14263998.21 Separation and Release of Claims Agreement YOU SHOULD CONSULT WITH AN ATTORNEY BEFORE SIGNING THIS RELEASE OF CLAIMS. This Separation and Release of Claims Agreement (the “Agreement”) is made by and between LivePerson, Inc. (the “Company”)...

14263998.21 Separation and Release of Claims Agreement YOU SHOULD CONSULT WITH AN ATTORNEY BEFORE SIGNING THIS RELEASE OF CLAIMS. This Separation and Release of Claims Agreement (the “Agreement”) is made by and between LivePerson, Inc. (the “Company”) and Xxxxxx XxXxxxxx (the “Executive”). WHEREAS, the parties wish to resolve amicably the Executive’s separation from the Company and establish the terms of the Executive’s severance arrangement; NOW, THEREFORE, in consideration of the promises and conditions set forth herein, the sufficiency of which is xxxxxx acknowledged, the Company and the Executive agree as follows: 1. Separation Date. The Executive’s effective date of separation from employment with the Company is December 31, 2023 (the “Separation Date” or the “Date of Termination”). As of the Separation Date, all salary payments will cease and any benefits the Executive has under Company-provided benefit plans, programs, or practices will terminate, except as required by federal or state law or as otherwise expressly set forth in this Agreement or the Employment Agreement (as defined below). 2. Severance Benefits. In return for the execution and non-revocation of this Agreement, and the Executive’s compliance with all of its terms, the Company agrees to provide the Executive with the payments and benefits set forth below and the parties agree as follows: a. As described in Section 7(b)(i) of the Employment Agreement, Executive is entitled to the “Accrued Benefits,” consisting of (i) to the extent not already paid, his unpaid Base Salary through, and any unpaid reimbursable expenses outstanding as of, the Date of Termination; (ii) all benefits, if any, that had accrued to the Executive through the Date of Termination under the plans and programs described in paragraph 5(b) of the Employment Agreement, or any other applicable plans and programs in which he participated as an employee of the Company, in the manner and in accordance with the terms of such plans and program, it being understood that any and all rights that the Executive may have to severance payments DocuSign Envelope ID: 2E6FCA85-5F1B-442B-A4ED-96D1901F8BE7F8708D41-7585-4796-BD1E-EEAA6E6C2638

2 by the Company shall be determined and solely based on the terms and conditions of this Agreement and not based on any severance policy or plan that the Company may have in effect as of the Date of Termination; (iii) his right to indemnification in accordance with Section 5(e) of the Employment Agreement; and (iv) directors’ and officers’ liability insurance coverage in accordance with Section 5(e) of the Employment Agreement; b. No amount is payable pursuant to Section 7(b)(iii) of the Employment Agreement, which provides for payment of Executive’s “Annual Cash Bonus with respect to the calendar year ended prior to the Date of Termination, when otherwise payable, but only to the extent not already paid” as Executive’s Annual Cash Bonus for 2022 has already been paid; c. Pursuant to Section 7(b)(iv) of the Employment Agreement, Executive is entitled to “severance pay in an amount equal to 18 months of base pay at his then current Base Salary rate,” it being understood that the aggregate gross sum of such severance pay is Nine- hundred seventeen thousand and seven-hundred Dollars ($917,700) (the “Severance Pay Amount”). The parties agree that rather than paying the Severance Pay Amount in installments over the course of 18 months: (i) the portion of the Severance Pay Amount that would otherwise be payable in 2024 (the gross amount of $611,800) shall be paid in a lump sum on the next administratively practicable payroll date following the effectiveness of this Agreement, (ii) a portion of the Severance Pay Amount that would otherwise be payable in 2025 in the gross amount of $205,658 shall be paid on January 15, 2025, and (iii) the remaining portion of the Severance Pay Amount shall be paid on the same schedule as it would have been paid under the Employment Agreement, with the gross amount of $23,766.99 payable on the first payroll date in May 2025, and the gross amount of DocuSign Envelope ID: 2E6FCA85-5F1B-442B-A4ED-96D1901F8BE7F8708D41-7585-4796-BD1E-EEAA6E6C2638

3 $25,491.67 payable on each of the second payroll date in May 2025 and the two payroll dates in June 2025; d. Pursuant to Section 7(b)(v) of the Employment Agreement, the Company will pay to Executive a “lump sum on the 30th day following the Date of Termination,” which the parties acknowledge is January 30, 2024, “provided that the period (if any) during which the Separation Agreement can be revoked has expired within such 30-day period,” in the gross amount of One million three-hundred seventy-six thousand five-hundred and ninety- five Dollars ($1,376,595); e. Pursuant to Section 7(b)(vi) of the Employment Agreement, if the Executive is eligible for and elects to continue his health insurance coverage under the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”), the Company will continue to contribute, until the earlier of (x) 18 months following the Date of Termination or (y) the date on which the Executive becomes eligible to receive group medical insurance coverage through another employer (the “COBRA Contribution Period”), toward the cost of the Executive’s COBRA premiums the same amount that it pays on behalf of active and similarly situated employees receiving the same type of coverage. The remaining balance of any premium costs, and all premium costs after the COBRA Contribution Period, shall be paid by the Executive on a monthly basis. After the COBRA Contribution Period, the Executive may continue receiving coverage under COBRA at his own cost if and to the extent that he remains eligible for COBRA continuation. The Executive agrees that he shall notify the Company in writing immediately following the date on which he becomes eligible to receive group medical insurance coverage through another employer; DocuSign Envelope ID: 2E6FCA85-5F1B-442B-A4ED-96D1901F8BE7F8708D41-7585-4796-BD1E-EEAA6E6C2638

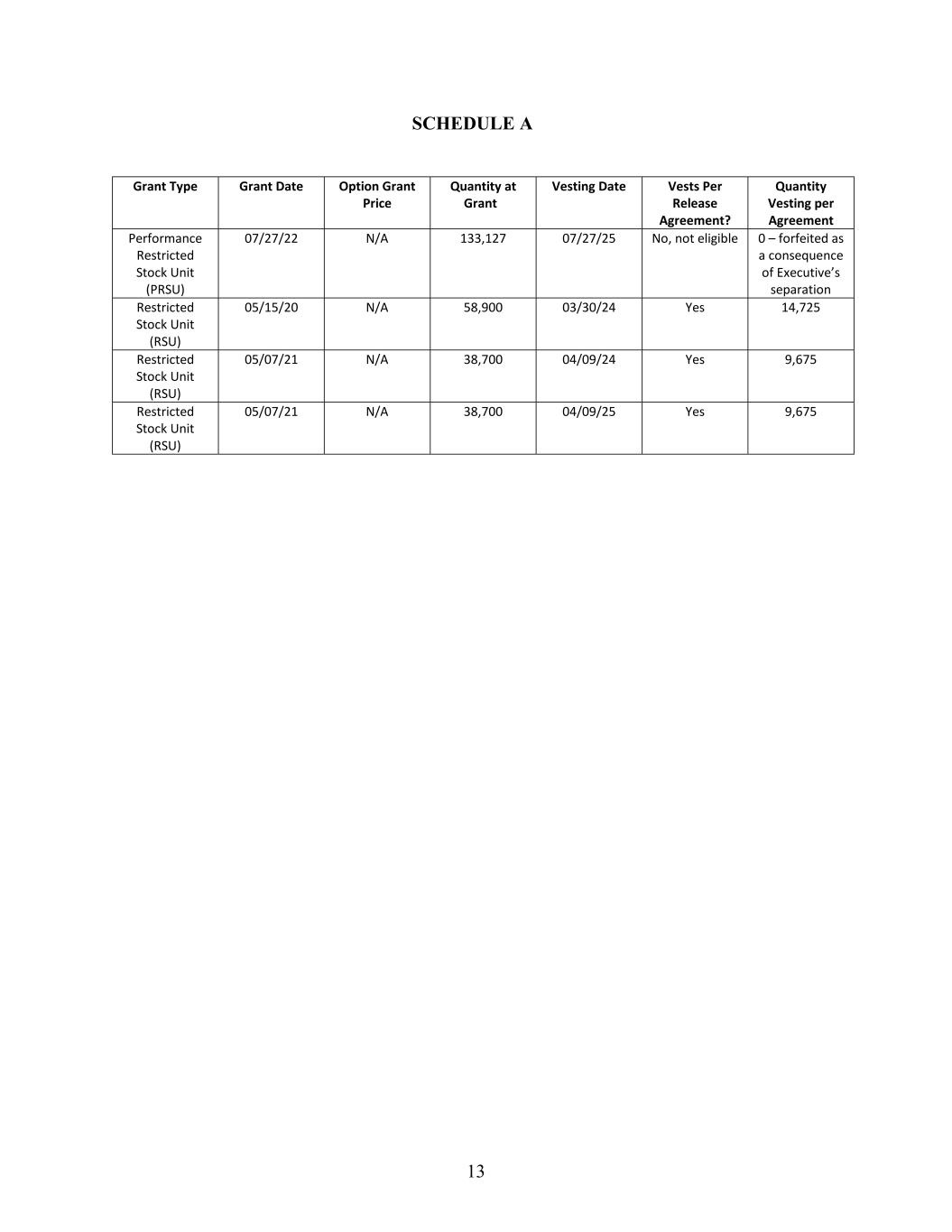

4 f. Pursuant to Section 7(b)(vii) of the Employment Agreement, “notwithstanding anything to the contrary in the Grant Documents, any stock options or RSUs held by the Executive on the Date of Termination that would have vested in the two year period following the Date of Termination if the Executive had remained employed by the Company for such period will immediately vest.” The parties acknowledge and agree that no Performance Restricted Stock Units (PRSUs) are subject to such vesting and that the same have been forfeited as a consequence of Executive’s separation of employment. For the avoidance of doubt, a schedule of Executive’s unvested restricted stock units and performance restricted stock units as of the Date of Termination is attached hereto as Schedule A; and g. Pursuant to Section 7(b)(viii) of the Employment Agreement, Executive would be entitled to an additional exercise period with respect to his vested stock options. Notwithstanding the same, and notwithstanding the additional vesting described in Section 2(f) above, the parties agree that all of Executive’s stock options, whether vested or unvested, shall be deemed cancelled with immediate effect, except that the 80,000 vested stock options granted to Executive on May 5, 2017, with an exercise price of $7.60 per share (the “Preserved Options”) shall not be cancelled and, notwithstanding anything to the contrary in the Grant Documents, the Preserved Options shall remain eligible to exercise for a period of two (2) years following the Date of Termination, which the parties acknowledge shall conclude on December 31, 2025. 3. Release of Claims. In consideration of the severance benefits, which the Executive acknowledges he would not otherwise be entitled to receive, the Executive hereby fully, forever, irrevocably and unconditionally releases, remises and discharges the Company, its officers, directors, stockholders, corporate affiliates, subsidiaries, parent companies, agents and DocuSign Envelope ID: 2E6FCA85-5F1B-442B-A4ED-96D1901F8BE7F8708D41-7585-4796-BD1E-EEAA6E6C2638

5 employees (each in their individual and corporate capacities), all employee benefit plans and plan fiduciaries (hereinafter, the “Released Parties”) from any and all claims, charges, complaints, demands, actions, causes of action, suits, rights, debts, sums of money, costs, accounts, reckonings, covenants, contracts, agreements, promises, doings, omissions, damages, executions, obligations, liabilities, and expenses (including attorneys’ fees and costs), of every kind and nature which the Executive ever had or now has against any or all of the Released Parties, including but not limited to any and all claims arising out of the Executive’s employment with and/or separation from the Company, including, but not limited to, all employment discrimination claims under Title VII of the Civil Rights Act of 1964, 42 U.S.C. § 2000e et seq., the Age Discrimination in Employment Act, 29 U.S.C. § 621 et seq., the Americans With Disabilities Act of 1993, 42 U.S.C., § 12101 et seq., as amended by the Older Workers Benefit Protection Act (OWBPA), the Equal Pay Act of 1963, 29 U.S.C. § 206(d), and the Family and Medical Leave Act, 29 U.S.C. § 2601 et seq., all as amended; all claims arising out of Section 806 of the Corporate and Criminal Fraud Accountability Act of 2002, 18 U.S.C. § 1681 et seq., the Fair Credit Reporting Act, 15 U.S.C. § 1681 et seq., and the Employee Retirement Income Security Act of 1974 (“ERISA”), 29 U.S.C. § 1001 et seq., all as amended; all claims under the New York Human Rights Law, N.Y. Exec. Law § 290 et seq., the New York City Human Rights Law, N.Y.C. Admin. Code § 8-101 et seq., N.Y. Civ. Rights Law § 40-c et seq. (New York anti-discrimination law), the New York Equal Pay Law, N.Y. Lab. Law § 194 et seq., and the New York Whistleblower Law, N.Y. Lab. Law § 740, all as amended; all common law claims including, but not limited to, actions in tort, defamation and breach of contract; all claims to any non-vested ownership interest in the Company, contractual or otherwise, including but not limited to claims to stock or stock options; and any claim or damage arising out of the Executive’s employment with or separation from the Company (including a claim for DocuSign Envelope ID: 2E6FCA85-5F1B-442B-A4ED-96D1901F8BE7F8708D41-7585-4796-BD1E-EEAA6E6C2638

6 retaliation) under any common law theory or any federal, state or local statute or ordinance not expressly referenced above; provided, however, that nothing in this Agreement (a) prevents the Executive from filing, cooperating with, or participating in any proceeding before the EEOC or a state Fair Employment Practices Agency (b) should be considered a release of the Executive’s (i) rights under any contract preserved by this Agreement, (ii) right to receive COBRA continuation coverage in accordance with applicable law, (iii) right to pursue claims under XXXXX with respect to an employee benefit plan pf the Company or (iv) rights to indemnification the Executive has or may have under the by-laws of the Company, the Employment Agreement or as an insured under any director’s and officer’s liability insurance policy now or previously in force. 4. Post Termination Obligations. The Executive acknowledges and reaffirms his obligation to keep confidential all non-public information concerning the Company which he acquired during the course of his employment with the Company (the “Proprietary Information”). The Executive further acknowledges and reaffirms his continuing obligations to the Company pursuant to the terms of Section 9 of the Employment Agreement and the Proprietary Information Agreement attached thereto as Exhibit B (the “Proprietary Information Agreement”), which obligations remain in full force and effect. Notwithstanding anything in the Proprietary Information Agreement: (a) Nothing in this Section 4 or the Proprietary Information Agreement shall prevent the Executive from disclosing Proprietary Information to the extent required by law. Additionally, nothing in this Section 4 or the Proprietary Information Agreement shall preclude the Executive’s right to communicate, cooperate or file a complaint with any U.S. federal, state or local governmental or law enforcement branch, agency or entity (collectively, a “Governmental Entity”) with respect to possible violations of any U.S. DocuSign Envelope ID: 2E6FCA85-5F1B-442B-A4ED-96D1901F8BE7F8708D41-7585-4796-BD1E-EEAA6E6C2638

7 federal, state or local law or regulation or otherwise make disclosures (including regarding Proprietary Information) to any Governmental Entity, in each case, that are protected under the whistleblower or similar provisions of any such law or regulation, without any requirement to provide notice to the Company that Executive is engaged in such communications or disclosures. Further, nothing in this Section 4 or the Proprietary Information Agreement shall preclude the Executive’s right to receive an award from a governmental entity for information provided under any whistleblower or similar program. (b) The Executive shall not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure of a trade secret that is made in confidence to a Federal, State, or local government official or to an attorney solely for the purpose of reporting or investigating a suspected violation of law. The Executive shall not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure of a trade secret that is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. If the Executive files a lawsuit for retaliation by the Company for reporting a suspected violation of law, the Executive may disclose the trade secret to his or her attorney and use the trade secret information in the court proceeding, provided, that that the Executive files any document containing the trade secret under seal, and does not disclose the trade secret, except pursuant to court order. 5. Return of Company Property. The Executive represents that he has returned to the Company all Company property and equipment in his possession or control, including, but not limited to, computer equipment (including, but not limited to, computer hardware, software and printers, wireless handheld devices, cellular phones, pagers, etc.), customer information, customer lists, employee lists, Company files, notes, contracts, records, business plans, financial DocuSign Envelope ID: 2E6FCA85-5F1B-442B-A4ED-96D1901F8BE7F8708D41-7585-4796-BD1E-EEAA6E6C2638

8 information, specifications, computer-recorded information, software, tangible property, identification badges and keys, and any other materials of any kind which contain or embody any proprietary or confidential material of the Company (and all reproductions thereof). The Executive also represents that he has not intentionally destroyed any electronic Company documents in connection with the termination of his Employment, including those that he developed or helped develop during his employment. The Executive further covenants to take all necessary steps to make known to the Company any accounts for his benefit, if any, in the Company’s name, which are known to Executive but not otherwise known to the Company, and otherwise to cooperate with the Company in, the cancellation of all accounts for his benefit, if any, in the Company’s name (and or the transition of those accounts to Executive), including, but not limited to, credit cards, telephone charge cards, cellular phone accounts, pager accounts, and computer accounts, and will not after the Separation Date use any such accounts that remain in the name of the Company. 6. Business Expenses and Final Compensation. The Executive acknowledges that he has been reimbursed by the Company for all business expenses incurred by him in conjunction with his employment with the Company and that no other reimbursements are owed to him. The Executive further acknowledges that he has been provided with all compensation and benefits due to him as of the Separation Date, including, but not limited to, any and all wages, bonuses, equity and any accrued but unused vacation time, and that he is not entitled to receive any additional consideration beyond that provided for pursuant to section 2 of this Agreement. 7. Cooperation. The Executive agrees to cooperate with the Company to the extent reasonably requested by the Board in the defense or prosecution of any claims or actions now in existence or which may be brought in the future against or on behalf of the Company; provided that, the Company shall make reasonable efforts to minimize disruption of the Executive’s other DocuSign Envelope ID: 2E6FCA85-5F1B-442B-A4ED-96D1901F8BE7F8708D41-7585-4796-BD1E-EEAA6E6C2638

9 activities. The Executive’s cooperation in connection with such claims or actions may include, but not be limited to, his being available to meet with Company counsel to prepare for trial or discovery or an administrative hearing or alternative dispute resolution and to act as a witness when requested by the Company at reasonable times designated by the Company. The Company shall reimburse the Executive for reasonable expenses incurred in connection with such cooperation, and to the extent that the Executive is required to spend substantial time on such matters, the Company shall compensate the Executive at an hourly rate of $250 per hour, to the extent compensation is permitted under applicable law. 8. Nature of Agreement. The Executive understands and agrees that this Agreement is a severance and settlement agreement and does not constitute an admission of liability or wrongdoing on the part of the Company. 9. Amendment. This Agreement shall be binding upon the parties and may not be abandoned, supplemented, changed or modified in any manner, orally or otherwise, except by an instrument in writing of concurrent or subsequent date signed by a duly authorized representative of the parties hereto. This Agreement is binding upon and shall inure to the benefit of the parties and their respective agents, assigns, heirs, executors, successors and administrators. 10. Validity. Should any provision of this Agreement be declared or be determined by any court of competent jurisdiction to be illegal or invalid, the validity of the remaining parts, terms, or provisions shall not be affected thereby and said illegal and invalid part, term or provision shall be deemed not to be a part of this Agreement. 11. Confidentiality. To the extent permitted by law, the Executive understands and agrees that the terms and contents of this Agreement, and the contents of the negotiations and DocuSign Envelope ID: 2E6FCA85-5F1B-442B-A4ED-96D1901F8BE7F8708D41-7585-4796-BD1E-EEAA6E6C2638

10 discussions resulting in this Agreement, shall be maintained as confidential by the Executive (provided, however, that Executive will not be prohibited from making disclosures to the Executive’s attorney, tax advisors, immediate family members), and none of the above shall be disclosed except to the extent required by federal or state law or as otherwise agreed to in writing by the authorized agent of each party. 12. Non-Disparagement. The Executive understands and agrees that as a condition for receipt of the severance benefits, he shall not make any false, disparaging or derogatory statements in public or private to any person or entity, including without limitation any media outlet, regarding the Company or any of its directors, officers, employees, agents, or representatives or regarding the Company’s business affairs and financial condition. This Section does not in any way restrict or impede the Executive from exercising protected rights to the extent that such rights cannot be waived by agreement or from complying with any applicable law or regulation or a valid order of a court of competent jurisdiction or an authorized government agency, provided that such compliance does not exceed that required by the law, regulation, or order. 13. Tax Acknowledgement. In connection with the severance benefits provided to the Executive pursuant to this Agreement, the Company shall withhold and remit to the tax authorities the amounts required under applicable law, and the Executive shall be responsible for all applicable taxes with respect to such payments and consideration under applicable law. The Executive acknowledges that he is not relying upon the advice or representation of the Company with respect to the tax treatment of any of the payments pursuant to this Agreement. 14. Entire Agreement. This Agreement contains and constitutes the entire understanding and agreement between the parties hereto with respect to severance and settlement DocuSign Envelope ID: 2E6FCA85-5F1B-442B-A4ED-96D1901F8BE7F8708D41-7585-4796-BD1E-EEAA6E6C2638

11 and cancels all previous oral and written negotiations, agreements, commitments, and writings in connection therewith. 15. Applicable Law and Consent to Jurisdiction. This Agreement shall be interpreted and construed by the laws of the State of New York, without regard to conflict of laws provisions. The Executive hereby irrevocably submits to and acknowledges and recognizes the jurisdiction of the courts of the State of New York or if appropriate, a federal court located in New York (which courts, for purposes of this Agreement, are the only courts of competent jurisdiction) over any suit, action or other proceeding arising out of, under or in connection with this Agreement or the subject matter hereof. 16. Acknowledgments. The Employee acknowledges that he has been given at least twenty-one (21) days to consider the release of claims set forth in this Agreement and that the Company advised him to consult with any attorney of his own choosing prior to signing this Agreement. The Executive further acknowledges that he may revoke this Agreement for a period of seven (7) days after the execution of this Agreement by sending written notice of such revocation by email to Xxxxxx Xxxxxxxxx at xxxxxxxxxx@xxxxxxxxxx.xxx. If no such revocation occurs, the Agreement (including the release of claims contained in this Agreement) will become irrevocable and binding and enforceable against the Executive, on the date next following the day on which the foregoing 7-day period elapsed. The Executive understands and agrees that by entering into this Agreement he is waiving any and all rights or claims he might have under the Age Discrimination in Employment Act, as amended by the Older Workers Benefit Protection Act, and that he has received consideration beyond that to which he was previously entitled. DocuSign Envelope ID: 2E6FCA85-5F1B-442B-A4ED-96D1901F8BE7F8708D41-7585-4796-BD1E-EEAA6E6C2638

12 17. Voluntary Assent. The Executive affirms that no other promises or agreements of any kind have been made to or with him by any person or entity whatsoever to cause him to sign this Agreement, and that he fully understands the meaning and intent of this Agreement. The Executive states and represents that he has had an opportunity to fully discuss and review the terms of this Agreement with an attorney. The Executive further states and represents that he has carefully read this Agreement, understands the contents herein, freely and voluntarily assents to all of the terms and conditions hereof, and signs his name of his own free act. IN WITNESS WHEREOF, all parties have set their hand and seal to this Agreement as of the date written below. Xxxxxx XxXxxxxx Date: LivePerson, Inc. By: Date: DocuSign Envelope ID: 2E6FCA85-5F1B-442B-A4ED-96D1901F8BE7 1/25/2024 F8708D41-7585-4796-BD1E-EEAA6E6C2638 1/31/2024

13 SCHEDULE A Grant Type Grant Date Option Xxxxx Xxxxx Quantity at Grant1 Vesting Date Vests Per Release Agreement? Quantity Vesting per Agreement Performance Restricted Stock Unit (PRSU) 07/27/22 N/A 133,127 07/27/25 No, not eligible 0 – forfeited as a consequence of Executive’s separation Restricted Stock Unit (RSU) 05/15/20 N/A 58,900 03/30/24 Yes 14,725 Restricted Stock Unit (RSU) 05/07/21 N/A 38,700 04/09/24 Yes 9,675 Restricted Stock Unit (RSU) 05/07/21 N/A 38,700 04/09/25 Yes 9,675 1 Note: Quantity at Grant includes the both vested and unvested awards and is provided to facilitate identification of the relevant grant. DocuSign Envelope ID: 2E6FCA85-5F1B-442B-A4ED-96D1901F8BE7F8708D41-7585-4796-BD1E-EEAA6E6C2638