LEASE OF PREMISES AT 35 GATEHOUSE DRIVE, WALTHAM, MASSACHUSETTS FROM ASTRAZENECA PHARMACEUTICALS LIMITED PARTNERSHIP TO MORPHIC ROCK THERAPEUTIC, INC.

LEASE

OF PREMISES AT ▇▇ ▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇,

▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇▇▇▇

FROM

ASTRAZENECA PHARMACEUTICALS LIMITED PARTNERSHIP

TO

MORPHIC ROCK THERAPEUTIC, INC.

TABLE OF CONTENTS

|

ARTICLE I. CERTAIN DEFINITIONS |

5 | |

|

ARTICLE II. LEASE OF PREMISES |

12 | |

|

Section 2.1 |

Lease of the Premises |

12 |

|

Section 2.2 |

Common Rights |

12 |

|

Section 2.3 |

Parking |

12 |

|

Section 2.4 |

Lease Term |

13 |

|

Section 2.5 |

Lease Amendment |

13 |

|

ARTICLE III. CONDITION OF PREMISES; CONSTRUCTION OF INITIAL IMPROVEMENTS; ALLOWANCE |

16 | |

|

Section 3.1 |

Condition of Premises |

16 |

|

Section 3.2 |

Tenant’s Work; Landlord’s Contribution. NOT APPLICABLE |

16 |

|

Section 3.3 |

Plans and Specifications |

16 |

|

Section 3.4 |

Signs |

17 |

|

ARTICLE IV. BASE RENT; ADDITIONAL RENT |

17 | |

|

Section 4.1 |

Base Rent |

17 |

|

Section 4.2 |

Certain Additional Rent |

18 |

|

Section 4.3 |

Taxes |

18 |

|

Section 4.4 |

Operating Costs |

19 |

|

Section 4.5 |

Payment for Electricity |

19 |

|

Section 4.6 |

Tenant’s Audit Rights |

20 |

|

ARTICLE V. USE OF PREMISES |

21 | |

|

Section 5.1 |

Permitted Use |

21 |

|

Section 5.2 |

Restrictions on Use |

22 |

|

Section 5.3 |

Hazardous Materials |

22 |

|

Section 5.4 |

Biohazard Removal and Animal Care |

24 |

|

ARTICLE VI. LANDLORD’S SERVICES |

25 | |

|

Section 6.1 |

Landlord’s Services |

25 |

|

Section 6.2 |

Extraordinary Use |

27 |

|

Section 6.3 |

Interruption; Delay |

27 |

|

Section 6.4 |

Additional Services |

28 |

|

Section 6.5 |

Landlord Indemnity |

28 |

|

Section 6.6 |

Compliance with Laws |

28 |

|

ARTICLE VII. CERTAIN OBLIGATIONS OF TENANT |

28 | |

|

Section 7.1 |

Rent |

28 |

|

Section 7.2 |

Utilities |

28 |

|

Section 7.3 |

No Waste |

29 |

|

Section 7.4 |

Maintenance; Repairs; and Yield Up |

29 |

|

Section 7.5 |

Alterations by Tenant |

30 |

|

Section 7.6 |

Trade Fixtures and Equipment |

31 |

|

Section 7.7 |

Compliance with Laws |

31 |

|

Section 7.8 |

Contents at Tenant’s Risk |

31 |

|

Section 7.9 |

Exoneration; Indemnification and Insurance |

32 |

|

Section 7.10 |

Landlord’s Access |

34 |

|

Section 7.11 |

No Liens |

34 |

|

Section 7.12 |

Compliance with Rules and Regulations |

35 |

|

ARTICLE VIII. SUBLETTING AND ASSIGNMENT |

35 | |

|

Section 8.1 |

Subletting and Assignment |

35 |

|

ARTICLE IX. RIGHTS OF MORTGAGEES AND GROUND LESSORS; ESTOPPEL CERTIFICATES |

37 | |

|

Section 9.1 |

Subordination to Mortgages and Ground Leases |

37 |

|

Section 9.2 |

Lease Superior at Mortgagee’s or Ground Lessor’s Election |

38 |

|

Section 9.3 |

Notice to Mortgagee and Ground Lessor |

38 |

|

Section 9.4 |

Limitations on Obligations of Mortgagees, Ground Lessors and Successors |

38 |

|

Section 9.5 |

Estoppel Certificates |

39 |

|

ARTICLE X. CASUALTY |

39 | |

|

Section 10.1 |

Damage From Casualty |

39 |

|

Section 10.2 |

Abatement of Rent |

40 |

|

Section 10.3 |

Landlord’s Right to Terminate |

40 |

|

ARTICLE XI. EMINENT DOMAIN |

40 | |

|

Section 11.1 |

Eminent Domain; Right to Terminate and Abatement in Rent |

40 |

|

Section 11.2 |

Restoration |

41 |

|

Section 11.3 |

Landlord to Control Eminent Domain Action |

41 |

|

ARTICLE XII. DEFAULT AND REMEDIES |

41 | |

|

Section 12.1 |

Event of Default |

41 |

|

Section 12.2 |

Landlord’s Remedies |

42 |

|

Section 12.3 |

Reimbursement of Landlord |

43 |

|

Section 12.4 |

Landlord’s Right to Perform Tenant’s Covenants |

43 |

|

Section 12.5 |

Cumulative Remedies |

44 |

|

Section 12.6 |

Expenses of Enforcement |

44 |

|

Section 12.7 |

Landlord’s Default |

45 |

|

Section 12.8 |

Limitation of Landlord’s Liability |

45 |

|

Section 12.9 |

Late Payment and Administrative Expense |

45 |

|

ARTICLE XIII. MISCELLANEOUS PROVISIONS |

46 | |

|

Section 13.1 |

Brokers |

46 |

|

Section 13.2 |

Quiet Enjoyment |

46 |

|

Section 13.3 |

Security Deposit |

46 |

|

Section 13.4 |

Notices |

48 |

|

Section 13.5 |

Waiver of Subrogation |

48 |

|

Section 13.6 |

Entire Agreement; Execution; Time of the Essence and Headings and Table of Contents |

49 |

|

Section 13.7 |

Partial Invalidity |

49 |

|

Section 13.8 |

No Waiver |

49 |

|

Section 13.9 |

Holdover |

49 |

|

Section 13.10 |

When Lease Becomes Binding |

50 |

|

Section 13.11 |

No Recordation |

50 |

|

Section 13.12 |

As Is |

50 |

|

Section 13.13 |

Financial Statements; Certain Representations and Warranties of Tenant |

50 |

|

Section 13.14 |

(a) Real Estate Confidentiality |

51 |

|

Section 13.15 |

Summary of Basic Terms |

53 |

SUMMARY OF BASIC TERMS

OFFICE LEASE

OF PREMISES AT ▇▇ ▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇,

▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇▇▇▇

TO

MORPHIC ROCK THERAPEUTIC, INC.

DATED AS OF AUGUST 5, 2015

The following is a summary of certain basic terms of this Lease which is intended for the convenience and reference of the parties. Capitalized terms used, but not defined, in this Summary of Basic Terms, have their defined meanings in this Lease. In addition, some of the following items or terms are incorporated into this Lease by reference to the item or term or to this “Summary of Basic Terms”.

1. Landlord: ASTRAZENECA PHARMACEUTICALS LIMITED PARTNERSHIP

2. Tenant: MORPHIC ROCK THERAPEUTIC, INC.

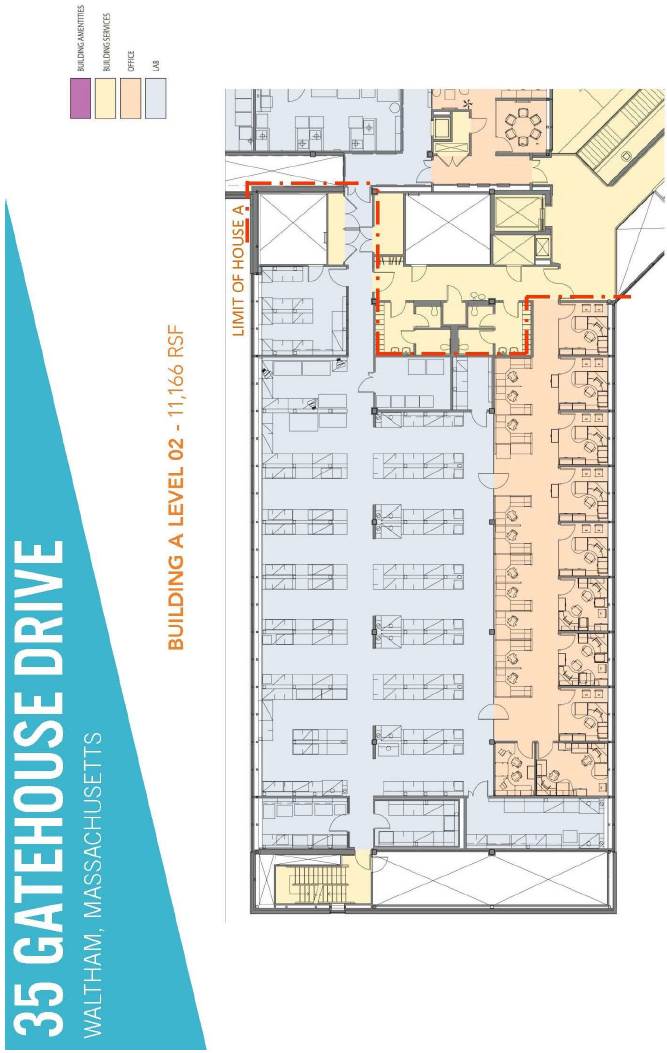

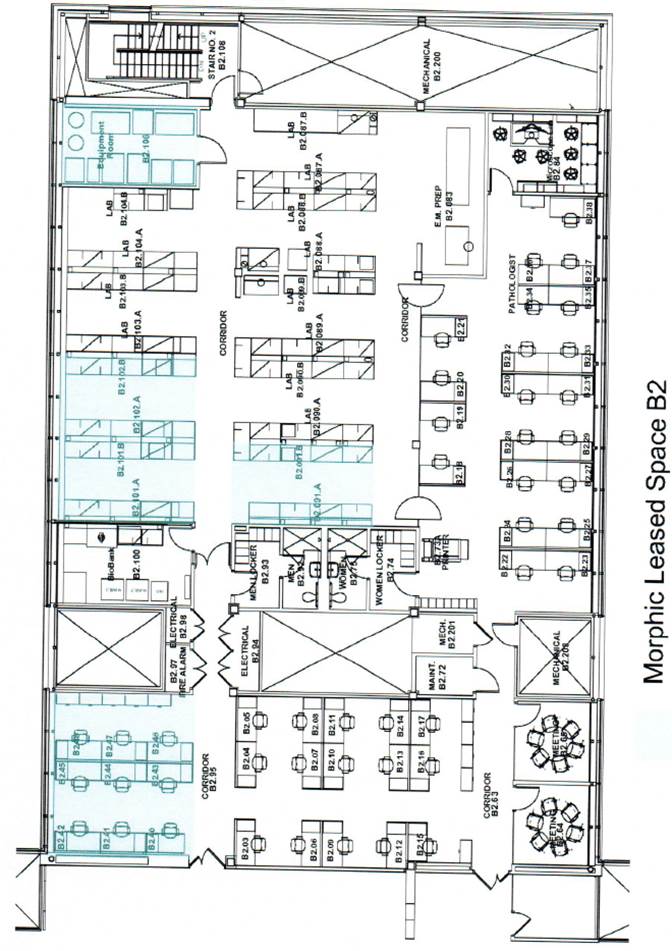

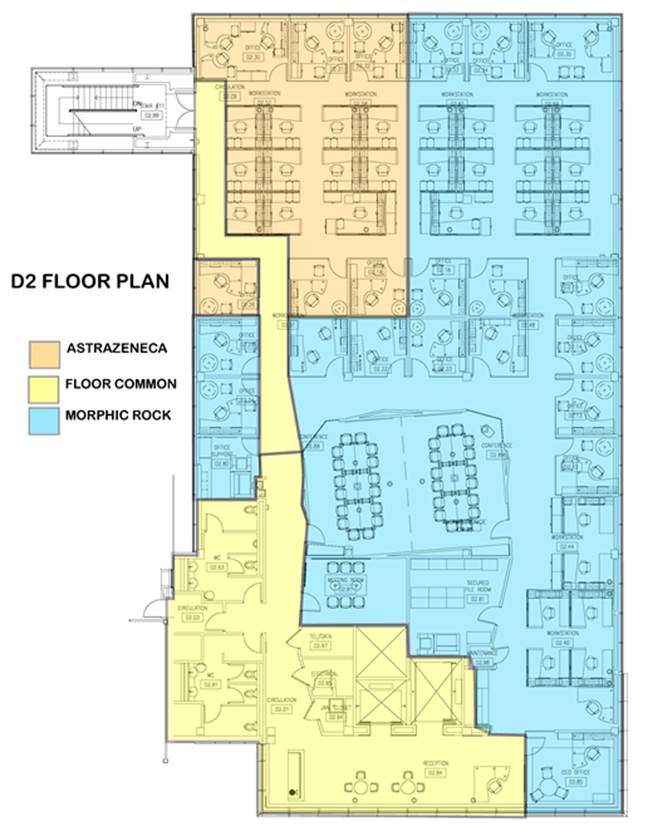

3A. Premises: Approximately 11,166 square feet of rentable space located in Building A on Level 2 of the Building (“A2”), depicted as the “Office” and “Lab” area within the “Limit of House A” on the floor plan attached hereto as Exhibit C.

3B. Landlord’s Property: The real property with the Building and any other improvements now or hereafter thereon, commonly known as ▇▇ ▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇▇▇▇, as described on Exhibit A and depicted on Exhibit B.

3C. Leasable Square Footage of the Premises: (which includes a proportionate share of the Common Areas of the Building): 11,166 rentable square feet.

3D. Leasable Square Footage of the Building: An agreed upon 297,576 rentable square feet, subject to adjustment in the event that the Common Areas of the Building are expanded or reconfigured.

3E. Landlord’s Equipment: The equipment owned by Landlord and located in the Premises on the date of Landlord’s delivery of the Premises to Tenant. A complete itemization of Landlord’s Equipment will be agreed upon and listed on an exhibit to this Lease within thirty (30) days after the Term Commencement Date. Tenant shall also have the right to use during the term hereof the Landlord’s work stations and furniture presently located in the Premises (“Landlord’s Furniture”) without warranty or representation as to their usage, fitness or condition. The Landlord shall have no obligation to maintain, replace or repair said furniture. The aforesaid furniture shall remain the property of the Landlord

and returned at the end of the Lease term in the same condition as on the Term Commencement Date, reasonable wear and tear and damage by fire or other casualty excepted.

4. Tenant Improvement Allowance: None. Tenant shall be responsible for and pay for its own Tenant improvements including, without limitation, for all telephone, data wiring and equipment installation throughout the Premises and for connection to the main demarcation room from local exchange carriers, domestic water distribution within the Premises, hot water requirements, safety equipment, laboratory waste removal and office cleaning.

5A. Lease Term: an approximately sixty-four calendar month period commencing on the Term Commencement Date and ending on the last day of the fifth (5th) Lease Year following the Rent Commencement Date, and, if exercised, the three (3) year period under the Right of Extension.

5B. Right of Extension: Tenant shall have the right to extend the Lease Term for one (1) three (3) year term in accordance with Section 2.4(b).

6. Permitted Use: General business offices, scientific research and development laboratory, and uses customarily accessory thereto. The foregoing notwithstanding, under no circumstances shall the Premises be used in any manner related to the Generic Drug business of any nature or description including, without limitation, the manufacture, development, sales, distribution or marketing of such products.

7. Tenant’s Parking Allocation: twenty-eight (28) unassigned parking spaces (2.5 spaces per 1,000 leasable square feet of the Premises), subject to the provisions of Section 2.3.

8. Base Rent: The Base Rent for the Initial Term shall be as set forth in the chart below:

|

Period |

|

Base Rent per rsf |

|

Annual Base Rent |

|

Monthly Base Rent |

| |||

|

Lease Year 1 |

|

$ |

37.00 |

|

$ |

413,142.00 |

|

$ |

34,428.50 |

* |

|

Lease Year 2 |

|

$ |

38.00 |

|

$ |

424,308.00 |

|

$ |

35,359.00 |

|

|

Lease Year 3 |

|

$ |

39.00 |

|

$ |

435,474.00 |

|

$ |

36,289.50 |

|

|

Lease Year 4 |

|

$ |

40.00 |

|

$ |

446,640.00 |

|

$ |

37,220.00 |

|

|

Lease Year 5 |

|

$ |

41.00 |

|

$ |

457,806.00 |

|

$ |

38,150.50 |

|

* Base Rent shall ▇▇▇▇▇ for the period beginning on the Rent Commencement Date in the amount of $9,761.83 per month for the three (3) months of the Lease Term following the Rent Commencement Date for a total Base Rent abatement of $29,285.50.

As used above, a “Lease Year” shall mean a period of twelve (12) full calendar months, where each successive Lease Year following Lease Year 1 shall commence on each anniversary of the Rent Commencement Date (or the first day of the first full calendar month following the Rent Commencement Date if the Rent Commencement Date is on a day other than the 1st of a calendar month).

The Base Rent for the Extension Term, if any, will be Fair Market Rent (as defined in Section 4.7 below), but in no event less than the Base Rent for the Lease Year immediately prior to such Extension Term.

9A. Additional Rent: Tenant’s Tax Escalation, Tenant’s Operating Cost Escalation, Water Service Charge and/or Tenant’s Electricity Costs and all other sums (other than Base Rent) payable by Tenant to Landlord under this Lease.

9B. Tenant’s Tax Escalation: Tenant’s Share of Taxes for any Tax Fiscal Year occurring in whole or in part during the Lease Term; payable monthly in equal installments. Tenant’s Tax Escalation for fiscal year 2015 is estimated to be approximately $8.09 per rentable square foot

9C. Tenant’s Operating Cost Escalation: Tenant’s Share of the Operating Costs for any calendar year occurring whole or in part during the Lease Term; payable monthly in equal installments. Tenant’s Operating Cost Escalation for fiscal year 2015 is estimated to be approximately $9.63 per rentable square foot.

9D. Tenant’s Electricity Costs: Tenant shall pay the costs for electricity for lights and plugs and HVAC service provided to the Premises in accordance with Sections 4.5 and 7.2 (“Tenant’s Electricity Costs”). If not separately metered or sub-metered, Tenant will pay its pro-rata costs monthly as allocated by the Landlord.

10. Heat and Utilities: Other than utilities furnished by Landlord pursuant to this Lease, Tenant shall be responsible for contracting directly with the utility providers for all utility service to the Premises, including, without limitation, all utilities necessary to provide supplemental HVAC service to the Premises. If not separately metered, Tenant will pay its pro-rata costs monthly as allocated by the Landlord.

11. Brokers: Transwestern RBJ.

12A. Tenant’s Address For Notices, Telephone Number, Fax Number and Taxpayer Identification No.:

Until the Term Commencement Date:

Morphic Rock Therapeutic, Inc.

c/o Polaris Venture Partners

▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇

▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇

Attn: ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇, CEO

And thereafter at the Premises to the attention of the same officer

With a copy to:

▇▇▇▇▇ ▇▇▇▇ LLP

▇▇▇ ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇

▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇

Attn: ▇▇▇▇ ▇. ▇▇▇▇▇▇, Esq.

Tenant F.I.D. #▇▇-▇▇▇▇▇▇▇

12B. Landlord’s Address for Notices:

AstraZeneca Pharmaceuticals LP

c/o MedImmune, LLC

▇▇▇ ▇▇▇▇▇▇▇▇▇ ▇▇▇

▇▇▇▇▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇

Attn: ▇▇▇▇ ▇▇▇▇▇▇▇▇ / Global Real Estate

With a copy to:

AstraZeneca Pharmaceuticals LP

▇▇▇▇ ▇▇▇▇▇▇▇ ▇▇▇▇

▇▇▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇

Attn: General Counsel

with a copy to:

▇▇▇▇▇▇ ▇▇▇▇▇▇▇, Esquire

▇▇▇▇▇▇▇▇ & English, LLP

▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇

▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇

12C. Landlord’s Address for Payment of Rent:

AstraZeneca LP

▇/▇ ▇▇▇▇▇▇▇▇▇▇▇▇

▇▇ ▇▇▇ ▇▇▇▇▇▇

▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇-▇▇▇▇

13. Security Deposit: $137,714.00 in the form of a standby letter of credit. See Section 13.3.

LEASE

THIS LEASE (this “Lease”), made as of the 5th day of August, 2015, by ASTRAZENECA PHARMACEUTICALS LIMITED PARTNERSHIP, a Delaware limited partnership, and MORPHIC ROCK THERAPEUTIC, INC., a Delaware corporation, is as follows.

W I T N E S S E T H:

ARTICLE I.

CERTAIN DEFINITIONS

In addition to the words and terms defined elsewhere in this Lease, the following words and terms shall have in this Lease the meanings set forth in this Article (whether or not underscored):

“Additional Rent” has the meaning set forth in Item 9A of the Summary of Basic Terms.

“Bankruptcy Law” means any existing or future bankruptcy, insolvency, reorganization, dissolution, liquidation or arrangement or readjustment of debt law or any similar existing or future law of any applicable jurisdiction, or any laws amendatory thereof or supplemental thereto, including, without limitation, the United States Bankruptcy Code of 1978, as amended (11 U.S.C. Section 101 et seq.), as any or all of the foregoing may be amended or supplemented from time to time.

“Base Rent” has the meaning set forth in Item 8 of the Summary of Basic Terms.

“Broker” has the meaning set forth in Item 11 of the Summary of Basic Terms.

“Building” means the interconnected office and laboratory buildings located on Landlord’s Property and shown on the Site Plan.

“Business Hours” means Monday through Friday, 8:00 a.m. to 6:00 p.m. and Saturdays 8:00 a.m. to 1:00 a.m., except holidays. The term “holiday” means the federal day of celebration of the following holidays: New Year’s Day, ▇▇▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇ Day, President’s Day, Memorial Day, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving, Christmas and any other weekday on which banks in the City of Boston, Massachusetts, are closed or required to be closed.

“Common Areas” means all areas of Landlord’s Property, as designated by Landlord from time to time, located inside or outside of the Building, which are not intended for the use of a single tenant and which are intended for (i) the non-exclusive common use of Landlord, Tenant and other tenants of portions of Landlord’s Property and their respective employees, agents, licensees and invitees and/or (ii) to serve the Building and/or Landlord’s Property. Common Areas include, without limitation, the lobby of the Building, common restroom facilities and stairwells of the Building, sidewalks, unreserved Parking Areas, access drives, landscaped areas, utility rooms, storage rooms, and utility lines and systems and the Common Facilities.

“Common Facilities” means those facilities located on Landlord’s Property which Landlord designates from time to time as “common facilities”, including, but not limited to, building systems, passenger elevators, materials dumb-waiters, pipes, ducts, wires, conduits, meters, HVAC equipment and systems, electrical systems and equipment and plumbing lines and facilities, cafeteria, showers, conference rooms, auditorium and video/telephone conferencing meeting facilities.

“Environmental Law” means the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”), 42 U.S.C. §9601 et seq., the Resource Conservation and ▇▇▇▇▇▇▇▇ ▇▇▇, ▇▇ ▇.▇.▇. §▇▇▇▇ et seq., the Hazardous Materials ▇▇▇▇▇▇▇▇▇▇▇▇▇▇ ▇▇▇, ▇▇ ▇.▇.▇. §▇▇▇▇ et seq., the Toxic Substances ▇▇▇▇▇▇▇ ▇▇▇, ▇▇ ▇.▇.▇. §▇▇▇▇ et seq., the Federal Water Pollution ▇▇▇▇▇▇▇ ▇▇▇, ▇▇ ▇.▇.▇. §▇▇▇▇ et seq., the Clean ▇▇▇▇▇ ▇▇▇, ▇▇ ▇.▇.▇. §▇▇▇▇ et seq., the Clean Air Act, 42 U.S.C. §7401 et seq., the Massachusetts Oil and Hazardous Material Release Prevention and Response Act, Chapter 21E of the Massachusetts General Laws, all regulations promulgated thereunder, and any other federal, state, county, municipal, local or other statute, law, ordinance or regulation (including any state or local board of health rules, regulation, or code), or any common law (including common law that may impose strict liability or liability based on negligence), which may relate to or deal with human health, the environment, natural resources, or Hazardous Materials, all as may be from time to time amended or modified.

“Event of Default” has the meaning given in Section 12.1.

“Extension Term” has the meaning given in Section 2.4(b).

“Generic Drug” means (i) a drug product that is comparable to brand/reference listed drug product in dosage form, strength, route of administration, quality and performance characteristics, and intended use, (ii) any drug manufactured, marketed or sold under its chemical name without advertising and/or (iii) any drug manufactured, marketed or sold under an Adopted Name assigned by the United States Adopted Names Council.

“Hazardous Materials” or “Hazardous Substances” means, at any time, (a) any “hazardous substance” as defined in §101(14) of CERCLA (42 U.S.C. §9601(14)) or regulations promulgated thereunder; (b) any “solid waste,” “hazardous waste,” or “infectious waste,” as such terms are defined in any Environmental Law at such time; (c) asbestos, urea-formaldehyde, polychlorinated biphenyls (“PCBs”), bio-medical materials or waste, nuclear fuel or material, chemical waste, radioactive material, explosives, known carcinogens, petroleum products and by-products and other dangerous, toxic or hazardous pollutants, contaminants, chemicals, materials or substances which may be hazardous to human or animal health or the environment or which are listed or identified in, or regulated by, any Environmental Law; and (d) any additional substances or materials which at such time are classified or considered to be hazardous or toxic under any Environmental Law.

“Initial Term” means the period beginning at 12:01 a.m. on the Term Commencement Date and ending at 11:59 p.m. on the last day of the fifth (5th) Lease Year following the Rent Commencement Date.

“Insurance Costs” includes the cost of insuring the entire Landlord’s Property, including without limitation the buildings and improvements now or hereafter situated thereon, and all operations conducted in connection therewith, with such policies, coverages and companies and in such limits as may be reasonably selected by Landlord in light of the practices of similarly situated commercial landlords of comparable properties in the City of Waltham, Massachusetts (and/or which may be required by Landlord’s lenders), including, but not limited to, fire insurance with extended or with all-risk coverage, comprehensive general liability (including products liability) insurance covering personal injury, deaths and property damage with a personal injury endorsement covering false arrest, detention or imprisonment, malicious prosecution, libel and slander, and wrongful entry or eviction, rent loss or business interruption insurance earthquake insurance, Ordinance and Law insurance, terrorism insurance, worker’s compensation insurance, plate glass insurance, contractual liability insurance, boiler insurance, and fidelity bonds. Insurance Costs shall not include any property insurance carried by Landlord with respect to equipment used exclusively by Landlord at the Building for Landlord’s pharmaceutical business operations or commercial general liability insurance for Landlord’s pharmaceutical business operations at the Landlord’s Property.

“Invitees” means employees, workers, visitors, guests, customers, suppliers, agents, contractors, representatives, licensees and other invitees.

“Land” means the land located at ▇▇ ▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇▇▇▇ more particularly described in Exhibit A and which is depicted on the Site Plan.

“Landlord” means AstraZeneca Pharmaceuticals Limited Partnership, its successors and assigns.

“Landlord’s Property” means the Land, the Building and all present or future appurtenances and/or improvements to the Land and/or the Building.

“Leasable Square Footage of the Building” has the meaning set forth in Item 3D of the Summary of Basic Terms.

“Leasable Square Footage of the Premises” has the meaning set forth in Item 3C of the Summary of Basic Terms.

“Lease Term” means the Initial Term and, if Tenant timely and properly exercises its right to extend pursuant to Section 2.4(b), the Extension Term(s).

“Legal Requirements” means all applicable laws, statutes, rules, regulations and requirements of governmental authorities, including, but not limited to, zoning laws, building codes and the Americans with Disabilities Act of 1990 and any amendments thereto, regulations and ordinances in connection therewith (“ADA”).

“Operating Costs” means all costs, expenses and disbursements of every kind and nature (except Taxes) which Landlord shall pay or become obligated to pay in connection with owning, operating, managing, insuring, maintaining, repairing or replacing Landlord’s Property, all as reasonably and in good faith determined by Landlord. For purposes of determining the Operating Costs, for any calendar year for which the Building is less than 95% occupied, the

Operating Costs for such calendar year which vary with occupancy shall be equitably adjusted to reflect the amount they would have been if the Building had been 95% occupied for such calendar year. In no event shall the provisions of this section entitle Landlord to collect from Tenant more than Tenant’s Share of 100% of Operating Costs actually incurred. Operating Costs shall include, by way of illustration, but not be limited to: all Insurance Costs; all charges payable by Landlord in connection with the performance of Landlord’s maintenance and repair obligations with respect to Landlord’s Property; all charges payable by Landlord to provide janitorial service to Landlord’s Property; all charges payable by Landlord to provide heating, ventilating and air conditioning services to the Building; all charges payable by Landlord to provide utility services to Landlord’s Property (except Tenant’s Electricity Costs or other similar electricity charges payable by other tenants); all costs related to trash, debris and refuse removal; all costs related to removal of snow and ice; all costs of pest and vermin control for the Common Areas; all costs of providing, maintaining, repairing and replacing of paving, curbs, walkways, landscaping, planters, roofs, walls, drainage, utility lines, security systems and other equipment; all costs of painting the exterior and Common Areas of the Building; all costs of repaving, resurfacing and restriping Parking Areas and drives; all costs of lighting, cleaning, waterproofing, repairing and maintaining Common Areas, Common Facilities and other portions of Landlord’s Property; the net cost to Landlord of providing food service as provided in Section 6.1(h); all costs of licenses, permits and inspection fees; all legal, accounting, inspection and consulting fees related to Landlord’s Property that are not specifically excluded herein; all costs of capital repairs and replacements to the Building or Common Areas, amortized over their expected useful life based upon and including a market rate of interest not to exceed eight percent (8%) per annum (subject to the limitation described below); all costs of wages, salaries and benefits of operating personnel, including welfare, retirement, vacations and other compensation and fringe benefits and payroll taxes for employees at or below the level of Building manager (provided that if any employee performs services in connection with the Building and other buildings, costs associated with such employee shall be proportionately included in Operating Costs based on the percentage of time such employee spends in connection with the operation, maintenance and management of the Building); management fees equal to 3% of gross rental revenues derived from Landlord’s Property (which management fees may be payable to an affiliate of Landlord); and all materials and supplies, including charges for telephone, overnight courier, postage, stationery, supplies and other materials and expenses required for the routine operation of the management office. However, notwithstanding the above, the following specific items shall not be included: (a) the cost of alterations to space in the Building leased to others (as well as space occupied by Landlord for purposes other than Building management); (b) debt service and ground rent payments; (c) any cost or expenditure for which Landlord is entitled to reimbursement by insurance proceeds or eminent domain proceeds, whether or not Landlord is actually reimbursed; (d) costs for which Landlord is entitled to reimbursement under warranties provided to Landlord by contractors who have warranty obligations, whether or not Landlord is actually reimbursed; (e) costs in connection with leasing space in Landlord’s Property, including brokerage commissions, lease concessions, rental abatements and construction allowances granted to specific tenants, attorneys’ fees and collection costs related to negotiation and enforcement of tenant leases; (f) the cost of providing electrical service (lights and plugs) to space leased to tenants; (g) expenses which are billed directly, or reasonably allocable exclusively, to any tenant of the Building; (h) salaries and bonuses other than as expressly included in Operating Costs as set forth above; (i) the cost of any

work or service performed on an extra-cost basis for any tenant of the Building; (j) capital expenditures, except for the amortization of capital expenditures (over their expected useful life based upon and including a market rate of interest not to exceed eight percent (8%) per annum) which (1) are required by laws which first become effective or applicable to Landlord’s Property after the Term Commencement Date, (2) are reasonably projected to achieve a savings in total Operating Costs over the Lease Term; or (3) are for repair or replacement of existing elements of Landlord’s Property; (k) the cost of any additions or improvements to the Building or Landlord’s Property; (l) depreciation, other than the amortization of capital improvements hereafter made as provided above; (m) costs incurred in connection with the sale, financing or refinancing of Landlord’s Property; (n) fines, costs, interest and/or penalties incurred due to the late payment of Taxes or Operating Costs, or any failure of Landlord to timely pay any obligation; (o) organizational expenses associated with the creation and operation of the entity that constitutes Landlord (as distinguished from the costs of Building operations) including, but not limited to, Landlord’s or Landlord’s property manager’s general corporate overhead or general administrative expenses; (p) advertising and promotional costs including tenant relation programs and events; (q) Landlord’s gross receipts taxes, personal and corporate income taxes, inheritance and estate taxes, other business taxes and assessments, franchise, gift and transfer taxes; (r) any costs, fees, dues, contributions or similar expenses for political, charitable, industry association or similar organizations; (s) costs incurred in connection with the original design and construction of the Building or Landlord’s Property, and the repair of damage to the Building or Landlord’s Property in connection with any type of casualty, event of damage or destruction or condemnation (other than the amount of any deductible payable by Landlord under any property insurance policy on Landlord’s Property, which amount shall be included in Operating Costs); (t) costs incurred in connection with upgrading the Building or Landlord’s Property to comply with insurance requirements, or life safety codes, ordinances, statutes, or other laws in effect and applicable to Landlord’s Property prior to the Term Commencement Date, including without limitation the ADA, including penalties or damages incurred as a result of non-compliance; (u) reserves of any kind; (v) any penalties or damages that Landlord pays to Tenant under this Lease or to other tenants of Landlord’s Property under their respective leases; (w) any costs, fines, interest or penalties incurred due to late payments or violations by Landlord of any governmental rule or authority; (x) legal fees, accountant fees and other expenses incurred in disputes with other former, current or future tenants or occupants of Landlord’s Property, or associated with the enforcement of any other leases of space in the Landlord’s Property, or the defense of Landlord’s title to or interest in the Building, Landlord’s Property or any part thereof; (y) services or installations available to any tenant in Landlord’s Property that are not also furnished to Tenant; (z) the cost of any service provided to Tenant or other occupants of Landlord’s Property for which Landlord is entitled to reimbursement (other than by a general reimbursement of operating expenses), whether or not Landlord is actually reimbursed; (aa) any cost or expense that is expressly excluded from Operating Costs, or expressly provided to be incurred by Landlord at its sole cost and expense, pursuant to any provision of this Lease; (bb) any Operating Cost charged to another tenant of Landlord’s Property that such tenant fails to pay; (cc) insurance premiums, or increases in insurance premiums, for any insurance required by any other tenant or occupant of Landlord’s Property that is not the same as or substantially equivalent to the insurance required of Landlord under this Lease; (dd) legal, mediation, arbitration, accounting and other fees and expenses incurred in disputes with the holder of any mortgage, deed of trust or other security instrument now or hereafter encumbering all or any part of

Landlord’s Property; (ee) any cost or expense payable to any of Landlord’s affiliates or divisions, to the extent that such cost or expense is in excess of that which would be charged by an unaffiliated person or firm for the same service in Waltham, Massachusetts; (ff) costs incurred by Landlord in connection with correction of defects in design and construction of the Building or Landlord’s Property; (gg) any cost or expense related to removal, cleaning, abatement or remediation of Hazardous Material in or about the Landlord’s Property, including without limitation, Hazardous Substances in the ground water or soil that are not the responsibility of Tenant under this Lease; (hh) any cost or expense occasioned by or resulting from any violation of law by any other tenant or occupant of Landlord’s Property or their respective Invitees, or by any person or entity other than Tenant or Tenant’s Invitees; (ii) any bad debt loss, rent loss, or reserves (including, without limitation, any reserves for bad debts or rent loss); (jj) contributions to reserves for Operating Costs, including reserves for capital improvements (whether or not otherwise allocable under this Lease); and (kk) contributions to political or charitable organizations. For purposes of determining exclusions from Operating Costs, Landlord shall be deemed to be a tenant or occupant of the Building, and all portions of the Leasable Square Footage of the Building where Landlord conducts its pharmaceuticals business operations to the exclusion of other tenants and occupants of the Property shall be deemed to be tenant space.

“Parking Areas” means those portions of Landlord’s Property which may be used for parking as depicted on the Site Plan, as such areas may be changed by Landlord from time to time. The Parking Areas presently consist of the Parking Garage and the surface parking areas as depicted on the Site Plan. The Parking Areas will not be changed to materially and adversely impact Tenant’s ingress and egress or to materially increase the distance from the Parking Areas to the Premises.

“Permitted Transferee” means (a) an entity controlling, controlled by or under common control with Tenant (a “Tenant Affiliate”), (b) an entity which succeeds to Tenant’s business by merger, consolidation or other form of corporate reorganization or (c) an entity which acquires all or substantially all of Tenant’s assets or stock; provided that an entity may not become a Permitted Transferee through or as a part of a bankruptcy or other similar insolvency proceeding. The foregoing notwithstanding, under no circumstances shall any Permitted Transferee use the Premises for uses related to the Generic Drug business of any nature or description including, without limitation, the manufacture, development, sales, distribution or marketing of such products.

“Permitted Use” has the meaning set forth in Item 6 of the Summary of Basic Terms.

“Person” means any individual, partnership, joint venture, trust, limited liability company, business trust, joint stock company, unincorporated association, corporation, institution or entity, including any governmental authority.

“Premises” has the meaning set forth in Item 3A of the Summary of Basic Terms.

“Rent Commencement Date” means the date that is one hundred twenty (120) days following the Term Commencement Date.

“Rules and Regulations” means the rules and regulations promulgated by Landlord with respect to Landlord’s Property, a copy of which is attached hereto as Exhibit D, as the same may be reasonably and in good faith modified by Landlord in a non-discriminatory manner from time to time upon notice to Tenant.

“Site Plan” means the site plan of Landlord’s Property attached hereto as Exhibit B which depicts the approximate size and layout of the Land, the Building and the Parking Areas.

“Specified Number” means twenty-eight (28), subject to the provisions of Section 2.3, based on a parking ratio of 2.5 spaces per 1,000 leasable square feet of the Premises.

“Summary of Basic Terms” means the Summary of Basic Terms which is affixed to this Lease immediately after the table of contents of this Lease.

“Tax Fiscal Year” means July 1 through June 30 next following, or such other tax period as may be established by law for the payment of Taxes.

“Taxes” means (a) all taxes, assessments, betterments, water or sewer entrance fees and charges including general, special, ordinary and extraordinary, environmental, or any other charges (including charges for the use of municipal services if billed separately from other taxes), levied, assessed or imposed at any time by any governmental authority upon or against the Land, the Building, or the fixtures, signs and other improvements thereon then included in Landlord’s Property and (b) all attorneys’ fees, appraisal fees and other fees, charges, costs and/or expenses incurred in connection with any proceedings related to an attempt to reduce the amount of the Taxes, change the tax classification and/or reduce the assessed value of Landlord’s Property, provided that such proceedings are reasonably projected to achieve a savings in total Taxes (taking into account the costs of the proceedings) over the Lease Term. This definition of Taxes is based upon the present system of real estate taxation in the Commonwealth of Massachusetts; if taxes upon rentals or any other basis shall be substituted, in whole or in part, for the present ad valorem real estate taxes, the term “Taxes” shall be deemed changed to the extent to which there is such a substitution for the present ad valorem real estate taxes. Taxes shall not include (i) any net income, capital, stock, succession, transfer, franchise, gift, estate or inheritance tax, except to the extent that such tax shall be imposed in lieu of any portion of Taxes; (ii) any item to the extent otherwise included in Operating Costs; (iii) interest and/or penalties incurred as a result of Landlord’s late payment of any Taxes; and (iv) any Taxes payable on fixtures and equipment of Landlord that are not available for the common use of all tenants.

“Tenant” means Morphic Rock Therapeutic, Inc., a Delaware corporation, its permitted successors and permitted assigns.

“Tenant Improvement Allowance” has the meaning set forth in Item 4 of the Summary of Basic Terms.

“Tenant’s Electricity Costs” has the meaning set forth in Item 9D of the Summary of Basic Terms.

“Tenant’s Share” means 3.75%, being the amount (expressed as a percentage) equal to (a) the Leasable Square Footage of the Premises divided by (b) the Leasable Square Footage of the Building (rounded to the nearest one-hundredth of one percent (0.01%).

“Term Commencement Date” means the earlier of August 15, 2015 or the date Tenant commences its initial occupancy of the Premises for the active conduct of its business.

ARTICLE II.

LEASE OF PREMISES

Section 2.1 Lease of the Premises.

Landlord hereby leases the Premises to Tenant, and Tenant hereby leases the Premises from Landlord, upon and subject to the terms and provisions of this Lease and all zoning ordinances, and easements, restrictions and conditions of record. Subject to all applicable Legal Requirements and Rules and Regulations, Tenant shall have access to the Premises on a seven days per week, 24 hours per day basis during the Lease Term, subject to closure where necessary or appropriate for maintenance, cleaning and repairs and those matters which are beyond Landlord’s reasonable control, including but not limited to, acts of God, accidents, breakdowns, war, civil commotion, fire or other casualty, labor difficulties, governmental regulations or orders and weather conditions. In the event that it is necessary for Landlord to close the Premises for maintenance, cleaning or repairs, Landlord shall limit the closure to the minimum duration necessary to accomplish the applicable maintenance, cleaning and repairs. Except in the event of emergency Landlord shall give Tenant not less than 72 hours advance written notice of any such closure.

Section 2.2 Common Rights. The Premises are leased subject to, and with the benefit of, the non-exclusive right to use in common with others at any time entitled thereto the Common Areas and Common Facilities for all such purposes as such areas may be reasonably designated, but only in connection with the use of the Premises for the Permitted Use in accordance with the Rules and Regulations. Landlord shall have the right from time to time to designate or change the locations, size or configuration of the Common Areas, and to modify or replace the Common Facilities, and to permit expansion of construction and new construction therein; provided, however, such changes shall not have a material adverse impact on Tenant’s access to, or use and enjoyment of, the Premises. Tenant shall not have the right to use those portions of the Common Areas designated from time to time by Landlord as for the exclusive use of one or more other tenants. Included herein is the right to use the Common Area conference center and conference rooms when not otherwise booked by the Landlord or others also entitled to use same, which use by Tenant shall be subject to Landlord’s allocation of such availability among such parties in Landlord’s reasonable discretion.

Section 2.3 Parking. Subject to the Rules and Regulations, Tenant’s Invitees are authorized to park not more than the Specified Number of passenger automobiles, at any time, in the unreserved Parking Areas in common with Landlord and other tenants of Landlord’s Property from time to time, on

a first come, first served basis. Tenant acknowledges that not all of the Specified Number of spaces are located on Landlord’s Property and agrees that, in order to use the full amount of the Specified Number, Tenant will be required to utilize spaces in the Parking Garage. In the event of a change in the Leasable Square Footage of the Premises, the Specified Number shall be adjusted pursuant to the formula used to calculate the Specified Number as of the date of the Lease. Tenant shall not (a) permit any Invitees of Tenant (other than visitors and guests) to park in spaces designated as “visitor” spaces, (b) permit any Invitees of Tenant to park in spaces designated as “reserved” spaces (unless reserved for Tenant), (c) permit the total number of passenger automobiles parked in the Parking Areas by Invitees of Tenant, at any time, to exceed the Specified Number, and (d) except for delivery trucks using designated loading and unloading facilities, permit any Invitee of Tenant to park any vehicle in the Parking Areas other than passenger automobiles. Landlord may, from time to time, designate one or more spaces as reserved for the exclusive use of one or more of the tenants and/or for Landlord’s Invitees, provided the same shall not materially and adversely affect Tenant’s parking rights hereunder. Subject to the Rules and Regulations, Tenant shall have non-exclusive access to two (2) loading docks located in ▇▇▇▇▇▇▇▇ ▇, ▇▇▇▇▇ ▇, and to the loading dock of the main building (A00).

Section 2.4 Lease Term.

(a) The Lease Term shall commence at 12:01 a.m. on the Term Commencement Date and, unless Tenant timely and properly exercises its right to extend pursuant to Section 2.4(b) or this Lease terminates early, shall end at 11:59 p.m. on the last day of the fifth (5th) Lease Year following the Rent Commencement Date. Provided Tenant has delivered to Landlord evidence of the insurance required under this Lease, Tenant shall have full access to the Premises upon the full execution of this Lease for the installation of telecommunications and computer systems, equipment, furnishings and other personal property. Notwithstanding such access, the Initial Term shall not commence until the Term Commencement Date.

(b) Provided that an Event of Default does not then exist, Tenant shall have the right to extend the Lease Term for one (1) period of three (3) years (the “Extension Term”) by giving Landlord written notice specifying such extension, which notice must be received by Landlord not less than twelve (12) months prior to the expiration date of the Initial Term. If such extension becomes effective, the Lease Term shall be automatically extended upon the same terms and conditions as are applicable to the Initial Term, except that (x) Base Rent for the applicable Extension Term shall be as set forth in Item 8 of the Summary of Basic Terms and (y) there shall be no further right to extend or renew beyond the first Extension Term.

Section 2.5 Lease Amendment. If, pursuant to any provision of this Lease, there is a change in any of the terms or amounts in the Summary of Basic Terms (including, without limitation, the Leasable Square Footage of the Building, the Leasable Square Footage of the Premises, Base Rent, or Tenant’s Share) then in effect, Landlord and Tenant will promptly execute a written amendment to, and restatement of, the Summary of Basic Terms, substituting the changed (or confirmed) terms and

recomputed amounts in lieu of each of the applicable terms and amounts then in effect which have been changed. As of the effective date of the amendment to the Summary of Basic Terms, the changed terms (and recomputed amounts) will be effective for all purposes of this Lease, and the amended and restated Summary of Basic Terms will be a part of, and incorporated into, this Lease.

Section 2.6 Landlord’s Equipment

During the Lease Term, Tenant shall have a license to use, at no additional cost to Tenant, Landlord’s Equipment. Landlord shall provide Tenant with nine (9) additional vent hoods (which vent hoods shall be part of Landlord’s Equipment) for Tenant to install in the Premises at Tenant’s sole expense. Tenant takes the Landlord’s Equipment in “AS IS” condition, and Landlord does not warrant or make any representation, express or implied, concerning the condition, adequacy or sufficiency for Tenant’s present or future purposes of the Landlord’s Equipment. Landlord shall perform any maintenance, repairs or restoration that may be required to the Landlord’s Equipment during the Lease Term, and Tenant shall reimburse Landlord for all costs in connection therewith within thirty (30) days following receipt of Landlord invoice. Tenant shall return the Landlord’s Equipment upon the expiration or earlier termination of this Lease in the same condition as of the Term Commencement Date, ordinary wear and tear and damage by fire or other casualty excepted. Under no circumstances shall Tenant remove any of Landlord’s Equipment from the Premises.

Section 2.7 Back-up Generator.

Tenant shall be permitted to connect its equipment located in the Premises to the back-up generator equipment serving the Building (the “Back-up Generator”), at no additional cost to Tenant, by plugging such equipment into the red electrical outlets currently located in the Premises (the “Back-up Generator Outlets”). Tenant’s use of such Back-Up Generator Outlets shall be at the sole risk and hazard of Tenant and Landlord does not warrant or make any representation, express or implied, concerning the condition, adequacy or sufficiency for Tenant’s present or future purposes of the Back-up Generator Outlets and/or Back-up Generator.

Section 2.8 Right of First Offer.

Subject to the provisions of this Section 2.8, Tenant shall have a one-time right of first offer (the “Right of First Offer”) on the then-available portions of Floor 1 of Building A (each, a “ROFO Space”) upon the following terms and conditions. This Right of First Offer is subject and subordinate to (i) the rights of third parties existing as of the date of this Lease, (ii) the rights, if any, of each tenant in such ROFO Space granted in the Initial Lease-Up (as defined below) with respect to a ROFO Space, and (iii) the right of Landlord or any affiliate of Landlord to use or occupy such ROFO Space.

Landlord will notify Tenant of its plans to market a ROFO Space (the “ROFO Notice”) for lease to any party unrelated to Landlord (it being acknowledged and agreed that the Right of First Offer shall not be applicable to space Landlord intends to occupy and/or provide to affiliates of Landlord), which ROFO Notice shall specify the location and square footage for such ROFO Space, Landlord’s estimate of the fair market rent for such ROFO Space, the date of

availability of such ROFO Space and all other material terms and conditions which will apply to such ROFO Space. The term of any ROFO Space shall be coterminous with the Lease Term for the Premises; provided, however, that in the event less than thirty (30) full calendar months remain in the Lease Term as of the date of availability of such ROFO Space, then (i) if the Extension Term has not yet been exercised, Tenant’s exercise of such Right of First Offer shall be subject to Tenant’s simultaneous exercise of the Extension Term (which shall thereupon be applicable to such ROFO Space) and (ii) if no Extension Term remains or is exercisable by Tenant, then this Section 2.8 shall be of no force or effect and Tenant shall have no further Rights of First Offer. Within ten (10) Business Days following its receipt of any ROFO Notice, Tenant shall have the right to accept the same by written notice to Landlord (the “ROFO Acceptance Notice”), provided that if Tenant disputes Landlord’s estimate of the fair market rent in the ROFO Acceptance Notice, the fair market rent for such space shall be determined as set forth in Section 4.7 below. If Tenant timely delivers a ROFO Acceptance Notice, Landlord and Tenant shall execute an amendment to the Lease incorporating the ROFO Space into the Premises upon the terms contained in the ROFO Notice within ten (10) Business Days following Landlord’s delivery to Tenant of a form therefor (and if the Landlord’s determination of fair market rent was disputed in the ROFO Notice and not agreed to as of the commencement of the term for such ROFO Space, then rent shall be Landlord’s determination of fair market rent until the finalization of the fair market rent appraisal, and any change in such rent amount shall be adjusted — with applicable credits or reimbursement for any underpayment or overpayment - thereafter).

If Tenant fails to timely deliver a ROFO Acceptance Notice within said ten (10) Business Day period or fails to execute Landlord’s form of amendment for such ROFO Space within ten (10) Business Days of receipt from Landlord, Tenant shall be deemed to have waived its rights with respect to a ROFO Space and Landlord shall be entitled, but not required, to lease all or any portion of such ROFO Space to any party or parties on such terms and conditions, including, without limitation, options to extend the term of such lease and/or expand the premises under such lease, and for such rent as Landlord determines, all in its sole discretion, and the Right of First Offer with respect to such ROFO Space in such ROFO Notice shall be of no further force or effect.

Notwithstanding any contrary provision of this Lease, any Right of First Offer, and any exercise by Tenant of any Right of First Offer shall be void and of no effect unless on the date Tenant timely delivers a ROFO Acceptance Notice to Landlord and on the commencement date of the amendment for a ROFO Space (as applicable): (i) this Lease is in full force and effect, (ii) no Event of Default has occurred under this Lease which remains continuing and uncured after any applicable notice and opportunity to cure and (iii) except with respect to a Permitted Transfer, Tenant shall not have assigned this Lease and there shall not be any sublease or subleases then in effect.

Tenant acknowledges and agrees that Tenant’s Right of First Offer with respect to any space that is not subject to a third-party lease on the date hereof (the “Vacant Space”) shall not be of any force or effect until such time as such Vacant Space has been initially leased to a third-party tenant after the date hereof (the “Initial Lease-Up”) and such lease (and any rights held by such tenant in any part of the Building consisting of a ROFO Space) has subsequently expired.

ARTICLE III.

CONDITION OF PREMISES; CONSTRUCTION OF INITIAL IMPROVEMENTS; ALLOWANCE

Section 3.1 Condition of Premises. Notwithstanding anything to the contrary herein contained, Tenant shall take the Premises “as-is”, in the condition in which the Premises are in as of the Term Commencement Date, without any obligation on the part of Landlord to prepare or construct the Premises for Tenant’s occupancy, and without any representation or warranty by Landlord to Tenant as to the condition of the Premises or the Building except as set forth in the next sentence. Notwithstanding the foregoing Landlord represents that the roof and all structural elements of the Building and all utility and building service systems located in the Building on the Term Commencement Date shall be in good working order and condition for use of the Premises as office, research and development and laboratory space on the Term Commencement Date.

Section 3.2 Tenant’s Work; Landlord’s Contribution. NOT APPLICABLE

Section 3.3 Plans and Specifications. Tenant shall be solely responsible for the preparation of the final architectural, electrical and mechanical construction drawings, plans and specifications (called “plans”) necessary for Tenant to construct the Premises for Tenant’s occupancy, which plans shall be subject to approval by Landlord’s architect and engineers and shall comply with their reasonable requirements to avoid aesthetic or other conflicts with the design and function of the balance of the Building. Landlord’s approval is solely given for the benefit of Landlord, and neither Tenant nor any third party shall have the right to rely upon Landlord’s approval of Tenant’s plans for any purpose whatsoever other than that Landlord does not object thereto under this Lease. Landlord’s architects and engineers shall respond (with approval or disapproval) to any plan submission by Tenant within 8 business days after Landlord’s receipt thereof. If Landlord fails to respond to any such submission within such 8 business day period, which failure continues for more than 2 business days after Tenant gives Landlord a written notice (the “Deemed Approved Notice”) advising Landlord that such plan submission shall be deemed approved within 2 business days of Landlord’s receipt of the Deemed Approved Notice, then such plan submission shall be deemed approved hereunder. The Deemed Approved Notice shall, in order to be effective, contain on the first page thereof, in a font at least twice as large as the font of any other text contained in such notice, a legend substantially as follows: “FAILURE TO RESPOND TO THIS NOTICE WITHIN TWO (2) BUSINESS DAYS AFTER RECEIPT HEREOF SHALL CONSTITUTE LANDLORD’S APPROVAL OF SUBMITTED PLANS.” In the event Landlord’s architect’s or engineers’ approval of Tenant’s plans is withheld or conditioned, Landlord shall send prompt written notification thereof to Tenant and include a reasonably detailed statement identifying the reasons for such refusal or condition, and Tenant shall promptly have the plans revised by its architect to incorporate all reasonable objections and conditions presented by Landlord and shall resubmit such plans to Landlord. Landlord’s architects and engineers shall respond (with approval or disapproval) to any plan re-submission by Tenant within 8 business days after Landlord’s receipt thereof. Such process shall be followed until the plans shall have been approved by Landlord’s architect and engineers without

unreasonable objection or condition. Without limiting the foregoing, Tenant shall be responsible for all elements of the design of Tenant’s plans (including, without limitation, compliance with law, functionality of design, the structural integrity of the design, the configuration of the Premises and the placement of Tenant’s furniture, appliances and equipment), and Landlord’s approval of Tenant’s plans shall in no event relieve Tenant of the responsibility for such design. Tenant agrees it shall be solely responsible for the timely preparation and submission of all such plans and for all elements of the design of such plans and for all costs related thereto. (The word “architect” as used in this Section 3.2 shall include an interior designer or space planner.) Tenant shall reimburse Landlord Landlord’s reasonable out-of-pocket expense incurred in connection with the review of Tenant’s plans.

Section 3.4 Signs. Tenant may not erect or keep any sign which is visible from the exterior of the Building, but Tenant may install a sign at its sole cost and expense at the entrance to the Premises subject to Landlord’s reasonable approval. All signs located in the interior and/or exterior of the Building (i) shall comply with all applicable Legal Requirements and the sign criteria included in the Rules and Regulations, and (ii) and shall have been reasonably approved in writing and in advance by Landlord following submission of detailed plans and specifications by Tenant to Landlord. Tenant shall maintain its signs in good condition and repair and in accordance with Legal Requirements. At the end of the Lease Term or earlier termination of this Lease, Tenant shall promptly remove Tenant’s signs, repair any damage caused by such removal, and return the affected portions of the Building to their condition existing prior to installation of the signs. Tenant shall be identified in the Building directory in the Building’s common lobby and with directional signage at the entry of the Building at Landlord’s cost and, at Tenant’s cost, on the sign board at the entrance to the complex which includes the Building and Premises.

ARTICLE IV.

BASE RENT; ADDITIONAL RENT

Section 4.1 Base Rent.

(a) Tenant shall pay Base Rent commencing on the Rent Commencement Date at the rate set forth in Item 8 of the Summary of Basic Terms.

(b) Base Rent shall be payable in equal monthly installments of 1/12th of the annual Base Rent then in effect and shall be paid without offset for any reason except as otherwise expressly provided herein, in advance, on the first day of each calendar month from and after the Rent Commencement Date. Base Rent and Additional Rent shall be paid either (i) by an “electronic funds transfer” system arranged by and among Tenant, Tenant’s bank and Landlord, or (ii) by check sent to Landlord’s address set forth in Item 12C of the Summary of Basic Terms, or at such other place as Landlord shall from time to time designate in writing. If Tenant is using checks, rent checks shall be made payable to AstraZeneca LP or to such other entity as Landlord may designate from time to time in writing. The obligations of Tenant to pay Base Rent and other sums to Landlord and the obligations of Landlord under this Lease are

independent covenants and obligations. The parties acknowledge and agree that the obligations owing by Tenant under this Section 4.1 are rent reserved under this Lease, for all purposes hereunder, and are rent reserved within the meaning of Section 502(b)(6) of the Bankruptcy Code or any successor provision thereto.

Section 4.2 Certain Additional Rent. From and after the Term Commencement Date Tenant shall pay to Landlord, without offset for any reason, all Additional Rent when due. If Tenant fails to pay any Additional Rent, Landlord shall have all the rights and remedies for failure to pay Base Rent. The parties acknowledge and agree that the obligations owing by Tenant under this Section 4.2 are rent reserved under this Lease, for all purposes hereunder, and are rent reserved within the meaning of Section 502(b)(6) of the Bankruptcy Code or any successor provision thereto.

Section 4.3 Taxes.

(a) Tenant shall pay to Landlord, as Additional Rent, an amount equal to Tenant’s Tax Escalation. Tenant’s Tax Escalation shall be estimated in good faith by Landlord at the beginning of each Tax Fiscal Year, and thereafter be payable to Landlord in equal estimated monthly installments together with the payment of Base Rent, subject to readjustment when the actual amount of Taxes is determined. After readjustment, any shortage shall be due and payable by Tenant within 30 days of demand by Landlord and any excess shall be credited against future Base Rent and Additional Rent obligations, or refunded if the Lease Term has ended or terminated early and Tenant has no further rent or surrender obligations to Landlord. If the taxing authority provides an estimated tax ▇▇▇▇, then monthly installments of Taxes shall be based thereon until the final tax ▇▇▇▇ is ascertained. Landlord shall furnish to Tenant, upon Tenant’s request, but not more than once in any year, a copy of the tax ▇▇▇▇ or any estimated tax ▇▇▇▇.

(b) If, after Tenant shall have made any payment under this Section 4.3, Landlord shall receive a refund of any portion of the Taxes paid on account of any Tax Fiscal Year in which such payments shall have been made as a result of an abatement of such Taxes, by final determination of legal proceedings, settlement or otherwise, Landlord shall, within 30 days after receiving the refund, pay to Tenant (unless an Event of Default has occurred) an amount equal to (i) the lesser of (A) Tenant’s Tax Escalation payments for such Tax Fiscal Year or (B) Tenant’s Share of the refund, which payment to Tenant shall be appropriately adjusted if Tenant’s Tax Escalation covered a shorter period than covered by the refund, less (ii) Tenant’s Share of all reasonable expenses incurred by Landlord in connection with such proceedings (including, but not limited to, reasonable attorneys’ fees, costs and appraisers’ fees), with Tenant’s Share being pro-rated for any partial Tax Fiscal Year at the beginning or end of the Term. Landlord shall have sole control of all tax abatement proceedings.

(c) Tenant’s obligation in respect of Taxes shall be prorated at the beginning and end of the Lease Term. If the final tax ▇▇▇▇ for the Tax Fiscal Year in which such expiration or termination of this Lease occurs shall not have been received by Landlord, then within 30 days after the receipt of the tax ▇▇▇▇ for such Tax Fiscal Year, Landlord and Tenant shall make appropriate adjustments of estimated payments.

(d) Without limiting the generality of the foregoing, Tenant shall pay all rent and personal property taxes attributable to its signs or any other personal property including but not limited to its trade fixtures, the existing or any future floor coverings, wall treatments and light fixtures in the Premises.

(e) Landlord may bring proceedings to contest the validity of the amount of any Taxes or to recover payment therefor. Tenant shall reasonably cooperate with Landlord in connection with such proceedings and shall pay to Landlord Tenant’s Share of all reasonable costs, fees and expenses of such proceedings promptly upon being billed therefor, with Tenant’s Share being pro-rated for any partial Tax Fiscal Year at the beginning or end of the Term. Any refund, rebate, credit or abatement of Taxes shall be equitably apportioned between the parties with due regard to the duties and rights of each under this Lease, after first reimbursing the parties participating in such contest or proceedings for their aforesaid respective costs and expenses in such contest or proceeding.

Section 4.4 Operating Costs. Tenant shall pay to Landlord, as Additional Rent, an amount equal to Tenant’s Operating Cost Escalation. Tenant’s Operating Cost Escalation shall be estimated in good faith by Landlord at the beginning of each calendar year, and thereafter be payable in equal estimated monthly installments, together with the Base Rent, subject to readjustment from time to time, but not more frequently than once in any calendar year, as reasonably determined by Landlord and also when actual Operating Costs are determined. After a readjustment, any shortage shall be due and payable by Tenant within 30 days of demand by Landlord and any excess shall be credited against future Base Rent and Additional Rent obligations, or refunded if the Lease Term has ended and Tenant has no further rent or surrender obligations to Landlord. Upon Tenant’s reasonable written request, Landlord shall provide Tenant with reasonable supporting documentation for the Operating Costs for the prior calendar year; provided that such request is received by Landlord within six months after the end of the calendar year to which such Operating Costs relate.

Section 4.5 Payment for Electricity. Landlord has installed a meter to measure the consumption of electricity by all of the tenants (including Tenant) on the floors of the Building in which the Premises are located. Tenant shall from and after the Term Commencement Date pay to Landlord, as Additional Rent, within 30 days of demand from time to time, but not more frequently than monthly, for its consumption of electricity, a sum equal to its pro rata share of such electrical costs (which shall be at Landlord’s cost and without ▇▇▇▇-up), which pro rata share shall be based on a ratio, the numerator of which is the area of the portion of the Premises subject to each such common meter and the denominator of which is the aggregate area occupied by tenants (including space occupied by Landlord as a tenant of the Building) on the floor of the Building in which such portion of the Premises is located sharing such common meter. The rate to be paid by Tenant for electricity shall exclude the costs incurred by Landlord in maintaining or replacing electrical meters, sub-meters or check-meters, but shall include any taxes or other charges imposed on the Landlord in connection with such electrical service. In the event Landlord installs a check-meter to measure the consumption of electricity by Tenant in any portion of the Premises, Tenant shall

pay to Landlord, as Additional Rent, on demand from time to time, but not more frequently than monthly, for its consumption of electricity as measured by such check-meter.

Section 4.6 Tenant’s Audit Rights. Annually, within 120 days after the end of each calendar year or Tax Fiscal Year, as applicable, Landlord shall furnish to Tenant a report setting forth in reasonable detail the Operating Costs and Taxes for the immediately preceding calendar year (in the case of Operating Costs) or Tax Fiscal Year (in the case of Taxes). Tenant shall have the right to audit Landlord’s books and records relating to Operating Costs and/or Taxes with respect to the period covered by each such report within six months after receipt of such report (such six month period being called the “Audit Period”) by delivering a notice of its intention to perform such audit to Landlord. If, as a result of such audit, Tenant believes that it is entitled to receive a refund of any Additional Rent paid by Tenant in respect of Operating Costs and/or Taxes, Tenant shall deliver to Landlord, no later than 30 days after expiration of the Audit Period, a notice demanding such a refund, together with a statement of the grounds for each such demand and the amount of each proposed refund. The cost of any such audit shall be paid by Tenant, except that, if it is established that the Additional Rent in respect of Operating Costs or Taxes, as applicable, charged to Tenant for the period in question was overstated by more than 3%, the reasonable out-of-pocket cost of such audit paid to a third party other than an employee of Tenant shall be paid or reimbursed to Tenant by Landlord. Provided that Landlord has complied with Section 4.3(b) or Section 4.3(e), as the case may be, an overstatement for the purposes of allocation of audit costs shall not be deemed to exist due to a refund of Taxes. Any audit shall be performed by either (a) Tenant’s or Tenant’s Affiliates regular employees or (b) a reputable certified public accountant reasonably acceptable to Landlord whose compensation is not contingent on the results of the audit. As a condition of Tenant’s right to audit under this Section 4.6, Tenant agrees, and shall cause any outside auditor retained by Tenant to agree, to maintain the confidentiality of the results of the audit, subject to the right to disclose such results in any legal proceedings regarding the accuracy of the charges for Additional Rent in respect of Operating Costs or Taxes. If Landlord determines that a report previously furnished by Landlord was in error, Landlord may furnish a corrective or supplemental report to Tenant within six (6) months after the original report was furnished, and if such corrective or supplemental report results in increased Additional Rent, the Audit Period for the year covered by such report shall be extended for six months after Landlord furnishes the corrective or supplemental report.

Section 4.7 Determination of Fair Market Rent.

“Fair Market Rent” shall mean (a) with respect to the Extension Term, the anticipated rent for the Premises for the Extension Term as of the commencement of the Extension Term under market conditions then existing and (b) with respect to a ROFO Space, the anticipated rent for the ROFO Space as of the commencement of the term for such ROFO Space under market conditions then existing.

With respect to the Extension Term, provided that Tenant timely delivers written notice that it is exercising its option to extend the term of the Lease, Landlord shall notify Tenant of Landlord’s estimate of the Fair Market Rent no later than the date that is eleven (11) calendar months prior to the expiration of the initial term of the Lease. No later than fifteen (15) days

after such notification, Tenant may dispute Landlord’s estimate of Fair Market Rent upon written notice thereof to Landlord which written notice shall contain Tenant’s estimate of the Fair Market Rent (the “Extension Term FMV Dispute Notice”).

If Tenant disputes Landlord’s estimate of Fair Market Rent, then the Fair Market Rent shall be determined by agreement between Landlord and Tenant during the next thirty (30) day period (the “Discussion Period”) following Tenant’s delivery of an Extension Term FMV Dispute Notice or a ROFO Acceptance Notice which disputes Landlord’s estimate of the fair market rent for a ROFO Space, as applicable.

If Landlord and Tenant are unable to agree upon the Fair Market Rent during the Discussion Period, then the Fair Market Rent shall thereafter be determined by the determination of a board of three (3) M.A.I. appraisers as hereafter provided, each of whom shall have at least five (5) years’ experience in the Waltham biotech rental market and each of whom is hereinafter referred to as “appraiser”, Tenant and Landlord shall each appoint one such appraiser and the two appraisers so appointed shall appoint the third appraiser (the “Neutral Appraiser”). The cost and expenses of each appraiser appointed separately by Tenant and Landlord shall be borne by the party who appointed the appraiser. The cost and expenses of the third appraiser shall be shared equally by Tenant and Landlord. Landlord and Tenant shall appoint their respective appraisers no later than fifteen (15) days after the expiration of the Discussion Period and shall designate the appraisers so appointed by notice to the other party. The two appraisers so appointed and designated shall appoint the Neutral Appraiser no later than thirty (30) days after the end of the Discussion Period and shall designate such appraiser by notice to Landlord and Tenant. The Neutral Appraiser shall then choose either the Landlord’s estimate of Fair Market Rent or the Tenant’s estimate of Fair Market Rent as the Fair Market Rent of the space in question as of the commencement of the Extension Term and shall notify Landlord and Tenant of its determination no later than forty-five (45) days after the end of the Discussion Period. The Fair Market Rent determined in accordance with the provisions of this Section shall be deemed binding and conclusive on Tenant and Landlord. Notwithstanding the foregoing, if either party shall fail to appoint its appraiser within the period specified above (such party referred to hereinafter as the “failing party”) the other party may serve notice on the failing party requiring the failing party to appoint its appraiser within ten (10) days of the giving of such notice and if the failing party shall not respond by appointment of its appraiser within said (10) day period, then the appraiser appointed by the other party shall be the sole appraiser whose choice of either the Landlord’s or the Tenant’s estimate of Fair Market Rent shall be binding and conclusive upon Tenant and Landlord. All times set forth herein are of the essence.

ARTICLE V.

USE OF PREMISES

Section 5.1 Permitted Use. Tenant shall not use or occupy the Premises for any purpose other than the Permitted Use.

Section 5.2 Restrictions on Use. Tenant shall use the Premises and Landlord’s Equipment in a careful, safe and proper manner, shall not commit or suffer any waste on or about Landlord’s Property or with respect to Landlord’s Equipment, and shall not make any use of Landlord’s Property and/or Landlord’s Equipment which is prohibited by or contrary to any laws, rules, regulations, orders or requirements of public authorities, or which would cause a public or private nuisance. Tenant shall comply with and obey all laws, rules, regulations, orders and requirements of public authorities which in any way affect the use or operation of Landlord’s Equipment and the use, operation or occupancy of Landlord’s Property. Tenant, at its own expense, shall obtain any and all permits, approvals and licenses necessary for use of the Landlord’s Equipment and the Premises (copies of which shall be provided to the Landlord), provided that Landlord shall be responsible for obtaining a certificate of occupancy for the Building generally (i.e., as opposed to a certificate of occupancy for the Premises after the performance of any work by Tenant, which shall be Tenant’s responsibility) and any other permits, approvals and licenses necessary generally for the use of Landlord’s Equipment and Landlord’s Property. Tenant shall not overload the floors or other structural parts of the Building; and shall not commit or suffer any act or thing on Landlord’s Property which is illegal, unreasonably offensive, unreasonably dangerous, or which unreasonably disturbs other tenants. Tenant shall not knowingly do or permit to be done any act or thing on Landlord’s Property or with Landlord’s Equipment which will invalidate or be in conflict with any insurance policies, or which will increase the rate of any insurance, covering the Building. If, because of Tenant’s failure to comply with the provisions of this Section or due to any use of the Premises or activity of Tenant in or about Landlord’s Property, the Insurance Costs are increased, Tenant shall pay Landlord the amount of such increase caused by the failure of Tenant to comply with the provisions of this Section or by the nature of Tenant’s use of the Premises. Tenant shall cause any fire lanes in the front, sides and rear of the Building to be kept free of all parking associated with its business or occupancy and in compliance with all applicable regulations. Tenant shall conduct its business at all times so as not to annoy or be offensive to other tenants and occupants in Landlord’s Property. Tenant shall not permit the emission of any objectionable noise or odor from the Premises and shall at its own cost install such extra sound proofing or noise control systems and odor control systems, as may be needed to eliminate unreasonable noise, vibrations and odors, if any, emanating from the Premises being heard, felt or smelled outside the Premises. Tenant shall not place any file cabinets bookcases, partitions, shelves or other furnishings or equipment in a location which abuts or blocks any windows.

Section 5.3 Hazardous Materials.

(a) Tenant shall be permitted to bring or keep in or on the Premises any Hazardous Material (hereinafter defined), so long as such Hazardous Material is specifically identified and enumerated in Tenant’s Hazardous Waste Management Program (as hereafter defined and as the same may be updated by Tenant from time to time upon reasonable prior notice to and with the approval of Landlord), which are hereby expressly permitted by Landlord (“Tenant’s Hazardous Materials”). Tenant’s Hazardous Materials shall at all times be brought upon, kept or used in accordance with (A) all applicable Environmental Laws (hereinafter defined) and regulations or requirements of insurance rating or insurance service organizations, (B) Tenant’s “Hazardous Waste Management Program,” which shall be provided by Tenant to

Landlord in advance of Hazardous Materials being brought by Tenant upon the Premises for Landlord’s review and approval, not to be unreasonably withheld, conditioned or delayed, and Tenant hereby acknowledges that Tenant shall be prohibited from bringing or keeping any Tenant’s Hazardous Materials in or on the Premises until Landlord has approved Tenant’s “Hazardous Waste Management Program” in writing, and (C) with respect to medical waste and so-called “biohazard” materials, all applicable laws and regulations and insurance regulations or requirements. Tenant shall be responsible for assuring that all laboratory uses are adequately and properly vented. Tenant’s Hazardous Waste Management Program shall be updated as reasonably required by Landlord or desired by Tenant (including the list of Tenant’s Hazardous Materials enumerated therein), but no less frequently than annually. Tenant’s Hazardous Waste Management Program shall also specify (i) a description of handling, storage, use and disposal procedures; and (ii) all plans or disclosures and/or emergency response plans which Tenant has prepared, including without limitation Tenant’s Hazardous Waste Management Plan, and all plans which Tenant is required to supply to any governmental agency or authority pursuant to any Environmental Law.