FIFTH AMENDMENT TO OFFICE LEASE AGREEMENT

Exhibit 10.19

FIFTH AMENDMENT TO

THIS FIFTH AMENDMENT TO OFFICE LEASE AGREEMENT (this “Amendment”) is dated, for reference purposes only, November 15, 2013, and is made and entered into by and between TP BUILDING I, LLC, a Utah Limited liability company (“Landlord”) and HEALTHEQUITY, INC., a Delaware corporation (“Tenant”).

A. On or about November 17, 2006, Landlord and Tenant entered into an Office Lease Agreement in which Landlord agreed to lease to Tenant certain premises located in The Pointe I, an office building (the “Building”) located at approximately 00 Xxxx Xxxxxx Xxxxx, Xxxxxx, Xxxx, as more particularly defined below. Said Office Lease Agreement has been amended by a First Amendment to Office Lease Agreement dated October 18, 2007, a Second Amendment to Office Lease Agreement dated March 2012, a Third Amendment to Office Lease Agreement dated August 22, 2012, and a Fourth Amendment to Office Lease dated June 27, 2013 (the “Fourth Amendment”). The Office Lease Agreement, First Amendment to Office Lease Agreement, Second Amendment to Office Lease Agreement, Third Amendment to Office Lease Agreement, and Fourth Amendment are hereinafter collectively referred to as the “Lease”.

B. Landlord and Tenant now desire to amend the Lease to expand the leased premises, adjust the Base Rent, correct certain miscalculations of the area of the Premises, and make certain other changes, all as stated herein.

1. Recitals. The foregoing recitals are hereby incorporated into this Amendment and form a part hereof.

2. Definitions. The following terms shall have the following meanings for purposes of this Amendment:

“Allowance” – shall mean the allowance of $127,402.50, as described in Section 8 of this Amendment.

“Amendment” – defined in the first paragraph above.

“Building” – the office building located at approximately 00 Xxxx Xxxxxx Xxxxx, Xxxxxx, Xxxx with the sign “Building 2” in which the Tenant is currently located.

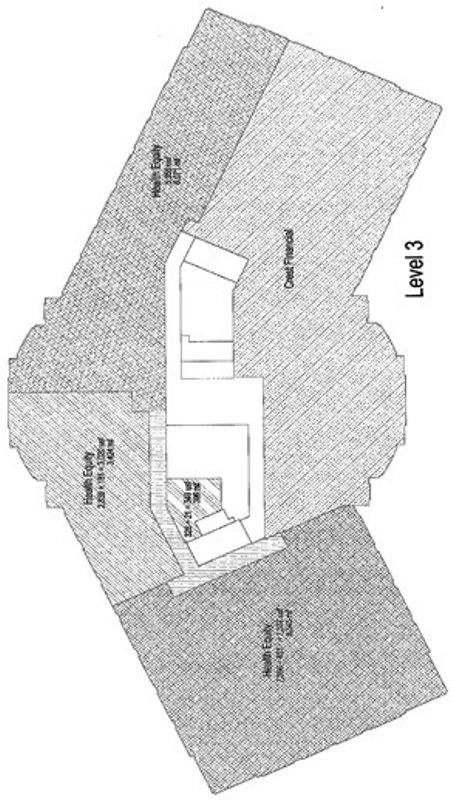

“Expansion Area” shall mean the entire three (3) spaces on the third floor of the Building which are labeled “3,424 RSF”, “396 RSF” and “6,071 RSF” on Exhibit “A” attached to this Amendment and incorporated by reference herein. “Expansion Area A” shall mean and include the spaces labeled “3,424 RSF” and “396 RSF” on Exhibit “A”. Landlord and Tenant agree that the Rentable Square Footage of Expansion Area A is 3,820 square feet and the Usable Square Footage of Expansion Area A is 3,369 square feet. “Expansion Area B” shall mean the space labeled “6,071 RSF” on Exhibit “A”. Landlord and Tenant agree that the Rentable Square Footage of Expansion Area B is 6,071 square feet and the Usable Square Footage of Expansion Area B is 5,355 square feet.

“Expansion Date” shall mean the date on which Landlord Substantially Completes the Landlord Work and delivers occupancy of the Expansion Area to Tenant.

“Fourth Amendment” shall mean the Fourth Amendment to Office Lease between Landlord and Tenant dated June 27, 2013.

“Free Rent Period” – Five (5) months for Expansion Area A, and three (3) months for Expansion Area B, as further defined and described in Section 6.

“Initial Premises” as used in this Amendment shall mean all premises leased by Tenant in the Building prior to the addition of the Expansion Area described in this Amendment.

“Known Brokers” – defined in Section 10.

“Landlord” – defined in the first paragraph of this Amendment.

“Landlord Work” shall mean the work of improvement to be performed by Landlord as described in the Work Letter attached hereto as Exhibit “B”.

“Lease” – defined in Recital A.

“Revised Premises” shall mean the premises governed by the Lease after the addition of the Expansion Area described in this Amendment, consisting of the Initial Premises and the Expansion Area.

“Substantially Complete” and “Substantially Completed” shall mean that Landlord shall have obtained a certificate of occupancy for the Expansion Area from the City of Xxxxxx and that Landlord shall have substantially completed the Landlord Work, with the only work remaining to be completed by Landlord being items that can be completed after occupancy has been taken without causing material interference with Tenant’s use of the Premises (i.e., so-called “punch list” items), which the parties shall agree upon in writing at the time of Substantial Completion, and which “punch list” items Landlord shall complete as soon as possible and in any event within 30 days of the Expansion Date.

“Tenant” – defined in the first paragraph of this Amendment.

2

All other capitalized terms used in this Amendment and not defined herein shall have the meanings attributed to such terms in the Lease.

3. Correction of Square Footage Calculations. Landlord recently retained a new architect for the Building. In connection with this Amendment, Landlord requested that this new architect review and correct the prior square footage calculations of each portion of the Revised Premises. Landlord’s architect has determined that the correct square footage calculations are as follows:

| Area |

Usable Sq. Ft. (USF) | Rentable Sq. Ft. (RSF) | ||||||

| 1st Floor (space taken in 3rd Amendment to Lease) |

8,926 | 9,739 | ||||||

| 1st Floor (space taken in 4th Amendment to Lease) |

2,260 | 2,466 | ||||||

| 3rd Floor (space defined in original lease and 1st Amendment to Lease) |

7,537 | 8,545 | ||||||

| 3rd Floor (Expansion Area A, being added by this 5th Amendment) |

3,369 | 3,820 | ||||||

| 3rd Floor (Expansion Area B, being added by this 5th Amendment) |

5,355 | 6,071 | ||||||

| 4th Floor (space defined in original lease and 1st Amendment to Lease) |

24,029 | 27,672 | ||||||

|

|

|

|

|

|||||

| Total for Revised Premises |

51,476 | 58,313 | ||||||

Exhibit “A” attached hereto shows the boundaries and square footages of each area of the Revised Premises. Landlord’s architect has also determined that the correct rentable square footage (RSF) of the entire Building is 109,244 square feet. Landlord and Tenant agree to be bound by these corrected square footage numbers and to use them going forward in the calculation of Base Rents, Tenant’s Pro Rata Share of Expenses and Taxes, and Tenant Improvement Allowances. Landlord and Tenant agree to waive any right of collection against Tenant or Landlord for any differences in square footage, operating expenses or operating expense reconciliations, Tenant Improvement Allowances or any other monetary considerations for these discrepancies which occurred prior to the Expansion Date. The sole remedy for the miscalculations shall be to correct the mistakes from the date of Expansion for either party.

4. Expansion of Premises. On the Expansion Date, Landlord agrees to deliver and lease the Expansion Area to Tenant and Tenant agrees to accept and lease the Expansion Area from Landlord. Thereafter, the Premises governed by the Lease will be the Revised Premises, including, for all purposes, the Initial Premises and the Expansion Area, which totals 58,313 Rentable Square Feet.

3

5. Lease Term for Expansion Area Coterminous With Initial Premises. The Termination Date for the lease of the Expansion Area will be April 30, 2019, which is the same as the Termination Date for the Initial Premises.

6. Base Rent.

A. Base Rent for Initial Premises. Tenant will continue to pay Base Rent on the Initial Premises at the rate described in the Lease, but using the corrected rentable square footages shown in Section 3.

B. Base Rent for Expansion Area A. The Base Rent rate for Expansion Area A will be the same as for the Initial Premises with the same 3% annual increases.

C. Base Rent for Expansion Area B. Base Rent for Expansion Area B will be, initially, $15.85 per Rentable Square Foot. Base Rent for Expansion Area B will increase by 3% annually, beginning December 1, 2014 and on each December 1 thereafter.

D. Free Rent Period. During the first three (3) months after the Expansion Date, no Base Rent will be charged on any of the Expansion Area. During the next two (2) months, Base Rent will be charged on Expansion Area B, but no Base Rent will be charged on Expansion Area A. Beginning five (5) months after the Expansion Date, Base Rent will be charged on all of the Expansion Area. The five (5) month period during which Base Rent is not charged on all or part of the Expansion Area as described above is sometimes referred to herein as the “Free Rent Period.” Although Base Rent will not be charged on some or all of the Expansion Area during the Free Rent Period, Tenant will pay its Pro Rata Share of Expenses and Taxes for the entire Expansion Area during the Free Rent Period. If the Expansion Date falls on a day other than the first day of a calendar month, the Base Rent for any month in which a free rent concession ends will be prorated according to the number of days in the month.

E. Base Rent Charts. Based on the foregoing, the following charts show the Base Rent to be paid by Tenant from November 1, 2013 through the end of the Term for Expansion Areas A and B and for the Initial Premises.

Base Rent Chart for Expansion Area A:

| Annual Rate | Rentable | Annual Base | Monthly Base | |||||||||

| Months |

Per Sq. Ft. | Sq. Ft. | Rent | Rent | ||||||||

| From Expansion Date thru end of 5-month Free Rent Period |

$ | 16.33 | 3,820 | *$62,380.60 Not Charged – |

$5,198.38 Not Charged – | |||||||

| From end of 5-month Free Rent Period thru November 30, 2014 |

$ | 16.33 | 3,820 | *$62,380.60 | $5,198.38 | |||||||

| December 1, 2014 thru November 30, 2015 |

$ | 16.82 | 3,820 | $64,252.40 | $5,354.37 | |||||||

| December 1, 2015 thru November 30, 2016 |

$ | 17.32 | 3,820 | $66,162.40 | $5,513.53 | |||||||

| December 1, 2016 thru November 30, 2017 |

$ | 17.84 | 3,820 | $68,148.80 | $5,679.07 | |||||||

| December 1, 2017 thru November 30, 2018 |

$ | 18.37 | 3,820 | $70,173.40 | $5,847.78 | |||||||

| December 1, 2018 thru April 30, 2019 |

$ | 18.93 | 3,820 | *$72,312.60 | $6,026.05 | |||||||

Notes: * Stated on an annualized basis, although there is less than a full year in the relevant period.

4

Base Rent Chart for Expansion Area B:

| Annual Rate | Rentable | Annual Base | Monthly Base | |||||||||

| Months |

Per Sq. Ft. | Sq. Ft. | Rent | Rent | ||||||||

| From Expansion Date thru end of 3-month Free Rent Period |

$ | 15.85 | 6,071 | *$96,225.35 Not Charged – Free Rent Period |

$8,018.78 Not Charged – Free Rent Period | |||||||

| From end of 3-month Free Rent Period until November 30, 2014 |

$ | 15.85 | 6,071 | *$96,225.35 | $8,018.78 | |||||||

| December 1, 2014 thru November 30, 2015 |

$ | 16.33 | 6,071 | $99,139.43 | $8,261.62 | |||||||

| December 1, 2015 thru November 30, 2016 |

$ | 16.82 | 6,071 | $102,114.22 | $8,509.52 | |||||||

| December 1, 2016 thru November 30, 2017 |

$ | 17.32 | 6,071 | $105,149.72 | $8,762.48 | |||||||

| December 1, 2017 thru November 30, 2018 |

$ | 17.84 | 6,071 | $108,306.64 | $9,025.55 | |||||||

| December 1, 2018 thru April 30, 2019 |

$ | 18.37 | 6,071 | *$111,524.27 | $9,293.69 | |||||||

Notes:

| * | Stated on an annualized basis, although there is less than a full year in the relevant period. |

5

Base Rent Chart for Initial Premises (all premises other than Expansion Area, with corrected RSF):

| Annual Rate | Rentable | Annual Base | Monthly Base | |||||||||||

| Months |

Per Sq. Ft. | Sq. Ft. | Rent | Rent | ||||||||||

| From November 1, 2013 thru November 30, 2013 |

$ | 15.85 | *45,956 | **$728,402.60 | $ | 60,700.22 | ||||||||

| December 1, 2013 thru January 10, 2014 |

$ | 16.33 | *45,956 | **$750,461.48 | $ | 62,538.46 | ||||||||

| January 11, 2014 thru November 30, 2014 |

$ | 16.33 | 48,422 | $790,731.26 | $ | 65,894.27 | ||||||||

| December 1, 2014 thru November 30, 2015 |

$ | 16.82 | 48,422 | $814,458.04 | $ | 67,871.50 | ||||||||

| December 1, 2015 thru November 30, 2016 |

$ | 17.32 | 48,422 | $838,669.04 | $ | 69,889.09 | ||||||||

| December 1, 2016 thru November 30, 2017 |

$ | 17.84 | 48,422 | $863,848.48 | $ | 71,987.37 | ||||||||

| December 1, 2017 thru November 30, 2018 |

$ | 18.37 | 48,422 | $889,512.14 | $ | 74,126.01 | ||||||||

| December 1, 2018 thru April 30, 2019 |

$ | 18.93 | 48,422 | **$916,628.46 | $ | 76,385.71 | ||||||||

Notes:

| * | Under the Fourth Amendment, Tenant is entitled to free base rent on 2,466 RSF on the First Floor until January 10, 2014. |

| ** | Stated on an annualized basis, although there is less than a full year in the relevant period. |

7. Pro Rata Share. Until the Expansion Date, Tenant’s Pro Rata Share of Expenses and Taxes shall be 44.32% (48,422 RSF in Initial Premises divided by 109,244 RSF in Building). From and after the Expansion Date, Tenant’s Pro Rata Share of Expenses and Taxes shall be 53.38% (58,313 RSF in the Revised Premises divided by 109,244 RSF in the Building).

8. Improvements and Allowance. All improvements in connection with this expansion shall be subject to the provisions of the Work Letter attached to this Amendment

6

as Exhibit “B” and shall be performed at Tenant’s expense, except that Landlord agrees to provide an Allowance to Tenant in an amount up to a maximum of $127,402.50 (calculated for reference purposes only as $10.00 x 3,369 Usable Square Feet in Expansion Area A, plus $17.50 x 5,355 Usable Square Feet in Expansion Area B), as more fully described in Exhibit “B”. The Allowance shall be used only for the Landlord Work to be performed in the Premises as described in the Work Letter. Tenant shall not receive any cash payment, credit or offset for any portion of the Allowance not used for the Landlord Work.

9. Parking. From and after the Expansion Date, Tenant shall be entitled to the use of 290 parking stalls, subject to the terms and conditions of the Lease governing parking.

10. Commissions. Landlord will pay any commission due to Coldwell Banker Intermountain which will in turn pay Cresa of Salt Lake City a commission equal to three percent (3%) of the gross full service equivalent rental value of the Expansion Area (collectively, the “Known Brokers”) in connection with this transaction. The parties acknowledge that they have not used any real estate brokers or finders with respect to this Amendment other than the Known Brokers. Each party represents and warrants to the other that the warranting party knows of no real estate broker or agent who is or might be entitled to compensation in connection with this Amendment other than Known Brokers. Each party, as indemnifying party, agrees to indemnify, defend and hold the other party harmless from and against any and all liabilities or expenses, including reasonable attorneys’ fees and costs, arising out of any claim for brokerage commissions, finder’s fees, or similar compensation by any person other than Known Brokers, which claim is based on any alleged act or agreement of the indemnifying party.

11. Confidentiality. Landlord and Tenant each acknowledge that the terms and conditions of this Amendment (including without limitation the rental rate and concessions granted to Tenant herein) and the Lease are to remain confidential, and may not be disclosed to anyone, by any manner or means, directly or indirectly, without the other party’s prior written consent; provided, however, that either party may disclose the terms and conditions of this Amendment and the Lease to its auditors, accountants, attorneys, brokers or its affiliate(s), as reasonably required in the conduct of such party’s affairs, or as required by legal process. The consent by a party to any disclosures shall not be deemed to be a waiver on the part of such party of any prohibition against any future disclosure.

12. Repayment of Rent Concession. Tenant acknowledges that its right to occupy the Expansion Area without paying Base Rent during the Free Rent Period is absolutely conditioned upon Tenant’s full, faithful and punctual performance of its obligations under the Lease, as amended hereby, including the payment of all rent. If Tenant defaults in its obligations under the Lease and does not cure such default after any required notice and within any applicable grace period, the Specified Percentage of the Base Rent for the Free Rent Period for the Expansion Area shall immediately become due and payable in full, at the applicable per square foot rate described in Section 6 of this Amendment. As used herein, the “Specified Percentage” shall mean the percentage equivalent to a fraction, the numerator of which is the number of months remaining in the Term as of the date of the default and the denominator of which is the number of months remaining in the Term at the end of the Free Rent Period.

7

13. Miscellaneous. The Lease and this Amendment contain all of the representations, understandings, and agreements of the parties with respect to matters contained herein. The parties acknowledge and agree that the Lease and this Amendment were both negotiated by all parties, that they shall be interpreted as if they were drafted jointly by all of the parties, and that neither the Lease, this Amendment, nor any provision within them, shall be construed against any party or its attorney because it was drafted in full or in part by any party or its attorney. Each of the individuals who have executed this Amendment represents and warrants that he or she is duly authorized to execute this Amendment on behalf of Landlord or Tenant as the case may be, that all corporate, partnership, trust or other action necessary for such party to execute and perform the terms of this Amendment have been duly taken by such party, and that no other signature and/or authorization is necessary for such party to enter into and perform the terms of this Amendment. This Amendment may be executed in any number of counterparts, provided each counterpart is identical in its terms. Each such counterpart, when executed and delivered will be deemed to be an original, and all such counterparts together shall be deemed to constitute one and the same instrument. Facsimile transmission of a signed counterpart shall be deemed to constitute delivery of the signed original. Time is of the essence in the interpretation and enforcement of this Amendment. This Amendment shall be governed by and construed in accordance with the laws of the State of Utah and each of the parties hereto submits to the non-exclusive jurisdiction of the courts of the State of Utah in connection with any disputes arising out of the Lease or this Amendment. In the event of any legal action arising under this Amendment, the prevailing party shall be entitled to recover all of its reasonable attorneys’ fees from the non-prevailing party.

14. Effect of Amendment on Lease. In the event of any conflict between the provisions of this Amendment and the provisions of the Lease, this Amendment will control. Except as modified hereby, the Lease remains in full force and effect between the parties.

15. Binding Only on Execution and Delivery. The submission of an unsigned copy of this Amendment by either party to the other shall not constitute an offer or option with respect to the matters contained herein. This Amendment shall become effective and binding only upon execution and delivery.

16. Exhibits. The following exhibits are attached to this Amendment and incorporated by reference herein:

Exhibit “A” – Depiction of Areas of Premises, including Expansion Area

Exhibit “B” – Work Letter

[Remainder of page is blank. Signatures follow on next page.]

8

| LANDLORD: | TENANT: | |||||||

| TP BUILDING I, LLC, a Utah limited liability company |

HEALTHEQUITY, INC., a Delaware corporation | |||||||

| By: |

|

By: |

| |||||

| Title: | Manager | Title: | EVP & CFO | |||||

| Date: | 11/13/13 | Date: | 11-8-13 | |||||

9

EXHIBIT “A”

DEPICTION OF PREMISES, INCLUDING EXPANSION AREA

Exhibit A – Page 1

Exhibit A – Page 2

Exhibit A – Page 3

EXHIBIT “B”

WORK LETTER

This Exhibit is attached to and made a part of the Fifth Amendment to Lease by and between TP BUILDING I, LLC, a Utah Limited liability company (“Landlord”), and HEALTHEQUITY, INC., a Delaware corporation (“Tenant”), for space in the Building located at 00 Xxxx Xxxxxx Xxxxx, Xxxxxx, Xxxx 00000.

As used in this Work Letter, the term “Premises” shall be deemed to mean the Expansion Area, as defined in the Amendment to which this Exhibit is attached.

| 1. | This Work Letter shall set forth the obligations of Landlord and Tenant with respect to the improvements to be performed in the Expansion Area for Tenant’s use. All improvements described in this Work Letter to be constructed in and upon the Premises by Landlord are hereinafter referred to as the “Landlord Work.” It is agreed that construction of the Landlord Work will be completed at Tenant’s sole cost and expense, except as provided herein and subject to the Allowance (as defined below). Landlord shall enter into a direct contract for the Landlord Work with a general contractor selected by Landlord, subject to Tenant’s approval, which shall not be unreasonably withheld. In addition, Landlord shall select any subcontractors used in connection with the Landlord Work, subject to Tenant’s approval, which shall not be unreasonably withheld. The construction contract for the Landlord Work (the “Construction Contract”) shall be subject to Tenant’s approval, which shall not be unreasonably withheld. |

The Landlord Work shall include the work in the approved “Plans” (defined below), including the following:

Replace carpeting in elevator lobby and common area hallways with the same carpet as currently installed in Tenant’s IT area.

Make ceiling grid consistent throughout all Expansion Areas (tie both Expansion Area A and Expansion Area B together with no headers.

Make light fixtures consistent with 18 cell parabolic fixtures throughout (the Expansion Area has some indirect lighting currently installed)

Recarpet the entire Expansion Area and a portion of the existing HealthEquity IT Department space with the Tenant’s carpet spec (find a natural break point).

Make all doors consistent with the balance of HealthEquity’s 3rd floor space.

Repaint throughout the Expansion Area, assume one field color and two accent colors with one accent wall in each office.

Install all IT/telecom/cable TV per Tenant’s specs (but not including actual TV’s, which will be provided by Tenant).

Exhibit B – Page 1

Install dedicated electrical circuits for any multifunction devices as shown on drawings.

Install in-floor electrical and data outlets in the conference rooms as shown on the drawings.

Sidelights as shown on the office and conference room doors.

Install locks on all office doors.

Install all plumbing and cabinetry/counters as shown on the drawings for the room labeled “breakroom”.

Install VCT in breakroom.

Install stain grade buffet on both sides of the conference room walls with granite top similar to those installed in the 1st floor conference room.

| 2. | Landlord’s architect shall be responsible for the timely preparation and submission of the final architectural, electrical and mechanical construction drawings, plans and specifications (called “Plans”) necessary to construct the Landlord Work. Landlord’s architect shall be responsible for all elements of the design of Tenant’s plans (including, without limitation, compliance with law, functionality of design, the structural integrity of the design, the configuration of the Premises and the placement of Tenant’s furniture, appliances and equipment). Landlord’s architect will prepare the Plans necessary for such construction at Tenant’s cost, which cost shall be paid out of the Allowance. Notwithstanding the foregoing, Landlord will provide free space planning services for the Expansion Area through EA Architecture (the cost of which free space planning services will not count against the Allowance). Landlord’s architect shall complete the plans within fourteen (14) business days following the full execution of this Amendment. Tenant shall have three (3) business days to review the plans and make any changes. Landlord’s architect shall have four (4) business days to make the requested changes and resubmit same to Tenant. Tenant shall have two (2) business days to approve the final plans. Time is of the essence in respect of preparation and submission of Plans by Tenant and Landlord. If the Plans are not approved by Tenant within the time frames outlined herein Tenant shall be responsible for one day of Tenant Delay (as defined in the Lease) for each day of delay. If the Plans are not prepared or approved by Landlord or Landlord’s architect within the time frames outlined herein Landlord shall be responsible for one day of Landlord Delay for each day of delay. |

| 3. | If Landlord’s estimate of the cost of the Landlord Work shall exceed the Allowance, Landlord, prior to commencing any construction of Landlord Work, shall submit to Tenant a written estimate setting forth the anticipated cost of the Landlord Work, including but not limited to labor and materials, contractor’s fees and permit fees. |

Exhibit B – Page 2

| Within three (3) Business Days thereafter, Tenant shall either notify Landlord in writing of its approval of the cost estimate, or specify its objections thereto and any desired changes to the proposed Landlord Work. If Tenant notifies Landlord of such objections and desired changes, Tenant shall work with Landlord to reach a mutually acceptable alternative cost estimate. The Construction Contract shall include a price not to exceed the estimate approved by Landlord and Tenant. |

| 4. | If the cost of construction as shown in the Construction Contract (with the approval of Tenant) shall exceed the Allowance (such amount exceeding the Allowance being herein referred to as the “Excess Costs”), Tenant shall pay to Landlord such Excess Costs, plus any applicable state sales or use tax thereon, within ten (10) days of receipt of Landlord’s invoice. The statements of costs submitted to Landlord by Landlord’s contractors shall be conclusive for purposes of determining the actual cost of the items described therein, subject to the fixed or maximum price in the Construction Contract. The amounts payable by Tenant hereunder constitute Rent payable pursuant to the Lease, and the failure to timely pay same constitutes both a Tenant Delay and an event of default under the Lease. |

| 5. | If Tenant shall request any change, addition or alteration in any of the Plans after approval as outlined in Paragraph 2 above, Landlord shall have such revisions to the drawings prepared, and Tenant shall reimburse Landlord for the cost thereof, plus any applicable state sales or use tax thereon, within ten (10) days of receipt of Landlord’s invoice, or deduct said cost from the remaining Allowance if any. Promptly upon completion of the revisions, Landlord shall notify Tenant in writing of the increased cost which will be chargeable to Tenant by reason of such change, addition or deletion. Tenant, within two (2) business days, shall notify Landlord in writing whether it desires to proceed with such change, addition or deletion. In the absence of such written authorization, Landlord shall have the option to continue work on the Premises disregarding the requested change, addition or alteration, or Landlord may elect to discontinue work on the Premises until it receives notice of Tenant’s decision, in which event Tenant shall be responsible for any Tenant Delay in completion of the Premises resulting therefrom. If such revisions result in a higher estimate of the cost of construction and/or higher actual construction costs which exceed the Allowance, such increased estimate or costs shall be deemed Excess Costs pursuant to Paragraph 4 hereof and Tenant shall pay such Excess Costs, plus any applicable state sales or use tax thereon, within ten (10) days of receipt of Landlord’s statement. |

| 6. | Following approval of the Plans and the payment by Tenant of the required portion of the Excess Costs, if any, Landlord shall cause the Landlord Work to be Substantially Completed in accordance with the approved Plans within One Hundred (100) days after the later of: (a) the date the Amendment to which this Work Letter is attached as an Exhibit is executed by Tenant and an executed original is forwarded to Landlord, or (b) the date Tenant approves the final plans for the Landlord Work as described in paragraph 2 above. |

| 7. | Landlord, provided Tenant is not in default beyond any applicable cure period, agrees to provide Tenant with an allowance (the “Allowance”) in an amount equivalent to $127,402.50. The Allowance will be applied only toward the cost of the Landlord |

Exhibit B – Page 3

| Work in the Premises. If the Allowance shall not be sufficient to complete the Landlord Work, Tenant shall pay the Excess Costs, plus any applicable state sales or use tax thereon, as prescribed in Paragraph 4 above. Landlord shall be entitled to deduct from the Allowance a construction management fee for Landlord’s oversight of the Landlord Work in an amount equal to 5% of the total cost of the Landlord Work. |

| 8. | Landlord shall indemnify, defend and hold Tenant harmless against all claims and liabilities made by any party in connection with the performance of the Landlord Work, except to the extent such claims or liabilities arise from negligent or wrongful acts or omissions of Tenant. Tenant shall indemnify, defend and hold Landlord harmless against all claims and liabilities made by any party as a result of activities of Tenant or its agents or contractors on or about the Premises, except to the extent such claims arise from negligent or wrongful acts or omissions of Landlord. |

| 9. | This Exhibit shall not be deemed applicable to any additional space added to the Premises at any later time (after completion of Landlord’s Work in connection with the Amendment to which this Exhibit is attached) or from time to time, whether by any options under the Lease or otherwise, or to any portion of the Premises or any additions to the Premises in the event of a renewal or extension of the original Term of the Lease, whether by any options under the Lease or otherwise, unless expressly so provided in the Lease or any amendment or supplement to the Lease. |

Exhibit B – Page 4