BRIDGE LOAN MODIFICATION AND RATIFICATION AGREEMENT

Exhibit 10.4

THIS BRIDGE MODIFICATION AND RATIFICATION AGREEMENT (this “Agreement”), made as of March __, 2013, by and between AIRTRONIC USA, INC., an Illinois corporation (the “Company”) and GLOBAL DIGITAL SOLUTIONS, INC., a New Jersey corporation (“Lender”).

WHEREAS, on or about October 18, 2012, the Company requested a credit facility from Lender under the terms, memorialized by, among other documents, (i) that certain Debtor In Possession Note Purchase Agreement between the Company and Lender (the “Note Agreement”), (ii) that certain 8 1/4 Secured Promissory Note made by the Company for the benefit of Lender (the “Note”); and (iii) that certain Security Agreement between the Company and Lender (the “Security Agreement,” and together with the Note Agreement, the Note and all other related loan documents, collectively, the “Bridge Loan Documents”). All terms used in this Agreement but not defined herein will have the meanings given to them in the Bridge Loan Documents.

WHEREAS, Lender is willing to provide the requested credit facility subject to the Bridge Loan Documents as amended by this Agreement.

NOW, THEREFORE, in consideration of the foregoing premises and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby covenant and agree as follows:

1. Modification of Bridge Loan Documents. The Bridge Loan Documents are modified as follows:

(a) The Bridge Loan will continue to be evidenced by the Note, as amended by this Agreement.

(b) The “Initial Funding Amount” will be $105,158.62, and the Company hereby acknowledges receipt of the Initial Funding Amount.

(c) The “Maximum Amount” will be $700,000.00.

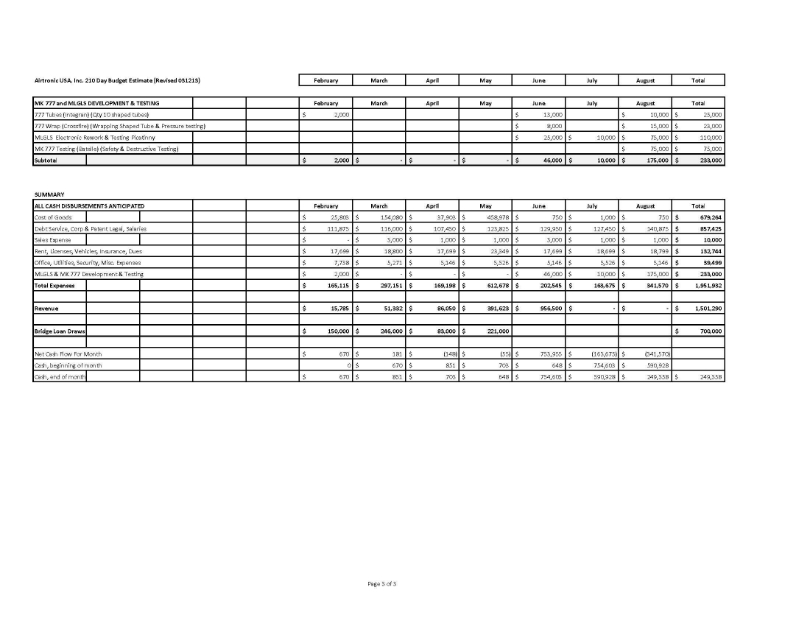

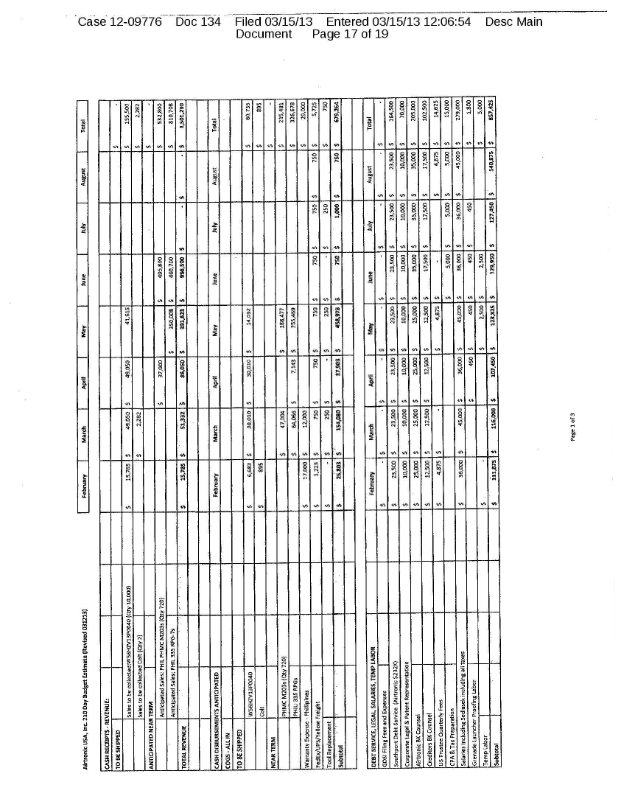

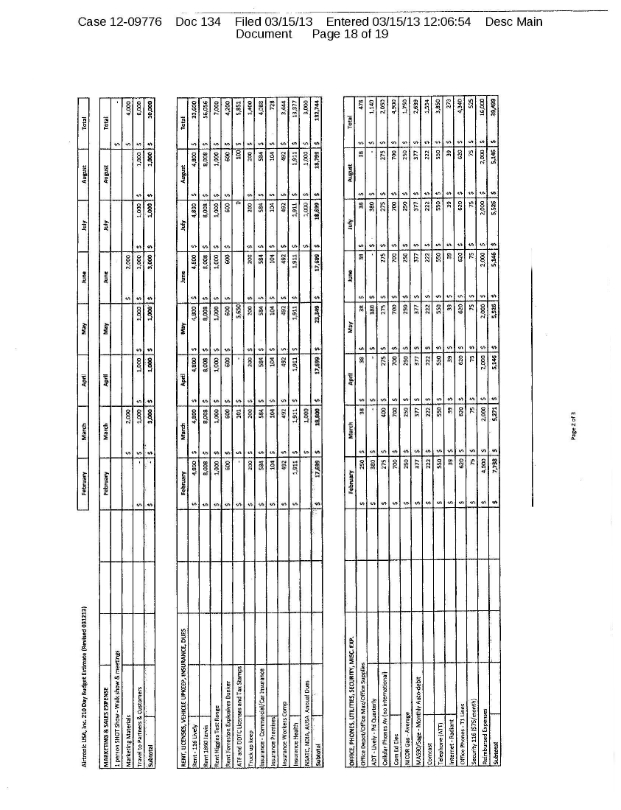

(d) On the terms and subject to the conditions set forth in this Agreement and the Bridge Loan Documents (including the conditions set forth in paragraph (e) below), and provided there does not then exist an Event of Default, Lender agrees to make loans to the Company from time to time in such amounts as are set forth and in accordance with the budget attached hereto as EXHIBIT A (the “DIP Budget”), so long as the aggregate amount of such advances outstanding at any time to the Company do not exceed the Maximum Amount. Requests for loans by the Company will be made on a weekly basis. Lender shall not make any loans for amounts in excess of the amounts set forth in the DIP Budget with regard to any itemized category of expense nor shall Lender make aggregate loans to the Company in excess of the Maximum Amount, unless Lender chooses to do so in its sole discretion and any necessary and appropriate court approvals are obtained.

(e) In addition to the conditions set forth in the Bridge Loan Documents, Lender’s obligation to make additional loans shall be subject to the following condition precedents: (i) Airtronic shall not fail to propose a plan for reorganization that is acceptable to Lender within the next 210 days or any shorter period prescribed by the court; (ii) no party other than Lender shall propose a plan for reorganization that is unacceptable to Lender; (iii) there shall be no material adverse change to the Company’s sales and revenue outlook, financial condition or prospects for reorganization under Chapter 11; (iv) there shall be no existing, uncured Event of Default; (v) the Lender shall not deem itself insecure for any other reason; and (vi) an order shall be entered in the Bankruptcy Case in the form and substance of the draft order attached hereto as EXHIBIT B.

1

(f) The definition of Event of Default for all of the Bridge Loan Documents shall be expanded to include: (i) any material adverse change in Airtronic’s sales and revenue outlook, financial condition or prospects for reorganization under Chapter 11; (ii) GDSI deems itself insecure for any reason; and (iii) Airtronic breaches any of the terms of the Bridge Loan Documents.

2. Ratification of Loan Documents and Collateral. All of the terms, provisions, covenants, representations and warranties contained in the Bridge Loan Documents are ratified and affirmed by the Company and the Lender in all respects and will remain in full force and effect as modified by this Agreement. Lender shall execute the Bridge Loan Documents simultaneous with the execution of this Agreement. Any property or rights to or interest in the property granted as security in the Bridge Loan Documents will remain as security for the Bridge Loan, as modified by this Agreement, and the obligation of the Company. In the event there is a conflict between any of the terms of the Bridge Loan Documents and the terms of this Agreement, then the terms of this Agreement shall be controlling.

3. Release of Lender. The Company hereby release, relinquish, discharge and waive any and all claims, demands, actions, causes of actions, suits, debts, costs, dues, sums of money, accounts, covenants, contracts, controversies, agreements, promises, trespasses, damages, judgments, executions, expenses and liabilities whatsoever, known or unknown, at law or in equity, irrespective of whether such arise out of contract, tort, violation of laws or regulations or' otherwise, which the Company (and its successors, assigns, legal representatives, heirs, executors or administrators) ever had, now have or hereafter can, may or shall have against Lender or its officers, directors, employees, representatives, agents, trustees, shareholders, partners, members, contractors, advisors, attorneys, subsidiaries, affiliates, predecessors, successors or assigns by reason of any matter, cause or thing whatsoever from the beginning of the world to and including the date of this Agreement arising out of, relating to, or in connection with, the Bridge Loan, the Bridge Loan Documents, this Agreement or the transactions contemplated hereunder, whether known or unknown as of the date hereof.

4. General Provisions.

(a) Each of the Loan Documents is hereby modified to the extent necessary so that the term “Bridge Loan Documents,” as such term may be used therein, will be deemed to include this Agreement.

(b) Lender's rights under this Agreement will be in addition to all of the rights of Lender under the Bridge Loan Documents.

(c) This Agreement is subject to enforcement by Lender at law or in equity, including, without limitation, actions for damages or specific performance.

(d) The Company agrees to execute and deliver all such documents and instruments, and do all such other acts and things, as may be reasonably required by Lender in the future to perfect, assure, confirm or effectuate the modification contemplated by and set forth in this Agreement.

(e) The Bridge Loan Documents as modified and this Agreement contain the entire agreement and understanding of the parties hereto with respect to the subject matter hereof and may not be amended, modified or discharged, nor any of their terms waived, except by an instrument signed in writing by the party to be bound thereby.

2

IN WITNESS WHEREOF, the parties hereto have executed this Bridge Loan Modification and Ratification Agreement as of the date first written above.

|

LENDER:

|

COMPANY: | ||||

| GLOBAL DIGITAL SOLUTIONS, INC., |

AIRTRONIC USA, INC.,

|

||||

| a New Jersey corporation |

an Illinois corporation

|

||||

| By: | /s/ Xxxxxxx X. Xxxxxxx |

By:

|

|||

| Name: Xxxxxxx X. Xxxxxxx | Name: | ||||

| Title: CEO | Title: | ||||

|

Address

|

|||||

3

IN WITNESS WHEREOF, the parties hereto have executed this Bridge Loan Modification an Ratification Agreement as of the date first written above.

|

LENDER:

|

COMPANY: | ||||

| GLOBAL DIGITAL SOLUTIONS, INC., |

AIRTRONIC USA, INC.,

|

||||

| a New Jersey corporation |

an Illinois corporation

|

||||

| By: |

By:

|

/s/ Merriellyn Xxxx, CEO | |||

| Name: | Name: Merriellyn Xxxx | ||||

| Title: | Title: Chief Executive Officer | ||||

| Address: 0000 Xxxxxx Xxxxxx Xxx Xxxxx Xxxxxxx XX 00000 XXX | |||||

4

1

2

3

4

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19