CONSENT AGREEMENT

Exhibit 10.13

EXECUTION

THIS CONSENT AGREEMENT (this “Agreement”) is made as of this 24th day of July, 2013 (“Effective Date”), by and between:

RIF V-JERSEY, LLC, a Delaware limited liability company (“Borrower”);

XXXXXXX INDUSTRIAL REALTY, INC., a Maryland corporation (the “REIT”);

XXXXXXX INDUSTRIAL REALTY, L.P., a Maryland limited partnership (“Xxxxxxx XX”, and together with the REIT, “New Guarantor”); and

U.S. BANK NATIONAL ASSOCIATION, AS TRUSTEE, SUCCESSOR-IN-INTEREST TO BANK OF AMERICA, N. A., AS TRUSTEE, SUCCESSOR BY MERGER TO LASALLE BANK, NATIONAL ASSOCIATION, AS TRUSTEE FOR XXXXXX XXXXXXX CAPITAL I INC., COMMERCIAL MORTGAGE PASS-THROUGH CERTIFICATES, SERIES 2005cTOPI7 (“Noteholder”), whose Master Servicer is Xxxxx Fargo Bank, National Association.

BACKGROUND

A. On or about November 29, 2004, XXXXX FARGO BANK, NATIONAL ASSOCIATION (“Original Lender”) made a certain loan and extended credit in the amount of SIX MILLION AND N0/100 DOLLARS ($6,000,000.00) (the “Loan”) to JERSEY BUSINESS PARK, a California general partnership (“Original Borrower”), as evidenced by those certain documents, including, but not limited to, the Loan Documents (the “Loan Documents”) more specifically described in Exhibit A attached hereto and incorporated herein for all purposes, in connection with I 0000 Xxxxxx Xxxxxxxxx, Xxxxxx Xxxxxxxxx, Xxxxxxxxxx (the “Property”).

B. Pursuant to that certain Assumption Agreement dated November 8, 2011, Original Borrower transferred to Borrower all of its right, title and interest in and to the Loan and the Loan Documents.

C. The parties hereto (other than Noteholder) have requested that Noteholder consent to: (i) the merger of each of Xxxxxxx Industrial Fund V, LP, a Delaware limited partnership (“Xxxxxxx Fund”) with and into Xxxxxxx XX (with Xxxxxxx XX being the surviving entity) (the “Xxxxxxx Fund Merger”); (ii} the merger of Xxxxxxx. Industrial Fund V REIT, LLC, a Delaware limited liability company (“Xxxxxxx Fund V REIT”) with and into the REIT (with the REIT being the surviving entity) (the “Xxxxxxx Fund V Merger,” and together with the Xxxxxxx Fund Merger, each a “Merger” and collectively the “Mergers”); (iii) the initial public offering of Xxxxxxx Industrial Realty, Inc., a Maryland limited partnership (the “REIT”), the sole general partner of Xxxxxxx XX (the “IPO”); and (iv) the assumption by Xxxxxxx XX of all of the obligations of Xxxxxxx Fund and the assumption by the REIT of all of the obligations of Xxxxxxx Fund V REIT, in each case as guarantor under the Loan by operation of law as a result of the applicable Merger.

TERMS AND CONDITIONS

NOW, THEREFORE, in consideration of the mutual promises and agreements set forth below, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, and intending to be legally bound, Borrower, New Guarantor and Noteholder agree as follows:

I. Defined Terms. All capitalized terms not otherwise defined herein shall have the meanings given to them in the Deed of Trust (as defined in Exhibit A attached hereto).

2. Ownership of Borrower.

Prior to the Effective Date, Borrower was owned:

| a) | I 00% by RIP V - SPE Owner, LLC, a Delaware limited liability company (“SPE Owner”) and managed by RIF V- SPE Manager, LLC, a California limited liability company (“Manager”); |

| b) | SPE owner was owned 100% by Xxxxxxx Fund; and |

| c) | Xxxxxxx Fund was owned 99.13% by Xxxxxxx Fund V REIT and 0.87% by Xxxxxxx Fund V Manager, LLC, a Delaware limited liability company. |

From and after the Effective Date (but subject to Section 6.15(c)(ii) of the Deed of Trust, as amended), Borrower is owned:

| d) | 100% by SPE Owner and managed by Manager; |

| e) | SPE Owner is owned 100% by Xxxxxxx XX; and |

| f) | The REIT is the sole general partner of Xxxxxxx XX. |

3. Consent by Noteholder. Subject to the terms and conditions contained herein, Noteholder hereby consents to the following: (i) the Mergers; (ii) the IPO; (iii) the assumption by Xxxxxxx XX of all of the obligations of the Xxxxxxx Fund as guarantor under the Loan by operation of law as a result of the Xxxxxxx Fund Merger; and (iv) the assumption by the REIT of all of the obligations of Xxxxxxx Fund V REIT as guarantor under the loan by operation of law as a result of the Xxxxxxx Fund V REIT Merger. The transfers described in paragraphs 2 and 3 are hereinafter referred to as the “Transaction”. Noteholder consents to the Transaction subject to the terms and conditions set forth herein.

4. No Release of Borrower; Ratification. As a further condition to Noteholder entering into this Agreement and giving its consent to the Transaction, Noteholder has required Borrower to ratify its liabilities and obligations under Loan Documents. Borrower hereby ratifies and confirms all of its obligations and liabilities under the Note and the Loan Documents.

5. No Release of Guarantor; Ratification. As a further condition to Noteholder entering into this Agreement and giving its consent to the Transaction, Noteholder has required Xxxxxxx XX, as successor of Xxxxxxx Fund, and the REIT, as successor of Xxxxxxx Fund V REIT, in each case by operation of law as a result of the applicable Merger, to ratify and confirm that it

2

has assumed all liabilities and obligations of Xxxxxxx Fund and Xxxxxxx Fund V REIT, as applicable, under the Existing Guaranty (as defined in Exhibit A attached hereto). Xxxxxxx XX hereby ratifies and confirms that, as a result of the Xxxxxxx Fund Merger, Xxxxxxx XX has assumed liabilities and obligations of the Xxxxxxx Fund under the Existing Guaranty, as amended pursuant to Section 9 below. The REIT hereby ratifies and confirms that, as a result of the Xxxxxxx Fund V REIT Merger, the REIT has assumed the liabilities and obligations of Xxxxxxx Fund V REIT under the Existing Guaranty, as amended pursuant to Section 9 below.

6. Borrower’s Representation and Warranties. To induce the Noteholder to enter into this Agreement, the Borrower hereby represents and warrants to the Noteholder that:

(a) Borrower is validly existing under the laws of the state of its organization and has full power and authority to enter into this Agreement, to execute and deliver all documents and instruments required hereunder, and to incur and perform the obligations provided for herein and therein, and to perform and carry out the terms of the Loan Documents, all of which have been duly authorized by all necessary entity action of the Borrower, and no consent or approval of any third party (other than the Noteholder, whose consent and approval is given pursuant to the terms of this Agreement) is required as a condition to the validity or enforceability hereof or thereof; except for the amendments set forth in Section 8 below, this Agreement has not affected any obligations and liabilities of Borrower under the Loan Documents;

(b) the current financial position of Borrower has not materially. or adversely changed from that reflected in the financial statements most recently provided to Noteholder;

(c) [intentionally omitted];

(d) this Agreement has been duly executed and delivered by the Borrower;

(e) this Agreement will constitute the valid and legally binding obligation of the Borrower, enforceable against the Borrower in accordance with its terms, except as may be limited by bankruptcy, insolvency, reorganization, moratorium and other similar Laws and equitable principles relating to or limiting creditors’ rights generally;

(f) the execution, delivery and performance by the Borrower of this Agreement will not violate (i) any provision of law or any order, rule or regulation of any court or governmental authority, or (ii) any instrument, contract, agreement, indenture, mortgage, deed of trust or other material document or obligation to which the Borrower is a party or by which the Property is bound;

(g) there is no action, suit, proceeding or investigation pending or, to Borrower’s knowledge, threatened that challenges the validity or enforceability of this Agreement or any of the Loan Documents, or any action required to be taken pursuant hereto or thereto;

(h) no Default has occurred and is continuing under the Note and/or the Loan · Documents; and

3

(i) Borrower further represents and warrants to Noteholder that Borrower is not, and none of the principals, affiliates or, to Borrower’s knowledge, other persons holding direct or indirect interests in Borrower are “Non-Qualified Persons” or “Embargoed Persons” as those terms are more particularly defined on Exhibit “B” attached hereto and made a part hereof.

7. REIT’s and Xxxxxxx LP’s Representation and Warranties. To induce the Noteholder to enter into this Agreement, each of the REIT and Xxxxxxx XX hereby represents and warrants to the Noteholder that:

(a) Such entity is or on the Effective Date will be validly existing under the laws of the state of its organization and has full power and authority to enter into this Agreement, to execute and deliver all documents and instruments required hereunder, and to incur and perform the obligations provided for herein and therein, and to perform and carry out the terms of the Loan Documents to which it is a party, all of which have been duly authorized by all necessary entity action of such party, and no consent or approval of any third party (other than the Noteholder, whose consent and approval is given pursuant to the terms of this Agreement) is required as a condition to the validity or enforceability hereof or thereof;

(b) after giving effect to the Mergers and the IPO, the financial position of such party shall not be materially and adversely different from that reflected in the proforma financial statements most recently provided to Noteholder;

(c) [intentionally omitted];

(d) this Agreement has been duly executed and delivered by such party;

(e) this Agreement will constitute the valid and legally binding obligation of Xxxxxxx XX, enforceable against the Xxxxxxx XX in accordance with its terms, except as may be limited by bankruptcy, insolvency, reorganization, moratorium and other similar Laws and equitable principles relating to or limiting creditors’ rights generally;

(f) the execution, delivery and performance by such party of this Agreement will not violate (i) any provision of law or any order, rule or regulation of any court or governmental authority, or (ii) any instrument, contract, agreement, indenture, mortgage, deed of trust or other material document or obligation to which such party is a party or by which such party, or any of such party’s property, is bound;

(g) there is no action, suit, proceeding or investigation pending or, to such party’s knowledge, threatened that challenges the validity or enforceability of this Agreement or any of the Loan Documents to which it is a party, or any action required to be taken pursuant hereto or thereto;

(h) no Default has occurred and is continuing under the Note and/or the Loan Documents; and

(i) such party is not, and none of the principals, affiliates or, to such party’s knowledge, persons holding direct or indirect interests in such party are “Non-Qualified Persons” or “Embargoed Persons” as those terms are more particularly defined on Exhibit “B” attached hereto and made a part hereof.

4

8. Amendments to Loan Documents. From and after the Effective Date, the Loan Documents are amended as follows:

The Deed of Trust

The following new definitions shall be added:

“Affiliate” shall mean any Person that, directly or indirectly (including through one or more intermediaries), Controls, is Controlled by or is under common Control with the Operating Partnership.

“Control” shall mean the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of an entity, whether through the ability to exercise voting power, by contract or otherwise.

“Operating Partnership” shall mean Xxxxxxx fudustrial Realty, L.P., a Maryland limited partnership.

“Person” shall mean any individual, corporation, partnership, joint venture, association, joint-stock company, limited liability company, trust, unincorporated organization, government or any agency or political subdivision thereof or any other form of entity.”

“REIT’’ shall mean Xxxxxxx Industrial Realty, Inc., a Maryland corporation.

Add to the following to the end of the definition of “Restricted Party’’:

“... provided, however, that the term ‘Restricted Party’ shall not include any limited partner of the Operating Partnership or any holder of securities of the REIT, or any Person owning direct or indirect interests in or through such limited partners of the Operating Partnership or such holders of securities of the REIT.”

Section 6.15(c)(ii) Permitted Equity Transfers

Delete provision added at the end of Section 6.15(c)(ii) pursuant to Section 22 of the Assumption Agreement.

Add the following after subsection (D) that was added to Section 6.15(c)(ii) pursuant to Section 8(b) of the Assumption Agreement:

“(E) Transfers of direct or indirect interests in Borrower to the Operating Partnership and any Affiliate, provided that the REIT shall continue to Control the Operating Partnership and Borrower; (F) issuances and Transfers of securities, options, warrants or other interests in the REIT, whether directly or indirectly; (G) issuances and Transfers of partnership interests and other interests in the Operating Partnership (including, without limitation, the adjustment of partnership units held by partners in the Operating Partnership to reflect redemptjons pertaining to the ]jmited partner interests in the Operating Partnership), whether directly or indirectly, provided that the REIT shall continue to Control the Operating Partnership; and (H) a merger, consolidation or exchange of securities to which the REIT or the Operating Partnership is a party, as applicable, provided that the surviving entity shall be the REIT or the Operating Partnership, as applicable, and that the REIT shall continue to Control the Operating Partnership and Borrower.”

5

Section 7.1(a) Optional Default

Delete Section 7.l(a)(vi)

9. Management. Noteholder acknowledges and approves, effective as of the closing date (and conditioned upon the closing) of the Transaction, (i) the termination of that certain Property Management Agreement dated as of August 11, 2011 by and between Borrower and Xxxxxxx Industrial Realty and Management, Inc., a California corporation, and (ii) Xxxxxxx XX or any wholly-owned subsidiary thereof as the new property manager. The form and substance of the new property management agreement shall be subject to Noteholder’s prior reasonable approval.

10. Releases, Covenants Not to Litigate, and Assignments. For the period from the inception of the Loan to and including the Effective Date, and in consideration for Noteholder’s consent given herein, Borrower, the REIT and Xxxxxxx XX (Borrower, the REIT and Xxxxxxx XX are sometimes collectively referred to as “Releasing Parties”) hereby :

(a) fully and finally acquit, quitclaim, release and discharge each of the Released Parties (the term “Released Parties” shall be defined as Original Lender, Noteholder, and Xxxxx Fargo, and their respective officers, directors, shareholders, representatives, employees, servicers, agents and attorneys) of and from any and all obligations, claims, liabilities, damages, demands, debts, liens, deficiencies or cause or causes of action (including claims and causes of action for usury), to, of or for the benefit (whether directly or indirectly) of the Releasing Parties, or any or all of them, at law or in equity, known or unknown, contingent or otherwise, whether asserted or unasserted, whether now known or hereafter discovered, whether statutory, in contract or in tort, as well as any other kind or character of action now held, owned or possessed (whether directly or indirectly) by the Releasing Parties or any or all of them on account of, arising out of, related to or concerning, whether directly or indirectly, proximately or remotely (x) the Note or any of the Loan Documents, or (y) this Agreement (except for the extent of the Released Parties obligations under this Agreement);

(b) waives any and all defenses to payment of the Note for any reason; and

(c) waives any and all defenses, counterclaims or offsets to the Loan Documents ((i), (ii), and (iii) above are collectively referred to as the “Released Claims”).

11. Conditions. It shall be a condition to the effectiveness of this Agreement that on or before the Effective Date, Noteholder shall have approved and be in receipt of:

(a) executed and filed organizational documents of Xxxxxxx XX and the REIT;

(b) the final, fully-executed merger agreement by and between Xxxxxxx Fund and Xxxxxxx XX, and the final, fully-executed merger agreement by and between Xxxxxxx Fund V REIT and the REIT;

(c) [intentionally omitted];

6

(d) confirmation that Borrower’s insurance policies (and insurance carriers) comply with any applicable requirements in the Loan Documents, including, without limitation, amounts and types of insurance, loss payee and applicable insurance certificates;

(e) a preliminary title report;

(f) a new title insurance policy or title insurance policy update and endorsements;

(g) property management contract between Borrower, as owner, and Xxxxxxx XX, as manager, and assignment thereof to Noteholder;

(h) an opinion of counsel, satisfactory to Noteholder as to form, substance and rendering attorney, opining to the validity and enforceability of this Agreement and the terms and provisions hereof, and any other Loan Documents contemplated hereby, the due execution and authority of Borrower, Xxxxxxx XX and the REIT, to execute and deliver this Agreement and perform their obligations under the Note and other Loan Documents, corporate and such other matters as reasonably requested by Noteholder;

(i) all credit, litigation, anti-terrorism, anti-money laundering and other searches, as Noteholder may require;

(j) certification from (i) Borrower certifying, among other things reasonably requested by Noteholder, that the current financial position of Borrower has not materially and adversely changed from that reflected in the financial statements most recently provided to Noteholder, and (ii) the REIT certifying, among other things reasonably requested by Noteholder, that after giving effect to the Mergers and the IPO, the financial position of the REIT and its consolidated subsidiaries shall not be materially and adversely different from that reflected in the pro forma financial statements most recently provided to Noteholder;

(k) Borrower shall have paid Noteholder all fees and all costs and expenses of Noteholder relative to this Agreement and the other Loan Documents and/or other documents executed pursuant hereto and any and all amendments, modifications and supplements thereto, and

(I) Borrower, the REIT and Xxxxxxx XX shall execute and/or deliver to Noteholder such other documents as Noteholder shall reasonably request.

12. Counterparts. It is understood and agreed that this Agreement may be executed in a number of identical counterparts, each of which shall be deemed an original for all purposes. It is understood and agreed that photostatic, facsimile or .pdf signatures of the original signatures of this Agreement, and/or photostatic, facsimile or .pdf copies of this Agreement fully executed, shall be deemed an original for all purposes. Any parties submitting a facsimile or pdf signature shall be estopped from denying that an original signature was required, and such parties hereby agree to provide original signatures upon demand by the other parties. The parties hereto waive. the “best evidence” rule or any similar law or rule in any proceeding in which this Agreement shall be presented as evidence.

7

13. Binding Effect. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

14. APPLICABLE LAW. THIS CONSENT AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE WHICH THE LOAN DOCUMENTS PROVIDE THAT THE. LOAN DOCUMENTS ARE TO BE GOVERNED BY AND CONSTRUED WITH.

[SIGNATURE PAGES FOLLOW)

8

IN WITNESS WHEREOF, the parties have caused this instrument to be signed and sealed the day and year first above written.

| NOTEHOLDER: | ||||

| U.S. BANK NATIONAL ASSOCIATION, AS TRUSTEE, SUCCESSOR-IN-INTEREST TO BANK OF AMERICA, N. A., AS TRUSTEE, SUCCESSOR BY MERGER TO LASALLE BANK, NATIONAL ASSOCIATION, AS TRUSTEE FOR XXXXXX XXXXXXX CAPITAL I INC., COMMERCIAL MORTGAGE PASS-THROUGH CERTIFICATES, SERIES 2005-TOPI7 | ||||

| By: | Xxxxx Fargo Bank, National Association, as Master Servicer under the Pooling and Servicing Agreement dated as of January I, 2005, among Xxxxxx Xxxxxxx Capital I Inc., Xxxxx Fargo Bank, National Association, C-III Asset Management (f/kla Centerline Servicing, Inc.), Bank of America, National Association, as successor by merger to LaSalle Bank, National Association, Xxxxx Fargo Bank, National Association, and ABN AMRO Bank N.V. | |||

| By: | /s/ Xxxxx Xxxxxx, Xx. | |||

| Name: Xxxxx Xxxxxx, Xx. | ||||

| Title: Assistant Vice President | ||||

THE UNDERSIGNED HEREBY CONSENTS TO THE TRANSACTION DESCRIBED HEREIN.

| MORTAGE ELECTRONIC REGISTRATION SYSTEMS, INC., a Delaware corporation | ||||

| By: | /s/ Xxxxx Xxxxxx, Xx. | |||

| Name: | Xxxxx Xxxxxx, Xx. | |||

| Title: | Assistant Secretary | |||

[Signature page to Consent Agreement]

| BORROWER: | ||||

| RIF V - JERSEY, LLC, a Delaware limited liability company | ||||

| By: | /s/ Xxxxxxx Xxxxxxx | |||

| Name: | Xxxxxxx Xxxxxxx | |||

| Title: | Authorized Signatory | |||

[Signature page to Consent Agreement - RIF V - Jersey, LLC]

| REIT: | ||||

| XXXXXXX INDUSTRIAL REALTY, INC., a Maryland corporation | ||||

| By: | /s/ Xxxxxxx Xxxxxxx | |||

| Name: Xxxxxxx Xxxxxxx | ||||

| Title: Co-Chief Executive Officer | ||||

| XXXXXXX XX: | ||||

| XXXXXXX INDUSTRIAL REALTY, LP, a Maryland limited partnership | ||||

| By: | Xxxxxxx Industrial Realty, Inc., a Maryland | |||

| corporation, its general partner | ||||

| By: | /s/ Xxxxxxx Xxxxxxx | |||

| Name: Xxxxxxx Xxxxxxx | ||||

| Title: Co-Chief Executive Officer | ||||

[Signature page to Consent Agreement - RIF V - Jersey, LLC]

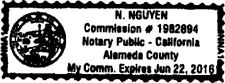

ACKNOWLEDGMENT FOR NOTEHOLDER

| STATE OF CALIFORNIA | ) | |||||

| ) | ||||||

| COUNTY OF ALAMEDA | ) |

On July 22, 2013, before me, X. XXXXXX, the undersigned Notary Public in and for said County and State, personally appeared Xxxxx Xxxxxx, Xx. , who proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to the within instrument and acknowledged to me that he executed the same in his authorized capacity, and that by his signature on the instrument the person, or the entity upon behalf of which the person acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

| WITNESS my hand and official seal. | ||||||

| /s/ X. Xxxxxx | ||||||

| Notary Public | ||||||

| My Commission Expires: | ||||||

| June 22, 0000 | ||||||

| ||||||

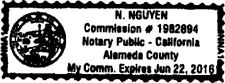

XXXXXXXXXXXXXX XX XXXX

| XXXXX XX XXXXXXXXXX | ) | |||||

| ) | ||||||

| COUNTY OF ALAMEDA | ) |

On July 22, 2013, before me, X. XXXXXX, the undersigned Notary Public in and for said County and State, personally appeared Xxxxx Xxxxxx, Xx. , who proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to the within instrument and acknowledged to me that he executed the same in his authorized capacity, and that by his signature on the instrument the person, or the entity upon behalf of which the person acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

| WITNESS my hand and official seal. | ||||||

| /s/ X. Xxxxxx | ||||||

| Notary Public | ||||||

| My Commission Expires: | ||||||

| June 22, 2016 | ||||||

| ||||||

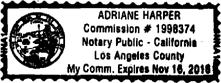

ACKNOWLEDGMENT FOR BORROWER

| STATE OF CALIFORNIA | ) | |||||

| ) ss | ||||||

| COUNTY OF LOS ANGELES | ) |

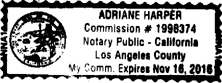

On July 22, 2013 before me, Xxxxxxx Xxxxxx, the undersigned Notary Public in and for said County and State, personally appeared Xxxxxxx Xxxxxxx, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

| WITNESS my hand and official seal. | ||||||

| /s/ Xxxxxxx Xxxxxx | ||||||

| Notary Public | ||||||

| My Commission Expires: | ||||||

| 11/16/16 | ||||||

| ||||||

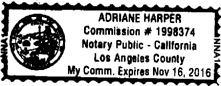

ACKNOWLEDGMENT FOR REIT

| STATE OF CALIFORNIA | ) | |||||

| ) ss | ||||||

| COUNTY OF LOS ANGELES | ) |

On July 22, 2013 before me, Xxxxxxx Xxxxxx, the undersigned Notary Public in and for said County and State, personally appeared Xxxxxxx Xxxxxxx, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/theirsignature(s) on the instrument the person(s), or the entity upon behalf of which the person(s)acted, executed the instrument.

| WITNESS my hand and official seal. | ||||||

| /s/ Xxxxxxx Xxxxxx | ||||||

| Notary Public | ||||||

| My Commission Expires: | ||||||

| 11/16/16 | ||||||

| ||||||

ACKNOWLEDGMENT FOR XXXXXXX XX

| STATE OF CALIFORNIA | ) | |||||

| ) ss | ||||||

| COUNTY OF LOS ANGELES | ) |

On July 22, 2013 before me, Xxxxxxx Xxxxxx, the undersigned Notary Public in and for said County and State, personally appeared Xxxxxxx Xxxxxxx, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

| WITNESS my hand and official seal. | ||||||

| /s/ Xxxxxxx Xxxxxx | ||||||

| Notary Public | ||||||

| My Commission Expires: | ||||||

| 11/16/16 | ||||||

| ||||||

EXHIBIT A

To

Consent and Assumption Agreement

1. Promissory Note Secured by Security Instrument, dated as of November 29, 2004, in the original principal amount of $6,000,000.00 from Original Borrower payable to the order of Original Lender (the “Note”).

2. Deed of Trust, Absolute Assignment of Rents and Leases and Security Agreement (and Fixture Filing), dated as of November 29, 2004 (the “Deed of Trust”), executed by Original Borrower to MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC., a Delaware corporation (“MERS”) as Beneficiary and nominee for Original Lender, which was recorded in the Official Records of the San Bernardino County Recorder, State of California (the “Official Records”) on December 10, 2004 as Document Number 2004-911545, covering the property commonly known as 00000 Xxxxxx Xxxxxxxxx, Xxxxxx Xxxxxxxxx, XX 00000 and more particularly described in the Deed of Trust (collectively, the “Property”).

3. Assumption Agreement (the “Assumption Agreement”), dated as of November 8, 2011, by and between Original Borrower, Borrower, Guarantor and Noteholder.

4. Memorandum of Assumption Agreement (the “Memorandum of Assumption”) dated as of November 8, 2011, by and between Original Borrower, Borrower, Guarantor and Noteholder and recorded November 9, 2011, as Document Number 2011-0465795, with the Official Records.

5. Financing Statement from Borrower in favor of Noteholder which was filed with the Delaware Secretary of State on November 9, 2011 as Initial Filing Number 20114328970.

6. Limited Guaranty (the “Existing Guaranty”), dated as of November 8, 2011, executed by the Existing Guarantor in favor of Noteholder.

7. Assignment of Management Contracts (the “Assignment of Contracts”) dated as of November 8, 2011, executed by Borrower in favor of Noteholder.