CONTRIBUTION AGREEMENT

THIS CONTRIBUTION AGREEMENT (the

“Agreement”) is entered as of this 29th day of

October, 2007, by and between Capital City Petroleum, Inc., a Delaware

corporation (“Assignee”), and Zenith Fund VI, LLC (d/b/a Capital City Energy

Fund VI, LLC), an Ohio limited liability company (“Assignor”).

WHEREAS, Assignor desires to contribute

all of Assignor’s right, title and interest in and to the oil and gas leases

(the “Leases”) and lands (the “Lands”) described in Exhibit A attached

hereto (the “Oil and Gas Properties”) to Assignee.

NOW, THEREFORE, in consideration of the

mutual promises and covenants hereinafter set forth, and for other good and

valuable consideration, the receipt and sufficiency of which are hereby

acknowledged, the parties hereby agree as follows:

1. Contribution of

Assets. Assignor hereby assigns, transfers, conveys and

delivers to Assignee, and Assignee hereby accepts from Assignor, all of the Oil

and Gas Properties, which include:

(a) Assignor’s

leasehold interests in oil, gas and other minerals, including working interests,

earned working interests, net profits interests, rights of assignment and

reassignment, and all other rights and interests in the Leases;

(b) All

fee interests in oil, gas and other minerals, including rights under mineral

deeds, conveyances, options and assignments;

(c) All

royalty interests, overriding royalty interests, production payments, rights to

take royalties in kind, and all other interests in and/or payable out of

production of oil, gas, and other minerals;

(d) All

rights and interests in or derived from operating agreements, unit agreements,

orders and decisions of state and federal regulatory authorities establishing

units, joint operating agreements, enhanced recovery agreements, water flood

agreements, farmout and farming agreements, options, drilling agreements,

unitization, pooling and communitization agreements, oil and/or gas sales

agreements, processing agreements, gas gathering and transmission agreements,

gas balancing agreements, salt water disposal and injection agreements,

assignments of operating rights, subleases, and any and all other agreements to

the extent they pertain to the Leases, Lands and the xxxxx located on the

Leases;

(e) All

rights of way, casements, surface fees, surface leases, servitudes and

franchises insofar as they pertain to the Leases and the xxxxx located on the

Leases;

(f) All

permits and licenses of any nature, owned, held or operated by Assignor in

connection with the Leases, Lands and the xxxxx located on the Lands subject to

the Leases;

(g) All

producing, non-producing, and shut-in oil and gas xxxxx, salt water disposal

xxxxx, water xxxxx, injection xxxxx, and all other xxxxx on or attributable to

the Leases, whether or not identified; and

(h) All

pumping units, pumps, casing, rods, tubing, wellhead equipment, separators,

heater treaters, tanks, pipelines, gathering lines, flow lines, valves, fittings

and all other surface and downhole equipments, fixtures, related inventory,

gathering and treating facilities, personal property and equipment used in

connection with the Leases and the xxxxx located on the Leases and all other

interests described above.

Notwithstanding

the date of execution of this Agreement, Assignor is assigning to Assignee the

Oil and Gas Properties effective as of October 1, 2007. For the

avoidance of doubt, any revenue related to the Oil and Gas Properties received

on or after October 1, 2007 will be the property of Assignee.

2. Consideration. The

total consideration provided to Assignor in connection with the contribution of

the Oil and Gas Properties to Assignee (valued at $1,460,446) is the issuance by

Assignee to Assignor (or its designee) of (a) 38,555.77 shares of Common Stock

of Assignee (valued at $12.50 per share) and (b) 39,139.95 shares of Series A

Preferred Stock of Assignee (valued at $25.00 per share).

3. Representations and

Warranties of Assignor. Assignor represents and warrants to Assignee as

follows:

(a) Organization and

Standing. Assignor is limited liability company duly

organized, validly existing, and in good standing under the laws of its state of

organization, has the power to own, lease and operate the properties it now

owns, leases and operates, and to carry on its business as now being conducted,

and is duly qualified or licensed to do business and are in good standing in

every domestic and foreign jurisdiction in the United States and elsewhere in

which the nature of its business or their ownership or leasing of property

requires such qualification.

(b) Authorization. Assignor

has all necessary power and authority to execute and deliver this Agreement and

to consummate the transactions contemplated hereby. The execution,

delivery and performance of this Agreement has been duly approved by all

necessary actions of Assignor, and this Agreement constitutes the valid and

binding obligation of Assignor enforceable against Assignor in accordance with

its terms, except as such enforceability may be limited by applicable

bankruptcy, insolvency, reorganization, moratorium or similar laws and general

principles of equity.

(c) AS-IS. Except

as specifically provided for herein, the Oil and Gas Properties are being sold

to Assignee on as “as is, where is” basis. ASSIGNOR MAKES NO

REPRESENTATION OR WARRANTY TO ASSIGNEE, EXPRESS OR IMPLIED, WITH RESPECT TO THE

OIL AND GAS PROPERTIES.

4. Representations and

Warranties of Assignee. Assignee represents and warrants to

Assignor as follows:

(a) Organization and

Standing. Assignee is a corporation duly organized, validly

existing, and in good standing under the laws of the State of Delaware, has the

power to own, lease, and operate the properties it now owns, leases and

operates, and to carry on its business as now being conducted, and is duly

qualified or licensed to do business and is in good standing in every domestic

and foreign jurisdiction in the United States and elsewhere in which the nature

of its business or its ownership or leasing of property requires such

qualification.

(b) Authorization. Assignee

has full power and authority and the legal right to enter into this Agreement

and to consummate the transactions contemplated hereby. The

execution, delivery, and performance of this Agreement has been duly approved by

all necessary actions, and the Agreement constitutes a valid and binding

obligation of Assignee enforceable in accordance with its terms, except as such

enforceability may be limited by applicable bankruptcy, insolvency,

reorganization, moratorium, or similar laws and general principles of

equity.

(c) Stock. The

authorized capital stock of the Assignee consists of 3,000,000 shares of Common

Stock, $0.001 par value per share (the “Common Stock”), and 325,000 shares of

Preferred Stock, $0.001 par value per share, all of which have been designated

“Series A Preferred Stock”). The Common Stock and Series A Preferred Stock

issued to Assignor pursuant to this Agreement are validly issued, fully paid and

nonassessable, and are free of any liens or encumbrances.

5. Issuance of

Warrant. In consideration for the efforts of Capital City

Partners, LLC in connection with the transaction contemplated by this Agreement,

Capital City Partners, LLC was issued a warrant to purchase 5651.22 shares of

Common Stock of Assignee with an exercise price of $12.50 per

share.

6. Code Section

351. Assignee and Assignor shall each use their best efforts

to cause the contribution of the Oil and Gas Properties and issuance of Common

Stock and Preferred Stock to the Assignee as an exchange described at

Sections 351(a) and (b) of the Internal Revenue Code of 1986, as amended (the

“Code”), and this Agreement should be interpreted to cause the contributions of

the Oil and Gas Properties by Assignor to Assignee in exchange for the Common

Stock and Preferred Stock of Assignee to be described at Sections 351(a) and (b)

of the Code, such that no gain or loss will be recognized by the Assignor to the

extent they receive stock within the meaning of Section 351(a) of the

Code.

7. Further Assurances;

Cooperation. Assignor agrees to execute and deliver such

further instruments of conveyance and transfer as Assignee may reasonably

request to convey and transfer effectively to Assignee the Oil and Gas

Properties.

8. Entire Agreement;

Amendment. This Agreement constitutes the entire agreement and

understanding of the parties hereto and supercede any prior written or oral

understandings of the parties. This Agreement may be amended only by

an instrument in writing executed by all parties hereto.

9. Governing

Law. This Agreement shall be governed by and construed in

accordance with the laws of the State of Delaware.

[Signature

Page Follows]

IN WITNESS WHEREOF, the parties have

executed this Contribution Agreement on the day and year first above

written.

|

Capital

City Petroleum, Inc.

|

|

|

By

/s/ Xxxxxxx

Xxxxxxxx

|

|

|

Its

CEO

|

|

|

Zenith

Fund VI, LLC (d/b/a Capital City Energy Fund VI, LLC)

|

|

|

By

Capital City Petroleum, Inc. (successor in interest to Capital City

Petroleum, LLC)

|

|

|

Its Manager

|

|

|

By

/s/ Xxxxxxx

Xxxxxxxx

|

|

|

Its

CEO

|

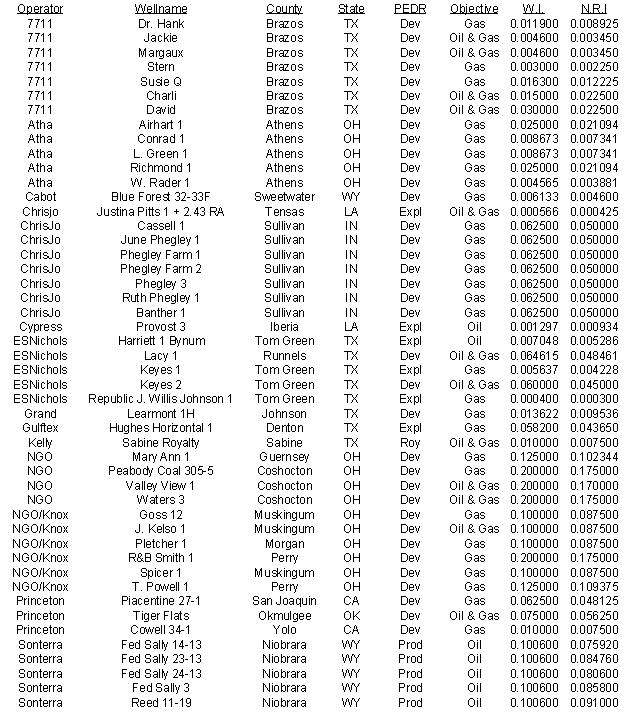

Exhibit

A

Oil and Gas

Properties