ISDA® International Swaps and Derivatives Association, Inc. NOVATION AGREEMENT dated as of February 28, 2007 among:

ISDA®

International

Swaps and Derivatives Association, Inc.

dated

as

of February 28, 2007 among:

THE

ROYAL

BANK OF SCOTLAND PLC.

(the

"Remaining

Party"),

NOVASTAR

MORTGAGE, INC. (the "Transferor")

AND

NOVASTAR

MORTGAGE SUPPLEMENTAL INTEREST TRUST, SERIES 2007-1 (the "Transferee").

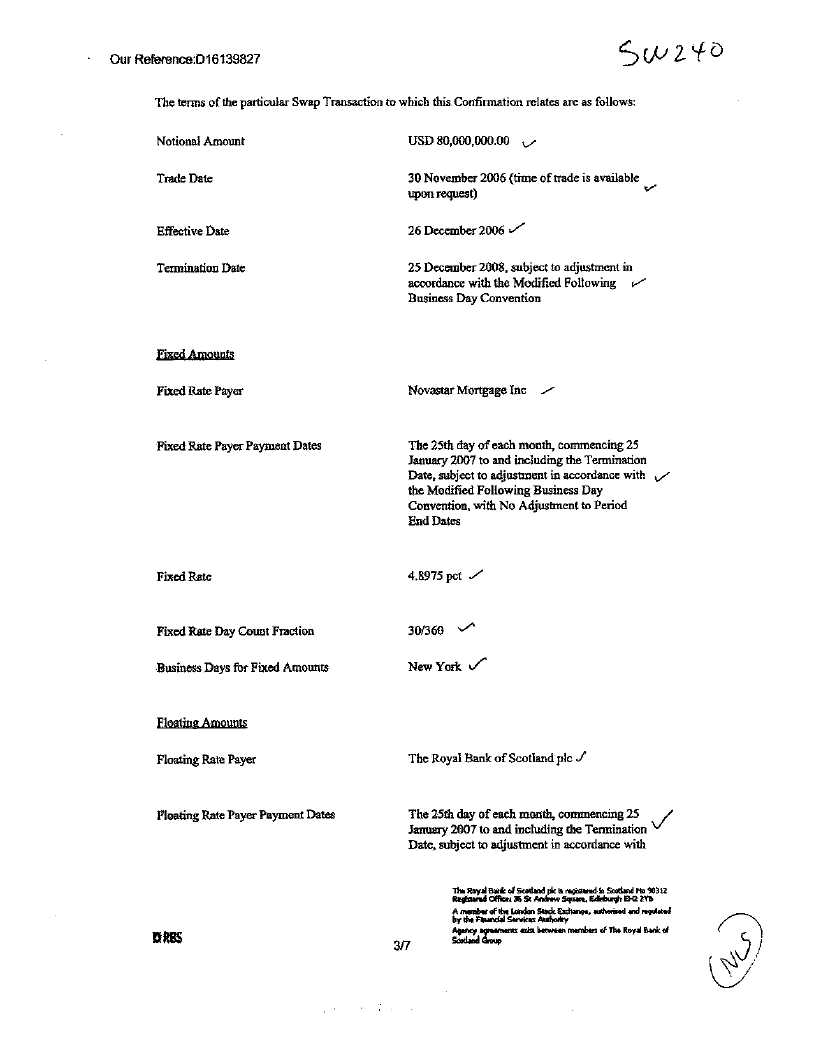

The

Remaining Party and the Transferor are parties to a 1992 ISDA Master dated

as of

July 19, 2006 (the “Old

Agreement”).

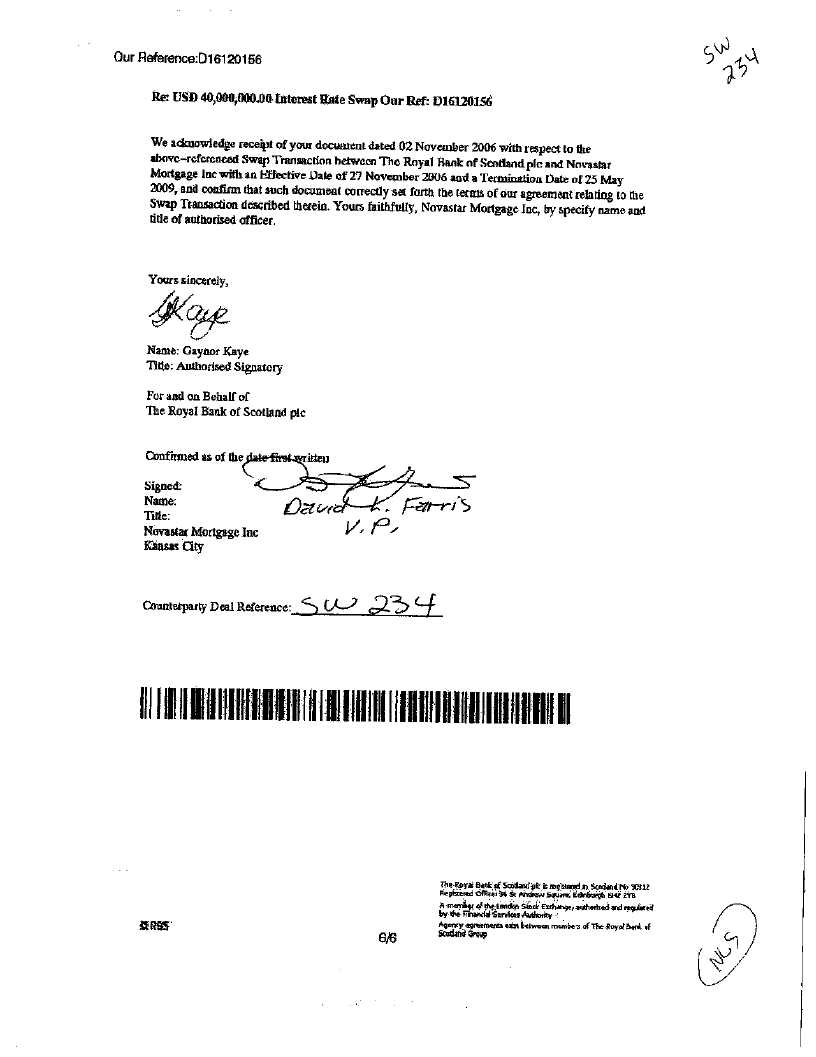

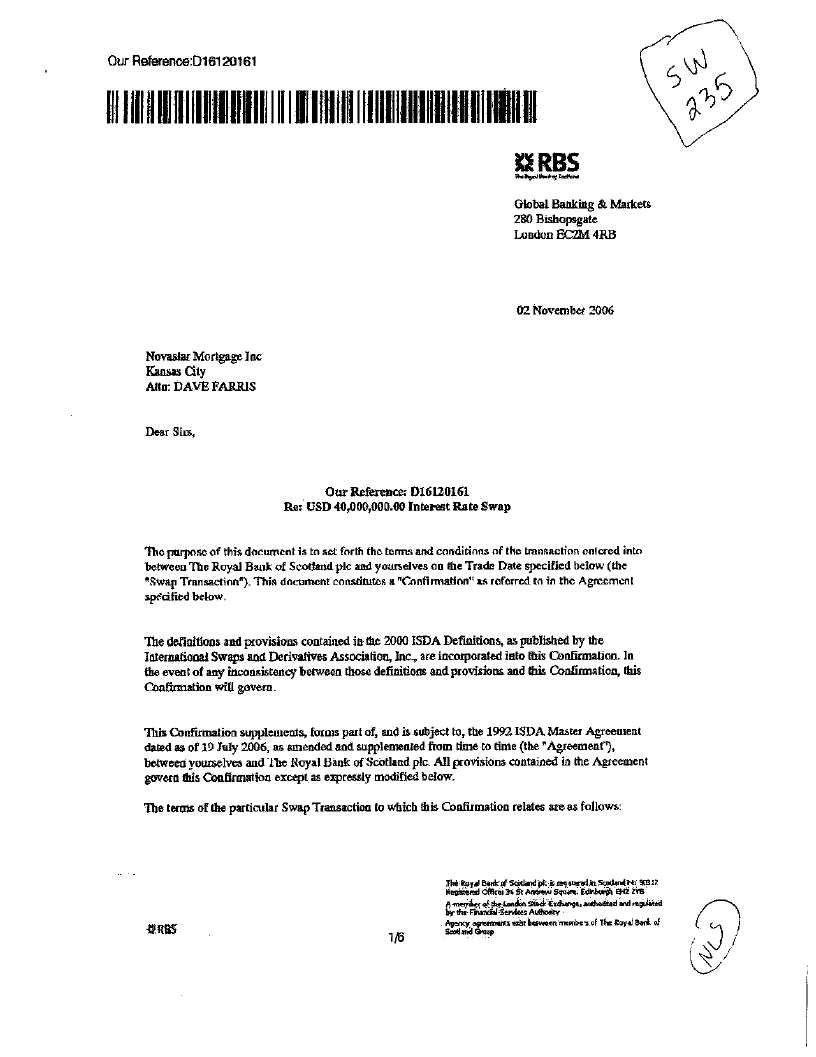

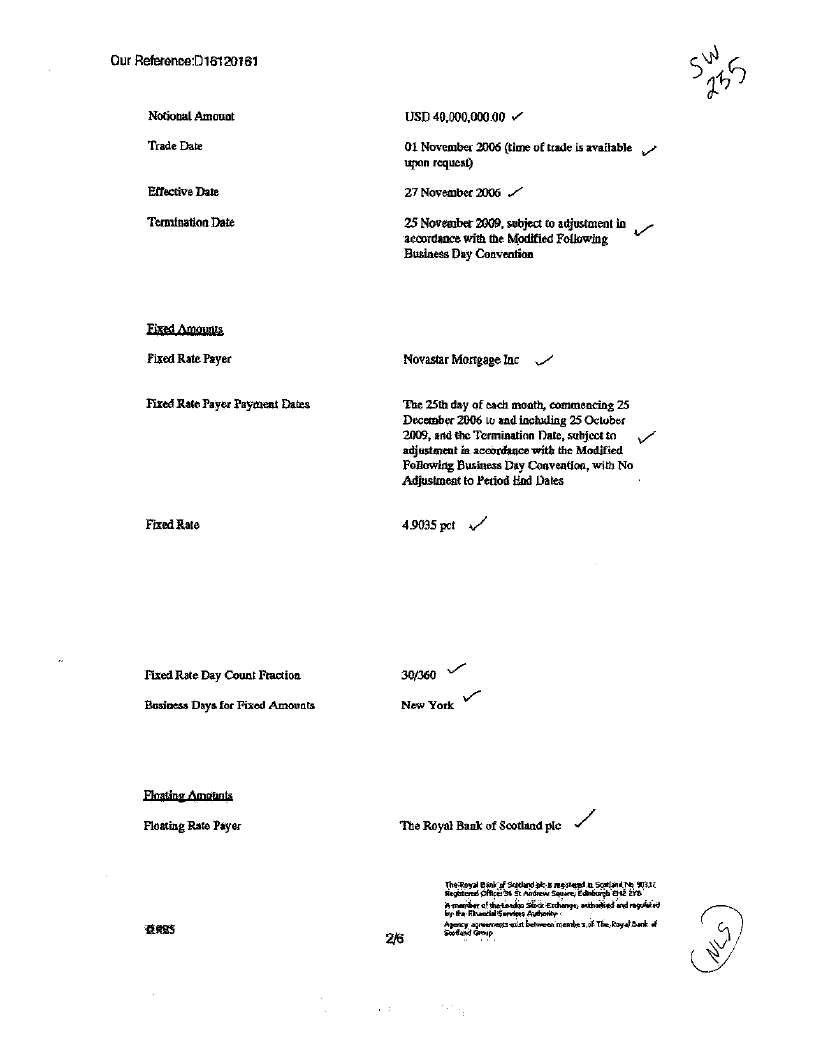

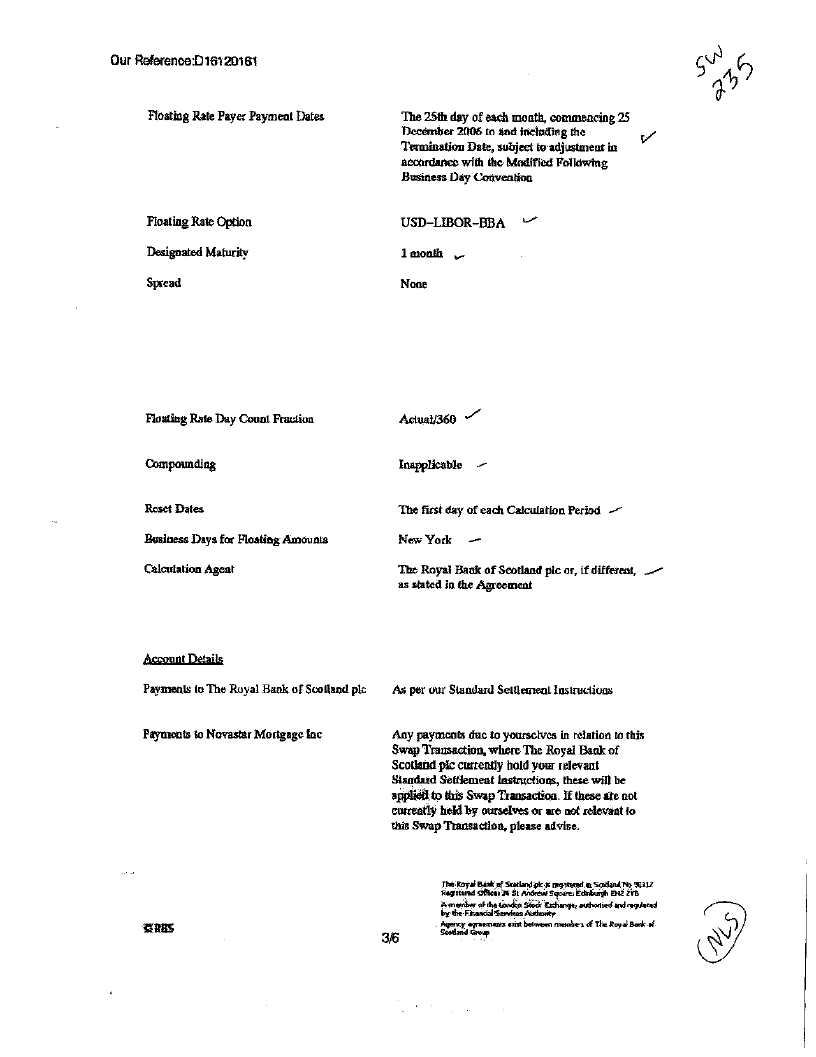

The

Remaining Party and the Transferor originally entered into certain transactions

(each an "Old

Transaction")

under

the Old Agreement, each evidenced by a Confirmation (an "Old

Confirmation")

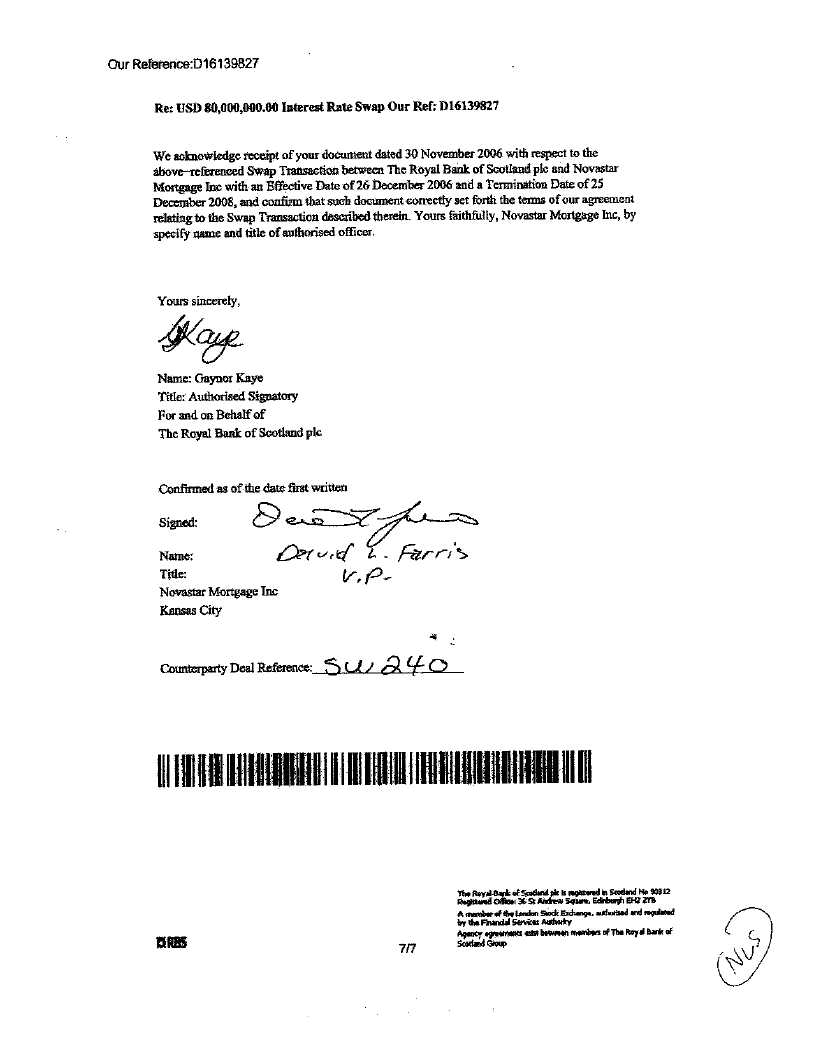

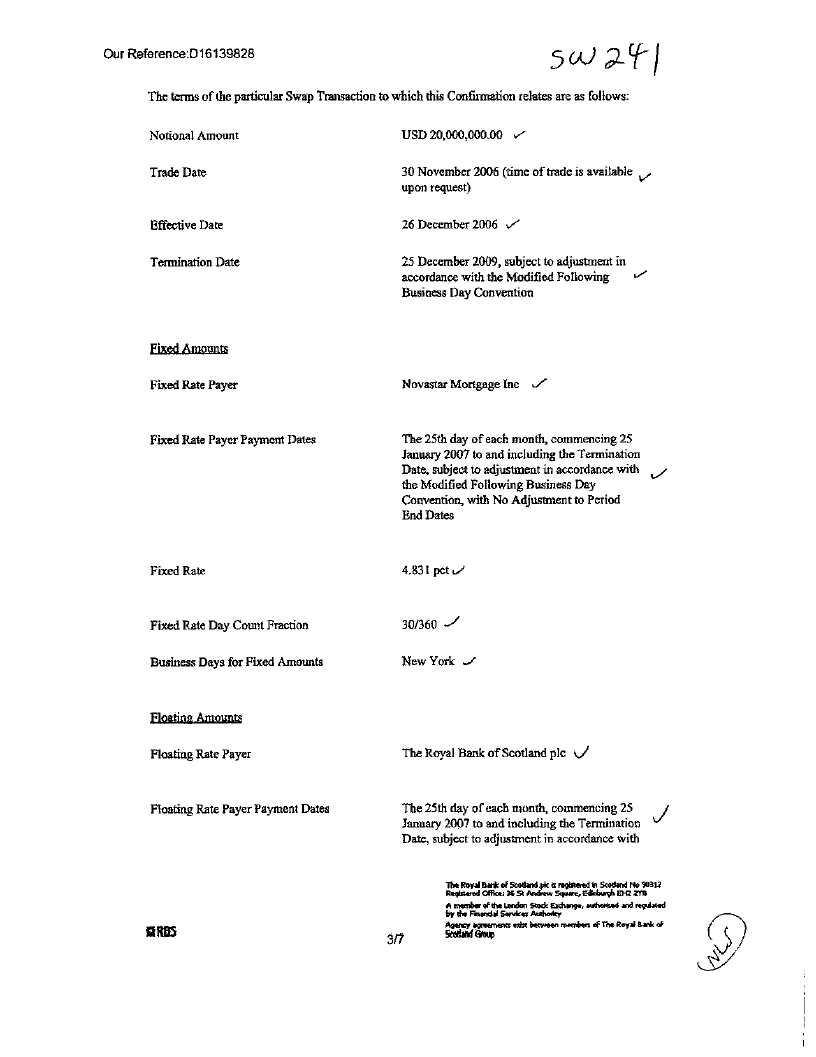

with

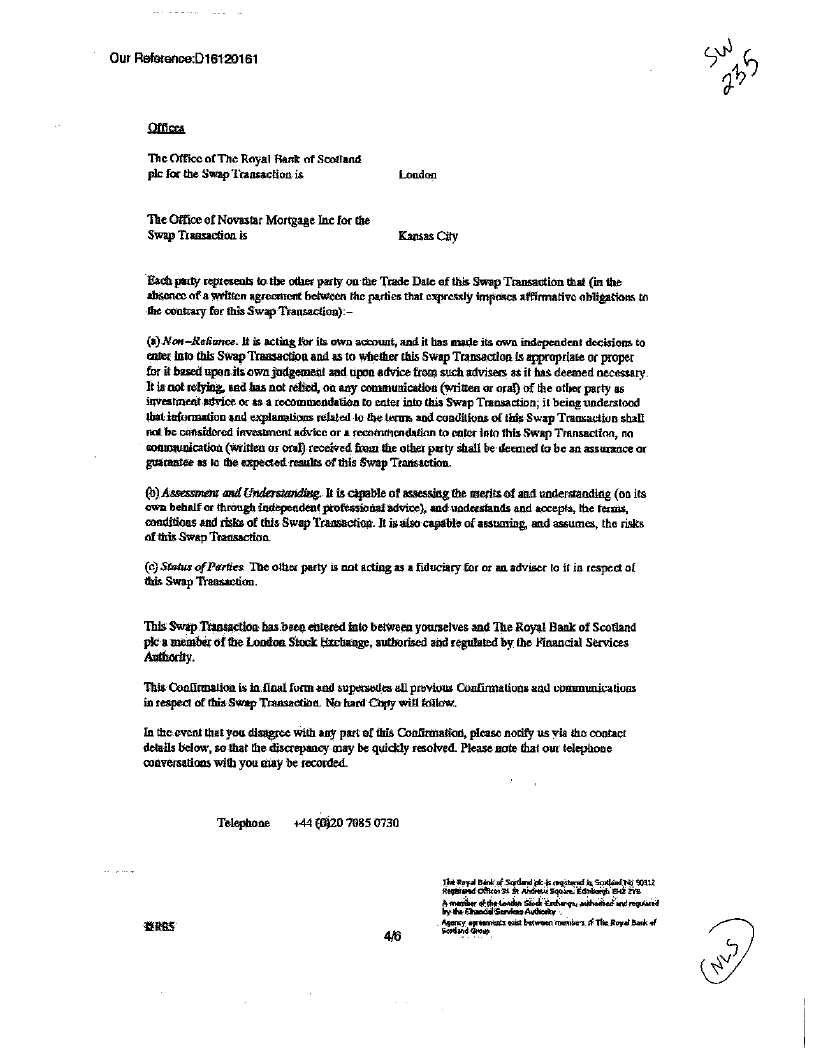

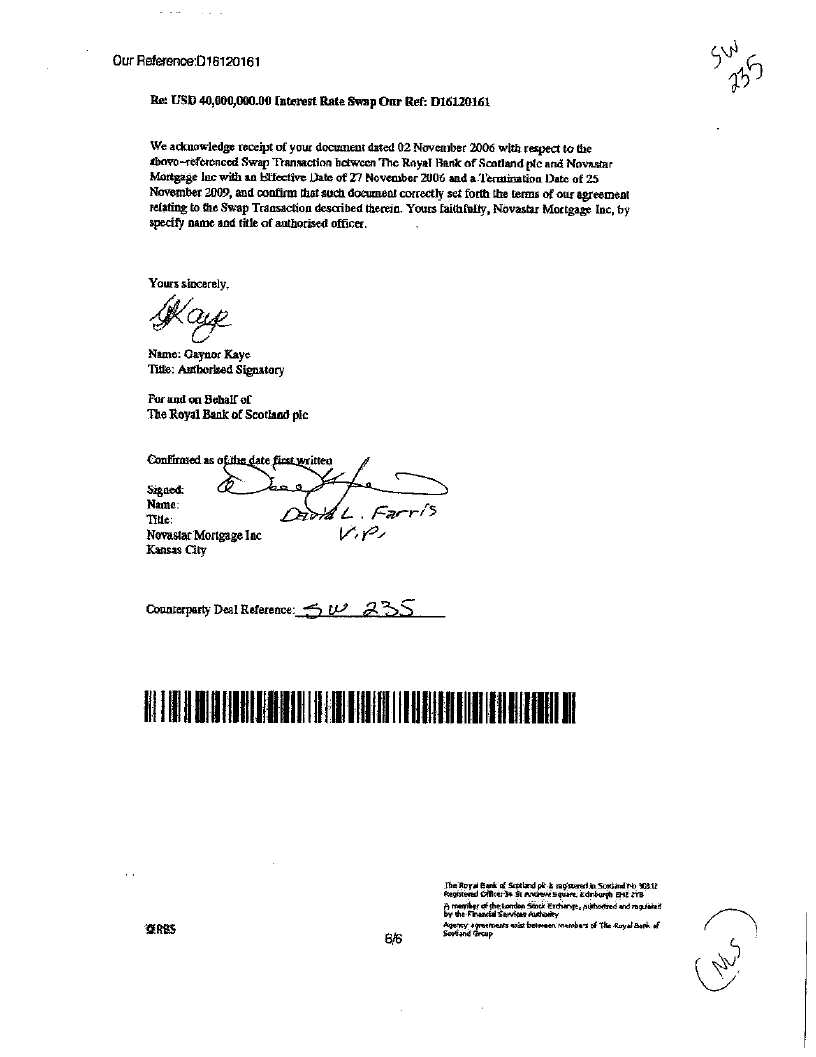

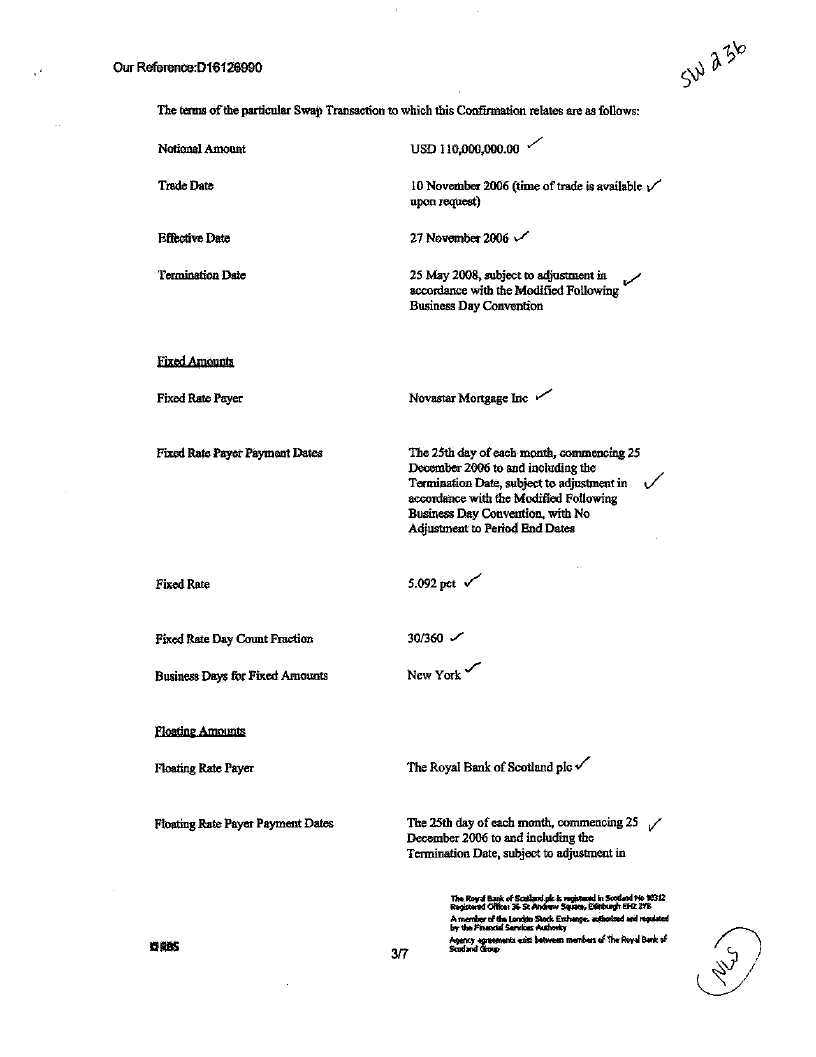

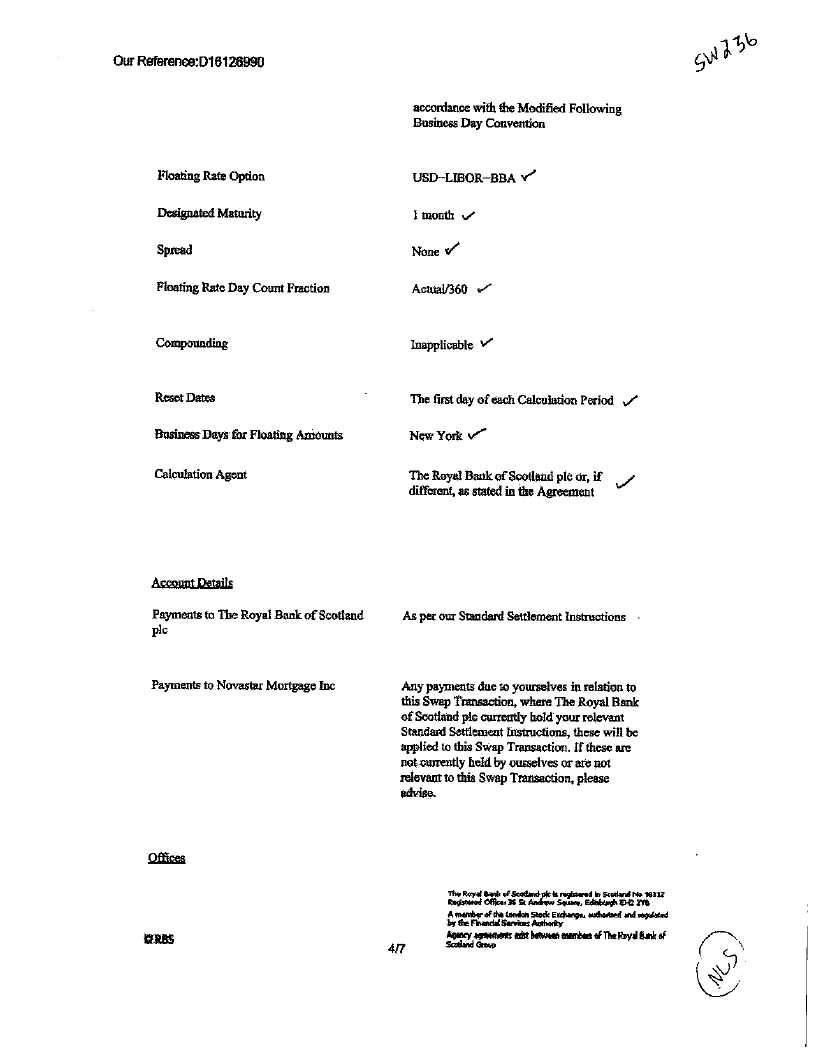

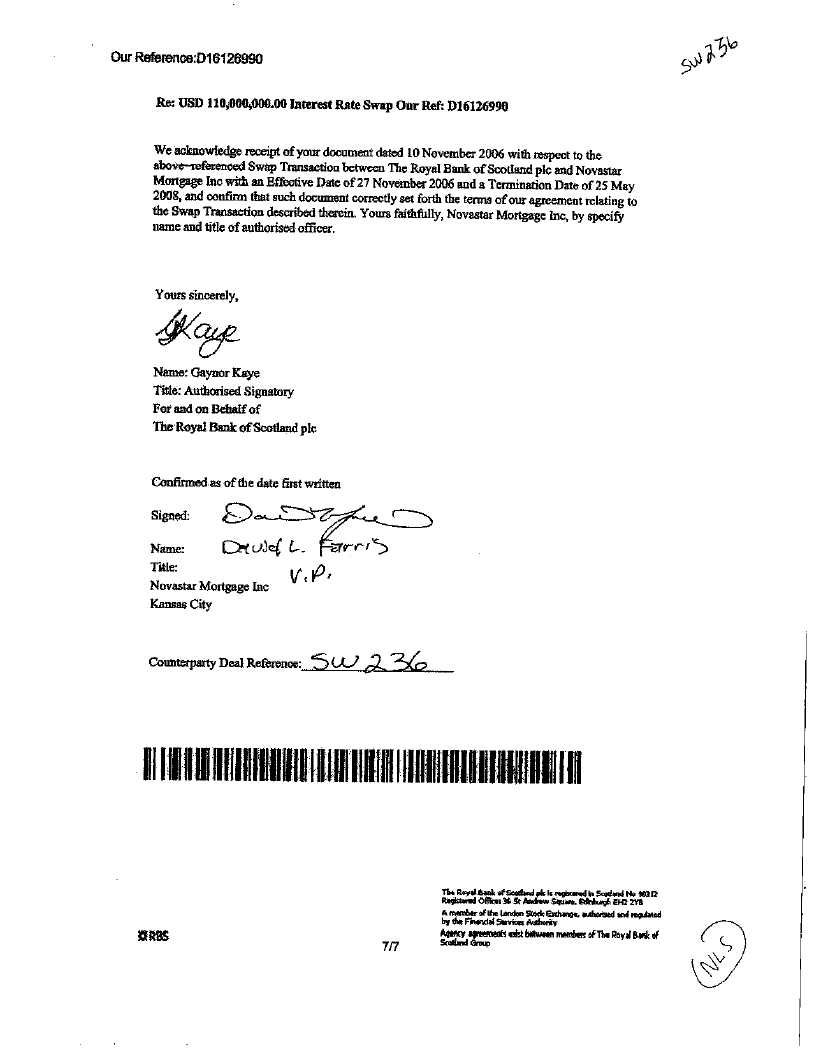

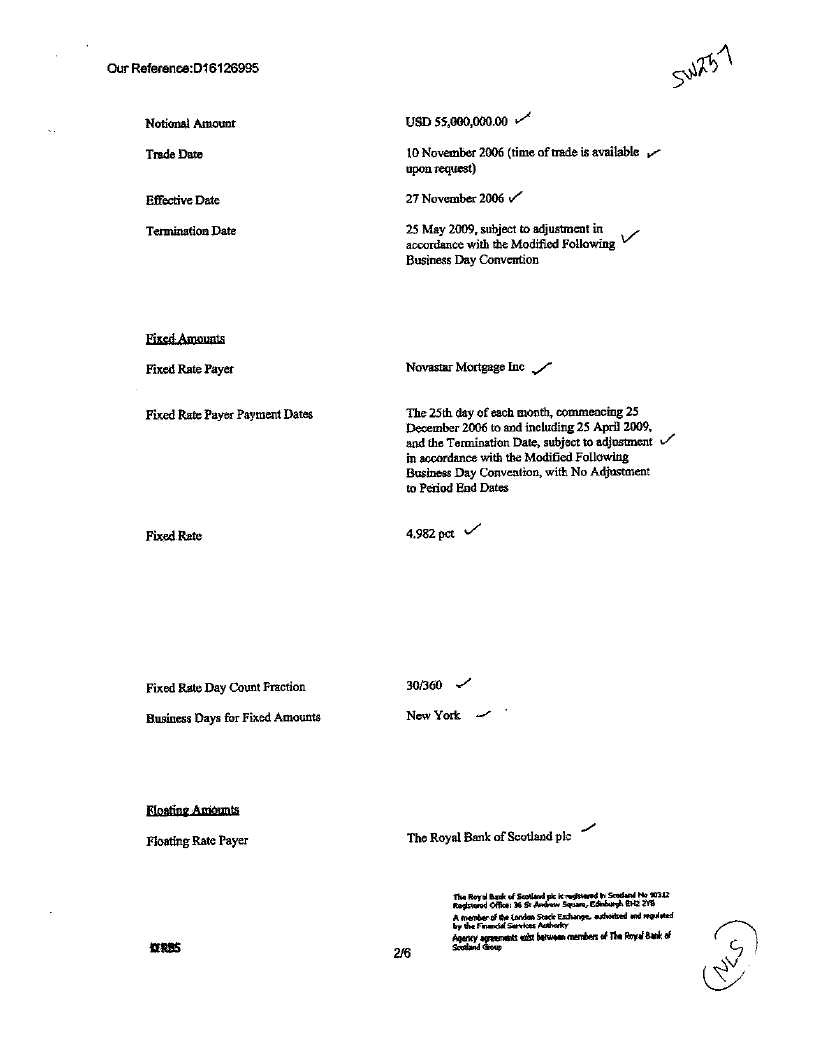

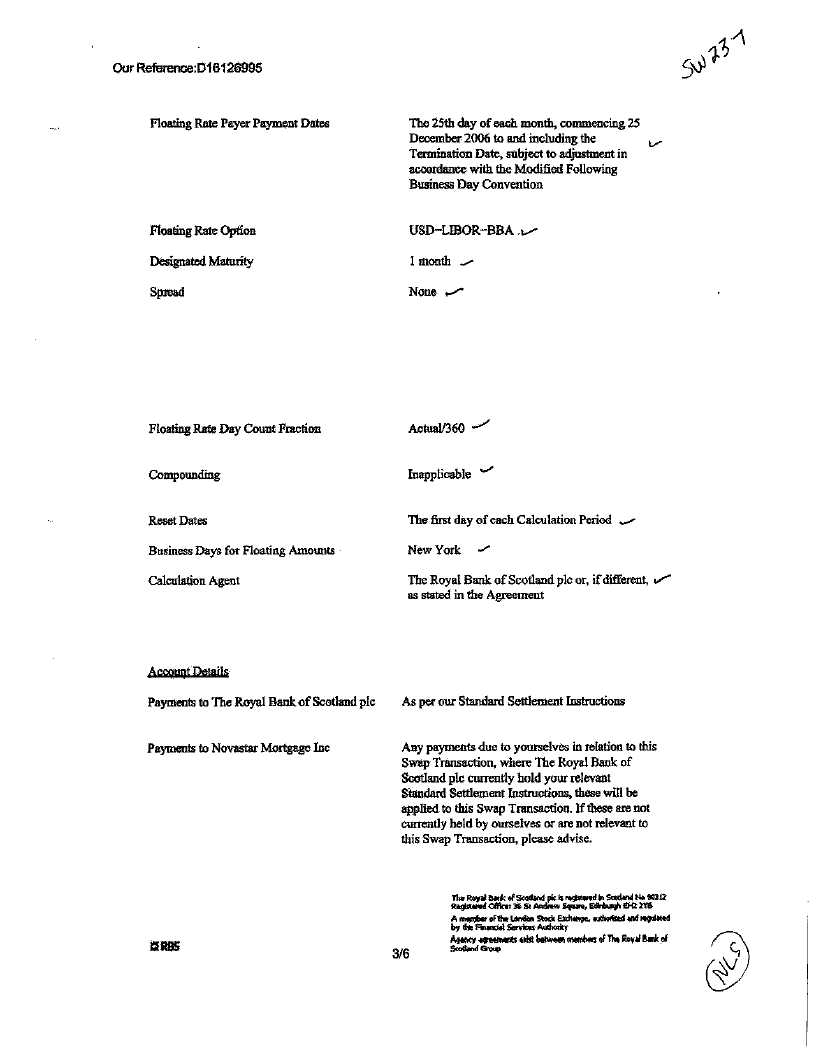

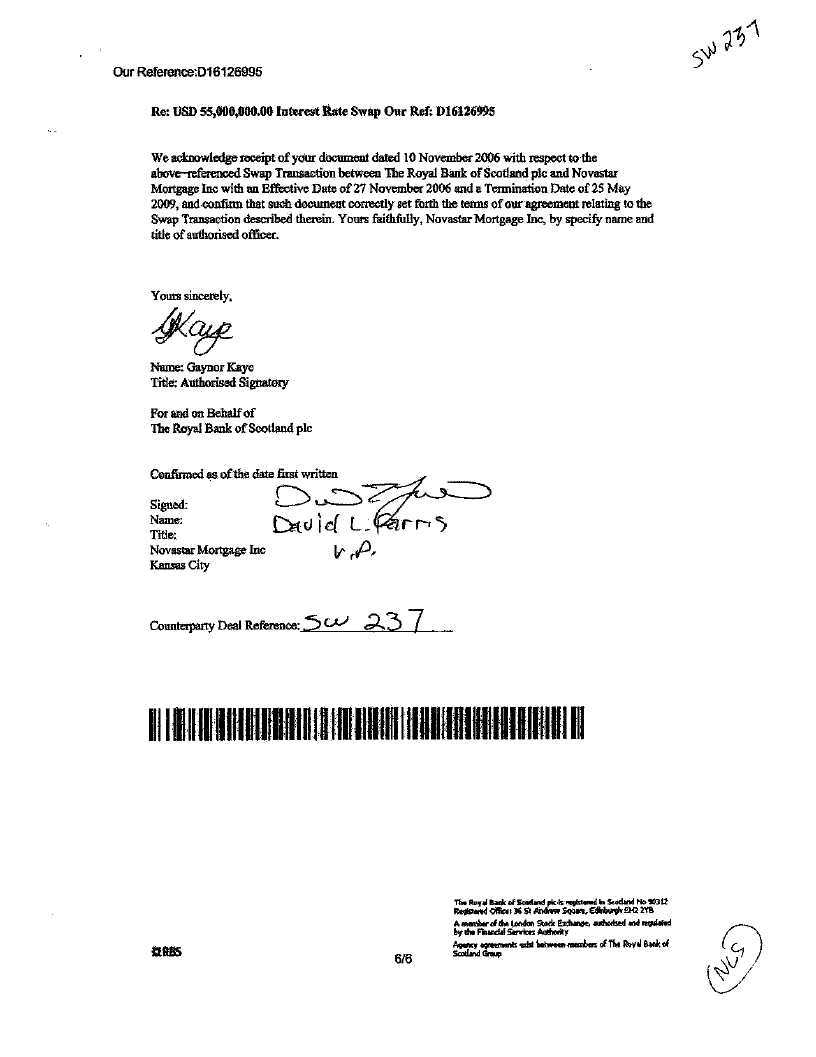

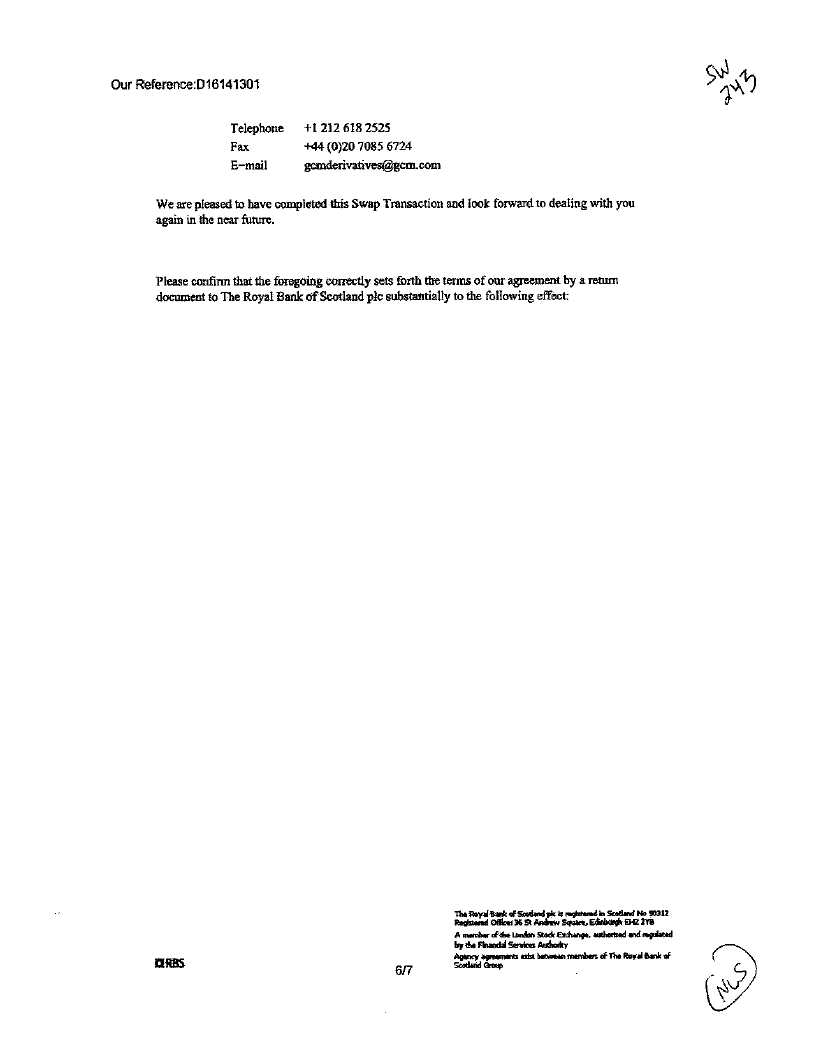

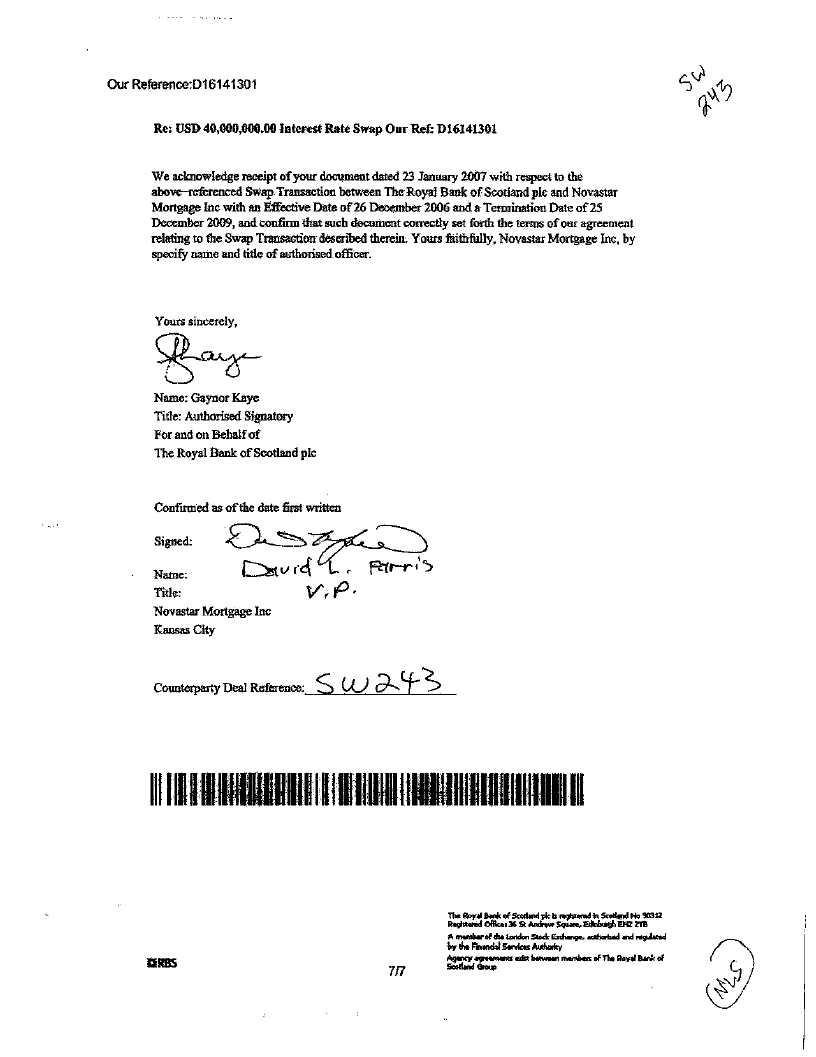

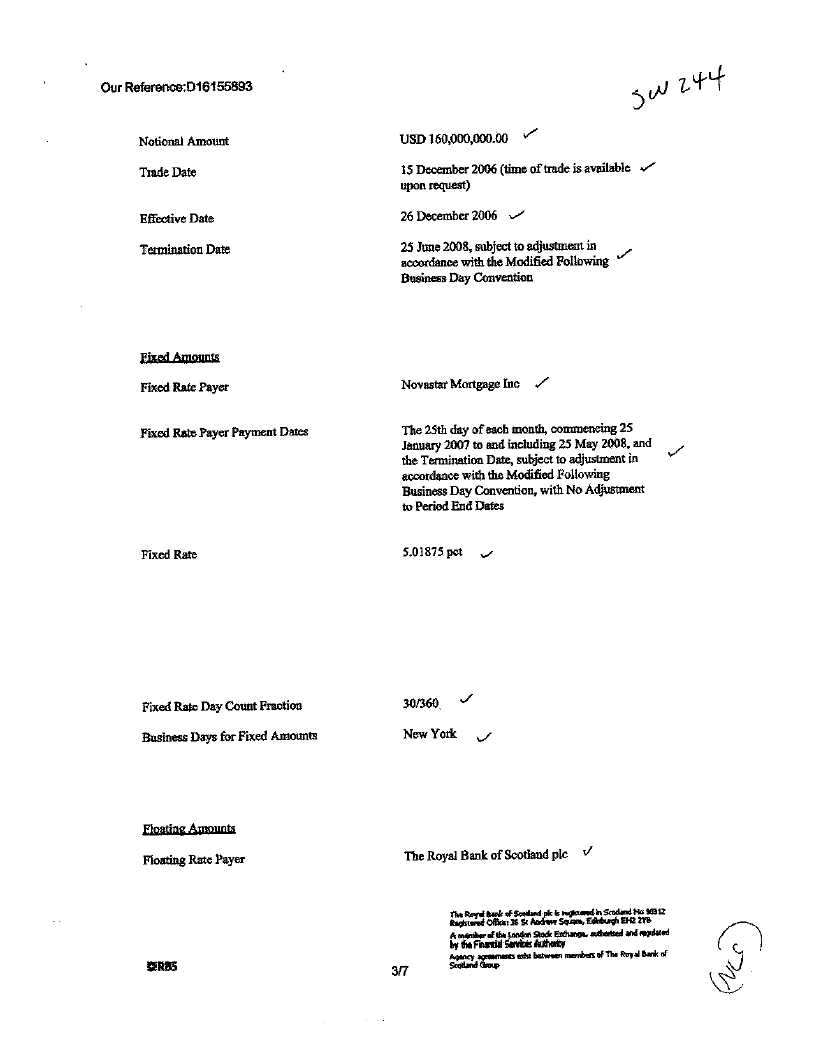

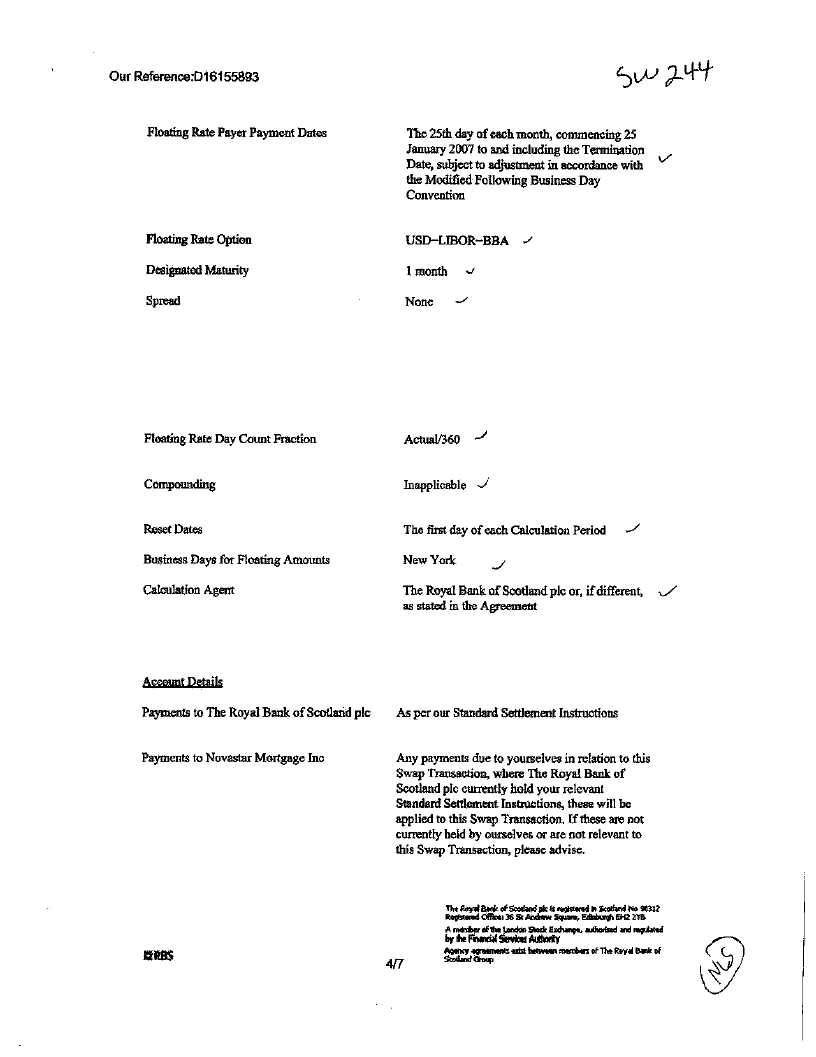

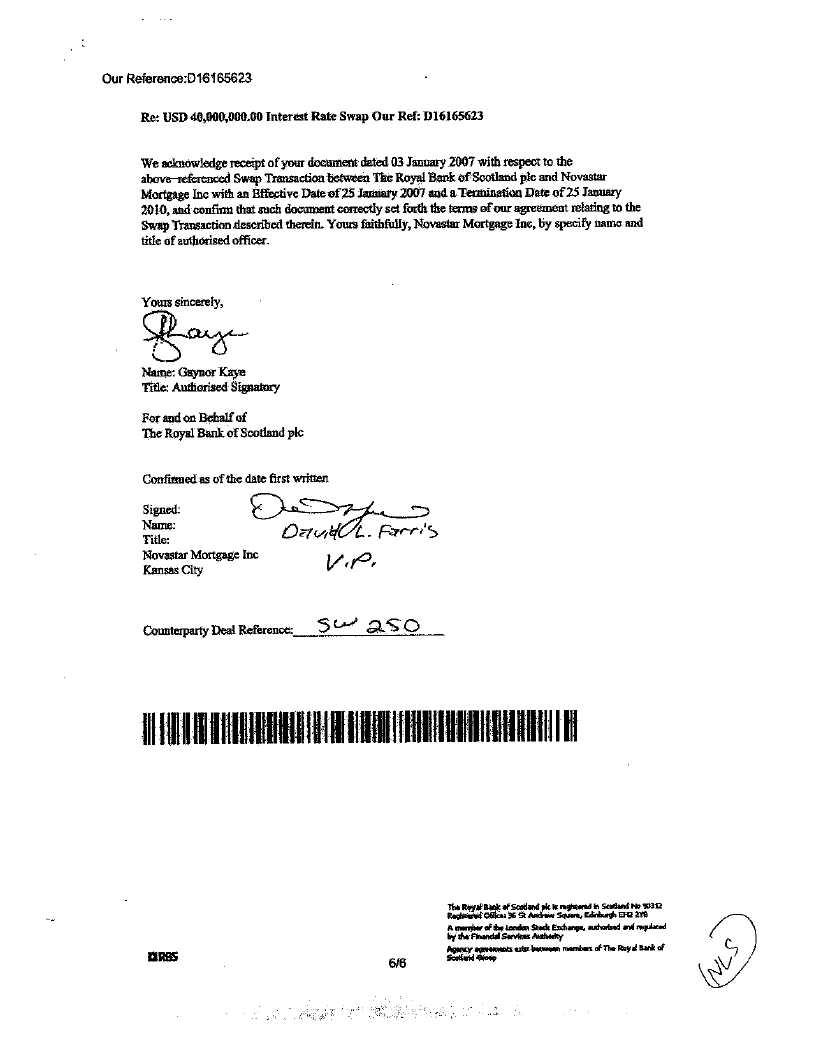

reference number D16120156, D16120161, D16126990, D16126995, D16139827,

D16139828, D16141301, X00000000, D16165622, D16165623 respectively, attached

hereto as Exhibit I.

The

Remaining Party and the Transferee are simultaneously entering into a 1992

ISDA

Master Agreement dated as of the date hereof in the form attached hereto

as

Exhibit II (the “New

Agreement”).

With

effect from and including February [28], 2007 (the "Novation Date")

the

Transferor wishes to transfer by novation to the Transferee, and the Transferee

wishes to accept the transfer by novation of, all the rights, liabilities,

duties and obligations of the Transferor under and in respect of each Old

Transaction, with the exception of the Excluded Rights and Obligations referred

to below, with the effect that the Remaining Party and the Transferee enter

into

a new transaction (each a "New

Transaction")

between them having terms identical to those of each Old Transaction, subject

to

the same exceptions and as more particularly described below. For the avoidance

of doubt, the first transaction period being novated in each Old Transaction

is

the full period ending on the Fixed Rate Payer Payment Date in March

2007.

The

Remaining Party wishes to accept the Transferee as its sole counterparty

with

respect to the New Transactions.

The

Transferor and the Remaining Party wish to have released and discharged,

as a

result and to the extent of the transfer described above, their respective

obligations under and in respect of the Old Transactions.

Accordingly,

the parties agree as follows: ---

|

1.

|

Definitions.

|

Terms

defined in the ISDA Master Agreement (Multicurrency-Cross Border) as published

in 1992 by the International Swaps and Derivatives Association, Inc. (the

"1992

ISDA Master Agreement")

are

used herein as so defined, unless otherwise provided herein. For purposes

of

this Novation Agreement, "Excluded

Rights and Obligations"

means

all obligations of each of the Transferor and the Remaining Party to Transfer

(as defined in the Credit Support Annex to the Old Agreement) Eligible

Collateral (as so defined) in respect of the Old Transactions and all related

rights of the Remaining Party and the Transferor under the Old Agreement.

|

2.

|

Transfer,

Release, Discharge and Undertakings.

|

Subject

to the execution and delivery of the New Agreement by each of the parties

thereto to the other, with effect from and including the Novation Date and

in

consideration of the mutual representations, warranties and covenants contained

in this Novation Agreement and other good and valuable consideration (the

receipt and sufficiency of which are hereby acknowledged by each of the

parties):

|

(a)

|

subject

to Section 2(d) of this Novation Agreement, the Remaining Party

and the

Transferor are each released and discharged from further obligations

to

each other with respect to each Old Transaction and their respective

rights against each other thereunder are cancelled, provided that

such

release and discharge shall not affect any rights, liabilities

or

obligations of the Remaining Party or the Transferor with respect

to

payments or other obligations due and payable or due to be performed

prior

to the Novation Date, and all such payments and obligations shall

be paid

or performed by the Remaining Party or the Transferor in accordance

with

the terms of the Old Transactions;

|

|

(b)

|

in

respect of each New Transaction, the Remaining Party and the Transferee

each undertake liabilities and obligations towards the other and

acquire

rights against each other identical in their terms to each corresponding

Old Transaction (and, for the avoidance of doubt, as if the Transferee

were the Transferor and with the Remaining Party remaining the

Remaining

Party, save for the Excluded Rights and Obligations and any other

rights,

liabilities or obligations of the Remaining Party or the Transferor

with

respect to payments or other obligations due and payable or due

to be

performed prior to the Novation Date). For the sake of clarity,

all

references to Independent Amounts shall be deemed deleted from

the

Confirmations for each New

Transaction;

|

|

(c)

|

each

New Transaction shall be governed by, form part of, and be subject

to the

New Agreement and the relevant Old Confirmation (which, in conjunction

and

as deemed modified to be consistent with this Novation Agreement,

shall be

deemed to be a Confirmation between the Remaining Party and the

Transferee), and the offices of the Remaining Party and the Transferee

for

purposes of each New Transaction shall be their offices at their

addresses

for notices provided for in the New Agreement;

and

|

|

(d)

|

on

the Novation Date, the Remaining Party shall transfer all of the

Posted

Collateral (as defined in the Credit Support Annex to the Old Agreement)

held by it in respect of the Old Transactions to the account or

accounts

of the Transferor identified by it by notice given to the Remaining

Party

as provided in the Old Agreement, and the Transferor shall transfer

all

Posted Collateral held by it in respect of the Old Transactions

to the

account or accounts of the Remaining Party identified by it by

notice

given to the Transferor as provided in the Old Agreement, in each

case

together with all Interest Amount and Distributions thereon (as

so

defined). The Remaining Party’s or the Transferor’s failure to effect

these transfers will continue to constitute Potential Events of

Default

and may constitute Events of Default under the Old Agreement

notwithstanding the transfer by novation contemplated

herein.

|

|

3.

|

Representations

and Warranties.

|

(a) On

the

date of this Novation Agreement:

(i) Each

of

the parties makes to each of the other parties those representations and

warranties set forth in Section 3(a) of the 1992 ISDA Master Agreement

with

references in such Section to "this Agreement" or "any Credit Support Document"

being deemed references to this Novation Agreement alone.

(ii) The

Remaining Party and the Transferor each makes to the other, and the Remaining

Party and the Transferee each makes to the other, the representation set

forth

in Section 3(b) of the 1992 ISDA Master Agreement, in each case with respect

to

the Old Agreement or the New Agreement, as the case may be, and taking

into

account the parties entering into and performing their obligations under

this

Novation Agreement.

(iii) Each

of

the Transferor and the Remaining Party represents and warrants to each

other and

to the Transferee that:

(A) it

has

made no prior transfer (whether by way of security or otherwise) of the

Old

Agreement or any interest or obligation in or under the Old Agreement or

in

respect of any Old Transaction; and

(B) without

prejudice to the obligations of the Remaining Party and the Transferor

referred

to in Section 2(d) of this Novation Agreement, as of the Novation Date,

all

obligations of the Transferor and the Remaining Party under each Old Transaction

required to be performed before the Novation Date have been

fulfilled.

(iv) Each

party represents to each of the other parties: --

(A) Non-Reliance.

Transferor and the Remaining Party is each acting for its own account,

and with

respect to the Transferee, Deutsche Bank National Trust Company is executing

as

Trustee for the Transferee. Each has made its own independent decisions

to enter

into this Novation Agreement and as to whether this Novation Agreement

is

appropriate or proper for it based upon its own judgment and upon advice

from

such advisers as it has deemed necessary. It is not relying on any communication

(written or oral) of the other parties as investment advice or as a

recommendation to enter into this Novation Agreement; it being understood

that

information and explanations related to the terms and conditions of this

Novation Agreement shall not be considered investment advice or a recommendation

to enter into this Novation Agreement. No communication (written or oral)

received from any of the other parties shall be deemed to be an assurance

or

guarantee as to the expected results of this Novation Agreement;

(B) Assessment

and Understanding. It is capable of assessing the merits of and understanding

(on its own behalf or through independent professional advice), and understands

and accepts, the terms, conditions and risks of this Novation Agreement.

It is

also capable of assuming, and assumes, the risks of this Novation Agreement;

and

(C) Status

of

Parties. None of the other parties is acting as a fiduciary for or an adviser

to

it in respect of this Novation Agreement.

(b) The

Transferor makes no representation or warranty and does not assume any

responsibility with respect to the legality, validity, effectiveness, adequacy

or enforceability of any New Transaction or the New Agreement or any documents

relating thereto and assumes no responsibility for the condition, financial

or

otherwise, of the Remaining Party, the Transferee or any other person or

for the

performance and observance by the Remaining Party, the Transferee or any

other

person of any of its obligations under any New Transaction or the New Agreement

or any document relating thereto and any and all such conditions and warranties,

whether express or implied by law or otherwise, are hereby

excluded.

4. Counterparts.

This

Novation Agreement (and each amendment, modification and waiver in respect

of

it) may be executed and delivered in counterparts (including by facsimile

transmission), each of which

will be deemed an original.

5. Costs

and Expenses.

The

parties will each pay their own costs and expenses (including legal fees)

incurred in connection with this Novation Agreement and as a result of

the

negotiation, preparation and execution of this Novation Agreement.

|

6.

|

Amendments.

|

No

amendment, modification or waiver in respect of this Novation Agreement

will be

effective unless in writing (including a writing evidenced by a facsimile

transmission) and executed by each of the parties or confirmed by an exchange

of

telexes or electronic messages on an electronic messaging system and subject

to

the Rating Agency Condition (as defined in the New Agreement).

|

7.

|

(a)

|

Governing

Law.

|

This

Novation Agreement will be governed by and construed in accordance with

the laws

of the State of New York without reference to the conflict of laws provisions

thereof.

|

(b)

|

Jurisdiction.

|

The

terms

of Section 13(b) of the 1992 ISDA Master Agreement shall apply to this

Novation

Agreement with references in such Section to "this Agreement" being deemed

references to this Novation Agreement alone.

(c) Not

Acting in Individual Capacity.

|

Deutsche

Bank National Trust Company is signing this Novation Agreement

solely in

its capacity as Trustee of the Transferee under the Pooling and

Servicing

Agreement among NovaStar Mortgage Funding Corporation, NovaStar

Mortgage,

Inc., U.S. Bank National Association, and Deutsche Bank National

Trust

Company dated as of February 1, 2007 (the "Pooling

and Servicing Agreement")

and in the exercise of the powers and authority conferred and

vested in it

thereunder and not in its individual capacity. It is expressly

understood

and agreed by the parties hereto that (i) each of the representations,

undertakings and agreements herein stated to be those of Transferee

is

made and intended for the purpose of binding only the Transferee,

(ii)

nothing herein contained shall be construed as creating any liability

for

Deutsche Bank National Trust Company, individually or personally,

to

perform any covenant (either express or implied) contained herein

stated

to be those of Transferee, and all such liability, if any, is

hereby

expressly waived by the parties hereto, and such waiver shall

bind any

third party making a claim by or through one of the parties hereto,

and

(iii) under no circumstances shall Deutsche Bank National Trust

Company be

liable for the breach or failure of any obligation, representation,

warranty or covenant made or undertaken by the Transferee under

this

Novation Agreement. All persons having any claim against the

Trustee

reason of the Transactions contemplated by this Novation Agreement

shall

look only to the assets of NovaStar Mortgage Supplemental Interest

Trust,

Series 2007-1 (subject to the availability of funds therefor

in accordance

with the Flow of Funds as set forth in Article IV of the Pooling

and

Servicing Agreement) for payment or satisfaction

thereof.

|

The

foregoing may not be construed to give to Majority Certificateholders any

rights

under this Novation Agreement.

|

(d)

|

Pooling

and Servicing Agreement.

|

Capitalized

terms used in this Novation Agreement that are not defined herein and are

defined in the Pooling and Servicing Agreement shall have the respective

meanings assigned to them in the Pooling and Servicing Agreement.

|

(e)

|

Agency

Role of Greenwich Capital Markets, Inc.

In

connection with this Novation Agreement, Greenwich Capital Markets,

Inc.

has acted as agent on behalf of the Remaining Party. Greenwich

Capital

Markets, Inc. has not guaranteed and is not otherwise responsible

for the

obligations of the Remaining Party under this

Agreement.

|

|

(f)

|

Calculation

|

|

Promptly

after each Reset Date, but

in no event later than three New York Business Days prior to

each related

Distribution Date, the

Calculation Agent shall deliver the reset notice in writing via

mail or

facsimile to the Trustee at the address provided in the notices

portion of

the New Agreement.

|

|

(g)

|

Account

Details

|

|

Remaining

Party:

|

The

Royal Bank of Scotland

|

Bank:

JPMorgan Chase Bank

ABA

No.: 000000000

Account

No.: 400930153

Attention:

Financial Markets Fixed Income and Interest Rate Derivative Operations,

London

SWIFT

Code: SWIFT XXXXXX0XXXX with JPMorgan Chase Bank, New York XXXXXX00

|

Transferee:

|

Deutsche

Bank National Trust Company

|

ABA

# 000000000

Acct

# 01419663

Acct

Name NYLTD Funds Control - Stars West

Ref:

Trust Administration - Novastar 2007-1, Hedge confirm #

[_____]

IN

WITNESS WHEREOF the parties have executed this Novation Agreement on the

respective dates specified below with effect from and including the Novation

Date.

|

THE

ROYAL BANK OF SCOTLAND PLC

|

NOVASTAR

MORTGAGE, INC.

|

|

By:

Greenwich Capital Markets, Inc., its agent

|

|

|

By:

/s/ Xxxxxxx Xxxxxxx

|

By:

/s/ Xxxxx X. Xxxxxx

|

|

Name:

Xxxxxxx Xxxxxxx

|

Name:

Xxxxx X. Xxxxxx

|

|

Title:

Vice President

|

Title:

Vice President

|

NOVASTAR

MORTGAGE SUPPLEMENTAL INTEREST TRUST, SERIES 2007-1

By:

Deutsche Bank National Trust Company, as Trustee under the Pooling and

Servicing

Agreement, acting not in its individual capacity, but solely in its capacity

as

Trustee to NovaStar Mortgage Supplemental Interest Trust, Series

2007-1

By:

/s/ Xxxxxxx Xxxxxxxxx

Name: Xxxxxxx Xxxxxxxxx

Title: Authorized Signer

Name: Xxxxxxx Xxxxxxxxx

Title: Authorized Signer

Exhibit

I

[Old

Hedge Confirmations attached behind this page]

Exhibit

II

[Form

of

New Agreement attached behind this page]