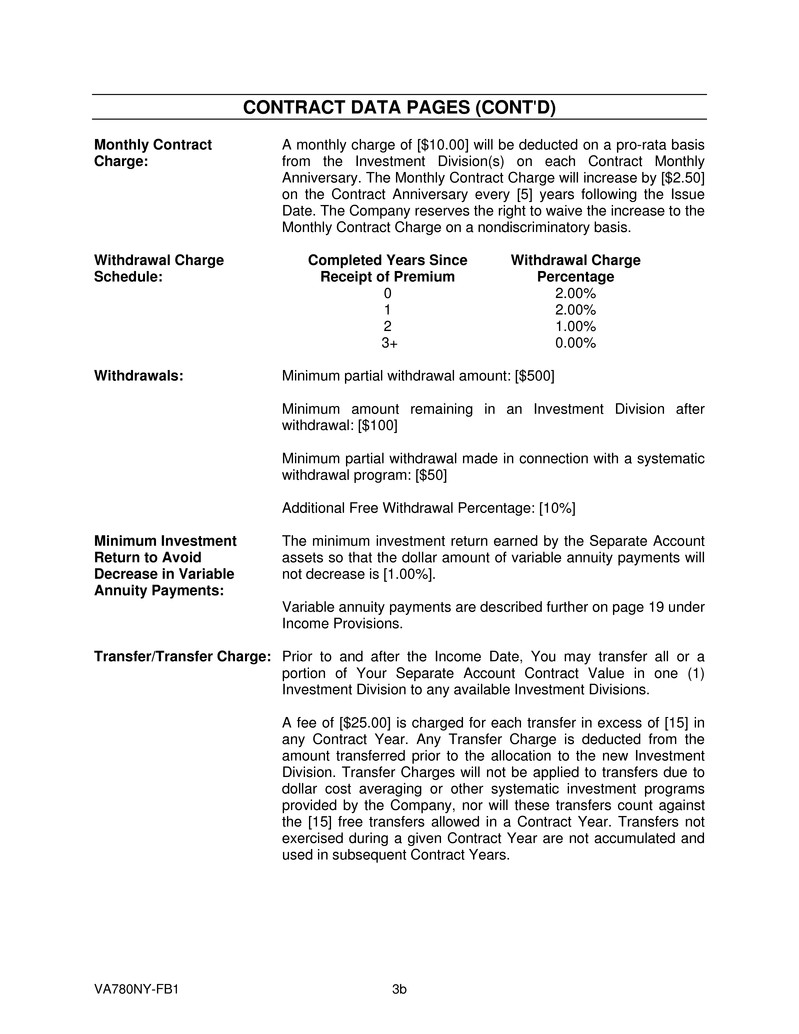

Monthly Contract A monthly charge of [$10.00] will be deducted on a pro-rata basis

Charge: from the Investment Division(s) on each Contract Monthly

Anniversary. The Monthly Contract Charge will increase by [$2.50]

on the Contract Anniversary every [5] years following the Issue

Date. The Company reserves the right to waive the increase to the

Monthly Contract Charge on a nondiscriminatory basis.

Withdrawal Charge Completed Years Since Withdrawal Charge

Schedule: Receipt of Premium Percentage

0 2.00%

1 2.00%

2 1.00%

3+ 0.00%

Withdrawals: Minimum partial withdrawal amount: [$500]

Minimum amount remaining in an Investment Division after

withdrawal: [$100]

Minimum partial withdrawal made in connection with a systematic

withdrawal program: [$50]

Additional Free Withdrawal Percentage: [10%]

Minimum Investment The minimum investment return earned by the Separate Account

Return to Avoid assets so that the dollar amount of variable annuity payments will

Decrease in Variable not decrease is [1.00%].

Annuity Payments:

Variable annuity payments are described further on page 19 under

Income Provisions.

Transfer/Transfer Charge: Prior to and after the Income Date, You may transfer all or a

portion of Your Separate Account Contract Value in one (1)

Investment Division to any available Investment Divisions.

A fee of [$25.00] is charged for each transfer in excess of [15] in

any Contract Year. Any Transfer Charge is deducted from the

amount transferred prior to the allocation to the new Investment

Division. Transfer Charges will not be applied to transfers due to

dollar cost averaging or other systematic investment programs

provided by the Company, nor will these transfers count against

the [15] free transfers allowed in a Contract Year. Transfers not

exercised during a given Contract Year are not accumulated and

used in subsequent Contract Years.

VA780NY-FB1 3c

CONTRACT DATA PAGES (CONT'D)

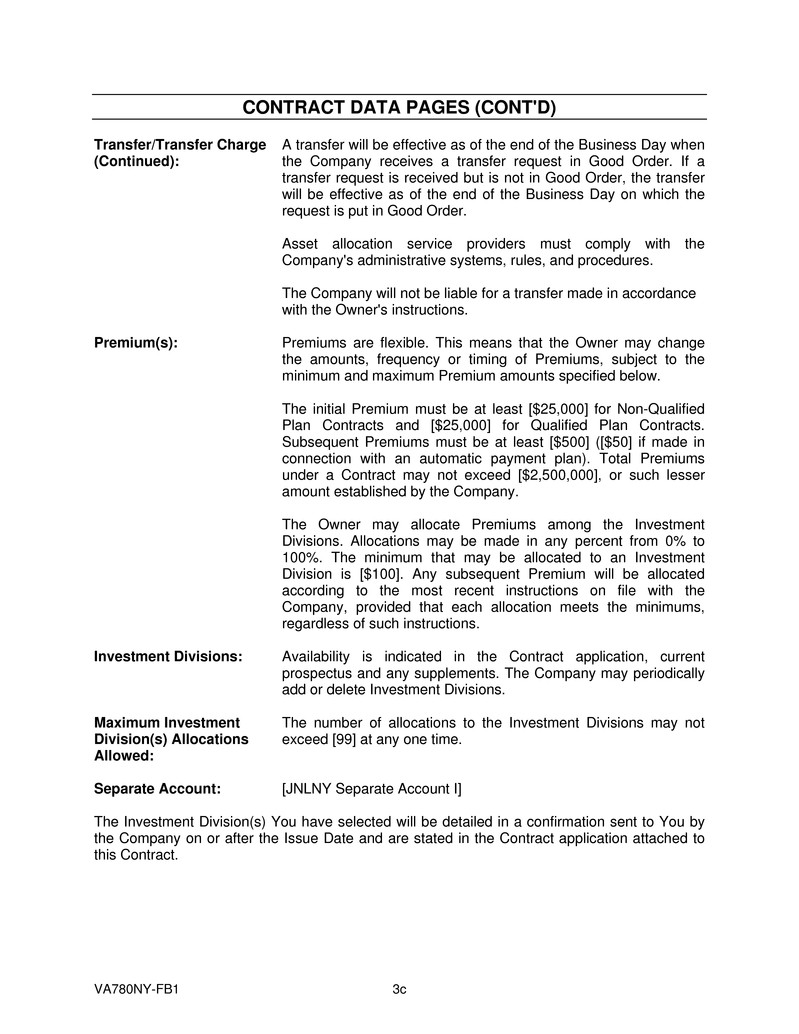

Transfer/Transfer Charge A transfer will be effective as of the end of the Business Day when

(Continued): the Company receives a transfer request in Good Order. If a

transfer request is received but is not in Good Order, the transfer

will be effective as of the end of the Business Day on which the

request is put in Good Order.

Asset allocation service providers must comply with the

Company's administrative systems, rules, and procedures.

The Company will not be liable for a transfer made in accordance

with the Owner's instructions.

Premium(s): Premiums are flexible. This means that the Owner may change

the amounts, frequency or timing of Premiums, subject to the

minimum and maximum Premium amounts specified below.

The initial Premium must be at least [$25,000] for Non-Qualified

Plan Contracts and [$25,000] for Qualified Plan Contracts.

Subsequent Premiums must be at least [$500] ([$50] if made in

connection with an automatic payment plan). Total Premiums

under a Contract may not exceed [$2,500,000], or such lesser

amount established by the Company.

The Owner may allocate Premiums among the Investment

Divisions. Allocations may be made in any percent from 0% to

100%. The minimum that may be allocated to an Investment

Division is [$100]. Any subsequent Premium will be allocated

according to the most recent instructions on file with the

Company, provided that each allocation meets the minimums,

regardless of such instructions.

Investment Divisions: Availability is indicated in the Contract application, current

prospectus and any supplements. The Company may periodically

add or delete Investment Divisions.

Maximum Investment The number of allocations to the Investment Divisions may not

Division(s) Allocations exceed [99] at any one time.

Allowed:

Separate Account: [JNLNY Separate Account I]

The Investment Division(s) You have selected will be detailed in a confirmation sent to You by

the Company on or after the Issue Date and are stated in the Contract application attached to

this Contract.

VA780NY-FB1 3d

CONTRACT DATA PAGES (CONT'D)

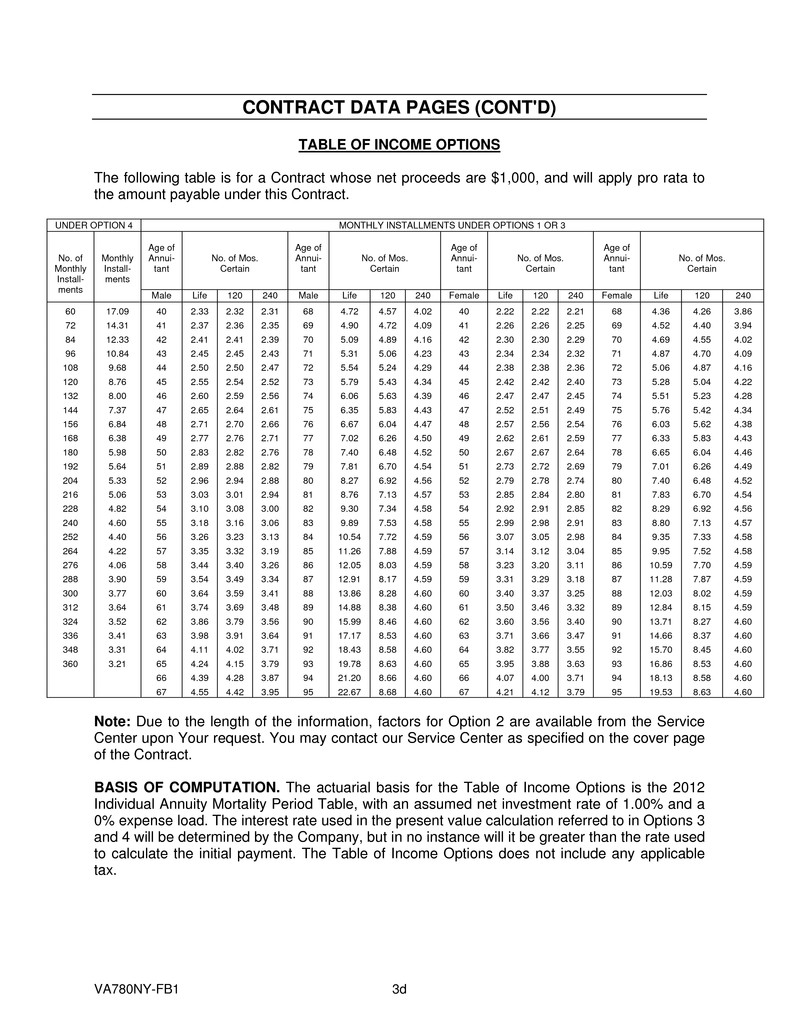

TABLE OF INCOME OPTIONS

The following table is for a Contract whose net proceeds are $1,000, and will apply pro rata to

the amount payable under this Contract.

UNDER OPTION 4 MONTHLY INSTALLMENTS UNDER OPTIONS 1 OR 3

No. of

Monthly

Install-

ments

Monthly

Install-

ments

Age of

Annui-

tant

No. of Mos.

Certain

Age of

Annui-

tant

No. of Mos.

Certain

Age of

Annui-

tant

No. of Mos.

Certain

Age of

Annui-

tant

No. of Mos.

Certain

Male Life 120 240 Male Life 120 240 Female Life 120 240 Female Life 120 240

60 17.09 40 2.33 2.32 2.31 68 4.72 4.57 4.02 40 2.22 2.22 2.21 68 4.36 4.26 3.86

72 14.31 41 2.37 2.36 2.35 69 4.90 4.72 4.09 41 2.26 2.26 2.25 69 4.52 4.40 3.94

84 12.33 42 2.41 2.41 2.39 70 5.09 4.89 4.16 42 2.30 2.30 2.29 70 4.69 4.55 4.02

96 10.84 43 2.45 2.45 2.43 71 5.31 5.06 4.23 43 2.34 2.34 2.32 71 4.87 4.70 4.09

108 9.68 44 2.50 2.50 2.47 72 5.54 5.24 4.29 44 2.38 2.38 2.36 72 5.06 4.87 4.16

120 8.76 45 2.55 2.54 2.52 73 5.79 5.43 4.34 45 2.42 2.42 2.40 73 5.28 5.04 4.22

132 8.00 46 2.60 2.59 2.56 74 6.06 5.63 4.39 46 2.47 2.47 2.45 74 5.51 5.23 4.28

144 7.37 47 2.65 2.64 2.61 75 6.35 5.83 4.43 47 2.52 2.51 2.49 75 5.76 5.42 4.34

156 6.84 48 2.71 2.70 2.66 76 6.67 6.04 4.47 48 2.57 2.56 2.54 76 6.03 5.62 4.38

168 6.38 49 2.77 2.76 2.71 77 7.02 6.26 4.50 49 2.62 2.61 2.59 77 6.33 5.83 4.43

180 5.98 50 2.83 2.82 2.76 78 7.40 6.48 4.52 50 2.67 2.67 2.64 78 6.65 6.04 4.46

192 5.64 51 2.89 2.88 2.82 79 7.81 6.70 4.54 51 2.73 2.72 2.69 79 7.01 6.26 4.49

204 5.33 52 2.96 2.94 2.88 80 8.27 6.92 4.56 52 2.79 2.78 2.74 80 7.40 6.48 4.52

216 5.06 53 3.03 3.01 2.94 81 8.76 7.13 4.57 53 2.85 2.84 2.80 81 7.83 6.70 4.54

228 4.82 54 3.10 3.08 3.00 82 9.30 7.34 4.58 54 2.92 2.91 2.85 82 8.29 6.92 4.56

240 4.60 55 3.18 3.16 3.06 83 9.89 7.53 4.58 55 2.99 2.98 2.91 83 8.80 7.13 4.57

252 4.40 56 3.26 3.23 3.13 84 10.54 7.72 4.59 56 3.07 3.05 2.98 84 9.35 7.33 4.58

264 4.22 57 3.35 3.32 3.19 85 11.26 7.88 4.59 57 3.14 3.12 3.04 85 9.95 7.52 4.58

276 4.06 58 3.44 3.40 3.26 86 12.05 8.03 4.59 58 3.23 3.20 3.11 86 10.59 7.70 4.59

288 3.90 59 3.54 3.49 3.34 87 12.91 8.17 4.59 59 3.31 3.29 3.18 87 11.28 7.87 4.59

300 3.77 60 3.64 3.59 3.41 88 13.86 8.28 4.60 60 3.40 3.37 3.25 88 12.03 8.02 4.59

312 3.64 61 3.74 3.69 3.48 89 14.88 8.38 4.60 61 3.50 3.46 3.32 89 12.84 8.15 4.59

324 3.52 62 3.86 3.79 3.56 90 15.99 8.46 4.60 62 3.60 3.56 3.40 90 13.71 8.27 4.60

336 3.41 63 3.98 3.91 3.64 91 17.17 8.53 4.60 63 3.71 3.66 3.47 91 14.66 8.37 4.60

348 3.31 64 4.11 4.02 3.71 92 18.43 8.58 4.60 64 3.82 3.77 3.55 92 15.70 8.45 4.60

360 3.21 65 4.24 4.15 3.79 93 19.78 8.63 4.60 65 3.95 3.88 3.63 93 16.86 8.53 4.60

66 4.39 4.28 3.87 94 21.20 8.66 4.60 66 4.07 4.00 3.71 94 18.13 8.58 4.60

67 4.55 4.42 3.95 95 22.67 8.68 4.60 67 4.21 4.12 3.79 95 19.53 8.63 4.60

Note: Due to the length of the information, factors for Option 2 are available from the Service

Center upon Your request. You may contact our Service Center as specified on the cover page

of the Contract.

BASIS OF COMPUTATION. The actuarial basis for the Table of Income Options is the 2012

Individual Annuity Mortality Period Table, with an assumed net investment rate of 1.00% and a

0% expense load. The interest rate used in the present value calculation referred to in Options 3

and 4 will be determined by the Company, but in no instance will it be greater than the rate used

to calculate the initial payment. The Table of Income Options does not include any applicable

tax.

VA780NY 4

DEFINITIONS

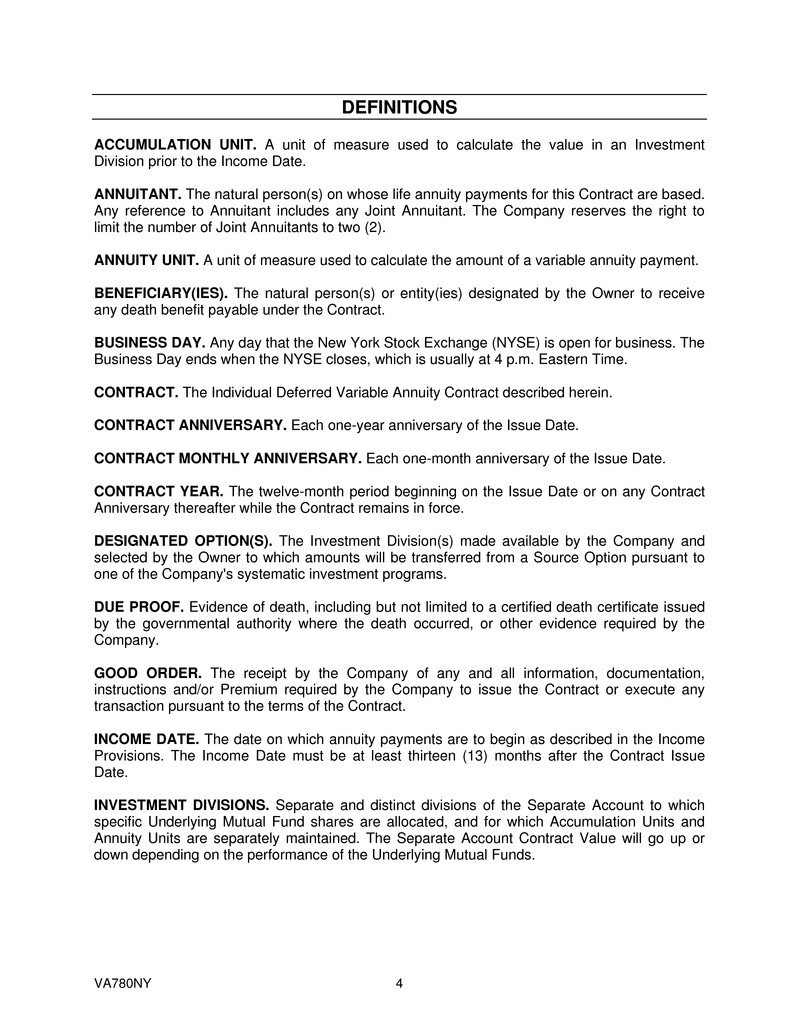

ACCUMULATION UNIT. A unit of measure used to calculate the value in an Investment

Division prior to the Income Date.

ANNUITANT. The natural person(s) on whose life annuity payments for this Contract are based.

Any reference to Annuitant includes any Joint Annuitant. The Company reserves the right to

limit the number of Joint Annuitants to two (2).

ANNUITY UNIT. A unit of measure used to calculate the amount of a variable annuity payment.

BENEFICIARY(IES). The natural person(s) or entity(ies) designated by the Owner to receive

any death benefit payable under the Contract.

BUSINESS DAY. Any day that the New York Stock Exchange (NYSE) is open for business. The

Business Day ends when the NYSE closes, which is usually at 4 p.m. Eastern Time.

CONTRACT. The Individual Deferred Variable Annuity Contract described herein.

CONTRACT ANNIVERSARY. Each one-year anniversary of the Issue Date.

CONTRACT MONTHLY ANNIVERSARY. Each one-month anniversary of the Issue Date.

CONTRACT YEAR. The twelve-month period beginning on the Issue Date or on any Contract

Anniversary thereafter while the Contract remains in force.

DESIGNATED OPTION(S). The Investment Division(s) made available by the Company and

selected by the Owner to which amounts will be transferred from a Source Option pursuant to

one of the Company's systematic investment programs.

DUE PROOF. Evidence of death, including but not limited to a certified death certificate issued

by the governmental authority where the death occurred, or other evidence required by the

Company.

GOOD ORDER. The receipt by the Company of any and all information, documentation,

instructions and/or Premium required by the Company to issue the Contract or execute any

transaction pursuant to the terms of the Contract.

INCOME DATE. The date on which annuity payments are to begin as described in the Income

Provisions. The Income Date must be at least thirteen (13) months after the Contract Issue

Date.

INVESTMENT DIVISIONS. Separate and distinct divisions of the Separate Account to which

specific Underlying Mutual Fund shares are allocated, and for which Accumulation Units and

Annuity Units are separately maintained. The Separate Account Contract Value will go up or

down depending on the performance of the Underlying Mutual Funds.

VA780NY 6

DEFINITIONS (CONT'D)

UNDERLYING MUTUAL FUNDS. The registered management investment companies in which

assets of the Investment Divisions of the Separate Account will be invested.

WITHDRAWAL CHARGE. The charge assessed against certain withdrawals from the Separate

Account Contract Value. The Withdrawal Charge Schedule is shown on the Contract Data

Page.

WITHDRAWAL VALUE. The Separate Account Contract Value, less any tax payable,

applicable Withdrawal Charges and Monthly Contract Charge.

VA780NY 10

GENERAL PROVISIONS (CONT'D)

TRANSFER. The conditions for transfer between Investment Divisions are explained on the

Contract Data Page. The Company reserves the right to restrict the number, means and

frequency of transfers per year that may be requested by the Owner.

Your ability to make transfers is also subject to modification if the Company determines that the

exercise by one or more Owners is, or would be, to the disadvantage of other Owners.

Restrictions may be applied in any manner reasonably designed to prevent any use of the

transfer provision which is considered by the Company to be to the disadvantage of other

Owners. A modification regarding Your ability to make transfers to or from one or more of the

Investment Divisions could include, but not be limited to:

1. The requirement of a minimum time period between each transfer.

2. Limiting transfer requests of an agent acting on behalf of one or more Owners or under a

power of attorney on behalf of one or more Owners.

3. Limiting the dollar amount that may be transferred at any one time.

The Company may from time to time offer systematic investment programs that allow You to

transfer funds among the Investment Divisions. These programs may include, but are not limited

to, dollar cost averaging, portfolio rebalancing, and the automatic monthly transfer of earnings

from the money market Investment Division to the Designated Option(s). After issue of Your

Contract, You may elect one of these programs by contacting the Company's Service Center,

and the Company will furnish all necessary forms to request these programs. The Company

makes no guarantee that these programs will result in a profit or protect against loss in a

declining market.

For the optional dollar cost averaging program, You may authorize the automatic transfer of a

fixed dollar amount or selected percentage of the value of a Source Option, periodically to one

or more Designated Option(s). The intervals between transfers may be monthly, quarterly,

semiannually or annually.

WRITTEN NOTICE. Written information or instructions given to the Company by You must be in

Good Order. Any written request or notice You make to the Company must be sent to the

Service Center, unless the Company advises You otherwise. A notice relating to Owner,

Beneficiary designation or Assignment changes shall take effect on the date the request is

signed by the Owner, subject to any payments made or actions taken by the Company prior to

receipt in writing at the Company's Service Center in Good Order. Otherwise, any other Written

Notice takes effect on the date it was received at the Service Center.

Any notice the Company sends to the Owner will be sent to the Owner's last known address

unless the Owner requests otherwise in writing. It is Your responsibility to promptly provide the

Company notice of Your address change or any error in a Company notice sent to You.

VA780NY 11

ACCUMULATION PROVISIONS

An Owner may not allocate Separate Account Contract Values to more than the maximum

number of Investment Divisions, specified on the Contract Data Page, at any one time.

SEPARATE ACCOUNT. The Separate Account consists of assets the Company has set aside

and has kept separate from the Company's general account assets and other segregated asset

accounts. The Separate Account assets will not be charged with liabilities arising out of any

other business the Company may conduct. All the income, gains, and losses resulting from

these assets are credited to or charged against the contracts supported by the Separate

Account, and not against any other contracts the Company may issue. The assets of the

Separate Account will be available to cover the liabilities of the Company's general account only

to the extent that the assets of the Separate Account exceed the liabilities of the Separate

Account arising under the Contracts supported by the Separate Account. The Separate Account

consists of several Investment Divisions. The assets of the Separate Account shall be valued at

least as often as any benefits of this Contract, but in no event will such valuation be less

frequent than monthly. The assets of the Separate Account will be valued at their fair market

value on the day the valuation occurs.

Accumulation Units. The Separate Account Contract Value may increase or decrease

depending on the performance of the Investment Divisions. In order to monitor the Separate

Account Contract Value during the accumulation phase, the Company uses a unit of measure

called an Accumulation Unit. The value of an Accumulation Unit may increase or decrease from

Business Day to Business Day. Adjustments to the Separate Account Contract Value, such as

withdrawals, transfers, and charges, result in the redemption of Accumulation Units. However,

these adjustments do not affect the value of the Accumulation Units.

When You make an allocation to the Investment Divisions, the Company credits Your Contract

with Accumulation Units. The number of Accumulation Units credited is determined by dividing

the amount allocated to any Investment Division by the Accumulation Unit Value for that

Investment Division at the close of the Business Day when the allocation is made.

Accumulation Unit Value. The Company determines the value of an Accumulation Unit for

each of the Investment Divisions by:

1. determining the total amount of money invested in the particular Investment Division;

2. subtracting from that amount any applicable taxes;

3. dividing the remainder by the number of outstanding Accumulation Units.

VA780NY 12

WITHDRAWAL PROVISIONS

At or before the Income Date, and while the Owner is living, the Owner may request a total or

partial withdrawal of the Separate Account Contract Value by submitting a request to the

Service Center on a withdrawal form available from the Company. For a total withdrawal, this

Contract must be returned to the Company's Service Center.

Amounts withdrawn from the Separate Account Contract Value may be subject to a Withdrawal

Charge.

Upon a total withdrawal, the Owner will receive the Withdrawal Value. The Withdrawal Value will

be based on values at the end of the Business Day on which the request for withdrawal is

received at the Company's Service Center in Good Order.

In no event shall the amount withdrawn, whether a total withdrawal or partial withdrawal,

exceed the Withdrawal Value.

Each partial withdrawal must be for an amount which is not less than the minimum partial

withdrawal amount specified on the Contract Data Page or, if less, the Owner's entire interest in

the Investment Division. If the Separate Account Contract Value is less than the minimum partial

withdrawal amount specified on the Contract Data Page, any withdrawal will be treated as a

total withdrawal and the Withdrawal Value will be paid. The minimum withdrawal amount may

vary in connection with an automatic withdrawal program.

The Owner's interest in each Investment Division from which the withdrawal is requested must

be at least equal to the minimum amount specified on the Contract Data Page after the

withdrawal is completed or the Owner's entire interest will be withdrawn.

The withdrawal will be made from each Investment Division in proportion to their current value,

unless otherwise specified. Withdrawals will be based on values at the end of the Business Day

on which the request for withdrawal is received in Good Order at the Service Center.

The Company will waive the Withdrawal Charge on any withdrawal necessary to satisfy the

minimum distribution requirements of the Internal Revenue Code. Any withdrawal in excess of

the required minimum distribution will cause the entire amount to be subject to any applicable

Withdrawal Charge.

You may elect to take a systematic withdrawal by surrendering a specific sum or a certain

percentage on a monthly, quarterly, semiannual or annual basis, subject to the minimum partial

withdrawal amount made in connection with a systematic withdrawal program specified on the

Contract Data Page. Such withdrawals will be counted in determining the portion of the

Separate Account Contract Value taken as an Additional Free Withdrawal. Systematic

withdrawals in excess of the Additional Free Withdrawal amount may be subject to a Withdrawal

Charge.

VA780NY 17

INCOME PROVISIONS

INCOME DATE. The date on which annuity payments are to begin. The Income Date must be

at least thirteen (13) months after the Contract Issue Date. If no Income Date is selected, the

Income Date will be the Latest Income Date. At any time at least seven (7) days prior to the

Income Date then indicated on the Company's records, the Owner may change the Income

Date by submitting Written Notice to the Company's Service Center, subject to the Latest

Income Date.

INCOME OPTIONS. The Owner, or any Beneficiary who is so entitled, may elect to receive a

single lump-sum distribution. However, a single lump-sum distribution will be deemed to be a

total withdrawal and will terminate the Contract.

Alternatively, an income option may be elected. The Owner may, upon prior Written Notice to

the Company at its Service Center, elect an income option at any time prior to the Income Date

or change an income option up to seven (7) days before the Income Date. Unless otherwise

designated, the Owner will be the payee.

If no other income option is elected, monthly annuity payments will be made in accordance with

Option 3 below, a life annuity with 120-month period certain. Payments may be made in

monthly, quarterly, semiannual or annual installments as selected by the Owner. However, if the

amount available to apply under an income option is less than $2,000, the Company has the

right to make payments in one single lump-sum. The single lump-sum payment will not be less

than would have been applied under an income option. If the first payment provided would be

less than $20, the Company may require payments to be made at quarterly, semiannual or

annual intervals so as to result in an initial payment of at least $20, or the Company has the

right to make one single lump-sum payment.

Income payments on the Income Date will not be less than those that would be provided by the

application of the Separate Account Contract Value to purchase a single premium immediate

annuity contract at purchase rates offered by the Company at that time to the same class of

annuitants. The amount at annuitization will not be less than the greater of the Withdrawal Value

or 95% of the Separate Account Contract Value.

NO WITHDRAWALS OF THE SEPARATE ACCOUNT CONTRACT VALUE ARE PERMITTED

DURING THE INCOME PERIOD FOR ANY INCOME OPTION UNDER WHICH PAYMENTS

ARE BEING MADE PURSUANT TO LIFE CONTINGENCIES.

Upon written election filed with the Company at its Service Center, the Separate Account

Contract Value will be applied to provide one of the following income options.

OPTION 1 - LIFE INCOME. An annuity payable monthly during the lifetime of the Annuitant.

Under this income option, no further payments are payable after the death of the Annuitant, and

there is no provision for a death benefit payable to the Owner. Therefore, it is possible under

Option 1 for the Owner to receive only one (1) monthly annuity payment under this income

option. In the event of the death of the Annuitant after the Income Date and prior to the first

monthly annuity payment, the amount allocated to the income option will be paid to the Owner

or the Owner's Beneficiary(ies).

VA780NY 18

INCOME PROVISIONS (CONT'D)

OPTION 2 - JOINT AND SURVIVOR INCOME. An annuity payable monthly while both the

Annuitant and a designated second person are living. Upon the death of either person, the

monthly annuity payments will continue during the lifetime of the survivor at either the full

amount previously payable or as a percentage (either one-half or two-thirds) of the full amount,

as chosen at the time of election of the income option. If a reduced annuity payment to the

survivor is desired, variable annuity payments will be determined using either one-half or two-

thirds of the number of each type of Annuity Unit credited. Fixed annuity payments will be equal

to either one-half or two-thirds of the fixed annuity payment payable during the joint life of the

Annuitant and the designated second person.

Annuity payments terminate automatically and immediately upon the death of the surviving

person without regard to the number or total amount of payments received. There is no

minimum number of annuity payments, and it is possible to have only one (1) monthly annuity

payment if both the Annuitant and the designated second person die before the due date of the

second payment. In the event of the death of the Annuitant and the second designated person

after the Income Date and prior to the first monthly annuity payment, the amount allocated to

this income option will be paid to the Owner or the Owner's Beneficiary(ies).

OPTION 3 - LIFE ANNUITY INCOME WITH 120 OR 240 MONTHLY PERIODS

GUARANTEED. An annuity payable monthly during the lifetime of the Annuitant with the

guarantee that if, at the death of the Annuitant, payments have been made for fewer than the

guaranteed 120 or 240 monthly periods, as elected, the balance of the guaranteed number of

payments will continue to be made to the Owner as scheduled. In the event the Owner dies

before the specified number of guaranteed payments has been made, the Beneficiary(ies) may

elect to continue receiving the fixed and variable payments according to the terms of this

Contract or may alternatively elect to receive the present value of any remaining guaranteed

payments in a single lump-sum, the amount of which is calculated by the Company. The present

value of any remaining guaranteed payments will be based on the total annuity payment as of

the date of the calculation.

OPTION 4 - INCOME FOR A SPECIFIED PERIOD. Under this income option, the Owner can

elect monthly payments for any number of years from 5 to 30. This election must be made for

full 12-month periods. In the event the Owner dies before the specified number of payments has

been made, the Beneficiary(ies) may elect to continue receiving the fixed and variable payments

according to the terms of this Contract or may alternatively elect to receive the present value of

any remaining guaranteed payments in a single lump-sum, the amount of which is calculated by

the Company. The present value of any remaining guaranteed payments will be based on the

total annuity payment as of the date of the calculation.

ADDITIONAL OPTIONS. Other income options may be made available by the Company.

VA780NY 20

INCOME PROVISIONS (CONT'D)

The value of a fixed number of Annuity Units will reflect the investment performance of the

Investment Divisions, and the amount of each payment will vary accordingly.

For each Investment Division, the Annuity Unit Value for any Business Day is determined by

multiplying the Annuity Unit Value for the immediately preceding Business Day by the net

investment factor for the Business Day for which the Annuity Unit Value is being calculated. The

result is then multiplied by a second factor which offsets the effect of the assumed net

investment rate. The net investment factor, which reflects changes in the net asset value of

Investment Divisions, is determined by dividing 1. by 2., where:

1. Is the net result of:

a. the net asset value of an Investment Division determined as of the end of the Business

Day, plus

b. the per share amount of any dividend or other distribution declared by the Investment

Division if the "ex-dividend" date occurs on the Business Day, plus or minus

c. a per share credit or charge with respect to any taxes paid or reserved for by the

Company which are determined by the Company to be attributable to the operation of

the Investment Division (no federal income taxes are applicable under present law); and

2. Is the net asset value of the Investment Division determined as of the end of the preceding

Business Day.