AMENDED AND RESTATED LEASE BY AND BETWEEN BERRUETA FAMILY L.P., LESSOR AND MOUSERA, INC., LESSEE Milpitas, California July 27, 2015

Exhibit 10.13

AMENDED AND RESTATED LEASE

BY AND BETWEEN

BERRUETA FAMILY L.P., LESSOR

AND

MOUSERA, INC., LESSEE

000 Xxxxxxxxxx Xxxxx

Xxxxxxxx, Xxxxxxxxxx

July 27, 2015

TABLE OF CONTENTSz

| 1. |

Lease | 1 | ||||

| 2. |

Term | 2 | ||||

| 3. |

Option to Extend | 2 | ||||

| 4. |

Monthly Base Rent | 3 | ||||

| 5. |

Additional Rent; Operating Expenses and Taxes | 4 | ||||

| 6. |

Payment of Rent | 8 | ||||

| 7. |

Security Deposit | 8 | ||||

| 8. |

Use | 9 | ||||

| 9. |

Hazardous Materials | 9 | ||||

| 10. |

Taxes on Lessee’s Property | 11 | ||||

| 11. |

Insurance | 11 | ||||

| 12. |

Indemnification | 12 | ||||

| 13. |

Tenant Improvements | 12 | ||||

| 14. |

Maintenance and Repairs; Alterations; Surrender and Restoration | 13 | ||||

| 15. |

Utilities and Services | 15 | ||||

| 16. |

Liens | 16 | ||||

| 17. |

Assignment and Subletting | 16 | ||||

| 18. |

Non-Waiver | 18 | ||||

| 19. |

Holding Over | 19 | ||||

| 20. |

Damage or Destruction | 19 | ||||

| 21. |

Eminent Domain | 20 | ||||

| 22. |

Remedies | 20 | ||||

| 23. |

Lessee’s Personal Property | 22 | ||||

| 24. |

Notices | 22 | ||||

| 25. |

Estoppel Certificate | 23 | ||||

| 26. |

Signage | 23 | ||||

| 27. |

Real Estate Brokers | 23 | ||||

| 28. |

Parking | 23 | ||||

| 29. |

Subordination; Attornment | 23 | ||||

| 30. |

No Termination Right | 24 | ||||

| 31. |

Lessor’s Entry | 24 | ||||

| 32. |

Attorneys’ Fees | 24 | ||||

| 33. |

Quiet Enjoyment | 24 | ||||

| 34. |

Financial Information | 24 | ||||

| 35. |

SDN List | 24 | ||||

| 36. |

Intentionally Deleted | 25 | ||||

| 37. |

Intentionally Deleted | 25 | ||||

| 38. |

General Provisions | 25 | ||||

SCHEDULE OF EXHIBITS

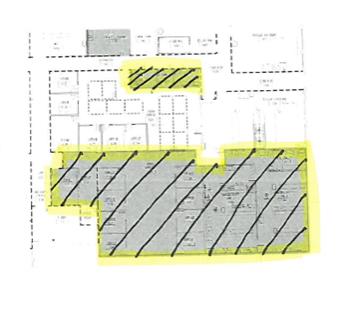

| EXHIBIT “A” |

Floor Plan of Premises | |

| EXHIBIT “B” |

Description of the Common Areas | |

| EXHIBIT “C” |

Commencement Memorandum | |

| EXHIBIT “D” |

Work Letter | |

| EXHIBIT “E” |

List of FF&E | |

| EXHIBIT “F” |

HVAC Adjustments | |

| EXHIBIT “G” |

Hazardous Materials | |

| EXHIBIT “H” |

HVAC Maintenance |

AMENDED AND RESTATED LEASE

000 Xxxxxxxxxx Xxxxx,

Xxxxxxxx, Xxxxxxxxxx

THIS AMENDED AND RESTATED LEASE, referred to herein as this “Lease,” is made and entered into as of July 27, 2015, by and between BERRUETA FAMILY L.P., a California limited partnership, hereafter referred to as “Lessor,” and MOUSERA, INC., a Delaware corporation, hereafter referred to as “Lessee” or “Mousera”.

RECITALS:

A. Lessor is the owner of the real property located in Milpitas, California, commonly referred to as 000 Xxxxxxxxxx Xxxxx, consisting of a parcel of land, together with all easements and appurtenances thereto (the “Land”) and the existing building thereon (the “Building”) containing approximately 66,306 rentable square feet and all other improvements located thereon. The Land and Building are referred to herein collectively as the “Property.” The floor plan of the Premises defined in Paragraph 1 is attached hereto as Exhibit “A” and incorporated by reference herein.

X. Xxxxxx and Lessee wish to enter into this Lease of the Premises upon the terms and conditions set forth herein.

NOW, THEREFORE, the parties agree as follows:

1. Lease.

(a) Lessor hereby leases to Lessee, and Lessee leases from Lessor, at the rental rate and upon the terms and conditions set forth herein, the Premises (as hereinafter defined). Beginning on the Commencement Date (as defined in Paragraph 2(a)), Lessor hereby leases to Lessee, and Lessee leases from Lessor, a portion of the Building consisting of approximately Eighteen Thousand Seven Hundred Seventy Nine (18,779) rentable square feet of the Building (the “Premises”), together with the right to use Lessee’s share of the on-site parking spaces pursuant to Paragraph 28, and the non-exclusive right to use the common areas of the Building and the other portions of the Property intended for use in common by the tenants of the Building, including the common restrooms, hallways, lobby, break room and shipping and receiving area, shown on Exhibit “B” hereto, as they may be modified by Lessor (the “Common Areas”). In performing any such modifications to the Common Areas, Lessor shall use commercially reasonable efforts not to unreasonably interfere with Lessee’s access to or use of the Premises or Lessee’s parking rights. Further, Lessee shall be allowed to use and install one server rack in the Building’s server/MPOE room. Lessee’s Pro Rata Share shall mean 28.33% (18,779/66,306); provided, however, Lessee’s Pro Rata Share as to utilities shall initially mean 38.5% of utility costs, subject to reasonable adjustment by Lessor, based on Lessee’s particular use of the Premises.

(b) Prior to the Commencement Date, the parties will itemize and list on Exhibit “E” all existing equipment located in the Premises that is owned by Lessor (the “FF&E’). Lessor hereby grants to Lessee a license to use such FF&E during the entire term of this Lease at no additional charge. Lessee agrees to maintain and use the FF&E with care and in a reasonable manner. Lessee shall return such FF&E to Lessor upon Lessee’s surrender of the Premises in substantially the condition existing as of the Commencement Date, normal wear and tear excepted. The FF&E is provided in its “AS IS, WHERE IS” condition, without representation or warranty whatsoever, except that Lessor represents and warrants to Lessee that Lessor owns title to the FF&E and has the right to license such FF&E to Lessee under the terms of this Lease. Lessee shall insure the FF&E under the property insurance policy required under this Lease and pay all taxes, if any, with respect to the FF&E. Lessee shall not remove any of the FF&E from the Premises without the consent of Lessor.

1

2. Term.

(a) The term of this Lease (the “term” or the “Term”) shall commence as of August 1 2015 (the “Commencement Date’). At Lessor’s request, the Commencement Date shall be confirmed in writing by Lessor and Lessee by the execution and delivery of the Commencement Memorandum in the form attached hereto as Exhibit “C”. Lessor shall deliver to Lessee possession of the portion of the Premises that Lessee is not occupying with the FF&E in place, with all base building mechanical, electrical, plumbing and other base building systems serving the Premises in good working order and repair (but only to the extent consistent with basic lab needs and not including any specialized equipment or FF&E or specialized use of any equipment) (collectively, the “Required Condition). Lessor shall promptly adjust the settings of the Building’s HVAC units serving the Premises as described in Exhibit “F”.

(b) The Term of this Lease shall expire, unless sooner terminated or extended in accordance with the provisions hereof or as permitted by law, on the last day of the eighty-fourth (84th) full calendar month after the Commencement Date.

3. Option to Extend.

(a) Provided Lessee is not in default of its obligations under this Lease beyond any applicable notice and cure period at the time of exercise or on the commencement date of the Extended Term (as hereinafter defined), Lessee shall have one (1) option to extend the Term of this Lease (the “Option to Extend”) for a period of five (5) years (the “Extended Term”) on the same terms and conditions as set forth in this Lease except that (i) the Monthly Base Rent for the Extended Term shall be adjusted to the Extended Term Rate, as defined in Paragraph 3(c) below, and (iii) Lessee shall accept the Premises in their then “as is” condition and Paragraph 13, subject to and without limiting, Lessor’s maintenance, repair and other obligations under this Lease; it being understood that Tenant Improvements (as defined below), shall not apply to the Extended Term. This Option to Extend is granted for the personal benefit of Mousera and its Permitted Transferee(s) only, and shall be exercisable only by Mousera or a Permitted Transferee (as defined in Paragraph 17(f) below). This option to extend may not be assigned or transferred to any assignee or sublessee, other than a Permitted Transferee, without the prior written consent of Lessor.

(b) Lessee shall give Lessor written notice of its intent to exercise its Option to Extend no earlier than twelve (12) months and no later than nine (9) months prior to the expiration of the initial Term (the “Option Exercise Period’). If Lessee does not exercise the Option to Extend within the Option Exercise Period, the Option to Extend shall lapse, time being of the essence.

(c) The initial Monthly Base Rent for the Premises during the Extended Term (the “Extended Term Rate”) shall be determined pursuant to the provisions of this Paragraph 3(c), and shall equal to the then current fair market rental for the Premises as of the commencement of the Extended Term, which shall be based on what a willing new lessee would pay and a willing lessor would accept at arm’s length for comparable premises in the Milpitas, California market of similar age, size, quality of construction and specifications for a lease similar to this Lease for the same uses specified hereunder and taking into consideration that there will be no free rent, improvement allowance, or other rent concessions, and other items that professional real estate brokers or professional real estate appraisers customarily consider, including, but not limited to, space availability, tenant size, distinctions between “gross” and “net” leases, parking charges and any other lease considerations, if any, then being charged or granted by the lessors of such similar commercial building projects.

2

(i) Upon the written request by Lessee to Lessor received by Lessor at any time during the Option Exercise Period and prior to the exercise by Lessee of the Option to Extend, Lessor shall, within fifteen (15) days of such request, give Lessee written notice of Lessor’s good faith opinion of the Extended Term Rate. Thereafter, but prior to the end of the Option Exercise Period, Lessee may give Lessor written notice of its intent to exercise its Option to Extend, and Lessor and Lessee shall enter into good faith negotiations in an effort to reach agreement on the Extended Term Rate.

(ii) If Lessor and Lessee are unable to agree upon the Extended Term Rate within fifteen (15) days of Lessee’s delivery of the exercise notice to Lessor, said amount shall be determined by appraisal. The appraisal shall be performed by one broker if the parties are able to agree upon one broker. If the parties are unable to agree upon one broker, then each party shall appoint a broker and the two brokers shall select a third broker. Each broker selected shall have at least ten (10) years of full-time commercial real estate brokerage experience in the Milpitas office/manufacturing rental market.

(iii) If only one broker is selected, that broker shall notify the parties in simple letter form of its determination of the Extended Term Rate within fifteen (15) days following its selection. Said appraisal shall be binding on the parties as the appraised current Extended Term Rate. If multiple brokers are selected, each broker shall within ten (10) days of being selected make its determination of the Extended Term Rate in simple letter form. If two (2) or more of the brokers agree on said amount, such agreement shall be binding upon the parties. If multiple brokers are selected and two (2) brokers are unable to agree on the Extended Term Rate, the Extended Term Rate shall be determined by taking the mean average of the appraisals; provided, that any high or low appraisal, differing from the middle appraisal by more than ten percent (10%) of the middle appraisal, shall be disregarded in calculating the average.

(iv) If only one broker is selected, then each party shall pay one-half of the fees and expenses of that broker. If three brokers are selected, each party shall bear the fees and expenses of the broker it selects and one-half of the fees and expenses of the third broker.

(d) Thereafter, provided that Lessee has previously given timely notice to Lessor of the exercise by Lessee of the Option to Extend, Lessor and Lessee shall execute an amendment to this Lease stating that the initial Monthly Base Rent for the Premises during the Extended Term shall be equal to the determination by appraisal.

4. Monthly Base Rent.

(a) Commencing on the Commencement Date and continuing on the first day of each calendar month thereafter until the end of the Term, Lessee shall pay to Lessor in monthly installments in advance the Monthly Base Rent for the Premises in lawful money of the United States as follows:

| Months |

Monthly Base Rent | |||

| 1 |

$ | 0 | ||

| 2 — 12 |

$ | 13,175 | ||

| 13 — 24 |

$ | 20,000 | ||

| 25 — 36 |

$ | 24,750 | ||

| 37 — 48 |

$ | 31,923 | ||

| 49 — 60 |

$ | 32,862 | ||

| 61 — 72 |

$ | 33,801 | ||

| 73 — 84 |

$ | 34,740 | ||

3

(b) Upon the execution and delivery of this Lease by Lessor and Lessee, Lessee shall pay to Lessor (i) the cash sum of Thirteen Thousand One Hundred Seventy-Five and 00/100 Dollars ($13,175) representing the initial full monthly installment of Monthly Base Rent (the “Initial Monthly Base Rent Installment”) payable by Lessee plus the estimated Operating Expenses and Taxes for the initial full month of this Lease in the amount of Twenty-Six Thousand Eight Hundred Forty Seven Dollars ($26,847), plus (ii) the cash Security Deposit (as defined in Paragraph 7 below). The Initial Monthly Base Rent Installment shall be credited against the Monthly Base Rent payable for the second full calendar month of the term. The Operating Expenses and Taxes paid upon execution and delivery of this Lease shall be credited against Lessee’s share of Operating Expenses and Taxes payable for the first (1st) full month of the Term.

5. Additional Rent; Operating Expenses and Taxes.

(a) In addition to the Monthly Base Rent payable by Lessee pursuant to Paragraph 4, commencing on the Commencement Date, Lessee shall pay to Lessor, as “Additional Rent,” (1) Lessee’s proportionate share of the Operating Expenses (as defined in Paragraph 5(b) below) of the Property and (2) Lessee’s proportionate share of the Taxes (as defined in Paragraph 5(c) below). Lessee’s pro rata share (the “Pro Rata Share”) of the Operating Expenses of the Property and the Taxes shall be equal to 28.33% and, subject to reasonable adjustment by Lessor based on usage by Lessee (as compared to the other tenants of the Building), 38.5% as to utilities that are not separately metered to the Premises. Monthly Base Rent and Additional Rent are referred to herein collectively as “rent.”.

(b) “Operating Expenses,” as used herein, shall include all commercially reasonable costs incurred by or on behalf of Lessor in connection with the operation, maintenance and repair of the Property, including the cost of all maintenance and repairs of the Property performed by Lessor pursuant to Paragraph 14 hereof, as determined by generally accepted accounting principles (unless excluded by this Lease), including, but not limited to:

Personal property taxes related to the operation and repair of the Property (except for taxes on Lessee’s personal property, which shall be Lessee’s sole responsibility, and taxes on the personal property of any other tenant or occupant of the Building or Property); any parking taxes or parking levies imposed on the Property in the future by any governmental agency; a reasonable management fee charged for the management and operation of the Property (Lessee’s Pro Rata Share of which shall not exceed three percent (3%) of Monthly Base Rent each month); water and sewer charges; waste disposal; insurance premiums for insurance coverages maintained by Lessor; license, permit, and inspection fees; charges for electricity, heating, air conditioning, gas, and any other utilities (including, without limitation, any temporary or permanent utility surcharge or other exaction and utilities to the Premises and other leased areas of the Building) not payable directly by tenants of the Building; security; maintenance, repair and replacement of the roof membrane; painting and repairing, interior and exterior; maintenance and replacement of floor and window coverings; repair, maintenance and replacement of air-conditioning, heating, mechanical and electrical systems, elevators, plumbing and sewage systems; janitorial service to the Common Areas; landscaping, gardening, and tree trimming; glazing; repair, maintenance, cleaning, sweeping, striping, and resurfacing of the parking area; repair to exterior Building lighting and parking lot lighting; supplies, materials, equipment and tools in the maintenance of the Property; costs for accounting services incurred in the calculation of Operating Expenses and Taxes; and the cost of any other capital expenditures for any improvements or changes to the Building which are required by laws, ordinances, or other governmental regulations adopted after the Commencement Date, or for any items or capital expenditures voluntarily made by Lessor which reduce Operating Expenses; provided, however, that except for capital improvements required because of Lessee’s particular use of the Property, if Lessor is required to make such capital improvements or any replacements provided for above which are considered capital expenditures, Lessor shall amortize the cost of said improvements over the useful life of said improvements

4

calculated in accordance with generally accepted accounting principles (together with interest on the unamortized balance at the rate equal to the effective rate of interest on Lessor’s bank line of credit at the time of completion of said improvements, or if Lessor has no line of credit in place, a commercially reasonable rate, but in no event in excess of ten percent (10%) per annum) as an Operating Expense in accordance with generally accepted accounting principles, except that with respect to capital improvements made to save Operating Expenses, such amortization shall not be at a rate greater than the actual savings in Operating Expenses. Operating Expenses shall also include any other expense or charge, whether or not described herein not specifically excluded by other provisions of this Lease, which in accordance with generally accepted accounting principles would be considered a commercially reasonable expense of operating, maintaining, and repairing the Property.

(c) Real property taxes and assessments upon the Property, during each year or partial year during the term of this Lease are referred to herein as “Taxes.”

As used herein, “Taxes” shall mean:

(1) all real estate taxes, assessments, charges and any other real property taxes which are levied or assessed against the Property including the Land, the Building, and all improvements located thereon, including any increase in Taxes resulting from a reassessment following any transfer of ownership of the Property or any interest therein or following any improvements to the Property; and

(2) all other taxes which may be levied in lieu of real estate taxes, assessments, and other fees, charges, and levies, general and special, ordinary and extraordinary, unforeseen as well as foreseen, of any kind and nature by any authority having the direct or indirect power to tax, including without limitation any governmental authority or any improvement or other district or division thereof, for public improvements, services, or benefits which are assessed, levied, confirmed, imposed, or become a lien (1) upon the Property, and/or any legal or equitable interest of Lessor in any part thereof; or (2) upon this transaction or any document to which Lessee is a party creating or transferring any interest in the Property; and (3) any tax or excise, however described, imposed in addition to, or in substitution partially or totally of, any tax previously included within the definition of “Taxes” or any tax the nature of which was previously included in the definition “Taxes.”

Not included within the definition of “Taxes” are any net income, profits, gross receipts, real property transfer taxes, franchise, estate, gift, or inheritance taxes imposed by any governmental authority and other taxes to the extent applicable to Lessor’s net income (as opposed to rents, receipts or income attributable to operations at the Building). “Taxes” also shall not include (i) penalties or interest charges assessed on delinquent Taxes so long as Lessee is not in default in the payment of Additional Rent, (ii) any items paid by Lessee under Paragraph 10 of this Lease and other similar taxes applicable to any other tenant of the Building, and (iii) Taxes attributable to periods of time outside the Term of this Lease.

With respect to any assessments which may be levied against or upon the Property, which under the laws then in force may be evidenced by improvement or other bonds, or may be paid in annual installments, only the amount of such annual installment (with appropriate proration of any partial year) and statutory interest shall be included within the computation of the annual Taxes levied against the Property.

5

(d) The following costs (“Costs’) shall be excluded from the definition of Operating Expenses:

(1) Costs occasioned by the gross negligence or willful misconduct of Lessor or Lessor’s agents, employees or contractors, or by the violation of law by Lessor, any other occupant of the Property, or their respective agents, employees or contractors;

(2) Costs for which Lessor receives reimbursement from others, including reimbursement from insurance;

(3) Interest, charges and fees incurred on debt or payments on any deed of trust or ground lease on the Property, and any other costs of selling, syndicating, financing, mortgaging or hypothecating any of Lessor’s interest in the Property;

(4) Costs incurred in repairing, maintaining or replacing any structural elements of the Building for which Lessor is responsible pursuant to Paragraph 14(a) hereof;

(5) Any wages, bonuses or other compensation of employees above the grade of building manager and any executive salary of any officer or employee of Lessor or for employees to the extent not stationed at the Property, including fringe benefits other than insurance plans and tax-qualified benefit plans;

(6) General office overhead and general and administrative expenses of Lessor, except as specifically provided in Paragraph 5(b), including without limitation, costs related to the operation of the business of the partnership, corporation or other entity which constitutes Lessor (including accounting and legal costs for such entity), as the same are distinguished from the costs of operation, management and repair of the Property;

(7) Costs occasioned by casualties or by the exercise of the power of eminent domain;

(8) Attorneys’ fees and other costs incurred in connection with negotiations or disputes with any other occupant of the Property and Costs arising from the violation by Lessor or any other occupant of the Property of the terms and conditions of any lease or other agreement;

(9) Costs incurred in connection with the presence of any Hazardous Materials on the Property that were not caused by or introduced by Lessee or its employees, agents, contractors, invitees, sublessees, successors or assigns;

(10) Expense reserves;

(11) Legal, accounting, construction, brokerage or other expenses related to other transactions or for the sole benefit of other tenants of the Building, including without limitation, leasing commissions, finder’s fees, advertising and promotional costs, attorneys’ fees, rental abatements and other expenses and concessions incurred in connection with leasing space to prospective tenants or other occupants, or to retain existing tenants;

(12) Costs of improvements installed for the exclusive use of other tenants or occupants of the Property;

(13) Costs of special services provided solely to an individual tenant of the Building other than Lessee (including excess utility usage);

6

(14) Costs for items that are expressly excluded from Operating Expenses elsewhere in this Lease;

(15) Political, charitable or similar civic contributions or donations;

(16) Insurance deductibles to the extent Lessee’s Pro Rata Share thereof would exceed one (1) month’s Base Rent and co-insurance payments; and

(17) payments in respect to overhead or profits to subsidiaries or affiliates of Lessor, or to any party affiliated with Lessor, for management or other services in or to the Building, or for supplies or other materials, to the extent that the cost of such services, supplies, or materials exceeds the fair market cost that would be charged by non-affiliated third parties dealing with Lessor on an arms-length basis.

(e) Prior to the execution of this Lease, Lessor has delivered to Lessee Lessor’s estimate of 2015 Operating Expenses and Taxes. Throughout the term of this Lease, as close as reasonably possible to the end of each calendar year thereafter, Lessor shall notify Lessee of the Operating Expenses and Taxes estimated by Lessor for the following calendar year. Concurrently with such notice, Lessor shall provide a description of such Operating Expenses and Taxes. Commencing on the Commencement Date, and on the first (1st) day of each calendar month thereafter, Lessee shall pay to Lessor, as Additional Rent, one-twelfth (1/12th) of the estimated Operating Expenses and Taxes. If at any time during any such calendar year, it appears to Lessor that the Operating Expenses and Taxes for such year will vary from Lessor’s estimate, Lessor may, by written notice to Lessee, revise Lessor’s estimate for such year and the Additional Rent payments by Lessee for such year shall thereafter be based upon such revised estimate. The increase in the monthly installments of Additional Rent resulting from Lessor’s revised estimate shall not be retroactive, but the Additional Rent for each calendar year shall be subject to adjustment between Lessor and Lessee after the close of the calendar year, as provided below. If the Property is not fully occupied during all or any portion of any year, Lessor may make an appropriate adjustment, in accordance with industry standards and sound management practices, of those Operating Expenses that vary based upon the occupancy level of the Property for each such year to so that the Operating Expenses reflect a fully occupied Property.

Upon giving Lessor five (5) days advance written notice, Lessee or its accountants shall have the right to inspect and audit Lessor’s books and records with respect to the Operating Expenses and/or Taxes for the prior calendar year in an office of Lessor, or Lessor’s agent, during normal business hours, once each calendar year to verify actual Operating Expenses and/or Taxes. Should Lessee retain any accountant or accounting firm to audit or inspect Lessor’s books and records pursuant to this Paragraph 5(e), such accountant or accounting firm shall be one of regional standing and retained on an hourly rate basis or based upon a fixed fee and shall not be paid on a contingency basis. Lessor’s books and records shall be kept in accord with generally accepted accounting principles. If Lessee’s audit of the Operating Expenses and/or Taxes for any year reveals a net overcharge of more than five percent (5%), Lessor shall promptly reimburse Lessee for the cost of the audit; otherwise, Lessee shall bear the cost of Lessee’s audit. If Lessee reasonably objects to Lessor’s estimated Operating Expenses and/or Taxes, Lessee shall nonetheless continue to pay on a monthly basis the Operating Expenses and Taxes based upon Lessor’s most current estimate until such dispute is resolved.

If Lessee’s Pro Rata Share of the Operating Expenses and Taxes for any year as finally determined exceed the total payments made by Lessee for such year based on Lessor’s estimates, Lessee shall pay to Lessor the deficiency, within thirty (30) days after Lessor’s request. If the total payments made by Lessee based on Lessor’s estimate of the Operating Expenses and Taxes exceed Lessee’s Pro Rata Share of Operating Expenses and/or Taxes, Lessee’s extra payment, plus the cost of an audit which is the responsibility of Lessor as set forth herein, if any, shall be credited against payments of Monthly Base Rent and Additional Rent next due hereunder or returned within thirty (30) days if the term has expired or this Lease has been terminated.

7

Notwithstanding the expiration or termination of this Lease, within thirty (30) days after Lessee’s receipt of Lessor’s notice for the calendar year in which this Lease terminates, Lessee shall pay to Lessor or shall receive from Lessor, as the case may be, an amount equal to the difference between the Operating Expenses and/or Taxes for such year, as finally determined, and the amount previously paid by Lessee on account thereof (prorated to the expiration date or the termination date of this Lease); provided, however, that Lessee shall have no obligation to pay any portion of any Operating Expense or Taxes that are fairly allocable to any period of time after the expiration or earlier termination of the Term of this Lease and Lessee’s surrender of possession of the Premises.

6. Payment of Rent.

(a) All rent shall be due and payable in lawful money of the United States of America at the address of Lessor set forth in Paragraph 24, “Notices,” without deduction or offset and without prior demand or notice, unless otherwise specified herein. Monthly Base Rent and Additional Rent shall be payable monthly, in advance, on the first day of each month for the entire term of this Lease. Lessee’s obligation to pay rent for any partial month at the commencement of the term, for any partial month immediately prior to a rental adjustment date (if the rental adjustment date is other than the first day of the calendar month), and for any partial month at the expiration or termination of the term, shall be based upon the number of days in such month.

(b) If any installment of Monthly Base Rent, Additional Rent or any other sum due from Lessee is not received by Lessor within five (5) days after the same is due, Lessee shall pay to Lessor an additional sum equal to five percent (5%) of the amount overdue as a late charge, provided however that Lessor shall provide Lessee written notice once per calendar year of any overdue amount prior to charging any late charges (so long as such payment is made within five (5) days after Lessor’s notice). The parties agree that this late charge represents a fair and reasonable estimate of the costs that Lessor will incur by reason of the late payment by Lessee. Acceptance of any late charge plus the overdue amount shall constitute a waiver of Lessee’s default with respect to such overdue amount. Any amount not paid within ten (10) days after Lessee’s receipt of written notice that such amount is due shall bear interest from the date due until paid at the lesser rate of (1) the prime rate of interest as published in the “Wall Street Journal,” plus two percent (2%) or (2) the maximum rate allowed by law (the “Interest Rate’), in addition to the late payment charge.

7. Security Deposit. Lessee shall provide a deposit with Lessor upon execution hereof the sum of Sixty-Six Thousand Six Hundred and 00/100 Dollars ($66,600) (the “Security Deposit”), as security for Lessee’s faithful performance of Lessee’s obligations under this Lease. Lessor is currently holding the sum of $21,480.00 as a security deposit pursuant to the terms of the Original Lease (defined below). Upon execution of this Lease, Lessee shall deposit with Lessor the balance of the Security Deposit. If Lessee fails to pay Monthly Base Rent or Additional Rent or charges due hereunder within applicable notice and cure periods, or otherwise defaults under this Lease (as defined in Paragraph 22), Lessor may use, apply or retain all or any portion of said Security Deposit to the extent reasonably necessary to cure the default, for the payment of any amount due Lessor, and to reimburse or compensate Lessor for any liability, cost, expense, loss or damage (including attorneys’ fees) which Lessor may suffer or incur by reason thereof. If Lessor uses or applies all or any portion of the Security Deposit, Lessee shall within ten (10) days after written request therefor, deposit with Lessor the amount sufficient to restore the Security Deposit to the original amount required by this Lease. Lessor shall not be required to keep all or any part of the Security Deposit separate from its general accounts. In no event or circumstance shall Lessee have the right to any

8

use of the Security Deposit and, specifically, Lessee may not use the Security Deposit as a credit or to otherwise offset any payments required hereunder, including, but not limited to, rent or any portion thereof. Lessee waives (i) California Civil Code Section 1950.7 (with the exception of subsection (b), which subsection is not waived and may be enforced by Lessee) and any and all other governmental laws, rules and regulations applicable to security deposits in the commercial context (“Security Deposit Laws’), and (ii) any and all rights, duties and obligations either party may now has, or in the future will have, relating to or arising from the Security Deposit Laws. Notwithstanding anything to the contrary herein, the Security Deposit may be retained and applied by Lessor (a) to offset rent which is unpaid either before or after termination of this Lease, and (b) against other damages suffered by Lessor before or after termination of this Lease. No part of the Security Deposit shall be considered to be held in trust, to bear interest or other increment for its use, or to be prepayment for any moneys to be paid by Lessee under this Lease. Within thirty (30) days the expiration or earlier termination of this Lease and Lessee’s surrender of possession of the Premises to Lessor, Lessor shall return to Lessee so much of the Security Deposit as has not been applied by Lessor pursuant to this paragraph, or which is not otherwise required to cure Lessee’s defaults.

8. Use. Lessee may use and occupy the Premises for research and development, office, and the housing, care, treatment of mice and small rodents, and for no other use or purpose without Lessor’s prior written consent, which shall not be unreasonably withheld as long as such use is in compliance with the applicable zoning for the Property and compatible with the uses of the other tenants in the Building. Any use of the Premises by Lessee or by any sublessee or assignee approved by Lessor pursuant to Paragraph 17 shall comply with the provisions of this Paragraph 8. Subject to the terms set forth in this Section 1, Lessee shall have the right to install a locked cage and rack (subject to Lessor’s approval of the specifications therefor, which shall not be unreasonably withheld) in the IT/server room that is currently part of the Common Areas.

9. Hazardous Materials.

(a) The term “Hazardous Materials” as used in this Lease shall include any substance defined or regulated as radioactive, flammable, toxic, a biohazard, medical waste, “hazardous material”, “extremely hazardous material”, “hazardous waste”, “hazardous substance,” “toxic substance,” “industrial process waste,” or “special waste” in any Environmental Laws as hereafter defined. Hazardous Materials shall include, but not be limited to, petroleum, gasoline, natural gas, natural gas liquids, liquefied natural gas, synthetic gas, and/or crude oil or any products, by-products or fractions thereof.

(b) Lessee shall not engage in any activity in or on the Premises or the Property which constitutes a Reportable Use of Hazardous Materials without the express prior written consent of Lessor and timely compliance (at Lessee’s expense) with all Environmental Laws. “Reportable Use” shall mean (i) the installation or use of any above or below ground storage tank, or (ii) the generation, possession, storage, use, transportation, or disposal of Hazardous Materials that require a permit from, or with respect to which a report, notice, registration or business plan is required to be filed with, any governmental authority, provided that Lessor hereby approves the use by Lessee of those Hazardous Materials stated on Exhibit G attached hereto and made a part hereof, and further provided that such Hazardous Materials are used, stored, transported and disposed of in compliance with all applicable Environmental Laws.

(c) “Environmental Laws” shall mean and include any Federal, State, or local statute, law, ordinance, code, rule, regulation, order, or decree regulating, relating to, or imposing liability or standards of conduct concerning, any hazardous, toxic, or dangerous waste, substance, element, compound, mixture or material, as now or at any time hereafter in effect including, without limitation, California Health and Safety Code §§25100 et seq., §§25300 et seq., Sections 25281(f) and 25501 of the California Health and Safety Code, Section 13050 of the Water Code, the Federal Comprehensive Environmental Response, Compensation and Liability Act, as amended, 42 U.S.C. §§9601 et seq., the Superfund Amendments and

9

Xxxxxxxxxxxxxxx Xxx, 00 X.X.X. §§0000 et seq., the Federal Toxic Substances Control Act, 15 U.S.C. §§2601 et seq., the Federal Resource Conservation and Recovery Act as amended, 42 U.S.C. §§6901 et seq., the Federal Hazardous Material Transportation Act, 49 U.S.C. §§1.801 et seq., the Federal Clean Air Act, 42 U.S.C. §7401 et seq., the Federal Water Pollution Xxxxxxx Xxx, 00 X.X.X. §0000 et seq., the River and Harbors Act of 1899, 33 U.S.C. §§40l et seq., and all rules and regulations of the EPA, the California Environmental Protection Agency, or any other state or federal department, board or any other agency or governmental board or entity having jurisdiction over the environment, as any of the foregoing have been, or are hereafter amended.

(d) If Lessee knows, or has reasonable cause to believe, that Hazardous Materials have come to be located in, on, under or about the Premises or the Property in violation of applicable Environmental Laws or this Lease, other than as previously consented to by Lessor, Lessee shall immediately give written notice of such fact to Lessor and provide Lessor with a copy of any report, notice, claim or other documentation which Lessee has concerning the presence of such Hazardous Materials.

(e) Lessee and Lessee’s agents, employees, and contractors shall not cause any Hazardous Materials to be discharged or released into the Building or into the plumbing or sewage system of the Building or into or onto the Land underlying or adjacent to the Building in violation of any Environmental Laws. Lessee shall promptly, at Lessee’s expense, take all investigatory and/or remedial action reasonably recommended, whether or not formally ordered or required, for the cleanup of any contamination in violation of Environmental Laws or the terms of this Lease caused by Lessee or caused by any of Lessee’s employees, agents, or contractors, and for the maintenance, security and/or monitoring of the Premises, the Property, or neighboring properties if such contamination is caused by discharge or a release of any Hazardous Materials by Lessee or by any of Lessee’s employees, agents, or contractors.

(f) Lessor, Lessor’s agents, employees, contractors and designated representatives, and the holders of any mortgages, deeds of trust or ground leases on the Premises (“Lenders’) shall have the right to enter the Premises at any time in the case of an emergency, and otherwise at reasonable times and with reasonable advance notice, subject to Lessee’s reasonable security requirements, for the purpose of inspecting the condition of the Premises and for verifying compliance by Lessee with Paragraph 9 of this Lease, and Lessor shall be entitled to employ experts and/or consultants in connection therewith to advise Lessor with respect to Lessee’s activities, including but not limited to Lessee’s installation, operation, use, monitoring, maintenance, or removal of any Hazardous Substance on or from the Premises.

(g) The costs and expenses of any such inspections shall be paid by the party requesting same, unless a default or breach of this Lease by Lessee or a violation of Laws (as defined below) or a contamination, caused by Lessee, is found to exist or to be imminent, or unless the inspection is requested or ordered by a governmental authority as the result of any such existing or imminent violation or contamination. In such case, Lessee shall upon request reimburse Lessor or Lessor’s Lender, as the case may be, for the reasonable, out-of-pocket costs and expenses of such inspections.

(h) Lessee shall indemnify, defend, protect and hold Lessor and its agents, employees, and the Premises and the Property harmless from any and all claims, damages, fines, judgments, penalties, costs, liabilities or losses (including, without limitation, any and all sums paid for settlement of claims, attorneys’ fees, consultant and expert fees) arising during or after the term of this Lease out of or involving any Hazardous Materials brought on to the Premises or the Property or used by or for Lessee or its agents, employees, contractors or invitees in violation of Environmental Laws or the terms of this Lease. Lessee’s obligations under this Paragraph 9(g) shall include, but not be limited to, the effects of any contamination or injury to person, property or the environment created or suffered by Lessee, and the cost of investigation (including consultants’ and attorneys’ fees and testing), removal, remediation, restoration and/or abatement thereof, or of any contamination therein involved, as required by Environmental Laws, and shall survive

10

the expiration or earlier termination of this Lease. No termination, cancellation or release agreement entered into by Lessor and Lessee shall release Lessee from its obligations under this Lease with respect to Hazardous Materials, unless specifically so agreed by Lessor in writing at the time of such agreement. Notwithstanding the foregoing or anything to the contrary contained in this Lease, under no circumstance shall Lessee be liable for, or obligated to indemnify, protect, defend or hold harmless Lessor or any of Lessor’s agents or employees from or against, any claims, damages, fines, judgments, penalties, costs, liabilities or losses arising out of or in connection with any Hazardous Materials present at any time on or about the Premises or the Property, or the violation of any Environmental Laws, except to the extent that any of the foregoing actually results from the introduction of Hazardous Materials on or about the Premises by Lessee or any of Lessee’s agents, employees, contractors or invitees.

10. Taxes on Lessee’s Property . Lessee shall pay before delinquency any and all taxes, assessments, license fees, and public charges levied, assessed, or imposed and which become payable during the Term and any extension thereof upon the FF&E and Lessee’s equipment, fixtures, furniture, and personal property installed or located on the Premises.

11. Insurance.

(a) Lessee shall, at Lessee’s sole cost and expense, provide and keep in force commencing with the Commencement Date of the Term and continuing during the Term, (i) a commercial general liability insurance policy, insuring against any and all liability occasioned by any occurrence in, on, about, or related to the Premises, or arising out of Lessee’s use, occupancy, alteration or maintenance of the Premises, having a combined single limit for both bodily injury and property damage in an amount not less than Two Million Dollars ($2,000,000) each occurrence and Four Million Dollars ($4,000,000) annual aggregate, (ii) “all risk” property insurance insuring the FF&E and all Lessee’s personal property and improvements installed or placed in the Premises by Lessee, (iii) workers’ compensation insurance with no less than the minimum limits required by law and (iv) employer’s liability insurance with such limits as required by law.

(b) All such insurance carried by Lessee shall be in a form reasonably satisfactory to Lessor and shall be carried with recognized insurance companies qualified to do business in California that have a general policyholder’s rating of not less than “A-” and a financial rating of not less than Class “VII” in the most current edition of Best’s Insurance Reports; Lessee shall provide prior notice to Lessor of any reduction or cancellation of such policies of at least thirty (30) days prior to such reduction or cancellation; and such insurance shall be primary as to Lessor. Prior to the Commencement Date and upon renewal of such policies not less than thirty (30) days prior to the expiration of the term of such coverage, Lessee shall deliver to Lessor certificates of insurance confirming such coverage, together with evidence of the payment of the premium therefor, naming Lessor and Lessor’s property manager as additional insureds. If Lessee fails to procure and maintain the insurance required hereunder and cure such failure within three (3) business days’ after notice from Lessor, Lessor may, but shall not be required to, order such insurance at Lessee’s expense and Lessee shall reimburse Lessor for all costs incurred by Lessor with respect thereto. Lessee’s reimbursement to Lessor for such amounts shall be deemed Additional Rent, and shall include all sums disbursed, incurred or deposited by Lessor, including Lessor’s costs, expenses and reasonable attorneys’ fees with interest thereon at the Interest Rate.

(c) Notwithstanding anything to the contrary contained in this Lease, Lessor and Lessee, on behalf of themselves and on behalf of anyone claiming under or through them by way of subrogation or otherwise, waive all rights and causes of action against and release each other, and their respective authorized representatives, employees, officers, directors, shareholders, managers, members, trustees, beneficiaries, assignees, subtenants, invitees, successors, agents, contractors and property managers, from (i) any liability arising out of any loss or damage to property in or to the Premises and/or

11

the other structures and improvements on the Land, and from (ii) any claims for damage to the fixtures, personal property, leasehold improvements and alterations of either Lessor or Lessee in or on the Premises or the Property, to the extent that either (i) or (ii) are caused by or result from risks required by this Lease to be insured against (or actually insured against) under any policies of property insurance carried by the parties or that would normally be covered by “all risk” or “special form” property insurance. This waiver and release applies whether or not the loss is due to the negligent acts or omissions or willful misconduct of Lessor or Lessee or their respective authorized representatives, employees, officers, directors, shareholders, managers, members, trustees, beneficiaries, assignees, subtenants, invitees, successors, agents, contractors and property managers. Subject to the foregoing, this release and waiver shall be complete and total even if such loss or damage may have been caused by the negligence of the other party, its managers, members, employees, agents, contractors, property managers or invitees.

12. Indemnification.

(a) Lessee waives all claims against Lessor and its employees, agents and contractors for damages to property, or to goods, wares, and merchandise stored in, upon, or about the Premises, and for injuries to persons in, upon, or about the Premises or the Property from any cause arising at any time, except as may be caused by the negligence (except to the extent any such claims are covered by the insurance Lessee is required to carry under this Lease or actually carries), gross negligence or willful misconduct of Lessor or its employees, agents or contractors. Lessee shall indemnify, defend, and hold harmless Lessor from claims, suits, actions, or liabilities, including attorneys’ fees, to the extent arising from (1) any activity, work, or thing done or permitted by Lessee in or about the Premises or the Property, (2) the acts or omissions of Lessee, its employees, agents or contractors, and (3) any event of default by Lessee in the performance of any obligation on Lessee’s part to be performed under this Lease; provided, however, that Lessee shall have no obligation to indemnify, defend or hold harmless Lessor from any such claims, suits, actions, or liabilities to the extent they are caused by the negligence (except to the extent any such claims, suits, actions, or liabilities are covered by the insurance Lessee is required to carry under this Lease or actually carries), gross negligence or willful misconduct or violation of applicable law by Lessor or any of Lessor’s agents, employees or contractors.

(b) Lessor shall not be liable to Lessee for any damage because of any act or negligence of any other occupant of the Building or any other owner or occupant of adjoining or contiguous property, nor for overflow, breakage, or leakage of water, steam, gas, or electricity from pipes, wires, or otherwise in the Premises or the Building, except to the extent caused by the gross negligence or willful misconduct of Lessor or Lessor’s employees, agents, or contractors. Except as otherwise provided herein, Lessee will pay for damage to the Premises or the Property caused by the misuse or neglect of the Premises or the Property by Lessee or its employees, agents, or contractors, including, but not limited to, the breakage of glass in the Building.

13. Tenant Improvements. Lessor shall, except with respect to disbursement of the Allowance as set forth in the Work Letter attached hereto as Exhibit “D”, and subject to and without limiting, Lessor’s repair, maintenance and other obligations under this Lease, have no obligation to make any repairs, improvements, additions or alterations to the Premises or to provide any tenant improvement allowance to Lessee. Lessee shall be solely responsible for constructing at its sole cost and expense the improvements to the Premises required for Lessee’s Permitted Use of the Premises in accordance with the terms of Section 13 hereof and the Work Letter attached hereto (the “Tenant Improvements”).

12

14. Maintenance and Repairs; Alterations; Surrender and Restoration.

(a) Lessor shall, at Lessor’s sole expense, keep in good order, condition, and repair and replace when necessary, the structural elements of the roof (excluding the roof membrane which Lessor shall maintain, but the cost of which shall be included as an Operating Expense as permitted under Paragraph 5), and the structural elements of the foundation and exterior walls (except the interior faces thereof, except to the extent damage to interior walls or floors is caused by leaks, seepage or exterior elements due to failure or poor condition of exterior walls, roof, foundation or structural elements) of the Building, and other structural elements of the Building and the Property as “structural elements” are defined in building codes applicable to the Building, excluding any alterations, structural or otherwise, made by Lessee to the Building. Lessor shall perform and construct, in a commercially reasonable time period and manner, and Lessee shall not be responsible for performing or constructing, any repairs, maintenance, or improvements (1) required as a result of any casualty damage, which shall be subject to Paragraph 20 below, or as a result of any taking pursuant to the exercise of the power of eminent domain, or (2) for which Lessor has a right of reimbursement from third parties based on construction or other warranties, contractor guarantees, or insurance claims.

(b) Lessor shall provide or cause to be provided and shall supervise the performance of, in a commercially reasonable time period and manner, as an Operating Expense of the Property as permitted under Paragraph 5(b) hereof, maintenance of the base Building mechanical, plumbing and electrical and all other base building systems serving the Premises (but only to the extent such maintenance is consistent with basic lab needs, and shall not include Lessee’s specialized equipment or specialized work required for certifications related to Lessee’s use except as provided in Exhibit “H”); the roof membrane; the outside areas of the Property; landscaping; tree trimming; resurfacing and restriping of the parking lot; repairing and maintaining the walkways; exterior building painting; exterior building lighting; and parking lot lighting. In the event Lessee provides Lessor with written notice of the need for any repairs, Lessor shall commence any such repairs request to be performed by Lessor hereunder promptly following receipt by Lessor of such notice and Lessor shall diligently prosecute such repairs to completion. Lessee, at its sole expense, shall perform at its sole cost any maintenance required for Lessee’s specialized equipment or specialized maintenance within the interior of the Premises and to building systems, and Lessee shall first submit all vendors performing such work in writing to Lessor for Lessor’s prior consent.

(c) Except as for Lessor’s obligation to deliver the Premises in the Required Condition and subject to Lessor’s express repair, maintenance and other obligations under this Lease, the Premises shall be accepted by Lessee in its “as is” condition with “all faults,” as of the Commencement Date and Lessor shall have no obligation whatsoever to alter, remodel, improve, repair, decorate or paint the Premises, the remainder of the Property or any part thereof either prior to or during the Term. Lessee agrees that the Premises are suitable for Lessee’s purposes. As of the Commencement Date, Lessee shall take good care of the interior of the Premises and shall make all repairs in the Premises necessary to preserve the interior of the Premises in good order and condition, except for ordinary wear and tear, which repairs shall be in quality and class equal to the condition of the Premises as of the Commencement Date. Without limiting the foregoing, Lessee shall provide all services and work relating to the operation, maintenance, repair, and replacement, as needed, of Lessee’s specialized equipment, and shall be responsible for any damage to the Property caused by Lessee or any of its employees, agents, contractors or invitees, including due to any misuse or excess use of the Building equipment servicing the Premises, subject to and without limiting Paragraph 9(c) above concerning waiver of subrogation rights and to the HVAC, mechanical, electrical, and plumbing systems in or to the extent exclusively serving the Premises, except for HVAC repairs as provided in Paragraph 14(b).

(d) Lessee may, from time to time, at its own cost and expense and without the consent of Lessor make internal alterations of a nonstructural, non-utility and non-mechanical nature to the interior of the Premises the cost of which in any one instance is Ten Thousand and 00/100 Dollars ($10,000.00) or less, provided Lessee first notifies Lessor in writing of any such nonstructural alterations. Except as provided in the immediately preceding sentence, Lessee shall not make any additional alterations, improvements, or additions to the Premises without delivering to Lessor a complete set of plans and

13

specifications for such work (including without limitation, if appropriate, architectural, structural, mechanical and electrical drawings and specifications), prepared by Lessee’s architect, engineer or contractor, obtaining and delivering copies to Lessor of any permits or other governmental approvals required for such work and obtaining Lessor’s prior written consent thereto. All alterations and additions shall be installed by an appropriately licensed contractor approved by Lessor, which approval shall not be unreasonably withheld, conditioned or delayed, at Lessee’s sole expense in compliance with all applicable laws, rules, regulations and ordinances. Lessee shall keep the Premises and the Property on which the Premises are situated free from any liens arising out of any work performed, materials furnished or obligations incurred by or on behalf of Lessee. Lessor may condition its consent to, among other things, Lessee agreeing in writing to remove any such alterations prior to the expiration of the Lease term and Lessee agreeing to restore the Premises to its condition prior to such alterations at Lessee’s expense. Upon Lessee’s written request, Lessor shall advise Lessee in writing at the time consent is granted whether Lessor reserves the right to require Lessee to remove any alterations from the Premises prior to the expiration or sooner termination of this Lease. Lessee shall pay Lessor all of Lessor’s reasonable, out-of-pocket costs related to such alterations, including a construction management fee of three percent (3%) of the cost of such alterations requiring a building permit.

(e) Lessee shall, at Lessee’s sole cost and expense, fully, diligently and in a timely manner, comply with all present and future “Laws,” which term is used in this Lease to mean all laws, rules, regulations, ordinances, directives, orders, covenants, permits of all governmental agencies and authorities, easements and restrictions of record, the requirements of any applicable fire insurance underwriter or rating bureau or board of fire underwriters, relating in any manner to the Premises and/or Lessee’s use or occupancy of the Premises (including but not limited to matters pertaining to environmental conditions on, in, under or about the Premises, including soil and groundwater conditions, subject to the provisions of Paragraph 9 hereof, which provisions of Paragraph 9, in the event of a conflict, shall take precedence and govern with respect to any conflicting provision contained in this Paragraph 14, and the use, generation, manufacture, production, installation, maintenance, removal, transportation, storage, spill, or release of any Hazardous Materials (except to the extent provided in Paragraph 9 hereof)), now in effect or which may hereafter come into effect. Lessee shall, within ten (10) business days after receipt of Lessor’s written request, provide Lessor with copies of all documents and information, including but not limited to permits, registrations, manifests, applications, reports and certificates, evidencing Lessee’s compliance with any Laws reasonably specified by Lessor, and shall immediately after receipt, notify Lessor in writing (with copies of any documents involved) of any threatened or actual claim, notice, citation, warning, complaint or report pertaining to or involving failure by Lessee or the Premises to comply with any Laws. Notwithstanding the foregoing, any structural changes or repairs or other alterations, changes or repairs to the Property of any nature which would be considered a capital expenditure under generally accepted accounting principles may be made by Lessor at Lessee’s expense if such repairs or changes are required by reason of the specific nature or specialized use of the Premises by Lessee (including vivarium use and alterations performed by Lessee). If such changes or repairs are not required by reason of the specific nature or specialized use of the Premises (including alterations performed by Lessee) and are capital expenditures, the cost of such changes or repairs shall be treated as an Operating Expense and amortized in accordance with and subject to the provisions of Paragraphs 5(b) and 5(d).

(f) During the term of this Lease, Lessee shall comply, at Lessee’s expense (but subject to and without limiting the last sentence of Paragraph 14(e) above), with all of the covenants, conditions, and restrictions affecting the Premises which are presently recorded in the Official Records of Santa Xxxxx County, California, and any covenants, conditions, and restrictions affecting the Premises that may be recorded in the future, provided that any such covenants, conditions or restrictions do not impair Lessee’s access to or use of the Premises or increase Lessee’s monetary obligations under this Lease.

14

(g) Lessee shall surrender the Premises by the last day of the Term or any earlier termination date, in accordance with Paragraph 13(d) and this Paragraph 14(g), with all of the improvements to the Premises, parts, and surfaces thereof clean and free of debris and in the same condition as on the Commencement Date, ordinary wear and tear, alterations that Lessee is not required to remove, damage caused by casualty or condemnation, and repair and maintenance that Lessor is required to perform excepted, with all closures and requirements by any governmental agencies with respect to the use of Hazardous Materials at the Premises completed; provided, however, that Lessee shall have the right to remove any specialized tenant improvements to the Premises installed and paid for by Lessee, in which event Lessee shall repair any damage to the Premises caused by such removal. If the Premises are not so surrendered, then Lessee shall be liable to Lessor for all costs incurred by Lessor in returning the Premises to the required condition. At least two (2) months prior to the surrender of the Premises, Lessee shall deliver to Lessor a description of the actions proposed (or required by any governmental authority) to be taken to surrender the Premises free from any residual impact from Lessee’s or its agent’s, employee’s or contractor’s use of Hazardous Materials (the “Surrender Plan”). Such Surrender Plan shall be accompanied by a listing of (i) all Hazardous Materials licenses and permits held by or on behalf of Lessee or Lessee’s agents, employees or contractors with respect to the Premises, and (ii) all Hazardous Materials (except standard office products) used, stored, handled, treated, generated, introduced, or disposed of from the Premises and any other information reasonably requested by Lessor and shall be subject to the review and approval of Lessor. On or before such surrender, Lessee shall deliver to Lessor evidence that the approved Surrender Plan has been satisfactorily completed. Lessee’s failure to surrender the Premises in accordance with the terms and conditions of this Lease, including, without limitation, this Paragraph 14(g) shall be deemed to be a material default under this Lease. “Ordinary wear and tear” shall not include any damage or deterioration that would have been prevented by good maintenance practice or by Lessee performing all of its obligations under this Lease. The obligations of Lessee shall include the repair of any damage occasioned by the installation, maintenance, or removal of Lessee’s trade fixtures, furnishings, equipment, and alterations, and the restoration by Lessee of the Premises to its condition upon the Commencement Date (ordinary wear and tear excepted) (A) if Lessor’s consent to alteration, additions or improvements was conditioned upon such removal and restoration upon expiration or sooner termination of the Lease term pursuant to Paragraph 14(d), or (B) if Lessee made any such alterations, additions, or improvements without obtaining Lessor’s prior written consent as required herein and within ten (10) days after the expiration or sooner termination of the Lease term Lessor gives written notice to Lessee requiring Lessee to perform such removal and restoration.

15. Utilities and Services.

(a) Lessee shall contract for and pay for directly all telephone, telecommunications and janitorial service and shall pay Lessor Lessor’s reasonable estimate of the cost of all electricity, gas, water, heat and air conditioning service, sewer charges, and all other utilities or services supplied to or consumed by Lessee, its agents, employees, contractors, and invitees on or about the Premises. Lessee acknowledges that (i) the Premises are not currently separately metered, and Lessor shall reasonably and equitably estimate the cost of the utilities provided to the Premises (provided, however, Lessor anticipates providing a disproportionate (based on square footage) amount of the utilities to Lessee, agreed at 38.5%, based on Lessee’s anticipated use of the Premises), which shall be fixed throughout the Term based on Lessee’s use of common utilities as compared to the use of such utilities by other tenants of the Building, (ii) Lessor shall have the right, at its sole cost (unless Lessor reasonably determines that Lessee has been using more than 38.5% of utilities, in which case such metering shall be at Lessee’s cost) to separately meter the Premises and (iii) Lessor may include the cost of such utilities in Operating Expenses or may separately invoice the cost of such utilities to Lessee, in which case Lessee shall pay such amounts within thirty (30) days of Lessor’s delivery of an invoice. Such payments shall constitute Additional Rent, and Lessee’s failure to make such payments on a timely basis will result in a late charge as provided in Paragraph 6(b) and constitute a default as described in Paragraph 22. Lessor shall reasonably determine Lessee’s actual usage

15

of common utilities as 38.5% of the actual cost of utilities, not less frequently than annually and shall deliver prompt written notice to Lessee of such determination, the amount of any underpayment or overpayment made by Lessee as to such utility usage and any adjustment to the amount of such utilities to be paid by Lessee thereafter to more accurately reflect Lessee’s usage thereof. Lessor shall credit any overpayment to the amount of Monthly Base Rent next coming due (or, if this Lease has expired, refund such amount to Lessee within thirty (30) days thereafter (after first deducting any amounts owing by Lessee under this Lease)) or Lessee shall, within thirty (30) days of Lessor’s delivery of such determination, pay the amount of such underpayment to Lessor.

(b) Lessor will use reasonable efforts to cause the main HVAC system serving the Premises to provide the airflow/pressurization and temperature regulations described in Exhibit “F”. Lessor hall not be liable to Lessee for any interruption or failure of any utility services to the Building or the Premises which is not caused by the negligence or willful misconduct of Lessor, or Lessor’s employees, agents, or contractors. Lessee shall not be relieved from the performance of any covenant or agreement in this Lease because of any such failure. Lessor shall make all repairs to the Premises required to restore such services to the Premises and the cost thereof shall be payable by Lessee pursuant to Paragraph 5 as a current Operating Expense, or as a capital improvement which is amortized over its useful life (together with interest thereon) as an Operating Expense in accordance with generally accepted accounting principles as described in Paragraph 5(b); provided, however, if such failure is caused by the gross negligence or willful misconduct of Lessor or Lessor’s employees, agents, or contractors, or by Lessor’s breach in the performance of Lessor’s express obligations hereunder, then Lessor shall bear such costs.

16. Liens. Lessee agrees to keep the Premises free from all liens arising out of any work performed, materials furnished, or obligations incurred by Lessee. Lessee shall give Lessor at least ten (10) calendar days prior written notice before commencing any work of improvement on the Premises. Lessor shall have the right to post notices of non-responsibility with respect to any such work. If Lessee shall, in good faith, contest the validity of any such lien, claim or demand, then Lessee shall, at its sole expense, defend and protect itself, Lessor and the Property against the same, and shall pay and satisfy any such adverse judgment that may be rendered thereon before the enforcement thereof against Lessor or the Property. If Lessor shall require, Lessee shall furnish to Lessor a surety bond satisfactory to Lessor in an amount equal to the amount of such contested claim or demand, indemnifying Lessor against liability for the same, as required by law for the holding of the Property free from the effect of such lien or claim.

17. Assignment and Subletting.

(a) Except as otherwise provided in this Xxxxxxxxx 00, Xxxxxx shall not hypothecate or encumber its interest under this Lease or any rights of Lessee hereunder, assign this Lease, or any interest, voluntarily or involuntarily, and shall not sublet the Premises or any part thereof, or any right or privilege appurtenant thereto, or suffer any other person (the agents and servants of Lessee excepted) to occupy or use the Premises, or any portion thereof, without the prior written consent of Lessor in each instance pursuant to the terms and conditions set forth below, which consent shall not be unreasonably withheld or delayed, subject to the following provisions. A transfer or series of transfers whereby fifty percent (50%) or more of the ownership interests in Lessee are transferred, or an assignment or transfer by operation of law or, subject to Paragraph 17(f) below, otherwise in connection with a merger, consolidation, reorganization, stock sale or other like transaction, shall also constitute an assignment hereunder. Notwithstanding the foregoing, the immediately preceding sentence will not apply to any change in the controlling ownership interest of the entity that constitutes Lessee which results from any of the following: (i) any transfer or sale of the stock or other ownership interest in Lessee (1) to the spouse(s) and/or children of a shareholder of Lessee, (2) to any trust, the beneficiary(ies) of which are family members of a shareholder of Lessee, (3) by reason of bequest or inheritance, or (4) in connection with the issuance of warrants or stock options to purchase Lessee’s stock, and the exercise of any purchase rights under any such warrants or stock options.

16

(b) If Lessee desires to assign or sublease this Lease or the Premises (other than by a Permitted Transfer (as defined in Paragraph 17(f) below)), at least thirty (30) days before the date Lessee desires such sublease or assignment to be effective (the “Transfer Date”), Lessee shall provide to Lessor the name and address of the proposed assignee or sublessee, and true and complete copies of all documents relating to Lessee’s prospective agreement to assign or sublease, a copy of a current financial statement for such proposed assignee or sublessee, and any other relevant information requested by Lessor and Lessee shall specify all consideration to be received by Lessee for such assignment or sublease in the form of lump sum payments, installments of rent, or otherwise (the “Transfer Notice”). For purposes of this Paragraph 17, the term “consideration” shall include all money or other consideration to be received by Lessee for such assignment or sublease. Within twenty (20) days after the receipt of such documentation and other information, Lessor (1) shall notify Lessee in writing that Lessor elects to consent to the proposed assignment or sublease subject to the terms and conditions hereinafter set forth, (2) shall notify Lessee in writing that Lessor refuses such consent, specifying reasonable grounds for such refusal, or (3) with respect to a proposed sublease or assignment of substantially all of the Premises for substantially the remaining Term, terminate this Lease with respect to the space described in the Transfer Notice as of the Transfer Date. Lessee and the proposed assignee or sublessee shall demonstrate to Lessor’s reasonable satisfaction that each of the criteria referred to in this subparagraph (b) is satisfied.

(c) Except with respect to any Permitted Transferees, Lessee shall pay to Lessor, as and when received by Lessee, fifty percent (50%) of the amount of any excess of the consideration to be received by Lessee in connection with said assignment or sublease over and above the Monthly Base Rent and Additional Rent fixed by this Lease and payable by Lessee to Lessor, after deducting only (i) a standard leasing commission payable by Lessee in consummating such assignment or sublease, (ii) the cost of reasonable tenant improvements performed specifically for the sublease and required to be made to the Premises to effectuate the sublease, provided that such improvements are performed in compliance with the provisions of this Lease, (iii) the fair market value of any goods or services provided by Lessee as additional consideration and (iv) commercially reasonable attorneys’ fees to effectuate the transfer.

(d) Each assignment or sublease agreement to which Lessor has consented shall be an instrument in writing in form satisfactory to Lessor, and shall be executed by both Lessee and the assignee or sublessee, as the case may be. Each such assignment or sublease agreement shall recite that it is and shall be subject and subordinate to the provisions of this Lease, that the assignee or sublessee accepts such assignment or sublease, that Lessor’s consent thereto shall not constitute a consent to any subsequent assignment or subletting by Lessee or the assignee or sublessee, and, except as otherwise set forth in a sublease approved by Lessor, agrees to perform all of the obligations of Lessee hereunder (to the extent such obligations relate to the portion of the Premises assigned or subleased), and that the termination of this Lease shall, unless Lessor elects, in its sole discretion otherwise, constitute a termination of every such assignment or sublease.

(e) In the event Lessor shall consent to an assignment or sublease, Lessee shall nonetheless remain primarily liable for all obligations and liabilities of Lessee under this Lease, including but not limited to the payment of rent.

(f) Notwithstanding the foregoing, Lessee may, without Lessor’s prior written consent, but with prior notice and documentation, as required pursuant to this Paragraph 17(f), provided to Lessor, sublet a portion or the entire Premises or assign this Lease to (i) a subsidiary, affiliate, division or corporation controlled or under common control with Lessee (“affiliate’); (ii) to a successor corporation related to Lessee by merger, consolidation or reorganization; or (iii) to a purchaser acquiring all or

17

substantially all of Lessee’s assets or stock (each such transaction referred to herein as a “Permitted Transfer” and each of the foregoing transferees referred to herein as a “Permitted Transferee), provided that in the case of (ii) or (iii) any such Permitted Transferee shall have a current verifiable net worth after the transfer at least equal to that of Lessee immediately prior to the transfer. Lessee’s foregoing rights in this Paragraph 17(f) to assign this Lease or to sublease all or a portion of the entire Premises shall be subject to the following conditions: (1) Lessee shall not be in default hereunder past any applicable cure period; (2) in the case of an assignment or subletting to an affiliate, Lessee shall remain liable to Lessor hereunder if Lessee is a surviving entity; (3) in the case of an assignment, the transferee or successor entity shall expressly assume in writing all of Lessee’s obligations hereunder; and (4) Lessee shall provide Lessor with prior notice of such proposed transfer and deliver to Lessor all documents reasonably requested by Lessor reasonably relating to such transfer, including but not limited to documentation sufficient to establish such proposed transferee’s verifiable net worth. It is expressly provided that any venture capital or other third party financing transaction shall be a Permitted Transfer and not require Lessor’s consent thereto provided that such financing transaction complies with the conditions to transfer set forth in this Paragraph 17(f).

(g) Subject to the provisions of this Paragraph 17, any assignment or sublease (if such consent is required hereunder) without Lessor’s prior written consent shall at Lessor’s election be void. The consent by Lessor to any assignment or sublease shall not constitute a waiver of the provisions of this Paragraph 17, including the requirement of Lessor’s prior written consent, with respect to any subsequent assignment or sublease. If Lessee shall purport to assign this Lease, or sublease all or any portion of the Premises, or permit any person or persons other than Lessee to occupy the Premises, without Lessor’s prior written consent (if such consent is required hereunder), Lessor may collect rent from the person or persons then or thereafter occupying the Premises and apply the net amount collected to the rent reserved herein, but no such collection shall be deemed a waiver of Lessor’s rights and remedies under this Paragraph 17, or the acceptance of any such purported assignee, sublessee, or occupant, or a release of Lessee from the further performance by Lessee of covenants on the part of Lessee herein contained.

(h) Lessee hereby acknowledges that the foregoing terms and conditions are reasonable and, therefore, that Lessor has the remedy described in California Civil Code Section 1951.4 (Lessor may continue the Lease in effect after Lessee’s breach and abandonment and recover rent as it becomes due, if Lessee has the right to sublet or assign, subject only to reasonable limitations).

(i) In the event of any sale or exchange of the Premises by Lessor and assignment of this Lease by Lessor, Lessor shall, provided that the assignee has assumed all obligations of Lessor under this Lease and Lessor has delivered any Security Deposit held by Lessor to Lessor’s successor in interest, be and hereby is entirely relieved of all liability under any and all of Lessor’s covenants and obligations contained in or derived from this Lease with respect to the period commencing with the consummation of the sale or exchange and assignment.

18. Non-Waiver.

(a) No waiver of any provision of this Lease shall be implied by any failure of Lessor or Lessee to enforce any remedy for the violation of that provision, even if that violation continues or is repeated. Any waiver by Lessor or Lessee of any provision of this Lease must be in writing.